WiFi Hot Spots

AT&T to provide free WiFi and private 5G at DFW airport; will invest $10 million worth of network upgrades

Dallas Fort Worth International Airport (DFW) entered into a partnership with AT&T, to provide the airport with a comprehensive wireless platform (CWP) that will enhance connectivity and critical infrastructure. As part of the proposed agreement, AT&T will invest $10 million worth of network upgrades in modernizing and expanding the network covering the DFW airport, to support airport operations and advance the free public Wi-Fi in the Airport’s terminals. This includes installing 200 new access points — and updating the 800 access points DFW already provides — to enable better coverage and faster speeds for customers. AT&T will also deploy a private 5G network for the Airport’s internal use to meet the rising demand for Internet of Things (IoT) uses cases and the digitization of airport operations.

“We know that being connected to the internet is an absolute must-have service for our customers. This proposed agreement signifies our commitment to ensure our customers will always remain connected at DFW Airport, so they can reliably stay online for work or entertainment while traveling,” said Mike Youngs, Vice President of Information Technology Services at DFW Airport.

The CWP will provide enhanced connectivity throughout the airport, including indoor and outdoor spaces, parking lots and runways. This faster connectivity means that travelers will have even faster access to airport services through the DFW Airport or airline app such as automated check-in, baggage tracking and lounge access.

The private cellular 5G network will offer more reliability and security, lower latency and greater capacity, providing operations teams with optimal connectivity that can be used for future use cases such as real-time data analytics and enhanced communication with critical airport systems. With these use cases, the airport’s management team will be better able to monitor and manage passenger traffic, security systems and baggage handling – improving efficiency and safety.

Image Credit: AT&T

“Modernizing airport technology needs to focus on both improving the efficiency and convenience for airlines and airport operations and the overall travel experience for passengers, while ensuring the safety and security of all those who pass through its gates,” said Jason Inskeep, Assistant Vice President, 5G Center of Excellence at AT&T. “We’re proud to work alongside DFW Airport and look forward to continuing our collaboration to bring the best connectivity solutions for all.”

DFW and AT&T will begin upgrading the network this summer, with the enhancements coming online by the fall. The project is contingent upon a final contract between AT&T and the DFW. Dallas Fort Worth International Airport is one of the most connected airports in the world and serves as a major job generator for the North Texas region by connecting people through business and leisure travel. With 168 gates in five terminals and an area spanning 18,000 acres, DFW Airport is the third-largest airport in the world by size.

In February 2021, AT&T and Boingo Wireless said in a press release that they were “working to deploy” AT&T 5G+ in 12 airports nationwide, including John F. Kennedy International Airport and LaGuardia Airport in New York City and Chicago O’Hare International Airport and Midway International Airport. Dallas Love Field Airport in also was among the airports announced.

References:

https://about.att.com/story/2021/5g_plus_boingo.html

AT&T touts 5G advances; will deploy Standalone 5G when “the ecosystem is ready”- when will that be?

AT&T realizes huge value from AI; will use full suite of NVIDIA AI offerings

AT&T Highlights: 5G mid-band spectrum, AT&T Fiber, Gigapower joint venture with BlackRock/disaggregation traffic milestone

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

MoffettNathanson: Fiber Bubble May Pop; AT&T is by far the largest (fiber) overbuilder in U.S.

A Tale of two Telcos: AT&T up (fiber & mid-band 5G); VZ down (net income falls; cost-cutting coming)

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

Comcast has about 22 million Wi-Fi hotspots which are available free of charge for its Comcast Business and Xfinity customers (including this author who has used their WiFi hotspots in Santa Clara, CA and Pacifica, CA).

Xfinity Communities serves about 250,000 properties from multi-dwelling units (MDUs) to single-family communities, assisted living residences, hospitals and college dormitories. Xfinity Communities has six special account managers to handle its top 40-50 largest property owners. Some of the properties it serves are spread out so the company is providing Wi-Fi not just to specific units but also in the lobbies, on the grounds and at the pool, etc.

Although Comcast has the technology to provide Wi-Fi to a whole building without wiring multiple individual units, it seems to prefer the more traditional model. “To serve individuals best you need some kind of wired technology,” said Mike Mancini, director of sales engineering for Xfinity Communities. “Every unit gets wired to make sure we can deliver the highest speeds possible,” he added.

Xfinity Communities can and does wire the dormitory building, but not every individual unit. “We do hook up entire buildings as well, and people don’t have gateways, they have an access point up on the wall. We can provide connectivity both ways, it really depends on the property. We’re very flexible,” Mancini said.

Xfinity Communities serves selected apartment buildings. With pre-installed xFi Gateways in every unit, residents get instant access to WiFi after moving in. They can sign up for Xfinity Internet upon arrival, lease the xFi Gateway, and get connected on the spot — all from the provider of the largest gig-speed network.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

Separately, Charter Communications this week announced the availability of its Advanced Wi-Fi for Spectrum Business customers across its 41-state footprint. Charter’s Advanced Wi-Fi includes its Red Dot Design router, which can support up to 200 devices simultaneously. And it includes greater coverage with Spectrum Wi-Fi Pods, which are additional access points for extended Wi-Fi coverage and more consistent speed to all corners of the business.

“Small businesses rely on technology, specifically the Internet and WiFi, to compete in today’s marketplace,” said Dave Rodrian, Group Vice President, WiFi Products, for Charter. “Now, with the launch of Advanced WiFi throughout our footprint, we can offer small and medium-sized businesses faster and more secure WiFi connections, giving them additional control over their network so they can improve their efficiency and productivity.”

More information about Advanced WiFi and other Spectrum Business connectivity services is available here.

References:

https://www.xfinity.com/multifamily

https://www.fiercewireless.com/wireless/comcast-touts-its-xfinity-communities-wi-fi

https://corporate.charter.com/newsroom/advanced-wifi-available-to-spectrum-business-customers

Technavio: Wireless access point market to grow at a CAGR of 6% 2022-2027

According to Technavio, the global wireless access point market size is estimated to grow by USD 6,961.75 million from 2022 to 2027. The market is estimated to grow at a CAGR of 6% during the forecast period. Moreover, the growth momentum will accelerate. North America will account for 32% of the growth of the global market during the forecast period. The report includes historic market data from 2017 to 2021.

The report also provides a comprehensive analysis of growth opportunities at regional levels, new product launches, the latest trends, and the post-pandemic recovery of the global market.

Market Definition:

- A wireless access point is a computer networking device that connects a wireless device and a wired network using a wireless standard such as Wi-Fi or Bluetooth.

- As a standalone device, a wireless access point is often linked to a router through a cable

- An access point is a networking hardware device that delivers and receives data on a wireless network

- An access point links users to other users on the network and acts as the point of connection between the WLAN and a fixed wire network

- Within a given network region, each access point can serve numerous users

- When a person goes outside the range of one access point, they are unavoidably handed over to the next access point

- A single access point is needed for a tiny WLAN

- The number required grows in direct proportion to the number of network users and the structural size of the network.

Key factor driving market growth:

- The increase in the development of smart cities is driving the growth of the global wireless access point market.

- Governments of various countries are investing large amounts in the construction of smart cities.

- These cities require public Wi-Fi networks to provide services such as safety and security, access to education, waste and water management, traffic management, infrastructure management, and healthcare.

- As a result, there will be a high demand for wireless access points in smart cities.

- Hence, the development of smart cities is expected to fuel the growth of the market during the forecast period.

The report provides actionable insights and estimates the contribution of all regions to the growth of the global wireless access point e growth of the global market during the forecast period. This growth is attributed to factors such as the increase in the use of the Internet and smartphones. The demand for bring-your-own-device (BYOD) solutions is also increasing in the region. In addition, the rising demand for 5G network acceleration has enabled firms and telecom component providers to develop advanced telecom infrastructure and related components. These factors will fuel the growth of the wireless access point market in the region during the forecast period.

Leading trends influencing the market:

1. The increase in the development of smart cities is driving the growth of the global wireless access point market.

- Governments of various countries are investing large amounts in the construction of smart cities.

- These cities require public Wi-Fi networks to provide services such as safety and security, access to education, waste and water management, traffic management, infrastructure management, and healthcare.

- As a result, there will be a high demand for wireless access points in smart cities.

- Hence, the development of smart cities is expected to fuel the growth of the market during the forecast period

2. The increase in 5G investments is a key trend in the global wireless access point market.

- The rise in these investments in 5G is creating a demand for 5G network infrastructure.

- Telecom service providers and network equipment providers will have to offer routers that will enable carriers to provide 5G services.

- Thus, an increase in investments in 5G will increase the adoption of devices such as wireless routers, which, in turn, will support the growth of the market during the forecast period.

The increase in the development of smart cities is a key factor driving the growth of the global wireless access point market. Across the world, governments are investing billions of dollars in the construction of smart cities or linked cities. This necessitates the use of public Wi-Fi networks to provide customers with services such as safety and security, access to education, waste and water management, traffic management, infrastructure management, and healthcare. It also offers LBS to city planners in order to obtain insight into how its residents live and how a smart city operates in order to deliver better services to people living in smart cities. As a result, there will be a high demand for wireless access points to be deployed in smart cities.

The government of China is focusing more on urbanization and the development of smart cities in its five-year plan. The development of a smart city includes identifying an urban area and facilitating economic growth and improved quality of life with technologies such as Wi-Fi connectivity. The databases and network systems here are connected to cameras, sensors, and control systems, where technology would be used for allocating services, managing traffic, and inventory, and managing and transferring information. Hence, with the development of smart cities, the market is expected to witness growth during the forecast period

The increase in 5G investments is the primary trend in the global wireless access point market growth. 5G is the next generation of communication technology, following 4G, and on commercialization, 5G will support data download speeds of 10,000 Mbps. There have been numerous investments in 5G across the world. The increasing investments in 5G are creating demand for 5G network infrastructure.

This is expected to accelerate the growth of the market during the forecast period. Such product launches enable telecom service providers and network equipment providers to offer routers, enabling carriers to provide 5G services. Thus, an increase in investments in 5G will propel the adoption of devices, including wireless routers, which will result in the growth of the market during the forecast period.

Major challenges hindering market growth:

- Latency issues are challenging the growth of the global wireless access point market.

- In remote areas, the quality of networks is low. Hence, mobile network operators need to build solutions to offer connectivity to IoT devices.

- This can impact the consumer segment, as individual consumers do not have access to high-speed Internet everywhere.

- Moreover, in countries with low internet speeds, such as Yemen, Cuba, and Sudan, the adoption of wireless APs is slow.

- Hence, low internet speeds and latency issues are negatively impacting the adoption of routers and APs.

- These factors will impede the market growth during the forecast period.

The latency issues are a major challenge for the growth of the global wireless access point market. The Internet is the backbone of the IoT devices market. IoT devices require reliable, high-speed internet connectivity to function effectively. Although many countries have advanced internet infrastructure, but in suburban areas and highways, where the quality of the network is usually poor, mobile network operators need to build solutions to offer connectivity to IoT devices in these areas. This challenge has the highest impact on the consumer segment, as individual consumers cannot have access to high-speed Internet everywhere.

Low internet speeds and latency (time taken by the data packet to travel between devices in a network) are affecting the adoption of routers and APs among consumers. Singapore has the fastest average download rate at 256 Mbps, followed by Hong Kong at 254 Mbps and Romania at 232 Mbps. Hence, the adoption of wireless APs is expected to be high in these countries. However, in countries with lower internet speeds, such as Yemen, Cuba, and Sudan, the adoption of wireless APs is slow, which creates latency issues and is expected to hinder the growth of the market during the forecast period.

Key Wireless Access Point Market Customer Landscape:

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

………………………………………………………………………………………………………………………………………

Methodology:

Technavio categorizes the global wireless access point market as a part of the global communications equipment market within the overall global information technology sector. The parent global communications equipment market covers manufacturers of enterprise networking products, including LANs, WANs, routers, telephones, switchboards, and exchanges. Technavio also includes communications infrastructure or telecom equipment market within the scope of the communications equipment market. Our research report has extensively covered external factors influencing the parent market growth during the forecast period.

……………………………………………………………………………………………………………………………………….

References:

CableLabs to bring mobility to WiFi for a better user experience

Introduction:

CableLabs said it has developed a new technology that brings mobile, cellular-like capabilities to Wi-Fi networks. That, of course goes beyond the charter of IEEE 802.11 Working Group[1.]. CableLabs also believes its technology will enable cable operators to cut down on MVNO costs by offloading even more data to their Wi-Fi networks (this author frequently uses Xfinity WiFi when away from home for mobile Internet access).

The cable networks research organization is focusing the technology on home networks that are comprised of multiple Wi-Fi access points (APs) and extenders, but also believes the pieces are in place to support other use-cases, such as Wi-Fi network deployments in commercial buildings and the Cable Wi-Fi roaming initiative that now comprises about 4 million hotspots.

There have been many attempts to do this over the years, typically relying on coercing the device to reconnect to the new AP, but this frequently seems not to work quite right. Sometimes, there’s a lag before a device switches APs, and sometimes the device never switches APs. Or sometimes, the device insists that an AP is still present, even though it no longer is—for example, when you leave your house in your car and your phone insists it’s still connected to your home Wi-Fi.

Note 1. The IEEE 802.11™ Working Group (WG) is responsible for developing Wireless Local Area Network (WLAN) standards under the authority of the IEEE® Project 802 LAN/MAN Standards Committee (802 LMSC). The 802.11 WG is one of several WGs that comprise the Project 802 LAN/MAN Standards Committee (such as IEEE 802.3 Ethernet).

How Does CableLabs Mobile Wi-Fi Work?

CableLabs Mobile Wi-Fi uses a central controller to group multiple access points or APs (WiFi routers) into one continuous network. The central controller detects which AP your device is closest to and connects your device to that AP. If you move—for example, getting up and walking to a different room—then the controller evaluates whether you would get the best experience by staying connected to the old AP or if your experience would be better by switching to a new one. If it’s the latter, the controller moves your device to the new AP without you even noticing.

Instead of asking the phone to reconnect to a different AP, CableLabs Mobile Wi-Fi moves the network itself to the new AP. It does this using a virtual Basic Service Set, or VBSS. A VBSS is a network set up exclusively for use by one device and can be moved from AP to AP without the device disconnecting and reconnecting. This makes the transitions between APs seamless and transparent to the phone.

So now, as you walk around your house with your device, the CableLabs Mobile Wi-Fi controller is moving your VBSS such that it follows along with you, hopping from one AP to another as you go. If you wander too far and go outside the range of all your APs (like when you drive away in your car), the CableLabs Mobile Wi-Fi controller detects this, closes your connection and tears down your VBSS so that your phone immediately knows there is no longer a Wi-Fi connection. The phone will then immediately switch to cellular data.

The result is that your device will be consistently connected to the best available AP in your space. Gone will be the days of being connected to an AP across the house instead of the one right next to you. Your Wi-Fi will be better and faster.

When Can I Get It?

CableLabs Mobile Wi-Fi is not yet available to end consumers. For the next step toward a commercial implementation of CableLabs Mobile Wi-Fi, CableLabs has joined and is working with the prpl Foundation to include Mobile Wi-Fi in the open-source prplMesh implementation of Wi-Fi Alliance EasyMesh™️. Go to the prpl website for more information about prplMesh and access to the prplMesh codebase. CableLabs is also working in Wi-Fi Alliance to support Wi-Fi CERTIFIED EasyMesh.

For more information on CableLabs Mobile Wi-Fi, reach out to Steve Arendt, Principal Architect & Director, Advanced Technology Group, CableLabs.

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Steve Glennon, a distinguished technologist at CableLabs, told Light Reading that Wi-Fi has done well in new iterations to beef up physical data rates as home broadband speeds continue to climb to 1 Gbit/s and beyond. But he argues that Wi-Fi has fallen short of the mark in attempts to seamlessly connect smartphones to the best link in multiple-AP environments after the initial Wi-Fi connection is established.

“In general, phones go down the path of saying, ‘I’m connected, life is good.’ And they spend a bunch of battery and compute trying to scan and work out what’s around and when should I switch,” Glennon said. “You might be sitting right next to a Wi-Fi extender and your phone is still getting cruddy throughput. The problem is it’s associated with the main AP back in the living room of the house and in fact you’re upstairs in the bedroom sitting right next to the extender.”

Glennon said Wi-Fi roaming work around 802.11k, 802.11r, and 802.11v help to recognize this issue, but suggests they’ve not been super-successful at fixing it by giving the phone more information to help select the best AP.

Instead of putting a bunch of focus on the smartphone and requiring that device to be constantly scanning, CableLabs wants to flip things around by treating multiple APs like a mobile network. And instead of having the phone associate with a physical AP, the approach proposed by CableLabs is to create a virtual access point that moves from AP to AP without requiring the phone to know what’s going on.

CableLabs says it accomplishes that through a Virtual Basic Service Set (VBSS), which aims to virtualize the concept of an access point being a piece of hardware. The VBSS effectively is a network that is set up exclusively for use by one device and can be moved from AP to AP without the device (the smartphone, in this case) disconnecting and reconnecting.

“It’s like the binary version of the SSID [service set identifier],” Glennon explained. “It’s kind of like the magic, unique identifier for the access point. And rather than having physical access points, we virtualized the access point. You’re no longer associating with a physical access point; you’re associating with a virtual one. And because it’s virtual, we can move that virtualized access point between different pieces of hardware, without the phone even knowing … We can take the virtual access point and move it around between different physical access points.”

Glennon said the new Mobile Wi-Fi tech also has the smarts to automatically kick the phone off the Wi-Fi link if performance on the closest AP is degrading and to shift the phone to the cellular network. And when the Wi-Fi environment improves, the system will flip the phone back to Wi-Fi.

The broad aim here is to improve the customer experience when the phone connects to Wi-Fi as the user moves about. But Glennon notes there’s also some big, potential benefits to cable operators that are now in the mobile game: offloading more data on Wi-Fi and lowering MVNO costs.

“Offloading your mobile connection to Wi-Fi as frequently and as completely as possible is the best financial outcome for the cable operator who’s offering mobile service,” he said. “The whole point here is make the Wi-Fi experience be really good, because then you’ll do more Wi-Fi offload and there’s more financial benefit to our [members].”

Glennon said the project started about five years ago. The initial use case is for multiple APs in the home, but the pieces are there to extend the capability to commercial businesses and other venues where cable operators have set up Wi-Fi networks, he said.

References:

CableLabs Brings Mobile Wi-Fi’s Power to Wi-Fi Industry for a Better User Experience

https://www.lightreading.com/broadband/cablelabs-aims-to-bring-mobility-to-wi-fi-/d/d-id/781328?

https://www.ieee802.org/11/QuickGuide_IEEE_802_WG_and_Activities.htm

OpenRoaming Enables Dublin’s Smart City Vision with Seamless, Secure, High-Performance Wi-Fi

The Wireless Broadband Alliance (WBA) and City of Dublin today announced a successful proof-of-concept trial of Open Roaming™ in Dublin, Ireland. Initially deployed at Bernardo Square, Dame Street and the City Council’s Amphitheatre, WBA Open Roaming enables residents and visitors to log- in only once and then maintain seamless connectivity as their smartphones, tablets and other Wi-Fi devices automatically switch between different public Wi-Fi hotspots. The success of the trial will pave the way for a larger city-wide deployment.

Dublin is a high growth city. It currently has a population in the Greater Dublin Area of around 2.02 million and is anticipated to grow to 2.2 million by 2031. It houses 30% of the country’s working population and attracts over 6.6 million overseas visitors a year. It is anticipated that OpenRoaming will be initially rolled out on over 150 AP’s across Dublin city.

Dublin’s WiFi rollout is part of its digital transformation project

Now available at over 1 million hotspots worldwide, WBA OpenRoaming frees users from the need to constantly re-register or re-enter log-in credentials — all while maintaining enterprise-grade security and privacy. The WBA OpenRoaming standard also enables enterprises, device OEMs, service providers and others to provide performance guarantees and — with Wi-Fi 6 and 6E— a carrier-grade experience as users roam between different public Wi-Fi venues.

The trial, initiated by Dublin City Council’s Smart Dublin programme and supported by the WBA and Virgin Media, also involved participation from CommScope and represents a key a milestone toward achieving Dublin’s smart city goals, which include:

- Providing communities, residents and businesses with seamless access to services online, as well as high-quality connectivity

- Giving tourists and other visitors free, secure, high-performance Wi-Fi access. Once they arrive and log on to an OpenRoaming-enabled hotspot, their device is automatically authenticated for use every time it switches to another OpenRoaming-enabled hotspot. This convenience makes it easier for them to find what they need, such as restaurant recommendations, transit schedules, directions and more.

- This seamless, secure experience ensures that they have the broadband connectivity they need for interactive immersive learning, research, hybrid study and more.

The success of the trial, initiated by Dublin City Council’s Smart Dublin program and supported by the WBA and Virgin Media, will pave the way for a larger city-wide deployment.

Tiago Rodrigues, CEO of the Wireless Broadband Alliance, said: “Wi-Fi is the foundation for smart cities. This successful proof-of-concept trial shows that that the City of Dublin and its residents, businesses and visitors all can depend on the WBA OpenRoaming standard to ensure that they always have convenient access to seamless, secure, carrier-grade Wi-Fi connectivity.”

Jamie Cudden, Smart City Lead, for the City of Dublin, said: “Dublin is at the forefront of a digital transformation that is serving as a model for other municipalities across Ireland and the world. Collaborations like this are key to the delivery of convenient, reliable and ubiquitous connectivity which is critical for achieving our smart city goals such as closing the digital divide and ensuring that government is responsive to the needs of citizens and businesses. This successful trial of WBA OpenRoaming is a milestone toward achieving all those goals.”

Bart Giordano, SVP Ruckus Networks, CommScope, said: “”As a founding partner in the OpenRoaming framework, we are pleased to announce with the WBA the successful launch of the OpenRoaming initiative and network for the City of Dublin. OpenRoaming brings the promise of seamless and secure connectivity to users and IoT devices all over the world. The core elements of OpenRoaming are in line with those of the Ruckus Network portfolio: cloud federation, cybersecurity, policy and automation. We look forward to expanding the City of Dublin’s network and capabilities and supporting OpenRoaming deployments worldwide. “

Aidan Darcy, VP Business & Wholesale at Virgin Media Ireland said: “It’s fantastic to be working with Dublin City Council on such an important initiative. Given the fact that we are the official provider of both the Wi-Fi and broadband infrastructure, we are able to offer cutting-edge broadband speeds and an exceptional Wi-Fi experience for residents and tourists availing of the new Dublin City Wi-Fi Zones. We’re passionate about connecting communities and, with this new initiative, we really feel we’ll be creating connections for good.”

Launched in May 2020, WBA OpenRoaming is now in Release 3, which will make the business and commercial aspects of roaming easier than ever before and importantly, cut back on hundreds of hours of legal and administrative time when establishing roaming settlement agreements.

World Wi-Fi Day – 20th June 2022:

This announcement comes just before World Wi-Fi Day (an annual WBA initiative), a global platform to recognize and celebrate the significant role Wi-Fi is playing in getting cities and communities around the world connected.

It is a unique opportunity to reflect on how we can reduce digital poverty through innovative projects that will connect the unconnected.

About the Wireless Broadband Alliance:

Wireless Broadband Alliance (WBA) is the global organization that connects people with the latest Wi-Fi initiatives. Founded in 2003, the vision of the Wireless Broadband Alliance (WBA) is to drive seamless, interoperable service experiences via Wi-Fi within the global wireless ecosystem. WBA’s mission is to enable collaboration between service providers, technology companies, cities, regulators and organizations to achieve that vision. WBA’s membership is comprised of major operators, identity providers and leading technology companies across the Wi-Fi ecosystem with the shared vision.

WBA undertakes programs and activities to address business and technical issues, as well as opportunities, for member companies. WBA work areas include standards development, industry guidelines, trials, certification and advocacy. Its key programs include NextGen Wi-Fi, Open Roaming, 5G, IoT, Testing & Interoperability and Policy & Regulatory Affairs, with member-led Work Groups dedicated to resolving standards and technical issues to promote end-to-end services and accelerate business opportunities.

The WBA Board includes Airties, AT&T, Boingo Wireless, Broadcom, BT, Cisco Systems, Comcast, Deutsche Telekom AG, Google, Intel and Viasat. For the complete list of current WBA members, click here.

References:

https://www.realwire.com/releases/WBA-OpenRoaming-Enables-Dublins-Smart-City-Vision

Aruba Introduces Industry’s 1st Enterprise-Grade Wi-Fi 6E Access Point

HPE subsidiary Aruba today announced the first commercially available, enterprise-grade Wi-Fi 6E [1.] solution set – the 630 Series of campus access points (APs), starting with the AP-635.

Note 1. Wi-Fi 6E refers to IEEE 802.11ax (Wi-Fi 6) products that support 6GHz wireless spectrum. Wi-Fi 6E enables faster speeds and lower latencies than Wi-Fi 6 and earlier iterations of WiFi (IEEE 802.11). WiFi 6 products are starting to appear in routers [2.] and silicon. Cisco has been selling a WiFi AP for enterprises since 2019.

Note 2. List of best WiFi 6 routers:

- Asus RT-AX86U. The best Wi-Fi 6 router overall. …

- Netgear Nighthawk RAXE500. The Wi-Fi 6e speed demon. …

- Netgear Orbi with Wi-Fi 6 (RBK852) Best Wi-Fi 6 mesh router. …

- Netgear Nighthawk XR1000. …

- Eero Pro 6. …

- Netgear Nighthawk AX8 (RAX80) …

- TP-Link Deco X20. …

- Linksys Max Stream MR9600

In April 2020, the Federal Communications Commission (FCC) allocated 1,200 megahertz of spectrum in the 6 GHz band for unlicensed WiFi use. That was the largest swath of spectrum approved for WiFi since 1989. Opening the 6 GHz band more than doubles the amount of RF spectrum available for Wi-Fi use, allowing for less congested airwaves, broader channels, and higher-speed connections and enabling a range of innovations across industries. Since the FCC decision to open the 6 GHz band, 39 additional countries that are home to over 1.3 billion people have opened the 6 GHz unlicensed band for Wi-Fi 6E. (Source: Wi-Fi Alliance)

The industry’s first enterprise-grade Wi-Fi 6E solution, the new Aruba 630 Series delivers greater performance, lower latency, and faster data rates to support high-bandwidth applications and use cases. The new Aruba 630 Series APs will be available in calendar third quarter 2021.

Currently, as organizations increase their use of bandwidth-hungry video, cope with increasing numbers of client and IoT devices connecting to their networks, and speed up their transition to cloud, the demand for Wi-Fi continues to rise. As a result, wireless networks are becoming oversubscribed, throttling application performance. This frustrates all network users by negatively impacting the user experience, reduces productivity, puts digital initiatives at risk, and stifles innovation.

“The Aruba 630 Series campus access points are the first enterprise-grade WiFi 6E access points to be introduced by any of the main enterprise networking providers,” Gayle Levin, marketing manager at Aruba, wrote in response to questions. “We’re seeing the most interest from large public venues, such as airports, stadiums, and lecture halls, as well as healthy interest from health care and higher education,” she added.

“With connectivity demands growing exponentially, Wi-Fi 6E can take advantage of up to seven, super wide 160 MHz channels and uncongested bandwidth in the 6 GHz band to deliver unprecedented multi-gigabit and low latency connectivity,” said Kevin Robinson, SVP of Marketing at Wi-Fi Alliance. “Wi-Fi 6E will spur enhanced innovations and exciting new services. Wi-Fi Alliance is pleased to see longtime member Aruba bringing Wi-Fi 6E solutions to market that will help organizations better support critical activities like videoconferencing, telemedicine, and distance learning.”

According to leading market intelligence research firm 650 Group, Wi-Fi 6E will see rapid adoption in the next couple of years, with over 350M devices entering the market in 2022 that support 6 GHz. 650 Group expects over 200% unit growth of Wi-Fi 6E enterprise APs in 2022.

The new Aruba Wi-Fi 6E solutions are part of Aruba ESP (Edge Services Platform), the industry’s first AI-powered, cloud-native platform designed to unify, automate, and secure the Edge. Able to predict and resolve problems at the network edge before they happen, Aruba ESP’s foundation is built on AIOps, Zero trust network security, and a unified campus to branch infrastructure to deliver an automated, all-in-one platform that continuously analyzes data across domains, tracks SLAs, identifies anomalies, and self-optimizes, while seeing and securing unknown devices on the network.

With Aruba’s new Wi-Fi 6E offerings, organizations can take advantage of the increased capacity, wider channels in 6 GHz, and significantly reduced signal interference with 3.9 Gbps maximum aggregate throughput to support high bandwidth, low latency services and applications such as high definition video, next-generation unified communications, augmented reality/virtual reality (AR/VR), IoT, and cloud. Additionally, with a new ultra tri-band filtering capability, which minimizes interference between the 5 GHz and 6 GHz bands, organizations can truly maximize use of the new spectrum.

“As we progress in our digital transformation, we are continually adding an increasing number of IoT devices to our network and transitioning to Wi-Fi as our primary network connection rather than Ethernet. We are being asked to support an expanded array of mission-critical, high bandwidth applications that support research as well as hyflex learning and entertainment, like streaming video, video communications, and AR/VR for our students, professors, and staff,” said Mike Ferguson, network manager and enterprise architect at Chapman University.

“With Aruba’s Wi-Fi 6E APs, we’re confident that we’ll be able to not just support our short-term needs, but we’ll have room to grow as well, which will keep all of our users happy, increase our competitiveness, and allow us to extend the lifecycle of this network deployment by 50%,” he added.

Aruba 630 Series Access Point Key Features:

- Comprehensive tri-band coverage across 2.4 GHz, 5 GHz, and 6 GHz with 3.9 Gbps maximum aggregate data rate and ultra-triband filtering to minimize interference

- Up to seven 160 MHz channels in 6 GHz to better support low-latency, high bandwidth applications like high-definition video and AR/VR

- Operates on existing IEEE 802.3at standards for PoE power so there is no need to rip and replace existing power supplies

- Advanced security with WPA3 and Enhanced Open to better protect passwords and data

- Flexible failover with two HPE Smart Rate Ethernet ports for 1-2.5 Gbps, offering true hitless failover from one port to another for both data and power

- Application assurance to guarantee stringent application performance for latency sensitive and high bandwidth uses by dynamically allocating and adjusting radio resources

- Cloud, controller, or controllerless operation modes to address campus, branch, and remote deployments

“Consumer appetite for ubiquitous wireless connectivity is limitless, whether at home or traveling the world,” said Mike Kuehn, president at Astronics CSC. “As a leading global provider of advanced technologies for the aerospace and defense industries – including some of the largest major airlines in the world – Aruba’s new Wi-Fi 6E AP gives us the ability to offer compelling and unique solutions that deliver a new, enhanced and more secure wireless experience to our customers.”

“Aruba has two decades of leadership in Wi-Fi innovations, backed by an unwavering commitment to providing our customers with the reliable, fast, high capacity, and secure connectivity they need to pursue and exceed their organizational objectives,” said Chuck Lukaszewski, vice president and wireless chief technology officer at Aruba.

“Since 2016 we have helped lead the advocacy effort that has led to the 6 GHz band being opened all over the world. As such, we are extremely proud to be the first vendor to bring enterprise-grade Wi-Fi 6E solutions to market so our customers can take advantage of the huge increase in capacity that 6 GHz delivers,” he added.

Aruba is also framing the new WiFi 6E access points as “an important element of Aruba’s Edge Services Platform (ESP)” because the equipment will sit at the edge of the network, Levin added. “By virtue of their position and role within the network, access points are vital in collecting edge data from client devices and IoT that feeds back into Aruba ESP.”

The vendor entered the edge services market with the cloud-native platform last year to target campuses, data centers, branches, and remote workers, but it only works with Aruba’s access points, switches, and SD-WAN gateways.

…………………………………………………………………………………………………………………………………….

References:

https://www.businesswire.com/news/home/20210525005243/en/

https://www.sdxcentral.com/articles/news/aruba-claims-first-enterprise-wifi-6e-aps/2021/05/

https://www.tomsguide.com/news/wi-fi-6e-explained

North Carolina School District deploys WiFi 6 from Cambium Networks; WiFi 6 vs 6E Explained

FCC to open up 6 GHz band for unlicensed use – boon for WiFi 6 (IEEE 802.11ax)

Linksys and Qualcomm Launch the First 5G and Wi-Fi 6 Mobile Hotspot in Korea and Hong Kong

Linksys, the connected home division within the Belkin International and Foxconn Interconnect Technology (FIT) entity (formerly owned by Cisco Systems), has introduced the first 5G and Wi-Fi 6 Mobile Hotspot in Korea with Korea Telecom (KT), the largest Korean mobile carrier and in Hong Kong with CSL. The Linksys 5G Mobile Hotspot is powered by the Qualcomm® Snapdragon™ X55 5G Modem-RF System and Qualcomm® FastConnect™ 6800 mobile connectivity system.

The Linksys 5G Mobile Hotspot harnesses 5G and Wi-Fi 6 for blazing fast and seamless connectivity. The device is the world’s thinnest and lightest 5G mobile hotspot and includes a USB-C port with Qualcomm® Quick Charge™ Technology, ensuring devices are powered up and optimally connected at home or on-the-go.

The Linksys 5G Mobile Hotspot enables a fast and stable network by utilizing the latest Wi-Fi 6 standard and dual-band Wi-Fi (802.11ax) technologies. With USB tethering that supports large-capacity LTE high-speed data, users can stay connected regardless of what environment or situation they are in.

“Mobile hotspots are essential to use fast, seamless wireless networks in a variety of environments, enabling increased connectivity, mobility and productivity across many use cases,” said L.C. Wu, chief operating officer, Connected Home Division (Linksys, Wemo, Phyn), Belkin International. “Linksys is excited to launch the first 5G mobile hotspot supporting 5G and Wi-Fi 6 in Korea with KT and Hong Kong with CSL. We will continue to rollout new innovative 5G devices around the world, and expect many consumers will enjoy a fast and stable mobile life with our products.”

Additional specs include:

- The thinnest and lightest 5G mobile hotspot in the market – 15.5mm thickness and 185g weight

- Connects up to 16 devices

- 4000mAh battery capacity allows all-day usage

Linksys 5G (BKE-500) 5G/WiFi 6 mobile hotspot: Image Credit: Linksys

The Linksys Mobile Hotspot will deliver 5G supersonic speeds to 15+ devices, all day, and on the go. The ultra-thin and lightweight design and all-day battery life is a match made in tech heaven.

- Portable 5G supersonic speed and bandwidth

- WiFi 6 speeds up to 1.8 Gbps (AX1800), Handles 15+ Devices

- Ultra-thin design for maximum convenience

- All-Day Battery capacity to keep you connected at all times*

- Powered by leading edge 5G technology by Qualcomm®

- Quick charging through USB-C, QC3.0 certified

- Future-ready with the latest IPv6 internet protocol

………………………………………………………………………………………………………………………………………………………………………………………….

About Linksys

The Linksys brand has pioneered wireless connectivity since its inception in 1988, being the first router brand to ship 100 million units worldwide. Recognized for its award-winning Velop Intelligent Mesh™ Technology and integrated Linksys Aware WiFi motion sensing software, Linksys enables a connected lifestyle with simplified home and business control, enhanced security and seamless Internet access through innovative features and a growing application and partner ecosystem. Linksys products are sold in more than 60 countries and can be found in major retailers around the world.

About Belkin International

In 2018, Foxconn Interconnect Technology merged with Belkin International (Belkin®, Linksys®, Wemo®, Phyn®) to create a global consumer electronics leader. Today, this group leads in connecting people with technologies at home, at work and on the go within the accessories (“Connected Things” – Belkin brand) and the smart home (“Connected Home” – Linksys, Wemo and Phyn brands) markets.

Qualcomm Snapdragon, Qualcomm FastConnect and Qualcomm Quick Charge are products iof Qualcomm Technologies, Inc. and/or its subsidiaries.

……………………………………………………………………………………………………………………………………………………………………………………

References:

Will IEEE 802.11ax be a “5G” Contender?

Note: Neither IEEE 802.11ax or 802.11ay have been presented to ITU-R WP 5D for consideration as an IMT 2020 Radio Interface Technology (RIT), which will be first evaluated at their July 2019 meeting. Hence, those future IEEE 802.11 standards will be orthogonal to IMT 2020 (the only real standard for mobile 5G). There are no official standards for 5G fixed Broadband Wireless Access (BWA). Despite what you may have read, all such “5G” BWA deployments (e.g. Verizon, C-Spire, etc) are proprietary.

IEEE 802.11ax-2019 will replace both IEEE 802.11n-2009 and IEEE 802.11ac-2013 as the next high-throughput WLAN amendment.

Summary:

The future IEEE 802.11ax standard will provide users with 5G-level speeds over Wi-Fi networks and be more economical, says a report from GlobalData. Equipment that supports a pre-standard version of IEEE 802.11ax is rolling out this year.

“The 802.11ax standard will drive a significant boost in capacity, efficiency and flexibility that should make Wi-Fi align closely with emerging 5G priorities,” GlobalData Technology Analyst John Byrne said in a press release. “The ability to support up to 12 simultaneous user streams from a single access point, 8×8 multi-user multiple input multiple output, and the use of much larger 80 MHz channels of wireless spectrum represent dramatic upgrades from the current state-of-the-art standard, 802.11ac.”

Byrne continued: “However, once the cost curve comes down, 802.11ax Wi-Fi has the potential to deliver 5G-like user experiences at a fraction of the cost of similar cellular gear. The ability to deploy Wi-Fi access points at significantly lower cost than 5G small cells offering similar performance characteristics could represent a significant selling point for Wi-Fi gear vendors.”

IEEE 802.11ax Carrier Wi-Fi:

The forthcoming IEEE standard will address challenges faced by carrier-provided Wi-Fi, including unreliability, suspect security and difficulty in integrating with cellular networks. The shift from 802.11ac to 802.11ax access points will begin as the cost curve falls through 2022. The equalization of 5G and Wi-Fi technology and 802.11ax’s lower cost could “represent a significant selling point for Wi-Fi gear vendors,” Byrne said.

Technology vendors believe that IEEE 802.11ax could be a big commercial success . In January 2018, Starry and Marvel said they would team to develop fixed wireless technologies. The deal includes the Starry millimeter wave integrated circuit and cloud management software and Marvel’s 802.11ax chipsets.

Aerohive plans to deliver its first 802.11ax access points in mid-2018. PCTel said in January that it haddeveloped a reference design for 802.11ax antennas for an unnamed “major 802.11ax Wi-Fi chipset manufacturer.” There’s a lot of chipset activity in particular, with Qualcomm already having launched its “802.11ax-ready” Atheros WCN3998 chipset in February and other companies like Intel laying out plans to begin offering chips this year. Chip company Skyworks is collaborating with Broadcom with modules integrated into Broadcom’s Max Wi-Fi 802.11ax solution and claims that its 2.4 and 5 GHz 802.11ax modules and Broadcom’s Max WiFi solutions “provide four times faster download speeds, six times faster upload speeds, enhanced coverage and up to seven times longer battery life when compared to 802.11ac Wi-Fi products available in the market today.” ABI Research has noted that in addition to those vendors, Marvell, Quantenna and Celeno have also made 802.11ax chipset announcements — mostly targeting the access point space — and that AP companies such as Asus, D-Link and Huawei have already put out 802.11ax-ready APs and gateways.

References:

http://en.ctimes.com.tw/DispNews.asp?O=HK27J9UJV4CSAA00NT

http://www.ieee802.org/11/Reports/tgax_update.htm

https://ieeexplore.ieee.org/document/7792393/

https://ieeexplore.ieee.org/document/7422404/

https://www.rcrwireless.com/20180322/wireless/802-11ax-is-on-its-way

IHS Markit: $3.5 Billion to be spent on Carrier Wi-Fi equipment between 2018 and 2022

by Richard Webb, IHS Markit

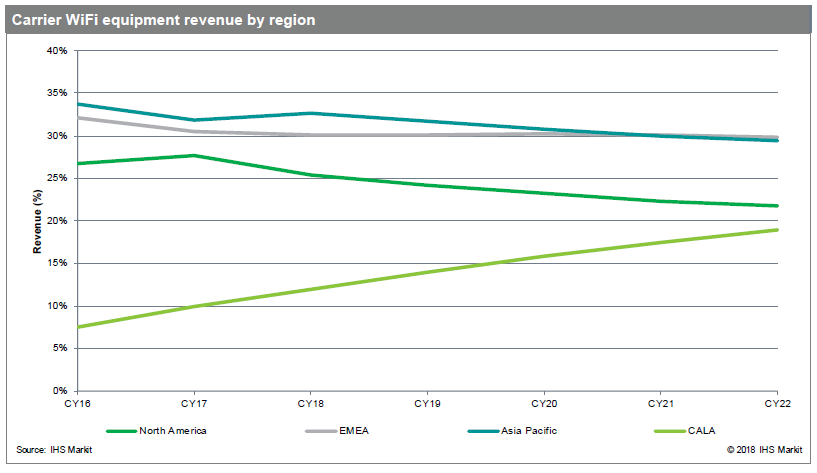

The carrier Wi-Fi equipment market continued to grow in 2017, driven by ongoing broadband demand and a strong role within 5G era. Revenue reached $626 million for the full-year 2017, increasing 1.3 percent from the prior year.

By 2022, the market is forecast to hit $725 million — a cumulative size of over $3.5 billion from 2018 to 2022 — based on two strong segments: standalone Wi-Fi access points (predominantly deployed by fixed-line operators and wireless ISPs) and dual mode Wi-Fi/cellular access points (deployed by mobile operators).

“The arrival of the 5G era will gradually transform network architectures, but the requirements for network density mean that Wi-Fi will continue to play a strong support role for mobile broadband end-users and for newer applications such as the Internet of Things and smart city,” said Richard Webb, director of research and analysis for service provider technology at IHS Markit. “We expect an uptick in carrier Wi-Fi investments through 2020, aligned with 5G network development.”

All regions are seeing strong demand for carrier Wi-Fi, demonstrating evidence of proliferation in developing countries in addition to developed markets where mobile data growth is well documented. However, the scale of requests for proposals (RFPs) from mobile operators in Asia Pacific — in particular China and Indonesia currently, with India likely to add to the groundswell closer to 2022 — means the region will be the strongest driver of growth, although all regions see continuous growth through this period.

More carrier Wi-Fi market highlights

- Dual mode 3G/Wi-Fi equipment revenue totaled just $17 million in 2017, a decline of 66.4 percent from the prior year

- Meanwhile, subscriber identity module (SIM)–based Wi-Fi access points are experiencing solid adoption growth (+21.6 percent in 2017 from 2016), driven by the desire to have closer integration between Wi-Fi and the mobile network

- Network functions virtualization (NFV) has strong potential benefits for fixed and mobile operators alike, such as opex and capex efficiencies, service flexibility and creation, reduced power usage and new service environments, including data analytics and location-based services

Carrier WiFi Equipment Market Tracker – H2 2017

This report tracks Wi-Fi equipment deployed by operators in public spaces for wireless internet access. It provides worldwide and regional market size, vendor market share, forecasts through 2022, analysis and trends for Wi-Fi hotspot controllers and carrier Wi-Fi access points.

Reference:

……………………………………………………………………………………………………………………………………………………………………………………….

In a separate report, Markets & Markets forecasts the Wi-Fi Market to be worth $15.60 Billion by 2022:

The rapid adoption of Wi-Fi technology is expected to make North America the largest region in market.

North America consists of developed economies, the US and Canada. In this region, Wi-Fi solutions and services are gaining traction within the businesses. The region’s strong financial position also enables it to invest heavily in the Wi-Fi technology. These advantages have provided North American organizations a competitive edge in the market. Moreover, the region has the presence of several major Wi-Fi vendors. Therefore, there is strong competition among the players. The number of enterprises adopting Wi-Fi solutions and services is quite high in North America as compared to the other regions.

The major vendors offering Wi-Fi solutions and services across the globe include Cisco (US), Aruba (US), Ruckus Wireless (US), Juniper Networks (US), Ericsson (Sweden), Panasonic (Japan), Huawei (China), Alcatel-Lucent Enterprise (France), Netgear (US), Aerohive Networks (US), and Riverbed Technology (US). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships, and collaborations, to enhance their position in the Wi-Fi market.

Qualcomm to ISPs: Mesh WiFi networking via IEEE 802.11ax is the future of smart homes

Mesh networking can centralize IoT and other devices in smart homes and make them easier to manage, according to Qualcomm’s Connectivity Business unit lead, Rahul Patel. Carrier-class mesh networking could resolve connection issues, said Patel who strongly suggests internet service providers (ISPs) offer a mesh networking service.

- Market research firm Gartner predicts that 8.4 billion connected “Things” will be in use in 2017, up 31 percent from 2016.

- A GMSA report “The Impact of the Internet of Things: The Connected Home” suggests that up to 50 connected or Internet of Things (IoT) devices will be in use in the average connected home by 2020.

According to Qualcomm’s Wi-Fi router consumer survey of 1500 respondents from the UK, France, and Germany this year, 50% said they use a device in three different rooms simultaneously. [Those folks must have a lot of people living in their homes with separate rooms!]

Today, home broadband networks sometimes find themselves buckling under the weight of numerous mobile, IoT, and connected devices. Information streams can become confused, bottlenecks occur, and ISP throttling can cause too much strain for efficiency or reliability (expect more of this as FCC has just repealed net neutrality rules).

Qualcomm’s mesh technologies, including Wi-Fi SON, are already used by vendors including Eero, Google Wi-Fi, TP-Link, Luma, and Netgear.

Qualcomm is directing its mesh WiFi standards efforts within the IEEE 802.11ax task group which it serves as co-vice chair. That specification is being designed to improve overall spectral efficiency, especially in dense deployment scenarios. It’s predicted to have a top speed of around 10 Gb/s and operate in the already existing 2.4 GHz and 5 GHz spectrum bands.

Qualcomm has created a 12-stream mesh WiFi platform powered by a quad-core iCMOS micro-processor with a 64-bit architecture.

Editor’s Note:

IEEE 802.11ax draft 3.0 is scheduled to go out for IEEE 802.11 Working Group Letter ballot in May 2018 with Sponsor Ballot scheduled for May 2019. Please see references for further details.

…………………………………………………………………………………………………………………….

Patel says that development is already in play to use the platform, and mesh will be the “next big thing” for the Wi-Fi industry, with products expected to appear in the market based on Qualcomm technologies in the second half of 2018.

Carrier-class mesh networking could be used to map entire neighborhoods, in which connectivity problems can be quickly detected and fixed without constant customer reports, complaints, and costly engineer footfall.

As consumers expect more from their home Wi-Fi, however, they also expect ISPs to make sure systems are in working order and deliver what they promise.

“The operator is shouldering the burden of fixing issues in the home,” Patel says. “If they don’t, cloud providers such as Google will take over.”

If ISPs do not rise to the challenge, consumers may choose to go to a cloud provider instead.

“That [home] traffic is getting piped into their clouds rather than BT or Sky, and so ISPs are losing out on the traffic they are piping into someones home,” Patel added. “You as an operation are perceived to be the one to support the Wi-Fi in the home.”

“If you (ISPs) don’t move fast, you lose out on the home becoming a cloud providers’ and have no control over what happens in the home,” Patel said.

References:

http://www.zdnet.com/article/mesh-networking-is-the-future-of-iot-smart-homes/

http://www.ieee802.org/11/Reports/tgax_update.htm