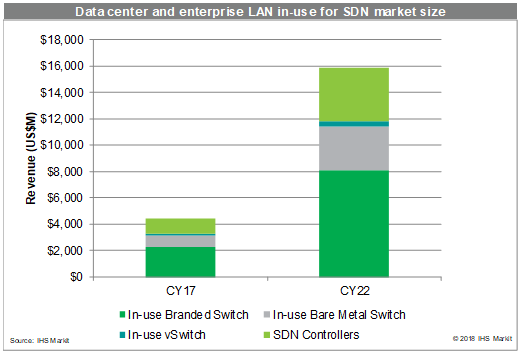

IHS Markit: Data Center and enterprise LAN SDN market totaled $4.4 Billion in 2017

Data Center & Enterprise SDN Hardware and Software Market Tracker from IHS Markit:

Highlights:

- Global data center and enterprise LAN software-defined networking (SDN) market revenue—including SDN-in-use bare metal and branded Ethernet switches and SDN controllers—is anticipated to reach $15.8 billion by 2022.

- Bare metal switch revenue came to $790 million in 2017, representing 26 percent of total in-use SDN-capable Ethernet switch revenue.

- Data center SDN controller revenue totaled $1.2 billion in 2017, and is expected to hit $4 billion by 2022, when it will represent 17 percent of data center and enterprise LAN SDN revenue.

- Cisco is number-one with 21 percent of 2017 in-use SDN revenue, VMware comes in at number-two with 19 percent, Arista at number-three with 15 percent, White Box at number-four with 12 percent and Huawei at number-five with 7 percent.

Notes:

- White Box is No. 1 in bare metal switch revenue, VMware leads the SDN controller market segment, Dell owns 44 percent of branded bare metal switch revenue in the second half of 2017, and HPE has the largest share of total SDN-capable (in-use and not-in-use) branded Ethernet switch ports.

- White box also ranked No. 1 in data center server revenue, pulling in 21 percent of the market in the first quarter, or $3.8 billion. Dell EMC dropped to second place in revenue at 20 percent ($3.6 billion), followed by Hewlett Packard Enterprise (HPE) at 18 percent ($3.2 billion).

IHS Markit analysis:

The data center and enterprise LAN market is maturing. In-use SDN revenue totaled $4.4 billion worldwide in 2017, and is expected to hit $15.8 billion by 2022. Innovations continue, with bare metal switch vendors announcing 400GE switches with new programmable silicon that incorporates an on-chip ARM processor to support artificial intelligence (AI) and machine learning (ML) and allows data plane protocols to be modified without changing silicon. Also of note, Edgecore Networks (Taiwan) contributed its 440GE switch design to the Open Compute Project (OCP).

SDN controllers for the data center also continue to add functionality, with increased support for interconnecting multiple on-premises data centers, and with support for interoperation between cloud service provider (CSP) data centers and enterprises as they build multi-clouds. Other notable enhancements include features that support container networking and integration with container management software such as Kubernetes.

Data center and enterprise LAN SDN is now mainstream and the market is expected to grow.

“Not all the $15.8 billion in revenue in 2022 is new. SDN-capable Ethernet switch revenue is existing revenue, and a portion of SDN controller revenue is displaced from the Ethernet switch market due to reduced port ASPs,” said Cliff Grossner, Ph.D., senior research director, IHS Markit. “Some network operators will elect to use bare metal Ethernet switches when deploying SDNs and rely on SDN controllers for advanced control plane features,” Cliff added.

About the report

The IHS Markit Data Center & Enterprise SDN Hardware & Software Market Tracker provides market size, market share, forecasts, analysis and trends for SDN controllers; SDN-capable bare metal Ethernet switches and branded Ethernet switches; and SD-WAN appliances and control and management. Vendors tracked include Arista, Aryaka, Cisco, Citrix, CloudGenix, Dell EMC, Fatpipe, HPE, Huawei, InfoVista, Juniper, NEC, Riverbed, Silver Peak, Talari, VMware, White Box, ZTE and others.

AT&T – Nokia Partnership for Reliable IoT Connectivity

AT&T is partnering with Nokia to provide reliable connectivity for the Internet of Things (IoT) devices. Chris Penrose, the President of the IoT Solutions of AT&T, said the carrier’s enterprise customers will benefit from this partnership through the simplified adoption of IoT devices and the improved ability of the network operator to respond to the concerns of its customers. Furthermore, the carrier noted in its announcement that this partnership enables AT&T to address specific business concerns of companies using latest technologies including 5G network slicing.

Worldwide IoT Network Grid (WING), a service that is developed and managed by Nokia, will be used by AT&T. WING assists network operators in managing IoT devices, securing connected appliances, and facilitating the billing of the carrier’s customers. Another advantage of utilizing Nokia’s WING service is that it allows AT&T’s customers to access the global IoT ecosystem and infrastructure of the Finnish tech firm. It is expected that the core network assets of Nokia’s WING service will become available in 20 different countries by 2020.

AT&T will also utilize its own cloud-based service dubbed as the Multi-Network Connect platform. This platform enables businesses to manage their IoT devices remotely using a variety of communication technologies, including 2G, 3G, 4G LTE, Low-Power Wide Area Network (LPWAN), and satellite. Aside from the compatibility with a variety of communications standards, the carrier claims that another benefit of using its Multi-Network Connect platform is the ability to manage and monitor the devices using a single portal.

The partnership will begin developing, testing and launching IoT offerings this year. Offerings will be available in more than 20 countries in Europe, Asia, North America, South America and the Middle East by the first quarter of 2020. The partners will target a number of industries, including transportation, health, manufacturing, retail, agriculture, utilities, consumer electronics and smart cities. The initiative will “help set the stage for the evolution to global 5G,” according to the companies.

More specifically, the partnership will:

- Address specific business requirements through capabilities like 5G network slicing that allows a single network to be partitioned into multiple networks.

- Meet local regulatory requirements for IoT devices.

This is not the only IoT partnership in which AT&T is involved. In February, the mega telco and Ericsson said that they are teaming up for IoT device certification. The collaboration includes testing, verification and “white glove” assistance with regulatory approval process. The program is available in more than 150 countries.

Early last year, AT&T said that Carrier, one of the world’s largest appliance and equipment manufacturers (made famous by Donald Trump’s visit), will build AT&T’s IoT functionality into its heating, ventilation and cooling (HVAC) product line.

References:

https://www.androidheadlines.com/2018/06/att-nokia-to-provide-reliable-iot-device-connectivity.html

https://www.business.att.com/solutions/Portfolio/internet-of-things/

http://www.telecompetitor.com/att-nokia-iot-partnership-targets-enterprises-worldwide/

“5G” Fixed Wireless Technology to be Deployed in Philippines by Globe Telecom in 2Q 2019

It certainly appears that any new or different wireless access technology is being called “5G,” even if it has nothing to do with the ITU-R IMT 2020 recommendations due to be completed in late 2020.

Case in point: Philippines telco Globe Telecom announced yesterday that its first “5G” network service is scheduled for commercial roll out by the second quarter of 2019. Globe President and CEO Ernest Cu said this version of “5G” technology would enable Globe to use (Huawei’s) Air Fiber technology in relation to deployment of fixed wireless broadband that would benefit individual customers at home and business clients alike. The new network will provide higher speeds, lower latency, and better capacity. This will enable Globe to deploy fixed wireless broadband at fiber-like speeds.

“Air Fiber internet, which makes use of fixed location wireless radios instead of fiber, could provide speeds ranging from 50 Mbps to 100 Mbps. “We have been preparing our network for sometime now with our existing vendor partners, including Huawei Technologies. We are happy to bring the Philippines in line with other countries who are early adopters of 5G. Once again, we stay true to our commitment to bring first world internet in the country.” Cu added.

Globe brings 5G technology to the Philippines. Globe President and CEO Ernest Cu (middle), together with Globe Chief Technology and Information Officer Gil Genio (right) and Huawei Southern Pacific Region Chief Strategy and Marketing Officer Lim Chee Siong (left), leads the launch of “5G” in the Philippines. (PRNewsfoto/Globe Telecom, Inc.)

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The new technology will also enable Globe to go over the circuitous approval process of deploying a fiber optic cable in the Philippines, which usually involves multiple permits from local government units (LGUs). The right of process can sometimes take years to obtain delaying fiber optic roll-out completion. “We can bring internet to more homes by deploying 5G compared to a typical fiber optic roll-out,” Cu said.

The 5G technology is expected to accelerate the adoption of Internet of Things (IoT) in the Philippines. Globe earlier announced that it is enabling its network by utilizing its spectrum assets, particularly the widely-contested 700-megahertz band.

Globe is currently piloting Narrow Band- Internet of Things (NB-IoT) technology in the country, while enhancing its mobile data services. Due to the telco’s inherent advantage of long reach, this spectrum is ideal to support NB-IoT services. Globe and China’s Huawei are collaborating in this journey, ensuring network readiness to support these services.

The Globe network has one of the largest deployment of Massive MIMO (MM) in Asia, as part of its strategic technology roadmap since 2016. MM is the fundamental radio access technology for 5G.

Globe has been spending over 31% of its annual total revenues to upgrade and expand its telecommunication and IT infrastructure. It has been ramping up its capital spend from P21.1 billion in 2012 to P36.7 billion in 2016 and P42.5 billionin 2017, in order to provide its subscribers of better broadband services. This year, Globe recently disclosed that it will further accelerate its capital expenditures to over P43.5 billion.

Back in November 2015, Globe extended its partnership with Huawei, signing a five-year contract involving the planning and design of a wireless broadband network, as well as the creation of a wireless innovation center. Huawei was also the technology partner of Globe when it implemented a $700-million network modernization program that began in 2011.

Huawei’s other “5G” fixed wireless trials using mmWave technology:

This past February, it was announced that Huawei and Canadian telco Telus have launched 5G wireless-to-the-home (WttH) trial service using a specially-designed 5G customer premise equipment (CPE) unit. The vendor said the trial is taking place in downtown Vancouver’s ‘5G Living Lab,’ a joint initiative between Huawei and Telus. Huawei said the use of a new 5G CPE is a new step towards the launch of consumer-oriented 5G-ready products to market. We wrote about that trial here.

Also in February, Deutsche Telekom and Huawei completed the world’s first multi-cell high millimeter waves field tests of 5G mobile communications with 73GHz mmWave technology (E-Band) under a large variety of real-world environments at the Deutsche Telekom campus in Bonn, Germany. In the comprehensive field tests, the 5G: haus partners addressed mmWave performance and propagation characteristics in both outdoor and indoor technology deployment.

Alex Choi, Senior Vice President, Technology Strategy & Innovation, Deutsche Telekom said: “Next generation services such as 3D immersive applications, mobile cloud service, gaming and social-networking applications require massive capacity and higher data rates. The use of higher range millimeter-wave spectrum bands is one of the enabling technologies to deliver the capacity increases and massive data rates required for 5G enhanced Mobile Broadband with massive data rates and ultra-fast experience. The verification of these features in our world’s first multi-cell 5G high mmWave field tests will point out the future direction for the industry’s ultra-high broadband experience for customers in both indoor scenarios as well as in extremely crowded areas. The successful trial result opens up a new door for applications and deployments of 5G mmWave.”

“This trial represents continued progress toward the launch of 5G, as we start to replicate both the in-home experience and network footprint we will see when 5G becomes commercially available in the near future,” said Ibrahim Gedeon, CTO at Telus. “Wireless 5G services will generate tremendous benefits for consumers, operators, governments and more through the use of advanced IoT devices, big data applications, smart city systems and other technologies of the future.”

For more information: A Peek into Huawei’s New WTTx CPE Technology

About Globe Telecom

Globe Telecom is a leading full service telecommunications company in the Philippines, serving the needs of consumers and businesses across an entire suite of products and services including mobile, fixed, broadband, data connections, internet and managed services. Its principals are Ayala Corporation and Singtel who are acknowledged industry leaders in the country and in the region. For more information, visit www.globe.com.ph. Follow us on Twitter: http://twitter.com/talk2Globe and Facebook: http://facebook.com/GlobePH

For more information, please contact:

Yoly C. Crisanto

Head, Corporate Communications

Globe Telecom, Inc.

Email Address: [email protected]

Globe Press Room: newsroom.globe.com.ph/

Twitter: @talk2GLOBE │ Facebook: http://www.facebook.com/globeph

IHS Markit: SD-WAN revenue = $162M in 1Q2018; MEF to Define SD-WAN Service

IHS Markit SD-WAN Revenue Report:

by Cliff Grossner, PhD, Senior Research Director and Advisor at IHS Markit

SD-WAN (appliance + control and management software) revenue reached $162M in 1Q18, up 12% QoQ and 2.3x over 1Q2017. VMware (after its VeloCloud acquisition) led the SD-WAN market with 19% share of 1Q2018 revenue, Aryaka was in second place with 18% revenue share, and Silver Peak rounded out the top 3 with 12%, according to the DC Network Equipment market tracker early edition from IHS Markit.

“SD-WAN is currently a maturing market, expected to reach $861M worldwide in 2018, as early adopters of SD-WAN are expanding existing deployments, having proved the SD-WAN business case. Adoption of SD-WAN is now ramping even in compliance-sensitive verticals such as healthcare and financial (the payment card industry),” said Cliff Grossner Ph.D., senior research director and advisor for cloud and data center at IHS Markit.

|

Worldwide SD-WAN revenue |

||||||

|

|

Revenue (US$M) |

% Change |

||||

|

|

|

|

1Q18 |

|||

|

VMware |

N/A |

$31.6 |

N/A |

|||

|

VeloCloud |

$26.8 |

N/A |

N/A |

|||

|

Aryaka |

$24.4 |

$29.1 |

19% |

|||

|

Silver Peak |

$17.6 |

$20.2 |

15% |

|||

|

Cisco |

$15.6 |

$19.5 |

25% |

|||

|

InfoVista |

$12.3 |

$9.6 |

-22% |

|||

|

Citrix |

$6.0 |

$7.1 |

18% |

|||

|

Talari |

$5.4 |

$5.9 |

9% |

|||

|

FatPipe |

$4.5 |

$4.3 |

-5% |

|||

|

Riverbed |

$2.5 |

$3.2 |

26% |

|||

|

CloudGenix |

$2.5 |

$2.5 |

0% |

|||

|

Huawei |

$3.3 |

$1.8 |

-45% |

|||

|

ZTE |

$0.7 |

$1.1 |

53% |

|||

|

Other |

$23.2 |

$26.2 |

13% |

|||

|

Total SD-WAN |

$145.0 |

$162.1 |

12% |

|||

|

Source: IHS Markit © 2018 IHS Markit |

||||||

“Many SD-WAN vendors have begun to incorporate analytics, utilizing rich telemetry data, into SD-WAN management platforms–enabling enterprises to monitor application traffic flow between multi-cloud environments,” said Grossner.

More Data Center Network Market Highlights

· F5 garnered 46% ADC market share in 1Q18 with revenue up 4% QoQ. Citrix had the #2 spot with 29% of revenue, and A10 (9%) rounded out the top 3 market share spots.

· 1Q18 ADC revenue declined 4% from 4Q17 to $453M and declined 4% over 1Q17

· Virtual ADC appliances stood at 31% of 1Q18 ADC revenue

Data Center Network Equipment Report Synopsis

The IHS Markit Data Center Network Equipment market tracker is part of the Data Center Networks Intelligence Service and provides quarterly worldwide and regional market size, vendor market share, forecasts through 2021, analysis and trends for (1) data center Ethernet switches by category [purpose built, bare metal, blade and general purpose], port speed [1/10/25/40/50/100/200/400GE] and market segment [enterprise, telco and cloud service provider], (2) application delivery controllers by category [hardware-based appliance, virtual appliance], and (3) software-defined WAN (SD-WAN) [appliances and control and management software]. Vendors tracked include A10, ALE, Arista, Array Networks, Aryaka, Barracuda, Cisco, Citrix, CloudGenix, CradlePoint, Dell, F5, FatPipe, HPE, Huawei, Hughes, InfoVista, Juniper, KEMP, Nokia (Nuage), Radware, Riverbed, Silver Peak, Talari, TELoIP, VMware, ZTE and others.

…………………………………………………………………………………………………………………………………………………

MEF to define SD-WAN service:

by Alan J Weissberger

The Metro Ethernet Forum is working on a common definition for SSD-WANs and is building out multivendor SD-WAN use cases.

- MEF is creating a SD-WAN service specification that will outline the required SD WAN components, such as application-centric quality of service and priority policy requirements.

- MEF’s Multi-Vendor SD-WAN Implementation project is one of the real-world results of the MEF 3.0 framework that was announced at MEF 17 in November. MEF 3.0 is a transformation framework for defining, delivering and certifying agile, assured and orchestrated network services across a global ecosystem of automated networks.

While SD-WAN has earned buzzword status across the telecoms industry, a lot of different offerings are available in the marketplace from a host of vendors. Currently, there are no clear definitions of what an SD-WAN service is.

MEF members are collaborating to develop an SD-WAN service specification that defines the service components, their attributes, and application-centric QoS, security, and business priority policy requirements to create SD-WAN services. This initiative is led by Riverbed and VeloCloud, now part of VMware, with major contributions from Fujitsu.

MEF is using the same blueprint that it successfully deployed when it defined Carrier Ethernet services 10 years ago—which led to the creation of an estimated $80 billion global market for Carrier Ethernet—to create the SD-WAN service definition specification.

“The significance of this work is that if you look at what MEF has done for the initial carrier Ethernet definition before that came out there were many, many different implantations,” said Ralph Santitoro, head of SDN/NFV/SD-WAN solutions for Fujitsu.

“You weren’t really sure what you were buying. The SD-WAN service market today is in exactly that same kind of state where you can go to different service providers and get an SD-WAN service but it’s apples to oranges to peaches and whatever, but it’s all different because there is no industry standard.

“The MEF is really the only organization in the industry that is actually putting a stake in the ground by defining what an SD-WAN service is.”

MEF hopes to have the specification finished ahead of its MEF 18 conference in October. When the specification is finished, MEF said it would pave the way for MEF 3.0 work on its Lifecycle Service Orchestration (LSO), MEF information models, policy-driven orchestration, intent, and other major projects that could be applied to SD-WAN services. All of those SD-WAN elements would then be integrated into the MEF 3.0 ecosystem to help service providers increase their automation efforts.

MEF’s Implementation Project features managed SD-WAN use cases that were driven by MEF’s membership that includes service providers. Because of mergers and acquisitions, service providers are faced with an increasing number of interoperability challenges where they need to support more than one SD-WAN solution.

5 Nordic Countries aim to be 1st interconnected 5G region in the world

The leaders of the five Nordic countries of Denmark, Finland, Iceland, Norway and Sweden have signed a letter of intent to accelerate the development of fifth-generation mobile systems (“5G”). The move aims to support these countries efforts to be among the world front runners in the roll-out of 5G wireless services. The announcement was made at an annual summit of the regional leaders that was hosted by Swedish Prime Minister, Stefan Lofven.

“The Nordic region is one of the most innovative regions in the world. The development of 5G is progressing quickly and the Nordic region will be at the fore of this development. It creates jobs and prosperity in our countries,” said Swedon Prime Minister Stefan Löfven.

The agreement involves the backing of governments and many of the leading telecom companies operating in the region, including infrastructure suppliers Ericsson and Nokia and mobile operators Telenor, Telia, TDC, Tele2, Iceland Telecom and Vodafone Iceland.

The declaration of intent states that the Nordic region will be the first interconnected 5G region in the world and identifies areas in which Nordic cooperation needs to be intensified. Yet there was no mention of IMT 2020 -the future ITU-R standard for “5G” radio aspects or the status of the non radio functions that are aligned with IMT 2020.

There’s certainly a track record that shows how collaboration in the wireless industry can work to support technical prowess and create high-paying technology jobs. The Nordic countries were among the first in the world to recognise opportunities in the broad deployment of wireless services. In the early 1980s, regional players developed the Nordic Mobile Telephone system, an analogue network that quickly became the most widely-adopted mobile service in the world, popular with enterprise users as well as consumers. Mobility became mainstream.

The success of that system, in terms of both the technology and collaborative efforts to create it, was one of the springboards that led to the development of the GSM standards with the European Telecommunications Standards Institute (ETSI). Sweden’s Ericsson and Finland’s Nokia were major participants in that European endeavour and those two companies still hold many of the GSM essential patents.

Although the Nordic region was instrumental in the development and democratisation of first- and second-generation mobile services, there’s been a dilution of technology leadership during the past decade. Companies from the US and South Korea began to dominate the market for handsets and the mobile ecosystem, and Chinese infrastructure makers eroded the leading positions of Ericsson and Nokia.

Concern that the Nordics — in fact, Europe in general — could be left behind in the early stages of 5G are certainly valid and worth addressing. Given the huge costs associated with deploying 5G, it may be that infrastructure and network sharing proves the only way for operators to make the economics add up.

Ericsson had an exclusive role as an industry advocate, with Cecilia Atterwall, the Head of Marketing and Communications at Ericsson’s Business Area Networks, addressing the prime ministers on how 5G is the foundation for the digitalization of industries and society. Ms. Atterwall’s address covered evolved mobile broadband and the Internet of Things (IoT) highlighting business and use cases covering: mobile broadband user experiences, smart cities, transport, and smart manufacturing – and how one 5G network could handle all such cases simultaneously.

The project aim is for “5G” technology to be a major part of the worlds telecom infrastructure enabling new industries and services beyond communications. The agreement between the five Nordic countries includes the technical coordination of 5G frequency bands throughout the region, and removing obstacles to 5G expansion and development of new testing facilities. Progress will be closely monitored by the Nordic Council of Ministers. Yet there’s no definition of what “5G” actually is!

The combined population of the five Nordic countries is only about 27 million. Much larger nations around the world are also working to take pole position in 5G. In Asia, the government of South Korea is hoping to avoid the existence of several separate 5G networks with patchwork coverage by mandating that the three mobile operators SK Telecom, KT and LG Uplus and Internet service provider SK Broadband work together on a single nationwide 5G network. The three major wireless China telecom operators are also cooperating on “5G’ technology.

In the US, T-Mobile and Sprint are using the importance of a fast and successful pre-standard “5G” roll-out as a main justification to win approval for a merger of the two carriers. They might be telling regulators what they want to hear, but there’s certainly some validity to the argument.

In many instances, 5G will be a group effort. We expect more cooperative projects to be announced as challenges arise.

References:

https://www.ccsinsight.com/blog/the-nordic-five-for-5g

https://www.government.se/press-releases/2018/05/new-nordic-cooperation-on-5g/

…………………………………………………………………….

Related Story: Hong Kong to make 5-GHz available for LAA

Artificial Intelligence (AI) and Internet of Things (IoT): Huge Impact on Tech Industry

Overview:

The biggest themes at IoT DevCon today in Santa Clara, CA are the following: AI will be pervasive in every industry during at least the next decade; voice is replacing the keypad/keyboard as the preferred human interface, IoT will fulfill its promise and potential once the cyber security and privacy issues have been solved.

As these innovative and cutting edge technologies fuse together experts in the market are forecasting exponential growth over the next seven years while revolutionizing everyday products with amazing potential.

Grand View Research projects the wireless mesh network alone will be worth north of $11 billion globally by the year 2025. One of the significant factors driving market growth is the variety of applications across multiple industries for these platforms, ranging from traditional business projects to emergency services. The inclusion of IoT and AI are expected to expedite the process, allowing for more efficient and effective operations of MESH applications and networks. AI not only involves massive parallel computing, but also lots of data movement is needed to come up with results.

Here are a few of the IoT DevCon sessions I attended today (please contact the author if you’d like details on any of them):

| 09:00-09:30 General Remarks and Notes on the Internet of Intelligent Things. ME1941» TIRIAS Research |

||

| 09:30-10:00 | KEYNOTE: Surviving the IoT Device Security Wild West ME1916» Arm |

|

| 10:00-10:30 | KEYNOTE ADDRESS: Wireless Connectivity (IoT) Testing Challenges and Considerations ME1859» Rohde & Schwarz |

|

| 10:30-11:00 | Morning Break – Day 1 | |

| 11:00-11:30 | KEYNOTE ADDRESS: Edge Computing Revolution ME1930» NXP |

|

| 11:30-12:00 | The Future of IoT from a Venture Capital Perspective ME1841» Bessemer Venture Partners |

|

……………………………………………………………………………………………………………………………

Gopher Protocol Inc Decentralized MESH System:

Gopher Protocol, a company specializing in the creation of Internet of Things (IoT) and Artificial Intelligence enabled mobile technologies, today announced that it has completed the first phase of its Decentralized MESH system architectural functionality simulation. These simulations tested Gopher’s unstructured MESH network, performing node and gateway communication scenarios while observing timing and performance. The team was able to successfully simulate “node to node” and “node to gateway” network communication, within a defined range.

From the company’s website:

Gopher Protocol (GOPH) Core Technology is a revolutionary new platform with products that will change the way people interact with technology and each other, because we believe that improving communications will benefit the modern world.

GOPH Microchips communicate via a private, secured protocol and can interact with internal states – microchips communicate with other microchips – and external environments – microchips interact with cell phones, mobile apps, computers, tablets, tracking devices and many other digital devices with access to conventional networks (WiFi and Cellular).

Our goal for GopherInsight Microchips is that they will potentially be installed in billions of mobile devices by the year 2020. This will allow GOPH to create its own private communication network, which will enormously benefit the user from behind the scenes. We utilize this private network to improve the computing power, database management, internal memory, and security of mobile devices equipped with GopherInsight Microchips! The potential is enormous and we are constantly developing more advanced features.

A wireless mesh network is a communications network made up of radio nodes (telephones or other connected devices) organized in a mesh topology (random dispersion across a given area). MESH refers to rich interconnection among devices or nodes. Wireless mesh networks typically consist of mesh clients(users) and gateways (internet access points). Other companies that have wireless mesh networks for IoT include Microchip’s MiWi™ (based on IEEE 802.15.4 – low-rate wireless personal area networks or LR-WPANs) and the Wirepas mesh network (based on Low Power Bluetooth).

Above illustration courtesy of Microchip

MiWi supports operation the IEEE 802.15.4 radio PHY in the sub-GHz and 2.4 GHz ISM bands. Developed to enable low-cost, commercial and smart home networks, MiWi is used in applications such HVAC systems and alarm sensors where reliable self-healing mesh networking is needed.

…………………………………………………………………………………………………………………………………………………………..

The Gopher Decentralized MESH network will be a mobile network, which adds additional complexity as the nodes move frequently. The main challenge of developing Gopher’s MESH network is updating routes of data considering that nodes are moving within the MESH. Managing these nodes is achieved by our time division based electronic hardware combined with Gopher’s Avant! Artificial Intelligence engine that is cognitively learning about the dynamic GEO locations of nodes and gateways in order to control the unstructured mesh network.

“This is a very significant stage for us” stated Danny Rittman, Gopher’s CTO. “We successfully conducted a node hopping simulation which we believe is one of the key technological hurdles in creating a MESH network. In addition, we also performed “node to gateway” communications and multiple “node hopping” all the way to a gateway. The results were successful for a defined range and beyond. We are now constructing testing boards to further analyze the technology in order to identify methods of improvements and advancements.”

“We are also working on our Avant! AI engine, providing it with the mathematical knowledge with the goal of developing it to a point to control the entire system. Unstructured networks are particularly difficult to control without the involvement of highly mathematical models and algorithms” continued Dr. Rittman. Gopher believes the development of a mesh network and technology is crucial to the creation of a communications network that disrupts the incumbent Internet and data providers that are the gatekeepers of communication access for the developed world. Gopher intends to bring connectivity to the hundreds of millions that cannot easily afford the current global cost of connectivity and to make the rapidly growing internet of things more affordable for all.

Read more about GOPH at http://www.marketnewsupdates.com/news/goph.html

……………………………………………………………………………………………………………………………………………………

Other related developments in IoT and AI include:

1. Microsoft Corporation recently announced a strategic partnership to deliver new technology developments and go-to-market initiatives that accelerate enterprise AI and IoT application development. As part of this partnership, the companies will create a “better together” solution, comprising the C3 IoT Platform™, a low-code, high-productivity PaaS for scaling AI and IoT across enterprises, fully integrated to operate on Microsoft Azure. C3 IoT will leverage Microsoft Azure as a preferred cloud platform and tap into the power of its intelligent capabilities. The companies will conduct co-marketing and co-selling strategies that rapidly scale distribution globally, as well as intensive training for dedicated teams to speed customers’ time to value. Close collaboration between Microsoft and C3 IoT will help enable customers to more rapidly develop and deploy AI-based applications for transformative use cases, such as AI predictive maintenance, dynamic inventory optimization, precision healthcare and CRM.

2. Naveen Rao, vice president and general manager of the Artificial Intelligence Products Group at Intel Corporation said in advance of the company’s upcoming AI DevCon:

This is an exciting week as we gather the brightest minds working with artificial intelligence (AI) at Intel AI DevCon, our inaugural AI developer conference. We recognize that achieving the full promise of AI isn’t something we at Intel can do alone. Rather, we need to address it together as an industry, inclusive of the developer community, academia, the software ecosystem and more. So as I take the stage today, I am excited to do it with so many others throughout the industry.

This includes developers joining us for demonstrations, research and hands-on training. We’re also joined by supporters including Google*, AWS*, Microsoft*, Novartis* and C3 IoT*. It is this breadth of collaboration that will help us collectively empower the community to deliver the hardware and software needed to innovate faster and stay nimble on the many paths to AI. Indeed, as I think about what will help us accelerate the transition to the AI-driven future of computing, it is ensuring we deliver solutions that are both comprehensive and enterprise-scale. This means solutions that offer the largest breadth of compute, with multiple architectures supporting milliwatts to kilowatts.

Enterprise-scale AI also means embracing and extending the tools, open frameworks and infrastructure the industry has already invested in to better enable researchers to perform tasks across the variety of AI workloads. For example, AI developers are increasingly interested in programming directly to open-source frameworks versus a specific product software platform, again allowing development to occur more quickly and efficiently.

Mr. Rao’s AI Devcon 2018 presentation is at:

https://s21.q4cdn.com/600692695/files/doc_presentations/2018/05/AI_Devcon_RAO_Final.pdf

Point Topic: 931.6M Fixed Broadband Connections at end of Q4-2017; VDSL Growth but Copper Connections Continue Decline

|

|

|

Is FCC Net Neutrality Rollback Coming? Will that spark cablcos investment in rural/ suburban areas? AT&T won’t challenge FTC

Net neutrality advocates are declaring June 26 another day of action in support of Democrats’ resolution to restore the 2015 Obama-era net neutrality rules. Public Knowledge, Common Cause, Consumers Union and other groups want to bring pro-net neutrality Americans directly to the offices of their representatives in the House to lobby for passage of the measure, drawn up under the Congressional Review Act. The Senate passed it 52-47 last month, and so far 124 House lawmakers have signed the paperwork to force a floor vote (they need 218, so they’ve got some work cut out for them). TechFreedom is hosting a more skeptical panel discussion on Democrats’ effort Tuesday. Among the panelists slated to appear is Grace Koh, who advised President Trump on telecom issues until she left the White House earlier this year.

Tom Leithauser of TR Daily (subscription required) wrote yesterday:

The rollback of net neutrality rules by the FCC will spark broadband investment in rural and suburban areas served by small and mid-sized cable TV operators, Matthew Polka, president and chief executive officer of the American Cable Association, said on this week’s “The Communicators” program.

“It created a sense of greater innovation and investment that these companies can now deploy,” Mr. Polka said on the show, which is set to air on C-SPAN tomorrow and C-SPAN2 on Monday.

He noted that broadband networks were increasingly being viewed as “infrastructure” by policy-makers and that deployment to underserved and unserved areas was a top priority at the FCC and among some members of Congress.

One impediment to broadband deployment, he said, is the time and cost required to arrange access to utility poles. Andrew Petersen, an ACA board member and senior vice president for TDS Telecom who also appeared on the C-SPAN program, said pole attachment rates for his company averaged $7.80 per pole, but were significantly higher in some markets. “It really retards our ability to make those investments to extend broadband,” Mr. Petersen said.

Mr. Petersen expressed hope that the FCC’s Broadband Deployment Advisory Committee would offer recommendations on ways to lower the cost of pole attachments and other broadband deployment expenses, which he said were his company’s top cost.

“When you bring robust broadband to a new area, you’re combatting the ‘homework gap,’ [and] you’re allowing for economic development and commerce to take place,” Mr. Petersen said. He said it was unlikely, however, for 5G service to bring broadband to unserved areas because those areas generally lack structures needed to place 5G equipment.

“We’re not bullish that 5G is going to make its way to suburban and rural areas immediately,” he said. “I don’t believe 5G technology is going to make its way to those areas in the next several years.”

In a related CNET post, Margaret Reardon wrote:

AT&T has given up efforts to challenge the Federal Trade Commission’s authority to regulate broadband (Internet access) providers. AT&T on Tuesday informed court officials that it would not file a petition to the US Supreme Court to challenge a lower court’s decision in the case. In 2014, the FTC sued AT&T in the US District Court of Northern California, accusing the company of promising unlimited data service to customers and then slowing that service down to rates that were barely usable. The case hasn’t yet gone to trial since AT&T had argued that the FTC has no authority over any of AT&T’s businesses.

The US Appeals court in Northern California rejected that argument in February and said the case could proceed. AT&T had until May 29 to file an appeal the the Supreme Court to challenge the decision.

AT&T indicated earlier this month in a status report submitted to the appeals court that it was considering appealing to the Supreme Court to stop the case.

This case was being closely watched by net neutrality supporters, because the question of whether the FTC has authority over AT&T would have had big implications for the future of the internet and whether there will be any cop on the beat ensuring that consumers are protected from big phone companies abusing their power online.

Why? When the Federal Communications Commission gave up its authority to police the internet with its repeal of net neutrality regulations in December, it specifically handed authority to protect consumers online to the FTC.

Net neutrality is the idea that all traffic on the internet should be treated equally and that large companies like AT&T, which is trying to buy Time Warner, can’t favor their own content over a competitor’s content. Rules adopted by a Democrat-led FCC in 2015 codified these principles into regulation. The current FCC, controlled by Republicans, voted to repeal the regulations and hand over authority to protect internet consumers to the FTC.

But there was one hitch in the law that could have made it impossible for the FTC to oversee some of the biggest broadband companies. Many of these companies, like AT&T and Verizon, also operate traditional telephone networks, which are still regulated by the FCC. AT&T argued that because some aspects of its business, like its traditional phone services, are regulated by the FCC, the FTC doesn’t have jurisdiction.

A federal appeals court disagreed with AT&T’s argument, stating the FTC can fill in oversight gaps when certain services, like broadband, aren’t regulated by the FCC. If AT&T had appealed to the Supreme Court and if the court had taken the case and ruled in AT&T’s favor, it would have meant that phone companies providing broadband or wireless internet services would be immune from government oversight. By contrast, cable companies, which do not operate traditional phone networks regulated by the FCC, would still be under the authority of the FTC.

For now, that doomsday scenario is put to rest and the lower court’s ruling that the FTC can, in fact, oversee all broadband providers stands.

Meanwhile, net neutrality supporters continue their fight to preserve the 2015 rules. Several states, including California and New York, are considering legislation to reinstate net neutrality rules. Earlier this year, Washington became the first state to sign such legislation into law. Governors in several states, including New Jersey and Montana, have signed executive orders requiring ISPs that do business with the state adhere to net neutrality principles.

Democrats in the US Senate are also trying to reinstate the FCC’s rules through the Congressional Review Act, which gives Congress 60 legislative days in which to overturn federal regulations. The resolution passed the Senate earlier this month and must pass the House of Representatives and eventually be signed into law by President Donald Trump to officially turn back the repeal of the rules.

IHS Markit: Optical Network Equipment Market off to slow start in 2018

By Heidi Adams, senior research director, IP and optical networks, IHS Markit

Highlights

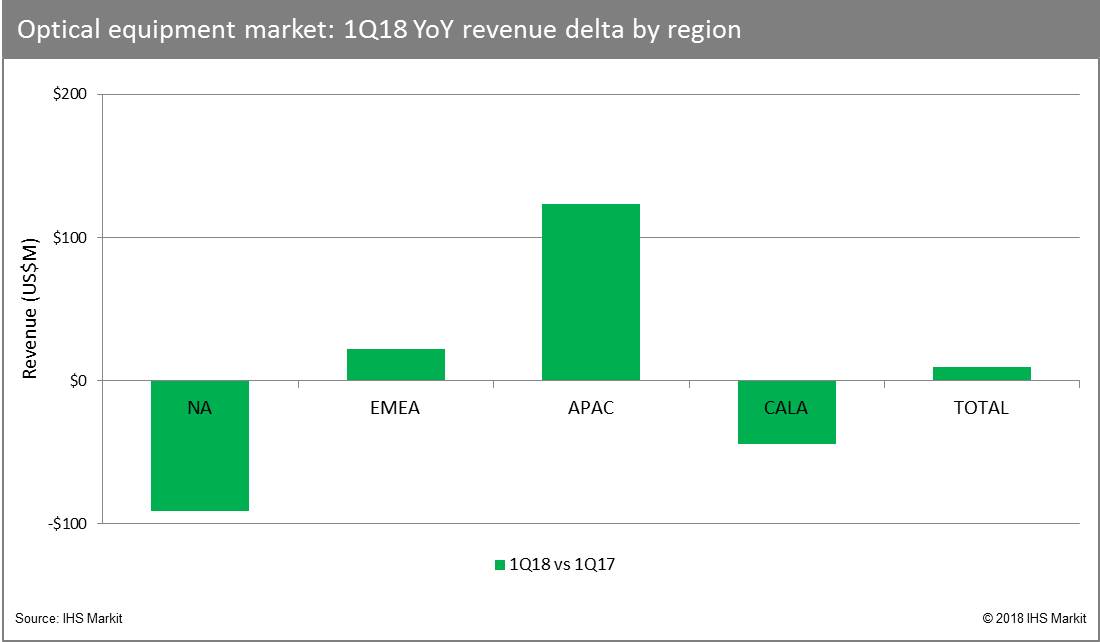

- Global optical network hardware revenue totaled $3.1 billion in the first quarter of 2018 (Q1 2018), declining 25 percent sequentially and remaining flat on a year-over-year basis.

- The global Q1 2018 optical equipment market net of China was down 2 percent year over year. China itself was up 7 percent year over year, and continues to be a key market for optical transport equipment.

- Huawei remained the overall optical equipment market leader in Q1 2018, with 26 percent market share.

Our analysis

After a strong close to 2017, the optical equipment market got off to a lackluster start in 2018. Modest year-over-year growth in Europe, the Middle East and Africa (EMEA) and Asia Pacific was not sufficient to overcome year-over-year spending declines in North America and the Caribbean and Latin America (CALA) regions in the quarter. Total optical equipment market spending was down 25 percent on a sequential basis, with all regions seeing quarter-over-quarter declines.

Wavelength-division multiplexing (WDM) continues to be the growth engine for the market. In Q1 2018, the WDM segment totaled $2.9 billion, up 3 percent year-over-year, thanks to gains in EMEA and Asia Pacific. Both the metro and long haul segments experienced low single-digit year-over-year growth in Q1 2018.

Synchronous optical networking (SONET)/synchronous digital hierarchy (SDH) continued its overall decline. Global revenue came to $206 million in Q1 2018, down over 25 percent year over year. This segment represented less than 10 percent of the total optical network equipment market in the quarter.

Huawei continued to lead the total optical equipment market by a wide margin in Q1 2018. Nokia secured second place based on continuing strength in EMEA and increasing business in Asia Pacific. Ciena maintained its leadership position in North America and remained number three overall in the global market. ZTE rounded out the top four, but faces a difficult journey ahead with the impact of US sanctions and a subsequent halt in major operations.

Unstoppable bandwidth demand drives long-term growth

IHS Markit anticipates a continuing ramp in network capacity to address growing bandwidth demand. In the metro, the primary driver is burgeoning bandwidth demand—to, from and between data centers.

Not to be ignored is the coming broader introduction and adoption of consumer 4K and higher video content and services on a variety of devices. The shift from data to video to virtual reality (VR)/augmented reality (AR) will add yet another set of bandwidth-intensive and latency-sensitive services to the mix toward 2022.

Finally, a further evolutionary shift in mobile network architectures in preparation for 5G and a range of new fixed and mobile machine-to-machine (M2M) and Internet of Things (IoT) applications will set the stage for an investment cycle at the farthest reaches of the optical access network.

Based on these industry trends, the optical equipment market will grow at a compound annual growth rate (CAGR) of 4.5 percent from 2017 to 2022, according to IHS Markit forecasts.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Editor’s Note:

We believe much of the anticipated fiber optic network growth will come from a variety of factors in the metro, including data center interconnect demands, higher-bandwidth video transmission (with the advent of 4K video) and eventually virtual and augmented reality. We think 5G mobile backhaul support is questionable in the next few years considering all the “5G” hype and lack of standards till IMT 2020 (5G radio aspects ONLY) recommendations are finalized in late 2020.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Optical Network Hardware Market Tracker – Q1 2018

This report tracks the global market for metro and long-haul WDM and SONET/SDH equipment and SONET/SDH and WDM ports. It provides market size, market share, forecasts through 2022, analysis and trends.

PointTopic: Fiber & cable make up 3/4 of global fixed broadband subscriptions

Fiber and cable networks are dominating the global broadband market, with the technologies now servicing 77% of fixed subscriptions, new figures from Point Topic have revealed.

According to the Global Broadband Statistics, which take into account subscriptions up to the end of 2017, more than 50% of people in more than 40 countries, including Singapore (97%), China (89%), United States (87%), and the UK (55%), are connected via full-fiber, fiber-fed copper or cable.

Point Topic Research Director Dr Jolanta Stanke told the Broadband Forum:

“We are finding that customers across most global regions increasingly prefer faster broadband services delivered over fiber and cable platforms, as opposed to ADSL. This trend will continue as more bandwidth-hungry young consumers become paying decision makers, even though superfast 4G LTE and 5G mobile broadband services will compete for their wallets.”

Fiber-fed subscriptions – including Fiber-to-the-Home (FTTH), Fiber-to-the-Building (FTTB), Fiber-to-the-Cabinet (FTTC), Very High Bitrate Digital Subscriber Line (VDSL), VDSL2 and G.fast – accounted for 57% of broadband subscriptions, with more than 530 million connections. Stanke agreed VDSL and Gfast were together largely responsible for the growth that fiber has seen, with more than 30 operators across all continents deploying or trialing G.fast.

“G.fast gives operators a more cost-effective variant of fiber that will be used by operators who want to upgrade their existing networks quicker and more easily,” she added. “This could enable them to serve more customers in less densely populated areas, where direct fiber investment is less economically feasible.”

In total, cable, including hybrid fiber-coaxial, accounted for 20% of all fixed broadband connections. According to the report, the latest standard of this technology is currently deployed across several markets, being especially popular in North America, and can deliver gigabit download speeds.

Broadband Forum CEO Robin Mersh said the figures reflect the fact that new technologies that let operators deploy fiber deep into the network without having to enter buildings themselves are quickly moving from trials to mass deployment.

“If operators want to deliver competitive broadband services, maximizing their investments through the use of technologies like G.fast is vital,” said Mersh. “Expanding the footprint of their existing fiber networks in this way is cost-effective and delivers the gigabit speeds consumers crave. The growing trend towards fiber, whether its fiber-fed copper or full fiber, and cable deployments highlighted by Point Topic’s report confirms that the Forum’s work on interoperability and management of ‘fiber-extending’ technologies is vitally important.”

The voracious demand for connectivity is evident in the increased demand for fiber, cable and coax despite the parallel growth of LTE and MAYBE (?) “5G.”

Though “5G” is in currently proprietary to each wireless network operator, huge investments in fiber, coax and copper are being made because strategic planners expect 5G to be mainstream in the next several years (we think NOT until late 2021 at the earliest when IMT 2020 recommendations are finalized and implemented in base stations and endpoint devices.

Last month, Broadbandtrends’ Global Service Provider G.fast Deployment Strategies surveyed 33 incumbent and competitive broadband operators from across the globe. The market research firm found that four in five service providers have G.fast plans for this year and that 27% are in active deployments. AT&T is a huge supporter of G.fast while Verizon is not.

About the Broadband Forum

Broadband Forum, a non-profit industry organization, is focused on engineering smarter and faster broadband networks. The Forum’s flagship TR-069 CPE WAN Management Protocol has now exceeded 800 million installations worldwide.