MoffetNathanson

U.S. broadband subscriber growth slowed in 1Q-2024 after net adds in 2023

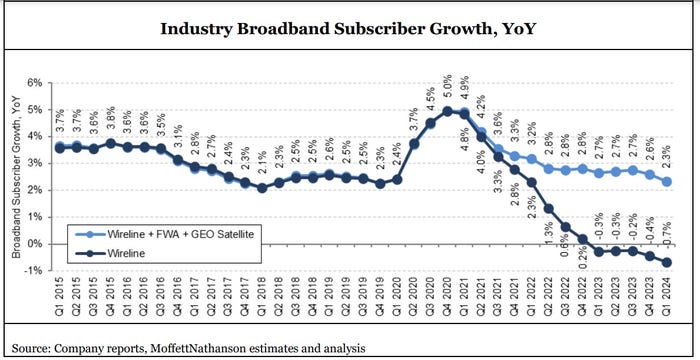

The pace of U.S. broadband subscriber growth slowed considerably in the first quarter of 2024 as fiber, fixed wireless access (FWA) and cable broadband service providers collectively turned in results that were worse than what they posted in the year-ago period.

Total industry net additions, including or excluding FWA and geosynchronous (GEO) satellite broadband providers, decelerated noticeably in Q1 2024. The total market’s growth rate decreased to just 2.3% year-over-year, the slowest since the COVID-19 pandemic, analysts at MoffettNathanson estimated in its latest broadband industry trends report (paid subscription required). When FWA and GEO satellite categories were excluded, the growth rate was much worse: -0.7%.

The overall number of U.S. broadband market subscribers decelerated by 299,000 net adds versus the year-ago quarter. “That was the most abrupt since Q2 2022,” said MoffettNathanson analyst Craig Moffett. “The bottom line is that penetration of home broadband stalled, and perhaps even declined in the quarter, particularly if one adjusts for the growth in homes passed in rural areas under RDOF [Rural Digital Opportunity Fund] subsidies and unsubsidized edgeouts,” Moffett wrote.

Here’s a breakdown of U.S. broadband subscribers by access type:

- Fixed Wireless Access (FWA) providers added 879,000 subs in Q1 2024, down from a gain of 925,000 in the year-ago period.

- Fiber net adds also slowed – from 487,000 in Q1 2024 versus a gain of 517,000 in the year-ago quarter.

- DSL losses of 560,000 in Q1 were similar to a year-ago loss of 571,000.

- MSO/cable network operators shed 169,000 broadband subs in Q1, much worse than a year-ago gain of about 71,000 subs.

“The culprit for cable’s weaker broadband net additions was a slower market growth rate,” though lower new household formation and cessation of ACP enrollments in the quarter also played a role, Moffett noted.

……………………………………………………………………………………………………………..

According to Statista, the total number of broadband subscribers in the U.S. stood at 114.7 million at the end of 2023, This was an increase of over four million subscribers compared to the previous year.

Source: Statista

…………………………………………………………………………………………………………………………

In March 2024, Leitman Research found that the largest cable and wireline phone providers and fixed wireless services in the U.S. – representing about 96% of the market – acquired about 3,520,000 net additional broadband Internet subscribers in 2023, similar to a pro forma gain of 3,530,000 subscribers in 2022.

Leitman Research findings for 2023:

- The top cable companies lost about 65,000 subscribers in 2023 – compared to about 530,000 net adds in 2022

- The top wireline phone companies lost about 80,000 total broadband subscribers in 2023 – compared to about 180,000 net losses in 2022

- Wireline Telcos had about 1.97 million net adds via fiber in 2023, offset by about 2.05 million non-fiber net losses

- Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 3,665,000 subscribers in 2023 – compared to about 3,185,000 net adds in 2022

- Fixed wireless services accounted for 104% of the total net broadband additions in 2023, compared to 90% of the net adds in 2022, and 20% of the net adds in 2021

“Top broadband providers added about 3.5 million subscribers in 2023, similar to the number of broadband adds in 2022,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Over the past four years, top providers added about 15.9 million broadband subscribers, compared to about 10.2 million net broadband adds in the prior four (pre-pandemic) years.”

………………………………………………………………………………………………………..

References:

https://www.lightreading.com/broadband/us-broadband-subscriber-pace-slows-across-the-board

https://www.statista.com/statistics/217938/number-of-us-broadband-internet-subscribers/

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Verizon’s 2023 broadband net additions led by FWA at 375K

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth

CenturyLink rebrands as LUMEN for large enterprise customers; adds Quantum Fiber

CenturyLink has taken on a new identity — Lumen — a name it says better highlights the company’s future direction and focus on selling business services to large customers. [Note that there is already a Texas based company named Lumen Technologies Inc so there’s sure to be confusion and a possible trademark lawsuit in the near future.]

Lumen is a measure of the brightness of light, and the company’s competitive advantage this century has come from its massive fiber network, stretching 450,000 route miles. That has helped CenturyLink survive even as consumers cut their home phone lines in favor of wireless providers and switched off DSL in favor of faster alternatives.

But transporting light signals can also be a commodity service. Lumen is now pushing to offer more higher-value applications and enterprise services directly to its customers, reflected in the company’s new motto: “The Platform for Amazing Things.”

Lumen says on its website:

Lumen is an enterprise technology platform that enables companies to capitalize on emerging applications that power the 4th Industrial Revolution. Most IT leaders don’t feel ready to face the nearly century’s worth of data-driven innovation they expect in the next five years.

“Our people are dedicated to furthering human progress through technology. Lumen is all about enabling the amazing potential of our customers, by utilizing our technology platform, our people, and our relationships with customers and

partners,” said Lumen CEO Jeff Storey, in a statement on the name change.

“For the past three years we have been reinventing ourselves and repositioning the company to deliver on a brand-new promise: Furthering human progress through technology,” said Lumen CTO Andrew Dugan, who held the same title at CenturyLink. “We have been considering this change for many months. We are ideally positioned to help resolve the biggest data and application challenges of our time—this is why now is the right time to introduce Lumen.”

The CenturyLink brand will continue to be used for residential and small business customers using traditional copper based networks. “CenturyLink, with its strong heritage, will remain as a trusted brand for residential and small business customers over traditional networks,” the company said.

………………………………………………………………………………………………………………………………………………………………………………………

The number of telecom and cloud service providers that have been acquired by CenturyLink is truly astounding. That list includes: US West (which was acquired by Qwest Communications), Embarq (which included Sprint Local and US Telecom), Savvis, App Frog, Tier 3, and the big one –Level 3 Communications in a deal valued at around $25 billion. Level 3, in turn, had also acquired a boat load of telecom providers such as Global Crossing and TW Telecom and before that: WilTel Communications, Broadwing Corporation, Looking Glass Networks, Progress Telecom, and Telcove (formerly Adelphia Business Solutions) and ICG Communications.

………………………………………………………………………………………………………………………………………………………………………………….

These acquisitions, long with internal software innovations, they have given Lumen the ability to provide enterprise customers with a variety of services in a variety of areas. However, the company still does not have presence in the cellular communications business.

“Unfortunately, today’s network, cloud and IT architectures present latency, cost and security challenges that inhibit the performance of distributed applications and real-time data processing. Ultimately, the world needs a new architecture platform that has been designed to support the intensive performance requirements of next-generation applications. And that is exactly what we aim to provide with Lumen,” said Lumen’s chief marketing officer Shaun Andrews, in a video message.

Smart cities, retail and industrial robotics, real-time virtual collaboration and automated factories are some of the applications that Lumen believes it can help customers achieve in what it and others call the 4th Industrial Revolution. Steam power, electricity and then the computer chip all pushed economic progress, and now the melding of the digital and physical worlds that connectivity permits is doing the same, Andrews added.

That is the future direction, where the company sees the greatest potential for growth and new revenues. But Andrews emphasized that residential and small business consumers will still deal with CenturyLink, a brand executives believe still has value two decades into the new century. It is the name that will continue to show up on residential customers’ bills. CenturyLink Field in Seattle will retain its name.

Another new entity, Quantum Fiber, will handle the residential and small business transition to digital as the company rolls out more fiber-optic connections directly to homes and businesses (FTTH and FTTP, respectively). The company added capacity to reach about 300,000 homes and small businesses last year with gigabit service and plans to reach another 400,000 this year, according to Fierce Telecom.

Lumen says the can provide the ability to control latency, bandwidth and security for applications across cloud data centers, the market edge and on-premises, according to a blog by Dugan. Instead of putting critical applications into a centralized cloud, Lumen’s edge compute platform, which includes more than 100 active edge compute nodes across large metro markets in the U.S—puts them closer to the end user for low latency and better security.

“The Lumen brand is focused on supporting our enterprise business customers. It alludes to our network strength and to the incredible capabilities powered by our platform to help transform how businesses operate,” Dugan said.

“Quantum Fiber is an important new brand within Lumen with a focus on superior fiber connectivity and a fully enabled digital customer experience,” Dugan said. “Quantum Fiber serves residential and small business customers, and Lumen focuses on enterprise, government and global businesses.”

In 2019, CenturyLink expanded its fiber network to reach an estimated 300,000 additional homes and small businesses with its gigabit service. CenturyLink’s consumer fiber-to-the-home (FTTH) projects provide symmetrical speeds of up to 940 Mbps. The faster speeds were enabled in parts of Boulder, Colo., Spokane, Wash., and Tucson, Ariz. last year.

CenturyLink previously said it would build out its fiber network to an additional 400,000 homes and small businesses this year, including in Denver, Omaha, Neb., Phoenix, Portland, Ore., Salt Lake City, Spokane, Wash., and Springfield, MO.

MoffetNathanson analysts wrote in a note to clients (emphasis added):

The flagship Lumen brand is targeted toward larger enterprises, the likes of which would be most likely to adopt the company’s most advanced services. The CenturyLink brand is being retained for legacy copper services delivered to residential customers and some SMBs, as well as existing FTTH customers. And the new Quantum Fiber brand is being introduced for SMB services delivered via the automated platform the company has been developing and has indicated it would soon be rolling out to on-net, out-of-region locations (mostly ex-Level 3 buildings), and will include consumer FTTH sold in a similar manner. The services and capabilities Lumen delivers to each of these customer segments varies dramatically, so it’s not at all inappropriate to have separate brands for each. Innumerable examples of this phenomenon exist across other industries – automotive, consumer products, airlines, apparel, media, and so on. Within the world of telecom, carriers often have brands that target different segments or highlight different product types (Verizon with FiOS, AT&T with Cricket, T-Mobile US with MetroPCS, Altice USA with Optimum vs. Lightpath, and so on).

CenturyLink was an amalgamation of many different companies, assets, and capabilities. Management’s decision to rebrand as Lumen, Quantum Fiber, and CenturyLink acknowledges those differences and gives management an opportunity to refresh and communicate its vision for the company to customers, employees, and investors.

Andrews said the name change won’t include a relocation to Denver of the corporate headquarters, which will remain in Monroe, La., home of the original CenturyLink. Of the company’s 40,000 employees globally, 5,800 are based in Colorado, and metro Denver remains an important hub of operations, especially the ones that Lumen will emphasize.

It remains to be seen what will happen with CenturyLink’s wholesale and carriers carrier backbone services, which acquisitions such as Level 3 and Global Crossing mainly focused on, i.e. selling high bandwidth fiber optic long haul links to other carriers.

References:

https://www.lumen.com/en-us/home.html

https://news.lumen.com/CTO-Andrew-Dugan-explains-how-the-Lumen-platform-keeps-data-moving