Month: June 2023

Spark New Zealand partnering with Lynk Global to offer a satellite-to-mobile service

Spark, the leading telco in New Zealand, announced it is collaborating with Lynk Global to offer a satellite-to-mobile service, aiming to enhance connectivity for its customers. Later this year, selected customers will be offered a free trial of the service.

The satellite-to-mobile service will enable periodic text messaging throughout the day during the initial trial. However, as more commercial satellites are deployed, Spark intends to expand the service in 2024 to offer more regular connectivity. The ultimate goal is to provide voice and data services to customers once they become reliably available.

Spark said while satellite coverage cannot reach 100 percent due to the requirement of a clear line of sight to the sky, it offers an additional layer of resilience, especially in light of increasingly severe and frequent weather events caused by climate change. By leveraging satellite connectivity, Spark aims to extend its network reach to areas that are currently underserved by traditional mobile coverage.

According to the Spark press release, the trial period will provide an opportunity to refine and enhance the service in alignment with the increasing number of satellites in orbit. Integration into Spark’s network and regulatory approval are also essential steps before the service can be officially launched.

Photo Credit: Spark New Zealand

The collaboration with Lynk Global and the existing partnership with Netlinkz, which aims to provide satellite broadband services, are part of Spark’s broader strategy to leverage satellite technology as part of its connectivity offering to customers. Spark says it is actively working with various partners to expand the range of services it can deliver.

In a separate announcement last week, Spark revealed its partnership agreement with Netlinkz to provide Starlink business-grade satellite broadband to customers later this year. This initiative follows ongoing trials with a select number of New Zealand businesses.

Spark Product Director, Tessa Tierney, said, “We believe satellite has an important role to play in connecting Aotearoa New Zealand. While satellite can’t provide 100% coverage – as you need a clear line of sight to the sky to get connected2 – it certainly adds an additional layer of resilience, particularly now, as we face increasingly severe and frequent weather events due to climate change. And once there are more satellites launched and the service is available more broadly, it will allow our mobile customers to start to use their phones in more areas that aren’t reached by traditional mobile coverage.”

“We know that our customers will be eager to start using satellite messaging, but the technology is still evolving, so the service and experience will improve and expand as the number of satellites in the sky increases. That’s why we’ve chosen to trial this technology with some of our customers first, to make sure we can offer a great product to our customers when we make it widely available. We also need to integrate the technology into our network and achieve regulatory approval to launch the service. But we are excited to see the possibilities this creates for New Zealanders and will be working hard to make it widely available as soon as we can.

“This partnership with Lynk, and our partnership with NetLinkz to offer a satellite business connectivity service are part of Spark’s broader strategy to use satellite as a part of our connectivity offer to customers. We are continuing to work with these and other potential partners to broaden the services Spark can offer.”

Spark’s introduction of satellite-to-mobile services and business-grade satellite broadband underscores its commitment to enhancing connectivity options for customers across the country, particularly in underserved areas. Spark said further details, including eligibility criteria and timelines, will be disclosed in the coming months.

………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.sparknz.co.nz/news/Spark-to-launch-satellite-to-mobile-service/

Spark New Zealand to Launch Satellite-To-Mobile Service With Lynk Global

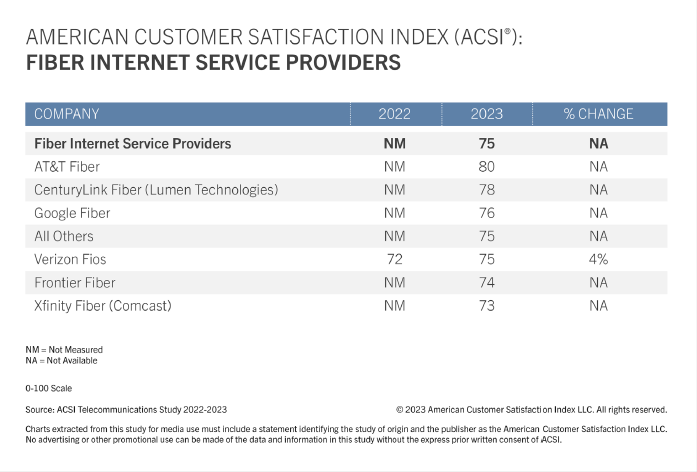

ACSI report: AT&T, Lumen and Google Fiber top ranked in fiber network customer satisfaction

AT&T is #1 in customer satisfaction for fiber optic network providers, according to a new report from the American Customer Satisfaction Index (ACSI). ACSI’s report rates consumer satisfaction for both fiber and non-fiber ISPs as well as for video streaming services and apps. For this study, ACSI interviewed more than 22,000 customers at random between April 2022 and March 2023.

AT&T Fiber tops fiber ISPs — and the entire industry — with a score of 80. CenturyLink (Lumen) Fiber is next at 78, followed by Google Fiber (76). The smaller group of fiber ISPs and Verizon Fios both score 75. Frontier Fiber and Xfinity Fiber round out the fiber ISPs at 74 and 73, respectively.

AT&T is targeting a few cities across Arizona and Nevada with its Gigapower joint venture, in partnership with BlackRock. Whereas Lumen just upped multi-gig coverage in its Quantum Fiber markets and Google Fiber announced several forthcoming builds.

Among non-fiber ISPs, T-Mobile takes the top spot with a score of 73. AT&T Internet finishes second at 72, while ACSI newcomer Sparklight sits in third place at 71. Kinetic by Windstream is next at 70, just outperforming Xfinity (68).

Despite an impressive showing among fiber ISPs, Lumen sits near the bottom in the non-fiber group with a score of 62. Frontier Communications and Optimum round out the non-fiber ISPs at 61 and 58, respectively.

“Across the entire customer experience, fiber service shows a strong advantage — from data transfer speed and service reliability to touchpoints like call centers and websites,” says Forrest Morgeson, Assistant Professor of Marketing at Michigan State University and Director of Research Emeritus at the ACSI. “That said, with well over half of U.S. households lacking access to fiber internet, availability remains a sticking point. As such, non-fiber ISP services remain an attractive option for many customers and should not be overlooked by providers.”

…………………………………………………………………………………………………………………………………………………………………

Fiber sets the pace for in-home Wi-Fi quality:

ACSI also measures key aspects of the in-home Wi-Fi experience for both customers who use equipment from their ISP and those who use third-party equipment that they have purchased.

Fiber ISPs (79) outperform both non-fiber ISPs (73) and third-party equipment providers (70) for overall Wi-Fi quality. The former far exceeds the other two in every customer experience benchmark, including strong marks for the security of its Wi-Fi connection (81) and reliability in terms of avoiding loss of service (80).

References:

No Surprise: AT&T tops leaderboard of commercial fiber lit buildings for 7th year!

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

Nokia will deliver its AirScale portfolio, including 5G Radio Access Network (RAN), to support Charter Communications’ 5G rollout in trial markets. It marks Nokia’s first win in the cablecos/MSO space for large-scale wireless 5G deployments. Charter will use Nokia’s 5G RAN solutions to deliver wireless 5G connectivity, faster speeds, and increased network capacity to Spectrum Mobile customers in its trial markets in the United States.

Up until now, cablecos have been MVNO rather than actually deploying their own wireless networks. All of the cable companies in the U.S. with mobile aspirations have had to partner with an existing mobile network operator – Verizon, AT&T or T-Mobile – to sell mobile services. And those MVNO partnerships are not cheap. For example, the financial analysts at Wells Fargo estimate that Charter and Comcast pay Verizon $12-$13 per month for each of their mobile customers.

Cable operators have spent more than $1 billion on Citizens Broadband Radio Service (CBRS) spectrum with the intention to build 5G networks to offload traffic from their leased mobile networks and to deliver the fastest wireless service. Using compact and lightweight small cell products, cable operators can more easily and cost-effectively provide 5G wireless connectivity by leveraging their existing DOCSIS infrastructure without having to build additional cell sites.

With 6 million customer lines as of Q1-2023, Charter’s Spectrum Mobile is the nation’s fastest growing mobile network provider. Charter offers its Spectrum Mobile service through an MVNO deal with Verizon but touts its ability to combine that with its Wi-Fi network. It’s also using Citizens Broadband Radio Service (CBRS) spectrum to offload mobile traffic from the leased network. Charter spent more than $464 million in the CBRS auction in 2020.

As Charter continues to grow its mobile customers, the company needed a 5G wireless connectivity solution to offload traffic from its leased mobile network. Charter will deploy Nokia’s 5G RAN products, including strand mounted radios for CBRS, baseband units, and a newly developed 5G CBRS Strand Mount Small Cells All-in-One portfolio on the company’s assets, which will help Charter continue to deliver mobile traffic in strategic locations across its 41-state footprint while providing customers with the best possible 5G service experience.

Justin Colwell, EVP, Connectivity Technology at Charter Communications, said: “Charter is committed to providing our customers a fully converged connectivity experience that combines high value plans with the fastest wired and wireless speeds throughout our footprint. Incorporating Nokia’s innovative 5G technology into our advanced wireless converged network will help us ensure that Spectrum customers in areas with a high concentration of mobile traffic continue to receive superior mobile connectivity, including the nation’s fastest wireless speeds.”

Shaun McCarthy, President of North America Sales at Nokia, said: “This news builds on our more than 20-year relationship working with Charter to enhance its network. We are excited to expand its current trial to additional select metropolitan markets in the US, enabling an enhanced user experience for Spectrum Mobile subscribers. This win strengthens Nokia’s leadership position in the MSO space for 5G wireless deployments.”

Nokia in the U.S.

Nokia is supplying 5G technologies across its portfolio to the major service providers and leading operators, as well as hyperscalers, enterprises, and government organizations in the US. The company has an unrivaled track record of innovation in the U.S. including Nokia Bell Labs, which pioneered many of the fundamental technologies that are being used to develop 5G and broadband standards. Today, more than 90 percent of the U.S. population is connected by Nokia network solutions.

*Based on year end 2022 subscriber data among top 3 cellular carriers.

………………………………………………………………………………………………………………………………………………………

Nokia may have competition in the CBRS/MSO space. Samsung will be introducing a new solution within its already existing CBRS portfolio: a new 5G CBRS Strand Small Cell. Designed to be easily deployed on the MSOs aerial strand assets, it enables use of their existing infrastructure, helping them save on deployment costs.

References:

Counterpoint Research: eSIM adoption now entering high-growth phase; +11% YoY in 2022

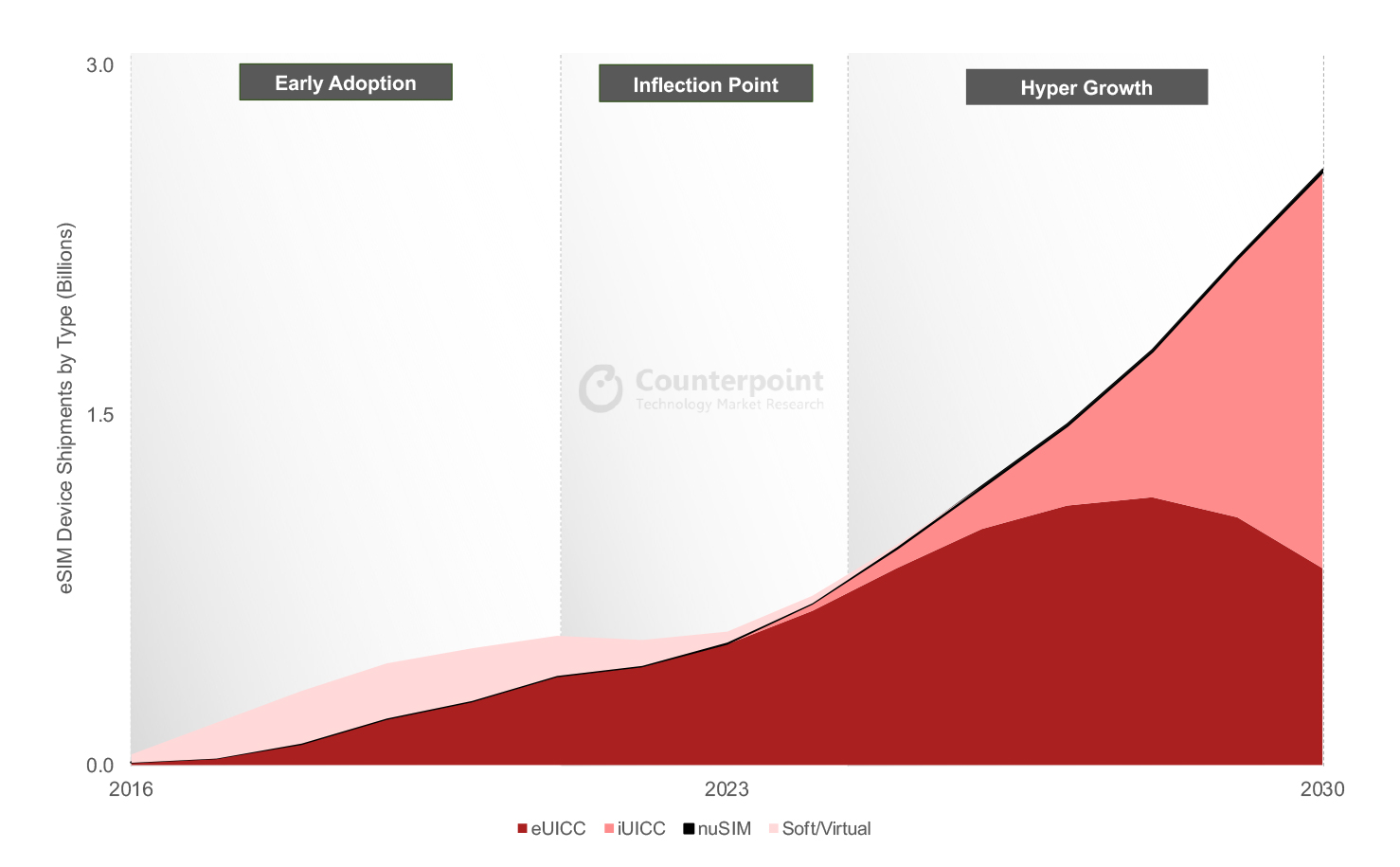

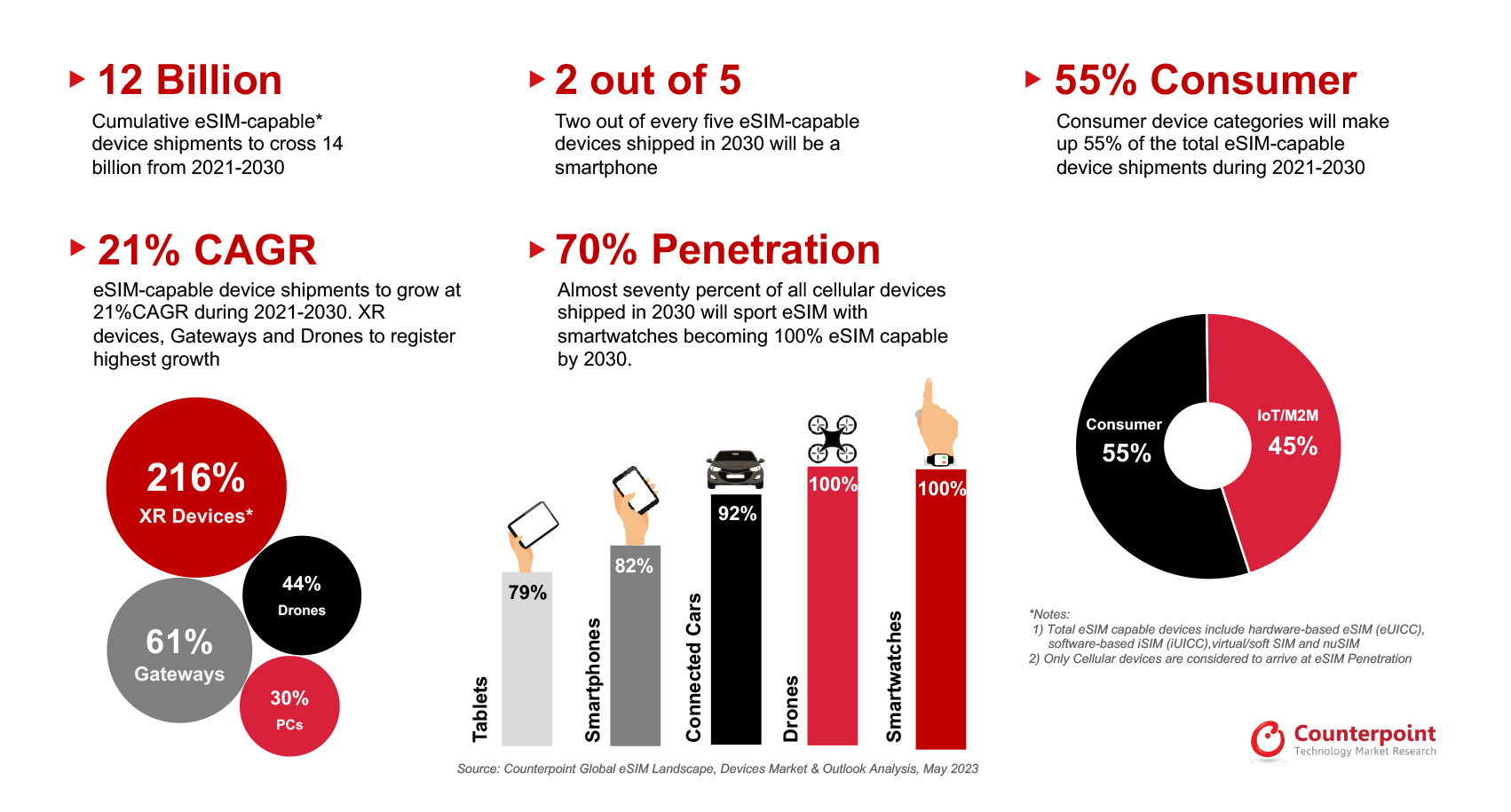

More than 6 billion xSIM (eSIM + iSIM) capable devices will be cumulatively shipped over the next five years, covering all form factors including hardware-based eSIM (eUICC), iSIM (iUICC), nuSIM and Soft SIM, according to Counterpoint’s latest eSIM Devices Market Outlook report.

Editor’s Note: An embedded SIM card – or eSIM – is pre-installed in a device and cannot be physically swapped. Instead, it is programmed remotely and can hold several SIMs at the same time. An integrated SIM (iSIM), meanwhile, is integrated in a device’s main processor, doing away with any form of dedicated hardware.

eSIM adoption has passed the inflection point and is now entering a high-growth phase, driven by the rising adoption of eSIM in smartphones, connected vehicles and cellular IoT applications. The next phase of growth will be driven by greater awareness of eSIM among mobile network operators (MNOs) and device manufacturers, facilitated by the flexibility, cost efficiency, security, cost savings and above all, the key role eSIM is playing in the digital transformation of MNOs.

In 2022, eSIM-capable device shipments grew 11% YoY to reach 424 million units despite a 3% YoY fall in overall cellular-connected device shipments due to weaker demand for smartphones. Globally, more than 275 MNOs support eSIM and provide connections to 30+ different eSIM-capable consumer device models on average. Furthermore, the number of cellular IoT modules and devices is continuously growing.

By 2030, 70% of all cellular devices are expected to support eSIM technology. Adoption will reach 100% in the smartwatch and drone segments; 92% for connected cars; 82% for smartphones; and 79% for tablets. Around 40% of eSIM devices will be smartphones, while 55% of eSIM devices shipped between 2021 and 2030 will be consumer devices.

Commenting on the outlook for xSIM-capable device shipments, Research Vice President Neil Shah said, “The physical MFF2/WLCSP form-factor soldered eSIM chip has been the go-to standard for eSIM implementation alongside the other niche alternative implementations such as soft SIM and nuSIM. Over the next five years, hardware-based eSIM (eUICC) will remain the dominant eSIM form factor and will account for more than half of all shipments.”

“The first wave of mainstream iSIM adoption will be seen across IoT applications driven by leading IoT chipset and module players such as Quectel, Telit, Sequans and Sony Semi (Altair) in partnership with leading xUICC players like Kigen, G+D and Thales. Other key stakeholders driving the adoption of iSIMs would include Qualcomm, IDEMIA, Truphone, Redtea Mobile, Oasis SmartSIM, Apple, Samsung and Nokia. Beyond 2028, iSIM is projected to take over as the dominant SIM form factor, with the shipments of iSIM-capable devices poised to climb to a cumulative 4 billion units by 2030.”

eSIM Has Reached an Inflection Point, Set to Enter a Period of Hyper-Growth

Source: Global eSIM Landscape – Market Outlook and Forecast

Commenting on eSIM adoption across different device categories, Senior Analyst Ankit Malhotra said, “Smartphones have been key in driving primary eSIM awareness among consumers and MNOs, and will continue to be the dominant eSIM-capable device category. Cellular connectivity in smartwatches is growing steadily which is also helping increase the penetration of eSIM-supported smartwatches. The adoption of entitlement servers by MNOs worldwide is a testament to the growing number of smartwatches and other companion devices powered by eSIM. Other cellular-capable consumer devices such as laptops and tablets will also see rapid eSIM adoption in the coming years.”

“The number of IoT/M2M devices equipped with eSIM is poised to grow faster than consumer device categories due to the natural cost, space and remote device management benefits that eSIM offers. The new eSIM IoT specifications SGP.31 by GSMA will accelerate eSIM adoption in the IoT segments potentially eradicating complexities of the existing eSIM Remote Service Provisioning (RSP) platform SM-DP/SM-SR for M2M/IoT segments.”

eSIM Devices Forecast and Analysis

Emerging device categories such as XR, drones and cellular gateways/FWA CPEs will be the fastest-growing categories. 5G-connected drones are another category that will benefit from eSIM technology and drive adoption across several use cases like last-mile delivery, disaster management, search and rescue, education, construction and agriculture. Regulation of beyond-visual-range drones in regions such as Europe will increase the adoption of eSIMs as well.

Automotive and smart mobility are huge growth areas as well. Connected cars are one of the largest and most obvious use cases for eSIMs. Consistent connectivity experience for mobility applications is becoming paramount, particularly for safety use cases such as eCall and the future rise of autonomous driving.

………………………………………………………………………………………………………………………………………………………………………………..

According to Omdia (owned by Informa), there is a compelling business case (subscription required) for eSIMs in the IoT market as they could help resolve connectivity issues plaguing enterprises. Some of the areas that could benefit include energy, healthcare and the financial sector, Omdia says.

Counterpoint forecasts iSIM will become the predominant type of SIM post-2028, with cumulative device shipments to reach 4 billion by 2030. Initial demand will come mainly from IoT applications, it says.

According to Omdia, the iSIM can alleviate issues such as chip shortages, energy and size constraints and increased security concerns. It also notes that cellular service providers such as AT&T, Vodafone and Deutsche Telekom have shown more enthusiasm for iSIMs than eSIMs.

References:

eSIM-Capable Devices Set for Hyper-Growth After Crossing Inflection Point

https://www.t-mobile.com/resources/what-is-an-esim-card

https://www.nytimes.com/2023/03/23/technology/personaltech/esim-sim-cards-travel.html

Orange Spain & Ericsson to build 5G Infrastructure for 3 High-Speed Rail Lines

In a statement, Orange highlighted it had won two of the three lots tendered by the transport infrastructure entity ADIF. It claimed its proposals for the lots received “the highest score” and its bids topped those from Vodafone.

In partnership with Ericsson, which is also supplying kit for Vodafone’s deployment, Orange will provide and maintain 5G infrastructure across the high speed rail corridors.

Announcing the award of its contracts, ADIF said it was part of attempts to “promote the digitisation and efficiency of the railway system” with the entity committing €117.3 million to deployment of 5G on the network and within its assets.

Alongside advantages for passengers, the organisation hailed 5G as a “critical catalyst in the digitisation of the economy in the coming years”.

Within the rail industry, it pointed to use cases including advanced logistics; real-time traffic management; automated vehicles; predictive maintenance; and improved surveillance in stations and on trains.

Orange says it is the first operator to launch 5G+, a network that consumes 90 percent less energy. Some of the notable sustainability initiatives undertaken by Orange include:

- 100% Green Energy Consumption: Since 2014, Orange has exclusively relied on green energy sources to power its operations, reinforcing their dedication to environmental responsibility.

- Device Recycling and Repair Program: Orange has implemented an ambitious program focused on recycling and repairing devices at their points of sale. By extending the lifespan of devices, they actively contribute to reducing electronic waste.

- Eco-Guidelines for Sustainable Practices: Orange has established eco-guidelines to encourage sustainable actions in their day-to-day operations. These guidelines serve as a roadmap, guiding employees in adopting environmentally friendly practices, even in the smallest gestures.

The ongoing efforts of Orange to promote sustainability demonstrate their commitment to mitigating their environmental impact. By integrating green energy, recycling and repair programs, and fostering sustainable practices, Orange is leading by example in its pursuit of a more sustainable future.

…………………………………………………………………………………………………………………………………………..

Separately, Orange Belgium has completed its acquisition of a controlling stake in telco operator, VOO SA. The closing of this deal will give Orange Belgium a 75% stake minus 1 share in VOO SA, with the remaining 25% plus one share retained by Nethys.

This transaction values VOO at an enterprise value of €1.8 billion for 100% of the capital. Orange Belgium will finance this transaction through an intra-Group loan.

Xavier Pichon, CEO of Orange Belgium, comments: “For decades, we developed our telecom skills and pioneering spirit to challenge the market, but as from today, we have the industrial power, tech means and commercial scale to accelerate and Lead the Future of the Belgian telco market in the interest of all consumers, employees and society in general.”

References:

Orange Launches 5G+ Network With Reduced Energy Consumption in Spain

Reuters: Majority of EU countries against network fee levy on Big Tech firms but 10 countries for it

Europe’s major telecommunications operators faced resistance from a majority of EU countries in their efforts to compel Big Tech companies to contribute to the funding of 5G and broadband deployment across the region, Reuters reported on Friday. At a meeting with EU industry chief Thierry Breton in Luxembourg on Thursday, telecoms ministers from 18 European countries either rejected the proposed network fee levy on tech firms, or demanded a study into the need and impact of such a measure, the sources said. That echoed comments made last month by EU telecoms regulators’ group BEREC.

European network operators including Deutsche Telekom, Orange, Telefonica and Telecom Italia want Big Tech to shoulder part of the network costs on the grounds that their data and content makes up a large part of network traffic. They have found a receptive ear in the European Commission’s industry chief Breton, a former chief executive of France Telecom and French IT consulting firm Atos.

Alphabet Inc’s Google, Apple Inc, Facebook parent Meta Platforms Inc, Netflix Inc, Amazon.com Inc and Microsoft Corp have rejected the idea of a levy, saying they already invest in the digital ecosystem.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/KMQKW6GCVVMPTGTGJ22KNYCMPQ.jpg)

European Union flags fly outside the European Commission headquarters in Brussels, Belgium, March 1, 2023. REUTERS/Johanna Geron

……………………………………………………………………………………………………………………………………………………………………………….

The European telecom ministers cited the lack of an analysis on the effects of a network levy, the absence of an investment shortfall, and the risk of Big Tech passing on the extra cost to consumers, the people said. They also warned about the potential violation of EU “net neutrality” rules, which require all users to be treated equally, as well as possible barriers to innovation, and a lower quality of products.

- Critics of a network levy included Austria, Belgium, Czech Republic, Denmark, Finland, Germany, Ireland, Lithuania, Malta and the Netherlands, the people said.

- On the other hand, France, Greece, Hungary, Italy, Spain and Cyprus were among 10 countries which backed the idea, one of the people said.

- Poland, Portugal and Romania either took a neutral stance or had not adopted a position, the people said, but another person said they favoured a network fee.

Breton is expected to issue a report by the end of June with a summary of feedback provided by Big Tech, telecoms providers and others, which will help decide his next steps. Any legislative proposal needs to be negotiated with EU countries and EU lawmakers before it can become law.

References:

Amazon NOT at all likely to offer mobile service to Prime Members or anyone else!

Wireless telecom stocks were down -5% to -9% at Friday morning’s open (they closed on June 2nd -4% to -6.25% lower). That horrendous performance was due to a Bloomberg article which claimed that “Amazon has been talking with wireless carriers about offering low-cost or possibly free nationwide mobile phone service to Prime subscribers, according to people familiar with the situation….It would let it offer Prime members wireless plans for $10 a month or possibly for free and bolster loyalty among its biggest spending customers, the people said, who requested anonymity to discuss a private matter.” About 167 million Amazon shoppers had Prime memberships as of March, unchanged from a year earlier, according to Consumer Intelligence Research Partners.

The Bloomberg article made this controversial statement, subsequently denied:

“The talks have been going on for six to eight weeks and have also included AT&T Inc. at times, but the plan may take several more months to launch and could be scrapped, an Amazon person said.”

Image Credits: Nathan Stirk / Getty Images

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Nothing could be further from the truth!

Amazon, T-Mobile US, AT&T and Verizon Communications all denied on Friday that anything is happening. T-Mobile’s statement on the matter strongly states that “Amazon has told us they have no plans to add wireless service.”

That echoes Amazon’s own statement which said “We are always exploring adding even more benefits for Prime members, but don’t have plans to add wireless at this time,” said Bradley Mattinger, an Amazon spokesperson.

“AT&T is not in discussions with Amazon to resell wireless services,” a company spokesperson said. A Verizon spokesperson told TechCrunch, “Verizon is not in negotiations with Amazon regarding the resale of the nation’s best and most reliable wireless network. Our company is always open to new and potential opportunities, but we have nothing to report at this time.”

T-Mobile told Barron’sthat “Amazon is a great partner to T-Mobile in many areas, and we are always interested in working more closely with our cross-town neighbors in new ways. However, we are not in discussions about inclusion of our wireless in Prime service, and Amazon has told us they have no plans to add wireless service.”

Wall Street analysts are skeptical that there is anything actually going on. MoffettNathanson analysts Craig Moffett and Michael Morton wrote in a research note published late Friday that any deal for Amazon to start its own phone service seems highly unlikely. (Moffett covers telecom and Morton covers internet stocks.) Moffett and Morton note that while Amazon could make it happen, the cost to the company of providing even a single line would be about $240 a year—above the annual cost of an Amazon Prime membership, currently at $139. And that’s just for one line—the costs would multiply with bigger families.

Another issue, they add, is that Amazon would suddenly be subject to regulation from the FCC. They point out that customer information is more tightly regulated in telecom than in related industries. That adds more risk to Amazon’s existing regulatory worries. “Even a minimal risk like this would be a deal breaker, in our view,” they write.

From a telecom perspective, the analysts also pour cold water on any potential deal. As for Dish Network , Moffett and Morton write, “there is virtually no chance…that Amazon would allow itself to play guinea pig on a start-up Dish wireless network.” Dish did not respond to a request for comment about the report.

In an interview with Barron’s, Moffett noted that Dish only has partial coverage— the company has launched service in 120 cities so far, but not in places like New York, Chicago, Los Angeles, Washington, or San Francisco. To cover the parts of the country it can’t reach, Dish has reseller agreements with both AT&T and T-Mobile. Moffett says that T-Mobile likely’s agreement with Dish doesn’t allow it to resell access to a third party—like Amazon. And AT&T’s agreement has similar language.

“Without the ability to resell AT&T or T-Mobile service, Dish simply isn’t a credible partner,” Moffett and Morton write. “Not only is their coverage insufficient to be a viable offering, but they’ve never operated a wireless network before, let alone a large-scale MVNO. [An MVNO is a carrier that has no network but instead resells service from other carriers.]”

With T-Mobile and Verizon having denied discussions, and Dish seeming very unlikely, that leaves only AT&T. And Moffett and Morton see little chance of that happening. “AT&T is smart enough to understand what an awful idea it would be to let Amazon into the hen house, in our view,” they wrote.

The two analysts also contend that a Prime Wireless plan wouldn’t do much to help Amazon grow its subscription business. They point out that Prime already has signed up about 80% of U.S. households and that churn rates for Prime are already “extremely low.”

Moffett and Morton conclude: “We’re skeptical that the incumbents would be willing to ink a deal with Amazon. We’re skeptical that Amazon would really want to. We’re skeptical that Amazon would be willing to do business with Dish Network. We’re skeptical about…well, all of it.”

Note also that Amazon failed dismally in 2014 with its Fire Phone, which was an attempt to compete with smart phones from Apple Inc. and Samsung Electronics Co., but it was killed a year later. MVNO brands including ESPN Mobile and Virgin Mobile both failed. Alphabet Inc. has the Google Fi service that runs on T-Mobile’s network and has only 2 million customers.

Let’s end with a question: One must consider if Bloomberg can be trusted as a reputable news source after their early morning June 2nd story?

References:

https://www.barrons.com/amp/articles/amazon-prime-phone-service-telecom-stocks-b439ae5a

https://www.barrons.com/articles/amazon-wireless-verizon-dish-stock-att-f23cad24?mod=article_inline