Month: February 2019

Open Compute Project (OCP) Survey: 2018 non-Board OCP revenue hit $2.56B with YoY growth=120%

Since its inception, the Open Compute Project (OCP) has worked to drive innovation in and around the data center industry, bringing together thousands of engineers from nearly two hundred member organizations. The demands on the modern data center continue to expand with the growth of IoT, security and edge computing, as well as increasing energy consumption requirements.

IHS Markit interviewed OCP members, suppliers and service providers, as well as incorporated their own in-depth industry research to determine revenue by region and vertical worldwide, as well as update their forecast through 2022. In order to ascertain a more accurate assessment of true marketplace adoption, usage by OCP Board member companies Facebook, Goldman Sachs, Intel, Microsoft and Rackspace was excluded from this study.

Among the preliminary findings:

· 2017 actual non-board revenue was $1.16 billion, just shy of the original forecast of $1.18 billion

· 2018 non-board OCP revenue tops the 2017 forecast, reaching $2.56 billion, compared to a forecast of $1.84 billion, with year-over-year growth of 120%

· 2017 Non-Board OCP revenue actuals show increased market share, from .87% to .91%, while overall Market Value dropped from $137 billion to $127 billion

· 2022 non-board OCP revenue share is expected to climb to more than 5% by 2022, at $10.7 billion, with a CAGR of 56%

· Servers, Storage and Networking are the fastest projected growth categories, with PON a potential high-growth area. Markets are just forming for disaggregated cell tower equipment, but Telco spend is expected to surpass Hyperscalers by 2021.

· The Government sector actually passed financial institutions in non-board OCP spending in 2017, while automotive and manufacturing is expected to have the highest 5-year CAGR. Healthcare is in the early stages of OCP adoption.

· There were no large changes in the forecast for regional growth – America’s still dominate due to Hyperscalers and Financial, but also now driven by Telco.

· APAC will surpass EMEA by 2020 with a CAGR of 108%, compared to EMEA at 59%.

Furthermore, the drivers of adoption of OCP are growing more diverse – cost reduction and power efficiency are still the biggest reasons why, but the market is now realizing that feature flexibility and conformance to those specifications approved by OCP provide a measure of “comfort” to the market.

“We are pleased that the adoption momentum continues and accelerates, and we value the insight provided by the study regarding barriers, challenges and opportunities. We are committed to continued improvement in the entire ecosystem to support the future growth.” stated Rocky Bullock, CEO for the Open Compute Project Foundation.

“The market ecosystem for OCP-certified equipment continues to mature, with more diversity for increased choice and an expanded supply chain allowing more tier-two CSPs, telcos and enterprise consumers to participate. A notable difference from last year’s study was the shift from direct factory purchasing to suppliers with local support, as additional market segments increased adoption,” said Cliff Grossner, Ph.D., executive director research and analysis, cloud and data center research practice at IHS Markit, a global business information provider. “OCP equipment market drivers such as serviceability, disaggregation and the flexibility to add new features took on a greater importance this year, which typically happens when a market matures and more mainstream buyers deploy.”

OCP and IHS Markit will release the full results of the research at the Annual OCP Global Summit, to be held in San Jose Convention Center in San Jose, CA March 14 – 15, 2019. This will include an Executive Track at 1:00 PM Pacific on Day 1 featuring the details of the findings to be presented by Cliff Grossner, and Vlad Galabov, Principle Analyst for Data Center Compute at IHS Markit.

References:

https://www.opencompute.org/summit/global-summit

IHS Markit: Ciena tops the list of optical equipment vendors + Cignal AI’s OFC Preview

By Heidi Adams, executive director, network infrastructure, IHS Markit

Each year IHS Markit surveys service providers, in order to find out which companies they view as the leaders of the optical equipment market. The survey also explores their perceptions of vendors in key decision metrics, like pricing, total cost of ownership, technology innovation, research-and-development (R&D) investment, and product reliability.

Following are some of the key findings from this year’s survey:

Optical equipment vendor leaders:

In brand awareness, respondents perceive Ciena, Huawei, and Nokia as the overall leaders for optical transmission and switching equipment in 2018, with no change in the rankings from last year. These results are well aligned with positioning in the global optical network hardware market in the first three quarters of 2018, where Huawei, Ciena, and Nokia were ranked as the top three vendors by market share in this period.

Ciena was the most cited leader in optical DCI, with Huawei and Infinera tied for second place. Ciena also made significant strides this year in market perception for leadership in optical disaggregation, rising from third position in our 2017 survey to first-ranked position in 2018. Coriant (now Infinera), Huawei and Nokia all tied for second place.

Purchasing criteria:

IHS Markit survey respondents were also asked to identify the leaders in purchasing criteria, including pricing, technology innovation, product reliability, service and support and investment in research and development. The top three vendor selection criteria for optical equipment purchasing decisions in 2018 were, as follows:

- Product reliability

- Pricing

- Total cost of ownership

Ciena was the leader in 2018 for service provider perception of vendor leadership in product reliability, technology innovation, management software, and investment in research and development. Huawei topped the list for service provider perception of vendor leadership in pricing, total cost of ownership, solution breadth, and financial stability. Nokia was perceived as the leader in service and support for optical networks.

Optical Equipment Vendor Leadership Service Provider Survey – 2018

This survey explores how service providers evaluate and select optical transmission and switching equipment suppliers. It covers vendors installed and under evaluation and service provider opinions of vendors, including on key vendor selection criteria.

…………………………………………………………………………………………………………………………………………………

Cignal AI on OFC 2019–

400ZR Steals the Show:

No single topic at OFC will command as much attention as 400ZR, which is based on fourth-generation coherent technology and an OIF standard for coherent short reach DCI applications. Product development is well underway with over a dozen component and equipment companies spending in excess of $300M in this effort. The market for short reach coherent extends well beyond the DCI needs of Microsoft and Google. Derivatives (known as ZR+ or ZR plus) are emerging which are designed to meet the broader needs of network operators everywhere. ZR is the first coherent technology that will be both standardized and pluggable, and the emergence of ZR products will shake up the optical equipment landscape. One major impact is that 10G WDM will become obsolete in its only remaining stronghold- the edge of the optical network. The greater question is what role standalone optical hardware will play in the network as the performance and interoperability of coherent pluggables improve. Expect a cascade of activity at OFC from component and equipment companies as they uncover their ZR plans and demonstrate the latest optical engines, and some bombshell announcements and partnerships from the leaders in this space – Inphi, Acacia, Ciena, Cisco, Huawei, Nokia, and NTT Electronics.

While fourth-generation 400G products have been announced at OFC already for the last two years, 2019 is the year that these products start deploying for revenue. Starting in early 2019, third generation solutions from Acacia (via multiple hardware vendors), Nokia, Huawei, Fujitsu, and Infinera will join Ciena in live network deployments. Now that 400G is deployed, there will be multiple roadmap announcements at OFC seeking to leapfrog 400G and propose the next generation of coherent optical speeds. 600G is a given, but there will be 800G and perhaps 1Tbps announcements as well. Components suppliers and equipment manufacturers will show roadmaps to higher speed sixthgeneration coherent optical components in preparation for a 2020 introduction.

We expect Infinera to disclose more detail on its ICE6 R&D efforts and would not be surprised to hear Ciena talk about a successor to the Wavelogic AI now that competitive products are arriving in the market.

Disaggregation Continues, with Many Definitions:

The disaggregation trend will continue to gain strength at OFC, but the definition will continue to change. Whereas the original concept was complete separation of switching transponders, ROADMs, and perhaps even components into separately manageable elements, now new solutions are starting to look more like traditional optical equipment. Compact modular systems, which are the most visible components of a disaggregation strategy, have moved from monolithic transponder or open line systems to more complex devices that can include switching and multiple functions in the same shelf. Some systems now even have modularity via cards (although they are called “sleds” rather than “cards”), making them look more like traditional systems in everything but physical dimensions. Several large operators are skeptical about disaggregation, while several others agree with the concept but consider current solutions too difficult to manage. Regardless, the industry-wide shift to disaggregation will accelerate as implementation becomes easier and better attuned to the needs of a wider variety of customers. General availability and customer announcements for 2019 are expected from several vendors, including ADVA, Cisco, Coriant, Fujitsu, and Nokia. In addition to the compact modular announcements,

Viavi: 55 Global 5G Deployments by Year-End; Deloitte on the Shift to 5G

Viavi’s 5G Forecast:

Fifty-five commercial 5G networks will be live by the end of the year, according to new 5G deployments research from Viavi Solutions. The eclectic firm (see About Viavi below) said that 13 fixed wireless and mobile 5G network were launched in 2018 and 42 more will be added this year. “The State of 5G Deployments” says that this is particularly impressive considering that the first deployments were not expected until 2020.

Viavi said that 21 5G deployments will be in Europe, 14 in the Middle East, 10 in Asia, eight in North America and two in Australasia.

“5G represents a paradigm shift in the way that networks are designed, deployed and managed, introducing inherent complexities in the architecture as well as exacting demands on performance and latency,” Sameh Yamany, Viavi’s Chief Technology Officer, said in a press release. “The anticipated improvements that 5G offers will depend on precise operation of multiple elements throughout the network.”

The momentum seems high. A year ago, only 28 service providers said they were in 5G field trials. The acceleration has occurred, Viavi notes, despite the lack of finalized standards from the 3GPP. Those are not expected until next year.

The lack of finalized standards would suggest some fluidity in Viavi’s findings. Simply, it’s difficult to conclusively say how many networks there are if it a precise definition of what that network consists of is not yet set.

It’s also worth noting that the usefulness of mobile 5G will be limited until the arrival of mobile devices. Indeed, the 5G handset market is shaping up to be more dramatic than the accelerating network build outs. In October, Strategy Analytics said that the high initial cost of 5G smartphones – which could retail for more than $1,000 – will require a return to the subsidy pricing model.

The emergence of 5G handsets also could roil the vendor landscape. Last November, Strategy Analytics said the dominance of Samsung and Apple could be challenged.

The complete State of 5G Deployments infographic is available here. The data was compiled from publicly available sources for information purposes only, as part of the VIAVI practice of tracking trends to enable cutting-edge technology development. The State of 5G Deployments serves as a companion document to the VIAVI Gigabit Monitor, a visual database of gigabit internet deployments worldwide.

About VIAVI:

VIAVI (NASDAQ: VIAV) is a global provider of network test, monitoring and assurance solutions to communications service providers, enterprises, network equipment manufacturers, civil, government, military and avionics customers, supported by a worldwide channel community including VIAVI Velocity Partners. We deliver end-to-end visibility across physical, virtual and hybrid networks, enabling customers to optimize connectivity, quality of experience and profitability. VIAVI is also a leader in high performance thin film optical coatings, providing light management solutions to anti-counterfeiting, consumer electronics, automotive, defense and instrumentation markets. Learn more about VIAVI at www.viavisolutions.com. Follow us on VIAVI Perspectives, LinkedIn, Twitter, YouTube and Facebook.

US Media Inquiries:

Sonus PR for VIAVI

Micah Warren

+1 (609) 247-6525

[email protected]

References:

https://www.telecompetitor.com/report-global-5g-deployments-to-number-55-by-year-end/

………………………………………………………………………………………………

Deloitte on The shift to 5G:

First-adopter countries embracing 5G could sustain more than a decade of competitive advantage. Unfortunately, an examination of how the United States compares internationally on investments critical to 5G deployment surfaces a concerning trend. It’s critical that this trend is immediately reversed to help promote US economic competitiveness.

Almost everyone agrees, 5G will generate new products and services— but how much of this value that will be captured by carriers is uncertain.

As another era of untapped economic potential emerges with the adoption of 5G technology—where the number of subscribers and the amount of information they can consume is no longer a limiting factor, but where an unlimited number of devices and applications can exchange, process, and synthesize massive amounts of data for our benefit—investment in upgrading the underlying communications infrastructure becomes even more critical.

But unless tangible steps are taken to help rebalance the private investment case for the upgrade with the demonstrated external benefits to other industries and the public good, the United States may risk losing the leadership it gained in the previous era. The negative consequences could take decades to overcome, and other countries are already making their moves. Policy makers, carriers, and industries with the most at stake should move now to streamline policies and processes and collaborate with ecosystem players to help create efficient solutions to investment barriers.

References:

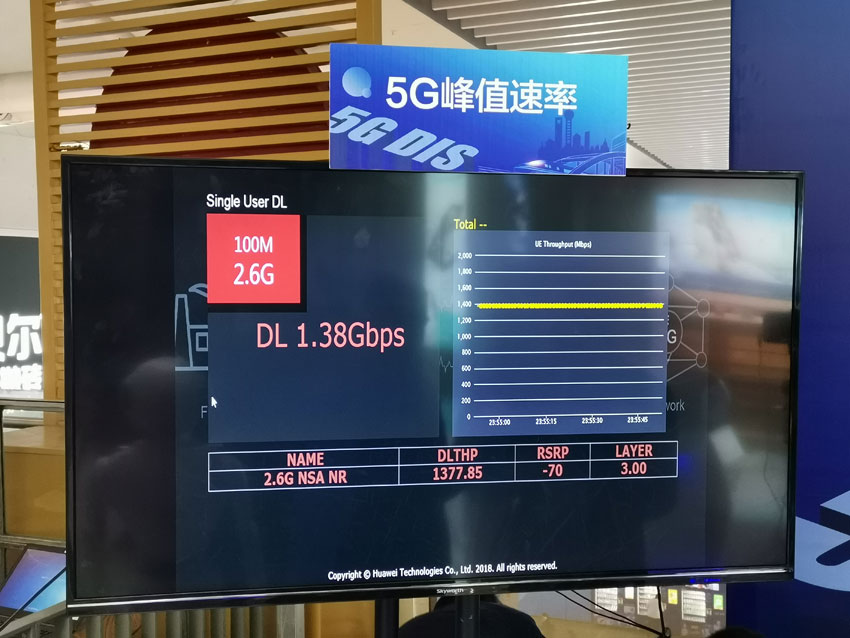

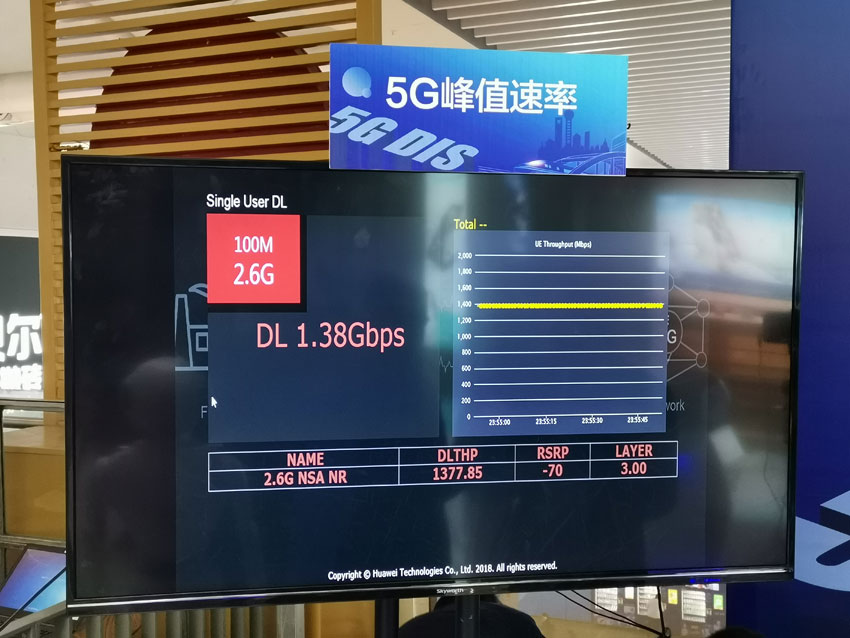

China Mobile & Huawei deploy indoor 5G at Shanghai rail station

Guests at the launch event included: Zhang Jianming, Vice Chairman of Shanghai’s Municipal Commission of Economy and Information Technology; Wang Guannan, Deputy Division Chief of the Shanghai Municipal Transportation Commission; Bai Zhengguo, Station Master of the Shanghai Railway Station; Li Xuecheng, Deputy General Manager of China Mobile Shanghai; Peter Zhou, Chief Marketing Officer (CMO) of Huawei’s Wireless Solution; Zang Binyu, Dean of the School of Software at Shanghai Jiao Tong University; and Xiao Yuhuo, General Manager of China Mobile Tietong Shanghai.

…………………………………………………………………………………………………………………………………………………………………………………………………

“Hongqiao Railway Station is leading the 5G commercial deployment in Shanghai,” said Zhang Jianming, Vice Chairman of Shanghai’s Municipal Commission of Economy and Information Technology. “The 5G digital indoor system will deliver a new travel experience. Passengers will feel they are getting more out of their journey. The railway station will show how 5G applications can improve the user experience and offer real benefits to the public. It will help speed up digital transformation for all sectors across the digital economy.”

“Shanghai is committed to building a Dual-Gigaband City. We are now planning field tests and pre-commercial trials of the technology. Ultimately, we will deploy 5G base stations across the whole city, and lead 5G commercial use in China,” he said.

“With Shanghai Jiao Tong University and Huawei, we have set up platforms to bring together the industry, academia, and research institutes. Through more investment in new infrastructure including AI, industrial Internet, and IoT, we will revitalize this city and build a hi-tech, intelligent Shanghai.”

As 5G industrialization accelerates, Huawei is working with partners in many industries to develop the indoor 5G industry, and enable smart buildings, remote healthcare, and smart railways. The whole world is becoming more intelligent.

Within the 5G world, the functions of mobile Internet, big data, cloud computing, and smart devices are constantly integrating and transforming. 5G is more than a next-generation technology. It is key infrastructure for the future digital world. Just as 2G transformed voice services and 4G transformed mobile Internet, 5G is the engine that will transform the world.

This vision of the future led Huawei to invest consistently in 5G R&D from 2009 onwards, paving the way for its leadership of the industry today. Huawei’s technological leadership has made it the technology supplier of choice for more and more customers. As of mid-January 2019, Huawei has signed 30 5G contracts and has shipped more than 25,000 5G base stations. Huawei possesses 2,570 patents on 5G.

China Mobile & Huawei deploy indoor 5G at Shanghai rail station

Guests at the launch event included: Zhang Jianming, Vice Chairman of Shanghai’s Municipal Commission of Economy and Information Technology; Wang Guannan, Deputy Division Chief of the Shanghai Municipal Transportation Commission; Bai Zhengguo, Station Master of the Shanghai Railway Station; Li Xuecheng, Deputy General Manager of China Mobile Shanghai; Peter Zhou, Chief Marketing Officer (CMO) of Huawei’s Wireless Solution; Zang Binyu, Dean of the School of Software at Shanghai Jiao Tong University; and Xiao Yuhuo, General Manager of China Mobile Tietong Shanghai.

…………………………………………………………………………………………………………………………………………………………………………………………………

“Hongqiao Railway Station is leading the 5G commercial deployment in Shanghai,” said Zhang Jianming, Vice Chairman of Shanghai’s Municipal Commission of Economy and Information Technology. “The 5G digital indoor system will deliver a new travel experience. Passengers will feel they are getting more out of their journey. The railway station will show how 5G applications can improve the user experience and offer real benefits to the public. It will help speed up digital transformation for all sectors across the digital economy.”

“Shanghai is committed to building a Dual-Gigaband City. We are now planning field tests and pre-commercial trials of the technology. Ultimately, we will deploy 5G base stations across the whole city, and lead 5G commercial use in China,” he said.

“With Shanghai Jiao Tong University and Huawei, we have set up platforms to bring together the industry, academia, and research institutes. Through more investment in new infrastructure including AI, industrial Internet, and IoT, we will revitalize this city and build a hi-tech, intelligent Shanghai.”

As 5G industrialization accelerates, Huawei is working with partners in many industries to develop the indoor 5G industry, and enable smart buildings, remote healthcare, and smart railways. The whole world is becoming more intelligent.

Within the 5G world, the functions of mobile Internet, big data, cloud computing, and smart devices are constantly integrating and transforming. 5G is more than a next-generation technology. It is key infrastructure for the future digital world. Just as 2G transformed voice services and 4G transformed mobile Internet, 5G is the engine that will transform the world.

This vision of the future led Huawei to invest consistently in 5G R&D from 2009 onwards, paving the way for its leadership of the industry today. Huawei’s technological leadership has made it the technology supplier of choice for more and more customers. As of mid-January 2019, Huawei has signed 30 5G contracts and has shipped more than 25,000 5G base stations. Huawei possesses 2,570 patents on 5G.

VSG’s U.S. Carrier Ethernet LEADERBOARD: CenturyLink #1, AT&T #2; U.S. CE port base grew >12%

Vertical Systems Group (VSG) announced that six companies achieved a position on its 2018 U.S. Carrier Ethernet (CE) LEADERBOARD (in rank order based on year-end 2018 retail port share): CenturyLink, AT&T, Verizon, Spectrum Enterprise, Comcast and Windstream. CenturyLink powered its way to the top spot in the year-end 2017 leaderboard after its acquisition of Level 3 Communications. AT&T led the U.S. Carrier Ethernet ranking from 2005-2016. Cox dropped out of the leaderboard and into VSG’s challenge tier on slower-than-market port growth.

To qualify for a rank on this 2018 LEADERBOARD, network providers must have 4% or more of the U.S. Ethernet services market. Shares are measured based on the number of billable retail customer ports in service as tracked by Vertical Systems Group.

“Despite its relative maturity, the Ethernet market continues to expand at a healthy pace. U.S. port installations grew more than twelve percent in 2018, in line with our forecasts,” said Rick Malone, principal of Vertical Systems Group. “However, revenue growth is not keeping pace with port growth due to falling prices and changing service mixes. One notable catalyst is the deployment of SD-WAN, which is resulting in customers shifting from switched Ethernet services to dedicated Internet access.”

Highlights of Vertical’s year-end 2018 U.S. Ethernet market share analysis:

- U.S. retail Ethernet customer installations grew to more than 1.1 million ports, up 12 percent from year-end 2017.

- Six Ethernet providers qualify for the 2018 LEADERBOARD, as compared to seven in 2017 and nine in 2016.

- Cox dropped out of the LEADERBOARD and into the Challenge Tier on slower than market port growth.

- Four Incumbent Carriers (CenturyLink, AT&T, Verizon, Windstream) and two Cable MSOs (Spectrum Enterprise, Comcast) are represented on the latest LEADERBOARD.

- The two Cable MSOs (Spectrum Enterprise and Comcast) had the highest port growth in the second half of 2018.

- Ethernet pricing declined in 2018 across all port speeds for the six service types tracked by Vertical (i.e., EPL, EVPL, DIA, Access to VPN, Switched Metro and VPLS).

- Each of the 2018 U.S. LEADERBOARD companies has received MEF CE 2.0 certification.

In addition to the LEADERBOARD providers, all other companies selling Ethernet services in the U.S. are segmented into two tiers as measured by port share.

The Challenge Tier includes providers with between 1% and 4% share of the U.S. retail Ethernet market. For year-end 2018, the following seven companies attained a position in the Challenge Tier (in alphabetical order): Altice USA, Cogent, Cox, Frontier, GTT, Sprint and Zayo.

The Market Player tier includes all providers with port share below 1%. Companies in the Market Player tier include the following providers (in alphabetical order): Alaska Communications, American Telesis, Atlantic Broadband, BT Global Services, Cincinnati Bell, Consolidated Communications, Crown Castle Fiber, DQE Communications, Expedient, FiberLight, FirstLight, Fusion, Global Cloud Xchange, Great Plains Communications, Logix Fiber Networks, LS Networks, Masergy, Midco, NTT America, Orange Business, RCN Business, Segra, Tata, TDS Telecom, Telstra, TPx, Unite Private Networks, US Signal, WOW!Business and other companies selling retail Ethernet services in the U.S. market.

Detailed Ethernet share results that power the Year-End 2018 Carrier Ethernet LEADERBOARD are available now exclusively through Vertical Systems Group’s ENS Research Program subscribers of @Ethernet. Contact us for subscription information and pricing.

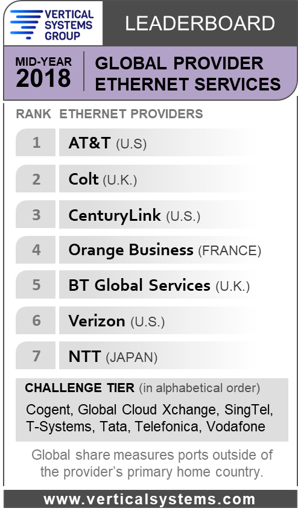

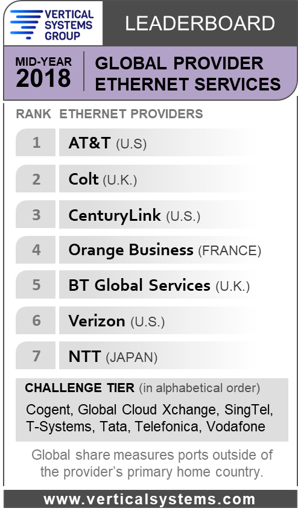

Here’s VSG Mid year 2018 Global Carrier Ethernet LEADERBOARD:

VSG’s U.S. Carrier Ethernet LEADERBOARD: CenturyLink #1, AT&T #2; U.S. CE port base grew >12%

Vertical Systems Group (VSG) announced that six companies achieved a position on its 2018 U.S. Carrier Ethernet (CE) LEADERBOARD (in rank order based on year-end 2018 retail port share): CenturyLink, AT&T, Verizon, Spectrum Enterprise, Comcast and Windstream. CenturyLink powered its way to the top spot in the year-end 2017 leaderboard after its acquisition of Level 3 Communications. AT&T led the U.S. Carrier Ethernet ranking from 2005-2016. Cox dropped out of the leaderboard and into VSG’s challenge tier on slower-than-market port growth.

To qualify for a rank on this 2018 LEADERBOARD, network providers must have 4% or more of the U.S. Ethernet services market. Shares are measured based on the number of billable retail customer ports in service as tracked by Vertical Systems Group.

“Despite its relative maturity, the Ethernet market continues to expand at a healthy pace. U.S. port installations grew more than twelve percent in 2018, in line with our forecasts,” said Rick Malone, principal of Vertical Systems Group. “However, revenue growth is not keeping pace with port growth due to falling prices and changing service mixes. One notable catalyst is the deployment of SD-WAN, which is resulting in customers shifting from switched Ethernet services to dedicated Internet access.”

Highlights of Vertical’s year-end 2018 U.S. Ethernet market share analysis:

- U.S. retail Ethernet customer installations grew to more than 1.1 million ports, up 12 percent from year-end 2017.

- Six Ethernet providers qualify for the 2018 LEADERBOARD, as compared to seven in 2017 and nine in 2016.

- Cox dropped out of the LEADERBOARD and into the Challenge Tier on slower than market port growth.

- Four Incumbent Carriers (CenturyLink, AT&T, Verizon, Windstream) and two Cable MSOs (Spectrum Enterprise, Comcast) are represented on the latest LEADERBOARD.

- The two Cable MSOs (Spectrum Enterprise and Comcast) had the highest port growth in the second half of 2018.

- Ethernet pricing declined in 2018 across all port speeds for the six service types tracked by Vertical (i.e., EPL, EVPL, DIA, Access to VPN, Switched Metro and VPLS).

- Each of the 2018 U.S. LEADERBOARD companies has received MEF CE 2.0 certification.

In addition to the LEADERBOARD providers, all other companies selling Ethernet services in the U.S. are segmented into two tiers as measured by port share.

The Challenge Tier includes providers with between 1% and 4% share of the U.S. retail Ethernet market. For year-end 2018, the following seven companies attained a position in the Challenge Tier (in alphabetical order): Altice USA, Cogent, Cox, Frontier, GTT, Sprint and Zayo.

The Market Player tier includes all providers with port share below 1%. Companies in the Market Player tier include the following providers (in alphabetical order): Alaska Communications, American Telesis, Atlantic Broadband, BT Global Services, Cincinnati Bell, Consolidated Communications, Crown Castle Fiber, DQE Communications, Expedient, FiberLight, FirstLight, Fusion, Global Cloud Xchange, Great Plains Communications, Logix Fiber Networks, LS Networks, Masergy, Midco, NTT America, Orange Business, RCN Business, Segra, Tata, TDS Telecom, Telstra, TPx, Unite Private Networks, US Signal, WOW!Business and other companies selling retail Ethernet services in the U.S. market.

Detailed Ethernet share results that power the Year-End 2018 Carrier Ethernet LEADERBOARD are available now exclusively through Vertical Systems Group’s ENS Research Program subscribers of @Ethernet. Contact us for subscription information and pricing.

Here’s VSG Mid year 2018 Global Carrier Ethernet LEADERBOARD:

Dec 2019 ITU-R WP 5D Workshop on IMT-2020 Terrestrial Radio Interfaces Evaluation

1. Background

Following the IMT-2020 developing process “Submission/Reception of the RIT and SRIT proposals and acknowledgement of receipt” in accordance with Document IMT-2020/2(Rev.1), ITU-R Working Party (WP) 5D started evaluation process for Independent Evaluation Groups (IEGs) from its 31st meeting in Oct. 2018, in conjunction with the ongoing IMT-2020 development under Step 3 of the IMT-2020 process.

At the 32nd meeting of WP 5D in July 2019, the Step 3 of the IMT-2020 developing process “Submission/Reception of the RIT and SRIT proposals and acknowledgement of receipt” will end in accordance with Document IMT-2020/2(Rev.1). In this context, all the submissions from proponents will be finalized at the 32nd meeting of WP 5D. In addition, WP 5D will acknowledge the completed submission(s) based on the materials provided by the proponents at the same meeting.

2. Objectives

ITU-R WP 5D will hold a workshop on IMT-2020 focusing on the evaluation of the candidate terrestrial radio interfaces in conjunction with the 33rd meeting in December 2019, in which interim evaluation reports are expected. This will facilitate the possibility on the IEGs to understand the details of the proposed candidate technologies, and to interact with WP 5D and other IEGs participating in the ITU-R evaluation process on IMT‑2020. This workshop is a continuation of the previous workshop on IMT-2020 held in 2017, Munich, which addressed the process, requirements, and evaluation criteria for IMT-2020 as well as views from proponents on the developments on IMT-2020 radio interface(s) and IEGs activities.

The objectives of the workshop are as follows;

– to promote information sharing on IMT-2020;

– to facilitate dialog among ITU-R WP 5D, the proponents and the evaluation groups; and in particular;

- to review the final submissions of the proposed RIT/SRIT for IMT-2020;

- to review the evaluation results reported by the IEGs at this stage;

- to demonstrate the WP 5D template which will be used to summarise evaluation results for each IEG, etc.;

- to present the details of the proposed RIT/SRIT including self-evaluation results and detailed evaluation method by RIT/SRIT Proponents;

- to introduce the evaluation activities and further plan by IEGs, and to share the information relating to the evaluation; and

- to review WRC-19 outcome and the implication on IMT-2020 evaluation and further development.

3. Draft Program of the Workshop

| Registration |

| Opening remarks by the Chairman of WP 5D |

| Welcome remarks by the Host of the 33rd WP 5D meeting |

| Presentations by ITU-R |

| Presentation by WP 5D (e.g., introduction to IMT-2020 evaluation process, status of submissions, status of evaluation and related information, etc.) |

| Presentations by IMT-2020 RIT/SRIT proponents |

| Presentations by IMT-2020 RIT/SRIT proponents (e.g. the introduction of technical characteristics according to final submission, the self-evaluation results and detailed evaluation method, and submission templates, etc.) [Editor’s note: This session could be divided into sub-sessions considering technology groups, each of which consists of technically identical proposals] |

| Q & A for each proponent in Session 2 |

| Presentations by registered independent evaluation groups |

| Presentations by the registered independent evaluation groups (e.g. evaluation activities of RIT/SRIT, initial independent evaluation results, useful experiences, tools, and future plans, etc.) |

| Presentation from each IEG

[Editor’s note: to consider the possibility of panel discussion etc. to facilitate the exchange of information on evaluation parameters among IEGs.] |

| Q & A for each IEG in Session 3 |

| Wrap up and Closing |

Note 1: The program and time schedule are subject to change.

Note 2: The program of sessions 2 and 3 would be based on number of requests for presentation from the interested bodies.

References:

The workshop information will be appropriately communicated and/or updated on the WP 5D webpage (https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/submission-eval.aspx).

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/submission-eval.aspx

IHS Markit: Cloud and Mobility Driving Enterprise Edge Connectivity in North America

IHS Markit Survey: Cloud and mobility driving new requirements for enterprise edge connectivity in North America

By Matthias Machowinski, senior research director, IHS Markit, and Joshua Bancroft, senior analyst, IHS Markit

Highlights

- By 2019, 51 percent of network professionals surveyed by IHS Markit will use hybrid cloud and 37 percent will adopt multi-cloud for application delivery.

- Bandwidth consumption continues to rise. Companies are expecting to increase provisioned wide-area network (WAN) bandwidth by more than 30 percent annually across all site types.

- Data backup and storage is the leading reason for traffic growth, followed by cloud services

- Software-defined WAN (SD-WAN) is maturing: 66 percent of surveyed companies anticipate deploying it by the end of 2020.

- Companies deploying SD-WAN use over 50 percent more bandwidth, than those who have not deployed it. Their bandwidth needs are also growing at twice the rate of companies using traditional WANs.

Analysis

Based on a survey of 292 network professionals at North American enterprises, IHS Markit explored the evolving requirements for enterprise edge connectivity, including WAN and SD-WAN. The study revealed that enterprise IT architectures and consumption models are currently undergoing a major transformation, from servers and applications placed at individual enterprise sites, to a hybrid-cloud model where centralized infrastructure-as-a-service (IaaS) complements highly utilized servers in enterprise-operated data centers. This process allows organizations to bring the benefits of cloud architectures to their own data centers – including simplified management, agility and scalability – and leverage the on-demand aspect of cloud services during peak periods. Respondents also reinforced the viewpoint that the hybrid cloud is a stepping stone to the emerging multi-cloud.

Changing business demographics is sparking the trend of more centralized applications: enterprises are moving closer to their customers, partners, and suppliers. They are adding more physical locations, making mobility a key part of their processes and taking on remote employees to leverage talent and expertise.

Following the current wave of application centralization, certain functions requiring low latency will migrate back to the enterprise edge, residing on universal customer premises equipment (uCPE) and other shared compute platforms. This development is still in its infancy, but it is already on the radar of some companies.

Hybrid cloud is an ideal architecture for distributed enterprises, but it is also contributing to traffic growth at the enterprise edge. Extra attention must be paid to edge connectivity, to ensure users don’t suffer from slow or intermittent access to applications. Performance is a top concern, and enterprises are not only adding more WAN capacity and redundancy, but also adopting SD-WAN.

The primary motivation for deploying SD-WAN is to improve application performance and simplify WAN management. The first wave of SD-WAN deployments focused on cost reduction, and this is still clearly the case, with survey respondents indicating their annual mega-bits-per-second cost is approximately 30 percent lower, with costs declining at a faster rate than in traditional WAN deployments. These results show that SD-WAN can be a crucial way to balance runaway traffic growth with budget constraints.

SD-WAN solutions not only solve the transportation and WAN cost reduction issue, but also help enterprises create a fabric for the multi-cloud. Features like analytics to understand end-user behaviour, enhanced branch security and having a centralized management portal all make SD-WAN an enticing proposition for enterprises looking to adopt a multi-cloud approach.

Enterprise Edge Connectivity Strategies North American Enterprise Survey

This IHS Markit study takes explores how companies are advancing connectivity at the enterprise edge, in light of new requirements. It includes traditional WAN and SD-WAN growth expectations, growth drivers, plans for new types of connectivity and technologies, equipment used, feature requirements, preferred suppliers, , and spending plans.

Communications Minister Manoj Sinha: India will not miss 5G opportunity; New Spectrum Bands Coming?

The economic impact of 5G is estimated to be over one trillion dollars for India, which is aggressively positioning itself to be at the forefront of the new age technologies, Communications Minister Manoj Sinha said on Tuesday. Vowing that India will “not miss the 5G bus”, the minister outlined the country’s strides in telecom over the last five years, highlighting the spike in data consumption, broadband user base, and low tariffs, but added that ensuring safety and sovereignty of digital networks will be a priority for the government.

“While we are gearing up for the next wave of digital transformation, it is also important to ensure the safety, security and sovereignty of digital communications…It is important that we focus on security testing and establish appropriate security standards. We have recently started a state-of-the-art facility for preparation of security assurance standards, putting us at the forefront of technology,” Sinha said.

“The economic impact of 5G is expected to be over one trillion dollars for India, and the consequent multiplier effect is expected to be much more,” Sinha said.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

The facility will work on security requirements and also facilitate development of testing and certification ecosystem in the country, Sinha said while speaking at India Telecom 2019 expo organised by Telecom Equipment and Services Export Promotion Council (TEPC). Terming 5G as a “game changer”, the minister said that flagship government programs like Digital India and smart cities will ride on 5G. “The economic impact of 5G is expected to be over one trillion dollars for India, and the consequent multiplier effect is expected to be much more,” Sinha said.

The minister underscored the need for promoting investments to build underlying infrastructure that would make 5G a success, and added that a working group has been constituted to initiate implementation of recommendations of high level forum on 5G that had submitted its report in August 2018. Sinha also said that the government is in favour of policies and regulations that will facilitate development of 5G based technologies and services. “To ensure that we are able to launch 5G services in India along with the world, we have established 5G test beds through industry-academia partnerships, and we expect trials to be conducted over the next 12 months,” he said. India will position itself as a “globally synchronized participant” in manufacturing and development of 5G based technologies, products and applications, Sinha added.

In her address, Telecom Secretary Aruna Sundararajan noted that connectivity needs of developing and developed markets were different. “Our challenges are different…we need telecom networks to deliver inclusion, basic services, to connect the unconnected, and serve the under-served,” she said, adding that India, with its technological prowess and manufacturing capabilities, is keen to partner other nations who are looking for affordable and robust digital communications solutions.

Rajiv Mehrotra, Chairman of VNL Ltd, highlighted the need to bridge the digital divide between rural and urban areas through connectivity solutions, and said that opportunities should be created for promoting indigenous telecom equipment manufacturing.

………………………………………………………………………………………………………………………………………………………………………….

Separately, the Telecom Regulatory Authority of India (Trai) could come out with the pricing and quantum of newer spectrum bands including millimeter wavelength (mmWave) range for 5G wireless technology rollout if the government seeks its view, a top official told ETT. “Government can ask for recommendations on new bands including millimeter wavelength (mmWave) band, and the telecom department can send us a reference,” Trai chairman Ram Sewak Sharma said, adding that the authority was in a view of opening up of all kinds of bands for newer technology.

The Narendra Modi-led government has already established a high-level 5G Forum under the Indo-American engineer and Stanford University professor emeritus AJ Paulraj which has already recommended newer bands to aid 5G rollout. It has suggested mmWave band for the 5G technology and said that 140 Mhz spectrum for backhaul usage should be allowed in addition to opening up of new bands for indoor access in line with practices worldwide.

References: