Comcast

U.S. cable commercial revenue to grow 6% in 2022; Comcast Optical Network Architecture; HFC vs Fiber

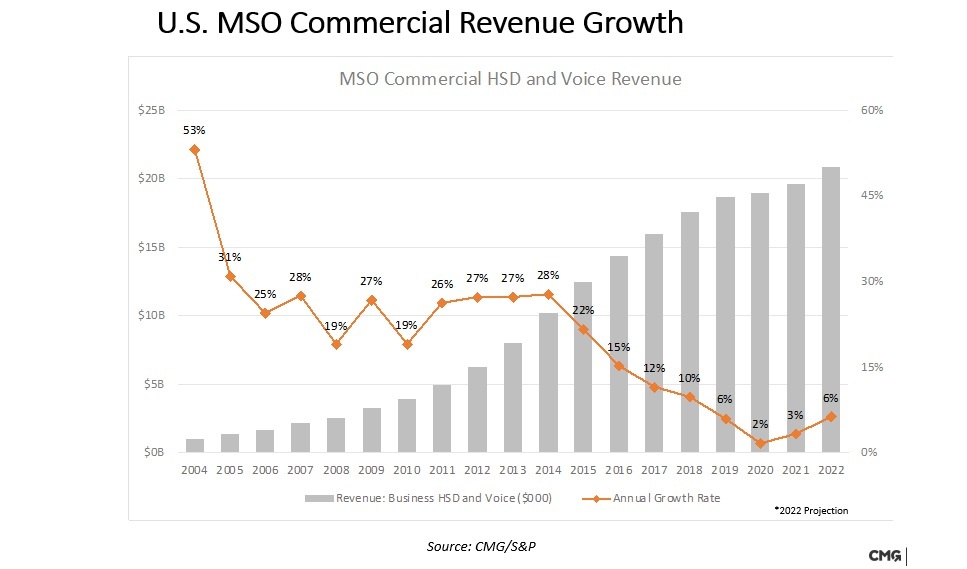

U.S. cable multi-service operators (MSO’s) now generate more than $20 billion a year in business services revenues as the sector has emerged as one of the most profitable for the industry. However, cablecos face major challenges in maintaining their growth pace because of the economic meltdown wrought by COVID-19 and the emergence of new all-fiber and wireless competitors.

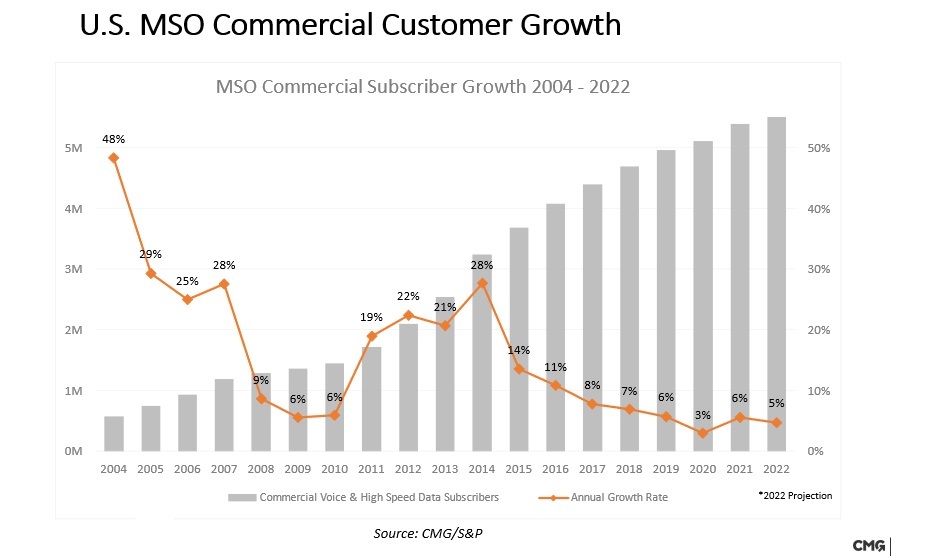

Cable business service revenues and customer growth each slowed during the first two years of the COVID-19 pandemic, but they are clearly increasing again at the end of 2022.

U.S. cablecos commercial revenue growth is set to hit 6% in 2022, up from just 2% in 2020 and 3% in 2021, Alan Breznick, cable/video practice leader at Light Reading and a Heavy Reading analyst said in opening remarks at Light Reading’s 16th-annual CABLE NEXT-GEN BUSINESS SERVICES DIGITAL SYMPOSIUM, which focused on cable business services. [The source of that data is CMG/S&P.]

“There are signs of things pointing up again for the [cable] industry,” Breznick told the virtual audience.

U.S. cable is expected to bring in $20.5 billion in total commercial services revenues in 2022. Broken down by segment, small businesses (up to 19 employees), at $14.6 billion, will continue to represent the lion’s share, followed by medium businesses (20-99 employees), at $3.3 billion, and large businesses (100-plus employees), at $2.6 billion.

Commercial customer growth is estimated to reach 5% in 2022, down slightly from 2021 levels, but almost doubling the growth rate seen in 2020, when businesses across the country were hit by pandemic-driven shutdowns and lockdowns. Breznick estimates that US cable has about 5.5 million commercial customers.

Christopher Boone, senior VP of business services and emerging markets at Cable One, acknowledged that the commercial services market is returning to a faster rate of growth. However, businesses – and smaller businesses, particularly – are feeling labor and inflationary pressure as things continue to open up.

“Everything is expensive, including labor, and it’s hard to find [workers],” Boone explained. “For the small business owner, I think it’s pretty tough right now.”

During the earlier phases of the pandemic, Boone said Cable One didn’t emphasize new work-from-home products but instead focused on the broader customer experience. For example, Cable One put some customers on a seasonable pause for the first time, forgave early termination fees, issued credits and, where appropriate, helped customers move to lower-level services.

“We really threw the rulebook out and just said, do what it takes to take care of the customers,” he said. Even if some small businesses fail, the hope is that those entrepreneurs will return and choose Cable One again, remembering that the company did right by them when times were tough. Moving forward, he said Cable One will stick to its knitting and focus on connectivity rather than look to expand its product line for the business segment.

“I think our product menu needs to look like In-N-Out and not The Cheesecake Factory,” Boone said, noting that Cable One has opted to sit on the sidelines with product categories such as SD-WAN. “We’re pretty cautious in terms of new product launches … We feel that connectivity is really our sweet spot.”

…………………………………………………………………………………………………………………………………………………………………………………………..

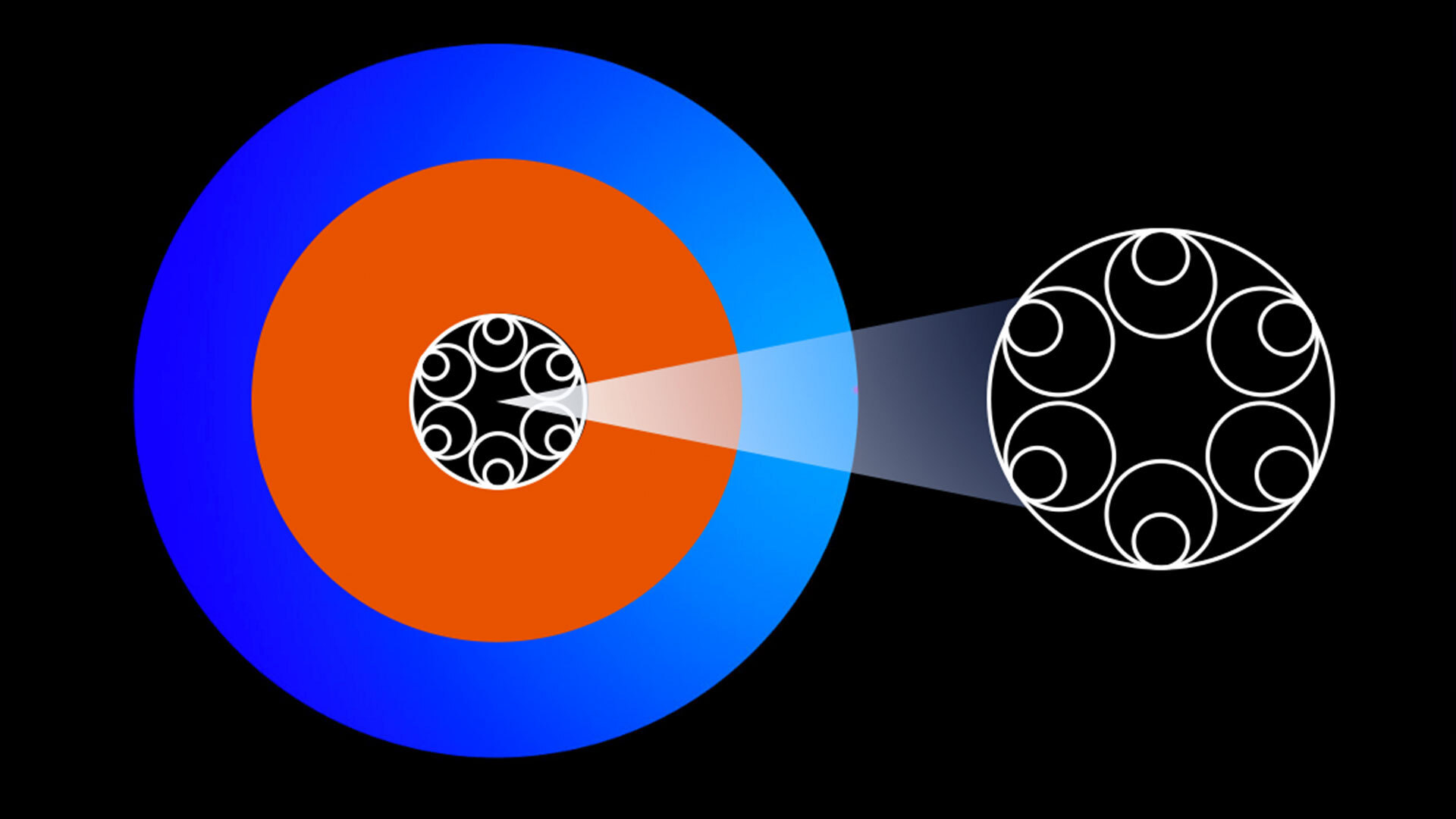

Comcast Business now serves, small, mid-range and enterprise-level customers with a variety of services including Metro Ethernet, wavelength services and Direct Internet Access. An important piece of the firm’s broader strategy revolves around a “unified optical network architecture” initiative that enables the MSO to serve a broad range of customer types, including those requiring that services are delivered to multiple locations in multiple markets.

Comcast’s unified optical architecture combines the access and metro optical networks using a set of items: network terminating equipment (NTE), a Wave Integration Shelf (WIS) and OTN (Optical Transport Network – ITU standard) “tails.”

The NTE is a small, optical shelf that today supports 10-Gig and 100-Gig up to a 400-Gig wavelength, and can reside at a single customer site or a data center. The WIS resides in the Comcast headend or hub, co-located with the metro optical line system, and serves as the demarcation point for commercial services. The OTN Tails are the key to connecting the access network to the metro network.

“We needed a way to provide commercial services to customers that were located in the access [network], but needed to reach the metro network to get to one of our routers for Internet access or possibly another segment of the access to connect their locations together,” Stephen Ruppa, senior principal engineer, optical architecture for Comcast’s TPX (technology, product and experience) unit, said this week during his keynote presentation.

The combining/meshing of the access and metro networks enables features such as remote management, performance monitoring data, alarming and a full “end-to-end circuit view,” including the customer sites themselves. “We use the same hardware, standards, configurations, designs, procurement, processes … in all the networks, regardless of the vendor,” Ruppa said.

And while there was once little need to connect two non-Comcast sites that resided in different areas or to provide connections greater than 10 Gbit/s, customer demands have changed. Ruppa said two products drove that demand and the desire to create the company’s unified optical architecture: wavelength services and high-bandwidth Metro Ethernet.

A modular, simplified, commoditized and easily repeatable architecture enables Comcast Business to “easily offer the next gen of 400-Gig wavelengths and Ethernet services with a very light lift,” he added.

………………………………………………………………………………………………………………………………………………….

Ed Harstead, Lead Technology Strategist, Chief Technology Office, Fixed Networks, Nokia presented the final keynote.

The panel session “Fighting Fiber with Fiber” was moderated by Breznick with panelists:

- Christian Nascimento, VP, Product Management & Strategy, Comcast Business

- Brian Rose, Assistant VP, Product Internet, Networking & Carrier Services. Cox Communications

- Steve Begg, VP/GM, Business Services, Armstrong Business Solutions

- Mark Chinn, Partner, CMG Partners

- Ed Harstead, Lead Technology Strategist, Chief Technology Office, Fixed Networks, Nokia

Decades old hybrid fiber-coax networks (HFC) drive fiber to the node outside of the premises, which is then hooked up using older cable (coaxial) technology. However, due to advances in cable technology such as the latest DOCSIS 4.0 technology, the cable industry has touted its newly developed technological capacity to support multi-gig symmetrical speeds over those hybrid networks. DOCSIS 4.0 currently supports speeds of up to 10 Gigabits (Gbps) per second download and 6 Gbps upload – its predecessor, DOCSIS 3.1, offered only 5 Gbps * 1.5 Gbps.

Christian Nascimento of Comcast stated that hybrid networks that deliver multi-gigabit speeds are “adequate” for smaller enterprises. “This is matter of matching the technology up with…the customer’s needs,” he said, adding that Comcast delivers these services in a “cost-effective way.”

For Cox Communications, the hybrid model is “an ‘and,’ not an ‘or,’” said Brian Rose, the assistant vice president of product internet for the cable company. While Cox may invest more heavily in fiber networks going forward, Rose said it will continue to invest in its cable networks as well. Rose said he welcomes market challenges from insurgent fiber deployers. “Competition is good for customers and the industry overall,” he said. “It pushes people to be better and to push the envelope.”

The panel wasn’t unanimously bullish on older cable technology, however. Ed Harstead of Nokia argued that a widespread transition to fiber is inevitable. “I don’t doubt that mom-and-pop businesses will be perfectly fine on [cable]. But to the extent that you need higher speeds and symmetrical speeds…it’s going to be fiber.”

The cable broadband industry faces an onslaught of criticism from fiber advocates. Organizations like the Fiber Broadband Association say their preferred technology performs better, last longer, and costs less in the long term than the competition. FBA President Gary Bolton has strongly opposed government support for all manner of non-fiber technology, including satellite and wireless.

……………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/cable-tech/cable-business-services-bounce-back/d/d-id/782175

Cable Providers Back Hybrid Fiber-Coax Networks in Face of Pure Fiber

Comcast to roll out DOCSIS 4.0 and Multi-Gig speeds in 2023; Fiber (not FWA) is the real competitor

Comcast is on a path to deliver 10Gbps connectivity. Speaking at a Bank of America investor conference on September 8th, Comcast EVP and Deputy CFO and Treasurer Jason Armstrong said the cable network operator will be in the market with DOCSIS 4.0 and offering symmetrical multi-gig broadband in the second half of 2023. Currently, upload speeds top out at 200 Mbps.

Armstrong said: “Comcast fiber connectivity has gone from 0% to 40% sort of across our footprint in a fairly linear fashion. And in that time frame, we’ve become America’s number one broadband provider, 32 million subs. I would tell you in the last couple of years through the pandemic, we added three million subscribers in an environment where fiber was actually picking up in terms of the presence in the markets that served against us….Fixed wireless access (FWA) is newer, but longer term, fiber is the real long-term competitor. And it always has been. Our view hasn’t changed. It’s a very viable competitor.”

“And longer term, if you think about it, any secular trend out there, whether it’s AR, VR, Metaverse, low latency gaming, the move from linear to streaming, every one of those is — those are bandwidth talks. That’s going to continue to move up usage profiles across the network. Those are all trends that work in our favor.”

Comcast said rollouts of its 2-gig offering are underway in Colorado Springs, Colorado; Augusta, Georgia; and Panama City Beach, Florida. It added the service will be available in a total of 34 markets by the end of 2022 and to more than 50 million locations across the country by the end of 2025. Comcast already offers speeds of up to 1.2 Gbps across its entire cable network using DOCSIS 3.1 technology and has been rolling out mid-split upgrades over the past several months in preparation for an update to DOCSIS 4.0. Speeds of up to 6 Gbps are already available to certain Xfinity fiber customers.

Elad Nafshi, EVP and Chief Network Officer at Comcast Cable, told Fierce Telecom the faster speeds will be available on any DOCSIS 3.1 modem, meaning no upgrades will be required. Elad noted the company’s recent launch of a Wi-Fi 6E router which will deliver the best user experience. According to Nafshi, the mid-split upgrades are just one small piece of the work it has put into enabling the new speed tier. He pointed to its deployment of a virtual cable modem termination system (vCMTS) as well as digital nodes and digital optics as critical pieces of the puzzle which also lay the groundwork for its future DOCSIS 4.0 rollout.

“The way we’re delivering the increased upstream speeds is by, for the very first time, launching DOCSIS 3.1 in the upstream. It’s by relying on the Octave platform that enables us to truly optimize the delivery of those greater upstream speeds by leveraging those new upstream frequencies in order to deliver on this product. Extending additional DOCSIS 3.1 channels, which enable us to deliver the 2-gig speeds as well. There’s a lot of firsts coming to market here,” he explained.

References:

https://www.xfinity.com/support/articles/requirements-to-run-xfinity-internet-speeds-over-1-gbps

Comcast Deploys Advanced Hollowcore Fiber With Faster Speed, Lower Latency

Comcast today announced what is believed to be the first-ever end-to-end deployment of advanced “hollowcore” fiber optics in the world by an Internet Service Provider (ISP). Hollowcore fibers deliver significantly lower latency than traditional fibers and over time will provide critical performance attributes. These fibers will help power Comcast’s network and support the delivery of multigigabit speeds through 10G b/sec.

Unlike traditional fibers, in which laser light travels over a solid glass core, “hollowcore” fibers are empty inside with air-filled channels. Since light travels nearly 50 percent faster through air than glass, data travels about 150 percent faster with up to 33 percent lower latency through “hollowcore” fiber compared to traditional fiber. The faster speed of light can be used to double the reach for latency critical applications or can speed up the transaction rates by around 47 percent.

For the deployment announced today, Comcast worked with hollowcore fiber cable solutions provider, Lumenisity.

“Hollowcore fiber is a leap forward in how we deliver ultra-fast, ultra-low latency and ultra-reliable services to customers,” said Elad Nafshi, EVP & Chief Network Officer at Comcast Cable. “As we continue to develop and deploy technology to deliver 10G, multigigabit performance to tens of millions of homes, hollowcore fiber will help to ensure that the network powering those experiences is among the most advanced and highest performing in the world.”

“The reality is that light travelling through air is about 50% faster than travelling through glass. The data throughput and the latency is greatly improved when you have a hollowcore fiber … The advantage is you can extend your reach at equal performance,” Nafshi said. Hollowcore fiber, like traditional fiber, can be used in the access, metro or core network, and is compatible with legacy fiber.

Comcast connected two locations in Philadelphia, which enables network engineers to continue to test and observe the performance and physical compatibility of hollowcore fiber in a real-world deployment. This 40-kilometer hybrid deployment of hollowcore and traditional fiber is believed to be the longest in the world by an Internet provider. Comcast successfully tested bidirectional transmission (upstream and downstream traffic traveling on a single fiber), used coherent and direct-detect systems (allowing for forward and backward technology compatibility), and produced traffic rates ranging from 10 gigabits per second (Gbps) to 400 Gbps all simultaneously on a single strand of hollowcore fiber.

“We are proud to be working with Comcast on the next generation hollowcore fiber, which we believe unlocks exciting new potential for connectivity around the world,” said David Parker, Executive Chairman of Lumenisity.

Hollowcore fiber will help to power the next generation of ultra-low latency technologies to support network virtualization, telemedicine, augmented and virtual reality, and other emerging services. Moving forward, Comcast is exploring opportunities to strategically deploy hollowcore fiber in select core- and access-network deployments. From 2017 to 2021, Comcast added more than 50,000 new route miles of fiber to its network and is actively building more fiber into cities and towns across the United States.

Comcast’s ongoing work to expand and evolve its fiber deployments – including this groundbreaking step forward with hollowcore fiber – helps to power Comcast’s ongoing 10G evolution, which will deliver reliable multigigabit upload and download speeds over the connections already installed in tens of millions of homes and businesses.

An illustration of the air-filled channels utilized in hollowcore fiber.

Source: Comcast

………………………………………………………………………………………………………………..

Comcast deployed more than 50,000 new route miles of fiber to its network from 2017 to 2021. The operator isn’t revealing how or when it might commercialize its use of hollowcore fiber, but the operator sees it playing a role for certain apps and use cases, such as telemedicine, AR/VR and network virtualization.

The operator might also use the technology to target new customer segments that are seeking greater throughputs and lower latencies.

From a broader standpoint, hollowfiber could provide a conduit for “10G,” an industry initiative focused on delivering symmetrical 10Gbit/s speeds, low latencies and enhanced security over fiber-to-the-premises (FTTP), hybrid fiber/coax (HFC) and wireless networks.

Citing its 40km connection in Philadelphia, Comcast is billing this as the world’s longest ISP deployment of hollowcore fiber so far.

But Comcast isn’t the only major operator working closely with Lumenisity. Last year, the startup announced BT was trialing its new optical fiber technology at its labs in Adastral Park, Ipswich. That trial involved a 10km-long hollowcore fiber from Lumenisity.

Lumenisity was spun out of the Optoelectronics Research Centre at the University of Southampton in 2017, with an aim to commercialize the development of hollowcore fiber.

In 2020, the startup closed a £7.5 million ($9.77 million) funding round from a group of investors that included BGF and Parkwalk Advisors and existing industrial strategic investors. Lumenisity has raised £12.5 million (US$16.28 million), according to Crunchbase.

Some key application areas Lumenisity has identified for its technology include financial, data center connectivity and connectivity for the separation of remote radio units and baseband units in 5G networks.

About Comcast Corporation:

Comcast Corporation (Nasdaq: CMCSA) is a global media and technology company that connects people to moments that matter. We are principally focused on broadband, aggregation, and streaming with 57 million customer relationships across the United States and Europe. We deliver broadband, wireless, and video through our Xfinity, Comcast Business, and Sky brands; create, distribute, and stream leading entertainment, sports, and news through Universal Filmed Entertainment Group, Universal Studio Group, Sky Studios, the NBC and Telemundo broadcast networks, multiple cable networks, Peacock, NBCUniversal News Group, NBC Sports, Sky News, and Sky Sports; and provide memorable experiences at Universal Parks and Resorts in the United States and Asia. Visit www.comcastcorporation.com for more information.

Media Contact:

David McGuire 215-422-2732

[email protected]

About Luminosity:

Lumenisity® Limited was formed in early 2017 as a spin-out from the world-renowned Optoelectronics Research Centre (ORC) at the University of Southampton (UK) to commercialize breakthroughs in the development of hollowcore optical fibre. We have built a team of industry leaders and experts to realise our goal to be the world’s premier high-performance Hollowcore fibre optic cable solutions provider, offering customers reliable, deployable, low latency and high bandwidth connections that unlock new capabilities in communication networks.

Lumenisity is well funded by a consortium of industrial and private investors. We recently relocated our headquarters to Romsey, UK after a substantial investment was made in developing a state of the art manufacturing and testing facility. Our vision is to be the world’s premier high-performance hollowcore fibre optic cable solutions provider offering our customers reliable, deployable, low latency and high bandwidth connections that unlock new capabilities in communication networks.

References:

Comcast 2021 Network Report: Data Traffic Increased Over Historic 2020 Levels; 10G Coming

Comcast broadband subscriber growth slows; Business services and Xfinity Mobile gain

Comcast Business Announces $28 Million Investment to Expand Fiber Broadband Network in Eastern U.S.

Comcast Earnings Report: Record Broadband Growth; 3 Core Strategy Tenets; Wireless Expansion

Comcast 2021 Network Report: Data Traffic Increased Over Historic 2020 Levels; 10G Coming

After hitting historic peaks in 2020, traffic on the Comcast network grew again in 2021, according to the Comcast 2021 Network Report, released today. Key takeaways:

- In 2021 alone, Comcast invested more than $4.2 billion to strengthen, expand and evolve the network – more than any previous year.

- Traffic patterns remained highly asymmetrical, as peak downstream traffic grew 2x faster than upstream traffic, more closely mirroring pre-pandemic trends.

- In 2021, downstream traffic rose 11% over 2020 levels, while peak upstream traffic rose just 5%. By comparison, 2020 network traffic levels spiked considerably – peak downstream traffic rose 38% while upstream traffic surged 56%

- Similar to last year, entertainment activities dominated peak network traffic, with video streaming accounting for 71 percent of downstream traffic.

“Over the past two years, our network has been a powerful and reliable pillar for our customers as they’ve navigated dramatic changes in how we live, learn, play and work,” said Charlie Herrin, President of Technology, Product, Experience at Comcast Cable. “The outstanding performance of the network throughout this time is a testament to our commitment to strategic investment, unceasing innovation, and the incredible talent and dedication of our technology teams across the country.”

Regarding traffic content, video streaming, at 71%, dominated peak network traffic on Comcast’s network in 2021, compared to 11% for gaming apps, 9% for web browsing and 2% for software updates.

2021 Network Traffic:

Comcast increased speeds for its most popular Xfinity speed tiers in 2021, including increasing gig speeds to 1.2 gigabits-per-second In 2021 alone, Comcast invested more than $4.2 billion to strengthen, expand and evolve the network – more than any previous year.

In addition to smart software and virtualization technologies that increase performance and reliability, Comcast took major steps in 2021 toward the next phase of network evolution. 10G technology will allow Comcast to deliver multi-gigabit upload and download speeds over the connections already in tens of millions of American homes. In 2021, Comcast completed successful tests of key technologies required to deliver 10G, including a world-first demonstration of a complete 10G connection from network to modem.

“Network investment is important, but the network architects and software engineers across Comcast are also innovating at the speed of software,” said Elad Nafshi, EVP & Chief Network Officer at Comcast Cable. “Our colleagues leading these innovations are creating the future for our customers.”

“We certainly haven’t had time to sit still during the past two years, but thanks to billions of investment, continuous innovation, and most importantly the incredible team we have working on the network at every level, we have stayed well ahead of demand, which is really borne out by our performance delivering above-advertised speeds to customers throughout the pandemic,” Nafshi said via email in response to questions from Light Reading.

Xfinity Gigabit Pro is a targeted, residential fiber-to-the-premises (FTTP) service that was recently upgraded to deliver symmetrical speeds of 3 Gbit/s. The cable operator also offers up to 1.2Gbit/s downstream and 35Mbit/s upstream on its DOCSIS 3.1 network.

“We’re always building our network in anticipation of whatever our customers may need in the future, so while traffic today remains heavily asymmetrical – with downstream accounting for 14.5x as much volume as upstream in the last six months of 2021 – we continue to be really excited about the multi-gig symmetrical capacity we are developing for our HFC plant, because it offers a unique path to provide those experiences to customers at scale,” Nafshi explained.

Comcast and other cable operators are now starting to focus on DOCSIS 4.0, a new platform for hybrid fiber/coax (HFC) networks that can deliver up to 10Gbit/s downstream and 6Gbit/s upstream. Recent Comcast tests have generated symmetrical speeds of 4 Gbit/s. Comcast has not announced when it expects DOCSIS 4.0-based services to be ready for prime time.

References:

https://corporate.comcast.com/press/releases/comcast-2021-network-report

https://corporate.comcast.com/press/releases/world-first-test-10g-modem-technology-multigigabit-speeds-to-homes

https://www.lightreading.com/cable-tech/comcast-says-network-traffic-still-rising-but-shifting-to-pre-pandemic-patterns/d/d-id/775741?

https://techblog.comsoc.org/2021/10/28/comcast-broadband-subscriber-growth-slows-business-services-and-xfinity-mobile-gain/

https://techblog.comsoc.org/2021/10/06/comcast-business-announces-28-million-investment-to-expand-fiber-broadband-network/

https://techblog.comsoc.org/2021/07/29/comcast-cable-business-firing-on-all-cylinders-wireless-doing-well-video-revenue-up/

Comcast broadband subscriber growth slows; Business services and Xfinity Mobile gain

The pace of broadband subscriber growth at Comcast slowed to 300,000 in Q3 2021. The +300,000 net adds were in line with analyst expectations of +296,000. But those gains were down from 633,000 adds in the year-ago quarter fueled by the COVID-19 pandemic, and off from the 379,000 adds in the pre-pandemic period of Q3 2019. Comcast ended the quarter with 31.68 million broadband subs, which accounted for 52.2% penetration of homes and businesses passed. Broadband revenues climbed 11.6%, to $5.8 billion.

On today’s earnings call, CEO Brian Roberts made no apologies. He said:

“Our Cable division continues to be a standout delivering over 7% revenue growth and the fifth consecutive quarter of double-digit EBITDA growth of 10%, fueled by our broadband business, which generated 300,000 net additions and contributed to a very healthy 255,000 net new customer relationships. Business services has emerged from the pandemic and was also a key driver of our results and we believe this momentum will continue.”

“Our success comes from our network advantage, innovative products and world-class operational capabilities, which enable us to provide an unparalleled experience. Just like in residential, we are proactively responding to the needs of our commercial customers and offering personalized solutions.”

Dave Watson, CEO of Comcast’s cable unit, attributed the broadband slowdown to a decrease in overall new connects across the company’s footprint, creating fewer opportunities for “jump balls” against broadband competitors. “However, broadband subscriber churn remains at historic lows certainly for quarter three,” he said. Watson added full year 2021 net additions are expected to come in around 2019 levels. Comcast had 1.4 million broadband net additions in 2019 and thus far in 2021 has added 1.115 million, meaning it would need to add 285,000 broadband subscribers in Q4 to hit its target.

“We haven’t changed our view on the long-term trajectory of the connectivity business,” Watson said on today’s earnings call, noting that Comcast has added 1.1 million broadband subs through the first three quarters of 2021. “I’m just as confident and optimistic in the prospects in this business as I’ve ever been … The runway [for broadband subscriber growth] is still absolutely there.”

Capital expenditures for the Cable division fell 5.4% in the quarter to $1.7 billion, as an uptick in spending on line extensions and scalable infrastructure failed to fully offset decreased investment in customer premise equipment.

3rd Quarter 2021 Highlights:

- Consolidated Adjusted EBITDA Increased 18.1% to $9.0 Billion; Adjusted EPS Increased 33.8% to $0.87; Generated Free Cash Flow of $3.2 Billion

- Returned $2.7 Billion to Shareholders Through a Combination of $1.5 Billion in Share Repurchases and $1.2 Billion in Dividend Payments

- Cable Communications Total Customer Relationship Net Additions Were 255,000; Total Broadband Customer Net Additions Were 300,000

- Cable Communications Adjusted EBITDA Increased 10.3% and Adjusted EBITDA per Customer Relationship Increased 5.3%

- Cable Communications Wireless Customer Line Net Additions Were 285,000, the Best Quarterly Result Since Launch in 2017

- NBCUniversal Adjusted EBITDA Increased 48.2% to $1.3 Billion, Including Peacock Losses

- Theme Parks Delivered Its Most Profitable Quarter Since the First Quarter of 2020, Driven by Universal Orlando; Celebrated the Grand Opening of Universal Beijing Resort on September 20th

- Sky Adjusted EBITDA Increased 88.8% to $971 Million; On a Constant Currency Basis, Adjusted EBITDA Increased 76.2%

Business services did very well, as revenues there rose 8.7%, to $2.2 billion. Comcast Business added about 18,000 new customers in Q3, and has added 72,000 business customers over the past year. “Business services have emerged from the pandemic,” Roberts said.

Roberts said the midsized and enterprise segments remain “underpenetrated” categories for Comcast Business. But they also represent areas the company will pursue more aggressively following the recent acquisition of SD-WAN and cloud platform specialist Masergy. Roberts added:

“While small business has led our growth for the last decade. We are still significantly underpenetrated in the mid-market and enterprise segments. We see a lot of potential to take share in our large addressable market, which just got even bigger post our recent acquisition of Masergy, which builds on our strong offering of technology solutions. Masergy has become a leading provider to companies worldwide and unlocks a customer segment that we don’t have today, particularly US-based organizations with multi-site global operations.”

Mobility is now rapidly becoming a major part of the Comcast story, while the company continues to lose pay video subscribers. Xfinity Mobile (MVNO from Verizon Wireless) reached a quarterly record of 285,000 net new subscribers in the third quarter.

- Roberts noted that Xfinity Mobile has achieved a penetration of about 6% of the company’s broadband base of nearly 32 million.

- Watson said Comcast will continue to tie mobile to its core broadband product, but expects Xfinity Mobile to pick up the pace. “We haven’t changed the strategic imperative behind mobile. But most certainly things have accelerated. Our goal … is to go faster, and to leverage mobile completely in everything that we do.”

Analyst Craig Moffett wrote in a note to clients (we highly recommend his service):

Q3 saw Comcast report a positive EBITDA contribution from Mobility for the third straight

quarter, with a swing of more than $100M from the $50M loss a year ago (Exhibit 3).

That Comcast has been able to achieve profitability even before meaningful traffic offload onto CBRS (likely still at least a year away) is significant in a number of ways. Yes, some additional EBITDA is always nice, particularly when compared to the losses of a year and two years ago. But more importantly, Comcast’s profitability demonstrates that they have the headroom to use wireless to defend broadband from incursions from TelCo fiber overbuilds, as we argued in Convergence Apocalypse? – October 14, 2021… and still contribute to overall profitability.

References:

https://www.cmcsa.com/news-releases/news-release-details/comcast-reports-3rd-quarter-2021-results

https://www.fiercetelecom.com/financial/comcast-reels-300k-broadband-subs-as-growth-slows

Comcast Business Announces $28 Million Investment to Expand Fiber Broadband Network in Eastern U.S.

Comcast Business today announced a two-year $28 million project to expand its network across four Mid-Atlantic states is well underway, touting it as part of an effort to bring 1 to 100Gbps service to thousands of additional enterprises in the region.

Once completed, Comcast Business will have committed a total of more than $110 million in area network expansions since 2015, to benefit nearly 35,000 of the region’s largest companies and organizations.

The operator said that work is focused on deploying new and densifying existing fiber across parts of Delaware, Maryland, Virginia and West Virginia, as well as the District of Columbia. Approximately $13 million was already invested in the extensions in 2020, with an additional $15 million set to be spent this year to deliver service to a total of nearly 7,000 new businesses.

The network expansion delivers speeds up to 1 Gigabit per second (Gbps) for small and medium-sized businesses and up to 100 Gbps for larger enterprises and will support the ability to bring new customers online quickly with advanced services, including fast business Wi-Fi for employees and guests, cybersecurity solutions, 4G LTE backup, business TV and more. Additionally, businesses of all sizes now will have access to a comprehensive portfolio of Comcast Business products and services to help meet the day-to-day demands that require large amounts of bandwidth, linking multiple sites or branch locations or connecting offices to third-party data centers.

The latest expansion deploys new fiber optic cable or densifies existing fiber services across the following areas:

- Delaware: Georgetown, Ocean View, Rehoboth Beach and Smyrna

- Maryland: Eastern Shore, Frederick and Montgomery County

- Virginia: Ashburn, Dulles, Harrisonburg, Leesburg, Lynchburg and Richmond; planned investments include Front Royal, Tysons Corner and Warrenton

- Washington, D.C.

- West Virginia: Huntington and Martinsburg

“Comcast’s infrastructure investment in Virginia supports our business community and helps us attract new businesses to the Commonwealth,” said Brian Ball, Virginia Secretary of Commerce and Trade.

Ed Rowan, senior director of Comcast Business Sales Operations in the Beltway Region, said in a press release:

“The ability to offer both diversity of network and carrier is becoming increasingly important to help drive economic development and transformation. Connectivity is at the core of this and, more than ever, is an integral factor as businesses expand and prepare for what’s next. Our network expansions across Comcast’s Beltway Region are the latest example of the significant technology investments we’ve made to increase the availability of our multi-Gigabit Ethernet services. These investments will help foster economic development, transform our local communities, and better meet next-generation capacity needs across the region.”

Comcast’s vast and growing fiber footprint spans 29 regional networks in 39 states and includes:

- An enhanced fiber optic network, with more than 150,000 miles of fiber, that provides high- speed, high quality, and high-definition services to a number of large companies

- A support structure made up of thousands of professionals with the knowledge and experience to handle any situation

- MEF-certified carrier class Ethernet that delivers standardized, scalable, and reliable Metro Ethernet solutions – at a service and hardware level

Comcast’s nationwide fiber optic network:

References:

Comcast: cable business firing on all cylinders, wireless doing well, video revenue up

Comcast added another 354,000 total broadband subscribers (334,000 residential and 20,000 business) in the second quarter of 2021, beating the 323,000 it added in the year-ago period. The U.S.’s largest broadband wireline provider ended the quarter with 31.38 million residential and business broadband customers, by far the most in the U.S.

Comcast’s broadband subscriber growth rate is very impressive, at 6.7% YoY, which was unchanged versus last quarter. Comcast Business was also a bright spot, with a strong acceleration in growth. Business services revenues were up 9.9% YoY, a huge acceleration from the 6.1% YoY rise last quarter and a beat versus consensus growth of 8.8%.

The strong results are way better than Comcast’s two largest competitors – AT&T and Verizon – which both reported poor Business Wireline results.

New Street Research analysts noted Comcast’s broadband net additions were “well above estimates,” noting it had previously forecast gains of 253,000 and the market consensus estimate was 270,000. Cavanaugh said the operator is now expecting total broadband net additions for 2021 to be up in the “mid-teens” compared to the 1.4 million net adds it posted in 2019.

Other highlights:

- Cable Segment revenue growth of 10.9% was fully 200 bps ahead of Wall Street consensus for 8.9% YoY growth – but indeed for every sub-segment.

- Broadband revenues were up 14.3% YoY on a reported basis (versus 13.6% consensus); adjusted for RSN credits in Q2 2020, broadband revenues were up 12.6% YoY.

- Business Services revenues were up 9.9% YoY (versus 8.8% consensus).

- Wireless revenues were up 70.6% YoY (versus 63.4%).

- Comcast’s Xfinity Mobile service added 280,000 mobile lines, a quarterly record for the company, up from adds of 126,000 in the year-ago period. Comcast, which launched mobile (via its MVNO with Verizon) in 2017, ended Q2 2021 with 3.38 million mobile lines. Mobile revenues rose 70.4%, to $556 million.

Dave Watson, CEO of Comcast Cable, said mobile is now tied into every sales channel. And the launch of a new unlimited plans focused on multi-line customers has also led to a “nice shift in mix,” he said.

Cable Communications CAPEX of $1.7 billion was up 16.8% year-on-year in Q2, accounting for 10.6% of the division’s revenue compared to 10.1% of revenue in the year-ago period.

In addition to investments in scalable infrastructure to increase network capacity, Comcast CFO Michael Cavanaugh said on an earnings call the money was spent on broadband CPE and line extensions.

“We have decided to move a bit faster to the next phase of DOCSIS using very cost-effective technology,” he said.

CEO Brian Roberts noted the company has been trialing gigabit and multi-gigabit symmetrical speeds since October 2020 “to great success.” While upstream traffic comprises only 10% of broadband usage on its network and “we don’t really have a consumer use case” for symmetrical speeds yet, “the strategy for our network is to plan ahead,” he said.

“We’re investing in architecture that allows us to go beyond where consumers are, and we can do all of this in a way that won’t affect the capital intensity ratios we currently enjoy,” he added.

Video sub losses continue but less than expected:

Comcast lost another 399,000 total video subs (364,000 residential and 34,000 business) in the period, improved from a year-ago loss of 477,000 customers. Comcast ended Q2 2021 with 18.95 million total video subs.

Nevertheless, video revenues were up 2.6% YoY (versus 0.8% consensus). Adjusted for Regional Sports Networks (RSN) credits in Q2 2020, video revenues were up 0.5% YoY.

Comcast remains excited about Flex, a video streaming/smart home product it offers for no added cost to broadband-only subscribers. Watson said Comcast has deployed more than 3.8 million Flex boxes, up from the 3.5 million the company reported in May.

Summary:

Consolidated revenue of $28.5 billion grew 20.4% year-on-year, with net income attributable to Comcast up 25.1% to $3.7 billion. Sales for the Cable Communications business increased 10.9% year-on-year to $16 billion.

Broadband revenue was up 14.3% to $5.7 billion, video revenue increased 2.6% to nearly $5.6 billion, business services revenue increased 9.9% to $2.2 billion and wireless revenue jumped 70.4% to $556 million.

……………………………………………………………………………….

References:

https://www.cmcsa.com/news-releases/news-release-details/comcast-reports-2nd-quarter-2021-results

https://www.cmcsa.com/static-files/c53499bd-4ff5-4e44-b793-74f8743a96dc

https://www.cmcsa.com/financials/earnings

https://www.fiercetelecom.com/financial/comcast-notches-record-q2-broadband-adds-354-000

Comcast Earnings Report: Record Broadband Growth; 3 Core Strategy Tenets; Wireless Expansion

Comcast added a record 633,000 residential and business broadband Internet customers in the Q3-2020, but lost another 273,000 video customers. Cable Communications total customer relationship net additions of 556,000, were the best quarterly result ever for the company.

Xfinity Mobile, Comcast’s mobile service via Verizon MVNO agreement, added 187,000 wireless subscriber in Q3-2020. That was down from additions of 204,000 lines in the year-ago quarter. There were 2.58 million mobile subs at the end of the quarter.

“We are nearly eight months into this pandemic – and despite many harsh realities, I couldn’t be more pleased and proud of how our team has worked together across the company to find safe and creative solutions to successfully operate in this environment. We are executing at the highest level; and perhaps, most importantly, accelerating innovation, which will drive long-term future growth. This third quarter, we delivered the best broadband results in our company’s history. Driven by our industry-leading platform and strategic focus on broadband, aggregation and streaming, we added a record 633,000 high-speed internet customers and 556,000 total net new customer relationships. At the same time, we’re growing our entertainment platforms with the addition of Flex, which has a significant positive impact on broadband churn and customer lifetime value. Our integrated strategy is also driving results in streaming with nearly 22 million sign-ups for Peacock to date, and we are exceeding our expectations on all engagement metrics in only a few months. And Sky continues to add customer relationships at higher prices while reducing churn to all-time lows in our core UK business. Going forward, and as we emerge from the pandemic, we believe we are extremely well positioned to provide seamless and integrated experiences for our customers and to deliver superior long-term growth and returns for our shareholders,” said Brian L. Roberts, Chairman and Chief Executive Officer of Comcast Corporation.

Cable Communications revenue increased 2.9% to $15.0 billion in the third quarter of 2020, driven by increases in high-speed internet, business services, wireless and advertising revenue, partially offset by decreases in video, voice and other revenue. These results were negatively impacted by accrued customer regional sports network (RSN) fee adjustments related to canceled sporting events as a result of COVID-19. Excluding these adjustments5, Cable Communications revenue increased 3.9%. High-speed internet revenue increased 10.1%, due to an increase in the number of residential high-speed internet customers and an increase in average rates.

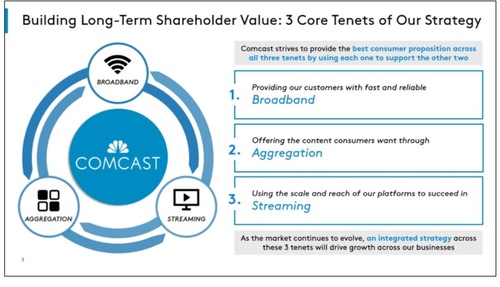

Comcast defined three “core tenets” that will drive its strategy focused on broadband Internet, content aggregation and scaling up its tech platforms for video streaming.

Source: Comcast

Xfinity Flex, Comcast’s free streaming video/smart home product for broadband-only customers, has helped the company retain its broadband base. Flex, which has about 1 million active users, has cut churn rates by 15% to 20% among new broadband customers that engage with the platform. Flex has also helped to offset Comcast’s pay-TV subscriber losses for the past two quarters.

“The goal of our common tech stack is to build once and deploy as many times in as many markets and in as many ways as possible on our network or through wholesale distribution,” Brian Roberts, Comcast’s chairman and CEO, said on the company’s earnings call. He noted that the approach generates “good margins” for the company.

Indeed, cable profit margins of 42.7% were up 290 bps YoY, continuing a steady uptrend and beating analyst consensus of 41.7% by 100 bps. Absent wireless, margins would have been 44.3%, the highest ever and fully 300 bps above the levels a year ago.

Meanwhile, Capital Expenditures (CAPEX) decreased 4.9% to $2.4 billion in the third quarter of 2020. Cable Communications’ capital expenditures decreased 2.5% to $1.8 billion. NBCUniversal’s capital expenditures decreased 29.3% to $357 million. Sky’s capital expenditures increased 127.3% to $237 million. For the nine months ended September 30, 2020, capital expenditures decreased 7.6% to $6.3 billion compared to 2019.

“We’re committed to accelerating the wireless business,” Dave Watson, CEO of Comcast Cable, said on today’s earnings call. Comcast may build out its own cellular infrastructure, at least on a targeted basis, which would effectively complement its MVNO arrangement with Verizon. Notably, Comcast was one of several cable operators that bid for and won CBRS spectrum, which it could use to offload mobile traffic in high-traffic areas. “We have the ability to evolve this [mobile] offering over time to where we choose to include our own wireless network with cellular infrastructure to generate even greater profitability in the most highly trafficked mobile areas,” Roberts said.

……………………………………………………………………………………………………………………………………………………………………………

Analyst Assessment:

Craig Moffett, principal of MoffettNathanson asks: Where are all the broadband subscribers coming from?

Verizon, AT&T, and now Comcast have all beaten expectations, and blown away historical growth rates. But it could also be asked of wireless, where, again, Verizon, AT&T, and now Comcast have all grown (Comcast a bit more slowly than expected, but it was solid growth nonetheless). It could even be asked of video, where, yes, Verizon, AT&T, and now Comcast have all lost fewer subscribers than expected. We, and the market, will be grappling with these questions for the next three months or longer. Let’s start by acknowledging the obvious: Comcast’s subscriber metrics in Q3 were absolutely stellar, whatever the explanation.

……………………………………………………………………………………………………………………………………………………………………………

References:

https://www.cmcsa.com/news-releases/news-release-details/comcast-reports-3rd-quarter-2020-results

https://www.cmcsa.com/events/event-details/q3-2020-comcast-corporation-earnings-conference-call

Comcast earnings beat with strong broadband subscriber growth; AT&T is still largest U.S. pay TV provider but bleeds video subs

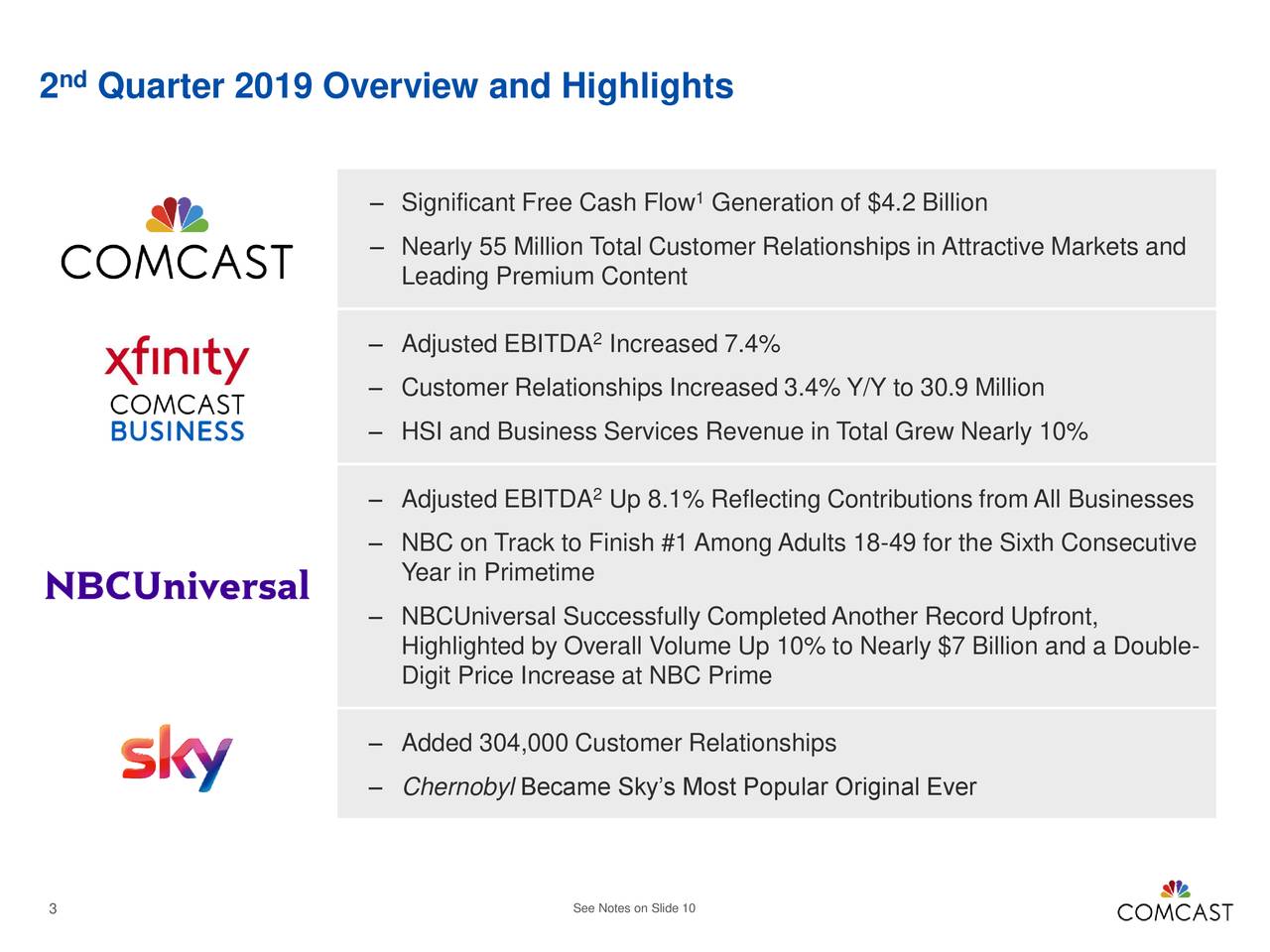

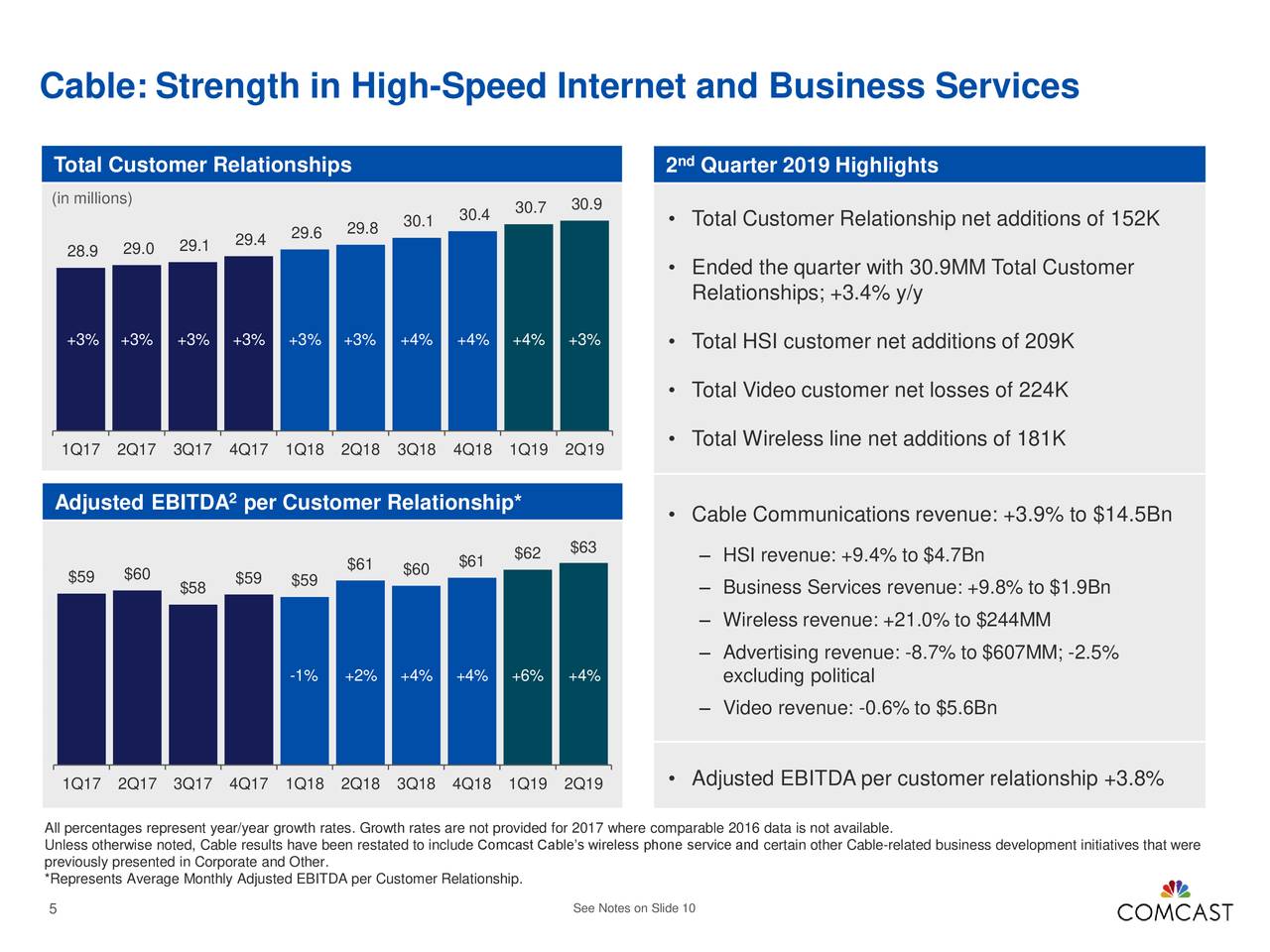

Despite much higher video subscriber losses than in the past, Comcast generated healthy revenue and profit margin increases in Q2-2019, based on the strength of its performance in the broadband, wireless, business services and other sectors. Comcast, the largest cable and broadband provider in the U.S., reported steady revenue and subscriber gains nearly across the board on July 25th, with the glaring exception of its slumping Xfinity pay-TV business. It also racked up revenue gains in its NBC Universal cable networks, broadcast TV and theme park units, as well as customer revenue gains at its new Sky operation in Europe.

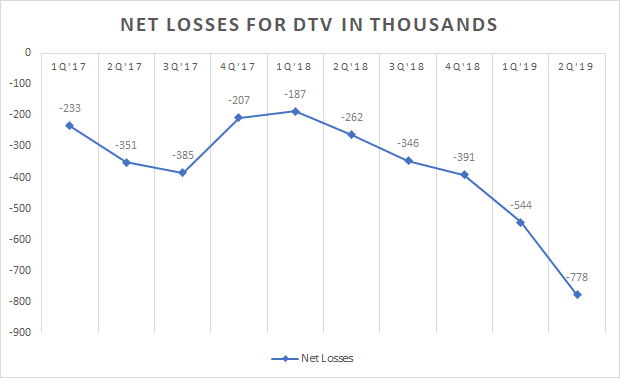

On the pay-TV side, Comcast suffered less collateral damage than most of its peers (e.g. AT&T Direct TV and Direct TV now bled subscribers in the most recent quarter – see Editor’s Note below). The cableco/MSO saw its video subscriber losses increase in the second quarter as cord-cutting by consumers accelerated. The company shed 224,000 video subs (209,000 residential and 15,000 business subs) during the quarter, far worse than its loss of 140,000 subs a year earlier. That reduced its total video base to 21.64 million, maintaining its status as the nation’s second-largest pay-TV provider behind AT&T. Despite these much heftier sub losses, Comcast’s video revenues declined just 0.6% on a year-over-year basis to $5.59 million, thanks to price hikes and subscriber tier upgrades. More importantly from the company’s perspective, video ARPU increased by 1.3%, as the operator, like a growing number of its peers, continues to shift its focus from low-margin to high-margin customers.

…………………………………………………………………………………………………………………………………………………………………………………………………………..

Editor’s Note: The second quarter is typically the worst of the year for pay-TV providers. For example, AT&T lost 778,000 premium TV subscribers in the second quarter, including DirecTV satellite and U-verse television customers – a sharp acceleration in subscriber losses from the 544,000 that cut the cord in Q1-2019. The total number of premium TV video connections fell to 22.9 million, its lowest total since June 30, 2017, when it stood at almost 25.2 million, an overall net loss of 2.3 million.

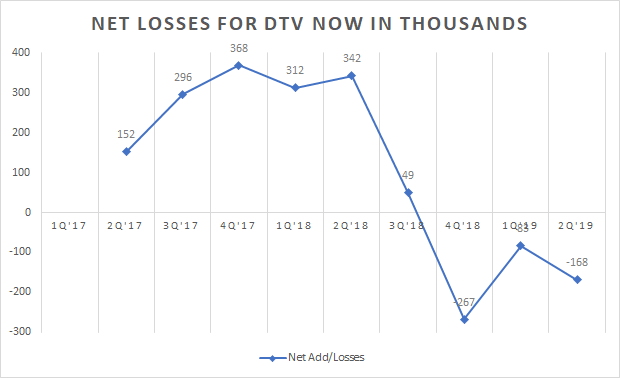

AT&T also lost 168,000 streaming DirecTV Now accounts and AT&T said it expects a similar level of video losses to continue in the current quarter. It’s somewhat surprising that AT&Ts video streaming offering is seeing a mass exodus with the number of subscribers peaking at 1.858 million in September 2018 to 1.34 million now, a decline of more than 500,000.

…………………………………………………………………………………………………………………………………………………………………………………………….

Comcast is by far the largest broadband provider in the U.S. (that’s right- ahead of AT&T, Verizon and CenturyLink). The cableco/MSO added 209,000 new broadband Internet subscribers (182,000 residential and 28,000 business) in the spring quarter, boosting its total broadband base to 27.8 million at the end of June. While that’s down markedly from its gain of 260,000 broadband subs a year earlier, the year-ago total marked the company’s best-ever broadband quarter. Comcast executives stressed that they’re well on their way to their 14th consecutive year of 1 million-plus broadband subscriber increases.

Broadband revenues surged 9.4% to $4.66 billion in the 2nd quarter, due to the impressive increase in broadband subscribers. Residential broadband ARPU (average revue per unit) rose by 4.2% year-over-year, as fewer bundling discounts and subscriber upgrades to higher-priced speed tiers lifted revenues even without price hikes.

“The ARPU is growing, broadband revenue is growing, and it’s margin accretive, so it’s helping the EBITDA growth,” said Comcast Cable President and CEO Dave Watson, in the cableco/MSO’s Q2 earnings call. “So overall, I think we have a solid pipeline for broadband innovation.”

…………………………………………………………………………………………………………………………………………………………………………….

On the wireless front, Comcast’s Xfinity Mobile service continued its steady, if slightly slower, ascent to profitability. The MSO added 181,000 mobile lines in Q2, raising its total to nearly 1.6 million lines. The strong mobile line gains were off from adds of 204,000 lines in the year-ago period but up from adds of 170,000 lines in Q1.

As a result, Comcast’s mobile revenues rose 21.0%, to $244 million. Operating cash flow from Comcast’s mobile business improved as well to $88 million, down substantially from a year earlier, as the new unit edges ever closer to profitability.

Speaking on the company’s earnings call Thursday morning July 25th, Comcast Senior EVP and CFO Mike Cavanagh said Xfinity Mobile is “already positively impacting [customer] retention and attracting new customers” to the company’s cable offerings. He predicted that the mobile unit will start producing positive economic results when penetration rates reach “the mid-to-high single digits.”

…………………………………………………………………………………………………………………………………………………………………………..

Similar to other large North American pay-TV providers that have reported Q2 earnings so far. “We’ll continue to emphasize our approach to this segment,” said Comcast Cable President and CEO Dave Watson. “We’re not going to chase the low end.”

Comcast officials still had no early results to share about Xfinity Flex, a new video streaming product for broadband-only customers that’s powered by the MSO’s cloud-based X1 platform (including the X1 voice-based navigation and search system) and integrated with OTT offerings like Netflix, Amazon Prime Video and YouTube. But executives said more information will come soon.

“It’s an important long-term product,” Watson said Flex on the company’s Q1 earnings call in April, noting it’s early use in a “targeted fashion” to build a broader video relationship with the operator’s broadband-only subs. “We think Internet-delivered video is a good thing for the cable business.”

Also on the streaming video front, Comcast executives revealed a bit more about the forthcoming OTT-delivered video service from the conglomerate’s NBCUniveral (NBCU) unit. Plans call for the OTTP offering, to be based on the existing Now TV platform of Comcast’s Sky service in Europe, to launch in April.

The new ad-supported service mainly will feature acquired movies and TV shows, rather than exclusive originals, at least at first, said NBCU CEO Steve Burke. Despite a market crowded with incumbents like Netflix and Amazon, as well as such new entrants as Disney, WarnerMedia and Apple, Burke is not worried, he said, in a statement.

“Our service is very different from Netflix,” said Burke. “We believe we’ve got some ideas that are innovative and don’t really want to share those until we get right close to launch, but we’re very pleased to have The Office and very optimistic about our streaming plans at this point.”

…………………………………………………………………………………………………………………………………………………………………………..

In a fresh research note issued after the earnings call this morning, Craig Moffett, a principal analyst at MoffettNathanson, gave an approving nod to this strategy:

“As cable operators stop chasing low-value video subscribers, their margins will rise with mix shift, their margins will improve further with improvement in video economics on those that remain; their margins will expand still further as broadband ARPU accelerates (fewer bundled discounts), and their margins will expand still further as their non-programming costs fall as a percentage of revenue. Almost predictably, Comcast raised its cable margin 2019 guidance yet again (now to ‘over’ 100 bps for the year, from previously ‘up to’).”

Comcast Business kept up its steady growth pace of the past decade and a half. With close to 2.4 million commercial “customer relationships,” the cableco boosted its business service take to $1.93 billion in the second quarter, up 9.8% from a year ago. As a result, the company is now on target to approach the $8 billion mark in annual business revenues this year.

References:

http://www.broadbandworldnews.com/author.asp?section_id=472&doc_id=753022&

https://www.cnbc.com/2019/07/25/comcast-q2-2019-earnings.html

https://www.cmcsa.com/financials/earnings

https://seekingalpha.com/article/4277488-t-mass-exodus-continues