Coherent optics

Coherent Optics: Synergistic for telecom, Data Center Interconnect (DCI) and inter-satellite Networks

by Kalar Rajendiran, Alphawave Semi (edited by Alan J Weissberger)

The telecommunications industry has experienced significant growth in recent years, driven by the increasing demand for high-speed internet and data services. This growth has created a surge in traffic on optical networks, leading to the development of new telecom network architectures that can support the increasing demand for bandwidth.

Optical networking technologies, such as coherent optics, have traditionally been developed for telecom applications. However, with the growth of hyperscale data centers and the increasing demand for high-speed networking, these technologies are now also being adopted in data center applications. Traditionally, data centers have used copper or short-range optical cables to connect servers and storage devices within the same data center. However, as data volumes continue to grow and data center interconnect (DCI) requirements increase, coherent optical networking is becoming an attractive option for data centers. With coherent optical networking, data centers can achieve higher data transmission rates over longer distances, resulting in increased data capacity and lower latency. 400G was the first data rate where hyperscale data center applications outpaced telecom applications in the use of coherent optics.

Coherent optics enables the transmission of high-speed data over long distances by using advanced signal processing techniques to mitigate the effects of signal distortion and noise. This technology is essential for supporting the growing demand for high-speed internet and data services, particularly in areas where traditional copper-based networks are not feasible. This trend is likely to continue and proliferate further going forward, driven by the ongoing growth of cloud computing, big data, AI/ML workloads and other data-intensive applications.

Another driver of the shift towards optical interconnects has been the increasing complexity of satellite networks. As satellite networks become more complex, the need for high-speed, low-latency communication between satellites becomes more important. Optical interconnects are ideal for this type of communication, as they offer very low latency and can support high-speed data transfer between satellites.

Optical telecom synergies have played a significant role in the evolution of inter-satellite communication. Many of the technologies and techniques used in optical telecom networks have been adapted for use in inter-satellite communication. Innovations in optical digital signal processing (DSP) and system automation also offer several optimization opportunities with inter-satellite interconnects. Benefits include:

- Improved Signal Quality: Optical DSP can be used to compensate for impairments in the optical signal, such as chromatic dispersion and polarization mode dispersion. This can improve the quality of the signal and reduce the bit error rate (BER), enabling high-quality communications over long distances.

- Reduced Latency: System automation can also be used to optimize the routing of data between satellites, minimizing the number of hops and reducing latency. This can improve the responsiveness of the system and enhance the user experience.

- Power-efficient Modulation Formats: Optical DSP can enable the use of power-efficient modulation formats, such as pulse-amplitude modulation (PAM), which can reduce the power consumption of the inter-satellite links while maintaining high data rates.

- Energy-efficient Signal Processing: Optical DSP can also be optimized to perform signal processing operations more energy-efficiently. For example, parallel processing and low-power digital signal processing techniques can reduce the power consumption of the signal processing circuitry.

At the recent Optical Fiber Communication (OFC) conference, Alphawave Semi (located in London, UK) showcased its ZeusCORE XLR test chip during the interoperability demonstration organized by the Optical Internetworking Forum (OIF). Alphawave Semi executives Loukas Paraschis, VP of Business Development and Tony Chan Carusone, CTO, presented on high-speed connectivity leadership. Their presentations touched on the growing synergies and optimization opportunities of inter-satellite interconnects and optical telecom through innovations in optical DSP and system automation.

As the volume of data traffic on optical networks continues to increase, it is essential to ensure that the cost of implementing and maintaining these networks remains affordable. This requires a delicate balance between increasing volume and decreasing costs, which can only be achieved through innovation and the development of highly-integrated co-designed solutions. These solutions combine multiple technologies and functions into a single device, reducing the complexity and cost of optical network infrastructure. This approach enables the development of more efficient, cost-effective optical networks that can meet the growing demand for bandwidth and high-speed data transmission.

To learn more about the ZeusCORE, visit the product page.

References:

Alphawave Semi at the Chiplet Summit

Alphawave IP is now Alphawave Semi for a very good reason!

Heavy Reading: Coherent Optics for 400G transport and 100G metro edge

Cable Labs: Interoperable 200-Gig coherent optics via Point-to-Point Coherent Optics (P2PCO) 2.0 specs

Adtran showcases coherent innovation at OFC 2023: FSP 3000 open line system & coherent 100ZR

Microchip and Cisco-Acacia Collaborate to Progress 400G Pluggable Coherent Optics

Cignal AI: Metro WDM forecast cut; IP-over-DWDM and Coherent Pluggables to impact market

Adtran showcases coherent innovation at OFC 2023: FSP 3000 open line system & coherent 100ZR

Adtran®, Inc., a leading provider of open and disaggregated networking solutions, today announced that its latest coherent innovation is being showcased at OFC 2023, as part of OFCnet. The demo reveals how the Adtran FSP 3000 open line system (OLS) can bring new levels of flexibility to optical networks by enabling optimized, tailored spectrum services. In collaboration with Acacia, Cisco, Coherent Corp., Corning, EXFO, Nokia and VIAVI Solutions, Adtran will showcase 100ZR, 200Gbit/s, 400Gbit/s OpenZR+ and 800Gbit/s connectivity. The FSP 3000 DCI OLS is also playing a key role in the OIF 400ZR demo at OFC.

“Our demo shows how the spectrum-as-a-service concept has the potential to revolutionize the way operators utilize their fiber resources. It highlights how it’s possible to slice up the network even in a metro environment. With fully flexible spectrum allocation, operators can provide a wide variety of differentiated services and ensure they leverage the full capacity of their infrastructure. Not only will this help tackle ever-increasing data demand, but it also offers a new route to revenue growth. Our compact FSP 3000 OLS is the key to realizing the full benefits of this open and flexible approach. It removes the limits of fixed channel grids so that untapped spectrum can be put to work,” said Jörg-Peter Elbers, head of advanced technology at Adtran.

…………………………………………………………………………………………………………………………..

Adtran also demonstrated its QSFP28 pluggable Coherent 100ZR [1.], which provides 100G coherent edge network connectivity. There was a live display of a 100ZR QSFP28 pluggable operating over a DWDM metro ring. The objective was to show how fiber based network operators can benefit from efficient and cost-effective deployment of coherent 100Gbit/s services with minimal power consumption and low footprint increase. The trial uses the multi-vendor OFCnet network setup with equipment at the Adtran booth as well as the Coherent and OFCnet booths.

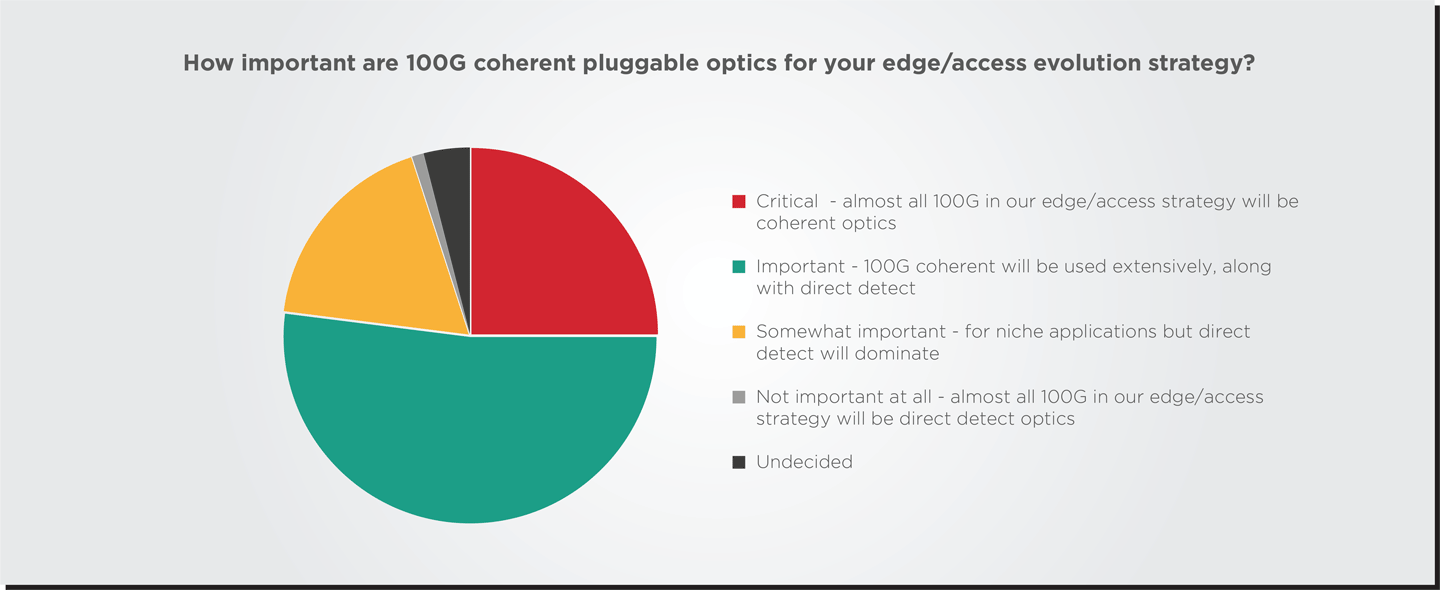

Note 1. In June 2022, transceiver developer II‐VI Incorporated (now Coherent Corp.) and optical networking solutions provider ADVA (now owned by Adtran) announced the launch of the industry’s first 100ZR pluggable coherent transceiver. A recently released Heavy Reading survey (see pie chart below) revealed that over 75% of network operators surveyed believe that 100G coherent pluggable optics will be used extensively in their edge and access evolution strategy. However, this interest had not really materialized into a 100ZR market because no affordable or power-efficient products were available. The most the industry could offer was 400ZR pluggables that were “powered-down” for 100G capacity.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Adtran’s Coherent 100ZR is purpose-built for the optical network edge. With its QSFP28 form factor and power specification, it enables easy and cost-effective upgrades to 100Gb/s data rates by plugging directly into existing head-ends, switches and routers. Co-developed by Adtran and Coherent, the DSP offers a range of deployment options, from local exchanges and central offices to harsh outdoor conditions such as street cabinets. These benefits are achieved thanks to the transceiver‘s features, which include a cost-, space- and power-optimized DSP specifically engineered for 100ZR. Adtran is also developing low-power silicon photonics integrated circuits that will enable faster and more energy-efficient solutions across a wide range of applications.

Quotes:

Saeid Aramideh, VP of Business Development at Optical Engines, Adtran said: “This demo is a significant milestone for network operators looking to expand their business capabilities. It highlights how our Coherent 100ZR can be easily and affordably integrated into a metro aggregation network, eliminating the need for costly infrastructure changes. This showcase reveals a valuable solution for operators seeking to support higher data rates at the network edge and highlights the potential for widespread adoption of 100Gbit/s coherent technology. We can’t wait to bring these benefits to our customers.”

Ross Saunders, GM of Optical Engines, Adtran said: “The technology we’re showcasing here will be a game-changer for service providers. It offers the ability to easily deploy coherent 100Gbit/s connectivity with compact footprint and lowest power consumption. By bringing coherent technology to the optical edge, we’re providing operators with a cost-efficient solution to upgrade edge aggregation networks to 100Gbit/s. Our Coherent 100ZR will also boost sustainability by lowering our customers’ carbon footprint. What’s more, it offers a way to deliver an improved experience for end-users by supporting higher data rates and improved service reliability.”

…………………………………………………………………………………………………………………………………………….

According to a recent Heavy Reading survey, 75% of operators believe that 100G coherent pluggable optics will be used extensively in their edge and access evolution strategy. However, market adoption has yet to materialize since affordable and power-efficient 100ZR-based products are currently not available due to stringent size and power consumption requirements that cannot be fulfilled by today’s tunable laser solutions.

Distribution of responses to a Heavy Reading survey question: How important are 100G coherent pluggable optics for your edge/access evolution strategy? The sample was composed of 87 people who work for network operators worldwide and are involved in network planning or purchasing network equipment.

Source: Heavy Reading

References:

https://www.fibre-systems.com/news/ofc-2023-adtran-demonstrates-coherent-100zr-qsfp28

Cisco restructuring plan will result in ~4100 layoffs; focus on security and cloud based products

Cisco’s Restructuring Plan:

Cisco plans to lay off over 4,100 employees or 5% of its workforce, the company announced yesterday. That move is part of a restructuring plan to realign its workforce over the coming months to strengthen its optical networking, security and platform offerings. Cisco noted in financial filings it expects to spend a total of $600 million, with half of that outlay coming in the current quarter. The company will also reduce its real estate portfolio to reflect an increase in hybrid work.

In a transcript of Cisco’s Q1 2023 Earnings Call on November 17th, Cisco Chief Financial Officer Scott Herren characterized the move as a “rebalancing.” On that call, Chairman and Chief Executive Officer Chuck Robbins said the company was “rightsizing certain businesses.”

Herren and CEO Chuck Robbins said the company is looking to put more resources behind its enterprise networking, platform, security and cloud-based products. In the long run, analysts expect Cisco margins to improve as more revenue comes from security and software products.

By inference Cisco is de-emphasizing sales of routers to service providers who are moving towards white boxes/bare metal switches and/or designing their own switch/routers.

A Cisco representative told Fierce Telecom:

“This decision was not taken lightly, and we will do all we can to offer support to those impacted, including generous severance packages, job placement services and other benefits wherever possible. The job placement assistance will include doing “everything we can do” to help affected employees step into other open positions at the company.”

Cisco implemented a similar restructuring plan in mid-2020 which included a substantial number of layoffs.

Growth through Acquisitions:

Much of Cisco’s revenue growth over the years has come from acquisitions. The acquisitions included Ethernet switch companies like Crescendo Communications. Kalpana and Grand Junction from 1993-1995. Prior to those acquisitions, Cisco had not developed its own LAN switches and was primarily a company selling routers to enterprises, telcos and ISPs.

Here are a few of Cisco’s acquisitions over the last five years:

- In 2017, Cisco acquired software maker AppDynamics for $3.7 billion. It bought BroadSoft for $1.9 billion in late 2017.

- In July 2019, Cisco acquired Duo Security for $2.35 billion, marking its biggest cybersecurity acquisition since its purchase of Sourcefire in 2013. Acquiring Duo Security bolstered Cisco in an emerging category called zero trust cybersecurity.

- In late 2019, Cisco agreed to buy U.K.-based IMImobile, which sells cloud communications software, in a deal valued at $730 million.

- In May 2020, Cisco acquired ThousandEyes, a networking intelligence company, for about $1 billion.

Aside from acquisitions, new accounting rules have been a plus for revenue recognition. The rules known as ASC 606 require upfront recognition of multiyear software licenses.

One bright spot for Cisco have been sales of the Catalyst 9000 Ethernet switches. The company claims they are the first purpose-built platform designed for complete access control using the Cisco DNA architecture and software-defined SD access. This means that this series of switches simplifies the design, provision and maintenance of security across the entire access network to the network core.

There is also an opportunity for Cisco in data center upgrades. The so-called “internet cloud” is made up of warehouse-sized data centers. They’re packed with racks of computer servers, data storage systems and networking gear. Most cloud computing data centers now use 100 gigabit-per-second communications gear. A data center upgrade cycle to 400G technology has been delayed.

Routed Optical Networking:

Cisco in 2019 agreed to buy optical components maker Acacia Communications for $2.6 billion in cash. China’s government delayed approval of the deal. In January 2021, Cisco upped its offer for Acacia to $4.5 billion and the deal finally closed on March 1, 2021. Acacia designs, manufactures, and sells a complete portfolio of high-speed optical interconnect technologies addressing a range of applications across datacenter, metro, regional, long-haul, and undersea networks.

Acacia’s Bright 400ZR+ pluggable coherent optical modules can plug into Cisco routers, enabling service providers to deploy simpler and more scalable architectures consisting of Routed Optical Networking, combining innovations in silicon, optics and routing systems.

Routed Optical Networking works by merging IP and private line services onto a single layer where all the switching is done at Layer 3. Routers are connected with standardized 400G ZR/ZR+ coherent pluggable optics.

With a single service layer based upon IP, flexible management tools can leverage telemetry and model-driven programmability to streamline lifecycle operations. This simplified architecture integrates open data models and standard APIs, enabling a provider to focus on automation initiatives for a simpler topology. It may be a big winner for Cisco in the near future as service providers move to 400G transport.

References:

https://www.fiercetelecom.com/telecom/cisco-plans-cut-5-workforce-under-600m-restructuring-plan

https://www.cisco.com/site/us/en/products/networking/switches/catalyst-9000-switches/index.html

https://www.cisco.com/c/en/us/about/corporate-strategy-office/acquisitions/acacia.html

Heavy Reading: Coherent Optics for 400G transport and 100G metro edge

Cable Labs: Interoperable 200-Gig coherent optics via Point-to-Point Coherent Optics (P2PCO) 2.0 specs

Cablecos use of 200-Gig coherent optical signals in their broadband access network progressed following a recent interop event at CableLabs that involved a five suppliers of coherent optical modules.

CableLabs confirmed that equipment and silicon from those players – Acacia (now part of Cisco), Ciena, Fujitsu Optical Components, Lumentum and Marvell – were found to interoperate with the organization’s Point-to-Point Coherent Optics (P2PCO) 2.0 specs [1.]. The number of participants might not be high, but what’s important is that the participants include DSP silicon from multiple manufacturers that represent the majority of the coherent optics industry.

Note 1. The P2PCO 2.0 specs doubled the operating capacity – from 100 Gbit/s per wavelength in the 1.0 specs, to 200 Gbit/s.

Demonstrating interoperability among so many different coherent DSP suppliers bodes incredibly well for network operators as it provides multi-vendor interoperability, which promotes scale and competition.

Image Courtesy of Cable Labs

Cable Labs conducted 100-Gig interops in 2018 and 2019. Those efforts tie into a broader initiative to use coherent optics technologies, typically used for long-haul, metro and submarine networks, to expand the capacity of fiber that’s already deployed on the hybrid fiber/coax (HFC) access network.

The CableLabs specs also describe a new technology called the Coherent Termination Device (CTD), which can be deployed in an outdoor aggregation node.

Matt Schmitt, a principal architect at CableLabs, said the scope of CableLabs’ interoperability efforts focus on the modules on the optical end – basically describing how a transceiver works at the physical layer.

And to help fit the cable network environment, the end of the network using the CTD is made to reside outdoors, rather than inside a facility.

“Almost every other application of coherent that you see, both ends of the link are in facilities,” such as a data center interconnect where many links are densely packed with racks and modules, Schmitt explained. The cable access application of coherent optics might involve one end that does sit at a facility, such as a hub site, with the other end involving the aforementioned field-deployed CTD.

“Those field boxes didn’t really exist when we started this,” he said.

The broader concept is to help cable operators improve the performance of their access network fibers situated between headends and hubs and fiber nodes for a range of use cases, and to do so without getting locked into one supplier.

CableLabs and its partners originally thought this 200-Gig interop would be completed sooner, but it was delayed a bit during the pandemic when travelling and in-person gatherings were limited or non-existent.

But Schmitt said the plus side of that intervening period meant that the interop ended up with wider supplier participation, particularly at the DSP (digital signal processor) level, than it might have otherwise.

Beyond raw capacity, the 200-Gig capability should help to support the new distributed access architecture (DAA), supported by multiple remote PHY or remote MAC/PHY devices, and the cable’s industry’s broader pursuit of delivering symmetrical 10Gbit/s performance to customers on the access network.

Schmitt said 200-Gig technology gets particularly interesting when operators look to support large, high-density areas that are being split into smaller service groups. It might also factor in as operators explore services beyond high-speed data over cable, such as mobile XHaul.

The use of CTDs with pluggable optics is also designed to support a relatively easy upgrade path. If an operator starts with 100-Gig, those modules can be swapped out for 200-Gig modules later.

This point-to-point P2P use case is just one aspect of coherent optics being explored by CableLabs. A separate-but-related coherent PON initiative still uses coherent signaling, but is focused on point-to-multipoint links.

For now, Schmitt said CableLabs doesn’t plan to hold another interop for P2PCO v2.0 products. “It really just worked so well. I’m not sure what more there will be to do in a follow-up interop,” he said.

CableLabs would be open to doing qualification testing for these new P2P coherent products if the market demands it. “Thus far, I haven’t been hearing of a big push for that,” Schmitt said. “I think people have been comfortable with what we’re getting from the interops and doing their own testing to see how it works.” As for next steps, this latest batch of handiwork will be showcased at the 10G Lab at CableLabs, Schmitt said.

Meanwhile, future commercial deployments will be determined by the availability of CPDs and interest form cable operators.

Among suppliers involved in the recent interop, Ciena confirmed that it currently has interoperable, CableLabs-compliant 200G coherent pluggables available as part of the supplier’s WaveLogic 5 Nano coherent pluggable portfolio.

Another factor for adoption will be costs compared to the 10-Gig DWDM tech that’s in use today. Schmitt acknowledges that the first endpoint is going to be greater with coherent technology, since it involves putting a switch or router in the field.

“Where it gets interesting is every time you need to add another device that’s sharing that same fiber run,” Schmitt said.

“With coherent, you have a higher upfront cost, but you’re going to have a much lower slope, because as you add more devices, all you have to do is add a pair of gray (standard) optics modules – very low cost … Where’s that crossover point in terms of number of endpoints? To me, is going to be one of the big deciders on when and how widespread the deployment of this technology gets.”

References:

A Jolt of Light: CableLabs Holds First 200G P2P Coherent Optics Interop

First Light for CableLabs® Point-to-Point Coherent Optics Specifications