Author: Alan Weissberger

Strategy Analytics: Huawei 1st among top 5 contributors to 3GPP 5G specs

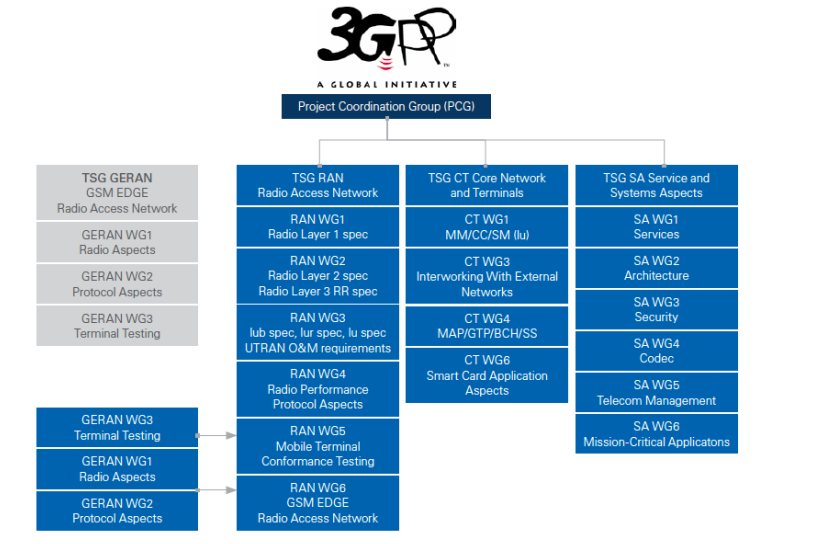

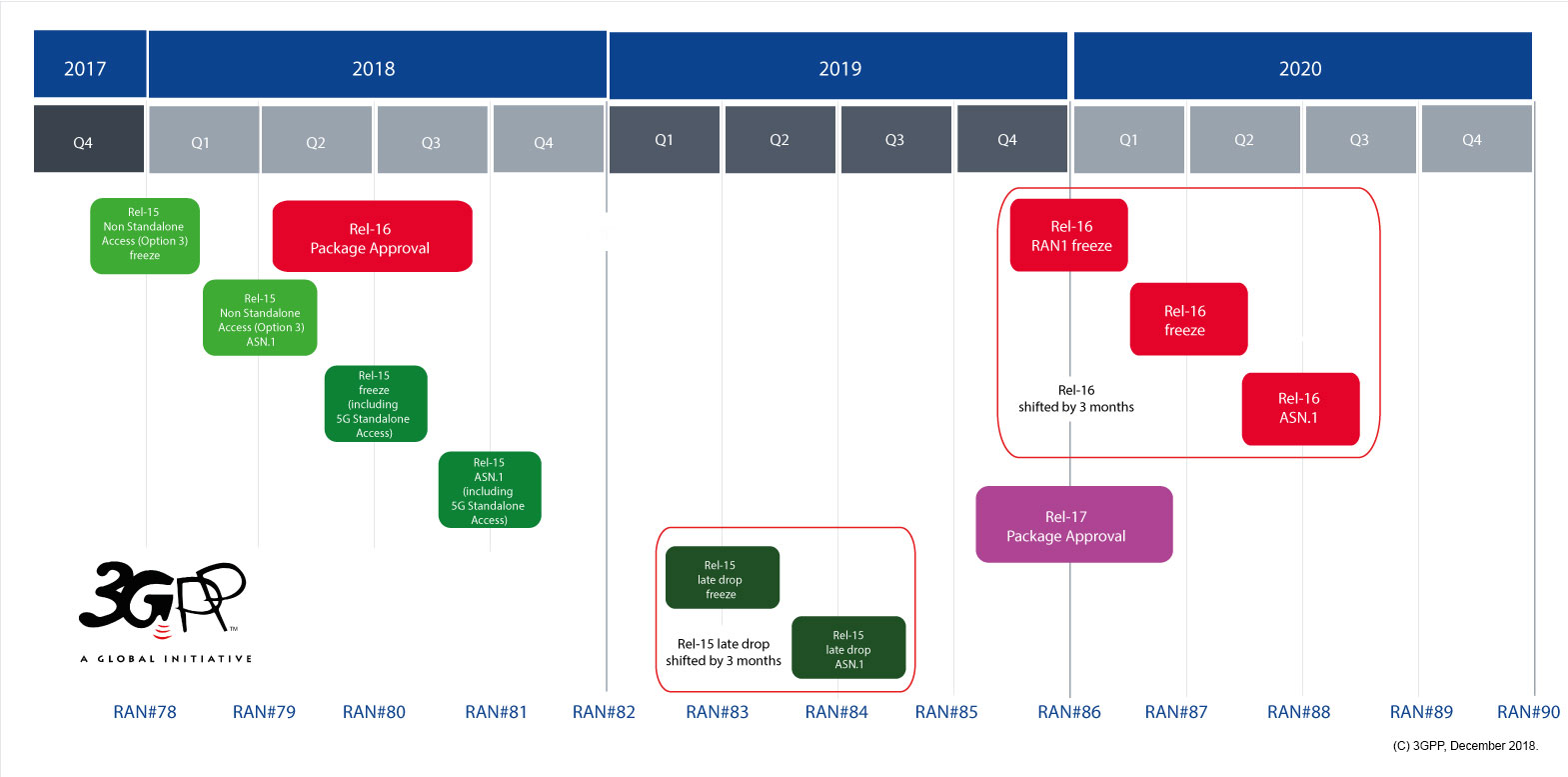

Even though there are more than 600 member companies participating in 3GPP, their 5G specification process is actually led by only a few leading telecom companies. New research from Strategy Analytics analyzes the contributions to 3GPP 5G specifications (Release 15 and Release 16) and finds that 13 companies contributed more than 78% 5G related papers and led 77% of the 5G related Work Items and Study Items.

The Strategy Analytics report “Who Are the Leading Players in 5G Standardization? An Assessment for 3GPP 5G Activities” is available to clients and registered guests here . The report assesses the 13 leading companies’ contributions to 3GPP 5G standards for the period of Releases 15 and 16 so far, based on the following criteria:

- Volume of 5G related papers, including submitted papers, approved/agreed papers and the ratio of approved/agreed papers to total submissions in all Technical Specification Groups (TSGs) and Working Groups (WGs)

- Chairmanship positions, i.e. Chairman and Vice Chairmen for all TSGs and WGs

- Rapporteurs of 5G related Work Items (WIs) / Study Items (SIs) in all TSGs and WGs

The results indicate that the top 5 companies in 3GPP 5G specification activities are Huawei, Ericsson, Nokia, Qualcomm and China Mobile.

Guang Yang , Director at Strategy Analytics, noted, “3GPP plays the central role in the ecosystem of global 5G standardization. By analyzing the contributions of industry players to 3GPP 5G standards, we can get an idea of different companies’ positions in 5G innovation as well as their influence in the global mobile industry. So we looked at 3GPP organization and work procedures to assess each company’s influence from multiple aspects.”

Sue Rudd , Director Networks and Service Platforms service, added, “According to our assessment, leading infrastructure vendors – Huawei , Ericsson and Nokia – made more significant contributions to 5G standards than other studied companies. Huawei leads in terms of overall contributions to the end-to-end 5G standards, while Ericsson leads in TSG/WG chairmanship and Nokia in approved/agreed ratio of 5G contribution papers .”

Phil Kendall , Executive Director at Strategy Analytics, added, “It is important to remember that the true nature of the standardization process is actually one of industry collaboration rather than competition. 3GPP standardization continues to be a dynamic process. It is expected that emerging players and new market requirements will increasingly impact priorities for 3GPP Release 17 standards.”

3GPP Timeline:

……………………………………………………………………………………………………

Mike Dano of Lightreading says “Huawei being the biggest contributor to the 3GPP’s 5G specs will undoubtedly worry U.S. lawmakers and regulators, who for years have argued the company poses a security threat to the nation. Huawei denies those allegations.”

“We must have a vocal presence at the standards bodies that are defining the rules for 5G. We have been woefully absent and need to make participation a priority,” wrote Mike Rogers in a recent opinion column. Rogers is a former US representative who co-authored the 2012 US government report initially outlining the security threats posed by Chinese equipment vendors like Huawei and ZTE.

“We need to work with our allies to staunch the spread of Huawei and other Chinese companies owned by the state. We need to better communicate what Chinese dominance of 5G means. This is something we have not successfully done, as shown by Britain deciding to allow Huawei into certain elements of the 5G network,” Rogers added.

Rogers now chairs the “5G Action Now” 501(c)4 advocacy organization, which has been working with the now-disbanded C-Band Alliance to speed up the C-Band spectrum auction in the US for 5G.

Indeed, legislation introduced early this year would require the Trump administration to develop a strategy to “promote United States leadership at international standards-setting bodies for equipment, systems, software, and virtually-defined networks relevant to 5th and future generation mobile telecommunications systems and infrastructure, taking into account the different processes followed by the various international standard-setting bodies.” That legislation passed the House and is now headed to the Senate.

Companies’ 3GPP contributions to the 5G specs [1.] don’t necessarily translate into revenues. For that, companies must patent their inventions.

Note 1. 3GPP specs vs 5G standards:

3GPP 5G specs in Release 15 and 16 have and will continue to be input to ITU-R WP 5D, but only some of those contributions will be in IMT 2020 which is currently restricted to the Radio Interface Technologies (RITs) or sets of RITs (SRITs). Other essential 5G specs like signaling, 5G packet core, 5G network management, etc will be standardized by SDOs (like ETSI) but the real work is done in 3GPP. Also note that IMT 2020 will have several NON 3GPP RITs from ETSI/DECT Forum and India (TSDSI).

…………………………………………………………………………………………………….

According to one study, Huawei leads in that respect also. IPlytics recently reported that the Chinese firm has far and away the most “declared 5G families” of patents, and the most filed since 2012.

However, it’s worth noting that UK law firm Bird & Bird argues that the reliance on such patent calculations isn’t very insightful, and that different methodologies yield different results.

………………………………………………………………………………………………

References:

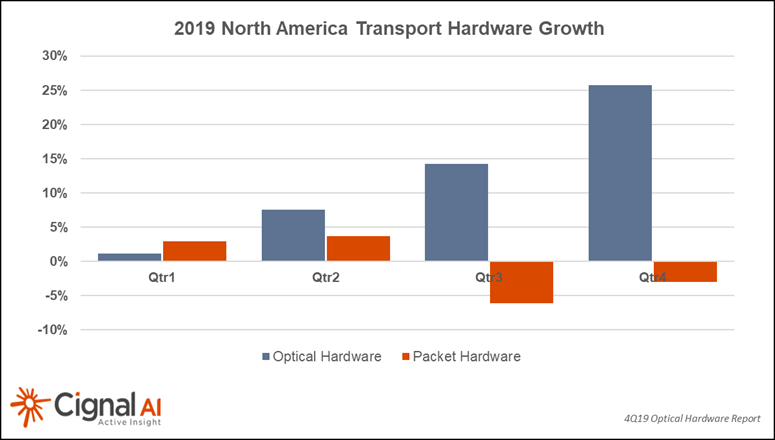

Cignal AI: Optical Network Equipment Sales +25% in 4Q2019 + 650 Group

Cignal AI:

Recent optical network equipment sales in North America were quite encouraging – up more than 25% for 4Q19 and 10% for all of 2019, according to the most recent Transport Hardware Report.

“After three years of North American spending declines as operators focused capex on wireless and access, optical hardware sales in the region revived and grew at a healthy pace for 2019, while packet hardware sales remained flat,” said Scott Wilkinson, Lead Analyst at Cignal AI. “Market leaders Ciena, Infinera, and Cisco all achieved optical sales growth exceeding 25% in 2019.”

Manufacturing at Huawei in Dongguan appears to be close to resuming normal levels of operation, although installation activity underway in China is still not clear. Ciena indicated a revenue impact of $30M during an earnings call in early March. It’s unclear right now what the ultimate impact will be; time will tell. We will revisit projections in April with the hope that events will be more certain at that time.

OFC was severely impacted when almost all major exhibitors pulled out of the show as health concerns mounted. The organizers did an admirable job of salvaging the technical sessions via Zoom teleconference.

Cignal AI will deliver a wrap-up report summarizing many of the important announcements that companies intended to make during the show. Look for it in the coming weeks, and if you have important news or perspective to share – contact us!

……………………………………………………………………………………………

Separately, a newly released report by 650 Group states that the Optical Transport Network market revenues increased 5% Y/Y in 4Q19. Revenues in four of the six geographic theatres experienced year over year growth, with North America having been the most robust.

“For the full year 2019, the top five Hyperscalers experienced the most growth out of any customer segment we track and has consistently been a top-performing customer segment in recent years,” said Chris DePuy, Technology Analyst and Founder at 650 Group. “Top vendors in the market are expecting their 800 Gbps optical transport technology to contribute to revenues towards the end of this year, 2020. We expect that optical transport systems companies that ship this new technology early will be well-positioned to take on the potential substitution threat of optical modules on switches and routers in the coming years.”

The forecast section of this report has been updated to reflect changes in both demand and supply related to health fears that have emerged in 1Q20. The report also reflects quantitative Data Center Interconnect (DCI) deployment scenarios across long-haul, metro, cloud, colocation, and telecom service providers.

For more information about the report, contact:

[email protected] or www.650group.com

Gartner: Top 10 Trends for Communications Service Providers (CSPs) in 2020

Key Findings:

-

Compared with previous cellular generations, the multilayered architecture of 5G creates opportunities for CSPs to expand beyond connectivity-centric solutions. However, disaggregation also allows new entrants to join incumbent CSPs in the 5G ecosystem.

-

Increasingly, network-based CSPs are exploring options to spin off network-related infrastructure into a separate entity, thereby unlocking funds needed for network upgrades and expansion while still meeting shareholder dividend commitments.

-

As live streaming of TV, games and e-sports enters the mainstream, the need to reduce latency and lower cost is driving hyperscale cloud providers, device manufacturers and developers to expand their influence out to the edge of CSPs’ networks.

-

Data, analytics and artificial intelligence (AI) now play an expansive and critical role in generating new business value, lowering costs and improving customer advocacy.

-

Cloud-native CSPs are emerging as aggressive challengers, and leading incumbent CSPs are expanding on efforts to virtualize their networks and adopt cloud-native capabilities.

Recommendations:

-

Pursue new capabilities and partnerships for 5G and streaming content by investigating how ecosystem approaches could be employed to meet business strategy goals.

-

Accelerate migration to cloud-native capabilities by appointing leaders who understand the business and technical implications that will arise.

-

Facilitate organizational alignment to become data-driven by establishing executive-level accountability and cross-functional oversight for data intelligence activities.

-

Maintain free cash flow from traditional telecommunications services by adopting automation, analytics and AI to improve operational efficiency and drive down costs.

Discussion:

Among the topics Gartner has observed as top of mind for CSPs include network virtualization and artificial intelligence. These are embellished in sections Becoming Data-Driven Becomes Critical and Cloud-Native as a Network Foundation, which explain the imperative needed to address what are becoming foundational capabilities. AI Enters the Workforce addresses the people context of AI, and how the move to automated provisioning and operations can, in the midterm, lead to augmentation, rather than wholesale replacement.

In the consumer market, digital content is well and truly dominating the strategy agenda. Livestreaming of TV, games, e-sports and other digital content is now mainstream. The need to improve performance and lower cost is driving the ecosystem of hyper-scale cloud providers, device manufacturers and developers to expand its influence into what was previously the exclusive domain of network-based CSPs.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

5G Assessment:

5G is viewed by mobile-network-based CSPs as a significant opportunity for growth, particularly in B2B. It also presents a challenge in terms of the level of investment required for coverage and capacity demands. At the same time, digital ecosystems are increasingly dominating the way industries function and, subsequently, how technology solutions are defined. This presents compelling opportunities for competitive market entrants looking to exploit opportunities to reinvent processes and define new operating models for industries.

-

Compared with previous cellular generations, the multilayered architecture of 5G (network plus software and services) creates opportunities for CSPs to expand beyond connectivity-centric solutions. However, disaggregation also allows new entrants to join incumbents in the 5G ecosystem.

-

CSPs aspire to derive value from 5G through enterprise solutions that expand the mobile ecosystem to new industries, enabling opportunities to participate in concepts such as factory of the future, autonomous transportation, remote healthcare, agriculture, digitized logistics and retail.

-

CSPs have found it difficult to identify strong monetization and operation efficiency opportunities for enterprise 5G, partly because of a lack of insight into key vertical markets.

5G improves drastically on previous generations of mobile cellular connectivity (3G and 4G), with peak data speeds of up to 20 Gbps, much higher network capacity and significantly lower latency. As such, 5G-capable handsets and smart devices will give rise to new experiences for consumers, such as gaming, esports, content streaming and virtual reality (VR), to name a few.

However, for CSPs, the enterprise segment will be key to monetizing higher-margin opportunities. To be successful, it will require a significant shift from 3G or 4G, where the focus was on delivering horizontal product and service offerings related to connectivity. By taking a platform approach to 5G, CSPs can potentially unlock new value through delivering industry-specific solutions.

The software-centric approach of disaggregating hardware and software (e.g. Open RAN) creates opportunities for new providers to offer solutions or services in the 5G ecosystem. It will enable enterprises to procure services from multiple providers in the ecosystem, enabling service flexibility and diversity, rather than being locked in with a single CSP.

The concept of 5G as a platform leverages a broad range of capabilities (beyond those related to connectivity, such as edge computing and network slicing). It also encompasses the use of data analytics, AI and machine learning, data aggregation, and service orchestration. Security will play an important role. Thus, the concept of 5G as a platform includes horizontal capabilities (common across industries) and vertical capabilities (specific to industries) that can enable CSPs to participate in emerging digital ecosystems.

Since the technology specifics of 5G are still a work in progress, there will be shifts in product or service offerings. Technology alliances and partnerships between diverse stakeholders are likely to arise. Such a nebulous market can be confusing for enterprises and participants, especially in the context of evolving standards.

An industry-platform-centric approach to 5G has the potential to enhance a CSP’s ability to deliver better business outcomes to their enterprise customers. However, new operating practices are required. The isolationist nature of processes, systems and methodologies within the network and IT will also need to be addressed (see “Unlocking the Value of Network and IT Fusion in CSPs”).

Most CSPs have begun implementing some of the foundational capabilities for treating 5G as a platform, such as software-defined networking and network function virtualization (NFV). These provide for the ability to divide services into smaller, software-driven functions, which allows businesses, operators and cloud providers to deploy and configure these services in a more-flexible manner. But again, these solutions and networks often lack interoperability.

Although it’s still early days for the 5G private network opportunity, regulators and standards bodies are beginning to put initiatives in place targeting this opportunity. CSPs have the potential to deliver turnkey network solutions into the industrial space. Equipment vendors would also have the option to do this directly.

Telenor deploys first commercial 5G network in Norway

On March 13th, Telenor Norway announced the commercial launch of a 5G network in nine towns and cities in Norway, following a 5G trial that began in Kongsberg in November 2018. Ericsson is Telenor’s 5G base station supplier.

………………………………………………………………………………………………………

“We are happy to announce that we have chosen Ericsson to start building the future 5G radio network in Norway, and I am confident we now are perfectly positioned to be in the forefront of the country’s network modernisation. As the first mobile operator on 5G in Scandinavia, Telenor will ramp up the roll out of 5G to our customers in Norway in 2020. The full modernisation of the mobile network in Norway is an ambitious undertaking, and something we are excited to get started on,” says Petter-Børre Furberg, CEO of Telenor Norway.

………………………………………………………………………………………………………

There are 38 5G base stations in Trondheim- Norway’s tech capital. The other 5G locations are Elverum, Askvoll, Svalbard, Kvitfjell, Heroya, Froya, and limited developments in the centres of Bodo and of Oslo, with Fornebu airport also served. Telenor will extend 5G in Oslo and open 5G networks in Bergen, Stavanger and Sandnes during 2020. In 2021, the operator will upgrade almost 2,000 base stations, rising to 8,500 over the next four to five years (see below for details).

“Telenor is proud to be the first mobile operator to launch a commercial 5G network in Norway, as we have worked tirelessly to stay at the forefront of the 5G development,” said Sigve Brekke, President and CEO of Telenor Group. “By bringing Norway into a new technological age, today’s opening marks another milestone in Telenor’s 165-year-long history. We expect 5G to be the key driver of transformation in this decade, and we are very much looking forward to continuing the roll-out of 5G to our customers.”

“Norway has some of the world’s fastest mobile networks, and with 5G, they become faster and even more reliable,” said Linda Hofstad Helleland, Norway’s Minister of Regional Development and Digitalisation. “Given the current situation in Norway, we see how important the digital infrastructure is for those quarantined and those working from home. The new 5G network will provide better mobile coverage and gradually better access to broadband across the country, which will reduce the vulnerability of an increasingly digitised society.”

“This is a day we have been looking forward to for a long time,” said Petter-Børre Furberg, CEO of Telenor Norway. “We launched our first 5G pilot as early as 2018, and since then we have been experimenting and exploring, trying to learn as much as we possibly can. Today, we are not only opening our 5G network in the city of Trondheim, we are also opening the very first commercial 5G network in Norway. In addition, we are making 5G commercially available in all locations where we, until now, have been running tests. As of today, Telenor customers with a 5G device will at these locations be able to connect to the mobile network of the future.”

Telenor said it will upgrade 8,500 base stations over the next few years. It remains to be seen how much of that work will be able to be done over the next few months, due to the coranavirus clamp downs.

“We have worked hard to become the first mobile operator in Norway to open the 5G network, and are now fully focused on our continued plans. During 2021, we will upgrade close to 2,000 base stations, while a total of 8,500 base stations will be upgraded within the next four to five years,” Furberg concluded.

…………………………………………………………………………………………………..

Telenor Norway and 5G:

- Telenor opened Scandinavia’s first 5G pilot in Kongsberg on 8 November 2018.

- Telenor launched Scandinavia’s largest 5G pilot in Elverum on September 26, 2019. In addition, Telenor announced pilots in nine further locations across the country and conducted Norway’s first video call over 5G.

- Telenor launched the world’s northernmost 5G pilot on the Norwegian archipelago of Svalbard.

- Telenor’s 5G network was commercially launched on 13 March 2020. Telenor customers with a 5G device can now connect to the next generation mobile network in nine different locations in Norway.

- Telenor will start development of 5G in Oslo, Bergen, Stavanger and Sandnes. The new mobile network will open in these cities during 2020.

- Telenor builds 5G in Trondheim in collaboration with Ericsson.

References:

Analysis: Nokia and Marvell partnership to develop 5G RAN silicon technology + other Nokia moves

Nokia has teamed up with semiconductor company Marvell Technology Group Ltd to develop customized 5G radio access system-on-chip leveraging its ReefShark technology. The alliance underscores Nokia’s commitment to deliver cost-effective and automated 5G network operations, especially at a time when it is aiming to walk the extra mile to revive its faltering 5G business.

As part of the agreement, Marvell Technology’s multi-core Radio Access Technology applications will be incorporated in Nokia’s AirScale RAN product line with its 5G-backed ReefShark portfolio. Equipped with customized ARM-architecture-based processor chips, this potential breakthrough innovation aims to deliver a best-in-class customer experience with reduced power consumption and enhanced performance and capacity.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Tommi Uitto, President of Mobile Networks at Nokia, said:

“This important announcement highlights our continued commitment to expanding the variety and utilization of ReefShark chipsets in our portfolio. This ensures that our 5G solutions are equipped to deliver best-in-class performance to our customers. As service providers continue to evolve their 5G plans and support growing traffic and new vertical services, the infrastructure and components must evolve rapidly. Adopting the latest advancements in silicon technology is a critical step to better serve our customers’ needs.”

“5G networks need to support billions of devices and machines, and this massive increase in volume and scale means that existing infrastructure and components must evolve rapidly, adopting technologies and techniques to enable to deploy 5G networks quickly, added Uitto.”

(Image credit: Nokia)

………………………………………………………………………………………………………………………….

Other Nokia Initiatives:

- Nokia also agreed to a partnership with Intel on programs to accelerate its 5G development. Intel’s new Atom chip is targeted at base stations. Nokia will ship Intel Atom-powered variants of its 5G AirScale radio access technology. The company will also use Intel’s second generation Xeon scalable processor in its AirFrame data center kit, allowing for common architecture from the cloud to the edge of 5G networks.

- Nokia said it needed several partnerships to enable it support and achieve its goals for 5G.

- Nokia will acquire optical networking technology provider Elenion. Nokia said that adding Elenion will broaden its addressable market and unlock some cost benefits.

- Nokia took a $561 million R&D loan which was signed with the European Investment Bank (EIB) in August 2018, but was only disbursed last month. The loan has an average maturity of about five years after disbursement according to Reuters. A Nokia representative said the company would use the loan to further accelerate its research and development of 5G technology

……………………………………………………………………………………………………………………………………………………………………………

Analysis by Zacks Equity Research:

Nokia has long struggled to undertake additional investments related to its 5G powered ReefShark SoCs. These SoCs are best known to leverage a single computer chip to operate an entire system. Unfortunately, its inability to develop ReefShark portfolio has hindered its cost-efficiency feature, compromising its profitability to rivals like Ericsson ERIC, which spends hefty amounts on R&D. Dearth of resources and geared up 5G spending cycle have also put Nokia at the risk of losing out on upcoming commercial launches.

The latest collaboration comes as a savior for the Finnish company to cater new vertical markets especially in the face of burgeoning network traffic and dynamic 5G plans. Dubbed as a key partnership, it is expected to reduce Nokia’s technical disparities and address the complex requirements of 5G NSA, SA, NR specifications for future 5G network deployments.

Nokia’s gross margin was negatively impacted by a high cost level associated with its first generation 5G products, product mix and profitability challenges in China. Despite a 4.2% rise in revenues in third-quarter 2019, the performance was marred by pricing pressure in early 5G deals and temporary capital expenditure constraints in North America related to the proposed merger of T-Mobile US and Sprint. This was followed by its decision to suspend dividend payments and slash guidance for 2020. The company has also decided to retrench about 180 employees in order to trim operating costs.

It remains to be seen whether Nokia will be able to script a turnaround amid a challenging macroeconomic environment and geopolitical uncertainties.

……………………………………………………………………………………………………………………………………………………………………………

About Marvell:

Marvell first revolutionized the digital storage industry by moving information at speeds never thought possible. Today, that same breakthrough innovation remains at the heart of the company’s storage, processing, networking, security and connectivity solutions. With leading intellectual property and deep system-level knowledge, Marvell’s infrastructure semiconductor solutions continue to transform the enterprise, cloud, automotive, industrial, and consumer markets. To learn more, visit: https://www.marvell.com/

About Nokia:

We create the technology to connect the world. Only Nokia offers a comprehensive portfolio of network equipment, software, services and licensing opportunities across the globe. With our commitment to innovation, driven by the award-winning Nokia Bell Labs, we are a leader in the development and deployment of 5G networks.

Our communications service provider customers support more than 6.1 billion subscriptions with our radio networks, and our enterprise customers have deployed over 1,000 industrial networks worldwide. Adhering to the highest ethical standards, we transform how people live, work and communicate. For our latest updates, please visit us online www.nokia.com and follow us on Twitter @nokia.

Media Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: [email protected]

Marvell Communications

Phone: +1 408 222 8966

Email: [email protected]

……………………………………………………………………………………………………………………………………………………………………………

References:

https://www.zacks.com/stock/news/797965/can-nokia-revive-its-5g-business-with-marvell-partnership

https://www.techradar.com/news/nokia-secures-5g-chip-partnerships-with-intel-and-marvell

O-RAN Alliance, Telecom Infra Project (TIP) & OCP Telco may open up telecom equipment market to new entrants

“There was more choice of network equipment suppliers 15 years ago than there is now and the industry is keen on expanding that vendor ecosystem,” Vodafone Group PLC’s Head of Network Strategy and Architecture, Santiago Tenorio, told Dow Jones Newswires.

For sure, the telecom industry would like to have more network equipment vendors to diversify supply chains, reducing risk and lowering costs. Network operators are pushing for change in the telecom-equipment market. Two international alliances of tech and telecom companies, universities and research centers are trying to develop networks that source gear from multiple vendors, which could attract new players to the market.

“Everybody wants it to happen,” said Janardan Menon, technology analyst at brokerage Liberum Capital. Mr. Menon expects progress to be slow but steady, and cautioned that it could take years before these open-architecture networks become a reality.

The O-RAN Alliance–which counts U.S. cell carriers Verizon Communications Inc., AT&T Inc. and Sprint Corp. as well as China Mobile Ltd. and Japan’s SoftBank Corp. among its members–is creating an ecosystem of new products that will support multi-vendor, interoperable radio-access networks. Meanwhile, the Telecom Infra Project, whose members include Facebook Inc. and Vodafone among others, is working on similar projects. Tech giants such as Intel Corp., Qualcomm Inc. and South Korea’s Samsung Electronics Co. are backing both groups.

Nokia is also a member of both the O-RAN Alliance and the Telecom Infra Project OpenRAN group. Ericsson has engaged with the O-RAN Alliance, which the Swedish company sees as aligning closer to its goals, but not with the Telecom Infra Project.

“Ericsson is actively contributing towards O-RAN specifications to make it a viable alternative in the future,” an Ericsson spokesperson said. Nokia and Huawei didn’t respond to requests for comment.

The O-RAN Alliance and the Telecom Infra Project (TIP) in February agreed to collaborate on 5G radio-access networks. They reached a liaison deal that allows for sharing information, referencing specifications and conducting joint testing.

Although some 4G projects using these open-architecture are already in operation, the technology isn’t yet ready to be deployed at scale. Facebook and Telefonica have launched a telecom-infrastructure company in Peru called Internet para Todos, which relies on so-called open radio-access network, or OpenRAN. Meanwhile, Vodafone is testing OpenRAN in rural parts of the U.K., following trials in South Africa and Turkey.

“OpenRAN is ready to be deployed commercially in pockets of the network, but not at scale throughout a market yet,” Mr. Tenorio said. “None of the smaller providers which OpenRAN is bringing into the market are ready yet to compete at scale with the likes of Nokia, Ericsson and Huawei,” he added.

The development of open-architecture networks began before Huawei’s blacklisting problems. The Telecom Infra Project was launched four years ago, and the O-RAN Alliance was formed in 2018 through the combination of two projects with shared goals.

There is no major U.S. manufacturer of cellular equipment currently, even though the U.S. is the biggest market in the industry for telecom equipment. The rise of open-architecture networks could create opportunities for smaller companies like Parallel Wireless, Mavenir or Altiostar, all of them based in the U.S., to have a say in the future of telecom networks.

It is unlikely that these new entrants take revenue from Huawei, Ericsson or Nokia in the next few years, said Liberum’s Mr. Menon. However, as the market begins to perceive that there are alternatives to the trio, their valuations could be hit, Mr. Menon said.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Telco is an important open hardware project within the Open Compute Project (OCP):

There is an industry desire to apply open hardware OCP model to the creation of open telecom optimized hardware. The OCP Telco Project enlists participants from telecom companies and carriers as well as sub systems, software, board and semiconductor suppliers who are seeking to use data center infrastructure to deliver IT services.

As technologists across industries participate in this community, OCP is creating and refining more designs, making it possible for more companies to transition from their old,existing proprietary solutions to Open Compute Project (OCP) solutions gear. and interoperable, multi-vendor supplier support.

The openEDGE Sub-Project is under the direction of the OCP Telco Project Group.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

https://telecominfraproject.com/

https://www.opencompute.org/projects/telco

https://techblog.comsoc.org/2020/02/12/nec-and-mavenir-collaborate-to-deliver-5g-open-vran-platform/

O-RAN Alliance, Telecom Infra Project (TIP) & OCP Telco may open up telecom equipment market to new entrants

“There was more choice of network equipment suppliers 15 years ago than there is now and the industry is keen on expanding that vendor ecosystem,” Vodafone Group PLC’s Head of Network Strategy and Architecture, Santiago Tenorio, told Dow Jones Newswires.

For sure, the telecom industry would like to have more network equipment vendors to diversify supply chains, reducing risk and lowering costs. Network operators are pushing for change in the telecom-equipment market. Two international alliances of tech and telecom companies, universities and research centers are trying to develop networks that source gear from multiple vendors, which could attract new players to the market.

“Everybody wants it to happen,” said Janardan Menon, technology analyst at brokerage Liberum Capital. Mr. Menon expects progress to be slow but steady, and cautioned that it could take years before these open-architecture networks become a reality.

The O-RAN Alliance–which counts U.S. cell carriers Verizon Communications Inc., AT&T Inc. and Sprint Corp. as well as China Mobile Ltd. and Japan’s SoftBank Corp. among its members–is creating an ecosystem of new products that will support multi-vendor, interoperable radio-access networks. Meanwhile, the Telecom Infra Project, whose members include Facebook Inc. and Vodafone among others, is working on similar projects. Tech giants such as Intel Corp., Qualcomm Inc. and South Korea’s Samsung Electronics Co. are backing both groups.

Nokia is also a member of both the O-RAN Alliance and the Telecom Infra Project OpenRAN group. Ericsson has engaged with the O-RAN Alliance, which the Swedish company sees as aligning closer to its goals, but not with the Telecom Infra Project.

“Ericsson is actively contributing towards O-RAN specifications to make it a viable alternative in the future,” an Ericsson spokesperson said. Nokia and Huawei didn’t respond to requests for comment.

The O-RAN Alliance and the Telecom Infra Project (TIP) in February agreed to collaborate on 5G radio-access networks. They reached a liaison deal that allows for sharing information, referencing specifications and conducting joint testing.

Although some 4G projects using these open-architecture are already in operation, the technology isn’t yet ready to be deployed at scale. Facebook and Telefonica have launched a telecom-infrastructure company in Peru called Internet para Todos, which relies on so-called open radio-access network, or OpenRAN. Meanwhile, Vodafone is testing OpenRAN in rural parts of the U.K., following trials in South Africa and Turkey.

“OpenRAN is ready to be deployed commercially in pockets of the network, but not at scale throughout a market yet,” Mr. Tenorio said. “None of the smaller providers which OpenRAN is bringing into the market are ready yet to compete at scale with the likes of Nokia, Ericsson and Huawei,” he added.

The development of open-architecture networks began before Huawei’s blacklisting problems. The Telecom Infra Project was launched four years ago, and the O-RAN Alliance was formed in 2018 through the combination of two projects with shared goals.

There is no major U.S. manufacturer of cellular equipment currently, even though the U.S. is the biggest market in the industry for telecom equipment. The rise of open-architecture networks could create opportunities for smaller companies like Parallel Wireless, Mavenir or Altiostar, all of them based in the U.S., to have a say in the future of telecom networks.

It is unlikely that these new entrants take revenue from Huawei, Ericsson or Nokia in the next few years, said Liberum’s Mr. Menon. However, as the market begins to perceive that there are alternatives to the trio, their valuations could be hit, Mr. Menon said.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Telco is an important open hardware project within the Open Compute Project (OCP):

There is an industry desire to apply open hardware OCP model to the creation of open telecom optimized hardware. The OCP Telco Project enlists participants from telecom companies and carriers as well as sub systems, software, board and semiconductor suppliers who are seeking to use data center infrastructure to deliver IT services.

As technologists across industries participate in this community, OCP is creating and refining more designs, making it possible for more companies to transition from their old,existing proprietary solutions to Open Compute Project (OCP) solutions gear. and interoperable, multi-vendor supplier support.

The openEDGE Sub-Project is under the direction of the OCP Telco Project Group.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

https://telecominfraproject.com/

https://www.opencompute.org/projects/telco

https://techblog.comsoc.org/2020/02/12/nec-and-mavenir-collaborate-to-deliver-5g-open-vran-platform/

Nokia Bell Labs sets world record in fiber optic bit rates

Nokia Bell Labs announced that its researchers set the world record for the highest single carrier bit rate at 1.52 Tbps over 80 km of standard single mode fibre, the equivalent of simultaneously streaming 1.5 million YouTube videos – which is four times the market’s existing approximately 400 Gbps. The company said this world record, along with other announced optical networking innovations, will further strengthen its ability to create networks for the 5G era that meet the ever-growing data, capacity and latency demands of Industrial Internet of Things (IIoT) and consumer applications.

Several of these achievements were presented as part of Nokia Bell Labs’ post deadline research papers at the Optical Fiber Communications Conference & Exhibition (OFC) that took place during March 9-15, 2020 in San Diego, CA. In addition, Nokia Bell Labs researcher Di Che was awarded the OFC Tingye Li Innovation Prize.

The highest single-carrier bitrate at 1.52 Tbps was set by a Nokia Bell Labs optical research team led by Fred Buchali. This record was established by employing a new 128 Gigasample/second converter enabling the generation of signals at 128 Gbaud symbol rate and information rates of the individual symbols beyond 6.0 bits/symbol/polarization. This accomplishment breaks the team’s own record of 1.3 Tbps set in September 2019 while supporting Nokia’s record-breaking field trial with Etisalat.

Nokia Bell Labs researcher Di Che and his team also set a new data-rate world record for directly modulated lasers (DML), which are crucially important for low-cost, high-speed applications such as datacenter connections. The DML team achieved a world record data rate beyond 400 Gbps for links up to 15 km.

Marcus Weldon, Nokia CTO and President of Nokia Bell Labs, said:

“It has been fifty years since the inventions of the low-loss fiber and the associated optics. From the original 45 Megabit-per-second systems to more than 1 Terabit-per-second systems of today – a more than 20,000-fold increase in 40 years – to create the fundamental underpinning of the internet and the digital societies as we know it. The role of Nokia Bell Labs has always been to push the envelope and redefine the limits of what’s possible. Our latest world records in optical research are yet another proof point that we are inventing even faster and more robust networks that will underpin the next industrial revolution.”

In addition to these world records, Nokia Bell Labs researchers have also recently achieved significant achievements in optical communications, including:

- The first field trial using spatial-division-multiplexed (SDM) cable over a 2,000km span of 4-core coupled-core fiber was achieved by researchers Roland Ryf and the SDM team. The experiments clearly show that coupled-core fibers are technically viable, offer high transmission performance, while maintaining an industry standard 125-um cladding diameter.

- A research team led by Rene-Jean Essiambre, Roland Ryf and Murali Kodialam introduced a novel new set of modulation formats that provide improved linear and nonlinear transmission performance at submarine distances of 10,000 km. The proposed transmission formats are generated by a neuronal network and can significantly outperform traditional formats (QPSK) used in today’s submarine systems.

- Researcher Junho Cho and team experimentally demonstrated capacity gains of 23% for submarine cable systems that operate under electrical supply power constraints. The capacity gains were achieved by optimizing the gain shaping filters using neural networks.

The researchers that achieved the world record and research results are part of Nokia Bell Labs’ Smart Optical Fabric & Devices Research Lab, which designs and builds the future of optical communications systems, pushing the state-of-the-art in physics, materials science, math, software and optics to create new networks that adapt to changing conditions and go far beyond today’s limitations.

……………………………………………………………………………………………………..

About Nokia

We create the technology to connect the world. Only Nokia offers a comprehensive portfolio of network equipment, software, services and licensing opportunities across the globe. With our commitment to innovation, driven by the award-winning Nokia Bell Labs, we are a leader in the development and deployment of 5G networks.

Our communications service provider customers support more than 6.4 billion subscriptions with our radio networks, and our enterprise customers have deployed over 1,300 industrial networks worldwide. Adhering to the highest ethical standards, we transform how people live, work and communicate. For our latest updates, please visit us online www.nokia.com and follow us on Twitter @nokia.

About Nokia Bell Labs

Nokia Bell Labs is the world-renowned industrial research arm of Nokia. Over its more than 90-year history, Bell Labs has invented many of the foundational technologies that underpin information and communications networks and all digital devices and systems. This research has resulted in 9 Nobel Prizes, three Turing Awards, three Japan Prizes, a plethora of National Medals of Science and Engineering, as well as three Emmys, two Grammys and an Oscar for technical innovations. For more information, visit www.bell-labs.com.

Media Inquiries:

Nokia

Communications

Phone: +358 (0) 10 448 4900

E-mail: [email protected]

……………………………………………………………………………………………..

References:

GSA: Over 250 5G devices announced with 67 commercially available

The Global mobile Suppliers Association (GSA) today reported that the number of announced 5G devices has broken the 250 barrier, spurred by a surge in 5G phone announcements. In January 2020, the number of announced 5G devices exceeded 200 for the first time; by early March[1] over 250 devices had been announced with GSA identifying 253 announced devices, of which at least 67 are commercially available today.

‘‘We are at a fascinating turning point in the industry where the whole ecosystem is embracing, pushing and delivering new 5G spectrum, networks and devices,” commented Joe Barrett, President of GSA. ‘‘The rate at which new 5G devices are being announced and the diversity of form factors points to continued rapid deployment and uptake of new 5G services. Based on vendors’ statements, we can expect more than 50 additional announced devices to become commercially available before the end of June 2020, and at GSA we’ll will be tracking and reporting regularly on these 5G device launch announcements for the industry as we continue to take the temperature of the 5G ecosystem.”

As more devices become commercially available, GSA is tracking vendor data on spectrum support. The latest market data reveals that just over two-thirds (68.0%) of all announced 5G devices are identified as supporting sub-6 GHz spectrum bands and just under one-third (30.8%) are understood to support mmWave spectrum. Just under 25% of all announced devices are known to support both mmWave and sub-6 GHz spectrum bands. The bands known to be most supported by announced 5G devices are n78, n41, n79 and n77.

Part of the GSA Analyser for Mobile Broadband Devices (GAMBoD) database, the GSA’s 5G device tracking reports global device launches across the 5G ecosystem and contains key details about device form factors, features and support for spectrum bands. Access to the GAMBoD database is only available to GSA Members and to GSA Associates subscribing to the service.

The March 2020 5G Ecosystem Report containing summary statistics can be downloaded for free from GSA’s website:

https://gsacom.com/paper/5g-devices-ecosystem-executive-summary-march-2020/?utm=devicereports5g

By mid-March 2020, GSA had identified:

- 16 announced form factors

- 81 vendors that had announced available or forthcoming 5G devices

- 253 announced devices (including regional variants, and phones that can be upgraded using a separate adapter, but excluding prototypes not expected to be commercialised and operator-branded devices that are essentially rebadged versions of other phones), including at least 67 that are commercially available:

o 87 phones, (up 25 from end January), at least 40 of which are now commercially available (up from 35 at end January). Includes three phones that are upgraded to offer 5G using an adapter.

o 76 CPE devices (indoor and outdoor, including two Verizon-spec compliant devices not meeting 3GPP 5G standards), at least 13 of which are now believed to be commercially available

o 43 modules

o 17 hotspots (including regional variants), at least nine of which are now commercially available

o 5 laptops (notebooks)

o 5 industrial grade CPE/routers/gateways

o 3 robots

o 3 televisions

o 3 tablets

o 3 USB terminals/dongles/modems

o 2 snap-on dongles/adapters

o 2 drones

o 2 head-mounted displays

o 1 switch

o 1 vending machine.

GAMBoD is a unique search and analysis tool that has been developed by GSA to enable searches of mobile broadband devices and new global data on Mobile Broadband Networks, Technologies and Spectrum (NTS). The 5G devices database contains details about device form factors, features, and support for spectrum bands. Results are presented as a list or in charts. Charts may be inserted into documents or presentations, subject to accreditation of GSA as the source.

GAMBoD is a resource dedicated to promoting the success and growth of the Mobile Broadband (MBB) industry and ecosystem and is fully available to all employees of GSA Executive and Ordinary Member companies and GSA Associates who subscribe to the service.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Availability of information about spectrum support is improving as a greater number become commercially available.

- Just over two-thirds (68.0%) of all announced 5G devices are identified as supporting sub-6 GHz spectrum bands and just under one third (30.8%) are understood to support mmWave spectrum. Just under 25% of all announced devices are known to support both mmWave and sub-6 GHz spectrum bands.

- Only 17 of the commercially available devices (25.4% of them) are known to support services operating in mmWave spectrum.

- 83.6% of the commercially available devices are known to support sub-6 GHz spectrum.

The bands known to be most supported by announced 5G devices are n78, n41, n79 and n77. We can expect the device ecosystem to continue to grow quickly and for more data to become available about announced devices as they reach the market. Based on vendors’ statements, we can expect more than 50 additional announced devices to become commercially available before the end of June 2020. GSA will be tracking and reporting regularly on these 5G device launch announcements. Its GAMBoD database contains key details about device form factors, features and support for spectrum bands. Summary statistics are released in this regular monthly publication.

About GSA

GSA is the voice of the mobile vendor ecosystem representing companies engaged in the supply of infrastructure, semiconductors, test equipment, devices, applications and mobile support services. GSA actively promotes the 3GPP technology road-map – 3G, 4G, 5G – and is a single source of information resource for industry reports and market intelligence. The GSA Executive board comprises of Ericsson, Huawei, Intel, Nokia, Qualcomm, and Samsung.

GSA Membership is open to all companies participating in the mobile ecosystem and operators, companies and government bodies can get access to GAMBoD by subscribing as an Associate. More details can be found at https://gsacom.com/gsa-membership

Verizon 5G Ultra Wideband service at DoE’s Pacific Northwest National Laboratory

“Our 5G Ultra Wideband network is built to support transformational innovations and solutions across all industries,” said Tami Erwin, CEO of Verizon Business. “There’s no doubt 5G’s increased data bandwidth and super-low lag will help play a critical role in evolving response connectivity and mission operations for first responders. We’ve seen exciting use cases come out of our 5G First Responder Lab and are thrilled to see the new applications that will arise from our work with PNNL.”

This engagement is part of Verizon Business’ broader strategy to partner with customers, startups, universities and large enterprises to explore how 5G can disrupt and transform nearly every industry. Verizon operates five 5G Labs in the U.S. and one in London that specialize in developing uses cases in industries ranging from health care to public safety to entertainment. In addition, Verizon is setting up 5G labs on-premise for several customers as part of an ongoing initiative to partner on 5G-related use cases to help customers transform their industries.

Verizon 5G Labs and Dignitas are also using the 5G network to enhance e-sports. The goals are to improve participants’ performance and recovery and to enable innovative fan/participant interactions. The first e-sports training facility is at Verizon’s 5G lab. It will serve as Dignitas’ west coast headquarters and home to its league of champions.

References:

https://www.verizon.com/about/news/verizon-business-national-lab

https://www.verizon.com/about/our-company/5g-labs

Verizon Explores 5G Use Cases for National Security, Energy Efficiency at DOE Lab