Month: February 2022

Dell’Oro: LTE still dominates private wireless market; will transition to 5G NR (with many new players)

Dell’Oro Group just published an updated Private Wireless market report with a 5-year forecast. According to the report, private wireless RAN revenues for the full-year of 2021 are slightly weaker than initially projected.

“The markdown is more driven by the challenges of converting these initial trials to commercial deployments than a sign that demand is subsiding,” said Stefan Pongratz, Vice President at Dell’Oro Group. “In fact, a string of indicators suggest private wireless activity is firming up not just in China but also in other regions,” continued Pongratz.

Additional highlights from the Private Wireless Advanced Research Report:

- Private wireless projections have been revised downward just slightly to factor in the reduced 2021 baseline.

- Total private wireless RAN revenues, including macro and small cells, are still projected to more than double between 2021 and 2026.

- The technology mix has not changed much with LTE dominating the private market in 2021 and 5G NR still on track to surpass LTE by the outer part of the forecast period, approaching 3 percent to 5 percent of the total 5G private plus public RAN market by 2026.

- Risks are broadly balanced. On the upside, the 5G enterprise puzzle has still not been solved. The successful launch of private 5G services by suppliers with strong enterprise channels could accelerate the private 5G market at a faster pace than expected. On the downside, 5G awareness is improving but it will take some time for enterprises to fully understand the value of private LTE/5G.

Comment & Analysis:

This author notes a bevy of new activity in the 5G private network space. It’s almost approaching a frenzy!

Yesterday, Cisco announced a “private 5G service that simplifies both 5G and IoT operations for enterprise digital transformation.” The company promised to show off the new product at the upcoming MWC trade show in Barcelona, Spain. Cisco to sell its 5G private network under an “as-a-service” model, such that enterprise customers who purchase it will only pay for what network resources they actually use. The company said that it would partner with unnamed vendors for all the necessary components, adding that it will run over midband spectrum. The company did not provide any further details. It should be noted that Cisco has never had ANY 2G/3G/4G/5G RAN products, as their wireless network portfolio has always been focused on WiFi (now for enterprise customers).

In late November 2021, Amazon unveiled its new AWS Private 5G service that will allow users to launch and manage their own private mobile network in days with automatic configuration, no per-device charges, and shared spectrum operation. AWS provides all the hardware, software, and SIMs needed for Private 5G, making it a one-stop solution that is the first of its kind. Dell’Oro Group’s VP Dave Bolan wrote in an email, “What is new about this (AWS Private 5G) announcement, is that we have a new Private Wireless Network vendor (AWS) with very deep pockets that could become a major force in this market segment.”

In addition, Mobile network operators like Deutsche Telekom, AT&T and Verizon offer private 5G networks, as do other cloud computing companies, mobile network equipment vendors like Ericsson and Nokia, system integrators like Deloitte, as well as startups like Betacom and Celona. So it’s a crowded market with suppliers each expecting a chunk of a very big pie.

I posed the seemingly contradictory finding of a less than forecast 2021 private wireless market vs the new private 5G players to Dell’Oro’s Pomengratz. In his email reply, Stefan wrote:

“If I had to summarize all our various projections I will just say that the things we know (public 5G MBB/FWA) are generally accelerating at a faster pace than expected while the things that we don’t know (private 5G/critical IoT etc.) are developing at a slower pace than expected.

And for this particular update, slower-than-expected comment was more related to revenues than activity. I agree with you that activity both when it comes to private trials and entering this space remains high.

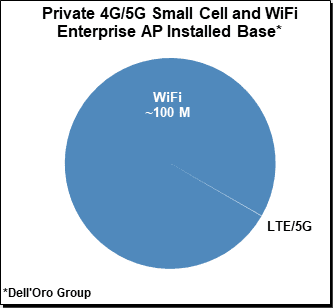

At the same time, we have talked about private cellular for a long time but the reality is that we have not yet crossed the enterprise chasm. Nevertheless, we have a very large market opportunity ($10B to $20B for just the private 4G/5G RAN) that is still up for grabs, hence the high level of interest.”

References:

Private Wireless Weaker Than Expected in 2021, According to Dell’Oro Group

https://www.cisco.com/c/en/us/products/wireless/private-5g/index.html

Deloitte to co-ordinate 5G private network field trial at the largest hospital in Latin America

Viasat reports record quarterly revenues; launch of ViaSat-3 satellites in late summer 2022

Viasat posted record fiscal third quarter revenues of $720 million, up 25% year-over-year, boosted by its recent acquisitions of RigNet and Euro Broadband Infrastructure (EBI), as well as growth in its in-flight connectivity (IFC) business. Nevertheless, the provider of satellite and wireless networking technology reported a loss of $6.6 million in its fiscal third quarter. Virgin Atlantic was an important new in-flight connectivity (IFC) customer while the company continued to expand their fixed broadband presence internationally.

Satellite services unit revenues increased 40% to a record $310 million, while government systems revenues rose 2% to $270 million. Commercial Networks revenues rose 55% to $140 million, driven by mobile IFC terminal deliveries and the performance of its ground antenna systems business.

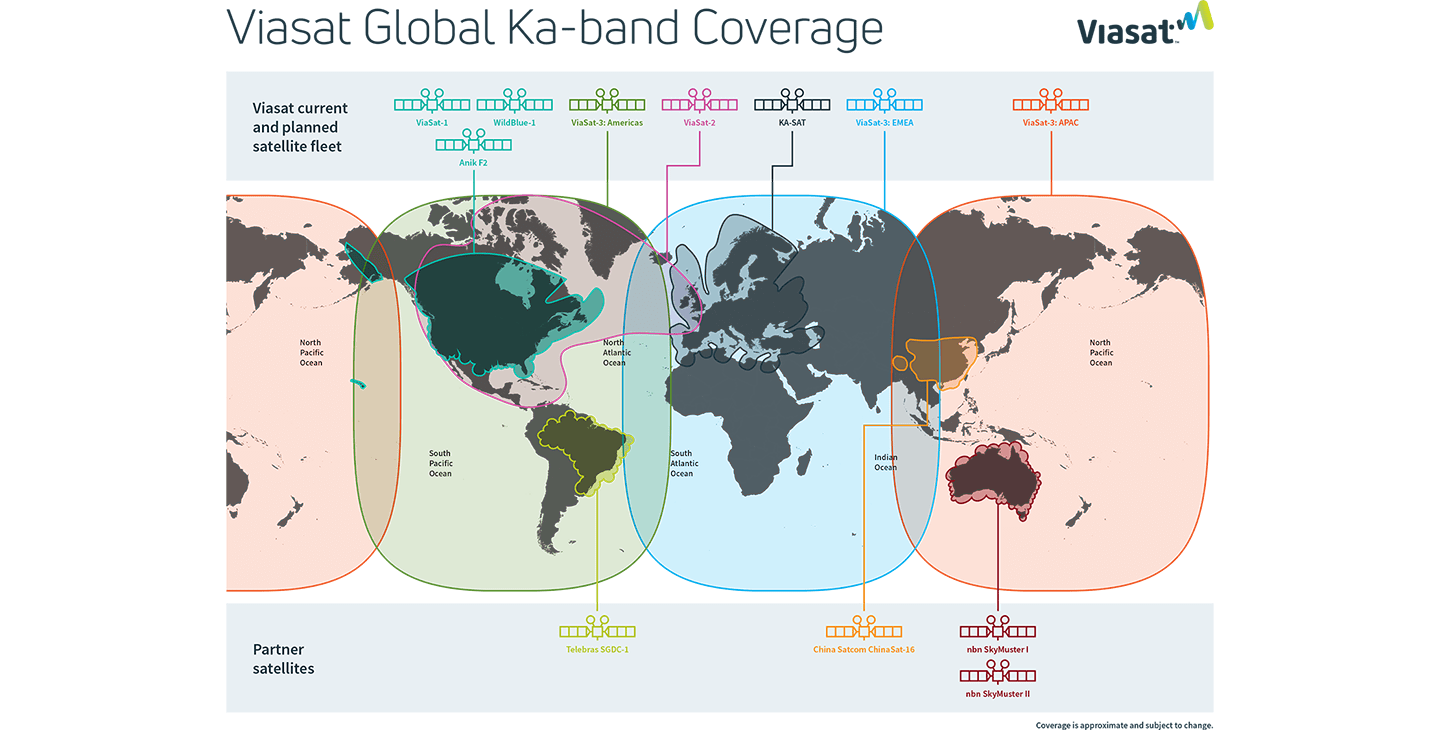

However, Viasat’s plan to provide global coverage with a set of new, high-capacity ViaSat-3 satellites has fallen a little behind schedule. The launch of the first of three satellites, set to cover the Americas, is now expected to happen in the late summer rather than in the first half of 2022.

The delay was due to a “modest slippage in our supply chain” fueled in part by the pandemic, Rick Baldridge, Viasat’s president and CEO, said on the company’s earnings call. “We’ve been working through limited availability of specific, critical skill workers.”

If the current plan holds, Viasat hopes to have the first ViaSat-3 satellite in service before the end of 2022. Future ViaSat-3 satellites are poised to cover the European, Middle East and Africa (EMEA) and Asia-Pacific regions.

Viasat executives said the company is making good progress with alpha testing of a space-ground integration system for ViaSat-3, and they don’t expect the scheduling delay on the first ViaSat-3 satellite to materially impact Viasat’s financial guidance.

The payload module for the second ViaSat-3 satellite (for the EMEA region) is at Viasat’s facilities, with about 95% of the payload units now installed, the company said.

Jeff Baumgartner of Light Reading wrote about ViaSat-3 competition:

How much of a competitive impact Viasat’s residential satellite broadband service is seeing from FWA (Fixed Wireless Access) or even Starlink is difficult to pinpoint. Viasat no longer reports U.S. subscriber numbers as it expands that piece of the business globally. However, the company did note there was a “slight decrease” in its U.S. subscriber base in its fiscal third quarter as Viasat reallocates satellite bandwidth for mobile services.

Viasat execs aren’t overly concerned about a new, faster and pricier “Premium” tier from Starlink [1.] that will start to reach business customers and other high-capacity users in the second quarter of 2022.

Note 1. Starlink Premium promises to deliver up to 500Mb/sec, but is very expensive. It sells for $500 per month and requires customers to also pay $2,500 for the satellite router and a new antenna outfitted with double the capacity of its predecessor. Starlink Premium, a service targeted to businesses and other users that require more speed and capacity, also requires customers to put up a $500 fully refundable deposit.

……………………………………………………………………………………………………………………

Viasat expects its proposed deal for Inmarsat to close by the end of 2022. The company was named the 2021 Global Satellite Business of the Year, by Euroconsult at the World Satellite Business Week Summit.

References:

https://investors.viasat.com/static-files/05cbc97c-8c9b-4a5f-a59c-762b4afaade9

https://www.viasat.com/space-innovation/satellite-fleet/global-satellite-internet/

India’s Production Linked Incentive (PLI) scheme for 5G equipment attracts Nokia & Ericsson

Nokia and Ericsson said India’s production-linked incentive (PLI) scheme [1.] for design-led 5G manufacturing will position India as a global manufacturing hub and allow them to deepen their manufacturing capabilities in the country.

Note 1. PLI is the sum of India government incentives that are directly linked to manufacturing performance. The more goods companies manufacture in India the better incentives they will get. The incentives are of diverse types: subsidies, monetary benefits, etc.

……………………………………………………………………………………………………………………

Nokia said it is exploring opportunities to manufacture more products in India in a cost-competitive manner to serve both the local and the global market. Nokia’s India spokesperson said the company was on track to fulfil its investment and production commitments under the existing PLI scheme for telecom equipment.

Swedish telecom equipment vendor Ericsson, in a separate statement, said 5G spectrum auction with 100% fiberization (backhaul) with public-private partnership (PPP) model by 2025 will help bridge the digital divide for an inclusive development of the nation in-line with the ‘Digital India’ vision.

“Design-led initiatives for 5G under the PLI scheme and 5% of USOF for R&D purposes will strengthen the ‘Make in India’ initiative, and contribute to making India a global manufacturing hub,” said Nitin Bansal, managing director for India at Ericsson.

Ericsson, along with Nokia, Akashastha Technologies, HFCL, Foxconn, Coral Telecom, VVDN Technologies, Dixon Technologies, Tejas Networks and GS India, were selected for the original PLI scheme. India’s Department of Telecommunications (DoT) approved 31 proposals in 2021 entailing investments of INR33.5 billion ($447.3 million) over the next four years.

“The scheme for design-led manufacturing to be launched for the 5G ecosystem as part of PLI will be a boost to the overall telecom and electronic sectors. It will also provide and promote research and development of technology and solutions and will enable affordable broadband and mobile communication,” says Sanjay Gupta, vice president and India managing director, NXP Semiconductors.

Some media reports suggest that it is possible that the funds for this scheme may come from the ongoing PLI scheme for the telecom sector.

The scheme is in keeping with the government’s keenness to position India as a telecom manufacturing destination with a growing emphasis on self-reliance and the domestic manufacturing ecosystem.

Chinese gear makers Huawei and ZTE are yet to receive trusted source approval from the National Cyber Security Coordinator (NCSC), which means the space is open to Indian manufacturers.

It’s possible that the government may mandate the Indian service providers to procure a certain percentage of their requirement from the Indian vendors only. The PLI scheme is timely, with the announcement that the 5G spectrum auction will be held in 2022.

Service providers are in the midst of conducting 5G trials, and will be investing heavily in 2022 to build networks. 5G capex is likely to increase significantly over the next few years – hopefully helping Indian manufacturers grab some share of the pie.

Orange Espana reveals 700MHz 5G rollout plans

Orange Espana has announced its plans for activation of 5G services on the 700 MHz band, describing the network as the largest 5G-700MHz network in Spain.

The 700 MHz band, already used by some operators for 4G, has the benefit of enabling good penetration inside buildings and good coverage with speeds comparable to those of mono-band 4G.

A few weeks after Vodafone said it would reach 109 localities by the end of the year, Orange responded that it will cover 1,100 towns and cities with the technology by December, including around 140 digital divide localities with less than 1,000 inhabitants.

The rollout will also include 140 towns and cities with more than 50,000 inhabitants and 820 localities with between 1,000 and 50,000 inhabitants across 30 provinces. Benefits of the 700 MHz band frequencies include lower latencies plus significantly better coverage in indoor and larger outdoor areas, said the operator.

Orange activated its first 5G antenna for the 700 MHz band at Valencia’s Polytechnic University last September, having switched on its Non-Standalone (NSA) 5G network in Madrid, Barcelona, Valencia, Seville and Malaga the previous year.

The launch comes after Orange paid EUR 350 million for a 2×10 MHz block in the government’s July 2021 auction of frequencies in the 700 MHz band. Orange has the largest amount of 5G-compatible spectrum in Spain thanks to its existing 110 MHz concession in the 3.5 GHz band, for which it paid EUR 173 million.

As of 30 September 2021, Orange Espana offered 5G coverage to over 50% of the population and had 620,000 5G subscriptions.

MetroNet’s FTTP buildout in Florida; Merger with Vexus Fiber

Continuing with the massive U.S. fiber to the premises (FTTP) movement, regional fiber carrier MetroNet (headquartered in Evansville, Indiana) said it will bring fiber-optic internet access directly to homes and businesses throughout the Deltona, FL and neighboring communities, including DeBary and Orange City.

Deltona marks the third community in Florida that will have access to MetroNet services through a fully funded $35 million investment in the community. The three-year construction project is set to begin in the summer of 2022, with the first customers able to receive service as early as the fall of 2022.

Once completed, Deltona will join the country’s internet elite as a Gigabit City. Only about 40 percent of households in the U.S. have access to symmetrical upload and download gigabit (1,000 mbps) speeds that only fiber optic networks can provide.

“MetroNet is thrilled for Deltona residents and businesses to have access to our future-proof services that will allow sparkling 4k video streaming, glitch-free gaming, crystal-clear virtual meetings, and internet experiences of the future that we can only begin to imagine,” said John Cinelli, MetroNet’s CEO. “MetroNet is proud to soon be able to add Deltona to our growing list of Gigabit Cities.”

MetroNet plans to hire local market management positions, sales and customer service professionals, and service technicians to support the Deltona area. Those interested in joining the MetroNet team can visit MetroNetInc.com/careers to search available positions and to submit applications.

………………………………………………………………………………………………………………………

Last week, Metronet announced it has merged with fellow independent fiber based network provider Vexus Fiber. The combined companies will continue to operate under their existing brands and with their existing executive roster. Financial terms of the deal were not disclosed.

Vexus, based in Lubbock, TX, deploys and operates FTTP networks in Texas and Louisiana, with plans for expansion in New Mexico. Markets currently serving those states include Lubbock, Amarillo, Wichita Falls, Abilene and surrounding areas of Texas, as well as Hammond, Covington and Mandeville in Louisiana. New FTTP networks in the Rio Grande Valley are in various stages of deployment (see “Vexus Fiber to Build FTTH Network in Rio Grande Valley Region of Texas”), Tyler, Nacogdoches, and San Angelo, TX; Lake Charles, LA; and Albuquerque and Santa Fe, NM. Investors in the company included Pamlico Capital and Oak Hill Capital.

Metronet is operating or building FTTP networks in more than 120 communities in Indiana, Illinois, Iowa, Kentucky, Michigan, Minnesota, Ohio, Florida, North Carolina, Virginia, Texas, Wisconsin, and Missouri. It had received cash from KKR last April (see.) “KKR will take stake in Metronet as part of new funding round”) Oak Hill Capital is also an investor. Both companies provide gigabit or faster broadband services to their residential and business customers.

“We are very excited to welcome Vexus Fiber and their partners to Metronet,” said Metronet CEO John Cinelli. “Vexus has rapid growth and a high-customer-service mindset, similar to Metronet, and joining them allows us to expand our service area to even more Americans.”

“At Wexus, our mission is to bring our high-quality service to as many homes and businesses as possible in the Southwest,” said Jim Gleeson, president and CEO of Wexus. “With this merger, we can reach even more people faster.”

About MetroNet:

MetroNet is the nation’s largest independently owned, 100 percent fiber optic company headquartered in Evansville, Indiana. The customer-focused company provides cutting-edge fiber optic communication services, including high-speed Fiber Internet and full-featured Fiber Phone with a wide variety of programming.

MetroNet started in 2005 with one fiber optic network in Greencastle, Indiana, and has since grown to serving and constructing networks in more than 150 communities across Indiana, Illinois, Iowa, Kentucky, Louisiana, Michigan, Minnesota, Ohio, Florida, North Carolina, Virginia, Texas, Wisconsin, Missouri, and New Mexico. MetroNet is committed to bringing state-of-the-art telecommunication services to communities — services that are comparable or superior to those offered in large metropolitan areas.

MetroNet has been recognized by PC Mag as one of the Top 10 Fastest ISPs in North Central United States in 2020 and Top 10 ISPs with Best Gaming Quality Index in 2021. Broadband Now has recognized MetroNet as the Top 3 Fastest Internet Providers and Fastest Fiber Providers in the Nation in 2020, and #1 Fastest Mid-Sized Internet Provider in two states in 2020. In 2020, MetroNet was awarded the Vectren Energy Safe Digging Partner Award from Vectren. For more information, visit www.MetroNetinc.com.

Media Contact: Katie Custer [email protected] 502.821.6784

References:

Sandvine: Google, Facebook, Microsoft, Apple, Amazon & Netflix generate almost 57% of Internet traffic

Sandvine’s newly released 2022 “Global Internet Phenomena Report” aggregates data from more than 160 Tier 1 and Tier 2 fixed and mobile networks worldwide to reveal unprecedented trends, such as:

• Rapid growth of 1Terabyte per month “heavy app users,” a trend that is expected to accelerate with the transition from 4G to 5G and the explosion of video everywhere across social, gaming, messaging, and immersive experiences;

• First-time “tipping of the scales,” with Google, Facebook, Microsoft, Apple, Amazon, and Netflix generating almost 57% of Internet traffic – more than everyone else, combined;

• QUIC [1.] multiplexed transport, encryption, and privacy protocols like Apple iCloud Private Relay obscuring network visibility for capacity planning and congestion management;

Note 1. QUIC is a Transport layer protocol used by more than half of all connections from the Chrome web browser to Google’s servers. Microsoft Edge and Firefox browsers also support it.

• Mashups of videos, payments, maps, chat, and other features increasing the need for more sophisticated machine learning techniques to measure and deliver optimal app quality of experience (QoE);

• Global rankings of “Top-10 Apps” in Video, Gaming, Social, Messaging, Enterprise Conferencing, with Google’s YouTube retaining the top spot in global app traffic share at 14.67% followed by Netflix at 9.39%, as well as other downstream/upstream and regional trends (Americas, EMEA, and APAC).

Samir Marwaha, Chief Strategy Officer, Sandvine said: “Our latest ‘Global Internet Phenomena Report’ shows that people care more about how their favorite apps perform than the underlying networks. This makes it crucial that 5G and Cloud service providers understand, at a granular level, the application quality of experience they are delivering to customers. That’s going to have the greatest impact on their brands and their ability to generate revenue streams within new business models.”

Gabriel Brown, Principal Analyst, Mobile Networks and 5G, Heavy Reading said:

“The top content producers serving more traffic and accounting for a greater share of network load has a big impact, but at least it is a known quantity. The other part of the story is the increasing diversity of traffic sources – from new streamers, live sports, gaming, and device updates – and the growth of complex apps that combine multiple traffic types and services in a single customer experience. In combination with the rise of QUIC and iCloud Private Relay, this is challenging operators to better understand where and when traffic originates. Insight into these emerging patterns can help operators manage network capacity and meet customer expectations.”

Get the Report and on-demand Webinar to see the hottest trends and insights derived from more than 2.5 billion internet subscribers. Also, check out other resources, such as our 5G Service Innovation and Intelligence Whitepaper, 5G Service Intelligence Engine (NWDAF) Whitepaper, Cloud-Ready Options, and Use Cases eBook.

About Sandvine:

Sandvine’s cloud-based Application and Network Intelligence portfolio helps customers analyze, optimize, and monetize application experiences using contextual machine learning-based insights and real-time actions. Market-leading classification of more than 95% of traffic across mobile and fixed networks by user, application, device, and location significantly enhances interactions between users and applications. For more information about delivering superior quality of experience with uniquely rich, real-time data that can drive performance and revenues, visit http://www.sandvine.com or follow Sandvine on Twitter @Sandvine.

Media Contact:

Susana Schwartz, Sandvine +1 816 680 1447 [email protected]

References:

https://www.sandvine.com/global-internet-phenomena-report-2022?hs_preview=khpPseNo-62343537839