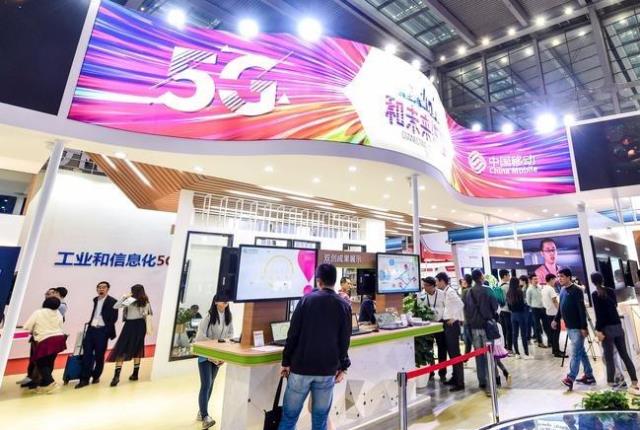

China 5G

China’s state owned telcos slash CAPEX to the lowest in decades!

China’s big three state-owned telecom operators are drastically slashing capital expenditures (CAPEX) before the next wave of heavy spending on 6G mobile network infrastructure beginning in 2030. Over a year ago, the IEEE Techblog reported the planned CAPEX reductions in this post.

- China Telecom expects its capital expenditure to decline by 11% to 83.6 billion yuan in 2025, returning to pre-5G expansion levels.

- China Mobile also plans to cut its capital expenditure by 8% in 2025, bringing spending close to 2012 levels.

- China Unicom, the smallest of the three, recorded the sharpest drop in spending.

Reasons for the Cuts:

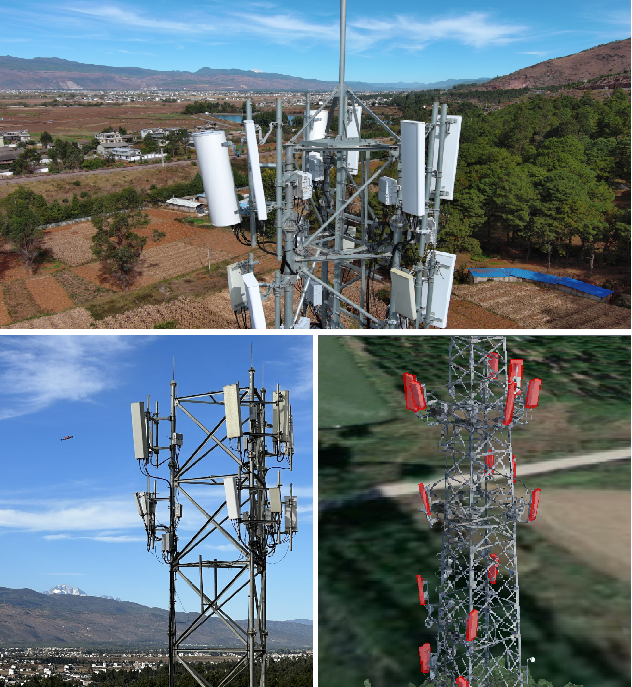

- The 5G network infrastructure buildout has largely reached its peak, with China already having 3.5 million 5G base stations.

- The companies are preparing for the next major investment cycle, which is expected to focus on 6G and AI infrastructure.

- The CAPEX cuts are also being driven by government directives to improve market value and increase shareholder dividends.

- The companies are prioritizing investments in AI infrastructure and computational infrastructure.

- China Mobile’s Chairman Yang Jie stated that the next major investment cycle is expected to focus on 6G and is unlikely to begin before 2028.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

1. China Mobile, the largest wireless carrier in China with over 1 billion subscribers, slashed its annual capital expenditure by over 9% to 164 billion yuan in 2024. The company plans to cut another 8% this year to 151.2 billion yuan. That amount is approaching the 2012 level of 127.4 billion yuan, and is set to decline further in the years to come.

“The overall investment size in the next two to three years will continue to steadily fall,” Yang Jie, China Mobile’s chairman, told reporters in Hong Kong last Thursday. Asked what would trigger the next capital spending spree, Yang said: “From what I see now, the next investment peak will be on 6G” — but he expects that to kick off around 2028. Until then, the industry veteran expects “the proportion of investment to expand in the areas of computation and AI.”

China Mobile Chairman Yang Jie told reporters in Hong Kong on March 20 that the next telecom investment peak would be for 6G mobile network building. (Photo by Kenji Kawase)

Jefferies telecom analyst Edison Lee, said China Mobile’s capex figures were “lower than expected.” The ratio versus its revenue was 18% last year, marking the first dip below 20%, and he expects this proportion to further sink to 16% this year. “This is negative for equipment vendors such as ZTE,” Lee said, although it provides more room for returns to shareholders.

2. China Telecom (#2 in China) announced on Tuesday that its CAPEX for 2024 came to 93.51 billion yuan ($12.9 billion), 5% lower than the previous year. The forecast for this year is even lower, at 83.6 billion yuan, down 11% and lowering the amount to the level before the peak 5G network investment years of around 2020 to 2023. However, with soaring demand for AI computing, it plans a further hike in digital infrastructure spending. It will boost investment in cloud computing and data centers by 22% to RMB45.5 billion ($6.3 billion), making it the biggest single capex item, accounting for 38% of the total.

The company said it’s focused on four technology directions: network, cloud and cloud-network integration, AI and quantum security. It revealed it had deployed 70,000 5G-A base stations in 121 cities, with 5G RedCap coverage in more than 200 cities, and said it had signed up 2.4 million subs to its pioneering D2D mobile satellite service.

Chairman Ke Ruiwen told Nikkei Asia that “the general trend is heading downward.” He added that “before building the new large-scale network (apparently referring to 6G), the investment trend is going continue falling.” He said the company would continue to pursue its strategy focused on cloud and digital transformation.

Source: Cynthia Lee/Alamy Stock Photo

3. China Unicom, the smallest of the three state owned telcos, also slashed its capital spending by 17% to 61.37 billion yuan in 2024, while planning a further reduction to 55 billion yuan this year. “Our investment emphasis has already shifted away from mobile broadband to computing network capabilities for internet data centers and cloud,” said Tang Yongbo, Unicom’s vice president. He also mentioned the impending heavy investment period when the 6G era arrives.

China Telecom and China Unicom have a “co-build, co-share” partnership for 5G investment.

…………………………………………………………………………………………………………………………………………………………………………………………………………………

All three Chinese network operators’ actual capital expenditure in 2024 were lower than the previous guidance they had provided, by an average of 5%. The sum of annual capital expenditure for the three Chinese telcos was 319 billion yuan for 2024, and the combined estimate for 2025 is 289.8 billion yuan. Including China Tower — a tower builder established in 2014 through a merger of the three telecom companies’ related businesses, and publicly listed in 2018 — the total capex last year was 351 billion yuan. This year’s projected amount of 322 billion yuan would be one of the lowest in decades.

References:

https://www.lightreading.com/finance/china-telecom-boosts-profit-cuts-capex

China Mobile & China Unicom increase revenues and profits in 2023, but will slash CAPEX in 2024

Dell’Oro: Global telecom CAPEX declined 10% YoY in 1st half of 2024

Omdia: Huawei increases global RAN market share due to China hegemony

China adds 20M “5G package” subscribers in July; 1H-2024 earnings gains outpace revenues for all 3 major China telcos

The number of 5G subscribers in China increased by a sizeable 20 million last month, according to new data from the country’s big three state owned network providers (China Mobile, China Telecom, China Unicom). Of the three, China Mobile is still the only one to report actual customers using its 5G network; China Telecom and China Unicom are sticking to their 5G package subscribers metric, which essentially means customers signed up to a 5G plan, regardless of whether they use 5G network services (most continue to use 4G).

- China Mobile’s July net adds came in at 13.7 million, pushing its 5G customer base up to a colossal 528 million. China Mobile disclosed that it has 129 million customers using its 5G New Calling over high-definition video service reached 129 million, of which, smart application subscribers numbered 11.82 million.

- China Telecom added 3.1 million 5G package customers for a total of 340 million. They did not talk about 5G in their earnings report (more below).

- China Unicom added 2.9 million 5G package customers for a total of 279 million. China Unicom shared details of its 5G network build-out, pointing out that its 5G mid-band base stations numbered in excess of 1.31 million as of mid-year, while low-band sites reached 780,000.

For each of them, cloud and digital transformation (rather than 5G subs) drove topline growth, profit rose more than revenue and shareholder returns increased.

- China Mobile said net profit had improved 5.3% to RMB80.2 billion ($11.2 billion), outpacing revenue, which rose 3% to RMB546.7 billion ($76.6 billion).

- China Telecom, reported net earnings of 21.8 billion Chinese yuan (US3.1 billion), an 8.2% gain over last year, with revenue up 2.8% and service revenue 4.3% higher.

- China Unicom reported 11.3% higher net income of 13.8 billion ($1.93) on the back of a 2.9% lift in sales to RMB197.3 billion ($27.6 billion).

China Mobile says its digital transformation business grew 11% to RMB147.1 billion ($20.6 billion), accounting for 26% of all revenue. China Telecom reported digital industry sales of RMB73.7 billion ($10.3 billion), a 7% increase, and China Unicom said revenue grew 7% to RMB43.5 billion ($6.1 billion).

Source: Cynthia Lee/Alamy Stock Photo)

All three state owned telcos experienced double-digit growth in cloud services. China Telecom’s Tianyi Cloud grew revenue by 20% to RMB55 billion ($7.7 billion), while China Mobile Cloud hiked sales by 19% to RMB50 billion ($7 billion) and China Unicom grew 24% to RMB32 billion ($4.5 billion).

…………………………………………………………………………………………………………………………………………………………………………………………………………………..

Silence is Golden?

There was a distinct lack of 5G commentary in China Telecom’s half year report; it is the last of the three to post numbers and did so alongside the publication of the market’s operational statistics for July. The telco shared its 5G package figures – it added almost 18 million in the first six months of 2024, incidentally – but made no other reference to the technology in a fairly wordy statement about its year-to-date performance. Instead, the operator focused on the progress of its digital transformation strategy, leaning heavily on the promise of artificial intelligence. Specifically, China Telecom is talking up what it terms AI+ – there’s always one – and the Xingchen large language model it launched at the back end of last year.

“The Company strengthened the integration and mutual promotion of capabilities in various fields, continuously enriched the Xingchen large model series product portfolio, empowered the intelligent transformation for thousands of industries, and supported enterprises to achieve costs reduction and efficiency enhancement,” it said.

…………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecoms.com/5g-6g/china-added-20-million-5g-subs-last-month

https://www.lightreading.com/finance/cloud-digital-transformation-drive-chinese-telcos-h1-growth

GSMA: China’s 5G market set to top 1 billion this year

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

China Telecom and China Mobile invest in LEO satellite companies

WSJ: China’s Telecom Carriers to Phase Out Foreign Chips; Intel & AMD will lose out

China’s telecom industry business revenue at $218B or +6.9% YoY

China’s mobile data consumption slumps; Apple’s market share shrinks-no longer among top 5 vendors

Mobile data demand is in a steep decline in China, the world’s largest 5G market by subscribers. China’s MIIT numbers released this week show per user data consumption (DOU) grew just 8.1% in the first half of the year. That compares to a 68% increase in 2019, the year that 5G licenses were issued. That fell to 13% in 2022 and 11% at end- 2023. Since then, there’s been a decrease in growth of nearly three percentage points in six months.

| Indicator name | unit | Cumulative from January to June | Year-on-year

Growth ( %) |

| Total volume of telecommunication business (at constant prices of the previous year) | 100 million yuan | 8992 | 11.1 |

| Operating income | 100 million yuan | 10712 | 2.8 |

| Including: Telecommunication business income | 100 million yuan | 8941 | 3.0 |

| Total call duration of fixed-line outgoing calls | 100 million minutes | 380 | -3.4 |

| Total mobile phone call duration | 100 million minutes | 10688 | -4.6 |

| Mobile SMS traffic | 100 million | 9407 | 0.5 |

| Mobile Internet access traffic | 100 million GB | 1604 | 12.6 |

| Average mobile Internet access traffic per household in the month (DOU) | GB/household · month | 18.15 | 8.1 |

| Note: 1. The duration of fixed-line outgoing calls and mobile phone calls includes the corresponding IP phone call duration.

2. Starting from February 2024, the 5G mobile Internet access traffic and the number of 5G mobile Internet users of China Radio and Television Network Group Co., Ltd. (hereinafter referred to as China Radio and Television) will be included in the industry summary data, and the data for the same period last year will be adjusted synchronously. |

|||

“While China has rapidly rolled out 5G and continues to perform well vs other markets, there is a limit to the number of people in the market that will engage in advanced data services; the slowdown in traffic growth is an indication that we could be reaching that limit,” according to GSMA.

Commercial 5G standalone (SA) networks, now present in seven APAC countries (Australia, India, Japan, the Philippines, Singapore, South Korea, and Thailand), will help fuel this growth, alongside 5G Advanced, RedCap and AI, creating opportunities to launch new 5G applications and kick start a fresh round in 5G investments for enterprises and consumers.

The authors of the report, GSMA Intelligence, expect 5G to add almost $130 billion to the Asia Pacific economy in 2030, with the manufacturing industry forecast to benefit the most, driven by new 5G-enabed applications including smart factories, smart-grids, and IoT-enabled products. Financial services and public administration are also expected to be big beneficiaries, as they turn to 5G to digitally transform services and operations. To help support this growth the GSMA today launched the GSMA APAC Fintech Forum, a new community programme to unite the connected fintech and commerce sectors with Asia Pacific’s mobile network operators through new technologies.

…………………………………………………………………………………………………………………………………………

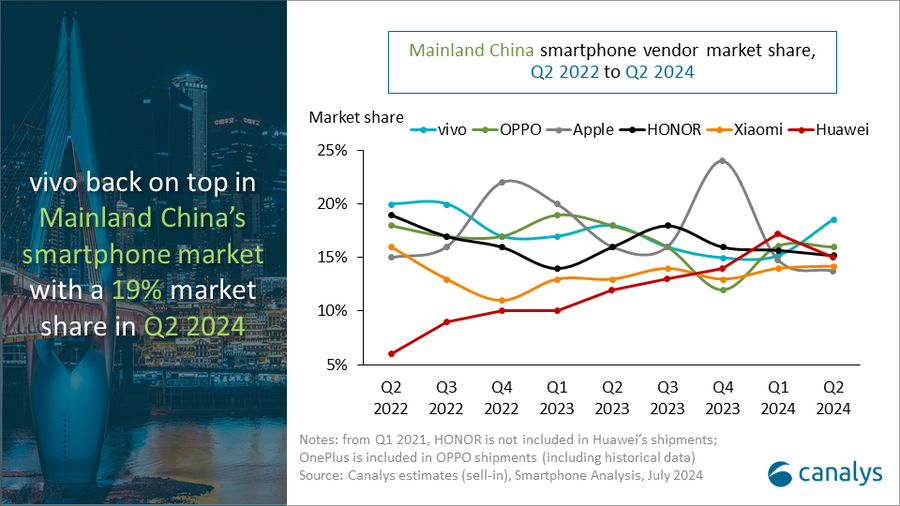

Meanwhile, Apple’s smartphone market share in China shrank by two percentage points in the second quarter of 2024 and the company is no longer one of the top vendors, according to data from market research firm Canalys. The decline underscores the difficulties the U.S. tech giant faces in its third-largest market.

Huawei’s smartphone shipments surged 41 per cent year on year in the the quarter, bolstered by the launch of its new Pura 70 series in April. Chinese smartphone vendors held the top five spots in the second quarter.

“It is the first quarter in history that domestic vendors dominate all the top five positions,” said Canalys Research Analyst Lucas Zhong. “Chinese vendors’ strategies for high-end products and their deep collaboration with local supply chains are starting to pay off in hardware and software features. HONOR’s latest Magic V3, which leverages GenAI, has significantly enhanced the user experience of foldable devices. Conversely, Apple is facing a bottleneck in mainland China. The vendor’s current channel strategy maintains a healthy inventory level and aims to stabilize retail prices and protect margins of channel partners. In the long term, the Chinese high-end market is ripe with opportunity. Local brands such as Huawei, HONOR, OPPO, and vivo are leading the way by incorporating technologies such as GenAI into products and services. Additionally, the localization of Apple’s Intelligence services in mainland China will be crucial in the next 12 months.”

People’s Republic of China (Mainland) smartphone shipments and annual growth

Canalys Smartphone Market Pulse: Q2 2024

|

Vendor |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

vivo |

13.1 |

19% |

11.4 |

18% |

15% |

|

OPPO |

11.3 |

16% |

11.4 |

18% |

-1% |

|

HONOR |

10.7 |

15% |

10.3 |

16% |

4% |

|

Huawei |

10.6 |

15% |

7.5 |

12% |

41% |

|

Xiaomi |

10.0 |

14% |

8.6 |

13% |

17% |

|

Others |

14.8 |

21% |

15.1 |

24% |

-2% |

|

Total |

70.5 |

100% |

64.3 |

100% |

10% |

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments. |

|||||

References:

https://www.miit.gov.cn/gxsj/tjfx/txy/art/2024/art_e2f06366bb134479a40cf4cf86445b1e.html

https://canalys.com/newsroom/china-smartphone-market-Q2-2024

https://www.lightreading.com/5g/slowing-mobile-numbers-cast-doubt-on-gsma-s-buoyant-forecasts

GSMA: China’s 5G market set to top 1 billion this year

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

China Mobile reports record operating revenues in 1st Quarter 2024

China Mobile, the world’s largest operator in terms of subscribers, recorded operating revenues of CNY263.7 billion ($36.4 billion) in the first quarter of the year, an increase of 5.2% year-on-year, the carrier said in its earnings statement. The company’s net profit increased 5.5% year-on-year to CNY29.6 billion. Also, the telco reported that revenue from telecommunications services was CNY219.3 billion, up by 4.5% year-on-year. The telco ended the first quarter of the year with a total of 488 million 5G subscribers. China Mobile had reported a net addition of 138 million 5G subscribers during 2023. In the mobile segment, the telco reached a total of 996 million subscribers at the end of March 2024, after an addition of 5 million customers during the first quarter.

Highlights:

- Adopt a strategy-led approach, driving new milestones in business performance

- Leverage innovation, deepening strategic transformation with remarkable results

- Expedite further business upgrade, facilitating mutual advancement of the “two new elements”

- Achieve breakthroughs amidst adversity, yielding fruitful results from innovation and reform Dedicated to enhancing shareholder returns, using a multi-pronged approach Forge ahead with determination, accelerating the building of a world-class enterprise

Mr. Yang Jie, Chairman of the Company commented, “In 2023, despite various challenges faced by the Company in a complex and severe macro- environment, we seized the opportunities emerging from accelerated economic and social digital transformation. This helped anchor us in our position as a world class information services and sci-tech innovation enterprise. Our efforts were focused on fully implementing our “1-2-2-5” strategy and strengthening innovation and core competitiveness to promote high-quality and sustainable development. Our business results reached new milestones, with revenue surpassing the RMB trillion mark for the first time in our history of development, and net profit attaining a record high. In terms of operations, our strategic transformation, reforms and innovation all advanced to a new level, underscoring our solid progress in establishing a world-class enterprise that takes pride in outstanding products, reputable brands, leading innovation and modern governance.”

“The Group will continue to pursue stable progress while forging ahead with a steadfast focus on integrity and innovation. We will enhance core functions, improve core competitiveness, expedite the cultivation and growth of emerging sectors of strategic importance, develop new quality productive forces at an accelerated pace, and establish ourselves as a world-class information services and sci-tech innovation enterprise to a high standard. With these efforts, we will consistently create greater value for our shareholders and customers,” the China state owned telco said.

China Mobile plans to launch 5G-Advanced (5G-A) technology in over 300 cities across China this year, according to local press reports. The telco, which claims a leading role in the development of 5G-A 3GPP specifications, also plans to promote the release of over 20 5G-A compatible phones within the year. To showcase its new 5G-A network, China Mobile has established 5G-A demonstration halls in various locations across China.

China Mobile’s vice president, Gao Tongqing, stated that this launch will further accelerate the development of new information infrastructure and unlock the full potential of 5G technology. The carrier also said it aims to achieve widespread adoption of 5G-A technology in China through partnerships with manufacturers and chip suppliers.

Beijing, Shanghai and Guangzhou are among the first cities where China Mobile will activate the new technology.

China had a total of 11.6 million mobile communication base stations as of the end of last year, of which 3.4 million were 5G base stations. 5G base stations currently account for nearly 29% of total mobile base stations in China. The ratio is 7.8 percentage points higher compared to the end of 2022.

Future Outlook:

The impact of the new wave of technological revolution and industrial reforms will continue to grow, so will the importance of integrated innovation. The three aspects of this integrated innovation will be highlighted in the power of information, the new generation information technology, and the merger of information service and social operation systems. At the same time this integrated innovation will deepen in three directions – the applications of a new generation of information technology to rapidly form new growth momentum, the collaboration of industry, academia, research and application to foster a new innovation paradigm, and the integration of digital and real economy to open up new development opportunities.

China Mobile sees valuable opportunities as they expand our information services. With the advocacy of the national “AI+” initiative and the further accelerated advancement of Digital China, the industry experiences new growth potential from the development of new quality productive forces. This progress brings forth the emergence of data as a new factor of production, computility as a new fundamental energy source and AI as a new instrument of production. The information services industry has not only in itself become an important sector for the development of new quality productive forces, but also a strong support for other sectors in this pursuit. General AI, particularly represented by AI large models, is developing robustly.

The role of AI is also fast changing from an assisting tool that helps different industries improve quality and efficiency, to an indispensable infrastructure and core capability that supports economic and social transformation and development. While AI brings forth disruptive applications, “AI+” opens up vast blue-ocean of opportunities. Fixating the vision of building a world-class information services and sci-tech innovation enterprise, we will capture opportunities arising from the development of “AI+” and extending our “5G+” initiatives towards 6 this direction. We will identify a new roadmap of transformation and upgrade through comprehensive, systematic and deep-dived integrated innovation. In doing so, we will drive more creation to enrich life, enhance quality production and support precise governance powered by digital intelligence. We will satisfy, drive and create demand to form a new for value growth trajectory and fuel the future development of the Company.

References:

p240321.pdf (chinamobileltd.com)

https://www.rcrwireless.com/20240423/carriers/china-mobile-q1-revenues-up-5-year-on-year

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

China Mobile & China Unicom increase revenues and profits in 2023, but will slash CAPEX in 2024

China Mobile verifies optimized 5G algorithm based on universal quantum computer

China Mobile to deploy 400G QPSK by the end of 2023

Omdia: China Mobile tops 2023 digital strategy benchmark as telcos develop new services

GSMA: China’s 5G market set to top 1 billion this year

China’s state sponsored 5G market is expected to add almost US$260 billion to its gross domestic product in 2030, with its 5G connections accounting for nearly a third of the worldwide total according to a recent GSMA report.

The report forecasts that more than half of Chinese mobile connections will be 5G by the end of 2024. 5G’s contribution to GDP in China is expected to reach almost $260 billion in 2030, which is 23% of the overall annual economic impact of mobile in China. Also by 2030, 5G connections in China will account for nearly a third of the global total, with 5G adoption in China reaching almost 90%, making it one of the leading markets globally.

The mobile industry contributed to 5.5% of China’s GDP last year, and in each of the coming years through 2030, nearly a quarter of that contribution will come from 5G – the highest echelon of current cellular technology – per the results of a study issued on Tuesday by the Group System for Mobile communications Association (GSMA).

Overall, the mobile market’s contribution to the Chinese economy will reach around US$1.1 trillion in 2030, GSMA said. Mats Granryd, Director General of the GSMA, said:

“It is great to see China, the world’s largest 5G market, commit so enthusiastically to the GSMA’s Open Gateway initiative to help drive the growth and maturity of the technology. As China surpasses 1 billion 5G connections this year, we expect to see further investment and potential in evolutions such as 5G-Advanced, 5G New Calling and 5G RedCap to improve user experience and unlock new revenue streams for operators.”

Photo credit: Shutterstock

GSMA’s Mobile Economy China 2024 report said the country’s entire mobile sector has so far provided a total of nearly 8 million jobs directly and indirectly, and generated US$110 billion in tax revenue in 2023 alone. According to that report:

- There are now 1.28 billion unique mobile subscribers in China – a penetration rate of 88%

- Mobile’s overall contribution to the Chinese economy in 2023 reached $970 billion, or 5.5% of GDP

- 5G is expected to reach 1.6bn connections in 2030, representing a third of the world’s total, and forecast to contribute $260 billion to China’s GDP

- An additional 290 million people in China now use mobile internet compared to eight years ago (2015), closing the country’s Usage Gap from 43% to just 16%

- Mobile data traffic in China is expected to quadruple by the end of the decade

China has the world’s most mobile phone users by a wide margin. As of the end of last year, there were 122.5 mobile phones for every 100 people, according to figures from the National Bureau of Statistics. The number of 5G base stations was nearly 3.38 million – a surge of 46% from a year earlier.

“China continues to set the pace for cutting-edge 5G technology standards,”the GSMA said, adding the country’s operators are “leading the way in the transition to 5G-advanced and 5G reduced capability networks. This is anticipated to kick-start a new round of 5G investment in 2024 and beyond.”

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

ABI Research: Telco transformation measured via patents and 3GPP contributions; 5G accelerating in China

Omdia: China’s 5G network co-sharing + cloud will create growth opportunities for Chinese service providers

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

ZTE, along with China Mobile’s Yunnan Branch, have created an accurate 3D model of the lineside infrastructure along the KunchuDali railway in China and used it to improve network performance. The companies introduced 5G-Advanced digital twin technology to build two core capabilities of digital site twinning and wireless channel twinning.

KunchuDali high-speed railway involves a large number of network planning challenges such as cross-bridge coverage, tunnel coverage, mountain-splitting area shielding, and abundant vegetation. It forms a vital segment of the China-Myanmar International Railway and the Trans-Asian Railway west line, connecting the key cities of Kunming, Chuxiong, Dali, and Lijiang in Yunnan Province. Serving as the backbone of the region’s transportation infrastructure, this route facilitates the daily movement of approximately 61,000 passengers, earning its reputation as the “golden tourism route.”

However, the railway’s construction and operation face formidable obstacles due to the rugged terrain characterized by fluctuating mountain ranges, perilous topography, and dense vegetation. Notably, a significant portion of the route traverses areas with a high concentration of bridges and tunnels, accounting for 64% of its total length. Moreover, many construction sites are situated in abnormal mountain zones, posing challenges to the efficiency and quality of surveying efforts.

China Mobile’s Yunnan Branch and ZTE introduced the 5G-Advanced digital twin technology to build two core capabilities of digital site twinning and wireless channel twinning. The 3D site twinning is achieved through UAV automatic flight control acquisition, thus implementing inspection survey of engineering parameters and AI identification of antenna assets, and guaranteeing engineering implementation quality with high efficiency and high quality.

- In June 2022, China Mobile unveiled a 6G network architecture which creates a virtual twin through digital means to realize a digital twin network architecture (DTN) with network closed-loop control and full lifecycle management; The service defines the end-to-end system to realize the full service system architecture (HSBA); In the group network, the Distributed Autonomous Network (DAN) with distributed, autonomous and self-contained features is implemented, which supports on-demand customization, plug and play and flexible deployment.

- ZTE’s RAN digital twin leverages digital twin, big data and artificial intelligence technologies, drastically enhancing network deployment and operation efficiency by minimizing resources and time needed for trial-and-error procedures of radio network deployment and optimization, making them more versatile, flexible and autonomous.

In addition, channel twinning is built in mountainous areas to achieve coverage prediction and optimization. The optimization elements required for mountainous areas, namely the azimuth, downtilt, power, and beam weights of antennas, are twinned and optimized beforehand. In this way, with the first-in-place construction of the pre-planning, the construction quality of the high-speed railway network is guaranteed faster and better, and the optimization period is shortened. Before the Spring Festival of 2024, the KunchuDali high-speed railway fully achieved the target of high-quality lines, with a coverage rate of 98.5% and a 5G download rate of more than 300Mbps. Compared with traditional planning and optimization methods, the KunchuDali high-speed railway saved more than RMB1.6 million and shortened the optimization period for nearly one month.

During the Spring Festival, China Mobile’s Yunnan Branch ensured an excellent internet experience for users with its high-quality high-speed railway network. The implementation of digital twin technology for high-speed railways enables efficient site surveys and coverage optimization to achieve higher efficiency and quality. This advancement fosters the deep integration of various industries with digital twin technology, paving the way for new industries, ecosystems, and operational modes. Furthermore, it lays a solid digital foundation for the future evolution towards 6G.

………………………………………………………………………………………………………………………………………………………….

According to Gartner, global digital twin revenues are expected to reach $183 billion by 2031. And when it comes to adoption, railway operators are at the forefront, using these virtual models to improve real-time asset management, reduce delays, and improve journey times.

In the UK, Transport for London (TfL) in 2022 announced plans to roll out a digital twin of the London Underground network so it can virtually monitor tracks and tunnels. Network Rail also offers a catalogue of training simulations built on digital twin technology.

According to an article in Mobility Innovators, bullet train operator JR East has deployed digital twins to monitor tracks, bridges and tunnels to enable predictive maintenance, while Hong Kong’s MTR (Mass Transit Railway) uses them to improve scheduling.

UAV automatic flight control acquisition implements 3D site twinning along the KunchuDali railway. Photo Credit: ZTE

……………………………………………………………………………………………………………………………………………………………………………………………………………..

ABOUT ZTE:

ZTE helps to connect the world with continuous innovation for a better future. The company provides innovative technologies and integrated solutions, and its portfolio spans all series of wireless, wireline, devices and professional telecommunications services. Serving over a quarter of the global population, ZTE is dedicated to creating a digital and intelligent ecosystem, and enabling connectivity and trust everywhere. ZTE is listed on both the Hong Kong and Shenzhen Stock Exchanges. www.zte.com.cn/global

……………………………………………………………………………………………………………………………………………………………………………………………………………..

https://www.zte.com.cn/global/about/news/china-mobile-zte-revolutionize-high-speed-railway-with-5g-a-digital-twin.html

https://www.zte.com.cn/global/solutions_latest/5g-advanced/digital_twin.html

https://www.telecoms.com/5g-6g/china-mobile-zte-use-digital-twin-to-improve-lineside-5g

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

What is 5G Advanced and is it ready for deployment any time soon?

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

China Mobile & China Unicom increase revenues and profits in 2023, but will slash CAPEX in 2024

China Mobile increased revenue 7.7% to 1.009 trillion Chinese yuan (US$140 billion) in 2023, with earnings up 3.7%. China Mobile’s biggest growth drivers were cloud computing and storage, which grew 66% to RMB83 billion ($11.5 billion), and 5G enterprise, which hiked sales by 30% to RMB47.5 billion ($6.6 billion). It also revealed it had earned RMB5.4 billion ($750 million) in 5G private networking revenue, up 113%. Its “new business” segment, which covers international, investments and applications, expanded 28% to RMB49.3 billion ($6.9 billion).

China Mobile’s capital spending was RMB180.3 billion ($25 billion), a 2.6% decrease from 2022. It gave no guidance for 2024, but CAPEX will surely decrease in 2024 and coming years due to a recent change to retain existing 5G network equipment longer than previously planned.

China Mobile’s Board on Thursday voted to extend the depreciable life of its 5G assets from seven years to ten years, based on the belief that much of its 5G network equipment will continue to be deployed after the arrival of 6G (IMT 2030) at the end of this decade (or later). The state owned telco said it expects “that 5G network investments shall be reused in 6G network infrastructure to the maximum extent, and therefore it is expected that 5G/6G networks will coexist after commercialization of 6G and 5G equipment will have a relatively long life cycle.”

The immediate effect of this decision will be to cut a massive 18 billion yuan ($2.5 billion) out of China Mobile’s depreciation bill this year. It’s the first time any major telco has formally declared that not only is it reluctant to spend on new 6G equipment, but that it also intends to keep its 5G assets as long as possible. That sends a clear warning that in the aftermath of the 5G capex binge, telcos have little appetite for big technology bets without a clear ROI.

…………………………………………………………………………………………………………………..

Meanwhile, China Unicom boosted net profit by 11.8% and topline revenue by 5.0%. Unicom said it had grown its cloud business by 42% to RMB51 billion ($7.1 billion), while its new computing and digital services business recorded RMB75 billion ($10.4 billion) in sales, up 13%.

“With 5G network coverage nearing completion, the Company’s investment focus is shifting from stable Connectivity and Communications (CC) business to high-growth Computing and Digital Smart Applications (CDSA) business. CAPEX was RMB73.9 billion in 2023. Network investment saw an inflection point.”

In 2023, Connectivity and Communications (CC) business, which encompasses mobile connectivity, broadband connectivity, TV connectivity, leased line connectivity, communications services as well as information services, achieved revenue of RMB244.6 billion. It contributed to three quarters of the service revenue of CC and CDSA combined. The Company’s connectivity scale further expanded, with the total number of CC subscribers exceeding one billion, representing an increase of about 140 million from the end of 2022.

China Unicom capital spending was flat at RMB73.9 billion ($10.3 billion), and it revealed it will slash CAPEX this year by RMB8.9 billion ($1.2 billion) or 12%.

References:

https://www.lightreading.com/5g/china-mobile-unicom-raise-red-flags-on-network-spend

https://www1.hkexnews.hk/listedco/listconews/sehk/2024/0321/2024032100246.pdf

https://www1.hkexnews.hk/listedco/listconews/sehk/2024/0319/2024031900241.pdf

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

China Mobile verifies optimized 5G algorithm based on universal quantum computer

Omdia: China Mobile tops 2023 digital strategy benchmark as telcos develop new services

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

China’s three state owned telecom operators have announced their subscriber totals for the month of December and for all of 2023. China’ Ministry of Industry and Information Technology (MIIT) said the big three had a combined net increase of approximately 24.82M 5G package subscribers in China, boosting their combined 5G package subscriber base to nearly 1.373B.

As of the end of December, 5G package subscribers accounted for 80.2% and 78.1% of China Mobile’s and China Telecom’s total mobile subscriber bases, respectively.

C114.net reported that 3.377 million 5G base stations have been built, constituting 28.5 percent of the total mobile base stations. There are 23.02 million ports with gigabit network service capabilities. More than 80% of administrative villages nationwide now have 5G connectivity, telecoms portal.

The foundation of the Internet of Things (IoT) is constantly being consolidated, with mobile IoT terminal users accounting for 57.5% of the total number of mobile network terminal connections. Technological industry innovation and development, the commercial deployment of 5G customized base stations and 5G lightweight technology, and the launch of the world’s first satellite communication smartphone, 6G, quantum communication, artificial intelligence and other innovative capabilities have significantly improved.

- China Mobile ended last year with 794.5 million subscribers to its 5G package (contract), while its total mobile subscriber base reached 991 million.

- China Telecom had a total of 407.7 million mobile users, of which 318.66 million had signed up to a 5G package (up by 50.7 million during 2023).

- China Unicom’s 5G package subscriber total hit 259.6 million by the end of last year, though disclosure on total mobile subscribers has not been provided. China Unicom also reported that there were 8,563 “virtual 5G industry private network” subscriber for the month of December which was an increase of 554 month-on-month and up 4,758 since the end of 2022.

Mobile Subscriber Stats for China’s Three Main Carriers (Unit: Millions)

| Operator | December 2023 Month-end Total |

% of Combined Installed 5G Sub Base |

December 2023 Net Change |

Net Change Since Prior Year-End |

|---|---|---|---|---|

| China Mobile | 991.00 | 0.05 | 15.99 | |

| 5G Package Subs | 794.50 | 57.87% | 15.70 | 180.50 |

| China Telecom | 407.77 | 0.54 | 16.59 | |

| 5G Package Subs | 318.66 | 23.21% | 4.03 | 50.70 |

| China Unicom | Not Available | |||

| 5G Package Subs | 259.64 | 18.91% | 5.08 | 46.91 |

China’s fourth 5G telecom network operator, China Broadnet, saw its 5G user base surpass 20 mln on October 19, the company revealed at the 2023 World 5G Convention held in Zhengzhou from December 5-7. Since that time, however, China Broadnet has not publicly released any updated 5G subscriber statistics.

Broadnet officially launched 5G network services just 19 months ago, on June 27, 2022. Because Broadnet is not yet reporting its 5G subscriber totals on a regular, monthly basis, Marbridge is not yet integrating its totals with those of China’s three more established telecom operators above.

Cautionary Note:

The Chinese telecom operators specifically report numbers for 5G packages, rather than citing 5G service users or connections, as while customers may have signed up for a 5G service package offer, that doesn’t necessarily mean they have a 5G-enabled device that enables them to hook up to their network operator’s 5G network, or indeed that their service provider is offering 5G services in their area just yet.

In addition to the growing 5G market in China, the fixed broadband segment is also very large. China Mobile had a total of 298 million wireline broadband customers at the end of December 2023, and throughout the year it added a total of 26 million fixed customers. China Telecom had 190 million fixed broadband subscribers by the year end, having added a total of 9.26 million wireline broadband users in 2023. China Unicom’s operational statistics for the last month of 2023 did not provide a breakdown of broadband customers.

References:

https://en.c114.com.cn/583/a1253372.html

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

China Unicom Jilin, the local affiliate of China Unicom in the Jilin province, has completed the deployment of a 2.1 GHz 8T8R 5G network for a segment of the national Harbin-Dalian high-speed railway with 5G network equipment from Huawei.

Tests show that 8T8R AAUs increase the coverage area by 44% compared with 4T4R, and 5G user experience improves by 5.2 times compared with 4G. The train passengers can heartily access the network for entertainment such as HD video, live streaming, and New Calling as well as for work on-the-move such as remote video conferencing.

In 2023, China Unicom embarked on a 5G coverage project along China’s sixteen trunk high-speed railways. Its affiliate in Jilin province contributed to its share of constructing the province’s premium 5G network for high-speed railways within the provincial borders. At first, this network construction project was daunted by four serious challenges. To begin with, the distance between sites is large. What’s worse, the penetration loss was greater with high-speed railways than common railways. Additionally, high-speed mobility increased the Doppler shift, a direct cause of performance deterioration. Lastly, user experience was poor due to short camping time caused by frequent handovers (every 3–4 seconds) on trains running at a high speed of 300 km/hr.

To address these challenges, in this project, China Unicom Jilin deployed the 2.1 GHz 8T8R AAU, and activated the High-speed Railway Excellent Experience feature and Cell Combination feature.

The 2.1 GHz 8T8R AAU solution integrates with technologies like multi-antenna, integrated high-gain array, intelligent beamforming, and precise and fast beam sweeping. Compared with 4T4R, it improves coverage by 7.5 dB, user experience by an impressive 55%, and capacity by 85%. This solution solves the problem of poor coverage caused by large distances and large insertion loss on high-speed railways. It also uses the same antenna as the legacy 4G 1.8 GHz network, simplifying site deployment and reducing tower rental by 10%. This series of solutions with Huawei FDD beamforming technology took home the GSMA GLOMO award for “Best Mobile Technology Breakthrough” and was listed in the “Guangdong Province Energy Saving Technology and Equipment (Product) Recommendation Catalogue”, issued by the Guangdong Energy Bureau in July 2023, for its excellent performance in energy saving.

After the High-Speed Railway Excellent Experience feature is enabled, the 5G base station proactively adjusts the signal frequency to offset the negative impact caused by frequency offset. This solves the Doppler shift problem in high-speed railway continuous coverage scenarios. After Cell Combination feature is enabled, the number of inter-cell handovers can be reduced in a cell combination network, which solves the problems of fast handovers and short camping time on high-speed railways. Test results show that after this feature is enabled, the access success rate increases to 99.4% and the call drop rate decreases by 57%. This overcomes the difficulties of difficult network access in ultra-high-speed scenarios.

This commercial deployment of the 2.1 GHz 8T8R AAU solution will greatly facilitate the operator’s future plans for similar 5G rollouts. China Unicom Jilin will continue to explore 5G network deployments in different scenarios as well as innovative applications of 2.1 GHz 8T8R in order to build differentiated 5G advantages based on service requirements in various 5G scenarios.

China Unicom to deploy Huawei’s 64T64R MetaAAU product-an upgrade of Huawei MetaAAU

China’s telecom industry business revenue at $218B or +6.9% YoY

Huawei’s comeback: 2023 revenue approaches $100B with smart devices gaining ground

ABI Research: Telco transformation measured via patents and 3GPP contributions; 5G accelerating in China

Omdia: China’s 5G network co-sharing + cloud will create growth opportunities for Chinese service providers

China’s telecom industry business revenue at $218B or +6.9% YoY

China’s Ministry of Industry and Information Technology (MIIT) said that in the first eleven months of 2023, the telecommunication industry’s collective business revenue soared to 1.55 trillion yuan, approximately 218 billion U.S. dollars, marking a 6.9% year-on-year increase.

Emerging sectors such as big data, cloud computing, and the Internet of Things (IoT) have shown significant growth. China’s three state owned network providers, China Telecom, China Mobile, and China Unicom have leveraged these technologies to catalyze a 20.1 percent surge in revenue from these areas, amounting to 332.6 billion yuan.

Cloud computing and big data have experienced explosive growth. Revenue from cloud computing surging by 39.7 percent and big data by 43.3 percent compared to the previous year. These figures underscore the central role of data-driven technologies in powering China’s telecom industry forward.

Broadband internet services continue to be a strong revenue stream for the three telecom giants, generating 240.4 billion yuan from January to November, which is an 8.5 percent increase year on year. This growth reflects the increasing demand for high-speed internet across China, as the country continues to embrace digital transformation in all sectors.

In conclusion, China’s telecommunication industry’s growth narrative in 2023 is not just a story of numbers but a chronicle of technological evolution and its integration into the fabric of society. With emerging sectors leading the charge, the industry’s upward trajectory seems poised to continue, as these technologies become increasingly embedded in the everyday lives of businesses and consumers alike.

……………………………………………………………………………………………………………

Separately, Mordor Intelligence forecasts the China Telecom Market size is expected to grow from USD 478.92 billion in 2023 to USD 547.43 billion by 2028, at a CAGR of 2.71% during the forecast period (2023-2028).

References:

https://english.news.cn/20231223/36996f5176e24d48a5677ddc160c99a5/c.html

China’s Telecom Sector Soars with Big Data and Cloud Computing Growth

https://www.mordorintelligence.com/industry-reports/china-telecom-market