WiFi 6

Research & Markets: WiFi 6E and WiFi 7 Chipset Market Report; Independent Analysis

According to Research & Markets, the WiFi 6E (IEEE 802.11ax) and WiFi 7 (IEEE 802.11be [1.]) chipset market is expanding rapidly, with projections indicating a rise from $33.65 billion in 2024 to $40.50 billion by 2025, and estimates reaching $149.65 billion by 2032. This growth reflects a notable CAGR of 20.50%, primarily driven by organizations upgrading their wireless networks in response to rising digital application use and increasing data volume.

Note 1. IEEE 802.11be standard was published July 22, 2025. The Project Approval Request (PAR) is here.

Enterprises today require scalable, secure wireless infrastructure capable of supporting diverse and demanding workloads. The latest WiFi chipsets improve network performance, facilitate secure operations, and support robust digital transformation strategies. Adopting Wi-Fi 6E and Wi-Fi 7 chipsets positions organizations to deliver secure, agile connectivity with higher speeds and lower latency.

- Application Areas: Automotive organizations implement advanced chipsets to support secure, reliable vehicle connectivity and enhance driver-assistance systems. In consumer electronics, manufacturers drive higher interactivity and seamless device experiences with updated wireless integration. Enterprises emphasize improved workforce mobility, while healthcare adopts secure, high-speed wireless for telemedicine and remote diagnostics. Industry operators deploy chipsets to enable robotics, automation, and smart manufacturing environments.

- End Users: Commercial enterprises in sectors such as hospitality, offices, and retail seek enhanced connectivity to increase operational efficiency and elevate customer engagement. Industrial segments-including utilities and manufacturing-prioritize automation and resilient communications infrastructure. Residential users focus on smart technology integration and flexible, connected home environments.

- Chipset Technologies: Integrated combo chips provide straightforward deployment for rapid delivery and compatibility, while discrete chipsets offer a tailored approach in high-volume or specialized scenarios. System-on-chip solutions bring high-density integration, maximizing energy efficiency and aligning with sustainability targets.

- Distribution Channels: Organizations maintain robust supply chains utilizing established resellers and digital platforms, ensuring prompt response to evolving logistical demands and market conditions.

- Regional Coverage: The Americas, Europe, Middle East and Africa, and Asia-Pacific each offer unique opportunities and regulatory landscapes, guiding deployment strategies and technology adoption in response to local dynamics.

- Company Profiles: The industry includes innovation-focused leaders such as Broadcom, Qualcomm, and MediaTek. These companies exhibit diverse approaches to integration and product differentiation across the competitive landscape.

Strategic Insights:

- The expanded wireless spectrum empowers businesses to scale connectivity, supporting data-rich operational environments where performance stability and capacity are critical.

- Next-generation chipset architectures enhance automation and real-time data management, particularly in healthcare and manufacturing, strengthening capabilities for time-sensitive applications.

- Collaborations between chipset vendors and device manufacturers improve compatibility, enabling tailored wireless infrastructure to address bespoke enterprise requirements.

- Maintaining a flexible supply approach-leveraging diverse distribution channels-supports organizational agility in facing evolving international trade and supply scenarios.

- Ongoing improvements in wireless security and system reliability support compliance and data protection needs for sectors operating under stringent regulatory requirements.

Market Insights:

- Surge in demand for Wi-Fi 7 chipsets optimized for multi-gigabit data throughput in dense public venues

- Integration of advanced OFDMA and multi-user MIMO enhancements to support simultaneous high-bandwidth applications

- Adoption of 6 GHz spectrum by enterprise networks to enable low-latency connectivity for critical IoT devices

- Development of energy-efficient chipset architectures to extend battery life in mobile and IoT applications

- Emergence of AI-driven adaptive beamforming techniques to improve signal reliability in complex environments

- Strategic partnerships between chipset vendors and cloud providers to accelerate edge computing deployments

- Certification focus on security enhancements such as WPA3-SAE to address evolving wireless threat vectors

- Custom chipset solutions for automotive and industrial automation requiring ultra-reliable low-latency performance

For more information about this report visit: https://www.researchandmarkets.com/r/q1rlgd

…………………………………………………………………………………………………………………………………

Independent Analysis:

The top three WiFi chipset vendors are:

- Broadcom Inc.: Broadcom is generally recognized as the market leader in the Wi-Fi 6/6E and Wi-Fi 7 segment, particularly in terms of revenue share. They supply chips for a wide range of devices, from high-performance consumer routers (e.g., Netgear, Asus models) to enterprise-grade networking equipment, and are a key supplier for platform upgrades like those in flagship smartphones.

- Qualcomm Technologies, Inc.: Qualcomm is a major competitor, especially in the mobile and networking infrastructure segments. Their “FastConnect 7800” chipset has positioned them for significant growth, with Wi-Fi 6E and 7 products expected to comprise a large portion of their Wi-Fi sales in 2025. They are also a primary chip provider for many high-end routers and mesh systems.

- MediaTek Inc.: MediaTek is a strong player, particularly in the consumer electronics space and in Asia-Pacific markets. Their “Filogic 380/880” Wi-Fi 7 chipsets have seen high demand, and they have strong partnerships with major brands like TP-Link and ZTE.

Other WiFi chipset vendors include: Marvell Technology Group, Intel, Realtek Semiconductor Corporation NXP Semiconductors, Texas Instruments, and Samsung Electronics Co. The market is competitive, with these vendors heavily investing in R&D and strategic partnerships to drive the adoption of new Wi-Fi standards from IEEE 802.11 WG.

The top markets for WiFi 6E/7 chipsets are: Smartphones, PC /laptops, Access Point/WiFi routers, CPE /gateways /extenders, industry verticals (e.g. manufacturing, automotive, industrial, home appliances, gaming, augmented reality, etc).

Sources: Gemini, Perplexity AI

……………………………………………………………………………………………………………………………………………………………………..

References:

https://www.ieee802.org/11/PARs/P802_11be_PAR_Detail.pdf

Wireless Broadband Alliance Report: WiFi 7, converged Wi-Fi and 5G, AI/Cognitive networks, and OpenRoaming

WiFi 7: Backgrounder and CES 2025 Announcements

WiFi 7 and the controversy over 6 GHz unlicensed vs licensed spectrum

MediaTek to expand chipset portfolio to include WiFi7, smart homes, STBs, telematics and IoT

MediaTek Announces Filogic Connectivity Family for WiFi 6/6E

Intel and Broadcom complete first Wi-Fi 7 cross-vendor demonstration with speeds over 5 Gbps

Qualcomm FastConnect 7800 combining WiFi 7 and Bluetooth in single chip

Rethink Research: Private 5G deployment will be faster than public 5G; WiFi 6E will also be successful

WBA field trial of Low Power Indoor Wi-Fi 6E with CableLabs, Intel and Asus

Aruba Introduces Industry’s 1st Enterprise-Grade Wi-Fi 6E Access Point

Wireless Broadband Alliance Report: WiFi 7, converged Wi-Fi and 5G, AI/Cognitive networks, and OpenRoaming

The Wireless Broadband Alliance (WBA) has today released its annual industry report and survey findings. The “WBA Industry Report 2026” contains the results of its annual industry survey across the Wi-Fi, cellular and enterprise ecosystem. Among its chief findings is that 62% of respondents have grown more confident to invest in Wi-Fi over the last 12 months (18% are as confident). Wi-Fi 7 is the technology most likely to be deployed in 2026, with 38% of respondents planning deployments. Closely behind that is the impact of AI, with 32% planning to deploy AI/Cognitive networks, which can transform Wi-Fi networking, with an ability to improve the performance and reliability of networks.

Here are a few highlights:

- 60% of respondents see converged Wi-Fi and 5G as key to enterprise flexibility and that both will co-exist.

- 38% plan to roll out Wi-Fi 7 in 2025/2026, while 65% say 6 GHz availability is important or critical to their Wi-Fi business.

- 32% plan to deploy AI/Cognitive networks.

Convergence matters more:

When asked about the role of Wi-Fi in converged networks with both 5G and private enterprise implementations, responses reinforced the view that the technologies are complementary and together benefit organizations. Six in ten (60%) said combining them would give their organization greater enterprise flexibility. The same proportion expect Wi-Fi and 5G to co-exist, rather than be a binary choice for enterprise networks.

OpenRoaming momentum:

The industry survey shows OpenRoaming transitioning into a period of mainstream planning with the need for seamless onboarding and roaming between Wi-Fi and cellular networks now seen as central business drivers. 38% of respondents say they had already deployed a OpenRoaming and/or Passpoint compliant network with a further 32% wishing to deploy in 2026, and 18% in 2027.

When asked what is driving investment in OpenRoaming/Passpoint, the top three reasons given were Enablement of frictionless Wi-Fi (63%), seamless access between Wi-Fi and 5G/LTE (60%) and seamless access across different networks (40%). Each of these responses relates to network access, highlighting that this element is the most important factor for the industry.

Wi-Fi’s role in business continuity:

Respondents also gave their views on the aspects of Wi-Fi they considered most important to their business at present, and what they expected to be the most important in the future. Network security and privacy was identified as the most important area for businesses today, with 76% of all responses. Tied second position for the current most important aspect of Wi-Fi, both with 70% of responses, were end user experiences (Quality of Experience and Quality of Service), and seamless authentication to Wi-Fi.

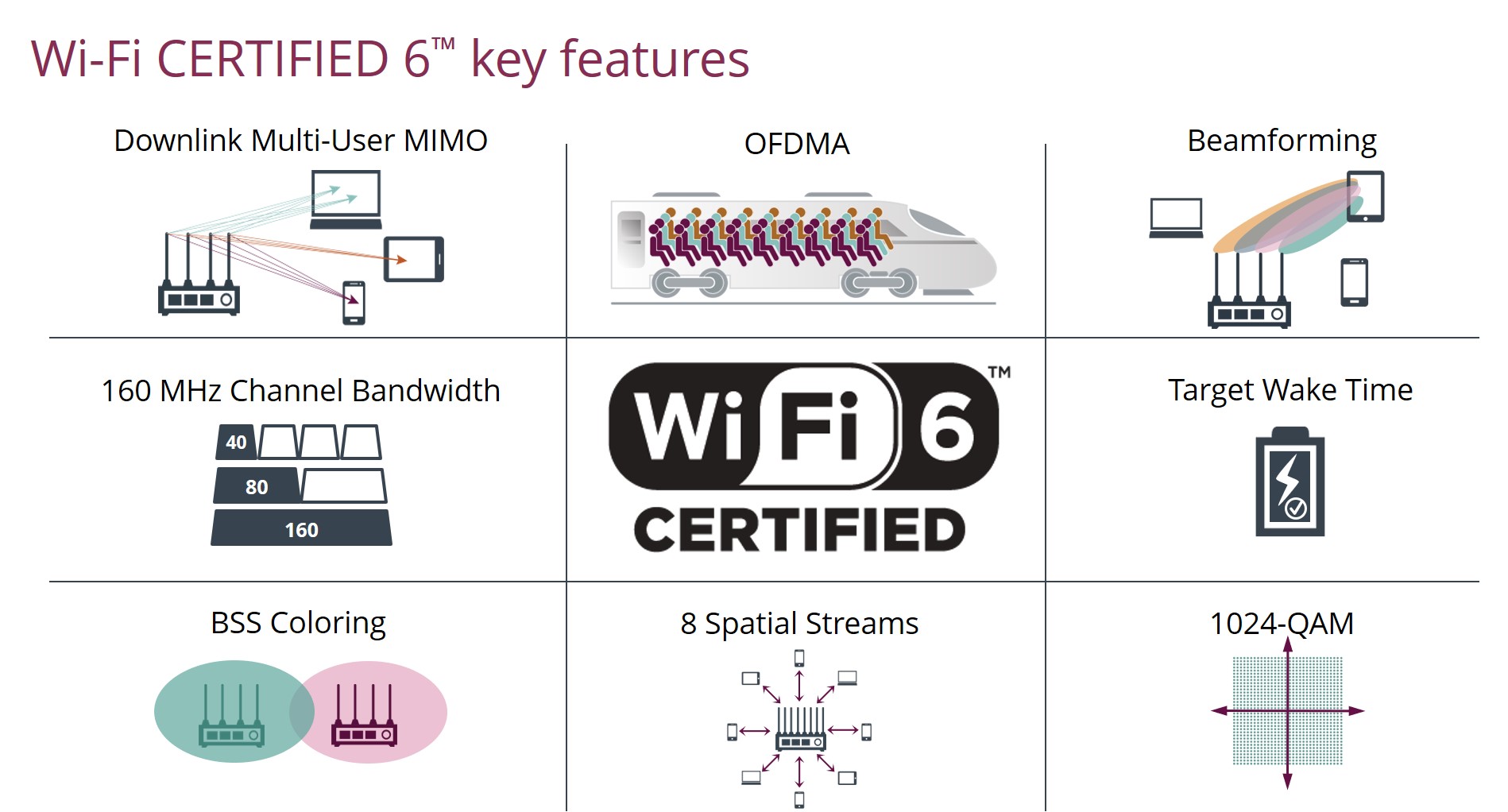

Asked about the most important new or improved feature of Wi-Fi 6E and Wi-Fi 7, respondents rated Multi-Link Operation (MLO) as the single most important at 46%, highlighting a sharp focus on latency, resilience and spectrum efficiency in dense environments. This was followed in joint second place by OFDMA Uplink & Downlink, and Mandatory WPA3 compliance (both 33%). Multi-User MIMO Uplink took third position at 32%.

Additional key survey findings:

- 6 GHz band availability seen as ‘important’ or ‘critical’ by 65% of respondents to the future of their Wi-Fi business and rollout, underscoring the centrality of 6 GHz to future Wi-Fi strategies

- City-wide public Wi-Fi deployed by 33% of relevant respondents, with a further 39% planning deployments for 2026/2027. The top three services organizations see Public Wi-Fi underpinning were supporting city services (70%), the provision of seamless, affordable, and secure internet access to users (65%), and to provide offload to carriers (49%). City governments around the world, such as the Tokyo Metropolitan Government (TMG), are already utilizing OpenRoaming to deliver all these services

Tiago Rodrigues, President and CEO of the Wireless Broadband Alliance, said: “This year’s WBA Industry Report survey makes it clear that the Wi-Fi community has moved to building the next generation of converged connectivity and the momentum is strong: Wi-Fi 7 and AI-driven networks, which can cut costs, while improving the operational efficiency, performance and reliability of networks, are at the top of deployment plans. 6 GHz is viewed as critical spectrum, and almost half of respondents are already deploying or planning OpenRoaming networks. Respondent’s priorities of security, privacy, Quality of Experience and seamless roaming between Wi-Fi and 5G are exactly where the WBA is focused through our programs of work. In a world where connectivity is business continuity, these findings show that Wi-Fi has become essential infrastructure for enterprises, operators and cities alike.”

The WBA Industry Survey 2026 collected input from 185 participants worldwide, with diverse job roles ranging from the C-suite and business strategy to those in research & development (R&D) and product management in a wide range of sectors.

About the Wireless Broadband Alliance:

Wireless Broadband Alliance (WBA) is the global organization that connects people with the latest Wi-Fi initiatives. Founded in 2003, the vision of the WBA is to drive seamless, interoperable service experiences via Wi-Fi within the global wireless ecosystem. The WBA’s mission is to bring together global industry leaders, collaborating to accelerate the development, integration and adoption of next-generation Wi-Fi and wireless technologies to deliver business growth, through innovation, technical and standards development, and real-world deployment programs.

Key programs include NextGen Wi-Fi, OpenRoaming, 5G, 6G, IoT, Smart Cities, Testing & Interoperability and Policy & Regulatory Affairs.

www.facebook.com/WirelessBroadbandAlliance

www.linkedin.com/company/2919934/

…………………………………………………………………………………………………………

References:

https://wballiance.com/industry-report-2026/

WiFi 7: Backgrounder and CES 2025 Announcements

WiFi 7 and the controversy over 6 GHz unlicensed vs licensed spectrum

MediaTek to expand chipset portfolio to include WiFi7, smart homes, STBs, telematics and IoT

CableLabs to bring mobility to WiFi for a better user experience

AT&T to provide free WiFi and private 5G at DFW airport; will invest $10 million worth of network upgrades

Qualcomm FastConnect 7800 combining WiFi 7 and Bluetooth in single chip

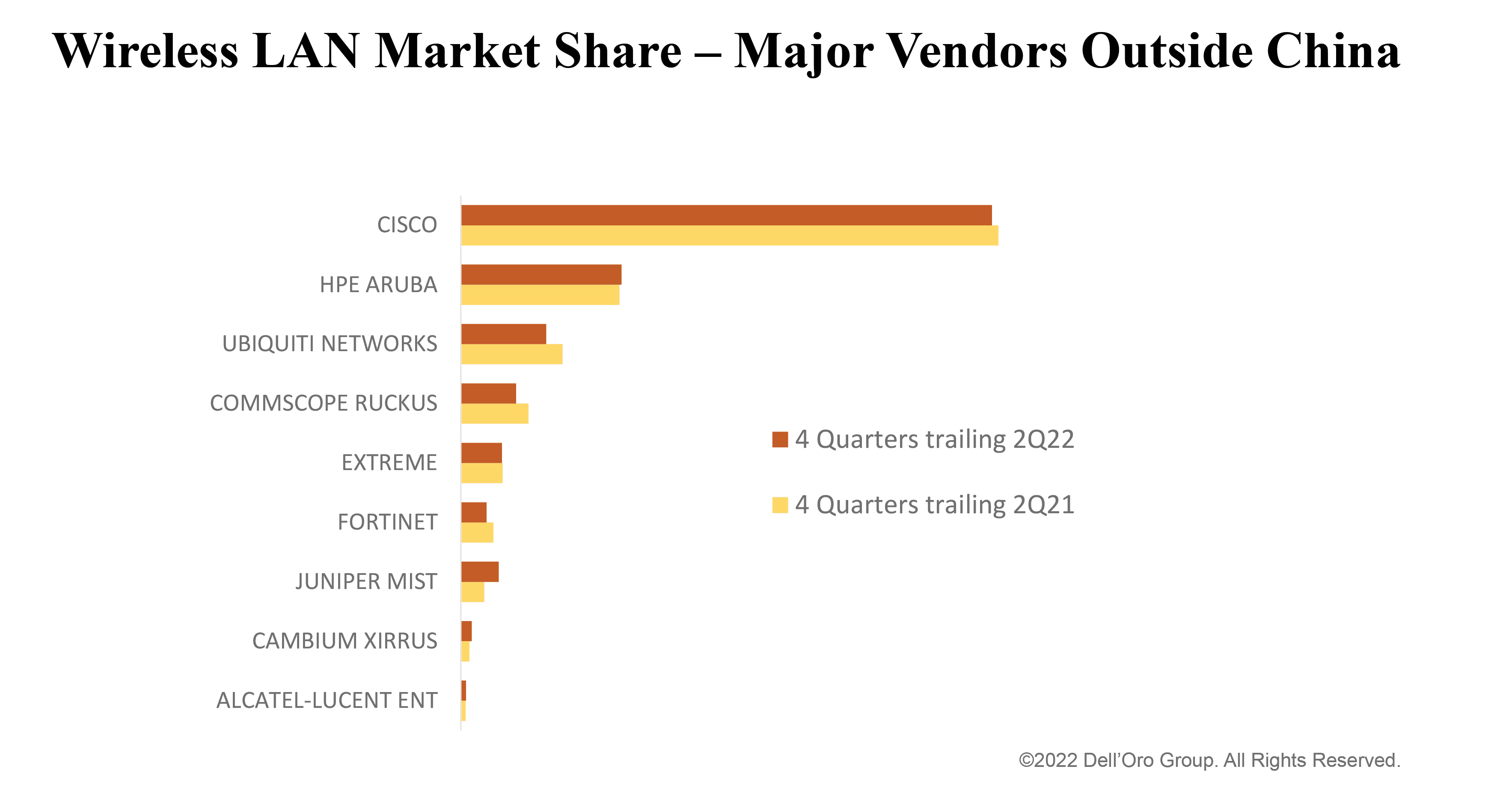

Dell’Oro Worldwide Wireless LAN market at new high in 2Q-2022; IDC reports 20.4% annual growth for enterprise segment

1. According to Dell’Oro Group’s Wireless LAN Quarterly Report, the Wireless LAN market reached a new high in the second quarter, eclipsing $2 Billion, with HPE Aruba and Juniper Mist overcoming supply constraints to contribute over two thirds of the shipment growth outside China. Enterprises saw a 10 percent increase in average prices compared to last year, boosting manufacturers’ revenues and helping to defray additional costs.

“HPE and Juniper really pulled rabbits out of their hats this quarter ̶ Aruba and Mist represent the majority of the growth in units shipped outside China,” says Siân Morgan, Wireless LAN Research Director at Dell’Oro Group. “It’s like a game of whack-a-mole for the manufacturers. They’ll get their hands on one particular access point component and then another shortage will pop up. We’re expecting shipments to be lumpy through the next few quarters.”

Cisco has promised shipments ‘en masse’ for enterprises, and all of the manufacturers are busy finding creative solutions: redesigning products, using brokerage firms, or bypassing component distributors.

“Wireless LAN solutions have also become more expensive for enterprises. It’s very rare to see such a long stretch of quarters with year-over-year price increases. It’s a combination of higher-end products being available, including the new Wi-Fi 6E technology, as well as a general move by the manufacturers to cover their escalating costs. Looking ahead we have to ask ourselves how long the market will bear these higher prices,” added Morgan.

Additional highlights from the 2Q 2022 Wireless LAN Quarterly Report:

- The Wireless LAN market saw two distinct phenomena driving the growth: one in China, and another one in the markets outside China.

- In light of the China lockdowns, the Wireless LAN market in China showed surprising strength with both Huawei and H3C pulling in strong quarters.

- Wi-Fi 6E shipments accelerated this quarter, as another half dozen vendors started shipping products supporting the new 6 GHz band. However, now in its fourth quarter of product availability, Wi-Fi 6E is lagging the adoption rate of the prior two generations of Wi-Fi.

- Revenue from public cloud-managed APs has outpaced the market. The cloud-managed AP business is still dominated by Cisco – although this quarter, Juniper grabbed an outsized market share in cloud-managed Wireless LAN.

Sian wrote in an email to this author, “It is difficult to judge changes in market share based on one or two quarters, given that supply constraints are making shipment volumes choppy. To understand how the market is unfolding it is useful to look at market share based on trailing four-quarter averages, which are shown in the chart below.

Dell’Oro note earlier this year that supply chain issues increased vendor backlogs by up to 15-times normal levels. “Many enterprises have planned network upgrades and the popular connection is Wi-Fi. The trouble is getting it. Several manufacturers announced that components from second and third-tier suppliers became the bottleneck in 1Q22,” said Tam Dell’Oro, Founder, CEO and Wireless LAN Analyst. “Supply constraints have resulted in highly volatile quarterly performance vendor-to-vendor depending on whether or not they have all the components. For example, sales may be up 20 percent in one quarter and down 20 percent the next. Another item, which could potentially cause delays, that we are keeping our eye on are the contract negotiations between the west coast dockworkers union and the Maritime Association,” added Dell’Oro.

The Dell’Oro Group Wireless LAN Quarterly Report offers complete, in-depth coverage of the Enterprise Outdoor and Indoor markets, Wireless LAN Controllers with tables containing manufacturers’ revenue, average selling prices, and unit shipments by the following wireless standards: 802.11ax (Wi-Fi 6 and 6E [6 GHz]), 802.11ac (Wi-Fi 5) Wave 1 vs. Wave 2, and historic IEEE 802.11 standards. The Enterprise market is portrayed by Public Cloud vs. Premises and Private Cloud deployments, as well as by ten Vertical markets and by Customer Size. To purchase these reports, please contact us by email at [email protected].

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

2. IDC reports that the enterprise segment of the worldwide wireless local area network (WLAN) market continued its strong growth in the second quarter of 2022 (2Q22), increasing 20.4% year over year to $2.1 billion. That’s according to the IDC report: “Worldwide Quarterly Wireless LAN Tracker.”

The 20.4% annualized growth builds on the enterprise WLAN market growing 17.1% year over year in the first quarter of 2022. In the first half of 2022, the enterprise WLAN market has grown 18.4% compared to the first half of 2021. Growth in the enterprise WLAN market continues to be driven by the latest Wi-Fi standard, known as Wi-Fi 6 or 802.11ax. Wi-Fi 6 access points (AP) made up 76.5% of the revenues in the Dependent AP segment and accounted for 62.7% of unit shipments within the segment. Wi-Fi 5 products, also known as 802.11ac, made up the remaining balance of Dependent AP sales.

The consumer segment of the WLAN market declined 3.5% year over year in 2Q22, with the quarter’s unit shipments remaining relatively flat at 0.6% growth compared to the first quarter of 2022. Adoption of Wi-Fi 6 continues in the consumer segment of the WLAN market too: In 2Q22, Wi-Fi 6 made up 33.5% of the market’s revenues.

“The enterprise WLAN market continues to grow at a rapid clip, emphasizing the importance of wireless technology in the network and digital transformation goals of organizations across the globe,” said Brandon Butler, research manager, Enterprise Networks at IDC. “The enterprise WLAN market is not immune to challenges however, with the supply chain disruptions and component shortages being notable examples. But strong demand for wireless refreshes to Wi-Fi 6 – and increasingly to Wi-Fi 6E – is buoying the market and leading to strong growth rates.”

The enterprise WLAN market had mixed results across the globe. In the United States, the market increased 15.7% annually, while in Latin America the market grew 47.7% from a year earlier. In Canada the market declined 1.6%. In Western Europe, the market increased 45.4%, but in Central and Eastern Europe, the market declined 20.6%. Within Central and Eastern Europe, Russia’s market declined 73.2% as the Russia-Ukraine war rages on. In the Middle East & Africa, the market rose 23.2%. In the Asia/Pacific region, excluding Japan and China, the market rose 26.5%, while in the People’s Republic of China the market increased 8.7% year over year. In Japan the market rose 6.2%.

Vendor highlights (note that Juniper Mist is NOT mentioned by IDC as a leading wireless LAN vendor):

- Cisco’s enterprise WLAN revenues increased 19.3% year over year in 2Q22 to $792.0 million, giving the company market share of 37.7%, compared to market share of 41.5% in the previous quarter, 1Q22.

- HPE-Aruba revenues rose 48.6% year over year in 2Q22, giving the company market share of 14.9%, down from 16.5% in the first quarter.

- Ubiquiti enterprise WLAN revenues increased 10.5% year over year in 2Q22, giving the company 7.9% market share in the quarter, up from 7.1% in 1Q22.

- Huawei enterprise WLAN revenues rose 20.0% year over year in 2Q22, giving the company 8.5% market share, up from 4.6% market share in the previous quarter.

- H3C revenues increased 16.4% year over year in 2Q22, giving the company market share of 4.6%, up from 4.3% in 1Q22.

The IDC Worldwide Quarterly Wireless LAN Tracker provides total market size and vendor share data in an easy-to-use Excel Pivot Table format. The geographic coverage includes nine major regions (USA, Canada, Latin America, People’s Republic of China, Asia/Pacific (excluding Japan & China), Japan, Western Europe, Central and Eastern Europe, and Middle East and Africa) and 60 countries. The WLAN market is further segmented by product class, product type, product, standard, and location. Measurement for the WLAN market is provided in vendor revenue, value, and unit shipments.

About IDC Trackers:

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

References:

HPE Aruba and Juniper Mist Navigate Component Shortages to Gain Share, According to Dell’Oro Group

https://www.idc.com/getdoc.jsp?containerId=prUS49663322

https://www.idc.com/getdoc.jsp?containerId=IDC_P23464

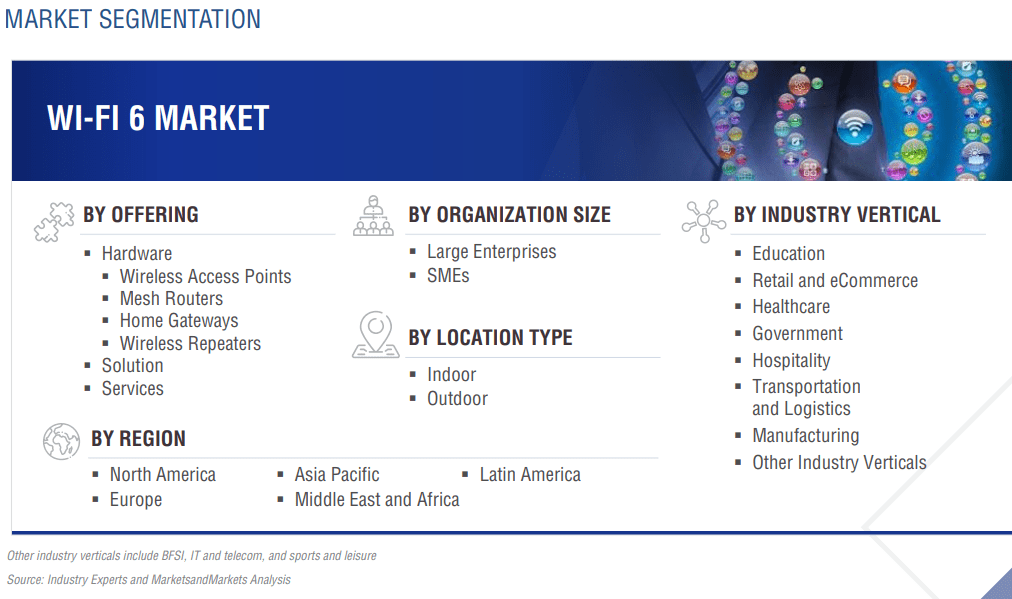

Global Wi-Fi 6 market forecast to grow from $11.5B in 2022 to $26.2B by 2027; CAGR=17.9%

According to a new research report “Wi-Fi 6 Market Global Forecast to 2027,” published by MarketsandMarkets™, the global Wi-Fi 6 market size is expected to grow from $11.5 billion in 2022 to $26.2 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 17.9% during the forecast period.

……………………………………………………………………………………………………………………………………

Editor’s Note:

Wi-Fi 6 is an acronym for the IEEE 802.11ax standard. Prior to the release of Wi-Fi 6, Wi-Fi standards were identified by version numbers ranging from 802.11b to 802.11ac.

…………………………………………………………………………………………………………………….

The managed services Wi-Fi 6 market segment is expected to grow at a higher CAGR than enterprise or consumer Wi-Fi 6 during the forecast period. Managed Service Providers (MSPs) offer are third–party IT service providers that remotely manage the IT infrastructure and systems of clients for backup and recovery of business–critical data. These service providers carry out 24/7 remote monitoring of Wi–Fi 6 networks for their commercial clients. Enterprises opt for managed services to overcome the challenges of budget constraints and technical expertise as managed service providers have skilled human resources, infrastructure, and industry certifications. They offer services to monitor and manage hardware devices and manage the availability and the performance of networks. They also ensure smooth operations and security of networks. The growth of the Wi–Fi 6 market is being driven by the increasing reliance by businesses on the use of IT to improve business productivity, coupled with a continuing rise in demand for specialized MSPs and cloud–based managed Wi–Fi 6 services.

Asia Pacific (APAC) region to record the highest growing region in the Wi-Fi 6 Market. Important countries include Australia, Japan, Singapore, India, China, and New Zealand. The region is expected to witness the fast-paced adoption of Wi-Fi 6 software. The Asia Pacific region is estimated to be the fastest-growing Wi-Fi 6 Market owing to the rise in the adoption of new technologies, high investments for digital transformation, the rapid expansion of domestic enterprises, extensive development of infrastructures, and increasing GDP of various countries. Rapidly growing economies, such as China, Japan, Singapore, and India, are implementing Wi-Fi 6 solutions across multiple business processes to provide effective solutions.

Key and innovative vendors in the Wi-Fi 6 market are:

Cisco Systems (US), Intel Corporation (US), Huawei Technologies (China), NETGEAR (US), Juniper Networks (US), Broadcom (US), Qualcomm Inc. (US), Extreme Networks (US), Ubiquiti Networks (US), Fortinet Inc. (US), Aruba Networks (US), NXP Semiconductors (Netherlands), AT&T (US), Cambium Networks (US), D-Link Corporation (China), Alcatel-Lucent (US), TP-Link (China), MediaTek (China), Telstra (Australia), Murata (Japan), Sterlite Technologies Limited (India), Celeno (Israel), H3C (China), Senscomm Semiconductor (China), XUNISON (Ireland), Redway Networks (UK), VSORA (France), NEWRACOM (US), WILUS Group (South Korea), Federated Wireless (US).

References:

Globe Telecom and Linksys deploy dual band mesh WiFi 6 system

Philippines network operator Globe Telecom has partnered with Linksys, a provider of home and business WiFi services, to provide Globe At Home subscribers with Linksys’ Atlas Pro 6 Dual-Band Mesh WiFi 6 system.

All Globe At Home subscribers can now pre-order the Linksys WiFi 6 Mesh device. Powered by Velop Intelligent Mesh, this dual-band WiFi 6 router is designed to allow more than 30 devices to connect across three bedrooms. It is best recommended for subscribers to Globe At Home’s Unli Fiber Up 70 Mbps plan and up, the operator added.

Globe customers can take up the Linksys Atlas Pro 6 (MX5502 – two units) for PHP 1,099 per month or for a one-time payment of PHP 19,995. For a limited time only, every pre-order will come with a bonus Samsung SmartThings camera worth PHP 5,500, Globe said.

“As a company whose mission is to give Filipinos the tools they need to keep winning in life despite all the challenges we face, we are always on the lookout for emerging technologies that can help us do just this,” says Barbie Dapul, Vice President for Marketing of Globe At Home. “From our improved unli, fiber internet plans to Globe Streamwatch 2-in-1 Entertainment Box, and now the Linksys Atlas Pro 6 WiFi Mesh, all of our efforts are geared towards turning Filipino houses into powerhouses; homes that are capable of enriching familial bonds and at the same time, fulfilling dreams.”

The Linksys Atlas Pro 6 makes so much sense especially in the post-pandemic setting with the internet becoming more central in people’s lives and the home becoming a central venue for work, school, gaming, and family entertainment. The WiFi 6 competency is designed to deliver gigabit WiFi speeds to every corner of the home, including balconies and outdoor areas, offering the best home mesh WiFi coverage to date.

“With more people working from home, and attending school online, home networks are becoming increasingly constrained, especially when used for video or other streaming applications,” said Kingsley Chan, Business Development Director, Linksys. “The new Linksys Atlas Pro 6 is designed to address this and provides all of the heavy WiFi lifting at a reasonable price.”

Access to 160 MHz unleashes the true power of WiFi 6 technology—the least-congested channels on the 5 GHz band offer incredibly fast connectivity. Faster peak data rates allow work-from-home, online learning, streaming, and gaming devices to operate simultaneously without diminished bandwidth. Meanwhile, advanced security and parental controls all add to the essentiality of this upgrade to any home.

Additional Features and Benefits

- 4X Faster Speed than WiFi 5, Powerful WiFi 6 Mesh Coverage: WiFi 6 sends and receives multiple streams of data simultaneously, providing up to 4X more WiFi capacity to handle more mobile, streaming, gaming, and smart home devices.

- Increased WiFi Range by 50%: Expands WIFI coverage up and lessens dead spots.

- Ultra-Low Latency: Faster WiFi performance for lag-free online gaming and HD streaming to any device, providing 4X more speed compared to WiFi 5.

- Easy set-up and WIFI controls with Linksys app let you access your network from anywhere, and view or prioritize which connected devices are using the most WiFi.

References:

https://www.globe.com.ph/about-us/newsroom/consumer/better-wider-wifi-globe-at-home-linksys.html

For more information, please visit shop.globe.com.ph/linksys-atlas-pro6-pre-order. You can also download the Globe At Home app and follow Globe At Home on Facebook.

https://www.linksys.com/us/velop/