Month: May 2019

GSA May Update: Gigabit LTE – Global Status

Editor’s Note:

Gigabit LTE will be the backbone of support for (3GPP Release 15) 5G NR-NSA as it’s used for signaling, evolved packet core (EPC), and network management. 5G with low latency, signaling and a 5G mobile packet core won’t be deployed in mass till IMT 2020 standard has been completed.

INVESTMENT IN GIGABIT LTE NETWORK TECHNOLOGIES WORLDWIDE:

- At the end of February 2019, GSA has identified 101 operators in 60 countries or territories investing in all the three core LTE-Advanced features for Gigabit LTE (defined as Carrier Aggregation, 4×4 MIMO or higher, and 256 QAM modulation in the downlink)

- 53 operators have deployed all three of these technologies and / or launched commercial services based on them

- 313 operators in 133 countries are investing in at least one of the key technologies

DISTRIBUTION OF GIGABIT LTE NETWORKS AND DOWNLINK SPEEDS OF THE FASTEST NETWORKS:

Gigabit LTE does not always equal Gigabit speed. Some networks capable of delivering 1 Gbps downstream do so without using all three key LTE-Advanced (AKA IMT Advanced in ITU-R) features; some networks using all three features do not achieve 1 Gbps

The fastest networks in the GSA database are:

- KDDI, SK Telecom, Swisscom, Telus, Turkcell: 1.2 Gbps

- KT: 1.167 Gbps(achieved using MPTCP to combine LTE with 3CA and WiFi)

- China Unicom: 1.156 Gbps

- Bell Mobility: 1.15 Gbps

- 3 Hong Kong, Singtel: 1.1 Gbps

- Optus: 1.03 Gbps

- Vodafone Italy: 1.023 Gbps

- AT&T Mobility, China Mobile Hong Kong, CYTA, Dialog Axiata, DNA, Elisa, HKT, Inwi(Wana), O2 Czech Republic, Ooredoo Qatar, Smartone, Sprint, StarHub, Telenor Denmark, TeliaSonera Denmark, Telstra, Vodafone Germany, Vodafone Ziggo: 1 Gbps

This data is taken from Gigabit LTE Networks: Analysis of Deployments Worldwide (May 2019) published by GSA and available from www.gsacom.com.

……………………………………………………………………………………………………………………………………………………………………..

LTE FAST FACTS: LTE IN UNLICENSED SPECTRUM (DATA AS OF END-APRIL 2019):

- 8 LAA (License Assisted Spectrum) [1] deployments/launches:

- AT&T (US), T-Mobile (US), AIS (Thailand), MTS (Russia), Smartone(Hong Kong), TIM (Italy), Turkcell, Vodafone Turkey (deployed)

- 28 LAA trials and deployments in progress in 18 countries

- The latest include MOTIV and Vimpelcomin Russia, and 3 Indonesia

- 1 eLAAtrial (SK Telecom)

- 3 LTE-U network deployments/launches

- T-Mobile (US) – though it is now switching focus to LAA, AIS (Thailand), Vodacom (South Africa)

- 8 LTE-U trials or pilots in progress

- 1 LWA launch …

- Chunghwa Taiwan and 2 others are trialing the technology (in Singapore and South Korea)

- 1 commercial launch of a private LTE network using CBRS

- 16 operators investing in CBRS trials in the US

- The latest are Altice, CDE Lightband, CoxCommnications, Extenet, Mobilitieand Windstream

- 21 commercially available modem/platform chipsets supporting unlicensed access

- 133 devices announced supporting LTE in unlicensed spectrum or shared spectrum using CBRS (including regional variants)

Note 1. A variant of LTE-Unlicensed is Licensed Assisted Access (LAA) and has been standardized by the 3GPP in Rel-13. LAA adheres to the requirements of the LBT protocol, which is mandated in Europe and Japan. It promises to provide a unified global framework that complies with the regulatory requirements in the different regions of the world.

- 3GPP Rel-13 defines LAA only for the downlink (DL).

- 3GPP Rel-14 defines enhanced-Licensed Assisted Access (eLAA), which includes uplink (UL) operation in the unlicensed channel.

- 3GPP Rel-15 The technology continued to be developed in 3GPP’s release 15 under the title Further Enhanced LAA (feLAA).

LTE Fast Facts are taken from the GSA report “LTE in Unlicensed Spectrum: Trials, Deployments and Devices April 2019”available from www.gsacom.com.

GSA reports are compiled from data stored in the GSA Analyser for Mobile Broadband Devices/Data (GAMBoD) database.

Key findings in OpenSignal’s “State of the Mobile Network Experience” report

According to a new OpenSignal report, South Korea is well ahead of any other country in the world when it comes to Download speed experience, with average speeds topping 50 Mbps. Only Norway comes close, with even third-placed Canada a clear 10 Mbps behind. OpenSignal saw a huge range of scores in this metric, with the lowest average score being less than 2 Mbps.

The biggest variation between Upload speed experience scores of our users was at the top end of the table, where the gap between leader Denmark and tenth-placed Canada was over 5 Mbps.

In only 13 of the 87 countries we rated our users averaged Latency experience scores under 40 milliseconds, while none scored under 30ms. One continent dominated our Latency Experience analysis, with six European countries in our top 10.5G’s designers target much improved latency as one of their goals.

At the other end of the scale we inevitably have developing countries, but it’s surprising to see India still lagging at 6.8 Mbps average despite all the investment from Reliance Jio, which has been focused on coverage rather than speed. India is doing a lot better in terms of 4G availability. The average Indian mobile user has access to 4G about 91% of the time according to OpenSignal.

Only four European countries made OpenSignal’s 4G Availability top 10 — the fewest of any of our award metrics. And both the U.S. and India made the top 10, despite being distinctly mid-table in all other key metrics. One of the standout countries to feature in the top five of our 4G Availability rankings was the U.S. which was distinctly mid-table across all other key award metrics but managed a fifth-place finish in 4G Availability. In our most recent Mobile Network Experience USA report, we saw Verizon overtake T-Mobile following a fierce battle in this metric. This rivalry has driven up 4G Availability in the country, leading to a world-class position for the U.S. in our rankings.

Indeed, 4G is becoming more and more ubiquitous, even in developing markets. OpenSignal’s analysis shows that the average 4G Availability

across the 87 countries experienced by our users is close to 80%, with 15 markets scoring over the 90% mark. The top ends of our tables were

largely dominated by European countries, but no one country appeared in the top 10 for all five of our key metrics. European countries, however,

dominated, racking up far more top 10 entries than any other region.

In a ranking of the 10 countries who scored highly across all five key metrics, only two were from outside Europe.

Norway was #1 in the Video Experience category despite of being even worse than Korea when comes to latency. Hungary was #2. Astonishingly, only six non European countries among the top 25 who all scored a Very Good rating (65-75 out of 100).

5G should mean more consumers will be able to enjoy a good mobile Video Experience more often because of the increased mobile capacity new high frequency 5G spectrum will provide to mobile operators.

You can download the complete OpenSignal (free) report here.

MEF SD-WAN Service Standard Now Publicly Available; ITU-T SD-WAN Work a Dead End?

After incorporating extensive feedback from service providers and technology vendor members, MEF is now moving the draft SD-WAN Service Attributes and Services standard (MEF 70) through the last phase of MEF membership and Board approval. The document is available for download here.

“MEF’s team of SD-WAN experts has worked overtime to develop a robust and timely industry standard following multiple rounds of in-depth peer review,” said Pascal Menezes, CTO, MEF. “We will officially publish MEF’s SD-WAN service standard by mid-July 2019, but we are making the final draft publicly available now because broad industry alignment on common terminology will be healthy for market growth.”

MEF’s SD-WAN service definition standard describes requirements for an application-aware, over-the-top WAN connectivity service that uses policies to determine how application flows are directed over multiple underlay networks irrespective of the underlay technologies or service providers who deliver them.

SD-WAN service relies on two or more network connections, directing traffic over one connection or the other based on pre-defined parameters, traffic levels and other variables. For example, a company might use an MPLS VPN and a direct internet connection, with mission-critical traffic routed over the MPLS connection, while less critical traffic travels over the internet connection.

MEF defines the SD-WAN UNI, or User to Network Interface, as the point of demarcation between the service provider network and the enterprise network, determining where each party’s functionality and responsibility ends. SD-WAN Edge defines the services available on the customer premises, which could be available through on-premises equipment or in the cloud. And the Underlying Connectivity Service, or UCS, is the underlay wide-area network, typically MPLS, LTE, cable broadband — likely in combination — and possibly from multiple vendors. Additionally, MEF defines the Tunnel Virtual Connection (TVC) as overlay tunnels that are built over the UCS, which provide interconnects between locations.

In summary, the MEF SD-WAN service standard introduces four relevant SD-WAN terms:

- SD-WAN UNI (user-network interface)

- SD-WAN Edge, where SD-WAN functionality is achieved, which could be a physical or virtual appliance such as a virtual network function in the cloud

- Underlay connectivity service (UCS), which is the wide area network service such as MPLS or IP

- Tunnel virtual connection (TVC), the connection created over the underlay network

SD-WAN Service Constructs:

Standardization will enable a wide range of ecosystem stakeholders to use the same terminology when buying, selling, assessing, deploying, and delivering SD-WAN services. The SD-WAN service definition is a foundational step for accelerating sales, market adoption, and certification of MEF 3.0 SD-WAN services orchestrated across a global ecosystem of service provider networks.

Next Steps for SD-WAN Service Standardization:

MEF already has begun work on the next phase of SD-WAN standardization (MEF 70.1), which covers more complex service attributes related to application business importance and prioritization, underlay network characteristics, and connectivity to private/public cloud services consistent with market priorities for SD-WAN services. MEF also is progressing standards work focused on LSO (Lifecycle Service Orchestration) APIs, application security, and intent-based networking for SD-WAN services.

Pilot MEF 3.0 SD-WAN Service Certification:

MEF remains on track to launch its pilot MEF 3.0 SD-WAN Service Certification program in 2019. This certification will test a set of service attributes and their behaviors defined in the SD-WAN standard and described in detail in the upcoming MEF 3.0 SD-WAN Service certification Blueprint. Service and technology companies interested in participating in the pilot should contact [email protected]

……………………………………………………………………………………………………………………

Read more at:

………………………………………………………………………………………………………………………………………………………………………………………..

ITU-T SD-WAN work item:

ITU-T has a SD-WAN work item under study, but as far as I can tell, there is no output yet. The project is named Signalling Requirement for SD-WAN service.

| Summary: | SD-WAN is an ecosystem of hardware (including customer-premises equipment, such as edge devices), software (including controllers), and services that enables enterprise-grade WAN performance, reliability, and security in a variety of ways. This Recommendation specifies signalling requirements for SD-WAN service. The signalling is to support the dynamically set up and manage the enterprise WAN connections. |

The three contacts for this work all are from China Mobile. Following are highlights from an unapproved draft spec:

Introduction:

[ITU-T Editor’s note in September 2018] It is needed to provide the difference between two types of SD-WAN, one is provided by enterprise itself, the other one is provided by the carrier. This Recommendation address the latter. Contributions are invited.

- The SD-WAN services could be provided by two types of providers. One type is the enterprise and the other is carrier. This Recommendation addresses the latter. The main differences between the two types are shown as below:Network performance monitoring and statistic collection: The enterprise launched service is only able to monitor the performance parameters of its own end-to-end path. While the carrier launched service is capable of monitoring not only the enterprise specific path but also the performance of the whole network. The over view of the network is more helpful for carrier to plan the end-to-end paths for thousands of enterprise as a whole.

- Service provision: when the path need to be switched over, the enterprises only has the authority to configure the CPE. If they need to change the path in core network, they have to ask the carrier to do so. In contrast, the service which is launched by carrier can be quickly changed by saving the communication time between enterprise and carrier.

ITU-T References:

The following ITU-T Recommendations and other references contain provisions which, through reference in this text, constitute provisions of this Recommendation. At the time of publication, the editions indicated were valid. All Recommendations and other references are subject to revision; users of this Recommendation are therefore encouraged to investigate the possibility of applying the most recent edition of the Recommendations and other references listed below. A list of the currently valid ITU-T Recommendations is regularly published.

The reference to a document within this Recommendation does not give it, as a stand-alone document, the status of a Recommendation.

[ITU-T Q.3300] Recommendation ITU-T Q.3300 (2014), Framework of software-defined networking;

[ITU-T Y.3011] Recommendation ITU-T Y.3011 (2012), Framework of network virtualization for future network.

AJW Comment: It doesn’t appear that this work item has made much progress recently.

……………………………………………………………………………………………………………………………………………………………………………………….

Huawei Ban Threatens Wireless Service in U.S. Rural Areas

“It’s really frustrating,” said Kevin Nelson was recently in the middle of his 1,538 ha farm in north-east Montana, about the poor cellular reception. “We keep being told it’s going to improve, it’s going to improve.” NOT LIKELY ANY TIME SOON!

Plans to upgrade the wireless service near Mr Nelson’s farm halted abruptly this month when US President Donald Trump issued an executive order that banned the purchase of equipment from companies “posing a national security threat.” That order was meant to bar network equipment from Huawei, the Chinese telecommunications giant, which is a major supplier of equipment to rural wireless companies.

The CEO of the wireless provider in Mr Nelson’s area said that without access to inexpensive Huawei products, his company could not afford to build a planned tower that would serve Mr Nelson’s farm. Nowhere will the changes be felt more acutely than in rural America, where wireless service is spotty despite years-long government efforts to improve coverage. They also add to the economic uncertainty created by the White House’s trade war with China. Farmers are fearful of an extended hit to their exports.

Huawei is essential for many wireless carriers that serve sprawling, sparsely populated regions because its gear for transmitting cell signals often costs far less than other options.

Mr Trump’s ban is forcing carriers such as Nemont, which serves Opheim, to scrap expansion plans. In addition, some of the companies already using Huawei equipment fear that they will no longer receive government subsidies meant to help get service to remote areas.

U.S. intelligence officials have accused Huawei of being an extension of the Chinese government, and said that its equipment could be vulnerable to espionage and hacking. President Trump also appears to be using Huawei as a bargaining chip in his escalating trade battle with China. “Huawei is something that is very dangerous,” he said last Thursday. “It’s possible that Huawei would be included in some kind of trade deal.”

Huawei has denied that it is a security risk, saying that it is an independent business that does not act on behalf of the Chinese government. It said that 500 carriers in more than 170 nations use its technology. “Restricting Huawei from doing business in the US will not make the US more secure or stronger,” Huawei said in a statement. “Instead, this will only serve to limit the US to inferior yet more expensive alternatives.”

Much of Mr Trump’s focus has been on the next generation of wireless technology, known as 5G. But Huawei already provides equipment to about a quarter of the country’s smallest wireless carriers. The Rural Wireless Association, a trade group that represents 55 small carriers, estimated that it would cost its members US$800 million to US$1 billion to replace equipment from Huawei and ZTE, China’s other maker of networking gear.

Nemont, based near Opheim, is one of those companies. Its footprint is 36,260 sq km, bigger than Maryland, and requires huge amounts of wires, towers and other costly infrastructure. But the company has only 11,000 paying customers. Nemont first reached out to Huawei nine years ago, when its members decided to upgrade their cellular network. With subsidies from the federal government, Nemont was prepared to spend about US$4 million on networking equipment such as routers and other gear to put on dozens of cell towers across the region.

Even at the time, officials in the Obama administration voiced concerns about Chinese equipment makers and their ability to break into US networks to steal intellectual property or hack into corporate or government networks. Defense Department officials and lawmakers said that they were concerned that the Chinese government and military could use the equipment to intercept American communications.

The officials were vague about their concerns over Huawei, then a little-known firm. But Mike Kilgore, the chief executive of Nemont, said that he had outlined Nemont’s plans to buy Huawei equipment in a letter to Senator Jon Tester, and asked whether Mr Tester had security concerns. Mr Kilgore said that he was ready to go another route if Huawei’s equipment would put customers at risk. “I was begging for them to say, ‘No, don’t buy it,'” he said.

Mr Tester’s office called him and said that it did not see any major concerns with picking Huawei, Mr Kilgore said. A spokesman for Mr Tester said that an aide had told Mr Kilgore to contact the Federal Bureau of Investigation (FBI) and other intelligence officials for advice. After the call, Mr Kilgore chose Huawei, which offered to customise its equipment and charge 20-30 per cent less than competitors.

Nemont, a wireless provider that serves an area larger than Maryland, scrapped some expansion plans after a recent executive order by President Trump. Photo Credit: Lynn Donaldson for The New York Times

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Nemont has since expanded its high-speed wireless network using almost all Huawei equipment. Mr Kilgore even visited Huawei’s headquarters in Shenzhen, China. He is the president of the Rural Wireless Association, the trade group. Huawei has a representative on the group’s board without voting rights, one of two board members who do not represent a wireless carrier.

“The other vendors hardly gave us the time of day, and now they have been acquired or are out of business,” Mr Kilgore said. “We took a gamble, but we clearly made the right bet.”

The technological upgrade changed lives. Kevin Rasmussen was recently in the cab of his tractor using an iPad connected to high-speed Internet beaming from a nearby cell tower. The connection worked with software on the iPad to help direct where the tractor poked holes in the soil and dropped seeds and fertilizer.

“I can sit up here in my tractor and do my banking, monitor six weather apps and read up on things like trade and Huawei, all on my phone,” Mr Rasmussen said. “Rural America needs this so badly.”

Many companies that extend wireless broadband to rural areas, like Nemont, depend on subsidies from the Federal Communications Commission (FCC). Ajit Pai, the FCC’s chairman, has proposed cutting off that money to carriers using equipment from Huawei or ZTE.

“We believe that it is important that networks are secure not just in urban areas, but in rural areas as well,” the agency said in a statement. “There are currently many rural broadband providers that use equipment that does not pose a national security risk.”

Mr Kilgore estimated that it would cost US$50 million to replace his Huawei equipment. If that is the only option, he said, he might have to shut down the company, leaving his customers without wireless service. Mr Rasmussen said that would be a big blow to his farming operation. “We’re getting squeezed on all sides,” he said. “The tariffs and trade affect our prices, and now this could affect our ability to farm.

Read more at:

https://www.nytimes.com/2019/05/25/technology/huawei-rural-wireless-service.html

Pre-Pub Version of ITU-T G.9701-2019: Fast access to subscriber terminals (G.fast) – Physical layer for copper wire or coax cables

Overview of ITU-T G.9701-2019 (as of May 24, 2019):

Summary:

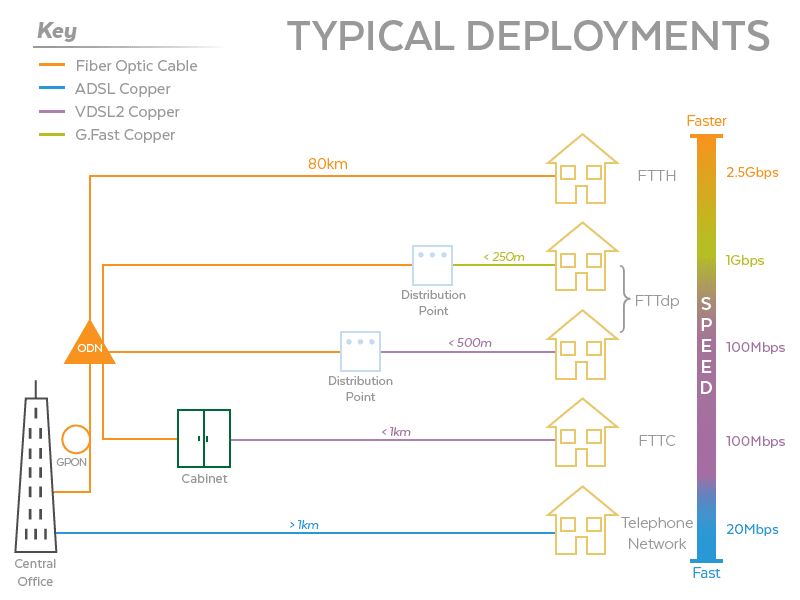

1. Previous version: Recommendation ITU-T G.9701-2014 specifies a gigabit broadband access technology that exploits the existing infrastructure of copper wire-pairs that were originally deployed for plain old telephone service (POTS) services. Equipment implementing this Recommendation can be deployed from fibre-fed distribution points (fibre to the distribution point, FTTdp) located very near the customer premises, or within buildings (fibre to the building, FTTB). This Recommendation supports asymmetric and symmetric transmission at an aggregate net data rate up to 1 Gbit/s on twisted wirepairs using spectrum up to 106 MHz and specifies all necessary functionality to support far-end crosstalk (FEXT) cancellation between multiple wire-pairs, and facilitates low power operation.

2. Recommendation ITU-T G.9701-2019 integrates ITU-T G.9701-2014 and all of its corrigenda and amendments, and adds support for the following new functionality: LPM classes, optional extension of probe sequence length, short CLR/CL messages, Annex R – Showtime reconfiguration, and Appendix IV – Targeted generalized vectoring with active G.9701 supporting lines (TGVA). It also adds several clarifications, and fixes various errors and inconsistencies including ANDEFTR support, SRA triggering and PMS-TC parameter requirements, and conditions for an rtx-uc anomaly.

Scope:

This Recommendation specifies the operation of a broadband access technology that exploits the existing infrastructure of wire-pairs that were originally deployed for plain old telephone service (POTS) and, with Amendment 3, adds support for operation over coaxial cables.

This Recommendation supports transmission at an aggregate net data rate (the sum of upstream and downstream rates) up to approximately 2 Gbit/s.

While asymmetric digital subscriber line transceivers 2 (ADSL2) – extended bandwidth (ADSL2plus) uses approximately 2 MHz of the spectrum, and very high speed digital subscriber line transceivers 2 (VDSL2) uses up to 35 MHz of the spectrum, this Recommendation defines profiles using spectrum up to 106 MHz and 212 MHz and specifies all necessary functionality to support the use of far-end crosstalk (FEXT) cancellation between ITU-T G.9701 transceivers deployed on multiple wire-pairs. The availability of spectrum up to 106 MHz or 212 MHz allows ITU-T G.9701 transceivers to provide reliable high data rate operation on very short loops. This Recommendation can be deployed from fibre-fed distribution points located very near the customer premises, or within the buildings. This Recommendation is optimized to operate over wire-pairs up to approximately 250 m of 0.5 mm diameter. However, it is capable of operation over wire-pairs up to at least 400 meters of 0.5 mm diameter, subject to some performance limitations.

This Recommendation defines a wide range of settings for various parameters (such as spectral usage and transmitter power) that may be supported by a transceiver. Therefore, this Recommendation specifies profiles to allow transceivers to support a subset of the allowed settings and still be compliant with the Recommendation. The specification of multiple profiles allows vendors to limit the implementation complexity and develop implementations that target specific service requirements. This edition of the Recommendation specifies transmission profiles for inband spectral usage of up to 212 MHz and maximum transmit power up to +8 dBm. This Recommendation operates in compliance with the power spectral density (PSD) specification in [ITU-T G.9700].

As per ITU-T Recommendations in the ITU-T G.99x series, this Recommendation uses [ITU-T G.994.1] to initiate the transceiver training sequence. Through negotiation during the handshake phase of the initialization, the capability of equipment to support this Recommendation and/or ITU-T G.99x series Recommendations (e.g., [ITU-T G.993.2] defining VDSL2) is identified. For reasons of interoperability, equipment may support multiple Recommendations such that it is able to adapt to the operating mode supported by the far-end equipment.

It is the intention of this Recommendation to provide, by negotiation during the initialization, U interface compatibility and interoperability between transceivers complying with this Recommendation, including transceivers that support different combinations of options. The technology specified in this Recommendation provides the following key application features:

• Best aspects of fibre to the home (FTTH): up to 2 Gbit/s aggregate net data rate;

• Best aspects of ADSL2: customer self-install and operation in the presence of bridged taps, avoiding operator truck-rolls to the customer premises for installation and activation of the broadband access service;

• Coexistence with ADSL2 and VDSL2 on adjacent wire-pairs;

• Low power operation and all functionality necessary to allow transceivers to be deployed as part of reverse powered (and possibly battery operated) network equipment and to adapt to environmental conditions (e.g., temperature);

• Management capabilities allowing transceivers to operate in a zero touch deployment, avoiding truck-rolls to the network equipment for installation and activation of new or upgraded broadband access service;

• Control of the upstream vs downstream transmission time to adapt net data rates to the needs of the business and the residential customers;

• Vectoring (self-crosstalk cancellation) for increased net data rates on wire-pairs that experience far-end crosstalk from ITU-T G.9701 transceivers in the same vectored group operating on other wire-pairs in the same cable or operating on other wire-pairs originating from the same network equipment;

• Network timing reference (NTR) and time-of-day (ToD) transport for network frequency and time synchronization between network and customer premises equipment;

• Configuration of spectrum use, including configuration of the transmit power spectral density (PSD) limitations and notches to meet electromagnetic compatibility (EMC) requirements.

The technology specified in this Recommendation uses the following key functionalities and capabilities:

• Transparent transport of data packets (e.g., Ethernet packets) at an aggregate (sum of upstream and downstream) data rate of up to 2 Gbit/s;

• In-band spectral usage up to 212 MHz;

• Configurable start and stop frequencies, PSD shaping and notching;

• Discrete multitone (DMT) modulation (2 048/4 096 subcarriers with 51.75 kHz subcarrier

spacing);

• Time-division duplexing (sharing time between upstream and downstream transmission);

• Low latency retransmission, facilitating impulse noise protection (INP) between the V and T reference points at all data rates to deal with isolated erasure events at the U reference point of at least 10 ms, without loss of user data;

• Forward error correction based on Trellis coding and Reed-Solomon coding;

• Vectoring (self-FEXT cancellation), where this edition of the Recommendation uses linear precoding;

• Discontinuous operation where not all of the time available for data transmission is used;

• Online reconfiguration (OLR) for adaptation to changes of the channel and noise characteristics, including fast rate adaptation (FRA).

With these functionalities and capabilities, the technology specified in this Recommendation targets the following aggregate net data rates over a 0.5 mm straight wire-pair for 106 MHz profiles:

• 500 to 1000 Mbit/s on a wire-pair shorter than 100 m;

• 500 Mbit/s at 100 m;

• 200 Mbit/s at 200 m;

• 150 Mbit/s at 250 m;

• 500 Mbit/s at 50 m, while operating in the band above 17 MHz.

References:

The following ITU-T Recommendations and other references contain provisions which, through reference in this text, constitute provisions of this Recommendation. At the time of publication, the editions indicated were valid. All Recommendations and other references are subject to revision; users of this Recommendation are therefore encouraged to investigate the possibility of applying the most recent edition of the Recommendations and other references listed below. A list of the currently valid ITU-T Recommendations is regularly published. The reference to a document within this Recommendation does not give it, as a stand-alone document, the status of a Recommendation.

[ITU-T G.117] Recommendation ITU-T G.117 (2007), Transmission impairments due to speech Processing.

[ITU-T G.994.1] Recommendation ITU-T G.994.1 (2018), Handshake procedures for digital subscriber line transceivers.

[ITU-T G.997.2] Recommendation ITU-T G.997.2 (2019), Physical layer management for ITU-T G.9701 transceivers.

[ITU-T G.9700] Recommendation ITU-T G.9700 (2019), Fast access to subscriber terminals (G.fast) – Power spectral density specification.

[ITU-T O.9] Recommendation ITU-T O.9 (1999), Measuring arrangements to assess the degree of unbalance about earth.

[ITU-T T.35] Recommendation ITU-T T.35 (2000), Procedure for the allocation of ITU-T defined codes for non-standard facilities.

[ISO 8601] ISO 8601:2000, Data elements and interchange formats – Information interchange – Representation of dates and times.

………………………………………………………………………………………………………………………………………………………………………………………………..

The complete document is available to ITU-T members with a TIES account.

Germany’s Contentious 5G Auction May Squeeze Telcos

Germany’s auction of 5G frequencies, now into its 10th week, has drawn 6 billion euros ($6.7 billion) in bids so far. That amount raised in a record 405 auction rounds for the 41 blocks on offer is more than experts thought companies would spend all together for all rounds. The duration of this auction has no precedent in Germany, with country’s 4G auction in 2010 lasting for 224 rounds.

German telco market leader Deutsche Telekom has complained that the regulator has forced up prices by offering too little spectrum. Deutsche Telekom leads in 13 of the blocks, with competitor Vodafone ahead in 12 and Telefonica Deutschland in eight, according to auction results published by the Federal Network Agency (BNetzA).

Source: Deutsche Telekom

……………………………………………………………………………………………………

New entrant 1&1 Drillisch, a ‘virtual’ mobile player controlled by United Internet, leads in eight blocks, as billionaire CEO Ralf Dommermuth pursues his dream of becoming Germany’s fourth operator.

Drillisch, and United Internet, have slashed their dividend payouts to conserve cash so that they can stay in the game.

As the telecom industry prepares for the costly rollout of new 5G networks, with little prospect of any immediate revenue growth from new 5G services, the spectrum bill is a further squeeze. And while bidding has recently slowed, the contest is not yet over.

Industry leaders say that inflated auction costs would undermine their ability to invest the billions needed to build 5G networks – as happened in a pricey spectrum auction in Italy last year.

………………………………………………………………………………………………………….

German telcos appear to be grasping expensively for a small amount of spectrum in the 3.6GHz range, the “mid-band” that looks optimal for the delivery of 5G services. The fight would have been less damaging and drawn-out had German regulators put more of these airwaves up for sale, according to Timotheus Höttges, the head of Deutsche Telekom. Instead, they chose to hold back 100MHz for industrial and local settings, such as German factories, leaving 300MHz to the telcos. Supply constraints have driven up the bids.

Competition has been especially fierce because of 1&1 Drillisch. Having previously bought network capacity from Telefónica, and functioned as a mobile virtual network operator, the broadband company is now determined to build a fourth mobile network using spectrum it picks up in the auction. After round 406, 1&1 Drillisch accounted for more than €1.1 billion ($1.2 billion) of the amount bid. Since the auction began, its share price has lost a quarter of its value as investors worry about the consequences of spending so much.

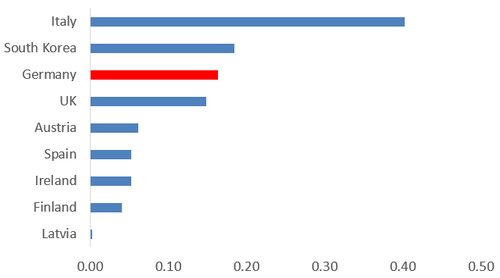

Outside Italy, Germany now values the mid-band at a higher level than any other European country that has licensed 5G spectrum. Were the auction to finish now, German telcos would pay about $0.16 per megahertz per head of population (per MHz pop, a common way of valuing spectrum) for 3.6GHz licenses. That edges Germany ahead of the UK, which raised about $0.15 (at current exchange rates) per MHz pop during a 3.4GHz auction in 2018. Spanish companies last year paid just €0.05 during a 3.6-3.8GHz auction (although this calculation does not consider usage fees they are also charged). Finland’s mid-band sale in October raised as little as $0.04.

However, the German auction is nowhere near Italy on this measure, and it will not even get close. After slapping just 200MHz of mid-band spectrum on the table, and slicing it like a badly cut pizza into uneven segments, Italian regulators made off with around $0.40 per MHz pop. The auction “winners” are now choking on their rewards. Telecom Italia and Vodafone, which landed the biggest mid-band concessions, are busy slashing jobs and pooling assets to ensure 5G rollout is affordable.

German telecom regulator Jochen Homann, the president of the Bundesnetzagentur, is said to have argued that bidders knew the conditions of the auction before it started and will have prepared accordingly. Yet analysts thought a spectrum sale would raise between €3 billion ($3.4 billion) and €5 billion ($5.6 billion), an upper limit the auction has now breached.

Light Reading says German authorities may still have cause to worry. While the country’s operators are in healthier shape than Italy’s, a large spectrum bill risks slowing down the pace of 5G rollout and jeopardizing national ambitions. With its large manufacturing sector, Germany is hopeful that 5G will support Industrie 4.0, a government initiative to bring communications technologies into factories and the workplace. The productivity boost this promises may be critical if Germany is to remain competitive with the US, China and other fast-developing Asian countries.

In the U.S., the FCC auctioned off 24GHz high-band spectrum in March 2019, with the announcement of more spectrum sales expected in the coming months. The U.S. has yet to allocate any mid-band spectrum.

References:

…………………………………………………………………………………………………………….

Related: World leaders in 5G:

VSG: 2018 U.S. Carrier Managed SD-WAN LEADERBOARD

Vertical Systems Group defines a managed SD-WAN service as a carrier-grade network offering for enterprise and business customers, which is managed by a network operator, and delivered over a software-defined network (SDN) service architecture that has separate control (overlay) and data (underlay) planes.

SD-WAN is one of three managed VPN segments that Vertical Systems tracks, along with MPLS and site-to-site VPNs. The top-five carrier managed SD-WAN companies are also leading providers of dedicated IP VPN services, which included landline and satellite connectivity.

VSG Research Highlights:

SD-WAN is one of the three Managed VPN segments that Vertical tracks, along with MPLS and Site-to-Site VPNs. Service migration analysis shows that the majority of Carrier Managed SD-WAN service installations to date are hybrid configurations that include partial conversions of existing Site-to-Site and MPLS networks.

- The top five Carrier Managed SD-WAN companies are also the leading providers of Dedicated IP VPN services, including landline and satellite connectivity.

- A number of SDN-based technologies are utilized to deliver Carrier Managed SD-WAN services. The fourteen LEADERBOARD and Challenge Tier providers use products from the following companies (in alphabetical order): Cisco/Viptela, Silver Peak, Versa, and VMware/VeloCloud, or employ their own internally developed technologies. Several SD-WAN service providers offer multiple solutions.

The 14 leaderboard and challenge tier providers used SD-WAN technologies from Cisco/Viptela, Silver Peak, Versa Networks and VMware/VeloCoud or deploy their own internally developed technologies. Several SD-WAN service providers, such as AT&T, Verizon and CenturyLink, have multiple SD-WAN offerings.

https://www.verticalsystems.com/2019/05/21/2018-sd-wan-us-leaderboard/

New Report: 5G deployments to drive new business opportunities and revenue growth

Mobile service providers anticipate significant new revenue opportunities from the coming deployment of high-speed 5G networks and a host of new IoT-driven use cases.

According to a new survey conducted by the Business Performance Innovation (BPI) Network, in partnership with A10 networks, cellcos also believe much-improved security will be essential to realizing that potential.

The new study report, “Securing the Future of a Smart World,” demonstrates that carriers are moving decisively toward 5G commercialization and that security is a top concern. You can download the free report here. A few highlights:

- 67% will deploy their first commercial 5G networks within 18 months and another 20% within two years

- 94% expect growth in network traffic, connected devices and mission- critical IoT use cases to significantly increase security and reliability concerns for 5G networks

- 79% say 5G is a consideration in current security investments

“Mobile carriers anticipate significant revenue opportunities and exciting new use cases as they move forward with their 5G deployments. However, the industry also recognizes that 5G will dramatically raise the stakes for ensuring the security and reliability of these networks,” said Gunter Reiss, vice president of A10 Networks.

“New mission-critical applications like autonomous vehicles, smart cities, and remote patient monitoring will make network reliability vital to the safety and security of people and businesses. Meanwhile, dramatic increases in traffic rates and connected devices will significantly expand the attack surface and scale for cyber criminals.”

Operators still have a significant amount of work ahead to fortify their networks for the coming of 5G. For example, while more than 80% of mobile operator respondents say they will need to upgrade Gi/SGi firewalls at the core of their networks, only 11% have completed the implementation of new Gi/SGi firewalls.

Realizing the potential of full-scale 5G networks requires major investments by carriers—and payback on that spend is a crucial issue for the telecommunications industry. Operators see significant opportunities to increase revenues and innovate new business models.

The top-three benefits derived from 5G

- 67% – Overall growth in the mobile market

- 59% – Better customer service and satisfaction

- 43% – The creation of new 5G-enabled business models

Top drivers for 5G

- 61% – Smart cities

- 48% – Industrial automation and smart manufacturing

- 39% – High-speed connectivity

- 35% – Connected vehicles

- 37% – Fixed wireless

Assessing 5G security needs

Chief among security concerns are core network security and DDoS protection.

- 63% – Advanced DDoS protection the most important security capability needed for 5G networks.

- 98% of respondents said core network security was either very important (72%) or important (26%) in 5G build-outs.

- 79% have or will upgrade their Gi/SGi firewalls

- 73% have or will upgrade their GTP firewall

“Operators overwhelmingly understand the importance of upgrading security in a more connected and smart world,” continued Reiss.

“Now it’s time to take decisive action. Carriers need to move ahead aggressively with their plans to upgrade legacy DDoS protection and consolidate security services at the core and edge of their networks to address the growing concerns. A10 Networks 5G security solutions including Gi/SGi firewall, GTP firewall and AI-based DDoS protection enable operators to secure and scale their networks now and protect against the massive cyber threat coming with 5G.”

References:

https://www.mysecuritymarketplace.com/product/securing-the-future-of-a-smart-world/

2019 IoT World: Market Research from Ovum & Heavy Reading; LPWAN Market to be >$65 billion by 2025

I. IoT World May 14, 2019 presentation by Alexandra Rehak, Practice Leader IoT, Ovum and Steve Bell, Sr. Analyst, Heavy Reading.

Edited by Alan J Weissberger

Ovum Forecasts:

- IoT devices will grow to 21.5bn by 2023, while revenue will nearly double to $860bn.

- Key trends driving IoT evolution in 2019: enabling technologies, new business models, (industry) verticalization, big data & analytics, new tools, e.g. AI/ML.

- Drivers for IoT deployment still focus on efficiency and customer

experience, but many enterprises are looking for new revenue. Top 4 IoT drivers are to improve: operation efficiency, customer engagement & experience, strategic decision making based on actionable insights, new revenue streams from value added products/services. - The biggest enterprise IoT challenge is data – how to secure it, how

to derive analytics value from it, how to integrate it. Top 3 barriers to enterprise IoT deployment: data security & privacy (has been top concern for last 10+ years), data analytics skills/data scientists, difficult to integrate with existing IT (and likely OT too), complexity of technical implementation (and systems integration).

Enabling Technologies:

1. LPWAN will be a key enabler for cheaper, massive scale IoT

connectivity – and 2019 will be the year it finally takes off (Alan has heard that for several years now! However, NB-IoT and LoRa are growing very quickly in 2019.)

• <$1 per month connectivity

• <$10 modules

• Low bandwidth, long battery life, extended coverage characteristics

• Use cases: smart cities, consumer IoT, asset monitoring, environmental monitoring

• NB-IoT, LTE-M, LoRa, Sigfox are the big four LP WANs

2. 5G enables enhanced IoT digital capabilities:

▪ High bandwidth services – eg UHD video

▪ Critical applications, which require low latency – e.g., autonomous driving, industrial applications (3GPP Release 16 and IMT 2020 approved standard)

▪ High bandwidth, low latency services – e.g., augmented reality

▪ Information intensive routines, which require low latency performance– eg smart advertising, True AI (is what we have today fake AI?)

▪ Services that can – but don’t readily – work over 4G, e.g., mobile video conferencing

3. Edge and the IoT opportunity:

Virtualized services (including gateways and vCPE), FOG nodes, life cycle management, linking silos (systems and data), many different applications, data analytics, AI/ML/DL, threat intelligence, device management services, security credential management.

4. Blockchain is still early-stage as an IoT enabler, but promising use

cases are emerging

- Authentication of devices joining IoT network

- Supply chain management and verification

- Smart grid microcontracts

- Autonomous vehicles

Blockchain will not suit all IoT security and contract requirements. That’s because it’s: Complex, heavy processing load, not yet fully commercialized, private blockchain space is fragmented, need for supporting regulatory/legal frameworks Autonomous vehicles.

………………………………………………………………………………………………………….

Industrial IoT (IIoT):

It’s becoming a core focus for the market – and an important testbed for 5G. Requires ultra reliable and very low latency.

IIoT is moving beyond efficiency gains:

• IIoT will grow in importance in 2019

• Drivers: efficiency and margins, competitive positioning, ‘job lots of one’

• Challenges: IT/OT integration, security, traditional business models

• Applications: simple asset tracking/monitoring to complex propositions (predictive maintenance, digital twin, robotics, autonomy)

• IoT, 5G, and AI form virtuous circle for industrial sector and factory

campuses

• Private LTE as another enabler (Steve Bell of Heavy Reading was very optimistic on this during the Thursday morning, May 17th round table discussion on 5G and LTE for IoT). So is this author!

……………………………………………………………………………………………………..

IoT value chain: evolution from ‘platform providers’ to ‘end-to-end

solution providers,’ simplifying the buying process. An end-to-end solution requires: sensors/devices/hardware, connectivity, platform (connectivity and device control/management), applications, analytics, integration.

Value chain evolution is also driving IoT business model innovation, for both enterprises and providers. For connectivity, this includes: flat rate IoT connectivity pricing (e.g. $5 per year), bundled IoT device connectivity, alternative IoT connectivity providers (e.g. Sigfox, Zigbee mesh, BT mesh, etc), private LTE (licensed frequencies so not contention for bandwidth as with WiFi).

…………………………………………………………………………………………………….

Summary and Recommendations:

- Enabling IoT technologies: 5G, LPWAN, edge, blockchain – developing

quickly – but shouldn’t be seen in isolation. - IoT data usage & security: Focus of customer concern – stronger support,

simpler tools needed to deliver value through analytics, eventually AI. - Vertical strategies: Industries face significant disruption – understand

how IoT will help your customer to transform and address these shifts. - New IoT business models: increasingly sophisticated – end customers

very interested, but need help to understand them, manage risk.

……………………………………………………………………………………………………………

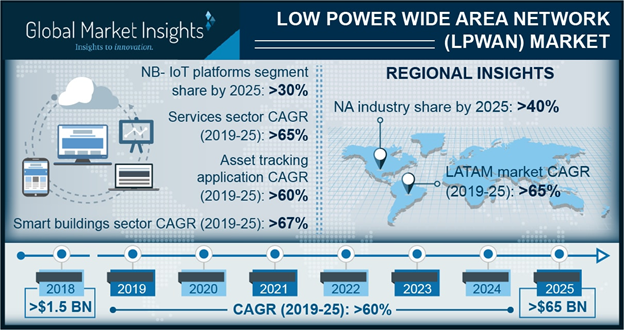

II. LPWAN Market Forecast from Global Market Insights, Inc.

The LPWAN market is set to grow from its current market value of more than $1.5 billion (€1.3 billion) to over $65 billion (€58.2 billion) by 2025, according to a new research report by Global Market Insights, Inc.

Low power wide area network market growth is driven by the growing deployment of LPWA technologies, including LoRa, NB-IoT, and LTE-M, offering a wide range of connectivity options to enterprises. These technologies provide broader network coverage and better battery life to connect various devices. LPWAN networks are becoming very popular among enterprises to support various IoT use cases for verticals including healthcare, manufacturing, agriculture, logistics, and utilities.

For instance, the rising penetration of Industrial IoT (IIoT) in the manufacturing industry has increased the demand for LPWA technologies, particularly NB-IoT and LTE-M, to enable reliable machine-to-machine communication. Industrial IoT connections are expected to increase nearly five times between 2016 and 2025, from 2.4 billion to around 14 billion connections.

By deploying LPWAN connections, manufacturing companies can increase their operational efficiencies to drive high productivity. Another factor fuelling the LPWAN market growth is increasing investments by companies in LPWAN technologies. For instance, in June 2017, Cisco contributed to a US$ 75 million Series D funding round for Actility, a LPWAN startup. Cisco’s investments in Actility enabled it to accelerate the development of IoT solutions.

The LPWAN platforms held a major market share of over 70% in 2018 owing to the deployment of various platforms, including NB-IoT, LoRaWAN, Sigfox, and LTE-M. Massive IoT deployments in various industry verticals, including utilities, manufacturing, transportation, and healthcare, has increased the demand for LPWAN platforms to support connected devices requiring low power consumption, long range, and low costs. Among all the platforms, LoRaWAN platforms held the highest market share of over 50% in 2018 as they use unlicensed spectrum and are best suited for applications that generate low traffic and require low-cost sensors.

In the services segment, the managed services segment is expected to hold low power wide area network market share of around over 30% in 2025. Managed services enable organisations to accelerate the deployment of LPWAN and reduce the time & expenses spent on training the IT staff. The on-premise deployment model is expected to grow at a CAGR of over 50% over the projected timeline. The demand for this deployment model will increase as it enables organisations to build & manage their own LPWAN for IoT-based applications.

References:

Ovum’s latest video on IoT with Alexandra Rehak: https://ovum.informa.com/products-and-services/research-services/internet-of-things

https://www.gminsights.com/industry-analysis/low-power-wide-area-network-lpwan-market

Verizon Shows Benefits of “5G” for First Responders; 5G Fast Facts

Verizon gave first responders a look at 5G networks in action this week. Firefighters and police saw demonstrations of technology at a Verizon, New York city event. “You’re able to speed up,” Former New York Police Commissioner Bill Bratton said in a speech to first responders on Monday.

Augmented reality could give firefighters greater visibility and smart lighting on streets could help police more quickly track gunshots, among other potential advances.

5G Fast Facts:

- Verizon has launched its mobile 5G network in parts of Chicago and Minneapolis, and you can see the first Verizon 5G speed test results. The first compatible phone is the Moto Z3, which isn’t 5G-capable out of the box but can be retrofitted with 5G connectivity with a 5G Moto Mod you can order now.

- Samsung just released the $1,299 Galaxy S10 5Gflagship on Verizon’s 5G network. The device sports a 6.7-inch display and six camera lenses, including two with depth-sensing time-of-flight sensors for improved augmented reality experiences. We tested the S10 5G on Verizon in Chicago to take advantage of 5G speeds, and while the phone occasionally cleared 1 Gbps, our average downloads were 700 Mbps. However, the phone is markedly faster than an LTE Galaxy S10.

- LG is releasing a 5G phone of its own, the LG V50 ThinQ 5G, and it will debut on Sprint’s network for $1,152 on May 31. Sprint is currently taking preorders, but has not yet announced when its network will go live. Sprint is also selling a $600 5G hub from HTC, which will give LTE devices in your home 5G speeds when in Wi-Fi range of the hub.

- Sprint has announced a May launch for its 5G network in a handful of cities. AT&T is taking heat took heat for its 5G Evolution logo, which looks a lot like 5G, with speeds closer to 4G. T-Mobile is eyeing the second half of the year for its 5G push.

- Apple will reportedly wait until 2020 to release a 5G smartphone. The company participates in ITU-R WP 5D which is standardizing IMT 2020 Radio Interface Technologies (RITs).

- Qualcomm has said that 20 operators around the world will roll out 5G in 2019, including all major US carriers. Twenty device makers have committed to using Qualcomm’s 5G components in their devices.