Lumen

Lumen and Ciena Transmit 1.2 Tbps Wavelength Service Across 3,050 Kilometers

Lumen and Ciena have teamed up for a significant new network trial. They have successfully demonstrated a 1.2Tbps wavelength spanning 3,050k m (more than 1,800 miles) on Lumen’s Ultra-Low-Loss (ULL) fiber network, making it the world’s longest 1.2 terabit non-regenerated signal. The trial leveraged Ciena’s WL6e technology over a 6500 photonic line system and Lumen’s fiber network between Denver and Dallas. They also used 800Gbps routing technology from Juniper’s PTX Series to establish Ethernet and IP services. Lumen’s 400G-enabled network already spans over 78,000 route miles, and the company continues to invest in next-generation fiber to enhance its Ultra-Low Loss (ULL) fiber network, the largest in North America.

Using 800G interfaces, Lumen and Ciena successfully tested and qualified the services to support wavelength, Ethernet, and IP services over the 1.2 Tbps single carrier channel. The live network trial from Denver to Dallas used Ciena’s latest WaveLogic 6 Extreme (WL6e) technology equipped in the Waveserver platform running over a 6500 photonic line system.

“1.2 terabits per second isn’t just about incredible speed and long distances, it’s about the value of enabling the next wave of digital transformation. Lumen is at the forefront of building a next-generation network designed to handle the explosive growth of AI and cloud workloads,” said Dave Ward, Lumen’s chief technology and product officer. “Our investment in increased capacity, powered by Ciena’s WaveLogic 6 technology, provides our hyperscale cloud partners and enterprises with the ultra-high-capacity connectivity needed to scale their AI and cloud applications. With 400G connectivity speeds today and a seamless upgrade path to 1.2 terabits, Lumen stands as the trusted network for AI.”

The trial also showcased the impressive performance and seamless interoperability between Ciena’s Waveserver platform and the Juniper PTX10002-36QDD Packet Transport Router at 800 Gbps over the ultra-long-haul 1.2 Tbps intercity network. By leveraging the performance, flexibility and scalability of the Juniper PTX Series Routers, Lumen successfully established Ethernet and IP services with minimal latency and zero packet loss throughout the tests.

Editor’s Note:

While the companies March 27th joint press release stated the 1.2T bps wavelength transport was a record, AT&T claimed two weeks earlier that it “achieved a long distance world record top speed of 1.6Tb/s over a single wavelength across 296 km of its long haul fiber optic network.” We reported that in this IEEE Techblog post. So yes, it’s a record considering the Lumen network wavelength distance was > 10 times that claimed by AT&T.

Faster connections up to 1.2 Tbps wavelengths means less lag, more capacity and the flexibility to handle the most data-hungry applications across multiple industries:

- AI & Machine Learning

- Hyperscale Cloud & Data Center Interconnects

- Financial Trading and Market Data Transport

- Cybersecurity & AI-powered Threat Intelligence

- Media & Streaming

“At Microsoft, the demand for ultra-high-speed, low-latency connectivity is growing exponentially as AI workloads, cloud applications, and real-time analytics scale,” Lumen said. “Lumen and Ciena’s successful wavelength trial showcases a forward-thinking approach to meeting these growing demands. By enabling more efficient data movement over vast distances, this solution helps us optimize cloud performance, enhance customer experiences, and support the rapid expansion of AI training and inferencing models across our global infrastructure.”

Ciena’s WL6e is the industry’s first high-bandwidth coherent transceiver using state-of-the-art 3nm silicon, capable of carrying capacity up to 1.6 terabits per second per wavelength.

“As the pioneer in high-speed optical innovation, we are dedicated to helping our customers set new benchmarks in network performance and efficiency,” said Brodie Gage, Ciena senior vice president, global products and supply chain. “This industry-first trial with Lumen marks a pivotal step in our efforts to prepare networks for the AI era. Lumen’s network does not stand still. Continuous investment in the latest network technology is essential for keeping up with bandwidth demands today and into the future.”

Additional Resources:

About Lumen Technologies:

Lumen is unleashing the world’s digital potential. We ignite business growth by connecting people, data, and applications – quickly, securely, and effortlessly. As the trusted network for AI, Lumen uses the scale of our network to help companies realize AI’s full potential. From metro connectivity to long-haul data transport to our edge cloud, security, managed service, and digital platform capabilities, we meet our customers’ needs today and as they build for tomorrow.

SOURCE: Lumen Technologies

References:

Analysts weigh in: AT&T in talks to buy Lumen’s consumer fiber unit – Bloomberg

AT&T sets 1.6 Tbps long distance speed record on its white box based fiber optic network

China Telecom with ZTE demo single-wavelength 1.2T bps hollow-core fiber transmission system over 100T bps

Lumen Technologies to connect Prometheus Hyperscale’s energy efficient AI data centers

The need for more cloud computing capacity and AI applications has been driving huge investments in data centers. Those investments have led to a steady demand for fiber capacity between data centers and more optical networking innovation inside data centers. Here’s the latest example of that:

Prometheus Hyperscale has chosen Lumen Technologies to connect its energy-efficient data centers to meet growing AI data demands. Lumen network services will help Prometheus with the rapid growth in AI, big data, and cloud computing as they address the critical environmental challenges faced by the AI industry.

Rendering of Prometheus Hyperscale flagship Data Center in Evanston, Wyoming:

……………………………………………………………………………….

Prometheus Hyperscale, known for pioneering sustainability in the hyperscale data center industry, is deploying a Lumen Private Connectivity Fabric℠ solution, including new network routes built with Lumen next generation wavelength services and Dedicated Internet Access (DIA) [1.] services with Distributed Denial of Service (DDoS) protection layered on top.

Note 1. Dedicated Internet Access (DIA) is a premium internet service that provides a business with a private, high-speed connection to the internet.

This expanded network will enable high-density compute in Prometheus facilities to deliver scalable and efficient data center solutions while maintaining their commitment to renewable energy and carbon neutrality. Lumen networking technology will provide the low-latency, high-performance infrastructure critical to meet the demands of AI workloads, from training to inference, across Prometheus’ flagship facility in Wyoming and four future data centers in the western U.S.

“What Prometheus Hyperscale is doing in the data center industry is unique and innovative, and we want to innovate alongside of them,” said Ashley Haynes-Gaspar, Lumen EVP and chief revenue officer. “We’re proud to partner with Prometheus Hyperscale in supporting the next generation of sustainable AI infrastructure. Our Private Connectivity Fabric solution was designed with scalability and security to drive AI innovation while aligning with Prometheus’ ambitious sustainability goals.”

Prometheus, founded as Wyoming Hyperscale in 2020, turned to Lumen networking solutions prior to the launch of its first development site in Aspen, WY. This facility integrates renewable energy sources, sustainable cooling systems, and AI-driven energy optimization, allowing for minimal environmental impact while delivering the computational power AI-driven enterprises demand. The partnership with Lumen reinforces Prometheus’ dedication to both technological innovation and environmental responsibility.

“AI is reshaping industries, but it must be done responsibly,” said Trevor Neilson, president of Prometheus Hyperscale. “By joining forces with Lumen, we’re able to offer our customers best-in-class connectivity to AI workloads while staying true to our mission of building the most sustainable data centers on the planet. Lumen’s network expertise is the perfect complement to our vision.”

Prometheus’ data center campus in Evanston, Wyoming will be one of the biggest data centers in the world with facilities expected to come online in late 2026. Future data centers in Pueblo, Colorado; Fort Morgan, Colorado; Phoenix, Arizona; and Tucson, Arizona, will follow and be strategically designed to leverage clean energy resources and innovative technology.

About Prometheus Hyperscale:

Prometheus Hyperscale, founded by Trenton Thornock, is revolutionizing data center infrastructure by developing sustainable, energy-efficient hyperscale data centers. Leveraging unique, cutting-edge technology and working alongside strategic partners, Prometheus is building next-generation, liquid-cooled hyperscale data centers powered by cleaner energy. With a focus on innovation, scalability, and environmental stewardship, Prometheus Hyperscale is redefining the data center industry for a sustainable future. This announcement follows recent news of Bernard Looney, former CEO of bp, being appointed Chairman of the Board.

To learn more visit: www.prometheushyperscale.com

About Lumen Technologies:

Lumen uses the scale of their network to help companies realize AI’s full potential. From metro connectivity to long-haul data transport to edge cloud, security, managed service, and digital platform capabilities, Lumenn meets its customers’ needs today and is ready for tomorrow’s requirements.

In October, Lumen CTO Dave Ward told Light Reading that a “fundamentally different order of magnitude” of compute power, graphics processing units (GPUs) and bandwidth is required to support AI workloads. “It is the largest expansion of the Internet in our lifetime,” Ward said.

Lumen is constructing 130,000 fiber route miles to support Meta and other customers seeking to interconnect AI-enabled data centers. According to a story by Kelsey Ziser, the fiber conduits in this buildout would contain anywhere from 144 to more than 500 fibers to connect multi-gigawatt data centers.

REFERENCES:

https://www.lightreading.com/data-centers/2024-in-review-data-center-shifts

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Superclusters of Nvidia GPU/AI chips combined with end-to-end network platforms to create next generation data centers

Initiatives and Analysis: Nokia focuses on data centers as its top growth market

Proposed solutions to high energy consumption of Generative AI LLMs: optimized hardware, new algorithms, green data centers

Deutsche Telekom with AWS and VMware demonstrate a global enterprise network for seamless connectivity across geographically distributed data centers

Microsoft choses Lumen’s fiber based Private Connectivity Fabric℠ to expand Microsoft Cloud network capacity in the AI era

Lumen Technologies and Microsoft Corp. announced a new strategic partnership today. Microsoft has chosen Lumen to expand its network capacity and capability to meet the growing demand on its datacenters due to AI (i.e. huge processing required for Large Language Models, including data collection, preprocessing, training, and evaluation). Datacenters have become critical infrastructure that power the compute capabilities for the millions of people and organizations who rely on and trust the Microsoft Cloud.

Microsoft claims they are playing a leading role in ushering in the era of AI, offering tools and platforms like Azure OpenAI Service, Microsoft Copilot and others to help people be more creative, more productive and to help solve some of humanity’s biggest challenges. As Microsoft continues to evolve and scale its ecosystem, it is turning to Lumen as a strategic supplier for its network infrastructure needs and is investing with Lumen to support its next generation of applications for Microsoft platform customers worldwide.

Lumen’s Private Connectivity Fabric℠ is a custom network that includes dedicated access to existing fiber in the Lumen network, the installation of new fiber on existing and new routes, and the use of Lumen’s new digital services. This AI-ready infrastructure will strengthen the connectivity capabilities between Microsoft’s datacenters by providing the network capacity, performance, stability and speed that customers need as data demands increase.

Art by Midjourney for Fierce Network

…………………………………………………………………………………………………………………………………………………………………………………..

“AI is reshaping our daily lives and fundamentally changing how businesses operate,” said Erin Chapple, corporate vice president of Azure Core Product and Design, Microsoft. “We are focused both on the impact and opportunity for customers relative to AI today, and a generation ahead when it comes to our network infrastructure. Lumen has the network infrastructure and the digital capabilities needed to help support Azure’s mission in creating a reliable and scalable platform that supports the breadth of customer workloads—from general purpose and mission-critical, to cloud-native, high-performance computing, and AI, plus what’s on the horizon. Our work with Lumen is emblematic of our investments in our own cloud infrastructure, which delivers for today and for the long term to empower every person and every organization on the planet to achieve more.”

“We are preparing for a future where AI is the driving force of innovation and growth, and where a powerful network infrastructure is essential for companies to thrive,” said Kate Johnson, president and CEO, Lumen Technologies (a former Microsoft executive). “Microsoft has an ambitious vision for AI and this level of innovation requires a network that can make it reality. Lumen’s expansive network meets this challenge, with unique routes, unmatched coverage, and a digital platform built to give companies the flexibility, access and security they need to create an AI-enabled world.”

Lumen has launched an enterprise-wide transformation to simplify and optimize its operations. By embracing Microsoft’s cloud and AI technology, Lumen can reduce its overall technology costs, remove legacy systems and silos, improve its offerings, and create new solutions for its global customer base. Lumen will migrate and modernize its workloads to Microsoft Azure, use Microsoft Entra solutions to safeguard access and prevent identity attacks and partner with Microsoft to create and deliver new telecom industry-specific solutions. This element alone is expected to improve Lumen’s cash flow by more than $20 million over the next 12 months while also improving the company’s customer experience.

“Azure’s advanced global infrastructure helps customers and partners quickly adapt to changing economic conditions, accelerate technology innovation, and transform their business with AI,” said Chapple. “We are committed to partnering with Lumen to help deliver on their transformation goals, reimagine cloud connectivity and AI synergies, drive business growth, and help customers achieve more.”

This collaboration expands upon the longstanding relationship between Lumen Technologies and Microsoft. The companies have worked together for several years, with Lumen leveraging Copilot to automate routine tasks and reduce employee workloads and enhance Microsoft Teams.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Lumen’s CMO Ryan Asdourian hinted the deal could be the first in a series of such partnerships, as network infrastructure becomes the next scarce resource in the era of AI. “When the world has talked about what’s needed for AI, you usually hear about power, space and cooling…[these] have been the scarce resources,” Asdourian told Fierce Telecom. Asdourian said Lumen will offer Microsoft access to a combination of new and existing routes in the U.S., and will overpull fiber where necessary. However, he declined to specify the speeds which will be made available or exactly how many of Microsoft’s data centers it will be connecting.

Microsoft will retain full control over network speeds, routes and redundancy options through Lumen’s freshly launched Private Connectivity Fabric digital interface. “That is not something traditional telecom has allowed,” Asdourian said.

Asdourian added that Lumen isn’t just looking to enable AI, but also incorporate it into its own operations. Indeed, part of its partnership deal with Microsoft involves Lumen’s adoption of Azure cloud and other Microsoft services to streamline its internal and network systems. Asdourian said AI could be used to make routing and switching on its network more intelligent and efficient.

…………………………………………………………………………………………………………………………………………………………………………………..

About Lumen Technologies:

Lumen connects the world. We are igniting business growth by connecting people, data, and applications – quickly, securely, and effortlessly. Everything we do at Lumen takes advantage of our network strength. From metro connectivity to long-haul data transport to our edge cloud, security, and managed service capabilities, we meet our customers’ needs today and as they build for tomorrow. For news and insights visit news.lumen.com, LinkedIn: /lumentechnologies, Twitter: @lumentechco, Facebook: /lumentechnologies, Instagram: @lumentechnologies and YouTube: /lumentechnologies.

About Microsoft:

Microsoft (Nasdaq “MSFT” @microsoft) creates platforms and tools powered by AI to deliver innovative solutions that meet the evolving needs of our customers. The technology company is committed to making AI available broadly and doing so responsibly, with a mission to empower every person and every organization on the planet to achieve more.

…………………………………………………………………………………………………………………………………………………………………………………..

References:

https://news.lumen.com/2024-07-24-Microsoft-and-Lumen-Technologies-partner-to-power-the-future-of-AI-and-enable-digital-transformation-to-benefit-hundreds-of-millions-of-customers

https://fierce-network.com/cloud/microsoft-taps-lumens-fiber-network-help-it-meet-ai-demand

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

Lumen, Google and Microsoft create ExaSwitch™ – a new on-demand, optical networking ecosystem

ACSI report: AT&T, Lumen and Google Fiber top ranked in fiber network customer satisfaction

Lumen to provide mission-critical communications services to the U.S. Department of Defense

Dell’Oro: Optical Transport market to hit $17B by 2027; Lumen Technologies 400G wavelength market

ACSI report: AT&T, Lumen and Google Fiber top ranked in fiber network customer satisfaction

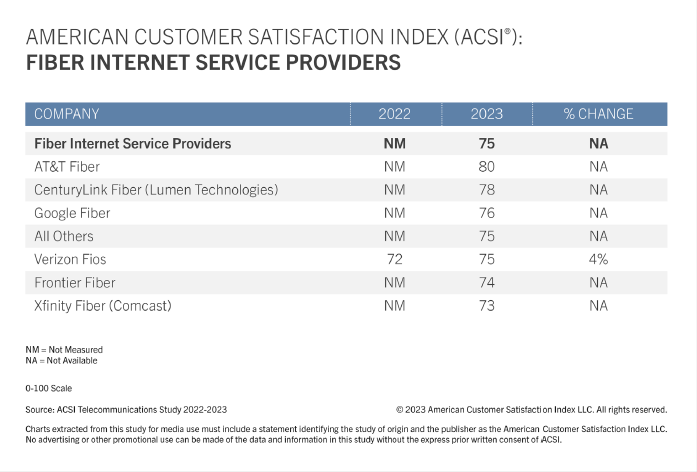

AT&T is #1 in customer satisfaction for fiber optic network providers, according to a new report from the American Customer Satisfaction Index (ACSI). ACSI’s report rates consumer satisfaction for both fiber and non-fiber ISPs as well as for video streaming services and apps. For this study, ACSI interviewed more than 22,000 customers at random between April 2022 and March 2023.

AT&T Fiber tops fiber ISPs — and the entire industry — with a score of 80. CenturyLink (Lumen) Fiber is next at 78, followed by Google Fiber (76). The smaller group of fiber ISPs and Verizon Fios both score 75. Frontier Fiber and Xfinity Fiber round out the fiber ISPs at 74 and 73, respectively.

AT&T is targeting a few cities across Arizona and Nevada with its Gigapower joint venture, in partnership with BlackRock. Whereas Lumen just upped multi-gig coverage in its Quantum Fiber markets and Google Fiber announced several forthcoming builds.

Among non-fiber ISPs, T-Mobile takes the top spot with a score of 73. AT&T Internet finishes second at 72, while ACSI newcomer Sparklight sits in third place at 71. Kinetic by Windstream is next at 70, just outperforming Xfinity (68).

Despite an impressive showing among fiber ISPs, Lumen sits near the bottom in the non-fiber group with a score of 62. Frontier Communications and Optimum round out the non-fiber ISPs at 61 and 58, respectively.

“Across the entire customer experience, fiber service shows a strong advantage — from data transfer speed and service reliability to touchpoints like call centers and websites,” says Forrest Morgeson, Assistant Professor of Marketing at Michigan State University and Director of Research Emeritus at the ACSI. “That said, with well over half of U.S. households lacking access to fiber internet, availability remains a sticking point. As such, non-fiber ISP services remain an attractive option for many customers and should not be overlooked by providers.”

…………………………………………………………………………………………………………………………………………………………………

Fiber sets the pace for in-home Wi-Fi quality:

ACSI also measures key aspects of the in-home Wi-Fi experience for both customers who use equipment from their ISP and those who use third-party equipment that they have purchased.

Fiber ISPs (79) outperform both non-fiber ISPs (73) and third-party equipment providers (70) for overall Wi-Fi quality. The former far exceeds the other two in every customer experience benchmark, including strong marks for the security of its Wi-Fi connection (81) and reliability in terms of avoiding loss of service (80).

References:

No Surprise: AT&T tops leaderboard of commercial fiber lit buildings for 7th year!

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

Lumen to provide mission-critical communications services to the U.S. Department of Defense

Lumen Technologies recently won a $223 million contract from the U.S. Defense Information Systems Agency (DISA) to provide secure, mission-critical communications services to the U.S. Department of Defense (DoD).

“The U.S. Department of Defense has a far-reaching mission to provide military forces to deter war and ensure our nation’s security. DoD selected Lumen to deliver voice communications services that will help it carry out its important mission using today’s technologies,” said Zain Ahmed, senior vice president, Lumen public sector. “DoD is modernizing its network and leveraging cloud-based technologies like the new voice system enabled by Lumen that securely connects our troops with modern communications tools wherever they are.”

- Lumen will supply DISA with modern hybrid-cloud voice and audio-conferencing services that support the Department of Defense (DoD)’s mission both inside and outside the U.S.

- The new Voice over Internet Protocol (VoIP) system saves the government money by eliminating the need for desk phones and supporting remote users as DoD transitions to a hybrid workforce.

- Lumen is serving as a trusted provider of secure, resilient communications services that enable more than 250,000 concurrent connections to DISA’s voice cloud system.

- Lumen is supplying unified communications services via an integrated phone system that runs over the company’s fiber network.

- Delivering voice and conferencing services from cloud data centers that meet DoD Impact Level 5 security standards provides modern capabilities with scalable infrastructure ready to meet warfighters’ needs on demand.

The new voice services will support DoD’s transition to a next generation 911 (NG911) system at military bases that can better pinpoint and route first responders to a caller’s location. The Lumen NG911 platform improves the delivery of emergency calls and enables residents to contact 911 not only by making a voice call—it also lays the foundation for the delivery of pictures and videos in the future.

- The $223 million task order has a base performance period of one year, with three additional one-year options and a potential six-month extension.

- It was awarded to Lumen under the General Services Administration’s 15-year, $50 billion Enterprise Infrastructure Solutions (EIS) program.

- Tyto Government Solutions, Inc. is a strategic subcontractor to Lumen. The two companies are working to fulfill the order’s technical requirements by delivering phone and conferencing services from highly available, resilient cloud data centers that meet DoD Impact Level 5 (IL5) security standards.

- Lumen is honored to support military and government agencies with innovative adaptive networking, edge cloud, connected security and collaboration services using the company’s platform for advanced application delivery solutions.

- The company provides a platform for IT modernization that delivers the security and reliability military and civilian agencies need to carry out their important missions.

- Learn more about our Defense Information Systems Agency $1.5 billion award to provide network transport to the U.S. Indo-Pacific Command Area of Responsibility: http://news.lumen.com/2022-11-01-Lumen-wins-1-5-billion-Defense-Information-Systems-Network-contract

- Learn more about our U.S. Department of Agriculture $1.2 billion network services award: https://news.lumen.com/2022-01-20-U-S-Department-of-Agriculture-awards-Lumen-1-2-billion-network-services-contract

- Learn more about our U.S. Department of the Interior $1.6 billion network services award: https://news.lumen.com/2020-01-16-U-S-Dept-of-the-Interior-Awards-CenturyLink-1-6-Billion-EIS-Network-Services-Win

- Learn more about how Lumen is supporting the public sector here:

https://www.lumen.com/public-sector.html

Lumen is guided by our belief that humanity is at its best when technology advances the way we live and work. With approximately 400,000 route fiber miles and serving customers in more than 60 countries, we deliver the fastest, most secure platform for applications and data to help businesses, government and communities deliver amazing experiences. Learn more about the Lumen network, edge cloud, security, communication and collaboration solutions and our purpose to further human progress through technology at news.lumen.com, LinkedIn: /lumentechnologies, Twitter: @lumentechco, Facebook: /lumentechnologies, Instagram: @lumentechnologies and YouTube: /lumentechnologies. Learn more about Lumen’s public sector capabilities on Twitter at @lumengov and on LinkedIn at @lumenpublicsector. Lumen and Lumen Technologies are registered trademarks in the United States.

Dell’Oro: Optical Transport market to hit $17B by 2027; Lumen Technologies 400G wavelength market

According to a recent forecast report by Dell’Oro Group, the Optical Transport equipment demand is forecast to increase at a 3 percent compounded annual growth rate (CAGR) for the next five years, reaching $17 billion by 2027. The cumulative revenue during that five year period is expected to be $81 billion.

“We expect annual growth rates to fluctuate in the near term before stabilizing to a more typical 3 percent growth rate,” said Jimmy Yu, Vice President at Dell’Oro Group. “There is still a large amount of market uncertainty this year due to the economic backdrop—economists are predicting a high chance of a recession in North America and Europe. However, at the same time, most optical systems equipment manufacturers are reporting record levels of order backlog entering the year, and we expect that most of this backlog could convert to revenue when component supply improves this year,” added Yu.

Additional highlights from the Optical Transport 5-Year January 2023 Forecast Report:

- Optical Transport market expected to increase in 2023 due to improving component supply.

- WDM Metro market growth rates in next five years are projected to be lower than historic averages due to the growing use of IP-over-DWDM.

- DWDM Long Haul market is forecast to grow at a five-year CAGR of 5 percent.

- Coherent wavelength shipments on WDM systems forecast to grow at 11 percent CAGR, reaching 1.2 million annual shipments by 2027.

- Installation of 400 Gbps wavelengths expected to dominate for most of forecast period.

About the Report

The Dell’Oro Group Optical Transport 5-Year Forecast Report offers a complete overview of the Optical Transport industry with tables covering manufacturers’ revenue, average selling prices, unit shipments, wavelength shipments (by speed up to 1.2+ Tbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers, optical switch, Disaggregated WDM, DCI, and ZR Optics.

……………………………………………………………………………………………………………………………………………………

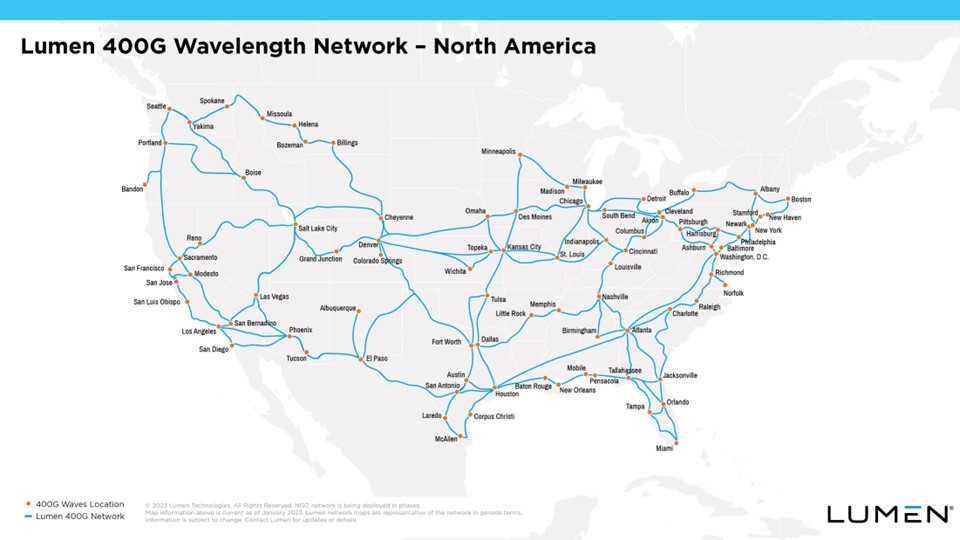

Separately, Lumen Technologies is expanding its 400G wavelength network across North America. Lumen said it has now deployed the network in 70 markets. More than 240 data centers have access to Lumen’s 400G Wavelength Services, and the network has over 800 Tbit/s of capacity.

Lumen said it plans to continue its intercity 400G expansion this year, pushing the network “deeper into the metro edge.” The company noted that wavelength services will assist customers in moving workloads to the cloud, and provide private, dedicated connections.

Enterprise customers can also examine network options, plan out their wavelengths and get cost estimates with Lumen’s Topology Viewer.

References:

https://www.prnewswire.com/news-releases/lumen-kicks-up-its-400g-offering-across-the-us-301730126.html

Lumen Technologies expands Edge Computing Solutions into Europe

Lumen Technologies announced the expansion of its edge computing services into Europe. The low-latency platform businesses need to extend their high-bandwidth, data-intensive applications out to the cloud edge. This expansion is part of Lumen’s continued investment in next-generation solutions that transform digital experiences and meet the demands of today’s global businesses.

“Edge computing is a game-changer. It will drive the next wave of business innovation and growth across virtually all industries,” said Annette Murphy, regional president, EMEA and APAC, Lumen Technologies. “Customers in Europe can now tap into the power of the Lumen platform, underpinned by Lumen’s extensive fiber footprint, to deploy data-heavy applications and workloads that demand ultra-low latency at the cloud edge. This delivers peak performance and reliability, as well as more capability to drive amazing digital experiences. Customers can focus efforts on developing applications and bringing them to market, rather than on time-consuming infrastructure deployment.”

Today, Lumen Edge Computing Solutions can meet approximately 70% of enterprise demand within 5 milliseconds of latency in the UK, France, Germany, Belgium, and the Netherlands. Additional locations are planned by end of year. Lumen Edge Computing Solutions bring together the power of the company’s expansive global fiber network, on-demand networking, integrated security, and managed services, with edge facilities and compute and storage services. This allows for quick and efficient deployment of applications and workloads at the edge, closer to the point of digital interaction. Customers can procure Lumen Edge Computing Solutions online, and within an hour gain access to high-powered computing infrastructure on the Lumen platform.

Lumen offers several edge infrastructure and services solutions to support enterprise innovation and applications of the 4th Industrial Revolution. These include:

- Lumen Edge Bare Metal offers dedicated, pay-as-you-go server hardware hosted in distributed locations and connected to the Lumen global fiber network. Edge Bare Metal delivers enhanced security and connectivity with dedicated, single tenancy servers designed to isolate and protect data and deliver high-performance.

- Lumen Network Storage enables customers to take advantage of secure, scalable, and fast storage where and when they need it. The service allows enterprises and public sector organizations to ingest and update data at the edge using whatever file storage protocol meets their needs.

- Lumen Edge Private Cloud provides pre-built infrastructure for high performance private cloud computing connected to the Lumen global fiber network. Lumen Edge Private Cloud is fully managed by Lumen and helps businesses go-to-market quickly with the capacity needed for interaction-intensive applications.

- Lumen Edge Gateway is a scalable Multi-access Edge Compute (MEC) platform for the premises. The service offers a compute platform for the delivery of virtualized wide area networking (WAN), security, and IT applications from multiple vendors on the premises edge.

Key Facts:

- Lumen Edge Computing Solutions meet approximately 97% of U.S. enterprise demand and approximately 70% of enterprise demand in the UK, France, Germany, Belgium, and the Netherlands within 5 milliseconds of latency.

- For a current list of live and planned Lumen edge locations, visit: https://www.lumen.com/en-uk/resources/network-maps.html#edge-roadmap

- As part of the Edge Computing Solutions deployment in Europe, Lumen enabled an additional 100G MPLS and IP network connectivity, as well as increased power and cooling at key edge data center locations.

- Lumen manages and operates one of the largest, most connected, most deeply peered networks in the world. It is comprised of approximately 500,000 (805,000 km) global route miles of fiber and more than 190,000 on-net buildings, seamlessly connected to 2,200 public and private third-party data centers and leading public cloud service providers.

- In EMEA, the Lumen network is comprised of approximately 42,000 (67,000 km) route miles of fiber and connects to more than 2,500 on-net buildings and 540 public and private third-party data centers.

Additional Resources:

- Lumen Edge Computing Solutions: https://www.lumen.com/en-us/solutions/edge-computing.html

- Lumen Edge Bare Metal: https://www.lumen.com/en-us/edge-computing/bare-metal.html

- Lumen Network Storage: https://www.lumen.com/en-us/hybrid-it-cloud/network-storage.html

- Lumen Edge Private Cloud: https://www.lumen.com/en-us/hybrid-it-cloud/private-cloud.html

- Lumen Edge Gateway: https://www.lumen.com/en-us/edge-computing/edge-gateway.html

About Lumen Technologies and the People of Lumen:

Lumen is guided by our belief that humanity is at its best when technology advances the way we live and work. With approximately 500,000 route fiber miles and serving customers in more than 60 countries, we deliver the fastest, most secure platform for applications and data to help businesses, government and communities deliver amazing experiences.

References:

Lumen Technologies Fiber Build Out Plans Questioned by Analysts

Lumen Technologies is one of a large and growing number of telecom companies counting on a broad expansion of its fiber network. The Fiber Broadband Association (FBA) recently reported that the fiber industry is entering its “largest investment cycle ever” thanks to the efforts of companies like AT&T, Verizon and Lumen.

Lumen hopes to build its fiber network to 12 million new locations over the coming years. But it won’t be easy, according to Lumen CEO Jeff Storey.

“Supply chains are stressed, and we continue working very closely with our diverse and valued suppliers to mitigate risk as we execute on our growth objectives,” Storey said this week during his company’s quarterly conference call, according to a Seeking Alpha transcript. Others have issued similar warnings.

“I don’t want to overstate the issue, but it’s something that we are really paying attention to and working with vendors. We are starting to see some companies hold off on taking new orders. And as we see that, then we are working to put in our mitigation plans to make sure it’s factored into our build plan. But it is an issue that I will highlight as a real one that we have to mitigate.”

Lumen Technologies reported fourth-quarter results and 2022 expectations that generally fell below the forecasts of some financial analysts.

“Lumen’s 2022 guidance will fuel concerns that the company will have no choice but to eventually let leverage rise to inappropriate levels, dial back on investment, cut the dividend, or choose some combination thereof,” wrote the financial analysts at MoffettNathanson. “In particular, 2022 EBITDA [earnings before interest, taxes, depreciation, and amortization] guidance was noticeably below expectations at a time when capex will be elevated.”

“Results at this stage don’t give investors confidence in the company’s ability to earn an adequate return,” wrote the financial analysts at New Street Research.

Lumen and other fiber providers like Frontier Communications and AT&T are moving forward with their fiber buildout plans. Some, like AT&T and Frontier, are reporting big gains in the number of their new fiber customers. But others, like Lumen, are not.

“The past few quarters have been relatively weak for broadband net additions for Lumen, even for its higher-speed fiber offering,” MoffettNathanson said of Lumen’s consumer broadband business. “This quarter’s broadband net adds were at the low end of what the company has reported over the past few years and were shy of consensus estimates.”

The financial analysts at Evercore wrote that Lumen’s business segment drives three-quarters of the company’s revenue, and that too remains stressed. “The jury remains very much out on the company’s prospects in this sector,” they wrote, noting that sales in the company’s business segment declined slightly in the fourth quarter when compared with the third quarter of last year.

New Street analysts say a key metric for Lumen will be the percentage of customers in a given area who opt to purchase its new fiber optic access. If Lumen gets 40% of potential customers to sign up, the company likely will generate profits. “At 30%, the company would likely destroy value,” they warned.

Lumen CEO Storey stated that the company has already managed to get an average of around 29% of customers in its new fiber markets to sign up for its service. And that, he said, is with relatively little marketing.

He expects that number to be above 40% in the months and years to come. “If you look at the quality of the product that we have, we have a very effective competitive product and even with the limited marketing, we are doubling our penetration rates in our traditional copper areas,” Storey said.

New findings from the financial analysts at Cowen are supportive of Lumen’s fiber optic build out plans. The Cowen analysts recently conducted a nationwide survey of more than 1,000 respondents and found that fiber-to-the-home (FTTH) “take rates” reached 56% among those surveyed.

“Take rate, or more specifically, market penetration, is a key driver of the FTTH business case,” they wrote. “We have previously noted that a penetration rate of 30-35% is the typical minimum break-even threshold when underwriting FTTH projects. When there is one broadband competitor, fiber penetration can approach high-50s and even 60% penetration levels in mature markets.”

Lumen CMO Shaun Andrews said: “One of the things that really differentiates us right now is our focus on fiber as part of the core infrastructure to an edge experience versus a distraction with 5G or content. And being able to look an enterprise in the eye and say ‘Not only do we have these capabilities, but we will build the fiber to you where you are.’ That resonates with customers, and I think that’s a differentiator.”

…………………………………………………………………………………………………………………………

Last month, Lumen reported that they secured a massive $1.2 billion contract with the U.S. Department of Agriculture (USDA), setting it up to give one of the biggest government agency networks a major makeover.

Under the contract, Lumen will “completely transform” the USDA’s network covering 9,500 locations across the country. It will provide a range of services, including SD-WAN, managed trusted internet protocol, zero-trust networking, edge computing, remote access, virtual private networking, cloud connectivity, unified communications and collaboration, contact center, voice-over-internet protocol, ethernet transport, optical wavelength, and equipment and engineering.

References:

https://www.lightreading.com/opticalip/analysts-fret-over-lumens-fiber-plans/d/d-id/775229?

https://www.fiercetelecom.com/telecom/lumen-reels-12b-contract-overhaul-usdas-legacy-network

Lumen’s big fiber roll-out push from 2.5M to 12M locations passed in the next few years

Lumen Technologies to empower customers to set up the wavelength subnetworks

CenturyLink rebrands as LUMEN for large enterprise customers; adds Quantum Fiber

Lumen’s big fiber roll-out push from 2.5M to 12M locations passed in the next few years

At the 2022 CitiApps Economy Virtual Conference yesterday, Lumen Technologies, Inc (formerly CenturyLink) President and CEO Jeff Storey said his company plans to increase its fiber deployments from 2.5 million locations to 12 million, which represents a five-times increase over the company’s traditional deployment rate. Storey said Lumen had been investing about 400,000 new fiber locations passed every year. “We have been very strategic and targeted and micro targeted in our approach to. We wanted to build — all digital experience of the quantum fiber platform, we’ve done that our NPS scores are really, really exceptional for quantum fiber. And so we’ve proven that we can build successfully, we proven that we can deliver successfully, and built all of the systems around the customer unnecessary to do that. So we’ll continue to invest there.”

Storey did not state how many years it would take company to reach 12M locations passed.

Separately, Lumen is expecting to close a sale of its local exchange business (formerly US West) to Apollo Funds in the second half of the year, which means it will retain mostly markets in metro areas. “We’ve rewritten the consumer playbook,” said Storey, noting that the company is now positioned as an “all-digital fiber brand.”

Like other broadband providers that have relied, in large part, on traditional copper network infrastructure, Lumen has been losing broadband customers in recent years. The company hopes that its investment in fiber will reverse that trend and has set a goal of returning to revenue growth within two to three years.

“Fiber wins. If you are competing with any other technology, fiber wins. And we’ll continue to deliver the majority of our services over fiber infrastructure and integrate those capabilities into an all digital experience. And when you do that, I think Lumen wins.” Storey said.

Lumen’s office building at 1025 Eldorado Blvd, Broomfield, CO 80021

……………………………………………………………………………………………………………………………………………………………..

Not surprisingly, considering Lumen’s emphasis on the business market for telecom services, Storey went on to note several advantages that are likely to be most appealing to business customers. In particular:

Fiber and data communications are more important than ever. But we don’t just look at it as data growth opportunity. For example, enterprises are shifting. I already said this, but more and more to hybrid environments. With hybrid employees, hybrid computing, hybrid network connect those employees, the computing, the applications that they use in the most sensible manner.

We look at combining our fiber infrastructure with capabilities like SASE, edge computing, and dynamic connections. Dynamic connections is really our network as a service capability. We create hybrid computing and networking environments that empower the enterprises to acquire, analyze and act on their data.

And looking over the Lumen platform, we enable new technologies and expanding our addressable market and we believe we’re in a great position to deliver. At the beginning of last year, we announced we’d have edge computing resources within five milliseconds, from 95% of U.S. enterprises. By the end of the year, we actually completed that somewhere in the middle of June, July, and today we’re around 97%. So we believe we have a great infrastructure tightly coupled with our fiber capabilities and we think there’s a great opportunity. Lumen and industry analysts agree, that is a major opportunity with 10s of billions of dollars in revenue potential. But it’s more than focusing on one product. It’s our ability to combine our services into holistic solutions for our enterprise customers.

Because we are a fiber-based platform… bringing our services to our customers with the connectivity of the fiber but also to cloud service providers, major data center providers,…private data centers of our customers [and] to eyeball networks,” he said, “we are in an excellent position to… help [customers] acquire their data, analyze their data [from] all of these different cloud options… and then act on their data.

In his opening remarks, Storey summed up Lumen’s strategic plan for 2022:

Our top priority is revenue growth, and we’re very focused on that, 2022 will be somewhat an investment year for Lumen, something CapEx and OpEx. CapEx is generally success-based initiatives that we have. But OpEx is a little more proactive investing in things like product development, marketing, brand, and other go-to-market initiatives that we have. We will continue to focus on investing and augmenting the Lumen platform, we believe it’s a great way to enable new technologies and expand our capabilities and our addressable market. We’ve already announced our accelerated quantum fiber bill, and plan to add more than 12 million locations over the coming years in the remaining 16 states that we operate in the states.

Lastly, we continue to invest in transforming our business for better customer experience, and operational efficiencies. We’ve done a great job of improving our customer experience, at the same time taking costs out of the business by using the technologies that we sell to our customers and then using other technologies in our business direct.

This strong increase in fiber deployment echoes what was said earlier this week at the 2022 CitiApps Economy Virtual Conference from Scott Beasley of Frontier Communications and AT&T’s CEO John Stankey. Also, from MSO Cable One’s joint venture with three private equity firms.

References:

Lumen’s Fiber Internet Offerings: https://www.lumen.com/en-us/networking/business-fiber.html

Webcast Replay: https://kvgo.com/citi-apps-economy-conference/lumen-technologies-jan-2022

CEO: Lumen Plans Fiber Deployment Rate of 5x its Historical Rate