Layer 123 Network Transformation Congress: Unlocking 5G Growth Requires New Operating Model

by Johanne Mayer, Director MayerConsult and TM Forum Distinguished Fellow

At the Layer123 Network Transformation Congress in San Jose, CA this week, the discussions predominantly focused on the network technology changes and references to traditional network transformation such as 3G to 4G and the benefits that transforming to 5G would bring.

However I would contend that unlocking growth in 5G requires a new operating model with new processes, automation and actual supplier implementation of standard APIs for Communications Service Providers (CSPs) to achieve the agility and speedier time to market to remain relevant in the new ecosystem which has consequential impact on what they need from their vendors.

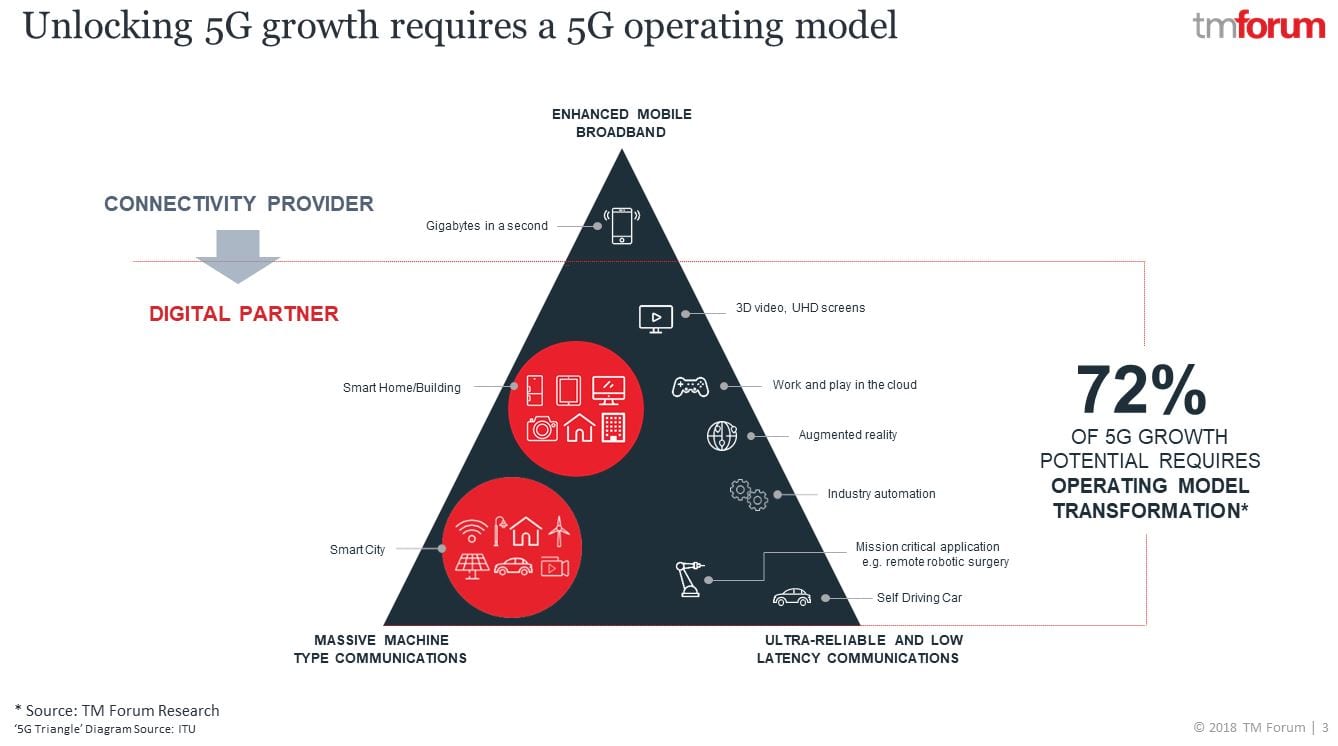

CSPs have predominantly packaged and sold products and services direct to customers with every technology, think 2G, 3G, 4G which have included connectivity and often a handset. Looking at 5G and IoT growth from the above figure, it’s highly unlikely that CSPs will package and resell connected cars, or robots for remote robotic surgery, or AR games with headsets, etc.

In addition, with today’s timeframes of 18 to 24 months to get new product to market due to the complexity and touch points between the network equipment and all of the operational and business support systems (OSS/BSS), we need to rethink how we do things for CSPs to stay relevant and profitable.

Traditional OSS and BSS have served us well but with newer cloud, SDN and NFV technologies, the relevance of understanding the relationships (think inventories) between products, services and resources is diminishing, and having to adapt to different APIs for each supplier is slowing CSP’s time to market and adding more cost pressure.

TM Forum has introduced its Open Digital Framework Concept to address CSP’s business challenges including business & IT agility, optimization, digital customer experience and both B2B and B2C growth through a set of core tools and standards along with support and guidance programs.

Of particular interest is the Open Digital Architecture (ODA) which focuses on seamless interactions between functional domains using a rich set of Open APIs which have been released and made available in Open Source (https://www.tmforum.org/open-apis/).

To achieve the seamless integration with 5G ecosystem partners and reduce costly time to market to stay competitive, the interaction and processes between the production and other functional areas need to change. The network needs to expose and fully manage the lifecycle of its set of capabilities as reusable services independent of products and resources.

The temptation today is for product and network engineers to translate the current product/network service into a monolithic network service model. Think NFV 5 years ago where we asked suppliers to place their code on white boxes. They abstracted the code from the current hardware and adapted the same thing on white boxes without taking advantage of micro-service architecture a la NFV2.

Since each product or network engineer selects their own suppliers for their products (e.g. internet security and managed firewall services) each used a firewall but likely from different suppliers. If each product engineering team were to expose their network service model, we would likely have exposure of “internet security” and “managed firewall service” as is (i.e. per early NFV) rather than “Firewall as a Service” micro-service that could be reused in both network services.

A TM Forum NaaS API Component Suite has been created in support of the complete lifecycle operations for each network as a service including service qualification, service configuration and activation, service test, service problem management and service usage. Also the more that product and network engineers can expose in relation to that reusable network service during the design time, the more automation can be developed reducing time to market to deliver products and offers to the market.

Is this too good to be true?

While the telecom industry keeps on saying that CSPs are too slow, it is rich in promoting proprietary APIs claiming that “my APIs are the best”, that standard APIs are not agile enough or that they can’t support “my differentiators” hence each of the OSS/BSS applications (think inventories, product catalogues, orchestrators, alarm management, performance management, SLA, etc.) has to use integration services to create adapters for each supplier, increasing time and costs and adding extra testing. The costs and delays in getting service up and running inherent in this business approach are simply not economically sustainable in the new business opportunities for CSPs.

The good news is that if suppliers don’t expose a service, for example it could be a core router supporting and routing several network services, but that device in itself does not expose a “reusable service” (think firewall or AAA or Eline, etc) then that supplier does not need to support the TM Forum NaaS (Network as a Service) APIs.

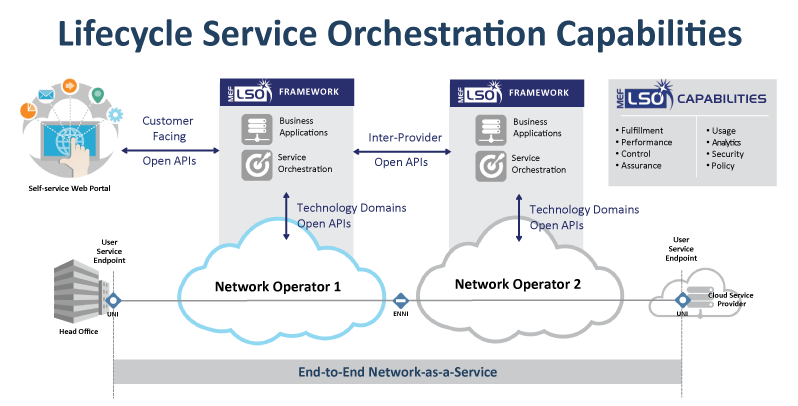

Using MEF LSO architecture, the NaaS component suite would fit the Legato interface point.

Conclusions:

As a supplier or CSP, it’s time to think where you want to fit in the new value chain.

I believe that more and more CSPs will start their transformation towards a NaaS architecture, allowing them to expose their network capabilities using standard and open APIs to be consumed seamlessly by their partners and customers.

For further information, the TM Forum is hosting a Network Transformation track at its Digital Transformation World event in Nice, May 14-16th, 2019. https://dtw.tmforum.org

………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

IG1167 ODA Functional Architecture R18.5.1

Global Architecture Forum – Webinar 1 NaaS

From network spaghetti to hyperscale simplicity

http://www.mef.net/lso/lifecycle-service-orchestration

……………………………………………………………………………………

Kindly post comments in the box below this article.

Alan J Weissberger

……………………………………………………………………………………

Huawei to compete in global consumer electronics market with world’s first “5G” TV

Huawei is reportedly preparing to produce the world’s first 5G TV as a way to challenge Apple and Samsung in the global consumer electronics market. The TV would include a “5G” modem [1] and 8K display resolution, allowing users to download high-resolution programming over cellular connections. Huawei would then be able to use some type of non standard “fixed 5G” network to download data-heavy content, such as 360 degree videos in which viewers can watch in every direction, and virtual reality programs. There are questions, however, over how soon the wider ecosystem for such services will be available.

Note 1. This author has no idea what fixed broadband network or frequencies will be used for this version of so called “5G.” Can’t emphasize enough that residential broadband Internet access and/or TV are NOT IMT 2020 use cases and are not being standardized by any accredited standards body.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Huawei’s first attempt to make TV sets is fueled by a desire to complete its “ecosystem” of consumer electronics — which already includes everything from smartphones to wearable devices — even as analysts voice doubts over the strength of its brand image. Among the potential benefits of a 5G TV is the fact it would not require the fiber optics or cable boxes that traditional cable or satellite broadcast services do. The TV could also act as a router hub for all other electronic devices in a home. The ultrahigh-definition 8K resolution, meanwhile, represents the most advanced TV screen on the market, with 16 times more pixels than the standard 1080 pixel high-definition. Indeed, 8K video is also shaping up as an important battlefield. Research company IHS Markit forecasts that shipments of 8K TVs will increase from less than 20,000 sets last year to 430,000 this year and to 2 million next year.

Huawei is the world’s biggest telecom equipment maker and in the first quarter of this year it overtook Apple to become the second-largest smartphone maker by shipments, just behind Samsung. It has signalled its determination to stay ahead in the 5G era. Besides 5G base stations, Huawei has already unveiled a 5G foldable smartphone and several home-use 5G routers that will be available later this year.

Samsung is currently the world’s biggest TV maker and just started shipping its own 8K TV without 5G capability starting at $4,999 this spring. Apple introduced the Macintosh TV in 1993, but it was not a hit, and the California tech giant has not released its own TV set since. It did, however, introduce a digital streaming box dubbed Apple TV in 2006 and has updated it several times to incorporate third-party applications, including Netflix. This March, the company unveiled Apple TV plus, a subscription service for original Apple content starring superstars such as Oprah Winfrey, Jennifer Aniston and Reese Witherspoon.

Many leading TV and camera makers are planning to roll out 8K products by 2020, as Japanese broadcaster NHK is set to broadcast the 2020 Tokyo Olympics in ultrahigh-definition. Samsung, LG Electronics, Sharp, China’s TCL, and Hisense all showcased 8K TVs at the Consumer Electronics Show earlier this year.

Huawei is not a total newcomer in the television business. The Chinese company’s chip arm Hisilicon Technologies is the world’s second-largest provider of TV chipsets after Taiwan’s MediaTek, and supplies to various local brands such as Hisense, Skyworth and Changhong, as well as Sharp. It also builds its own 5G modem chips in-house. Modem chips are a crucial component that help determine the speed of data transfers and the quality of phone calls. Although Huawei could secure large TV displays from local vendors BOE Technology Group and China Star Optoelectronics Technology, the supply of large, high-quality 8K displays is still dominated by Samsung Display, Samsung’s panel-making arm, analysts said.

“Compared with existing TV makers, Huawei likely has the most resources and knowledge related to 5G … so it’s very natural at the moment it would want to get into the sector,” said Eric Chiu, an analyst at WitsView. “It’s not yet known whether Huawei could quickly grab market share, but such a move could definitely help the Chinese company expand its brand into a new market and boost its ecosystem.”

C.Y. Yao, a tech analyst at the Taipei-based TrendForce, said there are still many challenges ahead for 5G-capable 8K TVs. “In addition to 5G base stations, you also need small-cell stations in the region, and there needs to be an ecosystem for 8K, including cameras, and 8K TV processors, encoders and decoders to broadcast 8K content, which are not yet mature.”

Cooperation with telecom operators to support the 5G service is also needed, which would disrupt current cable broadcasters, Yao added.

Huawei wants to complete is consumer electronics “ecosystem” and tie users more closely to its smartphones. © Reuters

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

In addition to getting into TVs, Huawei has also set a goal of becoming a top five PC maker by 2021 and target to triple shipments in that segment for 2019, a source told Nikkei. Though Huawei relies heavily on Intel for processor chips for laptops, the Chinese company is developing its own central processing units, or CPUs, for its computer product line, the person said.

Huawei is a latecomer to this market, having introduced its first laptop computer in late 2017. It shipped some 1 million units last year in the overall PC market of about 259 million units, according to research company IDC. Apple — whose MacBook line of laptops served as the inspiration for Huawei’s MateBook and MagicBook — is the world’s No. 4 PC maker, shipping some 18 million units last year.

President Linford Wang of Tablet&PC Product Line of Huawei Consumer Business Group told Nikkei that his company is making computers in hopes of completing its consumer electronics ecosystem. “But if we are able to expand our market share, that’s very welcome too.”

Joey Yen, an analyst at IDC, said Huawei’s emerging PC business is doing well in China, its home market, grabbing a nearly 4% share last year despite its recent entry and could gradually put some pressure on smaller PC makers such as Acer and Asustek Computer. “It also has chances to expand in emerging markets first,” said Yen.

While she was less confident about Huawei’s ability to challenge Apple’s strong brand image, she noted the thinking behind the company’s strategy. “It will surely hope that building key consumer electronics products such as laptops, smart speakers, earphones, and TVs will help consumers stay inside its ecosystem and be more loyal to Huawei’s phones.”

Huawei’s consumer electronics unit has become the company’s biggest revenue contributor for the very first time in 2018, making up 48.4% of annual sales of 721.2 billion yuan ($105.2 billion).

Its flagship telecom equipment business, however, experienced headwinds in many markets since last year as the U.S. has been lobbying allies to ban the use of the Chinese company’s equipment in crucial network infrastructure, citing cyber espionage concerns.

Huawei has consistently denied all the allegations and sued the American government on March 7 over being blocked from the U.S. Huawei has already rolled out a wearable product line including smart watches and wristbands, similar to Apple Watch and Fitbit’s offering. It also makes wireless earphones FreeBuds and FlyPods from its diffusion line Honor, to compete against Apple’s AirPods. The company’s AI speaker unveiled last October as an answer to Apple’ voice-activated Homepod. For 2018, it shipped 206 million units of smartphone and ranked as the world’s third largest vendor, just behind Samsung and Apple.

References:

https://www.techradar.com/news/huawei-is-developing-a-5g-8k-tv-because-thats-apparently-a-thing-now

Layer 123 Network Transformation Congress: Status of Network Automation, Orchestration, Zero (or Low) Touch Provisioning, SDN & NFV

The REALITY:

Disappointingly small number of deployments, many open source software and open API organizations (ONF, Linux Foundation, MEF, TM Forum, OCP, etc), pop-up consortiums (Cloud RAN, Open RAN, other disaggregated hardware), defunct standards organizations (e.g. ETSI, ITU-T, IEEE) that only produce functional requirements, reference architectures, and white papers or none of the above. Nothing that can be actually implemented via standardized exposed interfaces or APIs.

Discussion:

Tuesday April 30th and Wednesday May 1st I spent the entire day and early evening at the Layer 1,2,3 Network Transformation Congress which assessed the state of SDN, NFV, Open Source MANO (OSM), Open APIs (TM Forum and MEF), other Open Source management software, and topics related to what network operators have been talking about for at least eight years- computer controlled network automation and orchestration of services (sometimes referred to as service chaining). Contrary to the rah, rah cheerleader talk from a few network operators (especially AT&T), telco deployment of this new age open source software for automation and control of networks has been very slow. NFV actual deployments are minimal (if not zero) and SDN has become a marketing term that can mean any software control of network functions. Every network operator and cloud service provider uses different protocols, many of which they invented (e.g. Google’s routing protocol for DCI) along with a sprinkling of open source code (such as a SDN Controller).

Decades of man years has been invested in network operator proprietary network management software, which is used to provision new services, keep track and maintain existing services, facilitate moves and changes. One speaker said that he’d like to see light touch provisioning rather than zero touch. Another said that they stack the new automation, provisioning and orchestration software on top of their legacy software

For the cloud giants (e.g. Amazon, Google, Tencent, etc), it has been done, but in almost a totally proprietary fashion with almost all the network automation, control and management done using in house generated code. Amazon spoke at the conference and, in response to this author’s question, suggested the different types of network access for AWS. Microsoft spoke, not about Azure but their private enterprise network which doesn’t use any open source code. Moreover, it took two years to get 22 new sites connected via direct internet connections (<600M bit/sec) that would normally be served by copper lines (bonded DSL or short reach fiber).

Selected Quotes from Conference Participants:

Long time colleague Craig Matsumoto (whom I met when he was EE Times, but now at 451 Research) coined a new term during his presentation – “software programmable interconnection” (SPI) for data centers. Craig said: “We talk a lot about telcos. The question is what does network transformation mean for the data center world? What are they doing about it? We came up with this new term, software programmable interconnection (SPI) . It’s basically about the idea that data centers connect with one another with a fabric.” In this author’s opinion the SPI term captures the wide variety of software being used within and between data centers!

“For me covering data centers after covering telcos for so long, they’ve (data center operators) talked to me about using the SDN for pretty much anything that involved automation and the network. Anything that has software is SDN to them. We came up with a different term as a good way to encapsulate that some kind of software is being used that might or might not be SDN,” Matsumoto added.

Tuesday’s keynote speaker and Wednesday moderator Roy Chua, Founder and Principal of AvidThink – a boutique market research firm:

“With regard to the key takeaways, I think you’ve captured them. I was very impressed at the level of candor in the discussions and presentations. I liked the concrete examples and quantification of NFV uptake challenges and the recognition that we need to solve constrained problems than try to boil the ocean. There was definitely good content…..Appreciate all the excellent questions and enjoyed the discussion at lunch. And I am most grateful for your endorsement of the analysis that I do.”

This author recommends only a select few (<5) networking market analysts that do primary market research. Roy is one of those select few!

From Kaustubha Parkhi, Principal Analyst at Insight Research (a well respected Indian market research firm):

“There is no doubt that LSO [2] is essential. Equally essential is the pruning of its objectives and scope, which becomes a bit overwhelming at times. The objectives, in the present form are so broad-based that they cover everything from billing functions to network equipment deployment.” –>More on LSO in a forthcoming IEEE Techblog article.

Note 2. LSO (Lifecycle Service Orchestration) is the set of MEF-defined specifications enabling standardized service orchestration based on standardized lifecycles of end-to-end connectivity services across one or more network service domains. A key contribution is open APIs – to automate the entire lifecycle for services orchestrated across multiple provider networks and multiple technology domains within a provider network. LSO enables service providers to transition from a silo-structured BSS/OSS approach towards flexible end-to-end orchestration that unleashes the value of SDN and NFV. Standardized LSO APIs are critical for enabling agile, assured, and orchestrated services over automated, virtualized, and interconnected networks worldwide.

Above illustration courtesy of MEF

…………………………………………………………………………………………………………………………………………………………………………………………………………………

Conclusions:

I was pleasantly surprised by the honesty (if not brutal frankness) of the speakers. What a refreshing change from the never ending hype, exaggeration and lies one hears at most networking conferences – including the IEEE 5G Summits :-((.

With over 20 pages of handwritten notes and so many important things revealed, I am not able to write a detailed conference summary report on this free website. Hence, I solicit readers to email me what they’d like me to cover in future posts, after reading the conference agenda for Tuesday- Day 1 and Wednesday -Day 2.

Please remember that the IEEE Techblog does not accept advertisements so we can tell the real truth. Also we don’t charge for viewing posts or comments (no pay wall). Finally, this author has managed and contributed to this and predecessor website (community.comsoc.org) for over 10 years without any pay.

You may contact this author at: [email protected]

…………………………………………………………………………………………………………………..

References:

PRESENTATIONS FROM:

– WORKSHOP DAY: https://www.layer123.com/downloadfiles/NTC19_Presentations_WorkshopDay.zip

– DAY 1: https://www.layer123.com/downloadfiles/NTC19_Presentations_Day1.zip

– DAY 2: https://www.layer123.com/downloadfiles/NTC19_Presentations_Day2.zip

– FINAL ALL: https://www.layer123.com/downloadfiles/NTC19_Presentations_Final.zip

T-Mobile U.S. profit beats estimates; Plan to launch 5G on 600 MHz in 2H-2019

T-Mobile USA, the third-largest U.S. wireless carrier by subscriber count, beat Wall Street analysts estimates for first-quarter revenue and profit, as competitive pricing lured new subscribers to its monthly cellphone plans. Net income surged to $908 million, or $1.06 per share, in the three months ended March 31, from $671 million, or 78 cents per share, a year earlier. Analysts had expected the company to earn 91 cents per share, according to IBES data from Refinitiv. Revenue rose nearly 6 percent to $11.08 billion, in line with estimates.

T-Mo added a net 656,000 phone subscribers in the first quarter, up from 617,000 additions a year earlier and substantially more than the 612,000 new subscribers analysts had expected, according to research firm FactSet.

The wireless telco is awaiting approval of its $26 billion deal to buy smaller rival Sprint Corp, which it has said will give it scale to compete with market leaders Verizon Communications Inc and AT&T Inc.

T-Mobile US Chief Executive John Legere said during a post-earnings call with analysts that he remained “optimistic and confident” that U.S. regulators would recognize the merger as good for consumers, and said he still expects deal approval in the first half of this year.

Reuters reported last week that the U.S. Justice Department has told T-Mobile and Sprint it has concerns about the merger in its current structure. At a meeting on Wednesday, U.S. regulators questioned Sprint and T-Mobile executives about the deal.

John Legere, CEO of T-Mobile said: “We’re off to a fast start in 2019 with customer growth that accelerated year-over-year, record low churn and we expect to lead the industry in postpaid phone growth. We’re executing on our business plan and our guidance shows that we expect our momentum to continue.”

On the earnings call, Legere added: “And even with Charter and Sprint left to report. T-Mobile still took an estimated 88% of the industry’s postpaid phone growth. We also put up a customer growth number that accelerated year-over-year, extended our streak of more than 1 million total net per quarter to six years and delivered an all time record low postpaid phone churn results of 0.88%, by the way, that churn number is better than AT&T and within 4 basis points of Verizon.”

The company claims they have Industry Leading Network Performance:

- 99% of Americans now covered with a 4G LTE network that is second to none

- Fastest combined average of download and upload speeds for 21 quarters in a row

- Aggressive deployment of 600 MHz using 5G ready equipment, now reaching nearly 3,500 cities and towns

- On track to have the first nationwide 5G network available next year

Legere speaking on the earnings call:

“We continued to expand our 4G LTE coverage and deliver industry-leading network performance. Our network now covers approximately 326 million Americans with 4G LTE. And now we have 600 megahertz and 700 megahertz low band spectrum deployed to 304 million people across the country. In terms of 4G LTE speeds for 21 quarters in a row, we delivered the fastest combined average of download and upload speeds.

Our engineering team is hard at work building the foundation for America’s first real nationwide 4G network with an aggressive build out of 600 megahertz spectrum, which we expect to be ready next year as well as millimeter wave. Our 600 megahertz LTE deployment is on equipment that’s 5G ready. And we continue to make incredible progress since getting our hands on the spectrum. Almost 3,500 cities and towns in 44 states and Puerto Rico alive with LTE on 600 megahertz today, well ahead of expectations.

And we have 4,600 megahertz capable devices in our lineup today including the new iPhones. We plan to launch 5G on 600 megahertz as soon as we have compatible smart phones in the second half of this year. And if our merger with Sprint is approved, we will get access to unmatched available mid-band spectrum for 5G, which will result in a uniquely powerful 5G network with eight times the capacity by 2024 of the combined standalones today and 15 times average speeds by 2024 verses today.

We certainly watched Verizon’s 5G launch experiment on millimeter wave spectrum in tiny pockets of two cities with interest. Not surprisingly, customers are having a hard time finding a signal. And probably not just because Verizon won’t publish a coverage map. And I won’t even get into that trickery AT&T is using with customers on 5GE. While they both are pursuing 5G BS, we think 5G should be for everyone, everywhere. Having 5G on 600 megahertz in terms of coverage and adding Sprint spectrum for broad capacity will be a true game changer and will turn New T-Mobile into the undisputed 5G leader, not only in the U.S. but around the world. We remained very confident in our outlook for 2019 and it’s reflected in our guidance that Braxton will review in a minute.”

CTO Neville Ray answers a spectrum question from Simon Flannery of Morgan Stanley on the earnings call:

“As we’re rolling out 600 megahertz, we’re using 5G capable radio (3GPP Rel 15 “5G NR”). So obviously we’re taking new software on a regular basis, the 5G softwares coming in heavy and fast.

But here we are today, we’ve got over 1 million square miles of 600 megahertz LTE rolled out for across. It’s working in 44 states and Puerto Rico. And we have a 100 million covered POPs on 600 megahertz LTE. So we’ve said that in 2020, we’ll have a nationwide footprint on 5G. And as we look at our launch environment, when we get the terminals in the second half of 2019, we’re going to be lighting up an enormous footprint on 5G, an enormous footprint on 600 megahertz.

And we have a lot of spectrum as you point out. We were incredibly successful in the auction, which seems like yesterday, that was two years ago. And we intend to put down a very large three, four lane highway across the U.S. with 600 megahertz. And I think it’s going to be in stark contrast to the pockets of 5G that are out there today and very, very limited from AT&T and Verizon. And Verizon maybe doing more cities, but it seems to be a handful of sites in very urban environments with very limited range.

And we’re not sitting there just throwing rocks at millimeter wave. We believe in millimeter wave, but – and we will launch millimeter wave services ourselves. But I can tell you now the software is not mature. We continue to work with the same equipment and software as the Verizon guys have decided to launch and even have the goal to ask their customers to pay $10 bucks more a month to access wherever they could find it. I believe they pulled that back today. They’ve pulled back the $10 price like they were trying to force on people, but comparing contrast tens of millions of covered POPs with 5G to handfuls. That’s the excitement and scale of what we love to do with 5G. Not in 2020, but in 2019. And as soon as we can get those devices onto – and into our customer’s hands, we will.”

John Legere:

“I just editorialize, I’ve been doing this a long time, I’ve never seen a team move as fast to deploy spectrum as an excellent team that moved on this 600 MHz. Yes, we use to think that we are now across 3,500 cities and towns in 44 states and Puerto Rico, 1 million square miles of territory with 600 and all of that already 5G compatible. We talk about being the first one to be nationwide next year, a lot of times that’s defined as 200 million, maybe we’ll march past that. But here we are in April of 2019 already having accomplished that kind of a milestone. It’s amazing.”

Ray answers a multi-part question from Craig Moffett of MoffettNathanson LLC:

“I talked the lengths are about what we can do with 600 megahertz and obviously, as we light up, think about just on a standalone basis, lighting up 30 megahertz nationwide on top of the assets that we’ve deployed today. So speeds are absolutely going to move from the 30, 35 net averages, they that exist in the network today, into the 60s and 70s peak speeds are going to move well north probably not quite doubling where we are today, but into the hundreds of megabits per second.

That’s achievable, right. As you combine an aggregate, the 600 megahertz in with the mid-band spectrum that we have. So that’s a very interesting proposition. But it fails in comparison to what we can do with the New T-Mobile. And the rollout that we can achieve with 2.5 gigahertz and especially the amount of spectrum mid-band spectrum that we can push into 5G early, and address this need of mid-band 5G, which the world – the rest of the world is running with. Craig as you know, here in the U.S., we have this mid-band dilemma. We can solve that with the combination of T-Mobile and Sprint, and really move forward with a tremendous 5G experience with breadth and depth and all of the data and the fact points that John pointed out earlier in the messaging.

So that’s the piece I’m focused on. Obviously on a standalone basis, it’s a different world. But then that’s us and AT&T and Verizon and everybody else trying to figure out how do we move to that next level of performance with 5G in a world where the mid-band spectrum that’s needed to really drive that is not coming from auctions or from other sources in any real timeframe that’s comfortable for anybody.

But the combination of T-Mobile and Sprint creates that mid-band opportunity in a way that cannot be created in the U.S. marketplace over the coming years. That’s what’s so unique and exciting about the opportunity. And Craig, that’s where I spend my time. I’m thinking about that piece. I know we’ve got a very strong network. I’m adding a lot of 600 megahertz, a new spectrum to the asset that we have. So a lot of confidence there, but the excitement and the thing that we long for and look forward to is this combination of the Sprint.”

………………………………………………………………………………………………………………………………………………..

References:

https://www.t-mobile.com/news/t-mobile-q1-2019-earnings

Waiting for 5G? Researchers want early development of 6G telecom technologies in South Korea

by Lim Chang-won; email : [email protected]

South Korea has become a front runner in disseminating 5G mobile services, but researchers were not complacent, calling for the early and pre-emptive development of next-generation technologies for market advantage as it did in code-division multiple access (CDMA), a second-generation channel access method used in mobile phone standards.South Korea started providing 5G services for ordinary consumers on April 4, claiming to be “industry-first.” 5G is ten times faster than 4G. Although 6G is still seen as an illusion, researchers at the University of Oulu think the future-generation mobile network can transfer terabits per second, creating near-instant microsecond connectivity between societies.

“We have begun to discuss the development of 6G mobile communication technologies,”Kim Myung-joon, president of the Electronics and Telecommunications Research Institute (ETRI), told reporters on April 24. “I think securing intellectual property rights is more important than anything.”

ETRI is a major state-funded body in wireless communication domain that has played a crucial role in the history of South Korea’s telecom industry by commercializing CDMA technologies in the 1990s. The institute has been working on Terahertz (THz) band for 6G. THz is a unit of frequency defined as one trillion cycles per second.

Because 6G is 100 times faster than 4G LTE and five times faster than 5G, scientists say it will open a completely new era. China has already disclosed a roadmap to develop 6G for commercialization in 2030.

“Not only China but also other countries such as the U.S. and Japan are scrambling to develop 6G technologies.” said a mobile telecom industry official on condition of anonymity. “In order to secure a voice in national security or the international telecom market, preempting 6G-based technology is an essential task.”

In January, LG Electronics opened a 6G research lab through cooperation with the Korea Advanced Institute of Science & Technology (KAIST), a prestigious state science school, to secure core technologies for 6G mobile communication. “It is meaningful to start the development of 6G mobile communication technology ahead of others,” said Cho Dong-ho, a KAIST professor who heads LG‘s research lab.

http://ajudaily.com/view/20190426142351793

……………………………………………………………………………………………………………………………………………………………………….

6G Research Centre (Center) in South Korea:

In January 2019, LG Electronics and KAIST opened a 6G research centre to ‘lead in next-generation mobile telecommunications’, the pair said.

The LG-Electronics-KAIST 6G Research Centre will be housed at Daejeon, which is home to the university’s KAIST Institute research complex.

KAIST Institute was set up in 2006 and focuses on convergence research. LG Electronics said it will use the institute’s personnel and infrastructure to preemptively secure technology for 6G.

“We want to secure core technologies for sixth generation wireless network ahead of time,” the company said.

5G is yet to be commercialised but Asia already has its eyes on 6G as the competition heats up among them. China has said it will begin 6G research from 2020.

https://www.zdnet.com/article/lg-sets-up-6g-research-centre-at-kaist/

…………………………………………………………………………………………………………………………………………………………………………….

Reference:

AT&T Earnings Disappoint; 5G pricing ~ broadband fixed line & LAN replacement for business customers?

AT&T reported 2019 Q1 net income of $4.1 billion, or 56 cents per share, down from $4.66 billion, or 75 cents per share, in the same quarter the year before. Earnings, adjusted for one-time gains and costs, were 86 cents per share, beating analysts’ estimate by 1 cent. AT&T earnings continued its streak of either missing or just hitting analyst expectations. EPS was in line with expectations, while revenues were off $270M despite growing 17.8% Y/Y fueled by the Time Warner acquisition. Revenue grew 18 percent to $44.83 billion in the period, which missed Street forecasts. Thirteen analysts surveyed by Zacks expected $45.09 billion.

The U.S.’s second-largest wireless carrier after Verizon added 80,000 cellphone customers who pay a monthly bill, the more lucrative type of wireless customer. AT&T also added “prepaid” cellphone customers.

During AT&T’s earnings call, CEO Randall Stephenson said that he anticipates that there is a chance 5G mobile plans could more closely resemble broadband internet plans versus current LTE plans. For example, with LTE plans, it is priced based on how much data you need, but other than that, a customer on a 1GB data plan versus a customer on a 50GB data plan will experience the same speeds.

However, with 5G, Stephenson said, “I will be very surprised if, as we move into wireless, the pricing regime in wireless doesn’t look something like the pricing regime you see in fixed line. If you can offer a gig speed, there are some customers that are willing to pay a premium for 500 meg to a gig speed, and so forth. So I expect that to be the case. We’re two to three years away from seeing that play out.”

“Right now, from 5G what we’re seeing is exclusively businesses,” said Stephenson. “It’s serving as a LAN replacement product.” Business customers are installing a 5G router, but when more devices start showing up on the market with embedded 5G modems, “then you don’t even need the router,” he said.

AJW Comment: A 5G private LAN competes with private LTE and IEE 802.11ax. It’s hardly a slam dunk commercial success and is not even a use case for IMT 2020. ONCE AGAIN, THERE IS NO STANDARD FOR 5G UNTIL IMT 2020 HAS BEEN APPROVED!

3GPP Rel 15 “5G NR” (not a standard) is being deployed in two distinct sets of spectrum, with very different characteristics

………………………………………………………………………………………………………………………………………………………………………………………..

Stephenson noted that business customers pay more for higher speeds in AT&T’s fixed line offerings, and the company expects the same to hold true with 5G. Ultimately, the company expects a 5G “pricing regime” that will look similar to its fixed-line pricing regime. But it doesn’t expect that to play out for two to three years.

“We’ll have 5G coverage nationwide next year. We’ll offer 5G to both businesses and consumers.”

The AT&T CEO was also very bullish on the company’s FirstNet business for emergency services. FirstNet “has passed the halfway mark,” he said, adding that it serves 7,000 agencies with 570,000 subscribers. And he reiterated his point that FirstNet is helping AT&T speed the build-out of 5G.

AT&T CFO John Stephens elaborated, “We’re at 53% of our network buildout for FirstNet. For 5G we’re operational in 19 markets today, using that 39GHz mmWave spectrum.”

Stephenson added, “Turning up FirstNet is having exactly the impact we hoped it would have. The value proposition is now one of quality and speed and delivery of video.” FirstNet is driving a non-inconsequential impact on subscriber gains. In addition, it’s giving AT&T more penetration in rural communities and allowing the company to take market share. “FirstNet is going to be strategic for us for a number of years,” said Stephenson.

Will Hyperscale Cloud Companies (e.g. Google) Control the Internet’s Backbone?

Rob Powell reports that Google’s submarine cable empire now hooks up another corner of the world. The company’s 10,000km Curie submarine cable has officially come ashore in Valparaiso, Chile.

The Curie cable system now connects Chile with southern California. it’s a four-fiber-pair system that will add big bandwidth along the western coast of the Americas to Google’s inventory. Also part of the plans is a branching unit with potential connectivity to Panama at about the halfway point where they can potentially hook up to systems in the Caribbean.

Subcom’s CS Durable brought the cable ashore on the beach of Las Torpederas, about 100 km from Santiago. In Los Angeles the cable terminates at Equinix’s LA4 facility, while in Chile the company is using its own recently built data center in Quilicura, just outside of Santiago.

Google has a variety of other projects going on around the world as well, as the company continues to invest in its infrastructure. Google’s projects tend to happen quickly, as they don’t need to spend time finding investors to back their plans.

Curie is one of three submarine cable network projects Google unveiled in January 2018. (Source: Google)

……………………………………………………………………………………………………………………………………………………………………………………..

Powell also wrote that SoftBank’s HAPSMobile is investing $125M in Google’s Loon as the two partner for a common platform, and Loon gains an option to invest a similar sum in HAPSMobile later on.

Both companies envision automatic, unmanned, solar-powered devices in the sky above the range of commercial aircraft but not way up in orbit. From there they can reach places that fiber and towers don’t or can’t. HAPSMobile uses drones, and Loon uses balloons. The idea is to develop a ‘common gateway or ground station’ and the necessary automation to support both technologies.

It’s a natural partnership in some ways, and the two are putting real money behind it. But despite the high profile we haven’t really seen mobile operators chomping at the bit, since after all it’s more fun to cherry pick those tower-covered urban centers for 5G first and there’s plenty of work to do. And when they do get around to it, there’s the multiple near-earth-orbit satellite projects going on to compete with.

But the benefit both HAPSMobile and Loon have to their model is that they can, you know, reach it without rockets.

…………………………………………………………………………………………………………

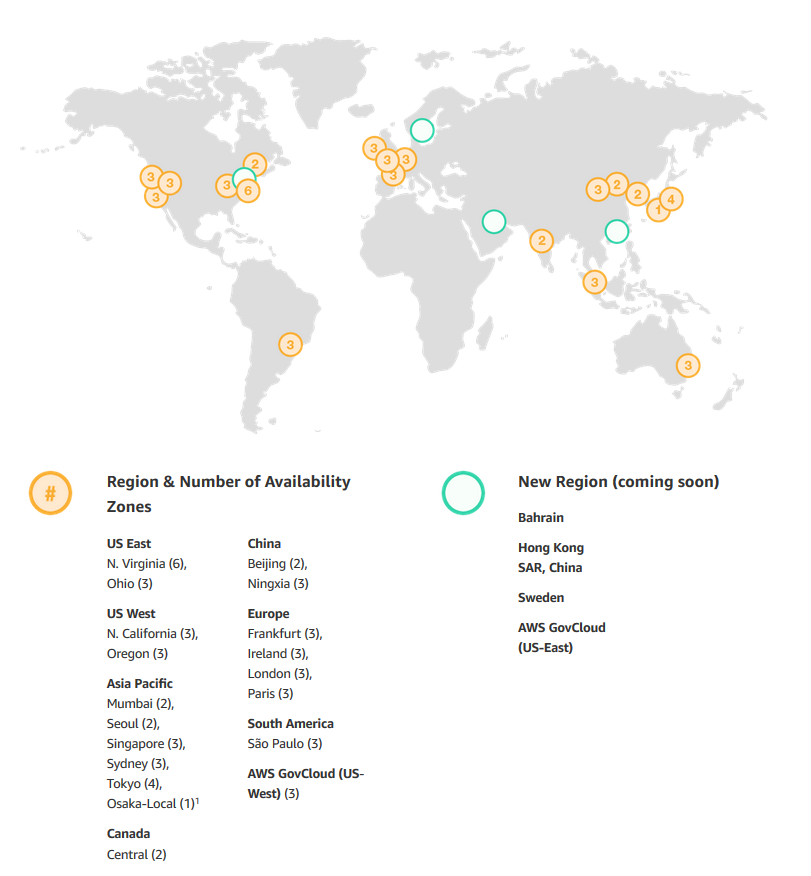

AWS’s Backbone (explained by Sapphire):

An AWS Region is a particular geographic area where Amazon decided to deploy several data centers, just like that. The reason behind a chosen area is to be close to the users and also to have no restrictions. At the same time, every Region is also connected through private links with other Regions which means they have a dedicated link for their communications because for them is cheaper and they also have full capacity planing with lower latency.

What is inside a Region?

- Minimum 2 Availability Zones

- Separate transit centers (peering the connections out of the World)

How transit centers work?

AWS has private links to other AWS regions, but they also have private links for the feature AWS Direct Connect – a dedicated and private & encrypted (IPSEC tunnel) connection from the “xyz” company’s datacenters to their infrastructures in the Cloud, which works with the VLANs inside (IEEE 802.1Q) for accessing public and private resources with a lower latency like Glacier or S3 buckets and their VPC at the same time between <2ms and usually <1ms latency. Between Availability Zones (inter AZ zone) the data transit there’s a 25TB/sec average.

From AWS Multiple Region Multi-VPC Connectivity:

AWS Regions are connected to multiple Internet Service Providers (ISPs) as well as to Amazon’s private global network backbone, which provides lower cost and more consistent cross-region network latency when compared with the public internet. Here is one illustrative example:

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

From Facebook Building backbone network infrastructure:

We have strengthened the long-haul fiber networks that connect our data centers to one another and to the rest of the world.

As we bring more data centers online, we will continue to partner and invest in core backbone network infrastructure. We take a pragmatic approach to investing in network infrastructure and utilize whatever method is most efficient for the task at hand. Those options include leveraging long-established partnerships to access existing fiber-optic cable infrastructure; partnering on mutually beneficial investments in new infrastructure; or, in situations where we have a specific need, leading the investment in new fiber-optic cable routes.

In particular, we invest in new fiber routes that provide much-needed resiliency and scale. As a continuation of our previous investments, we are building two new routes that exemplify this approach. We will be investing in new long-haul fiber to allow direct connectivity between our data centers in Ohio, Virginia, and North Carolina.

As with our previous builds, these new long-haul fiber routes will help us continue to provide fast, efficient access to the people using our products and services. We intend to allow third parties — including local and regional providers — to purchase excess capacity on our fiber. This capacity could provide additional network infrastructure to existing and emerging providers, helping them extend service to many parts of the country, and particularly in underserved rural areas near our long-haul fiber builds.

………………………………………………………………………………………………….

Venture Beat Assessment of what it all means:

Google’s increasing investment in submarine cables fits into a broader trend of major technology companies investing in the infrastructure their services rely on.

Besides all the datacenters Amazon, Microsoft, and Google are investing in as part of their respective cloud services, we’ve seen Google plow cash into countless side projects, such as broadband infrastrucure in Africa and public Wi-Fi hotspots across Asia.

Elsewhere, Facebook — while not in the cloud services business itself — requires omnipresent internet connectivity to ensure access for its billions of users. The social network behemoth is also investing in numerous satellite internet projectsand had worked on an autonomous solar-powered drone project that was later canned. Earlier this year, Facebook revealed it was working with Viasat to deploy high-speed satellite-powered internet in rural areas of Mexico.

While satellites will likely play a pivotal role in powering internet in the future — particularly in hard-to-reach places — physical cables laid across ocean floors are capable of far more capacity and lower latency. This is vital for Facebook, as it continues to embrace live video and virtual reality. In addition to its subsea investments with Google, Facebook has also partnered with Microsoft for a 4,000-mile transatlantic internet cable, with Amazon and SoftBank for a 14,000 km transpacific cable connecting Asia with North America, and on myriad othercable investments around the world.

Needless to say, Google’s services — ranging from cloud computing and video-streaming to email and countless enterprise offerings — also depend on reliable infrastructure, for which subsea cables are key.

Curie’s completion this week represents not only a landmark moment for Google, but for the internet as a whole. There are currently more than 400 undersea cables in service around the world, constituting 1.1 million kilometers (700,000 miles). Google is now directly invested in around 100,000 kilometers of these cables (62,000 miles), which equates to nearly 10% of all subsea cables globally.

The full implications of “big tech” owning the internet’s backbone have yet to be realized, but as evidenced by their investments over the past few years, these companies’ grasp will only tighten going forward.

China Unicom to launch 5G consumer services May 2019 in 7 Chinese cities

China Unicom on Tuesday announced that it would offer 5G services for a selected group of users to try the ultra-fast wireless network, becoming the first Chinese telco to offer 5G services to the public and marking the start of consumer 5G in the country. At a conference in Shanghai, the carrier also announced other plans for 5G, including devices and global cooperation, boosting its advances in the rollout of the ultra-speed network. But analysts said that despite the progress, final commercialization could take more time to be realized.

China Unicom launched its 5G trial services on Tuesday at its global partner conference in Shanghai, saying that it is the first telecom carrier in China to offer the public 5G trial services, according to a statement the company sent to the Global Times. As part of the program, China Unicom will provide selected users 5G services as well as handsets that are capable of running on 5G networks, the statement said. With China Unicom’s move to offer consumer 5G, China will become one of the first countries to launch commercial 5G, following launches in the US, South Korea and some in Europe.

At the conference, the company also announced that it would launch 5G services in seven Chinese cities, including Beijing, Shanghai and Guangzhou, capital of South China’s Guangdong Province, and it displayed five mobile devices that support 5G connections. Although other companies, including China Mobile, have conducted tests on 5G networks, China Unicom’s move shows that China might be near the final rollout of the network, analysts said.

“China is making a lot of progress in developing 5G-related technologies. With the software and hardware ready, we can expect that 5G licenses will soon be granted to operators, such as China Telecom and China Unicom,” Xiang Ligang, director-general of the Information Consumption Alliance, told the Global Times on Tuesday.

Xiang noted that the readiness in the “key parts of the 5G industrial chain” means that hardware, including 5G base stations and 5G devices, as well as software, including the provision of stable 5G networks, are both ready for commercialization.

Overall deployment of 5G in China is moving forward smoothly, and it is expected to see more application of the next generation of mobile technologies in the Internet of Things, healthcare, smart manufacturing and others, the Ministry of Industry and Information Technology said on Tuesday.

“The most challenging thing is how to use 5G technologies well,” Wen Ku, director of the telecom department at the ministry, told a press briefing in Beijing, noting that the most mature applications so far are in the consumer and auto sectors.

China Unicom said it has formed an alliance on innovative 5G applications with dozens of companies in areas such as media, the industrial internet, automobile, healthcare and education.

“The application of any technology becomes mature through trial and error,” Xiang said. “The trial application in the seven cities will provide the operator with important feedback so that the 5G service can be improved when it’s in official use.”

Still, there could be a way to go before the final commercialization of 5G in China, according to Fu Liang, a Beijing-based independent telecom analyst. “There is still so much to be explored in terms of how 5G can be applied in different areas like education, entertainment or transportation,” Fu said. “Yes it can increase downloading speed, but it will take time for people and companies to adapt and make full use of it.” Fu estimates that with steady steps of development of applications, 5G technologies will be widely used with smart devices by the beginning of next year.

5G is “a very different scenario,” Qualcomm 5G marketing director Ignacio Contreras tells VentureBeat, and is “coming fast” to the country. Instead of lagging behind, China will offer 5G at the beginning of its lifecycle, though it’s unclear just how geographically widespread the high-speed, low-latency networks will actually be at first. The carrier says it will offer initial service in seven cities, including Shanghai, Beijing, Hangzhou, Shenzhen, and Xiong’an New Area.

China Unicom’s launch will be backed by numerous Qualcomm Snapdragon X50modem-based 5G devices from Chinese companies, most notably including OnePlus, OPPO, Vivo, Xiaomi, and ZTE. Initially, many of these devices will be fairly similar to one another thanks to their use of Qualcomm’s Snapdragon 855chipset, but there will be variations in both form factor and pricing.

For instance, flexible-screened Alpha smartwatch maker Nubia is releasing a “mini 5G” smartphone designed to be smaller than the roughly 6.4-inch-screened 5G phones other carriers have shown. And Xiaomi is expected to offer Chinese consumers a 5G phone in the sub-$700 price range, well below the $1,000 and up premium pricetags favored by LG’s and Samsung’s South Korean smartphones.

Other companies will offer 5G-ready devices for the Chinese market. Domestic manufacturer Huawei has promised to offer aggressively priced 5G devices with its own Balong 5000 modems, as well as a $2,600 foldable tablet-phone called Mate X. Taiwan’s MediaTek is planning to supply chips for mid-range and premium phones for Chinese consumers, as well.

References:

http://www.ecns.cn/business/2019-04-24/detail-ifzhpeef7887790.shtml

CB Insights: What’s next for 5G

As expected, there is no mention of 5G standards or IMT 2020 in this entire 31 page report. This is an unedited excerpt:

As numerous wireless carriers plan to offer 5G service in the coming year, the entire telecom industry is hard at work to capitalize on this shift to higher radio wave frequencies:

• Qualcomm recently unveiled the Snapdragon 855 chipset, which grants smartphones 5G capabilities. The Snapdragon 855 will roll out in early 2019.

• Verizon launched its first 5G broadband internet networks in 4 cities during late 2018 and plans to release 5G wireless service in 2019 after its first 5G-ready phones hit the market.

• AT&T rolled out 5G mobile hotspots in a dozen cities in 2018 and will be adding at least 9 more in 2019.

• Sprint and LG plan to release the first 5G smartphone in the first half of 2019. Sprint will have its 5G network in place in at least 9 cities by the time the smartphone launches.

• Motorola unveiled its new 5G Moto Mod in 2018; the mod snaps onto the back of the Moto Z3 and turns it into a 5G-capable device. The 5G mod will be available for purchase

in 2019.

• Companies like Zayo are helping to lay the necessary fiber to support these 5G networks, while others like Siklu are providing fixed wireless antennas and small cells.

• Manufacturers of 5G devices also play one of the more important roles in 5G adoption: device manufacturers need growing coverage, while wireless networks need a growing number of compatible devices.

Verizon’s Earnings Beat; CEO:”We are leading the world in development of new technologies”

Verizon (VZ) posted earnings per share of $1.22, up from $1.17 per adjusted share in the comparable year-ago quarter. Revenues were $32.1 billion, versus $31.8 billion in the first quarter of 2018. Analysts in a Bloomberg consensus forecast expected the company to post earnings per share of $1.17 on revenues of $32.15 billion. Hence, the company beat earnings forecasts.

The company added 61,000 retail net postpaid additions, a key metric of how many users lock in a contract, which included 174,000 postpaid smartphone net additions. Verizon’s service revenues rose 4.4% during the first 3 months of 2019, helped in part by customers added higher-priced plans and new connections, the company said. Separately, Verizon added a net of 52,000 Fios Internet connections, but lost a net 53,000 Fios Video connections.

Verizon, which has begun its mobile 5G rollout in Chicago and Minneapolis (the only supported device is the Motorola Z3 with the 5G Moto Mod), said that its 5G mobile network buildout was part of its $4.3 billion in capital expenditures.

“2019 is shaping up to be an exciting year for Verizon,” said chairman and CEO Hans Vestberg in a statement. “We are leading the world in the development of new technologies with the launch of our 5G Ultra Wideband network. Our ambition remains unchanged to provide the most advanced next-generation networks in the world.”

AJW Comment:

What’s really interesting, is that as far as we know, Verizon doesn’t even participate in ITU-R WP 5D meetings. That is where IMT 2020 (5G radio aspects) is being standardized, with 3GPP contributing the input documents supported by most ITU-R delegates. An AT&T rep chairs that committee and another AT&T rep chairs the sub working group on IMT frequency aspects. Yet both companies falsely claim they’ve deployed “standards based” mobile 5G despite the FACT that the IMT 2020 Radio Interface Technology (RIT) won’t be selected by the evaluation groups till the fall of 2020.

Sprint, T-Mobile USA, and Dish are the other U.S. network operators that regularly attend ITU-R WP 5D meetings. Qualcomm, Apple, Intel and a few other U.S. member companies also attend those meetings.

So we wonder if Ericsson ONLY gets their IMT 2020 information from their network equipment vendors rather than obtain it directly by attending ITU meetings?

……………………………………………………………………………………………………………………………………………………………………………………

Update on April 25. 2019:

U.S. cities with Verizon 5G Ultra Wideband

- Chicago

- Minneapolis

U.S. cities that will get Verizon 5G Ultra Wideband in 2019

- Atlanta

- Boston

- Charlotte

- Cincinnati

- Cleveland

- Columbus

- Dallas

- Des Moines

- Denver

- Detroit

- Houston

- Indianapolis

- Kansas City

- Little Rock

- Memphis

- Phoenix

- Providence

- San Diego

- Salt Lake City

- Washington D.C.

Verizon wants its mobile 5G to offer impeccable speeds with low latency. To meet those demands, Verizon will initially deploy its 5G Ultra Wideband network on millimeter wave spectrum (mmWave). While mmWave will undoubtedly offer the fastest 5G experience, it has its flaws.

One of the notable challenges with the implementation of new “small cell” towers is the fact that they require local government approval — essentially meaning that carriers need approval in every city they want to install these new towers. To attempt to speed that up, Verizon is encouraging customers to lobby their elected officials. The new “Let’s 5G” website is aimed at both informing people about 5G and what it could offer, and informing users on how they can speed up the process of 5G deployment.

Verizon will initially roll out its 5G service on 28 GHz spectrum. One of the challenges with using the high-band spectrum is that it does not easily cover a large area, and penetration is a serious challenge. Over the next several years, Verizon will build out its 5G network around the country using small cells, and will eventually deploy service on a mid- and low-band spectrum.

In a real-world demonstration of the network at CES 2019, CEO Hans Vestburg showed speeds of 900 Mbps, as well as a crystal-clear video conference with the first fixed-wireless customer in Texas.

For the next several years Verizon’s 5G service will piggyback off its massive 5G network. Expect to see 5G service in larger cities and busy places like airports and stadiums, but you will be unlikely to see the service in the suburbs and rural areas for years to come.

SOURCE: https://www.digitaltrends.com/mobile/verizon-5g-rollout/