4G

Point Topic Analysis: 4G LTE /5G tariffs provided by mobile operators across Europe

Point Topic has compared the average monthly subscription charges and download speeds offered by mobile broadband providers across the EU-28, Norway and Switzerland. All prices are quoted in US dollars at PPP (purchasing power parity) rates to allow for easier comparison.

Overall 4G/5G tariff trends

In Q2 2020, the average monthly charge for residential 4G/5G data services varied from $73.62 (PPP) in Greece to $17.27 (PPP) in Italy.

Figure 1. Average residential 4G/5G monthly tariff in PPP$, Q2 2020

…………………………………………………………………………………………………………………………………………………………………………………………………………..

In some instances, a relatively low average monthly charge comes with high average data cap (Figure 2). For example, this quarter Switzerland, Denmark and the Netherlands stand out as being at the high end of data allowances but at the low end of monthly charges, providing the best value for money to subscribers. This is reflected in the average cost per GB of data in these countries being among the lowest in Europe (Figure 3). In Slovakia, Czech Republic, Cyprus and Greece, on the other hand users pay a high monthly price for very low data allowance.

Figure 3. Average cost per GB of 4G/5G data in PPP$, Q2 2020

One of the factors which complicates comparing mobile broadband services between countries and against fixed broadband services is the fact that some mobile operators do not report bandwidth on their tariffs. Even when they do, the difference between the theoretical maximum bandwidths and the actual ones is much higher for mobile broadband compared to fixed.

Figure 4. Average theoretical downstream speed on residential 4G/5G services, Q2 2020

Nevertheless, Figure 4 shows which countries are investing in higher speed and more advanced networks, including those using the LTE-Advanced technology as well as those which are rolling out 5G. For example, Switzerland was among countries who offered lowest average downstream speeds in Q1 2019, however, after introducing 5G services it offers the second highest average downstream speed of 760Mbps and the top 5G speed of 2Gbps. The average speed in Italy also increased significantly after the 5G launch. The country now offers the highest average downstream speed of 1Gbps having overtaken Switzerland in Q4 2019. Denmark and Austria, among others, offer relatively low bandwidth, while being among the most generous markets in terms of data allowances[1].

[1] It should be noted that Denmark is a special case. The 71Mbps refers to the maximum download speed that the Danish operators are allowed to market after agreement with the consumer ombudsman. In fact, TDC’s theoretical maximum speed in 2018 was 413Mbps.

Regional and country benchmarks

The data will vary at a country level but when comparing the markets of Central & Eastern and Western Europe at a regional level, Western Europe came out on top in terms of the average data allowance with 167GB per month, compared to 116GB in Central & Eastern Europe. At the same time, customers in Western Europe were charged a lower average monthly subscription at $32.95 PPP. In Central & Eastern Europe, the same indicator was $37.26 PPP (Figure 5). Hence, the average cost per GB in Central & Eastern Europe was significantly higher at $0.32 PPP, compared to $0.20 PPP in Western European markets. In terms of downstream speeds, both regions recorded the same average speed of 242 Mbps.

Figure 5. Regional tariff benchmarks for residential 4G/5G services, Q2 2020

Among the selected six mature markets, Sweden stands out in terms of the top average data cap and Italy in terms of the lowest average monthly charge (Figure 6).

Figure 6. Tariff benchmarks for residential 4G/5G services in six major European economies, Q2 2020

The mobile operators in Sweden offer consumers on average 145GB a month while the Netherlands follow with 123GB average allowance. For several quarters in a row the Netherlands offered the highest average monthly charge among the selected six markets but in Q3 2019 the prices dropped significantly, and the country is now the second cheapest with only Italy offering a lower average monthly subscription of $17.27 PPP. The Netherlands offers the lowest average cost per GB, currently at $0.20 PPP, compared to $3.36 PPP in Germany (Figure 7).

Figure 7. Average data and cost of 4G/5G services in selected countries, Q2 2020 (in $PPP)

To compare the prices that residential customers pay for unlimited monthly 4G/5G data in various European markets, we selected the countries which offered such tariffs in Q2 2020 (Figure 8).

Figure 8. Entry level monthly charge for unlimited data on residential 4G/5G tariffs, Q2 2020

The entry level unlimited data tariffs in the countries at the high end of the spectrum (Sweden) were 3.5 times higher than those at the low end (Switzerland). However, when customers paid $54.84 PPP for unlimited data in Sweden, they were purchasing 4G services with speeds up to 300Mbps, while in Switzerland they were charged $15.57 (PPP) for the advertised 4G speed of up to 10Mbps.

Country ranking

Comparing countries by using the average cost of mobile broadband subscriptions is a straightforward idea but the variation in entry level versus median and average costs can be significant. To help provide an easy way of comparing directly we have taken the $PPP data on entry level, median and average tariffs, produced rankings and then compared the variance (Table 1).

Table 1. Country scorecard by residential 4G/5G tariffs, Q2 2020

* Countries which now offer 5G

We have included a ‘variance’ column to indicate how different ranks for the different metrics are spread. We see that the wide spread in Austria, Slovakia and Spain for example is represented by high variance. At the other end of the scale countries like Poland, Sweden or Croatia rank rather consistently.

Why such market differences between countries?

There is no simple clear-cut explanation as many factors come into play. The length of time after the 4G/5G networks were launched, service take-up, the market shares of ‘standalone’ and of multi-play bundles, the extent of competition from fixed broadband services with comparable bandwidth, the availability and the cost of 4G/5G spectrum, the regulatory pressures to offer mobile broadband services in remote and rural areas as a priority, the demographic characteristics and life-styles of the users and the cord-cutting tendencies will all have influenced the 4G and 5G offerings available in different European markets. A further statistical modelling would provide more insight into these differences.

What Point Topic measured

This analysis is based on more than 800 tariffs from all major mobile broadband providers from the EU-28, Norway and Switzerland. In total, we provide data on 88 operators from 30 countries. We track a representative sample of tariffs offered by each operator, making sure we include the top end, the entry level and the medium level tariffs, which results in a broad range of prices and data allowances.

We use this data to report on pan-European trends in tariffs and bandwidths offered. We also report on regional trends and variations across countries. The data can be used to track changes in the tariffs offered by individual operators as well.

Technologies

We track mobile broadband tariffs provided over 4G LTE and LTE-Advanced technologies. For the sake of brevity, we are referring to both of them as ‘4G LTE’ or sometimes ‘4G’. From Q2 2019, a small number of 5G tariffs are included in our analysis. Countries which offered 5G commercially at the time of our quarterly data collection are marked with an asterisk (*).

Standalone and bundled

We record 4G / 5G tariffs which are offered as SIM only data only, some of which come with a device (a modem). From Q2 2017 onwards we do not track tariffs bundled with tablets. However, we do record multi-play service bundles (mobile broadband plus TV, fixed broadband and/or voice). From this quarter, they are not included in this analysis, only in the tariff database. We track monthly tariffs rather than daily, weekly or pay as you go, and exclude tariffs offered as part of the smartphone purchase.

Residential and business

We record both business and residential mobile broadband tariffs. The analysis in this report is based on residential tariffs.

Currency

To allow for comparison between countries with different living standards, this report refers to the tariffs in $ PPP (purchasing power parity). The data on PPP conversion rates is provided by the World Bank. The tariffs in our database are also available in local currencies, USD, EUR and GBP.

Notes on methodology

In order to represent the tariffs we collate more efficiently, we have consolidated the tariff benchmark spreadsheets into a single file. This is available to subscribers to the Mobile Broadband Tariffs service – click here to access the full file.

If there is a particular element that you cannot find, and you wish to have available please contact us on [email protected].

Coverage and methodology

A full set of mobile broadband tariff data is available for download as part of Point Topic’s Mobile Operator Tariffs Service. The data set contains the most up-to-date end of quarter tariff information including such details as monthly rental, connection speed, data allowance, equipment costs, service features and special offers.

Price comparison issues

This analysis is intended as a general indicator of the trends in 4G/5G service pricing across Europe. There are several additional variables that complicate the process of making a direct comparison of mobile broadband tariffs. They need to be taken into account when making a more in-depth analysis:

- Device charges: Some 4G/5G monthly tariffs include all charges for devices, for example, routers or dongles, whereas others come with additional one-off (upfront) costs which can be substantial. We include monthly device charges in the total monthly subscription, and it is this figure that is used in the analysis. One-off charges are more difficult to compare as they vary depending on the device and the monthly charge a user is prepared to pay.

- Bundling: Increasingly, mobile operators are entering the multi-play arena by bundling their mobile broadband services with voice services, fixed broadband and TV. At the moment, the Mobile Broadband Tariffs service provides access to a sample of multi-play bundles from Europe and beyond. Note: although 4G/5G tariffs which come with a device may be regarded as bundles, we refer to them as standalone mobile broadband services as the device such as a modem is regarded as ‘equipment’, in line with our fixed broadband tariff methodology. The analysis presented in the current report only refers to ‘standalone mobile broadband’ tariffs.

- Data allowances: Some operators offer entry-level services with very low data caps. From

Q1 2017, the minimum data allowance we include is 1GB per month. In most cases, however, these limits are generous enough for a typical user and, in some cases, even comparable to those offered by fixed broadband providers. An increasing number of tariffs are offered with ‘unlimited’ data usage. To make it possible to include these tariffs in our calculations, we assigned 600GB per month to the unlimited data tariffs. - Downstream and upstream speeds: Some operators do not report mobile broadband speeds, not least because they are so variable. Others do, and where this is the case we record the theoretical maximum speed. In reality, the actual average speed can be lower up to 10 times or more. This should be taken into account when comparing 4G LTE services with fixed broadband, for example.

References:

http://point-topic.com/free-analysis/4g-5g-tariffs-in-q2-2020/

Analysis of Open Network Foundation new 5G SD-RAN™ Project

Executive Summary:

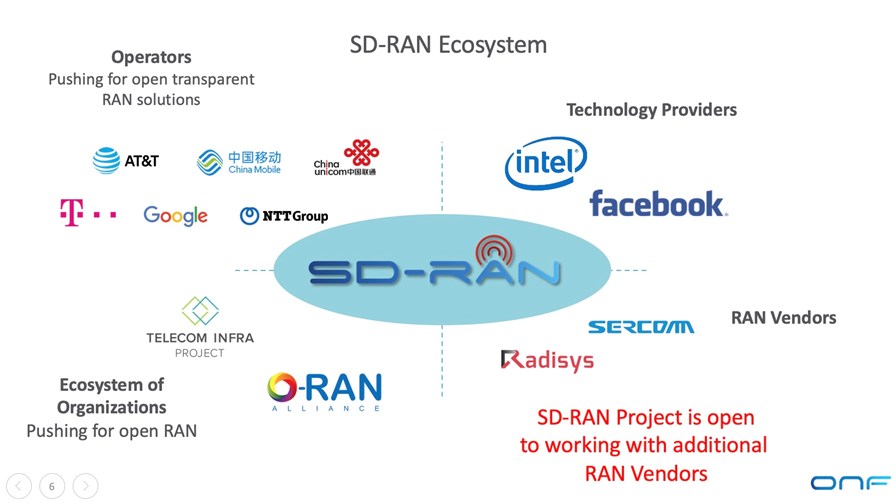

In a move that will help promote multi-vendor interoperability, the Open Networking Foundation (ONF) today announced the formation of the SD-RAN project (Software Defined Radio Access Network) to pursue the creation of open source software platforms and multi-vendor solutions for mobile 4G and 5G RAN deployments. Initially, the project will focus on building an open source Near Real-Time RAN Intelligent Controller (nRT-RIC) compatible with the O-RAN architecture.

The new SD-RAN project is backed by a consortium of leading operators and aligned technology companies and organizations that together are committed to creating a truly open RAN ecosystem. Founding members include AT&T, China Mobile, China Unicom, Deutsche Telekom, Facebook, Google, Intel, NTT, Radisys and Sercomm. All the project members will be actively contributing, and this includes the operators contributing use cases and trialing the results, according to the ONF. However, the larger cellular base station vendors that are ONF members, Nokia, Samsung, ZTE, Fujitsu, NEC were silent on their participation in this SD-RAN project.

There may be some confusion caused by ONF’s SD-RAN project as it is the third Open RAN consortium. The O-RAN Alliance and TIP Open RAN project are working on open source hardware and open interfaces for disaggregated RAN equipment, like a 4G/5G combo base station.

In a brief video chat yesterday, Timon Sloane, VP of Ecosystem and Marketing for ONF told me that this new ONF SD-RAN project would be in close contact with the other two Open RAN consortiums and distinguished itself from them by producing OPEN SOURCE SOFTWARE for disaggregated RAN equipment—something he said the O-RAN Alliance and TIP Open RAN project were NOT doing.

That should go a long way in dispelling that confusion, but it nonetheless presents a challenge on how three consortiums can effectively work together to produce meaningful open source software code (ONF) and hardware (O-RAN Alliance and TIP) specifications with joint compliance testing to ensure multi-vendor interoperability.

Sloane told Matt Kapko of SDXCentral: “The operators really are pushing for separation of hardware and software and for enabling new innovations to come in in software without it being tightly coupled to the hardware that they purchase. And xApps are where the functionality of the RAN is to be housed, and so in order to do this in a meaningful way you have to be able to do meaningful functions in these xApps,” Sloane said.

However, no mention was made in the ONF press release of a liaison with either 3GPP or ITU-R WP5D which are producing the standards and specs for 5G and have already done so for 4G-LTE. Neither of the aforementioned O-RAN consortiums have liaisons with those entities either.

There are other complications with Open RAN (independent of SD-RAN), such as U.S. government’s attempt to cripple Huawei and other China telecom equipment vendors, need for a parallel wireless infrastructure, legacy vs greenfield carriers. These are addressed in Comment and Analysis section below.

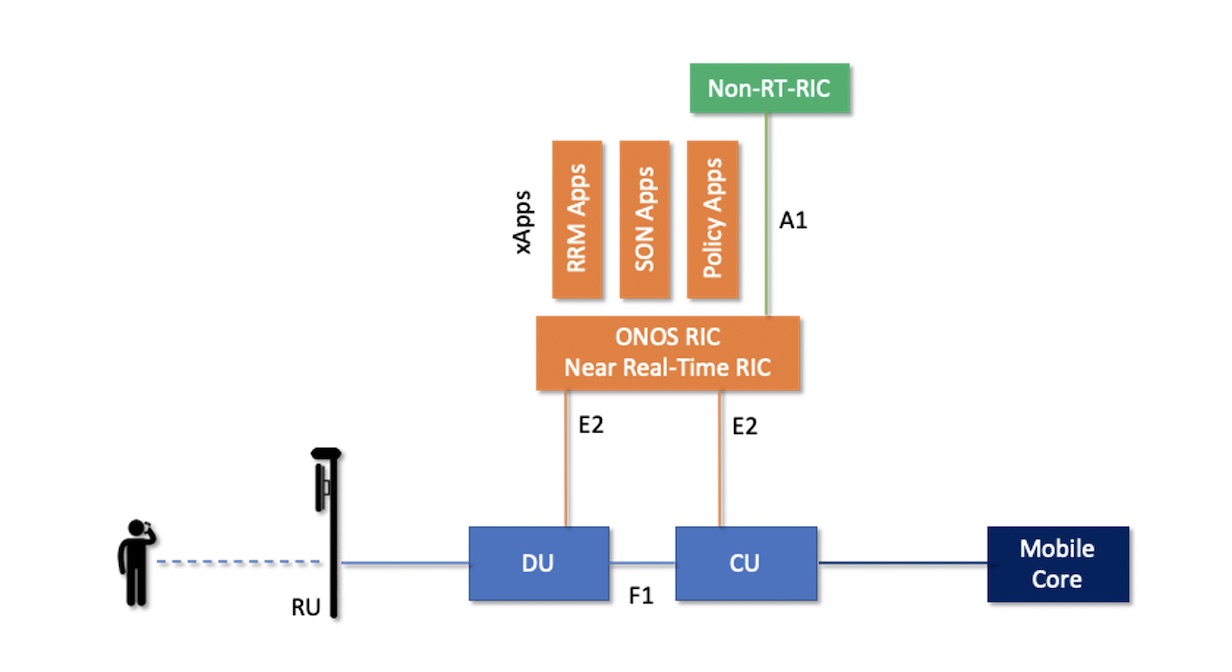

µONOS-RIC:

Central to the project is the development of an open source near-real time RIC called µONOS-RIC (pronounced “micro-ONOS-RIC”).

µONOS is a microservices-based SDN controller created by the refactoring and enhancement of ONOS, the leading SDN controller for operators in production tier-1 networks worldwide. µONOS-RIC is built on µONOS, and hence features a cloud-native design supporting active-active clustering for scalability, performance and high availability along with the real-time capabilities needed for intelligent RAN control.

µONOS-RIC is designed to control an array of multi-vendor open RAN equipment consistent with the O-RAN ALLIANCE architecture. In particular, the O-RAN ALLIANCE E2 interface is used to interface between µONOS-RIC and vendor supplied RAN RU/DU/CU RAN components.

xApps running on top of the µONOS-RIC are responsible for functionality that traditionally has been implemented in vendor-proprietary implementations. A primary goal of the SD-RAN project (and, not coincidentally, for the operators who founded the O-RAN consortium) is to enable an external intelligent controller to control the RAN so that operators have both visibility and control over their RAN networks, thus giving operators ownership and control over how spectrum is utilized and optimized along with the tools to deliver an optimal experience for users and applications.

……………………………………………………………………………………………………………………………………………………………………………………………………

Relationship to O-RAN Alliance, O-RAN Software Community and TIP:

The participating members of the SD-RAN project plan to implement, prototype and trial an advanced architecture that enables intelligent RIC xApps to control a broad spectrum of SON and RRM functionality that historically has been implemented as vendor-proprietary features on bespoke base station equipment and platforms. SD-RAN’s focus and goals are complementary to various efforts across the industry, including work taking place within the O-RAN ALLIANCE, the O-RAN Software Community and the TIP OpenRAN Project Group.

SD-RAN will follow O-RAN specifications as they are developed and will also make use of components of existing open source to facilitate interoperability. As the project pioneers new functionality, all extensions and learnings that come from building the system will be contributed back to O-RAN ALLIANCE, with the intent that these extensions can inform and advance the O-RAN specifications.

The SD-RAN work inside the ONF community will take place in parallel with work being contributed to the O-RAN Software Community. The intent is for interoperable implementations to come out of both efforts, so that a mix of open source and vendor proprietary components can be demonstrated and ultimately deployed.

Timing and Availability:

The SD-RAN project already has a working skeleton prototype of the µONOS-RIC controller above a RAN emulation platform through the E2 interface. This implementation is demonstrating handover and load balancing at scale, supporting over 100 base stations and 100,000 user devices with less than 50ms handover latency (less than 10ms latency for 99% of all handovers).

The SD-RAN community is advancing towards a field trial by early 2021, working with RAN vendors to integrate carrier-grade RU/DU/CU components while in parallel implementing xApps to demonstrate SON and RRM functionality. Interested parties are encouraged to contact ONF for additional information.

Quotes Supporting the SD-RAN Project:

“AT&T strongly supports the development of specifications and components that can help drive openness and innovation in the RAN ecosystem. The O-RAN ALLIANCE’s specifications are enabling the ecosystem, with a range of companies and organizations creating both open source and proprietary implementations that are bringing the open specifications to life. The ONF SD-RAN project, along with the O-RAN OSC, will expand the ecosystem with an nRT-RIC that can support xApps and help demonstrate their interoperability. This project will help accelerate the transition to an open RAN future.”

Andre Fuetsch, President and Chief Technology Officer, AT&T Labs

“China Mobile co-founded O-RAN in order to promote both the opening of the RAN ecosystem for multi-vendor solutions and the realization of RAN with native intelligence for performance and cost improvement. An open nRT-RIC with support for open xApps that go beyond policy-based control and SON to also enhance Radio Resource Management (RRM) will make it possible for operators to optimize resource utilization and application performance. We are excited to see the development of an open nRT-RIC and xApps in the SD-RAN project led by ONF, and expect this work to help advance the state-of-art for open and intelligent RAN.”

Dr. Chih-Lin I, Chief Scientist, Wireless Technologies, China Mobile

“China Unicom has been a long-term partner with ONF. We continue to see the benefits of the ONF’s work and the impact it has on our industry. The SD-RAN project is now applying the ONF’s proven strategy for disaggregating and creating open source implementations to the 5G RAN space in order to foster innovation and ecosystem transformation. We are excited by this work, and are committed to trialing a solution as it becomes available.”

Dr. Xiongyan Tang, Network Technology Research Institute, China Unicom

“Deutsche Telekom is a huge believer in applying disaggregation and open source principles for our next-generation networks. DT has ONF’s mobile core platform (OMEC) in production and we are taking ONF’s broadband access (SEBA/VOLTHA) platform to production towards the end of 2020. This journey has shown us the tremendous value that is created when we can build solutions based on interoperable multi-vendor components intermixed with open source components. ONF’s SD-RAN project is leveraging these same principles to help accelerate innovation in the RAN domain, and we are excited to be an active collaborator in this journey.”

Dr. Alex Jinsung Choi, SVP Strategy & Technology Innovation, Deutsche Telekom

“Connectivity is an integral part of Facebook’s focus to bring people closer together. We work closely with partners to develop programs and technologies that make connectivity more affordable and accessible. Through our collaboration with ONF on their SD-RAN project, we look forward to engaging with the community to improve connectivity experiences for many people around the world.”

Aaron Bernstein, Facebook’s Director of Connectivity Ecosystem Programs

“Google is an advocate for SDN, disaggregation and open source, and we are excited to see these principles now being applied to the RAN domain. ONF’s SD-RAN project’s ambition to create an open source RIC can help invigorate innovation across the mobile domain.”

Ankur Jain, Distinguished Engineer, Google

“Intel is an active participant of the ONF’s SD-RAN project to advance the development of open RAN implementations on high volume servers. ONF has been leading the industry with advanced open source implementations in the areas of disaggregated Mobile Core, e.g. the Open Mobile Evolved Core (OMEC), and we look forward to continuing to innovate by applying proven principles of disaggregation, open source and AI/ML to the next stepping stone in this journey – the RAN. SD-RAN will be optimized to leverage powerful performance, AI/ML, and security enhancements, which are essential for 5G and available in Intel® Xeon® Scalable Processors, network adapters and switching technologies, including Data-Plane Development Kit (DPDK) and Intel® Software Guard Extensions (Intel SGX).”

Pranav Mehta, Vice President of Systems and Software Research, Intel Labs

“NTT sees great value in transforming the RAN domain in order to foster innovation and multi-vendor interoperability. We are excited to be part of the SD-RAN ecosystem, and look forward to working with the community to develop open source components that can be intermixed with vendor proprietary elements using standard O-RAN interfaces.”

Dai Kashiwa, Evangelist, Director of NTT Communications

“Radisys is excited to be a founding member of the SD-RAN project, and we are committed to integrating our RAN software implementation (CU & DU) with O-RAN interfaces to the µONOS-RIC controller and xApps being developed by the SD-RAN project community. This effort has the potential to accelerate the adoption of O-RAN based RIC implementation and xApps, and we are committed to working with this community to advance the open RAN agenda.”

Arun Bhikshesvaran, CEO, Radisys

“As a leading manufacturer of small cell RAN equipment and an avid supporter of the open RAN movement, Sercomm is excited to collaborate with the SD-RAN community to open E2 interfaces and migrate some of our near-real-time functionalities from the RAN equipment into xApps running the μONOS-RIC controller. This is a nascent yet dynamic area full of potential, and we are committed to working with the SD-RAN ecosystem to build solutions ready for trials and deployment.”

Ben Lin, CTO and Co-Founder, Sercomm

“TIP’s OpenRAN solutions are an important element of our work to accelerate innovation across all elements of the network including Access, Transport, Core and Services. We are excited about the collaboration between our RIA subgroup and ONF’s SD-RAN project to accelerate RAN disaggregation and adoption of open interfaces. Through this collaboration we will enable the OpenRAN ecosystem to leverage the strengths of data science and AI/ML technologies to set new industry benchmarks on performance, efficiency and total cost of ownership.”

Attilio Zani, Executive Director for Telecom Infra Project (TIP)

…………………………………………………………………………………………………………………………………………………………………………………………………

Comment and Analysis of Open RAN Market:

Disclaimer: Like all IEEE Techblog posts, opinions, comment and analysis are ALWAYS by the authors and do NOT EVER represent an opinion or position by IEEE or the IEEE Communications Society. This should be obvious to all in the 11 1/2 years of this author’s contribution to the IEEE Techblog and its predecessor- ComSoc Community blogs.

…………………………………………………………………………………………………………………………………………………………………………

Besides NOT having a liaison with either 3GPP or ITU-R, the following Open RAN issues may limit its market potential. These are NOT specific to the ONF SD-RAN project, but generic to Open RAN deployments.

- U.S. officials promoting Open RAN as a way to decrease the dominance of Huawei, the world’s biggest vendor of mobile equipment by market share and also to thwart the rise of other vendors like ZTE and China Information and Communication Technology Group (CICT) which recently won a small part of s China Mobile contract. Obviously, China’s government will fight back and NOT allow any version of Open RAN to be deployed in China (likely to be the world’s biggest 5G market by far)! That despite China Mobile and China Unicom’s expressed interest in Open RAN (see Quotes above). Remember, that the three big China carriers (China Mobile, China Telecom, China Unicom) are all state owned.

- Dual infrastructure: If a legacy wireless carrier deploys Open RAN, existing wireless infrastructure equipment (base stations, small cells, cell tower equipment, backhaul, etc) must remain in place to support its customers. Open RAN gear (with new fronthaul and backhaul) won’t have wide coverage area for many years. Therefore, current customers can’t simply be switched over from legacy wireless infrastructure to Open RAN gear. That means that a separate separate and distinct WIRELESS INFRASTRUCTURE NETWORK must be built and physically installed for Open RAN gear. Yet no one seems to talk or write about that! Why not?

- Open RAN is really only for greenfield carriers with NO EMBEDDED WIRELESS INFRASTRUCTURE. Rakuten and Dish Network are two such carriers ideally suited to Open RAN. That despite a lot of noise from AT&T and Deutsche Telekom about Open RAN trials. All the supporting quotes from legacy carriers are indicative of their interest in open source software AND hardware: to break the stranglehold the huge wireless equipment vendors have on cellular infrastructure and its relatively high costs of their proprietary network equipment and element management systems.

- Open RAN should definitely lower initial deployment costs (CAPEX), but may result in INCREASED maintenance cost (OPEX) due to the difficulty of ensuring multi-vendor interoperability, systems integration and MOST IMPORTANTLY tech support with fault detection and rapid restoration of service.

Conclusions:

Considering all of the above, one may conclude that traditional cellular infrastructure, based on vendor specific equipment and proprietary interfaces, will remain in place for many years to come. As a result, Open RAN becomes a decent market for greenfield carriers and a small market (trial or pilot networks) for legacy carriers, which become brownfield carriers after Open RAN is commercially available to provide their cellular services.

Given a smaller than commonly believed market for Open RAN, this author believes the SD-RAN project is a very good idea. That’s because it will make open source software available for Open RAN equipment, something that neither the O-RAN Alliance of TIP Open RAN project are doing. Of course, having more vendors producing Open RAN white boxes and software does add to the systems integration and tech support that only large (tier 1) telcos (like AT&T, Deutsche Telekom, NTT and cloud companies (like Google, Facebook, Microsoft) have the staff to support.

In a follow up phone conversation today, Timon Sloane told me that network operators want a fully functional and powerful RAN Intelligent Controller (RIC) to gain visibility and control over their RANs, but that has yet to be realized. To date, such controllers have been proprietary, rather than open source software.

The ONF µONOS-RIC is a key software module to realize that vision, Timon said. It is very much like a (near) real time operating system for an Open RAN. If successful, it will go a long way to promote multi-vendor interoperability for Open RAN deployments. Success and good luck ONF!

………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.prnewswire.com/news-releases/onf-announces-new-5g-sd-ran-project-301117481.html

https://www.sdxcentral.com/articles/news/onf-picks-up-where-o-ran-alliance-falls-short/2020/08/

Verizon and Ericsson proof-of-concept trial of Integrated Access Backhaul (IAB) for 5G mmWave network

Today, Verizon and Ericsson announced the successful test of an alternative wireless solution for fiber backhaul: a battery-powered millimeter wave (mmWave) cell site that can be rapidly deployed for wireless 5G network backhaul, while awaiting permanent fiber or power cabling to be installed. The technology trialed can also be used for quick cell site deployments (without fiber backhaul) in emergency mobile communications with first responders.

For years, regulatory approvals, permitting, licensing for small cells coupled with long times for physical installation of fiber for cell backhaul builds, have slowed down 4G-LTE deployments. Given the dramatic increase in cell sites (macro and small) required to build out 5G (especially mmWave with its short range), this deployment bottleneck will get a whole lot worse. Verizon refers to its mobile 5G network as “5G Ultra Wideband.”

……………………………………………………………………………………………….

Verizon 5G mm Wave Cell being installed. Photo Credit: Verizon

The Verizon/ Ericsson trial used Integrated Access Backhaul (IAB) technology, which Verizon said last year would be a key tool to expanding its emerging (pre-standard) 5G mobile network.

Verizon IAB uses airlink (aka cellular) connections over mmWave spectrum instead of fiber for part of the wireless signals journey from the user to the (4G or 5G) core of the network. It dynamically allocates a portion of bandwidth for consumers to send data to base stations/small cells and another portion for the cells to connect with the core of the network.

Using mmWave with IAB for both parts of the connection (cell to/from device AND cell to/from 4G-5G core) obviates the immediate need for fiber backhaul. However, when fiber has been installed and lit, it can replace the portion of the wireless network delivering data to the 4G/5G network core. That’s because the millimeter wave spectrum allocated to wireless backhaul can be reallocated for cell to/from wireless device connections once the fiber backhaul infrastructure is in place. That simultaneously boosts both device access speeds and network performance.

IAB is a smart use for millimeter wave spectrum, which prior to the 5G era was widely viewed as unusable for consumer devices and instead was used for applications like line of sight, point-to-point high speed Internet access.

“Fiber is the ideal connection between our network facilities,” said Bill Stone, Verizon’s Vice President of Planning, in a press release. “It carries a ton of data, is reliable, and has a long roadmap ahead as far as technological advancements. It is essential. However, this new IAB technology allows us to deploy 5G service more quickly and then fill in the essential fiber at a later time.”

In an email exchange with RCR Wireless, Karen Schulz, a spokesperson for Verizon, provided further insight into Stone’s comment regarding the role that IAB technology will ultimately play in Verizon’s 5G network.

“We have another phase of trials coming up that will incorporate multi-hops,” Schulz told RCR Wireless. “That is our next step leading to commercial deployment.”

She added that the plan is to actively use IAB as an “acceleration tool” in Ultra Wideband service deployment within UWB footprints.

“Meaning,” she explained, “that it will help us get 5G sites on the air more quickly […] but we do not intend to use the airlink indefinitely. It will help us speed the deployment of cell sites and we will use the airlink for backhaul until we are able to run fiber to the site.”

“Ericsson’s microwave and fiber mobile transport solutions are an important enabler for 5G services,” said Ulf Forssen, Head of Standards & Technology, Development Unit Networks, Ericsson. “This IAB proof of concept demonstrates a complementary solution, enabling faster deployment of the high-quality, high-performance 5G transport needed in a 5G world.”

……………………………………………………………………………………………….

New resources for first responders:

Verizon said that the proof-of-concept also demonstrated that mobile cell sites, which often are deployed during emergencies, can be served by IAB:

In addition to bringing new cell sites on air more efficiently, this proof-of-concept trial showed that mobile cell sites can also be connected using IAB. This becomes a critical asset for first responders and public safety agencies who need temporary cell coverage for search and rescue operations, disaster recovery efforts or other emergency situations. Verizon owns a fleet of mobile cell sites which are regularly deployed for these situations. However, until recently they have required a fiber connection to carry data, restricting where they can be deployed, or a satellite connection, which are limited and costly. Now, with IAB technology, coupled with portable generators for power, cell sites can be deployed more rapidly and to a wider range of locations.

“When our first responders need us, we will be there with the resources they need to accomplish their mission critical work,” said Stone. “IAB technology gives us many more options to ensure communications resources are where our first responders need them anytime they call on us.”

…………………………………………………………………………………………………….

Author’s Note:

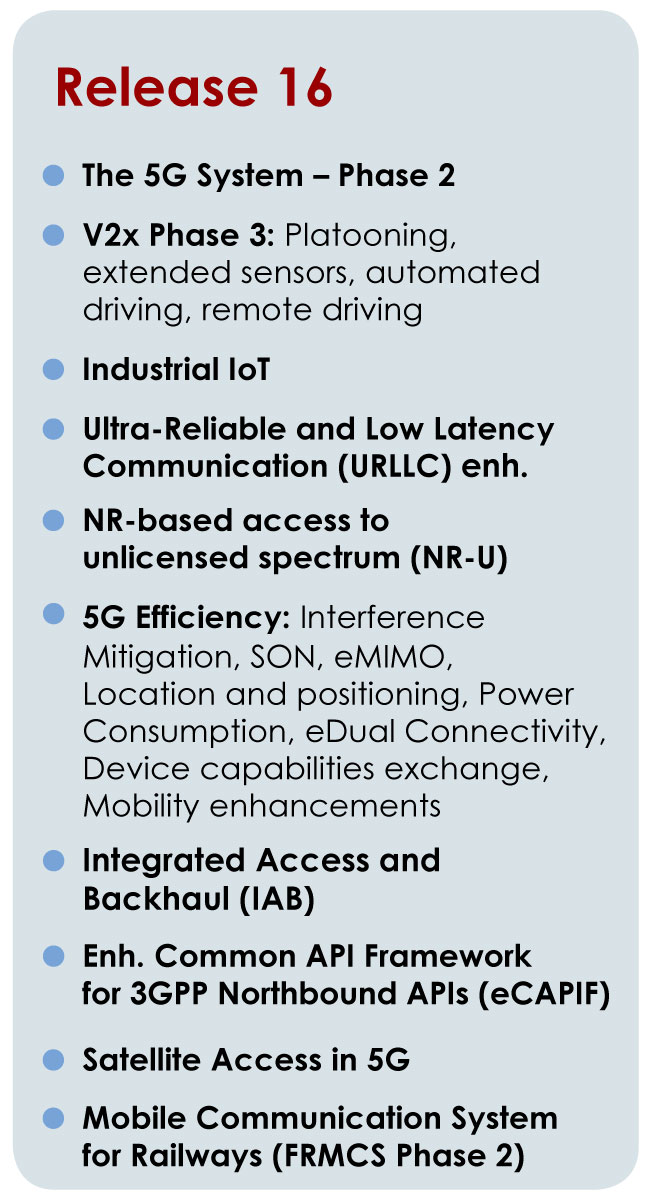

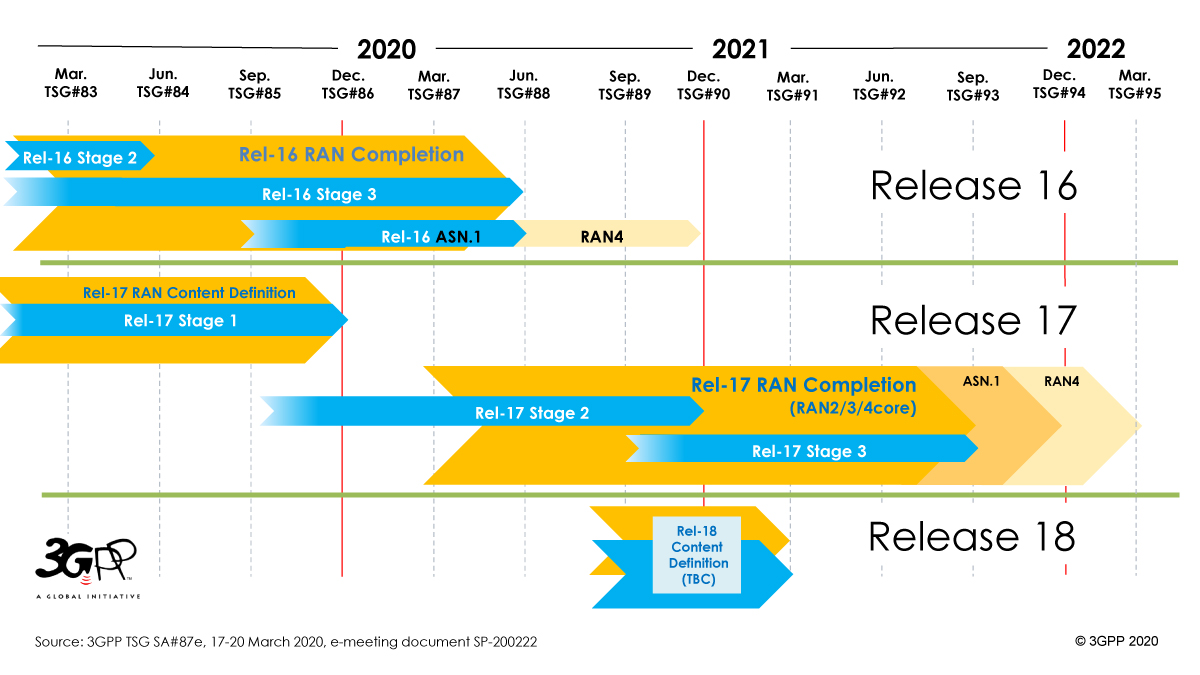

IAB is a component of the 3GPP’s Release 16, which was frozen on July 3, 2020.

IAB doesn’t seek to replace traditional and fiber connections between cell towers, which enable massive quantities of data to be transmitted over networks. Instead, it enables wireless carriers the ability to set up a completely mobile 5G cell site in an area that doesn’t yet have power and/or fiber.

That could give first responders immediate access to 5G’s ultra high bandwidth and low latency for emergency drone operations or video conferences, while Verizon or other carriers work with partners and local governments to install permanent wired infrastructure.Verizon notes that while it’s still betting heavily — billions of dollars — on fiber, IAB will enable it to launch 5G services faster at specific locations, “then fill in the essential fiber at a later time.”

…………………………………………………………………………….

Appendix: 5G mmWave Frequencies:

Based on ITU-R WRC 19 conference recommendations, ITU-R WP5D is revising of Recommendation ITU-R M.1036-6: Frequency arrangements for implementation of the terrestrial component

of International Mobile Telecommunications in the bands identified for IMT in the Radio Regulations.

The new spectrum added will include the following mmWave frequencies, which are likely to be used with the forthcoming IMT 2020.specs standard:

Frequency arrangements in the bands: 24.25-27.5 GHz, 37-43.5 GHz, 45.5-47 GHz. 47.2-48.2 GHz, 66-71 GHz. Those mmWave frequencies will all use unpaired TDD for duplex operation, i.e. separation of input/output transmissions over the same frequency bands.

References:

Verizon, Ericsson test IAB as an ‘acceleration tool’ for 5G deployment

Verizon and Ericsson test instant 5G cell towers for emergencies

Non-coherent Massive MIMO for High-Mobility Communications

By Ana García Armada, PhD, Professor at Universidad Carlos III de Madrid

Introduction:

While driving on a highway in Europe (as a passenger), I tried my smartphone’s 4G-LTE connection and the best I could get was 30 Mbps downlink, 10 Mbps uplink, with latency around 50 msec. This is not bad for many of the applications we use today, but it is clearly insufficient for many low latency/low jitter mobile applications, such as autonomous driving or high-quality video while on the move.

At higher speeds, passengers of ultra-fast trains may enjoy the travel while working. Their 4G-LTE connections are often good enough to read or send emails and browse the internet. But would a train passenger be able to have a video conference call with good quality? Would we ever be able to experience virtual reality or augmented reality in such a high mobility environment?

How to achieve intelligent transport systems enabling vehicles to communicate with each other has been the subject of several papers and reports as per Reference [1]. Many telecommunications professionals are looking to 5G for a solution, but it is not at all certain that the IMT 2020 performance requirements specified in ITU-R M.2410 for low latency with high speed mobility will be met anytime soon (by either 3GPP Release 16 or IMT 2020 compliant specifications).

Editor’s Note: In ITU-R M.2410, the minimum requirements for IMT 2020 (“5G”) user plane latency are: 4 ms for eMBB (enhanced mobile broadband) and 1 ms for URLLC (ultra high reliability, ultra low latency communications).

IMT 2020 is expected to be approved by ITU-R SG D after their November 23-24,2020 meeting, which is one week after the ITU-R WP 5D approval at their November 17-19, 2020 meeting.

There are three different “5G Radios” being progressed as IMT 2020 RIT/SRIT submissions: 3GPP, DECT/ETSI, and Nufront. The TSDSI’s (India) submission adds Low Mobility Large Cell (LMLC) to 3GPP’s “5G NR.”

……………………………………………………………………………………………………………………………………….

The fundamental reason why we do not experience high data rates using 4G-LTE lies in the signal format. That did not change much with 3GPP’s “5G NR,” which is the leading candidate IMT 2020 Radio Interface Technology (RIT). Please refer to Editor’s Note above.

In coherent detection, a local carrier mixes with the received radio frequency (RF) signal to generate a product term. As a result, the received RF signal can be frequency translated and demodulated. When using coherent detection, we need to estimate the channel (frequency band). The amount of overhead strongly depends on the channel variations. That is, the faster we are moving, the higher the overhead. Therefore, the only way to obtain higher data rates in these circumstances is to increase the allocated bandwidth (e.g. with carrier aggregation [2]) for a particular connection, which is obviously a non-scalable solution.

Coherent Communications, CSI, and OFDM Explained:

A coherent receiver creates a replica of the transmitted carrier, as perfectly synchronized (using the same frequency and the same phase) as possible. Combining coherent detection with the received signal, the baseband data is recovered with additive noise being the only impairment.

However, the propagation channel usually introduces some additional negative effects that distorts the amplitude and phase of the received signal (when compared to the transmitted signal). Hence, the need to estimate the channel characteristics and remove the total distortion. In wireless communications, channel state information (CSI) refers to known channel properties of a communication link, i.e. the channel characteristics. CSI needs to be estimated at the receiver and is usually quantized and sent back to the transmitter.

Orthogonal frequency-division multiplexing (OFDM) is a method of digital signal modulation in which a single data stream is split across several separate narrowband channels at different frequencies to reduce interference and crosstalk. Modern communications systems using OFDM carefully design reference signals to be able to estimate the CSI as accurately as possible. That requires pilot signals in the composite Physical layer frame (in addition to the digital information being transmitted) in order to estimate the CSI. The frequency of those reference signals and the corresponding amount of overhead depends on the characteristics of the channel that we would like to estimate from some (hopefully) reduced number of samples.

Wireless communications were not always based on coherent detection. At the time of the initial amplitude modulation (AM) and frequency modulation (FM), the receivers obtained an estimate of the transmitted data by detecting the amplitude or frequency variations of the received signal without creating a local replica of the carrier. But their performance was very limited. Indeed, coherent receivers were a break-through to achieve high quality communications.

Other Methods of Signal Detection:

More recently, there are two popular ways of non-coherently detecting the transmitted data correctly at the receiver.

-

One way is to perform energy or frequency detection in a similar way to the initial AM and FM receivers.

-

In differential encoding, we encode the information in the phase shifts (or phase differences) of the transmitted carrier. Then, the absolute phase is not important, but just its transitions from one symbol to the other. The differential receivers are much simpler than the coherent ones, but their performance is worse since noise is increased in the detection process.

Communications systems that prioritize simple and inexpensive receivers, such as Bluetooth [3], use non-coherent receivers. Also, differential encoding is an added feature in some standards, such as Digital Audio Broadcasting (DAB). The latter was one of the first, if not the first standard, to use OFDM in wireless communications. It increases the robustness to mitigate phase distortions, caused by the propagation channel for mobile, portable or fixed receivers.

However, the vast majority of contemporary wireless communications systems use coherent detection. That is true for 4G-LTE and “5G NR.”

Combining non-coherent communications with massive MIMO:

Massive MIMO (multiple-input, multiple-output) groups together antennas at the transmitter and receiver to provide better throughput and better spectrum efficiency. When massive MIMO is used, obtaining and sharing CSI threatened to become a bottleneck, because of the large number of channels that need to be estimated because there are a very large number of antennas.

A Universidad Carlos III de Madrid research group started looking at a combination of massive MIMO with non-coherent receivers as a possible solution for good quality (user experience) high speed mobile communications. It is an interesting combination. The improvement of performance brought by the excess of antennas may counteract the fundamental performance loss of non-coherent schemes (usually a 3 dB signal-to-noise ratio loss).

Indeed, our research showed that if we take into account the overhead caused by CSI estimation in coherent schemes, we have shown several cases in which non-coherent massive MIMO performs better than its coherent counterpart. There are even cases where coherent schemes do not work at all, at least with the overheads considered by 4G-LTE and 5G (IMT 2020) standards. Yet non-coherent detection usually works well under those conditions. These latter cases are most prevalent in high-mobility environments.

Editor’s Note: In ITU-R M.2410, high speed vehicular communications (120 km/hr to 500 km/hr) is mainly envisioned for high speed trains. No “dead zones” are permitted as the “minimum” mobility interruption time is 0 ms!

When to use non-coherent massive MIMO?

Clearly in those situations where coherent schemes work well with a reasonable pilot signal overhead, we do not need to search for alternatives. However, there are other scenarios of interest where non-coherent schemes may substitute or complement the coherent ones. These are cases when the propagation channel is very frequency selective and/or very time-varying. In these situations, estimating the CSI is very costly in terms of resources that need to be used as pilots for the estimation. Alternatives that do not require channel estimation are often more efficient.

An interesting combination of non-coherent and coherent data streams is presented in reference [5], where the non-coherent stream is used at the same time to transmit data and to estimate the CSI for the coherent stream. This is an example of how coherent and non-coherent approaches are complementary and the best combination can be chosen depending on the scenario. Such a hybrid scheme is depicted in the figure below.

Figure 1. Suitability of coherent (C), non-coherent (NC) and hybrid schemes (from reference [5])

……………………………………………………………………………………………………………………………………………………….

What about Millimeter Waves and Beam Steering?

The advantage of millimeter waves (very high frequencies) is the spectrum availability and high speeds. The disadvantages are short distances and line of sight communications required.

Compensating for the overhead by adding more bandwidth, may be a viable solution. However, the high propagation loss that characterizes these millimeter wave high frequency bands creates the need for highly directive antennas. Such antennas would need to create narrow beams and then steer them towards the user’s position. This is easy when the user equipment is fixed or slowly moving, but doing it in a high speed environment is a real challenge.

Note that the beam searching and tracking systems that are proposed in today’s wireless communications standards, won’t work in high speed mobile communications when the User Endpoint (UE) has moved to the coverage of another base station at the time the steering beams are aligned! There is certainly a lot of research to be done here.

In summary, the combination of non-coherent techniques with massive MIMO does not present any additional problems when they are carried out in millimeter wave frequencies. For example, reference [6] shows how a non-coherent scheme can be combined with beamforming, provided the beamforming is performed by a beam tracking procedure. However, the problem of how to achieve fast beam alignment remains to be solved.

Concluding Remarks:

Non-coherent massive MIMO makes sense in wireless communications systems that need to have very low complexity or that need to work in scenarios with high mobility. Its advantage is that it makes possible communications in places or circumstances where the classical coherent communications fail. However, this scheme will not perform as well as coherent schemes under normal conditions.

Most probably, non-coherent massive MIMO will be used in the future as a complement to well-understood and (usually) well-performing coherent systems. This will happen when there are clear market opportunities for high mobility, high speed, low latency use cases and applications.

References:

[1] ITU report: “Setting the scene for 5G: opportunities and challenges”, 2018, https://www.itu.int/en/ITU-D/Documents/ITU_5G_REPORT-2018.pdf

[2] F. Kaltenberger et al., “Broadband wireless channel measurements for high speed trains,” 2015 IEEE International Conference on Communications (ICC), London, 2015, pp. 2620-2625, doi: 10.1109/ICC.2015.7248720.

[3] L. Lampe, R. Schober and M. Jain, “Noncoherent sequence detection receiver for Bluetooth systems,” in IEEE Journal on Selected Areas in Communications, vol. 23, no. 9, pp. 1718-1727, Sept. 2005, doi: 10.1109/JSAC.2005.853791.

[4] ETSI ETS 300 401, “Radio broadcasting systems; DAB to mobile, portable and fixed receivers,” 1997.

[5] M Lopez-Morales, K Chen Hu, A Garcia Armada, “Differential Data-aided Channel Estimation for Up-link Massive SIMO-OFDM”, IEEE Open Journal of the Communications Society -> in press.

[6] K Chen Hu, L Yong, A Garcia Armada, “Non-Coherent Massive MIMO-OFDM Down-Link based on Differential Modulation”, IEEE Trans. on Vehicular Technology -> in press.

……………………………………………………………………………………………………………………………………………………….

About Ana García Armada, PhD:

- Spanish version (updated Jan 2020)

- English version (updated Jan 2020)

- Google Scholar: link

- ResearchGate: link

- Academia.edu: link

China Mobile has 15.4 million 5G customers; 5G+ is primary focus area

China Mobile today published its 2019 annual financial report, stating that the company’s operating revenue reached CNY745.9 billion -a year-on-year increase of 1.2% – and its net profit was CNY106.6 billion ($15 billion) – a year-on-year decrease of 9.5%.

The fall in net profits was largely due to a spike in financing costs – up from RMB144 million ($20.2 million) to RMB3.25 billion ($460 million).

Operating revenue was just 1.2% higher, at RMB745.9 billion ($104.8 billion), while telecom services revenue improved by a meager 0.5%.

A few highlights:

- The largest China telecom network provider acquired 15.4 million 5G customers in the first three months after launch.

- In 2019, China Mobile’s mobile users increased by 25.21 million, reaching a total of 950 million. Its mobile Internet data traffic increased by 90.3% year-on-year and its mobile Internet DOU reached 6.7GB.

- Wireline broadband customers grew by 30.35 million to a total of 187 million.

- China Mobile’s family broadband users reached 172 million, an increase of 17.1% year-on-year. Its family broadband comprehensive ARPU reached CNY35.3.

- At the end of 2019, China Mobile’s government and corporate clients reached 10.28 million, a year-on-year increase of 43.2%. The company’s international business revenue saw a year-on-year increase of 31.4%.

Mr. Yang Jie, China Mobile’s Chairman of the Board said in the press release:

“We were faced with a challenging and complicated operating environment in 2019 where the upside of data traffic was rapidly diminishing and competition within the telecommunications industry and from cross-sector players was becoming ever more intense. Coupled with this was the impact of government policies, including the continued implementation of the “speed upgrade and tariff reduction.”

Against this backdrop, all of us at China Mobile joined together to overcome these hurdles and work towards our ultimate goal of becoming a world-class enterprise by building a dynamic “Powerhouse”. This was centred on the key strategy of high-quality development, supported by a value-driven operating system that leverages our advantages of scale to drive further convergence, integration and digitization across the board.

We structured our organization to enable effective and synergetic capability building and collaborative growth, while nurturing internal vitality. In addition, we further implemented our “5G+” plan to spearhead the development of “four growth engines”, comprising the “customer,” “home,” “business” and “new” markets. These measures have helped us obtain positive momentum in overall operating results, which was a hard-earned achievement for us in a tough year.”

Yang noted that the COVID-19 epidemic had driven more and more businesses and consumers online and encouraged greater takeup of digital and cloud-based services. “We will leverage these opportunities, as well as the 5G network, to further develop the information and communications services market.”

Business Market:

The “business” market was China Mobile’s new growth engine and we strove to nurture new growth points by fully leveraging our cloud and network convergence advantages, building on our DICT (data, information and communications technology) infrastructure comprising IDC, ICT, Mobile Cloud, big data and other corporate applications and information services. Buoyed by active promotion of our “Network + Cloud + DICT” smart services, customers and revenue recorded rapid growth.

As of the end of 2019, the number of corporate customers increased to 10.28 million, representing year-on-year growth of 43.2%.

Focusing on key sectors such as industry, agriculture, education, public administration, healthcare, transportation and finance, the company deepened go-to-market resources to promote DICT solutions that cater to sector-specific scenarios. This strategy has boosted DICT revenue to RMB26.1 billion, or growth of 48.3% year-on-year, contributing a larger portion of our overall revenue.

“5G+” Achieved a Good Start:

China Mobile sped up the development of 5G and have been fully implementing its “5G+” plan since June 2019, when we were granted the 5G licence. These initiatives have shown good initial results.

The company actively participated in setting international standards for 5G to drive technological development. It led 61 key projects in relation to 5G international standards setting and own more than 2,000 5G patents. It also helped to continuously strengthen the Standalone 5G (within 3GPP Release 15 and 16).

Its “six international standards (3GPP specifications are not standards) on 5G system architecture” and “38 international standards including 5G NR (New Radio) terminals and base station radio frequency” scooped all the top prizes in the 2019 Science and Technology Awards presented by the China Communications Standards Association, demonstrating our leadership in 5G communications standards.

At the same time, the company accelerated the implementation of “5G+” by formulating well- coordinated development of 5G and 4G. It constructed and began operating more than 50,000 5G base stations and launched 5G commercial services in 50 cities. Emerging technologies such as AI, IoT (Internet of Things), cloud computing, big data and edge computing were assimilated into 5G (5G+AICDE) and developed more than 200 critical capabilities, while making breakthroughs in over 100 5G joint projects.

In terms of 5G+Eco, we aimed to develop the ecosystem with other industry players. Through its 5G Innovation Centre and 5G Industry Digital Alliance, more than 1,900 partners were attracted.

The 5G Device Forerunner Initiative, guiding manufacturers to launch 32 5G devices, was established. The level of maturity was basically the same between the 2.6 GHz and 3.5 GHz industry chains. Benefiting from forward-looking planning and effective execution, we expanded 5G+X, where “X” stands for the wider application of 5G, in applications that have been adopted by a plethora of industry sectors, as well as the mass market. For the latter, we launched exclusive plans for 5G customers and feature services such as ultra-high definition videos, cloud-based games and full-screen video connecting tones. As of the end of February 2020, our 5G plans attracted 15.40 million package customers – maintaining an industry-leading position.

In terms of vertical sector, China Mobile explored the possibility of combining 5G with AICDE capabilities, extending collaboration in the industry and deep-diving into classic manufacturing scenarios to develop our leadership in 5G smart manufacturing, 5G remote medical services and 5G automated mining, among other sectors. A total of 50 group-level demo application projects were implemented.

Looking ahead, 5G presents infinite possibilities. China Mobile will continue to take a systematic approach to planning and steadily implementing our “5G+” initiatives. The company will speed up technology, network, application, operations and ecosystem upgrades, accelerate industry transformation by converging technologies, integrate data to strengthen information transmission in society, and introduce digitized management to build the foundation for digital society development. By doing so, China Mobile will seek more extensive 5G deployment, covering more sectors and creating greater efficiency and social value.

…………………………………………………………………………………………….

References:

https://www.chinamobileltd.com/en/file/view.php?id=226450

https://www.chinatechnews.com/2020/03/19/26442-china-mobile-net-profit-down-9-5-in-2019

https://www.lightreading.com/asia/china-mobile-reports-154m-5g-customers/d/d-id/758329?

Telefónica and partners pursue development of 4G/5G Open RAN technology

Telefónica has announced an agreement to develop 4G and 5G Open RAN technology with partner companies Altiostar, Gigatera Communications, Intel, Supermicro and Xilinx. The Spain based pan European network operator also said it intends to launch vendor-neutral 4G and 5G Open RAN trials in UK, Germany, Spain and Brazil this year.

Telefonica said this latest collaboration comprises the necessary design and developments, integration efforts, operational procedures and testing activities required to deploy Open RAN in its networks. The Spanish network operator says this is part of its continuing efforts to lead network transformation towards 5G and that the collaboration would progress the design, development, optimisation, testing and industrialisation of Open RAN technologies across its footprint this year.

The collaboration focuses on the distributed units (DUs) and remote radio units (RRUs). The DUs implement part of the baseband radio functions using the FlexRAN software reference platform and servers based on the Intel Xeon processor. The RRUs connect through open interfaces, based on O-RAN Alliance’s fronthaul specification, and software that manages the connectivity in an open cloud RAN architecture.

Telefonica said DUs and RRUs will be designed with 5G-ready capabilities, meaning they can work in either 4G or 5G mode by means of a remote software upgrade. It will be testing the 4G and 5G hardware and software components in the lab and in the field this year, integrating an Open RAN model as part of its UNICA Next virtualization program.

……………………………………………………………………………………………….

The premise is that Open RAN will be cheaper as it encourages more suppliers into the market, especially in terms of the baseband hardware where economies of scale from using standard IT can be deployed.

A cloudified open radio access architecture can also enable faster software innovation and advanced features like network automation, self-optimization of radio resources and coordination of radio access nodes.

The main goal of the trial is to define precisely the hardware and software components in 4G and 5G to guarantee seamless interoperability. This includes:

• Testing the complete solution in the lab and in the field,

• Integrating the Open RAN model as part of the end-to-end virtualisation program (UNICA Next),

• Maturing the operational model, and

• Demonstrating new services and automation capabilities as offered by the Open RAN model.

The DUs and RRUs are designed with 5G-ready capabilities and so can work in 4G or 5G mode by means of a remote software upgrade.

…………………………………………………………………………………………………………

The OpenRAN trial also supports exposure to third-party, multi-access edge computing (MEC) applications through open Application Programming Interfaces (APIs), and integration with the virtualisation activities in the core and transport networks. Open interfaces also mean that operators can upgrade specific parts of the network without impacting others.

Telefónica describes this openness to third-party MEC applications as “the cornerstone” to bringing added-value to the customers by enabling a variety of rich 5G services, like virtual and augmented reality, online gaming, connected car, the industrial internet of things (IoT) and more.

Edge-computing applications running in the telco cloud can benefit from the strong capillarity of the access network, so services can be tailored instantly to match the users’ needs and the status of the live network.

……………………………………………………………………………………………..

Quotes:

Enrique Blanco, Telefónica’s CTIO: “Once again, Telefónica is leading the transformation towards having the best-in-class networks in our Operations with our customers as key pillars. Open RAN is a fundamental piece for that purpose while widening the ecosystem.”

“Telefónica is known for its leading-edge network and has been championing open vRAN implementations to bring greater network service agility and flexibility,” said Pierre Kahhale, Altiostar Vice President of Field Operations. “By bringing together the best-of-breed innovation, Telefonica is looking to achieve this vision into their network. We look forward to supporting this transformation of Telefonica’s network.”

Heavy Reading principal analyst Gabriel Brown: “Up to now, the open RAN action has been all about 4G. In 5G, the major integrated systems vendors [Ericsson, Huawei, Nokia, Samsung, ZTE] have been supplying their state-of-the-art systems to the market for about 18 months,” creating a big gap between what is available from them and what can be sourced from the open RAN community, says the analyst. “This move by Telefónica could help to stop that gap getting too much wider.”

“Gigatera Communications and Telefonica has been actively working to ensure state of the art technologies are being deployed. We truly value our partnership as we engage and revolutionize the industry.”, Daniel Kim, President.

“Open RAN offers a way for service providers to enhance customer experiences and enable new revenue-generating applications,” said Dan Rodriguez, vice president and general manager of Intel’s Network Platforms Group. “We are collaborating closely with Telefonica and the broader ecosystem, and also participating in initiatives like the O-RAN Alliance, to help accelerate innovation in the industry.”

“Supermicro is excited to partner with Telefónica, a premier telecommunications provider, to deliver server-class 5G solutions based on Open RAN architecture,”, Charles Liang, president and CEO of Supermicro. “Working closely with Telefónica on the deployment of 5G in the significant EMEA region, Supermicro’s history of rapid time-to-market for advanced, high-performance, resource-saving solutions is a key component for the successful implementation of next-generation applications, especially as x86 compute designs migrate to the telco market.”

“Xilinx is excited to collaborate with the disruptive mobile operator Telefónica as it leads the move to O-RAN” said Liam Madden, executive vice president and general manager, Wired and Wireless Group, Xilinx. “Our adaptable technology supports multiple standards, multiple bands and multiple sub-networks, providing Telefónica with a unique and flexible platform for radio, fronthaul, and acceleration for 4G and 5G networks.”

………………………………………………………………………………………………..

References:

https://www.mobileeurope.co.uk/press-wire/telefonica-partners-to-launch-4g-and-5g-open-ran-trials

https://www.totaltele.com/505252/Telefonica-rallies-a-posse-of-Open-RAN-vendors-to-take-on-5G

https://telecominfraproject.com/openran/

https://www.lightreading.com/4g-3g-wifi/telefonica-takes-open-ran-into-5g-territory/d/d-id/758293?

Verizon CEO Hans Vestberg’s technology related remarks on 4Q2019 earnings call

Note: Copy editing was done to correct grammar errors and delete extraneous words/phrases.

- Our partnership with AWS Amazon on the 5G mobile edge compute, is a totally new way of accessing a market that we have not been into.

- We fulfilled our 5G commitment to deploy in 30 cities. We made 31. We said we’re going to launch 5G Home with the NR standard. We did that, and we said we’re going to launch the first 5G mobile edge compute. We did that in Chicago in December.

- If you think about our priorities for 2020, first of all, continue to grow on the core business. We showed this year we can continue to grow 4G and our core business, and that we’ll continue to do in 2020 as well, including building our network to be the best network in this market. Secondly is leveraging our new assets that we’re building.

- We’re building out fiber. We’re building our 5G and seeing that we can start leveraging that with our customer.

- This year, we’ll continue to have a lot of focus on our 5G build-out and we will come back to that later on how we see the 5G market when we will have an Investor Day later in February.

Verizon claims 5G leadership with 31 mobile cities, 16 NFL stadiums, 4 basketball arenas; launched 5G Edge and NR-based 5G Home

………………………………………………………………………………………………………………………………………….

- We’re very excited about the opportunities that Verizon business group has, because that’s why we started building the Verizon Intelligent Edge Network some three, four years ago in order to actually address this market in the best way, and the traction we are seeing with our customers is really good.

- So I think that our technology department have no constraints on what they need to do in 2020. This is what they have plans for in order for us to continue to fortify our 4G network, to continue with strong additions in the 5G as well as continue with our fiber build. And when it comes to the monetization of the fiber build, we’re already starting to do that.

- Many of the fibers right now are going to our cell sites on air because that was a part of it. Then, of course, it has come a little bit later in monetization for our small and medium businesses and enterprise business, etc. But clearly, we’re already now seeing the benefits of doing that. So going into 2020, I think we have a very solid capital allocation for our capex.

- Ronan Dunne (VZ CTO) already said in the beginning of the year that we’re going to have some 20 5G devices coming out in the market this year. So of course, we’re going to see more 5G devices coming out. It’s going to be more build in the markets in 2020 than we had last year. So of course, this is a year that there is going to be even more 5G things coming in. When it comes to any particular phones coming out in the market, we cannot really comment on it because that, we’ll leave to the company to do.

- If this is a market which has a high degree of iOS, that means that when a 5G phone will come out from Apple, that will be important for many consumers to look into what they think is a good change. In our case, I think we’re building a unique 5G experience with our millimeter wave that nobody else is building and have the capability to do. So I think that’s really where the difference will come.

- We already have the best 4G network as you have seen in the latest J.D. Power and RootMetrics. We’re going to continue to have that. So we’re going to give the best experience for customers. And we — and I’m confident that how we are building the network will make a big difference. And that’s why we also feel very confident if — with all these devices coming out, including if the iPhone would come out, that we will have a good chance to actually grab more customers that want to be on our network. When it comes to the spectrum and all of that, I mean, I think that I might have talked about this so many times. We have all the assets to deploy our 5G strategy when it comes to millimeter wave and using dynamic spectrum sharing, be available nationwide when our customers are ready.

- Everything from spectrum to how you densify (wireless) networks and what type of software you put in, and that’s a long-term planning how to do that right. And I think that’s something where you — or people around us go wrong when I look at us because think about how we have been performing, and many actually thought that we would never sustain an unlimited. And the more the network is growing, we’re getting more and more headroom as we’re continuing deploying our software and the engineering capabilities we have in the company.

- We think the C-band (3.7-to-4.2 GHz) is an important spectrum for many reasons. That frequency will be global. So roaming will be done on it, and that’s very important for U.S. market to get into that. And it’s very important for Verizon to get into that. But it’s not hindering our strategy right now to deploy a great 5G network and be able to capture the market for 5G.

- On the CBRS, as you know, we have already started for quite a long time ago to do trials and see how it works, and it works fine. We think it’s a good addition to the portfolio that in order to see that we get good customer expectations. So we think CBRS is an important spectrum, even though it is sort of more share than anything else, but it’s going to be definitely something we’re using as it comes out.

- Secondly, when it comes to the 5G Home, you’re confirming, actually what we have in front of us. The next-generation chipset that goes into the CP for 5G Home will come out. At least, the plan right now is in third quarter, which means that commercial product is probably coming out a little bit later because it takes some time from the chipset to the device. By then, we will have, of course, deployed far more millimeter wave across the country, so we will be able to start launching many more markets when that happens. So that will come back to a little bit more about that when have our Investor Day the 13th of February, talk a little bit more about it. But that’s in the grand scheme, the plans for 5G Home, and that’s no different from what we said half a year ago.

- When it comes to the mix and match, we want to give our (residential) customers options on top of the broadband. If it’s the fiber broadband or if it’s the 5G Home broadband, we want to give them options. Of course, one option is always to have a broadband and having over-the-top services. But another is, of course, giving the mix and match option right now to see that they use the right packages that is more fitted for them. Still, of course, it’s what they can choose whatever channels you have because they come in packages. But the early — or early indication is, of course, that customers that has been on trial for a month, they clearly see what channels they’re using and what package we can suggest for that, that is going to be more optimized. So I think for us, we just think about our customers and where the market is going, and we want to give them the option of actually having different ways they can address the market when it comes to their content consumption. And I think it’s good for our customer experience, but it’s also good for our customers because all of them can do it. So as you said, it’s a little bit early, but I think that our customers are very happy that we’re giving them this option. And I think this is what everyone see where the market is going, meaning more and more over-the-top content is coming in and you want — you need thought, mixing and matching that. And here, we have a great opportunity given our service strategy, and we can work with all the type of option in the content market as we’re not owning any content.

- We always do the trade-off between owning and leasing or sharing fiber with someone, and that is a very prudent or financially disciplined way of looking at our deployment. In many cases, we see it as owning it has really an advantage for us because of the multi-use of our network. Now we’re doing sites all the time. We’re going to create revenue for our business side. So we probably have a couple of years left on doing that. But in general, I feel good about the pace we have right now and the multi-use of the fiber we have. And I think this is one of the most critical assets in a network today — in today’s world, especially as we build Verizon Intelligent Edge Network and you want actually to start delivering the 5G experience that we’re expecting. We need this fiber to be there. So that’s basically where we are with the fiber.

- We have already gotten Dynamic Spectrum Sharing (DSS) to work from the software point of view. And the majority of our baseband is ready for taking DSS. So what we have said, I’m not going to give you an exact date, but I’m going to tell you, we’re going to be ready when we feel the market is ready and our customers need to have that coverage. And again, remember, we want to have the best network performance-wise. We don’t want to deploy it because it’s called 5G. We want to see that we actually give a superior performance to our customers. And that’s why we think that the millimeter wave, what we’re doing there is extremely important because we talked about 10 to 20x, at least more throughput and speed than we have on the 4G network, and we still have the best 4G network. So I think that’s what we already assessed. When we meet at the Investor Day, we’re going to talk a little bit more about the technology sector.

- When it comes to the 5G and where we are, I think that you saw last year that we had a strong deployment coming in during ’19, but of course, we have even higher ambitions in ’20. And we will also come back and talk a little bit about — more about that. But it goes in all three directions in our multipurpose network. It’s for the mobility case, for the home case, and it’s also for the 5G mobile edge compute case, not forgetting that, because all three of them are using our multipurpose network. And when it comes to use cases, I can do some of them.

- On the mobile edge compute, we see a lot of optimization in factories. We see private 5G networks in order to keep the data and the security and the throughput in a facility, if that’s a campus, whatever, that use case has come up very early on.

- What we can do with millimeter wave in the stadium, how we can use broadcasting cameras with 5G, a lot of new innovation, both with consumer, but also for the distribution of content. With our spectrum positioning, we basically are limited on the uplink when it comes to stadiums, which is the big blocker today in a stadium. So I think you’re going to see quite a lot next four or five days on consumer cases (at the NFL Superbowl in Miami, FL) as well as we will continue to give you more insights to it the next couple of weeks and when we meet in New York here.

- We have told you where 5G will come in, which is more of 2021. So we work with assets we have right now, but we build also a great foundation on 5G going forward for the years after.

…………………………………………………………………………………………………….

2020 Priorities for Verizon: Executing 2020 from a position of strength

1. Strengthen & Grow Core Business

• Extend our network leadership through continued innovation

• Strengthen and grow core business in Consumer, Business & Media

2. Leverage Assets to Drive New Growth

• Scale 5G / MEC / OneFiber & other assets for new growth

• Differentiate brand through trust & innovation

3. Drive Financial Discipline & Strength in Balance Sheet

• Accelerate revenue and earnings growth to drive strong cash flows

• Disciplined capital and operating spend

4. Infuse a PurposeDriven & CustomerCentric Culture

• Put customers at the center of everything we do

• Drive responsible business as part of our strategy

References:

https://www.verizon.com/about/investors/quarterly-reports/4q-2019-earnings-conference-call-webcast

Samsung acquires network services provider TWS; SK-Telecom launches Global MEC Task Force

1. Samsung Acquires Network Services Provider TeleWorld Solutions to Accelerate U.S. 5G Network Expansion

Samsung Electronics Co., Ltd. today announced the completion of an agreement to acquire TeleWorld Solutions (TWS), a network services provider headquartered in Chantilly, VA.

TWS provides network design, testing and optimization services to mobile service and cable operators, equipment OEMs and other companies across the U.S. With network builds associated with 5G and 4G LTE enhancements advancing in the U.S, the acquisition will address the need for end-to-end support in delivering network solutions.

TWS, a privately owned company, will operate as a wholly owned subsidiary of Samsung Electronics America, Inc. The service offerings and customers of TWS complement Samsung’s growth among networks infrastructure clients. With competencies in radio frequency (RF) and network design service—as well as installation, testing, and optimization services—TWS will continue to serve its existing customers and clients they currently support with Samsung. The TWS leadership team will continue to manage the business and, together with Samsung, address the network upgrade cycle occurring in the US.

With a growing position in the US networks industry, along with its 5G technology leadership, Samsung Networks has collaborated with major U.S. network operators to fulfill 5G’s network expansion. As its growth continues through network operator agreements and enterprises seeking their own cellular networks, the combination of Samsung and TWS will help customers address next-generation demands.

…………………………………………………………………………………………………………..

2. SK Telecom Joins Forces with Bridge Alliance Members for Cooperation in 5G MEC

SK Telecom today announced the launch of the ‘Global MEC Task Force’ with Bridge Alliance member operators, including Singtel, Globe, Taiwan Mobile and PCCW Global, for cooperation in 5G mobile edge computing (MEC).

SK Telecom will share its lessons-learned in 5G and MEC areas with other members that are preparing to launch 5G, while making joint efforts for the development of MEC technologies and services. The company will also play a leading role in setting international MEC standards to build an interoperable MEC platform.

MEC is being highlighted as a key technology that can improve the performance of ultra-low latency services such as cloud gaming, smart factory and autonomous driving by creating a shortcut for mobile data communications.