Omdia: How telcos will evolve in the AI era

Dario Talmesio, research director, service provider, strategy and regulation at market research firm Omdia (owned by Informa) sees positive signs for network operators.

“After many years of plumbing, now telecom operators are starting to see some of the benefits of their network and beyond network strategies. Furthermore, the investor community is now appreciating telecom investments, after many years of poor valuation, he said during his analyst keynote presentation at Network X, a conference organized by Light Reading and Informa in Paris, France last week.

“What has changed in the telecoms industry over the past few years is the fact that we are no longer in a market that is in contraction,” he said. Although telcos are generally not seeing double-digit percentage increases in revenue or profit, “it’s a reliable business … a business that is able to provide cash to investors.”

Omdia forecasts that global telecoms revenue will have a CAGR of 2.8% in the 2025-2030 timeframe. In addition, the industry has delivered two consecutive years of record free cash flow, above 17% of sales.

However, Omdia found that telcos have reduced capex, which is trending towards 15% of revenues. Opex fell by -0.2% in 2024 and is broadly flatlining. There was a 2.2% decline in global labor opex following the challenging trend in 2023, when labor opex increased by 4% despite notable layoffs.

“Overall, the positive momentum is continuing, but of course there is more work to be done on the efficiency side,” Talmesio said. He added that it is also still too early to say what impact AI investments will have over the longer term. “All the work that has been done so far is still largely preparatory, with visible results expected to materialize in the near(ish) future,” he added. His Network X keynote presentation addressed the following questions:

- How will telcos evolve their operating structures and shift their business focuses in the next 5 years?

- AI, cloud and more to supercharge efficiencies and operating models?

- How will big tech co-opetition evolve and impact traditional telcos?

Customer care was seen as the area first impacted by AI, building on existing GenAI implementations. In contrast, network operations are expected to ultimately see the most significant impact of agentic AI.

Talmesio said many of the building blocks are in place for telecoms services and future revenue generation, with several markets reaching 60% to 70% fiber coverage, and some even approaching 100%.

Network operators are now moving beyond monetizing pure data access and are able to charge more for different gigabit speeds, home gaming, more intelligent home routers and additional WiFi access points, smart home services such as energy, security and multi-room video, and more.

While noting that connectivity remains the most important revenue driver, when contributions from various telecoms-adjacent services are added up “it becomes a significant number,” Talmesio said.

Mobile networks are another important building block. While acknowledging that 5G has been something of a disappointment in the first five years of the deployment cycle, “this is really changing” as more operators deploy 5G standalone (5G SA core) networks, Omdia observed.

Talmesio said: “At the end of June, there were only 66 telecom operators launching or commercially using 5G SA. But those 66 operators are those operators that carry the majority of the world’s 5G subscribers. And with 5G SA, we have improved latency and more devices among other factors. Monetization is still in its infancy, perhaps, but then you can see some really positive progress in 5G Advanced, where as of June, we had 13 commercial networks available with some good monetization examples, including uplink.”

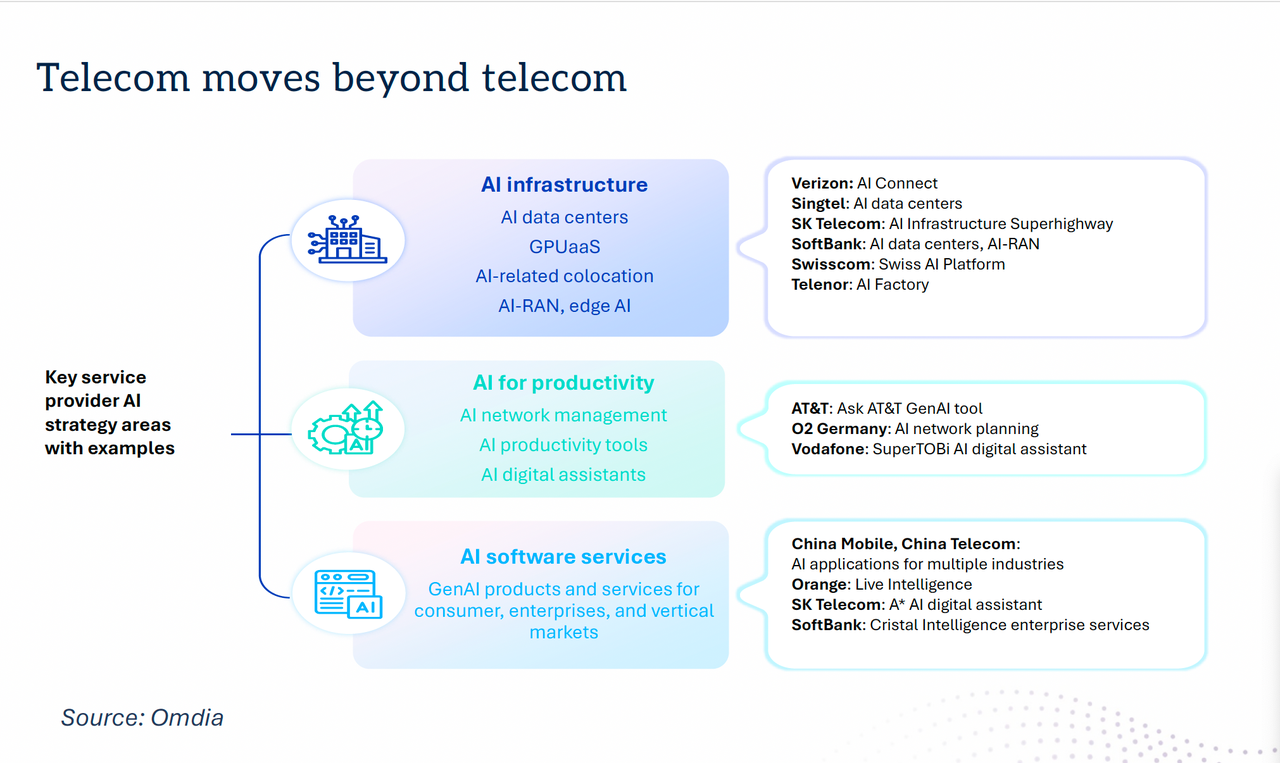

“Telecom is moving beyond telecoms,” with a number of new AI strategies in place. For example, telcos are increasingly providing AI infrastructure in their data centers, offering GPU as-a-service, AI-related colocation, AI-RAN and edge AI functionality.

Dario Talmesio, Omdia

……………………………………………………………………………………………………………………………………………………

AI is also being used for network management, with AI productivity tools and AI digital assistants, as well as AI software services including GenAI products and services for consumer, enterprises and vertical markets.

“There is an additional boost for telecom operators to move beyond connectivity, which is the sovereignty agenda,” Talmesio noted. While sovereignty in the past was largely applied to data residency, “in reality, there are more and more aspects of sovereignty that are in many ways facilitating telecom operators in retaining or entering business areas that probably ten years ago were unthinkable for them.” These include cloud and data center infrastructure, sovereign AI, cyberdefense and quantum safety, satellite communication, data protection and critical communications.

“The telecom business is definitely improving,” Talmesio concluded, noting that the market is now also being viewed more favorably by investors. “In many ways, the glass is maybe still half full, but there’s more water being poured into the telecom industry.”

References:

https://networkxevent.com/speakers/dario-talmesio/

https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/pushing-telcos-ai-envelope-on-capital-decisions

Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

Omdia: Huawei increases global RAN market share due to China hegemony

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Omdia: Cable network operators deploy PONs

Hopefully, telcos will evolve from being passive providers of connectivity to intelligent, automated, and customer-centric platforms. By integrating artificial intelligence (AI) across their operations, they will fundamentally change how networks are managed, services are delivered, and new revenue streams are generated.

This evolution is already happening, with most telecommunications companies either piloting or actively deploying AI. The upcoming IMT 2030 (6G) standard is being developed by ITU-R and 3GPP with AI functionality, accelerating this transformation toward autonomous, AI-native networks.

Here are a few take-aways:

1. Autonomous, self-optimizing networks:

AI will automate and enhance nearly every aspect of network management, leading to more reliable and efficient infrastructure.

Predictive maintenance: AI models will analyze network data to predict equipment failures before they occur. This allows providers to perform proactive maintenance, reducing costly downtime and service interruptions.

Intelligent network optimization: Real-time analysis of traffic patterns will allow AI to dynamically allocate network resources, re-route traffic, and balance loads. This will prevent congestion, improve performance, and lower energy consumption.

Intent-based networking: Future networks will be so intelligent that engineers can set high-level business goals (e.g., “prioritize bandwidth for hospital traffic”), and AI will automatically translate them into network configurations and deploy them.

“Self-healing” networks: AI-driven automation will enable networks to automatically detect, diagnose, and fix issues with minimal human intervention.

2. AI-driven personalization and customer experience:

Providers will use AI to shift from mass-market offerings to highly personalized services that improve satisfaction and reduce churn.

Enhanced customer support: AI-powered virtual assistants and chatbots will provide 24/7, multilingual support, handling routine inquiries and troubleshooting with greater efficiency. This frees up human agents to focus on complex cases.

Proactive service: AI will monitor network performance to identify and resolve potential service issues before a customer ever notices them.

Personalized offerings: Machine learning will analyze customer usage patterns and behavior to create targeted offers and promotions. This can include personalized plan recommendations, upgrades, and loyalty rewards.

Churn prediction: AI models will identify customers at high risk of switching to a competitor, allowing providers to launch targeted retention campaigns with personalized incentives.

3. New AI-native revenue streams:

AI will allow telecom providers to create new services and business models beyond traditional connectivity, opening up billions in new revenue.

Platform for AI at the edge: With 5G and 6G networks, telecom providers are positioned to offer AI services closer to the end-user. This enables AI-powered applications like autonomous vehicles, industrial automation, and augmented reality that require ultra-low latency.

Network slicing: Providers will offer “slices” of the network tailored for specific applications, with AI dynamically managing resources to ensure guaranteed quality of service. For instance, a network slice for a hospital might prioritize ultra-low latency for remote surgery, while another might prioritize bandwidth for a video streaming service.

Security-as-a-service: AI-powered security features, such as real-time threat detection and fraud prevention, can be offered to enterprise customers.

Data and analytics services: By anonymizing and aggregating network data, providers can offer valuable market intelligence and analytics to enterprises.

Challenges for telecom providers:

To fully realize the benefits of the AI era, telecom companies must overcome several key challenges:

Modernizing infrastructure: Many providers rely on legacy systems that are incompatible with AI integration. Refactoring these monolithic systems and adopting cloud-native architectures is a significant hurdle.

Data governance and silos: AI requires access to high-quality data, but telecommunication data is often fragmented across different systems. Establishing a unified data governance framework is essential for AI to deliver accurate insights.

Workforce skills: As AI automates routine tasks, network engineers and customer service agents will need new skills to manage and interpret AI-driven systems. Providers must invest in upskilling their workforce to adapt.

Initial investment: The cost of infrastructure upgrades, AI software, and talent can be substantial. Providers must build a clear business case and prioritize use cases with a high return on investment (ROI) to fund broader transformation.

Ethical and regulatory concerns: With AI and network slicing, new ethical considerations around data privacy, network neutrality, and security emerge, requiring proactive engagement with regulators.

“Global labor opex, a $300 billion ticket, was down by an unexciting 2.2% in 2024,” said Dario Talmesio, global research director at Omdia, referring to a tracker that monitors opex levels across the telco industry. “Given the amount of job losses in the sector, we wonder if AI costs more than the job it replaces.”

https://www.lightreading.com/ai-machine-learning/verizon-ceo-wants-aggressive-cuts-after-vestberg-culled-45k-jobs