TÉRAL RESEARCH

Téral Research: 5G SA core network deployments accelerate after a very slow start

5G deployments started with the non-standalone (NSA) mode (using a 4G core network) and are now gradually migrating to Stand Alone (SA) core network to unleash a plethora of use cases. 5G SA offers improved latency and bandwidth, enabling advanced services and applications. 5G SA goes far beyond mobile and will eventually become the network that bridges all networks together, with the new sophisticated service-based architecture (5G SBA) designed by the 3GPP. Although many of the network functions (NFs) featured in the 5G SBA come from existing ones currently active in 2G/3G and 4G networks, novel functions such as the network slice selection function (NSSF) are being introduced.

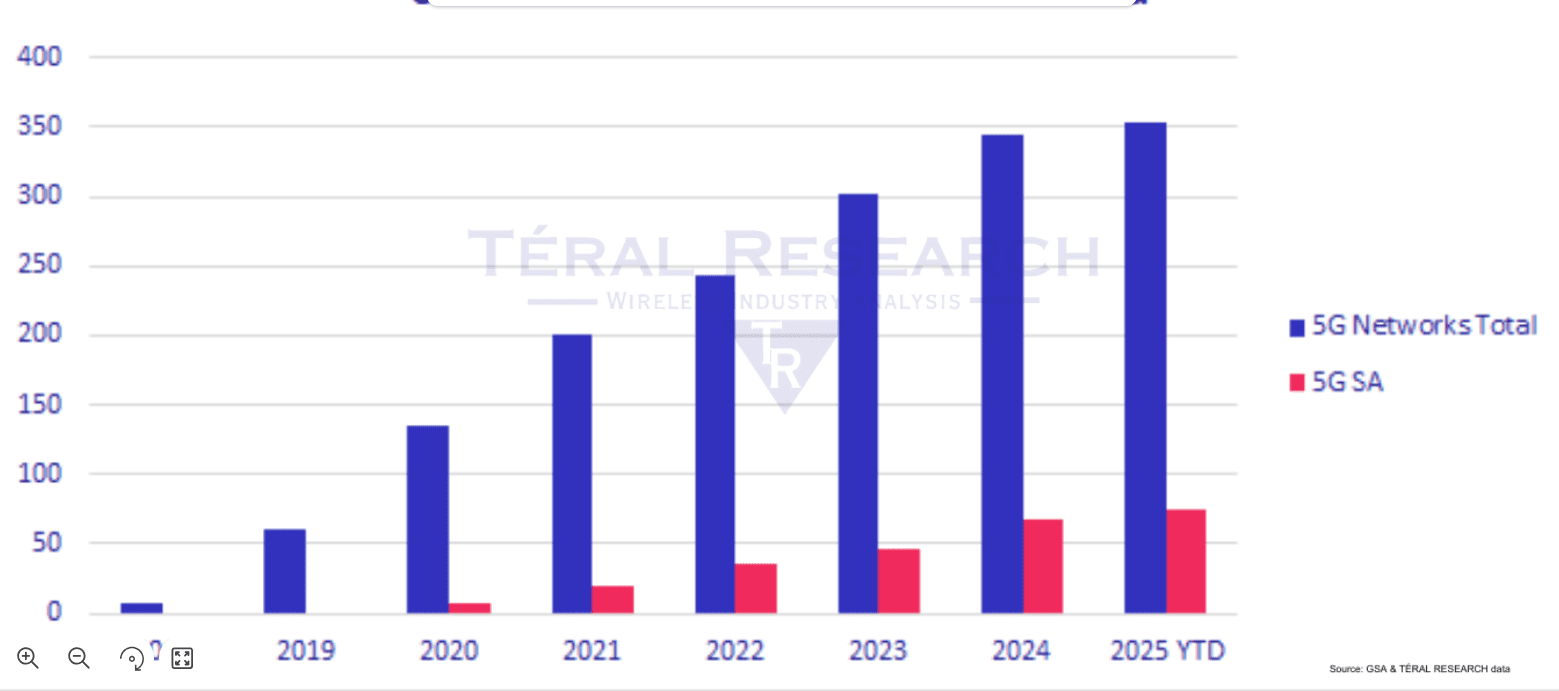

After a very slow start during the past five years, Téral Research [1.] says the migration to 5G SA has increased. Of the total 354 commercially available 5G public networks reported at the end of 1Q25, 74 are 5G SA – up from 49 one year ago.

Note 1. Based on a communications service provider (CSP) survey and discussions with many vendors, Téral Research’s 5G SA report analyzes several of the 5G Core SBA functions and provides global and regional market sizes and forecasts by focusing on the NFs implemented by CSPs (e.g., UDM, UDR, AUSF, NRF, NEF and NSSF, PCF, BSF, CHF) to enable use cases beyond enhanced mobile broadband (eMBB), fixed wireless access (FWA), and private 5G.

……………………………………………………………………………………………………………………………………………………………………..

2024 had the highest number of 5G SA commercial launches: 21 networks went live to offer commercial 5G SA services last year. The success of FWA services, the introduction of smartphone plans enabled by the increasing number of available 5G SA devices, and the rise of VoNR drove this SA migration.

Key findings include:

-

Network slicing is taking off for various services, including for military use cases.

-

The single vendor approach remains predominant for each domain.

-

67% of 5G SA core deployment are cloud-based but due to data sovereignty concerns,

CSPs favor private cloud infrastructures.

-

The global 2024 market for 5G SA Core + SDM + Policy & Charging grew 12% YoY and hit $3.8B, slightly below our forecast.

-

Sustained by its domestic market, Huawei leads global 2024 sales for 5G SA Core + SDM + Policy & Charging, followed by Ericsson and Nokia, respectively. However, Nokia leads the global commercial 5G SA footprint. ZTE comes in fourth place for global total sales and second for 5G SA core sales behind Huawei.

In the meantime, technical challenges related to 5G network architecture complexity, 3GPP methods for exchanging information across 4G vs. 5G, policy orchestration and enforcement, real-time analytics and insights and data analytics are still lingering but being solved.

Built on a solid CSP pipeline of 559 cellular networks in the world that have yet to be migrated to 5G SA, Téral’s model produced a forecast that shows the global 5G SA Core/5G Data Management/5G Policy market to cross the $4B bar by year-end, which is 20% YoY growth. Last year’s downward revision put our forecast on track and therefore we have not made any significant change in this forecast update.

……………………………………………………………………………………………………………………………………

Editor’s Note: In 2025, about a dozen more mobile network operators (MNOs) are expected to deploy 5G Standalone (SA) networks, according to Fierce Network and Moniem-Tech. This will include some major CSPs like AT&T and Verizon, who have previously deployed 5G SA on a limited basis. ……………………………………………………………………………………………………………………………………

In the long run, Teral foresees a significant ramp up in CSPs’ migration to 5G SA that adds to the ongoing activity continuously fueled by the emergence of new use cases going beyond eMBB, FWA, and private 5G. Therefore, Téral expects the market to grow at a 2025-2030 CAGR of 11%. Asia Pacific will remain the largest market throughout the forecast period and 5G SA core the most important domain to start with, followed by 5G Data Management.

Finally, the disaggregated multi-domain nature of 5G core SBA brings a broad range of contenders that include the traditional telecom network equipment vendors, a few mobile core specialists, a handful of subscriber data management (SDM) specialists, a truck load of policy and charging rules function (PCRF) players, the OSS/BSS providers and the system integrators and providers of IT services.

References:

Téral Research :: June 2025 5G SA Core, SDM and Policy

Ookla: Europe severely lagging in 5G SA deployments and performance

Vision of 5G SA core on public cloud fails; replaced by private or hybrid cloud?

GSA: More 5G SA devices, but commercial 5G SA deployments lag

Building and Operating a Cloud Native 5G SA Core Network

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

5G SA networks (real 5G) remain conspicuous by their absence

TÉRAL Research: Sharp declines in Wireless Infrastructure Market 1Q-2024

The global wireless infrastructure market, including 2G/3G/4G/5G RAN and core networks, experienced significant declines both sequentially (-31%) and YoY (-26%) in 1Q-2024. However, these declines are not unprecedented.

“Such decline has happened before in 2002 and 2003 due to a sharp decrease in TDMA and PDC systems shipments, as well as in the post-LTE peak era from 2016 to 2019, when each year’s first quarter posted a 20%+ YoY decline. And that’s not all, looking at bellwether Ericsson’s networks sales historical data, 1Q was also down 20%+ sequentially during the 5G boom,” said Stéphane Téral, Founder and Chief Analyst at TÉRAL RESEARCH.

Huawei continues to be the largest wireless network infrastructure vendor, Nokia and ZTE Corporation’s lost market share, while Samsung Networks position was steady.

Téral states that 2024 marks the third consecutive year of a wireless disinvestment cycle yet the market is poised for a slight rebound in 2H2024 driven by open RAN and 5G upgrades.

………………………………………………………………………………………………………………..

Stéphane attended Oracle’s Applications & Industries Analyst Summit at the Oracle Conference Center in Redwood Shores, California. This two-day event showcased how Oracle is integrating Generative AI into its Fusion Data Intelligence Platform, enhancing ERP, EPM, SCM, HCM, and CX applications with AI-powered updates. Oracle’s industry verticals, particularly their 5G CSP monetization and digital experience strategies, promise to end the 5G monetization drought. With Oracle migrating databases to its cloud and leveraging AI, CSPs can expect increased efficiency and growth.

References:

https://www.linkedin.com/pulse/whats-new-t%C3%A9ral-research-t-ral-research-qsmec/

https://www.teralresearch.com/resources

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

What is 5G Advanced and is it ready for deployment any time soon?