Century Link

ACSI report: AT&T, Lumen and Google Fiber top ranked in fiber network customer satisfaction

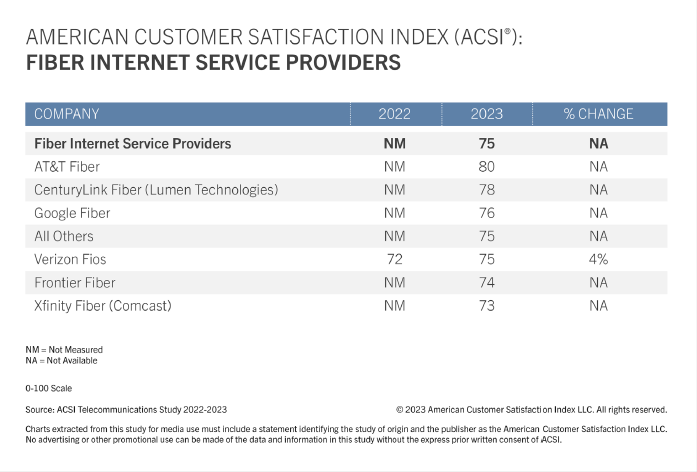

AT&T is #1 in customer satisfaction for fiber optic network providers, according to a new report from the American Customer Satisfaction Index (ACSI). ACSI’s report rates consumer satisfaction for both fiber and non-fiber ISPs as well as for video streaming services and apps. For this study, ACSI interviewed more than 22,000 customers at random between April 2022 and March 2023.

AT&T Fiber tops fiber ISPs — and the entire industry — with a score of 80. CenturyLink (Lumen) Fiber is next at 78, followed by Google Fiber (76). The smaller group of fiber ISPs and Verizon Fios both score 75. Frontier Fiber and Xfinity Fiber round out the fiber ISPs at 74 and 73, respectively.

AT&T is targeting a few cities across Arizona and Nevada with its Gigapower joint venture, in partnership with BlackRock. Whereas Lumen just upped multi-gig coverage in its Quantum Fiber markets and Google Fiber announced several forthcoming builds.

Among non-fiber ISPs, T-Mobile takes the top spot with a score of 73. AT&T Internet finishes second at 72, while ACSI newcomer Sparklight sits in third place at 71. Kinetic by Windstream is next at 70, just outperforming Xfinity (68).

Despite an impressive showing among fiber ISPs, Lumen sits near the bottom in the non-fiber group with a score of 62. Frontier Communications and Optimum round out the non-fiber ISPs at 61 and 58, respectively.

“Across the entire customer experience, fiber service shows a strong advantage — from data transfer speed and service reliability to touchpoints like call centers and websites,” says Forrest Morgeson, Assistant Professor of Marketing at Michigan State University and Director of Research Emeritus at the ACSI. “That said, with well over half of U.S. households lacking access to fiber internet, availability remains a sticking point. As such, non-fiber ISP services remain an attractive option for many customers and should not be overlooked by providers.”

…………………………………………………………………………………………………………………………………………………………………

Fiber sets the pace for in-home Wi-Fi quality:

ACSI also measures key aspects of the in-home Wi-Fi experience for both customers who use equipment from their ISP and those who use third-party equipment that they have purchased.

Fiber ISPs (79) outperform both non-fiber ISPs (73) and third-party equipment providers (70) for overall Wi-Fi quality. The former far exceeds the other two in every customer experience benchmark, including strong marks for the security of its Wi-Fi connection (81) and reliability in terms of avoiding loss of service (80).

References:

No Surprise: AT&T tops leaderboard of commercial fiber lit buildings for 7th year!

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

Lumen’s big fiber roll-out push from 2.5M to 12M locations passed in the next few years

At the 2022 CitiApps Economy Virtual Conference yesterday, Lumen Technologies, Inc (formerly CenturyLink) President and CEO Jeff Storey said his company plans to increase its fiber deployments from 2.5 million locations to 12 million, which represents a five-times increase over the company’s traditional deployment rate. Storey said Lumen had been investing about 400,000 new fiber locations passed every year. “We have been very strategic and targeted and micro targeted in our approach to. We wanted to build — all digital experience of the quantum fiber platform, we’ve done that our NPS scores are really, really exceptional for quantum fiber. And so we’ve proven that we can build successfully, we proven that we can deliver successfully, and built all of the systems around the customer unnecessary to do that. So we’ll continue to invest there.”

Storey did not state how many years it would take company to reach 12M locations passed.

Separately, Lumen is expecting to close a sale of its local exchange business (formerly US West) to Apollo Funds in the second half of the year, which means it will retain mostly markets in metro areas. “We’ve rewritten the consumer playbook,” said Storey, noting that the company is now positioned as an “all-digital fiber brand.”

Like other broadband providers that have relied, in large part, on traditional copper network infrastructure, Lumen has been losing broadband customers in recent years. The company hopes that its investment in fiber will reverse that trend and has set a goal of returning to revenue growth within two to three years.

“Fiber wins. If you are competing with any other technology, fiber wins. And we’ll continue to deliver the majority of our services over fiber infrastructure and integrate those capabilities into an all digital experience. And when you do that, I think Lumen wins.” Storey said.

Lumen’s office building at 1025 Eldorado Blvd, Broomfield, CO 80021

……………………………………………………………………………………………………………………………………………………………..

Not surprisingly, considering Lumen’s emphasis on the business market for telecom services, Storey went on to note several advantages that are likely to be most appealing to business customers. In particular:

Fiber and data communications are more important than ever. But we don’t just look at it as data growth opportunity. For example, enterprises are shifting. I already said this, but more and more to hybrid environments. With hybrid employees, hybrid computing, hybrid network connect those employees, the computing, the applications that they use in the most sensible manner.

We look at combining our fiber infrastructure with capabilities like SASE, edge computing, and dynamic connections. Dynamic connections is really our network as a service capability. We create hybrid computing and networking environments that empower the enterprises to acquire, analyze and act on their data.

And looking over the Lumen platform, we enable new technologies and expanding our addressable market and we believe we’re in a great position to deliver. At the beginning of last year, we announced we’d have edge computing resources within five milliseconds, from 95% of U.S. enterprises. By the end of the year, we actually completed that somewhere in the middle of June, July, and today we’re around 97%. So we believe we have a great infrastructure tightly coupled with our fiber capabilities and we think there’s a great opportunity. Lumen and industry analysts agree, that is a major opportunity with 10s of billions of dollars in revenue potential. But it’s more than focusing on one product. It’s our ability to combine our services into holistic solutions for our enterprise customers.

Because we are a fiber-based platform… bringing our services to our customers with the connectivity of the fiber but also to cloud service providers, major data center providers,…private data centers of our customers [and] to eyeball networks,” he said, “we are in an excellent position to… help [customers] acquire their data, analyze their data [from] all of these different cloud options… and then act on their data.

In his opening remarks, Storey summed up Lumen’s strategic plan for 2022:

Our top priority is revenue growth, and we’re very focused on that, 2022 will be somewhat an investment year for Lumen, something CapEx and OpEx. CapEx is generally success-based initiatives that we have. But OpEx is a little more proactive investing in things like product development, marketing, brand, and other go-to-market initiatives that we have. We will continue to focus on investing and augmenting the Lumen platform, we believe it’s a great way to enable new technologies and expand our capabilities and our addressable market. We’ve already announced our accelerated quantum fiber bill, and plan to add more than 12 million locations over the coming years in the remaining 16 states that we operate in the states.

Lastly, we continue to invest in transforming our business for better customer experience, and operational efficiencies. We’ve done a great job of improving our customer experience, at the same time taking costs out of the business by using the technologies that we sell to our customers and then using other technologies in our business direct.

This strong increase in fiber deployment echoes what was said earlier this week at the 2022 CitiApps Economy Virtual Conference from Scott Beasley of Frontier Communications and AT&T’s CEO John Stankey. Also, from MSO Cable One’s joint venture with three private equity firms.

References:

Lumen’s Fiber Internet Offerings: https://www.lumen.com/en-us/networking/business-fiber.html

Webcast Replay: https://kvgo.com/citi-apps-economy-conference/lumen-technologies-jan-2022

CEO: Lumen Plans Fiber Deployment Rate of 5x its Historical Rate

Lumen to sell local incumbent carrier operations in 20 states to Apollo Funds for $7.5 billion

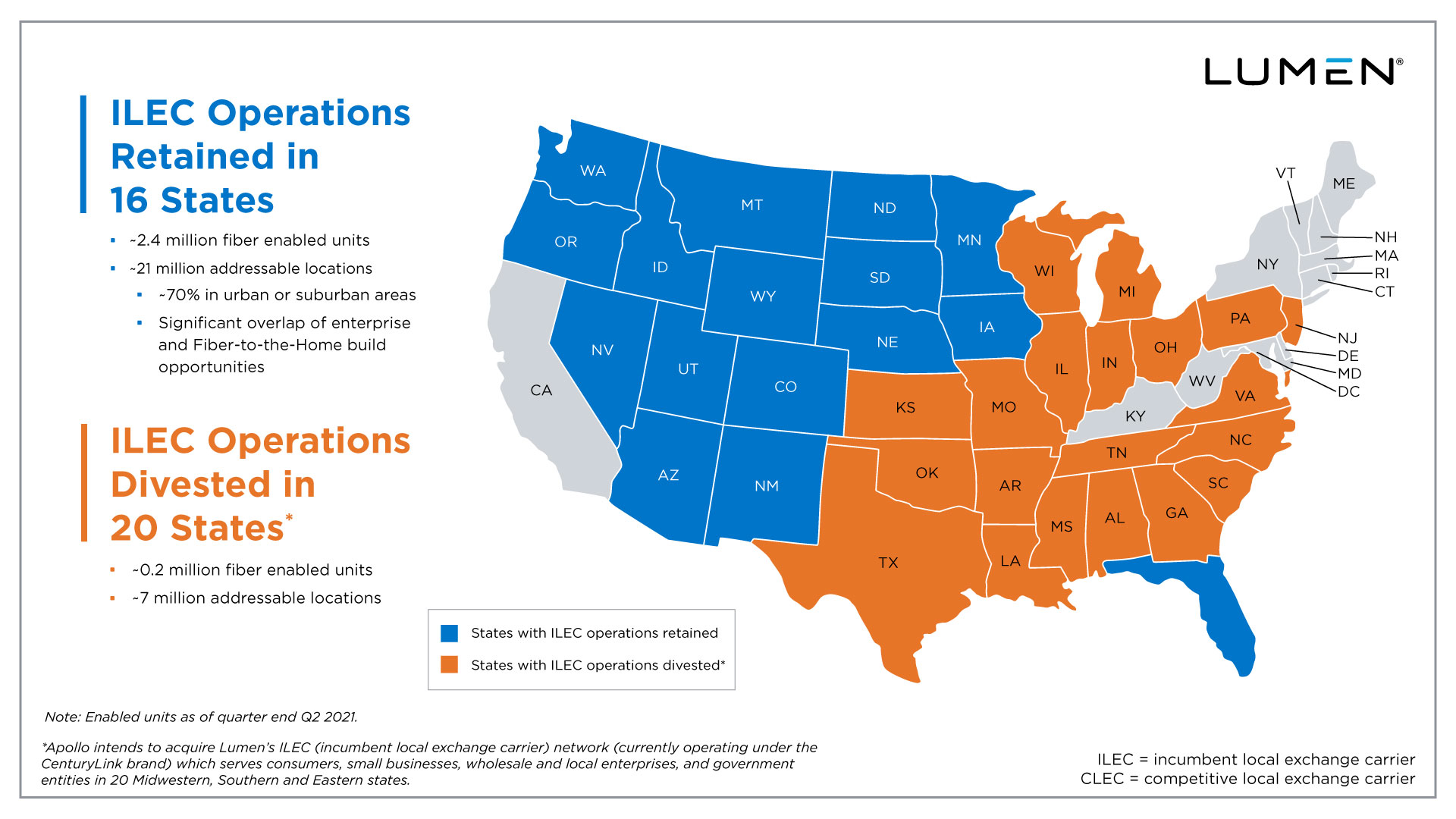

Lumen Technologies, formerly known as CenturyLink, has agreed to sell a large part of its U.S. network to Apollo Global Management for $7.5 billion, according to a report by The Wall Street Journal on Tuesday. The report was later confirmed by Lumen.

A collection of telephone lines and broadband infrastructure (which cover 6 million residential and business customers across 20 states, mostly in the U.S. Midwest and Southeast) are included in the deal. So is $1.4 billion of assumed debt by Lumen.

“If you look at the markets that we’re transferring to Apollo, these are markets that Lumen would not have invested as heavily in,” Lumen CEO Jeff Storey said in an interview. “Apollo will put the investment into these markets that we believe they can sustain.”

Lumen’s remaining operations will focus on large business clients, which generate most of its revenue, as well as home-broadband subscribers in 16 states including Colorado, Florida and Washington.

The sale is the latest course change for Lumen, the company known as CenturyLink until its 2020 rebranding. CenturyLink was among the few remnants of the former AT&T monopoly (e.g. US West then Qwest) to survive into the 21st Century, though it avoided copying peers’ pursuit of wireless customers and focused its attention on landlines. In July, Lumen said it was selling its Latin American assets to infrastructure investor Stonepeak Partners LP for $2.7 billion.

CenturyLink grew much bigger after it agreed in 2016 to merge with Level 3 Communications, a network operator focused on large U.S. business customers. The combination yielded billions of dollars in savings and tax advantages, though executives faced challenges stitching together the business cultures of CenturyLink, based in Monroe, LA, and the operations inherited from Level 3 in Broomfield, CO.

For Apollo, the Lumen deal plays into a thesis the firm has developed with the new company’s executives around the need for fiber-based broadband to be expanded in the U.S. While fiber is a superior consumer broadband technology, many potential providers of fiber have lacked the access to capital to upgrade their sprawling networks, according to Aaron Sobel, the Apollo partner who led the deal. As a standalone company, the new entity won’t have other capital needs that take priority.

“It’s very difficult to carve out these states from a large telco,” Mr. Sobel said. “You’re dealing with a business that is legacy and theoretically declining and returning it to growth.”

Lumen is keeping the customers and pieces of its consumer broadband network that seem like a good fit for its fiber business. Everything else it had no plans to invest in is headed to the new company, as it discussed would happen just a few weeks ago.

“We are actively looking at selling non-core assets to unlock value in our business,” Lumen CEO Jeff Storey said during an earnings conference call in May. “If we find transactions that are positive to shareholders, we won’t hesitate to move forward.”

Apollo’s plans aren’t laid out in detail in The WSJ’s article, but it did identify several former Verizon executives who would be leading the new telecom concern absorbing Lumen’s mostly copper-based customers. They include Bob Mudge, Chris Creager and Tom Maguire, a group that helped launch Verizon’s FiOS FTTH service.

Just last week Lumen announced it was selling its Latin American business to Stonepeak, an investment firm, for $2.7 billion. In that transaction, Lumen formed a U.S.-based company that would be in Stonespeak’s portfolio to operate and run its divested network and other assets.

About the Transaction

|

What Does Lumen Retain? |

What Will Apollo Acquire? |

|

21mm Enabled Units |

7mm Enabled Units |

|

2.4mm Fiber Enabled Units |

0.2mm Fiber Enabled Units |

|

3.4mm Broadband Subscribers |

~1.3mm Broadband Subscribers |

|

687k Fiber Subscribers |

59k Fiber Subscribers |

………………………………………………………………………….

MoffetNathanson’s Nick Del Deo, CFA, wrote in a note to clients:

During its Q1 earnings call, Lumen made clear that it was actively looking to optimize its portfolio and was open to asset sales. Moreover, it indicated that share repurchases might be under consideration if the stock price remained at what the company believes to be depressed levels. The company delivered on both fronts.

Last week, Lumen announced it had agreed to sell its Latin American unit to Stonepeak for $2.7B at a ~9x EBITDA multiple.

Not content with one deal, today it announced another to sell about one quarter if its ILEC business to Apollo for $7.5B at a ~5.5x EBITDA headline multiple. And it announced that its Board has approved a $1B share repurchase program that management may use opportunistically over the next two years.

Lumen secured a solid price for the ILEC assets that it is selling to Apollo. However, when considered in tandem with the LatAm deal, they are unlikely to be materially de-levering.

References:

https://news.lumen.com/apollo-transaction-resource-center

Lumen and Microsoft Azure in mutually beneficial partnership

Lumen Technologies, formerly CenturyLink, has identified Microsoft Azure as its preferred public cloud service provider for enterprise customers’ workloads, and will incorporate additional enterprise application capabilities from Azure to Lumen’s wireline telco platform. Microsoft has in turn named Lumen a preferred partner that will support Azure globally via Lumen’s networking, infrastructure and managed services.

Mutual customers will benefit from being able to run their Microsoft-based solutions closer to where digital interactions are occurring using the global Edge Computing services of Lumen, creating one of the fastest, most secure platforms for applications and data.

“Working with Microsoft, Lumen will offer businesses and developers capabilities at the edge that are unique in the industry,” said Shaun Andrews, executive vice president and chief marketing officer for Lumen. “By deeply integrating more of our platform services with Microsoft Azure, we can help businesses quickly utilize their data for the insights they want and need, with the ability to support unique and customized use cases. We’re excited about the innovations and amazing new digital experiences we can enable for our mutual customers by extending Azure to the edge of our global network.”

Lumen will collaborate with Microsoft on several future go-to-market efforts to support mutual customers worldwide, using the resources of the Lumen Edge Experience Center, including:

- A certified Azure deployment which will be able to run in Lumen Edge Computing nodes worldwide, unlocking more low latency and high bandwidth use cases for customers of Azure service platform.

- Communication sector solutions based around Private 5G networks that would leverage the cloud-native software capabilities of Microsoft and the Lumen fiber network and Edge Computing capabilities. These solutions would allow customers to optimize their wireless networks and push workloads even closer to digital interactions.

- Enterprise sector managed solutions for a wide range of Microsoft software and cloud services to help optimize performance of business workloads and support a customer’s entire workforce, wherever they may reside.

“By making Microsoft Azure technology available on the Lumen platform we are giving enterprises access to an environment where they can get the low-latency performance they need for critical applications, with the familiarity of Microsoft services and tools,” said Yousef Khalidi, corporate vice president, Azure for Operators at Microsoft. “With this collaboration we are expanding the ways in which businesses can connect Azure to their enterprise networks and are excited about having Lumen as a collaboration partner to expand the number of use cases we can achieve at the edge of the network.”

Further solidifying their alliance, Lumen has selected Azure as the preferred public cloud venue for workloads that serve its enterprise customers, helping to improve customer experience for the Lumen platform and transforming the ways in which new service features get added to the platform. Enterprise customers will benefit from having consistent access management experiences across all Lumen digital services. Lumen will also leverage Azure, Microsoft Power Apps and Microsoft 365 E5 Security & Compliance for its internal digital transformation.

Additionally, Microsoft has named Lumen as one of its preferred partners supporting Azure globally with Lumen networking, infrastructure, and managed services. Enterprise customers will benefit from having even more high-performing network connectivity to all their Azure services from the Lumen platform.

Lumen’s network includes nearly 450,000 global route miles of fiber and over 180,000 on-net buildings connected to global edge nodes. In addition, Lumen says it has 350 data centers globally, and 2,200 third-party data centers in North America, Europe & Middle East, Latin America and Asia Pacific.

Key Facts:

- Lumen is a certified Microsoft Managed Services Partner for a wide range of Microsoft software and cloud services and Microsoft Gold Partner.

- Lumen edge nodes are designed to meet 95% of U.S. enterprise demand within 5 milliseconds of latency.

- For a current list of live and planned edge locations, visit: https://www.lumen.com/en-us/solutions/edge-computing.html#edge-computing-map

- The Lumen network is comprised of approximately 450,000 global route miles of fiber and more than 180,000 on-net buildings, seamlessly connected to global edge nodes, 350 Lumen data centers globally, and 2,200 third-party data centers in North America, Europe & Middle East, Latin America, and Asia Pacific.

Additional Resources:

For more information on Lumen Edge computing solutions visit: www.lumen.com/edge\

For more information on Azure Stack visit: https://azure.microsoft.com/en-us/overview/azure-stack/

Learn more about Lumen Solutions for Microsoft Teams here: https://www.lumen.com/en-us/communications/ucc.html

About Lumen Technologies:

Lumen is guided by our belief that humanity is at its best when technology advances the way we live and work. With approximately 450,000 route fiber miles and serving customers in more than 60 countries, we deliver the fastest, most secure platform for applications and data to help businesses, government and communities deliver amazing experiences. Learn more about the Lumen network, edge cloud, security, communication and collaboration solutions and our purpose to further human progress through technology at news.lumen.com/home

LinkedIn: /lumentechnologies, Twitter: @lumentechco, Facebook: /lumentechnologies, Instagram: @lumentechnologies and YouTube: /lumentechnologies.

Lumen and Lumen Technologies are registered trademarks in the United States.

…………………………………………………………………………………………………………………………………………………………

References:

https://www.lumen.com/en-us/about/4th-industrial-revolution.html

Lumen Technologies and T-Mobile collaborate on edge compute for enterprise customers

Following this week’s Verizon-AWS announcement on Multi-access Edge Computing (MEC), T-Mobile US has entered the mobile edge computing business using wireline carrier Lumen Technologies (formerly CenturyLink) as its initial preferred vendor.

T-Mobile US has taken a decidedly different MEC approach compared to its two domestic rivals (Verizon and AT&T). The U.S.’s #2 wireless network operator effectively views the edge as a latter opportunity that doesn’t merit a large initial investment. Its edge computing initiatives are exclusively focused on businesses and government agencies that fall under Lumen’s enterprise unit and T-Mobile for business.

“By pairing America’s largest and fastest 5G network with Lumen’s enterprise solutions, we can break down industry barriers and deliver unparalleled network reach to enterprise and government organizations looking to optimize their applications across networks,” Mike Katz, EVP for T-Mobile for Business, said in a prepared statement. “With our leading 5G network, Lumen and T-Mobile have the opportunity to accelerate business innovation in an era where the network is more critical than ever,” Katz added,

Enterprise applications will likely benefit from Lumen’s hundreds of thousands of fiber connected enterprise locations paired with T-Mobile’s “largest and fastest 5G network.”

“The Lumen platform, with 60 plus planned edge market nodes distributed on our high-capacity global fiber network enables application designs with latency of 5 milliseconds or less between the workload and the endpoint device,” wrote David Shacochis, VP of enterprise technology and field CTO at Lumen.

“Lumen’s fiber reach and edge computing resources can augment business solutions for T-Mobile customers, and private wireless solutions can augment business solutions for Lumen customers,” Shacochis added.

“The companies envision starting with metropolitan areas where they are already well connected, and expanding their joint go-to-market over time,” Shacochis wrote, adding that more details about commercial availability and services will be shared throughout 2021.

These efforts aim to address the pressing needs of enterprises to transform their networks to meet the data-intensive challenges across a variety of industries and use cases. Both companies will also continue to drive innovation in this space through T-Mobile’s labs and Tech Experience Center and the Lumen Edge Experience Center.

“Our relationship with T-Mobile aims to introduce a powerful trifecta – access to national 5G wireless and fiber connectivity, managed services across a range of technologies and edge computing resources,” said Shaun Andrews, executive vice president and chief marketing officer for Lumen Technologies. “T-Mobile’s expansive 5G footprint coupled with our extensive edge computing platform would provide enterprise developers with the best of both worlds to power the next wave of digital business.”

- For a current list of Lumen live and planned edge locations, visit: https://www.lumen.com/en-us/solutions/edge-computing.html#edge-computing-map

- The Lumen low latency network is comprised of approximately 450,000 global route miles of fiber and more than 180,000 on-net buildings, seamlessly connected to:

- 2,200 public and private third-party data centers in North America, Europe & Middle East, Latin America, and Asia Pacific

- Leading public cloud service providers including Amazon Web Services, Microsoft Azure ExpressRoute & Azure Government, Google Cloud, IBM Cloud and Oracle Cloud

T-Mobile’s partnership with Lumen is likely just the beginning. “As in all things with 5G, I think a lot of our efforts have to be done through partnerships,” said John Saw, EVP of advanced and emerging technologies at T-Mobile. Apparently, the network operator will form partnerships with many of the big vendors in the space, including hyperscalers (Google, Amazon, Microsoft), and other specialized mobile edge computing vendors.

Similarly, Shacochis said Lumen is also “open to and looking at” other partnerships in the wireless space. Lumen executives outlined a plan to offer edge compute services in August 2019. The company deployed its first block of edge nodes and obtained its first customer in Q3-2020, before formally launching its edge platform in December 2020.

Building on cloud partnerships with Microsoft Azure, Google Cloud and Amazon Web Services (AWS), Lumen bolstered its edge capabilities through additional deals with VMware and IBM.

…………………………………………………………………………………………………………………………….

References:

https://www.sdxcentral.com/articles/news/lumen-lands-t-mobiles-first-5g-edge-contract/2021/04/

https://www.fiercetelecom.com/telecom/lumen-strikes-edge-compute-deal-t-mobile

https://www.sdxcentral.com/edge/definitions/multi-access-edge-computing-vendors/

IBM and Verizon Business Collaborate on 5G, Edge Computing and AI Solutions for Enterprise Customers

CenturyLink rebrands as LUMEN for large enterprise customers; adds Quantum Fiber

CenturyLink has taken on a new identity — Lumen — a name it says better highlights the company’s future direction and focus on selling business services to large customers. [Note that there is already a Texas based company named Lumen Technologies Inc so there’s sure to be confusion and a possible trademark lawsuit in the near future.]

Lumen is a measure of the brightness of light, and the company’s competitive advantage this century has come from its massive fiber network, stretching 450,000 route miles. That has helped CenturyLink survive even as consumers cut their home phone lines in favor of wireless providers and switched off DSL in favor of faster alternatives.

But transporting light signals can also be a commodity service. Lumen is now pushing to offer more higher-value applications and enterprise services directly to its customers, reflected in the company’s new motto: “The Platform for Amazing Things.”

Lumen says on its website:

Lumen is an enterprise technology platform that enables companies to capitalize on emerging applications that power the 4th Industrial Revolution. Most IT leaders don’t feel ready to face the nearly century’s worth of data-driven innovation they expect in the next five years.

“Our people are dedicated to furthering human progress through technology. Lumen is all about enabling the amazing potential of our customers, by utilizing our technology platform, our people, and our relationships with customers and

partners,” said Lumen CEO Jeff Storey, in a statement on the name change.

“For the past three years we have been reinventing ourselves and repositioning the company to deliver on a brand-new promise: Furthering human progress through technology,” said Lumen CTO Andrew Dugan, who held the same title at CenturyLink. “We have been considering this change for many months. We are ideally positioned to help resolve the biggest data and application challenges of our time—this is why now is the right time to introduce Lumen.”

The CenturyLink brand will continue to be used for residential and small business customers using traditional copper based networks. “CenturyLink, with its strong heritage, will remain as a trusted brand for residential and small business customers over traditional networks,” the company said.

………………………………………………………………………………………………………………………………………………………………………………………

The number of telecom and cloud service providers that have been acquired by CenturyLink is truly astounding. That list includes: US West (which was acquired by Qwest Communications), Embarq (which included Sprint Local and US Telecom), Savvis, App Frog, Tier 3, and the big one –Level 3 Communications in a deal valued at around $25 billion. Level 3, in turn, had also acquired a boat load of telecom providers such as Global Crossing and TW Telecom and before that: WilTel Communications, Broadwing Corporation, Looking Glass Networks, Progress Telecom, and Telcove (formerly Adelphia Business Solutions) and ICG Communications.

………………………………………………………………………………………………………………………………………………………………………………….

These acquisitions, long with internal software innovations, they have given Lumen the ability to provide enterprise customers with a variety of services in a variety of areas. However, the company still does not have presence in the cellular communications business.

“Unfortunately, today’s network, cloud and IT architectures present latency, cost and security challenges that inhibit the performance of distributed applications and real-time data processing. Ultimately, the world needs a new architecture platform that has been designed to support the intensive performance requirements of next-generation applications. And that is exactly what we aim to provide with Lumen,” said Lumen’s chief marketing officer Shaun Andrews, in a video message.

Smart cities, retail and industrial robotics, real-time virtual collaboration and automated factories are some of the applications that Lumen believes it can help customers achieve in what it and others call the 4th Industrial Revolution. Steam power, electricity and then the computer chip all pushed economic progress, and now the melding of the digital and physical worlds that connectivity permits is doing the same, Andrews added.

That is the future direction, where the company sees the greatest potential for growth and new revenues. But Andrews emphasized that residential and small business consumers will still deal with CenturyLink, a brand executives believe still has value two decades into the new century. It is the name that will continue to show up on residential customers’ bills. CenturyLink Field in Seattle will retain its name.

Another new entity, Quantum Fiber, will handle the residential and small business transition to digital as the company rolls out more fiber-optic connections directly to homes and businesses (FTTH and FTTP, respectively). The company added capacity to reach about 300,000 homes and small businesses last year with gigabit service and plans to reach another 400,000 this year, according to Fierce Telecom.

Lumen says the can provide the ability to control latency, bandwidth and security for applications across cloud data centers, the market edge and on-premises, according to a blog by Dugan. Instead of putting critical applications into a centralized cloud, Lumen’s edge compute platform, which includes more than 100 active edge compute nodes across large metro markets in the U.S—puts them closer to the end user for low latency and better security.

“The Lumen brand is focused on supporting our enterprise business customers. It alludes to our network strength and to the incredible capabilities powered by our platform to help transform how businesses operate,” Dugan said.

“Quantum Fiber is an important new brand within Lumen with a focus on superior fiber connectivity and a fully enabled digital customer experience,” Dugan said. “Quantum Fiber serves residential and small business customers, and Lumen focuses on enterprise, government and global businesses.”

In 2019, CenturyLink expanded its fiber network to reach an estimated 300,000 additional homes and small businesses with its gigabit service. CenturyLink’s consumer fiber-to-the-home (FTTH) projects provide symmetrical speeds of up to 940 Mbps. The faster speeds were enabled in parts of Boulder, Colo., Spokane, Wash., and Tucson, Ariz. last year.

CenturyLink previously said it would build out its fiber network to an additional 400,000 homes and small businesses this year, including in Denver, Omaha, Neb., Phoenix, Portland, Ore., Salt Lake City, Spokane, Wash., and Springfield, MO.

MoffetNathanson analysts wrote in a note to clients (emphasis added):

The flagship Lumen brand is targeted toward larger enterprises, the likes of which would be most likely to adopt the company’s most advanced services. The CenturyLink brand is being retained for legacy copper services delivered to residential customers and some SMBs, as well as existing FTTH customers. And the new Quantum Fiber brand is being introduced for SMB services delivered via the automated platform the company has been developing and has indicated it would soon be rolling out to on-net, out-of-region locations (mostly ex-Level 3 buildings), and will include consumer FTTH sold in a similar manner. The services and capabilities Lumen delivers to each of these customer segments varies dramatically, so it’s not at all inappropriate to have separate brands for each. Innumerable examples of this phenomenon exist across other industries – automotive, consumer products, airlines, apparel, media, and so on. Within the world of telecom, carriers often have brands that target different segments or highlight different product types (Verizon with FiOS, AT&T with Cricket, T-Mobile US with MetroPCS, Altice USA with Optimum vs. Lightpath, and so on).

CenturyLink was an amalgamation of many different companies, assets, and capabilities. Management’s decision to rebrand as Lumen, Quantum Fiber, and CenturyLink acknowledges those differences and gives management an opportunity to refresh and communicate its vision for the company to customers, employees, and investors.

Andrews said the name change won’t include a relocation to Denver of the corporate headquarters, which will remain in Monroe, La., home of the original CenturyLink. Of the company’s 40,000 employees globally, 5,800 are based in Colorado, and metro Denver remains an important hub of operations, especially the ones that Lumen will emphasize.

It remains to be seen what will happen with CenturyLink’s wholesale and carriers carrier backbone services, which acquisitions such as Level 3 and Global Crossing mainly focused on, i.e. selling high bandwidth fiber optic long haul links to other carriers.

References:

https://www.lumen.com/en-us/home.html

https://news.lumen.com/CTO-Andrew-Dugan-explains-how-the-Lumen-platform-keeps-data-moving

CenturyLink Q2-2020 Earnings Beat; Fiber and Low Latency are the Foundation for Emerging Applications

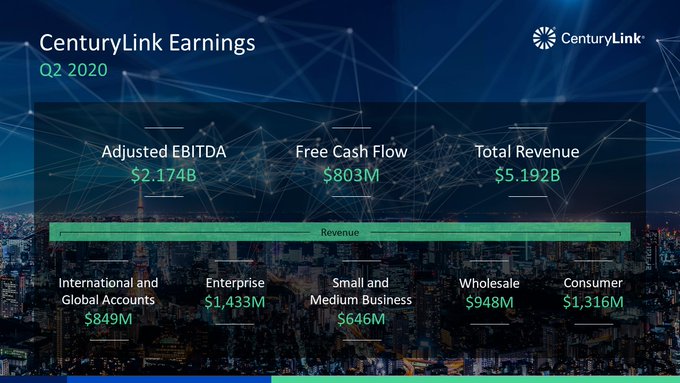

CenturyLink Inc. on Wednesday reported second-quarter net income of $377 million which beat analysts expectations. The global communications and IT services company posted revenue of $5.19 billion in the period compared to $5.375 billion for the second quarter 2019.

The company’s communications services include local and long-distance voice, broadband, Multi-Protocol Label Switching (MPLS), private line (including special access), Ethernet, hosting (including cloud hosting and managed hosting), data integration, video, network, public access, Voice over Internet Protocol (VoIP), information technology, and other ancillary services. CenturyLink also serves global enterprise customers across North America, Latin America, EMEA, and Asia Pacific.

“We had a solid quarter of both revenue and sales results, highlighted by the performance in Enterprise, iGAM and consumer broadband,” said Jeff Storey, president and CEO of CenturyLink. “We have delivered for our customers in record time, and our agility positions us well to combine our network infrastructure with our cloud, security, edge and collaboration services into a platform that meets our customers’ data and application needs. I’m proud of the CenturyLink team’s response to COVID-19 and how we have worked with our customers, communities and each other, both in the current crisis and for the long-term.”

During CenturyLink’s Q2 2020 earnings call Wednesday afternoon, Storey said:

“The economic effects of the pandemic created uncertainty for our customers, partners, the company, and the market in general. It‘s also highlighted the absolutely essential and durable nature of CenturyLink’s services and infrastructure in an all-digital world. We own the critical infrastructure — everything from the extended fiber network, to the deep interconnection relationships required to deliver customers scalable, secure network that is easily and flexibly consumed.”

“Our customers see that using next generation technologies enabled them to adapt their business models more rapidly and are working to take advantage of tools like artificial intelligence and machine learning across distributed compute resources and high performance networking. This translates into greater demand for transport services, hybrid WAN connectivity, network based security, edge computing and managed services as enterprises adjust to a more data dependent and distributed operating environment. This new normal has also increased consumers’ need for digital services and the demand for data shows no signs of slowing.”

“As our customers moved beyond the first wave of crisis response, we‘ve seen a marked change in their engagement and increased urgency in their dialog around longer-term digital transformation of their work environment.”

………………………………………………………………………………………………………………………………………………

CenturyLink has been pleasantly surprised with the demand for broadband it‘s seeing from the consumer segment right now as many employees continue to work from home as a result of the pandemic. Indeed, 75% of CenturyLink employees are now working from home, Storey said.

Enterprise sales orders grew year-over-year for dynamic, fiber-based services as customers started “buying again” in the second fiscal quarter, Storey said. Enterprise is a market segment that includes CenturyLink‘s high-bandwidth data services, managed services and SD-WAN services. Revenues increased by about 1 percent to $1.43 billion during the carrier’s fiscal second quarter compared to $1.41 billion in Q2-2019.

Small and medium business (SMB) sales fell 6.1 percent during the quarter to $646 million compared to $688 million in Q2 2019. CEO Storey said that CenturyLink will be actively working to grow its SMB customer base in future quarters. The carrier hopes to attract more SMB customers in the same way it‘s gained traction with enterprises, through its fiber-based network offerings, together with services such as embedded security, edge computing, IP enablement and managed services, Storey said.

In addition to COVID-19, the SMB segment continued to be plagued by legacy voice declines, said CenturyLink‘s CFO Neel Dev. “We are monitoring [this segment] and working closely with our customers,” he said. ”Over the long-term, we believe SMB represents a growth opportunity for us … it’s a large addressable market.”

During the quarter, CenturyLink added 42,000 1-gig and above customers, a record since the company began expanding their fiber to the home efforts.

CenturyLink’s Global Network Statistics:

- 450K Fiber Route Miles

- 170K+ On-Net Buildings

- 27M Technical Space (square feet)

- 2,200+ Public Data Centers On-Net

- 100+ Edge Compute Nodes (Enabling > 98% of U.S. Enterprises within latency of 5ms)

–>Most highly connected Internet peering backbone in the world

…………………………………………………………………………………………………………….

Two distinct business models with an all-digital operating mindset:

1. Enterprise:

- Growth-oriented, fiber-based Enterprise services

- Fiber is the enabler for all emerging communications technologies

- Highly scalable, global network

- Services are enhanced by cloud, security, WAN and edge initiatives

2. Consumer and Small Business:

- Coupling Century Link’s extensive footprint with greater digital engagement

- Expand efforts to grow Small Business group of customers

- Investing in growth with fiber-based, high-speed broadband

Fiber and Low Latency are the Foundation for Emerging Applications

• IoT

• Smart manufacturing and retail

• Personalized healthcare and finance

• Robotics

• AI/Big Data

• Augmented Reality/Virtual Reality

• Real-time video analytics

• 5G enablement (fiber backhaul for wireless telco partners)

More from CEO Storey:

“This agility is key to our strategy and is underpinned by our ongoing transformation from a telecom service provider to a leading technology company providing network and network supported technology solutions to today’s digital market.

We all know how well positioned our infrastructure is, that our value proposition is more than having great infrastructure. I frequently talk to employees about how our relationships with customers must be rooted in CenturyLink’s capabilities to drive their success, rather than the mindset of speeds and feeds and circuits of a typical telecom company.

As a technology company, we combine our deep infrastructure strength with a digital operating environment that enables our customers to turn their data and connectivity into a strategic advantage.

We integrate network, compute and operational technologies with managed services to simplify their business operation. Capabilities like orchestration services help them control the thousands of widely distributed devices and digital assets they now have to manage. The COVID-19 crisis didn’t create this need, but it has certainly amplified and accelerated it. And you can see this in our second quarter results with improving revenue trend led by revenue growth in enterprise, solid performance in iGAM on a constant currency basis and growth in consumer broadband.”

CenturyLink says they are well-positioned to capture expanding addressable market opportunities. Some examples are: Manufacturing, Gaming, and Retail. Storey highlighted the company’s change from wireline telecom and and IT services to a digital technologies solutions provider:

“This is the CenturyLink of the future, a company that delivers digital technology solutions to our customers differentiated through our world-class fiber infrastructure. If you consider the increasing demand across all customer verticals to move massive datasets as quickly as possible to widely distributed processing resources, our infrastructure is very well aligned to meet this shift in requirement.

By combining just 100 or so of our existing technical spaces with our deeply distributed fiber network, we can serve around 95% of US enterprise locations within five milliseconds of latency. Further, as operators of one of the largest and most interconnected networks in the world, we enable our customers to efficiently and effectively collect, process and move their data seamlessly across public clouds, private clouds, public data centers, company-owned data centers and the various work locations of the enterprise whether in employee’s homes or in the office. Now I see examples of this in our business every day.”

Century Link selected by Internet2 for Advanced Optical Fiber & Professional Services

Internet2, a non-profit, member-driven advanced technology community, selected CenturyLink to provide the fiber network and related professional services for the technology community’s network infrastructure. Contractual fiber-use agreements extend through at least 2042.

The forthcoming Internet2 network will use the company’s low-loss optical fiber for the majority of its footprint. CenturyLink’s optical fiber is ITU-T G.652.D compliant and designed to be optimized for high bit rate coherent systems using advanced modulation schemes supporting 100G and above. Internet2 also chose CenturyLink to provide the professional services to migrate to the new platform, which will be equipped with a flex-grid open-line system from Ciena.

“We believe the combination of the most advanced fiber from CenturyLink with the latest coherent transmission technologies from Ciena provides enormous opportunities to enable research and academic pursuits in the United States,” said Rob Vietzke, vice president of network services for Internet2, in a prepared statement.

“Whether it is tracking the origins of Neutrinos in the Antarctic, comparing gene sequences or studying the climate, this new optical network, with its ability to span very long distances at very high bandwidths [with] improved efficiency, is essential to providing the best research infrastructure for data-intensive science on the globe.”

Map of Internet2® Network Advanced Layer 1 Service, December 2019 (Source: CenturyLink) – Image courtesy of Matthew Wilson

……………………………………………………………………………………………………….

Internet2’s core infrastructure components include the nation’s largest and fastest research and education network. The network currently connects 321 U.S. universities, 60 government agencies, 43 regional and state education networks and through them supports more than 100,000 community anchor institutions, among others.

“One of America’s leading research and education organizations (Internet2) placed its trust in CenturyLink to upgrade its network to a high-speed, high-capacity, fiber-optic network that will support today’s leading-edge research projects,” said Sonia Ramsey, CenturyLink’s vice president for the state and local government and education market. “Internet2’s selection of CenturyLink recognizes the company’s long-standing relationship with the research and education community and our commitment to meet the community’s ever-increasing advanced technology needs,” she added.

CenturyLink recently overpulled a large portion of its national fiber footprint and also realigned amplifier spacing to create more efficient resources for optimized optical networks. Internet2 will migrate its segments to the new fiber on all available segments and continue to work with CenturyLink to migrate the remaining segments as their build-out continues.

With the low-loss optical fiber and the upgraded optronics kit, Internet2 will have the ability to reach anywhere on its domestic footprint with an unregenerated wavelength of up to 200G. Many high-use spans on Internet2’s Network will also support 400G and 800G wavelengths with existing technologies and higher bitrates are expected in the coming years as new DSP technology comes into production. Internet2 has been able to achieve unregenerated spans without employing Raman amplification, a reduction in complexity and improved efficiency both at installation and for ongoing operations.

…………………………………………………………………………………………………..

About Internet2:

Internet2® is a non-profit, member-driven advanced technology community founded by the nation’s leading higher education institutions in 1996. Internet2 serves 321 U.S. universities, 60 government agencies, 43 regional and state education networks and through them supports more than 100,000 community anchor institutions, over 1,000 InCommon participants, 56 leading corporations working with our community, and 70 national research and education network partners that represent more than 100 countries.

Internet2 delivers a diverse portfolio of technology solutions that leverages, integrates, and amplifies the strengths of its members and helps support their educational, research and community service missions. Internet2’s core infrastructure components include the nation’s largest and fastest research and education network that was built to deliver advanced, customized services that are accessed and secured by the community-developed trust and identity framework.

Internet2 offices are located in Ann Arbor, Mich.; Denver, Colo.; Washington, D.C.; and West Hartford, Conn. For more information, visit www.internet2.edu or follow @Internet2 on Twitter.

About CenturyLink:

CenturyLink is a technology leader delivering hybrid networking, cloud connectivity, and security solutions to customers around the world. Through its extensive global fiber network, CenturyLink provides secure and reliable services to meet the growing digital demands of businesses and consumers. CenturyLink strives to be the trusted connection to the networked world and is focused on delivering technology that enhances the customer experience. Learn more at http://news.centurylink.com/.

Media Contact

Sara Aly, Internet2

[email protected]

References:

CenturyLink offers Multi Cloud Connect L2 Service for Fiber-fed Buildings

CenturyLink has unveiled its Dynamic Connections, a Layer 2 (L2) based offering that provides access to many different cloud computing services. The third biggest U.S. wire-line carrier has partnered with Amazon Web Services and AWS GovCloud, saying it will add connections to Google Cloud and Microsoft Azure in coming weeks, then will add IBM, Oracle and other cloud computing services.

With growing day-to-day operations, organizations need a fast and easier way to connect their locations and data centers to cloud service providers. CenturyLink says they offer a complete portfolio of solutions for cloud connectivity. The company’s global access and extensive wavelength, Ethernet and IP VPN connectivity options are designed to meet today’s hybrid cloud requirements.

CenturyLink says they will provide high-performance connections to AWS, Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud Infrastructure, and other leading public and private clouds along with more than 2,200 third-party data centers.

Dynamic Connections is available to enterprise and government customers in fiber-fed buildings globally. CenturyLink has about 130,000 of those today, via an optical Ethernet port.

According to CenturyLink, the customer needs the right hardware and the right size port, but assuming that, they can turn up bandwidth from “as small as 10 Megabits/sec to up to 3 Gigabits/sec,” says Paul Savill, senior vice president of core network and technology solutions at CenturyLink.

“They would use log-in credentials to pull an inventory of all Ethernet ports they have at that enterprise in their locations across the world and they can then see that either in a map view or a list view,” Savill explains. “Then they can drill down to whatever location they want to connect- pick that Ethernet port and then pick the cloud service provider they want, at wherever location that is in the world, whatever data center it is running in, and then indicate the size of the bandwidth.”

Savill said that competing multi-cloud connect offerings –from AT&T’s NetBond, Verizon’s Secure Cloud Interconnect and Orange Business Services’ private and public cloud connections, etc. “can’t match our scale and flexibility.” [There is also Equinix Cloud Exchange Fabric].

As a L2 service, it doesn’t touch the Internet, which thereby provides greater security. In addition, CenturyLink is offering an open API for the service so that enterprise customers can build it into their own back-office systems and use those for provisioning instead of the portal.

Editor’s Note:

After CenturyLink acquired Savvis in 2011, the combined company attempted to promote its own cloud computing service using MPLS IP VPN for customer access to it. This new multi-cloud connect service is a huge improvement over that earlier solution. It will be interesting to see how it competes with AT&T Netbond, Verizon’s Secure Cloud Interconnect service, and Equinix Cloud Exchange Fabric.

References:

https://www.nasdaq.com/article/centurylink-introduces-cloud-connect-dynamic-connections-cm1035159

Century Link tops Mid-Year 2018 U.S. Carrier Ethernet LEADERBOARD

CenturyLink maintains the top spot in Vertical Systems Group’s (VSG) mid-year 2018 U.S. Carrier Ethernet Services Leaderboard. AT&T, #1 in 2017, claimed the #2 spot, followed by Verizon, Spectrum Enterprise, Comcast, Windstream and Cox. All of the companies maintained their year-end positions. The leaderboard ranks incumbent telcos in order based on U.S. retail Ethernet port share. VSG calls this an industry benchmark for measuring Ethernet market presence.

CenturyLink’s acquisition of Level 3 Communications, along with continued growth in Ethernet ports for both companies, allowed it to power its way to the top of the year-end ranking.

“After a flurry of M&A activity duing the past two years, the Ethernet marketplace stabilized during the first half of 2018,” said Rick Malone, VSG principal. “U.S. port growth was more than 6 percent for the period, with accelerating deployments of multi-gigabit speed services. Most providers experienced acute price compression across all data rates, partially offsetting the revenue typically generated from higher-speed services. All providers are grappling with longer sales cycles due to SD-WAN, however the impact on the U.S. Ethernet base has been negligible to date.”

Other providers selling Ethernet services in the U.S. are segmented into two tiers as measured by port share. The first, or challenge tier, includes Altice USA, Cogent, Frontier Communications, GTT, Sprint – which is attempting to merge with T-Mobile – and Zayo.

The second or Market Player tier includes all providers with port share below 1%. Companies in the Market Player tier include the following providers (in alphabetical order): Alaska Communications, American Telesis, BT Global Services, Cincinnati Bell, Consolidated Communications, Crown Castle Fiber, DQE Communications, Expedient, FiberLight, FirstLight, Fusion, Global Cloud Xchange, Great Plains Communications, Hawaiian Telecom, Logix Fiber Networks, LS Networks, Lumos Networks, Masergy, MegaPath, Midco, NTT America, Orange Business, RCN Business, Tata, TDS Telecom, Telstra, TPx Communications, Unite Private Networks, US Signal, Vodafone, WOW!Business and other companies selling retail Ethernet services in the U.S. market.