Fiber deployments

BT’s CEO: Openreach Fiber Network is an “unstoppable machine” reaching 9.6M UK premises now; 25M by end of 2026

BT’s chief executive said its broadband network is now an “unstoppable machine” that will ultimately “end in tears” for many of its fiber optic competitors. “There is only going to be one national network,” Philip Jansen told the Financial Times. “Why do you need to have multiple providers?” BT said on Thursday that its networking division Openreach had laid fiber to 9.6M premises, with 29% of people in those areas opting to move over to its fiber optic connectivity offering.

BT has long provided the main wholesale network in Britain, giving access to TalkTalk and Sky among other OTT players. BT is ploughing billions of pounds into its network, extending its fiber offerings to 25M premises by end of 2026.

Competitors to Openreach, backed by billions in private capital, are racing to lay full fiber across the UK before the incumbent gets there. They include Virgin Media O2 and more than 100 alternative networks known as “altnets.”

Virgin Media O2 is seeking to upgrade its network to fiber by 2028 and has formed a joint venture between its owners, Spain’s Telefónica and Liberty Global, as well as infrastructure fund Infravia, to lay fiber to an additional 7M premises across the UK and offer wholesale access to other broadband providers. That’s in areas not already covered by the existing Virgin Media network. Industry insiders say network operators need to sign up about 40% of customers in any given location where they are building to make their business viable.

“Building is irrelevant — it’s how many people you’ve got on the network,” Jansen said. “No one else has got a machine anywhere near ours. It’s . . . unstoppable.” He said that the market would probably shake out to be just a “couple of big players” as well as a smattering of specialist providers for things like rural areas and multi-occupancy buildings — a process that would “end in tears” for many of the other operators. Jansen added that while BT had been spending large amounts of cash this year to fund its build efforts, once the construction phase ends he hopes the company will generate “a lot more cash” and could increase the dividend offered to shareholders.

“BT was on the back foot five years ago, we’re unquestionably on the front foot now,” he added. “Investors who own the company need a return.” BT maintained its full-year outlook on Thursday as it posted third-quarter revenue and earnings in line with analysts’ expectations. Revenue fell 3% in the third quarter compared with the same period in the previous year, to £5.2bn, which it attributed in part to lower sales in its global division and a loss of income from BT Sport following the completion of a joint venture with Warner Bros Discovery.

In November BT announced that it would increase its cost-savings target by £500mn to £3bn by 2025 as it sought to mitigate higher energy and inflation costs. As part of the cost-cutting drive, Jansen said there would be fewer people working at BT over the next five years, although he refused to be drawn on numbers. BT has already reduced its net headcount by 2,000 over the past two years, despite significant recruitment at Openreach. It has pushed ahead with inflation-linked price rises in 2023 for the majority of its consumer and wholesale customers in spite of cross-party calls for telecoms companies to reverse the decision during a cost of living crisis. “Right now the [capital expenditure] has to be paid for somehow,” Jansen said. “Hopefully inflation comes down and it won’t be so painful for everyone.”

References:

https://www.ft.com/content/031dcf72-dfaf-4e90-85d2-335ef703dbd1

Openreach on benefit of FTTP in UK; Full Fiber rollouts increasing

Super fast broadband boosts UK business; Calls to break up BT & sell Openreach

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

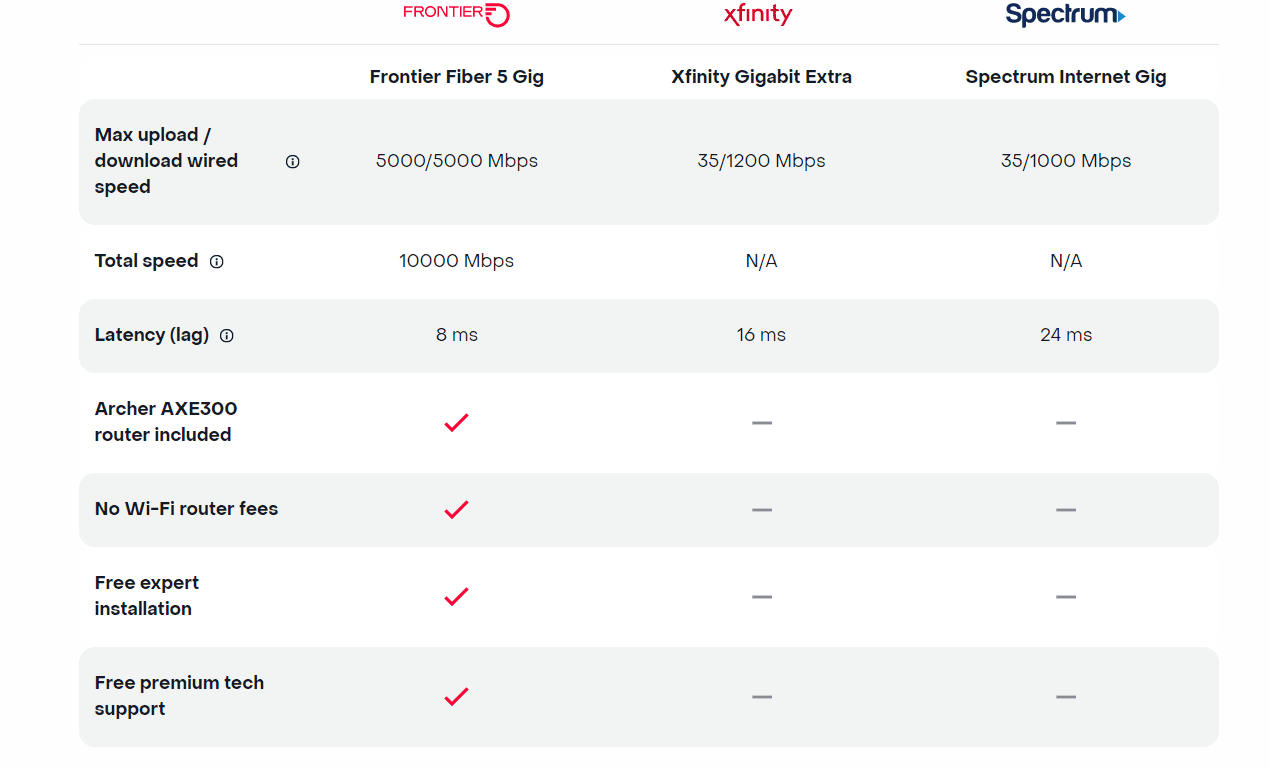

Today, Frontier Communications launched the nation’s only network-wide 5 Gig fiber internet service. With the launch of 5 Gig, Frontier will provide customers across its 25 state fiber network – not just select markets – the opportunity to sign up for the new premium service with blazing-fast speeds. The company says that 5 Gig internet has 125x faster upload speeds, 5x faster download speeds and 2.5x less latency than cablecos [1.], but they don’t specify the cable network speeds or latency.

Note 1. Comcast currently offers 1 and 2 Gig Internet. The company announced a successful trial of the world’s first live, multigigabit symmetrical Internet connection powered by 10 Gbps and Full Duplex DOCSIS 4.0 last December. Charter Communications is also planning a DOCSIS 4.0 upgrade to deliver download speeds of 5 Gbps and 10 Gbps over the coming years, but isn’t currently planning to bring symmetrical service offerings to market.

Frontier’s 5 Gig fiber internet service enables customers to run multiple connected devices at their fastest possible speeds. This means:

- Symmetrical download and upload speeds at up to 5 gigabits per second

- 125x faster upload speed than cable

- 1.6 seconds to download Adobe Photoshop on PC (1GB)

- <36 seconds to download a House of Dragons episode in 4K (22 GB)

- <2 minutes to download a 100-minute 8K movie (67 GB)

- 99.9% network reliability

The 5 Gig internet offer starts at $154.99 a month with autopay and includes uncapped data + Wi-Fi router + free installation + premium tech support. There are no additional Wi-Fi or router fees, no data caps or overage charges. The inclusion of a Archer AXE300 Wi-Fi 6E router is a major advantage, because most installed WiFi routers are WiFi 5= IEEE 802.11ac which won’t support giga bit speeds.

Frontier also dropped the price of its 2-gig internet service, which debuted in February 2022 at a cost of $149.99 per month. That service is now priced at $109.99 per month.

New Street Research stated that Frontier’s 5-gig rollout will “help establish Frontier as a leader in network capabilities and drive the message that this is a new Frontier.” The analysts added, “It also helps drive the message that they are delivering a product that Cable can’t.” Furthermore, New Street noted the move could contribute to growth in average revenue per user (ARPU) given the price drop for the 2-gig plan could “drive some incremental demand for that too.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

On Frontier’s Q3 2022 earnings call, CEO Nick Jeffrey noted 45% to 50% of new customers were taking its 1 Gbps and 2 Gbps plans. Among its installed base, uptake of 1-gig or faster speeds stood at 15% to 20%. That was up sequentially from 10% to 15% in Q2, Jeffrey said at the time.

Frontier is set to report Q4 2022 earnings on February 24th. In a 4Q 2022 earnings preview, the ISP disclosed it added 75,000 new fiber customers and 8,000 total broadband subscribers in the quarter. That was 17% more fiber broadband customers than it had at the end of 2021. For the fifth consecutive quarter, fiber broadband customer additions outpaced copper broadband customer losses, resulting in 8,000 total broadband customer net additions in the fourth quarter of 2022.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Other Competition:

AT&T, Altice USA, Lumen Technologies and Ziply Fiber all already provide symmetrical speeds of 5 Gbps or faster. And Google Fiber has announced plans to debut 5-gig and 8-gig plans early this year. But Frontier claimed it is the only operator thus far to roll out such speeds networkwide.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

About Frontier Communications:

Frontier is a leading communications provider offering gigabit speeds to empower and connect millions of consumers and businesses in 25 states. It is building critical digital infrastructure across the country with its fiber-optic network and cloud-based solutions, enabling connections today and future proofing for tomorrow. Rallied around a single purpose, Building Gigabit America™, the company is focused on supporting a digital society, closing the digital divide, and working toward a more sustainable environment. Frontier is preparing today for a better tomorrow. Visit frontier.com.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Media Contact:

Chrissy Murray, VP, Corporate Communications

+1 504-952-4225 [email protected]

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://frontier.com/shop/internet/fiber-internet/5-gig

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

AT&T Highlights: 5G mid-band spectrum, AT&T Fiber, Gigapower joint venture with BlackRock/disaggregation traffic milestone

On AT&T’s earnings call this week, CEO John Stankey provided these highlights:

- AT&T network teams have also consistently outpaced our mid-band 5G spectrum rollout objective. In fact, we now reach 150 million mid-band 5G POPs, more than double our initial 2022 year-end target. Our goal remains to deploy our spectrum efficiently and in a manner that supports traffic growth. In the markets where we have broadly deployed mid-band 5G, 25% of our traffic in these areas already takes advantage of our mid-band spectrum.

- We also expect to continue our 5G expansion, reaching more than 200 million people with mid-band 5G by the end of 2023.

- AT&T had more than 1.2 million AT&T Fiber net adds last year. The fifth straight year we’ve totaled more than 1 million AT&T Fiber net adds. And after 2.9 million AT&T Fiber net adds over the last 2.5 years, we’ve now reached an inflection point where our fiber subscribers outnumber are non-fiber DSL subscribers. The financial benefits of our fiber focus are also becoming increasingly apparent as full year fiber revenue growth of nearly 29% has led to sustainable revenue and profit growth in our Consumer Wireline business. As we scale our fiber footprint, we also expect to drive margin expansion.

- AT&T has the nation’s largest and fastest-growing fiber Internet, and we expect continued healthy subscriber growth as we grow our fiber footprint. As we keep expanding our subscriber base will drive efficiencies in everything we do. AT&T considers fiber a multiyear opportunity that will transform the way consumers’ and businesses’ growing connectivity needs are met in the ensuing decade and beyond.

- AT&T Fiber will be passing 30 million-plus consumer and business locations within our existing wireline footprint by the end of 2025. We finished last year with approximately 24 million fiber locations passed, including businesses, of which more than 22 million locations are sellable, which we define as our ability to serve. We remain on track to reach our target of 30 million plus passed locations by the end of 2025. The simple math would suggest 2 million to 2.5 million consumer and business locations passed annually moving forward. As we previously shared, build targets will vary quarter-to-quarter in any given year based on how the market is evolving.

- AT&T’s Gigapower joint venture announcement with a BlackRock infrastructure fund has not yet closed, we’re very excited about the expected benefit. Through this endeavor, Gigapower plans to use a best-in-class operating team to deploy fiber to an initial 1.5 million locations, and I would expect that number to grow over time. This innovative risk-sharing collaboration will allow us to prove out the viability of a different investment thesis that expanding our fiber reach not only benefits our fiber business, but also our mobile penetration rates. But what makes me most enthusiastic about this endeavor is that we believe Gigapower provides us long-term financial flexibility and strategic optionality and what we believe is the definitive access technology for decades to come, all while sustaining near-term financial and shareholder commitments.

- AT&T sees huge opportunities to connect people who previously did not have access to best-in-class technologies through broadband stimulus and Broadband Equity, Access, and Deployment (BEAD) funding. As I shared before, we truly believe that connectivity is a bridge to possibility in helping close the digital divide by focusing on access to affordable high-speed Internet is a top priority of AT&T. The intent of these government programs is to provide the necessary funding and support to allow both AT&T and the broader service provider community that means to invest alongside the government at the levels needed to achieve the end state of a better connected America.

- Our commitment to fiber is at the core of our strategy. In footprint, we’re on track to deliver our 30 million plus location commitment and we’re building the strategic and financial capabilities to take advantage of further opportunities as they emerge.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

AT&T’s open disaggregated core routing platform was carrying 52% of the network operators traffic at the end of 2022, according to Mike Satterlee, VP of AT&T’s Network Core Infrastructure Services in an interview with SDxCentral. Satterlee described this platform as the carrier’s “common” or “core backbone,” which supports about 594 petabytes of data traffic per day. This core backbone is a multi-part architecture spanning from AT&T’s nationwide network switch and cloud provider connections to its consumer- and enterprise-facing broadband and mobility services.

AT&T’s core platform uses Broadcom’s Jericho2 hardware design and Ramon switching chips, the carrier’s distributed disaggregated chassis (DCC) white box router architecture, and Israel based DriveNets Network Cloud (DNOS) software. It’s fed by AT&T’s edge router platform that sits in regional connection points. It uses the Broadcom silicon, Cisco software platform, and hardware from UfiSpace.

Satterlee said AT&T is running a nearly identical architecture in its core and edge environments, though the edge system runs Cisco’s disaggregates software. Cisco and DriveNets have been active parts of AT&T’s disaggregation process, though DriveNets’ earlier push provided it with more maturity compared to Cisco.

“DriveNets really came in as a disruptor in the space,” Satterlee said. “They don’t sell hardware platforms. They are a software-based company and they were really the first to do this right.”

AT&T began running some of its network backbone on DriveNets core routing software beginning in September 2020. The vendor at that time said it expected to be supporting all of AT&T’s traffic through its system by the end of 2022.

“It’s completely open in the sense that either vendor software could run in either places of the network,” Satterlee explained, adding that this was very helpful during the COVID-19 pandemic. “By having a common platform it’s just a matter of switching out the [network operating system] so we were able to very quickly redirect equipment for different use cases within AT&T and it was just a simple software change controlled by SDN.”

AT&T is targeting 65% of its traffic running on the disaggregated architecture by the end of this year. This will be important to support AT&T’s fiber and 5G push, which was enhanced late last year through a deal the carrier struck with BlackRock to expand its fiber footprint.

John Gibbons, assistant VP for AT&T’s Network Infrastructure Services, added that this also paves the way for the carrier to roll out 800-gigabit support for its backbone. “We don’t have to swap out the core router to get to 800-gig,” Gibbons said. “We can actually add to the current chassis. … We can add the new box to start growing it out from there. That’s the flexibility. It’s like the building-block model.

“Pretty much everything we spoke about supports our two biggest initiatives, which is growing the AT&T fiber broadband as well as 5G, and it’s all the underpinnings of those services,” Gibbons said.

References:

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T Deploys Dis-Aggregated Core Router White Box with DriveNets Network Cloud software

Dell’Oro: Optical Transport market to hit $17B by 2027; Lumen Technologies 400G wavelength market

According to a recent forecast report by Dell’Oro Group, the Optical Transport equipment demand is forecast to increase at a 3 percent compounded annual growth rate (CAGR) for the next five years, reaching $17 billion by 2027. The cumulative revenue during that five year period is expected to be $81 billion.

“We expect annual growth rates to fluctuate in the near term before stabilizing to a more typical 3 percent growth rate,” said Jimmy Yu, Vice President at Dell’Oro Group. “There is still a large amount of market uncertainty this year due to the economic backdrop—economists are predicting a high chance of a recession in North America and Europe. However, at the same time, most optical systems equipment manufacturers are reporting record levels of order backlog entering the year, and we expect that most of this backlog could convert to revenue when component supply improves this year,” added Yu.

Additional highlights from the Optical Transport 5-Year January 2023 Forecast Report:

- Optical Transport market expected to increase in 2023 due to improving component supply.

- WDM Metro market growth rates in next five years are projected to be lower than historic averages due to the growing use of IP-over-DWDM.

- DWDM Long Haul market is forecast to grow at a five-year CAGR of 5 percent.

- Coherent wavelength shipments on WDM systems forecast to grow at 11 percent CAGR, reaching 1.2 million annual shipments by 2027.

- Installation of 400 Gbps wavelengths expected to dominate for most of forecast period.

About the Report

The Dell’Oro Group Optical Transport 5-Year Forecast Report offers a complete overview of the Optical Transport industry with tables covering manufacturers’ revenue, average selling prices, unit shipments, wavelength shipments (by speed up to 1.2+ Tbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers, optical switch, Disaggregated WDM, DCI, and ZR Optics.

……………………………………………………………………………………………………………………………………………………

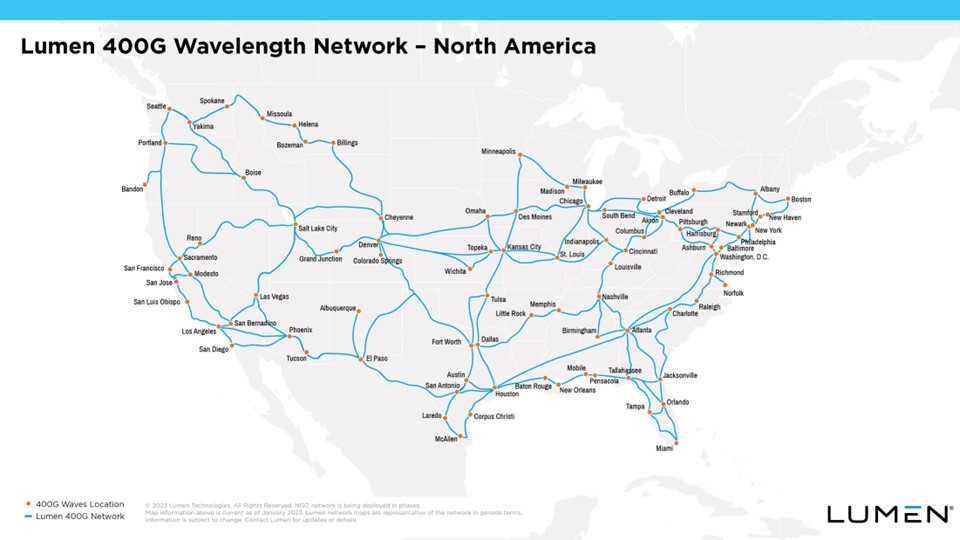

Separately, Lumen Technologies is expanding its 400G wavelength network across North America. Lumen said it has now deployed the network in 70 markets. More than 240 data centers have access to Lumen’s 400G Wavelength Services, and the network has over 800 Tbit/s of capacity.

Lumen said it plans to continue its intercity 400G expansion this year, pushing the network “deeper into the metro edge.” The company noted that wavelength services will assist customers in moving workloads to the cloud, and provide private, dedicated connections.

Enterprise customers can also examine network options, plan out their wavelengths and get cost estimates with Lumen’s Topology Viewer.

References:

https://www.prnewswire.com/news-releases/lumen-kicks-up-its-400g-offering-across-the-us-301730126.html

Fiber Build-Out Boom Update: GTT & Ziply Fiber, Infinera in Louisiana, Bluebird Network in Illinois

This week GTT Communications, Infinera, and Bluebird Network all announced network expansions within the U.S. The various announcements follow AT&T’s deal last month with venture capital firm BlackRock to deploy a multi-gigabit fiber network to 1.5 million customer locations using a commercial open access platform.

GTT Communications, Inc., a leading global provider of managed network and security services to multinational organizations, has announced that it has expanded its partnership with Ziply Fiber, a provider of fiber networks purpose-built for the internet, to establish a new network Point of Presence (PoP) to serve the fast-growing data center market in Portland, Oregon. The two companies linked in hopes to “serve the fast-growing data center market” in the city, according to the announcement.

The new PoP is providing an initial 400G of capacity to customers in the U.S. Pacific Northwest region and will expand the power of GTT’s global Tier 1 IP network by offering an additional option for customers to connect in 11 major data centers and the Hillsboro subsea cable landing station, expanding the reach of GTT via Ziply Fiber’s high-count Silicon Forest fiber cross connection service.

“We are pleased to expand our partnership with GTT to establish a new network PoP in Portland to help customers in the region and beyond to connect to area data centers as well as other geographies,” said Mike Daniel, vice president of Enterprise Sales at Ziply Fiber. “Our regional fiber network, combined with GTT’s global Tier 1 network and suite of leading managed networking and security services, will give enterprises new options to improve connectivity securely and reliably.”

GTT’s global Tier 1 IP backbone is ranked among the largest in the industry1 and connects more than 260 cities on six continents. With the addition of the new Portland PoP, GTT customers in the region can benefit from the improved connectivity, security and scalability available through GTT’s suite of managed connectivity services.

Ziply Fiber’s network was architected to meet today’s increasing digital demands and was engineered to be fully redundant, with a dual infrastructure that maintains customer connections even when issues arise. Ziply Fiber maintains a four-state footprint in Washington, Oregon, Idaho and Montana and has built redundancies into its network to avoid service interruptions, while updating routing to steer clear of congestion across the broader internet. This ensures content is accessible directly on the fiber backbone and can be accessed more quickly.

“This new PoP deployment creates an exciting opportunity to use the Ziply Fiber network to allow our regional data center customers to easily connect to and take advantage of GTT’s global Tier 1 IP network and our full suite of managed services offerings,” said Jim Delis, president, Americas Division, GTT. “Our work with Ziply Fiber demonstrates GTT’s continued focus on investment to expand the reach of our network for customers with locations in the Pacific Northwest.”

GTT will offer additional customer options to connect in 11 data centers and the Hillsboro subsea cable landing station. Jim Delis, president for GTT’s Americas Division, stated the PoP deployment will enable the network provider’s data center customers to link into its tier-one IP network.

………………………………………………………………………………………………………………………………………………..

Infinera announced today that the Louisiana Board of Regents, acting on behalf of the statewide Louisiana Optical Network Infrastructure (LONI) and the Board of Supervisors of Louisiana State University (LSU) and Agricultural and Mechanical College, has selected and deployed Infinera’s advanced coherent optical networking solutions to upgrade LONI. Also announced today is the initial deployment of four 400G optical channels along a 220-mile intrastate route in Louisiana.

LONI connects 38 university campuses and data centers and provides connectivity to additional research and education networks in other states. The solution, which increases LONI’s network capacity by a factor of 10, comprises Infinera’s XTM Series open line system and GX Series transponders. The upgraded network expands the ability for the research and education community to share and access information, resources, and remote instruments in real time.

LONI promotes scientific computing and technology across Louisiana and is the backbone infrastructure to the state’s heroic research efforts. These efforts are made possible by utilizing cutting-edge technology to push the limits of scientific discovery at leading university campuses and achievable with LONI’s high-bandwidth optical network. Infinera’s XTM Series line system coupled with GX Series high-performance transponders equips LONI with a 200G/400G/600G solution that offers unmatched high-bandwidth services to its customers today and is scalable to 800G in the future. Infinera’s combined solution delivers superior performance, increasing LONI’s service offering with more bandwidth, greater flexibility, and faster data transfer capabilities.

“A high-capacity state-of-the-art network is critical to enabling breakthrough discoveries that can only be achieved through multi-site collaboration and cloud connectivity,” said Lonnie Leger, LONI’s Executive Director. “We are committed to offering our members up to 100G and deploying Infinera’s innovative solutions, which exceeded both our expectations and commitment, enabling us to exceed what other state universities can offer.”

“LONI operates with a small staff, which requires a highly automated network and cost-effective solution that enables them to meet their bandwidth growth requirements,” said Nick Walden, Senior Vice President, Worldwide Sales, Infinera. “The Infinera team worked closely with LONI to deliver a solution that met their needs now and positions them to meet future bandwidth needs with minimal maintenance and manpower to operate.”

“As bandwidth continues its relentless growth driven by new high-speed applications such as 5G, [augmented reality], [virtual reality], and cloud services, legacy copper-based networks – such as DSL and cable – are simply not capable [of] meeting the bandwidth requirements,” Robert Shore, SVP of marketing at Infinera, told SDxCentral.

Shore added that the current fiber boom “reinforces Infinera’s focus on continuing to innovate and manufacture optical transport solutions that can help network operators effectively leverage their fiber deployments from the core of their network all the way to the very edge.”

Infinera also announced that its ICE6 solution was deployed along the trans-Pacific Unity Submarine Cable System connecting Japan and the U.S., doubling the capacity of that connection.

……………………………………………………………………………………………………………………………………………………….

Bluebird Network completed a 126-mile fiber buildout in Illinois. The route connects the towns of Aurora, Dixon, DeKalb, Sterling, and Rock Falls to Bluebird’s network and services, and provides a “diverse route” to Chicago, the company stated.

Bluebird’s management noted the deployment builds on its recently acquired middle-mile fiber network assets from Missouri Telecom, and expansion into Salina, Kansas, and Waterloo, Iowa.

“Bluebird has no plans to slow down its fiber expansions any time soon,” Bluebird Network President and CEO Michael Morey stated in the release tied to its Kansas and Iowa expansion. “To foster even more growth and strengthen connectivity for businesses in the Midwest, we have builds underway for additional expansions coming online this summer.”

Those moves come on the heels of the AT&T/BlackRock JV that is looking to deploy fiber to more than 30 million locations within AT&T’s 21-state wireline footprint by the end of 2025, and positions the newly created Gigapower entity to boost its reach outside of those initial 21 states.

The deal also prompted a predication from Analysys Mason, saying the move further indicates “that the [U.S.] wireline market is entering a period of profound transformation that will leave it more aligned with the market structures seen in Europe.”

…………………………………………………………………………………………………………………………………………………

References:

https://www.sdxcentral.com/articles/news/us-fiber-build-booms/2023/01/

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier Communications previewed its Q4 2022 results today, revealing it gained 75,000 new fiber customers and had 8,000 total broadband net additions.

- Strong customer growth in Q4 led Frontier to finish 2022 with 17% more fiber broadband customers than it had at the end of 2021.

- For the fifth consecutive quarter, fiber broadband customer additions outpaced copper broadband customer losses, resulting in 8,000 total broadband customer net additions in the fourth quarter of 2022.

During a Citi investor conference presentation following the announcement, CFO Scott Beasley said growth spanned both new and existing markets and resulted in part from gains made against cable competitors. “We continue to outpace our cable competitors, gaining share in nearly every geography we operate in. Our new position as the ‘un-cable’ provider is taking hold. We are bringing customers a superior product and it is paying off in record broadband customer growth.”

According to Beasley, the vast majority of its net additions are customers who are new to Frontier rather than those converting from a legacy DSL service. That means most either moved into or within the operator’s territory during the quarter or switched from cable. “We had success against every competitor in every geography,” the CFO stated. Asked whether cable’s recent efforts to woo consumers with fixed-mobile bundles presented a challenge, Beasley said Frontier hasn’t yet “seen much of an impact from their converged offerings.”

Frontier doesn’t appear to be concerned about advances from fixed wireless access (FWA) rivals either. New Street Research noted Frontier’s net add announcement implied it lost 67,000 copper subscribers, which was significantly higher than the 56,000 the analyst firm had expected. However, Beasley said fixed wireless has had “very little impact” on its fiber gross additions.

Regarding its DSL based services, Beasley said “we haven’t seen any significant impact from fixed wireless (FWA)” in terms of churn but acknowledged FWA is “nibbling around the edges” where new movers only have the choice between Frontier’s DSL or a fixed wireless product.

Beasley added despite macroeconomic challenges and a recessionary environment, Frontier hasn’t seen any slowdown in bill payments or tier step-downs from customers. In fact, as it works to achieve a goal of 3% to 4% year-on-year average revenue per user (ARPU) growth by the end of 2023, he said it will actually look to encourage customer plan step-ups. Beasley noted uptake of its gigabit plans currently stands around 15% among Frontier’s base and around 45% for new customers, leaving plenty of room for movement. The company will also implement “normal base price increases to reflect higher input costs” and use gift card promotions to retain and gain other subscribers, he said.

Media Contact:

Chrissy Murray

VP, Corporate Communications

+1 504-952-4225

[email protected]

References:

https://investor.frontier.com/news/news-details/2023/Frontier-Adds-Record-Fiber-Broadband-Customers-in-Q4-2022/default.aspx

https://investor.frontier.com/events-and-presentations/events/event-details/2023/Citi-Communications-Media–Entertainment-Conference/default.aspx

https://www.fiercetelecom.com/broadband/frontier-bags-75k-fiber-subs-q4-2022-eyes-arpu-gains-23

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications Accelerates Fiber Build Out -10 Million locations passed by 2025

Frontier Communications and Ziply Fiber to raise funds for fiber optic network buildouts

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T and a unit of investment titan BlackRock will form a joint venture to operate a commercial fiber-optic platform, with AT&T as its first wholesale tenant. The objective is to further propel AT&T’s fiber ambitions outside of the carrier’s traditional 21-state wireline footprint and move on AT&T’s long-simmering fiber expansion plans. The newly formed joint venture (JV) — Gigapower, LLC — expects to provide a best-in-class fiber network to internet service providers (ISPs) and other businesses across the United States.

The Gigapower joint venture will operate the commercial fiber service. That service – not to be confused with AT&T’s previous “GigaPower” broadband offering – will be targeted at internet service providers (ISPs) and enterprises.

BlackRock’s work in the venture will be through its Alternatives division and through a fund managed by its Diversified Infrastructure business. That business recently raised $4.5 billion in initial investor commitments. AT&T executive veteran Bill Hogg was named CEO of Gigapower.

The JV’s initial plans are to deploy a multi-gigabit fiber network to 1.5 million customer locations using a commercial open access platform. This will be incremental to AT&T’s own fiber deployment plans targeted at reaching more than 30 million locations within its 21-state wireline footprint by the end of 2025. The JV will tap into AT&T’s nationwide 5G wireless service to support sales outside of its traditional wireline footprint. This will allow it to take advantage of AT&T’s already established enterprise arrangements and more quickly get a sales channel up and running.

“Now more than ever, people are recognizing that connecting changes everything,” said John Stankey, CEO of AT&T. “With this joint venture, more customers and communities outside of our traditional service areas will receive the social and economic benefits of the world’s most durable and capable technology to access all the internet has to offer.”

“We are excited to form the Gigapower joint venture in partnership with AT&T, which will be serving as not only a joint owner but also the first wholesale tenant. We believe Gigapower’s fiber infrastructure designed as a commercial open access platform will more efficiently connect communities across the United States with critical broadband services,” said Mark Florian, Global Head of Diversified Infrastructure, BlackRock. “We look forward to partnering with Gigapower’s highly experienced management team to support the company’s fiber deployment plans and shared infrastructure business model.”

Gigapower plans to deploy a reliable, multi-gig fiber network to an initial 1.5 million customer locations across the nation using a commercial open access platform. The Gigapower fiber deployment will be incremental to AT&T’s existing target of 30 million-plus fiber locations, including business locations, by the end of 2025. Combined with existing efforts within AT&T’s 21-state footprint, this capital efficient network deployment will advance efforts to bridge the digital divide, ultimately helping to provide the fast and highly secure internet people need. This network expansion will also help spur local economies in each of the communities in which Gigapower operates.

“Fiber is the lifeblood of digital commerce,” said Bill Hogg, CEO of Gigapower. “We have a proven team of professionals building this scalable, commercial open access wireline fiber network. Our goal is to help local service providers provide fiber connectivity, create the communications infrastructure needed to power the next generation of services and bring multi-gig capabilities to help close the gap for those who currently are without multi-gig service.”

Tammy Parker, Principal Analyst at GlobalData, a leading data and analytics company, wrote:

“AT&T is pursuing a shrewd path to extend its fiber footprint nationwide without assuming all the risk by itself. Although the new Gigapower platform will be operated as a joint venture with BlackRock, offering commercial open access to not only AT&T but also other internet service providers and businesses, the carrier’s influence features prominently: the moniker ‘GigaPower’ was formerly applied to AT&T’s fiber-based service, which was renamed ‘AT&T Fiber’ in October 2016.

“The Gigapower platform will serve customers outside of AT&T’s traditional 21-state wireline footprint, and as the platform’s first wholesale tenant AT&T will be able to sell fiber service in more wireline markets, complement its nationwide mobile service footprint, and enable the carrier to market fixed-mobile service bundles in those markets. Over time, AT&T should be able to leverage this dual-technology capability to not only attract new customers and revenue streams, but also increase customer retention as subscribers who take multiple services from a carrier tend to be ‘stickier’ and less likely to stray to a rival service provider.

“The AT&T and BlackRock JV poses a competitive challenge to cable providers and regional fiber providers, whose broadband reaches are geographically restricted, though those carriers could possibly become tenants on the open access Gigapower platform to extend their own footprints.

“Gigapower will also help AT&T extend its fiber offerings to compete against the highly successful fixed wireless access (FWA) services being marketed by rivals T-Mobile US and Verizon to residential and business broadband customers both inside and outside of AT&T’s existing wireline service area. However, unlike FWA services, which can ride on top of existing mobile network coverage and are often self-installable, fiber requires the deployment of new infrastructure and truck rolls to the premises to be served, impacting time to market for AT&T and BlackRock’s ambitious plan. Additionally, Gigapower’s initial footprint will cover only 1.5 million customer locations, and it is unclear what the deployment timeline will be.

“After largely extracting itself from its previous foray into entertainment, AT&T continues doubling down on its broadband focus, committing to both 5G and fiber nationwide. AT&T’s JV with BlackRock has the potential to alter the broadband landscape, not only by enabling AT&T to market fiber in more markets but also by providing a platform for public-private broadband partnerships between Gigapower and local municipalities. However, it will take time to see results from this long-term play.”

References:

https://www.sdxcentral.com/articles/analysis/att-bags-blackrock-for-gigapower-fiber-jv/2022/12/

RVA LLC: Fiber Deployment in U.S. Reaches Highest Level Ever; Google Fiber Returns

Fiber facility service providers passed 7.9 million additional homes in the U.S. in 2022—the highest annual deployment ever, even with challenges in materials supply chain and labor availability, according to a fiber deployment report from the Fiber Broadband Association.

The 2022 Fiber Provider Survey was based on research conducted by RVA LLC Market Research & Consulting (RVA). Their researchers found that there are now a total of 68 million fiber broadband passings in the U.S., with strong recent increases of 13% over the past 12 months and 27% over the past two years. The survey also found that 63 million unique homes have now been passed (this figure “excludes homes with two or more fiber passings”). To date, fiber has passed nearly half of primary homes and over 10% of second homes. The annual fiber deployment rate is likely to be even higher over the next five years as BEAD and other broadband funding programs kick in.

In its research, RVA notes that although deployment expectations from individual companies are in constant flux based on many factors, many service providers have announced network builds exceeding the fiber footprint they have built through private funding. Canada is seeing strong fiber deployment as well, with about 66% of homes passed.

“High-quality broadband has become more important to consumers every year. Fiber broadband exceeds all other types of delivery in every single measurement of broadband quality, including speeds, uptime, latency, jitter, and power consumption,” Gary Bolton, Fiber Broadband Association president and CEO, said in a prepared statement. “For the consumer this has real-world impacts, like more productivity, better access to health care and education, more entrepreneurism, and the option of more rural living. For society, this means more sustainability and, ultimately, digital equity.”

Mike Render, Founder and CEO of RVA, will present the findings of the 2022 Fiber Provider Survey on Fiber for Breakfast, Wednesday, December 28, 2022, at 10:00am ET. Click here to register for the episode.

About the Fiber Broadband Association (FBA):

The Fiber Broadband Association is the largest and only trade association that represents the complete fiber ecosystem of service providers, manufacturers, industry experts, and deployment specialists dedicated to the advancement of fiber broadband deployment and the pursuit of a world where communications are limitless, advancing quality of life and digital equity anywhere and everywhere. The Fiber Broadband Association helps providers, communities, and policy makers make informed decisions about how, where, and why to build better fiber broadband networks. Since 2001, these companies, organizations, and members have worked with communities and consumers in mind to build the critical infrastructure that provides the economic and societal benefits that only fiber can deliver. The Fiber Broadband Association is part of the Fibre Council Global Alliance, which is a platform of six global FTTH Councils in North America, LATAM, Europe, MEA, APAC, and South Africa. Learn more at fiberbroadband.org.

The Fiber Broadband Association is also helping with the expansion by helping to train installers through its Optical Telecom Installation Certification (OpTIC) Path program.

Press Contact:

Ashley Schulte

Connect2 Communications for the Fiber Broadband Association

[email protected]

…………………………………………………………………………………………………………………………………………………………….

Separately, Light Reading says that Webpass to play role in Google Fiber’s new expansion efforts. “As we continue to grow our footprint across the country, we’re integrating this [wireless] method for delivering high-speed service in more areas where it makes sense in all our existing cities and in our new expansion areas as well,” Tom Brownlow, senior network operations manager at Google Fiber, and Blake Drager, the head of technology at Google Fiber’s Webpass business, wrote in a post to the company’s website.

Google Fiber recently announced talks were underway with city leaders in five states – Arizona, Colorado, Nebraska, Nevada and Idaho – about expanding fiber services to various communities. Cities to make Google Fiber’s new-build list recently include Omaha, Nebraska, Mesa, Arizona and Lakewood, Colorado. Brownlow and Drager didn’t specify which of those expansion markets might include wireless offerings.

References:

MoffettNathanson: ROI will be disappointing for new fiber deployments; FWA best for rural markets

From two recent research reports to clients, MoffettNathanson chief analyst Craig Moffett wrote:

There is no question that there will be a great deal of new fiber deployed in the U.S. But we expect it will be considerably less than current worst-case scenarios for two reasons.

- There simply isn’t sufficient labor availability for all operators to meet the projections they’ve set forth (this issue will be significantly exacerbated by the upcoming rural Broadband Equity, Access, and Deployment (BEAD) program, which will introduce a dramatic new source of labor demand).

- The expected return from fiber overbuilds will be disappointing, in our view, both because deployment costs (including the cost of capital) have risen sharply, and because expected densities of available markets are falling sharply.

We are skeptical about the returns that will be generated by fiber builds, as costs are rising and densities are falling. The spiraling costs of fiber deployment also make it likely that there will be upward, not downward, pressure on broadband ARPU in competitive markets, as overbuilders scramble to cost-justify not only their existing projects, but, perhaps more importantly, the projects on which they have not yet broken ground (and which, without a more generous ARPU assumption, can no longer be return-justified). Craig had argued earlier this year that the fiber buildout bubble may pop.

Wireless operators have an enormous cost advantage in offering fixed wireless access (FWA) service on preexisting network facilities; the marginal cost of offering FWA is zero if it is simply using excess capacity. The capacity available for such a strategy is relatively limited, making the strategic leverage of FWA relatively limited as well. Cable operators have a smaller, but still significant, cost advantage in offering wireless services that can offload at least some of their traffic onto existing infrastructure. And unlike wireless operators offering FWA, their capacity to do so is unlimited.

Almost no telecom investor with whom we have spoken views FWA as an important part of the story for the companies that actually offer it. Investors seem to have already come to the view (for the wireless operators, at least) that FWA is at best a costly sideline in rural markets. Longer term, the bigger threat to cable broadband is likely fiber rather than fixed wireless, Moffett said. But even with that, the analyst seems to be less concerned that cable operators will overspend on fiber or that overbuilders will present more competition.

The convergence arguments for fiber to the home (FTTH) are arguably even weaker. As we’ve pointed out often, AT&T’s wireline footprint covers but 45% or so of the U.S. (by population), and of that, just a third is wired for fiber. In total, then, AT&T can deliver a bundled solution to just 15% or so of the population. In our view, a strategy (bundling) that “works” in 15% of the country isn’t a strategy.

We certainly aren’t convinced that the U.S. market will be fundamentally shaped by convergence. But if it is, the cable operators, not the telcos, are positioned to benefit.

References:

MoffettNathanson: Fiber Bubble May Pop; AT&T is by far the largest (fiber) overbuilder in U.S.

Comcast demos 10Gb/sec full duplex with DOCSIS 4.0; TDS deploys symmetrical 8Gb/sec service

Comcast announced in a press release it successfully tested a symmetrical multi-gigabit DOCSIS 4.0 connection on its live network, taking a major step toward “offering 10G-enabled services” in the second half of 2023. In Philadelphia, where Comcast is headquartered, it connected service at an undisclosed business location using multiple cable modems and a DOCSIS 4.0-enabled 10G node. If you’re wondering what 10G means, the answer is — more than 5G. As we noted in 2019, the cable industry rolled out its marketing term just in time to have something that’s twice as many Gb/sec as 5G wireless has.

DOCSIS 4.0 technology should enable download speeds of up to 10Gbps with 6Gbps uploads, and Comcast said a lab test in January achieved more than 4Gbps speed in both directions.

Earlier this year, Comcast announced it was working on rolling out multi-gig Internet speeds to more than 50 million residences and businesses in the U.S. by the end of 2025. The company planned on deploying 2Gbps speeds to 34 cities by the end of this month and has also given a slight bump to download speed on internet service in many areas.

The advantage of 10G tech is that it should make multi-gig speeds available for both downloads and uploads (currently, Comcast’s gigabit plans include upload speeds of just 200Mbps), just as it is with fiber optic internet connections. However, for anyone considering upgrading, we should note that you will probably need another new cable modem.

Ideally, this will increase speeds for those in places where fiber isn’t available, especially non-metropolitan areas. And in places that have competition, it measures closer against rivals that deliver fiber services, such as Verizon, AT&T, Google, and Frontier Communications, which are already offering some customers symmetrical multi-gigabit connections.

“We started this year with the announcement of our world-first test of 10G modem technology capable of delivering multi-gig speeds to homes and, as of today, 10G is a reality with the potential to transform and evolve the Internet as we know it,” said Elad Nafshi, EVP and Chief Network Officer at Comcast Cable. “It’s been an incredible year of progress, and we look forward to continuing to refine and harden our 10G technology as we work to make this service—and all its incredible benefits—available to all customers in the years ahead.”

……………………………………………………………………………………………………………………………………………………………………………………………

Separately, TDS Telecom [1.] said its new symmetrical 8Gb/sec (gig) service is already available in more than 75 of its fiber markets and runs $295 per month. While most U.S. operators [2.] are sticking with 2-gig as their top tier product for now, a handful of others have already pushed further into multi-gig territory. AT&T and Ziply Fiber, for instance, both offer residential plans providing up to 5 Gbps. And fewer still have gone beyond that. Lumen Technologies introduced an 8-gig tier for its Quantum Fiber service in August and Google Fiber has announced plans to trot out 5-gig and 8-gig plans in early 2023. Lumen’s service costs $300 per month.

Note 1. TDS Telecom offers internet service across 31 states with the greatest coverage in Wisconsin, Tennessee, and Utah.

Note 2. TDS is competing directly against AT&T, Comcast, Consolidated Communications and Lumen in the territory it serves.

While TDS in a press release pitched the 8-gig product as suitable for power users such as gamers and content creators, an operator representative told Fierce Telecom it doesn’t initially expect significant uptake of the plan. Instead, such offerings are tools in a marketing war being waged across the broadband industry.

Wire 3 offers a 10-gig service to customers in Florida, and Tennessee’s EPB and also provides a 25-gig service. However, it is not likely that consumers need those kinds of speeds currently.

On TDS’s Q3 2022 earnings call, TDS CFO Michelle Brukwicki stated its 1-gig and 2-gig plans are “important tools that will allow us to defend and win new customers.” She added nearly a quarter of new customers are taking its 1-gig service where it is available and its faster, higher-APRU tiers helped it boost residential broadband revenue in the quarter. However, TDS expects to miss 2022 fiber build target.

References:

https://corporate.comcast.com/press/releases/comcast-live-10g-connection-4-gig-symmetrical-speeds

https://www.theverge.com/2022/12/12/23505779/comcast-multi-gigabit-10g-docsis-40-cable-fiber-isp

https://www.fiercetelecom.com/broadband/tds-cranks-fiber-speeds-8-gbps