Heavy Reading

U.S. fiber rollouts now pass ~52% of homes and businesses but are still far behind HFC

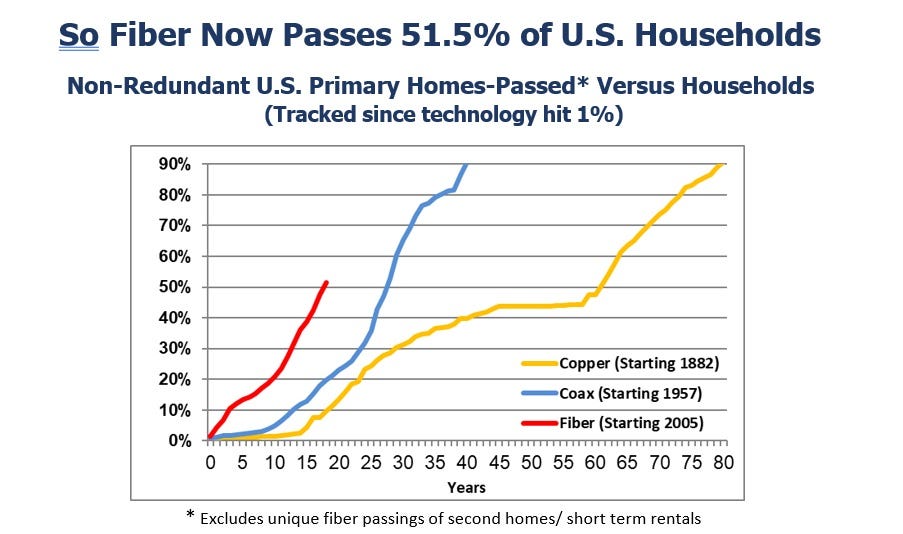

Fiber optic network deployments have reached a milestone as they now pass more than 50% of U.S. households, according to recent report from the Fiber Broadband Association (FBA) [1.] and RVA Market Research and Consulting. Fiber broadband deployment set a new historical record in 2023, passing nine million new homes at a growth rate of 13% year-over-year. The 2023 North America Fiber Provider Survey, sponsored by the FBA, concluded that 77.9 million U.S. homes were passed with fiber, with nearly 52% of all the nation’s unique homes and businesses passed.

Note 1. The FBA is an all-fiber trade association that provides resources, education, and advocacy for companies, organizations, and communities that want to deploy fiber networks. The FBA’s goal is to raise awareness and provide education about the fiber deployment process, safe worksites, and effective fiber installs.

Image Credit: The Fiber Broadband Association (FBA)

………………………………………………………………………………………………………………………………………………………………………………………….

The last $10 billion U.S. Treasury American Rescue Plan (ARP) funding for infrastructure projects such as broadband networks is being distributed this year. The $42.5 billion in NTIA BEAD funding available over the next few years will significantly contribute to enabling and upgrading communities across America with the high-speed, low-latency broadband necessary for participation in today’s 21st-century society. We are seeing a steady stream of NTIA approvals and expect the first states to make BEAD awards in the second half of 2024.

Here’s how the growth of fiber has risen in recent years compared to coax cable (or hybrid fiber/coax, HFC) and the long history of copper.

“Thanks to this latest surge, fiber lines now pass nearly 78 million U.S. homes, up 13% from a year ago,” Alan Breznick, Heavy Reading analyst and the cable/video practice leader at Light Reading, explained in recorded opening remarks here at Light Reading’s 17th’s annual Cable Next-Gen event. Almost 69 million of those locations are “unique” fiber homes, meaning that about 9 million are passed by more than one fiber provider, Breznick added.

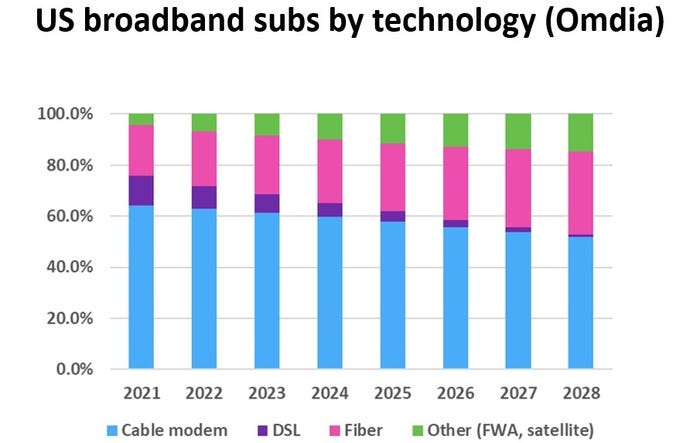

The share of broadband technology is also evolving. While HFC remains the primary way of delivering broadband, fiber-to-the-premises (FTTP) and fixed wireless access (FWA) will continue to make their presence felt in the coming years. Omdia (owned by Informa) expects cable’s share of that mix to drop over the next four years, hitting about 55% by 2028, while fiber’s share is expected to rise to 30% by that time, Breznick explained.

For the cable industry, fiber and FWA are not solely about competition. Many operators are also using FTTP extensively in greenfield deployments and subsidized rural buildouts. They are deploying it on a targeted basis via a new generation of nodes that can support multiple access technologies, including HFC and wireless.

CableLabs has put fiber-to-the-premises on the front burner via a pair of new working groups. A recent survey from Omdia shows that more than one-third of cable operators have already deployed passive optical networking (PON) in some form. That number will “undoubtedly keep rising” thanks to initiatives such as the Broadband Equity Access and Deployment (BEAD) program, Breznick said. Omdia expects spending on next-gen cable technologies to tick up in 2024 and 2025 and then reach a relatively steady annual state through 2029.

Meanwhile, operators such as Mediacom Communications have tapped into FWA to extend the reach of broadband in rural areas. Combined, they demonstrate some of the reasons why the industry has been shedding the “cable” label via rebranding efforts and name changes in recent years.

Cable’s broadband challenge is to grow broadband subscribers as it faces more broadband competition combined with historically low churn and a slow housing move market. “If it feels like an uphill battle for cable, maybe that’s because it is. But that doesn’t mean it has to be a losing battle,” Breznick said. “That’s because the cable industry still has plenty of tricks left up its sleeve.”

Those tricks include the use of next-generation DOCSIS 3.1 (sometimes called DOCSIS 3.1+ or extended DOCSIS 3.1) that can bump up speeds as high as 8 Gbit/s by opening up new orthogonal frequency division multiplexing (OFDM) channels. Some operators, including Comcast, Charter Communications, Rogers Communications, Cox Communications and Cable One, have begun to deploy DOCSIS 4.0 or have put it squarely on their network upgrade roadmaps.

And though cable operators’ network spending is expected to be down in the first half of 2024, vendors are optimistic that the spigots will start to open up again in the second half of the year as operators pick up the pace.

References:

https://www.lightreading.com/fttx/us-fiber-rollouts-reach-tipping-point-but-are-still-far-behind-hfc

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Nokia’s launches symmetrical 25G PON modem

Heavy Reading Survey: Network White Boxes and Cell Site Backhaul Connectivity

Heavy Reading’s (owned by Informa) 2023 survey attracted 87 qualified network operator responses from around the world who shared their views on transport deployment issues and timelines, fronthaul networks and RAN centralization, routing and synchronization, and 5G edge connectivity.

Network disaggregation has been defined as “The separation of networking equipment into functional components and allowing each component to be individually deployed.” The disaggregated network approach first gained major attention in 2012 when standards organization ETSI formed a working group to define how telecom operators could move to a cloud-native model for deploying networking and services.

White Box Deployment Model:

In the disaggregated network model, the network operating system/software is separate from the underlying hardware (white boxes), with each supplied by different vendors. White boxes can be bare metal switches, routers, packet-optical equipment or DWDM transponders. They are mostly used by cloud service providers and large network operators.

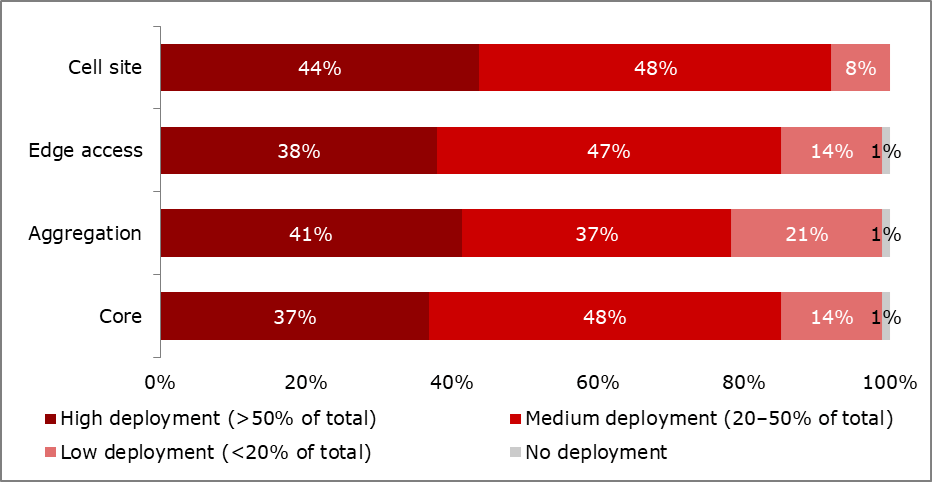

Network operators surveyed by Heavy Reading expect white box elements to have their highest deployments in cell sites and aggregation nodes. 44% of operators expect high deployments in cell sites (defined as greater than 50% of total elements), followed closely by aggregation, with 41% expecting high deployments.

Among the top benefits of white box cell site and aggregation deployments are easy integration into the RAN, compact footprint where space is at a premium and scaling from 10G to 400G on the same platform.

How extensively does your organization expect to deploy white box optical transport platforms over the next three years for the following 5G transport segments?

Source: Heavy Reading

…………………………………………………………………………………………………………………………………………………………………..

Cell Site Backhaul:

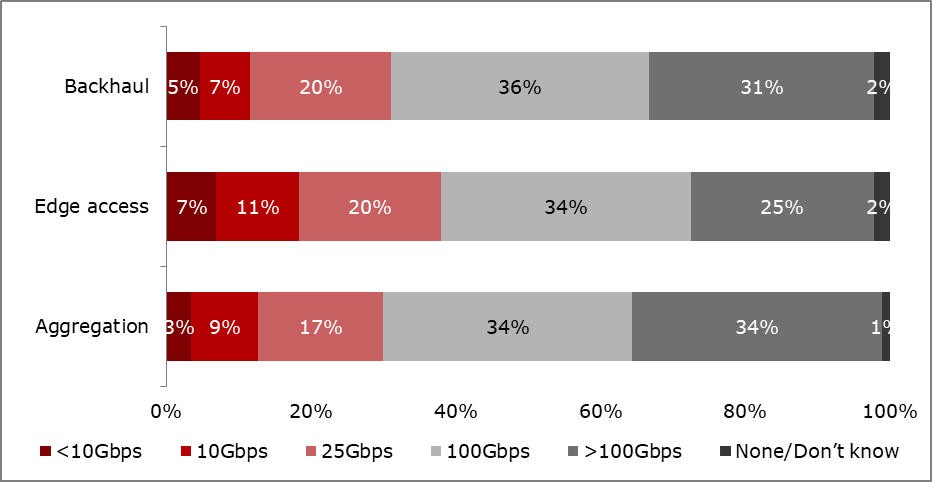

5G requires a huge increase in capacity per cell site, with 10 Gbps replacing 1 Gbps as the standard for cell site backhaul speed. This tenfold jump in capacity is needed to meet initial 5G cell site requirements, as well as to provide room to grow for future increases. But the impact on 5G transport segments goes well beyond 10G, based on Heavy Reading survey results. Just over two-thirds of operators expect at least 100Gbps of capacity will be required in backhaul (67%) and aggregation (68%), while just under two-thirds of respondents (59%) expect that greater than 100 Gbps will be needed in edge access.

Heavy Reading found that 10Gbps to the individual cell site will be sufficient. However, network operators will often carry traffic from multiple cell sites, such as when using ring topologies for backhaul or when aggregating traffic coming in from multiple cell site locations. These survey results provide strong support that 100 Gbps and even 400 Gbps will play major roles in edge, aggregation and backhaul networks over the medium term.

What is your average expected bandwidth capacity in each of the following segments over the next three years (i.e., end of 2025)?

Source: Heavy Reading

………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g-and-beyond/transport-priorities-for-next-phase-of-5g/a/d-id/784462?

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

Disaggregation of network equipment – advantages and issues to consider

Heavy Reading: “The Journey to Cloud Native” – Will it be a long one?

To gauge how carriers are planning and implementing cloud-native technology, and in collaboration with Juniper, Nokia and Red Hat, Heavy Reading asked 92 global telco service providers about their plans for transition to cloud native. In their report, “The Journey to Cloud Native,” Heavy Reading analyzes the choices service providers are making along the road to cloud native and what challenges they are encountering along the way.

The migration to cloud native brings largescale shifts for the communications service providers (CSPs), including:

- The move to microservices

- Standardized access to these microservices via API exposure

- The integration of multiple operational layers and domains for application management

- Automation across the application lifecycle through the use of DevOps

These are profound changes to the application development and management environment of the CSPs, and will be tackled with dedicated internal resources and expanded partnerships with telecommunication equipment vendors (TEMs), integrators and hyper-scalers (Amazon, Google, Microsoft, Facebook, etc.).

Editor’s Note: There are no standards or implementation specs for “Cloud Native” 5G SA core network or anything else. Rakuten Symphony (Japan) and Reliance Jio (India) claim they are going to implement “Cloud Native” 5G SA core network themselves and sell the specifications and software to other service providers. Good luck! We think it will be a very long journey to cloud native for telecom network operators/5G SA core network service providers.

The prospect of cloud native:

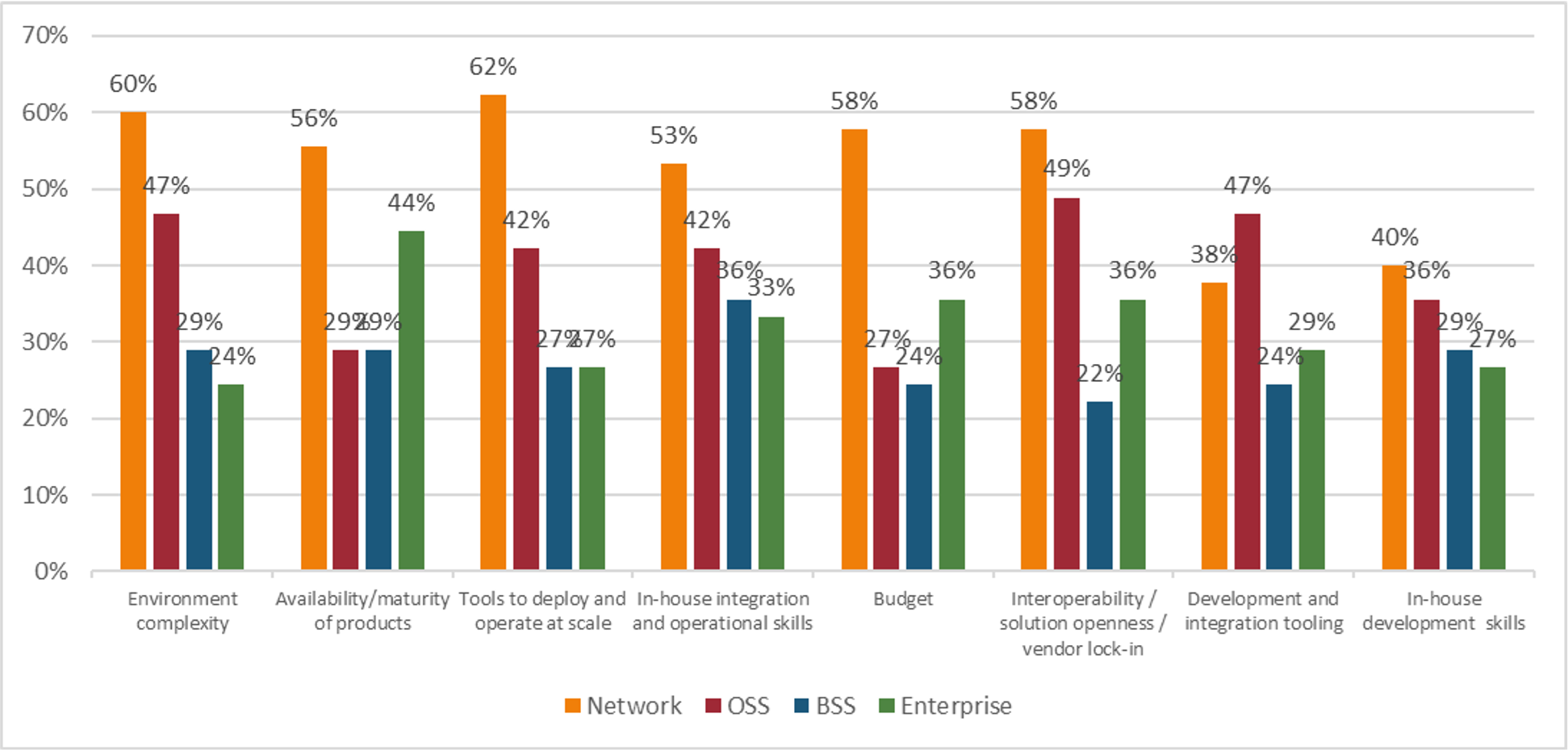

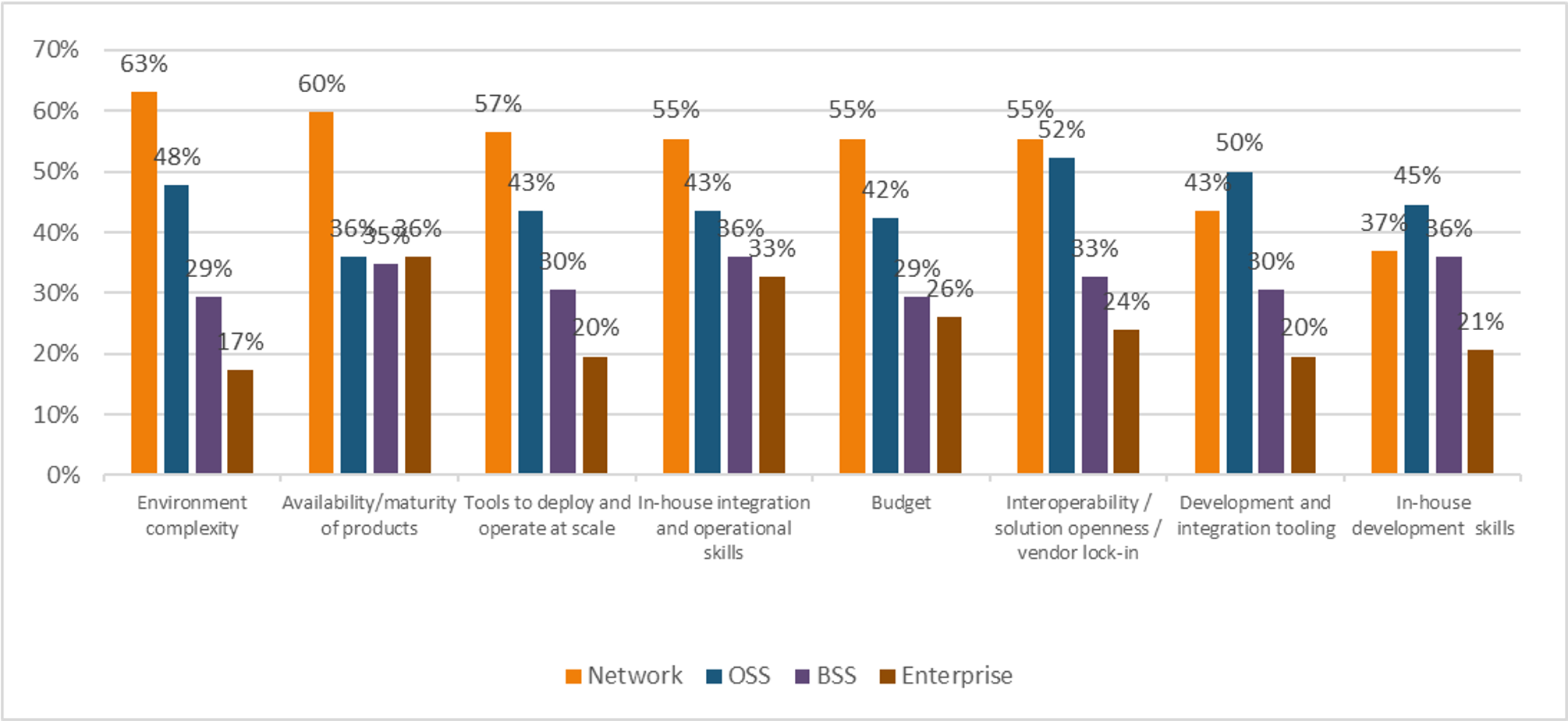

Heavy Reading queried the survey pool about where they were experiencing the greatest challenge in deploying cloud native: the network, operations support systems (OSS), business support systems (BSS), or the enterprise (see Figure 1). Heavy Reading established earlier in the survey that cloud native will be deployed first for network workloads. Respondents plan to transition workloads to the OSS business areas next, then BSS, and lastly, the enterprise.

In almost all cases, respondents ranked the challenges in that same order: first network, then OSS, BSS, and enterprise. The only challenges that were considered more severe in an area other than the network were “in-house development and integration skills” and “development and integration tooling,” where the OSS space was recognized as a greater challenge than the network. This is not surprising given that most Tier 1 carriers have dozens of OSS solutions in operation. They do much of any integration work between systems internally and some OSS systems are stand-alone – dedicated to siloed services.

Figure 1: The network space is seeing the most implementations and the most challenges N=92

Q: In which business areas are you experiencing significant challenges to going cloud native? Check all that apply. Source: Heavy Reading

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Looking only at the survey results from respondents who have already deployed cloud native, (see figure 2), which is half of the respondent pool, there are significant differences compared to the rest of the survey base. In the network area, “tools to deploy and operate at scale” is a greater challenge by 11 percentage points compared to respondents planning to deploy cloud native in one to two years.

“Budget” in the OSS area plummets between those who have not yet deployed cloud native, (57% of respondents considering it a challenge), and those who have already deployed cloud native, (27% of the respondents finding it to be a concern).

Those who have already deployed cloud native also consider all of the challenges in the enterprise area to be greater than the survey base as a whole and all of the challenges in the BSS area to be less of a challenge. Their firsthand experience with implementing cloud native in the network area has opened their eyes to the challenges that await them in the enterprise space. However, they are more confident that they have the support needed, near term, for BSS tasks which include billing, revenue, and customer management.

n=45: only respondents that have already implemented Cloud Native

Source: Heavy Reading

Heavy Reading’s findings might be a good indication that CSPs today are committed to their journey to cloud native, but face daunting challenges that will require expanded partnerships with the cloud-native ecosystem, including platform vendors, ISVs (Independent Software Vendors), TEMs (Telecom Equipment Manufacturers???) and hyper-scalers.

To gain more in-depth details of service providers’ perspective on cloud-native migration, download and read the full report now.

— Jennifer Clark, Principal Analyst, Cloud Infrastructure and Edge Computing, Heavy Reading

References:

https://www.lightreading.com/new-report-highlights-cloud-native-migration-challenges/a/d-id/774623?

https://www.lightreading.com/lg_redirect.asp?piddl_lgid_docid=773720

EXFO/Heavy Reading Survey: Nearly half of all mobile network operators plan to deploy 5G SA within 1 year

EXFO worked with Heavy Reading to conduct a survey of Mobile Network Operators (MNOs) across North America and Europe to understand their approach to 5G SA core network and the revenue opportunity it presents. 49% of MNOs are planning to deploy 5G SA within the next year, while a further 39% will deploy 5G SA within one to two years. The main drivers for deploying 5G SA are to support enhanced consumer offerings such as virtual reality, augmented reality and mobile gaming; accelerate time to market for new services; and offer network slice-based services.

While 76% of MNOs believe service assurance will be necessary to sell advanced 5G services and meet stringent service level agreements (SLAs), operations teams don’t have real-time visibility into how outages and degradations impact customers—whether they are humans or “machines” (critical, latency-sensitive applications and devices like emergency services or factory floor robots). 65% of MNOs say that this lack of actionable insight is preventing them from automating networks and fault resolution, which are essential to meeting demanding performance expectations in enterprise applications.

Specifically, most MNOs said they need a range of new tools and capabilities to generate revenues from 5G services:

- 86% say they need real-time network, service and quality of experience intelligence

- 85% say they need to be able to monitor per-service and per-device performance.

- 81% say they need AI-driven anomaly and fault detection, as well as root cause analysis.

- 82% say they need monitoring of end-to-end network slices.

“The opportunity to generate revenues from 5G SA lies in automated networks, which means service providers must deliver on enterprise service level agreements. This survey with Heavy Reading reinforces what we hear regularly from our customers: mobile network operators want greater service assurance and analytics to deliver actionable insights into network performance and user experience,” said Philippe Morin, CEO at EXFO. “This is where EXFO’s unique, adaptive approach to service assurance comes into play. By taking a source-agnostic approach to data collection and analytics, combined with a fully cloud-native architecture, our service assurance platform integrates with legacy and new 5G systems to provide a unified, end-to-end view of customer experience, device and network performance.”

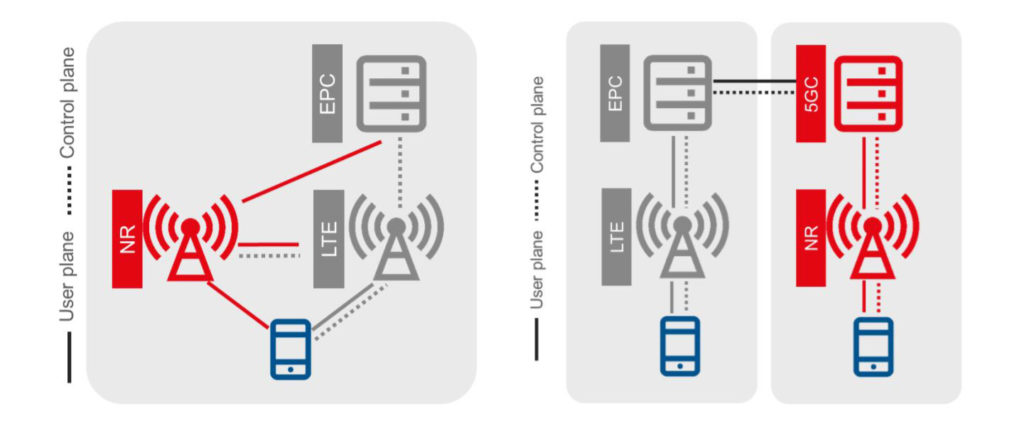

5G NSA (LTE & EPC) 5G SA (NR connected to 5G core)

Benefits of 5G SA core network:

- MNOs can launch new enterprise 5G services such as smart cities, and smart factories

- It is fully virtualized, cloud-native architecture (CNA), which introduces new ways to develop, deploy and manage services

- The architecture enables end to end slicing to logically separate services

- Automation drives up efficiencies while driving down the cost of operating the networks.

- By standardizing on a cloud-native approach, MNOs can also rely on best of breed innovation from both vendors and the open-source communities

“When you look at the number of RFPs that are out there and the dialog we’re having, I think we’re now starting to see the need [to move]from what I would call studying or doing assessment, to potentially now looking at deploying [5G SA],” Morin said. He pointed out that there have been numerous announcements by carriers around 5G private networks and enterprise-based services, which he says are the initial drivers for 5G SA deployment — and are also driving the need for enhanced service assurance capabilities.

“When you’re talking about more business-focused use cases, service-level agreements become even more important and that’s why [there is a]need for service assurance,” Morin said. In contrast to previous network generations, where service assurance was often considered only after a variety of other decisions were made, the expectations of serving enterprise use cases are making service assurance a higher priority. “It’s pretty clear, as you deploy 5G SA, especially in the context of … [having]machines connected to this, IoT devices and so on, and more of an enterprise focus, that service assurance requirements are much more front and center than what we’ve seen in the previous protocols.”

Morin sites two key 5G SA capabilities that offer value:

- The ability to support billions of connections (massive machine-to-machine communications.

- Network slicing to enable differentiated services at scale.

With those opportunities, comes the requirement for MNOs to ensure that they can provide the levels of service and scalability that slicing and massive IoT demand — and that’s where operators will need better monitoring tools, visibility and insights, Morin says, and their acknowledgement of that need is reflected in the survey. EXFO’s joint survey found that 76% of the surveyed MNOs believe that service assurance will be necessary for deploying 5G SA. “I’m pretty sure we would not have the same stats, if you would’ve asked the same questions around 3G and 4G,” Morin added.

“If you’re going to have business use cases that machines are going to be relying on to be able to execute that application, machines won’t be as tolerant as humans, because the service won’t be able to operate. So what this means is that the network operators need a better view of insights on the network performance, that in the past, because it was for humans, maybe was not as required. But clearly, now, for 5G SA and 5G revenues that are going to be driven out of this, getting better visibility on what is happening that is down to the device level– not just the customer; the device, the service and the network — and end-to-end visibility will be really, really critical.”

There’s also the changing nature of service assurance and visibility strategy and tools to consider. As enterprises moved into making use of big data, their strategies and architectures often involved pouring network data into a massive data lake and then retrieving information from there as needed.

“With 5G, and 5G Standalone in particular, we absolutely believe that’s not going to be the architecture of choice. … You cannot wait for the issue to come up, and go into a data lake to try to figure out what happened in the last 15 minutes. We believe that it’s got to be real-time, it’s got to be adaptive — because you can’t start getting information from all the devices and all the IoT. This would have a big impact on your overall cost structure.”

Morin said that 5G SA core network’s cloud-based, orchestrated and automated nature enables the company to support machine-learning and generate insights only when an anomaly or service issue/problem is detected. AI will then determine whether data is needed from the device, service or network layer in order to resolve the issue(s).

“If you’re going to really make 5G SA a success, it will require a higher level of automation, and I do believe that service assurance will be what I would call an automation enabler. If you don’t have that capability to monitor and in an automated way, provide actionable insights to [a specifics]use case and to [a specific]SLA, I think it will be very difficult to go into a high-volume deployment with 5G SA.”

………………………………………………………………………………………………………………………………………………

Author’s Note:

Despite the optimistic results of this 5G SA core network survey, just 13 network operators had launched commercial public 5G SA networks as of the middle of August 2021. Some 45 other operators are planning or deploying 5G SA for public networks, and 23 operators are involved in tests or trials. That’s out of a total of 176 commercial 5G networks launched worldwide (163 of them are 5G NSA networks)!

Note also that there are no ITU standards or 3GPP specifications for how to implement a 5G SA Core network. There are many choices which will lead to different, incompatible implementations of the 5G Core network

References:

https://www.exfo.com/en/products/service-assurance-platform/nova-core/

https://www.exfo.com/en/resources/blog/mobile-private-networks-5g/

https://www.affirmednetworks.com/sa-and-nsa-5g-architectures-the-path-to-profitability/