Fiber deployments

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier Communications previewed its Q4 2022 results today, revealing it gained 75,000 new fiber customers and had 8,000 total broadband net additions.

- Strong customer growth in Q4 led Frontier to finish 2022 with 17% more fiber broadband customers than it had at the end of 2021.

- For the fifth consecutive quarter, fiber broadband customer additions outpaced copper broadband customer losses, resulting in 8,000 total broadband customer net additions in the fourth quarter of 2022.

During a Citi investor conference presentation following the announcement, CFO Scott Beasley said growth spanned both new and existing markets and resulted in part from gains made against cable competitors. “We continue to outpace our cable competitors, gaining share in nearly every geography we operate in. Our new position as the ‘un-cable’ provider is taking hold. We are bringing customers a superior product and it is paying off in record broadband customer growth.”

According to Beasley, the vast majority of its net additions are customers who are new to Frontier rather than those converting from a legacy DSL service. That means most either moved into or within the operator’s territory during the quarter or switched from cable. “We had success against every competitor in every geography,” the CFO stated. Asked whether cable’s recent efforts to woo consumers with fixed-mobile bundles presented a challenge, Beasley said Frontier hasn’t yet “seen much of an impact from their converged offerings.”

Frontier doesn’t appear to be concerned about advances from fixed wireless access (FWA) rivals either. New Street Research noted Frontier’s net add announcement implied it lost 67,000 copper subscribers, which was significantly higher than the 56,000 the analyst firm had expected. However, Beasley said fixed wireless has had “very little impact” on its fiber gross additions.

Regarding its DSL based services, Beasley said “we haven’t seen any significant impact from fixed wireless (FWA)” in terms of churn but acknowledged FWA is “nibbling around the edges” where new movers only have the choice between Frontier’s DSL or a fixed wireless product.

Beasley added despite macroeconomic challenges and a recessionary environment, Frontier hasn’t seen any slowdown in bill payments or tier step-downs from customers. In fact, as it works to achieve a goal of 3% to 4% year-on-year average revenue per user (ARPU) growth by the end of 2023, he said it will actually look to encourage customer plan step-ups. Beasley noted uptake of its gigabit plans currently stands around 15% among Frontier’s base and around 45% for new customers, leaving plenty of room for movement. The company will also implement “normal base price increases to reflect higher input costs” and use gift card promotions to retain and gain other subscribers, he said.

Media Contact:

Chrissy Murray

VP, Corporate Communications

+1 504-952-4225

[email protected]

References:

https://investor.frontier.com/news/news-details/2023/Frontier-Adds-Record-Fiber-Broadband-Customers-in-Q4-2022/default.aspx

https://investor.frontier.com/events-and-presentations/events/event-details/2023/Citi-Communications-Media–Entertainment-Conference/default.aspx

https://www.fiercetelecom.com/broadband/frontier-bags-75k-fiber-subs-q4-2022-eyes-arpu-gains-23

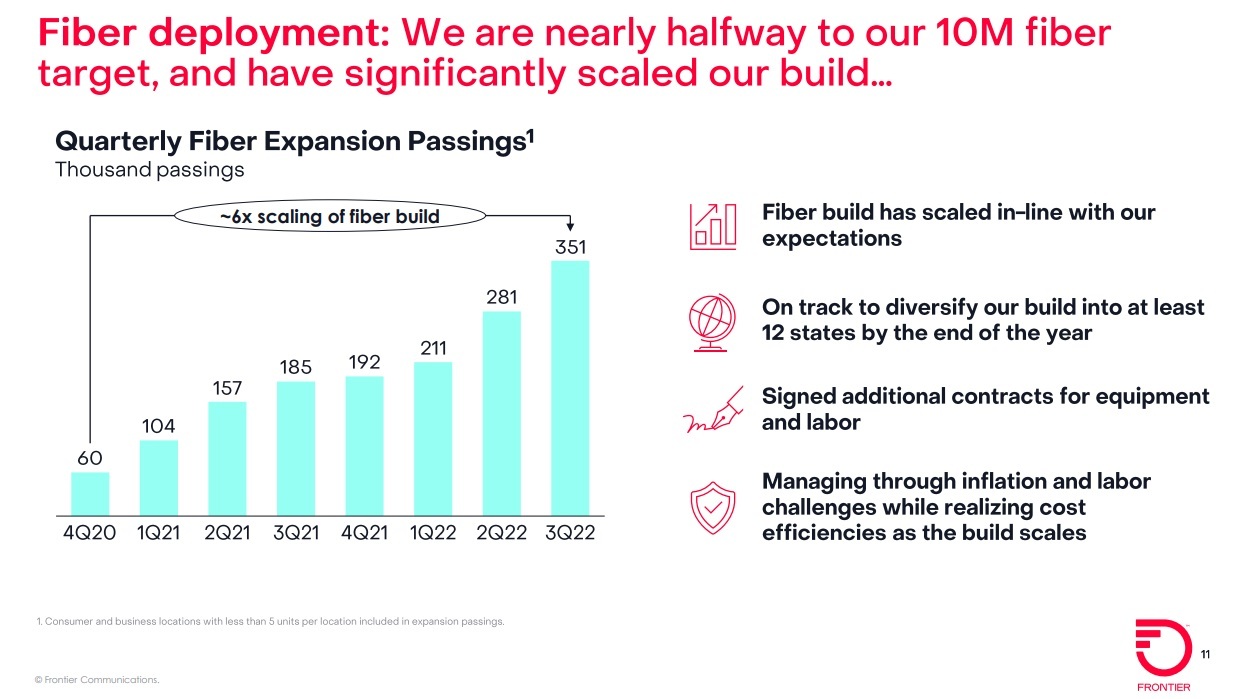

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications Accelerates Fiber Build Out -10 Million locations passed by 2025

Frontier Communications and Ziply Fiber to raise funds for fiber optic network buildouts

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T and a unit of investment titan BlackRock will form a joint venture to operate a commercial fiber-optic platform, with AT&T as its first wholesale tenant. The objective is to further propel AT&T’s fiber ambitions outside of the carrier’s traditional 21-state wireline footprint and move on AT&T’s long-simmering fiber expansion plans. The newly formed joint venture (JV) — Gigapower, LLC — expects to provide a best-in-class fiber network to internet service providers (ISPs) and other businesses across the United States.

The Gigapower joint venture will operate the commercial fiber service. That service – not to be confused with AT&T’s previous “GigaPower” broadband offering – will be targeted at internet service providers (ISPs) and enterprises.

BlackRock’s work in the venture will be through its Alternatives division and through a fund managed by its Diversified Infrastructure business. That business recently raised $4.5 billion in initial investor commitments. AT&T executive veteran Bill Hogg was named CEO of Gigapower.

The JV’s initial plans are to deploy a multi-gigabit fiber network to 1.5 million customer locations using a commercial open access platform. This will be incremental to AT&T’s own fiber deployment plans targeted at reaching more than 30 million locations within its 21-state wireline footprint by the end of 2025. The JV will tap into AT&T’s nationwide 5G wireless service to support sales outside of its traditional wireline footprint. This will allow it to take advantage of AT&T’s already established enterprise arrangements and more quickly get a sales channel up and running.

“Now more than ever, people are recognizing that connecting changes everything,” said John Stankey, CEO of AT&T. “With this joint venture, more customers and communities outside of our traditional service areas will receive the social and economic benefits of the world’s most durable and capable technology to access all the internet has to offer.”

“We are excited to form the Gigapower joint venture in partnership with AT&T, which will be serving as not only a joint owner but also the first wholesale tenant. We believe Gigapower’s fiber infrastructure designed as a commercial open access platform will more efficiently connect communities across the United States with critical broadband services,” said Mark Florian, Global Head of Diversified Infrastructure, BlackRock. “We look forward to partnering with Gigapower’s highly experienced management team to support the company’s fiber deployment plans and shared infrastructure business model.”

Gigapower plans to deploy a reliable, multi-gig fiber network to an initial 1.5 million customer locations across the nation using a commercial open access platform. The Gigapower fiber deployment will be incremental to AT&T’s existing target of 30 million-plus fiber locations, including business locations, by the end of 2025. Combined with existing efforts within AT&T’s 21-state footprint, this capital efficient network deployment will advance efforts to bridge the digital divide, ultimately helping to provide the fast and highly secure internet people need. This network expansion will also help spur local economies in each of the communities in which Gigapower operates.

“Fiber is the lifeblood of digital commerce,” said Bill Hogg, CEO of Gigapower. “We have a proven team of professionals building this scalable, commercial open access wireline fiber network. Our goal is to help local service providers provide fiber connectivity, create the communications infrastructure needed to power the next generation of services and bring multi-gig capabilities to help close the gap for those who currently are without multi-gig service.”

Tammy Parker, Principal Analyst at GlobalData, a leading data and analytics company, wrote:

“AT&T is pursuing a shrewd path to extend its fiber footprint nationwide without assuming all the risk by itself. Although the new Gigapower platform will be operated as a joint venture with BlackRock, offering commercial open access to not only AT&T but also other internet service providers and businesses, the carrier’s influence features prominently: the moniker ‘GigaPower’ was formerly applied to AT&T’s fiber-based service, which was renamed ‘AT&T Fiber’ in October 2016.

“The Gigapower platform will serve customers outside of AT&T’s traditional 21-state wireline footprint, and as the platform’s first wholesale tenant AT&T will be able to sell fiber service in more wireline markets, complement its nationwide mobile service footprint, and enable the carrier to market fixed-mobile service bundles in those markets. Over time, AT&T should be able to leverage this dual-technology capability to not only attract new customers and revenue streams, but also increase customer retention as subscribers who take multiple services from a carrier tend to be ‘stickier’ and less likely to stray to a rival service provider.

“The AT&T and BlackRock JV poses a competitive challenge to cable providers and regional fiber providers, whose broadband reaches are geographically restricted, though those carriers could possibly become tenants on the open access Gigapower platform to extend their own footprints.

“Gigapower will also help AT&T extend its fiber offerings to compete against the highly successful fixed wireless access (FWA) services being marketed by rivals T-Mobile US and Verizon to residential and business broadband customers both inside and outside of AT&T’s existing wireline service area. However, unlike FWA services, which can ride on top of existing mobile network coverage and are often self-installable, fiber requires the deployment of new infrastructure and truck rolls to the premises to be served, impacting time to market for AT&T and BlackRock’s ambitious plan. Additionally, Gigapower’s initial footprint will cover only 1.5 million customer locations, and it is unclear what the deployment timeline will be.

“After largely extracting itself from its previous foray into entertainment, AT&T continues doubling down on its broadband focus, committing to both 5G and fiber nationwide. AT&T’s JV with BlackRock has the potential to alter the broadband landscape, not only by enabling AT&T to market fiber in more markets but also by providing a platform for public-private broadband partnerships between Gigapower and local municipalities. However, it will take time to see results from this long-term play.”

References:

https://www.sdxcentral.com/articles/analysis/att-bags-blackrock-for-gigapower-fiber-jv/2022/12/

RVA LLC: Fiber Deployment in U.S. Reaches Highest Level Ever; Google Fiber Returns

Fiber facility service providers passed 7.9 million additional homes in the U.S. in 2022—the highest annual deployment ever, even with challenges in materials supply chain and labor availability, according to a fiber deployment report from the Fiber Broadband Association.

The 2022 Fiber Provider Survey was based on research conducted by RVA LLC Market Research & Consulting (RVA). Their researchers found that there are now a total of 68 million fiber broadband passings in the U.S., with strong recent increases of 13% over the past 12 months and 27% over the past two years. The survey also found that 63 million unique homes have now been passed (this figure “excludes homes with two or more fiber passings”). To date, fiber has passed nearly half of primary homes and over 10% of second homes. The annual fiber deployment rate is likely to be even higher over the next five years as BEAD and other broadband funding programs kick in.

In its research, RVA notes that although deployment expectations from individual companies are in constant flux based on many factors, many service providers have announced network builds exceeding the fiber footprint they have built through private funding. Canada is seeing strong fiber deployment as well, with about 66% of homes passed.

“High-quality broadband has become more important to consumers every year. Fiber broadband exceeds all other types of delivery in every single measurement of broadband quality, including speeds, uptime, latency, jitter, and power consumption,” Gary Bolton, Fiber Broadband Association president and CEO, said in a prepared statement. “For the consumer this has real-world impacts, like more productivity, better access to health care and education, more entrepreneurism, and the option of more rural living. For society, this means more sustainability and, ultimately, digital equity.”

Mike Render, Founder and CEO of RVA, will present the findings of the 2022 Fiber Provider Survey on Fiber for Breakfast, Wednesday, December 28, 2022, at 10:00am ET. Click here to register for the episode.

About the Fiber Broadband Association (FBA):

The Fiber Broadband Association is the largest and only trade association that represents the complete fiber ecosystem of service providers, manufacturers, industry experts, and deployment specialists dedicated to the advancement of fiber broadband deployment and the pursuit of a world where communications are limitless, advancing quality of life and digital equity anywhere and everywhere. The Fiber Broadband Association helps providers, communities, and policy makers make informed decisions about how, where, and why to build better fiber broadband networks. Since 2001, these companies, organizations, and members have worked with communities and consumers in mind to build the critical infrastructure that provides the economic and societal benefits that only fiber can deliver. The Fiber Broadband Association is part of the Fibre Council Global Alliance, which is a platform of six global FTTH Councils in North America, LATAM, Europe, MEA, APAC, and South Africa. Learn more at fiberbroadband.org.

The Fiber Broadband Association is also helping with the expansion by helping to train installers through its Optical Telecom Installation Certification (OpTIC) Path program.

Press Contact:

Ashley Schulte

Connect2 Communications for the Fiber Broadband Association

[email protected]

…………………………………………………………………………………………………………………………………………………………….

Separately, Light Reading says that Webpass to play role in Google Fiber’s new expansion efforts. “As we continue to grow our footprint across the country, we’re integrating this [wireless] method for delivering high-speed service in more areas where it makes sense in all our existing cities and in our new expansion areas as well,” Tom Brownlow, senior network operations manager at Google Fiber, and Blake Drager, the head of technology at Google Fiber’s Webpass business, wrote in a post to the company’s website.

Google Fiber recently announced talks were underway with city leaders in five states – Arizona, Colorado, Nebraska, Nevada and Idaho – about expanding fiber services to various communities. Cities to make Google Fiber’s new-build list recently include Omaha, Nebraska, Mesa, Arizona and Lakewood, Colorado. Brownlow and Drager didn’t specify which of those expansion markets might include wireless offerings.

References:

MoffettNathanson: ROI will be disappointing for new fiber deployments; FWA best for rural markets

From two recent research reports to clients, MoffettNathanson chief analyst Craig Moffett wrote:

There is no question that there will be a great deal of new fiber deployed in the U.S. But we expect it will be considerably less than current worst-case scenarios for two reasons.

- There simply isn’t sufficient labor availability for all operators to meet the projections they’ve set forth (this issue will be significantly exacerbated by the upcoming rural Broadband Equity, Access, and Deployment (BEAD) program, which will introduce a dramatic new source of labor demand).

- The expected return from fiber overbuilds will be disappointing, in our view, both because deployment costs (including the cost of capital) have risen sharply, and because expected densities of available markets are falling sharply.

We are skeptical about the returns that will be generated by fiber builds, as costs are rising and densities are falling. The spiraling costs of fiber deployment also make it likely that there will be upward, not downward, pressure on broadband ARPU in competitive markets, as overbuilders scramble to cost-justify not only their existing projects, but, perhaps more importantly, the projects on which they have not yet broken ground (and which, without a more generous ARPU assumption, can no longer be return-justified). Craig had argued earlier this year that the fiber buildout bubble may pop.

Wireless operators have an enormous cost advantage in offering fixed wireless access (FWA) service on preexisting network facilities; the marginal cost of offering FWA is zero if it is simply using excess capacity. The capacity available for such a strategy is relatively limited, making the strategic leverage of FWA relatively limited as well. Cable operators have a smaller, but still significant, cost advantage in offering wireless services that can offload at least some of their traffic onto existing infrastructure. And unlike wireless operators offering FWA, their capacity to do so is unlimited.

Almost no telecom investor with whom we have spoken views FWA as an important part of the story for the companies that actually offer it. Investors seem to have already come to the view (for the wireless operators, at least) that FWA is at best a costly sideline in rural markets. Longer term, the bigger threat to cable broadband is likely fiber rather than fixed wireless, Moffett said. But even with that, the analyst seems to be less concerned that cable operators will overspend on fiber or that overbuilders will present more competition.

The convergence arguments for fiber to the home (FTTH) are arguably even weaker. As we’ve pointed out often, AT&T’s wireline footprint covers but 45% or so of the U.S. (by population), and of that, just a third is wired for fiber. In total, then, AT&T can deliver a bundled solution to just 15% or so of the population. In our view, a strategy (bundling) that “works” in 15% of the country isn’t a strategy.

We certainly aren’t convinced that the U.S. market will be fundamentally shaped by convergence. But if it is, the cable operators, not the telcos, are positioned to benefit.

References:

MoffettNathanson: Fiber Bubble May Pop; AT&T is by far the largest (fiber) overbuilder in U.S.

Comcast demos 10Gb/sec full duplex with DOCSIS 4.0; TDS deploys symmetrical 8Gb/sec service

Comcast announced in a press release it successfully tested a symmetrical multi-gigabit DOCSIS 4.0 connection on its live network, taking a major step toward “offering 10G-enabled services” in the second half of 2023. In Philadelphia, where Comcast is headquartered, it connected service at an undisclosed business location using multiple cable modems and a DOCSIS 4.0-enabled 10G node. If you’re wondering what 10G means, the answer is — more than 5G. As we noted in 2019, the cable industry rolled out its marketing term just in time to have something that’s twice as many Gb/sec as 5G wireless has.

DOCSIS 4.0 technology should enable download speeds of up to 10Gbps with 6Gbps uploads, and Comcast said a lab test in January achieved more than 4Gbps speed in both directions.

Earlier this year, Comcast announced it was working on rolling out multi-gig Internet speeds to more than 50 million residences and businesses in the U.S. by the end of 2025. The company planned on deploying 2Gbps speeds to 34 cities by the end of this month and has also given a slight bump to download speed on internet service in many areas.

The advantage of 10G tech is that it should make multi-gig speeds available for both downloads and uploads (currently, Comcast’s gigabit plans include upload speeds of just 200Mbps), just as it is with fiber optic internet connections. However, for anyone considering upgrading, we should note that you will probably need another new cable modem.

Ideally, this will increase speeds for those in places where fiber isn’t available, especially non-metropolitan areas. And in places that have competition, it measures closer against rivals that deliver fiber services, such as Verizon, AT&T, Google, and Frontier Communications, which are already offering some customers symmetrical multi-gigabit connections.

“We started this year with the announcement of our world-first test of 10G modem technology capable of delivering multi-gig speeds to homes and, as of today, 10G is a reality with the potential to transform and evolve the Internet as we know it,” said Elad Nafshi, EVP and Chief Network Officer at Comcast Cable. “It’s been an incredible year of progress, and we look forward to continuing to refine and harden our 10G technology as we work to make this service—and all its incredible benefits—available to all customers in the years ahead.”

……………………………………………………………………………………………………………………………………………………………………………………………

Separately, TDS Telecom [1.] said its new symmetrical 8Gb/sec (gig) service is already available in more than 75 of its fiber markets and runs $295 per month. While most U.S. operators [2.] are sticking with 2-gig as their top tier product for now, a handful of others have already pushed further into multi-gig territory. AT&T and Ziply Fiber, for instance, both offer residential plans providing up to 5 Gbps. And fewer still have gone beyond that. Lumen Technologies introduced an 8-gig tier for its Quantum Fiber service in August and Google Fiber has announced plans to trot out 5-gig and 8-gig plans in early 2023. Lumen’s service costs $300 per month.

Note 1. TDS Telecom offers internet service across 31 states with the greatest coverage in Wisconsin, Tennessee, and Utah.

Note 2. TDS is competing directly against AT&T, Comcast, Consolidated Communications and Lumen in the territory it serves.

While TDS in a press release pitched the 8-gig product as suitable for power users such as gamers and content creators, an operator representative told Fierce Telecom it doesn’t initially expect significant uptake of the plan. Instead, such offerings are tools in a marketing war being waged across the broadband industry.

Wire 3 offers a 10-gig service to customers in Florida, and Tennessee’s EPB and also provides a 25-gig service. However, it is not likely that consumers need those kinds of speeds currently.

On TDS’s Q3 2022 earnings call, TDS CFO Michelle Brukwicki stated its 1-gig and 2-gig plans are “important tools that will allow us to defend and win new customers.” She added nearly a quarter of new customers are taking its 1-gig service where it is available and its faster, higher-APRU tiers helped it boost residential broadband revenue in the quarter. However, TDS expects to miss 2022 fiber build target.

References:

https://corporate.comcast.com/press/releases/comcast-live-10g-connection-4-gig-symmetrical-speeds

https://www.theverge.com/2022/12/12/23505779/comcast-multi-gigabit-10g-docsis-40-cable-fiber-isp

https://www.fiercetelecom.com/broadband/tds-cranks-fiber-speeds-8-gbps

U.S. cable commercial revenue to grow 6% in 2022; Comcast Optical Network Architecture; HFC vs Fiber

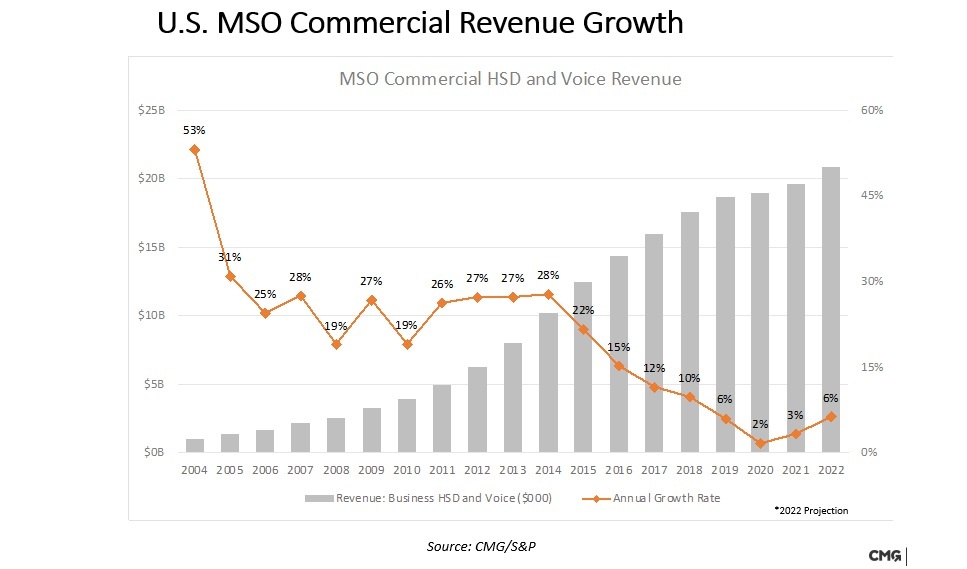

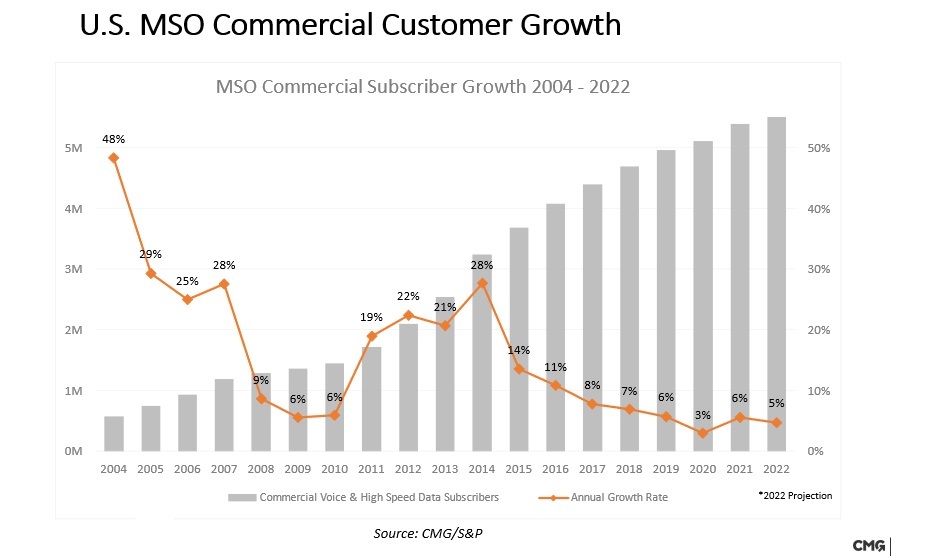

U.S. cable multi-service operators (MSO’s) now generate more than $20 billion a year in business services revenues as the sector has emerged as one of the most profitable for the industry. However, cablecos face major challenges in maintaining their growth pace because of the economic meltdown wrought by COVID-19 and the emergence of new all-fiber and wireless competitors.

Cable business service revenues and customer growth each slowed during the first two years of the COVID-19 pandemic, but they are clearly increasing again at the end of 2022.

U.S. cablecos commercial revenue growth is set to hit 6% in 2022, up from just 2% in 2020 and 3% in 2021, Alan Breznick, cable/video practice leader at Light Reading and a Heavy Reading analyst said in opening remarks at Light Reading’s 16th-annual CABLE NEXT-GEN BUSINESS SERVICES DIGITAL SYMPOSIUM, which focused on cable business services. [The source of that data is CMG/S&P.]

“There are signs of things pointing up again for the [cable] industry,” Breznick told the virtual audience.

U.S. cable is expected to bring in $20.5 billion in total commercial services revenues in 2022. Broken down by segment, small businesses (up to 19 employees), at $14.6 billion, will continue to represent the lion’s share, followed by medium businesses (20-99 employees), at $3.3 billion, and large businesses (100-plus employees), at $2.6 billion.

Commercial customer growth is estimated to reach 5% in 2022, down slightly from 2021 levels, but almost doubling the growth rate seen in 2020, when businesses across the country were hit by pandemic-driven shutdowns and lockdowns. Breznick estimates that US cable has about 5.5 million commercial customers.

Christopher Boone, senior VP of business services and emerging markets at Cable One, acknowledged that the commercial services market is returning to a faster rate of growth. However, businesses – and smaller businesses, particularly – are feeling labor and inflationary pressure as things continue to open up.

“Everything is expensive, including labor, and it’s hard to find [workers],” Boone explained. “For the small business owner, I think it’s pretty tough right now.”

During the earlier phases of the pandemic, Boone said Cable One didn’t emphasize new work-from-home products but instead focused on the broader customer experience. For example, Cable One put some customers on a seasonable pause for the first time, forgave early termination fees, issued credits and, where appropriate, helped customers move to lower-level services.

“We really threw the rulebook out and just said, do what it takes to take care of the customers,” he said. Even if some small businesses fail, the hope is that those entrepreneurs will return and choose Cable One again, remembering that the company did right by them when times were tough. Moving forward, he said Cable One will stick to its knitting and focus on connectivity rather than look to expand its product line for the business segment.

“I think our product menu needs to look like In-N-Out and not The Cheesecake Factory,” Boone said, noting that Cable One has opted to sit on the sidelines with product categories such as SD-WAN. “We’re pretty cautious in terms of new product launches … We feel that connectivity is really our sweet spot.”

…………………………………………………………………………………………………………………………………………………………………………………………..

Comcast Business now serves, small, mid-range and enterprise-level customers with a variety of services including Metro Ethernet, wavelength services and Direct Internet Access. An important piece of the firm’s broader strategy revolves around a “unified optical network architecture” initiative that enables the MSO to serve a broad range of customer types, including those requiring that services are delivered to multiple locations in multiple markets.

Comcast’s unified optical architecture combines the access and metro optical networks using a set of items: network terminating equipment (NTE), a Wave Integration Shelf (WIS) and OTN (Optical Transport Network – ITU standard) “tails.”

The NTE is a small, optical shelf that today supports 10-Gig and 100-Gig up to a 400-Gig wavelength, and can reside at a single customer site or a data center. The WIS resides in the Comcast headend or hub, co-located with the metro optical line system, and serves as the demarcation point for commercial services. The OTN Tails are the key to connecting the access network to the metro network.

“We needed a way to provide commercial services to customers that were located in the access [network], but needed to reach the metro network to get to one of our routers for Internet access or possibly another segment of the access to connect their locations together,” Stephen Ruppa, senior principal engineer, optical architecture for Comcast’s TPX (technology, product and experience) unit, said this week during his keynote presentation.

The combining/meshing of the access and metro networks enables features such as remote management, performance monitoring data, alarming and a full “end-to-end circuit view,” including the customer sites themselves. “We use the same hardware, standards, configurations, designs, procurement, processes … in all the networks, regardless of the vendor,” Ruppa said.

And while there was once little need to connect two non-Comcast sites that resided in different areas or to provide connections greater than 10 Gbit/s, customer demands have changed. Ruppa said two products drove that demand and the desire to create the company’s unified optical architecture: wavelength services and high-bandwidth Metro Ethernet.

A modular, simplified, commoditized and easily repeatable architecture enables Comcast Business to “easily offer the next gen of 400-Gig wavelengths and Ethernet services with a very light lift,” he added.

………………………………………………………………………………………………………………………………………………….

Ed Harstead, Lead Technology Strategist, Chief Technology Office, Fixed Networks, Nokia presented the final keynote.

The panel session “Fighting Fiber with Fiber” was moderated by Breznick with panelists:

- Christian Nascimento, VP, Product Management & Strategy, Comcast Business

- Brian Rose, Assistant VP, Product Internet, Networking & Carrier Services. Cox Communications

- Steve Begg, VP/GM, Business Services, Armstrong Business Solutions

- Mark Chinn, Partner, CMG Partners

- Ed Harstead, Lead Technology Strategist, Chief Technology Office, Fixed Networks, Nokia

Decades old hybrid fiber-coax networks (HFC) drive fiber to the node outside of the premises, which is then hooked up using older cable (coaxial) technology. However, due to advances in cable technology such as the latest DOCSIS 4.0 technology, the cable industry has touted its newly developed technological capacity to support multi-gig symmetrical speeds over those hybrid networks. DOCSIS 4.0 currently supports speeds of up to 10 Gigabits (Gbps) per second download and 6 Gbps upload – its predecessor, DOCSIS 3.1, offered only 5 Gbps * 1.5 Gbps.

Christian Nascimento of Comcast stated that hybrid networks that deliver multi-gigabit speeds are “adequate” for smaller enterprises. “This is matter of matching the technology up with…the customer’s needs,” he said, adding that Comcast delivers these services in a “cost-effective way.”

For Cox Communications, the hybrid model is “an ‘and,’ not an ‘or,’” said Brian Rose, the assistant vice president of product internet for the cable company. While Cox may invest more heavily in fiber networks going forward, Rose said it will continue to invest in its cable networks as well. Rose said he welcomes market challenges from insurgent fiber deployers. “Competition is good for customers and the industry overall,” he said. “It pushes people to be better and to push the envelope.”

The panel wasn’t unanimously bullish on older cable technology, however. Ed Harstead of Nokia argued that a widespread transition to fiber is inevitable. “I don’t doubt that mom-and-pop businesses will be perfectly fine on [cable]. But to the extent that you need higher speeds and symmetrical speeds…it’s going to be fiber.”

The cable broadband industry faces an onslaught of criticism from fiber advocates. Organizations like the Fiber Broadband Association say their preferred technology performs better, last longer, and costs less in the long term than the competition. FBA President Gary Bolton has strongly opposed government support for all manner of non-fiber technology, including satellite and wireless.

……………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/cable-tech/cable-business-services-bounce-back/d/d-id/782175

Cable Providers Back Hybrid Fiber-Coax Networks in Face of Pure Fiber

MoffettNathanson: Fiber Bubble May Pop; AT&T is by far the largest (fiber) overbuilder in U.S.

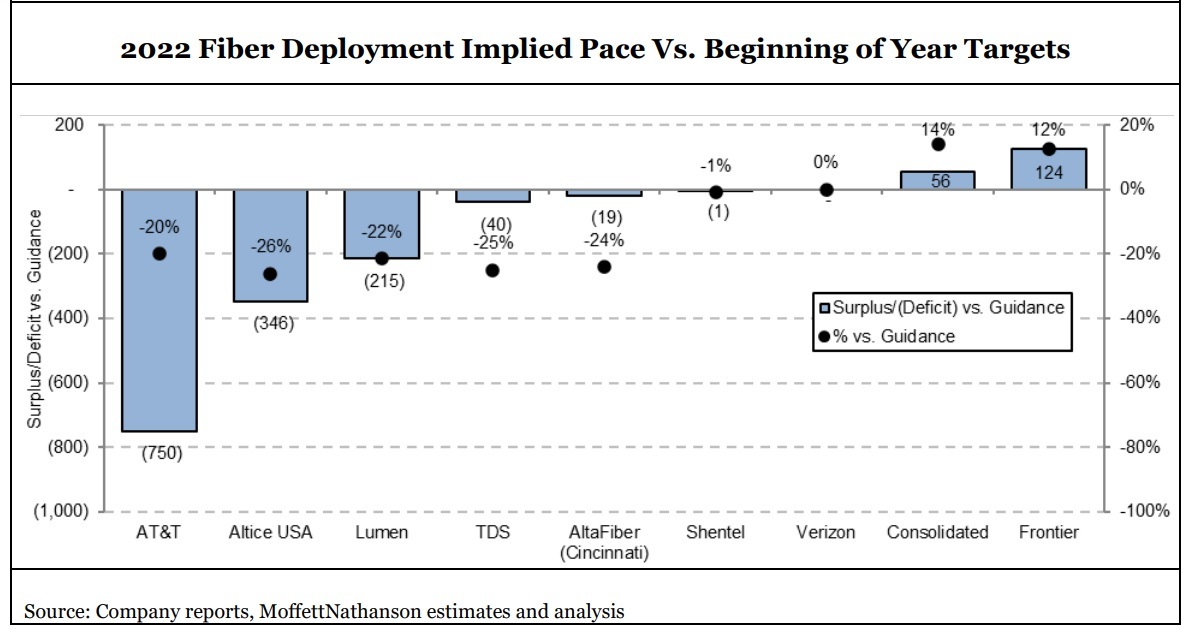

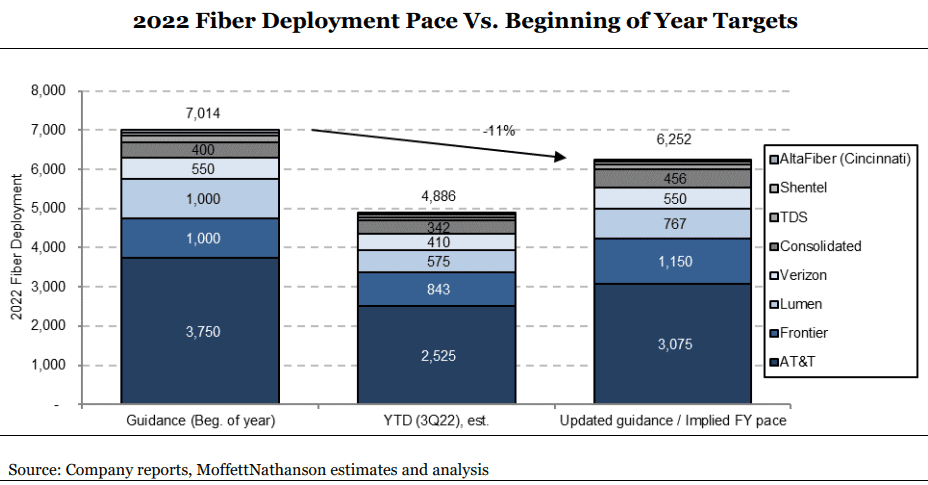

Fiber network build-outs are still going strong, even as the pace of those builds slowed a bit in 2022. Our colleague Craig Moffett warns that the fiber future isn’t looking quite as bright due to an emerging set of economic challenges that could reduce the overall rate of return on those build-outs. Rising costs, reflecting labor cost inflation, equipment cost inflation, and higher cost of capital, all point to diminished investment returns for fiber overbuilds. Craig wrote in a note to clients:

Our by-now familiar tally of planned competitive fiber builds for 2022 started the year at to 6M or so homes passed. By early Spring it had climbed to 7M. It currently sits at ~8M. Next year’s number is flirting with 10M. All for an industry that has never built even half that many in a single year. As we approach the end of the year, however, it is clear that the actual number, at least for this year, will fall short. The number is still high, to be sure… but lower.

There does not appear to be a single explanation for the construction shortfall; some operators blame labor supply, some permitting delays. And some, of course, are actually doing just fine. For the industry as a whole, however, notably including AT&T, by far the nation’s largest (fiber) overbuilder, the number will almost certainly end the year meaningfully below plan. Costs appear to be rising, as well. Here again, there is no single explanation. Labor costs are frequently cited, but equipment costs are rising as well. For example, despite construction shortfalls, AT&T’s capital spending show no such shortfall, suggesting higher cost per home passed. Higher cost per home passed, coupled with a higher cost of capital, portend lower returns on invested capital.

If, as we expect, investment returns for fiber overbuilds increasingly prove to be inadequate, the capital markets will eventually withdraw funding. Indeed, this is how all bubbles ultimately pop. There are already signs of growing hesitancy. To be sure, we don’t expect a near-term curtailment; operators’ plans for the next year or two are largely locked in. Our skepticism is instead about longer-term projections that call for as much as 70% of the country to be overbuilt by fiber. We believe those kinds of forecasts are badly overstated.

As recent as its Q3 2022 earnings call, AT&T has reiterated that it’s on track to expand its fiber footprint to more than 30 million locations by 2025. The company deployed fiber to about 2.3 million locations through the third quarter of this year, but appears hard-pressed to meet its guidance to build 3.5 million to 4 million fiber locations per year.

Given that the fourth quarter is typically a slow construction period, AT&T “looks to be well behind its deployment goals,” Moffett wrote. “If the company retains the pace of deployment in Q3, they will end the year 675K homes short of their goal, or an 18% shortfall compared to the midpoint of their target.”

But AT&T isn’t alone. Lumen has also fallen behind its target, as has TDS and altafiber (formerly Cincinnati Bell) and Altice USA. Those on track or ahead of pace include Frontier Communications, Consolidated Communications and Verizon.

The analysts at Wells Fargo recently lowered their fiber buildout forecasts for 2022 and 2023. They cut their 2022 forecast for the US to about 8 million new fiber locations, down from 9 million. For 2023, they expect the industry to build about 10 million locations, cut from a previous expectation of 11 million.

Though overall buildout figures are still relatively high, some operators recently have blamed a blend of reasons for the recent slowdown in pace, including a challenging labor supply, permitting delays and rising costs for capital and equipment.

“Labor costs are frequently cited, but equipment costs are rising as well,” Moffett noted. “For example, despite construction shortfalls, AT&T’s capital spending show no such shortfall, suggesting higher cost per home passed.”

And, like the pace of buildouts, the cost situation is clearly not the same for all operators. While Consolidated is seeing the cost per home passed rising to a range of $600 to $650 (up from $550 to $600), Frontier expects its costs to remain at the expected range of $900 to $1,000.

But more generally, Moffett believes the returns on those investments “will only weaken further as buildouts are necessarily pushed out to less attractive, lower density, markets.”

One takeaway from that, Craig warns, is that fiber overbuilding is poised not only to generate lower returns that originally hoped, but that there also will be upward, not downward, pressure on broadband prices.

With respect to the pace of fiber build-outs, there’s heavy demand for labor for today’s overbuilding plans, and it will only get heavier as the $42.5 billion Broadband Equity, Access and Deployment (BEAD) program gets started.

With respect to the pace of fiber build-outs, there’s heavy demand for labor for today’s overbuilding plans, and it will only get heavier as the $42.5 billion Broadband Equity, Access and Deployment (BEAD) program gets started.

Remedies are out there, with Moffett pointing to the Fiber Broadband Association’s rollout of its OpTICs Path fiber technician training program earlier this year as one example. ATX Networks, a network tech supplier, is contributing with the recent launch of a Field Personnel Replenishment Program.

But they might not completely bridge the gap. “These efforts may help expand capacity, but they are unlikely to fully meet demand, and they are almost certainly not going to forestall near-term labor cost inflation, in our view,” Moffett wrote.

With rising equipment costs and the cost of capital also factoring in, Moffett views a 20% rise in fiber deployment (for both passing and connecting homes) a “reasonable range” in the coming two to three years.

Moffett wonders if network operators will be forced to raise prices to help restore returns to the levels anticipated when fiber buildout plans were first conceived. While it’s unclear if competitive dynamics will allow for that, “it does appear to us that expectations of falling ARPU [average revenue per user] are misplaced,” Craig wrote.

But the mix of higher cost of capital and deployment for fiber projects, paired with deployment in lower density markets or those with more buried infrastructure, stand to reduce the value of such fiber projects further.

“Capital markets will sniff out this dynamic long before the companies themselves do, and they will withdraw capital. This is, of course, how bubbles are popped,” Moffett warned.

The MoffettNathanson’s report also provided an update on broadband subscriber metrics. US cable turned in a modest gain of 38,000 broadband subs in Q3 2022, an improvement from cable’s first-ever negative result in Q2. Cable saw broadband subscriber growth of 1.2% in Q3, down from +4.4% in the year-ago quarter. U.S. telcos saw broadband subscriber growth fall to -0.5% in Q3, versus +.06% in the year-ago quarter.

Meanwhile, fixed wireless additions set a new record thanks to continued growth at both Verizon and T-Mobile. However, T-Mobile’s 5G Home business posted 578,000 FWA subscriber adds in Q3, up just 3.2% from the prior quarter.

References:

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communicatons massive fiber build-out continued in the third quarter (Q3-2022), as the company added record number of fiber subscribers to reach a total of 4.8M fiber locations. Frontier is poised to reach 5 million locations passed with fiber-to-the-premises (FTTP) networks this month, putting it at the halfway point toward a goal to reach at least 10 million locations with fiber by the end of 2025. The company added a record 64,000 fiber subscribers, beating the 57,000 expected by analysts. That helped to offset greater than expected copper subscriber losses of -58,000. Consumer fiber Q3 revenue climbed 14% to $424 million while consumer copper fiber dropped 3% to $361 million.

Frontier built FTTP to a record 351,000 fiber optic premises in Q3-2022, handily beating the 185,000 built out in the year-ago quarter and the 281,000 built in Q2 2022. Frontier ended Q3 with 1.50 million fiber subs, up 16% versus the year-ago quarter.

“We delivered another quarter of record-breaking operational results,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “Our team set a new pace for building and selling fiber this quarter. At the same time, we radically simplified our business and delivered significant cost savings ahead of plan. This is a sign of a successful turnaround.

“Our team has rallied around our purpose of Building Gigabit America and is laser-focused on executing our fiber-first strategy. As the second-largest fiber builder and the largest pure-play fiber provider in the country, we are well-positioned to win.”

Third-quarter 2022 Highlights:

- Built fiber to a record 351,000 locations to reach a total of 4.8 million fiber locations, nearly halfway to our target of 10 million fiber locations

- Added a record 66,000 fiber broadband customers, resulting in fiber broadband customer growth of 15.8% compared with the third quarter of 2021

- Revenue of $1.44 billion, net income of $120 million, and Adjusted EBITDA of $508 million

- Capital expenditures of $772 million, including $18 million of subsidy-related build capital expenditures, $442 million of non-subsidy-related build capital expenditures, and $170 million of customer-acquisition capital expenditures.

- Net cash from operations of $284 million, driven by healthy operating performance and increased focus on working capital management

- Nearly achieved our $250 million gross annual cost savings target more than one year ahead of plan, enabling us to raise our target to $400 million by the end of 2024

In Frontier’s “base” fiber footprint of 3.2 million homes (in more mature areas where fiber’s been available for several years), penetration rose 30 basis points in Q3 to 42.9%. “When we look at the growth over the past year, we see a clear path to achieving our long term target of 45% penetration in our base markets,” Frontier CEO Nick Jeffery said.

Penetration rates in Frontier’s expansion fiber footprint for the 2021 cohort is on target and is exceeding expectations in the 2020 expansion fiber footprint, he said.

Fiber ARPU (average revenue per user) was up 2.6% year-over-year, but came a little short of expectations thanks in part to gift card promotions. Frontier’s consumer fiber ARPU, at $62.97, missed New Street Research’s expectation of $63.67 and a consensus estimate of $64.51. Copper ARPU, however, beat estimates: $49.65 versus an expected $48.57.

Frontier CEO Jeffery said faster speeds remain a top ARPU driver, with 45% to 50% of new fiber subs selecting tiers offering speeds of 1Gbit/s or more. Fiber subs taking speeds of 1Gbit/s or more now make up 15% to 20% of Frontier’s base, up from 10% to 15% last quarter, he said.

Frontier currently has no plans to raise prices due to inflation and other economic pressures, but the company left the door open to such a move.

“We’ll be a rational pricing actor in this market,” Jeffery said. “If those [inflationary pressures] don’t moderate, then of course we maybe consider pricing actions to compensate…just as we’re seeing others doing.”

Frontier also has no immediate plans to strike an MVNO deal that would enable it to use mobile in a bundle to help gain and retain broadband subscribers – a playbook already in use by Comcast, Charter Communications, WideOpenWest and Altice USA.

As churn rates remain stable and low, Jeffery explained, “the argument for using some of that scarce capital to divert into an MVNO to solve a problem that we don’t yet have, I think, would probably not make our shareholders super happy.” Importantly, Frontier has experience in the mobile area from execs who previously worked at Vodafone, Verizon and AT&T.

“We’re watching it very closely and if consumer behavior changes or if the market changes in a material way that impacts us such that moving some of our scarce capital to build or partner with an MVNO would be a smart thing to do, we’ll do it and we’ll do it very quickly,” Jeffery said. “But now isn’t the moment for us.”

Frontier ended the quarter with $3.3 billion of liquidity to fund its fiber build. Beasley said Frontier has additional options if needed, including taking on more debt, selling non-core real estate assets, access to government subsidies and the benefits of a cost-savings plan that has exceeded the target (from an original $250 million to $400 million).

References:

The conference call webcast and presentation materials are accessible through Frontier’s Investor Relations website and will remain archived at that location.

https://events.q4inc.com/attendee/387527166

https://www.lightreading.com/broadband/frontiers-big-fiber-build-nears-halfway-point-/d/d-id/781503?

Clearwave Fiber Expands Fiber Buildout in Savannah, Hinesville and Richmond Hill, GA

Clearwave Fiber [1.] continues its construction of a state-of-the art, all-Fiber Internet network in the “Coastal Empire.” This latest expansion for the Savannah-based operation marks a continuation of almost 6,000 route miles of Fiber in the Southeast and Midwest. The company’s goal is to bring the most advanced and fastest Internet available to more than 500,000 homes and businesses across the United States by the end of 2026.

Note 1. Clearwave Fiber was formed in January of 2022 as a rebranding of Hargray Fiber, which has been serving the Southeast for 70+ years. Senior leadership and operations management have a long history with Hargray and now lead Clearwave Fiber during this rapid expansion.

………………………………………………………………………………………………………………………………………………………..

“Clearwave Fiber is excited to contribute to the continual growth in Southeast Georgia and provide such a crucial resource to residents and commercial operations,” said Clearwave Fiber General Manager John Robertson. “We’re committed to providing communities with the high-speed connectivity that is essential for families, businesses and local economies.”

“We’re ingrained in the fabric of Savannah and its surrounding communities,” said Clearwave Fiber Chief Operating Officer Gwynne Lastinger. “Our sales and technical support staff live and work in the Coastal Empire and we continue to add to our team of more than 500 throughout the Southeast and Midwest.”

With gigabit download and upload speeds, Clearwave Fiber will bring 10 times more speed to consumer doorsteps at a time when fast, reliable Internet is becoming increasingly critical to modern households and businesses. Remote work, streaming, gaming, smart home technology and multiple device connectivity all require robust, reliable connections. Clearwave Fiber is committed to providing hassle-free, high-quality Fiber data connection to every location of its growing footprint.

“We’re seeing an increase in households where multiple online activities are occurring at the same time. Many Internet connections aren’t up to the task of keeping it all running at top speeds,” said Robertson. “Clearwave Fiber solves the problem of the bandwidth issues that happen when everyone in the house is connected. We also have solutions for businesses that keep them operating on a fast, reliable network.”

For many consumers, Internet touches every facet of daily life. Remote work, telehealth, and virtual learning all require robust, reliable connections. A 2022 study by Deloitte indicated that 45 percent of surveyed households include one or more remote workers, and 23 percent include at least one or more household member attending school from home. Additionally, 49 percent of U.S. adults had virtual medical appointments in the past year.

In addition, the Deloitte report noted that the average U.S. household now utilizes a total of 22 connected devices, including laptops, tablets, smartphones, smart TVs, game consoles, home concierge systems like Amazon Echo and Google Nest, fitness trackers, camera and security systems, and smart home devices such as connected exercise machines and thermostats.

Supporting this burgeoning ecosystem of household devices can challenge companies serving customers over DSL or cable systems. “Older copper wire and coaxial networks worked just fine for the technologies they were built for. Copper lines are great for telephone calls and coax worked well for cable TV, but those networks struggle to deliver the kind of bandwidth possible with fiber,” noted Lastinger. “Fiber optic technology is the future. Fiber networks are more durable, more consistent, and they move data at the speed of light. Best of all, our network easily keeps pace with technology innovations, exponentially increasing demands for bandwidth, and evolving customer needs. The options are almost limitless.”

Fiber networks are currently being installed on Wilmington and Whitemarsh Islands, Windsor Forest, Hinesville, Rincon, Pooler and Richmond Hill. Clearwave Fiber is scheduled to complete these projects by the end of November and will continue working in other areas in the region into 2023 and beyond.

For more information, visit ClearwaveFiber.com

References:

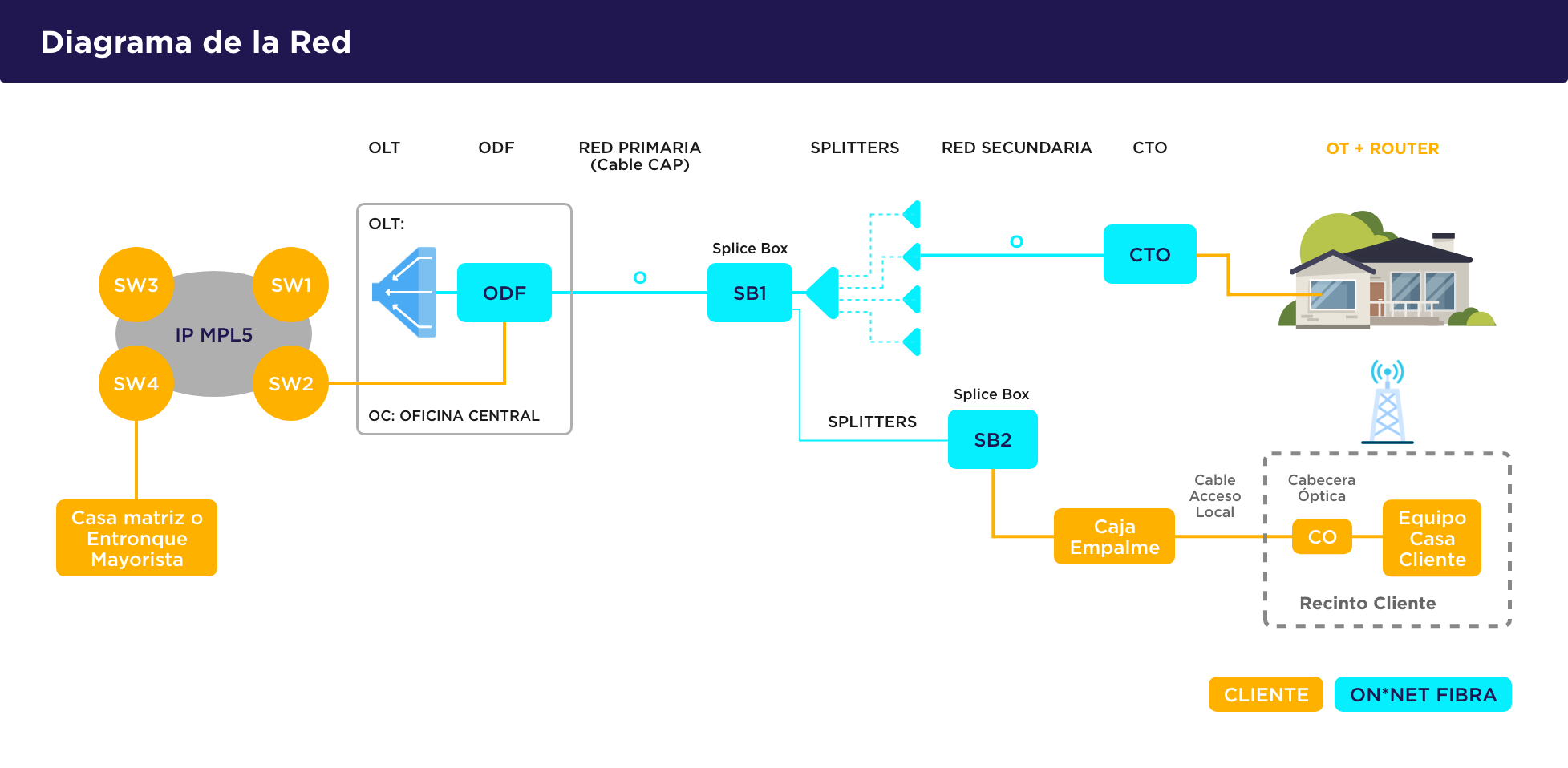

Chile’s Entel to sell fiber optic assets for $358 million to ON*NET Fibra

Chilean telecoms giant Entel (which this author consulted for in 2002 and 2005) said on Saturday it would sell the assets of its fiber optic business, which provides services to homes, to local company ON*NET Fibra (?) in a deal worth $358 million.

The sale, led by investment banks BNP Paribas, Santander and financial adviser Scotiabank, is subject to approval by Chile’s economic regulator, expected in the first half of 2023.

Entel and ON*NET Fibra signed an agreement as part of the deal that will enable Entel to continue offering internet services for residences on ON*NET’s network, Entel said in a statement.

…………………………………………………………………………………………………………………………………………………………….

“By selling our network, rather than leaving the fixed market, we are increasing coverage rapidly to offer our internet services to the home at efficient costs and without the need to invest the sums required for a fiber deployment with this coverage,” the statement added.

Following the closing of this transaction, ON*NET Fibra is expected to reach more than 4.3 million homes in 2024. Entel has operations in Chile and Peru and has more than 20 million mobile subscribers.

Source: ON*NET Fibra

……………………………………………………………………………………………………………………….

References: