Month: June 2022

T-Mobile Launches Voice Over 5G NR using 5G SA Core Network

T-Mobile has deployed commercial Voice over 5G (VoNR, or Voice Over (5G) New Radio) service in limited areas of Portland, Oregon and Salt Lake City, Utah. The Un-carrier plans to expand VoNR to many more areas this year. Now that Standalone 5G (5G SA) is beginning to carry voice traffic with the launch of VoNR, other real 5G services, such as network slicing and security are likely to be deployed. T-Mobile customers with Samsung Galaxy S21 5G smartphones can take advantage of VoNR today in select areas.

“We don’t just have the leading 5G network in the country. T-Mobile is setting the pace for providers around the globe as we push the industry forward – now starting to roll out another critical service over 5G,” said Neville Ray, President of Technology at T-Mobile. “5G is already driving new levels of engagement, transforming how our customers use their smartphones and bringing unprecedented connectivity to areas that desperately need it. And it’s just going to get better thanks to the incredible T-Mobile team and our partners who are tirelessly innovating and advancing the capabilities of 5G every day.”

Standalone 5G removes the need for an underlying 4G LTE network and 4G core, so 5G can reach its true potential. In other words, it’s “pure 5G”, and T-Mobile was the first in the world to deliver it nationwide nearly two years ago.

The addition of VoNR takes T-Mobile’s standalone 5G network to the next level by enabling it to carry voice calls, keeping customers seamlessly connected to 5G. In the near-term, customers connected to VoNR will notice slightly faster call set-up times, meaning less delay between the time they dial a number and when the phone starts ringing. But VoNR is not just about a better calling experience. Most importantly, VoNR brings T-Mobile one step closer to truly unleashing its standalone 5G network because it enables advanced capabilities like network slicing that rely on a continuous connection to a 5G core.

“VoNR represents the next step in the 5G maturity journey-an application that exists and operates in a complete end-to-end 5G environment,” says Jason Leigh, research manager, 5G & Mobility at IDC. “Migrating to VoNR will be a key factor in developing new immersive app experiences that need to tap into the full bandwidth, latency and density benefits offered by a 5G standalone network.”

“The commercial launch of the VoNR service is another important step in T-Mobile’s successful 5G deployment,” said Fredrik Jejdling, Executive Vice President and Head of Business Area Networks at Ericsson. “It demonstrates how we as partners can introduce 5G voice based on the Ericsson solution.”

“We are proud of our partnership with T-Mobile to bring the full capabilities of 5G to customers in the United States,” said Tommi Uitto, President, Nokia Mobile Networks. “Nokia’s radio and core solutions power T-Mobile’s 5G standalone network – and this VoNR deployment is a critical step forward for the new 5G voice ecosystem.”

“At Samsung, we want to give our users the best possible 5G experience on every device – and today’s announcement represents a big step forward,” said Jude Buckley, Executive Vice President, Mobile eXperience at Samsung Electronics America. “By supporting extensive integration and testing, and working alongside an industry leader like T-Mobile, we’re bringing to life all the benefits of 5G technology with the help of our Samsung Galaxy devices.”

VoNR is available for customers in parts of Portland, Ore. and Salt Lake City with the Samsung Galaxy S21 5G and is expected to expand to more areas and more 5G smartphones this year including the Galaxy S22.

T-Mobile is the U.S. leader in 5G with the country’s largest, fastest and most reliable 5G network. The Un-carrier’s Extended Range 5G covers nearly everyone in the country – 315 million people across 1.8 million square miles. 225 million people nationwide are covered with super-fast Ultra Capacity 5G, and T-Mobile expects to cover 260 million in 2022 and 300 million next year.

………………………………………………………………………………………………………………………………………………………

Voice Over NR Network Architecture:

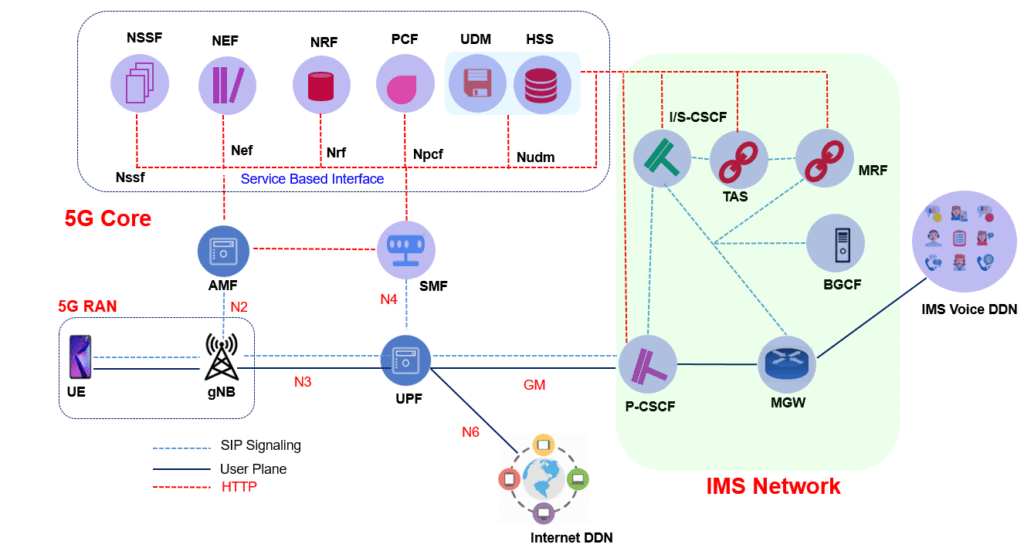

Voice Over NR network Architecture is consist of 5G RAN, 5G Core and IMS network. A high level architecture is shown below. (Only major network functions are included). This network architecture supports Service based interface using HTPP protocol.

VoNR Key Pointers:

- VoNR rely upon IP Multimedia Subsystem (IMS) to manage the setup, maintenance and release or voice call connections.

- UE PDCP should support RTP and RTCP, RoHC compression and MAC layer should support DRX

- SIP is used for signaling procedures between the UE and IMS.

- VoNR uses a QoS Flow with 5QI= 5 for SIP signaling messages and QoS Flow with 5QI= 1

- QoS Flows with 5QI= 5 is non-GBR but should be treated with high priority to ensure that SIP signaling procedures are completed with minimal latency and high reliability.

- QoS Flow with 5QI= 1 is GBR. This QoS Flow is used to transfer the speech packets after connection establishment

- gNB uses RLC-AM mode DRB for SIP signaling and RLC-UM mode for Voice Traffic (RTP) DRBs

- 3GPP has recommended ‘Enhanced Voice Services’ (EVS) codecs for 5G

- EVS codec supports a range of sampling frequencies to capture a range of audio bandwidths.

- These sampling frequencies are categorized as Narrowband, Wideband, Super Wideband and Full band.

- VoNR UE provides capability information during the NAS: Registration procedure with IE ‘ UE’s Usage Setting’ indicates that the higher layers of the UE support the IMS Voice service.

- The AMF can use the UE Capability Request to get UE’s support for IMS Voice services. gNB can get UE Capability with RRC: UE Capability Enquiry and UE Capability response to the UE. The UE indicates its support for IMS voice service with following IEs

-

- ims-VoiceOverNR-FR1-r15: This field indicates whether the UE supports IMS voice over NR FR1

- ims-VoiceOverNR-FR2-r15: This field indicates whether the UE supports IMS voice over NR FR2

- within feature set support IE ims-Parameters: ims-ParametersFRX-Diff, voiceOverNR : supported

-

References:

https://www.techplayon.com/voice-over-nr-vonr-call-flow/

Samsung’s Voice over 5G NR (VoNR) Now Available on M1’s 5G SA Network

LightShed Partners on 5G, Unsustainable Wireless Growth Bubble, Revenue Opportunities

Excerpts from LightShed Partners report – The Wireless Industry’s 5G Growth Problem, MAY 31, 2022 ~ by WALTER PIECYK AND JOE GALONE (Registration required):

Wireless operators in the United States committed to invest over $200 billion into 5G (spectrum licenses, network equipment and build out costs), but does anyone care? Consumers have shown little interest in switching between service providers because of 5G. They have also been slow to upgrade to higher-priced 5G rate plans with their existing provider.

5G has not been enough to attract wireless consumers to higher priced rate plans. The major telcos have enabled 5G on all of their unlimited post-paid rate plans. Verizon withholds its “Ultra-Wideband” 5G from entry level subscribers but includes this faster speed level on the rest of their rate plans. We are skeptical faster 5G is inducing many subscribers to upgrade.

Despite the macro headwinds, we expect 1.5-3.0% growth in post-paid phone subscribers going forward. That’s not terrible, but it implies that industry net adds will fall to 6.7 million this year from 9.4 million in 2021. That is 1.9 million (22%) below consensus. Our peers may be excluding ~950k of base “cleanups” and network shutdowns in their estimates. That is odd as this is churn of subs that are allegedly paying their bills. Even if we excluded this “clean-up” our estimate would still be 1 million below consensus in 2022.

So where can wireless operators find more revenue growth?

Our outlook for industry subscriber growth is clearly not enough to generate the higher sustainable revenue growth that many investors prefer unless a wireless operator is taking material share. It’s hard to make a long-term case for notable shifts in market share in the wireless industry. Network differentiation has tightened, churn rates are at record lows. Plus, any material change to pricing would have an unwanted impact to the free cash flow of their large subscriber bases. So then what?

Wireless operators can attempt to boost revenue growth with wireless home broadband (aka Fixed Wireless Access or FWA), wholesale and IoT. But post-paid phone revenue, which represents 75% of total service revenue, is still the primary driver of growth. We estimate that in 2022, post-paid phone revenue will contribute 260 basis points of the 3.4% industry growth that we forecast. And in 2023, we expect it to contribute 220 basis points of our 3.2% expected growth. Without post-paid phone revenue growth, these companies have major growth challenges.

We are skeptical that premium services like hotspot data or better video streaming quality are incentives to move up rate plans. We invite any company to offer data on why this will offer a tailwind of upgrades over the next five years.

How much extra growth does Home Broadband offer?

We expect wireless home broadband to add an incremental $1 billion of recurring revenue per year for the wireless industry. That represents about 40 basis points of our industry revenue growth estimate of 3-4%. The impact of home broadband on growth is meaningful to T-Mobile and Verizon, contributing 100 bps and 60 bps respectively to their total wireless service revenue growth. Our wireless home broadband estimates are below the guidance of these companies, and therefore also likely below consensus – as we highlighted on our recent initiation of Charter. (Link) AT&T prefers to pursue a fiber growth strategy.

Home broadband is enabled by spectrum depth not 5G:

5G proponents would note that home broadband is a 5G application that helps to justify the $200 billion industry investment. But if that money had been plowed into spectrum and capex for LTE, we believe there would be little difference in the resulting revenue generated by home broadband. The thick spectrum blocks that operators purchased or acquired help LTE speeds and capacity in largely the same way it enables 5G. In addition, we have yet to notice perceptible differences in latency between 5G and LTE as measured (perhaps incorrectly) by the ping on speed tests. Only Dish Networks appears to be taking the capabilities of 5G down a path that is materially superior than what can be achieved with LTE and traditional network design.

References:

BT and Ericsson in partnership to provide commercial 5G private networks in the UK

BT and Ericsson have entered a new multi-million-pound joint partnership to provide commercial 5G private networks for the UK market – the first agreement of its kind. The multi-year contract will enable BT to sell 5G services to businesses and organizations in industries like manufacturing, defense, education, retail, healthcare, transport and logistics. It’s critically important to note that to be effective, a 5G private network requires a 5G Core which facilitates all the 5G features and essentials, e.g. network slicing, automation, MEC, security, etc.

The agreement comes just after BT confirmed it was investing close to £100m over the next three years to accelerate the development of customer solutions which integrate emerging technologies like 5G, IoT, Edge Compute, Cloud and AI.

5G Private Networks provide secure indoor and outdoor 5G cellular coverage, making them suitable for a range of uses – particularly in environments such as factories, education campuses and other large sites where security and ultra-low latency connectivity are important.

New innovative applications and IoT capabilities can be enabled through a private 5G network to improve productivity, optimise operations and drive cost savings, such as asset tracking, predictive maintenance, connected sensors, real-time data processing, automation and robotics.

According to a forecast from MarketResearch.com, 5G Private Networks are predicted to grow at an average rate of 40 per cent a year between 2021 and 2028, by which time the market will be worth $14bn (£10.7bn). Both BT and Ericsson believe there is significant demand from UK businesses looking to take advantage of the benefits the new technology can provide.

From MarketResearch.com:

“Key market players are strategically building partnerships with industry giants to set up a private 5G network to provide high-speed secure connectivity to their customers. For instance, in Feb 2020, Nokia Corporation deployed a private 5G network infrastructure for Lufthansa Technik for virtual inspection of engine parts remotely for its civil aviation clients. Moreover, the rising demand for enhanced bandwidth connectivity for secured enterprise applications is anticipated to fuel the adoption of private 5G services globally.”

Marc Overton, BT’s Managing Director for Division X, Enterprise, said: “This UK-first we have signed with Ericsson is a huge milestone and will play a major role in enabling businesses’ transformation, ushering in a new era of hyper-connected spaces.

“We have combined our skill and expertise at building converged fixed and mobile networks with Ericsson’s leading, sustainable and secure 5G network equipment, to offer a pioneering new proposition that will be attractive to many industries. 5G private networks will also support smart factory processes and the advancement of Industry 4.0 which can realise significant cost savings and efficiencies for manufacturers.

“Unlike a public network, a private 5G network can be configured to a specific business’s needs, as well as by individual site or location. They also provide the foundation to overlay other innovative technologies such as IoT, AI, VR and AR, opening up a multitude of possibilities.”

Katherine Ainley, CEO Ericsson UK & Ireland said: “This ground-breaking agreement with BT means we are together taking a leading role in ensuring 5G has a transformative impact for the UK. The high quality, fast and secure connectivity provided by Ericsson Private 5G can help organisations make all-important efficiency gains that can create safer, more productive, and sustainable business operations and help the country build global leaders in the industries and technologies of the future.”

Case study: BT and Ericsson have already worked together on several major projects incorporating private 5G networks, including Belfast Harbour in Northern Ireland, as they accelerate its ambition to become the world’s best regional smart port.

The partners have installed a 5G private network across 35 acres of operational port. This is helping to drive operational efficiencies and accelerate its digital transformation through optimising processes across transport, logistics, supply chain and shipping, as well as boosting productivity through the smooth-running of the Port’s operations.

Every year more than 1.75 million people and over half a million freight vehicles arrive and depart through the Port every year. While 24 million tonnes of goods are managed and carried by ferries, container ships and cargo vessels.

“With activity on that scale you need smart technology that can really make a difference. And that’s what our standalone private 5G network is enabling at the Port,” added Marc Overton.

“We’re now into phase two of the project and this includes various use cases such as teleoperation of heavy plant machinery, artificial reality (AR) for remote maintenance, as well as enhanced video AI analytics and the use of drones for surveillance and inspections.”

The partnership is also exploring how 5G and other emerging technologies such as AI, IoT and Connected Autonomous Vehicles can be used together to enhance public safety, physical security, and address climate change across the Port and other parts of Belfast City.

Mike Dawson, Corporate Services Director, Belfast Harbour Commissioners, said: “Throughout 2021 and to the end of 2022, we will have completed the implementation of both Public and Private 5G Networks. These are the foundation for several Smart and Green port initiatives, including CCTV cameras, Air Quality Monitors, Drones, MiFi units to maximise operational efficiencies and a Digital Twin. The technologies have supported our data collection on the movement of people and things through our Road Traffic Screens, Wayfinding App and a Community App for Traffic.”

BT Group is the UK’s leading provider of fixed and mobile telecommunications and related secure digital products, solutions and services. We also provide managed telecommunications, security and network and IT infrastructure services to customers across 180 countries.

BT Group consists of four customer-facing units: Consumer serves individuals and families in the UK; Enterprise and Global are our UK and international business-focused units respectively; Openreach is an independently governed, wholly owned subsidiary, which wholesales fixed access infrastructure services to its customers – over 650 communication providers across the UK.

British Telecommunications plc is a wholly-owned subsidiary of BT Group plc and encompasses virtually all businesses and assets of the BT Group. BT Group plc is listed on the London Stock Exchange.

For more information, visit www.bt.com/about

References:

https://www.marketresearch.com/Grand-View-Research-v4060/Private-5G-Network-Size-Share-14553525/

India’s 5G spectrum auctions likely to be delayed yet again; Broadband India Forum weighs in

India’s 5G rollout is already behind schedule due to repeated delays (from early 2020) in the 5G spectrum auction. It now appears that the auction will be delayed even further, resulting in even more delays in 5G rollout. The competing interests of telecom service providers (TSPs) and technology giants seeking private networks appear to have slowed the auctioning of 5G spectrum, causing the delay, according to a recent The Hindu Businessline report.

The auction was meant to take place in early June, according to India’s Telecom Minister, but there would be a delay because the Cabinet has not yet adapted the TRAI’s plan. Because issuing the notice inviting applications (NIA) and holding stakeholder meetings can take at least 45 days from the date of Cabinet approval, the auction is unlikely to take place in June.

The main reason for the delay is that various industry bodies and tech giants have requested that the captive 5G networks be allocated to them. Despite the fact that 5G private network users’ spectrum allocation has been excluded from the upcoming auction, these players have addressed the government through their representative bodies. They argue that keeping them out of the country will adversely impact the country’s efforts to digitalize its economy and make its products more competitive in the global market.

The Broadband India Forum (BIF), whose members include Amazon, Cisco, Facebook, Google, Intel, Adani, and Reliance, among others, urged the government to provide this spectrum via an administered allocation route at a nominal rate or for free. Furthermore, TRAI recommended allocating 5G spectrum to enterprises for the construction of their own private captive networks, which they day improves industry efficiency.

The BIF urged the Government to provide these spectrum through administered allocation route at some nominal rates or give it for free. “We should think of the country, the consumer…it is the benefit of the consumer, efficiency of the enterprise and finally improvement of the economy. It (spectrum) is strictly for captive usage for improvement of efficiency,” said TV Ramachandran, President at BIF.

He said not only 5G, but captive network can be set up with 4G also, which the industry body has been requesting the government to open up. For instance, airports, ports, hotels and hospitals around the world use captive network to communicate within their campuses, and that gives faster response time, too.

Telecom Regulatory Authority of India (TRAI), in its recommendations, had also said that non-telecom enterprises would be allocated a 5G spectrum for building their private networks.

For captive network, spectrum is assigned to enterprises, is utilized within a limited geographic area. Therefore, it is also referred as spectrum for localized or local use. Spectrum assigned for localised private captive networks is used in such a manner that the signals are restricted within its geographic area and do not cause interference to other outside systems.

References:

India’s 5G auction delayed again to April-May 2022 – Credibility Gap?