Verizon FioS will no longer offer home television and internet on bundled plans

On January 9, 2020, Verizon stated it was eliminating multi-year contracts, multi-service bundles, weird added fees at the bottom of bills, and other nickel and dime cable charges. Instead, Fios will offer Internet at a couple of speeds, priced at $40 to $80 monthly, and a couple of TV packages, priced from $50 to $90. The channel line ups of the TV packages will be more customizable than in the past, as well.

“Customers have been loud and clear about their frustrations with cable, and we’ve listened. As a result, we’re transforming our approach to Internet and TV offers by giving customers more choices and more transparency,” says Frank Boulben, Senior Vice President of Consumer Marketing and Products at Verizon. “Customers are tired of having to buy a bundle with services they don’t want to get the best rates, and then discover that those rates didn’t include extra fees and surcharges. We’re putting an end to the traditional bundle contract and putting customers in control.”

To replace bundles, Verizon has chosen to give consumers greater flexibility through what it calls Mix & Match. With Mix & Match, Verizon customers can choose between three internet tiers ranging from $40 to $80 per month, and from cable packages offered either through Verizon’s in-house Fios service or through the company’s partnership with YouTube TV. Verizon offers three Internet speed options for FiOS customers – 100 Mbps, 300 Mbps and Gigabit Connection.

NOTE: Triple-play bundles refer to long-term contracts with a company such as Comcast Corp. or Charter Communications Inc. that provide internet, television and landline phone service for one “discounted” rate. These packages force you to have an old-school home phone number, seemingly just for telemarketers to call, and dozens of TV channels you’ll never watch but will nevertheless subsidize. However, many subscribers only want a fast internet connection to binge on Netflix or Amazon Prime and gain access to a handful of their favorite network shows.

………………………………………………………………………………………………………………………………………………………………………..

Mix & Match builds on Verizon’s strategy to adapt to changing consumer habits; the company has reported a net loss in Fios TV subscribers every quarter since 2016 – coinciding with the rise of subscription-based internet streaming services.

Consumers can change their service selection each month, whereas Verizon had previously offered one- and two-year contracts for discounted introductory bundles. This practice sowed frustration among consumers, as many wanted internet alone but were forced to also buy home television, or because the service price escalated after the introductory contract expired, Verizon SVP Frank Boulben told The Wall Street Journal.

………………………………………………………………………………………………………………………………………………………………………..

AT&T is emblematic of the limitations of bundling in a sufficiently competitive environment: The company used lots of debt to pay over $150 billion to purchase DirecTV and Time Warner ($67 billion acquisition of satellite television provider DirecTV in 2015 and $86 billion acquisition of Time Warner in 2018). The goal was to build up its media assets and combine with its wireline and wireless networks to distribute new content. Unfortunately for AT&T, it hasn’t been able to leverage those combined assets via bundles in a way that drives consumer interest and subscriptions. AT&T executives proclaimed the mergers would bring “a fresh approach to how the media and entertainment industry works for consumers, content creators, distributors and advertisers.”

Many Wall Street analysts at the time expressed concern that the debt incurred from the company’s mergers would make that goal untenable. And they were right! AT&T’s bottom line has been bleeding from loss of DirecTV customers while they have not yet been able to monetize the content obtained from Time Warner.

………………………………………………………………………………………………………………………………………………………………………..

As Verizon runs into similar problems in the home, it’s increasing the modularity of its product options and also expanding into segments like VR and cloud gaming. How Verizon fares with this new approach in its home business will be an instructive lesson for the wireless industry as a whole — particularly as mobile operators continue to pursue bundling as a strategy outside the home as well, pairing mobile offerings with media to draw in and retain mobile subscribers.

………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.verizon.com/about/news/verizon-disrupts-cable-industry

https://www.businessinsider.com/verizon-discontinues-bundling-internet-cable-services-2020-1

https://www.latimes.com/business/story/2020-01-09/verizon-breaks-the-cable-bundle-but

Taiwan raises more than 138 billion TWD in 5G spectrum auction amongst fierce competition

Taiwan completed its 5G spectrum auction on 16 January, after 261 rounds of bidding. Total bids reached 138.08 billion TWD (approximately USD 4.6 billion), DigiTimes reports, citing a statement from Taiwanese regulator National Communications Commission (NCC).

- Chunghwa Telecom, Taiwan Mobile, Far EasTone Telecommunications and Taiwan Star Telecom won spectrum in the 3.5GHz band. Asia Pacific Telecom also participated in the auction. According to the same source, the unit price per 10MHz bandwidth in the 3.5GHz band reached TWD 5.075 billion, which made it “the most expensive 5G bandwidth in the world.”

- Chunghwa Telecom won 90MHz of spectrum in the 3.5GHz frequency band for TWD 45.675 billion and also secured 600MHz in the 28GHz band for TWD 618 million.

- Far EasTone won 80MHz in the 3.5GHz band with a bid of TWD 40.6 billion, as well as 400MHz in the 28GHz band for TWD 412 million.

- Taiwan Mobile secured 60MHz of spectrum in the 3.5GHz frequency band for TWD 30.4 billion and 200MHz in the 28GHz frequency band for TWD 206 million. Judging from Taiwan Mobile’s current business model, the company is likely to team up with Asia Pacific for rendering related 5G services, leveraging 60MHz bandwidths it won in the 3.5GHz band.

- Taiwan Star won 40MHz in the 3.5GHz band for TWD 19.708 billion, and

- Asia Pacific Telecom secured 40MHz of spectrum in the 28GHz frequency band for TWD 412 million.

- Chunghwa Telecom and Far EasTone secured 90MHz and 80MHz of spectrum in the 3.5GHz band, respectively. Digitimes says these two carriers are expected to compete fiercely in a number of 5G service segments, including IoT, AI and big data.

……………………………………………………………………………………………………………………………………………..

RCR Wireless: Taiwan to open 4.8GHz to 4.9GHz band for dedicated 5G testing

……………………………………………………………………………………………………………

Bloomberg had this to say about Taiwan’t 5G spectrum auction:

The rising costs for licenses shows carriers expect the faster networks — due later this year in Taiwan — will provide a market advantage over competitors. The auction results so far are “blowing away expectations,” New Street Research analysts said in a note dated Jan. 6.

“There is no sign that the bidding will end soon,” Sheih Chi-mau, chairman and chief executive officer of the island’s biggest carrier Chunghwa Telecom, said Monday night in remarks at a company event. “It may take a few more days. The competition is fierce.”

While some other sales of 5G spectrum in similar bands have drawn bigger totals, Taiwan’s is the richest relative to population, according to New Street.

Taiwan’s bidding war suggests strong demand for mid-spectrum airwaves like the 3.5Ghz band in other markets, including for a U.S. sale of the so-called C-Band that could bring about $50 billion. Taiwan has about 29 million mobile phone accounts, an average of more than one per person, but its neighbor China has more than a billion. What makes Taiwanese subscribers especially attractive is that they’re the biggest consumers of data in Asia, according to researcher Tefficient. Average per-user data consumption at Taiwan’s carriers reached as high as 17.6GB per month, compared with 7.6GB in China and 8.5GB in South Korea.

South Korean carriers established the world’s first full commercial 5G services last April. They are expected to have reached 5 million subscribers by the end of 2019. Operators in other countries including the U.S., U.K., Japan and Australia have also offered limited services to the public with plans to introduce wider networks this year.

From LightReading— Robert Clark, contributing editor:

Taiwan’s 5G auction has completed its first round in near-record territory, with the five operators committing NT$138 billion ($4.6 billion) for more than three times the government reserve price.

Just over NT$137 billion went to the 3.5GHz band, putting the medium-sized Asian economy third behind Italy and Germany in aggregate spending and second in terms of spending per megahertz. Bids for the 28GHz frequencies raised about NT$1 billion.

But the auction isn’t over. The regulator, NCC, called a halt Thursday morning after the smallest player, Hon Hai-backed Asia-Pacific Telecom, withdrew from 3.5GHz bidding.

The process will resume on February 21, when the operators are expected to negotiate with each other for specific frequencies within the spectrum bands. The NCC said it would step in only if they are unable to reach agreement.

The biggest winners were Chunghwa Telecom, the number-two operator, which bid NT$45.7 billion for 90MHz of 3.5GHz spectrum, FarEasTone, which committed $40.6 billion for 80MHz, and Taiwan Mobile, which will pay NT$30.45 billion for 60MHz.

Table 1: Current Bids in Taiwan’s 5G Auction

| Chungwha Telecom | FarEasTone | Taiwan Mobile | Taiwan Star | Asia-Pacific Telecom | |

| 3.5GHz | 90MHz; NT$45.67B | 80MHz; NT$40.6B | 60MHz; NT$30.45B | 40MHz; NT$19.71M | N/A |

| 28GHz | 600MHz; NT$618M | 400MHz; NT$412M | 200MHz; NT$206M | N/A | 400MHz; NT$412M |

| Source: NCC Units. | |||||

Local credit agency Taiwan Ratings has warned that with debt loads already expected to rise to fund the 5G rollout, the unexpected high cost of spectrum is adding further pressure. It forecasts operators may “adopt a more conservative approach to infrastructure deployment.”

Investors aren’t too thrilled, either. Since the auction began a month ago, they’ve marked Taiwan Mobile down 4.4% and FarEasTone 2.1%. Chunghwa’s stock is unchanged.

Chunghwa Telecom, the part state-owned giant, has forecast annual 5G investment of up to NT$9-10 billion ($300-334 million), with total cost expected to significantly overtake its total NT$60 billion investment in 4G.

The official Central News Agency reported that telco execs have said privately that, because the sum raised far exceeds the government’s anticipated revenue take, they expect relief measures in the form of tax cuts, incentives, basestation subsidies or other measures.

So far none of these has materialized, but NCC Acting Chairman Chen Yaw-shyang says the government can introduce “administrative measures” to ensure consumers enjoy access to “high-quality and affordable” 5G.

He said the Taiwan cabinet would hold an interdepartmental meeting to discuss distribution of the auction proceeds, including investment in upgrading telecom infrastructure, Taipei Times reported.

The Taiwan Telecommunications Industry Development Association (TTIDA) has also called for 5G to be exempt from spectrum usage charges and for a delay on the issue of spectrum for private network services. (See Taiwan’s Telcos Seek Govt. Help as 5G Auction Blows Out.)

………………………………………………………………………………………………………

References:

https://www.digitimes.com/news/a20200116PD221.html

https://www.lightreading.com/asia-pacific/taiwan-calls-temporary-halt-on-$46b-auction/d/d-id/756907?

Samsung acquires network services provider TWS; SK-Telecom launches Global MEC Task Force

1. Samsung Acquires Network Services Provider TeleWorld Solutions to Accelerate U.S. 5G Network Expansion

Samsung Electronics Co., Ltd. today announced the completion of an agreement to acquire TeleWorld Solutions (TWS), a network services provider headquartered in Chantilly, VA.

TWS provides network design, testing and optimization services to mobile service and cable operators, equipment OEMs and other companies across the U.S. With network builds associated with 5G and 4G LTE enhancements advancing in the U.S, the acquisition will address the need for end-to-end support in delivering network solutions.

TWS, a privately owned company, will operate as a wholly owned subsidiary of Samsung Electronics America, Inc. The service offerings and customers of TWS complement Samsung’s growth among networks infrastructure clients. With competencies in radio frequency (RF) and network design service—as well as installation, testing, and optimization services—TWS will continue to serve its existing customers and clients they currently support with Samsung. The TWS leadership team will continue to manage the business and, together with Samsung, address the network upgrade cycle occurring in the US.

With a growing position in the US networks industry, along with its 5G technology leadership, Samsung Networks has collaborated with major U.S. network operators to fulfill 5G’s network expansion. As its growth continues through network operator agreements and enterprises seeking their own cellular networks, the combination of Samsung and TWS will help customers address next-generation demands.

…………………………………………………………………………………………………………..

2. SK Telecom Joins Forces with Bridge Alliance Members for Cooperation in 5G MEC

SK Telecom today announced the launch of the ‘Global MEC Task Force’ with Bridge Alliance member operators, including Singtel, Globe, Taiwan Mobile and PCCW Global, for cooperation in 5G mobile edge computing (MEC).

SK Telecom will share its lessons-learned in 5G and MEC areas with other members that are preparing to launch 5G, while making joint efforts for the development of MEC technologies and services. The company will also play a leading role in setting international MEC standards to build an interoperable MEC platform.

MEC is being highlighted as a key technology that can improve the performance of ultra-low latency services such as cloud gaming, smart factory and autonomous driving by creating a shortcut for mobile data communications.

Through the task force, SK Telecom expects to lead the expansion of the 5G MEC ecosystem to the Asian countries, and develop valuable overseas market opportunities for its 5G technologies/services including MEC.

As the first chair of the task force, SK Telecom will be hosting the first MEC workshop with Bridge Alliance from January 13 to 15 at its headquarters located in Seoul, Korea. The workshop will identify potential regional MEC-based use cases, and discuss business models and commercialization plans.

The company will introduce its 5G strategies, 5G MEC-based use cases including smart factory, and 5G clusters including ‘LoL Park.’

“As the global 5G pioneer, SK Telecom is committed to contribute to the expansion of the global 5G ecosystem,” said Lee Kang-won, Vice President and Head of Cloud Labs of SK Telecom. “SK Telecom will work closely with Bridge Alliance Member Operators to help accelerate their progress in 5G and MEC, and create a pan-Asian 5G MEC ecosystem.”

“As the role of telecommunications companies is expanding beyond simply providing mobile connectivity to offering new values based on infrastructure, Bridge Alliance believes that this cooperation will serve as a key driver for realizing win-win business opportunities to all members,” said Ong Geok Chwee, CEO of Bridge Alliance.Photo: (from left) Ha Min-yong, VP and Head of Global Alliance Group, SK Telecom, Ong Geok Chwee, CEO of Bridge Alliance, and Lee Kang-won, VP and Head of Cloud Labs, SK Telecom.

For more information, please contact [email protected] or [email protected]

https://www.sktelecom.com/en/press/press_detail.do?page.page=1&idx=1439&page.type=all&page.keyword=

……………………………………………………………………………………………………

U.S. telcos on 5G rollouts (“vague promises”), devices, IoT/smart cities

Here’s what AT&T, Sprint, T-Mobile, and Verizon said about their 5G network rollouts, soon-to-be available devices, and Smart City plans at CES 2020:

AT&T on 5G Devices, Network Plans:

Carrier and media goliath AT&T talked about 5G devices at this year’s CES event in Las Vegas, NV. Currently, AT&T only sells one 5G-capable phone, the Samsung Galaxy Note 10 Plus 5G, but AT&T plans to have 15 5G phones available for use on its low-band 5G spectrum during 2020 (see Comment in the box below this article). The Dallas-based service provider said that other mobile devices, such as laptops, tablets, and hotspots will also be available this year, but no exact number of products were provided.

AT&T’s low-band 5G network went live in December 2019 and is currently available in parts of 19 cities. The carrier’s other 5G network that is built on millimeter-wave and is referred to as 5G Plus is live in parts of 35 cities. AT&T said that it plans to cover 200 million people with its 5G network by this summer.

Sprint IoT, Smart City Updates:

Wireless provider Sprint could merge with T-Mobile any day now, but the Overland Park, Kansas-based carrier hasn’t slowed down in the meantime. Sprint took to CES to launch several new offerings and update the market on its IoT plans.

Sprint unveiled its Certainty network design model, which unites its entire business wireline portfolio, including its wireless, IoT, and security solutions. The carrier also launched IoT Factory 2.0, a dedicated platform that solution providers and businesses can use to build custom IoT solutions for small-to-mid sized businesses in the food service, healthcare and agriculture space.

Chris Brydon, Regional Vice President Sales, Sprint Business Northwest Region via LinkedIn:

We believe hashtagIoT has the power to improve people’s lives. Here’s a story illustrating how an IoT application can be so much more than just a cold, lifeless piece of tech. Watch the very human difference it makes in the lives of a man and his family. https://lnkd.in/gdyeT9N hashtagWorksForBusiness

Sprint updated the market on its Smart City initiative on Tuesday. Specifically in Georgia, the provider said that in 2020 “micropositioning” technology, which combines next-generation wireless technologies and small cells will be installed within city infrastructure in areas to enable real-world navigation for autonomous machines, more connected sensors and IoT solution testing in its innovation Center for solutions such as refrigeration and monitoring, and security robots in Peachtree Corners’ Town Hall. Sprint also has plans to integrate additional Smart City technology in Greenville, South Carolina, and Arizona State University.

T-Mobile Talks 5G, Avoids Sprint Mega-Merger Talk:

T-Mobile didn’t address the main topic on everyone’s mind when thinking about the Magenta-colored carrier: its in-progress $26 billion mega-merger with wireless competitor Sprint. Instead, the “Un-Carrier” took to the show to highlight its 5G connectivity.

In a surprising move last month, the Bellevue, Wash.-based provider launched its nationwide 5G network using 600 MHz spectrum acquired in the recent incentive auction, as well as two 5G phones capable of using its 600 MHz spectrum. T-Mobile originally planned to launch the network in 2020.

Verizon 5G Devices and Ultra Wideband Availability:

AT&T’s biggest competitor, Verizon, also came to CES armed with 5G updates. Compared to AT&T’s 15 devices, Basking Ridge, N.J.-based Verizon vowed to have 20 5G-capable devices in 2020 and said these devices would be competitively priced anywhere between $600-$800. Currently, Verizon has four 5G-capable smartphones. Subscribers interested in 5G will have to pay an additional $10 on top of their current unlimited data plan, Verizon said, but the company didn’t name any specific device manufacturers.

Verizon’s ultra wideband 5G network is available in parts of 30 cities today, including Chicago, Los Angeles, and New York City, as well as Hoboken, N.J. Des Moines, Iowa; and Providence, RI. Please see Comment in the box below this article.

………………………………………………………………………………………

Mike Dano of Lightreading wrote that AT&T and Verizon made “vague (uncertain?) promises” for their 5G mmWave networks:

in a New Year-themed post, AT&T’s Scott Mair wrote that “you’re in for an exhilarating ride on the AT&T 5G network in 2020 and beyond,” but he did not offer any specifics about what the carrier will do with its “5G+” network. Then, during a subsequent appearance at an investor event this week, AT&T CFO John Stephens said only that the operator’s 5G network would “continue to improve and grow.”

Similarly, Verizon touted its “vision” for its network in 2020 in a release issued this week, but said only that customers should “expect more great innovations and technology advancements from us in 2020 including a more aggressive build out of our 5G network.” At that same investor event, Verizon’s Ronan Dunne said “we will be continuing to drive hard” in 5G, but didn’t offer any specifics.

The bottom line here is that neither operator is offering any concrete information on the number of cities, cell sites or customers it plans to touch with mmWave 5G in 2020. As Heavy Reading analyst Gabriel Brown writes, it’s time for these operators to show their hands.

………………………………………………………………………………………………

From a marketwatch.com article titled: The long-promised ‘Year of 5G’ arrives with more promises and little 5G

For years, telecommunications companies and gadget makers have invaded CES to talk about how big 5G was going to be in 2020.

At CES 2020 though the promise was still unfulfilled as the faster wireless service is still spotty and not entirely what was envisioned.

Without the premier connections that were promised, it is questionable how many consumers will buy the more expensive 5G-enabled devices that were introduced at the giant trade show this year, even though the same glowing predictions of a new future were readily available throughout Las Vegas.

5G promises faster data speeds, a reduction in lag time, and greater density for smart devices, all things that could eventually be catalysts for futuristic applications like autonomous driving and connected cities. More immediately, carriers are focused on exposing businesses and customers to those faster data speeds, where and when they can.

Verizon Communications Inc. expects to launch 20 devices with access to 5G by the end of the year, up from the seven that currently exist, according to Tami Erwin, who heads the company’s business group. AT&T Inc. mobility executive Kevin Petersen told MarketWatch at CES that accessibility will also be a key theme in the year ahead.

T-Mobile US claimed that it conducted a nationwide 5G rollout at the end of last year, providing access over a greater area but at slower data speeds than competitors. Verizon and AT&T both plan to add new cities to their coverage later this year, with AT&T still expecting to have nationwide coverage this year also.

Bob O’Donnell, president of TECHnalysis Research, cautions that these upgrades won’t happen right away due to some technical aspects of the 5G rollout. The more exciting type of 5G, millimeter-wave spectrum, primarily works outdoors and on campuses where it’s been specifically deployed. Sub-6 5G service works indoors and offers some benefits in speed and latency, but it’s a less dramatic step up from the 4G service consumers have come to know.

“The pieces are coming together but the forward-looking benefits are still a few years off,” O’Donnell said. Part of the issue is that 5G currently runs on top of 4G, rather than in a stand alone manner. Moving to stand alone 5G requires that carriers “refarm” spectrum frequencies from 4G to 5G, but they’re hesitant to make that big leap right away while most customers are still using 4G connections and while few phones support 5G.

“That’s like opening a 10-lane highway only for people with electric cars,” he said, since only a small minority of drivers would have access.

Making 5G a reality is a bit of a “chicken and egg” scenario, according to O’Donnell, given that carriers thinking about moving away from 4G want there to be enough devices in the market to take advantage of the new wireless standard, and consumers want to make sure 5G networks are broad enough before investing in a mobile device that works on the network.

The device part of the equation showed signs of progress at CES, with connected PCs being one notable category. Lenovo Group Ltd. announced it will launch in the spring the Yoga 5G two-in-one device, which it says is the first 5G PC. Always-connected PCs let customers rely on cellular connectivity rather than hunt for WiFi networks, and the 5G products shown by Lenovo, HP Inc. HPQ, and others offer faster speeds than 4G ones currently on the market.

Those devices are more expensive than competitive gadgets without access to the technology, though, and that will most likely continue to be the case. Samsung Electronics Co. Ltd. will be holding a smartphone launch in early February, where the company is expected to introduce a family of 5G Galaxy devices, and Apple is thought to be planning a 5G iPhone rollout later this year, with analysts expecting the 5G versions of those popular smartphones to carry a higher price tag.

Instinet analyst Jeffrey Kvaal expects “a large increase” in 5G unit sales for 2020, up from a small base of sales last year, but he thinks most of these sales will come at the expense of 4G devices, rather than a rush of upgrades. He estimates that 5G could boost a phone’s retail price by at least $75.

Today’s devices tend to be in the $1,000-plus range, but consumers should “start to see prices coming down, which ultimately helps the adoption curve,” as more mid-tier devices come to market this year equipped with 5G capabilities. Verizon’s consumer chief executive Ronan Dunne said at a Citi investor conference earlier this week that there could be 5G devices priced below $600 by the end of the year.

AT&T Chief Financial Officer John Stephens told investors at the Citi conference that trying to predict 5G unit sales is missing the point a bit, since handset sales are “not a profitable enterprise for a business like ours.” The company sees various new service revenue opportunities from being able to compete “in the geographies where our service has gotten much better.”

The promise of 5G goes well beyond smartphones, and executives pointed out that the services that have developed in the past decade likely wouldn’t have existed without the move to 4G.

“If someone was watching a streaming video on a connection 10 years ago, you would’ve swatted the phone out of their hand and said they were going to use up the whole monthly data plan in 13 seconds,” Qualcomm’s vice president of engineering John Smee told MarketWatch. Now, streaming over wireless is commonplace. Verizon’s Erwin noted that the proliferation of ride hailing also wouldn’t have been possible without the upgrade in data speeds.

AT&T’s Petersen thinks it’s too soon to know what the killer use case for 5G will be, but he’s upbeat about its ability to provide upgraded experiences in gaming, translation and medicine. A reduction in latency, or lag time, could create better responsiveness for gamers and reduce awkward pauses when people are using mobile devices to translate from one language to another in real time. Doctors could more easily monitor patients remotely after procedures by using connected devices.

Over time, the expected benefits of 5G and the growth of accessible smart devices could change the way consumers and workers think about doing data-heavy tasks. Smee even suggested that it could replace the need for Wi-Fi for most users.

“If you think of your cable modem or your DSL and you look at the rates you get compared to the 5G data rate, all of a sudden wireless is the preferred medium and that’s a big game changer versus the idea that you have to have wired connectivity to have high data rates,” he said.

References:

https://www.crn.com/slide-shows/networking/ces-2020-top-telecom-carriers-talk-5g-new-devices-and-iot

Nokia claims to have 63 signed 5G contracts

Nokia has reached 63 commercial 5G contracts worldwide, positioning it as a global leader in the delivery of end-to-end 5G solutions. The 5G customer list includes AT&T, KDDI, Korea Telecom, LG Uplus, NTT Docomo, O2, SK Telecom, SoftBank, Sprint, STC, T-Mobile US, Verizon, Vodafone Italy and Zain Saudi Arabia. Nokia said it expects to add “many more new deals” this year. The 63 signed commercial contracts exclude any other type of 5G agreements, such as paid network trials, pilots or demonstrations. If such agreements were to be included, the total number of 5G agreements would reach over 100, Nokia said. The group counts more than 350 customers for 4G-LTE.

The company noted that its equipment has been selected by many of the early 5G adopters. It’s working with all four nationwide operators in the US, all three operators in South Korea and all three nationwide operators in Japan. The early start should provide it with extra expertise to assist the next wave of operators launching 5G.

“This milestone highlights the quality and customer confidence in our 5G portfolio and we expect this to continue this year with the addition of many more new deals,” said Tommi Uitto, President of Mobile Networks at Nokia. “Our global end-to-end portfolio includes products and services for every part of a network, which are helping network operators to enable key 5G capabilities such as network slicing, distributed cloud and the industrial Internet of Things. We are delighted that our technologies are helping to shape the delivery and deployment of 5G technologies worldwide and the myriad benefits these will bring to businesses and consumers alike.”

The 63 signed commercial contracts exclude any other type of 5G agreements, such as paid network trials, pilots or demonstrations. If such agreements were to be included, the total number of 5G agreements would reach over 100. Nokia is also a vendor of choice for almost all of the leading early adopter 5G markets.

“Nokia is the only network supplier whose 5G technology has been contracted by all four nationwide operators in the US, all three operators in South Korea and all three nationwide operators in Japan”, Uitto said. “We have more than 350 customers in 4G, but these first 63 customers represent some two thirds of our global Radio Access Networks business in a typical year. Further, these 63 contracts – across the most important pioneering markets, across low bands, middle bands and high bands, and across traditional and cloud network architectures – provide us with invaluable early experiences and insights for the benefit of the rest of the world. So, it is a great start”, he continued.

Nokia claims to be the only vendor with a globally available end-to-end product portfolio that covers all 5G network elements, including radio, core, cloud and transport as well as management, automation and security. This offers operators and enterprise customers with a simple and efficient step-wise upgrade to existing radio access, core and transport domains which helps customers to a faster path to 5G. Approximately 60% of Nokia’s 5G customers select more than just New Radio from its end-to-end portfolio.

Nokia also declared more than 2 000 5G patent families as essential for 5G, a year after making its first declarations for the 3GPP Release 15 specification. Nokia continues to contribute to 3GPP Release 16 as well as participate in ITU-R WP 5D where IMT 2020 radio aspects are being standardized.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

About Nokia

We create the technology to connect the world. We develop and deliver the industry’s only end-to-end portfolio of network equipment, software, services and licensing that is available globally. Our customers include communications service providers whose combined networks support 6.1 billion subscriptions, as well as enterprises in the private and public sector that use our network portfolio to increase productivity and enrich lives.

Through our research teams, including the world-renowned Nokia Bell Labs, we are leading the world to adopt end-to-end 5G networks that are faster, more secure and capable of revolutionizing lives, economies and societies. Nokia adheres to the highest ethical business standards as we create technology with social purpose, quality and integrity. www.nokia.com

Media Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: [email protected]

References:

Investment Analysts: Soft Telecom Capital Spending (CAPEX), but 5G in China to Grow 25% in 2020

Investor’s Business Daily reports that Goldman Sachs‘ Rod Hall and Bank of America‘s Tal Liani issued separate notes Tuesday and Wednesday which came to the same conclusion: Despite the ultra hyped 5G buildup, they see overall telecom capital spending remaining soft in 2020.

Hall said, “Telco capital spending trends look set to be muted with China being the only driver of growth,” in his note, issued Tuesday. He sees 5G growth in China of 25% this year, but predicts only a 2% hike in global telecom capital spending.

Hall added: “The carrier environment is challenged globally by flat or declining revenue streams with 5G thus far offering limited or no additional revenue opportunities.”

BofA’s Liani concurred in his Wednesday note. He sees global telecom capital spending up only 1% to 2% in 2020, despite 5G network build-outs. The 5G build-out may fail to impress U.S. wireless customers over the next 12 months, he adds. “Contrary to the belief that the U.S. is an early leader with 5G, we see potential for users to be disappointed with either lack of coverage or lack of improvement, or both,” Liani said. Here is an excerpt of his January 8, 2020 note to clients:

5G becomes mainstream, but the U.S. will likely lag:

5G traction remains front and center for 2020, and we expect the first phase of a major smartphone refresh cycle in 2H20, with all major vendors launching 5G devices. In 2019, we saw initial network build-outs, and we expect the device/semiconductor ecosystem to catch up in 2020, supporting and enabling ubiquitous 5G devices. However, some regions may lag behind, particularly the US where a lack of quality 5G spectrum injects delays vs. certain parts of Europe, China, Korea and Japan where mid-band spectrum is more readily available. Our top pick related to this theme is Qualcomm as the semi provider benefits from 5G devices and the China launch.

Verizon Communications and AT&T likely will lower spending on existing fourth-generation networks, says Goldman Sachs’ Hall. They’ll also pare back spending on wireline networks. “Although U.S. 5G deployments should advance in 2020 our U.S. telecom team expects wireless capex to be roughly flat in 2020 as 5G increases are mostly offset by slowing non-5G spending,” Hall said.

Makers of electronic chips, network gear and fiber-optic technologies should gain from the 5G build-out, analysts say. Other5G stocks to watch will be tied to the deployment of “small cell” antennas, radio access network equipment as well as cloud computing infrastructure. Goldman Sachs favors fiber-optic play Corning. It’s cautious on gear makers Nokia and Ericsson.

Liani said Apple’s expected launch of 5G iPhones in late 2020 could be a game-changer. However, he says consumers may be disappointed in the 5G network coverage and 5G speeds provided by Verizon, AT&T, T-Mobile US and Sprint. That’s because not enough mid-band radio spectrum is available yet for 5G services, Liani said.

He calls Qualcomm one of the best 5G stocks to buy because it’s dependent on smartphone sales, not core network upgrades. Qualcomm‘s customers include Apple and Chinese smartphone makers.

In 2020, we see potential for mass device availability to usher in the first meaningful device upgrade cycle for 5G,” Liani added. “In 2021 and 2022, we expect the network equipment investments to potentially pick up once again as 5G usage accelerates and new applications emerge. Most importantly, however, spectrum availability drives both network upgrades and likely customer satisfaction with the new 5G networks.

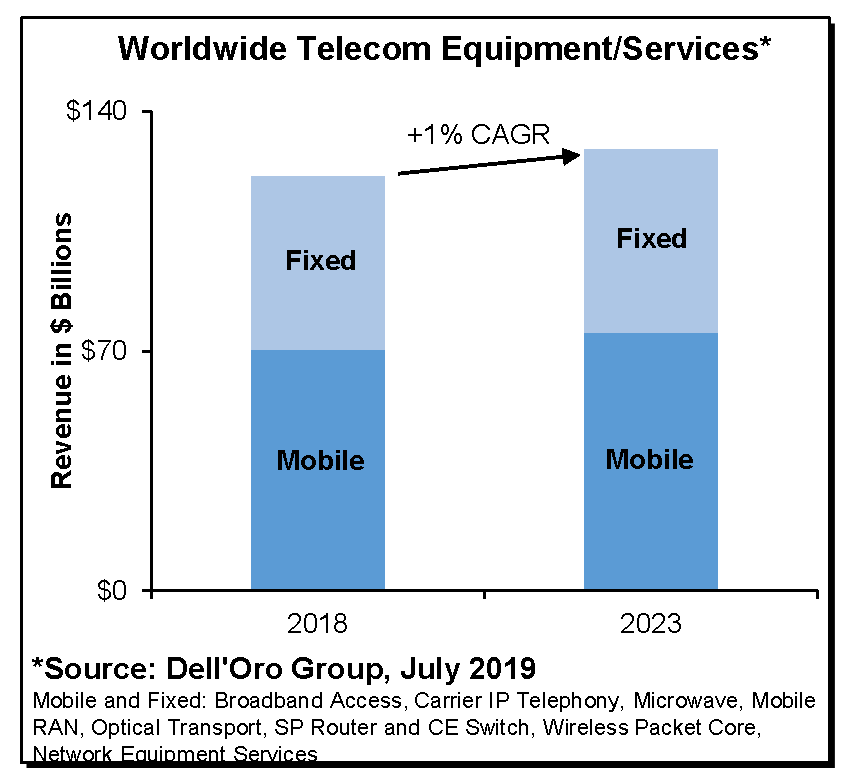

Let’s close with an interesting graph from Dell’Oro Group which shows very little growth in telecom equipment/services through 2023:

Reference:

https://www.investors.com/news/technology/5g-stocks-telecom-capital-spending/

……………………………………………………………………………………………………………………………………………………………………………..

Addendum: BoAML – Hardware vendors bow to the white box:

Hardware standardization and white box networking continue and drive changes in IT equipment purchasing behavior. Hardware vendors are increasingly being forced to react to three major realities:

1) public cloud capex represents the majority of growth and some companies (e.g. Cisco) find it hard to penetrate,

2) software is taking the forefront, with vendors of traditional networking gear, like ADC, switching, or routing, facing significant pricing pressure and a new breed of competitors, and

3) the value is also pushed to semiconductors, with Cisco’s SiliconOne semiconductor strategy and the proposed acquisition of Acacia designed to address the associated risk and opportunity

Lastly, the trends of software-defined networking, white boxes, and cloud migration come together to support our fifth major trend for 2020: the shift to software-defined branch/campus offices. In our view, this trend began with SD-WAN, continued with Cisco’s Catalyst 9k introduction, and comes fully together with the acceleration of WiFi 6.

Gartner: Telco Pricing Options for 5G Services (before 5G is standardized)

by Stephanie Baghdassarian with Comments by Alan J Weissberger

Introduction:

The advent of 5G will bring opportunities for Communications Service Providers (CSPs) to renew their commercial approach to end users. Whether they propose new services or repackage existing ones, CSPs should focus on simplicity and flexibility to make the most of their offerings.

CSPs should differentiate their 5G services by selecting and combining pricing approaches that fit with their customer base but not limit themselves to pricing as a tool to promote 5G.

…………………………………………………………………………………………….

AJW Comment: This Gartner report is only available by subscription. However, we think it is very premature as “5G” networks continue to be deployed well before the IMT 2020 set of standards is completed ( IMT 2020.specs for RIT/SRIT won’t be completed till end of Nov 2020 at the earliest). Hence, CSPs really don’t have any foundation to charge for 5G services till at least 2021.

From the ITU 5G Backgrounder webpage:

IMT-2020, the name used in ITU for the standards of 5G, is expected to continue to be developed from 2020 onwards, with 5G trials and pre-commercial activities already underway to assist in evaluating the candidate technologies and frequency bands that may be used for this purpose. The first full-scale commercial deployments for 5G are expected sometime after IMT-2020 specifications are finalized.

Furthermore, spectrum is a scarce and very valuable resource, and there is intense – and intensifying – competition for spectrum at the national, regional and international levels. As the radio spectrum is divided into frequency bands allocated to different radiocommunication services, each band may be used only by services that can coexist with each other without creating harmful interference to adjacent services.

ITU-R studies examine the sharing and compatibility of mobile services with a number of other existing radiocommunication services, notably for satellite communications, weather forecasting, monitoring of Earth resources and climate change and radio astronomy.

National and international regulations need to be adopted and applied globally to avoid interference between 5G and these services and to create a viable mobile ecosystem for the future — while reducing prices through the global market’s economies of scale and enabling interoperability and roaming.

That’s why it was important for the additional spectrum to be used by 5G to be identified and harmonized at global and regional levels. For similar reasons, the radio technologies used in 5G devices need to be supported by globally harmonized standards.

CES 2020: Lenovo Yoga 5G claims to be the first 5G laptop PC

Lenovo has displayed the world’s first “5G” laptop at CES 2020 in Las Vegas, NV. The Chinese company says the Lenovo Yoga 5G is the first PC to be able to connect to (pre-IMT 2020 standard) 5G mmWave networks. However, neither the spectrum used nor the “5G” networks supported were disclosed. The Yoga 5G also supports Bluetooth 5.0 wireless connectivity, but (astonishingly) WiFi is not listed in the data sheet.

The Lenovo Yoga 5G will go on sale in the first quarter of 2020, starting at $1,499 (around £1,200, AU$2,100), and in North America will be known as the Lenovo Flex 5G.

The Lenovo Yoga 5G was previously known as Project Limitless before its official name was unveiled yesterday at CES 2000. As with other Yoga laptops, this is an ultra-portable 2-in-1 device, with a screen that can be folded backwards to turn it into a tablet.

The Lenovo Yoga 5G is also the first laptop to run on the Qualcomm Snapdragon 8cx platform, which includes built-in support for 5G connections, allowing the Yoga 5G to connect via a service provider and access super-fast mobile internet. According to Lenovo, this will allow the user to download large files easily, with download speeds of around 4Gb/s. The company says its 5G laptop is “up to 10 times faster than 4G through a 5G service provider when on the move and reliable WiFi access at home.” That’s quite impressive!

Lenovo said in a press release “5G technology will change entire industries as we know them, disrupting some while helping to launch others.”

Lenovo NOTES:

- Requires 5G network service and separately purchased cellular data plan that may vary by location. Additional terms, conditions and/or charges apply. Connection speeds will vary due to location, environment, network conditions and other factors.

- “5G” Download speeds vary by region and service provider, e.g. Verizon in U.S. offers up to 4Gbs/second. Network strength also varies by 5G service provider.

References:

Lenovo Breaks Barriers with New Consumer Technology Unveiled at CES 2020

https://news.lenovo.com/wp-content/uploads/2020/01/Lenovo-Yoga-5G_14Inch_Qualcomm.pdf

Juniper Research: Telco Operator Voice Revenue to Drop 45% by 2024, Under a Growing OTT Challenge

A new study from Juniper Research has found that mobile operator voice revenue will drop to $208 billion by 2024 from $381 billion in 2019, as users continue to prefer more flexible and free OTT (Over-the-Top) services.

The new research, Mobile Voice: Emerging Opportunities for Operators & Vendors 2019-2024, forecasts that third-party OTT voice services will continue to grow; nearing 4.5 billion users by 2024. The study found that while this trend will contribute to declining voice revenue for operators, 5G proliferation will propel a number of nascent mobile voice and video services; generating fresh revenue streams for service providers.

Operator Voice Revenue Falls, as OTT managed VoIP Users Continue to Grow

The research forecasts that operator voice revenue will decline by 45% by 2024, in the face of an increase of 88% in the total number of third-party OTT mVoIP users over the next five years. The study urges operators to invest in AI-enabled communications platforms that facilitate competitive voice service delivery.

However, the research anticipates that improved 4G coverage and a growing number of capable devices will boost the number of mobile video call users; partially offsetting voice revenue losses. The study forecasts that ViLTE (Video over LTE) operator revenue will exceed $33 billion by 2024.

RTI (Real-Time-Interaction) and Vo5G (Voice Over 5G)

The report anticipates that 5G proliferation will generate new revenue streams for operators by enabling innovative use cases for VoLTE and ViLTE. The study notes that high data throughput and low latency will propel emerging services such as RTI, remote control and Vo5G, which will find wide application across a range of industries.

Additionally, the research prompts operators to accelerate VoLTE launches, in order to benefit from emerging Vo5G services. The study notes that establishing a 5G-enabled IMS (IP Multimedia Subsystem) infrastructure for VoLTE will provide a pivotal foundation for future voice services rollouts, which operators can monetise in upcoming years.

For more insights on mobile voice, download the free whitepaper: How Will 5G Evolve Mobile Voice in an AI-driven World.

……………………………………………………………………………………………..

Juniper Research provides research and analytical services to the global hi-tech communications sector, providing consultancy, analyst reports and industry commentary.

For further details please contact:

Sam Smith, Press Relations

Telephone: +44(0)1256 830002

Email: [email protected]

Samsung #1 in Global 5G smartphone sales with 6.7 Million Galaxy 5G Devices in 2019

Samsung Electronics Co., Ltd. said that it shipped more than 6.7 million Galaxy 5G smartphones globally in 2019, giving consumers the ability to experience next-generation speed and performance. As of November 2019, Samsung accounted for 53.9% of the global 5G smartphone market and led the industry in offering consumers five Galaxy 5G devices globally, including the Galaxy S10 5G, Note10 5G and Note10+ 5G, as well as the recently launched Galaxy A90 5G and Galaxy Fold 5G.

The 6.7 million in Samsung 5G smartphone sales eclipses the 4 million target the firm set itself, though as its main Android competitor (Huawei) is being stifled by political friction, it is hardly surprising Samsung has stormed into the lead. Note also that Apple has not announced a 5G smartphone and probably will not do so till late 2020. In the absence of main competitors, Samsung is maintaining its leadership position in the 5G segment as well as 4G-LTE.

“Consumers can’t wait to experience 5G and we are proud to offer a diverse portfolio of devices that deliver the best 5G experience possible,” said TM Roh, President and Head of Research and Development at IT & Mobile Communications Division, Samsung Electronics. “For Samsung, 2020 will be the year of Galaxy 5G and we are excited to bring 5G to even more device categories and introduce people to mobile experiences they never thought possible,” he added.

The Galaxy Tab S6 5G, which will be available in Korea in the first quarter of 2020, will be the world’s first 5G tablet bringing ultra-fast speeds together with the power and performance of the Galaxy Tab series. With its premium display, multimedia capabilities and now, 5G, the Galaxy Tab S6 5G offers high-quality video conferencing, as well as a premium experience for watching live and pre-recorded video streams or playing cloud and online games with friends.

“5G smartphones contributed to 1% of global smartphone sales in 2019. However, 2020 will be the breakout year, with 5G smartphones poised to grow 1,687% with contribution rising to 18% of the total global smartphone sales volumes,” said Neil Shah, VP of Research at Counterpoint Research. “Samsung has been one of the leading players catalyzing the 5G market development in 2019 with end-to-end 5G offerings from 3GPP standards contribution, semiconductors, mobile devices to networking equipment. With tremendous 5G growth opportunities on the horizon, Samsung, over the next decade, is in a great position to capitalize by further investing and building on the early lead and momentum, ” Shah added.

………………………………………………………………………………………………………………………………………………………………………………………….

Sidebar: Qualcomm or Samsung 5G silicon in future 5G devices?

It has become widely accepted that the latest Qualcomm chipset features in the majority of flagship smartphone devices throughout the year. Only two smartphone makers – Samsung and Huawei – have said they were making their own 5G chipsets which would be integrated into their 5G smartphones. Will Samsung use both its own silicon as well as Qualcomm’s in future 5G devices?

Over the next few months Qualcomm will begin shipping both the Snapdragon 865 and Snapdragon 765 chipsets. The Snapdragon 865 is more powerful, though 5G is on a separate modem, potentially decreasing the power efficiency of devices. The Snapdragon 765 has 5G connectivity integrated, though is notably less powerful. Whichever chipset OEMs elect for, there will be a trade-off to stomach.

Looking at the rumours spreading through the press, it does appear many of the smartphone manufacturers are electing for the Snapdragon 865 and a paired 5G modem in the device. Samsung’s Galaxy S11, Sony Xperia 2 and the Google Pixel 5 are only some of the launches suggested to feature the Snapdragon 865 as opposed to its 5G integrated sister chipset.

With Mobile World Congress 2020 in Barcelona just two months away, there is amble opportunity for new 5G devices to be launched prior, during and just after the event. It will be interesting to see what 5G silicon is used in them.

Incomplete (or non existent) 5G Standards:

Of critical importance is that there are currently no standards for 5G implementations. The closest is IMT 2020.SPECS which won’t be completed and approved till November 23-24, 2020 ITU-R SG5 meeting or later. That spec will likely not include the 5G packet core (5GC), network slicing, virtualization, automation/orchestration/provisioning, network management, security, etc which will either be proprietary or use 4G LTE infrastructure. It also might not include signaling, ultra low latency or ultra high reliability, depending on completion of those items in 3GPP Release 16 and its disposition to ITU-R WP 5D.

………………………………………………………………………………………………………………………………………………………………………………………..

For nearly a decade, Samsung has worked to bring 5G from the lab to real life by working closely with carrier partners, regulatory groups and government agencies to develop the best 5G experience possible. As a leading contributor to industry groups like 3GPP and O-RAN Alliance, Samsung is committed to an open, collaborative approach to networking, which has helped to accelerate delivery of 5G to consumers and businesses. Over the past year, in addition to launching a robust 5G device portfolio, the company reached several historical milestones including providing network equipment for the world’s first 5G commercial service in Korea as well as working closely with global carrier partners to expand 5G networks and introduce 5G experiences and use cases.

In the year ahead, Samsung says they will continue to lead the market in 5G innovation by introducing new advancements that will improve the speed, performance and security of Galaxy 5G devices even further. In 2020, these advancements will give even more people access to new mobile experiences that change the way they watch and interact with movies, TV and sports, play games and talk with friends and family.

For more information about Samsung Galaxy 5G devices please visit news.samsung.com/us/galaxy-5g/, www.samsungmobilepress.com or www.samsung.com/galaxy.

References:

https://news.samsung.com/us/samsung-galaxy-5g-devices-shipping-more-than-6-million-2019/

https://telecoms.com/501580/samsung-claims-the-5g-lead-after-6-7-million-shipments/

https://www.extremetech.com/mobile/304091-samsung-shipped-over-6-7-million-5g-phones-in-2019