Month: July 2021

AT&T to be the primary network services provider for DISH MVNO customers

The ten-year agreement, which CNBC said was worth at least $5 billion, will serve as a back-up while the company rolls out its own mobile network. Dish has relied to date mainly on the T-Mobile network, as part of the deal signed last year to acquire Boost Mobile and other assets from T-Mobile following its merger with Sprint.

AT&T will also provide transport and roaming services, to support Dish’s 5G network roll-out. Dish said it is committed to becoming the fourth facilities-based carrier in the U.S. and is aiming to bring its cloud-native, OpenRAN-based 5G network to 70% of the population by 2023.

“With an MVNO deal past 2027, Dish can focus on denser markets and leave rural to AT&T,” said MoffettNathanson principal analyst Craig Moffett. “Dish desperately needs an MVNO to fall back on past 2027, because the economics of building to rural are awful, and a network that doesn’t have rural isn’t tenable.”

Tammy Parker, Senior Analyst at GlobalData, a leading data and analytics company, offered her opinion:

This deal is highly beneficial to AT&T as the company not only gains at least $5bn in revenue streams over the term of this ten-year agreement from new MVNO subscribers, it will also have access to DISH’s spectrum holdings to support DISH customers on the AT&T network. The NSA is not exclusive for either party, so both can go out and find new dance partners; however, given the depth and breadth of this agreement, that would appear both unlikely and unnecessary.

Both companies are poised to ride the US wireless industry’s ongoing growth wave. This is increasingly driven by the rollout of 5G, which enables faster network speeds, lower latency and new use cases, including Internet of Things services, that will result in many users having multiple wireless subscriptions. According to GlobalData’s latest forecasts, the number of unique mobile users in the US will increase by 5% over the next five years. Furthermore, total mobile subscriptions in the US will expand by more than 30% during that time and there will be nearly 692.6 million US mobile subscriptions by year-end 2026.

A fascinating part of this new arrangement is that it provides a glimpse into AT&T’s concerns regarding the possibility that DISH could sell out to another entity, perhaps even Amazon or Google. Rumors have abounded, even before DISH agreed to build its 5G network on Amazon Web Services’ (AWS) cloud platform, about possible negotiations between Amazon and DISH regarding the former’s potential use of DISH’s forthcoming 5G network to offer new services. Though there is nothing new to report there, this NSA stipulates that AT&T will be allowed to terminate the NSA in the event of a qualifying change of control of DISH. This could include a rival wireless provider, US cable company or ‘certain large technology companies’ taking over 50% more of the voting power or economic value of DISH. AT&T would still have to support DISH’s MVNO customers for up to two years after such a termination. “T-Mobile, and its Sprint network, is currently the primary MVNO partner for Boost and Republic. Ting operates on every nationwide network except AT&T. However, although DISH’s involvement saved T-Mobile’s acquisition of Sprint, the relationship between DISH and T-Mobile appears to have been fraught from the start. T-Mobile’s plans to shutter its 3G network by January 2022, leaving many of DISH’s customers without network service, has created an especially contentious standoff between the two companies, which likely helped pave the way for DISH’s new agreement with AT&T.”

Dish has 8.89 million retail wireless subscribers as of its last quarterly earnings report, while AT&T has more than 186 million mobile subscribers.

CNBC said that the pact is a potential precursor to a DirecTV-Dish merger since it brings AT&T and Dish closer together. Jonathan Chaplin, an analyst at New Street Research, said in a note to clients that one of the biggest obstacles to a merger has been the notion that “AT&T hates Dish.” Some of those bad feelings stem from the botched 2007 merger, when AT&T felt Ergen had reached a handshake deal and negotiated in bad faith, according to people familiar with the deal who asked not to be named because the discussions were private.

But the telecommunications world has dramatically shifted from 2007. AT&T is no longer run by Randall Stephenson, who stepped down as CEO last year. The wireless giant is reorganizing itself around 5G and fiber networks. AT&T could use the $5 billion Dish will give it over the next 10 years to pay down debt from its two enormous acquisitions of WarnerMedia and DirecTV.

While AT&T’s MVNO pact allows Dish to be a stronger competitor to AT&T, “getting access to Dish’s spectrum could help improve AT&T’s competitive position,” noted Chaplin, and facilitating a merger between DirecTV and Dish will help both companies.

Bringing together two competing satellite-TV providers — especially as both companies lose pay-TV customers each quarter as the world shifts to digital streaming television — would unlock billions in synergies, as satellites can be retired, duplicative jobs eliminated and competitive costs eradicated.

Still, regulators would need to feel comfortable that a Dish-DirecTV would be beneficial for consumers. While that remains uncertain, “it is a hurdle, not a barrier,” wrote Chaplin.

………………………………………………………………………………………………..

References:

Optimistic 5G Market forecasts by GlobalData and Research&Markets

- Global 5G service revenues will total $609 billion (€517bn).

- 5G is forecast to generate monthly ARPU of $14.15 in 2026, more than double 4G’s monthly ARPU of $5.48.

- 5G is expected to bring down the per-bit cost for carriers. The basic cost efficiencies that 5G brings will enable operators and developers alike to create new applications for the technology as it becomes to mature and develop.

“Although we have not yet seen all that 5G is capable of in early deployments, the technology has a multitude of future opportunities for telecom operators,” said Lynnette Luna, Principal Analyst with GlobalData. “Not only will capacity bring down the per-bit cost for carriers, the basic cost efficiencies that 5G brings will enable operators and developers alike to create new applications for the technology as it becomes to mature and develop.

[We believe that those 5G telco opportunities will ONLY be realized via deployment of a 5G SA Core network.]

“This growing innovation will contribute to an expected rise in 5G mobile subscriptions worldwide. At the end of 2026, GlobalData predicts there will be 3.9 billion such subscriptions, representing 35.1% of total subscriptions.”

Some revenue-generating strategies seen in the US and Europe on 4G networks also resonate on 5G networks. Within the US postpaid wireless market in particular, operators have always enticed users to sign up for premium plans through service bundles, such as video streaming and gaming.

In some markets, we are beginning to see more advanced bundles marketed with 5G, said GlobalData. Vodafone is in the process of rolling out Nreal smart glasses in its 5G markets across Europe, offering an interest-free hardware bundle and an app called Vodafone 5G Reality AR.

“Operators will continually improve their bundles with new 5G features. Eventually they will take advantage of ultra-low latency and consistent gigabit data speeds,” Luna concludes.

…………………………………………………………………………………………………………………………………………………………..

Separately, Research & Markets new report, 5G In Defense Global Market Report 2021: COVID-19 Growth and Change forecasts that the global 5G in defense market is expected to grow from $39.62 million in 2020 to $71.24 million in 2021 at a compound annual growth rate (CAGR) of 79.82%.Major players in the 5G in defense market are Ericsson, Huawei, Nokia Networks, Samsung, NEC, Thales Group, L3Harris Technologies Inc., Raytheon Technologies, Ligado Networks, Wind River Systems Inc., AT&T, and Qualcomm Technologies Inc.

The 5G-Defense Market growth is mainly due to the high speed, low latency (?) offered by 5G and growing adoption of autonomous and connected defense devices. The market is expected to reach $646.61 million in 2025 at a CAGR of 73.57%.

The 5G in defense market consists of sales of 5G technology and services by entities (organizations, sole traders, and partnerships) that are engaged in providing 5G technology and services for military and homeland security uses. 5G for defense is expected to improve reconnaissance, intelligence, and surveillance systems and processing, streamline logistics systems for increased efficiency and enable new methods of control and command. 5G in defense is used to transfer video, text, image, and voice data with faster bandwidth of 300 GHz to create data on demand for the battlefield.

The main types of communication infrastructure for 5G in defense are small cell, macro cell, radio access network (RAN). Small cell infrastructure uses wireless receivers and transmitters to provide network coverage to smaller areas. Macro cell provides radio coverage for cellular networks through large towers and antennas across a wider area. Radio Access Network (RAN) connects individual devices to other parts of a network through radio connections.

The various network technology in 5G in defense include software-defined networking (SDN), fog computing (FC), mobile edge computing (MEC), network functions virtualization (NFV). The different types of network used comprises enhanced mobile broadband (eMBB), ultra-reliable low-latency communications (URLLC), and massive machine type communications (MMTC). 5G in defense are used in areas such as military and homeland security.

North America was the largest region in the 5G in defense market in 2020. Asia Pacific region is predicted to record fastest growth over the forecast period. The regions covered in this report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

The countries covered in the 5g in defense market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, and USA.

References:

We haven’t even begun to see 5G’s capabilities, says GlobalData – GlobalData

https://www.telecomlead.com/5g/5g-to-bring-in-arpu-of-14-15-per-month-versus-5-48-for-4g-100889

Markets and Markets: Managed Services Market revenues at $354.8 billion by 2026

According to a new report by Markets and Markets, the global Managed Services market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.9% annually, to reach $354.8 billion by 2026 from $242.9 billion in 2021. Enterprises across the globe and verticals are highly investing in their IT infrastructure to maintain their competitive position and attain operational excellence.

The report is titled, “Managed Services Market with COVID-19 Impact Analysis, by Service Type (Managed Security, Managed Network, and Managed Data Center and IT Infrastructure), Vertical, Organization Size, Deployment Type, and Region – Global Forecast to 2026.”

As enterprises are adopting highly complex technologies regardless of their size, they turn to MSPs to manage their IT infrastructure, thus delivering services faster and more efficiently. These technologies are forcing enterprises to redefine their business strategies and emphasize information security. Managed services help enterprises maintain and manage the IT infrastructure and address risks associated with IT assets in an efficient and cost-effective way. This helps enterprises focus on their core competency without increasing the IT footprint.

Managed service vendors around the globe have increased their offerings in the managed services segment. The emergence of new technologies such as blockchain, AI, ML, and data analytics is helping MSPs to enhance their offerings and empower organizations. Enterprises require experts to guide them with their complex IT infrastructure. MSPs around the globe are helping organizations with different managed services such as managed security and managed networks. The objective of these managed services is to enhance and bolster different business verticals so that productivity can be improved, and organizations can focus on their core businesses.

Lack of IT skilled professionals, cost reduction and IT budget constraints, need for cloud-based managed services, high security monitoring to avoid high data loss and downtime cost, and enhanced business productivity are the major factors expected to drive the growth of the Managed Services Market. The lack of sales and marketing staff, training, and cybersecurity could create challenges in front of MSPs during the forecast period. The major factor that may restrain the growth of the Managed Services Market is increasing pressure from statutory regulations across the globe. However, high cloud adoption, the need for automation, and a continuous increase in the demand from SMEs are creating opportunities for MSPs.

Organizations existing IT staff may not be adequately capable of keeping up with new technological trends. Hiring skilled professionals for SMEs and small businesses in their growing stage might not be a good idea as it will misbalance the budget for organizations. A lack of skilled IT security services has made organizations vulnerable to cyber-attacks hindering their brand equity. Managed services can help in bridging the gap by providing their expertise to organizations so that they can focus on their core businesses. Lack of IT skilled professionals can boost Managed Services Market, as it can support growing enterprises that cannot afford to hire additional permanent staff for their IT systems. These technologies are complex in nature, thus required IT experts to deliver maximum output. However, enterprises are finding it difficult to find such talents and thus are reaching out to MSPs.

According to a survey, 60% of enterprises reported that the IT challenges are becoming more acute, and IT is getting harder to manage, while ~90% of the IT enterprises report that their cloud skills gaps have nearly doubled in the past three years (2016–2019), in one or more cloud disciplines, compared with just 50% in 2016. Nearly 70% of the enterprises are reaching out to MSPs to fill cloud IT skill gaps.

Organizations always look for third parties with experts who can provide them managed services in cost-effective and reduced risks. Managed services help to control and reduce various costs and risks. MSP can provide cost-effective and risk-aversion solutions to organizations where they mitigate risk for organizations with their team of experts. Also, with the dynamic nature of work, various risks have been identified and addressed. This can boost Managed Services Market. Low IT budgets and the adoption of the Operation Expenditure (OPEX) model put tremendous pressure on enterprises. IT downtime affects enterprises’ revenue severely. Managed services reduce Total Cost of Ownership (TCO), increase IT uptime, and cut additional staffing costs. Hence, to tackle the above challenges and inherent benefits, enterprises are leveraging managed IT services.

According to a study, unplanned downtime costs enterprises USD 58,000 for every 100 users. Owing to a server and network downtime, the average employee loses 12.4 hours and 6.2 hours per year, respectively. However, by implementing managed IT infrastructure services, it is possible to reduce server and network downtime by more than 85%. By bypassing the need for additional staffing costs, enterprises have experienced a 42% savings in IT budget, according to a study.

North America is one of the most technologically advanced regions in the world. It holds the highest share in the global Managed Services Market. It consists of countries such as the US and Canada. These countries are the early adopters of managed services in the region as North American countries have sustainable and well-established economies, which empower them to invest in R&D activities, thereby contributing to the development of new technologies strongly. The leading managed service vendors in the region include IBM, Cisco, Cognizant, Rackspace, and DXC Technologies. These vendors are investing heavily toward the adoption of managed services by various organic and inorganic strategies. Managed services played a crucial role in the North American channel. Value-added resellers (VAR) are transforming their business by adopting remotely delivered services to their portfolios. These services drive the growth and profitability of channel partners. Network security, cloud-based application, and endpoint security are the majorly used managed services in the region. As the report of Barracuda MSP prepared by 2112 Group “, 21% to 30% of revenue is generated from managed services by channel partners.”

Cloud technology is being used to build new platforms both for customer engagements and for digital transformation. Nearly 70% of enterprises are working in a multi-cloud environment. However, applying a multi-cloud environment to enhance customer engagement is a challenge for most enterprises due to the lack of skill and infrastructure. This has opened an opportunity for MSPs with DevOps experience and those who can offer consumption-based pricing models. Also, during the COVID-19 pandemic, the cloud is gaining more and more traction. This shift from on-premise mode to the cloud is proving to be a boon for managed service providers as it opens an array of opportunities in verticals such as managed security, managed network, managed data center, and IT infrastructure, managed mobility, managed information, and managed communication and collaboration services.

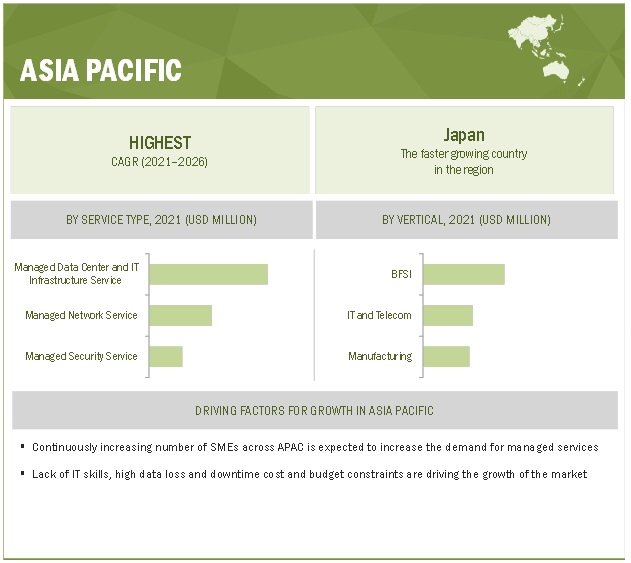

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

APAC is one of the fastest-growing regions in terms of the adoption of managed services. Enterprises across APAC are demanding more managed services as compared to other regions to tackle to address the growing range of technology and business challenges. The highly competitive market conditions and the need for improved productivity have forced APAC enterprises to adopt advanced technologies cloud, AI, ML, and IoT. This has fueled the growth of the managed services market further. Australia, India, Japan, New Zealand, and China are the major contributors to the managed services market in the region. However, MSP business models and technology are now mature in the US, Australia, and across Europe; thus, there is a huge potential in APAC.

Additionally, the lack of IT skills, high data loss, and downtime cost and budget constraints drive the growth of the market in the region. Managed security services are the most demanded service across the region by enterprises due to a large number of cyberattacks and less developed infrastructures to discover breaches. According to a study, Asian enterprises take 1.7 times longer than the global median to discover a breach. Large enterprises in APAC could incur an economic loss of USD 30 million due to a cyberattack or data breach. Retails and consumer goods, healthcare, manufacturing, and telecom and IT are the top verticals contributing to the managed services market in the region.

The Managed Services Market report includes major vendors, such as IBM (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), Cisco (US), DXC (US), TCS (India), Rackspace (US), AT&T (US), Verizon (US), Dimension Data (South Africa), Infosys (India), HCL (India), Ericssion (Sweden), GTT Communications (US), NTT Data (Japan), Happiest Minds (India), Huawei (China), Nokia Networks (Finland), CenturyLink (US), Wipro (India), Cognizant (US),Capgemini (France), BT (UK), Deloitte (UK), Secureworks (US), Alert Logic(US), BAE Systems (UK), Trustwave (US), Hughes (US), MeTtel (US), Microland (India), Optanix (US), Essintial (US), Intact Tech (US), 1-Net (Singapore), Ascend technologies (US), SecureKloud (India), Aunalytics (US), AC3 (Australia), Cloud Specialists (Australia), Corsica Technologies (US), and Empist (US).

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1141

North America is one of the most technologically advanced regions in the world. It holds the highest share in the global Managed Services Market. It consists of countries such as the U.S. and Canada. These countries are the early adopters of managed services in the region as North American countries have sustainable and well-established economies, which empower them to invest in R&D activities, thereby contributing to the development of new technologies strongly. The leading managed service vendors in the region include IBM, Cisco, Cognizant, Rackspace, and DXC Technologies. These vendors are investing heavily toward the adoption of managed services by various organic and inorganic strategies. Managed services played a crucial role in the North American channel. Value-added resellers (VAR) are transforming their business by adopting remotely delivered services to their portfolios. These services drive the growth and profitability of channel partners. Network security, cloud-based application, and endpoint security are the majorly used managed services in the region. As the report of Barracuda MSP prepared by 2112 Group “, 21% to 30% of revenue is generated from managed services by channel partners.”

The Managed Services Market report includes major vendors, such as IBM (US), Fujitsu (Japan), Accenture (Ireland), Atos (France), Cisco (US), DXC (US), TCS (India), Rackspace (US), AT&T (US), Verizon (US), Dimension Data (South Africa), Infosys (India), HCL (India), Ericsson (Sweden), GTT Communications (US), NTT Data (Japan), Happiest Minds (India), Huawei (China), Nokia Networks (Finland), CenturyLink (US), Wipro (India), Cognizant (US),Capgemini (France), BT (UK), Deloitte (UK), Secureworks (US), Alert Logic(US), BAE Systems (UK), Trustwave (US), Hughes (US), MeTtel (US), Microland (India), Optanix (US), Essintial (US), Intact Tech (US), 1-Net (Singapore), Ascend technologies (US), SecureKloud (India), Aunalytics (US), AC3 (Australia), Cloud Specialists (Australia), Corsica Technologies (US), and Empist (US).

References:

https://www.marketsandmarkets.com/Market-Reports/telecom-managed-services-market-117103536.html

AFNR RF exposure study shows small increase in radiation in France

France’s spectrum agency ANFR [1.] has released a study (in French) of radio frequency (RF) exposure measurements collected in the immediate vicinity of 1,000 town halls across France during 2020. ANFR was requested by the Ministry of Ecological Transition (MTE) to renew the project to measure public exposure to electromagnetic waves over more than 1,000 town hall places. This campaign ran from March to December 2020 using the national monitoring of public exposure.

Note 1. AFNR:

AFNR, France’s National frequency agency, is a public administrative establishment that was created by the French 26 July 1996 telecommunications regulation Act giving it the mission of managing the French radio spectrum

The establishment was born through the merger of two main missions:

1. Inter-ministerial spectrum management, at the time within the remit of the Telecommunications Coordination committee and the Post and Telecommunications senior management;

2. The management and control of independent radio networks previously within the remit of the French National Radiocommunications Department

………………………………………………………………………………………………………………………………………………….

All the results are available at www.cartoradio.fr. This project of measurements follows on from the previous ones which were held in 2014 and 2017 in the same town hall squares. The cities were chosen during the first study for their representativeness of the French population. The objective of those studies was to provide an indicator of average radiation exposure at national level. The objective of this study is to present the exposure levels obtained in 2020 and to analyze their evolution since 2014.

The results of the current campaign are directly comparable with those collected in the same 1,000 locations in 2014 and in 2017, in order to analyze the evolution of radiation over time. The latest report shows a small increase in the average RF measurement compared to the previous campaign (0.54 V/m from 0.46 V/m in 2017). This follows the slight uplift reported between 2014 and 2017 (from 0.38 V/m to 0.46 V/m).

Commenting on mobile-related radiation, the agency said that exposure linked to LTE had increased marginally, while exposure linked to 2G/3G had remained broadly stable. The study was carried out before the launch of 5G in France.

The study was released alongside two other publications, summarizing the results from other measurements carried out by ANFR teams in France. Overall, these teams collected 4,700 data points in 2020 as part of their ongoing monitoring work on radiation exposure.

Earlier this month, the agency released the findings from a recent project focused on the 26 GHz millimeter-wave (mmWave) band, collecting measurements during the 5G pilot carried out by Orange and railway company SNCF at the train station in the city of Rennes. The study found that the exposure values were significantly lower than the regulatory limit of 61 V/m set for the 26 GHz band. They ranged from 0.4 V/m to 3.2 V/m depending on the conditions of the tests, which included both realistic and extreme scenarios.

The agency has also recently published the results of nearly 300 measurements collected near Linky smart meters last year, detecting values well below the regulatory limit.

References:

https://www.anfr.fr/fileadmin/mediatheque/documents/expace/20210716-campagne-mairies-2020.pdf

https://www.anfr.fr/fileadmin/mediatheque/documents/expace/study-exposure-paris14-english.pdf

https://www.anfr.fr/en/anfr/about-us/

Are there any new services/apps leveraging 5G network capabilities?

At the Asia Tech X conference this week in Singapore, telco executives and analysts shared some lessons in building 5G networks. In a panel discussion session titled, “New Services Leveraging on the Capabilities of 5G Networks,” the consensus was that 5G doesn’t offer much value for traditional operators. At least not until 5G SA core network is widely deployed and available.

Note that 95% or more of deployed 5G networks use Non Stand Alone (NSA) mode, which requires a 4G LTE/EPC anchor for everything except the RAN (which uses 5G NR).

This panel session was supposed to address the following:

- How can telco operators further monetize 5G networks?

- Emerging technologies to differentiate from competitors

- Maximizing opportunities with new IoT consumer products to generate revenue

Once you register (free), you can watch a replay of the session here.

Olivier Rival, a Boston Consulting Group partner based in Singapore, said a breakdown of the 5G value chain did not make for happy reading for telcos. “Connectivity is about 12% to 18% of the total value of 5G – not much more than that,” Rival said.

Julian Gorman, head of GSMA Asia-Pacific, said APAC is the leading region for 5G. He said that 4G revenue would peak in 2023 at which time 5G would take over. With respect to consumer services, video streaming, high speed Internet access at large sports arenas are the most popular to date. However, 5G users are looking for lower cost service and find that early coverage is spotty. Gorman told the audience that the industry needs to do a lot of work in managing 5G expectations:

“For three years we’ve been saying [5G will deliver] 1ms latency, 10Gbit/s peak data rate, ‘enterprise is going to change overnight.’ Those peak technology speeds are not what we should be talking about. We should be talking about how you’re going to change lives and what people are going to use it for. We can play a big part in that value chain and step above connectivity. But we need to act with a better story as an industry.”

Manjot Singh Mann, CEO of Singapore’s M1, said his company is transitioning from 5G NSA (launched in September 2020) to SA, but didn’t say when that might happen. He said that 5G NSA is really 4G+ only providing eMBB service at a faster speed than 4G-LTE. On the other hand, 5G SA is a “game changer.” It provides a rich set of capabilities like lower latency, faster speeds, network slicing, B2B services, B2B2C, etc. There needs to be one driving factor that makes 5G technology relevant but that hasn’t been identified yet. Singapore government and regulator is looking at 5G in terms of its smart nation objective. That puts telcos in that country in a good position to realize the 5G vision.

“As long as telcos keep talk about 5G in terms of speeds as a differentiator, there’s no value in it. You have to find a value addition (for 5G) to succeed. Where will that value add come from? You’re always putting more and more into CAPEX on diminishing (revenue) from xG’s deployed. If we don’t create value from 5G we’ll always be asking this question. The value in Singapore will come from B2B and B2B2C applications which M1 is now monetizing to create value.”

M1 has undergone a digital transformation over the past 18 months. It has changed its IT stack and restructured itself to become a digital service platform. It was now “92% in the cloud” with a fully cloud-native BSS/OSS, he said.

“That allows you to have quick integration with partners that you bring onto your ecosystem so you can provide services to your consumers that are contextualized and real-time. I think that is where our future lies because we have been able to create this digital platform. We are now onboarding our partners so we are able to deliver those services to our customers.”

Changing people and processes has been another challenge. M1 has been trying to build a more innovative, risk-taking culture. “It takes a lot to get that culture going,” he added.

Indosat Ooredoo (Indonesian) COO Vikram Sinha said his company was trying new ways of working, setting up teams that break the functional silos and embrace risk and reward. No one function can solve all these problems, Sinha said. “As leadership team, we need to tell our teams it’s OK to fail, but fail fast and move on. I’m happy to say we have seen some change,” he added. Augmented reality, via a Snapchat partnership is being pursued for B2B applications. “5G is a journey. For telcos is about getting the ecosystem right, with partners and developers.”

Ian Watson CEO of Cellcard (a Cambodian network operator) said his company is working with GSMA to deploy 5G. Currently, Cellcard has more than 3100 4G-LTE cell sites deployed. Content creation, AR and VR for consumers are targeted 5G use cases for Cellcard. B2B market will be a longer investment for Cellcard, which is not a business hub like Singapore that has many businesses.

…………………………………………………………………………………………………………………………………………………………..

A fireside chat session titled, “Real Life 5G Applications in Asia,” was to address these points:

- Consumer 5G Applications taking place in Asia

- Delving into consumer pick up rates and expectations in Asia

- Enticing consumers through new devices and services at attractive price points

The participants were Aps Chikhalikar, Head of TMT, Asia Pacific Japan for Service Now; and Nicole McCormick Senior Principal Analyst Omdia.

Once you register (free), you can watch a replay of that session here.

Separately, Singapore plans to invest $50 million in a program to support research on AI and cybersecurity for future communications structures, Deputy Prime Minister Heng Swee Keat announced this week. As part of the Future Communications Research & Development Program, Singapore plans to set up new communications testbeds in 5G and beyond-5G, support technology development, and build up a local talent pool.

References:

https://virtual-event.asiatechxsg.com/event/asia-tech-x-singapore/planning/UGxhbm5pbmdfNTE1NTU5

https://virtual-event.asiatechxsg.com/event/asia-tech-x-singapore/planning/UGxhbm5pbmdfNTE1NTYw

https://www.lightreading.com/asia/5g-offers-little-value-for-traditional-telco/d/d-id/770886?

https://www.itnews.asia/news/the-asia-pacific-5g-revolution-is-real-and-happening-now-567044

AT&T’s network expansion is giving its customers “the full 5G experience” (?)

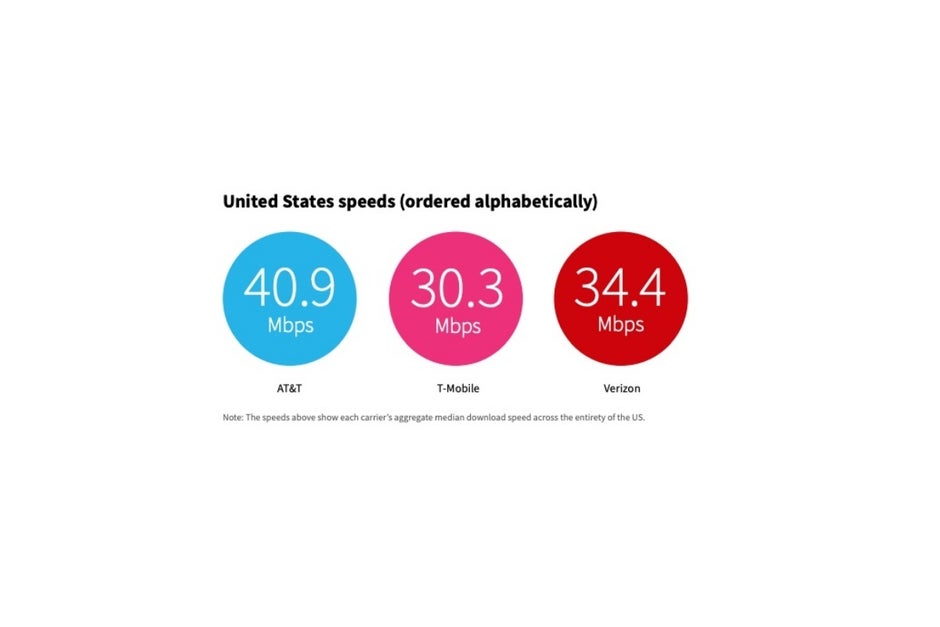

AT&T reports reaching at least 250 million people with low-band 5G, beating its milestone for its 5G network by six months. The carrier is also extending its 5G millimeter-wave infrastructure to 20 venues and areas in 38 cities. AT&T aims to deploy mmWave in 40 instances of each category this year, and has formed partnerships with companies such as Boingo Wireless to further 5G efforts in airports and other large indoor locations.

Source: AT&T

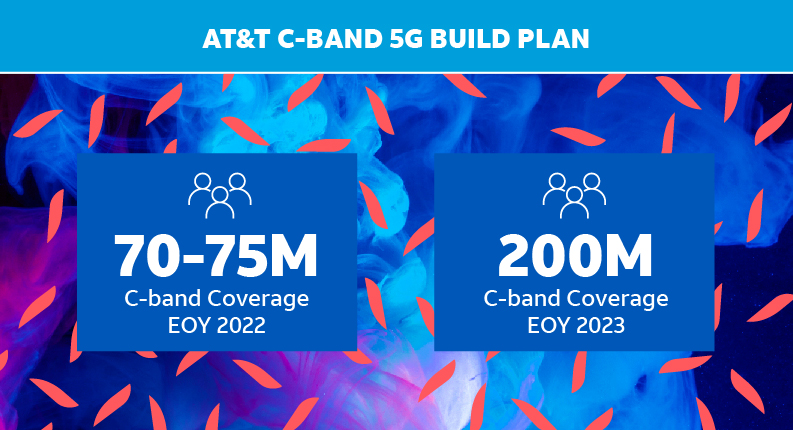

AT&T says it hopes its newly acquired 5G C-band spectrum (AT&T acquired 80 MHz of it during the most recent FCC auction) will cover 70 to 75 million Americans by the end of 2022, with the goal of increasing that number to 200 million by the end of 2023. Currently, AT&T says its standard 5G (aka sub-6GHz 5G) network covers more than 250 million people in the U.S., while its faster 5G+ network (aka mmWave 5G) is available in parts of 38 cities along with 20 stadiums and venues across the country. AT&T’s new mid-band spectrum will be faster than its low-band 5G, but slower than its lightning fast (but hard to find) 5G+.

AT&T says it’s completing the first successful C-band field test call. The carrier hopes to quickly deploy C-band spectrum when the first 40 MHz is made available to them later this year.

Source: AT&T

“Sports fans love watching the game, as well as the experiences surrounding it. AT&T 5G+ is advancing the fan experience by enabling enhancements that help make the games and their favorite players come alive. And when it comes to entertainment, our 5G network will allow viewers to be immersed like never before. Just like the thrill of a last second victory, bringing to life experiences that matter to our customers is an incredible feeling – that’s the power of advanced networks enabling advanced fandom.”

– Mo Katibeh, SVP, AT&T Network Infrastructure and Build

Some of AT&T’s most collaborative and innovative partners include the Chicago Bulls, the Dallas Cowboys, Miami HEAT and the NBA and the WNBA where we serve as the Official 5G Innovation Partner.

“It’s crucial for us to align with partners who share similar core values. We couldn’t be more in-sync as we are with AT&T. We can’t wait to give HEAT Nation a premiere fan experience through AT&T’s network and technology.”

– Eric Woolworth, President of Business Operations, The HEAT Group

AT&T says it’s giving its customers the full 5G experience now “through our continued network build, dynamic partnerships, drive to innovate and combination of spectrum. We’re providing the coverage, reliability, security and speeds that our customers deserve along with the ability to deliver the experiences and enable the innovation that’s important to them. AT&T’s 5G network is already giving our customers the full experience. And we’re just getting started.”

Rebuttal:

The true 5G experience can only be realized via 5G services, features and functions which are ONLY available with a 5G SA core network. AT&T, along with almost every other 5G network operator, has deployed 5G NSA which utilizes 4G LTE for everything other than the RAN (3GPP’s 5G NR). In particular, every 5G NSA deployment uses the 4G Evolved Packet Core (EPC) which can only deliver 4G services, features and functions.

References:

https://about.att.com/story/2021/full_5g_experience.html

Bell Canada Partners selects Google Cloud to Deliver Next-Generation Network Experiences

Another major national telco has forged a significant relationship with a public cloud service provider to tap into the latter’s functionality and distributed cloud platform. Today, it’s Bell Canada and Google Cloud.

Bell Canad, Canada’s largest telecommunications company, and Google Cloud today announced a strategic partnership to power Bell’s company-wide digital transformation, enhance its network and IT infrastructure, and enable a more sustainable future. This new, multi-year partnership will combine Bell’s 5G network leadership with Google’s expertise in multi-cloud, data analytics, and artificial intelligence (AI), to deliver next-generation experiences for Bell customers across Canada.

As a strategic technology partner, Google Cloud will enable Bell to drive operational efficiencies, increase network automation, and deliver richer customer experiences through the following initiatives:

- Shifting critical workloads to the cloud: By moving and modernizing IT infrastructure, network functions, and critical applications from on-premise to Google Cloud, Bell will be able to drive greater operational efficiencies and enable better application performance.

- Unlocking multicloud, next-generation network technology: With the combined power of Bell’s 5G network and Anthos, Google Cloud’s multicloud solution, Bell will deliver a consistent customer experience with greater automation and enhanced flexibility that scales with customer demand. The increased speed and bandwidth capacity of the Bell 5G network will support applications that can respond faster and handle greater volumes of data than previous generations of wireless technology.

- Leveraging the power of AI, data and analytics: Bell will leverage Google Cloud’s expertise in AI and big data to gain unique insights through real-time network data analytics that will enhance the customer experience, improve service assurance, and assist with network capacity planning.

- Joining forces on a sustainable future: Bell and Google share a common goal to run more sustainable businesses. As the cleanest cloud in the industry, Google Cloud will contribute to Bell’s target of achieving carbon neutral operations by 2025, and reducing greenhouse gas emissions by 2030 in line with the Paris Climate Agreement.

“We’re excited to partner with Google Cloud as part of our ongoing digital transformation and take Bell’s 5G network leadership to the next level,” said Mirko Bibic, CEO, BCE Inc. and Bell Canada. “Supporting Bell’s goal to advance how Canadians connect with each other and the world, Google’s proven expertise in cloud and leadership in sustainability will provide our customers with even faster, more reliable access to the best broadband network and communications services in Canada.”

“The acceleration of 5G has created new opportunities for industry leaders like Bell to redefine their business and create richer customer experiences,” said Thomas Kurian, CEO, Google Cloud. “We’re proud to partner with Bell to support their transformational shift to the cloud, and power a better network experience for people and businesses across Canada.”

As demands on mobile networks evolve and increase, Bell and Google Cloud will collaborate throughout the next decade on new innovations, including cloud solutions for enterprise customers and consumers powered by Google edge solutions, and enhanced customer service through automation and AI. In addition, the two companies will look at new ways to expand Bell’s existing partnership with Google to evolve the network experience and introduction of next-generation services across residential, mobile, and more.

Bell Canada says its relationship with Google Cloud will enable it to “drive operational efficiencies, increase network automation, and deliver richer customer experiences” through a number of initiatives, namely: Shifting multiple workloads from private systems to its partner’s platforms; leveraging “Google Cloud’s expertise in AI and big data to gain unique insights through real-time network data analytics that will enhance the customer experience, improve service assurance, and assist with network capacity planning; and combining the operator’s 5G connectivity with Anthos-hosted applications for an experience that “can respond faster and handle greater volumes of data than previous generations of wireless technology.”

They even squeezed a sustainability angle from the relationship, boasting that the collaboration would help the operator hit its target of achieving carbon neutral operations by 2025.

And this is just the start: The partners say they will “collaborate throughout the next decade on new innovations, including cloud solutions for enterprise customers and consumers powered by Google edge solutions, and enhanced customer service through automation and AI. In addition, the two companies will look at new ways to expand Bell’s existing partnership with Google to evolve the network experience and introduction of next-generation services across residential, mobile, and more.”

Like many network operators, Bell Canada is not monogamous in its public cloud relationships: Only weeks ago it announced it is teaming up with Amazon Web Services (AWS) for telco edge service developments and will integrate AWS Wavelength Zones into its 5G network in an effort to encourage developers to create new services, particularly low-latency applications that can take advantage of edge compute assets and 5G connectivity.

Same is true for Google Cloud- they have many relationship with many telecom service providers. Earlier this year, Google Cloud signed a 10-year deal with the Canadian telco Telus. Additionally, the cloud company extended its partnership with AT&T to offer edge computing and software tools to create 5G applications. As the growth of 5G and edge computing open up new economic opportunities, the major public cloud providers have been busy inking deals with CSPs and other players in the 5G ecosystem.

In addition to its new telco deals, Google recently announced a partnership with Intel to develop reference architectures and technologies that will accelerate the deployment of 5G and edge network solutions.

References:

https://www.prnewswire.com/news/google-cloud/

https://www.zdnet.com/article/google-cloud-signs-multi-year-deal-with-bell-canada/

Related:

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

Mediatek Dimensity 5G Open Resource Architecture to power new 5G smartphones

Taiwan based Mediatek has announced the Dimensity 5G Open Resource Architecture that provides brands with more flexibility to customize key 5G mobile device features to address different market segments. The open resource architecture gives smartphone brands closer-to-metal access to customize features for cameras, displays, graphics, artificial intelligence (AI) processing units (APUs), sensors and connectivity subsystems within the Dimensity 1200 chipset. Devices powered by MediaTek’s Dimensity 5G Open Resource Architecture customized chipsets will hit the global market this month (July 2021).

Mediatek is one of only two semiconductor companies (Qualcomm is the other) that have developed and are selling 5G silicon on the merchant market (Huawei, Samsung and soon Apple will have 5G silicon for internal product use). The company’s 5G chip sets are intended for 5G endpoint devices (like smartphones), rather than for base stations or small cells (where the equipment vendor designs their own ASICs).

“MediaTek is collaborating with the world’s largest smartphone brands to unlock customized consumer experiences that differentiate flagship 5G smartphones,” said Dr. Yenchi Lee, deputy general manager of MediaTek’s Wireless Communications Business Unit. “Whether it’s novel multimedia features, unmatched performance, brilliant imaging or more synergy between smartphones and services, with our architecture device makers can tailor their devices to complement a variety of consumer lifestyles.”

Key ways that brands can customize the Dimensity 5G Open Resource Architecture includes multimedia experiences that allow access to the in-chip, multi-core AI and display processors. 5G smartphone brands can tailor multimedia experiences and unlock more synergy between the chipset and the smartphone’s display and audio hardware. Brands will be able to sync the latest Bluetooth features with profiles to match their wireless accessories, such as headsets or gaming peripherals.

Hybrid multiprocessing is included. It is the open resource architecture that gives 5G brands the freedom to fine-tune a device’s performance and power-efficiency.

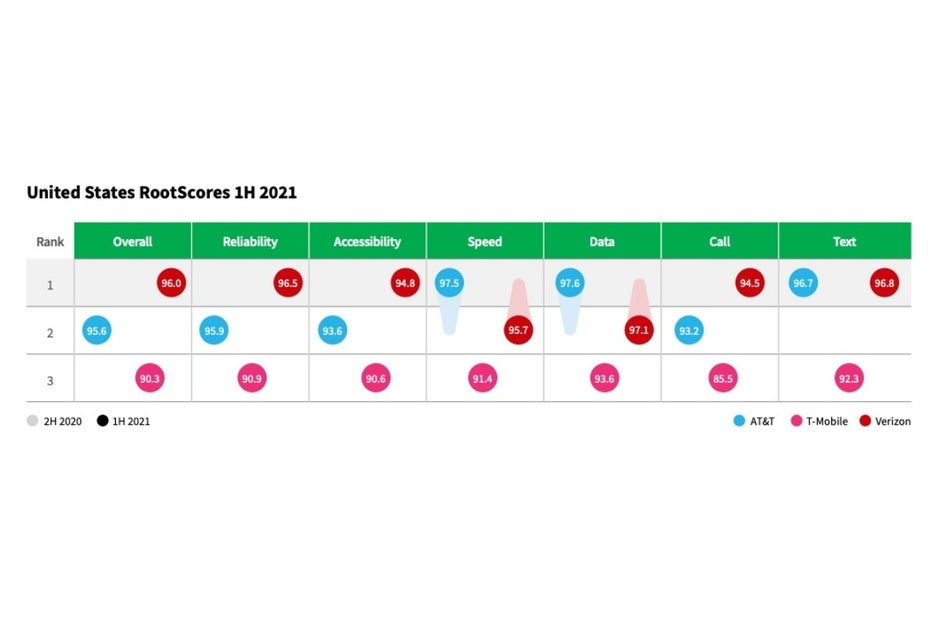

RootMetrics: Verizon wins 5 of 7 U.S. RootScore awards

RootMetrics (owned by IHS-Markit) conducted nearly 3 million tests in the first half of 2021 to see how the mobile carriers performed across the entire U.S., within the 50 states, and across the country’s 125 most populated metropolitan markets. The network monitoring firm also examined 5G results for each network as expansion continues.

Verizon remains the carrier to beat:

Verizon delivered another excellent performance in 1H 2021. The carrier won or shared five out of seven U.S. RootScore Awards and earned more State and Metro Area RootScore Awards than any other carrier. Verizon also continued its trend of offering strong speeds and great reliability in major cities, and as shown in our last 5G Scorecard, Verizon has also delivered outstanding Everyday 5G data reliability more often than the other carriers.

AT&T shows major improvements across the board:

After taking a slight step back for speed in 2H 2020, AT&T delivered faster speeds, better reliability, and strong Everyday 5G results in 1H 2021. AT&T took home three US RootScore Awards in 1H 2021 compared to one in 2H 2020, while significantly increasing its tally of State and Metro Area RootScore Awards. And as our 5G Scorecard series has shown, AT&T has also delivered fast Everyday 5G download speeds more consistently than the other carriers in 1H 2021.

T-Mobile improves in major metros:

T-Mobile continued to perform well in our metro area testing, delivering good and improved median download speeds, with stronger reliability since 2H 2020. The carrier also provided the top Everyday 5G availability in RootMetrics’ June 5G Scorecard, and its 5G speeds have continued to improve since 2H 2020.

State RootScore Award tally – by category:

Overall Reliability Accessibility Speed Data Call Text Total

AT&T 25 26 18 41 36 28 43 217

T-Mobile 0 1 2 4 0 1 8 16

Verizon 41 43 38 24 27 45 46 264

……………………………………………………………………………………………………………………………………………

Metro performance in a nutshell:

AT&T continued its trend of improvement we saw in our national and state testing to the metro level in 1H 2021. AT&T won far more awards than in 2H 2020, registered faster speeds, good reliability, and delivered fast Everyday 5G download speeds.

T-Mobile increased its tally of RootScore Awards since 2H 2020, delivered much better speed results, and showed improved reliability. T-Mobile has also continued to deliver impressive Everyday 5G availability. Verizon remained the top-performing carrier at the metro level.

Verizon delivered good speed and reliability results and earned by far the most Metro Area RootScore Awards. Verizon’s 5G has also continued to expand, with the carrier recording particularly strong Everyday 5G data reliability results.

……………………………………………………………………………………………………………………………………………………………….

………………………………………………………………………………………………………………………………………………

References:

https://rootmetrics.com/en-US/content/us-state-of-the-mobile-union-1h-2021

Samsung partners with GBL to deploy 5G testbed for U.S. Army

Samsung has teamed up with GBL Systems Corporation [1.] to deploy new 5G testbeds at U.S. Army military bases for Augmented Reality/Virtual Reality. The testbeds are part of a broader initative announced by the Department of Defense in October, which awarded $600 million in contracts for 5G testing at several US military test sites. GBL and Samsung have been contracted to support one of the largest testbeds, demonstrating the use of AR and VR over 5G networks for training applications.

Note 1. GBL Systems Corporation (GBL) is a leading provider of systems engineering, software services, advanced technology solutions to the U.S. Department of Defense (DoD)

Under the deal, GBL will be responsible for prototype creation, technology integration, and aligning the system with DoD requirements. Samsung will deliver its 5G end-to-end system and technical expertise, including network products such as its Massive MIMO Radios, cloud-native 5G Standalone (SA) Core, and Galaxy 5G mobile devices. The goal is to deploy a scalable, resilient and secure 5G network for AR/VR-based mission planning and training.

The testbeds will support AR for live field military training exercises. Simulated scenarios include virtual obstacles found in the combat theater, and overlays of data and instruments relied on by military personnel. Testing will start in a lab environment using Samsung’s mmWave and mid-band 5G radios. Field testing will then follow at two U.S. Army training bases that will support a live and simulated Army brigade.

Samsung Networks and GBL Systems deploy 5G testbeds for the U.S. Department of Defense, enabling evaluation of AR/VR applications in mission planning and training. U.S. Army trainees will use AR/VR goggles to see enhanced digital content overlaid onto real-world environments.

……………………………………………………………………………………………………………………………………………………….

“GBL is excited to work with Samsung to rapidly field a 5G network that is scalable, resilient, and secure to create a prototype test bed in support of a new DoD 5G-enabled AR/VR training capability,” said Jim Buscemi, CEO. “This effort has the potential to revolutionize how the DoD performs distributed training exercises that are more combat-like to significantly advance warfighter readiness.”

“Samsung is pleased to collaborate with GBL to deliver a reliable, resilient and secure 5G network for the DoD to evaluate new capabilities for our U.S. troops,” said Imran Akbar, Vice President and Head of New Business Team, Networks Business, Samsung Electronics America. “We believe in the transformative power of 5G and look forward to assisting the U.S. Department of Defense as they use this technology to increase training safety and strengthen the Nation’s defense capabilities.”

Samsung’s 5G solution enables quality, real-time imagery to be shared by many participants simultaneously. The Army trainees will use AR/VR goggles to see enhanced digital content overlaid onto the real world, and can use this digital imagery to interact with and acquire information about their real environment. This expands what’s possible in military training today, and provides a competitive advantage against adversaries.

Samsung pioneered the successful delivery of the first 5G end-to-end solutions in 2018, including chipsets, devices, radios, and the core network. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and Artificial Intelligence (AI) powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users worldwide, including customers of leading U.S. operators.

References:

https://www.telecompaper.com/news/samsung-gbl-to-deploy-5g-testbed-for-us-army–1390248