Informa

Omdia: How telcos will evolve in the AI era

Dario Talmesio, research director, service provider, strategy and regulation at market research firm Omdia (owned by Informa) sees positive signs for network operators.

“After many years of plumbing, now telecom operators are starting to see some of the benefits of their network and beyond network strategies. Furthermore, the investor community is now appreciating telecom investments, after many years of poor valuation, he said during his analyst keynote presentation at Network X, a conference organized by Light Reading and Informa in Paris, France last week.

“What has changed in the telecoms industry over the past few years is the fact that we are no longer in a market that is in contraction,” he said. Although telcos are generally not seeing double-digit percentage increases in revenue or profit, “it’s a reliable business … a business that is able to provide cash to investors.”

Omdia forecasts that global telecoms revenue will have a CAGR of 2.8% in the 2025-2030 timeframe. In addition, the industry has delivered two consecutive years of record free cash flow, above 17% of sales.

However, Omdia found that telcos have reduced capex, which is trending towards 15% of revenues. Opex fell by -0.2% in 2024 and is broadly flatlining. There was a 2.2% decline in global labor opex following the challenging trend in 2023, when labor opex increased by 4% despite notable layoffs.

“Overall, the positive momentum is continuing, but of course there is more work to be done on the efficiency side,” Talmesio said. He added that it is also still too early to say what impact AI investments will have over the longer term. “All the work that has been done so far is still largely preparatory, with visible results expected to materialize in the near(ish) future,” he added. His Network X keynote presentation addressed the following questions:

- How will telcos evolve their operating structures and shift their business focuses in the next 5 years?

- AI, cloud and more to supercharge efficiencies and operating models?

- How will big tech co-opetition evolve and impact traditional telcos?

Customer care was seen as the area first impacted by AI, building on existing GenAI implementations. In contrast, network operations are expected to ultimately see the most significant impact of agentic AI.

Talmesio said many of the building blocks are in place for telecoms services and future revenue generation, with several markets reaching 60% to 70% fiber coverage, and some even approaching 100%.

Network operators are now moving beyond monetizing pure data access and are able to charge more for different gigabit speeds, home gaming, more intelligent home routers and additional WiFi access points, smart home services such as energy, security and multi-room video, and more.

While noting that connectivity remains the most important revenue driver, when contributions from various telecoms-adjacent services are added up “it becomes a significant number,” Talmesio said.

Mobile networks are another important building block. While acknowledging that 5G has been something of a disappointment in the first five years of the deployment cycle, “this is really changing” as more operators deploy 5G standalone (5G SA core) networks, Omdia observed.

Talmesio said: “At the end of June, there were only 66 telecom operators launching or commercially using 5G SA. But those 66 operators are those operators that carry the majority of the world’s 5G subscribers. And with 5G SA, we have improved latency and more devices among other factors. Monetization is still in its infancy, perhaps, but then you can see some really positive progress in 5G Advanced, where as of June, we had 13 commercial networks available with some good monetization examples, including uplink.”

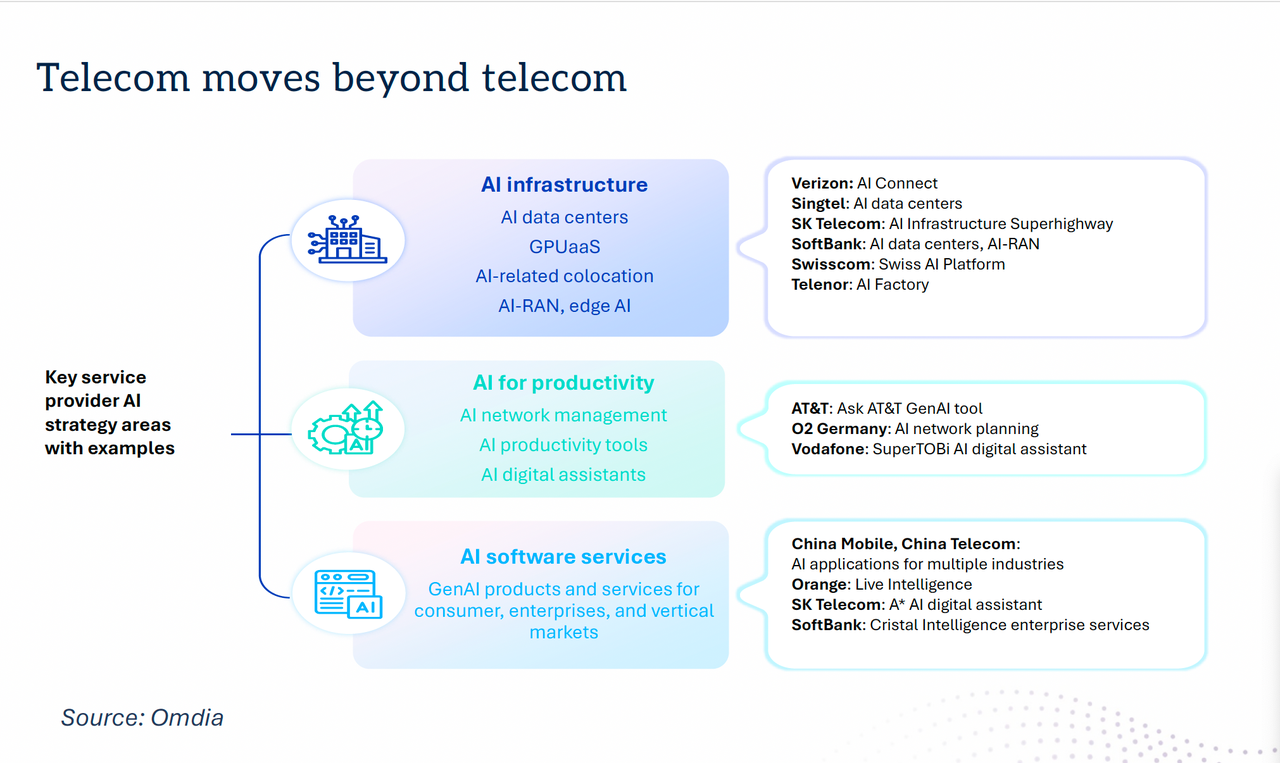

“Telecom is moving beyond telecoms,” with a number of new AI strategies in place. For example, telcos are increasingly providing AI infrastructure in their data centers, offering GPU as-a-service, AI-related colocation, AI-RAN and edge AI functionality.

Dario Talmesio, Omdia

……………………………………………………………………………………………………………………………………………………

AI is also being used for network management, with AI productivity tools and AI digital assistants, as well as AI software services including GenAI products and services for consumer, enterprises and vertical markets.

“There is an additional boost for telecom operators to move beyond connectivity, which is the sovereignty agenda,” Talmesio noted. While sovereignty in the past was largely applied to data residency, “in reality, there are more and more aspects of sovereignty that are in many ways facilitating telecom operators in retaining or entering business areas that probably ten years ago were unthinkable for them.” These include cloud and data center infrastructure, sovereign AI, cyberdefense and quantum safety, satellite communication, data protection and critical communications.

“The telecom business is definitely improving,” Talmesio concluded, noting that the market is now also being viewed more favorably by investors. “In many ways, the glass is maybe still half full, but there’s more water being poured into the telecom industry.”

References:

https://networkxevent.com/speakers/dario-talmesio/

https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/pushing-telcos-ai-envelope-on-capital-decisions

Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

Omdia: Huawei increases global RAN market share due to China hegemony

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Omdia: Cable network operators deploy PONs

U.S. fiber rollouts now pass ~52% of homes and businesses but are still far behind HFC

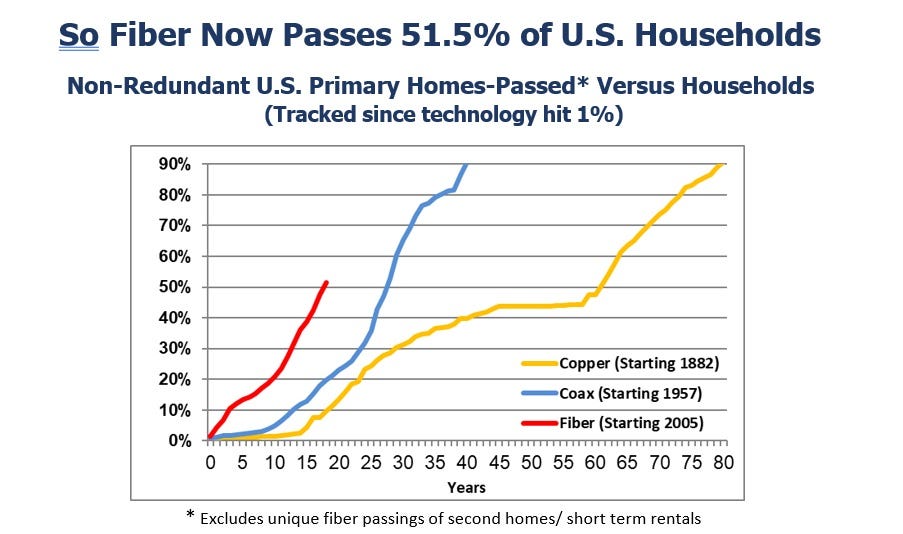

Fiber optic network deployments have reached a milestone as they now pass more than 50% of U.S. households, according to recent report from the Fiber Broadband Association (FBA) [1.] and RVA Market Research and Consulting. Fiber broadband deployment set a new historical record in 2023, passing nine million new homes at a growth rate of 13% year-over-year. The 2023 North America Fiber Provider Survey, sponsored by the FBA, concluded that 77.9 million U.S. homes were passed with fiber, with nearly 52% of all the nation’s unique homes and businesses passed.

Note 1. The FBA is an all-fiber trade association that provides resources, education, and advocacy for companies, organizations, and communities that want to deploy fiber networks. The FBA’s goal is to raise awareness and provide education about the fiber deployment process, safe worksites, and effective fiber installs.

Image Credit: The Fiber Broadband Association (FBA)

………………………………………………………………………………………………………………………………………………………………………………………….

The last $10 billion U.S. Treasury American Rescue Plan (ARP) funding for infrastructure projects such as broadband networks is being distributed this year. The $42.5 billion in NTIA BEAD funding available over the next few years will significantly contribute to enabling and upgrading communities across America with the high-speed, low-latency broadband necessary for participation in today’s 21st-century society. We are seeing a steady stream of NTIA approvals and expect the first states to make BEAD awards in the second half of 2024.

Here’s how the growth of fiber has risen in recent years compared to coax cable (or hybrid fiber/coax, HFC) and the long history of copper.

“Thanks to this latest surge, fiber lines now pass nearly 78 million U.S. homes, up 13% from a year ago,” Alan Breznick, Heavy Reading analyst and the cable/video practice leader at Light Reading, explained in recorded opening remarks here at Light Reading’s 17th’s annual Cable Next-Gen event. Almost 69 million of those locations are “unique” fiber homes, meaning that about 9 million are passed by more than one fiber provider, Breznick added.

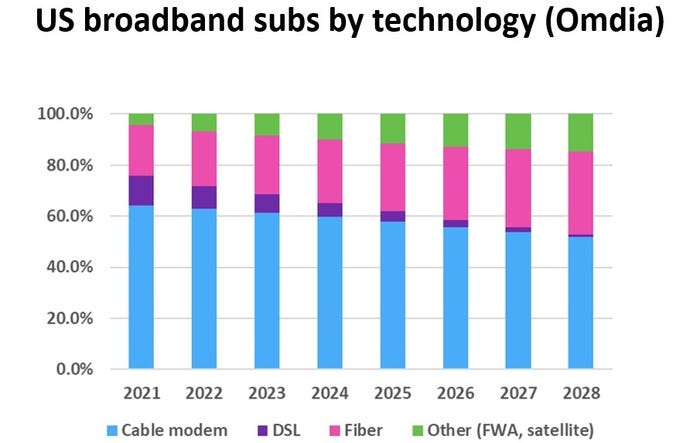

The share of broadband technology is also evolving. While HFC remains the primary way of delivering broadband, fiber-to-the-premises (FTTP) and fixed wireless access (FWA) will continue to make their presence felt in the coming years. Omdia (owned by Informa) expects cable’s share of that mix to drop over the next four years, hitting about 55% by 2028, while fiber’s share is expected to rise to 30% by that time, Breznick explained.

For the cable industry, fiber and FWA are not solely about competition. Many operators are also using FTTP extensively in greenfield deployments and subsidized rural buildouts. They are deploying it on a targeted basis via a new generation of nodes that can support multiple access technologies, including HFC and wireless.

CableLabs has put fiber-to-the-premises on the front burner via a pair of new working groups. A recent survey from Omdia shows that more than one-third of cable operators have already deployed passive optical networking (PON) in some form. That number will “undoubtedly keep rising” thanks to initiatives such as the Broadband Equity Access and Deployment (BEAD) program, Breznick said. Omdia expects spending on next-gen cable technologies to tick up in 2024 and 2025 and then reach a relatively steady annual state through 2029.

Meanwhile, operators such as Mediacom Communications have tapped into FWA to extend the reach of broadband in rural areas. Combined, they demonstrate some of the reasons why the industry has been shedding the “cable” label via rebranding efforts and name changes in recent years.

Cable’s broadband challenge is to grow broadband subscribers as it faces more broadband competition combined with historically low churn and a slow housing move market. “If it feels like an uphill battle for cable, maybe that’s because it is. But that doesn’t mean it has to be a losing battle,” Breznick said. “That’s because the cable industry still has plenty of tricks left up its sleeve.”

Those tricks include the use of next-generation DOCSIS 3.1 (sometimes called DOCSIS 3.1+ or extended DOCSIS 3.1) that can bump up speeds as high as 8 Gbit/s by opening up new orthogonal frequency division multiplexing (OFDM) channels. Some operators, including Comcast, Charter Communications, Rogers Communications, Cox Communications and Cable One, have begun to deploy DOCSIS 4.0 or have put it squarely on their network upgrade roadmaps.

And though cable operators’ network spending is expected to be down in the first half of 2024, vendors are optimistic that the spigots will start to open up again in the second half of the year as operators pick up the pace.

References:

https://www.lightreading.com/fttx/us-fiber-rollouts-reach-tipping-point-but-are-still-far-behind-hfc

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Nokia’s launches symmetrical 25G PON modem

Omdia: Big increase in Gig internet subscribers in 2022; Top 25 countries ranked by Cable

Global gigabit internet subscriptions are expected to increase to 50 million in 2022, more than doubling from 24 million at the end of 2020, according to a new report from market research firm Omdia (owned by Informa).

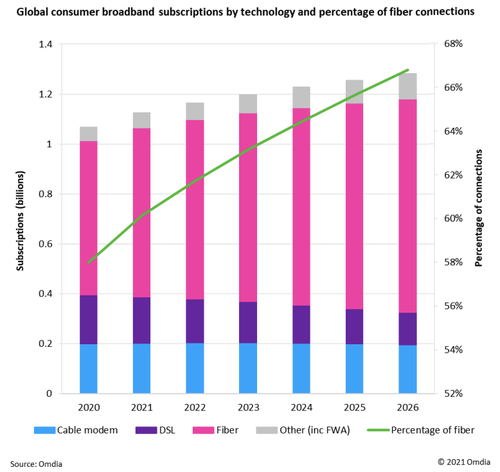

The Omdia report states that accelerated fiber deployments are helping to drive an increase in gigabit connectivity.

“Demand for reliable broadband is set to drive growth in gigabit services, with fiber playing a key role,” said Peter Boyland, principal analyst, broadband at Omdia.

“There were fewer than 620 million fiber subscriptions globally at the end of 2020, but we expect these to grow to 719 million in 2022, or 62% of total subscriptions.” The majority of fiber internet subscribers are expected to be in China.

However, Omdia warns that service providers must “carefully consider market demand” for their gigabit strategies and make targeted investments in fiber.

“Service providers need to carefully plan and execute gigabit network rollout, analyzing a number of factors, including infrastructure challenges, market competition, and expected demand,” writes Omdia. “But this does not stop with network rollout – operators need to continually monitor potential competitors and constantly innovate, refresh, and build service offerings so they stay ahead of rivals.”

The analysts also point out the opportunity for vendors in the market who can help service providers build “future proof” networks. “Vendors can offer long-term solutions such as monitoring and automation tools to extend the operator/vendor relationship beyond network rollouts,” the report recommends.

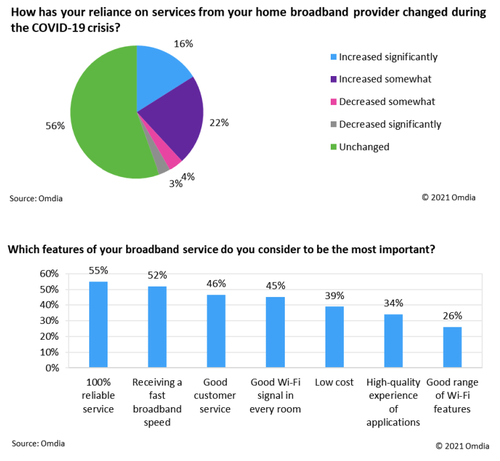

Of course, what matters most to consumers is reliable service. According to Omdia’s Digital Consumer Insights survey, 36% of respondents said they were more reliant on broadband services during COVID-19, and 55% of respondents said reliability ranked top among the most important home broadband features.

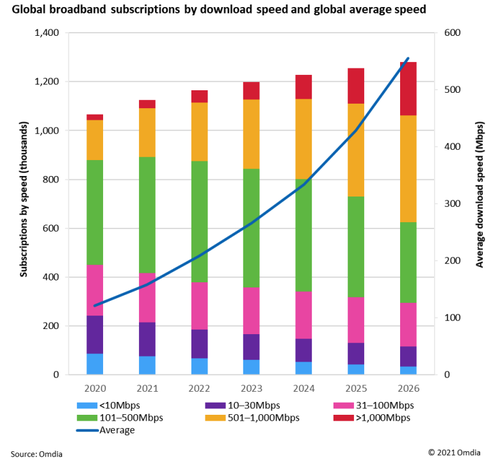

All of this gigabit and fiber growth will impact broadband speeds for years to come. According to Omdia:

“In 2020, just 2% of broadband subscriptions were more than 1Gbps, but this is expected to double to 4% in 2022.”

–>See table below for the 25 countries with the fastest AVERAGE internet speeds, ranked by Cable. Note that none of them is close to 1Gbps.

The report says that subscribers with access to 500 Mbit/s-1 Gbit/s will increase from 15% in 2020 to 21% in 202, with 17% of broadband subscriptions projected to reach speeds over 1 Gbit/s by 2026.

While high-bandwidth entertainment like augmented and virtual reality (AR/VR) and gaming were thought to be the main drivers for ever-faster home broadband speeds in pre-pandemic times, Omdia’s report doesn’t think they are significantly important for gigabit Internet growth, referring to them just once as “other drivers.”

……………………………………………………………………………………………

Internet comparison site Cable has ranked the countries with the fastest broadband internet in the world based on over 1.1 billion speed tests across 224 countries and territories.

“The acceleration of the fastest countries in the world has finally plateaued this year as they reach FTTP pure fibre saturation. Increases in speed among the elite performers, then, can be attributed in greater part to uptake in many cases than to network upgrades. Meanwhile, though the countries occupying the bottom end of the table still suffer from extremely poor speeds, 2021’s figures do indicate that the situation is improving,” said Dan Howdle of Cable.

Here are the 25 countries with the fastest download speeds:

| 1 | Jersey | JE | WESTERN EUROPE | 274.27 |

| 2 | Liechtenstein | LI | WESTERN EUROPE | 211.26 |

| 3 | Iceland | IS | WESTERN EUROPE | 191.83 |

| 4 | Andorra | AD | WESTERN EUROPE | 164.66 |

| 5 | Gibraltar | GI | WESTERN EUROPE | 151.34 |

| 6 | Monaco | MC | WESTERN EUROPE | 144.29 |

| 7 | Macau | MO | ASIA (EX. NEAR EAST) | 128.56 |

| 8 | Luxembourg | LU | WESTERN EUROPE | 107.94 |

| 9 | Netherlands | NL | WESTERN EUROPE | 107.30 |

| 10 | Hungary | HU | EASTERN EUROPE | 104.07 |

| 11 | Singapore | SG | ASIA (EX. NEAR EAST) | 97.61 |

| 12 | Bermuda | BM | NORTHERN AMERICA | 96.54 |

| 13 | Japan | JP | ASIA (EX. NEAR EAST) | 96.36 |

| 14 | United States | US | NORTHERN AMERICA | 92.42 |

| 15 | Hong Kong | HK | ASIA (EX. NEAR EAST) | 91.04 |

| 16 | Spain | ES | WESTERN EUROPE | 89.59 |

| 17 | Sweden | SE | WESTERN EUROPE | 88.98 |

| 18 | Norway | NO | WESTERN EUROPE | 88.67 |

| 19 | France | FR | WESTERN EUROPE | 85.96 |

| 20 | New Zealand | NZ | OCEANIA | 85.95 |

| 21 | Malta | MT | WESTERN EUROPE | 85.20 |

| 22 | Estonia | EE | BALTICS | 84.72 |

| 23 | Aland Islands | AX | WESTERN EUROPE | 81.31 |

| 24 | Canada | CA | NORTHERN AMERICA | 79.96 |

| 25 | Belgium | BE | WESTERN EUROPE | 78.46 |

It is the fourth year of the assessment and the latest ranking uses data collected in the 12 months up to 30th June 2021 to evaluate internet speed by country.

References:

https://www.cable.co.uk/broadband/speed/worldwide-speed-league/