Month: October 2021

Telenor Deploys 5G xHaul Transport Network from Cisco and NEC; xHaul & ITU-T G.8300 Explained

NEC Corp. and Cisco have been selected by Telenor to deploy 5G xHaul transport networks in Norway and Denmark. 5G-xHaul proposes a converged optical and wireless network solution able to flexibly connect Small Cells to the core network.

In April this year, NEC and Cisco entered a Global System Integrator Agreement (GSIA) to expand their partnership for accelerating the deployment of innovative 5G IP transport network solutions worldwide. This project is a flagship initiative in which the two companies take full advantage of the GSIA and collaborate to deliver state-of-the-art networks to the customer.

NEC and Telenor have a well-established history of working together, and this project is an extension of a global frame agreement signed in 2016 for Telenor’s 4G IP / Multi-Protocol Label Switching (MPLS) network in Scandinavia, to deliver next-generation networks to the operator.

For this specific project, Cisco will supply its NCS 540 series as the cell site router and NEC will provide value added services built on its expertise both in the IT and network domain to implement an architecture that enables flexible and highly scalable end-to-end IP/MPLS networks with bandwidth that can support the high-capacity and low-latency communication required by 5G.

“As a One-stop Network Integrator, NEC takes a customer-first approach, providing optimal solutions that match individual requirements based on our best-of-breed ecosystem, consisting of NEC’s own products and those from industry-leading partners such as Cisco. We are excited to contribute to the advancement of Telenor’s 5G network evolution,” said Mayuko Tatewaki, General Manager, Service Provider Solutions Division, NEC Corporation.

“At Cisco, we continue to look for ways we can shape the future of the internet by providing unparalleled value to our customers and our partners,” said Shaun McCarthy, Vice President of Worldwide Sales, Mass Infrastructure Group, Cisco. “Through our partnership with NEC, we can help Telenor connect more people in Norway and Denmark and provide the automation and orchestration necessary to meet future demands on the network.”

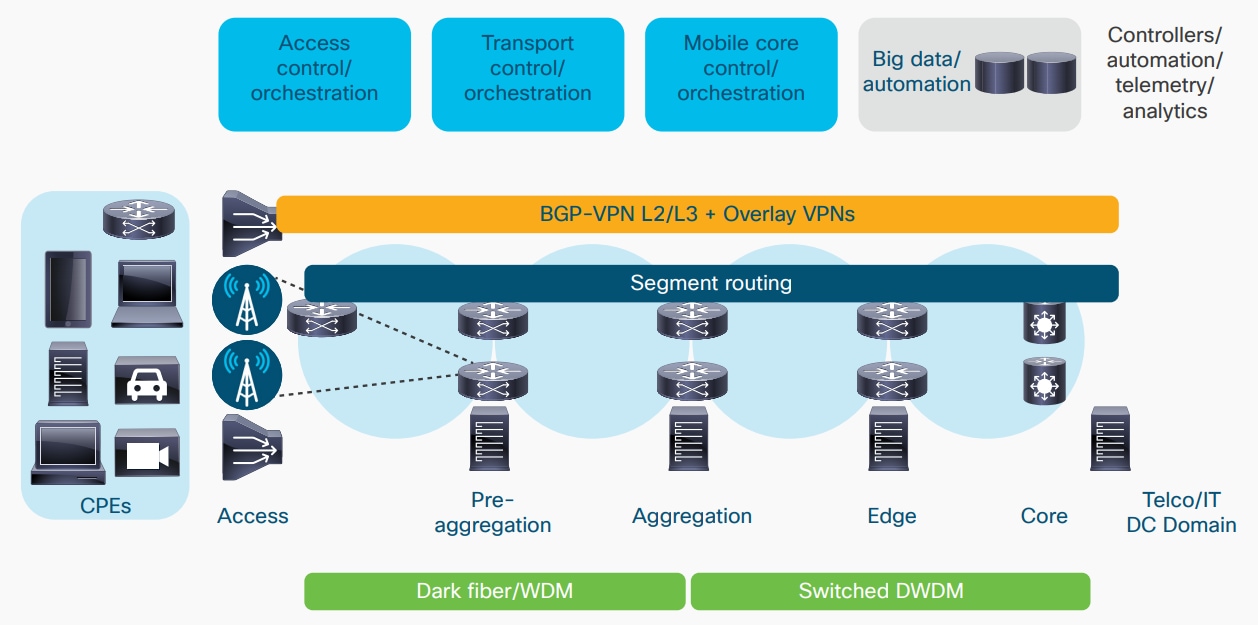

Cisco believes that a converged, end-to-end packet infrastructure, beginning in the access layer and stretching via the network data center all the way to the core, based upon segment routing and packet-based QoS, provides the underlying xHaul transport network (see Figure below). This provides the most flexibility of application placement, the best scalability, the most robust reliability, and the leanest operational costs. On top of this, we layer VPN services, either based on BGP-based VPNs or business software-defined WAN (SD-WAN) technologies, to provide the means to support a multi-service environment capable of supporting strict SLAs.

Overall Architecture for 5G xHaul:

Editor’s Note:

ITU-T G.8300 recommendation “Characteristics of transport networks to support IMT-2020/5G” defines the requirements for the Physical layer transport network support for the 5G fronthaul, midhaul and backhaul networks. The digital clients are the digital streams to/from the 5G entities (e.g., RU, DU, CU, 5GC/NGC) and other digital clients carried in the access, aggregation and core transport networks. The requirements and characteristics are documented for each of the fronthaul, midhaul and backhaul networks as defined in this recommendation.

The factors addressed include:

• Relationship of 5G network architecture to transport network architecture

• Operations, administration, and maintenance (OAM) requirements

• Timing performance and time/synchronization distribution architecture

• Survivability mechanisms

………………………………………………………………………………………………………………………………

NEC and Telenor have worked together before, with this announcement representing an extension of a previous global frame agreement signed in 2016 for Telenor’s 4G IP/Multi-Protocol Label Switching (MPLS) network in Scandinavia. As part of the agreement, the system integrated helped Telenor prepare, enable and perform the migration of services in a turnkey arrangement.

Going forward, NEC and Cisco will continue making collaborative efforts to further enhance their joint solution portfolio and to optimize regional activities for advancing the digital transformation of customers across the globe.

References:

https://newsroom.cisco.com/press-release-content?type=webcontent&articleId=2203825

http://Telenor Deploys 5G xHaul Transport Network from Cisco and NEC

https://www.nec.com/en/press/201603/global_20160331_01.html

Juniper Research: Mobile Roaming and the $2 Billion Revenue Leakage Problem

Juniper Research has found that the inability to distinguish between 4G and 5G data traffic using current standards will result in greater roaming revenue losses as the travel industry returns to pre-pandemic levels and 5G adoption increases. Juniper expects losses from roaming data traffic misidentification will rise to $2.1 billion by 2026 if the industry doesn’t implement the Billing & Charging Evolution Protocol (BCE), an end-to-end industry-wide standard defined by the GSMA that introduces new capabilities that identify roaming data traffic over different network technologies.

In response, the new research, Data & Financial Clearing: Emerging Trends, Key Opportunities & Market Forecasts 2021-2026, cited the support by operators for the BCE (Billing & Charging Evolution) protocol as being a key strategy to minimize the extent of revenue leakage. BCE is an end-to-end industry-wide standard defined by the GSMA that introduces new capabilities that identify roaming data traffic over different network technologies.

This issue of misidentifying roaming data will only be exacerbated by the rising number of 5G subscribers roaming internationally. The report forecasts that there will be over 200 million 5G roaming connections by 2026; rising from 5 million in 2021. This growth is driven by increasing 5G adoption and a return to pre-pandemic levels of international travel. In response, it urged operators to identify emerging areas of potential revenue leakage by leveraging machine learning in roaming analytics tools to efficiently assess roaming behavior and data usage.

In addition, the report found that, to effectively mitigate the growing complexity of clearing processes arising from increased demand for data when roaming, operators must move away from established roaming clearing practices in favor of BCE.

Research author Scarlett Woodford remarked:

“By combining BCE with AI-enabled roaming analytics suites, operators will be ideally positioned to deal with the rise in roaming data. Separating roaming traffic by network connectivity is essential to allow operators to charge roaming partners based on latency and download speed, and maximize overall 5G roaming revenue.”

Steering of Roaming Explained:

Roaming revenue can be drastically affected by regional regulations and pricing decreases; resulting in operators seeking alternative ways of generating profits from roaming traffic. The term ‘Steering of Roaming’ refers to a process in which roaming traffic is redirected to networks with whom an operator has the best wholesale rates. Operators are able to prioritize which network a device connects to when multiple networks are within range. Mobile operators are able to decide which partner network their subscribers will use whilst roaming, in order to reduce outbound roaming costs and ensure that roaming subscribers receive high-quality service.

Operators can rely on third-party enterprises to provide this service, such as BICS, with business analytics used to guide roaming traffic and identify preferential partner networks. If implemented correctly, steering of roaming can help operators increase margins through the reduction of operating costs. Roaming traffic is directed to the partner network offering the best rates, ultimately resulting in operators being able to pass these savings onto their subscribers with lower roaming charges.

References:

https://www.juniperresearch.com/pressreleases/roaming-revenue-losses-to-surpass-$2bn

https://www.juniperresearch.com/whitepapers/mobile-roaming-the-2-bn-revenue-leakage

UK-India research project to progress 5G and future telecom networks

The UK-India Future Networks Initiative (UKI-FNI) is a£1.4 million project, led by the University of East Anglia in collaboration with other UK and Indian universities. Its objective is to build the capability, capacity, and relationships between the two countries in telecoms diversification technologies and research for 5G and beyond. The project will explore hardware and software solutions for future digital networks, as well as develop a joint UK/India vision for Beyond 5G and 5G. The development of Open Radio Access Networks (OpenRAN) will be a key part of the project.

The project is funded by the UK Engineering & Physical Sciences Research Council (EPSRC).

The 5G/6G Innovation Centre (5G/6GIC) at the University of Surrey in the UK will play a key role in a project to examine advanced technologies for future digital telecoms networks. The 5G/6GIC will work with the University of East Anglia (project lead), University College London and the University of Southampton in the UK; and the Indian Institute of Technology (IIT) Delhi and the Indian Institute of Science in (IIS) Bangalore.

The 5G vision of the Centre includes:

- Indoors and outdoors

- Dense urban centres with capacity challenges

- Sparse rural locations where coverage is the main challenge

- Places with existing infrastructure, and areas where there is none

India has an excellent research and innovation base in networking systems software and has the complex testbeds required for proving new technologies. Indeed, under a previous £20 million EPSRC initiative led in the UK by Prof Parr (the India-UK Advanced Technology Centre), the team collaborated for more than 10 years with partners across India – an experience that will be leveraged in the UKI-FNI project.

Prof Parr said: “To those of us who have access to telecommunications services and the Internet, it comes as no surprise how reliant we are on voice, data and web services for email, video conferencing and file sharing, as well as social media for business and personal needs. This has been much more visible during the Covid pandemic. For the telecoms service providers there are important considerations in providing all these systems across regions and nations, including performance, cyber security, energy efficiency, scalability and operational costs for maintenance and upgrades.”

“The consideration on costs is attracting increasing attention when we consider the limited number of global vendors who manufacture and supply the systems over which our data flows across the national and international networks.”

There is a global push to explore innovations that will deliver the infrastructure, systems and services for next-generation mobile communication networks. Part of this drive is coming from network operators who are seeking solutions to reduce the costs for network components by aiming to remove dependence and lock-in to a small group of telecom original equipment manufacturers.

A leading idea is that the 5G infrastructure should be far more demand/user/device centric with the agility to marshal network/spectrum resources to deliver “always sufficient” data rate and low latency to give the users the perception of infinite capacity. This offers a route to much higher-performing networks and a far more predictable quality of experience that is essential for an infrastructure that is to support an expanding digital economy and connected society.

Sanjeev K Varshney, Head of International Cooperation at the DST, said: “The announcement of the India-UK partnership to develop newer research opportunities in future telecom networks is very timely and we look forward to developing new bilateral collaboration in this and other emerging areas of mutual interest.”

Rebecca Fairbairn, Director UKRI India, said: “UKRI India, in collaboration with our partner funders in India, is delighted to announce a drive towards a new Indo-UK research and innovation partnership on future telecom networks.

“Bringing together both our countries’ scientists, engineers, and innovators we will jointly develop new knowledge and high-impact research and innovation in line with our shared 2030 India-UK roadmap.”

Professor Gerard Parr, Principal Investigator for UKI-FNI, University of East Anglia, said: “There are many benefits to be accrued from the UKI-FNI project as we explore new innovative solutions in hardware, software and protocols.

“Ultimately, we will develop a roadmap for a much larger, mutually beneficial and longer-term collaboration between India and the UK in the important digital telecoms sector.”

References:

https://www.surrey.ac.uk/institute-communication-systems/5g-innovation-centre

https://www.uea.ac.uk/news/-/article/uea-leads-on-uk-india-future-telecom-network-partnership-c2-a0

Orange and Nokia deploy 4G LTE private network for Butachimie in Alsace, France

Orange Business Services and Nokia are deploying a redundant and secure 4G-LTE private mobile network that can be upgraded to 5G network at Butachimie’s Chalampé plant in Alsace, France. The network uses the 2.6 GHz spectrum, which French regulator Arcep has designated for mobile networks built to meet businesses’ specific needs. It also uses TDD (Time Division Duplexing) to separate wireless transmit and receive channels.

Butachimie will connect factory equipment and assets to the network, which is expected to allow technicians to geolocate assets with pinpoint accuracy. Nokia will supply a dedicated core network as well as RAN equipment, so that all network data stays onsite. The companies said both the factory equipment and the data it generates will be visible on the network at all times, enabling the manufacturer to prevent failures and ensure continuous production.

This private 4G network allows Butachimie teams to gain controlled and effective access to information system applications; they can also take advantage of new services via wirelessly connected devices (geolocation, intercom, camera, real-time sharing of videos and images, etc.). In addition, the equipment and the data collected ensure a high level of network availability of more than 99.99%, which makes it possible to forecast incipient network failures and guarantee continuous production within the plant.

Stéphane Cazabonne, project manager at Butachimie, said: “Our digital transformation and modernization plan has to meet very stringent challenges in terms of security and availability. Therefore, it is essential for us to be able to rely on reliable partners who can provide us with technological robustness, personalized support, and our business knowledge and related uses. Thanks to Orange Business Services and Nokia, we are taking a new step towards developing the Factory of the Future by offering our operators new tools to increase our performance and competitiveness in our industry. With this scalable network, we can finally benefit from the performance and benefits of the technology, such as 5G, which is already predicted.”

Butachimie’s Chalampé Plant. Photo credit: Butachimie

Butachimie’s Chalampé Plant. Photo credit: Butachimie

Orange Business Services provides advice and technical support on full network management and the use cases around it. Industry 4.0 [1.] current or future. In the design phase, Orange Business Services considered the scalability of the private mobile network, in particular by designing an architecture adapted to the principles of Mobile Edge Computing.

Note 1. Towards Factory 4.0:

Since 2010 Butachimie has been involved in the MIRe project. All the electronics on the site will be completely reviewed and modified by 2022 in order to optimize production. Digitalizing our processes and incorporating digital tools will allow us to improve both performance and competitiveness. It will also speed up process development while following the fundamental rules of safety and sustainability.

…………………………………………………………………………………………………………………………………………………

Denis de Drouâs, director of the private radio networks program at Orange Business Services, said that Butachimie chose a private network that is “totally independent from the public network.” However, other manufacturers may select different solutions.

For example, Schneider Electric is using a hybrid network model that combines private and public 4G and 5G infrastructure. The network uses Orange’s commercial 5G frequencies in the 3.4-3.5GHz bands, but Schneider’s critical data is kept on its campus and can be used for low-latency, edge-based applications.

Orange says it “slices its public network” for enterprise customers, according to de Drouâs. However, that is not the same as “network slicing” (?) which requires a 5G SA core network. Commercial frequencies are used, and the “private slice” guarantees the customer a specific quality of service.

This 4G Private Mobile Network is the backbone for all future applications currently under development as part of the Butachimie digital transformation project.

References:

WSJ: U.S. Wireless Carriers Are Winning 5G Customers for the Wrong Reason

AT&T and Verizon’s heavy promotions lead to booming growth, but value of next-gen networks to users still unclear, by Dan Gallagher

Even before the country’s two largest wireless carriers reported strong quarterly results this week, Morgan Stanley (MS) had a bit of cold water to splash on those carriers.

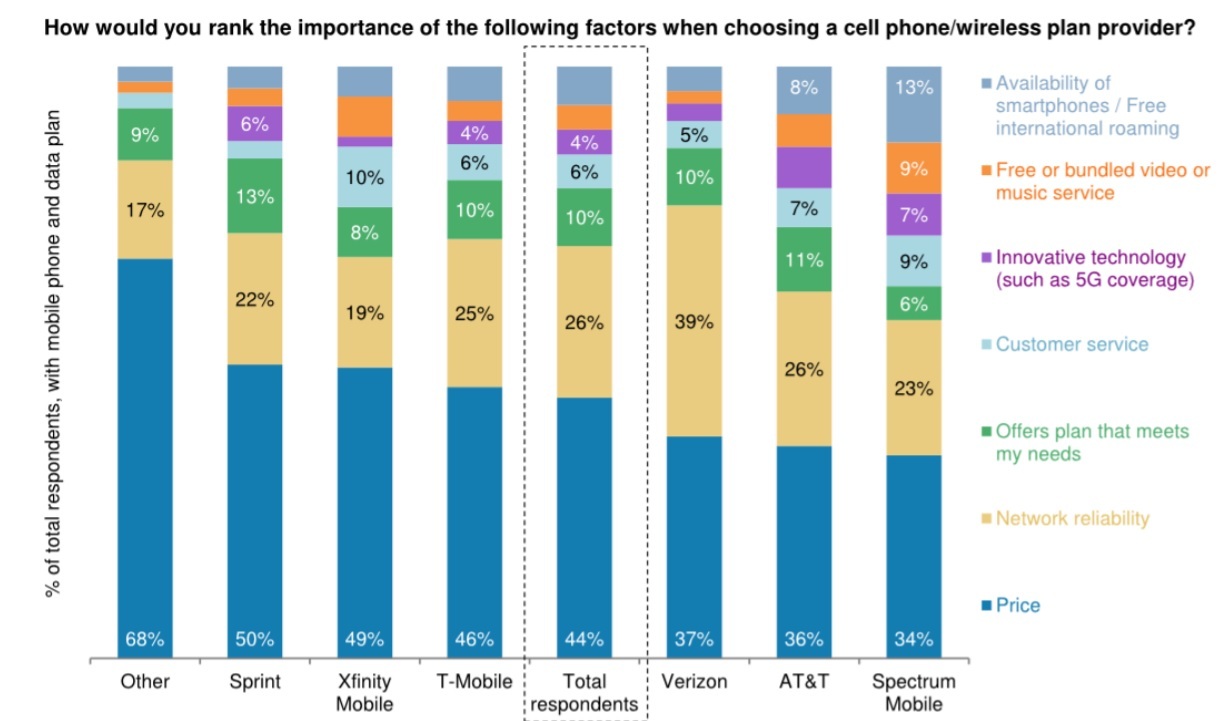

The investment bank published the results of its ninth annual broadband and wireless survey on Monday. Among the findings were that only 4% of respondents cited “innovative technology” such as 5G as an important factor in their choice of service. That number was unchanged from the previous year’s survey—despite an unremitting onslaught of marketing from wireless carriers and device makers for the next-gen wireless standard. [IEEE Techblog reported the results of the MS survey here]

That would appear inconsistent with the strong growth in wireless services reported by AT&T and Verizon VZ this week. On Wednesday, Verizon reported adding 429,000 postpaid wireless subscribers during the third quarter, which is up 52% from the number added in the same period last year. On Thursday morning, AT&T said it added 928,000 such users to its rolls in the same period—up 44% from the same period last year and the highest number of net new additions in more than a decade of what are considered the industry’s most valuable base of customers.

The two carriers have been selling 5G hard over the past couple of years. That picked up significantly last fall, when Apple Inc. launched its first iPhones compatible with the next-generation wireless technology. Those phones have been in hot demand. Analysts estimate total iPhone sales jumped 25% to a record of 237 million units in Apple’s fiscal year that ended last month, according to consensus estimates on Visible Alpha. The 5G-compatible iPhone 12 and 13 models are expected to account for more than 80% of that number.

But customers appear to be driven more by old-fashion promotions than cutting-edge technology. AT&T, Verizon and T-Mobile —which reports its results on Nov. 2—offered heavy discounts last year for iPhone 12 models paired with new 5G plans. That appears to have continued with the newest crop; wireless analyst Craig Moffett of MoffettNathanson notes that “promotions tied to premium unlimited plans have gotten richer” with the introduction of the iPhone 13 family this year. Indeed, the Morgan Stanley survey found price to be the most compelling driver in choice of a wireless plan, with 44% of respondents citing it as their top factor.

FTC Staff Report Finds Many ISPs Collect Troves of Personal Data while Consumers Have No Options

The Federal Trade Commission (FTC) staff report released on Thursday, October 21st found that a group of broadband Internet Service Providers (ISPs), including AT&T, Charter Communications, Comcast and Verizon, collect troves of personal data, and that consumers don’t have much choice on how that data is used.

Question to Ponder: Haven’t we all intuitively known that, just like Big Tech (Amazon, Google, Facebook, Apple, Microsoft) our privacy has been compromised by ISPs in return for “free services,” whereby our personal information is sold to “target advertisers?”

The report was approved unanimously 4-1 by the commission, with FTC chair Lina Khan issuing a separate statement. Khan said the FTC report highlighted:

1) Problems with the notice-and-consent framework for data collection and sharing;

2) The expansion of ISPs into vertically integrated businesses including ones providing content for their broadband “pipes”; and

3) The potential use of “hyper-granular” online dossiers to discriminate against users.

Many ISPs collect and share far more data about their customers than many consumers may expect—including access to all of their Internet traffic and real-time location data—while failing to offer consumers meaningful choices about how this data can be used, according to an FTC staff report on ISPs’ data collection and use practices.

The staff report, which details the expanding scope and some troubling aspects of some ISP data collection practices, stems from orders the FTC issued in 2019 using its authority under 6(b) of the FTC Act to six internet service providers, which make up about 98 percent of the mobile Internet market:

- AT&T Mobility LLC;

- Cellco Partnership, which does business as Verizon Wireless;

- Charter Communications Operating LLC;

- Comcast Cable Communications, which does business as Xfinity;

- T-Mobile US Inc.; and

- Google Fiber Inc.

The FTC also issued orders to three advertising entities affiliated with these ISPs: AT&T’s Appnexus Inc., rebranded as Xandr; Verizon’s Verizon Online LLC; and Oath Americas Inc., rebranded as Verizon Media. The FTC sought information on their data collection and use practices, as well as any tools provided to consumers to control these practices.

As noted in the report, these companies have evolved into technology giants who offer not just internet services but also provide a range of other services including voice, content, smart devices, advertising, and analytics—which has increased the volume of information they are capable of collecting about their customers. The report identified several troubling data collection practices among several of the ISPs, including that they combine data across product lines; combine personal, app usage, and web browsing data to target ads; place consumers into sensitive categories such as by race and sexual orientation; and share real-time location data with third-parties.

At the same time, the report found the privacy protections many of the companies offer raised several concerns. Even though several of the ISPs promise not to sell consumers personal data, they allow it to be used, transferred, and monetized by others and hide disclosures about such practices in fine print of their privacy policies. For example, several news outlets noted that subscribers’ real-time location data shared with third-party customers was being accessed by car salesmen, property managers, bail bondsmen, bounty hunters, and others without reasonable protections or consumers’ knowledge and consent, according to the report.

Many of the ISPs also claim to offer consumers choices about how their data is used and allow them to access such data. The FTC found, however, that many of these companies often make it difficult for consumers to exercise such choices and sometimes even nudge them to share even more information. In addition, while several of the ISPs promise to only keep the data for as long as needed for business purposes, the definition of what constitutes a “business purpose” varies widely among the companies.

The FTC report also found that ISPs use web browsing data and group consumers using “sensitive characteristics such as race and sexual orientation.”

The report concludes that many of the ISPs’ data collection and use practices mirror problems identified in other industries and underscore the importance of restricting data collection and use.

The Commission voted 4-0 to approve and issue the report. Staff presented findings from the report at today’s open virtual Commission meeting. Chair Lina M. Khan issued a separate statementon the report.

Cable Industry Response from the NCTA:

The report drew a sharp rebuke from the cable industry (as represented by the NCTA — The Internet & Television Association), maintaining that it provided a “highly distorted view” that casts them in the same arena as aggressive “Big Tech platforms” which are well known to compromise users privacy via data collected and sold to advertisers.

The NCTA said in a October 21st statement:

The FTC’s report provides a highly distorted view of ISP data collection policies and inappropriately attempts to lump broadband providers into the same category as the Big Tech platforms.

Cable broadband providers take seriously their responsibility to safeguard the personal information of their customers and do not surveil their customers or sell their location data. Viewed objectively, today’s presentation is a broad attack on online advertising generally, not specific ISP actions. And what is further missing from today’s report is the much larger story about Big Tech platforms that are premised on maximizing user attention.

What is needed is a consistent set of privacy rules across the online marketplace on a technology-neutral basis. We look forward to continued engagement with policymakers to forge a strong, consistent framework for privacy protection.

–>What will come of the FTC staff report is not entirely clear. FTC chair Lina Khan said it would be part of an “ongoing conversation” about privacy and data practices that could be “incorporated” into FTC action, according to Multichannel News.

…………………………………………………………………………………………………………………………………………………….

FTC Boilerplate Text:

The Federal Trade Commission works to promote competition and to protect and educate consumers. You can learn more about consumer topics and file a consumer complaint online or by calling 1-877-FTC-HELP (382-4357). For the latest news and resources, follow the FTC on social media, subscribe to press releases and read our blogs.

…………………………………………………………………………………………………………………………………………………….

Separately, Politico reported that tech and telecom companies were among the top 20 spenders for the third quarter of 2021, according to a ranking of lobbying expenditures compiled by POLITICO Influence. Facebook was No. 5 at $5.1 million, with Amazon right behind it with $4.7 million. NCTA — The Internet & Television Association ranked 15th, spending $3.3 million, and Comcast was 18th, with $3.1 million.

CCS Insights: 5G connections will triple this year to 637M, then to 1.34B in 2022

5G connections (is that the same as 5G subscribers?) will reach well over 1 billion next year, despite the threat of component shortages hitting the supply chain this Christmas, according to a new forecast by CCS Insights. Total 5G connections will triple this year to 637 million, before more than doubling in 2022 to 1.34 billion, CCS Insight predicts. The market research firm says that China will continue to lead in volume terms, at least for the next few years.

Smartphones with 5G capability have until now largely remained sheltered from component shortages affecting the global mobile phone market.

“In another turbulent year for the mobile phone market, supply constraints in low- to mid-tier segments, paired with weak demand in emerging markets, have dampened sales. But 5G-enabled devices have so far continued to find their way to the hands of people in the world’s most advanced markets, with 560 million 5G-capable smartphones projected to sell in 2021”, notes Marina Koytcheva, vice president of forecasting at CCS Insight. But concerns about the supply of high-end devices, including the iPhone, during the Christmas quarter remain and pose a risk to adoption of 5G, even if that risk is temporary.

Telecom operators in Western Europe, North America, China and other advanced markets in Asia continue to roll out 5G networks, overcoming difficulties posed by the Covid-19 pandemic, uncertainties about the role of Chinese network equipment-maker Huawei, and an unstable macroeconomic environment.

In South Korea, 5G is on track to account for 30% of mobile connections by the end of 2021. Strong mobile phone sales in the run-up to Christmas will help the US achieve 25% penetration, surpassing the Chinese market. Although China was an early trailblazer for 5G, shaky demand for smartphones in 2021 means that 5G is forecast to account for only 24% of cellular device connections by the end of the year.

In contrast, Western Europe is still lagging some other markets, limited by delayed spectrum auctions in some countries, slow government decision-making about the role of Huawei, and weakened demand for mobile phones amid the pandemic. Although the speed of 5G roll-out is improving, this relatively gradual start means that 5G won’t account for more than half of cellular device connections in the region until 2024.

Once the spectrum is allocated and telecom operators start deploying 5G networks, how quickly people adopt 5G depends on their willingness to buy 5G-capable devices. “Things are looking up on that front; the global mobile phone market is projected to recover in 2022, and prices of 5G handsets continue to fall steadily. Our forecast for 3.6 billion 5G connections worldwide by 2025 is still firmly on track,” says Koytcheva.

In addition to mobile phones and related devices such as tablets, CCS Insight has identified two other drivers for 5G adoption: industrial cellular Internet of things devices and fixed wireless access (we agree). Both have strong prospects, despite being projected to contribute only 9% of worldwide 5G connections in 2025. Adoption of 5G in industrial applications is seeing positive momentum in China, and is set to get a boost in the US when carriers start switching off their legacy 3G networks.

Fixed wireless access remains a niche technology for now, mostly complementing fibre broadband, but some network operators are increasingly turning their attention to this opportunity with business users, recognizing that the potential revenue per connection could be significantly higher than that from connecting households.

A summary of CCS Insight’s new forecast for 5G connections is presented in the chart below:

Source: CCS Insights

……………………………………………………………………………………………………………………………………………..

The publication of nine-month 5G subscriber numbers from two of China’s three mobile operators is quite revealing (if true?).

- China Mobile is adding 5G customers at a rate of around 11 million per month according to its latest financial report. The world’s biggest mobile operator had 160 million 5G network subscribers at the end of September, up from 127 million three months earlier.

- China Telecom, which is due to report on Friday, had 146.6 million 5G package customers at the end of August. A “back of the envelope” calculation by Mary Lennighan of telecoms.com suggests there are more than a quarter of a billion true 5G subscribers in China.

CCS Insight predicts that the U.S. will leap ahead of China in 5G on the back of strong smartphone sales in the run-up to Christmas, giving it 25% 5G penetration to China’s 24%, the latter hit by shaky demand for smartphones this year as noted above.

References:

https://telecoms.com/511861/global-5g-connections-set-to-break-the-billion-mark-next-year/

https://telecoms.com/511854/china-mobile-is-adding-11-million-real-5g-users-per-month/

More details of CCS Insight’s extensive 5G service can be found at: https://www.ccsinsight.com/research-areas/5g-networks

AT&T earnings, mobility and consumer broadband grow; stiff competition lies ahead

AT&T today reported a net profit of $5.9 billion in the third quarter, up from $2.8 billion a year ago. Adjusted EPS, excluding the one-time effects of the divestments, reached $0.87 versus $0.76 a year earlier. The company now expects full-year adjusted EPS to be at the high end of the earlier indicated low- to mid-single digit growth range and free cash flow should meet the $26 billion target.

AT&T said it was on track to meet its full-year targets. Revenues for the three months to September were still down 5.7 percent year-on-year to $39.9 billion due to the spin-off its pay-TV business in July, along with other divestments and weaker sales in Business Wireline.

Source: AT&T

…………………………………………………………………………………………………………………………………….

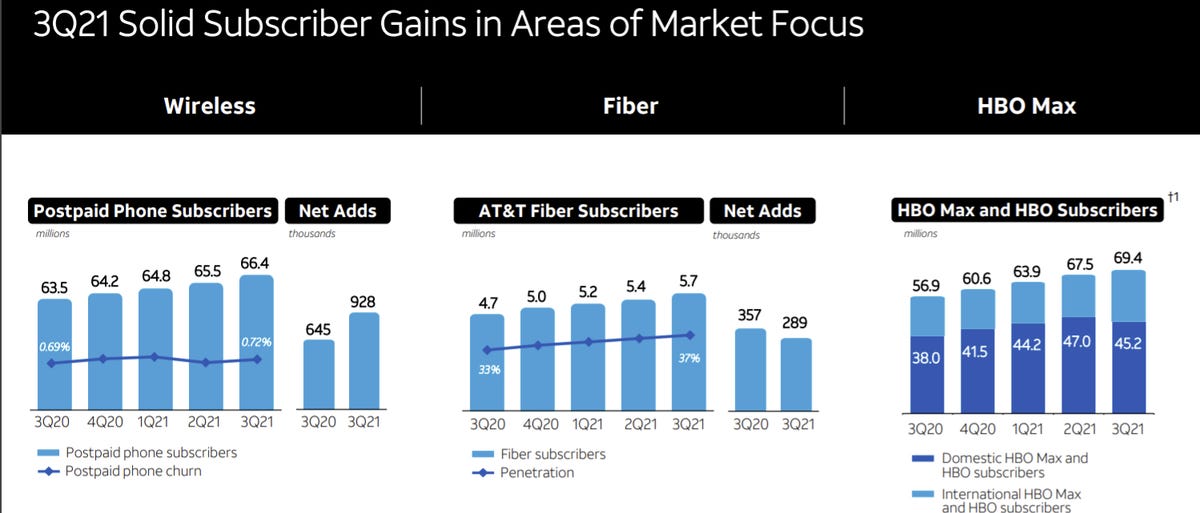

Mobility is AT&T’s largest and most important business, accounting for 48% of consolidated

revenues, and more than two thirds of pro-forma revenues post divestitures. The company’s mobile business did quite well in the third quarter, adding over 1 million postpaid lines. AT&T has now added 4.4 million wireless postpaid subscribers over the past four quarters. Jeff McElfresh, Chief Executive Officer, AT&T Communications said on today’s earnings call (see analyst Craig Moffett’s comments below):

Our (wireless) strategy is working here at AT&T. As we’ve demonstrated, it’s the fifth consecutive quarter where we have driven some momentum and gaining (market) share. Our net add strength here in the quarter at 928,000, that compares to what we had produced back in 2019 in the third quarter of 101,000. And we’re driving strong service revenue growth. And we just posted the largest total EBITDA that we’ve generated out of the wireless business segment. The best part about it, Phil, is that our customers are telling us that we’re doing a good job. These churn levels that are low are a signal to the service and the value that we’re offering and our NPS feedback that we’ve received is the highest that we’ve ever received.

I’d also point to things like our FirstNet program. We’re starting to reach some scale here. Third quarter, we posted the highest net add quarter since launching the program and we’ve arrived at a position of leadership and strength in the law enforcement segment under the public safety sector. And so all in all, it’s been the operational changes that we’ve made at AT&T that has driven really strong momentum in our customer counts.

For comparison, arch rival Verizon added a net 699,000 postpaid subscribers including 429,000 postpaid phones in the third quarter. T-Mobile US will report third quarter results on November 2nd after the stock market closes.

HBO subscribers grew to nearly 70 million by the end of the quarter. Excluding its U.S. video business (to be spun off and merged with Discovery (DISCA) by the middle of next year), revenues rose to $38.1 billion from $36.4 billion in the year-ago quarter, and adjusted operating improved to $8.1 billion from $7.8 billion.

“We continue to execute well in growing customer relationships, and we’re on track to meet our guidance for the year,” said John Stankey, AT&T CEO. “We had our best postpaid phone net add quarter in more than 10 years, our fiber broadband net adds increased sequentially, and HBO Max global subscribers neared 70 million. We also have clear line of sight on reaching the halfway mark by the end of the year of our $6 billion cost-savings goal.”

Third-quarter revenues were $28.2 billion, up 3.8% year over year due to increases in Mobility and Consumer Wireline more than offsetting a decline in Business Wireline. Operating contribution was $7.1 billion, up 0.8% year over year, with operating income margin of 25.2%, compared to 26.0% in the year-ago quarter.

Highlights of AT&T’s Consumer Wireline business:

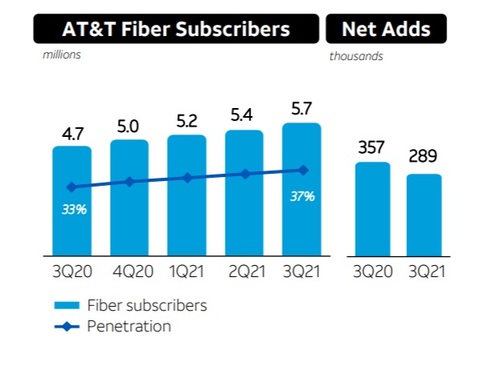

- 289,000 AT&T Fiber net adds; penetration about 37%

- Revenues up 3.4%; broadband revenues up 7.6% with ARPU growth of 5.2%

Growth in fiber broadband is an important part of AT&T’s new strategy, with billions of dollars of capital investment planned to expand its network and win new customers. In the third quarter, broadband internet subscriber growth was underwhelming. The company added a net 5,700 broadband customers, versus the consensus of 52,000. That includes a smaller-than-expected 289,000 fiber adds and a larger-than-expected loss of 261,000 DSL customers. Yet AT&T CFO Pascal Desroches said on today’s earnings call:

Our Fiber growth was solid. We had our highest Fiber gross adds ever and we continue to win share wherever we have Fiber. We added 289,000 Fiber customers in the quarter, and more than 70% of the Fiber net adds are new AT&T broadband customers and this gives us great confidence as we continue to build out our Fiber footprint.

CEO Stankey added a bit more color by saying:

We’re on this path to substantially increase our Fiber footprint and that stretches across both our consumer and our business base. And I think as you’ve known from past history, this is — it’s not uncommon for us to go through these ramps of infrastructure builds. We’ve done that many times before. We’ve recently been through one where we went through a multi-year ramp on fiber builds that we kind of started executing around the 2015 timeframe. They always, as you move through the front end of them, have a few moments where they’re a little bit lumpy and a little bit rocky because that’s the nature of it.

Source: AT&T

…………………………………………………………………………………………………………………………………………..

AT&T said it cut operating expenses by $3.4 billion in the past 12 months, to $32.8 billion. Divestments and lower sports programming costs were offset by higher wireless equipment costs and higher costs for other types of content at WarnerMedia, plus increased sales and marketing expenses. Operating profit was helped also by lower depreciation and amortization following earlier asset write-downs.

Earnings report summary:

- AT&T added 1,218,000 postpaid wireless net additions in the third quarter as well as 249,000 prepaid phone ads and 928,000 postpaid phone net ads.

- AT&T’s mobility unit reported revenue growth of 7% in the third quarter to $19.1 billion and operating income of $6 billion.

- AT&T’s equipment revenue was $4.6 billion, up 15%, due to strong smartphone sales.

- AT&T Fiber added 289,000 net customers and broadband revenue was up 7.6% in the third quarter from a year ago.

- WarnerMedia revenue in the third quarter was $8.4 billion, up 14.2% from a year ago.

“AT&T lays claim to the most hated stock and the most maligned management team in our universe,” wrote New Street analyst Jonathan Chaplin after AT&T’s earnings report on Thursday morning. “…We continue to expect AT&T to struggle as T-Mobile and cable rise. That certainly doesn’t seem to have happened this quarter though, with exceptionally strong net adds in wireless; however, it’s unclear how much credit investors will give AT&T for the newfound resilience in its wireless business, at least in light of everything else.”

With respect to AT&T’s carrier competitors, analyst Craig Moffett wrote in note to clients:

In Wireless, competitor T-Mobile has staked out the rather unusual dual position of lowest cost AND best network. TMobile is expanding its footprint, retail presence, and market share in rural America, and it is targeting market share gains in business wireless. Verizon is planning a march “up the stack,” with a focus on mobile edge compute in the 5G enterprise market. Verizon’s network strategy, somewhat quixotically we would argue, still has a large component of millimeter wave ultra-wideband. But, as a backup, Verizon has amassed a huge trove of C-Band spectrum, and they claim the industry’s densest network.

As we inch toward the finish line of the 3.45 GHz spectrum auction, we will probably learn that AT&T has narrowed, but not fully closed, their spectrum gap versus Verizon (but not T-Mobile). What will its network strategy be? In Business Wireline, it is the nation’s largest incumbent, facing declining share and eroding pricing. What will its Business Wireline strategy be?

………………………………………………………………………………………………………………………………………………….

On October 11th, AT&T awarded a 5 year contract to Ericsson in order to accelerate the expansion of AT&T’s 5G network. This deal helps support deployment of the service provider’s recently acquired C-band spectrum and the launch of 5G Standalone (SA) (which has been outsourced to Microsoft Azure).

Ericsson will help AT&T to bring its 5G network to more consumers, businesses and first responders across key industries – including 5G use cases in sports and venues, entertainment, travel and transportation, business transformation and public safety. AT&T’s network evolution is made possible in part by the Ericsson Radio System portfolio, which includes the Advanced Antenna System (AAS), Advanced RAN Coordination and Carrier Aggregation technologies.

The deployments will support future network enhancements like Cloud RAN, which offers communications services providers increased flexibility, faster delivery of services and greater scalability in networks. The platform supports a centralized RAN architecture enabled by Ericsson Fronthaul Gateway, a new technology that will enable a more efficient transport of the fronthaul interface by converting it to packet (eCPRI).

References:

https://about.att.com/story/2021/q3_earnings.html

https://investors.att.com/financial-reports/quarterly-earnings/2021

Verizon broadband – a combination of FWA and Fios (but not so much pay TV)

Verizon today announced its earnings for the third quarter of 2021, with the company posting net income of $6.6 billion, operating revenue of $32.9 billion, and $1.55 in earnings per share. Verizon now expects total wireless service revenue growth of around 4%, an increase to prior guidance of 3.5% to 4%. It’s earnings guidance was also revised upwards. Verizon adjusted earnings per share of $5.35 to $5.40 is now forecast for the current quarter – an increase from its prior guidance of $5.25 to $5.35.

“We had a strong third quarter, delivering on our strategy and growing in multiple areas,” Verizon Chairman and CEO Hans Vestberg said in the earnings release. “Our disciplined strategy execution demonstrated growth in 5G adoption, broadband subscribers and business applications. We are increasing our 2021 guidance, and we continue to expand our 4G LTE and 5G network leadership. We fully expect to have a strong finish to the year as we accelerate deployment of 5G to our customers across the country,” he added.

“Verizon reported another quarter of strong financial and operating performance,” Verizon Chief Financial Officer Matt Ellis said in the press release. “We are seeing strong demand for connectivity across our Consumer and Business segments as our Mix and Match and Business Unlimited value propositions, network quality and unique partnerships are resonating with both new and existing customers. We grew revenue in the quarter, achieved solid cash flow, completed the sale of Verizon Media and increased the dividend for a 15th consecutive year.”

The #1 wireless telco in the U.S. lost 68,000 net video subscribers from its Fios (FTTH/FTTP) service in the third quarter. “The telecom giant has been shifting its video focus away from Fios TV to partnerships with third-party streaming services as it positions itself as a key distribution platform for them. For example, Verizon has a deal with The Walt Disney Co. for the Disney bundle, which gives customers with select Verizon wireless unlimited plans access to Disney streaming services Disney+, Hulu and ESPN+,” said the Hollywood Reporter.

During the quarter, Verizon sold off its Verizon Media unit, which consisted of formerly dominant tech brands like AOL and Yahoo. The unit was acquired by Apollo Global Management, although Verizon continues to hold a 10 percent stake.

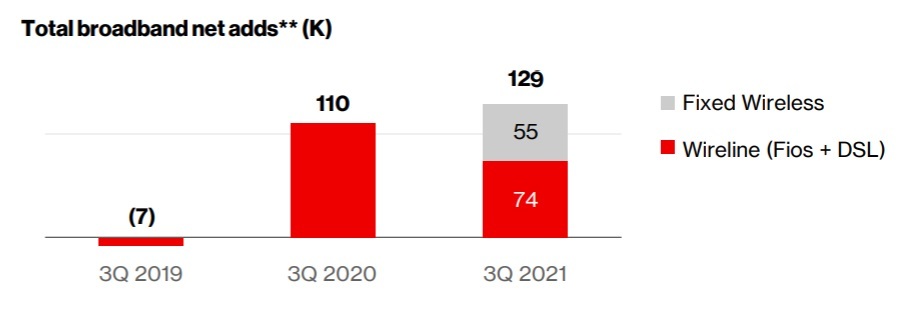

Verizon reported 129,000 broadband net additions in the third quarter, comprised of Fios, DSL and FWA subscribers, during the quarter. Of those, there were 55,000 Fixed Wireless Access (FWA) subscriber adds , which was about 42% of the 129,000 total broadband net adds generated in the quarter. Verizon FWA has a total of ~150,000 subscribers.

Source: Verizon Infographic from 3Q 2021 Earnings Report

Verizon CEO Hans Vestberg said during the earnings call, “We’re on track to meet our fixed wireless access household coverage targets with an expected 15 million homes passed by the end of the year between 4G and 5G. To date, 5G Home is in 57 markets and 4G LTE Home is in over 200 markets across all 50 states.”

Verizon first began offering 4G LTE Home in July 2020 and has really accelerated its rollout. The company has also rolled out 5G Home. Verizon executives on today’s earnings call noted that the FWA subscriber base is a mix of customers getting service from its 4G/LTE network and via Verizon’s 5G millimeter wave (mmWave) network. The company’s FWA base currently is a mix of residential and business customers, but did not break out that ratio. But they did note that there’s about a rough 50/50 split between FWA customers that are coming from Verizon’s existing base and from other service providers. CFO Matt Ellis said Verizon’s FWA customers aren’t solely focused on rural areas, as Verizon is also seeing “good traction” with the product in urban and suburban areas.

Verizon now seems to favor FWA over Fios, probably because of significantly lower installation costs for the former. Yet the company is not giving up on Fios. “In addition to fixed wireless access, we’re pleased with the great performance of Fios and continue to grow the open-for-sale volumes within our footprint.”

Indeed, Fios Internet net adds were 104,000 in the quarter. The telco is increasing its Fios footprint, adding over 400,000 open-for-sale locations this year. One analyst noted that Verizon hasn’t talked about increasing its Fios brand within its ILEC for quite some time.

Chief Financial Officer Matt Ellis said, “On the Fios expansion, we see great opportunity. We have been investing in that for a number of years; maybe haven’t spoken about it quite as much. But it continues to be a very good growth driver for the business.”

The company reported that Fios revenue of $3.2 billion in the quarter was up 4.7% year over year, driven by continued growth in customers as well as Verizon’s effort to increase the value of each customer by encouraging them to step up in speed tiers.

“We remain focused on bringing in high-quality net adds,” said Elllis. “The mix and match pricing structure for both wireless and Fios provides opportunity to migrate customers to higher value tiers and bring in customers on higher value plans. Our strategy is focused on increasing the value we receive from every connection.”

Vestberg said, “Our strategy is becoming a national broadband provider with the best access to the tech for our customers, including Fios, fixed wireless access on 5G, on 4G, mmWave and C-band.”

In a research note to clients, analyst Craig Moffett discussed Verizon’s broadband business:

Verizon’s FiOS service continues to show strength, a product of both more aggressive pricing and a lessening drag from video as the video base shrinks. Notably, Verizon is also beginning to see some contribution from fixed wireless access.

- FiOS internet subscriber gains of 104K were almost spot on with consensus. DSL losses

remained relatively steady (-30K) despite the fact that the base of legacy DSL has been

gradually depleted. Overall broadband net additions came in at 129K, which includes

55K fixed wireless connections. The company reported that it had 150K fixed wireless

broadband customers at the end of Q3. Wireline broadband net additions were strong,

at 74K, but were still weaker than expected. Notably, the company has guided to an

addition of 400K FiOS homes open for sale, the first meaningful expansion of homes

available for sale in some time (note that “open for sale” does not necessarily equate to

new build – particularly in New York, there has long been a large gap between homes

already passed and homes open for sale – but it is likely that there is at least some new

build here. - Like peers, Verizon is losing video subscribers (down 68K, a little worse than the 54K

loss we had expected, and worse than the 62K loss a year ago despite a smaller

denominator). Their decline rate of 7.2% is broadly in line with the rate of decline for the

industry overall.

With respect to Verizon’s 5G strategy and competition (e.g. T-Mobile), Craig wrote:

As we creep up to the 5G epoch, we’re on the brink of a very different industry. Despite a relatively healthy third quarter report – albeit against relatively easy year ago comps – there are reasons for disquiet. A post-COVID service revenue growth recovery has already begun to slow, and incremental revenue streams from 5G are still uncertain. Industry structure, which once appeared to be getting better – we went from four to three with the merger of Sprint and T-Mobile – is now arguably getting worse, as we now arguably go from three to five with the emergence of hybrid MVNO/MNO networks from Cable and Dish. Verizon is on the brink of a very different competitive position.

T-Mobile’s 5G network is increasingly viewed as better than Verizon’s for coverage, speed, and reliability. Verizon’s one-time bid for sustained superiority – millimeter wave “ultra-wideband” service – currently accounts for just one half of one percent of the time 5G users are connected.

Craig notes that Verizon’s initial gambit to retain network superiority in 5G was built on millimeter wave spectrum. The very limited propagation of millimeter wave spectrum, however, demands an incredibly dense wired backhaul network, at enormous cost, lest customers are simply out of range much of the time. Verizon is, anecdotally at least, well ahead of peers in network densification. Still, recent data (once again, from OpenSignal) suggests that, while 5G customers of Verizon’s 5G service are connected to mmWave spectrum much more often than are 5G customers of AT&T or T-Mobile, that is still too trivial a percentage of the time (one half of one percent). That’s hardly the basis of an advantaged network.

T-Mobile has an advantage in both spectrum propagation (coverage) and spectrum depth (speed). And Verizon still charges a premium. Retention and growth will be harder in a world where their network superiority has been ceded to a lower priced service.

In conclusion, Craig states that Verizon enjoyed years as the best network, but it will be harder to maintain that claim in the 5G era, where T-Mobile has a coverage and spectrum depth (speed) advantage. And where TMobile and the company’s Cable MVNO partners charge meaningfully lower prices than Verizon does for the same or better service.

Verizon’s Year End 2021 Priorities:

• Expand 5G leadership (?) and drive adoption; mmWave deployment and C-Band launch

• Customer differentiation and scaling premium experiences

• Transform the business; Tracfone acquisition and Verizon Media Group sale

• Accelerate and amplify 5 vectors of growth; Network-as-a-Service strategy

References:

https://www.lightreading.com/5g/verizon-has-150000-fixed-wireless-access-subs-/d/d-id/772925?

https://www.slashgear.com/verizon-5g-home-internet-expands-to-cover-more-cable-cutters-07694326/

Morgan Stanley finds little interest in 5G; Finland’s Oulu says 5G won’t mature till 2027

Morgan Stanley surveyed 3,500 broadband customers and found that only 4% of respondents said they would switch carriers to access new technologies like 5G. End users had little interest in an “innovative technology” like 5G, according to the survey results.

It should come as no surprise to IEEE Techblog readers that Finnish university researchers are warning that 5G technology won’t actually mature until the year 2027. Ari Pouttu, vice-director of the 6Genesis program at Finland’s University of Oulu, it might be years more before we see 5G’s “killer app.” Oulu is where a lot of cutting-edge network development happens, so readers should pay attention to what their researchers say.

Ari Pouttu, vice-director of the 6Genesis program at Finland’s University of Oulu, it might be years more before we see 5G’s “killer app.”

“5G is now being introduced, but we only have the first part of 5G in the market, and that’s 4G on steroids,” [5G NSA is 5G NR RAN with 4G LTE core and signaling). That’s not the real promise of 5G. The real promise of 5G is connecting all the objects, bringing intelligence into the service,” Pouttu said.

“The appearance of 5G not serving us more than 4G is partially true, partially wrong,” according to Pouttu. “When we go a few years into the future, the capacity of 4G systems comes to the limit, and we need 5G to continue this path.”

Pasi Leipala, CEO of Haltian, followed up with tacit agreement that the 5G era may be about changes in an ambient industrial world you don’t necessarily see. Haltian is an IoT company focused on smart office buildings and inventory sensors.

“If you have a pallet of something, 10,000 units, how do you track where those assets are going? How do you assure that nobody is stealing those, that they’re in the right place at the right time?” Leipala asked. But that kind of sensor density and energy efficiency will take 6G, not the current form of 5G, he said. “You always overestimate the near future and underestimate the far future,” he lamented.

However, all hope is not lost. According to a new Bloomberg article, some believe the metaverse is how wireless network operators will recoup their 5G investments.

Telecommunications companies are looking to build a platform based on the metaverse, an idea that inspired “Ready Player One” and online games by market darlings such as Roblox Corp. Early-stage examples include virtual and augmented reality headsets or glasses that provide immersive experiences. Advanced versions — still years away pending super-fast wireless data speeds — combine multiple technologies like holograms to bring the internet to life: 3D avatars of people working, interacting and relaxing in digital replicas of offices, factories and leisure venues.

Recognizing the business potential, telcos ranging from China Mobile Ltd. to Verizon Communications Inc. and SK Telecom Co. are jumping into the fray — alongside online-game developers — to build a “killer app” that could resemble a blend of today’s social media and e-commerce, but on steroids. Operators could earn a third more in revenue, potentially reaching $712 billion by 2030, if they introduce such innovative 5G applications on top of just laying pipes, according to a research by Ericsson AB’s research arm Consumer & IndustryLab.

Pernilla Jonsson of Ericsson’s Consumer & Industry Lab suggested that the metaverse might be a 5G “killer app” that would help operators avoid becoming dumb pipes.

“The metaverse is our future business model. It will be our core business platform,” Cho Ik-hwan, SK Telecom’s vice president and head of mixed reality development, told the publication. “We want to create a new kind of economic system. A very giant, very virtual economic system.”

“The metaverse will need the speed and capabilities of the faster network to fully optimize futuristic applications and keep pushing progress. It is critical to pay attention to these mind-bending and evolving applications. The metaverse transformation is global. It will impact us all,” according to an article published last year on Verizon’s website titled “The metaverse is coming – it just needed 5G.”

References:

https://www.lightreading.com/5g/is-sun-finally-starting-to-shine-on-5g/a/d-id/772907

https://www.pcmag.com/news/why-you-wont-really-feel-5g-until-2027

https://www.lightreading.com/aiautomation/the-metaverse-will-save-5g-thats-so-cute!/a/d-id/772368?