Dell’Oro: RAN market stable, Mobile Core Network market +14% Y/Y with 72 5G SA core networks deployed

A recently published report from Dell’Oro Group notes that after two years of steep declines, initial estimates show that total Radio Access Network (RAN) revenue—including baseband, radio hardware, and software, excluding services—was flat outside of China and up when excluding North America.

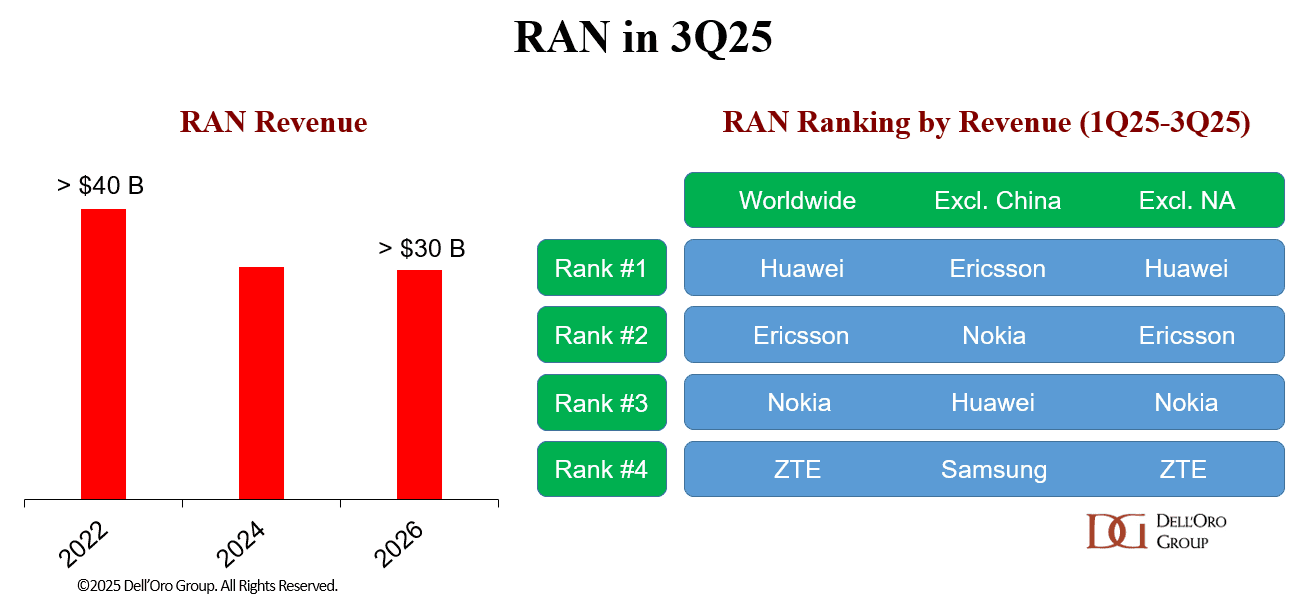

“The nearly stable results for the 1Q25-3Q25 period bolster the flat growth thesis we have communicated for some time, reflecting the current state of the 5G network,” said Stefan Pongratz, Vice President of RAN market research at the Dell’Oro Group. “While near-term RAN expectations remain muted, some of the leading RAN suppliers are still cautiously optimistic that more investments are needed over the long-term to ensure the networks evolve from a connectivity pipe into an intelligence grid. Huawei and Ericsson are the clear #1 and 2 players globally – their combined share makes up nearly two-thirds of the RAN market (see table below).” Pongratz added.

Additional highlights from the 3Q 2025 RAN report:

- In the quarter, growth in EMEA was nearly enough to offset declining revenue in North America and the Asia Pacific regions.

- The top 5 RAN suppliers, based on worldwide revenues for the 1Q25-3Q25 period, are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Market is becoming more concentrated—the top five suppliers accounted for 96 percent of the 1Q25-3Q25 RAN market, up from 95 percent in 2024.

- Huawei and Ericsson’s worldwide RAN revenue share improved for the 1Q25-3Q25 period relative to 2024.

- Huawei and Nokia’s RAN revenue share outside of North America improved for the 1Q25-3Q25 period relative to 2024.

- The short-term outlook remains unchanged, with total RAN expected to remain mostly stable in 2026.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-7 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

………………………………………………………………………………………………………………………………………….

Data from Omdia, a Light Reading sister company, shows Ericsson, Huawei and Nokia were even more dominant last year than they were in 2023, growing their combined RAN market share by 2.3 percentage points over this period, to 77.4%. Besides China’s ZTE, the only other contender with more than a percentage point of market share was Samsung.

…………………………………………………………………………………………………………………………………………..

Another recent Dell’Oro Group report reveals that the Mobile Core Network (MCN) market revenue outside China surged 14% year-over-year (Y/Y) in 3Q 2025. Twelve Mobile Network Operators (MNOs) have now selected to move forward with 5G-Advanced (the marketing term used for the next phases of 3GPP’s 5G specs, which started with Release 18 and continues with Release 19 and beyond).

“The Chinese market experienced abnormally high growth in 3Q 2024. As a result, the China market revenue declined 39 percent Y/Y for 3Q 2025,” stated Dave Bolan, Research Director at Dell’Oro Group. “The revenue for all the other regions increased, between 9 percent and 17 percent Y/Y, resulting in a worldwide revenue decline of 2 percent Y/Y. As noted, revenue worldwide excluding China rose 14 percent Y/Y, continuing the trend in subscribers migrating to 5G Standalone (5G SA), and revenue worldwide excluding North America declined 5 percent Y/Y.

“MNOs are moving forward with 5G SA (72 in our last count) and moving forward to take advantage of monetization opportunities. Network Slicing announcements continued. Of note is Reliance Jio (India), which announced 10 network slices with guaranteed service level agreements (SLAs) at scale. In October, T-Mobile launched Edge Control, providing enterprises with what Dell’Oro Group refers to as an MNO-provided Mobile Private Network (MPN). This is in response to the challenges of implementing 5G SA Private Wireless networks in the shared CBRS spectrum in the US.

“We have identified 12 MNOs that have commercially launched 5G-Advanced networks (not all this quarter), to take 5G to the next level with new features and performance. MNOs include: China Mobile, China Telecom, China Unicom, CTM (Macau), Du (UAE), e& (UAE), HKT (Hong Kong), Singtel (Singapore), Telstra (Australia), T-Mobile (USA), YTL (Malaysia), and Zain (Kuwait),” added Bolan.

Additional highlights from the 3Q 2025 Mobile Core Network and Multi-Access Edge Computing Report include:

- Region rankings were: EMEA; Asia Pacific, excluding China; China and North America tied; CALA.

- Vendor rankings (with more than 5 percent share) were: Huawei, Ericsson, Nokia, and ZTE.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Traditional Packet Core, Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, Signaling, Circuit Switched Core, and IMS Core by geographic regions. To purchase this report, please contact us at [email protected].

About Dell’Oro Group:

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions.

For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

MCN Market Up 14 Percent Outside China in 3Q 2025, According to Dell’Oro Group

Market research firms Omdia and Dell’Oro: impact of 6G and AI investments on telcos

Omdia on resurgence of Huawei: #1 RAN vendor in 3 out of 5 regions; RAN market has bottomed

Omdia: Huawei increases global RAN market share due to China hegemony

Dell’Oro Group: RAN Market Grows Outside of China in 2Q 2025

Dell’Oro: RAN revenue growth in 1Q2025; AI RAN is a conundrum

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Highlights of Dell’Oro’s 5-year RAN forecast

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

Dell’Oro: Mobile Core Network Market 5 Year Forecast

Dell’Oro: AI RAN to account for 1/3 of RAN market by 2029; AI RAN Alliance membership increases but few telcos have joined

Dec 2025 Update by Stefan Pongratz:

RAN market stability is expected in 2026. After two steep years of declines that erased roughly $8–9 B of RAN revenue between 2021 and 2024, preliminary findings indicate that market conditions continued to stabilize in the third quarter. This supports the flat-growth thesis we have been communicating for some time and reflects both the maturation of the 5G network and the limited RAN upside beyond traditional consumer-driven Mobile Broadband (MBB), including FWA, private wireless, and premium MBB.

Reflecting on the year and the expectations outlined for 2025, it appears that the high-level message that RAN conditions are improving is mostly correct, though with some regional caveats. Europe, the Middle East, and Africa (EMEA) is performing better than initially expected, in part due to currency exchange rate fluctuations. At the same time, 5G activity in India is coming in below expectations, partly due to coverage delays with the smaller carriers.

The results are mixed across the emerging RAN segments. Private wireless growth is in line with expectations. Preliminary findings from the recently updated Private Wireless report suggest that the positive momentum driving the roughly 40% increase in 2024 extended into 1H25, with worldwide private wireless RAN revenue accelerating rapidly in the first half. And even though Open RAN is stabilizing, growth is still landing at the low end of the 5% to 10% target for the year, in line with market conditions in the U.S. and Japan and the pace of adoption in Europe.

Looking ahead to 2026, we expect more of the same with stable overall investments dominated by regional MBB variations. At the same time, growth prospects will remain favorable with select RAN segments, including 5G, AI RAN, Open RAN, Cloud RAN, and Private Wireless.

In summary, the RAN market is adjusting to a post–5G peak-rollout environment characterized by slower data traffic growth and few catalysts likely to alter the flat-growth outlook. Global RAN projections remain essentially unchanged, with the market expected to hold steady in 2026. Beneath the flat topline, however, several segments—including private wireless, 5G, Open RAN, Cloud RAN, AI RAN, and small cells—are still poised for growth. In other words, while overall revenue growth will be muted, 2026 should nevertheless be an eventful year.

https://www.delloro.com/2026-predictions-ran-market/

Data from Omdia (owned by Informa) states that spending on RAN equipment dropped from $45 billion in 2022 to $35 billion in 2024. Excluding China, Omdia forecasts a low-single-digit percentage increase in revenues last year. But nobody anticipates a major recovery.

From the start of 2023and September 2025, Ericsson cut more than 15,600 full-time jobs, roughly 15% of the international total.

Ericsson has drawn attention to its investment in application-specific integrated circuits (ASICs) as a reason for the growth in R&D spending. But it increasingly champions cloud RAN, which substitutes Intel’s general-purpose processors (GPPs) for those ASICs in baseband equipment (although not in radios). As the capability of those GPPs improves, investors may wonder why Ericsson is still pumping money into custom baseband silicon. Maintaining two software tracks – one for purpose-built and the other for cloud RAN – itself looks duplicative.

Nokia’s global workforce shrank by almost 27%, nearly 27,500 jobs, between 2018 and the end of 2024, when its annual report showed that 75,600 employees remained. The figure may have grown with last year’s takeover of Infinera, which employed about 3,000 people before the acquisition. Yet in November, CEO Justin Hotard said another 5,000 Nokia jobs would be cut to finalize the restructuring plan initiated under previous management.

https://www.lightreading.com/5g/ericsson-and-nokia-cuts-reflect-the-grisly-state-of-5g