China 5G

China Mobile reports 9.5% increase in sales; depreciation and electricity expenses will increase at relatively high rates

China Mobile is the world’s largest wireless network operator by customers, serving 940 million total subscribers in the Q1 2021. The #1 China carrier had 189 million 5G customers a March, an increase of 24 million since December. Its 4G-LTE use base also grew during Q1 2021, up 36 million year-on-year to 788 million.

China Mobile reported a 9.5% year-on-year increase in sales, to 198.4 billion Chinese yuan ($30.6 billion), for its first quarter of 2021. China Mobile’s net profit increased by 2.3% to about RMB24.1 billion ($3.7 billion).

The company states that continued to devote concerted efforts to promoting digitalized and intelligent transformation and achieving high-quality development. Placing a special focus on its “4×3” strategic core and fully implementing the “5G+” plan, it managed to maintain stable growth in key business performance indicators and delivered sound development momentum, taking solid steps towards becoming a world-class enterprise by building a dynamic “Powerhouse.”

China Mobile Chairman Yang Jie said following its large-scale 5G network deployment, it expects corresponding depreciation and electricity expenses to increase at relatively high rates.

Following the large scale operation of 5G, the China Mobile Group expects the corresponding depreciation and electricity expenses will increase at relatively high rates. As the Group scales up the development of DICT and other information services, the demand for resources to address the need for business transformation and upgrade will remain robust.

Facing these challenges and pressure, the Group will continue to explore new sources to increase revenue, and at the same time take measures to lower costs and enhance efficiency. It will also precisely allocate resources by adhering to the principle of ensuring a sufficient budget for areas essential to promote growth, while reducing and controlling expenses on certain selected areas.

While fostering business transformation, promoting innovation and nurturing new areas of growth, the Group will strive to achieve stable and healthy growth in telecommunications services revenue and net profit, maintain good profitability and continuously create value for investors.

China Mobile said it was under pressure to make other cutbacks to cope with the increase in electricity fees and depreciation charges in 2020.

China Mobile’s The revenue growth was mainly due to a 67 per cent increase in handset sales to CNY20.8 billion, which the operator credited to a wider range of 5G models at more affordable prices. Telecoms service turnover increased 5.2 per cent to CNY177.7 billion.

Total subscribers fell by 6 million to 940 million. ARPU edged up 1.1 per cent to CNY47.40, while average monthly data usage increased 34.9 per cent to 11.2GB. The volume of total voice minutes increased 8.3 per cent and SMS usage dropped 12.6 per cent.

China Mobile also faces a huge capital expenditure bill this year as it extends 5G services outside the big cities and into less densely populated communities. It plans to spend RMB183.6 billion ($28.3 billion) in total, up from RMB180.6 billion ($27.8 billion) last year. In its last annual report, it said that approximately RMB110 billion ($17 billion) would go toward 5G rollouts.

…………………………………………………………………………………………………………………………………..

References:

https://www.chinamobileltd.com/en/file/view.php?id=246145

https://www.lightreading.com/5g/china-mobile-warns-of-mounting-5g-costs/d/d-id/768941?

MIIT: China has 260M 5G subs; Telecom business revenue significantly increased

China telecom regulator MIIT (Ministry of Industry and Information Technology) revealed this week that China has 260 million 5G subscribers at the end of February 2021. That is a huge number and more than the rest of the world combined [1.], but still a long way short of the 361 million claimed by the three operators. in February.

- China Mobile reported 173.2 million 5G package customers compared to 15.4 million 5G customers in February 2020. China Mobile’s overall mobile subscriber base was said to be 937.16 million at the end of February, down from 940.86 million in January.

- China Telecom added a total of 6.2 million 5G subscribers in February 2021 for a total of 103.4 million.

- China Unicom had 84.5 million 5G subscribers at the end of February 2021.

Note 1. GSA says that global 5G subscriptions grew by 57% in the fourth quarter of 2020 to reach nearly 401 million globally (representing 4.19% of the entire global mobile market). By the end of 2025, 5G will account for 31% of the global market (at 3.39 billion subscriptions), although LTE will still be dominant at 53.3% of all global mobile subscriptions.

……………………………………………………………………………………………………………………………………….

China’s vice-minister of industry and information technology Liu Liehong recently said that a total of 718,000 5G base stations have been built in China, accounting for nearly 70% of the world’s total 5G cell sites.

During Mobile World Congress Shanghai 2021, government officials said that Chinese carriers have invested more than CNY260 billion ($40.2 billion) to build the world’s largest 5G network.

MIIT further stated:

The growth rate of telecom business revenue has increased significantly. From January to February, the total revenue of telecommunications services reached 237.3 billion yuan, an increase of 5.8% year-on-year, and the growth rate increased by 4.3 percentage points year-on-year. The total telecommunications business calculated at the constant price of the previous year was 249.1 billion yuan, a year-on-year increase of 25.9%.

The scale of mobile phone users is basically stable, and 5G users are developing rapidly. As of the end of February, the total number of mobile phone users of the three basic telecommunications companies reached 1.592 billion, a year-on-year increase of 0.8%. As of the end of February, the number of 5G mobile terminal connections of the three basic telecommunications companies reached 260 million, a net increase of 61.3 million from the end of the previous year, accounting for 16.3% of mobile phone users.

Light Reading’s Robert Clark wrote: “The three (China) telcos’ annual filings over the past two weeks indicate that between them they spent a hefty 173 billion yuan ($26.5 billion) on 5G and they’re not slowing down; they’ve set aside another 185 billion yuan for 2021.”

“Their pricing, with plenty of encouragement from government officials, is also aggressive, with China Mobile’s 5G entry package costing just 128 yuan ($19.56). The heavy investment and the moderate pricing in pursuit of national objectives is why their results indicate little reward for the effort so far.”

MIIT also commented on other telecom services (besides 5G):

Data and Internet business revenue accounted for 60%, supporting the steady growth of overall telecom business revenue. From January to February, the three basic telecommunications companies completed fixed data and Internet business revenues of 41.5 billion yuan, a year-on-year increase of 10.2%, accounting for 17.5% of telecommunications business revenues, accounting for a year-on-year increase of 0.8 percentage points, driving a 1.7 percentage point increase in telecommunications business revenue . The revenue from mobile data and Internet services showed a decline for the first time. The completed business revenue was 106.2 billion yuan, a year-on-year decrease of 1.2%, and its share of telecom business revenue fell to 44.7%.

Fixed and mobile voice services declined steadily, and their share of telecom business revenue continued to decline. From January to February, the three basic telecommunications companies completed fixed voice and mobile voice business revenues of 3.82 billion yuan and 18.64 billion yuan, a year-on-year decrease of 1.1% and an increase of 5.0%, respectively, accounting for 9.5% of the total revenue of telecommunications services, and a decrease of 0.1%. Percentage points. The rapid growth of income from emerging businesses has strongly promoted the growth of telecom business income. The three basic telecommunications companies are actively transforming and upgrading, promoting IPTV, Internet data centers, big data, cloud computing, artificial intelligence and other emerging businesses. From January to February, they completed a total of 36.2 billion yuan in related business income, a year-on-year increase of 28.9%. The proportion increased sharply by 2.8 percentage points year-on-year to 15.3%, driving the growth of telecom business revenue by 3.6 percentage points.

The proportion of fixed broadband access users with speeds above 100M has exceeded 90%, and the number of gigabit users has continued to increase. The total number of fixed Internet broadband access users reached 492 million, a year-on-year increase of 8.9% and a net increase of 8.67 million from the end of the previous year. Among them, there are 463 million FTTH/O users, accounting for 94% of the total number of fixed Internet broadband users. The number of fixed Internet broadband access users with an access rate of 100Mbp and above reached 450 million, accounting for 90.4% of the total number of users, an increase of 0.5% from the end of the previous year; the promotion of gigabit broadband services was accelerated, and the access rate of 1000Mbps and above was fixed. The number of Internet broadband access users reached 8.03 million, a net increase of 1.63 million over the end of the previous year.

Mobile Internet traffic increased significantly, and DOU remained at a relatively high level in February. From January to February, the cumulative mobile Internet traffic reached 30.9 billion GB, a year-on-year increase of 31.8%. Among them, the Internet traffic through mobile phones reached 29.7 billion GB, a year-on-year increase of 31.2%, accounting for 96% of the total mobile Internet traffic. In February, the average mobile Internet access traffic (DOU) per household was 10.85GB/household, which was 1.97GB/household higher than the same period last year.

The penetration rate of fixed broadband access users of 100M and above tends to be even in all regions. As of the end of February, fixed broadband access users of 100Mbps and above in the eastern, central, western and northeastern regions reached 189.68 million, 11.17 million, 116.57 million and 26.74 million, respectively, accounting for 89.3. %, 91.7%, 90.8% and 91.8%. The difference between the highest proportion of fixed broadband access users above 100M and the lowest proportion in each province was 15.3 percentage points.

China Unicom and China Telecom say nearly a quarter of their mobile customers are on 5G plans. Chna Unicom boosted ARPU 4%, while China Telecom reported 5G ARPU nearly 50% above its blended ARPU.

China Mobile reported a 1% rise in profit but, despite the huge 5G subscriber base, recorded another decline in mobile ARPU.One winner for China Mobile was broadband access, which grew 17%, while China Telecom and China Unicom both experienced large increases in their smart home services.

………………………………………………………………………………………………………………………………………

Editorial Comment:

Many experts don’t trust economic numbers released by China’s government. Questions over the accuracy of China’s economic data, including industry groups like telecom, persist due to the lack of transparency used in the collection process. Critics say the government does not state how the data is collected or the different components that form the final numbers that are released to the public.

The methodology China uses to calculate its economic and industry data is opaque, and some knowledgeable people even accuse the government of abruptly changing methods without announcement to distort figures and hide declines.

The motivation seems to be to make China’s economy and industry groups look much stronger than they really are.

Most analysts treat any official Chinese data with caution and skepticism. Yet they have few, if any ways to establish an alternative, more accurate assessment of the world’s second-largest economy.

…………………………………………………………………………………………………………………………………………..

References:

https://www.miit.gov.cn/gxsj/tjfx/txy/art/2021/art_82f101e1d078447fac75443a50348b7c.html

https://www.lightreading.com/asia/china-5g-race-taking-its-toll-on-operators/d/d-id/768369?

https://gsacom.com/paper/lte-and-5g-subscribers-march-2021-q4/

China tops 200M 5G subs while operators move to 5G SA

According to filings by China’s state owned telcos, China now has more than 200 million “official 5G subscribers.” China Mobile and China Telecom tallied 147.4 million and 74.9 million “5G package subscribers” respectively as of November 30, 2020. China Mobile adding nearly 19 million subs last month.

“Package subscribers” is a unique category that includes subscribers that have migrated to 5G but are still using 4G phones, which greatly overstates the actual 5G user numbers.

- China Mobile is adding 5G subs at a fast pace, with 18.6 million adds last month and 15.2 million in October.

- China Telecom added more than 7 million every month since August.

- The third telco, China Unicom, has suffered a net loss of 11.4 million subs for the year to date. It had 307.1 million mobile customers at November 30, down 1.9 million on the previous month.

Some energetic price-cutting has helped. At launch time in November 2019 the lowest package price was 128 yuan ($19.57). Now many plans are being sold at 100 yuan ($15.29) or less.

………………………………………………………………………………………………………………………………………….

Separately, the three state owned network operators are said to be close to deploying 5G standalone (SA) with a 5G core network. China Unicom and China Telecom are leading the move.

China Telecom says its 5G standalone network is commercially available in more than 300 cities, according to Sohu.

According to THEELEC, China Unicom will expand 5G network slicing technology to the whole country next year, the company said on December 7th at a press conference in Beijing. China’s third largest telco launched 5G SA network in over 300 cities this year, the company said. Last month, it added network slicing technology to its 5G network in Beijing and Guangdong Province.

Miao Shouye, the head of China Unicom’s 5G co-construction project with China Telecom, spoke at the “2020 Communication Industry Conference and the 15th Communication Technology Annual Conference” on December 17th. He said that “China has achieved full leadership in the 5G field.”

Also, that China Unicom launched the world’s first commercial network slicing service in Beijing and Guangdong in November. It will be commercially available nationwide next year, C114 reported.

Data shows that China has more than 700,000 5G base stations , accounting for 80% of the world’s total; 5G users exceed 160 million, accounting for 70% of the world’s total. The rapid development of networks and users has also driven the development of terminals. China’s 5G terminal shipments accounted for more than 60%, and 5G thousand yuan phones began to appear.

In Miao Shouye’s view, mobile internet is about to enter the 5G era. “It is estimated that by 2021, the penetration rate of 5G users in China will cross the 20% mark.”

In 2020, China Unicom has achieved good results in 5G co-construction and sharing. According to reports, as of the end of this year, the two parties have shared 5G base stations with a scale of 380,000 stations, realizing 5G coverage in cities and key counties at prefecture-level and above across the country, and completing the goal of jointly building “one network.” At the same time, co-construction and sharing also saves 5G expenses, CAPEX saves 40% and OPEX saves 35% annually. Based on such a co-built and shared network, the rate has been further improved, and the world’s highest 3.2Gbps peak experience rate of 200MHz full sharing is the first.

As the network is deployed, technology is constantly evolving. Miao Shouye pointed out that China Unicom is the first operator in the world to implement SA commercial networks . In June this year, China Unicom announced the commercialization of its 2B SA network; in September, the commercialization of 2C SA; in November, China Unicom achieved the world’s first commercial slicing in Beijing and Guangdong; it is expected that by 2021, 5G slicing will be commercialized nationwide.

In terms of security, China Unicom is actively building 5G security capabilities. The flexible combination of 5G network, MEC , and slice security capabilities provide multiple levels of protection capabilities to meet customized security requirements.

China Unicom continues to carry out technological innovation to enhance user experience. In October this year, China Unicom joined forces with Huawei to demonstrate the first 5G R17 FDD ultra-large bandwidth prototype device PoC field test. At the same time, China Unicom also cooperated with Huawei to carry out innovative experiments, and the throughput rate reached 4.7Gbps.

Miao Shouye believes that the 5G industry supply chain should work together from the terminal to the network to improve capabilities. At the terminal level, power consumption and heating issues need to be paid attention to; terminal network coordination still needs to be continuously strengthened; industry terminals/modules are lacking, shipments are small, and diversity is poor.

- At the network level, 5G standards (ITU) and specifications (3GPP) continue; 5G equipment has high energy consumption and pressure on network operating costs. Network empowerment needs to be improved, such as network slicing, 5G+TSN (Time Sensitive Networking), etc.

- At the business level, 2C killer applications still need to be explored; 5G products need to be continuously improved in practice; 2B business models need to be explored; business applications still need to be incubated.

Meanwhile, China Mobile hasn’t given a timetable for standalone deployment or services, although executives have promised they are building a “premium” SA network.

References:

https://www.lightreading.com/asia/china-5g-crosses-200m-mark-as-operators-prep-for-sa/d/d-id/766292?

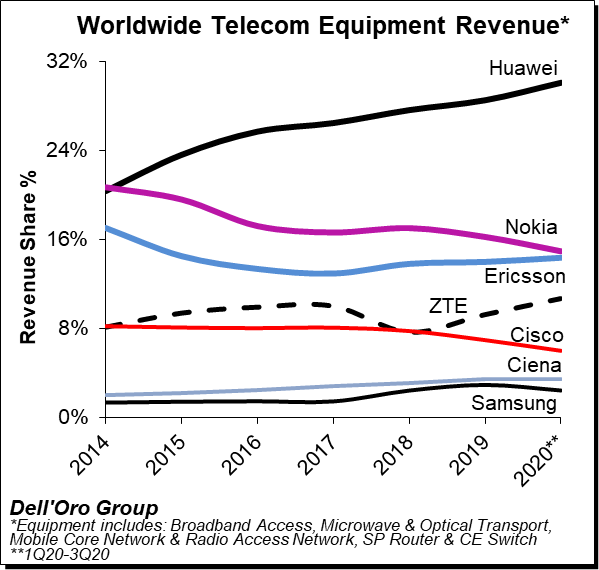

Dell’Oro: Telecommunication Equipment Market 1Q20 to 3Q20 +China’s New 5G Base Stations

Preliminary estimates by the Dell’Oro Group suggest the overall telecom equipment market advanced 9% Year-Over-Year (Y/Y) during 3Q20 and 5% Y/Y for the 1Q20-3Q20 period. That market includes: Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch (CES).

The analysis contained in these reports suggests revenue rankings remained stable between 2019 and 1Q20-3Q20, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers, accounting for more than 80% of the total market. At the same time, revenue shares continued to be impacted by the state of the 5G rollouts in highly concentrated markets.

Huawei and ZTE are both on course to gain two percentage points of market share each this year, at the expense of Nokia, Cisco and Samsung. With investments in China outpacing the overall market, we estimate Huawei and ZTE collectively gained about 3 percentage points of revenue share,” wrote Dell’Oro Analyst Stefan Pongratz in his blog on the matter, implying they actually grabbed around 1.5 percentage points each.

Dell’ Oro estimates the following revenue shares for 2019 and the 1Q20-3Q20 period for the top seven suppliers:

- Following the 4% Y/Y decline during 1Q20, the positive trends that characterized the second quarter extended into the third quarter, underpinned by strong growth in Optical Transport and multiple wireless segments including 5G RAN, 5G Core, and Microwave Mobile Backhaul. Technology segments that were impacted more materially by COVID-19 and the lockdowns during 1Q20 continued to stabilize in the quarter.

- Preliminary estimates indicate increasing Mobile Infrastructure and Optical Transport revenues offset declining investments in Microwave Transport and SP Routers & CES for the 1Q20-3Q20 period.

- The overall telecom equipment market continued to appear disconnected from the underlying economy. While the on-going transition from 4G to 5G is helping to offset reduced capex in slower-to-adopt mobile broadband markets, we also attribute the disconnect to the growing importance of connectivity and the nature of this recession being different than in other downturns improving the visibility for the operators.

- With investments in China outpacing the overall market, we estimate Huawei and ZTE collectively gained about 3 percentage points of revenue share between 2019 and 1Q20-3Q20, together comprising more than 40% of the global telecom equipment market.

- The Dell’Oro analyst team has not made any material changes to the overall outlook and projects the total telecom equipment market to advance 5% to 6% in 2020 and 3% to 4% in 2021. Total telecom equipment revenues are projected to approach $90 B to $95 B in 2021.

………………………………………………………………………………………………………………………………………………………………..

Judging from a report by China Daily “China to build 1 million new 5G stations in 2021.” it appears Huawei and ZTE will continue to increase their telecom equipment market share. Reporter Ma Si of China Daily spoke to Wu Hequan, an academician at the Chinese Academy of Engineering, who reckons China will build over a billion 5G base stations next year, taking the grand total to 1.7 million by the end of the year.

China workers working at the construction site of a 5G base station at Chongqing Hi-tech Zone in Chongqing, Southwest China. [Photo/Xinhua]

“As the construction of 5G networks accelerates, the cost of building each 5G base station will go down,” said Wu. “Even if Chinese telecom carriers earmark the same amount of 5G investments in 2022 as they have done this year, they can build far more 5G base stations next year than this year. I believe Chinese telecom carriers will build more than one million 5G base stations next year, though the specific construction targets will have to wait for the telecom carriers’ official announcements.”

China Mobile, China Telecom and China Unicom did not immediately respond to requests for comment from China Daily.

Wu’s remarks are in line with China’s top industry regulators’ predictions the nation will “moderately” push ahead 5G construction in the next few years. The Ministry of Industry and Information Technology said in October as the country is set to enter a lead-in period in the next three years, China will continue to build 5G networks in a rhythm that is moderately ahead of schedule, so the wider coverage of 5G can help promote its use in more industrial and consumer scenarios.

That lead-in period, according to some industry insiders, means new products, new formats and new models of 5G application are constantly emerging and such applications are shifting from single application to large-scale and systemic scenarios.

China seems to be all the more determined to ensure its domestic telecoms industry goes from strength to strength. In response to the threat to the U.S. from China, John Ratcliffe wrote in the Wall Street Journal (on-line subscription required for access): “Beijing is preparing for an open-ended period of confrontation with the U.S. Washington should also be prepared. Leaders must work across partisan divides to understand the threat, speak about it openly, and take action to address it.”

…………………………………………………………………………………………………………………………………………………………..

References:

Key Takeaways—Telecommunication Equipment Market 1Q20 to 3Q20

Chinese telecoms kit vendors gained global market share this year

https://www.chinadaily.com.cn/a/202012/02/WS5fc74e99a31024ad0ba99633.html

China Telecom launches 5G standalone cloud native network with Tianyi Cloud

China Telecom claims it has launched what it says is the world’s largest 5G standalone (SA) network. Executives announced the start of commercial 5G SA operations during a company virtual conference last week and said their 5G SA network is currently supported by 30 devices, with 100 expected by year-end.

China Telecom’s 5G SA end-to-end capability testing with Tencent and Huawei was completed in September. Earlier in the week, China Telecom said it will offer 5G SA services to over 300 cities in China at a press event held with Qualcomm at Guangzhou, China.

Like all the other telcos on the path to 5G SA (only T-Mobile US has deployed it), China Telecom’s is said to be 5G SA is a cloud native network called the “Tianyi Cloud.” Company leaders said it’s 5G SA cloud network can guarantee “five-nines reliability,” secure network slicing and latency of below 5ms. In particular:

With the popularization of cloud computing, hybrid multi-cloud has become the new normal for cloud migration. It is just necessary to realize high-speed network interconnection and unified management between multi- clouds. The full-stack hybrid cloud launched by Tianyi Cloud realizes the same technical architecture of the underlying cloud platform and has no cloud capabilities. It extends and covers the deployment of three scenarios: edge, private cloud, and industry cloud. At the same time, it provides first-line multi-cloud capabilities, a dedicated line connects multiple mainstream public cloud service providers at the same time, and high-speed interconnection between public and private clouds can also be realized. In addition, it is worth mentioning that Tianyi Cloud’s full-stack hybrid cloud has been adapted to national production and production at the chip, hardware, and operating system levels, and has the ability to provide national production and service services.

The new generation of cloud-native database developed by Tianyi Cloud completely independently developed and technically tackled key problems. It successfully realized the de-IOE of China Telecom’s core IT system database. Telecom users and billion-level terminal equipment access. Through continuous upgrading and evolution, Tianyi Cloud’s new generation of cloud-native database has reached financial-level data security and high reliability, and has continuously broken through the limits of scale and performance, while being compatible with a complete database ecological chain, so as to meet customers’ diverse data service needs.

Also, China Telecom officially launched the “Cloud Terminal” plan at the event. Tianyi Cloud, as the base of the cloud terminal strategy, has independently created a cloud computer through computing in the cloud, data in the cloud, application in the cloud, security in the cloud, and imagination in the end mode. And cloud mobile phone products.

President and COO Li Zhengmao said the arrival of the 5G era provided the opportunity and the technical ability for the integration of cloud and the network.

In terms of 5G cloud integration, Hu Zhiqiang said:

“In the 5G era, cloud-network integration has entered a new realm. Cloud-network integration is the goal that Tianyi Cloud pursues.” On the one hand, Tianyi Cloud launched an intelligent edge video cloud to break through the bottleneck of ultra-high-definition real-time encoding technology. At the same time, it has real-time scheduling capabilities of millions of video streams. On the other hand, 5G is a cloud-based network. Tianyi Cloud provides 99.999% reliability guarantee and exclusive slice data security, achieving a comprehensive TCO reduction of more than 90%, and a delay of less than 5ms.”

A white paper presented at last week’s event describes China Telecom’s cloud-network integration as driven by open sharing, open network capabilities, multi-network access 5G and SD-WAN support. The China Telecom paper said the company was a hybrid multi-cloud strategy, integrating Alibaba Cloud, Tencent Cloud, Huawei Cloud, AWS, Azure and others into its aggregation platform.

In conclusion, Hu Zhiqiang said: “China Telecom Tianyi Cloud will continue to strengthen technological innovation, strengthen open cooperation, and accelerate the construction of a digital China and a smart society, and make greater contributions with partners.”

………………………………………………………………………………………………………………………………………………………………………………………………….

References:

http://www.c114.com.cn/news/117/a1143514.html

https://www.lightreading.com/asia/china-telecom-gets-cracking-on-5g-standalone/d/d-id/765464?

China says it has deployed 700,000 5G base stations this year; Huawei’s forecast

China says it has deployed 700,000 5G base stations this year; Huawei’s forecast

China has announced it has built nearly 700,000 5G base stations this year, exceeding its original target of 500,000, South China Morning Post reports. That’s more than twice the number of 5G base stations in the rest of the world combined, according to China’s Ministry of Industry and Information Technology (MIIT) vice-minister Liu Liehong.

The vice-minister said there are currently more than 180 million devices operating on China’s 5G network.

“The good infrastructure has spurred a range of new 5G-based applications,” Liu said in remarks reported by Chinese media Sina News. “For instance, the smart education sector has witnessed the emergence of new education models such as ultra-high-resolution, remote interactive teaching powered by 5G, immersive teaching with augmented and virtual reality technology and hologram classrooms during the Covid-19 pandemic.”

To achieve complete coverage, China will need 10 million 5G base stations in total, which involves an overall investment of CNY 2 trillion (approximately USD 280 billion) of investment, according to Zhang Yunyong, CPPCC member and president of the China Unicom Research Institute.

Chinese President Xi Jinping has singled out 5G networks and data centres as top priorities in the country’s plans to invest in “new infrastructure”. The next-generation network is considered a fundamental element of China’s new digital infrastructure, aimed at driving greater connectivity for consumers and businesses.

………………………………………………………………………………………………………………………………………………………..

The latest analysts’ estimate from Jefferies, put the total number of 5G base stations across the country at 650,000. Their data projected China’s three major telecommunications network operators to have up to 750,000 5G base stations by the end of this year.

Analysts said that although the 5G base station roll out has been impressive, it was still only a fraction compared with China’s huge base of 1.2 billion 4G users, creating a situation where consumers have been reluctant to upgrade to more costly 5G plans because there are no killer apps and must-have consumer services.

South Korea, the first country in the world to provide 5G services, has 115,000 base stations in operation, according to government data in April. The South Korean government recently announced that the number of 5G service users across the country reached 8.65 million in August.

The global 5G network infrastructure market is expected to nearly double to USD 8.1 billion in 2020, according a report from Gartner.

…………………………………………………………………………………………………………………………………………………………………………………………………….

Huawei Technologies expects 5G users to account for 20% of total mobile users in China and South Korea by the end of June 2021, Ryan Ding, president of Huawei’s carrier business group, said during a presentation at the company’s Global Mobile Broad Forum in Shanghai, China.

The executive said that 5G adoption was happening faster than some of the initial predictions in China, with operator China Mobile now having 130 million 5G subscribers, ahead of its target of 100 million for the year.

“5G is developing much faster than previous generations. Currently, there are more than 100 commercial 5G networks worldwide, and budget 5G mobile phones have dropped to CNY1,000 ($151). This is driving up the number of 5G users around the world, and leading carriers are already benefitting from 5G data plans. They are seeing an increase in the ARPU of 5G users through multi-metric service packages and upgraded services like 5G messaging and enriched calling,” Ding said.

…………………………………………………………………………………………………………………………………………………………………………………………………….

References:

5G users to account for 20% of China’s mobile base by June 2021: Huawei

China Mobile has 114M “5G Package” subscribers vs 204M broadband wireline customers

China Mobile announced yesterday that it had approximately 946 million mobile customers as at 30 September 2020, which was down about 1 million from the previous quarter. There were 770 million 4G customers and 114 million 5G package customers. The latter number is a 44 million increase in the past three months. However, the growth in 5G subscribers is not quite what it seems. Like China Telecom, China Mobile uses the term “5G package customers,” which counts 4G customers on 5G plans. [The 3rd state owned China telco – China Unicom – does not yet give a breakout of 5G subs from its mobile subscriber base.] The 4G subscriber base, reflecting some migration to 5G package plans, shrank by 10 million during Q3-2020.

During the first three quarters of the year, China Mobile handset data traffic increased by 35.0% year-on-year to 65.3 billion GB with handset data DOU reaching 9.1GB. Total voice usage dropped by 7.1% year-on-year to 2,258.0 billion minutes, showing a further reduced rate of decline. Total SMS usage rose by 15.5% year-on-year to 713.0 billion messages and maintained favourable growth. Mobile ARPU continued to demonstrate a flattened rate of decline, dropping by 2.6% year-on-year to RMB48.9 for the first three quarters of the year.

As of 30 September 2020, China Mobile’s total number of broadband wireline customers was 204 million, with a net increase of 17.17 million for the first three quarters of the year. Wireline broadband ARPU amounted to RMB32.4.

Image Credit: China Mobile

China Mobile said it will “continue to put in an all-out effort to implement the “5G+” plan, further promote scale-based and value-oriented operations and foster the all-round development of CHBN markets, thereby maintaining growth in telecommunications services revenue for the full-year of 2020.” The Group acknowledged the increasing cost associated with 5G operations and maintenance, but did not elaborate on what those costs were:

Facing the challenges resulting from increasing costs incurred by 5G operations and maintenance and business transformation, the Group will allocate resources by adhering to the principle of ensuring a sufficient budget for areas essential to promote growth, while reducing and controlling expenses on certain selected areas. In addition, it will take further measures to reduce costs and enhance efficiency, alongside efforts to maintain good profitability. The Group will maintain stable profit attributable to equity shareholders for the full-year of 2020, continuously creating value for investors.

Ericsson, which previously received a $593 million 5G contract with China Mobile for base stations wrote in an email to Light Reading: “”We have been riding on the investments in China and there are likely to be more than 500,000 base stations by the end of the year in China launched on 5G and of course we are quite pleased to participate in that rather fundamental and quite strong rollout.”

Market research firm Dell’Oro forecasts that China’s 5G rollout will drive an 8% increase in worldwide sales of radio access network products this year. Excluding China, it forecasts no growth in the RAN infrastructure market. Additional highlights from Dell’Oro’s 2Q2020 RAN report:

- 5G NR radio shipments accelerated 5x to 6x during 1H20, driven by robust growth in China.

- Millimeter Wave 5G NR deployments continued to advance rapidly, with revenues growing nearly four-fold.

- Initial estimates suggest that vendor rankings remained stable between 2019 and 1H20, while revenue shares changed somewhat as the Chinese suppliers reached new revenue share highs.

- Near-term RAN forecast has been adjusted upward, to reflect the faster-than-expected growth in China.

………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.chinamobileltd.com/en/file/view.php?id=237832

https://www.lightreading.com/5g/china-mobile-5g-subs-top-114m-in-q3/d/d-id/764778?

https://www.lightreading.com/5g/ericsson-rides-high-on-china-5g-boom/d/d-id/764770?

Huawei Executive: “China’s 5G user experience is fake, dumb and poor”-is it a con game?

RAN Market Growth Accelerated in 1H20, According to Dell’Oro Group

Huawei Executive: “China’s 5G user experience is fake, dumb and poor”-is it a con game?

At the opening ceremony of the China International Information and Communication Exhibition on October 14th, Ding Yun, executive director of Huawei Technologies Co., Ltd said that China’s 5G user experience has three problems of “fake, dumb, and poor.” In particular, some users have a 5G LOGO on their mobile phones, but they are not connected to the 5G network, cannot make 5G calls, or frequently switch signals, according to an article by Xia Xutian on the Sina Tech website.

How could a Huawei executive say such things about its home country which supposedly has very close ties, impact and influence on the world’s top telecom equipment supplier and #1 or #2 global smartphone vendor? See Comment and Analysis below for more on this.

While China has built the world’s largest 5G network, it has a gap in experience, coverage, and commercial closed-loop operation, Ding Yun said. For comparison purposes, that the 5G downlink rate in South Korea is more than 600 megabits while the average in China is only a bit more than 270 megabits. South Korea’s 5G user penetration at the end of September reached 25%, while China’s penetration level is only about 8%.

“Objectively speaking, I am also a 5G user. We have just completed the first phase of 5G construction today. It is indeed a great improvement over the 4G experience, but our network still has many problems. I use three words to sum it up: fake, dumb, bad/poor.”

Huawei’s Ryan Ding speaking at the China International Information and Communication Exhibition about 5G in China

Photo Credit: Huawei

…………………………………………………………………………………………………………………………………………………………………………………………………………….

What’s fake? In many cases the user’s smartphone has a 5G logo but no 5G coverage. The experience is still 4G, but the display is 5G. Those users are not connected to the 5G network and can’t make 5G calls.”

What is dumb? Some places in China have 5G signal coverage, but there is no 4G anchor station, so calls cannot be made. He said the anchor point of 4G happens to be on the edge of multiple cells. The frequent handover of 4G and 5G results in a very poor user experience.

Ding Yun noted that although the number of 5G users in China has reached 150 million, the matching rate of networks, mobile phones and packages of 5G users is still very low. Many users have bought 5G packages, but their mobile phones are still 4G. There are also many users who have 5G mobile phones, but there is no 5G network coverage in their geographical area.

Ding Yun pointed out that operations and maintenance costs are also an unavoidable issue for 5G. At present, the peak rate of 5G is 25 times that of 4G, but 5G equipment (especially mmWave if and when deployed in China) will greatly increase the power consumption of 5G base stations, which poses a huge challenge to the entire power supply system (not to mention the huge electricity costs incurred by the 5G network operator).

“We have conducted a survey on the power consumption of China’s network. About 32% of the sites have insufficient power, and in some places, the battery capacity is also insufficient,” he added.

Ding Yun urged 5G network operators to:

1] build out 5G business ecosystems through innovative and differentiated applications;

2] reduce expenditure and optimize the TCO of operators from an overall perspective; and

3] look towards the future and upgrade the current operating platform as soon as possible to face potential problems such as the bill storm that 5G will bring.

In response to the 3rd objective, Huawei is using big data to connect user data, operational data, and terminal data, so that the machine, network, and applications can provide a better match.

In conclusion Ding Yun suggested the following:

- To build the most successful 5G for thousands of industries, wireless network operators must first have a deep understanding of the industries they are targeting. Different industries have different specific requirements for 5G in terms of latency, reliability/availability, throughput, security, etc. Therefore, to develop 5G industry applications, we first need to clarify the boundaries of capabilities, consolidate the ability base to serve thousands of industries, implement a replicable business model, and actively promote ecological construction, especially the development of application ecology.

- As operators expand the construction of 5G industry applications from connection to connectivity + computing, and then to SLA (network) slicing, their corresponding business models will gradually shift from a direct sales model to a value sharing model that combines active integration and integration . Ultimately, the business model of 5G industry applications will develop in the direction of multi-path, closed-loop, and multi-win as operators choose their roles.

- Unify (5G and other) standards and develop ecology. (What 5G standards is he referring to? There are none at this time). The application development of the 5G industry is not only a matter for operators, but also requires the entire industry chain to “stretch it into one strand” and integrate the telecommunications industry with other industries to form industry standards. Only in this way can the development of 5G industry applications be accelerated.

…………………………………………………………………………………………………………………………………………………………………………………………………

Comment and Analysis:

Ding Yun’s remarks are a refreshing change from the usual self congratulatory speeches given by 5G network operators and equipment suppliers (like Huawei). We are astonished he can be so honest with the Chinese government and China Communist Party having so much control over telecommunications and other industries in China.

Here are a few copy/paste (and translated from Chinese to English) Sina reader comments:

“I have not found a demand for 5G in the current application (environment)”

“Haha, so embarrassing![[Yun Bei] [Yun Bei]](http://comment.sinaimg.cn/emoji/png/2018new_kuxiao_org.png)

![[Yun Bei] [Yun Bei]](http://comment.sinaimg.cn/emoji/png/2018new_kuxiao_org.png) “

“

“China’s 5G, got up early. Experience the night episode (where there is no 5G service to conserve electricity costs for carriers)”

“In Qingdao, there is basically no real 5G SA network. When only the SA mode is selected, the 5G signal is gone, and now the operator’s 5G speed limit is 500M bps”

“The conclusion is that I continue to use my 4G”

“The worst is a three-year contract with China Mobile”

“The three major operators are too hateful and must be punished.”

“China network operators are deliberately lowering the 4G signal, forcing everyone to use 5G. Just this dirty trick, give his grandma a whistle.”

“No 5G signal coverage.”

“Fake, dumb, and bad are synonymous with China’s three major network operators.”

“What is the conclusion? For 5G, it’s better to wait first, don’t worry about changing phones ![[Hee hee] [Hee hee]](http://comment.sinaimg.cn/emoji/png/2018new_xixi_org.png) , let alone changing pricing packages. It’s not very useful and costs money.

, let alone changing pricing packages. It’s not very useful and costs money.![[Yun Bei] [Yun Bei]](http://comment.sinaimg.cn/emoji/png/2018new_kuxiao_org.png) “

“

“The basic meaning is, the operator, burn me![[doge] [doge]](http://comment.sinaimg.cn/emoji/png/2018new_doge02_org.png) “

“

……………………………………………………………………………………………………………………………………………………………………………………………

Email from a very knowledgeable, anonymous Chinese 5G expert corroborates what Ding Yun said:

- China claims they have 100 millions of 5G end point devices now. Actually, those are mostly 4G handsets whose users were coerced to subscribe to a 5G package. The 3 major state owned network operators purposely lowered 4G-LTE speeds and forced subscribers change to the 5G package which only provides the previous 4G-LTE speeds.

- China claims they have deployed 40,000 5G NR base stations. But without URLLC (ultra high reliability, ultra low latency) enhancements to 5GNR (3GPP Release 16) and mMTC (massive machine to machine communications) standards, 5G NR is not complete. (3GPP has not set a date for the conclusion and evaluation of URLLC in the RAN performance testing which is supposed to be in the “frozen” 3GPP Release 16 set of specs)

- There are no mmWave 5G base stations at all in China.

- Currently China 5G base stations consume huge amounts of energy, so the 3 major 5G network operators shut them down at night to reduce electricity bills. Note the above readers comment, “Experience the night episode.”

- Former minister of China Ministry of Finance and seated deputy minister of the Ministry of Industry and Information Technology (MIIT) recently publicly expressed concerns about China’s 5G development and investments. They said China had made bad 5G investments and that China has not yet balanced the 3G and 4G investments made by its network operators).

- What kind of joke is this?

References:

https://finance.sina.com.cn/tech/2020-10-15/doc-iiznezxr6037613.shtml

https://www.wsbtv.com/news/ap-explains-promise/KEKKYBDSVGE4W66CY24PMOYMJA/

ZTE reports strong 1st Half 2020 financials; 5G Flexhaul; Automatic Antenna Pattern Control Trial with China Mobile

ZTE reported strong first half financial results, with operating revenues up 5.8 percent from the year before to RMB 47.20 billion and net profit increasing 26.3 percent to RMB 1.86 billion. Net profit after extraordinary items increased 47.4 percent to RMB 0.9 billion. The operating cash flow grew over 61 percent to RMB 2.04 billion while spend on research and development (R&D) advanced to RMB 6.64 billion.

In the first half of 2020, the company strengthened its cash flow and sales revenue collection management. Its net cash flow from operating activities for H1 2020 is approximately RMB2.04 billion, about 61.1% year-on-year growth. With great commitment to 5G R&D investment, the company’s R&D spending increased to RMB6.64 billion in H1 2020, covering 14.1% of operating revenue.

In light of the coronavirus pandemic and its impact, ZTE decided to push its R&D initiatives and to take advantage of the mega shift brought on by its own ongoing digital transformation. The company also focused on customer service, helping to achieve a steady growth of business.

ZTE put its in-house new-generation core chipsets for access, bearer and fixed-networks into large-scale commercial deployments, further improving the performance, integration and energy efficiency ratio of its chipsets. The company is also focusing on strengthening its algorithm processes, new materials and new technologies in general, as it helps build 5G commercial networks and works towards becoming the “ultimate” cloud company.

In terms of operator network business, ZTE, underpinned by the rapid 5G rollouts in China, achieved revenue of RMB34.97 billion, a year-on-year growth of 7.7%. (Note that ZTE and Huawei were recently banned from the UK’s 5G rollouts). In 1st half o 2020, the company continuously strengthened the landscape of global network infrastructure.

Proactively taking advantages of new infrastructure construction and new services, ZTE further explored market growth opportunities, with the revenue of ZTE’s government and enterprise business reaching RMB4.82 billion, a year-on-year growth of 2.5%. The company further explored high-value overseas markets while promoting healthy operations during the period.

In its consumer business, ZTE has continuously strengthened its 5G terminal (mostly smartphones) agreements with over 30 wireless network operators around the world, with a focus on China’s “open market.”

Moving forward, ZTE says it will continuously strengthen the research and development, operate steadily and proactively address the risks and challenges in the global markets, thereby achieving the quality growth. Meanwhile, the company will seize the opportunities of new infrastructure and network technology innovations to expand its market shares, accelerate the digital transformation, and improve the organizational efficiency, so as to become an ultimate cloud company.

The company recently announced its 5G Flexhaul solution, which adopts a minimal forwarding plane architecture and a cloud-native control plane to provide 5G fronthaul, midhaul, and traditional backhaul, flexibly meeting the differentiated needs of 5G multi-scenarios and the ultimate performance challenges of 5G services. Based on a full range of self-developed and the industry’s only “3-in-1” highly integrated 5G bearer chip, combined with the pioneering FlexE Channel technology, ZTE’s 5G Flexhaul solution not only provides ultra-large bandwidth capabilities, but also supports massive connections for different services Provide differentiated SLA guarantee and network slicing capabilities to provide customers with a flexible, scalable, and operable 5G bearer network.

……………………………………………………………………………………………………………………………………………………………………………………..

ZTE’s announced financial report comes one day after the company said that it has completed the trial of Automatic Antenna Pattern Control (AAPC) self-optimization solution in Guangzhou, China along with the Guangzhou branch of China Mobile.

By means of the seamless integration between the AI technology and the network structure optimization, this solution can greatly simplify the optimization and O&M of the 5G Massive MIMO network, thereby effectively improving the efficiency and reducing the costs.

The trial result shows that the network coverage rate has increased by nearly 12%, and the signal strength has increased about 4-to-5 dB while the signal-to-noise ratio has increased nearly 1-to-2 dB and the download rate has risen by about 10%.

The solution is based on ZTE’s intelligent AAPC optimization tool, employing the AI algorithm and the network management platform to quickly search and lock the optimal antenna parameters in complex scenarios. According to the MR (measurement report) data, the solution can accurately evaluate the quality of the network coverage.

In addition, the solution has adopted an AI model to achieve the iterative optimization, and the optimal matching between scenarios and antenna parameters, so as to create an end-to-end operational solution of self-configuration and self-evaluation.

Moving forward, ZTE and China Mobile will further explore various complex scenarios, and develop a larger-scale AI self-optimization system, expecting to accelerate the transformation and upgrade of intelligent networks.

About ZTE:

ZTE is a provider of advanced telecommunications systems, mobile devices and enterprise technology solutions to consumers, operators, companies and public sector customers. The company has been committed to providing customers with integrated end-to-end innovations to deliver excellence and value as the telecommunications and information technology sectors converge. Listed in the stock exchanges of Hong Kong and Shenzhen, ZTE sells its products and services in more than 160 countries.

References:

https://www.zte.com.cn/global/about/news/20200828e1.html

https://www.zte.com.cn/global/about/news/20200827e1.html

https://www.zte.com.cn/china/solutions/201905201708/201905201738/5G_Flexhaul

ZTE facilitates 4G and 5G co-evolution with a comprehensive set of solutions

No stopping Huawei: 1st half 2020 revenues rose 13.1%, to $64.9 billion despite U.S. led boycott; ~60% of biz from China!

Huawei Technologies Co Ltd, the #1 telecom equipment company #2 smartphone maker, reported a 13.1% rise in revenue in the first half of the year, showing slower growth as U.S. officials continue to pressure the company’s suppliers and customers. Revenue rose to 454 billion yuan ($64.90 billion) in the first half of the year. ($1 = 6.9958 Chinese yuan renminbi or RMB). That was compared to 401.3 billion yuan revenues the year before. Huawei’s growth rate was down from 23.2% in the first half 2019. Huawei said net profit margins were 9.2%, up from 8.7% in the first half 2019.

FILE PHOTO: Huawei’s new flagship store is seen ahead of tomorrow’s official opening in Shanghai, following the coronavirus disease (COVID-19) outbreak, China June 23, 2020.

REUTERS/Aly Song/File Photo: REUTERS

……………………………………………………………………………………………………………………

The results were published as Huawei fights a U.S.-led campaign to ban it from Europe’s 5G markets and choke off its supplies of components based on U.S. design expertise or manufacturing technology. Speculation has risen that UK authorities will this week move to exclude Huawei from the country’s 5G market just months after saying they would restrict it to 35% of any radio access or fiber broadband network.

The UK government previously thought such restrictions – combined with a ban on Huawei in the intelligent “core” of any network – would mitigate the risk and minimize disruption to service providers reliant on Huawei technology.

But security watch dogs are now worried the latest U.S. sanctions would heighten risks and potentially threaten Huawei’s ability to continue serving UK operators.

While other European governments and operators have similar concerns, Huawei has been able to rely on a 5G rollout in China for sales growth.

Victor Zhang, the company’s head of government affairs, told UK officials last week that Huawei will this year erect about half a million base stations for Mobile, Telecom and Unicom, China’s three national operators.

The company has referred to the scale of the Chinese deployment in refuting suggestions it may run out of components early next year. With the current 35% cap on its UK role, it needs components for only about 20,000 UK base stations, which it can easily supply through existing inventory, said a Huawei spokesperson.

A breakdown of the figures released today indicates growth in all three of Huawei’s business lines.

At the carrier division, which develops network products for communications service providers, sales were up 9%, to RMB159.6 billion ($22.8 billion), despite coronavirus-triggered lockdowns in some of Huawei’s most important markets.

While Huawei did not provide a regional breakdown of the numbers, a Chinese splurge on 5G equipment is likely to have fueled the increase given the pressure elsewhere.

Last year, the Chinese market accounted for nearly 60% of Huawei’s entire business, a figure that proves any European restrictions would have only a limited effect on the company.

Huawei’s relatively small enterprise business managed a 15% increase in sales, to RMB36.3 billion ($5.2 billion), while its device-making consumer business – which last year blamed U.S, sanctions for wiping about $10 billion off sales – said revenues were up 16%, to about RMB255.8 billion ($36.6 billion).

“Our business depends on delivering what our customers need,” said Zhang in a prepared statement about the latest numbers. “These results show that they continue to choose Huawei when they want reliability, security and value.”

Zhang said: “Our priority here is to build a better-connected UK where everyone can benefit from 5G and fiber broadband, no matter where they live.”

BT and Vodafone, the UK operators most heavily reliant on Huawei’s products, have told UK officials they need at least five years to phase out the Chinese vendor. Anything less and customers would face major disruption, including outages as equipment is replaced, said technology executives during a parliamentary committee last week.

…………………………………………………………………………………………………………..

Huawei’s rise in sales comes after more than a year of pressure from American officials on the company’s suppliers and customers. The company sells 5G networking equipment to carriers and smart phones and laptops to consumers.

American officials placed Huawei on a blacklist in May of last year, restricting sales to the company of U.S.-made goods such as semiconductors. Huawei built up inventories and also continued to design its own chips and have them manufactured by Taiwan Semiconductor Manufacturing Co Ltd and others.

“Huawei has promised to continue fulfilling its obligations to customers and suppliers, and to survive, forge ahead, and contribute to the global digital economy and technological development, no matter what future challenges the company faces,” the company said in a statement on Monday.

In May, U.S. officials announced new rules aimed at constricting Huawei’s ability to self-supply chips, an ability that is critical to its efforts to sell 5G networking gear.

The first half results showed faster growth than Huawei’s first quarter results released in April. For the first quarter, revenues rose by about 1% to 182.2 billion yuan, versus 39% growth posted a year previous. Net profit margin in the first quarter narrowed to 7.3% from about 8% a year earlier.

Huawei did not report unit shipments of phones. Research firm IDC reported Huawei was the second largest phone maker in the first quarter of 2020, with 17.8% market share, behind No. 1 Samsung Electronics Co Ltd and ahead of No.3 Apple Inc.

References: