Analysys Mason

Analysys Mason Open Network Index: survey of 50 tier 1 network operators

Open networks apply proven cloud concepts to the networking domain while enabling components to be sourced from a broad ecosystem of vendors. Open networks boast high levels of automation and programmability and are built around the concept of utilizing a common, horizontal cloud platform that supports cloud-native network functions from multiple vendors and from multiple network domains. Network operators can enhance the flexibility, agility, composability, innovation and operational efficiency of their networks by implementing open architectures and open operating models.

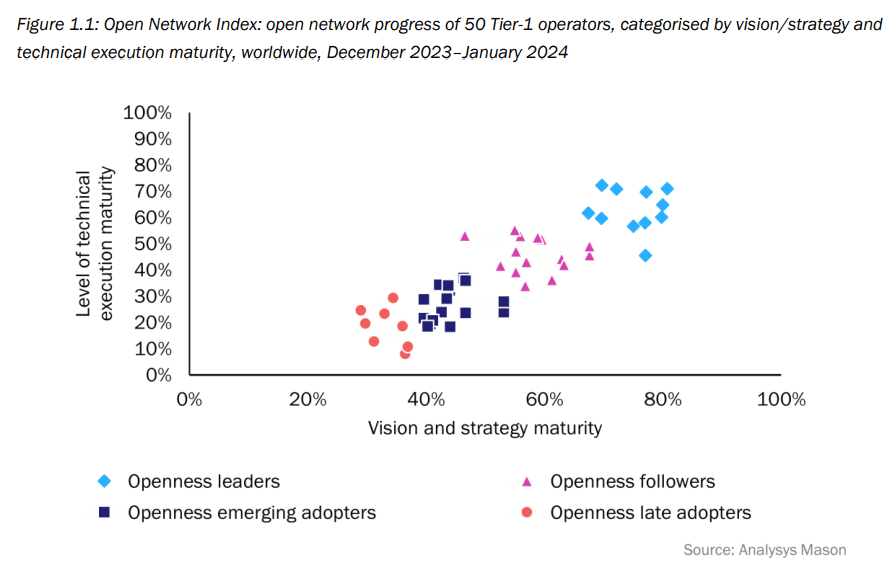

According to a survey conducted by Analysys Mason, ninety percent of global telecom service providers believe open networks are critical to their survival. However, only 20% have an open network strategy in place. Analysys Mason surveyed 50 leading Tier-1 operators worldwide between December 2023 and January 2024.

The analysts then benchmarked operator progress from a vision/strategy perspective and a technical perspective to form the first iteration of Analysys Mason’s Open Network Index (ONI). The survey and report were commissioned by Dell Technologies, but Analysys Mason says it does not endorse any of the vendor’s products or services.

The market research firm defines open networks as those based on non-proprietary technologies and standards, including open hardware and software developed by open communities, as well as software technologies that individual vendors are exposing, typically through open application programming interfaces (APIs), to anyone who wants to use them.

“Operators need to urgently develop an openness strategy and ensure that they approach openness in the right way,” the report authors said.

The analysts said that overall, survey respondents displayed a strong willingness to align themselves with open networking principles. But the technical implementation of open network architectures remains challenging.

The survey results partitioned the 50 network operators into four distinct categories:

- Openness leaders have a deep commitment to open networks and are supported at the highest levels of the organization. This category includes a higher proportion of operators from developed Asia–Pacific (APAC) than in any of the following categories.

- Openness followers are implementing aspects of open networks, but they take a more tactical approach because they lack the strong level of senior executive support that the openness leaders enjoy.

- Openness emerging adopters are operators that are just starting their journey. The category includes operators from developing markets that have a vision but have not yet started to deploy the architectures. The category also includes cautious adopters with lower ambitions for open networks.

- Openness late adopters do not have a clear concept of what an open network is, and they have not yet started to formulate a strategy for achieving openness or to win senior executive support. They have a low appetite for risk and perceive significant risks associated with moving away from incumbent vendors.

Many operators have strong engagements with well-established telecoms industry bodies such as the GSMA and the TM Forum. These bodies have traditionally aimed to improve standardisation and foster multi-vendor interoperability, but their activities in the areas of open cloud platforms and open operating models have been somewhat peripheral. Operators should deepen their involvement with initiatives such as the Cloud Native Computing Foundation (CNCF), Nephio and Sylva, which champion open infrastructure and open operations, and support the fundamentals of horizontal cloud platforms.

In addition, operators should engage with the O-RAN Alliance (which is NOT a standards body/SDO), which is leading multi-vendor Open RAN interface and interoperability standards, with these standards leveraging distributed, cloud-native-based architectures. Participation in these initiatives facilitates knowledge sharing, enables operators to shape future standardization efforts and empowers operators to exert greater influence over their vendors.

References:

https://www.analysysmason.com/operator-network-index-rma16-rma18

Analysys Mason’s gloomy CAPEX forecast: “there will not be a cyclical recovery”

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

Analysys Mason: 40 operational 5G SA networks worldwide; Sub-Sahara Africa dominates new launches

Analysys Mason’s gloomy CAPEX forecast: “there will not be a cyclical recovery”

Telco capex declined worldwide in 2023, and predictions in end-of-financial year results indicate further declines this year. Analysys Mason warns that a “long decline” in capital expenditure has now started. “There will not be a cyclical recovery,” says one subhead (see below). Analysys Mason crunched a lot of numbers to arrive at this conclusion, processing historical data for about 50 of the largest operators in the world. Importantly, it also looked at the long-term guidance issued by those companies. Capex has peaked partly because telcos in many regions have completed or are near completing a once-in-a-lifetime upgrade to full-fiber networks. Clearly, that’s bad news for companies selling the actual fiber. Operators will continue to invest in the active electronics for these lines, but that represents a “tiny fraction” of the initial cost.

This new Analysys Mason gloomy CAPEX forecast comes after Dell’Oro and Omdia (owned by Informa) previously forecast another sharp fall in telco spending on mobile network products this year after the big dip of 2023.

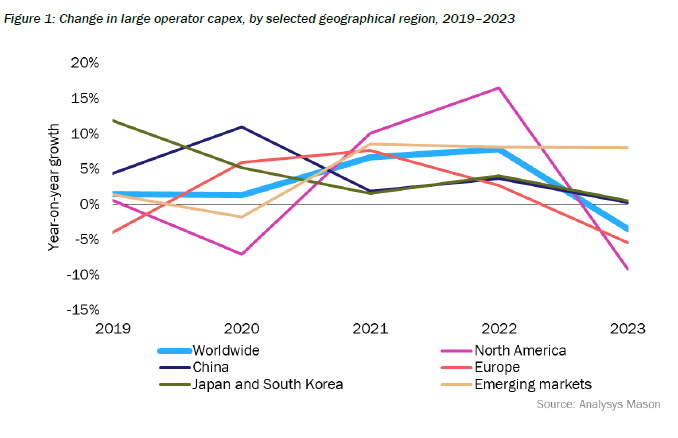

Figure 1. below aggregates change in capex, excluding spectrum, in 2023 (or FY2023/2024) for 50 of the largest operators in the world, all with annual capex of over USD1 billion in 2023. These operators account for about 78% of telecoms capex worldwide. Of the 42 operators that provided guidance on capex in 2024, 28 forecast a fall. A notable class of exceptions consisted of cable operators and latecomers to FTTP upgrade, but most of the emerging-market-focused operators indicated a decline.

The steepest decline was in North America. The decline was steeper for the three largest mobile network operator (MNO) groups (–18.1%). This was offset by rises in capex by the two large US cablecos, for which upgrades of HFC plant are now an imperative. The obvious reason for the sharp decline is the near-completion of 5G roll-out, although FTTP capex remains flat.

In China, capex was flat overall. This disguises a decline in 5G and fixed broadband capex, which, taken together with transmission, fell 7% in 2023. The delta of capex has gone on what operators call ‘computility’ (compute power in data centers and edge) and capabilities (developing the ability to serve mainly the industrial enterprise). Together these two items now account for about 35% of operator capex.

In Japan and South Korea, capex was also more or less flat (+0.5%). As in China, a high proportion of capex in Japan now goes on adjacent lines of business.

Capex declined by 5.5% in Europe. The European figure disguises the impact of the large number of smaller players in the continent. 5G spending has peaked, but so too has FTTP spending. FTTP spend represents a very high share of capex in Europe (about one half), although this is distributed differently across individual countries. Countries like France and Spain have passed that peak, but even in the UK, a relatively late starter, spend has plateaued. Among operators in emerging markets, the smallest group in absolute capex terms, there was a rise of 8%, steady now for three years running, driven almost entirely by India, and offset by declines elsewhere.

There will not be cyclical recovery of capex:

Operators’ longer-term projections of capex suggest, if anything, steepening declines in capex. Our forecasts indicate that capital intensity (capex/revenue) will fall from around 20% now to 12–14% by the end of the decade. Capex will fall basically because customers do not need more than the 1Gbit/s fibre and unlimited 5G that the current networks are easily capable of delivering, and growth in measurable demand slows every year. This will have the following effects:

•Fall in fixed access spend. Capex on FTTP is essentially a one-off investment in passive assets with very long useful lives. Future capex on upgrades (in effect replacements) of FTTP actives will come at a tiny fraction of this cost. The pipeline of plans for commercial build is running dry, although this is offset by some hefty subsidies for rural build, particularly in the USA. Those cablecos that have not already started will have to brace themselves for programs of replacement of HFC/DOCSIS by FTTP/xPON.

•We expect only limited uplift for 5G SA/5G Advanced. This is in part because some operators will not be able to justify a further upgrade after 5G NSA, in part because of slack demand, and in part because the sums involved will be lower than for the roll-out of 5G NSA.

•6G will not be capex-intensive. There is little appetite in free-market economies without centralised planning (and perhaps not so much even there) for a capex-intensive generational upgrade to 6G. There will be no cyclical uplift.

•There will be more outsourcing, i.e. replacement of capex by an opex line. This occurs mainly in infrastructure, but also in migrations of operations (IT capex) to the cloud. Yet this does not mean that capex is simply shifting from one class of business to another; infra companies exist in a world with similar constraints.

•In these circumstances there is a clear case for capex investment in anything that maximizes the efficient (and sustainable) use of the physical assets as they stand, and unlocks any opportunities that exist in new business-models. This is prominent in many operator outlooks.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

William Webb, an independent consultant and former executive at UK telecom regulator Ofcom, forecasts an S-curve flattening by 2027. In a forthcoming book called “The end of telecoms history,” Webb returns to predictions he first made in 2016 to gauge their accuracy. Using recent historical data from Barclays, he was able to show a close alignment with the S-curve he drew about eight years ago. If this behavior continues, growth rates “will fall to near zero by around 2027, with significant variations by country,” says Webb in his book, giving a sneak preview to Light Reading.

Webb’s broad rationale is that there is an upper limit on daily gigabyte consumption, just as there is only so much the average person can eat or drink. All Webb had to do was assume there will be some future gorging by customers on high-quality video, the most calorific meal for any smartphone. “Once they are watching video for all their free moments while downloading updates and attachments there is little more that they could usefully download,” he writes.

What of future services people do not currently enjoy? Outside virtual reality – which, for safety reasons, will probably always happen in a fixed-line environment – no app seems likely to chew through gigabytes as hungrily as moving images do in high definition. Webb clearly doubts the sort of artificial intelligence (AI) services being advertised by Apple will have much impact whatsoever.

“There may be substantially more traffic between data centers as models are trained but this will flow across high-capacity fiber connections which can be expanded easily if needed,” he told Light Reading by email. “At present AI interactions are generally in the form of text, which amounts to miniscule amounts of traffic.”

“Indeed, if time is diverted from consuming video to AI interactions, then AI may reduce the amount of network traffic,” he continued. Even if AI is used in future to create images and videos, rather than words, it will probably make no difference given the amount of video already consumed, merely substituting for more traditional forms of content, said Webb.

For those confident that data traffic growth stimulates investment, the other problem is the lack of any correlation between volumes and costs. Advanced networks are designed to cope with usage up to a certain high threshold before an upgrade is needed. Headline expenses have not risen in lockstep with gigabytes.

References:

https://www.lightreading.com/5g/ericsson-and-nokia-may-be-stuck-with-skinflint-customers-for-years

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

“The “5G Train Wreck” we predicted five years ago has come to pass. With the possible exception of China and South Korea, 5G has been an unmitigated failure- for carriers, network equipment companies, and subscribers/customers. And there haven’t been any significant performance advantages over 4G.”

Barriers for telcos deploying AI in order to improve network operations

Communications service providers (CSPs) face a host of barriers, such as accessing high-quality data, that impede thesir ability to effectively deploy AI which could improve network and service operations, according to new research commissioned by Nokia and conducted by Analysys Mason.

“CSPs are unable to access high-quality data sets (which will enable them to make more accurate decisions) because they are using legacy systems with proprietary interfaces. This will restrict how quickly they can integrate AI into their networks,” according to the research, which is based on responses from 84 CSPs surveyed globally.

Almost 50 percent of Tier-1 CSPs ranked data collection as the most challenging stage of the telco AI use case development cycle.

Further, the research found that only six percent of CSPs surveyed believe they are at the most-advanced level of automation, or zero-touch automation, which relies on AI and machine learning (ML) algorithms to manage and improve network operations. The high-quality data issue is also impacting CSPs’ ability to retain AI talent.

Still, 87 percent of CSPs have started to implement AI into their network operations, either as proof of concepts or into production; with 57 percent saying they have deployed telco AI use cases to the point of production.

CSP respondents said they believe AI will help improve network service quality, top-line growth, customer experience, and energy optimisation to meet their sustainability goals.

The research said CSPs should evaluate their telco AI implementation strategies and develop a clear roadmap for AI implementation to overcome their data challenge and other impediments, such as an inability to scale AI use case deployments. The report can be found here.

Adaora Okeleke, Principal Analyst, at Analysys Mason said: “CSPs must transition to more-autonomous operations if they are to manage networks more efficiently and deliver on their main business priorities. But as this research demonstrates, accessing high-quality data remains a critical obstacle to deploying telco AI within their networks. They need to really examine their AI implementation strategies to work around this data quality issue.”

Andrew Burrell, Head of Business Applications Marketing, Cloud and Network Services at Nokia, said: “AI has a crucial role in driving step changes in network performance, including cutting carbon footprints. CSPs are aware of the challenges of more deeply embedding AI into their operations and, as this research points out, the steps they can take to positively alter that situation, including building the right ecosystem of vendor partners with the right skillsets that can better cater to their network needs.”

Resources and additional information:

Webpage: https://www.nokia.com/networks/ai-ops/

References:

Analysys Mason & Light Reading: cellular data traffic growth rates are decreasing

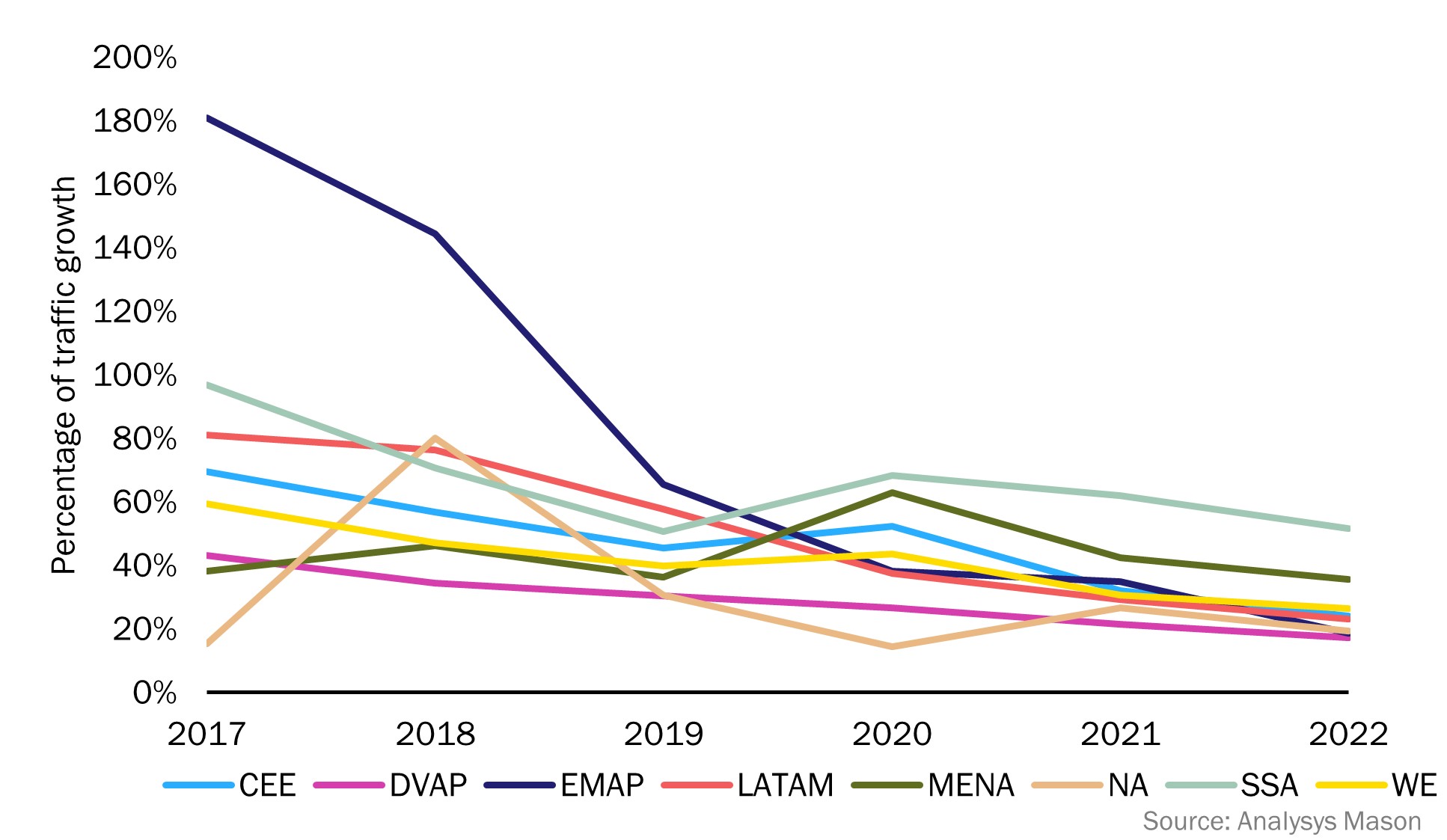

According to Analysys Mason, the telecoms industry is fixated on the idea of a constant and dramatic increase in data consumption by cellular network users. However, the growth rates are no longer increasing. The annual growth in cellular data traffic slowed, worldwide, from more than 90% in 2018 to 34% in 2021 and again to around 22% in 2022.

These figures include a surge in cellular data traffic generated by customers with fixed–wireless access (FWA) services. FWA customers (due to time spent watching TV and video streaming) often generated more than 200–500GB per month which is 16 times more than an average mobile cellular data customer, in 2022.

This means there is an even steeper decline in the growth of data traffic generated by mobile handsets, decreasing from an annual rate of 104% in 2018 to 21% in 2022.

Figure 1: Cellular data traffic growth rates by region, 2017–2022

CEE = Central and Eastern Europe, DVAP = Developed Asia–Pacific, EMAP = Emerging Asia–Pacific, LATAM = Latin America, MENA = Middle East and North Africa, NA =North America, SSA = Sub-Saharan Africa, WE = Western Europe

……………………………………………………………………………………………………………

From Light Reading:

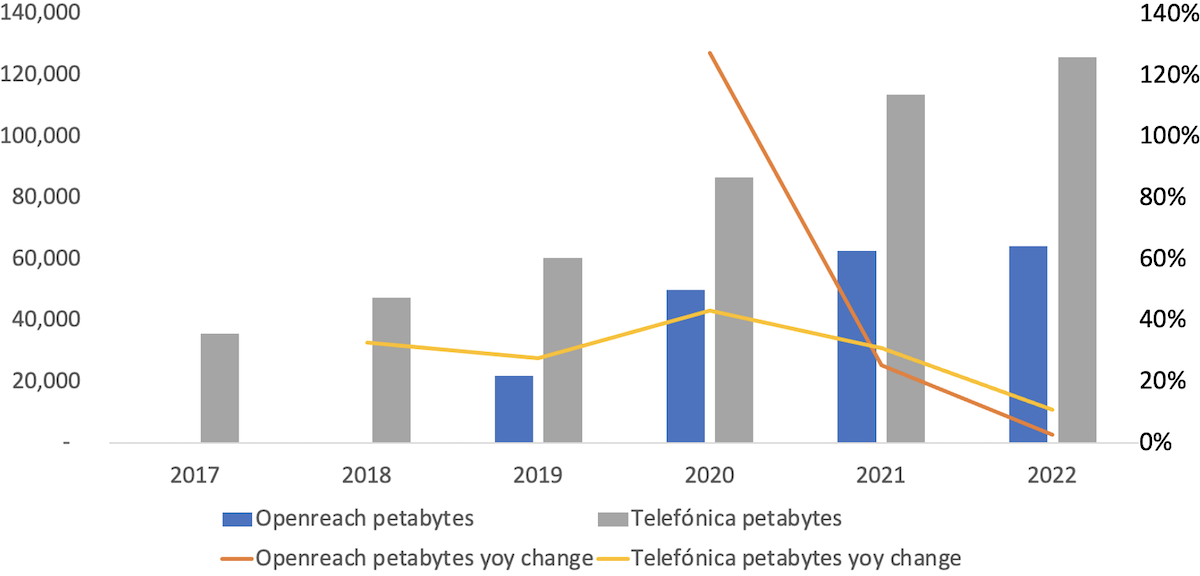

- Data traffic on Openreach, the UK’s main broadband network, grew just 3% last year after rising 25% in 2021 and 127% in 2020 (the year of mass pandemic induced lockdowns).

- A similar trend is observable across the various fixed and mobile networks operated by Spain’s Telefónica. Traffic surged 43% in 2020, but the rate of increase dipped to 11% last year. If the trend persists, the petabytes will soon be dropping.

……………………………………………………………………………………………………………………………….

5G was expected to propel cellular data usage onto a new growth trajectory. However, this is not taking place at all.

Following the launch of 5G services, operators reported very high initial 5G data usage rates. This was primarily caused by the heaviest LTE users upgrading to 5G handsets and services. This migration simultaneously caused a decline in the average traffic generated by users with LTE handsets. The impact of the early adopters was subsequently diluted as less-intensive users upgrade to 5G handsets and services. Then, organic growth in usage started to mask some of the effects of the migration. Over time, though, we can look at whether the total growth in usage across all handset types is sustained. South Korea is a good example to look to. In South Korea, there was an initial surge in data usage the year 5G was introduced, but this effect was short-lived. Average data use by subscribers with 5G handsets fell from its high starting point, became flat and then started to rise once more but only at a low single-digit rate. Average usage by LTE handset owners has been steadily decreasing. Overall, average data traffic growth across all handset types has slowed for 3 years in a row.

Figure 2: Cellular network data traffic growth, South Korea, December 2018–December 2022

| Monthly usage (MB) | December 2018 | December 2019 | December 2020 | December 2021 | December 2022 |

| 4G smartphone traffic per subscriber | 8177 | 9753 | 9650 | 8619 | 7591 |

| 5G smartphone traffic per subscriber | 27 282 | 26 744 | 26 834 | 27 589 | |

| 4G smartphone usage growth | 21% | 19% | –1% | –11% | –12% |

| 5G smartphone usage growth | –2% | 0% | 3% | ||

| Average growth (2G, 3G, 4G and 5G handsets) | 23% | 38% | 18% | 15% | 10% |

Source: Analysys Mason

Operators are currently using FWA to fill the gap between capacity and demand in their 5G networks, but the revenue per megabyte that they generate from FWA services is much lower than that for mobile cellular data services. Relying on FWA traffic to fill 5G networks will not satisfy mobile operators’ investors in the long run. Some operators will also need to limit FWA availability because without the careful management of FWA traffic on 5G networks, there could be negative impacts on the quality of service for non-FWA users.

Only new applications and services will unlock future annual growth rates of 30% or more. However, it is unlikely that the types of services that could significantly accelerate cellular data traffic growth will have a substantial near-term impact.

- Higher definition video and TV services could potentially drive a new wave of data usage. Device capability is an obstacle to this possibility, as most mobile handsets are either not capable of displaying high-definition content or the screen size is too small for users to see the difference. A surge in the use of tablets to view TV on mobile networks could change this – although tablet users tend to use Wi-Fi as their primary means of connectivity. A few mobile operators have introduced mobile cellular data packages that include subscriptions to on-demand TV. This has the potential to drive up data traffic, but there are limits to the amount of time people can spend watching TV when they are away from their homes. Lack of time is likely to prevent excessive mobile TV consumption away from the home. Within the home – even when they have unlimited mobile data packages – users don’t tend to switch to their mobile networks. They typically continue to use devices connected to their home fixed broadband and Wi-Fi for extended TV viewing.

- Connected cars have been regarded as a potential source of high-volume data traffic. But this will likely not happen soon. Most new cars equipped with a mobile connection still only have LTE capabilities, and most of those are only used for telematics. Some original equipment manufacturers (OEMs), as well as operators, have introduced service packages to encourage in-car use of services (based on embedded and aftermarket connections). Even still, usage volumes have been low even in luxury vehicles. Other potential drivers of traffic are C-V2X systems for intelligent transport networks and autonomous vehicles. But despite numerous tests and trials, C-V2X infrastructures are years away, and fully autonomous vehicles still have technical and regulatory hurdles to overcome before they are deployed in meaningful numbers.

- Metaverse services – including AR and VR, and services using haptics – have the potential to generate a high volume of data traffic. In the next 4 or 5 years, the number of users with AR and VR headsets is expected to reach 300–400 million , but faster take-up will be restricted by the cost of end-user equipment, and most image processing will be done using equipment within the home. Eventually, metaverse use cases could involve vast numbers of customers, with cloud processing of fully immersive environments and services requiring very low latency and very high bandwidth.

- However, most of the usage will take place indoors where a combination of fibre and Wi-Fi seems much more suited to the service requirements.

The volume of cellular data traffic is increasing in absolute terms, but the annual change measured in percentage terms is going to be much lower than what is has been historically. Analysys Mason’s new report Wireless network data traffic: worldwide trends and forecasts 2022–2028 evaluates the prospects for cellular data growth over the coming 5 years, with global cellular data traffic nearly tripling worldwide to 2.7ZB in 2028, with a limited metaverse uptick at the end of the period.

References:

https://www.analysysmason.com/research/content/articles/cellular-data-traffic-rdnt0/