4G

Samsung and Marvell develop SoC for Massive MIMO and Advanced Radios

Korean electronics giant Samsung Electronics said it has developed a new System-on-Chip (SoC) for its Massive MIMO and other advanced radios in partnership with U.S. chipmaker Marvell. It is expected to be available in Q2 2021 for use in equipment sold to Tier-One network operators.

The SoC is designed to help implement new technologies, which improve cellular radios by increasing their capacity and coverage, while decreasing power consumption and size. The new SoC is equipped to support both 4G and 5G networks simultaneously and aims to improve the capacity and coverage of cellular radios. It is claimed to save up to 70 percent in chipset power consumption compared to previous solutions.

“We are excited to extend our collaboration with Marvell to unveil a new SoC that will combine both companies’ strengths in innovation to advance 5G network solutions,” said Junehee Lee, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “Samsung prioritizes the development of high-impact 5G solutions that offer a competitive edge to our operators. We look forward to introducing this latest solution to the market shortly.”

Samsung and Marvell have been working closely to deliver multiple generations of leading network solutions. Last year, the companies announced a collaboration to develop new 5G products, including innovative radio architectures to address the compute power required for Massive MIMO deployments.

“Our collaboration with Samsung spans multiple generations of radio network products and demonstrates Samsung’s strong technology leadership. The joint effort includes 4G and 5G basebands and radios,” said Raj Singh, Executive Vice President of Marvell’s Processors Business Group. “We are again honored to work with Samsung for the next generation Massive MIMO radios which significantly raise the bar in terms of capacity, performance and power efficiency.”

“Marvell and Samsung are leading the way in helping mobile operators deploy 5G with greater speed and efficiency,” said Daniel Newman, Founding Partner at Futurum Research. “This latest collaboration advances what’s possible through SoC technology, giving operators and enterprises a distinct 5G advantage through optimized performance and power savings in network deployments.”

Samsung has pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios, and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing connectivity to hundreds of millions of users around the world.

……………………………………………………………………………………………………………………………………………….

On the network equipment side, Samsung Electronics recently won a 5G contract with Japanese telco NTT DOCOMO, as it seeks to challenge incumbents like Huawei, Ericsson, and Nokia in the telecom equipment business, according to media reports.

In India, Samsung Electronics is likely to apply for a production-linked incentive (PLI) scheme for telecom equipment manufacturing, benefiting from India’s program to locally make 4G and 5G gear and other equipment – for sales both in India and overseas, ET recently reported.

Samsung would then join other global manufacturers such as Cisco, Jabil, Flex and Foxconn, besides European telecom equipment vendors Nokia and Ericsson in applying for the PLI scheme that seeks to boost local production of telecom equipment and reduce imports.

References:

https://telecom.economictimes.indiatimes.com/news/samsung-marvell-develop-soc-for-5g-radios/81720284

Samsung Boosts the Performance of Massive MIMO

Samsung Collaborates With NTT DOCOMO on 5G

Strategy Analytics: Global sales of 4G, 5G-enabled PCs rise 70% in 2020

Global sales of cellular-enabled mobile PCs grew by 70% to an annual record of over 10 million units for the first time in 2020 as home workers sought improved connectivity in response to the closure of office facilities during the Covid-19 pandemic, according to an analysis from Strategy Analytics.

North America accounted for nearly half of 3G, 4G and 5G-enabled PC shipments, while Europe and Asia-Pacific accounted for 45%. The researchers estimate that more than 26 million cellular-enabled PCs are now in use worldwide, an increase of 25 percent in twelve months.

While 4G-LTE dominated the market in 2020, accounting for 97% of cellular-enabled PC shipments, 5G notebook launches in 2021 are showing a greater diversity in price points, form factors and vendor participation, the study said. The researchers expect 5G to build its share towards 69 percent by 2025, a growth that will depend on improvements in customer education by vendors, carriers and retailers.

“What form new pricing plans take in the 5G world must be informed by a holistic view of the consumer, which devices they use where, and what they use them for,” says Chirag Upadhyay, Industry Analyst. “In the enterprise space, vendors, carriers and resellers must be able to explain how connected notebooks help save companies money in the field and help reduce security breaches compared to mobile hotspots or dongles.”

Eric Smith, Director, Connected Computing Devices, added: “We see this is a ‘when’ problem, not an ‘if’ problem. Cellular connected notebooks will become more commonplace over the next decade but the key to when that happens lies in how industry players introduce the idea to consumers. A clear view into how users choose cellular plans is crucial for vendors, carriers, and even retailers to understand how to better educate consumer segments of more cellular-embedded options.”

References:

Another Open RAN Consortium: 5G Open RAN Ecosystem led by NTT Docomo

Japan wireless network operator NTT Docomo has partnered with 12 companies to create the ‘5G Open RAN Ecosystem.’ The companies are: Dell Technologies Japan, Fujitsu, Intel, Mavenir, NEC, NTT Data, Nvidia, Qualcomm Technologies, Red Hat, VMware, Wind River and Xilinx.

Their plan is to accelerate open radio access networks (Open RAN) and help enable global network deployment to serve diverse company and operator needs in the 5G era.

The O-RAN Alliance, which NTT Docomo has helped lead since its launch, has developed specifications and promoted products that allow operators to combine disaggregated base station equipment. Docomo has been actively developing the products for its own 4G/5G network in Japan.

Docomo will start talks with the 12 companies on accelerating open RAN introduction to operators.

Specifically, NTT DOCOMO’s target is to package best-of-breed RAN and to introduce, operate and manage them based on demands from operators considering open RAN introduction. By leveraging its years of activities in driving open network and know-how (which realized the world’s first open RAN for 5G using O-RAN), NTT DOCOMO is committed to maximize companies’ strengths in furtherance of the 5G Open RAN Ecosystem, and providing high-quality and flexible networks.

5G Open RAN Ecosystem:

Image courtesy of Viavi Solutions

………………………………………………………………………………………………….

Additionally, NTT DOCOMO will develop vRAN (virtualized RAN) with higher flexibility and scalability to further drive open RAN targeting commercialization in 2022. As COTS (Commercial Off-The-Shelf) servers can be used and dedicated equipment are not required for vRAN, it is possible to realize flexible and cost efficient networks. As of today, NTT DOCOMO will start discussion towards verification of vRAN, including performance assessments. As for the vRAN verification environment that will be constructed, opportunities for remote usage will be made available for operators themselves to freely conduct tests.

NTT DOCOMO says it will continue to cooperate with various industry partners towards accelerating wide adoption of open network, especially O-RAN and vRAN, which can cater for diversifying needs with flexibility and agility.

Comment & Analysis::

As with the two other Open RAN alliances (TIP Open RAN and O-RAN), the new 5G Open RAN Ecosystem does NOT have a formal liaison agreement with either 3GPP or ITU-R WP 5D (4G-LTE and IMT 2020 standards). Yet they are all trying to implement disaggregated network elements/equipment for 4G and 5G.

Last month legacy mobile operators Deutsche Telekom, Orange, Telefonica and Vodafone Group established a collaboration or Memorandum of Understanding (MoU) covering the rollout and development of open RAN technology, in a bid to ensure the continent keeps up with early pacesetters, namely Rakuten Mobile and NTT Docomo in Japan.

Today, Telecom Italia (TIM) said it has joined that initiative to support the development and implementation of Open RAN as the technology of choice for future mobile networks across Europe. TIM said it was committed to the development of innovative mobile network systems that used open virtualized architecture to facilitate increasingly agile, flexible, secure and functional 5G services.

However, there are no standards or 3GPPP specifications on Open RAN. Therefore, one must question if there will be different versions coming out of each consortium? Will the virtualized Open RAN architecture be implemented consistently? Will the 4G/5G endpoints be affected by different Open RAN implementations?

What is Open RAN is a good tutorial on this increasingly important subject.

References:

…………………………………………………………………………………………………

NTT DOCOMO to Establish a 5G Consortium in Thailand

NTT Docomo and an international group of several other companies have recently established a consortium to provide 5G services, first in Thailand and later in other Asia Pacific countries with the possible inclusion of additional partners. The initial members of the 5G Global Enterprise solution Consortium (5GEC) will be Activio, AGC, Advanced Wireless Network, Exeo Asia, Fujitsu, Loxley Public Company, Mobile Innovation, NEC Corp, NEC Networks & System Integration, NTT Communications, NTT Data Institute of Management Consulting, NTT Docomo, and NTT Ltd.

https://www.nttdocomo.co.jp/english/info/media_center/pr/2021/0203_00.html

Global Data: Huawei #1 amongst 5 major LTE RAN vendors

Executive Summary:

GlobalData, a leading market data and analytics company, has rated Huawei’s LTE RAN portfolio to be a leader in the market. In competitive analyses of five major RAN vendors, GlobalData evaluated 4G LTE base station portfolios according to four key areas important to mobile operators: baseband unit (BBU) capacity, radio unit portfolio breadth, ease of deployment and technological evolution. GlobalData found Huawei to be a Leader in all four categories and a Leader overall among its peers.

Editor’s Note/ Disclaimer:

We don’t know whether Huawei paid Global Data (?) to evaluate 4G LTE vendor portfolios or if that was done indepedently on Global Data’s own initiative. It’s disturbing that we could not find a related report or media press release on the company’s website after doing multiple searches.

…………………………………………………………………………………………………………………………………………………………………………………………..

LTE RAN Basics: In the RAN, radio sites provide radio access and coordinate the management of resources across the radio sites. User Equipment (e.g. wireless network endpoints) are connected to Nodes (base stations or small cells) using LTE. Radio Network Controllers are wirelessly connected to the core network which for LTE is called the Evolved Packet Core (EPC). This is depicted in the illustration below:

Source: Research Gate

……………………………………………………………………………………………………………………………………………………………………………………

Huawei has introduced new advances in its LTE RAN portfolio to enhance the coverage and capacity of mobile networks. It also offers solutions to aid the coordination of 4G and 5G networks and to enable new services for operators. The Chinese IT behemoth has the highest BBU cell capacity – in terms of both LTE carriers and Narrowband IoT – of any major RAN vendor. It also offers more radio units and more Massive MIMO options than other vendors and supports a wide array of 4G spectrum bands. To make deployment easier, Huawei offers multiple novel solutions, including its Super Blade Site and Bracelet Kit offerings. And to help operators evolve their networks technologically, Huawei has been proactive in commercializing spectrum-sharing capabilities such as its CloudAIR solution, which allows various access technologies (2G/3G/4G/5G) to use the same spectrum, and its SuperBAND solution, which can improve user experience under multi-frequency networks.

This portfolio is well-suited to meet the diverse needs of the world’s mobile operators, and Huawei continues to expand its RAN portfolio to help operators prepare for the future and maximize the value of their LTE networks.

Coverage:

Adequate network coverage is an essential characteristic for ensuring quality mobile services. It becomes especially important in LTE networks as 5G is deployed in high-frequency bands whose coverage footprint areas are more limited. LTE must cover the areas that 5G does not.

To enhance the coverage of 4G/5G networks, Huawei has introduced the Blade Pro solution. The Blade Pro Ultra-Wideband Remote Radio Unit (RRU) is a pole-mountable RU that supports three low or medium Frequency-Division Duplex (FDD) bands simultaneously: it currently supports 700 MHz, 800 MHz and 900 MHz; and in late 2021, it will support 1.8 GHz, 2.1 GHz and 2.6 GHz.

By supporting three frequency bands in a single 25-kilogram unit, the Blade Pro eliminates the need for two boxes, reducing the load on poles, easing the burden on installers and making deployment faster, smoother and less expensive. Making installation easier means operators are better able to increase coverage by expanding or densifying their networks.

Capacity:

Operators face the eternal challenge of keeping up with ever-increasing user demand for data at faster speeds in the space of finite spectrum. One way to add network capacity without finding additional spectrum is to deploy greater antenna arrays, upgrading radios with two transceivers to those with four or eight, for example, or adding Massive MIMO antennas bearing 32 or 64 arrays.

Huawei’s LTE RAN portfolio now includes a radio unit with eight transceivers and receivers for enhanced capacity, useful for urban hotspot areas. The “Smart 8T8R” solution also gives operators flexibility in their migration to 5G. The FDD 8T8R RRU is hardware-ready for 5G NR, and the antenna array is software-defined, meaning its configuration can be adjusted – without changing the hardware – for example, to six sectors for LTE and three sectors for 5G. The solution also dynamically adjusts the power supply allocated to sectors according to how users are distributed. This flexibility can be helpful in allowing operators to serve specific needs on a site-by-site basis and to adapt in real time to changes in user behavior. On TDD side, meanwhile, Huawei leverages its considerable research in TDD-LTE to offer an 8T8R IMB (Intelligent Multi-Beam) solution, which is also based on a software-defined antenna and promises to deliver 1.8-2.2x capacity gains compared with more common products.

For even higher capacity needs, Huawei has introduced the “Smart Massive MIMO” solution, a dual-band 5G-ready 4G radio with 32 transceivers and receivers promising three to five times the download speeds compared with more common products. Like the Smart 8T8R solution, Smart Massive MIMO automatically adjusts the power allocated to individual beams based on user traffic patterns. This lends efficiency in two ways, since Massive MIMO beamforming is itself a more efficient use of mobile spectrum than traditional antenna arrays, and the Smart Massive MIMO solution uses its power supply more efficiently than typical Massive MIMO gear.

4G/5G Coordination:

In addition to the ways Huawei’s aforementioned gear balances and coordinates 4G and 5G networks, its portfolio also includes other solutions to further optimize the relationship between the two.

Its SuperBAND solution uses artificial intelligence (AI) to aggregate network scheduling – the coordinated allocation of radio resources to mobile signals – among multiple frequency carriers, essentially boosting network capacity beyond the divisions and fragmentation of various spectrum bands. In 4G/5G networks, SuperBAND can perform this aggregation across both 4G and 5G, maximizing spectral efficiency and, ultimately, optimizing the quality of the user experience.

Meanwhile, Huawei also offers Dynamic Spectrum Sharing (DSS) as part of its CloudAIR solution. DSS allows 4G and 5G traffic to share the same spectrum bands, increasing spectral usage efficiency; it also allows 4G and 5G traffic to dynamically switch from one band to another, regardless of radio access technology, in response to congestion on specific bands, ensuring the best use of spectrum even as user behavior changes. CloudAIR goes even further, applying a similar spectrum-sharing function to 2G and 3G traffic as well for a more comprehensive capability that is especially relevant to markets where legacy networks remain.

New Service Enablement:

Enhancing and optimizing the network are important aims, but from a commercial perspective, one of the most important imperatives operators face is the need to deliver new revenue-generating services. Huawei’s LTE RAN portfolio addresses this requirement in multiple ways.

Huawei’s Voice-over-LTE solution, VoLTE Plus, helps operators migrate voice traffic from legacy technologies like 2G and 3G to LTE, not only achieving higher quality voice service but also allowing operators to sunset their legacy networks and repurpose their VoLTE investments for the future. In addition, Huawei’s latest VoLTE solution, goes further, adding four new capabilities that help protect the quality of voice service in 4G/5G networks:

- 5G-to-LTE EPS fallback

- LTE-to-5G fast return

- New Enhanced Voice Services capabilities

- Dedicated services that allow for optimization on LTE

Beyond voice, Huawei’s LTE portfolio also supports Narrowband IoT, to capture opportunities in the Internet-of-Things space. The vendor’s roadmap also targets support for 5G NB-IoT in particular, which will allow operators with existing IoT services to migrate those services to their 4G/5G network and replace disparate or ad-hoc legacy networks with a unified network that yields multiple revenue streams from a common infrastructure investment.

Huawei’s portfolio also enables new services via fixed wireless access (FWA) products. Amid the global pandemic, the increase in telecommuting and home-based learning based on video connections has increased the demand for residential broadband networks. Where fiber isn’t available, FWA is vital in building these residential networks. Huawei’s LTE-based FWA solutions have achieved enviable momentum in the market. The vendor has also added 4G/5G customer premises equipment to its portfolio, giving these networks a future-proof migration path to continued service enablement.

Conclusion

Huawei’s LTE RAN portfolio continues to evolve in order to help operators maximize the value of their networks as they prepare for the future. New solutions in the portfolio enhance the coverage and capacity of LTE networks as well as maximize network efficiency by coordinating 4G and 5G operations. Meanwhile, Huawei offers multiple solutions aimed at enabling the delivery of additional services that can help operators grow revenue in a variety of ways, including VoLTE, the Internet of Things and FWA.

SOURCE: GlobalData

Reference:

https://www.prnewswire.com/news-releases/globaldata-lte-ran-innovation-and-competitiveness-insight-301202706.html

Verizon realizes operational efficiencies as massive cost cutting continues; 4G-LTE Home (Fixed Wireless Access)

Speaking at the Citi 2021 Global TMT investor conference on January 5, 2021, Verizon executive Ronan Dunne said the telco’s operational efficiency has continued to increase, largely due to cutting $10 billion in costs, which was first announced four years ago by then CEO Lowell McAdam.

Dunne said Verizon has been reaping billions of dollars every year in operational efficiencies from the core of how it builds network to the efficient way it carries traffic on that network with its One Fiber strategies. Verizon’s One Fiber project, which has been underway for five years, combined all of the telco’s fiber needs and planning into one project. It also allows Verizon to plot out its fiber uses cases and purchasing plans across all of its sectors.

“But as regards (to) the focus of operational efficiency, it’s a ruthless, consistent focus inside the business in exactly the same way as balance sheet strength has always been a watchword of Verizon. And so rest assured those will continue to be as important in ’21 and ’22 as they have been in the last few years.”

Regarding cost cutting, Dunne had this to say: “So yes, Matt (Verizon CFO Matt Ellis) has talked about our commitment to a $10 billion cost program, and we’ve made excellent progress on that. But in my time in the wireless business originally and then consumer, we’ve made significant strides. We’re talking about billions of dollars every year in operational efficiencies. From — right from the core of how we build the network, to be highly, highly efficient, how we carry traffic on the network with our One Fiber strategies to how we serve customers and deliver experiences. And across all of those vectors, we see continued opportunity.”

In addition to densification of the wireless network, backhaul and fronthaul, and enabling wireline access, having fiber deep is key for supporting radio access networks (RAN) as well as provisioning an increasing number of small cells. Verizon CTO Kyle Malady built the telco’s Intelligent Edge Network, which has allowed Verizon to lower its operational costs by benefiting “from efficiencies within the core and right through the business.”

“The particular area that I’m focused on in my part of the business is really AI at scale,” Dunne said. “That really allows us to improve our CRM (Customer Relationship Management) efficiency. So the efficiency of every dollar invested in acquisition and retention. Also the efficiency of every dollar invested in those elements that are customer service elements, and distribution elements,” he added.

Dunne opined that when you think about Verizon you recognize its network as a platform, it’s distribution as a platform and it’s billing and services platforms. He believes the opportunity to improve the efficiency of those platforms through investment in technology.

He also talked about the relationships with Microsoft and AWS for edge computing as a new platform capability that’s available both to us internally but also available to customers and partners. “So that’s the strategy. So we see the opportunity to grow highly efficiently as well as serve the existing base more efficiently and lots more to come there.”

“I’m not building a fixed wireless access network,” said Dunne, expressing a bit of frustration regarding a question of whether the company is on target to hit that 30 million homes passed goal. “I’m building a 5G mobility network with a second use case where it’s appropriate, where it covers 5G Office and 5G Home, so we just shouldn’t lose sight of that.”

Dunne says that he believes they are still on track, but the reality on the ground has Verizon constantly updating its 5G mobility strategy of where and how the service gets deployed. That reality impacts the ramp up of 5G Home, potentially slowing its deployment. The service is currently in 12 markets, with very limited footprints in those markets.

Verizon’s recently launched 4G LTE Home fixed wireless service (intended for rural subscribers) should also be included in a discussion of the company’s overall fixed wireless goals. The carrier’s 5G Home service and the goals associated with it pre-date the launch of the new 4G LTE based fixed wireless service, that Verizon initially said would target smaller markets.

Image Credit: Getty

……………………………………………………………………………………………………………………………………………………………………………………………….

“One of the other things that I think is important for people to think about is that as we build out the 5G network, we’ve also built 4G Home and we’ve seen significant response to that,” said Dunne. “My addressable market for Home, for me, has always been not limited to the specific of a 5G fixed wireless, but a broader ambition to be able to participate in the home.”

4G LTE fixed wireless access offers peak speeds of 50 Mbps for now, compared to its 5G Home service which claims average speeds of 300 Mbps. Nevertheless, Dunne sees this broader footprint of 4G and 5G fixed wireless combined with mobility, as a formidable competitor to cable broadband, and its fixed wireless homes passed goal attainment should be agnostic to the underlying wireless technology.

Can 5G fixed wireless access be an alternative to cable?

“Well, then my strong view is, yes, it can. But to be clear, we only build where there’s a mobility case to build. We’re not building a stand-alone 5G fixed wireless network. So sometimes when respectfully, people get frustrated with us and say, well, hold on a second. What about — I want to see all your discrete reporting of 5G fixed wireless or why aren’t you there or there or there? The answer, which — forgive me, but I keep repeating is because I’m not building a fixed wireless access network. I’m building a 5G mobility network with a second use case, where it’s appropriate, where it covers 5G office and 5G home. So we shouldn’t lose sight of that.

So as I build over that sort of 7-, 8-year horizon, one of the realities is that I will be updating my mobility deployment patterns all the time. So we’re not really — we’re not saying that, that sort of 7, 8 years for the 30 million homes time line is shifting. But what I am saying is we continue to optimize the mobility 5G deployment strategy. And as a result, we continue to finesse and update the practicalities of that relative to the homes past. But one of the other things that I think is important for people to think about is that as we build out the 5G network, we’ve also built 4G home, and we’ve seen significant response to that. And yes, that’s a maybe a 50 meg product rather than a 500 meg product. But for a lot of people, that’s important. And that also affords us this opportunity that as we build out 5G, as we put more nodes in place, but also as we put more carriers out there, deploy more spectrum, et cetera, we have this ability to build a home portfolio, which is carrier — basically bearer-agnostic. And I think the thing for us is that we see the opportunities to participate in tens of millions of homes across the U.S. as really attractive.

What I want to do is have toolkit that says, in my Fios footprint, if fiber is the right thing to do, great. If anywhere in the U.S. 5G ultra-wideband is available to me, I have that. And in other places, I have my 4G increasingly enhanced performance in that network, which may ultimately be a 5G nationwide solution. So my addressable market for home for me has always been not limited to the specific of a 5G fixed wireless but a broader ambition to be able to participate in the home and to bring the scale benefits of that to my customers who see Verizon as the partner of choice.”

We think we have a very strong growth opportunity, which is stimulate the base, spread through our network and distribution as

a platform, our access to the market across all of the available segments and really execute on a very strong, high performance, both network, but also a set of experiences….

References:

https://www.verizon.com/about/investors/citi-2021-global-tmt-west-virtual-conference

https://www.verizon.com/about/sites/default/files/2021-01/Citi-Conf-Transcript-01052021.pdf

https://www.fiercetelecom.com/telecom/verizon-closes-its-10-billion-cost-cutting-goal

https://www.pcmag.com/news/verizon-launches-unlimited-4g-home-internet-for-rural-users-here-are-the

Work from Home Reality Impacts Market for New Networking Technologies

SOURCE: Bigleaf Networks

Introduction:

Hype around next generation wireless standards (e.g. WiFi6/IEEE 802.11ax, 5G: ITU-R IMT 2020.SPECS/3GPP Release 16) has become a distraction, according to Bigleaf Networks founder and CEO, Joel Mulkey. Marketers are promoting these new technologies which sacrifice reliability to push faster speeds that are mostly useless in the new work from home era.

Mulkey and Bigleaf Vice President of Product, Jonathan Petkevich, looked into the reality behind the marketing hype around 5G and WiFi 6, as well as other networking trends such as satellite networks and artificial intelligence, in a wide-ranging panel discussion hosted for the company’s customers, partners, and agents.

As IT leaders look to regain their footing in 2021, many tech conversations that were trending at the beginning of 2020 picked up where they left off, while other trends emerged. Below are selected highlights from Mulkey and Petkevich’s conversation:

The Work From Home Reality:

“If you look at some of the Stay-At-Home mandates that have happened over the course of 2020, we estimate that about 85 million people are working from home, and that’s a big shift towards where we were at the start of 2020,” said Mulkey. “Starting at about the mid-March timeframe, 88% of organizations asked employees or required employees to work from home. About 57% of the US workforce started to work from home on a regular basis. So that was a big shift towards most people working in the office, with a few people working remotely in regional or local areas. And a lot of organizations have been talking about how they’re switching to a more long-term remote work-from-home strategy.”

Adapting to this new work from home reality meant frantically moving technology to the cloud. Part of that shift meant IT and network infrastructure teams needed to revamp their networks to support the connection reliability and application performance required in this kind of new normal.

“You need to have a healthy path between the device you’re using and the cloud server, otherwise you’re not going to have a usable experience,” said Mulkey. “One of the things we’re seeing companies running into is a sudden realization that quality of connectivity is really important.”

The Danger of WiFi 6:

According to Gartner, WiFi (IEEE 802.11) is the primary high performance network technology that companies will use through 2024. Today, roughly 96% of organizations use some form of wireless technology with many of those companies looking to move to faster versions of those networking capabilities in the next couple of years. Mulkey and Petkevich say the hype is hurting companies.

“Ensuring that you have technology that’s built on the latest standards makes sense,” said Petkevich. “I don’t know that 5G or WiFi 6 are drastically changing how a business operates day-to-day. There’s a little bit of over-hype around the speed and performance and some of the promise that’s with both of these.”

“WiFi 6 is a bit misplaced in our industry’s priorities and 5G is a marketing mess,” said Mulkey. “WiFi 6 is good for really dense, high bandwidth needs. So if you have an office with 1,000 people in a small area or you’re trying to provide WiFi offload in a stadium, WiFi 6 has technologies that will help you out. But if you’re a normal person and you’ve got a house with a couple of kids and you need to make sure your WiFi doesn’t drop-out when you’re on Zoom calls, I don’t see WiFi 6 moving the needle there. In fact, I think it’s harmful. The WiFi industry has become so focused on a story of faster, faster, faster, that the pace of innovation comes at the sacrifice of reliability. What you really need is stable WiFi connectivity that doesn’t drop out, that deals really well with roaming, that has some more intelligence to the quality of connectivity rather than prioritizing speed.”

5G Hype and Rural America:

“Now, 5G is interesting because there’s some really promising stuff there,” continued Mulkey. “Imagine if you didn’t even need WiFi, you just had always-on connectivity from all your devices at say, 100 megabits a second. That was the vision cast for it. The problem is, it’s almost all hype. What you need for the really high speeds is millimeter wave connectivity, which is really only going to be available in dense urban areas. So the folks that absolutely need good 5G today in rural areas or suburban areas without good landline connectivity, are probably not gonna get that millimeter wave behavior, surely not in rural areas.”

“We really have most of the benefits, if not all of them, with 4G today, so the evolution from a 4G to 5G in these longer distance connections is minimal to nothing,” added Mulkey. “It’s just a marketing term slapped on 4G. Now, 4G has gotten better since your phone first said 4G on it, but you’re not going to magically be able to stream 3D Star Wars style holograms because your phone has a 5G icon on it. That may come some day, but it won’t be 2021.”

Satellites:

Those who have the toughest time with WAN internet connectivity are those in rural areas or suburban areas that have been abandoned by the telecom and cable operators. An area Mulkey and Petkevich see low Earth orbit satellite networks moving beyond hype.

“The issue with traditional satellites is latency,” said Petkevich. “Starlink fixes that. So it’ll be interesting to see that play out in 2021.”

Artificial Intelligence in the Network:

44% of IT decision-makers believe that AI and machine learning can help companies optimize their network performance, and more than 50% identify AI as a priority investment needed to deliver their ideal network and make things work for them.

“There are two main ways that AI is in use today. You have a consumer-facing flavor — Siri on my iPhone, or the way that Google can find me images of apples; and then you have the hidden AI that nobody knows about — the instantaneous response of a Google search, where they’ve built smart technology that would fall under the definitions of AI to make sure that your request for Google gets to the right server from the right path and gets back to you as efficiently and effectively as possible,” said Mulkey. “Those technologies are available today. The challenge is they’re not available to the everyday person. This is an area where we, ourselves, have dedicated people and resources to figure out, ‘How can we make our network behave in an autonomous manner far better than it could if there were just people controlling it?'”

“There’s a kind of a misconception that when we talk about AI, the first thought is all the wonderful movies that have come out over the years,” quipped Petkevich. “Where we are today is there’s a lot of innovation going on to make this more tangible and more practical for businesses to use on the smaller scale, and not reserve it for the large enterprises of the world, and make it more generally available. This is definitely an area where a technology is moving beyond its hype.”

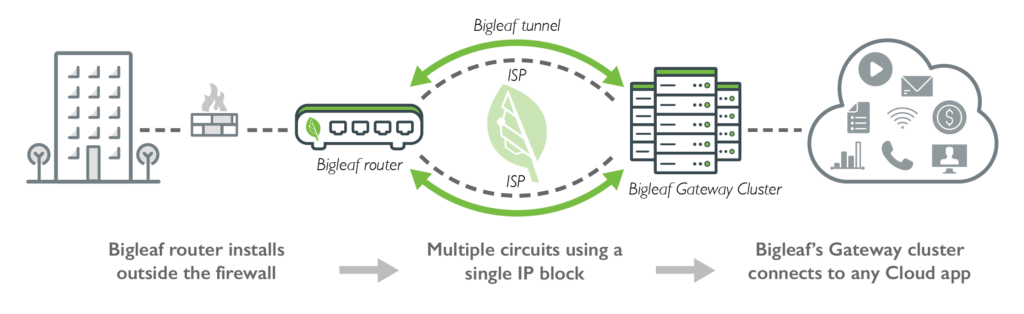

About Bigleaf Networks:

Bigleaf Networks is the intelligent networking service that optimizes Internet and Cloud performance by dynamically choosing the best connection based on real-time usage and diagnostics. Inspired by the natural architecture of leaves, the Bigleaf Cloud-first SD-WAN platform leverages redundant connections for optimal traffic re-routing, failover and load-balancing. The company is dedicated to providing a better Internet experience and ensuring peace of mind with simple implementation, friendly support and powerful technology. Founded in 2012, Bigleaf Networks is investor-backed, with service across North America.

Bigleaf combines a simple on-site installation, intelligent hands-off operations, and redundancy at every level to turn commodity broadband connections into a worry-free, Enterprise-grade connection to your applications.

…………………………………………………………………………………………………………………………………………………………………………………………..

References:

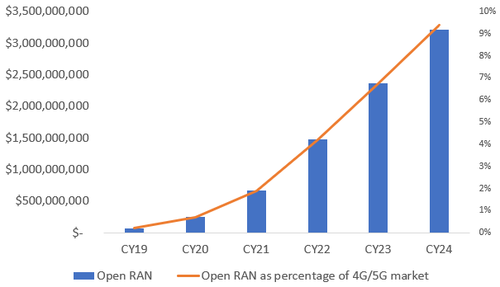

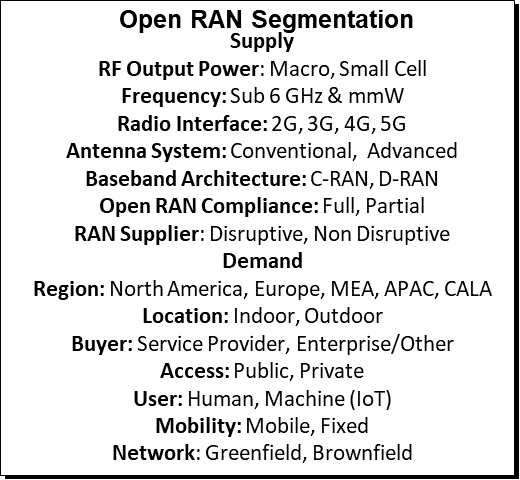

Omdia and Dell’Oro Group increase Open RAN forecasts

In an updated forecast out this month, Informa owned Omdia predicts that Open RAN is likely to generate about $3.2 billion in annual revenues by 2024. That would make it about 9.4% of the total 4G and 5G cellular market.

That forecast implies a massive increase on last year’s sales of just $70 million (see Dell’Oro forecast below), and Omdia’s Open RAN numbers have been raised significantly in the last few months. Previously, it was expecting Open RAN to generate about $2.1 billion in revenues in 2024.

Telco buy-in and support is critical, according to Daryl Schoolar, practice leader at Omdia responsible for the firm’s Open RAN forecasts. “Mobile operators remain the real driving force behind the development of open virtual RAN,” he says. “I see this as a positive sign for the market versus other technology and network developments I have seen during my career that were driven by vendors and ultimately went nowhere. The bigger market opportunity is with brownfield deployments, but this takes more time to accomplish as operators have to integrate open RAN with their legacy network systems and make sure those legacy networks and services are not adversely impacted,” Schoolar added.

Here are some of the network operators that have committed to OpenRAN:

- Japan’s Rakuten, which already operates a 4G and 5G network based on open RAN. While customer numbers remain low, its early success has undoubtedly encouraged others.

- Telefónica and Rakuten have announced a partnership to accelerate the development of Open RAN technology for 5G access and core networks, and the associated operations support systems (OSS). They will jointly test, develop and procure Open RAN systems.

- Dish Network, is another greenfield builder that is using open RAN technology to roll out a fourth mobile network in the US. which is primarily focused on business customers.

- Orange sees a role for Open RAN vendors to provide more “plug and play” indoor coverage for businesses through 2021 and 2022. Open RAN could also play a part in the macro network, although that is more likely to come from 2023, and still requires work.

Dell’Oro Group (see forecast below) says: “Dish is running into delays in the US market, Rakuten is moving forward at a rapid pace in Japan deploying a variety of both sub 6 GHz and mmWave RAN systems. In addition, some of the Japanese telecom equipment vendors (e.g. NEC) are reporting that the lion share of their radio shipments are already O-RAN compatible.”

Open RAN progress:

Source: Omdia

……………………………………………………………………………………………………………………

Omdia notes that Open RAN is a potential dilemma for the big telco equipment vendors like Ericsson and Nokia (which intends to supply Open RAN products). The risk is that it decreases their market share for traditional cellular gear, as wireless network providers opt for Open RAN products developed by alternative suppliers. Yet open RAN might also bring opportunities in new markets for the old guard. “Either way, vendors cannot ignore this market trend,” says Omdia.

Gabriel Brown, a principal analyst at Heavy Reading, a sister company to Omdia and Light Reading, says he is positive about Open RAN but warns against expectations of liftoff next year. “The right timeline to view it on is a four-to-five-year timeline,” he said in a discussion with Light Reading this week. “I think next year continues to be primarily trials, scaling the trials … and some operators moving into production networks, but I don’t think it’s the year when it all takes off.”

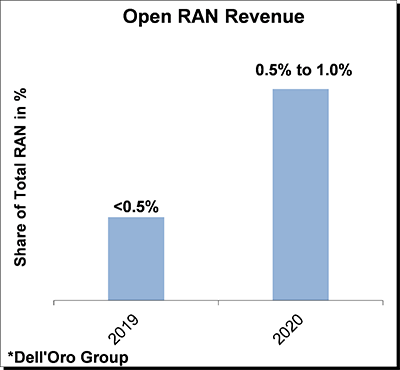

Separately, Dell’Oro Group’s latest Open RAN forecast, projects that Open RAN baseband and radio investments—including hardware, software, and firmware excluding services—will more than double in 2020 with cumulative investments on track to surpass $5B over the forecast period.

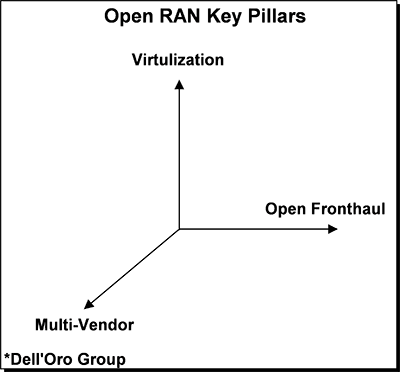

Open and Virtual RAN continues to gain momentum, bolstered by Ericsson now formalizing its support with its Cloud-RAN announcement. The uptake remains mixed. In this blog we will discuss three key takeaways for the 3Q20 quarter including:

1) The primary objective of Open RAN is to address market concentration and vendor lock-in;

2) Open RAN revenues are trending ahead of schedule;

3) Not all Open RAN is disruptive.

Source: Dell’Oro Group

Dell”Oro says that the more favorable Open RAN outlook to a confluence of factors including:

- Verification from live networks the technology is working in some settings;

- Three of the five incumbent RAN suppliers are planning to support various forms of Open RAN – “Partial Open RAN” (open and virtual but not multi-vendor) are at this juncture captured in the Open RAN estimates meaning we require the first two pillars but we are excluding the third multi-vendor requirement as a necessity to reflect the Open RAN movement;

- The geopolitical uncertainty has escalated significantly in the past six months, with multiple operators reassessing and/or reviewing their reliance on Huawei’s RAN portfolio, resulting in an improved entry point for the Open RAN suppliers;

- Progress with full virtualization is firming up, with multiple suppliers announcing the commercial availability of V-RAN, consisting of both vCU and vDU;

- Operators are increasingly optimistic the technology will move beyond the rural settings for brownfield deployments;

- Policies to stimulate Open RAN are on the rise.

Source: Dell’Oro Group

“We estimate total open RAN revenues are tracking ahead of schedule,” wrote Stefan Pongratz of Dell’Oro Group, noting the market research firm recently raised its 2020 open RAN revenue forecast to $300,000 from $200,000. “On the other hand, the lion share of any ‘security’ related RAN swaps are still going to the traditional RAN players, suggesting the technology for basic radio systems remains on track but the smaller players also need to ramp up investments rapidly to get ready for prime time and secure larger brownfield wins.”

…………………………………………………………………………………………………………….

References:

https://www.lightreading.com/open-ran/open-ran-will-be-$32b-market-in-2024-says-omdia/d/d-id/765889?

https://omdia.tech.informa.com/OM011039/Open-RAN-commercial-progress-in-2020 (must be an Omdia client to access)

https://www.delloro.com/open-ran-results-mixed-in-3q20/

Dell’Oro: RAN growth accelerates due to “torrid pace” of 5G NR in 3Q2020

Dell’Oro has upgraded its near-term outlook for the RAN market to reflect stronger-than-expected activity in China, Europe and North America. The market researcher now expects the market to approach USD 70-80 billion over the combined 2020 and 2021 period.

The improved outlook in Dell’Oro’s Q3 RAN market report indicates continued positive momentum. The upswing begun in the second half of 2018 extended into the third quarter, with surging demand for 5G propelling the RAN market to robust year-over-year growth, the researcher said. It estimates that the overall 2G to 5G RAN market advanced 10-20 percent year-on-year in the third quarter, meaning annual growth in eight out of the last nine quarters.

“While we correctly identified that the RAN market would appear disconnected from the underlying economy throughout this year, we also underestimated the pace and the magnitude of these 5G rollouts,” said Stefan Pongratz, analyst with the Dell’Oro Group. “This shift from 4G to 5G, including low-band-and mid-band 5G NR, continued to accelerate at a torrid pace in the quarter, underpinned by stronger-than-expected 5G activity in multiple regions.”

Additional highlights from the 3Q20 RAN report:

- RAN revenue shares were impacted to some degree by the state of the 5G rollouts in China and North America, resulting in share gains for both Huawei and ZTE over the 1Q20-3Q20 period.

- The near-term outlook remains favorable for both macro and small cells, with combined 2020 and 2021 2G-4G and 5G base station shipments projected to eclipse 10 M units.

- We have adjusted the near-term RAN market outlook upward, to reflect stronger than expected activity in China, Europe, and North America, with total RAN projected to approach $70 B to $80 B for the combined 2020 and 2021 period.

Editor’s Note: The RAN market today is almost entirely provided by a handful of vendors making cellular base stations and small cells. Those are: Huawei, Ericsson, Nokia, Samsung, ZTE, and Fujitsu. In the future, there is a movement to both Open RAN and Cloud RAN which would disrupt the current deployments with disaggregated hardware and open software. We are very skeptical of those two over hyped industry initiatives.

Radio Access Network illustration from Resource Gate

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ revenue, transceivers or RF carrier shipments, macro cell and small cell BTS shipments for 5G NR Millimeter Wave, 5G NR Sub 6 GHz, LTE, and WCDMA/GSM. The report tracks the RAN market by region and includes market data for Massive MIMO. The report also includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com

References:

Surging Demand for 5G Accelerates RAN Growth, According to Dell’Oro Group

GSA forms new 4G and 5G Fixed Wireless Access Forum; FWA Market Review & Analysis

The Global mobile Suppliers Association (GSA) today announced the establishment of the GSA 4G-5G Fixed Wireless Access Forum to bring together leading chipset, module, and terminal vendors – as well as other telecommunications industry representatives, who wish to promote 4G and 5G Fixed Wireless Access (FWA) technology, products and services – to report on progress of FWA deployments, identify use cases and encourage global adoption.

The GSA 4G-5G FWA Forum will build on the work done by the recently formed GSA Fixed Wireless Access Working Group to coordinate industry initiatives to deliver fixed wireless broadband services based on LTE and 5G access networks. The founding members of the FWA Working Group are Ericsson, Huawei, Nokia, Samsung and ZTE. Membership to GSA Working Groups is open to all GSA Executive and Ordinary Members.

Underpinning the work of the new GSA 4G-5G FWA Forum is GSA’s research and role as the voice of the mobile ecosystem. GSA publishes regular industry reports and market data determine the extent and nature of fixed wireless access broadband service availability based on LTE or 5G around the world. As part of its industry advocacy,

GSA’s research team will share its latest global fixed wireless access update in its next GSA Snapshot Webinar on 24 November (16:00 GMT). Details on how to register for and attend the free webinar are available here https://gsacom.com/webinar-fixed-wireless-access/

Joe Barrett, President, Global mobile Suppliers Association, commented: “In a relatively short space of time, fixed wireless broadband access has become a mainstream service. Today we see hundreds of operators selling LTE-based fixed wireless access services around the world, and dozens more already live with 5G FWA services for home or business broadband. In addition, fixed wireless access device vendors have grown to over 100 globally and against this backdrop of real and significant market demand, the onus is on the FWA community to work together to drive business success.

“GSA has an unrivalled track record and experience in bringing together vendors, regulators and operators from across the 4G and 5G ecosystems and the formation of the new GSA 4G-5G FWA Forum will bring this experience to Fixed Wireless Access to help accelerate its development globally,” Barrett continued.

The scope of the new GSA 4G-5G FWA Forum includes:

· Sharing trends in the industry, identifying directions in technical development, accumulating and promoting successful experiences

· Improving the 4G and 5G FWA technologies required to provide wireless broadband connection solutions with increased performance and cost-effectiveness

· Fostering collaboration among FWA suppliers to improve the industry’s ecosystem and ensure business success

· Promoting the success of the FWA industry to accelerate the provisioning of broadband access to anyone, anywhere

The new GSA 4G-5G FWA Forum and Fixed Wireless Access Working Group is a key pillar of GSA’s growing industry advocacy; this work also includes the GSA Spectrum Group, the largest single spectrum advocacy team in the mobile industry representing the vendor ecosystem in 4G and 5G spectrum discussions with governments, regulators and other policy makers.

Membership and participation in the GSA 4G-5G FWA Forum is open to chipset, module, and terminal vendors, together with industry representatives from across the telecommunications ecosystem who wish to promote Fixed Wireless Access (FWA) technology, products and services.

For more information or a GSA 4G-5G FWA Forum Application Forum, please email [email protected].

………………………………………………………………………………………………………………………………………………………………………………….

About GSA:

GSA is the voice of the global mobile ecosystem representing companies engaged in the supply of infrastructure, semiconductors, test equipment, devices, applications and mobile support services. The organization plays a central role in promoting 3GPP technology, advocating spectrum policies and stimulating IMT industry development. The association is a single source of information for industry reports and market intelligence

The GSA GAMBoD database is a unique search and analysis tool that has been developed to enable searches of LTE and 5G devices and new global data on Mobile Broadband Networks, Technologies and Spectrum (NTS). Results are presented as a list or in charts. Charts may be inserted into documents or presentations, subject to accreditation of GSA as the source.

GAMBoD is a resource dedicated to promoting the success and growth of the Mobile Broadband (MBB) industry and ecosystem and is fully available to all employees of GSA Executive and Ordinary Member companies and GSA Associates who subscribe to the service.

- More information on GAMBoD is available at: https://gsacom.com/gambod/

- Press Release for New GSA FWA Forum: https://gsacom.com/press-release/new-gsa-fwa-forum/

………………………………………………………………………………………………………………………………………………………………………………….

STL Partners — FWA Market Review and Analysis:

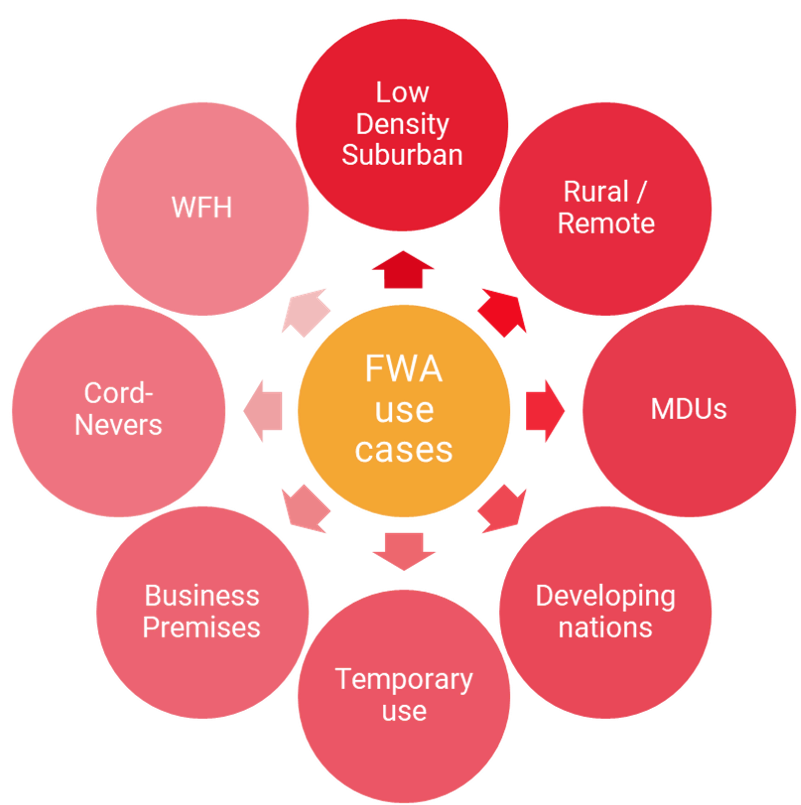

Today, fixed-wireless access (FWA) is used for perhaps 8-9% of broadband connections globally, although this varies significantly by definition, country and region. There are various use cases (see below), but generally FWA is deployed in areas without good fixed broadband options, or by mobile-only operators trying to add an additional fixed revenue stream, where they have spare capacity.

FWA via 4G -LTE using licensed spectrum has already experienced rapid growth of in numerous markets, such as South Africa, Japan, Sri Lanka, Italy, and the Philippines. This past week, T-Mobile announced an expansion of their 4G FWA called Home Internet service.

This growth has been driven by the combined impact of mobile network operators (MNOs) commercialising FWA services to households in underserved urban areas, the slow pace of fibre roll-out in some countries, government subsidies for rural broadband, and improvements in network planning tools and customer premise equipment with easier self-install options.According to STL Partners’ latest research and market forecasts, 5G is likely to have a major impact for operators in the coming years, especially from 2022 onwards as more spectrum becomes available to more operators, and equipment prices fall.

Nonetheless, 4G – LTE will continue to be more important than 5G in the FWA market overall at a global level over the next 5 years; the technology is much further down the cost- and experience curve, as well as using existing network infrastructure and spectrum.

Historically, most FWA has required an external antenna and professional installation on each individual house, although it also gets deployed for multi-dwelling units (MDUs, i.e. apartment blocks) as well as some non-residential premises like shops and schools. More recently, self-installed indoor CPE with varying levels of price and sophistication has helped broaden the market, enabling customers to get terminals at retail stores or delivered direct to their home for immediate use.

Looking forward, the arrival of 5G mass-market equipment and larger swathes of mmWave and new mid-band spectrum – both licensed and unlicensed – is changing the landscape again, with the potential for fibre-rivalling speeds, sometimes at gigabit-grade.

STL believes that the biggest changes and opportunities catalysed by 5G FWA will be:

• Alternative source of gigabit broadband in urban areas without fibre, or with poor competition and pricing.

• Mobile-only operators will target attractive demographic or sub-regional niches that fit with their existing and planned 5G footprint.

• Fixed and fixed-mobile converged broadband providers will use 5G FWA as a backup or enhancement for fixed-line services.

• The growing democratisation of 5G, with better support of unlicensed spectrum, plus cloud-delivered core networks and edge offload, will broaden its range beyond traditional MNOs to some wireless internet service providers (WISPs), cable operators, and others.

• Local licensing and new tranches of unlicensed spectrum will create options for municipalities, education agencies, and other public-sector bodies to offer 5G FWA for home-schooling, telemedicine, and other applications.

• In the longer term (2023 onwards) improved mmWave technology, including repeaters and other forms of signal-booster, could expand the addressable market for gigabit FWA.

FWA Use Cases…. Source STL Partners

………………………………………………………………………………………………………………………………………………………………………………….

References:

T‑Mobile expands Home Internet to over 130 additional cities

T‑Mobile expands Home Internet to over 130 additional cities

T-Mobile US will increase its Home Internet service to more than 130 additional cities and towns across Michigan, Minnesota, New York, North Dakota, Ohio, Pennsylvania, South Dakota, West Virginia and Wisconsin. The move comes after it massively expanded its home broadband pilot to more than 20 million households in October.

The $50/month Home Internet pilot service will be deployed in underserved rural markets — through LTE-based coverage, with 5G service coming soon. The company says that only 63 percent of adults in rural America currently have access to high-speed internet.

“Home broadband has been broken for far too long, especially for those in rural areas, and it’s time that cable and telco ISPs have some competition,” said Dow Draper, T-Mobile EVP, Emerging Products. “We’ve already brought T-Mobile Home Internet access to millions of customers who have been underserved by the competition. But we’re just getting started. As we’ve seen in our first few months together with Sprint, our combined network will continue to unlock benefits for our customers, laying the groundwork to bring 5G to Home Internet soon.”

T-Mobile Home Internet is just $50/month all-in and features many of the same benefits that have made T-Mobile the fastest growing wireless provider for the past seven years:

- Self-installation. That means there’s no need for installers to come to your home.

- Taxes and fees included.

- No annual service contracts.

- No maddening “introductory” price offers. What you pay at sign-up is what you’ll pay as long as you have service.

- No hardware rental, sign-up fee or installation costs (because set-up is so easy!).

- No data caps.

- Customer support from the team that consistently ranks #1 in customer service satisfaction year after year.

Now that customers have had access to T-Mobile Home Internet since 2019, the reviews are in … and the feedback speaks for itself. Customers give T-Mobile Home Internet an average Net Promoter Score (NPS) of 42, compared to -75 (that’s a negative 75!) for their previous provider. Seventy-three percent report saving money with T-Mobile Home Internet, with 50% saving more than $30 per month (that’s $360 annually!).

The Home Internet pilot provides home broadband on the Un-carrier’s LTE network. With additional capacity unlocked by the merger with Sprint, T-Mobile is preparing to launch 5G Home Internet commercially nationwide, covering more than 50% of U.S. households within six years and providing a badly needed alternative to incumbent cable and telco ISPs.

Home broadband is one of the most uncompetitive and hated industries in America. Rural areas in particular lack options: more than three-quarters have no high-speed broadband service or only one option available. And when there’s no choice, customers suffer. It’s no wonder internet service providers have the second lowest customer satisfaction ratings out of 46 industries, beating cable and satellite TV companies by just one point according to the ACSI (American Customer Satisfaction Index)!

T-Mobile Home Internet service is available on a first-come, first-served basis, where coverage is eligible, based on equipment inventory and local network capacity, which is expanding all the time. For more information on T-Mobile Home Internet or to check availability for your home in these areas, visit t-mobile.com/isp.

Reference: