Broadband Status

Kagan: Broadband Wireline Internet growth slowing with cable leading telcos; U.S. vs Europe cord cutters compared

Broadband service providers continued to gain customers ahead of widespread competition from pre-standard 5G wireless offerings, but growth is slowing as nearly four out of five homes in the U.S. now subscribe to a wireline internet connection, according to a new report released today.

Kagan, a media research group within S&P Global Market Intelligence, estimates cable and telecom providers combined added 339,000 residential subscribers in the second quarter. The momentum was largely driven by the cable industry. Cable operators saw the rate of growth shrink on a sequential and annual basis, but they did not however lack market share gains, adding nearly half a million new residential customers versus a net loss for the telecoms of 155,000 customers.

Ian Olgeirson, Research Director at Kagan commented: “We estimate wireline broadband penetration increased slightly to 78.5% of occupied households. Cable’s residential gains did not match the levels from the previous or year-ago quarters, but net adds in the trailing 12 months are still higher at 2.8 million when compared to the same period in 2018. Telco broadband slumped in the second quarter, returning to a pattern of six-figure losses after holding steady in the first quarter. Growth in telco fiber-to-the-home connections was not sufficient to overcome losses to legacy copper and fiber-to-the-node DSL connections.”

Separately, Kagan says that Americans are not the only ones cutting the cord. The vibrant and free-to-air broadcasting options available in most of the EU countries we surveyed makes paying for TV a hard sell, subscription video on demand or otherwise.

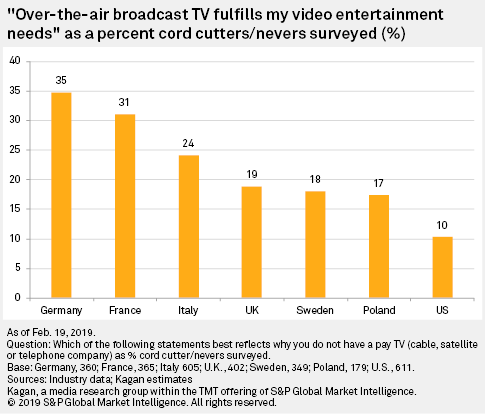

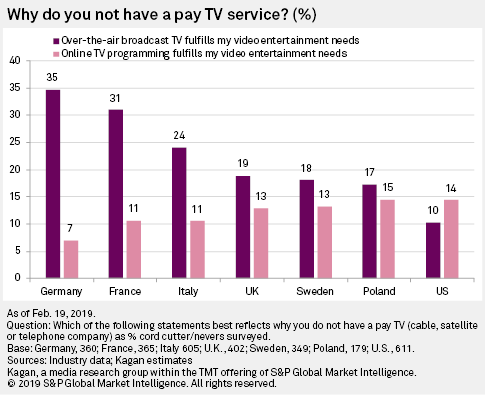

For instance, when Kagan asked cord cutters and “cord nevers” why they cut the cord or never added a video service, 35% of German cord cutters/nevers answered that “rabbit ears” fulfill their video entertainment needs. All respondents from EU countries surveyed scored above 15% on this metric. But just 10% of U.S. survey-takers felt the same way.

Kagan thinks the longer history with pay TV in the U.S., one that was forecast by Paul Kagan in the late 1960s, has left Americans with more paid TV options than Europeans, leading to fewer viewers stateside who mostly use over the air, or OTA.

But the longer pay TV history in the U.S. does not imply Americans like paying for the service.

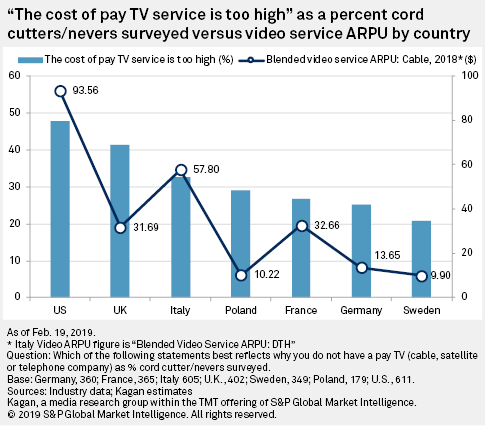

Nearly half of American cord cutters/nevers said price was the main reason they cut the cord or never connected, the highest rate among all seven countries we reviewed. Americans pay close to $100 per month on average for traditional multichannel video services, with EU countries coming in lower. Sweden’s average monthly fee for video is under $10 and survey-takers there were consequently less concerned with pricing. A significant factor in lower pay TV access prices in Europe is that sports and premium channels are only included in top TV tiers, with basic packages boosted by a large number of OTA (over the air) channels.

U.S. survey-takers were also the only ones to say online video services were more important than free OTA in terms of why they cut the cord or never added a cord. For instance, while 10% of Americans said rabbit ears were enough reason to cut the cord, 14% said the same about online video services, including Netflix. Again, this could be a case of the U.S. being first to market with online video services and remaining relatively ahead of the pack.

As traditional media companies look towards a digital future it’s important to remember that what matters to US consumers might matter less overseas.

About S&P Global Market Intelligence:

At S&P Global Market Intelligence, we know that not all information is important—some of it is vital. We integrate financial and industry data, research and news into tools that help clients track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities globally can gain the intelligence essential to making business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). For more information, visit www.spglobal.com/marketintelligence

Brazil launches first phase of 100G fiber project, expands 4G and edge cloud networks

Brazil’s Ministry of Science, Technology, Innovation and Communications, in partnership with the National Education and Research Network (RNP), has launched the first phase of the Ciencia Conectada program, which will expand the broadband infrastructure using optical fiber in the North and Northeast regions. The academic internet network is expanding its speed from 10 Gbps to 100 Gbps, benefiting federal universities, federal institutes and research units, in addition to fostering economy and local development.

The first phase of the program will reach 77 locations, six states, 16 cities, and 64 federal, state and private institutions this year. By 2021, the 16 metropolitan networks that will allow the connection of 1,317 schools to the internet will be completed.

…………………………………………………………………………………………………………………………………………………

4G networks reached 144 new cities in Brazil in the first half of 2019, taking the total to 4,573, where 96 percent of the population live, according to data published by Telebrasil. In the period January-May, 12.3 million new 4G Sim cards were activated, for a total of 142 million 4G users.

Over the 12 months to June, 24 million new 4G Sim cards were activated (20%). In the same period, 146 new cities were connected to 3G networks, taking the total to 5,433 cities, where 99.7 percent of the Brazilian population lives.

The number of mobile internet users reached 207.6 million, according to the industry group. If fixed connections are included, there were a total of 239.3 million internet users at the end of May. Of these, 31.7 million were fixed broadband subscribers, a segment that grew 4.6 percent in 12 months, with 1.8 million new accesses.

https://www.telecompaper.com/news/brazil-extends-4g-networks-to-144-more-cities-in-h1–1304151

…………………………………………………………………………………………………………………………………………………..

TIM Brazil is expanding its edge cloud network using Nokia AirFrame servers that feature 2nd-gen Intel Xeon Scalable processors to virtualise its data centres by 2021.

The news will make TIM the first operator in Latin America to adopt the AirFrame technology for its data centre servers, improving server capacity and delivering better quality, internet access and video consumption for its users in Brazil.

“Virtualisation is important to improve user experience in our network, which will count with more speed and data usage stability,” said Leonardo Capdeville, CTIO, TIM. “With this core virtualisation, TIM is leading with a 5G pilot project over the network. This process also allows us to strengthen our customers’ data protection.”

The rollout will comprise of 1000 state-of-the-art AirFrame servers that will virtualise network functions to guarantee better customer experience. As well as creating edge data centres the agreement with Nokia also moves TIM Brazil a step closer to 5G, which requires a cloud core for network activities.

“Nokia’s unique solution, designed to support precisely this evolution to 5G, will give TIM Brazil a crucial ongoing competitive advantage as they evolve their core networks into cloud,” added Leandro Monteiro, Nokia sales director in Brazil. “Nokia is proud to partner with TIM as it invests in cloud native technologies to maintain its position as one of Latin America’s most efficient networks.”

https://www.capacitymedia.com/articles/3824033/tim-brazil-expands-edge-cloud-capabilities

Comcast earnings beat with strong broadband subscriber growth; AT&T is still largest U.S. pay TV provider but bleeds video subs

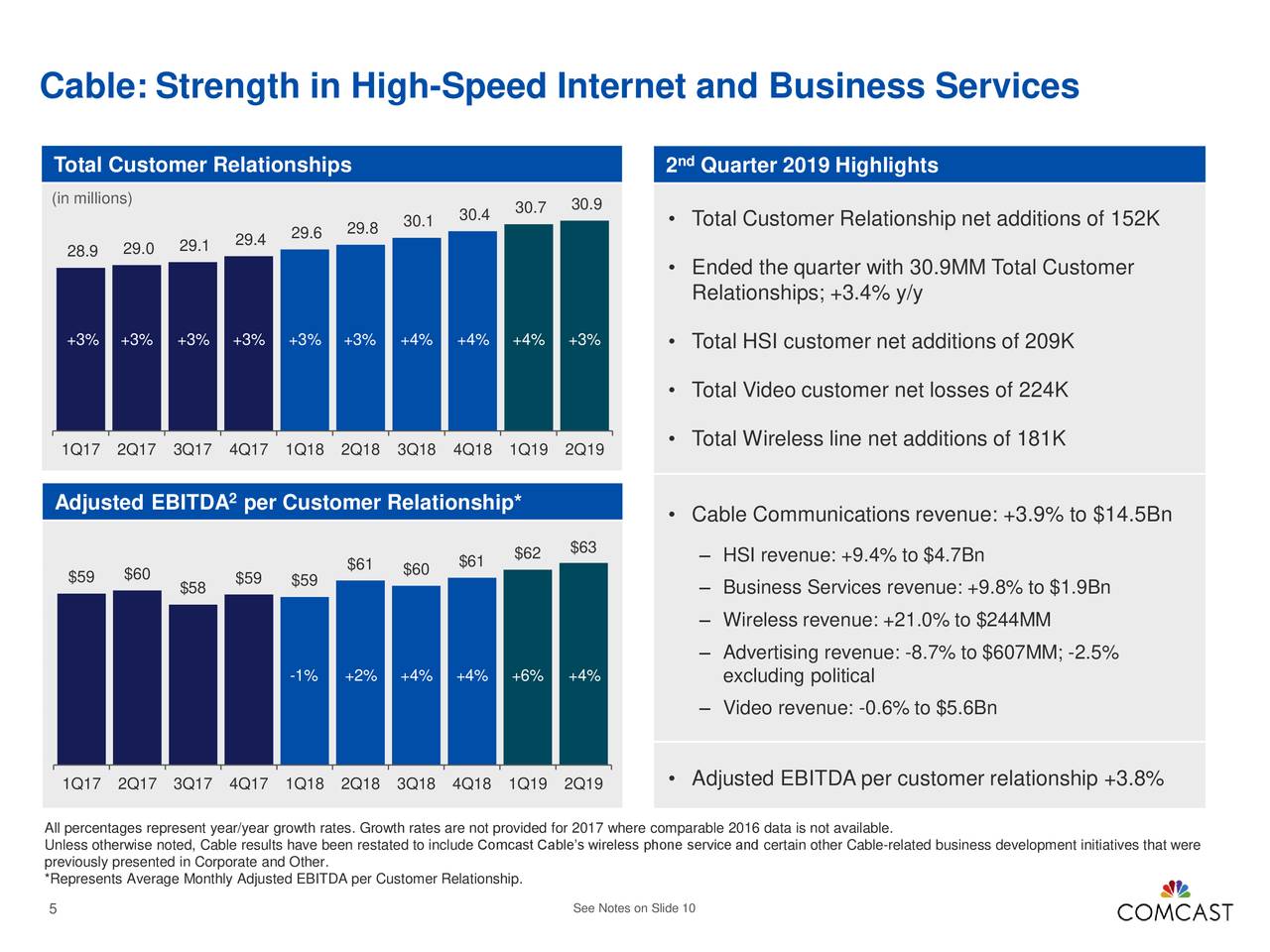

Despite much higher video subscriber losses than in the past, Comcast generated healthy revenue and profit margin increases in Q2-2019, based on the strength of its performance in the broadband, wireless, business services and other sectors. Comcast, the largest cable and broadband provider in the U.S., reported steady revenue and subscriber gains nearly across the board on July 25th, with the glaring exception of its slumping Xfinity pay-TV business. It also racked up revenue gains in its NBC Universal cable networks, broadcast TV and theme park units, as well as customer revenue gains at its new Sky operation in Europe.

On the pay-TV side, Comcast suffered less collateral damage than most of its peers (e.g. AT&T Direct TV and Direct TV now bled subscribers in the most recent quarter – see Editor’s Note below). The cableco/MSO saw its video subscriber losses increase in the second quarter as cord-cutting by consumers accelerated. The company shed 224,000 video subs (209,000 residential and 15,000 business subs) during the quarter, far worse than its loss of 140,000 subs a year earlier. That reduced its total video base to 21.64 million, maintaining its status as the nation’s second-largest pay-TV provider behind AT&T. Despite these much heftier sub losses, Comcast’s video revenues declined just 0.6% on a year-over-year basis to $5.59 million, thanks to price hikes and subscriber tier upgrades. More importantly from the company’s perspective, video ARPU increased by 1.3%, as the operator, like a growing number of its peers, continues to shift its focus from low-margin to high-margin customers.

…………………………………………………………………………………………………………………………………………………………………………………………………………..

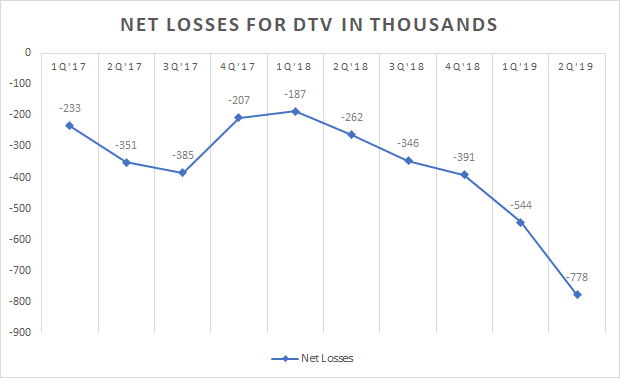

Editor’s Note: The second quarter is typically the worst of the year for pay-TV providers. For example, AT&T lost 778,000 premium TV subscribers in the second quarter, including DirecTV satellite and U-verse television customers – a sharp acceleration in subscriber losses from the 544,000 that cut the cord in Q1-2019. The total number of premium TV video connections fell to 22.9 million, its lowest total since June 30, 2017, when it stood at almost 25.2 million, an overall net loss of 2.3 million.

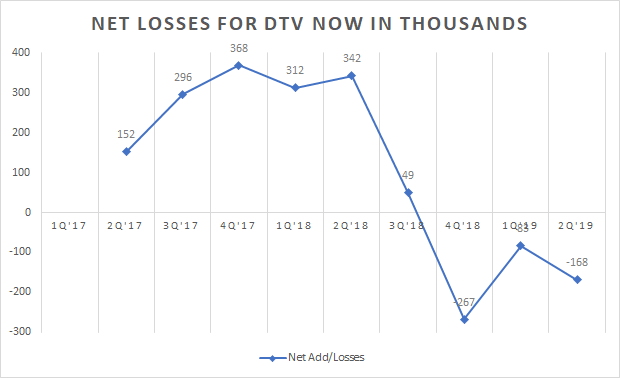

AT&T also lost 168,000 streaming DirecTV Now accounts and AT&T said it expects a similar level of video losses to continue in the current quarter. It’s somewhat surprising that AT&Ts video streaming offering is seeing a mass exodus with the number of subscribers peaking at 1.858 million in September 2018 to 1.34 million now, a decline of more than 500,000.

…………………………………………………………………………………………………………………………………………………………………………………………….

Comcast is by far the largest broadband provider in the U.S. (that’s right- ahead of AT&T, Verizon and CenturyLink). The cableco/MSO added 209,000 new broadband Internet subscribers (182,000 residential and 28,000 business) in the spring quarter, boosting its total broadband base to 27.8 million at the end of June. While that’s down markedly from its gain of 260,000 broadband subs a year earlier, the year-ago total marked the company’s best-ever broadband quarter. Comcast executives stressed that they’re well on their way to their 14th consecutive year of 1 million-plus broadband subscriber increases.

Broadband revenues surged 9.4% to $4.66 billion in the 2nd quarter, due to the impressive increase in broadband subscribers. Residential broadband ARPU (average revue per unit) rose by 4.2% year-over-year, as fewer bundling discounts and subscriber upgrades to higher-priced speed tiers lifted revenues even without price hikes.

“The ARPU is growing, broadband revenue is growing, and it’s margin accretive, so it’s helping the EBITDA growth,” said Comcast Cable President and CEO Dave Watson, in the cableco/MSO’s Q2 earnings call. “So overall, I think we have a solid pipeline for broadband innovation.”

…………………………………………………………………………………………………………………………………………………………………………….

On the wireless front, Comcast’s Xfinity Mobile service continued its steady, if slightly slower, ascent to profitability. The MSO added 181,000 mobile lines in Q2, raising its total to nearly 1.6 million lines. The strong mobile line gains were off from adds of 204,000 lines in the year-ago period but up from adds of 170,000 lines in Q1.

As a result, Comcast’s mobile revenues rose 21.0%, to $244 million. Operating cash flow from Comcast’s mobile business improved as well to $88 million, down substantially from a year earlier, as the new unit edges ever closer to profitability.

Speaking on the company’s earnings call Thursday morning July 25th, Comcast Senior EVP and CFO Mike Cavanagh said Xfinity Mobile is “already positively impacting [customer] retention and attracting new customers” to the company’s cable offerings. He predicted that the mobile unit will start producing positive economic results when penetration rates reach “the mid-to-high single digits.”

…………………………………………………………………………………………………………………………………………………………………………..

Similar to other large North American pay-TV providers that have reported Q2 earnings so far. “We’ll continue to emphasize our approach to this segment,” said Comcast Cable President and CEO Dave Watson. “We’re not going to chase the low end.”

Comcast officials still had no early results to share about Xfinity Flex, a new video streaming product for broadband-only customers that’s powered by the MSO’s cloud-based X1 platform (including the X1 voice-based navigation and search system) and integrated with OTT offerings like Netflix, Amazon Prime Video and YouTube. But executives said more information will come soon.

“It’s an important long-term product,” Watson said Flex on the company’s Q1 earnings call in April, noting it’s early use in a “targeted fashion” to build a broader video relationship with the operator’s broadband-only subs. “We think Internet-delivered video is a good thing for the cable business.”

Also on the streaming video front, Comcast executives revealed a bit more about the forthcoming OTT-delivered video service from the conglomerate’s NBCUniveral (NBCU) unit. Plans call for the OTTP offering, to be based on the existing Now TV platform of Comcast’s Sky service in Europe, to launch in April.

The new ad-supported service mainly will feature acquired movies and TV shows, rather than exclusive originals, at least at first, said NBCU CEO Steve Burke. Despite a market crowded with incumbents like Netflix and Amazon, as well as such new entrants as Disney, WarnerMedia and Apple, Burke is not worried, he said, in a statement.

“Our service is very different from Netflix,” said Burke. “We believe we’ve got some ideas that are innovative and don’t really want to share those until we get right close to launch, but we’re very pleased to have The Office and very optimistic about our streaming plans at this point.”

…………………………………………………………………………………………………………………………………………………………………………..

In a fresh research note issued after the earnings call this morning, Craig Moffett, a principal analyst at MoffettNathanson, gave an approving nod to this strategy:

“As cable operators stop chasing low-value video subscribers, their margins will rise with mix shift, their margins will improve further with improvement in video economics on those that remain; their margins will expand still further as broadband ARPU accelerates (fewer bundled discounts), and their margins will expand still further as their non-programming costs fall as a percentage of revenue. Almost predictably, Comcast raised its cable margin 2019 guidance yet again (now to ‘over’ 100 bps for the year, from previously ‘up to’).”

Comcast Business kept up its steady growth pace of the past decade and a half. With close to 2.4 million commercial “customer relationships,” the cableco boosted its business service take to $1.93 billion in the second quarter, up 9.8% from a year ago. As a result, the company is now on target to approach the $8 billion mark in annual business revenues this year.

References:

http://www.broadbandworldnews.com/author.asp?section_id=472&doc_id=753022&

https://www.cnbc.com/2019/07/25/comcast-q2-2019-earnings.html

https://www.cmcsa.com/financials/earnings

https://seekingalpha.com/article/4277488-t-mass-exodus-continues

Paul Budde: What Does ‘Peak Telecom’ Mean for 5G? Asian Telecoms Maturity Index

By Paul Budde, edited by Alan J Weissberger

Peak Telecom and 5G:

“Peak telecom” is described as the maximum point of expansion reached by the traditional telecommunications industry before the internet commoditized the industry to a utility (dumb) pipe.

I thought of this when I read the recent outcomes of the famous Ericsson Consumer Lab survey. The company used the results of the survey to counteract market criticism regarding the viability of the telco business models in the deployment of 5G.

It will come as no surprise that Ericsson, as a manufacturer of 5G gear, has given the report a positive spin. However, I remain skeptical about the short-term business models for the deployment of 5G (so does the editor). Once full deployment happens over the coming decade, I certainly can see long-term opportunities. These will revolve around content and apps as well as areas such as IoT in smart homes, cities and energy. However, the question is, will this lead to new financial opportunities for the telcos? Peak telecom questions such an outcome.

What exactly do these broader 5G opportunities mean for the telecommunications operators — the companies who have to build the infrastructure? It is here that we can see that we have reached peak telecom. For several years now, we have seen that growth in the telecom industry is rather stagnant. Profits are still being made but mostly generated by lowering costs. For example, new telecom access speeds are provided at no extra cost to the users. Basically, consumers are getting more for the same price.

There has continuously been the promise of new revenues that could be generated through a range of new telecoms development (internet, broadband, smartphones). The telcos have, however, largely failed to move into the content/app market where the new profits are occurring. Companies such as Amazon, Facebook, Google, Alibaba, Tencent and Netflix have been the primary commercial beneficiaries of these developments.

The Ericsson report mentions that mobile access in congested areas and in mega-cities is becoming a problem and that 5G will assist here. I agree, but will customers pay extra for it?

It also mentions opportunities for 5G to be an alternative to fixed broadband and for it to become a key technology in fixed wireless networks. There certainly will be niche market opportunities here, but this is a highly price-sensitive market. The economics of mass fixed infrastructure favors it over mobile infrastructure. Any gains here will basically be a substitution of a fixed service they already provide, so the overall net gain for the industry will be neglectable.

The report indicates that 20% of smartphone users are prepared to pay a premium for 5G. The current commercial 5G service in South Korea is charging a meager 10% premium. No doubt, in coming years, through competition even that premium will disappear.

The report indicates that consumers expect new innovation such as foldable phones, VR glasses, AI, 360-degree camera, robotics and so on. All true but it all depends how affordable these products and service will be and again who will develop these next “must-have” products? Here, also, the telcos will most likely be missing out.

I fully agree with the report’s assessment that we have to look at 5G over the more extended period. As mentioned, there are good reasons to believe that once full deployment exists, it will open up many new business opportunities.

However, will this promise be enough for telcos to make the substantial upfront investments that are needed? This without a clear indication if they can extract any significant new revenues from 5G? The more likely scenario is that the digital giants are going to be the ones that will reap the real profits of those innovations.

I stick to my argument that the key reason for the telcos to move into 5G is because of network efficiencies, which lead to lower costs.

–>This is absolutely critical in this peak telecom market.

To end on a more positive note for the industry, there is the first mover advantage with short term premium price opportunities for those who can tap into the early adopters’ market. There is always a group of users who simply do want to have the newest of the newest, whatever the price. The size of this market varies — depending on how “hot” the new product is seen by this market segment — and could be anywhere between 10% and 25%.

This is certainly attractive for the telcos as it allows them to recoup some of the initial investment rapidly. In relation to mobile products and services, this mainly relates to “must have” gadgets and, in particular, the smartphone. The current price (in Korea) of a 5G phone is approximately US$1,500 (AU$2,153), without any outstanding features.

The lack of attractive smartphones could be another negative for some of the early adopters. Time will tell.

Asia Telecoms Maturity Index:

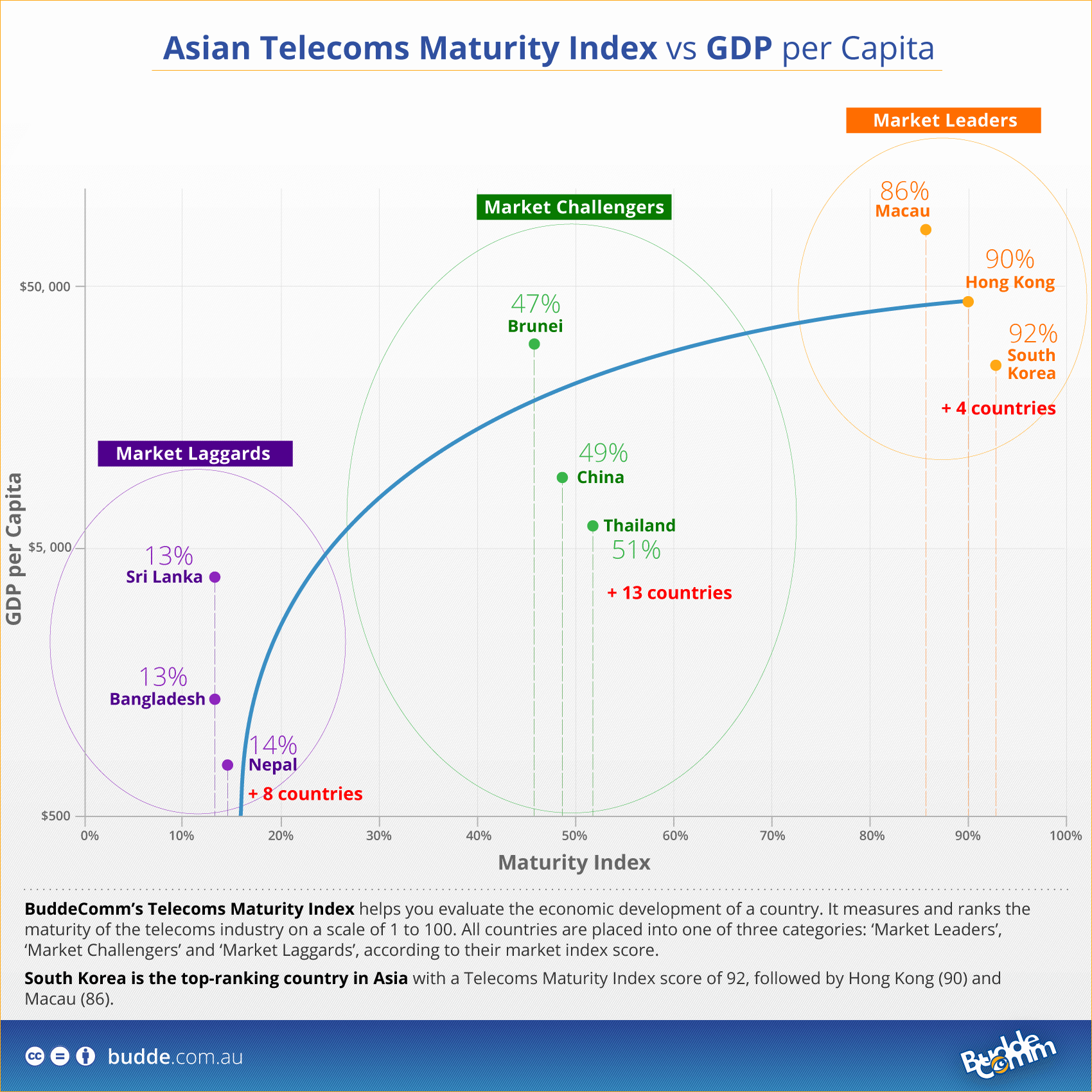

This index, created by Paul Budde, analyzes the Broadband, Mobile and Fixed Line markets of a specific country as well as a range of parameters to help you evaluate the economic development of a country.

BuddeComm’s Telecoms Maturity Index measures and ranks the maturity of a country’s telecoms industry on a scale of 1 to 100. All countries are placed into one of three categories: ‘Market Leaders’, ‘Market Challengers’ and ‘Market Laggards’, according to their Market Index score.

The Telecoms maturity index is used to fuel regional analysis, it provides a unique approach and allows a comprehensive country vs region comparison.

Asia – Mobile Network Operators and MVNOs

Asian countries in the Market Leaders category have fixed broadband penetrations in the range of 25% and 42% and mobile broadband penetrations in the range of 98% and 135%. South Korea is the top-ranking country in Asia with a Telecoms Maturity Index score of 92, followed by Hong Kong (90) and Macau (86).

Find more information on the Asian telecoms market or Contact Us.

For more information on BuddeComm’s Telecoms Maturity Index, see:

- Africa – Fixed Broadband Market – Statistics and Analyses

- Africa – Mobile Network Operators and MVNOs

- Asia – Fixed Broadband Market – Statistics and Analyses

- Asia – Mobile Infrastructure and Mobile Broadband

- Asia – Mobile Network Operators and MVNOs

- Asia – Telecom Forecasts

- Europe – Mobile Network Operators and MVNOs

- Latin America – Mobile Network Operators and MVNOs

- Middle East – Mobile Infrastructure and Mobile Broadband

- Middle East – Mobile Network Operators and MVNOs

https://www.budde.com.au/Research/Buddecomm-Telecoms-Maturity-Index

Dell’Oro: Broadband access revenue declines 2% y/y in Q1-2019

In a new report published Monday June 10th, Dell-Oro Group said that global revenue for broadband access equipment declined 2 percent Y/Y in 1Q 2019, reaching $2.9 Billion. Increased shipments of XG-PON1, XGS-PON, NG-PON2 OLT ports, and DOCSIS 3.1, CPE offset CCAP (Converged Cable Access Platform) spending declined for the second straight quarter.

“The 10 Gbps FTTH deployments continue to build momentum,” said Jeff Heynen, Research Director, Broadband Access and Home Networking. “The next-gen fiber increases nearly offset the weakness in cable CCAP spending, as cable operators push off new capacity purchases while they determine how to move forward with distributed access architectures,” Heynen added.

Following are additional highlights from the 1Q 2019 Broadband Access Quarterly Report:

- Total cable access concentrator revenue decreased 38 percent Y/Y to $275 M, driven by a strong slowdown in CCAP channel purchases in North America and EMEA.

- Total DSL port shipments decreased 21 percent Y/Y, with ADSL ports down 71 percent and VDSL ports down 20 percent.

- Total PON OLT port shipments increased 7 percent Y/Y, with XGS-PON ports up 337 percent.

- Total SOHO WLAN units increased 13 percent Y/Y, driven by the driven by 19% Y/Y growth in broadband CPE with WLAN and 125% Y/Y growth in mesh router units.

According to Dell’Oro Group’s Q1 2019 Broadband Access Quarterly Report, total cable access concentrator revenue was down 38% year over year to $275 million, driven by the slowdown in CCAP channel purchases in North America and EMEA.

Reference:

http://www.delloro.com/news/broadband-access-equipment-revenue-dipped-2-9-b-1q-2019

Dell’Oro PRESS RELEASES:

SHIPMENT OF 25 GBPS PORTS REACHED A NEW HEIGHT IN 1Q 2019 DESPITE SERVER MARKET SLOWDOWN, ACCORDING TO DELL’ORO GROUP

Rest of the Ethernet Controller and Adapter Market Remains Challenged

REDWOOD CITY, Calif. – June 11, 2019 – In a newly published report by Dell’Oro Group, the trusted source for information about the telecommunications and networking industries, shipments of 25 Gbps Ethernet controller and adapter ports reached a new height … Continued

1Q 2019 ENTERPRISE WLAN MARKET LIFTED BY STRONG SURGE IN NORTH AMERICA FOR THREE CONSECUTIVE QUARTERS, ACCORDING TO DELL’ORO GROUP

Cisco and HPE Aruba Scored Most Significant Revenue Gains

REDWOOD CITY, Calif. – June 11, 2019 – According to a recently published report by Dell’Oro Group, the trusted source for market information about the telecommunications, networks, and data center IT industries, the 1Q 2019 Enterprise Wireless LAN (WLAN) market … Continued

SERVER MARKET REVENUE GREW AT THE SLOWEST PACE IN EIGHT QUARTERS IN 1Q 2019, ACCORDING TO DELL’ORO GROUP

Cloud Capex Forecasted to Revert to Stronger Growth by Late 2019

REDWOOD CITY, Calif. – June 10, 2019 – According to a recently published report from Dell’Oro Group, the trusted source for market information about the telecommunications, networks, and data center IT industries, the worldwide Server market grew at the slowest … Continued

China Broadcasting Network Corp. to launch mobile network; already provides cable TV, Internet and Telecom services in China

As China state-owned telecom carriers (Unicom, China Mobile, China Telecom) prepeare for launch of 5G services, Beijing is supporting the creation of a new full-service telco by upgrading the nation’s cable network giant, China Broadcasting Network Corp. This is evident from the flurry of initiatives from the state-owned cable TV network operator to enhance its infrastructure and emerge as a stronger entity that can join the Big Three telecom firms in their own game.

Last month, China Broadcasting, an entity set up to run the nation’s cable TV system before being awarded, in 2016, a license to operate internet and telecom services, announced strategic partnerships with CITIC Group and Alibaba Group to help speed up efforts for network upgrades.

Under the cooperation agreements, China Broadcasting, which was founded by what is currently known as the National Radio and Television Administration (NRTA), will receive assistance from CITIC and Alibaba “for integrated development and upgrading of the nation’s cable TV networks as well as related product development and management,” state news agency Xinhua reported.

China aims to make its national cable TV networks smarter and create new generation radio and TV technology infrastructure by integrating cable TV networks and letting 4K, 5G, IPv6, big data, artificial intelligence and quantum communications technologies play their roles, Nie Chenxi, the head of the NRTA, said at the signing ceremony.

China Broadcasting’s plans comes as the traditional cable TV business faces a tough challenge in the era of internet TV and streaming services, throwing up the need for operators to upgrade themselves and expand their services via two-way interactive high speed broadband infrastructure.

Currently, telecom operators like China Telecom and China Mobile are offering fiber-to-the-home or fiber-to-the-building broadband networks to provide dedicated bandwidth for each broadband line, while cable network can only adopt a share-bandwidth approach. That has made it difficult for cable networks to compete with the fiber broadband operators.

China has seen cable TV subscribers falling in number after hitting a peak in 2016. Last year, subscribers were estimated at 223 million, down 8.75 percent from a year ago. The industry has seen its profitability get constrained and profit margins decline amid the weak subscriber figures. Meanwhile, IPTV and OTT video platforms had around 150 million users in 2018.

As the industry gets reshaped, CITIC is emerging as a key player in the reform of China’s cable network. The group, as a matter of fact, is not new to telecom network deployment. It owns CITIC Guoan network in Beijing, which is expanding its cable network operation across the nation. The conglomerate is also exploring new business models by teaming up with local cable operators to operate smart community service platforms for citizens.

Such experience puts CITIC in a good position to help integrate China’s state-owned nationwide cable network into a single valuable backbone network to deliver high definition content to TV as well as mobile devices.

CITIC Group can also help ease the financial burden of the government on network capital expenditure. Though there isn’t an equity deal, CITIC’s partnership with China Broadcasting can help the latter catch up with the three big state-owned telecom carriers through a market-driven approach.

In November last year, mainland media quoted Chinese authorities as saying that they have allowed China Broadcasting to build 5G networks, a move that will allow the market to transform into a four-player battleground. China Daily cited sources close to the Ministry of Industry and Information Technology as saying that China Broadcasting, which was formed in 2014 by combining several regional cable TV operators, was officially applying for a 5G license. That will help boost competition in the industry that has long been dominated by three players — China Mobile, China Unicom and China Telecom.

In China, traditional cable TV service has been facing keen competition from online media services such as IPTV, OTT video as well as Internet video. Telecom operators are using fiber broadband to provide IPTV services to their broadband users, while OTT players like Youku and Tencent also dominate the screen time of Chinese users.

Amid this situation, cable TV network operators need to invest not only on the content but also the network technology to provide triple or even quad play in the market to catch up with the telecom carriers.

China Broadcasting is preparing to launch a mobile network using the 700MHz spectrum band. The spectrum is currently being used for domestic analogue television broadcasting. Now, China Broadcasting and CITIC have formed a joint venture, China Broadcasting Network Mobile, to operate a mobile business on 700Mhz band. The joint venture is expected to receive a mobile license from the Chinese government so that they can build a network across the nation to challenge the dominance of the Big Three operators.

As the low-band 700MHz spectrum can have better network coverage compared with other frequency bands, the joint venture will be in a good position to provide better coverage for high speed mobile internet using 5G technology. Once the 5G war kicks off, apart from China Broadcasting, CITIC Group could also effectively become a major player in the China telecom market.

References:

http://www.ejinsight.com/20190409-china-cable-network-reform-what-it-means-for-telecom-industry/

https://en.wikipedia.org/wiki/Telecommunications_industry_in_China

http://english.cctv.com/2016/05/06/VIDElPgPCFpnb3m4hk1XC3Gq160506.shtml

GSMA to ITU-D: Addressing Barriers to Mobile Network Coverage in the Developing World

by Ms. Lauren Dawes, GSMA-UK [email protected]

Abstract:

- While mobile broadband (3G or 4G) coverage in the developed world is ubiquitous, 800 million people are still not covered by mobile broadband networks. In rural areas the cost of building and operating mobile infrastructure can be twice as expensive compared to urban areas, with revenues up to 10 times smaller.

- In addition, 3.2 billion people live in areas covered by mobile broadband networks but are not using mobile internet services. A large scale consumer survey conducted by the GSMA revealed that affordability was the greatest barrier to using mobile internet services.

- Both the private sector and public sector have important roles to play in improving the business case for mobile network coverage expansion.

- By providing precise and granular data on mobile coverage, GSMA Mobile Coverage Maps can help operators determine the costs of providing mobile broadband services in uncovered areas and support the development of mobile networks.

- For example, GSMA Coverage maps can help mobile operators assess the relevance of infrastructure sharing deals. Indeed, infrastructure sharing can help to lower the risk and costs of investments in network expansion. Regulators should seize this opportunity and ensure all forms of voluntary infrastructure sharing between operators are permitted.

- GSMA Coverage Maps can also help other stakeholders – including governments, NGOs, and private companies that rely on mobile connectivity – to strategically target their activity, by helping them identify the locations with existing coverage.

- In this context, policy-makers are encouraged to adopt policies that will support mobile operators’ efforts to provide affordable mobile internet services. This includes:

- Removing sector specific taxes which have an impact on the price of mobile devices and the costs of providing mobile internet services;

- Adopting pro-investment supply side policies in areas such as spectrum policy and planning;

- Providing open and non-discriminatory access to state-owned public infrastructures.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………

Discussion:

Mobile is now the most common – and often the only way – that many people around the world access the internet, with 3.6 billion now subscribing to mobile internet services. However, while mobile broadband (3G or 4G) coverage in the developed world is ubiquitous, 800 million people are still not covered by mobile broadband networks. In rural areas the cost of building and operating mobile infrastructure can be twice as expensive compared to urban areas, with revenues up to 10 times smaller. As a result, mobile operators who expand their networks to rural areas often find that they lose money or take a long time to produce a return on investment. While seeking to grow their coverage (and hence their subscriber base) they can struggle to identify locations that could be economically viable.

In addition, 3.2 billion people live in areas covered by mobile broadband networks but are not using mobile internet services – thus indicating that whilst coverage is a necessary criteria, it alone cannot address the problem of digital inclusion. A large scale consumer survey conducted by the GSMA[1] revealed that affordability was the greatest barrier to using mobile internet services, for people who were aware of mobile internet. In almost all the sample countries, the greatest barriers to mobile internet use are access to, and the cost of, internet-enabled handsets and data. These barriers are clearly interlinked, representing the importance of the overall cost of mobile internet access. The analysis also indicates that, although cost is an important consideration for both women and men in many of the surveyed countries, this barrier disproportionately affects women. For example, in Dominican Republic, 53% of female mobile users who do not use mobile internet, but are aware of it, cited handset cost as a key barrier to mobile internet use compared to 37% of men. In a similar sample in Kenya, 43% of women and 31% of men stated that not having access to an internet-enabled mobile phone was a major barrier to using mobile internet.

Both the private sector and public sector have important roles to play in improving the business case for mobile network coverage expansion.

Precise and granular data is key to help mobile operators, governments and others to determine the costs of providing mobile broadband services in uncovered areas and support the development of sustainable networks. In this context, the GSMA developed Mobile Coverage Maps[2]: a tool to help operators and others estimate the precise location and size of uncovered populations. These maps will allow users to:

- Gain an accurate and complete picture of the mobile coverage in a given country by each generation of mobile technology (2G, 3G and 4G)

- Estimate the population living in uncovered or underserved settlements with a very high level of granularity (e.g. small cities, villages or farms)

- Search for uncovered settlements based on population size.

GSMA Mobile Coverage Maps are therefore a key tool to help operators improve the efficiency of their investments. For example, GSMA Coverage maps can help mobile operators assess the need for infrastructure sharing deals. Indeed, infrastructure sharing can help to lower the risk and costs of investments in network expansion. Regulators should seize this opportunity and ensure all forms of voluntary infrastructure sharing between operators are permitted. This is especially the case since the costs savings of such commercial arrangements can be significant, reducing capital investment and on-going operating costs by between 50% and 80% -depending on market structure and the sharing model – which can be reinvested in network expansion[3]. This helps to close the ‘coverage gap’ and encourage operators to venture into rural areas they might otherwise have not wanted or could not afford to go to.

GSMA Mobile Coverage Maps can also help other stakeholders – including governments, NGOs, and private companies that rely on mobile connectivity – to strategically target their activity, by helping them identify the locations with existing coverage.

In this context, it is critical for policy makers to adopt economic policies that will support mobile operators’ efforts to provide affordable services.

- Mobile is the main gateway to the internet for consumers in many parts of the world today, particularly in developing countries. Despite this, governments in many of these countries are increasingly imposing – in addition to general taxes – sector-specific taxes on consumers of mobile services and devices and on mobile operators. This poses a significant risk to the growth of the services among citizens, limiting the widely acknowledged social and economic benefits associated with mobile technology. This latest report from GSMA Intelligence https://www.gsmaintelligence.com/research/?file=8f36cd1c58c0d619d9f165261a57f4a9&download examines mobile sector taxation over time and its impact on affordability and connectivity. The report highlights the taxes applied to mobile services and how certain taxes can raise the affordability barrier and reduce the ability of citizens to take part in digital society. It also explores the impact of uncertain tax regimes on operators’ ability to continue investing in new networks. The report shows how sector-specific taxes can create inefficiency, inequity and complexity, and hinder achievement of the UN Broadband Commission’s target for affordable broadband for all by 2025.

- Effective pro-investment supply side policies should also be adopted in areas such as spectrum policy and planning to encourage long term investment in the sector and result in more affordable mobile internet services being made available to all.

- Providing open and non-discriminatory access to state-owned public infrastructures such as public buildings, roads, railways and utility service ducts can also significantly reduce the costs of network roll-out and can be key to providing the site access and necessary backhaul capacity so critical to operator investments.

[1] The analysis is based on findings from quantitative face-to-face surveys with women and men in 23 low- and middle-income countries across Asia, Africa and Latin America. Source: Gender Gap Report 2018. GSMA (2019). Available here: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2018/04/GSMA_The_Mobile_Gender_Gap_Report_2018_32pp_WEBv7.pdf

[2] GSMA Mobile Coverage Maps use data collected directly from mobile operators and overlay it with the High Resolution Settlement Layer, a dataset developed by Facebook Connectivity Lab and the Center for International Earth Science Information Network (CIESIN) at Columbia University. This data estimates human population distribution at a hyperlocal level, based on census data and high-resolution satellite imagery. We have further enriched this data by adding socioeconomic indicators and key buildings such as schools, hospitals, and medical centres. The Mobile Coverage Maps are accessible here: www.mobilecoveragemaps.com

[3] Unlocking rural coverage: Enablers for commercially sustainable mobile network expansion. GSMA (2016). Available here: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2016/07/Unlocking-Rural-Coverage-enablers-for-commercially-sustainable-mobile-network-expansion_English.pdf

OpenVault: Broadband Internet Usage Accelerated in 2018

Executive Summary:

U.S. households consumed an average of 268.7 gigabytes (GB) of data in 2018, up from 201.6 GB for 2017, according to a new report about U.S. household broadband data consumption from OpenVault, a provider of data consumption and analytics software. Median usage was 145.2 GB per household in 2018, up from 103.6 GB in 2017. The increase in average consumption was 33.3% and the increase in median consumption was 40%.

Open Vault attributed the different growth rates to growing consumption across service providers’ entire subscriber bases, rather than growth only among heavy users. Their year end 2018 data showed that:

U.S. Household Broadband Data Consumption:

- Average usage for households with flat-rate pricing was 282.1 GB per household, which was more than 9% higher than the 258.2GB average usage for households on usage-based billing (UBB) plans. Average usage for all households was 268.7GB/HH in 2018, up from 226.4GB/HH at the end of June 2018 and a 33.3% increase over the YE 2017 average of 201.6GB/HH.

- Median usage was 145.2GB/HH in 2018, up from 116.4GB/HH in June 2018 and a 40% increase over the YE 2017 median of 103.6GB/HH.

- The percentage of flat-rate (non-UBB) households exceeding 1 terabyte (TB) of usage was 4.82%, a full percentage point higher than the 3.81% of UBB households that exceeded the 1 TB threshold.

- The percentage of households using 1TB or more almost doubled in 2018, rising to 4.12% of all households from 2.11% in 2017, while the percentage of households exceeding 250 GB rose to 36.4% from 28.4% during the same time frame.

In addition to analyzing trends in broadband consumption, OpenVault also tracked expansion within the US consumer device landscape, observing a 5.3% increase in connected devices when comparing the week after Christmas with the week before Christmas. While Amazon, Samsung and Apple collectively accounted for the majority of the growth, the 15.6% rate of increase for Amazon devices was significantly higher than the rates of growth for Samsung (4.1%) and Apple (2.9%).

“As connected devices, streaming services and broadband speeds increase, service providers need an alternative to infrastructure upgrades that would enable them to keep up with demand,” said Josh Barstow, Open Vault executive vice president of corporate strategy and business development, in a prepared statement about the U.S. household broadband data consumption research. “Our analysis makes it clear that usage-based billing is among the most effective tools the industry has in managing consumption and reducing the need for massive capital expenditures.”

……………………………………………………………………………………………………………………………………………………………………………………..

Point Topic: Global fixed broadband take-up & forecasts to 2025 + Rethink TV: China to lead in gigabit broadband services

1. Point topic – FTTH/FTTP/FTTB:

Market research firm Point Topic predicts that 59% of broadband subscribers worldwide will be served by fiber to the home/premises/building (FTTH/FTTP/FTTB) by the end of 2025. That represents an 11% jump from current levels. Please see Rethink TV’s findings below, which corroborate the rise of fiber access based broadband network access.

Point Topic forecasts that there will be 1.2 billion fixed broadband subscribers worldwide by the end of 2025. Broadband subscriber totals exceeded 1 billion in the third quarter of this year, the market research firm points out. Approximately 89% of these subscribers reside in one of the top 30 markets as defined by subscriber numbers recorded in this year’s second quarter.

Within these markets, FTTH and related options will grab market share primarily from xDSL, which should decline 19% to 9% during the forecast period. While overall subscriber numbers for fiber to the curb (FTTC) and VDSL, as well as DOCSIS-based hybrid fiber/coax (HFC), should climb during the forecast window, market share will remain fairly stable. FTTC will account for approximately 12% of connections, while HFC will check in at 19%, the researchers estimate.

While legacy copper networks have been losing customers to more advanced technologies for years. It looks like direct fibre networks will attract the majority of new customers, with DSL figures forecast to drop to hundreds or tens of thousands in most technologically advanced markets.

However, one cannot completely discount FTTC/VDSL and cable platforms, preferred by some operators, and especially their more advanced versions such as G.fast and Docsis 3.1 which are capable of gigabit speeds. We have seen their deployment gather pace in certain regions of the world (see their latest map).

The advent of 5G should have a dampening effect on fixed broadband in the forecast period, according to Point Topic. They are awaiting data from the field as 5G service is rolled out before predicting how much of an impact that market will have on fixed broadband.

The forecasts include data for the top 30 fixed broadband markets and the rest of the world. Point Topic has based them on historical data on fixed broadband take up. The forecasts include trends in subscriber churn for various broadband technologies, the size of the addressable market at country level, and current and planned network upgrades.

http://point-topic.com/free-analysis/fixed-broadband-take-up-forecasts/

…………………………………………………………………………………………………….

Point Topic’s most recent outputs put the total number of global fixed line broadband subscribers at 983 million at the end of June. Current adoption rates mean that the billionth broadband line appeared in September 2018, probably in China they say.

Technologies rarely manage to spread through the world so quickly, in only twenty years more than half the households in the world have a fixed broadband line.

http://point-topic.com/billion-lines-fixed-broadband-half-world/

……………………………………………………………………………………………………

2. Rethink TV – China to lead in gigabit broadband:

A recent report from Rethink TV, the video research arm of Rethink Technology Research, says that “in advanced countries such as France, Switzerland and South Korea, more than 50% of households will take 1Gbps broadband by 2023.” Rethink TV says that 57% of the world’s 1Gbps connections installed by 2023 will be in China. Over 42% of all Chinese homes will have access to 1Gbps services, thanks to “a series of massive build-outs led by China Mobile.” Rethink CEO and co-founder Peter White, says that China will have 191 million homes connected to 1Gbps by 2023, leading the world market. Japan will have 19.4 million and South Korea will have 9.5 million 1Gbps homes. Today, China is already substantially in the lead with 18.8 1 Gbps lines, with France on 4 million, Japan on 3.8 million and the US on 3 million.

In sharp contrast, only 11% of North America households will have 1Gbps connections by 2023 (see map) – even though the US, at 33.5 million households, will be the second largest market behind China.

“Gigabit broadband will accelerate faster than previous forecasts have imagined, growing tenfold over the next five years,” said Rethink. “After a two-year period of being high priced luxuries, 1Gbps broadband will become commonplace and inexpensive.”

Fiber optics based network access will take over in most parts of the world from copper-based technologies such as G.fast, except in the US, where cable TV networks will rely on DOCSIS 3.1. “Laggards in percentage terms will include the United Kingdom and Germany and much of Latin America,” said Rethink.

https://rethinkresearch.biz/report/gigabit-broadband-forecast-to-2023/

Point Topic: Global fixed broadband take-up & forecasts to 2025 + Rethink TV: China to lead in gigabit broadband services

1. Point topic – FTTH/FTTP/FTTB:

Market research firm Point Topic predicts that 59% of broadband subscribers worldwide will be served by fiber to the home/premises/building (FTTH/FTTP/FTTB) by the end of 2025. That represents an 11% jump from current levels. Please see Rethink TV’s findings below, which corroborate the rise of fiber access based broadband network access.

Point Topic forecasts that there will be 1.2 billion fixed broadband subscribers worldwide by the end of 2025. Broadband subscriber totals exceeded 1 billion in the third quarter of this year, the market research firm points out. Approximately 89% of these subscribers reside in one of the top 30 markets as defined by subscriber numbers recorded in this year’s second quarter.

Within these markets, FTTH and related options will grab market share primarily from xDSL, which should decline 19% to 9% during the forecast period. While overall subscriber numbers for fiber to the curb (FTTC) and VDSL, as well as DOCSIS-based hybrid fiber/coax (HFC), should climb during the forecast window, market share will remain fairly stable. FTTC will account for approximately 12% of connections, while HFC will check in at 19%, the researchers estimate.

While legacy copper networks have been losing customers to more advanced technologies for years. It looks like direct fibre networks will attract the majority of new customers, with DSL figures forecast to drop to hundreds or tens of thousands in most technologically advanced markets.

However, one cannot completely discount FTTC/VDSL and cable platforms, preferred by some operators, and especially their more advanced versions such as G.fast and Docsis 3.1 which are capable of gigabit speeds. We have seen their deployment gather pace in certain regions of the world (see their latest map).

The advent of 5G should have a dampening effect on fixed broadband in the forecast period, according to Point Topic. They are awaiting data from the field as 5G service is rolled out before predicting how much of an impact that market will have on fixed broadband.

The forecasts include data for the top 30 fixed broadband markets and the rest of the world. Point Topic has based them on historical data on fixed broadband take up. The forecasts include trends in subscriber churn for various broadband technologies, the size of the addressable market at country level, and current and planned network upgrades.

http://point-topic.com/free-analysis/fixed-broadband-take-up-forecasts/

…………………………………………………………………………………………………….

Point Topic’s most recent outputs put the total number of global fixed line broadband subscribers at 983 million at the end of June. Current adoption rates mean that the billionth broadband line appeared in September 2018, probably in China they say.

Technologies rarely manage to spread through the world so quickly, in only twenty years more than half the households in the world have a fixed broadband line.

http://point-topic.com/billion-lines-fixed-broadband-half-world/

……………………………………………………………………………………………………

2. Rethink TV – China to lead in gigabit broadband:

A recent report from Rethink TV, the video research arm of Rethink Technology Research, says that “in advanced countries such as France, Switzerland and South Korea, more than 50% of households will take 1Gbps broadband by 2023.” Rethink TV says that 57% of the world’s 1Gbps connections installed by 2023 will be in China. Over 42% of all Chinese homes will have access to 1Gbps services, thanks to “a series of massive build-outs led by China Mobile.” Rethink CEO and co-founder Peter White, says that China will have 191 million homes connected to 1Gbps by 2023, leading the world market. Japan will have 19.4 million and South Korea will have 9.5 million 1Gbps homes. Today, China is already substantially in the lead with 18.8 1 Gbps lines, with France on 4 million, Japan on 3.8 million and the US on 3 million.

In sharp contrast, only 11% of North America households will have 1Gbps connections by 2023 (see map) – even though the US, at 33.5 million households, will be the second largest market behind China.

“Gigabit broadband will accelerate faster than previous forecasts have imagined, growing tenfold over the next five years,” said Rethink. “After a two-year period of being high priced luxuries, 1Gbps broadband will become commonplace and inexpensive.”

Fiber optics based network access will take over in most parts of the world from copper-based technologies such as G.fast, except in the US, where cable TV networks will rely on DOCSIS 3.1. “Laggards in percentage terms will include the United Kingdom and Germany and much of Latin America,” said Rethink.

https://rethinkresearch.biz/report/gigabit-broadband-forecast-to-2023/