Month: October 2021

Nokia deploys shared 5G RAN (MORAN) with SoftBank and KDDI in Japan

Nokia today announced that it has been selected by Japanese mobile operators, SoftBank Corp. and KDDI as one of the vendors to deploy Japan’s shared RAN. This deployment will deliver 5G services to both SoftBank and KDDI subscribers in the country. Nokia will install a Multi-Operator Radio Access Network (MORAN) [1.], which will allow both companies to share the RAN while keeping core networks separate. Network sharing helps support efficient RAN deployments as base station sites and infrastructure (equipment) are shared.

Note 1. In MORAN everything in the RAN (antenna, tower, site, power) except the radios are shared between two or more network operators.

The two Japanese telcos announced plans to deploy a shared network, or a Multi-Operator Radio Access Network (MORAN), in June, using equipment from Ericsson and other vendors. We now know that Nokia is one of those other vendors. Ericsson equipment supports network sharing using both TDD (Time Division Duplex) and FDD (Frequency Division Duplex) as well as 4G/LTE and 5G New Radio (NR). The solution consists of Ericsson Radio System products such as RAN Compute (base band) , radio and transport – with the powerful system on a chip, Ericsson Silicon, bringing innovative various solutions such as Ericsson Spectrum Sharing and Ericsson Uplink Booster.

KDDI and SoftBank will particularly focus on quickly building robust 5G network leveraging Ericsson Radio System products and solutions for multiple-bands. Ericsson’s future-proof network-sharing solution will significantly contribute to their nationwide network deployment of 5G and beyond. Ericsson and the service providers have completed verifications and started to deploy the solution commercially.

Under this contract, Nokia will supply its latest AirScale products including baseband and radio platforms. Nokia’s MORAN is triple mode and covers LTE, 5G as well as Dynamic Spectrum Sharing. In particular, Nokia will provide its new generation of ReefShark System-on-Chip based plug-in cards to increase the capacity of the AirScale baseband. The new ReefShark-powered plug-in cards are easily installed and simplify the upgrade and extended operation of all AirScale deployments. They also deliver up to eight times more throughput compared to previous generations. Nokia’s modular AirScale baseband will enable SoftBank and KDDI to scale capacity flexibly and efficiently and as their 5G business evolves.

MORAN is a way for mobile operators to share radio access network infrastructure, reduce their costs, expand the coverage of their networks and achieve an efficient and effective roll-out of new technologies. The RAN uses dedicated radio frequencies assigned to each service provider ensuring they maintain independent control of their resources. Nokia supports a range of network sharing solutions suiting all operating scenarios. Nokia’s flexible MORAN solution can also be utilized by mobile operators and enterprises for private networks, as well as public networks or industrial campuses.

MORAN should help Softbank and KDDI roll out 5G faster and cheaper. Costs will decrease and subscriber coverage will be quicker. They are also working together on a shared rural coverage project announced 18 months ago, that will see them share base station assets to build out 5G more quickly in rural areas.

Tomohiro Sekiwa, Senior Vice President and CNO, SoftBank, said: “In order to deliver the best 5G experience to customers nationwide as quickly as possible, SoftBank is working with KDDI to develop a shared 5G network. In this effort, a Multi-Operator Radio Access Network is a key technology that will bring various efficiencies and we look forward to the high performance of Nokia’s products in this regard.”

Tatsuo Sato, Vice President and Managing Officer, Technology Planning, KDDI, said: “We are pleased to work closely with both Nokia and SoftBank to accelerate 5G network deployment across Japan. With this Multi-Operator Radio Access Network, we anticipate delivering the superior unique experiences of 5G to customers faster.”

Tommi Uitto, President of Mobile Networks at Nokia, said: “Nokia has been at the forefront of network sharing around the world since the deployment of the world’s first commercial shared network. We have a long-standing partnership with both SoftBank and KDDI and are excited to work collaboratively with them on this project. Our latest AirScale solutions will be utilized, including the new baseband plug-in cards to add capacity where it is needed and deliver best-in-class 5G connectivity to their customers.”

It will be interesting to see the impact that this network gear sharing deal has on SoftBank and KDDI’s respective 5G businesses in the coming months and years.

Resources:

Activate massive 5G capacity with Nokia AirScale

AirScale baseband | Nokia

AirScale Active Antennas | Nokia

AirScale Radio | Nokia

Network Sharing

References:

https://telecoms.com/511728/kddi-and-softbank-add-nokia-to-shared-5g-ran-ticket

https://www.ericsson.com/en/press-releases/2021/6/ericsson-sets-up-japans-first-multi-operator-ran-with-kddi-and-softbank

Network Infrastructure Sharing and the MORAN Concept:

https://www.itu.int/dms_pub/itu-s/opb/itujnl/S-ITUJNL-JFETF.V1I1-2020-P10-PDF-E.pdf

https://www.youtube.com/watch?v=VlzuxMR2xQ4

ONF and Deutsche Telekom Demonstrate Fully Disaggregated Open RAN and SD-WAN

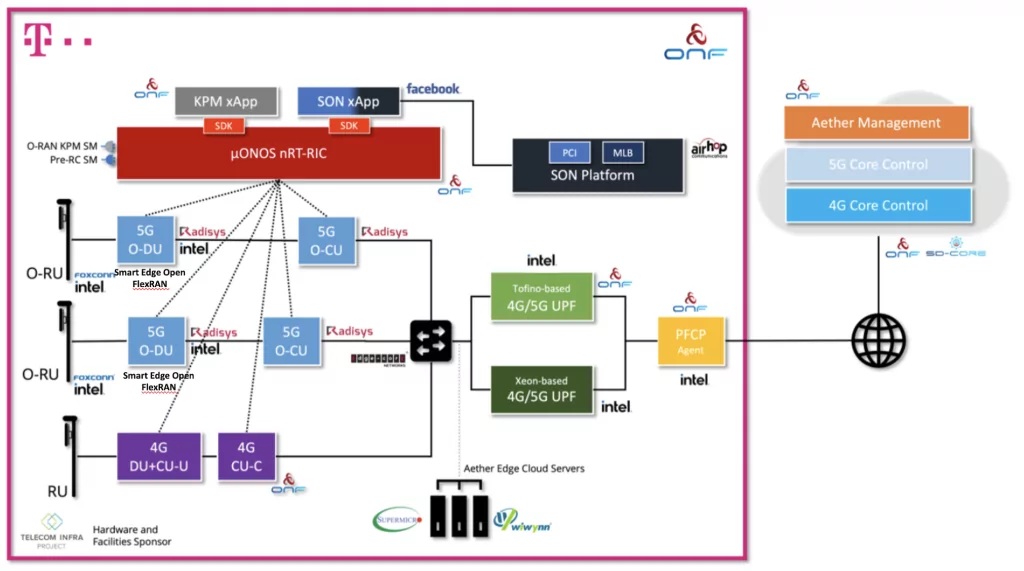

Deutsche Telekom is working with the Open Networking Foundation (ONF) and eight vendors to test software-defined radio access networks (SD-RAN) and Open RAN in what it calls a fully disaggregated system. This is the first field trial implementing fully disaggregated open RAN solutions using ONF’s RAN Intelligent Controller (RIC) software platform as defined by the O-RAN architecture. This 4G and 5G Standalone (SA) outdoor trial is live at Deutsche Telekom in Berlin, Germany.

In addition, the Facebook-backed Telecom Infra Project (TIP) is taking part by providing hardware and facilities out of the TIP Community Lab in Berlin hosted by Deutsche Telekom.

Carriers are investing in open RAN to enable a new breed of modular and customizable 5G solutions to accelerate innovation and enable the mix-and-match of best-of-breed components from multiple vendors. Open RAN gives operators choice and flexibility to customize and optimize their networks. This SD-RAN trial hosted by DT highlights the promise and flexibility of open RAN by integrating components from eight companies: AirHop, Edgecore, Facebook, Foxconn, Intel, Radisys, Supermicro and Wiwynn. Additionally, the Telecom Infra Project (TIP) is participating by providing hardware and facilities out of the TIP Community Lab in Berlin hosted by DT. The on-site field trial integration and testing is being coordinated and supported by Highstreet Technologies.

The live trial features horizontally disaggregated hardware (separate RU, DU, and CU units), as well as vertically disaggregated software components including an open source near real-time RIC (nRT-RIC) and xApps coming from the ONF’s SD-RAN project. By integrating proprietary and open source components, including a near real-time RIC and xApps, this ground-breaking trial exemplifies a model for how future open RAN deployments are envisioned to take shape.

The entirety of the trial is operationalized leveraging ONF’s Aether platform, a centrally-managed, multi-cloud, cloud-native platform providing Connectivity-as-a-Service, and highlights network slicing with multiple UPFs running at the edge. The SD-Core component of Aether provides 5G connectivity and the control plane running from the public cloud while SD-Fabric is a fully programmable network fabric optimized for the edge cloud used to instantiate a P4-based 4G/5G UPF in hardware.

Aether hosts the Radisys containerized CU while the Intel® Smart Edge Open (formerly known as OpenNESS) software toolkit hosts the Radisys DU to enable cloud-native deployment of the RAN workload with optimization on the 3rd Gen Intel® Xeon® Scalable processor and Intel® vRAN Dedicated Accelerator ACC100. The CU and DU are integrated with ONF’s nRT-RIC, xApps, SD-Core 5G core and Foxconn O-RU.

“The Berlin SD-RAN Open RAN Trial, is a momentous step towards realizing the vision of fully disaggregated and intelligent RAN, leveraging ONF’s leading open source RAN Intelligent Controller software platform. In addition to open fronthaul, this trial includes disaggregated RU/DU/CU units, and also vertically disaggregates the RIC and xApps according to SDN principles. Together, we are demonstrating the power of truly open RAN and ecosystem collaboration to accelerate innovation.”

– Alex Choi, Senior Vice President Strategy & Technology Innovation, Deutsche Telekom and Founding Board Member, O-RAN Alliance

“The SD-RAN Berlin Trial with DT is a significant industry milestone for open RAN. At ONF we are seeing tremendous interest from the mobile community for our open source implementation of the O-RAN architecture, and this trial demonstrates the maturity of the SD-RAN open source RIC and xApp development platform.”

– Guru Parulkar, Executive Director, ONF

“AirHop is thrilled to be participating in this DT SD-RAN trial. We are contributing commercially hardened 5G xApps that work with the complete Open RAN end-to-end solution. The trial demonstrates that commercial xApps can be quickly integrated and deployed using O-RAN defined standard interfaces to deliver automated performance optimization.”

– Yan Hui, CEO, AirHop

“Open systems are the future, and Edgecore is pleased to be leading the charge and to be providing open network hardware that is running software from ONF as part of this DT SD-RAN trial. It has been amazing working with this dynamic community, and a real pleasure to be collaborating with DT on this effort.”

– Jeff Catlin, VP of Technology, Edgecore Networks

“We are excited to see multiple ecosystem partners collaborating to test and trial this disaggregated Open RAN solution. We have made great progress with the RIC-xApp portability paradigm and we look forward to continuing to make contributions to the SD-RAN project.”

– Manish Singh, Head of Wireless Ecosystem Programs, Facebook

“Foxconn has contributed the Radio Units (RUs) that are deployed in the SD-RAN trial. Given that this represents the first deployment of a truly disaggregated RAN solution, we’ve been very pleased with the collaboration and commitment shown by the whole SD-RAN community.”

– Dr. Benjamin Wang, Sr. 5G RD Director, Infrastructure Product Division, Foxconn

“Our long-standing collaboration with ONF and its partners reflects our priority to collaborate with the Open Source community and aligns very well to initiatives such as Intel Smart Edge Open® targeted for open innovation and developer acceleration. It is great to see an entire portfolio of Intel technologies enabling ONF SD-RAN and SD-Core ranging from Intel® Xeon® Scalable processors, vRAN accelerators to software offerings such as Intel® FlexRAN and Smart Edge Open® get featured in this trial, paving the way to the next wave of disaggregated and intelligent networks.”

– Renu Navale, VP & GM in the Network Platforms Group, Intel

“The OCP and ONF have a synergistic relationship, with OCP focused on open hardware and ONF focused on open software that can run on OCP hardware. The SD-RAN trial with DT exemplifies this relationship, demonstrating OCP Inspired™ openEdge servers from Wiwynn, an OCP Certified Solution Provider, running critical components of the SD-RAN solution.”

– Steve Helvie, VP of Channel, Open Compute Project (OCP)

“As a founding member of the SD-RAN initiative with ONF, Radisys is excited to participate in this important SD-RAN trial at DT, demonstrating use cases of RAN optimization and multi-vendor interoperability. We worked closely with the ONF community to develop service models, use cases and in the end-to-end integration of this field trial. This is a significant step towards commercial adoption of O-RAN based solutions by operators.”

– Arun Bhikshesvaran, CEO, Radisys

“Supermicro is excited to have our servers included in the SD-RAN Berlin trial. This trial is a significant step in realizing the potential of open RAN, and it has provided a great opportunity for multi-vendor collaboration and learning. We are a strong supporter of open source and disaggregation, and believe that it is essential for enabling 5G edge, core and cloud networks.”

– Jeff Sharpe, Director, 5G / IoT Edge Solutions, Supermicro

“TIP is pleased to be collaborating to support the SD-RAN Berlin Trial. The RIA sub-group of the TIP OpenRAN project is prioritizing use cases for open RAN that are being highlighted by this effort, so we see terrific synergies working with ONF and the broader SD-RAN community to support this first-of- its-kind trial featuring a multi-vendor mix of RU/DU/CU controlled by an open RIC and xApps.”

– Attilio Zani, Executive Director, Telecom Infra Project

“Wiwynn is pleased to be providing our edge cloud optimized servers as part of the DT SD-RAN trial. These systems are designed for edge and telco applications, and are certified by ONF for the Aether platform used for this DT trial. We are committed to building solutions optimized for open RAN deployments, and we’re very excited to see this DT trial advancing the state-of-the-art for open RAN.”

-Steven Lu, Senior Vice President, Wiwynn

DEUTSCHE TELEKOM SD-RAN TRIAL EVENT:

ONF and DT will be co-hosting a virtual event October 19th offering an in-depth view into the trial and key learnings from the community. Featuring live keynotes and on-demand talks from operator and vendor leaders from across the open RAN movement. Register to hear about lessons learned directly from the experts who have deployed the first trial of its kind! The event is open to anyone.:

Deutsche Telekom SD-RAN Trial – Webinar

October 19th, 2021

5pm CEST, 11am EDT, 8am PDT

REGISTER HERE

References:

ONF and Deutsche Telekom Demonstrate Fully Disaggregated Open RAN with Open RIC Platform

Google Distributed Cloud for 5G network operators – another form of lock-in?

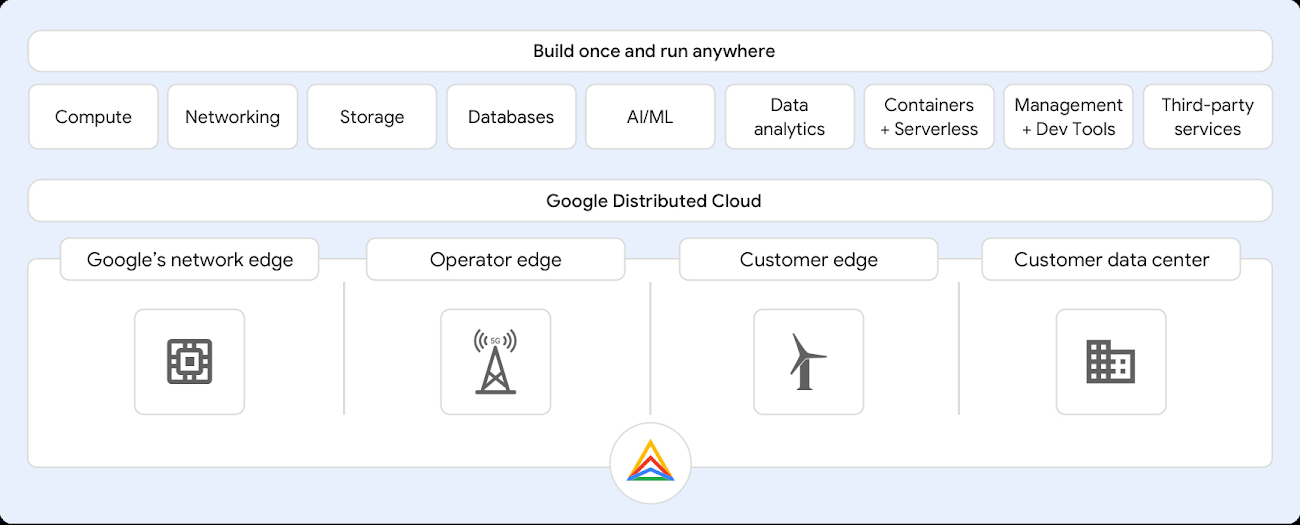

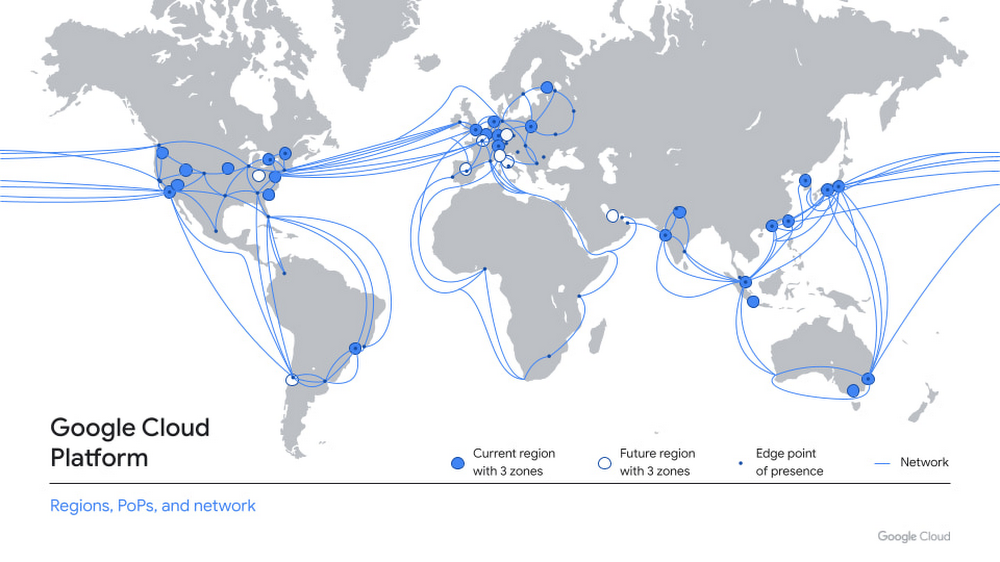

At Google Cloud Next ’21 the cloud giant announced Google Distributed Cloud, a portfolio of solutions consisting of hardware and software that extend Google cloud infrastructure to the edge and into the customer premises data center. This new offering permits wireless network operators to run their 5G core and radio access network (RAN) functions on Google Distributed Cloud in a variety of locations. These could include a telco’s own facilities, premises owned by customers or Google’s network of about 140 centers. One unifying theme is that hosting functions in a multitude of places – and not just a couple of big data centers – would shorten the distance that data signals must travel and cut service-interfering latency, a measure of the journey time. Functions can also be co-hosted with enterprise applications, according to Google.

In particular, Google Distributed Cloud can run across multiple locations, including:

- Google’s network edge – Allowing customers to leverage over 140+ Google network edge locations around the world.

- Operator edge – Enabling customers to take advantage of an operator’s edge network and benefit from 5G/LTE services offered by our leading communication service provider (CSP) partners. The operator edge is optimized to support low-latency use cases, running edge applications with stringent latency and bandwidth requirements.

- Customer edge – Supporting customer-owned edge or remote locations such as retail stores, factory floors, or branch offices, which require localized compute and processing directly in the edge locations.

- Customer data centers – Supporting customer-owned data centers and colocation facilities to address strict data security and privacy requirements, and to modernize on-premises deployments while meeting regulatory compliance.

The first products under this portfolio include Google Distributed Cloud Edge and Google Distributed Cloud Hosted. Google Distributed Cloud Edge is now available for preview, while Google Distributed Cloud Hosted set to become available in preview in the first half of 2022.

Google Distributed Cloud Edge is primarily aimed at wireless network operators. It is designed to exist in the operator edge, customer edge and Google edge locations, of which there are over 140 around the world.

while Google Distributed Cloud Hosted is meant for public-sector and commercial customers that need to meet strict data residency, security or privacy requirements. Both are fully managed and comprise hardware and software solutions, including artificial intelligence and analytics capabilities.

During a media briefing, Google Cloud’s VP and GM of Open Infrastructure Sachin Gupta said “This portfolio allows customers to focus on applications and business initiatives rather than management of their underlying infrastructure. In other words, they can just leave the complexity to us.”

Gupta added that the Distributed Cloud Edge product enables network operators to run 5G core and radio access network functions closer to users, allowing them to slash latency and “offer their enterprise customers high-speed bandwidth, with private 5G and localized compute.” In a blog, the executive added the product advances previously announced work with Ericsson and Nokia to deliver cloud-native network applications. He said that Distributed Cloud Hosted is a “safe and secure way to modernize on premises deployments without requiring any connectivity to Google Cloud.”

Google Distributed Cloud is built on Anthos, an open-source-based platform that unifies the management of infrastructure and applications across on-premises, edge, and in multiple public clouds, all while offering consistent operation at scale. Google Distributed Cloud taps into our planet-scale infrastructure that delivers the highest levels of performance, availability, and security, while Anthos running on Google-managed hardware at the customer or edge location provides a services platform on which to run applications securely and remotely.

Using Google Distributed Cloud, customers can migrate or modernize applications and process data locally with Google Cloud services, including databases, machine learning, data analytics and container management. Customers can also leverage third-party services from leading vendors in their own dedicated environment. At launch, a diverse portfolio of partners, including Cisco, Dell, HPE, and NetApp, will support the service.

As Google’s global network increases in reach, the company will be building out service-centric networking capabilities to simplify everything from connectivity to observability. For organizations with interconnects, VPNs, and SD-WANs, Networking Connectivity Center provides a centralized management model, with monitoring and visualization through our Network Intelligence Center. And, with Private Service Connect, partners and customers such as Bloomberg, MongoDB, and Elastic are now able to easily connect services without having to configure the underlying network.

Enterprises with workloads both on-premises and in the cloud can leverage hybrid load balancing to securely optimize application delivery. To help you detect and prevent malicious bot attacks, we recently integrated reCAPTCHA Enterprise with Cloud Amor. Together with Cloud IDS, the Google network edge is fortified with best-in-class security.

Obviously, virtualization is a network operator prerequisite so that network software runs on common, off-the-shelf compute servers. After virtualizing, network operators could theoretically integrate their networks with Google’s distributed cloud.

Iain Morris of Light Reading offers his opinion:

Operators might do this if they believe a deal with Google costs less than operating a private cloud, or if it promises other benefits. But it means giving the hyper-scaler a big say over technology strategy and would have been inconceivable just a few years ago, when the valuation gap between telecom players and Internet firms was not so extreme and telcos were much warier of tie-ups.

For a start, it would obviously hand prominent roles to Anthos, Google’s application management platform, and Kubernetes, a container orchestration platform that Google originally designed. Even when Google’s facilities are not being used, it will effectively manage the hardware and software.

Obviously, neither Ericsson or Nokia were listed as partners or systems integrators as their purpose built wireless network equipment and 5G SA core network software are in direct competition with 5G deployments using hyper-scale cloud service providers (AWS, Azure, Google Cloud) technology. Ericsson will launch virtual RAN software next year while Nokia´s AirScale Cloud RAN solution is in trials with major wireless network operators, including AT&T (which has outsourced its 5G SA core network to Amazon AWS). Nonetheless, those two major network equipment vendors made supportive comments:

“The announcement of Google Distributed Cloud supports Ericsson’s vision of the network becoming a platform of innovation, enabling companies across the ecosystem to deliver the applications of the future the way they need to, unlocking the full potential of 5G and edge,” said Rishi Bhaskar, Head of Hyperscale Cloud Providers for Ericsson North America.

“This announcement builds on our on-going partnership with Google Cloud to develop Nokia cloud-native 5G core and Nokia radio solutions for Google’s edge computing platform,” said Nishant Batra, Nokia Chief Strategy and Technology Officer. “By extending this relationship into Google Distributed Cloud Edge, we will increase customer choice and flexibility, ultimately helping our global customer base with multiple cloud-based solutions to deliver 5G services on the network edge.”

Curiously, there was no mention of software partners in Google’s announcement, but any RAN software would have to work with the underlying base station hardware. Who takes responsibility for that is something 5G network operators must resolve before committing to Google Cloud.

Iain says that network operators teaming up with cloud service providers is a new form of lock-in substituting cloud hyper-scalers from wireless network equipment vendors. He wrote:

What’s entirely unclear is why operators should worry less about dependency on Google than they currently do about their heavy reliance on Ericsson, Huawei and Nokia. Switching from one RAN vendor to another is costly but feasible, as swap-outs of Huawei in Europe are showing. Moving from one public cloud to another may be as tricky as quitting a crime syndicate. In 2019, Snapchat developer Snap warned in a regulatory filing that moving systems between public clouds would be “difficult to implement” and demand “significant time and expense.”

If this and other hyper-scaler offers take off, the real losers would probably not be Ericsson and Nokia – which can still sell radio units and provide RAN software – but the vendors of private cloud software, such as VMware and Red Hat (owned by IBM). More generally, the public cloud could also be a threat to some of Google’s own hardware partners. “The server vendors (Dell, HPE etc) also lose out,” says James Crawshaw, a principal analyst with Omdia (a sister company to Light Reading, in an email. “Although they are going to be building and shipping the Google boxes, I suspect the margins on these will be lower than the regular servers they sell enterprises.”

Few telcos have been as brave/reckless (delete according to bias) as Dish and gone all-in with a public cloud. That is partly because brownfield operators would be writing off the servers they already own. Nevertheless, Crawshaw expects public cloud usage to keep rising. “Servers are depreciated over three to seven years depending on the business and how fresh they like their IT,” he says. “So while the telcos will continue to run their own clouds, they will increase their public cloud usage over time and only partially renew their private estate.”

AT&T, Bell Canada, Telus, Telenet, TIM, Reliance Jio and Orange are all on the growing list of operators that have put some IT workloads on Google Cloud. “Some of these are running packet core and RAN applications as well,” says Gupta. Contrast that with Dish Network which is wholly reliant on the AWS public cloud and AT&T which has its own physical 5G RAN, but will use the public AWS cloud for its 5G SA core network.

“Some years ago, everyone was saying we would have vendor lock-in with Ericsson, Huawei and Nokia and no one mentioned Oracle and Cisco and now the light is on hyper-scalers,” said Yves Bellego, Orange’s director of network strategy, during a recent interview with Light Reading. “In fact, that risk is something we have always been very concerned about.” That would imply cloud hyper-scaler lock-in is something network operators must carefully evaluate.

…………………………………………………………………………………………………………………………………………….

References:

https://www.fiercetelecom.com/telecom/google-targets-telcos-new-distributed-cloud-infrastructure

https://telecoms.com/511704/google-launches-a-more-flexible-iteration-of-its-cloud-portfolio/

Draft new ITU-R report: Applications of IMT (4G, 5G) for Specific Societal, Industrial and Enterprise Usages

Introduction and Call for Contributions:

A preliminary new ITU-R draft report M.[imt.industry] addresses the usage, technical and operational aspects and capabilities of IMT for meeting specific needs of societal, industrial and enterprise usages. ITU-R WP 5D invites the views of External Organizations (Including 3GPP TSG SA WG 6 (SA6)) involved in standardization and development of applications of IMT to provide industrial and enterprise usages and applications, required capabilities, technical and operational aspects and any other related material that would facilitate in completion of this Report.

External organizations may wish to provide information on the relevant work as indicated in Question ITU-R 262/5. External Organizations are invited to submit material preferably to the 40th meeting of WP 5D but no later than 41st meeting of WP 5D which is planned for 13-24 June 2022.

ITU-R WP 5D looks forward to collaborating with External Organizations on this matter.

Backgrounder:

ITU-R Report M.2441, published in 2018, provided an initial compilation of usage of IMT in specific applications. Further, it introduces potential new emerging applications of IMT in areas beyond traditional voice, data and entertainment type communications as envisaged in the vision for IMT-2020. PPDR, one of the specific applications of IMT is addressed in Report ITU-R M.2291.

This report has been developed in response to Question ITU-R 262/5 which calls upon ITU-R to study specific industrial and enterprise applications, their emerging usages, and their functionalities, that may be supported by IMT.

Today’s industrial automation is powered by ICT technology and this trend will increase manifold with advent of new broadband mobile technologies such as IMT-2020 (5G), leading to increased business efficiencies, improved safety, and enhanced market agility. Industry 4.0 enables industries to fuse physical with digital processes by connecting all sensors and actuators, machines and workers in the most flexible way available. Tethering them to a wired network infrastructure is expensive and, ultimately, it will limit the possible applications of Industry 4.0. Industrial grade private wireless will unleash its real potential by providing the most flexible and cost-effective way to implement a wide range of Industry 4.0 applications.

Current IT based automation solutions are well adapted for day-to-day business communications but are limited in reliability, security, predictable performance, multiuser capacity and mobility, all features which are required for operational applications that are business or mission critical. Similarly, applications in mines, port terminals or airports require large coverage area, low latency and challenging environments, which so far only two-way mission critical radios could meet. In both mining and port terminals, remotely operated, autonomous vehicles, such as trucks, cranes and straddle carriers are used requiring highly reliable mission critical mobile communications.

Take manufacturing, with thousands of factories with more than 100 employees, as an example, typical business cases revolve around controlling the production process, improving material management, improving safety, and introducing new tools. Research has shown that manufacturers can expect to see a tenfold increase in their returns on investment (ROIs) with IMT-2020, while warehouse owners can expect a staggering fourteenfold increase in ROI. Fortunately, IMT-2020 is available in configurations perfectly suited to building industrial-strength private wireless networks to support Industry 4.0. They bring the best features of wireless and cable connectivity and have proven their capabilities both in large consumer mobile networks area as well as in many industrial segments. The time is ripe for many industries to leverage private and captive IMT-2020 to increase efficiencies and automation. In simple terms –

(i) A private network is a dedicated network of the enterprise involving connections of the people, systems and processes of the enterprise.

(ii) A private network is a dedicated network by the enterprise setup internally in the enterprise by internal IT teams or outsourced.

(iii) A private network is a dedicated network for the enterprise to enable communication infrastructure for the systems and people associated with the enterprise.

The emergence of ultrafast IMT-2020 technology in higher (mmWave) frequency bands as well provides manufacturers with the much-needed reliable connectivity solutions, enabling critical communications for wireless control of machines and manufacturing robots, and this will unlock the full potential of Industry 4.0.

Apart from manufacturing, many other industries are also looking at IMT-2020 as the backbone for their equivalent of the Fourth Industrial Revolution. The opportunity to address industrial connectivity needs of a range of industries include diverse segments with diverse needs, such as those in the mining, port, energy and utilities, automotive and transport, public safety, media and entertainment, healthcare, agriculture and education industries, among others.

Some recent trial of IMT in port operations demonstrated the “5G New Radio (5G NR)” capabilities for critical communications enablers such as ultra-reliable low-latency communication (URLLC), enhanced mobile broadband (eMBB) to support traffic control, AR/VR headsets and IoT sensors mounted on mobile barges and provides countless possibilities to improve efficiency and sustainability in seaports and other complex and changing industrial environments. In response to the impact of COVID-19 pandemic some ports are increasing/accelerating their adoption of digital processes, automation and other technologies to enhance efficiency and resiliency to crises such as a global pandemic.

Similarly, in mining exploration sites, the drilling productivity could be substantially increased through automation of its drills alone. Additional savings from increased usage of equipment could also lead to lower capital expenditures for mines (CapEx) as well as a better safety and working environments for their personnel.

Even the most advanced factories of today still largely depend on inexpensive unlicensed wireless networks that have several drawbacks, such as lack of protection and potential interference in dense settings and complex fixed connections that are difficult to manage in large industrial settings. While the unlicensed spectrum is freely available, it is severely limited in quality of service (QoS) and support for mobility. In smart manufacturing, such networks cannot support the mobile requirements of automated guided vehicles (AGVs) or the even some of the faster moving arms of robots. It also does not support low power requirements of sensors and other IoT devices. Further, it cannot support the high density of sensors, devices, robots, workers and vehicles that are operating in a typical manufacturing plant.

An example of an application in health care that need critical communications that is supported by new capabilities of IMT is remote robotic surgery. A latency of 1 millisecond is critical in providing haptic feedback to a surgeon that is connected through a mobile connection to a surgical robot. A high data rate is needed to transfer high-definition image streams. As an ongoing surgery cannot be interrupted an ultra-reliable communication is needed to keep connection down-time and packet loss very low.

A new generation of private IMT networks is emerging to address critical wireless communication requirements in public safety, manufacturing industries, and critical infrastructure. These private IMT networks are physical or virtual cellular systems that have been deployed for private use by a government, company or group of companies. A number of administrations took the lead to enable locally licensed or geographically shared IMT spectrum available for enterprise use and have begun to recognize spectrum sharing and localised broadband networks in providing flexibility and meeting the needs of critical communications by vertical industries and enterprises. Some administrations have decided to partition the IMT spectrum between commercial carriers and private broadband and others enabled opportunistic use and dynamic access to IMT spectrum that is licensed to commercial carriers.

Industrial and enterprise usages and applications supported by IMT:

- IMT applications in mining sector

- IMT applications in oil and gas sector

- IMT applications in distribution and logistics

- IMT applications in construction and similar usages

- IMT applications in enterprises and retail sector

- IMT applications in healthcare

- IMT applications in utilities

- IMT applications community and education sector

- IMT applications in manufacturing

- IMT applications in airports and ports

- IMT applications in the agriculture sector

- IMT applications for in-flight passengers’ broadband communication

Required capabilities of Industrial and Enterprise usages supported by IMT:

[Editor notes: This section, when completed, will include categories of applications/usages and corresponding requirements supported by IMT]

Technical and operational aspect of industrial and enterprise usages supported by IMT:

TBD

Case studies:

TBD

Spectrum aspects:

[Editor’s note: Frequency bands, if any, can be added later from contributions]

Private IMT broadband networks need to operate in frequency bands identified for IMT in order to benefit from the economies of scale of the global IMT ecosystem. The choice of which frequency band(s) to use for local area networks is determined at the national level.

IMT frequency bands in which local area private networks have been deployed or are being planned include: TBD

Editor’s Note: ITU-R M.1036 recommendation titled, ‘Frequency arrangements for implementation of the terrestrial component of International Mobile Telecommunications (IMT) in the bands identified for IMT in the Radio Regulations,” is used for public terrestrial IMT networks.

Courtesy of WSJ: Here’s a yacht equipped with the Meridian 5G Dome Router, for 5G connectivity offshore. PHOTO: MOTORYACHT MUSASHI

Regulatory aspects:

Increased use of local (small cell) private network deployments can expand wireless capacity within existing spectrum resources.

Alternative spectrum allocation mechanisms may be needed to grant spectrum access to local area private networks to enable spectrum sharing by multiple networks operating in a portion of a frequency band or share spectrum with incumbent networks.

National Table of Frequency Allocations (NTFAs) primarily specify the radio services authorized by a national administration in frequency bands and the entities which have access to them. Frequency bands may be allocated to certain services or application on an “exclusive” or “shared” basis. The Licensed Shared Access (LSA) concept has been originally introduced as an enabler to unlock access to additional frequency bands for mobile broadband under individual licensed regime while maintaining incumbent uses. It was also developed with the aim of making a dynamic use of spectrum possible, whenever and wherever it is unused by incumbent users.[5]

LSA offers a regulatory tool to make available additional spectrum resource for use by mobile broadband when spectrum re-farming is not feasible or desirable. It is however defined as a general concept which does not specify the nature of the incumbents and LSA users. LSA licensees and incumbents operate different applications and are subject to different regulatory constraints. They would each have exclusive individual access to a portion of spectrum at a given location and time.[5]

Spectrum access mechanisms to enable spectrum sharing and deployment of local area private networks include: TBD

Dynamic spectrum access:

In the context of ITU-R Report SM.2405, dynamic spectrum access (DSA) stands for the possibility of a radio system implementing cognitive radio systems (CRS) capabilities to operate on a temporary unused/unoccupied spectrum and to adapt or cease the use of such spectrum in response to other users of the band. Cognitive Radio System (CRS) is defined as a radio system employing technology that allows the system to obtain knowledge of its operational and geographical environment, established policies and its internal state; to dynamically and autonomously adjust its operational parameters and protocols according to its obtained knowledge in order to achieve predefined objectives; and to learn from the results obtained.

In USA, the FCC established the Citizens Broadband Radio Service (CBRS) in April of 2015 and created a three-tiered access and authorization framework to accommodate shared use of the band 3550-3700 MHz between private organizations and incumbent military radar and fixed satellite stations. Access and operations are managed through the use of an automated frequency coordination system, called Spectrum Access System (SAS).

Related ITU-R documents:

[1] Question ITU-R 262/5 – Usage of the terrestrial component of IMT systems for specific applications. (Copy reproduced in Attachment 2).

[2] Recommendation ITU-R M.2083 – Framework and overall objectives of the future development of IMT for 2020 and beyond.

[3] Report ITU-R M.2440 – The use of the terrestrial component of International Mobile Telecommunications (IMT) for Narrowband and Broadband Machine-Type Communications.

[4] Report ITU-R M.2441 – Emerging usage of the terrestrial component of International Mobile Telecommunication (IMT).

[5] Report ITU-R SM.2404 – Regulatory tools to support enhanced shared use of the spectrum

[6] Report ITU-R SM.2405 – Spectrum management principles, challenges and issues related to dynamic access to frequency bands by means of radio systems employing cognitive capabilities

Telecom Italia (TIM) launches satellite Internet service; partners with Oracle for multi-cloud

Telecom Italia (TIM) is launching the new TIM SUPER SAT Internet service for new customers who live in areas of Italy not yet covered by fixed broadband and ultra-broadband networks. With this technology and the exclusive agreement signed recently with Eutelsat, customers will be able to browse at speeds up to 100M bit/s in download and 5M bit/s in upload.

The initiative confirms TIM’s commitment to overcome the digital divide, by providing Italian families with super-fast satellite Internet access in geographical areas not yet reached by TIM’s Fiber or Fixed Wireless Access (FWA) networks.

TIM Super Sat costs €49.90 (US$43) per month including a satellite kit complete with a satellite dish, a Wi-Fi modem and installation by a technician. It comes with a fair usage policy of 100GB per month at maximum speeds, after which speeds are reduced to 4Mbit/s (1Mbit/s upload).

The new TIM SUPER SAT offer also includes the sale of a satellite kit complete with a satellite dish, a Wi-Fi modem and installation by a specialized technician.

The service comes at something of a premium compared to terrestrial services: TIM currently offers 40Mbit/s 5G FWA services for €29.90 ($26) a month and FTTH with 1Gbit/s speeds also at €29.90 per month.

Although not mentioned in the October 8th press release, the new TIM Super Sat service is the result of an agreement signed by TIM and France-based satellite company Eutelsat in November 2020. TIM signed the strategic agreement with Eutelsat to provide connectivity to the most isolated and remote areas of the country. The satellite, due to enter into service in 2022, will also be built by Thales Alenia Space and will have Ka-band capacity of 500 Gbit/s.

Under its agreement with Eutelsat, TIM is purchasing the entire transmission capacity for Italy on the two new high-performance satellites that Eutelsat has either activated or will activate in the coming months: the Konnect and Konnect VHTS (very high throughput satellite).

In service since November 2020, Eutelsat Konnect has a total capacity of 75 Gbit/s and is capable of offering speeds of up to 100 Mbit/s in 15 European countries. Konnect VHTS is expected to allow speeds of up to 200 Mbit/s once it comes into operation.

For more information and to request the offer, interested customers can consult the usual channels and the dedicated page TIM SUPER SAT.

Italy Lags in European Broadband Internet:

In 2020, Italy ranked 24 out of 27 European Union member states in its take-up of ultrafast Internet of at least 100 Mbit/s, according to the Digital Economy and Society Index (DESI).

In its 2021 annual report, national statistics agency Istat noted that while Italy’s national recovery program has the “ambitious goal” of providing broadband coverage of at least 1 Gbit/s to the entire population by 2025, Italy is currently lagging far behind in the availability of ultra-broadband connections compared with other EU countries.

………………………………………………………………………………………………………………………………..

TIM and Oracle team up to offer multi-cloud services in Italy:

Oracle, TIM (Telecom Italia) and Noovle (TIM Group’s cloud company) [1.], today announced that they have signed a collaboration agreement as part of a plan to offer multi-cloud services [2.] for enterprises and public sector organizations in Italy.

Note 1. Launched in January 2021, Noovle SpA is TIM Group’s dedicated center of excellence for cloud and edge computing, with a focus on supplying bespoke multi-cloud services to TIM customers.

Note 2. Multi-cloud refers to using several instances of multiple clouds from different vendors. With multi-cloud, the use of different vendors means access to different features, underlying infrastructure, security, and other elements specific to the vendor’s offerings. Multi-cloud ties this all together, allowing enterprises and organizations to have access across vendors so data can be placed in an environment best suited to its capabilities.

………………………………………………………………………………………………………………………………….

Under the agreement, TIM Group plans to utilize advanced cloud infrastructure technologies to support its goal of advancing Italy’s digital modernization and establishing its position, through Noovle, as the market reference point for enterprise multi-cloud services in the country.

The three companies plan to bring their respective assets and expertise to develop and manage multi-cloud architecture services for Italian enterprises.

- Noovle brings an extensive data center network in Italy, which has been developed to the highest technological, security and environmental standards in line with TIM Group’s environmental, social and governance (ESG) goals.

- TIM provides an extensive sales network across the country, enabling the integration of cloud services with the Group’s ICT services portfolio: from IoT and 5G services to cybersecurity and advanced fixed and mobile connectivity services.

- Oracle brings its next-generation cloud infrastructure with its built-in security, superior performance, and availability, which is ideally suited for mission-critical and cloud native workloads in large enterprise and public sector environments.

A collaborative model, which includes connecting major cloud providers’ platforms in a multi-cloud environment, will support public and private organizations in addressing the challenges of digital transformation through advanced multi-cloud services, enabling operational efficiency, lower costs, and high security standards.

Oracle’s hybrid and multi-cloud strategy also aligns closely with TIM Group’s objectives in ensuring that all customer data is hosted in-country and customers have a cloud solution that meets their data sovereignty needs. TIM selected Oracle Cloud Infrastructure as part of its multi-cloud strategy to migrate the Group’s mission-critical data management workloads to the public cloud.

References:

https://www.gruppotim.it/en/press-archive/market/2021/CS-TIM-SUPER-SAT-ENG.html

https://www.lightreading.com/satellite/tim-launches-satellite-service-for-underserved/d/d-id/772683?

https://www.eutelsat.com/en/satellites.html

https://www.gruppotim.it/en/press-archive/market/2021/PR-TIM-Noovle-Oracle-ENG-08102021.html

Bharti Airtel, Ericsson conduct India’s first rural 5G trial; Ericsson – India Q & A

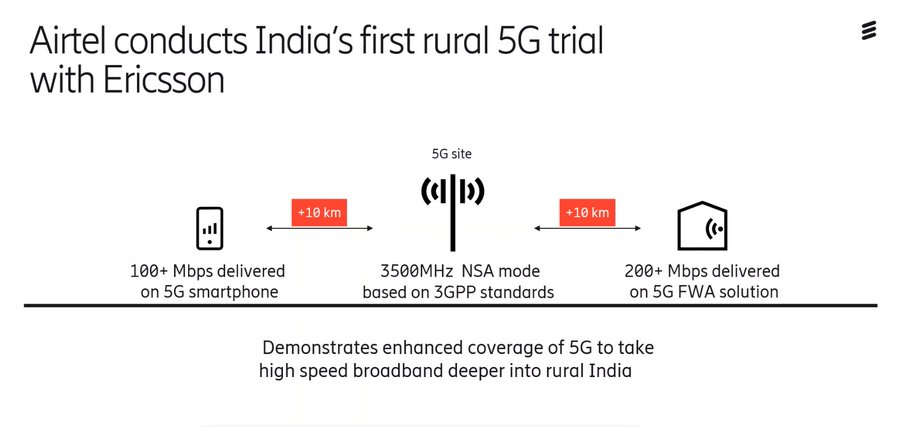

On October 5th Bharti Airtel said it has conducted India’s first rural 5G trial with Swedish telecoms equipment maker Ericsson. The demonstration took place in Bhaipur Bramanan village on the outskirts of Delhi/NCR using 5G trial spectrum allocated by India’s Department of Telecommunications (DoT).

“The trial showcases the massive potential offered by 5G towards bridging the digital divide by enabling access to high speed broadband through solutions such as enhanced mobile broadband (eMBB) and Fixed Wireless Access (FWA) services,” the companies said in a joint statement.

The trial demonstrated over 200Mbps throughput on 3GPP-compliant 5G Fixed Wireless Access (FWA) device located more than 10km from the site.

The trial also showcased that a commercially available 3GPP-based 5G smartphone could connect to the test network and record over 100Mbps speeds at a distance of more than 10km from the site.

The 5G site was powered by Ericsson’s 3GPP-compliant 5G radio. The trial was carried out by utilizing the allocated mid-band trial spectrum in 3500MHz band and existing FDD spectrum band.

“Having demonstrated India’s first 5G network and also the first 5G cloud gaming experience, Airtel is proud to have also conducted the nation’s first 5G trial in a rural geography. 5G will be a transformational technology when it comes to delivering broadband coverage to the last mile through use cases like FWA and contribute to a more inclusive digital economy,” said Randeep Singh Sekhon, Airtel CTO.

“The technology milestone of extended coverage achieved by Ericsson and Airtel as part of the ongoing 5G trial in India is even more significant since it demonstrates how 5G can ‘connect the unconnected’ in India, enable faster 5G rollout and truly help India realize its ‘Digital India’ vision,” added Nunzio Mirtillo, Head of Ericsson South east Asia, Oceania and India.

According to an Ericsson study, on average, a 10% increase in the Mobile Broadband adoption ratio causes a 0.8% increase in GDP.

Airtel has previously demonstrated cloud gaming in a 5G environment, as part of its 5G trials in Gurgaon’s Manesar. It had used the mid-band spectrum provided by the DoT for this purpose. The Sunil Mittal-led telco has also been rallying to ensure that any new 5G handset sold in India must support all existing bands in India for 5G, including the mmWave bands.

Earlier this year, Airtel successfully demonstrated 5G services over a live 4G-LTE network in Hyderabad, marking an industry first. It is also conducting 5G trials in multiple cities across India and validating technologies and use cases through the trial spectrum allotted by the DoT . Airtel has partnered with Ericsson and Nokia for these trials.

………………………………………………………………………………………………………………………

Q and A with Nunzio Mirtillo, head of Ericsson (Southeast Asia, Oceania and India):

How has been the market performing for Ericsson this year?

We have been doing well in India and increasing our market share constantly. Over the past three/four years, we have been increasing our market share in India and we have kept our market share when the merger with Vodafone and Idea happened. When it comes to Bharti, we have increased market share substantially in the last few years, both on core and on radio, showing two things – one, our willingness to stay and increase our presence in India, and two, that we are competitive. Because you can be willing to do something but then you also need to be competitive in terms of technology, in terms of TCO and we have been showing that. And on top of that we have been delivering quite a good quality of service to our customers because that is ultimately what counts the most.

Have your telco partners been spending on network expansion aggressively?

We know the situation of Vodafone Idea, and I believe they have a great chance to do well in India and I think they will. And now with the latest from the government, I hope they will have a nice restart. When it comes to Jio we are not a relevant partner with Jio when it comes to the radio business, although we work with Jio. I think they have been also doing their job and their investment in a nice way. But Bharti has accelerated quite a lot in the last few years, and you can see the result in their market evaluation and also in terms of subscriber acquisition, ARPU increase, and we have been part of that journey, partnering with them as well. Showing that India is a market where if you do invest, you provide network quality and you have the right strategy and the right focus, the market is there. And if you do well, you will get the payback for that.

How do you see this whole 5G story panning out in the Indian market?

The sooner the better for the country actually. As everyone says in Q1, the spectrum will be made available from the government to the operators. So, I really hope so. India has been a bit sleepy for a while but then in the last three, four years it really did catch up quite a lot on 4G. So now the country should not lose momentum.

Secondly, the government should make available at least between 80 to 100 megahertz of 3.5GHz or the mid-band to the existing operators and also make sure that they auction millimeter wave spectrum which is a 400 megahertz which will be very much needed going forward to match the tremendous demand of mobile broadband that will be there in the future. And also, you also need to take care of the transport network, so we also need enough spectrum on the E band for connecting the 5G networks.

That’s what we believe and that’s the basic and India cannot, in my view, go below basic because there’s the Digital Highway for the country, it’s not only kind of business as such. It’s really a vital infrastructure for the future of India. And they also need to make sure that they deliver that spectrum at a reasonable price because otherwise they will impact from the start the ones that are supposed to invest.

I think they will be reasonable, because I have seen a lot of good things in India in the last few years with the tremendous push shown on Digital India, Make in India, and it’s all good programs.

References:

Bloomberg: U.S. Billionaire’s Battle Over FCC’s 12 GHz Spectrum Policy

Charlie Ergen of Dish Network and Michael Dell of Dell Technologies have a plan to open up little-used wireless frequencies to millions of customers with a new 5G service. However, another billionaire strenuously objects. Elon Musk’s SpaceX filed an objection with the U.S. Federal Communications Commission (FCC), which governs airwaves distribution, saying the “scheme” would wreck his broadband-from-orbit service.

Dish Network responded with an FCC filing that accused SpaceX of “flimsy” and “far-fetched” criticism. RS Access LLC, a Dell company, cited what it calls SpaceX’s “long history of misleading information, rule-flaunting, and ad hominem attacks.”

The billionaires paths collide in a swath of spectrum known as the 12 gigahertz band [1.] Ergen and Dell have asked the FCC to allow higher-power traffic in 12 gigahertz airwaves they control in cities around the U.S. That’s 82 markets including New York and Chicago for Dish, and 60 markets including Austin, Texas and Omaha, Nebraska for Dell’s airwaves company, RS Access.

……………………………………………………………………………………………………………………………………………

Note 1. 12 GHz (more precisely 12.2-12.7 GHz Band ) is NOT one of the approved frequency bands in the revision to ITU Recommendation M.1036-6, which specifies ALL frequency bands for the TERRESTRIAL component of IMT (including IMT 2020). Despite that, the FCC is considering expanded terrestrial service rights in 500 megahertz of mid-band spectrum between 12.2-12.7 GHz (12 GHz band) without causing harmful interference to incumbent licensees.

………………………………………………………………………………………………………………………………………..

The 12 GHz spectrum band is currently restricted to one-way use. License holders include SpaceX, AT&T/DirecTV, Dish and other satellite providers, as well as companies that use the spectrum for downstream fixed wireless communications.

Some license holders, including Dish and fixed wireless provider RS Access, want the FCC to allow two-way use of the band. To support that view, RS Access submitted the RKF Engineering study that concluded that two-way use of the band would not interfere with incumbent users to the FCC.

Roberson and Associates found that 1 MHz of 12 GHz spectrum can carry 3.76 times as much data as 1 MHz of 28 GHz spectrum under peak throughput conditions.

Long-time 12 GHz 5G proponent RS Access refers to a report that identifies recent technology advances for making the 12 GHz band very desirable for 5G, including Massive MIMO, beamforming and 5G carrier aggregation.

………………………………………………………………………………………………………………………………………

This raucous battle of billionaires stands out on the ordinarily placid docket of the FCC, which is more often limited to detailed technical concerns such as antenna characteristics and signal power/ attenuation. It reflects the fortunes to be made as the U.S. moves toward 5G networks that will be used in many places, depending on the use case. A government auction earlier this year of 5G airwaves brought in $81 billion as the largest U.S. wireless providers snapped up frequencies; another airwaves sale that could net $25 billion is under way.

“It says they ain’t making spectrum no more!” said Tom Wheeler, a former FCC chairman. Spectrum describes the array of frequencies that companies use to offer telecommunications.

Space X also uses the 12 gigahertz frequencies. In FCC filings the company says the proposed higher-power signals could overwhelm the faint broadband signals that travel from its orbiting fleet of 1,500 or more satellites to customers’ rooftop receiving dishes.

Currently, services in the 12 gigahertz band are limited to low power under FCC rules designed to avoid interference with other users. Airwaves with higher power are typically worth more money, since their signals can travel farther and reach more customers. The increased potency can also increase the risk of overpowering other users’ signals.

Dish “has mastered the use of empty promises and attacks on competitors,” SpaceX told the FCC in a filing. Dell’s spectrum-holding RS Access told the FCC that SpaceX is offering a “false premise.” Dish then accused SpaceX of mounting an “attempt to obfuscate the issues.”

The fight has been brewing for at least five years. Dish and other holders of 12 gigahertz airwaves in 2016 asked the FCC to boost power for terrestrial users of the airwaves, citing skyrocketing demand for mobile data. At the time SpaceX’s first Starlink broadband satellite was three years from its 2019 launch. Dish and its partners at the time suggested satellite services should lose rights in the band.

Dell’s investment firm had made its purchase of 12 gigahertz airwaves via RS Access, which reached for influence inside the Beltway. It hired former House telecommunications counsel Justin Lilley, according to an October 2020 filing. Lilley’s roster of clients has included spectrum innovator Ligado Networks, wireless giant T-Mobile US and Facebook.

Lobbying expenses surged. Dell’s MSD Capital with no lobbying expenditures since its founding in 1998, spent $150,000 on lobbying in 2020, according to data compiled by Open Secrets, a non-profit that tracks money in Washington.

Dish, with a longtime presence in Washington, spent $1.8 million lobbying in 2020 and SpaceX spent $2.2 million, with each engaging more than three dozen lobbyists according to Open Secrets.

Dell called then-FCC Chairman Ajit Pai twice, in September and November of 2020. Ergen and Pai spoke in July of 2020. On Dec. 23, Musk called Pai — after two earlier calls between the two, according to FCC disclosure filings.

The FCC began its formal consideration with a 4-0 vote in January 2021, during the closing days of Ajit Pai’s tenure as FCC Chairman. The Republican left the agency following the presidential election, leaving the issue to the current FCC that is split 2-to-2 along partisan party lines.

Supporters formed a coalition that includes Dish, Dell, policy groups and two trade groups that include Dish as a member. RS Access presented a 62-page technical study that concluded coexistence between the 5G use and the satellite services can be achieved.

SpaceX, in a filing, said the airwaves are worth far less. Still it said RS Access and Dish were seeking “a windfall” by leveraging airwaves that today are useless.

“You don’t have to have them removed from the band at all,” V. Noah Campbell, chief executive officer of RS Access, said in an interview with Bloomberg. Campbell likened the proposal to a water main that’s been used at low capacity. “We just want the pipe open,” he said.

The spectrum in question could be worth as much as $54 billion if the FCC allows the change, according to a study submitted to the FCC by a Dell owned company. SpaceX, in a filing, said the airwaves are worth far less. The company said RS Access and Dish were seeking “a windfall” by leveraging airwaves that today are useless.

Dish Network has emphasized expanded demands for its 5G service, which is designed to connect not just mobile phones, but also IoT devices including baby monitors, vehicles, aerial drones, tractors, and factory gear. Dish has emphasized expanded demands for 5G service, which is designed to connect not just mobile phones, but also devices including baby monitors, vehicles, aerial drones, tractors, and factory gear.

“This band is really good for 5G,” Dish Executive Vice President Jeff Blum said in an interview with Bloomberg. “And it would be a missed opportunity if the commission left the status quo in place.”

References:

https://www.bloomberg.com/news/articles/2021-10-09/billionaires-musk-ergen-and-dell-brawling-over-spectrum-at-fcc (PREMIUM ARTICLE)

Battle Lines Thicken Over 5G Use of 12 GHz Spectrum, with SpaceX in the Crosshairs

https://www.fiercewireless.com/regulatory/massive-mimo-adaptive-beam-forming-spiff-up-12-ghz-band

Jio, Airtel, and Vodafone Idea Couldn’t Deliver True 4G Speeds in India

While 5G is coming (some day soon?) to India, and there are 4G networks present in almost all of the country, there is one thing that can’t be ignored. The private telecom operators who have built a strong business around providing 4G coverage throughout the country have failed to deliver ‘true 4G’ to Indians. Bharat Sanchar Nigam Limited (BSNL) is still a 2G/3G player, so that state-run telco is not included in this article.

According to the ‘Speed test Global Index’ report from Ookla [1.], India is currently at the 126th position in terms of providing the fastest mobile data speeds to users. Pakistan is ahead of India at 120th position.

Note 1. Here are the top 10 countries with the fastest mobile Internet speed in Mbps as of end of July 2021:

| 1 | – | United Arab Emirates | 195.52 |

| 2 | – | South Korea | 192.16 |

| 3 | +3 | Norway | 173.54 |

| 4 | -1 | Qatar | 169.17 |

| 5 | -1 | China | 163.45 |

| 6 | +1 | Saudi Arabia | 149.95 |

| 7 | +1 | Kuwait | 141.46 |

| 8 | -3 | Cyprus | 136.18 |

| 9 | – | Australia | 126.97 |

| 10 | – | Bulgaria | 126.21 |

| 11 | +1 | Switzerland | 115.83 |

| 12 | -1 | Luxembourg | 110.67 |

| 13 | +3 | Denmark | 103.35 |

| 14 | -1 | Netherlands | 100.48 |

| 15 | +2 | Oman | 97.81 |

| 16 | -1 | Sweden | 97.06 |

| 17 | -3 | United States | 96.31 |

| 18 | – | Singapore | 91.75 |

| 19 | – | Canada | 87.65 |

| 20 | +4 | Finland | 83.01 |

Mobile download speed jumped 59.5% over the last year globally to 55.07 Mbps

………………………………………………………………………………………………………………………………..

The average mobile Internet speed delivered to users in India was 17.96 Mbps. In comparison, the number one country on the list, United Arab Emirates (UAE), offers users 195.52 Mbps speeds while the U.S. average is 96.31 Mbps. There is a humongous difference between UAE and India.

So why does a telecom operator like Jio, which has so much profits in the books, can’t provide very high-speed networks to the users? This question also applies to companies like Vodafone Idea and Bharti Airtel.

The problem is getting higher mobile internet speeds would have costed the end-consumer a lot more money. Today, India offers mobile data at one of the cheapest/most affordable rates globally. From paying more than Rs 200 for each G Byte of mobile data in 2016, now Indians pay less than Rs 10 for the same amount.

This has allowed even the low-income Indian people to latch on to the same network services as the high-income ones. Since Jio arrived with ultra low prices, India’s mobile telcos could either reduce the price of data, or they could go out of business.

Because of affordable plans and services, which benefitted a lot to the customers, the overall profit margins and the average revenue per user (ARPU) started to drop. This resulted in the telcos being limited in their capacity to make investments in the networks to enhance performance.

In simple words, if the telcos don’t charge you more, they don’t earn more. If they don’t earn more, they can’t invest in their networks and really can’t provide you with the 4G experience customers in countries like the UAE do.

But there’s one more thing to factor in here. It is not just how the Indian market is that is responsible for this. But the telcos have also been fighting to get the larger subscriber market share. Companies like Jio can easily hike tariffs and support Vi and Airtel in doing the same. But Jio won’t go for the tariff hike to increase ARPU because it wants a larger subscriber market share. The other companies are also handicapped because of the same. However, it is not like Vi and Airtel don’t want a better subscriber market share; it’s just that the ball is in Jio’s court at the moment.

Further, the government had also put so much stress on the sector. There were so many forms of statuary dues, regulatory norms that involved so much money going out of the operators’ pockets. However, the recent relief package should be able to help with that.

India’s mobile operators are limited to provide a premium service to each of their customers because of their limited return on investments (ROI).

Note that providing better network services also includes purchasing more airwaves from the government, which involves thousands of crores. There are also other investments such as network towers, fiber conversion costs, and much more than a normal mobile consumer is aware of.

References:

https://telecomtalk.info/jio-airtel-vi-couldnt-deliver-true-4g/471560/

MTN Consulting: Network Infrastructure market grew 5.1% YoY; Telco revenues surge 12.2% YoY

Telecom network infrastructure (NI) vendors had a 5.1% year-over-year (YoY) increase in revenue during the second quarter 2021, reflecting a significant pullback from a 10% gain in the previous quarter, according to MTN Consulting.

The market share leaders in the global telco NI market remain Huawei, Ericsson, Nokia, and ZTE, who are also the top providers of 5G infrastructure. After these top four, China Comservice took the fifth spot in 2Q21 due to services sales with domestic telcos. Cisco and Intel followed in the sixth and seventh spots, leveraging strength in the router market, and data centers and virtualization, respectively. CommScope, NEC, and Fiberhome round out the top 10.

- CommScope is a key provider in the connectivity market, both fixed and mobile, and for broadband CPE.

- NEC is becoming an important player in the emerging open RAN market.

- Fiberhome has a significant market share for network equipment in the Chinese telco market, across optical transport and mobile networks.

- Samsung, ranked 11 in 2Q21, is also a notable player in telco NI, as it is rising in the US due to success at Verizon, and has strong potential in Europe.

MTN Consulting’s telco network infrastructure market share study includes a wide range of vendor types and cuts across hardware, software, and services. That’s in contrast to other market research firms that only count telecom equipment vendors.

If one considers only hardware and software revenues from network equipment providers (NEPs), total revenues were $121.6 billion for the 2Q2021 annualized. The top ten providers for this market are Huawei, Nokia, Ericsson, ZTE, Intel, NEC, Cisco, Fiberhome, Samsung, and Fujitsu. The top four of these suppliers account for 64% of market revenues. This category (NEP hardware & software) most directly maps into what is sometimes reported as the “telecom equipment” market.

Vendors collectively received $110.4 billion in revenue during the first half of 2021, up 7.4% from the first half of 2020. Some of that growth can be attributed to a weak first half of 2020 when the initial spread of COVID-19 clobbered network infrastructure spending plans, Matt Walker, chief analyst at MTN Consulting, explained.

“Labor costs are a big part of telco opex (and rising), and automation is a key area of investment in 2021 for nearly all major telcos,” Walker wrote. “Numerous telcos are reporting that network operations are taking up a larger portion of the opex pie. This is important because vendors are increasingly selling into opex budgets within their telco customers, not just capex budgets. That’s especially true on the services and software sides.”

Total telco capex for the first half of 2021 jumped 9.8% year over year to $151.1 billion, he said, noting that the analyst firm added Airspan, Google Cloud, Amazon Web Services (AWS), and Microsoft Azure to its telco market coverage at the beginning of 2021. Telco capex grew 15% year over year in the second quarter of 2021 while telco opex climbed 14% during the same period.

The biggest YoY Telco NI sales jumps in 1H21 were easily recorded by Ericsson and Nokia, up $1.46 and $1.01B respectively. Cisco, Samsung, and Dell Technologies (VMWare) also saw sizable growth in the telco vertical, as did several vendors riding China’s 5G boom: China Comservice, ZTE, and Fiberhome. On the downside, Huawei’s $1.48B YoY decline in Telco NI sales in 1H2021 was far worse than any other supplier (due to being banned by the U.S. and other countries for political reasons).

Huawei market share decreased the most YoY, when comparing its annualized share in 2Q2021 with that of 2Q2020. As predicted, the company’s share of telco NI has now fallen below 20% (19.01% in 2Q2021, annualized).

For other NI vendors, most changes are due to one of three factors: M&A, telco spending cycles, and technology dislocations.

- Recent M&A deals of note include Capgemini-Altran, CommScope-ARRIS, ECI-Ribbon, Hengtong-Huawei Marine, Casa-Netcomm, and Amdocs-Openet.

- A number of vendors have been impacted by telcos’ 5G infrastructure push, including the recent shift towards core network spending.

- Several large countries are seeing growth in fiber access deployment spending.

- Telcos’ increased adoption of the cloud in a variety of forms cuts across a large number of the changes seen in the below charts. AWS, Azure and GCP have all seen dramatic growth in their telco vertical revenues in the last few quarters, as has Dell Technologies (VMWare) and Arista.

Regarding declines in NI market share, Samsung’s annualized share change reflects a dropoff in Korean 5G spend as it still awaits a pickup in the US, India and/or Europe.

Nokia’s share has stabilized, after falling due to a perception of falling behind in mobile RAN radio technology, as well as its backing away from China. Huawei’s share decline is due to political and supply chain obstacles.

Webscalers/Cloud Service Providers Penetrate Telco Market:

Nearly a decade ago, as cloud services began gaining popularity, many telcos hoped to be direct beneficiaries on the revenue side. The cloud market went a much different direction, though, with large internet-based providers (aka webscalers) proving to have the global scale and deep pockets able to develop the market effectively. From 2011-2020 webscale operators invested over $700 billion in capex, a big portion of it devoted to building out their cloud infrastructure.

The cloud sector has geared its offerings to businesses of all stripes and sizes. Serving telecom operators was not an initial focus for many reasons. Telcos have unique network requirements and stringent reliability criteria, and tend to make purchasing decisions slowly. Many telcos also viewed cloud providers with trepidation, as potential competitors on the enterprise side. Yet the telecom market is also one of the biggest around, viewed as a prize worth fighting for. Nearly $300 billion in annual capex and $1.2 trillion in opex (excluding depreciation) are figures that are hard to ignore. Amazon Web Services (AWS) made the earliest strides in telecom, in 2015 (with Verizon), but Azure and GCP were serious about the market by 2017. Last year, Microsoft bolstered its 5G and cloud-based telecoms offerings with the big-ticket acquisitions of Affirmed Networks and Metaswitch Networks.

This telco-webscale collaboration activity has picked up in the last 12-18 months. Webscale operators help telcos with service and application development, shifting of workloads, and developing, enabling and marketing cloud-based services. Collaborations can involve delivery of a portfolio of 5G edge computing solutions that leverage the telco’s 5G network and the webscale operator’s global cloud coverage, as well as its expertise in areas like Kubernetes, AI/ML, and data analytics. Managing costs is a central purpose of telcos’ willingness to partner with webscale providers. Increasingly, the webscale operators who deliver cloud services are competing alongside traditional telco-facing vendors like Amdocs, Citrix, CSG and Nokia.

For the four quarters ended 2Q2021, MTN Consulting estimates that AWS, Azure and GCP had aggregate revenues to the telco sector of $1.92 billion, up 78% from the 1Q2020 annualized period. These cloud providers will sometimes be valuable partners for telco-focused vendors, but in many cases they will be competitors, and are important to track.

Telco spending outlook for remainder of 2021:

Telco industry capex is likely to come in around $300B for 2021, only slightly up from $295B in 2019. Telco opex budgets are a bit more appealing for vendors. Opex (excluding depreciation & amortization) is roughly 4x capex, and the network operations-related (“netops”) piece of opex is growing for many telcos. For 2021, MTN Consulting projects netops opex of about $297B, from $282B in 2020, and telco outsourcing of netops tasks are widespread and growing. Cloud providers are taking advantage of some of this growth, but a large number of traditional Telco NI vendors sell into telco opex budgets.

…………………………………………………………………………………………………………………………….

In a related report, MTN says that telco revenues surged to 12.2% (for the first time in at least a decade on a YoY basis) coming in at $478.4 billion (B). But this unusually high growth is due to a weak base in 2Q20, when revenues totaled $426.5B, the lowest ever during the 1Q2011-2Q2021 period. Also, as witnessed in 1Q2021, the trend of currency appreciation against the US dollar in several key markets continued to play out in the latest quarter.

Annualized telco revenues also grew for the second straight quarter, posting $1.88 trillion with a YoY growth rate of 5.5% in 2Q21. At the network operator level, five of the top 20 best performing telcos by topline in 2Q21 posted double-digit growth on an annualized basis. These include Deutsche Telekom (30.6% YoY vs. annualized 2Q20), China Telecom (17.6%), China Mobile (17.3%), and China Unicom (14.1%). By the same criteria, the worst telco growth came from Softbank (-13.9%) during the same period. America Movil and Telefonica were only the two other operators among the top 20 to post a decline in revenues. While the big swings at Deutsche Telekom and Softbank are due to the former closing its acquisition of Sprint from Softbank in April 2020, growth witnessed by other operators was mostly an outcome of low base effect. Another factor for some operators is non-service revenues, as these have grown with 5G device sales in many markets.

The biggest capex spender in 2Q21 on a single quarter and annualized basis was China Mobile. This was despite the company’s YoY drops of 6.4% and 15.3% in the single quarter and annualized 2Q21 periods, respectively, enabled by CM’s network partnership with CBN. Nine out of the top 20 operators by annualized capex spend posted double-digit growth rates in the period ended 2Q21. Some of these include: Deutsche Telekom (52.1% YoY vs. annualized 2Q20), Vodafone (24.2%), Orange (17.6%), and BT (25.6%). On an annualized capital intensity basis, Rakuten beats all other telcos handily with a roughly 183% capex/revenue ratio for the quarter; its greenfield network rollout is reaching its peak. Other capital intensity standouts include: Globe Telecom (49.9%), PLDT (43.1%), Oi (41%), Telecom Egypt (34.1%), CK Hutchison (32.7%), True Corp (31.3%), and Digi Communications (31.2%).

To improve operational efficiency, telcos are resorting to several initiatives specifically aimed at digitizing the sales and marketing function. Amid the pandemic last year, telcos were forced to operate with minimal human intervention, and automation efforts have only accelerated since then. As telco execs aim for more automated networks to sustain and grow profitability, automation will be a key selling point for vendor solutions.

Telco industry headcount continues to decline, falling to 4.838 million in 2Q21, down from 4.944 million a year ago. Telco spending on digital transformation, software-defined networks (SDN) and AI tools have facilitated a smaller workforce. MTN Consulting expects headcount reductions to continue via attrition and voluntary retirement schemes, heading towards 4.5 million by 2025. However, we also expect telcos to invest heavily in their workforce: retraining existing employees on digital platforms, and hiring highly skilled software savvy employees. The average telco employee salary will rise as a result, an outlook consistent with 2Q21 results – annualized labor costs per employee increased to $61.5K in 2Q21 from $57.8K in 2Q20.

All four major geographical regions experienced double-digit growth in revenues from 2Q2020. But in capex terms, Europe was a standout as it managed to grow by 29.9% on a YoY basis in 2Q2021. The region also recorded not just an uptick but also the highest annualized capital intensity of 18.4% in 2Q2021, while all other regions witnessed a fall when compared to the same period last year. Europe’s capex growth story is courtesy of a late start to 5G spending due to delayed spectrum auctions, coupled with increased efforts in FTTH deployments and government-supported rural rollouts.

References:

https://www.mtnconsulting.biz/product/telecoms-biggest-vendors-2q21-edition/

https://www.mtnconsulting.biz/product/telecommunications-network-operators-2q21-market-review/

Dell’Oro: Worldwide Telecom Equipment Revenue +10% Year over Year

Reports and Data: Telecom Cloud Market to grow at CAGR of 19.7% through 2026

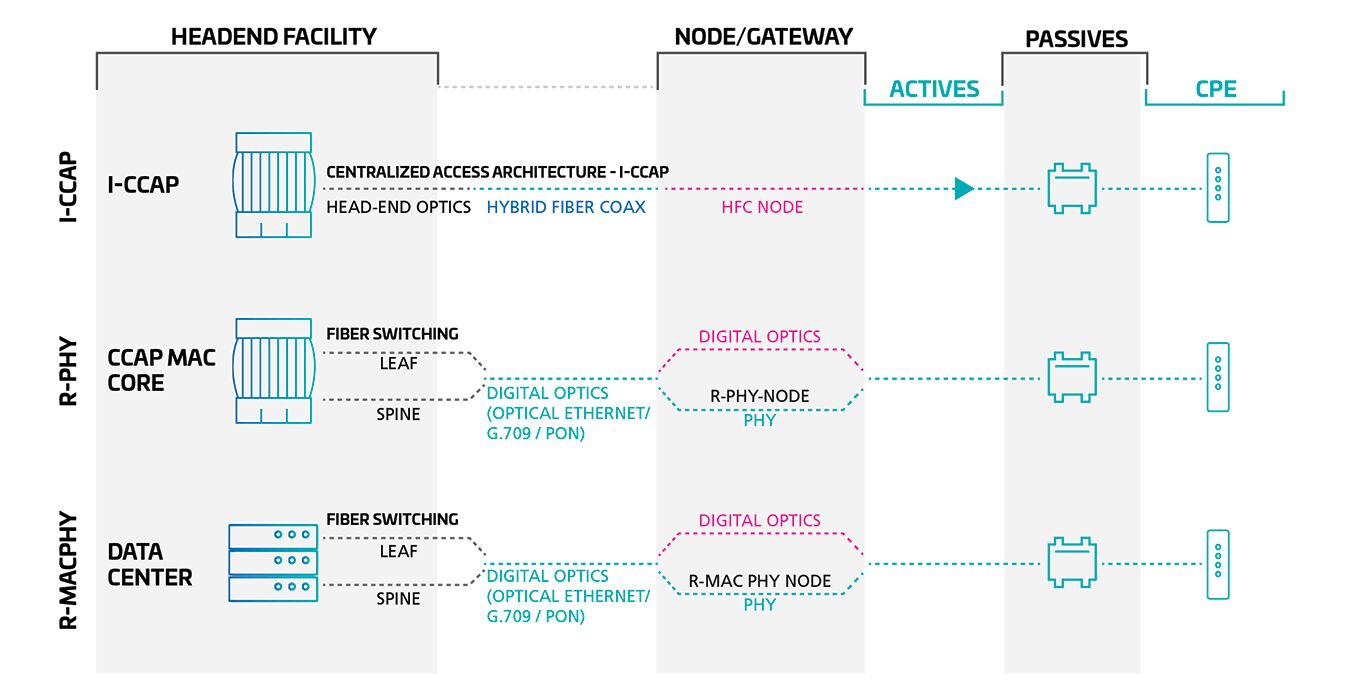

Distributed Access Architectures (DAA) Explained, Market Assessment and GCI Deployment

DAA Tutorial:

Distributed Access Architecture (DAA) – not to be confused with 1970’s Data Access Arrangement – is a method used to decentralize cable networks by relocating select functions that have typically resided in the headend or hub to intelligent fiber nodes, closer to the subscriber.

DAA enables the evolution of cable networks by decentralizing and virtualizing headend and network functions. DAA extends the digital portion of the headend or hub domain out to the fiber-optic node and places the digital-to-RF interface at the optical-coaxial boundary in the node. Replacing the analog optics from the headend converts the fiber link to a digital fiber Ethernet link, increasing the available bandwidth by improving fiber efficiencies (wavelengths and distance) and directional alignment with the NFV/SDN/FTTx systems of the future.