5G from Space

Telecoms.com’s survey: 5G NTNs to highlight service reliability and network redundancy

Telecoms.com survey results, presented in the report Private networks and NTNs: Transcending the boundaries of 5G, highlight the reinforcement of service reliability and additional layer of network redundancy as the most frequently selected impact of the convergence of 5G and Non Terrestrial Networks (NTN)s, according to nearly half of respondents. Engineers and developers are the biggest proponents of this impact with more than three in five respondents highlighting its value from a technical perspective. The extra network redundancy is backup connectivity from NTNs to existing 5G networks (e,g, dye to a cell tower failure or massive power outage) and the ability to ensure continued service whether in times of crisis or otherwise.

Meanwhile, two in five C-Suite executives think it’s either too early to determine the benefits or that NTNs will only achieve a minimal impact on 5G performance, hinting that they may need more convincing to achieve full buy-in.

‘Deployment costs’ are identified as the top concern when converging NTNs with 5G for many organisations in telecoms and particularly so for CSPs, while ‘cost of infrastructure’ is the most frequently selected key challenge slowing down the large-scale adoption of private 5G.

The cost barrier is neither new nor surprising for these topics, or for many other telecom topics being surveyed, but what this is compounded with now is a global economy that hasn’t been stable for some time, whether due to the global pandemic, or the ever-growing number of wars around the world.

On private 5G, the report also highlights several 5G standalone features that are considered most important to enterprises. Here, network responsiveness (low latency, handover time, and ultra-low data rates) is flagged as the top feature closely followed by network slicing in radio (that is, reserving capacity for specific applications).

The report argues that “while these results shed light on key technical capabilities that telecom professionals consider to be critical for the use of enterprises in a private 5G environment, it is also important to note that focusing on business outcomes and use cases versus technical capabilities is likely more meaningful in discussions with enterprises.”

………………………………………………………………………………………………………………………………………

3GPP introduced NTN into its Release 17, which provided an initial framework and Release 18 which included enhancements. 3GPP continues to work on NTN in Release 19 and beyond, focusing on aspects like onboard satellite processing, Ku-band frequencies, and integration with terrestrial networks.

-

Release 17: This release introduced the initial framework for 5G NTN, including support for NB-IoT and 5G NR NTN.

-

Release 18: This release focused on performance enhancements and additional frequency bands for 5G NTN.

-

Release 19 and beyond: Future releases, including 19, will continue to build on the NTN standard, with plans to enhance onboard satellite processing, expand to Ku-band frequencies for 5G NTN, and improve the integration between terrestrial and non-terrestrial networks.

3GPP looks forward to the continuous collaboration with ITU-R WP 4B for the finalization of Recommendation ITU-R M.[IMT-2020-SAT.SPECS], which will be the official standard for 5G satellite to ground communications.

………………………………………………………………………………………………………………………………………………………

References:

https://tc-resources.telecoms.com/free/w_defa8859/

https://www.3gpp.org/technologies/ntn-overview

ITU-R recommendation IMT-2020-SAT.SPECS from ITU-R WP 5B to be based on 3GPP 5G NR-NTN and IoT-NTN (from Release 17 & 18)

Standards are the key requirement for telco/satellite integration: D2D and satellite-based mobile backhaul

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

Momentum builds for wireless telco- satellite operator engagements

AT&T deal with AST SpaceMobile to provide wireless service from space

AT&T and satellite network provider AST SpaceMobile are teaming up to provide wireless service from space — a challenge to Elon Musk’s SpaceX, which struck a similar deal two years ago with T-Mobile US. AT&T and AST SpaceMobile formalized the partnership following an earlier testing period. They said on Wednesday that their agreement to build a space-based broadband network will run through 2030.

AT&T head of network Chris Sambar will join the AST SpaceMobile board, deepening a relationship that dates back to at least 2018. Sambar said in an interview that his team is confident in AST SpaceMobile’s technology, as demonstrated by the performance of the BlueWalker 3 test satellite. The relationship is moving from “loose partner to a strategic partner,” he said.

Wireless providers are in a race to offer connections for the world’s estimated 5 billion mobile phones when those devices are in remote areas beyond the reach of cell towers. For consumers, these services hold the promise of connectivity along rural roads and in places likes national parks. The service is typically marketed as a supplement to standard wireless coverage.

The new satellite network will work with ordinary mobile phones, offering a level of convenience that’s lacking in current call-via-satellite services, which require the assistance of bulky specialized equipment.

“Space-based direct-to-mobile technology is designed to provide customers connectivity by complementing and integrating with our existing mobile network,” said Jeff McElfresh, Chief Operating Officer, AT&T. “This agreement is the next step in our industry leadership to use emerging satellite technologies to provide services to consumers and in locations where connectivity was not previously feasible.”

“Working together with AT&T has paved the way to unlock the potential of space-based cellular broadband directly to everyday smartphones. We are thrilled to solidify our collaboration through this landmark agreement,” said Abel Avellan, AST SpaceMobile Founder, Chairman, and CEO. “We aim to bring seamless, reliable service to consumers and businesses across the continental U.S., transforming the way people connect and access information.”

AST SpaceMobile this summer will send five satellites to Cape Canaveral, Florida, for launch into low Earth orbit. AT&T’s Sambar didn’t say when service to customers might begin. “This will be a full data service, unlike anything you can get today from a low-Earth orbit constellation,” Sambar said.

T-Mobile is working with the low-Earth orbiting Starlink service from Musk’s Space Exploration Technologies Corp. The mobile carrier earlier said that its calling-via-satellite service could begin this year.

SpaceX has roughly 6,000 satellites aloft in low-Earth orbit — far more than any other company. The trajectory, with satellites circling near the Earth’s surface, allows communications signals to travel quickly between spacecraft and a terrestrial user.

SpaceX in January launched its first set of satellites capable of offering mobile phone service. The service “will allow for mobile phone connectivity anywhere on Earth,” Musk said in a post on X, the social network formerly known as Twitter, though he added that technical limitations mean “it is not meaningfully competitive with existing terrestrial cellular networks.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

About AST SpaceMobile

AST SpaceMobile, Inc. is building the first and only global cellular broadband network in space to operate directly with standard, unmodified mobile devices based on our extensive IP and patent portfolio, and designed for both commercial and government applications. Our engineers and space scientists are on a mission to eliminate the connectivity gaps faced by today’s five billion mobile subscribers and finally bring broadband to the billions who remain unconnected. For more information, follow AST SpaceMobile on YouTube, X (formerly Twitter), LinkedIn and Facebook. Watch this video for an overview of the SpaceMobile mission.

References:

https://about.att.com/story/2024/ast-spacemobile-commercial-agreement.html

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

AST SpaceMobile achieves 4G LTE download speeds >10 Mbps during test in Hawaii

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

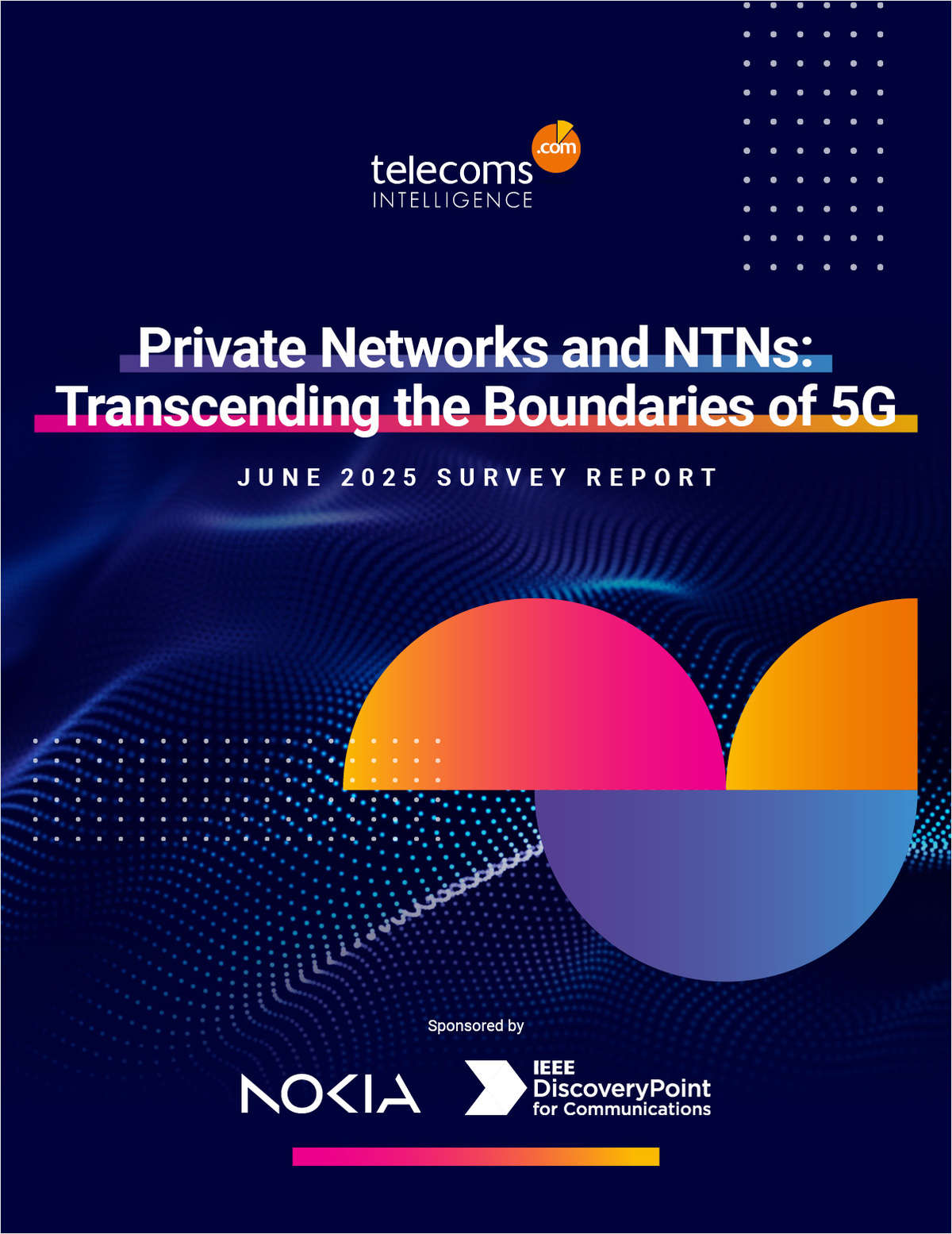

Converged terrestrial and satellite connectivity is a given, but the path is strewn with unknowns and sizable technological and business challengers, according to satellite operator CEOs. Hopefully, 3GPP Release 18 will contain the necessary specifications for it to be implemented as we explained in this IEEE Techblog post.

During Access Intelligence’s Satellite 2024 conference in Washington DC this week, Viasat CEO Mark Dankberg said satellite operators must start thinking and acting like mobile network operators, creating an ecosystem that allows seamless roaming among them. Terrestrial/non-terrestrial network (NTN) convergence requires “a complete rethinking” of space and ground segments, as well as two to three orders of magnitude improvement in data pricing, Dankberg said. Standards will help get satellite and terrestrial to fit together, but that evolution will happen slowly, taking 10 to 15 years, Iridium CEO Matt Desch said. It remains to be seen how direct-to-device services will make money, he added. Satellite-enabled SOS messaging on smartphones “is becoming free, and our satellites are not free — we need to make money on it some way,” Desch added.

The regulatory environment around satellite has changed tremendously during the past decade, with the FCC very oriented toward mobile networks’ spectrum needs and now satellite matters making up most of the agenda for the 2027 World Radiocommunication Conference, Desch said. However, there will be regulatory challenges to resolve in satellite/terrestrial convergence, he predicted. There are significant synergies in having a 5G terrestrial network and satcom assets under one roof, he said. Blurring the lines between terrestrial and non-terrestrial makes it easier for manufacturers to build affordable equipment that operates in both modes, Desch concluded.

That inevitable convergence is being driven by declining launch costs, maturing technologies and improved manufacturing, all of which make non-terrestrial network connectivity more economically competitive, said EchoStar CEO Hamid Akhavan. He said the EchoStar/Dish Network combination (see 2401020003) was driven in part by that convergence, consolidating EchoStar’s S-band spectrum holdings outside the U.S. with Dish’s S-band holdings inside the country. The deal also melds Dish’s network operator expertise with Hughes’ satellite expertise.

Wednesday Opening General Session: Are Satellite and Cellular Worlds Converging or Colliding?

To ensure space’s sustainability, missions must follow the mantra of “leave nothing behind,” sustainability advocates said. Space operators should have more universal protocols and vocabulary when exchanging space situational awareness data, as well as more uniformity in what content gets exchanged, said Space Data Association Executive Director Joe Chan. When it comes to space sustainability, clutter isn’t necessarily dangerous, and any rules fostering sustainability should avoid restricting the use of space, he said. Space lawyer Stephanie Roy of Perkins Coie said a mission authorization framework covering space operations that fall outside the regulatory domain of the FCC, FAA and NOAA is needed. Space operators and investors see sustainability rules as inevitable and want to ensure they allow flexibility and don’t mandate use of any particular technology, she added. Many speakers called for a “circular economy” in space, with more reuse of materials via refueling, reuse or life extension.

Separately, space sustainability advocates urged a mission authorization regulatory framework and universal use of design features such as docking plates enabling on-orbit serving or towing. Meanwhile, conference organizers said event attendance reached 14,000.

Also, ITU Secretary-General Doreen Bogdan-Martin urged the satellite industry to join ITU’s Partner2Connect digital coalition aimed at addressing digital divide issues, particularly in the least-developed nations and in landlocked and small island developing countries. The digital divide “is right up there” with climate change as a pressing issue for humanity, said Bogdan-Martin. She noted the coalition has received $46 billion in commitments, with a target of $100 billion by 2026.

References:

https://communicationsdaily.com/article/view?BC=bc_65fb60473d5de&search_id=836928&id=1911572

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

https://www.3gpp.org/specifications-technologies/releases/release-18

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

AST SpaceMobil announced its latest satellite-based connectivity milestone, making “5G” voice and data connections between a standard smartphone and a satellite. We say “5G” because there are no 5G satellite standards – only ITU-R M.2150 for terrestrial 5G. 3GPP Rel 17-20 will specify 5G SatCom.

Using the BlueWalker 3 test satellite and its 693-square-foot array — the largest such commercial telecommunications array in low Earth orbit — engineers at AST SpaceMobile made history on September 8, 2023, by demonstrating the first-ever 5G cellular connectivity from space directly to everyday smartphones. The company proved the feat using AT&T cellular spectrum in Maui, Hawaii, to make a voice call to Vodafone in Madrid, Spain. The call was facilitated by Nokia’s network core. The company also recently achieved other firsts in space-based cellular broadband, an industry it pioneered: voice calls, 4G data downloads of more than 14 Mbps, and 4G video calls.

AST SpaceMobile has included a YouTube link of its own in its latest announcement.

The two new milestones come in the wake of AST SpaceMobile’s announcement in April that it had completed the first ever space-based voice calls using normal smartphones.

It has, of course, come under scrutiny for that claim. In July Lynk, which is building an LEO constellation to create what it terms ‘cell towers in space,’ also claimed to have completed the world’s first voice calls over its network. Lynk seemed to hang much of its claim on the fact that it had a video as proof, although opinions vary on how conclusive such a video could be.

“Once again, we have achieved a significant technological advancement that represents a paradigm shift in access to information. Since the launch of BlueWalker 3, we have achieved full compatibility with phones made by all major manufacturers and support for 2G, 4G LTE, and now 5G,” said AST SpaceMobile CEO Abel Avellan. It’s worth noting that BlueWalker 3 is a test satellite; AST Space Mobile plans to launch its first five commercial satellites in the first quarter of next year.

“Making the first successful 5G cellular broadband connections from space directly to mobile phones is yet another significant advancement in telecommunications AST SpaceMobile has pioneered,” Avellan declared. Vodafone, AT&T and Nokia also contributed – slightly less self-congratulatory – statements about their own roles in proceedings and the potential of the technology to connect the unconnected.

It’s hard to argue with that last point, which is part of the reason why satellite-based connectivity is having something of an extended moment in the spotlight, with AST SpaceMobile, Lynk, Sateliot and others talking up their various achievements.

AST SpaceMobile describes itself as “the company building the first and only space-based cellular broadband network accessible directly by standard mobile phones.”

………………………………………………………………………………………………………………………….

References:

First-Ever 5G Connectivity from Space to Everyday Smartphones Achieved by AST SpaceMobile

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

AST SpaceMobile achieves 4G LTE download speeds >10 Mbps during test in Hawaii

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

FCC proposes regulatory framework for space-mobile network operator collaboration

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

China’s answer to Starlink: GalaxySpace planning to launch 1,000 LEO satellites & deliver 5G from space?

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

New research from Juniper Research forecasts that network operators will generate $17 billion of additional revenue from 3GPP‑compliant 5G satellite networks between 2024 and 2030.

Editor’s Note: There is no serious work in ITU-R on 5G satellite networks as we’ve previously detailed. The real SatCom air interface specifications work is being done by 3GPP, under the umbrella term of NTN (Non-terrestrial Networks), in Release 17 and the forthcoming Release 18.

ITU-R WP5D is responsible for terrestrial IMT radio interfaces (IMT-2000, IMT-Advanced and IMT-2020/M.2150 as well as IMT for 2030 and Beyond), so it won’t be involved in standardizing radio interfaces satellite networks.

ITU-R Working Party 4B (WP 4B) is responsible for recommendations related to: Systems, air interfaces, performance and availability objectives for FSS, BSS and MSS, including IP-based applications and satellite news gathering.

…………………………………………………………………………………………………………………..

The market research firm urges network operators to sign partnerships with SNOs (Satellite Network Operators) which will enable operators to launch monetizable satellite-based 5G services to their subscribers. SNOs possess capabilities to launch next-generation satellite hardware into space, as well as being responsible for the operation and management of the resulting networks.

The new report, Global 5G Satellite Networks Market 2023-2030 offers the most reliable source of data for the market.

Operators Hold the Key Billing Relationship:

Juniper Research predicts the first commercial launch of a 5G satellite network will occur in 2024, with over 110 million 3GPP‑compliant 5G satellite connections in operation by 2030. To capitalise on this growth, the research urges operators to prioritise immediate partnerships with SNOs that can launch GSO (Geostationary Orbit) satellites. These satellites follow the rotation of the earth to always be located above the country that the operator serves; providing consistent connectivity.

Additionally, operators must leverage their pre-existing billing relationship with mobile subscribers and enterprises as a platform to grow 5G satellite connectivity revenue over the next seven years. The report anticipates this existing billing relationship will enable operators to rapidly drive the adoption of satellite connectivity by integrating satellite services into existing terrestrial networks.

Key Forecasts:

- Total Operator-billed 5G Satellite Revenue 2024-2030: $17bn

- Total 3GPP-compliant 5G Satellite Connections in 2030; $110mn

- Average Revenue per 5G Satellite Connection in 2030: $7.98

………………………………………………………………………………………………………………….

3GPP Releases related to SatCom:

3GPP Rel-17 is enabling the launch of satellite-based communications. Unlike traditional telecommunications ecosystems, the development of this market will be defined by the entrance of a new category of players – satellite vendors. These vendors will work with network operators to deploy NTNs (Non-terrestrial Networks) that side alongside terrestrial networks.

NTNs are a joint development between network operators and satellite vendors to drive growth of telecommunications services. In the future, NTNs will integrate directly with satellite-based networks to provide connectivity with comprehensive services.

However, the development of NTN specifications is far from complete, the 3GPP roadmap includes provisions in 3GPP Releases 18 and 19 for enhancements to satellite services. 3GPP Release 20 includes the provision of satellite-based standards for future 6G networks. It is only with these standards that satellite networks can progress past traditional use cases, such as weather monitoring, global positioning services and broadcasting, which require low-to-medium throughput rates and do not need low latency.

Additionally, satellites have not been required, as the low data rates provided by previous iterations of satellite technologies, combined with the high costs of satellite connectivity, have not been able to compete with the service provided by terrestrial networks.

These will be the most immediate benefits of satellite-based services for 5G networks:

• Increased network coverage: Satellites will provide increased coverage to areas where terrestrial networks are financially unviable. This is most notable in rural areas where there is little demand for cellular connectivity; leaving operators with no return on investment into the needed backhaul infrastructure and base stations.

• Increased support of backhaul infrastructure: Given the data-intensive nature of 5G services, satellite infrastructure will be used to carry data in a similar fashion to fibre services in terrestrial networks.

• Increase network capacity and throughput: Satellites can offload data from terrestrial networks. As the number of 5G connections increases, so will the data generated. In turn, satellites can not only provide coverage in areas where there is little support for 5G services, but they can also alleviate geographical areas that require high throughput and support for a large number of connections.

• More network resilience: Satellites will provide an additional layer of network redundancy for communication services during natural disasters or network outages. When terrestrial networks are inoperable, satellites will be used for connectivity in the absence of terrestrial network.

Preparation for 6G Networks:

However, the research predicts operators will increasingly rely on SNOs for service provision as 6G development accelerates. Research author Sam Barker commented:

“Operators must not only think of 5G satellite services when choosing an SNO partner, but also the forward plan for 6G networks, including coverage and throughput capabilities.”

About the Research Suite:

This new Juniper market research suite offers the most comprehensive assessment of the 3GPP‑compliant 5G satellite network to date; providing analysis and forecasts of over 24,000 data points across 60 markets over five years.

View the 5G Satellite Networks market research: https://www.juniperresearch.com/researchstore/operators-providers/5g-satellite-networks-research-report

Download a free sample: https://www.juniperresearch.com/whitepapers/5g-satellite-networks-the-17bn-operator

References:

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

U.S. military sees great potential in space based 5G (which has yet to be standardized)

Some analyst say that space-based 5G (which has yet to be standardized) will enable enhanced service to cities but also connects remote regions, including areas without traditional mobile service, ships off-shore, through natural disasters and in contested battlefields. Features of 5G from Space might include: connecting massive numbers of Internet of Things (IoT) sensors and devices.

From a March 14, 2023 Congressional Research Service In Focus report, National Security Implications of 5G Mobile Technologies:

5G mobile technologies will increase the speed of data transfer and improve bandwidth over existing fourth generation (4G) technologies, in turn enabling new military and commercial applications. 5G technologies are expected to support interconnected or autonomous devices, such as smart homes, self-driving vehicles, precision agriculture systems, industrial machinery, and advanced robotics. 5G for the military could additionally improve intelligence, surveillance, and reconnaissance (ISR) systems and processing; enable new methods of command and control (C2); and streamline logistics systems for increased efficiency, among other uses. As 5G technologies are developed and deployed, Congress may consider policies for spectrum management and national security, as well as implications for U.S. military operations.

U.S. military leaders are telling the wireless and satellite industries they see great potential in 5G, and they’re asking for standards, open interfaces and simple devices.

“I am excited to see what the next couple of years will bring,” said Brigadier General Steve Butow, space portfolio director at the U.S. Defense Innovation Unit. “It is important to take advantage of technologies produced at scale.” Butow joined Colonel Joseph Roberts, assistant program executive officer, PEO C3T, U.S. Army, on a panel at SATELLITE 2023 entitled “The Role of Space-Based 5G in Military Communications.” Executives from defense contractor Lockheed Martin and satellite giant Hughes were also on the panel.

Roberts said space-based 5G can be a “game changer” because it creates “the opportunity to connect every soldier on the battlefield.” Butow encouraged the wireless industry to “migrate to open architectures.” He said that if the industry adopts open interfaces it will “create an environment where we can do lots of business with you.”

Source: Getty Images

At least one satellite operator is also advocating for open interfaces for the wireless infrastructure industry. Open RAN is a top priority for HughesNet® in its work with Dish Network, explained Rick Lober, VP and GM at Hughes’ government and defense division. “We are pushing that very hard,” he said, adding “I’m not sure everyone is on board.”

Lober added that he hopes users of network infrastructure will take full advantage of open RAN by working with a diverse set of vendors. “If you are going to have a program that is about open standards, do not award it to one company,” he said.

Dawna Morningstar, director, next generation solutions at Lockheed Martin, said industry standards are “the critical underpinning” that enables interoperability and scalability. She said Lockheed Martin is actively engaged with wireless industry standards boards. She highlighted 3GPP Release 17’s (not a standard) inclusion of interoperability with non-terrestrial networks. “We can now have these open solutions for air and space that can integrate seamlessly with the terrestrial networks,” she said. “We can get the intelligence down where it needs to be, and back up and distributed.”

Verizon’s Cory Davis, AVP Public Safety at Frontline, said the military is interested in portable 5G private network solutions. Verizon’s Tactical Humanitarian Operations Response (THOR) 5G on wheels has the capabilities the military wants, Davis said, but the form factor is too big for some use cases. “They want to put THOR in a backpack and take it to the desert,” Davis said.

References:

https://www.lockheedmartin.com/5gfromspace

https://www.fiercewireless.com/tech/ericsson-qualcomm-test-space-based-5g-thales