SK Telecom Builds ‘5G Cluster’ which includes AR, VR, and AI for South Korea

Overview of ‘5G Cluster:”

SK Telecom today announced its strategy to build ‘5G Cluster’ nationwide to further foster 5G services and benefits. Since the world’s first “5G” commercialization in April 2019, the number of 5G subscribers in South Korea has surpassed 1 million- far more than in any other country.

SK Telecom’s ‘5G Cluster’ is an advanced 5G environment with cutting-edge ICT including AR, VR, and AI. The Korean telco plans to build ‘5G Cluster’ in business districts, parks, factories, and etc. to provide differentiated 5G service and benefits in both of B2C and B2B sectors.

In the B2C sector, SK Telecom will operate ‘5G League of Legends (LoL) Park’ at Jonggak, Seoul, starting from July 25. At ‘5G LoL Park’, customers can view messages from supporting fans nationwide with Augmented Reality (AR) by facing their smartphones toward a certain location. Customers can also enjoy VR live broadcasting and VR playback during the games.

Starting this August, SK Telecom will provide a service that allows customers to meet a variety of animals, including giant cats and wyverns (a winged two-legged dragon with a barbed tail), using AR in Olympic Park and Yeouido Park, Seoul. For example, if customers hold their smartphones toward ‘The Lone Tree’ in Olympic Park, a giant cat will appear on smartphone screen in AR.

Moreover, the company plans to transform Jamsil Students’ Gymnasium into a 5G Stadium. SKTelecom will further expand 5G experience spaces with immersive media by the end of this year.

In the B2B sector, SK Telecom will apply 5G network and ‘Mobile Edge Computing’ (MEC) solution to SK Hynix to build a ‘5G Smart Factory’. The two companies expect that this will drastically reduce time to detect defective semiconductor products and more efficiently manage production and logistics.

Furthermore, SK Telecom plans to build a total of 12 Mobile Edge Computing (MEC) for 5G networks, to be located at key regions nationwide (South Korea). In particular, the company will provide dedicated 5G edge cloud service for enterprises that are in need of security and ultra-low latency communications, including manufacturing, media, finance, and game industry.

“With ‘5G Cluster’ as our key focus, SK Telecom will provide customers with outstanding service and pleasure that are beyond the imagination,” said Yoo Young-sang, Executive Vice President and Head of MNO Business of SK Telecom. “We will strive to create added values to different industries and regions.”

Yoo Young-sang, head of mobile network operator business at SK Telecom, speaks during a press conference at the company’s 5G smart office in Seoul, Thursday. Photo Courtesy of SK Telecom

“We are currently constructing smart factory systems at SK Hynix plants. We expect our 5G services will enable many companies in the manufacturing sector to use the automated logistics system and control manufacturing process in real time,” Yoo said. “By accumulating practical experiences with SK Hynix, we will bring about technological innovation.”

……………………………………………………………………………………………………………………………………………………………………………

About SK Telecom:

SK Telecom is the largest mobile operator in Korea with nearly 50 percent of the market share. As the pioneer of all generations of mobile networks, the company has commercialized the fifth generation (5G) network on December 1, 2018 and announced the first 5G smartphone subscribers on April 3, 2019. With its world’s best 5G, SK Telecom is set to realize the Age of Hyper-Innovation by transforming the way customers work, live and play.

Building on its strength in mobile services, the company is also creating unprecedented value in diverse ICT-related markets including media, security and commerce.

For more information, please contact [email protected] or [email protected]

………………………………………………………………………………

Related posts:

SK Telecom and Samsung Bring South Korea Closer to 5G Standalone Commercialization

MWC 2019: Korean companies set to present new world of 5G connectivity & smart phones

OpenSignal reports on 5G Speeds and 4G LTE Experience in South Korea & Other Countries

ITU-R WP5D Brazil Meeting: Complete IMT 2020 RIT/SRITs from 3GPP, China & Korea advance; Nufront submits new EUHT RIT

SOURCE: Meeting Report of ITU-R WP5D Working Group on Technology Aspects (17 July 2019)

IMT-2020 RIT/SRITs:

This past week’s 32nd meeting of ITU-R WP 5D in Brazil was a milestone for the IMT-2020 process described in Document IMT 2020/2(Rev.1): Step 3 – submission / reception of the RIT and SRIT proposals and acknowledgement of receipt.

Seven submissions of candidate IMT-2020 RIT/SRITs were received at this meeting. Importantly, some were updates to their previous submissions.

- 3GPP – RIT

- 3GPP -SRIT

- China (People’s Republic of)

- South Korea (Republic of)

- ETSI (TC DECT) and DECT Forum

- TSDSI (India)

- Nufront [1]

Note 1. At this week’s ITU-R WP5D meeting in Brazil, Nufront (Beijing) Technology Co. Ltd (Nufront) proposed ‘EUHT’ RIT as the candidate IMT-2020 radio interface technology. The Nufront new candidate RIT is in addition to the RIT/SRITs previously input by 3GPP, China, South Korea, TSDSI (India), ETSI/DECT Forum.

Nufront provided the characteristics template, link budget template, compliance template, and self-evaluation report of the EUHT RIT. The submission templates follow the ITU-R IMT-2020 submission format and guidelines as defined in Report ITU‑R M.2411.

–>Please refer to my Comment in the box below this article. It provides background on motivation for Nufront’s EUHT RIT proposal and their (failed) attempt to get IEEE 802.11AX to be included as either a merged RIT or a SRITs.

…………………………………………………………………………………………………………………………………………………………………………………..

After review of all the submissions (see Table 1. below) under the IMT-2020 process Step 3 (the cut off date for submissions of candidate IMT 2020 RIT/SRITs), the meeting determined that the submissions from 3GPP (SRIT and RIT), China and Korea are “complete” per section 5 of Report ITU-R M.2411. Therefore, they fulfilled the requirements for submission in Step 3 of the IMT-2020 process.

The meeting is of the view that, the supplied self-evaluation and any amendments accepted during this meeting for the submissions of ETSI (TC DECT) and DECT Forum (the component RIT DECT-2020 NR), Nufront and TSDSI do not yet permit WP 5D to determine if a complete and satisfactory self-evaluation as required by the IMT-2020 process has been fully provided.

A way forward for these submissions has been agreed by the meeting (Doc. 5D/TEMP/778-only available to those who have a TIES account). The Proponents should provide the full details requested in the process and in the specifically defined way to WP 5D, considering the comments raised in this meeting, in order for WP 5D to proceed further in the process with the submissions.

A decision on the submission above shall be taken in 33rd meeting WP 5D in December 2019.

For convenience, these submitted proposals are also posted on the “Web page for IMT-2020 submission and evaluation process.”

Under the IMT-2020 submission and evaluation process, the ITU-R will now proceed with the detailed evaluation of the proposed candidate technologies until 34th meeting of WP 5D in February 2020.

Table 1. Candidate RIT/SRIT Submissions from 3GPP, China, Korea, ETSI and DECT Forum, Nufront and TSDSI:

Seven submissions of candidate IMT-2020 RIT/SRITs were received at this meeting; some were updates to their previous submissions.

Table 3.4.3.A (documents listed are only available to those who have a TIES account with itu.int)

| RIT/SRIT Proponent | Candidate Technology Submission |

| 3GPP – SRIT | Docs. 5D/1215 and 5D/1216 |

| 3GPP – RIT | Docs. 5D/1215 and 5D/1217 |

| China (People’s Republic of) | Doc. 5D/1268 |

| Korea (Republic of) | Doc. 5D/1233 |

| ETSI (TC DECT) and DECT Forum | Docs. 5D/1230 and 5D/1253 |

| Nufront | Doc. 5D/1238 |

| TSDSI | Doc. 5D/1231 |

………………………………………………………………………………………………………………………………………………………………………………………….

IMT-2020/VVV:

The meeting agreed to complete this document (IMT-2020/VVV) at this meeting, rather than the original plan of the #34 meeting. During development of the document, it was agreed to follow the approach adopted by WP 5D for the development of IMT-Advanced (aka “LTE Advanced).

The finalized new IMT-2020/VVV document on “Process and use of the Global Core Specification (GCS), references, and related certifications in conjunction with Recommendation ITU-R M.[IMT-2020.SPECS]” is in Document 5D/TEMP/728 (only available to those who have a TIES account).

…………………………………………………………………………………………………………………………………………………………………………………………..

Synchronization of multiple IMT-2020 TDD networks:

This meeting received two input documents and continued the discussion. It was decided to carry forward all the input documents and to continue the work at the WP 5D #34 meeting in February 2020 (see Objectives for meeting #34 below).

…………………………………………………………………………………………………………………………………………………………………………………………..

Documents for consideration by WP 5D closing plenary:

The following documents were agreed by WG Technology Aspects and were provided to WP 5D closing plenary for approval.

- Draft IMT-2020/VVV − Process and the use of Global Core Specification (GCS), references and related certifications in conjunction with Recommendation ITU R M.[IMT-2020.SPECS]

- Draft IMT-2020 document − Detailed schedule for finalization of the first release of new Recommendation ITU-R M.[IMT-2020.SPECS] “Detailed specifications of the terrestrial radio interfaces of International Mobile Telecommunications-2020 (IMT-2020)”

- Liaison statement to External Organizations on the detailed schedule for finalization of the first release of new Recommendation ITU-R M.[IMT‑2020.SPECS]

- Liaison statement to 3GPP proponent concerning the time interval to provide transposing references for IMT 2020

- Many more documents, which are beyond the scope of the IEEE Techblog

…………………………………………………………………………………………………………………………………………………………………………………………..

Objectives for the ITU-R WP 5D meetings #33 and #34:

I. The next ITU-R WP 5D meeting #33, scheduled to be held in December 2019, will be entirely focused on the activities of the Technology Aspects Working Group. It should be noted that neither the General Aspects Working Group nor the Spectrum Aspects Working Group will be in session at the 33rd meeting. The next meeting at which Working Group Spectrum Aspects will be in session will be at the 34th meeting of WP 5D scheduled to be held in February 2020.

5D meeting #33 will be a focused meeting on the following technology aspects and will include the workshop on evaluation of IMT-2020 terrestrial radio interfaces (Doc. 5D/TEMP/809):

- Review additional materials to be provided by the candidate IMT-2020 RIT/SRIT proponents ETSI (TC DECT) and DECT Forum, Nufront and TSDSI, per the agreed way forward at the 32nd WP 5D meeting with regard to their respective submissions;

- Review of external activities in Independent Evaluation Groups through interim evaluation reports.

- Continue work on revision of Recommendation ITU-R M.1457-14

Note: SWG Out of band emissions and SWG Radio Aspects will not have any session at the WP 5D #33 meeting. Contributions to the respective work items would be considered at the WP 5D #34 meeting.

II. The key objectives of the Technology Aspects WG for the 34th ITU-R WP 5D meeting:

- Review of external activities and evaluation reports of Independent Evaluation Groups. Complete evaluation reports summary (IMT-2020/ZZZ).

- Continue the work on “Over-the-air (OTA) TRP field measurements for IMT radio equipment utilizing AAS” based on the requested response from 3GPP and expected input from other organisations and administrations.

- Continue work on revision of Recommendation ITU-R M.1457-14.

- Continue work on synchronization of multiple IMT-2020 TDD networks.

Special Details About WP 5D Meeting #33 – December 2019:

This is a focused Technology Aspects Working Group meeting on the conclusion of Step 3, continuation of Step 4, and the evaluation of IMT-2020 submitted candidate technologies including a Workshop, and related matters. Sessions of the meeting of the Working Groups and their SWGs in WP 5D meeting #33 are:

| Working Groups/SWGs | |

| Technology Aspects | IN SESSION |

| SWG COORDINATION

SWG EVALUATION SWG IMT SPECIFICATIONS |

IN SESSION |

| General Aspects | NOT in session |

| Spectrum Aspects | NOT in Session |

| Ad Hoc Workplan | IN SESSION –

ONLY for matters directly related to the Technology Aspects WG |

……………………………………………………………………………………………………………………………………………………………………………..

Appendix I: High-level scopes for Working Party 5D working and Ad hoc Groups:

| Group | Scope | Chairman |

| WG GENERAL ASPECTS | – To develop deliverables on services, forecasts, and also convergence of services of fixed and mobile networks which take account the needs of end users, and the demand for IMT capabilities and supported services. This includes aspects regarding the continued deployment of IMT, other general topics of IMT and overall objectives for the long-term development of IMT. To update the relevant IMT Recommendations/Reports.

– To ensure that the requirements and needs of the developing countries are reflected in the work and deliverables of WP 5D in the development of IMT. This includes coordination of work with ITU-D Sector on deployments of IMT systems and transition to IMT system. |

K.J. WEE

Korea |

| WG TECHNOLOGY ASPECTS | – To provide the technology related aspects of IMT through development of Recommendations and Reports. To update the relevant IMT‑2000 and IMT-Advanced Recommendations. To work on key elements of IMT technologies including requirements, evaluation, and evolution. To develop liaison with external research and standardization forums, and to coordinate the external and internal activities related to the IMT-2020 process.

– To manage the research topics website and its findings. |

H. WANG

China |

| WG SPECTRUM ASPECTS | – To undertake co-existence studies, develop spectrum plans, and channel/frequency arrangements for IMT. This includes spectrum sharing between IMT and other radio services/systems coordinating as appropriate with other Working Parties in ITU-R. | A. JAMIESON

New Zealand |

| AD HOC WORKPLAN | – To coordinate the work of WP 5D to facilitate efficient and timely progress of work items. | H. OHLSEN

Sweden |

Appendix II: Work with involved organizations, including research entities:

The strategy for ITU-R WP 5D going forward is to gather information from the organizations involved in the global research and development and those that have an interest in the future development of IMT and to inform them of the framework and technical requirements in order to build consensus on a global level.

ITU-R WP 5D can play an essential role to promote and encourage these research activities towards common goals and to ensure that information from the WP 5D development on the vision, spectrum issues, envisioned new services and technical requirements are widespread among the research community. In the same manner, WP 5D encourages inputs from the external communities involved in these research and technology developments.

It is evident that continuing dialogue between the ITU and the entities taking part in research is a key to the continuing success of the industry in advancing and expanding the global wireless marketplace.

Working Party 5D, as is the case with all ITU organizations, works from input contributions submitted by members of the ITU. In order to facilitate receipt of information from external entities who may not be direct members of ITU, the Radiocommunication Bureau Secretariat may be considered as the point of interface, in accordance with Resolution ITU-R 9‑5.

The following major activities are foreseen to take place outside of the ITU, including WP 5D, in order to successfully complement the WP 5D work:

–Research on new technologies to address the new elements and new capabilities of IMT‑2020;

–Ongoing development of specifications for IMT and subsequent enhancements.

Appendix III: Agreed overall deliverables/work plan of WP 5D and technical requirements in order to build consensus on a global level:

The following table provides the schedule of when approval of the planned major deliverables will be achieved following the procedures of WP 5D.

| Date | Meeting | Anticipated Milestones |

| December 2019 | Geneva WP 5D #33

(max. 4 day meeting) |

• Focus meeting on evaluation – review of external activities in Independent Evaluation groups through interim evaluation reports

• Workshop on evaluation of IMT-2020 terrestrial radio interfaces |

| February 2020 | [TBD] WP 5D #34 | • Finalize Doc. IMT-2020/ZZZ Evaluation Reports Summary

• Finalize Addendum 5 to Circular Letter IMT‑2020 • Finalize draft new Report M.[IMT.AAS] • Finalize draft new Report ITU-R M.[HAPS-IMT] • Finalize draft new Report ITU-R M.[IMT.1 452-1 492 MHz] • Finalize draft new Report ITU-R M.[IMT.MS/MSS.2GHz] • Further update/Finalize draft new Report/Recommendation ITU-R |

| June 2020 | [TBD] WP 5D #35 | • Finalize draft new Report ITU-R M.[IMT-2020.OUTCOME]

• Finalize Addendum 6 to Circular Letter IMT‑2020 |

| October 2020 | [TBD] WP 5D #36 | • Finalize Addendum 7 to Circular Letter IMT‑2020 (if needed)

• Finalize revision 15 of Recommendation M.1457 |

| November 2020 | Geneva WP 5D #36bis

(3 day meeting) |

• Finalize draft new Recommendation ITU-R M.[IMT‑2020.SPECS]

• Finalize Addendum [7/8] to Circular Letter IMT‑2020 |

Appendix IV: Detailed workplan for the development of a working document towards a preliminary draft new Report ITU-R M.[IMT-2020 BROADBAND REMOTE COVERAGE]:

Source: Document 5D/TEMP/760 (Ericsson)

| Title | “IMT-2020 for remote sparsely populated areas providing high data rate coverage” |

| Identifier | M.[IMT-2020 TERRESTRIAL BROADBAND REMOTE COVERAGE] |

| Document type | Report |

| WP 5D Lead Group | WG Technology Aspects |

| SWG Chair | Marc Grant, AT&T |

| Editor | <TBD> |

| Focus for scope and work | This Report provides details on prospects associated with provisioning of enhanced mobile broadband services to remote sparsely populated and under-served areas proposing enhancements of user equipment as well as for networks in suitable frequency bands:

− for user equipment, possible solutions based on affordable user deployed RF amplifier equipment combined with access to local spectrum could be considered and examined; and − for networks, possible solutions based on high gain massive MIMO antennas could be reviewed. |

| Related documents | Question ITU-R 77-7/5 − “Consideration of the needs of developing countries in the development and implementation of IMT”

Question ITU-R 229-4/5 − “Further development of the terrestrial component of IMT” |

| Milestones | Meeting No. 32 (9-17 July 2019, Búzios, Brazil)

1 Call for contributions in the WP 5D Chairman’s Report. Meeting No. 33 ([10-13 December 2019, Geneva, Switzerland]) 1 [No sessions scheduled]. Meeting No. 34 (19-26 February 2020, <TBD>) 1 Consider received contributions. 2 Draft liaison statements as required. 3 Produce working document. 3 Review and revise the detailed workplan as required. Meeting No. 35 (24 June – 1 July 2020, [China])) 1 Consider the received contributions. 2 Consider any necessary liaison statements. 3 Elevate the working document to a preliminary draft new Report. 4 Review and revise the detailed workplan as required. Meeting No. 36 (7-14 October 2020, [India]) 1 Consider the received contributions. 2 Consider any necessary liaison statements. 3 Elevate the preliminary draft new Report to a draft new Report for submission to Study Group 5. |

…………………………………………………………………………………………………

Update- Addendum 4 to Circular Letter 5/LCCE/59 24 July 2019:

To Administrations of Member States of the ITU, Radiocommunication Sector Members, ITU-R Associates participating in the work of Radiocommunication Study Group 5 and ITU Academia

Subject: Acknowledgement of IMT-2020 proposals, future plans and evaluation report requests

Evaluation Workshop:

WP 5D will hold a Workshop on “IMT-2020 Terrestrial Radio Interfaces Evaluation” from 10 to 11 December, 2019 during its 33rd meeting to provide an interactive discussion among IEGs, proponents and WP 5D delegates.

The workshop will be held at the same venue as the 33rd meeting of WP 5D. The program of the workshop and detailed information about the workshop registration can be found on the “Web page for IMT-2020 submission and evaluation process” (under “Workshop on IMT-2020 Terrestrial Radio Interfaces Evaluation”). Parties interested in the details of the workshop (program, registration deadline, etc.) are kindly requested to check the workshop website periodically before the 33rd WP 5D meeting.

Evaluation Group discussion area:

The Evaluation Group discussion area can be found on “Web page for IMT-2020 submission and evaluation process.”

This discussion area is to exchange views on the characteristics of the proposed radio interface(s) technologies submitted by proponents and to discuss evaluation related issues among IEGs and the proponents.

The discussion area is available on a subscription basis for ITU-R members, designated representatives of the proponents of candidate technology submissions and designated representatives of the IEGs. Focal points of both the proponents and IEGs are requested to provide details of the designated representatives. IEGs and proponents are encouraged to participate in the Evaluation Group discussion area, and share the experiences that might be helpful to progress the evaluation activities.

Request for evaluation reports:

Following the IMT-2020 process on “Submission/Reception of the RIT and SRIT proposals and acknowledgement of receipt” in accordance with Document IMT-2020/2(Rev.2), WP 5D started the evaluation process from its 31st meeting in October 2018, and will last until its 34th meeting in February 2020.

Therefore, WP 5D expects to receive the final evaluation reports from the Independent Evaluation Groups on those IMT-2020 candidate technology RIT(s)/SRIT(s) that have been evaluated by its 34th meeting. While WP 5D kindly requests the independent evaluation groups to provide an interim

evaluation report for its 33rd meeting in December 2019 in which the Workshop on IMT-2020 evaluation will also be held. It is also suggested that the evaluation reports contain information including the use of Report ITU-R M.2412, the considered test environment(s), the evaluated RIT(s)/ SRIT(s), and the evaluation results as requested by the compliance templates, but not limited to those. It is also requested that the interim evaluation report includes as much detail about the evaluation as possible.

Revision to Document IMT-2020/2:

Revision 2 to Document IMT-2020/2 “Submission, evaluation process and consensus building for IMT-2020”, is now available on “IMT-2020 documents”. This revision contains an additional WP 5D meeting planned in November 2020 to complete the Recommendation for detailed specifications of radio interface technologies for the terrestrial components of IMT-2020.

Updates to the ITU-R web page for the IMT-2020 submission and evaluation process and IMT-2020 documents Any future changes to the submission and evaluation process will be announced in Addenda to this

Circular Letter. Other information, such as information on the Workshop on IMT-2020 Terrestrial Radio Interfaces Evaluation, and interim evaluation report(s) will be updated dynamically on the “Web page for IMT-2020 submission and evaluation process” and “IMT-2020 documents.”

Consequently, Members and Sector members interested in the IMT-2020 development process including evaluation activities are kindly requested to periodically check the website.

Mario Maniewicz

Director

AT&T announces cloud partnership with Microsoft 1 day after similar deal with IBM

AT&T has entered into a multi-year, cloud-based collaborative effort with Microsoft the day after announcing an alliance with IBM [1] that also focused on cloud computing. The teleco and media giant will move many of its non-network apps to Microsoft Azure and use the company’s 365 software suite while Microsoft will deploy new AT&T technologies, such as 5G, to build edge computing applications.

Comment: This is yet another proof point that telco cloud computing has been a dismal failure. AT&T and Verizon have both sold off many of their data centers and given up on cloud computing/storage in favor of the much bigger players (e.g. Amazon, Microsoft, Google and IBM in the U.S.). This new agreement appears to be a big win for Microsoft Azure, and probably at the expense of Amazon AWS, Google and IBM cloud rivals.

…………………………………………………………………………………………………………………………………………………………………………………………………….

“AT&T and Microsoft are among the most committed companies to fostering technology that serves people,” said John Donovan, CEO of AT&T Communications in a prepared statement. “By working together on common efforts around 5G, the cloud, and AI, we will accelerate the speed of innovation and impact for our customers and our communities,” he added (John is NEVER at a loss for words!)

Microsoft CEO Satya Nadella with AT&T Communications CEO John Donovan

…………………………………………………………………………………………………………………………………………………………………………………………………….

Observation:

The AT&T Microsoft partnership appears to be broader than the just announced AT&T IBM deal (see note 1 below). That deal is cloud-focused as well but is limited to the AT&T Business Solutions business unit, helping to better manage internal applications. A key objective of the IBM deal is to provide tools for AT&T Business solutions to better serve enterprise customers.

…………………………………………………………………………………………………………………………………………………………………………………………………….

AT&T partnerships on edge computing:

AT&T and Microsoft had earlier announced a deal on mobile edge computing which we reported here. Earlier this year, AT&T said it will work with Hewlett Packard Enterprise (HPE) to help businesses harness powerful edge capabilities. The two companies have agreed to a go-to-market program to accelerate business adoption of edge connections and edge computing.

…………………………………………………………………………………………………………………………………………………………………………………………….

Note 1. AT&T – IBM Cloud Parthership:

AT&T Communications will work with IBM to modernize AT&T Business Solutions’ internal software applications, enabling migrations to the IBM Cloud. IBM will provide infrastructure to support AT&T Business’s applications. AT&T Business will use the Red Hat open source platform to manage workloads and applications. IBM will be the primary developer and cloud provider for AT&T Business’s operational applications and will help manage the AT&T Communications IT infrastructure, on and off-premises and across different clouds –private and public.

As part of the agreement, AT&T Business will be IBM’s primary provider of software defined networking and will leverage the carrier’s latest technologies including 5G, Edge Compute, and IoT as well as multi-cloud capabilities using Red Hat.

Additionally, the two companies will work together on edge computing platforms, which will help enterprise clients capitalize on the power of 5G network speeds and the internet-connected devices and sensors at the edge of the network.

“In AT&T Business, we’re constantly evolving to better serve business customers around the globe by securely connecting them to the digital capabilities they need,” said Thaddeus Arroyo, CEO of AT&T Business, in a prepared statement. “This includes optimizing our core operations and modernizing our internal business applications to accelerate innovation. Through our collaboration with IBM, we’re adopting open, flexible, cloud technologies, that will ultimately help accelerate our business leadership.”

References:

https://about.att.com/story/2019/microsoft.html

https://www.business.att.com/products/multi-access-edge-computing.html

AT&T owns >630 MHz nationwide of mmWave spectrum + HPE partnership for Edge Networking & Computing

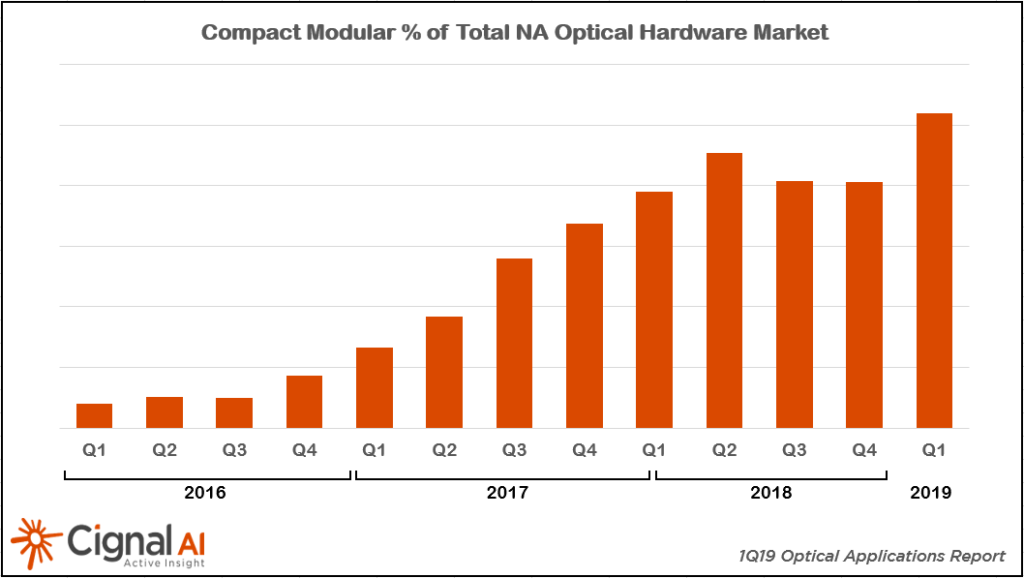

Cignal AI: Modular Optical Sales Expand, Reaching Over $275M

Almost 30% of North American Optical Hardware Shipments Now in Compact Modular Format

by Cignal AI staff

Compact modular optical hardware is being used in more network applications than ever before, driving up sales during the first quarter of 2019 as reported in the latest Optical Applications Report from market research firm Cignal AI.

Compact modular optical systems were first used by cloud operators for data center interconnect applications but have since expanded well beyond into many other operators and applications. Market share leaders include the Ciena Waveserver, Infinera CX and Groove, and Cisco 1000 series.

The report illustrates significant growth throughout most regions as the compact modular customer base expands beyond cloud and webscale operators to include traditional telco customers pursuing network disaggregation. Compact modular hardware sales exceeded $275 million in Q1 and are tracking to exceed $1 billion in revenue this year. Growth was most pronounced in North America this quarter, where it accounted for almost 30% of the entire optical market and is expected to continue advancing through 2023.

“Network applications for the compact modular form factor have expanded well beyond the original data center interconnect deployments,” said Scott Wilkinson, Lead Analyst for Optical Hardware at Cignal AI. “Applications now include traditional telco networks, metro and long haul deployments, and even some early trials for subsea deployment. We expect this spending trend to increase in 2019 as new compact modular products come to market from a variety of vendors.”

Cignal AI’s 1Q19 Optical Applications Report details market share for the first quarter of 2019 and provides forecasts in three key markets: compact modular equipment, advanced packet-OTN switching hardware, and 100Gbps+ coherent WDM port shipments across multiple speeds. Hardware and coherent port shipments are forecasted through 2023. The Applications Report is issued quarterly.

Additional 1Q19 Applications Report Key Findings:

Ciena expanded its dominance in compact modular with over 50% market share in Q1. The combined Infinera/Coriant held on to second place despite declining sales.

Acacia [1] AC1200-based platforms are expected to have an impact starting next quarter. Cisco (which is acquiring Acacia) compact modular sales paused in Q1 in anticipation of the NCS1004 platform.

Note 1. Cisco and Acacia Communications entered into a definitive agreement under which Cisco has agreed to acquire Acacia for a consideration of US$2.6 billion.

……………………………………………………………………………………………..

Almost 500k physical coherent ports have shipped in the last 12 months. Currently, over 70% of coherent ports are shipped by the top five vendors in the market.

After a 2018 recovery year, long haul port shipments are starting to pick up. Metro growth is advancing at a similar pace, as next-generation coherent enables an upgrade from 100Gbps.

Packet OTN growth is slowing. New deployments are limited to China and parts of APAC as networks in other regions evolve away from the packet OTN architecture.

About the Optical Applications Report:

The Cignal AI Optical Applications Report includes market share and forecasts for revenue and port shipments for optical equipment designed to meet the needs of specific applications: 100G+ coherent, and compact modular and advanced packet-OTN switching hardware.

Vendors examined include Acacia, Adtran, ADVA, Ciena, Cisco, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Inphi, NEC, Nokia, NTT Electronics (NEL), Padtec, Tejas, Xtera and ZTE.

Deliverables include Excel files with complete data sets, PowerPoint summaries and Cignal AI’s Active Insight news reporting. Cignal AI clients with Applications report subscriptions may access this material on the Cignal AI website.

About Cignal AI:

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report:

| Sales: [email protected] Web: Contact us |

SK Telecom with Swisscom: World’s First “5G” Roaming Service

SK Telecom announced today that it will begin the world’s first 5G roaming service [1] from midnight KST on July 16 through a strategic partnership with Swisscom, the largest telecommunications provider in Switzerland.

Note 1. Not only is there no standard for “5G’ roaming (or even signaling.control plane), but there are no standards for anything related to 5G radio and non radio aspects. Hence, this “5G’ roaming agreement is specific to these two carriers. They have obviously agreed on a roaming/handoff spec for 5G NR (3GPP Rel 15) in the data plane and LTE signaling in the control plane.

………………………………………………………………………………….

Swisscom, which boasts over 6 million mobile subscriptions, started to roll out its 5G network on April 17th. The company currently provides 5G service in 110 cities and villages including Zurich, Geneva and Bern as well as rural and touristic areas.

SK Telecom’s customers using Samsung Galaxy S10 5G smartphone will be able to use 5G roaming service through Swisscom when visiting Switzerland after upgrading their devices with the latest software update. In the future, SK Telecom plans to provide software upgrades to LG V50 users and further expand 5G roaming service to other countries around the globe.

“SK Telecom once again proved its leadership in advanced roaming technology with the launch of world’s first 5G roaming service” said Han Myung-jin, Vice President and Head of MNO Business Supporting Group of SK Telecom. “We will continuously expand our 5G roaming service to enhance customer experience and benefits.”

Meanwhile, with the aim to enable its customers to make and receive high-quality, free-of-charge international roaming voice calls while travelling to 171 countries across the world, SK Telecom launched ‘baro’ on December 17, 2018. As of June 2019, ‘baro’ has attracted 2.2 million users and 38 million cumulative calls (total of 800,000 hours of voice calls). Moreover, ‘baro’ won the ‘Best Mobile Technology Breakthrough in Asia’ award at the 2019 Asia Mobile Awards held as part of MWC19 Shanghai.

…………………………………………………………………………………………………..

About SK Telecom:

SK Telecom is the largest mobile operator in Korea with nearly 50 percent of the market share. As the pioneer of all generations of mobile networks, the company has commercialized the fifth generation (5G) network on December 1, 2018 and announced the first 5G smartphone subscribers on April 3, 2019. With its world’s best 5G, SK Telecom is set to realize the Age of Hyper-Innovation by transforming the way customers work, live and play.

Building on its strength in mobile services, the company is also creating unprecedented value in diverse ICT-related markets including media, security and commerce.

……………………………………………………………………………………………………….

For more information, please contact:

[email protected] or [email protected].

About Swisscom:

Swisscom, Switzerland’s leading telecoms company and one of its leading IT companies, is headquartered in Ittigen, close to the capital city Berne. Outside Switzerland, Swisscom has a presence on the Italian market in the guise of Fastweb. About 20,000 employees generated sales of CHF 2’860 million to the end of the 1st Quarter 2019. It is 51% Confederation-owned and is one of Switzerland’s most sustainable and innovative companies.

…………………………………………………………………………………………..

Media Contacts:

Yong-jae Lee

SK Telecom Co. Ltd.

(822) 6100 3838

(8210) 3129 6880

Irene Kim

SK Telecom Co. Ltd.

(822) 6100 3867

(8210) 8936 0062

Ha-young Lee

BCW Korea

(822) 3782 6421

Israel Ministry of Communications publishes 5G frequencies auction

Israel’s Ministry of Communications is publishing the auction for 5G frequencies today. The tender winners will be announced in the fourth quarter of the year, after which the frequencies will be allocated to the companies.

The auction utilizes the Vickrey method – a public auction in sealed envelopes. The party making the highest bid wins the auction, but will pay the second highest price. The state is using this method in order to get the maximum value, while at the same time avoiding inflated prices.

As first reported by “Globes,” the Ministry of Communications will try to allocate the most desirable frequencies, 700 MHz, to all of the cellular companies. These frequencies are the best and most effective of all the 5G frequencies. Two other frequencies are being offered in addition to 700 MHz.

In order to support the venture, the state will provide substantial incentives to operators in the form of a NIS 500 million refund to encourage the operators to act quickly. The current government cannot make the decision, because it is a transition government, but the Ministry of Communications has agreed in principle not to increase the yearly fees paid by the cellular companies.

All of the cellular operators currently pay NIS 300 million annually, and this figure is not expected to change in the next four years. The cellular operators will pay a one-time amount in the tender framework, but part of it will be refunded to them on the basis of meeting targets.

The participants in the tender will pay the license fee only in January 2022. This postponement will enable them to allocate the money in the first two years to investments in technology. The Israel government will later allow the operators to bid in another tender in which they will provide wireless Internet for homes.

The auction will be managed using a method called combinatorial clock auctions. This method enables bidders to compete simultaneously in all of the frequency areas. The frequencies in the auction will be offered only to companies agreeing to found a shared network. The aim is to avoid an inefficient allocation of frequencies.

The systems of incentives for deployment is composed of two tracks: reducing the fees for the frequencies – a annual reduction of 28% of all the frequency fees for four years. The operators will be required to meet engineering targets each year. The benefit will be provided at the beginning of each year, assuming that the operator meets the targets.

In the second track, the state will provide an incentive of up to NIS 200 million. The cellular companies will have to establish 250 5G broadcasting centers. The operator that builds the most sites will receive up to NIS 82 million – 41% of the total incentive. The builder of the second most sites will get NIS 66 million, and the operator in third place will receive NIS 52 million.

The Ministry of Communications believes that the public will begin benefiting from the new technology in 2020. Minister of Communications David Amsalem said today, “This technological measure will leave its mark for decades from now. With the introduction of the new 5G technology, the smart digital revolution will get underway and affect all spheres of life: smart homes, smart cities, smart medicine, making the outlying areas closer to the central area, education. autonomous vehicles, advanced industry, etc.

“The financial state of the companies at this time has not escaped us, and the tender also takes this situation into account. I congratulate my friends and participants in the tenders committee for their professional work. The dedication and responsibility exercised is what made it possible to lay the cornerstone today for the next era of technology.”

Amsalem added, “All of our lives are going to change as a result of 5G. Human life is going to develop concurrently with the industrial revolution, and the technology is therefore of critical importance. There is of course an amazing team here that has been working on this for over 18 months. It is a difficult, complicated matter, as are the tenders. There is something extremely sophisticated here. I want to take this opportunity to thank the ministry’s employees for what they have done up until now, and it has to be pushed forward as much as possible. The revolution has two arteries: the frequencies tender and the other story that completes it, which is fiber-optics. Both of them together will enable us to make progress, so that Israel adapts itself to global technology. Today, if you lag behind in some aspect, you become an underdevelopment country.”

………………………………………………………………………………………………..

Published by Globes, Israel business news – en.globes.co.il July 14, 2019

https://en.globes.co.il/en/article-israeli-govt-publishes-5g-frequency-auction-1001293454

………………………………………………………………………………………….

Also see these previous Globes articles:

Timelines for IMT 2020 (subject to change) and 3GPP Release 16

15 July 2019 Update & Clarification:

For the completion of Step 8 (see revised description below) and the finalization of the draft new Recommendation ITU-R M.[IMT‑2020.SPECS] in Working Party 5D, a completion date of the WP 5D meeting No. 36, currently planned for 7-14 October 2020 had previously been chosen.

However, this completion date has been shifted to a new WP 5D Meeting #36bis planned for 17-19 November 2020 (shown in above table). The focus of this ‘bis’ meeting is specifically the technology aspects and associated matters necessary to finalize the draft new Recommendation ITU-R M.[IMT-2020.SPECS].

This shift was done to assist the Transposing Organizations by providing them additional time to prepare their transposed standards aligned with the Global Core Specification that would be provided to WP 5D meeting #35 (24 June – 1 July 2020).

The additional time afforded by scheduling a new WP 5D Meeting #36bis as the new completion meeting of the draft new Recommendation ITU-R M.[IMT-2020.SPECS] affords the Transposing Organizations at least 13 weeks of time after WP 5D Meeting #35 to provide the Radiocommunication Bureau by the indicated due date (8 October 2020) with the relevant technical material (e.g., the URL hyperlinks) and other related administrative matters to ITU-R after the Meeting #35, in proper alignment with the GCS.

The ITU-R Secretariat, upon receipt of this material from the Transposing Organizations will administratively prepare (i.e., compile, edit, format, etc.) the final draft of the Recommendation incorporating all the technologies (RITs and SRITs) agreed by ITU-R for inclusion in Step 8 and make it available to WP 5D Meeting #36bis.

Step 8 – Development of radio interface Recommendation(s):

In this step a (set of) IMT-2020 terrestrial component radio interface Recommendation(s) is developed within the ITU-R on the basis of the results of Step 7, sufficiently detailed to enable worldwide compatibility of operation and equipment, including roaming.

This work may proceed in cooperation with relevant organizations external to ITU in order to complement the work within ITU‑R, using the principles set out in Resolution ITU-R 9-5.

Step 9 – Implementation of Recommendation(s):

In this step, activities external to ITU-R include the development of supplementary standards (if appropriate), equipment design and development, testing, field trials, type approval (if appropriate), development of relevant commercial aspects such as roaming agreements, manufacture and deployment of IMT-2020 infrastructure leading to commercial service.

……………………………………………………………………………………………………………………………………………………………………………………………………………

3GPP input to IMT 2020 RIT/SRIT and Release 16 Schedule:

3GPP notes that with the complexities of 5G as a new generation of technology and the importance of the new Recommendation ITU-R M.[IMT-2020.SPECS] globally for all stakeholders (including support for the results of WRC-19), any additional time afforded to the External Organizations in Step 8 for provision of the URL references would be of great benefit to all the radio interface technology proponents, not just 3GPP.

3GPP welcomes any accommodation WP 5D might make concerning the scheduling of the work to conclude the first release of Recommendation ITU-R M.[IMT-2020.SPECS] and kindly asks for feedback to 3GPP from that discussion.

……………………………………………………………………………………………………………………

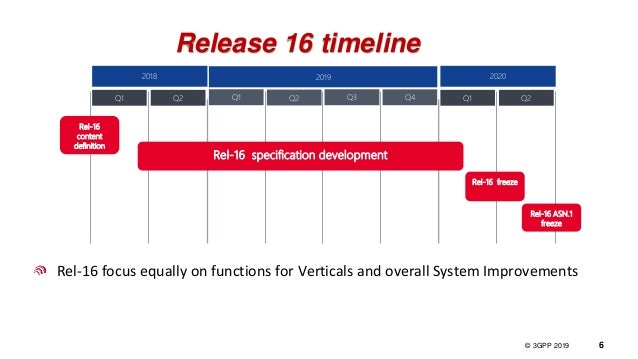

From 3GPP Webinar – 3 July 2019:

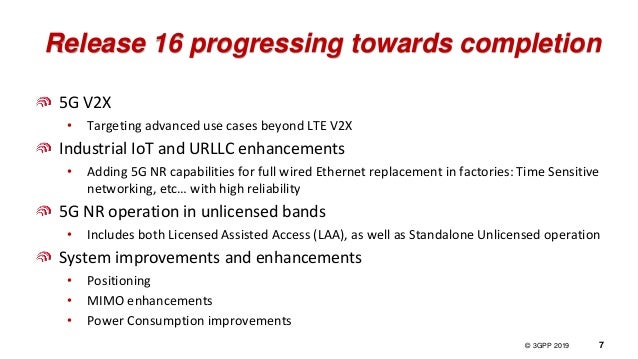

“For the (industry) verticals, there are three distinct pillars that we are focused on: Automotive, Industrial IoT and Operation in unlicensed frequency bands.

For 5G based V2X, which builds on the two iterations of the LTE-V2X, we are now adding advanced features – primarily in the area of low latency use cases.

The second focus is industrial IoT and URLLC enhancements. Factory automation, in particular, is a strong pillar for 5G going forward. We are trying to ensure that the radio side covers all of the functions that all the verticals need for factory automation. What this means in practice is that we are trying to make sure 5G NR can fully replace a wired Ethernet – currently used – by adding time sensitive networking and high reliability capabilities.

The third pillar is operation in unlicensed bands. We have seen different schemes for generic 5G licensing strategies in Europe and in other parts of the World. We have seen in some countries that certain licensed bands have been allocated for vertical use cases, though that is not the case for a majority of countries. The use of unlicensed bands provides a great opportunity – where licensed spectrum is not an option. We are now focused on not only what we have with LTE, which is the licensed assisted access scheme, but also on standalone unlicensed operation – to be completed in Release 16.

Release 16 also delivers generic system improvements & enhancements, which target Mobile Broadband, but can also be used in vertical deployments –> Particularly: positioning, MIMO enhancements and Power consumption improvements.”

See and listen to this 3GPP Webinar at: https://vimeo.com/346171906

………………………………………………………………………………………………………………………………………………….

Annex 1. From ATIS contribution to ITU-R WP5D July 2019 meeting in Brazil:

3GPP has agreed revised completion dates for Release 16 – schedule shifted out by 3 months:

Release 16 RAN-1 Freeze RAN # 86 December 2019

Release 16 RAN Stage 3 Freeze RAN # 87 March 2020

Release 16 ASN.1 Freeze RAN # 88 June 2020

Release 16 RAN-4 Freeze RAN # 89 September 2020

……………………………………………………………………………………………………………………

Submitted on behalf of the 3GPP Proponent of the 3GPP submission, which is collectively the 3GPP Organizational Partners (OPs). The 3GPP OPs are ARIB, ATIS, CCSA, ETSI, TSDSI, TTA and TTC (http://www.3gpp.org/partners)

IMT 2020: Concept of Global Core Specification (GCS) and Transposing Organization(s)

Introduction:

When completed, Recommendation ITU-R M.[IMT-2020.SPECS] will contain the detailed specifications of the radio interfaces of IMT-2020. The structure and philosophy adopted for M.[IMT-2020.SPECS] for IMT2020 is based on those used in Recommendations ITU-R M.1457 for IMT-2000 and ITU-R M.2012 for IMT-Advanced, which have been successfully utilized for two decades through numerous revisions of Recommendations ITU-R M.1457 and ITU-R M.2012.

A key concept is the continued use of the Global Core Specification (GCS) provided by the GCS Proponent and references to standards of Transposing Organization(s) [1.] authorized by the GCS Proponent whereby the detailed standardization is undertaken within the Transposing Organization that operates in concert with the RIT/SRIT Proponent and/or GCS Proponent entities.

The relationship between the GCSs for IMT-2020 radio interface technologies and the corresponding transposed standards is such that the GCSs are the framework for their corresponding detailed transposed specifications. Recommendation ITU-R M.[IMT-2020.SPECS] may also include references to specific related standards of the Transposing Organizations. There may be one or more entities that exist within a GCS Proponent for a given GCS.

It is also permissible to not have a separate GCS for a particular radio interface technology, in which case all the detailed specifications of that particular radio interface technology (the Directly Incorporated Specification1) would be fully contained directly within the Recommendation ITU-R M.[IMT-2020.SPECS].

This understanding of whether a GCS would or would not be utilized in the context of a particular radio interface technology within Recommendation ITU-R M.[IMT-2020.SPECS] is necessary so that the proper structure and content of the Recommendation is chosen to properly reflect the technology specifications.

Consequently, the RIT/SRIT Proponent is requested to indicate at an early stage to the ITU-R its preliminary intention to submit a Global Core Specification, in advance of the required formal certifications, which will be used to form the basis of information in the Recommendation ITU‑R M.[IMT-2020.SPECS].

The ITU-R (Working Party 5D) will review any GCS or DIS submission(s) and agree/approve or suggest changes in conjunction with the development and the ultimate approval by ITU-R of the final published version of Recommendation ITU-R M.[IMT-2020.SPECS] and the established schedules.

ITU-R (WP 5D and/or the Radiocommunication Bureau) will maintain liaison with the relevant External Organizations (RIT/SRIT Proponents, GCS Proponents, and Transposing Organizations) on the required deliverables and also the relevant schedules and administrative matters associated with the various stages of the development of the Recommendation ITU‑R M.[IMT-2020.SPECS] and its revisions over time.

………………………………………………………………………………………………………………………………………..

ITU-R WP 5D will review any GCS or DIS submission(s) and agree/approve or suggest changes in conjunction with the development and the ultimate approval by ITU-R of the final published version of Recommendation ITU-R M.[IMT-2020.SPECS] and the established schedules.

ITU-R (WP 5D and/or the Radiocommunication Bureau) will maintain liaison with the relevant External Organizations (RIT/SRIT Proponents, GCS Proponents, and Transposing Organizations) on the required deliverables and also the relevant schedules and administrative matters associated with the various stages of the development of the Recommendation ITUR M.[IMT-2020.SPECS] and its revisions over time.

Respecting the integrity of the GCSs and ensuring that the transposed standards are consistent with the GCS:

To assure users of Recommendation ITU-R M.[IMT-2020.SPECS] of the integrity of the GCS for a particular technology, and to ensure that the transposed standards are consistent with the common globally agreed vision of IMT-2020, completeness and traceability of the GCS and the transposed standards is a foremost obligation of the ITU-R.

As noted above, the IMT-2020 specifications could be developed around a “Global Core Specification” (GCS), which is related to externally developed materials incorporated by specific references for a specific technology. The submitted GCSs as accepted by WP 5D for inclusion in Recommendation ITU-R M.[IMT-2020.SPECS] will be placed on the relevant ITU website and indicated by hyperlinks in each relevant technology Section of Recommendation ITU-R M.[IMT2020.SPECS].

The GCS provided by the GCS Proponent would form the nucleus of Recommendation ITUR M.[IMT-2020.SPECS]. For each radio interface technology in Recommendation ITU-R M.[IMT2020.SPECS] (whether presented as a single RIT or as one of the component RITs within an SRIT) there will be only one corresponding GCS. A GCS will have one or more GCS Proponents. Each component RIT within a SRIT may be separately addressed with regard to its GCS and the associated GCS Proponents.

Each GCS would correspond to separate sets of transposed standards/specifications from one or more individual standards development organizations or equivalent entities. For each separate set of transposed standards/specifications, there will be only one Transposing Organization.

The referenced standards of the authorized Transposing Organizations [1.] must be technically consistent with the corresponding GCS while allowing a limited amount of flexibility to accommodate, e.g. minimal regional differences. An example of a regional difference would be a regional adjustment for differing frequency bands. Adherence to this format and principle assures a common global standard for IMT-2020 as codified in Recommendation ITU-R M.[IMT2020.SPECS] including the external materials incorporated by reference.

The receipt of information with regard to Recommendation ITUR M.[IMT-2020.SPECS] that is related to a business relationship of the ITU and the relevant external organizations complements and support activities such as the technical work under the purview of the relevant Study Group within the ITU. It must be noted that where this document addresses administrative matters it does not intend to usurp the Study Group or Working Party authority but merely seeks to provide additional critical information to the deliberations on Recommendation ITU-R M.[IMT-2020.SPECS] as to the individual or collective intent and/or actions of the RIT/SRIT Proponents, GCS Proponents, and/or Transposing Organizations that support a particular technology, a corresponding GCS, and the related transposed standards.

NOTE 1. A Transposing Organization is an individual entity authorized by a GCS Proponent to transpose the relevant GCS into specific standards and to provide specific references and hyperlinks (Transposition References) for the purposes of Recommendation ITU-R M.[IMT-2020.SPECS]. A Transposing Organization:

1) must have been authorized by the relevant GCS Proponent to produce transposed standards for a particular technology, and

2) must have the relevant legal usage rights.

………………………………………………………………………………………………………………………………………………………………………….

It is noted that the entity or entities that make up a GCS Proponent may also be a Transposing Organization. It should also be noted that the term Transposing Organization is always indicated to be a single entity. It is also noted that, for the purposes of Recommendation ITU-R M.[IMT-2020.SPECS], the ITUR will only recognize as valid those Transposing Organizations that have been identified to the ITU-R by the GCS Proponent as authorized to transpose the GCS Proponent’s GCS.

Neither a GCS Proponent nor a Transposing Organization need to be a formal “Standards Development Organization” or “SDO.” For example, “SDO” here could represent an industry entity, organization, individual company, etc. that, if applicable, also qualifies appropriately under the auspices of Resolution ITU-R 9.

…………………………………………………………………………………………….

References:

https://www.itu.int/md/R15-IMT.2020-C-0020/en

https://www.itu.int/pub/R-RES-R.9

ITU-R Report: U.S. Experience on the use of terrestrial IMT systems in frequency bands below 1 GHz

Draft New Report M.[IMT.EXPERIENCES] – Annex 6 U.S.A

SOURCE: U.S. via FCC

Introduction:

On March 17, 2010, the FCC released The National Broadband Plan, establishing a roadmap for initiatives to stimulate economic growth, spur job creation and boost America’s capabilities in education, health care, homeland security and more. The plan includes sections focusing on economic opportunity, education, health care, energy and the environment, government performance, civic engagement and public safety. The Plan fulfilled a Congressional mandate to ensure every American has “access to broadband capability,” including a detailed strategy for achieving affordability and maximizing use of broadband. One of the key elements of the plan is ensuring efficient allocation and use of government-owned and government-influenced assets. The Plan recommended making an additional 500 MHz of spectrum newly available for broadband within 10 years, of which 300 MHz should be available for mobile use within five years. In order to achieve this goal, the FCC established principles to:

– Enable incentives and mechanisms to repurpose spectrum to more flexible uses. Mechanisms include incentive auctions, which allow auction proceeds to be shared in an equitable manner with current licensees as market demands change. These would benefit both spectrum holders and the American public. The public could benefit from additional spectrum for high-demand uses and from new auction revenues. Incumbents, meanwhile, could recognize a portion of the value of enabling new uses of spectrum. For example, this would allow the FCC to share auction proceeds with broadcasters who voluntarily agree to use technology to continue traditional broadcast services with less spectrum.

– Ensure greater transparency of spectrum allocation, assignment and use to foster an efficient secondary market.

– Expand opportunities for innovative spectrum access models by creating new avenues for opportunistic and unlicensed use of spectrum and increasing research into new spectrum technologies.

600 MHz:

In 2014, the FCC adopted a Report and Order for Incentive Auctions. The incentive auction is a new tool authorized by Congress to help the Commission meet the Nation’s accelerating spectrum needs. Broadcasters were given the unique financial opportunity in the “reverse auction” phase of the incentive auction to return some or all of their broadcast spectrum usage rights in exchange for incentive payments. By facilitating the voluntary return of spectrum usage rights and reorganizing the broadcast television bands, the FCC could recover a portion of ultra-high frequency (“UHF”) spectrum for a “forward auction” of new, flexible-use licenses suitable for providing mobile broadband services. Payments to broadcasters that participate in the reverse auction can strengthen broadcasting by funding new content, services, and delivery mechanisms. And by making more spectrum available for mobile broadband use, the incentive auction will benefit consumers by easing congestion on the Nation’s airwaves, expediting the development of new, more robust wireless services and applications, and spurring job creation and economic growth.

The broadcast incentive auction itself comprised of two separate but interdependent auctions – a reverse auction, which will determine the price at which broadcasters will voluntarily relinquish their spectrum usage rights; and a forward auction, which will determine the price companies are willing to pay for flexible use wireless licenses. The lynchpin joining the reverse and the forward auctions is the “repacking” process. Repacking involves reorganizing and assigning channels to the remaining broadcast television stations in order to create contiguous blocks of cleared spectrum suitable for flexible use. In order to be successful, each of the components must work together. Ultimately, the reverse auction requires information about how much bidders are willing to pay for spectrum licenses in the forward auction; and the forward auction requires information regarding what spectrum rights were tendered in the reverse auction, and at what price; and each of these depend on efficiently repacking the remaining broadcasters.

The reverse and forward auctions was integrated in a series of stages. Each stage will consist of a reverse auction and a forward auction. Prior to the first stage, the initial spectrum clearing target is determined. Broadcasters indicate through the pre-auction application process their willingness to relinquish spectrum usage rights at the opening prices. Based on broadcasters’ collective willingness, the initial spectrum clearing target will be set at the highest level possible (up to 126 megahertz of spectrum) without exceeding a pre-determined national aggregate cap on the interference between wireless providers and TV stations (“impairments”) created when TV stations must be assigned to the wireless band. Under this approach, the auction system will establish a band of wireless spectrum that is generally uniform in size across all markets. Then the reverse auction bidding process will be run to determine the total amount of incentive payments to broadcasters required to clear that amount of spectrum.

The forward auction bidding process will follow the reverse auction bidding process. If the “final stage rule” is satisfied, the forward auction bidding will continue until there is no excess demand, and then the incentive auction will close. If the final stage rule is not satisfied, additional stages will be run, with progressively lower spectrum targets in the reverse auction and less spectrum available in the forward auction. The final stage rule is a set of conditions that must be met in order to close the auction at the current clearing target; failure to satisfy the rule would result in running a new phase at the next lowest clearing target.

The FCC’s central objective in designing this incentive auction is to harness the economics of demand for spectrum in order to allow market forces to determine its highest and best use. We are also mindful of the other directives that Congress established for the auction, including making all reasonable efforts to preserve, as of the date of the passage of the Spectrum Act, the coverage area and population served of remaining broadcast licensees. The auction affords a unique opportunity for broadcasters who wish to relinquish some or all of their spectrum rights, but we emphasize that a broadcaster’s decision to participate in the reverse auction is wholly voluntary. In the descending clock auction format we chose, for example, a broadcaster need only decide whether it is willing to accept one or more prices offered to it as the reverse auction proceeds; if at any point the broadcaster decides a price is too low, it may drop out of the reverse auction. No station will be compensated less than the total price that it indicates it is willing to accept.

The FCC also recognizes the importance of broadcasters that choose not to participate in the reverse auction. To free up a portion of the UHF spectrum band for new, flexible uses, Congress authorized the Commission to reorganize the broadcast television spectrum so that the stations that remain on the air after the incentive auction occupy a smaller portion of the UHF band. The reorganization (or “repacking”) approach we adopted will avoid unnecessary disruption to broadcasters and consumers and ensure the continued availability of free, over-the-air television service.

Ultimately, our actions will benefit consumers of telecommunications services. While minimizing disruption to broadcast television service, we seek to rearrange the UHF spectrum in order to increase its potential to support the changing needs of 21st Century consumers. We recognize that the same individuals may be consumers of television, mobile broadband – using both licensed and unlicensed spectrum – and other telecommunications services. To benefit such consumers, and consistent with the framework of the Spectrum Act, we have strived for balance in our decision-making process between television and wireless services, and between licensed and unlicensed spectrum uses.

Band Plan:

FCC adopted a “600 MHz Band Plan” for new services in the reorganized UHF spectrum. By maximizing the spectrum’s value to potential bidders through features such as paired five megahertz “building blocks,” the Band Plan will help to ensure a successful auction. By accommodating variation in the amount of spectrum we recover in different areas, which depends on broadcaster participation and other factors, the Band Plan will ensure that the repurposing of spectrum for the benefit of most consumers nationwide is not limited by constraints in particular markets. The Band Plan will promote competition and innovation by creating opportunities for multiple license winners and for future as well as current wireless technologies. Because it is composed of a single band of paired spectrum blocks only, our Band Plan also simplifies the forward auction design. We adopt for new licensees flexible-use service rules, and technical rules similar to those governing the adjacent 700 MHz Band, an approach that should speed deployment in the 600 MHz band. Devices will be required to be interoperable across the entire new 600 MHz Band.

The FCC concluded that the 600 MHz Band Plan we adopt best supports our central goal of allowing market forces to determine the highest and best use of spectrum, as well as our other policy goals for the incentive auction, including the Commission’s five key policy goals for selecting a band plan. The Band Plan enhances the economic value and utility of the repurposed spectrum by enabling two-way (paired) transmissions throughout this well-propagating “coverage band.” This approach also simplifies auction design by offering only a single configuration – paired blocks – which allows for maximum interchangeability of blocks, and enables limited market variation, thus avoiding a “least common denominator” problem. It also provides certainty about the operating environment for forward auction bidders by establishing guard bands between television and wireless services in order to create spectrum blocks that are reasonably designed to protect against harmful interference. Further, the 600 MHz Band Plan promotes competition. By offering only paired blocks in a single band, and by licensing on a Partial Economic Area (“PEA”) basis, the 600 MHz Band Plan will promote participation by both larger and smaller wireless providers, including rural providers, and encourage new entrants. Finally, the 600 MHz Band Plan, composed of a single, paired band, promotes interoperability and international harmonization.

The 600 MHz Band Plan we adopt consists of paired uplink and downlink bands offered in 5 + 5 megahertz blocks. The uplink band will begin at channel 51 (698 MHz), followed by a duplex gap, and then the downlink band. We will license the 600 MHz Band on a geographic area license basis, using PEAs. Further, we will accommodate market variation: specifically, we will use the 600 MHz Band Plan in all areas where sufficient spectrum is available; and in constrained markets where less spectrum is available, we may offer fewer blocks, or impaired blocks, than what we offer generally in the 600 MHz Band Plan. Finally, we establish technically reasonable guard bands to prevent harmful interference and to ensure that the spectrum blocks are as interchangeable as possible.

Because the FCC did not know the exact number of blocks licensed or their frequencies until the incentive auction concludes, the 600 MHz Band Plan we adopted represents a framework for how to license the repurposed spectrum. The Technical Appendix sets forth each of the specific 600 MHz Band Plan scenarios based on the number of television channels cleared; ultimately, the repurposed spectrum will be licensed according to one of these scenarios.

The FCC noted that offering downlink-only blocks in the 600 MHz auction may undermine competition. Because providers must pair downlink-only blocks with existing spectrum holdings, new entrants would not be able to use downlink-only blocks, thus limiting their utility. In contrast, offering paired spectrum blocks will benefit all potential 600 MHz Band licensees. Further, offering downlink-only blocks would further complicate the auction design without a commensurate benefit. As explained above, downlink-only blocks are less valuable than paired blocks to bidders, and offering both paired and unpaired blocks would introduce additional differences among licenses in the forward auction and increase the amount of time the auction takes to close.

Finally, our all-paired band plan generally has nationally consistent blocks and guard bands, which will promote interoperability. In contrast, offering downlink-only blocks could exacerbate interoperability concerns by separating the 600 MHz Band into two bands. If we license both unpaired and paired blocks, we would expect that the industry standards body would create separate bands for the paired blocks and unpaired blocks, as it has done previously. If the 600 MHz Band were split into two separate bands, then some devices could support part, but not all, of the Band. Concerns were also raised over the potential for wireless carriers using downlink-only blocks to configure their networks so as to create barriers to roaming. Limiting the auction to paired blocks will help to ameliorate these concerns. It will also promote international harmonization, and in particular, should help to address cross-border issues with Canada and Mexico.

Repurposing for Mobile Use:

On 18 January 2017, the auction satisfied both of the conditions of the final stage rule, assuring that the auction will close in Stage 4. At $19.8 billion in gross revenue for 70 MHz of spectrum, the incentive auction is among the highest grossing auctions ever conducted by the FCC. The auction created a first-of-its-kind market for repurposing commercially-held spectrum licenses for new uses. The model is part of the foundation of the future of U.S. spectrum allocation and use policy designed for 21st century realities. The US incentive auctions started in March 2016 and has satisfied the rules for the final stage which means that 84 MHz (614-698 MHz) will be cleared from broadcasting including 70 MHz of licensed spectrum and 14 MHz for unlicensed.

Frequency arrangement from US incentive auction:

Following the conclusion of the incentive auction, the transition to the reorganized UHF band will be as rapid as possible without causing unnecessary disruption. Television stations that voluntarily turn in their licenses or agree to channel share must transition from their pre-auction channels within three months of receiving their reverse auction payments. The time required for stations reassigned to a new channel to modify their facilities will vary, so we will tailor their construction deadlines to their situations. This approach will ensure that stations transition as quickly as their circumstances allow, and allow coordination of deadlines where, for example, one station must vacate a channel before another can begin operating on its new channel. No station will be allowed to operate on a channel that has been reassigned or repurposed more than 39 months after the repacking process becomes effective. In other words, the repurposed spectrum will be cleared no later than 39 months after the effective date. Most new licensees should have access to 600 MHz spectrum well before then. Consistent with Congress’s mandate, we also establish procedures to reimburse costs reasonably incurred by stations that are reassigned to new channels, as well as by multichannel video programming distributors to continue to carry such stations.

As the U.S. Congress recognized, the incentive auction and the transition that follows require coordination with our cross-border neighbors, Canada and Mexico. Because of these common borders, the Commission has established processes and agreements to protect television and wireless operations in border areas from harmful interference. The FCC staff has used these processes to fully inform Canadian and Mexican officials regarding the incentive auction and, beginning in 2013, formed technical groups to meet routinely to plan for harmonious use of the reorganized UHF band following the incentive auction. Commission leadership has supplemented these efforts, meeting with their Canadian and Mexican counterparts to emphasize the need for and mutual benefits of harmonization. We are confident that the long and successful history of close cooperation with Canada and Mexico regarding the use of radio spectrum along our common borders will continue before, during, and after the incentive auction.

700 MHz:

The recovery of the 700 MHz Band was made possible by the conversion of television broadcasting from the existing analog transmission system to a digital transmission system. Because the digital television (DTV) transmission system is more spectrally efficient than the analog system, less spectrum will be needed for broadcast television service after the transition to DTV on channels 251 is complete. The USA which switched-off its analogue transmissions in 2009, and was the first Administration to relocate the channels 52 to 69 to advanced wireless service.

The successful auction of the 700 MHz band has facilitated a nationwide roll-out of IMT (LTE) deployments, including establishing valuable spectrum for public safety uses. The U.S. 700 MHz band plan divides the 698-806 MHz frequency range into a lower 700 MHz portion and an upper 700 MHz portion. The final band plan is available at: http://wireless.fcc.gov/auctions/data/bandplans/700MHzBandPlan.pdf

To enable operability along border areas, the FCC has worked through bilateral coordination processes with its neighbours to address issues with variation in adopted band plans. The U.S. and APT FDD band plans are incompatible in their assignment of uplink and downlink spectrum therefore careful coordination of spectrum is required along the border areas. Due to overlapping base and mobile transmission of one band plan with base and mobile receiving frequencies of the other band plan, several interference scenarios can be found along the border.

According to a July 2012 survey, the U.S. 700 MHz ecosystem has grown rapidly to include 193 LTE device products including Modules for M2M, notebooks, phones, routers for hotspots, tablets and USB modems supported by over 18 manufacturers. 3GPP defines a number of bands in 700 MHz: Band 12: (Lower 700 MHz) 699 MHz-716 MHz /729 MHz-746 MHz; Band 13: (Upper C 700 MHz) 777 MHz-787 MHz /746 MHz-756 MHz; Band 14: (Upper D 700 MHz) 788 MHz798 MHz /758 MHz-768 MHz; Band 17: (Lower B, C 700 MHz) 704 MHz-716 MHz /734 MHz-746 MHz.

OpenSignal: U.S. has fastest “5G” download speed out of 8 countries tested

by Ian Fogg, OpenSignal (edited and augmented by Alan J Weissberger)

Overview:

In Opensignal’s latest analysis of 5G, we’ve looked at the maximum real-world speeds seen in eight countries which have launched 5G services. The maximum download speeds smartphone users see are much faster than the average speeds experienced by 5G users as the market research firm expected. OpenSignal relies on crowd-sourced, device-based data and regular application servers for its information on user-experienced speeds, as opposed to test servers that may be located within an operator’s network. Data was collected between April 1st and June 30th.

The highest maximum speeds were seen by 5G users in the U.S. with 1815 Mbps, which is approximately three times as fast as 4G users’ maximum speed. Switzerland followed in second place with 1145 Mbps and South Korea ranked third with 5G users’ maximum speed of 1071 Mbps. The speeds we measured in these three leading countries were significantly faster than the maximum speed in European markets where 5G has only just launched such as Italy or Spain, or in the UK where the first operator to launch 5G only has 40 MHz of suitable spectrum which is far below 5G technology’s 100 MHz channel size sweet spot.

The current 5G maximum speed is so much greater in the U.S., because wireless network operators there are already able to use mmWave spectrum for 5G. This is extremely high capacity and extremely fast spectrum but has very limited coverage compared with the 3.4-3.8 GHz 5G “mid band” spectrum typically used in most of the other countries we analyzed where mmWave spectrum is not yet available.

Real-world measurements of 5G maximum speed accurately record the experience:

Opensignal says they focus on analyzing the true end-to-end network experience of mobile users. Our approach means the speeds we measure represent the typical real-world experience of smartphone users. This means other speed tests which use dedicated test servers that are often located very close to a user inside the same operator’s network will inflate speeds compared with Opensignal’s real-world measurement of maximum speed.

To measure the real-world experience accurately, Opensignal’s tests connect our users’ smartphones to the same servers that host all the popular mobile apps and websites which all smartphone users connect to daily.

Editor’s Note: Some deployed pre-standard 5G networks (like AT&T’s) don’t have 5G smartphone endpoints at this time. AT&T only sells a Netgear “puck” which is a WiFi router with AT&T’s 5G used for backhaul.

…………………………………………………………………………………………………………………………………………………………………………………………..

……………………………………………………………………………………………………………………………

The 5G experience is set to improve quickly:

At this early stage of the 5G era, the maximum speeds are already many times higher than the maximum speed we have measured with our 4G users. The difference between 5G users’ max speed and 4G users ranged from 2.7 times as fast in the USA, 2.6 times as fast in Switzerland, down to Australia where the maximum speed experienced by 4G users was so extremely fast – close to the theoretical best performance of 4G – that the maximum 5G speed was actually slightly slower than the maximum 4G speed.

Opensignal expects 5G maximum speeds to continue to increase as 5G expands its reach. This is just the start of the 5G era and the market is moving quickly. More 5G services will launch using more spectrum and wider channels — there are few 5G services currently using 5G’s ideal 100 MHz channel size — and 5G technology evolves to be able to combine the performance of multiple 5G channels and bands together to boost both the maximum and average 5G speeds and further improve the mobile user experience of 5G users.