Mobile Network Market

Telia’s mobile network with CBTC technology deployed in Oslo metro line

Telia is claiming a European first with the deployment of a digital signaling system on the Oslo metro that operates over the Nordic telecom operator’s commercial 4G/5G mobile network. Sporveien is the Oslo subway transport operator.

Developed by Siemens Mobility, the system uses communications-based train control (CBTC) technology to link trains, trackside equipment and central control systems. According to Telia, CBTC enables far more precise train-position tracking than legacy signaling platforms, allowing operators to safely reduce headways and run trains more closely together.

Morten Karlsen Sørby, acting Head of Telia Norway: “As far as we know, only the New York City Subway uses a mobile network as part of a signaling system. It places high demands on availability and service quality, and Telia is ready to deliver. We congratulate Sporveien on this new system, and we’re very proud of our innovative collaboration with both Sporveien and Siemens Mobility.”

Today’s launch is on the Oslo Metro’s line 4 between Brattlikollen and Bergkrystallen, with implementation across the entire subway scheduled for 2030. The current signaling system has been in place since the Metro opened in 1966.

Birte Sjule, CEO of Sporveien: “The subway can only operate with a well-functioning signaling system, so this project is extremely important for Oslo’s residents. By replacing technology that has passed its useful life, we’ll reap additional benefits such as more frequent departures and increased capacity in the years to come.”

The solution delivered to Sporveien is part of Telia’s Enterprise Mobile Network (EMN) portfolio, which offers advanced and customized connectivity services to support industrial digitalization. EMN can use either 4G or 5G technology, or a combination, depending on the specific needs of the business.

Private 5G is now being integrated into CBTC systems to provide higher capacity, lower latency, and improved performance, especially in urban and high-demand environments. Companies are actively rolling out and testing CBTC with 5G, making it a next-generation standard for some new and retrofitted systems.

References;

Ericsson and Telia said to provide lower 5G latency & power dissipation/longer battery life

Non-coherent Massive MIMO for High-Mobility Communications

Selected Applications/Use Cases by Industry for ITU-R International Mobile Telecommunications (IMT) – 3G, 4G & 5G

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

Telco spending on radio access network (RAN) infrastructure, which is the largest share of capex, has dropped sharply in the last couple of years. It fell 11% in 2023, to about $40 billion, according to Informa owned market research firm Omdia (see References below for Dell’Oro’s numbers).

For 2024, Omdia predicts another decline of between 7% and 9%. Instead of buying new equipment, telcos have used existing supplies in their where houses.

Traffic growth rates also appear to have slowed. The graphic used in Ericsson’s latest mobility report pictures this very clearly, showing a church steeple of a traffic spike in 2019 and 2020 before a shallower downward-sloping gradient to the first half of 2024. That’s shown in this chart:

.jpg?width=700&auto=webp&quality=80&disable=upscale)

Source: Ericsson

Ericsson’s latest numbers, available through its mobility visualizer tool, shows the monthly volume of global mobile data rose by just 4.34% in the second quarter of 2024, compared with the first quarter. This is much lower than the rate of 10.76% Ericsson observed in the corresponding quarter four years earlier. The actual increase in 2024 was 6.27 exabytes. In 2020, it was 4.86 exabytes.

RAN product revenues have been falling at their sharpest rate in many years despite the 6.27-exabyte increase in monthly data volumes that happened in the second quarter. There are no signs that current 4G and 5G networks are about to keel over beneath an avalanche of data. It remains to be seen whether mobile networks are sufficiently robust to cope with many more exabytes of mobile data traffic or if telcos care about any service problems caused by congestion due to increased traffic.

There is also no obvious correlation between traffic growth and expenditure, according to Coleago Consulting. Spain’s Telefónica supported 17,054 petabytes of data on its global networks in 2015, its annual reports show. By 2023, the amount had rocketed to 146,074. Yet its capital intensity has fallen from more than 17% to just 14% over this period. Energy use, a proxy for operating costs, is also down, dropping from about 6,578 gigawatt hours in 2015 to 6,012 last year. Despite all that data consumption by its customers, Elisa’s capital intensity last year was less than 15%.

In Germany, the average monthly data usage per mobile customer (rather than per capita) amounted to 7.4 Gbytes and this may have risen to around 8 Gbytes in 1H 2024. In 2024, mobile data consumption in Finland was around 10 times higher compared to Germany. In Finland mobile operators have implemented 5G-SA and sell a user experience in terms of speed (Mbits/s) as opposed to data volume (Gbytes). As of October 2024, Elisa Finland offered a speed of 300 Mbits/s with unlimited data volume for €34.99. By contrast, in Germany, Telekom’s offer for 20 Gbytes is priced at €39.95 per month. For unlimited data usage Telekom charges €84.95, which is 2.5 times more costly than Elisa’s unlimited offer. It is unreasonable to assume that there is no price elasticity of demand. Surely, if prices in Germany were like those in Finland, monthly mobile data usage per customer would be much higher.

Monthly average revenue per user (ARPU) for a postpaid customer of Deutsche Telekom, Germany’s biggest telco, has fallen from €22 (US$23.7) before the launch of 5G to about €20 ($21.6) for the most recent quarter. Clearly, cost realities are especially awkward for Europe’s telcos, which have refused to give up their “fair share” argument that big content companies should pay for network usage because of all the traffic they supposedly generate. Critics disagree, saying that the telco’s own customers are the traffic generators, and they have already paid for it, even if pricing schemes do not help telcos to grow their sales.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.lightreading.com/5g/data-traffic-growth-or-decline-there-s-no-upside-for-telecom

https://www.coleago.com/insights/the-end-of-telecoms-history-not-really/

Analysys Mason & Light Reading: cellular data traffic growth rates are decreasing

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

China’s mobile data consumption slumps; Apple’s market share shrinks-no longer among top 5 vendors

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

Amazon NOT at all likely to offer mobile service to Prime Members or anyone else!

Wireless telecom stocks were down -5% to -9% at Friday morning’s open (they closed on June 2nd -4% to -6.25% lower). That horrendous performance was due to a Bloomberg article which claimed that “Amazon has been talking with wireless carriers about offering low-cost or possibly free nationwide mobile phone service to Prime subscribers, according to people familiar with the situation….It would let it offer Prime members wireless plans for $10 a month or possibly for free and bolster loyalty among its biggest spending customers, the people said, who requested anonymity to discuss a private matter.” About 167 million Amazon shoppers had Prime memberships as of March, unchanged from a year earlier, according to Consumer Intelligence Research Partners.

The Bloomberg article made this controversial statement, subsequently denied:

“The talks have been going on for six to eight weeks and have also included AT&T Inc. at times, but the plan may take several more months to launch and could be scrapped, an Amazon person said.”

Image Credits: Nathan Stirk / Getty Images

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Nothing could be further from the truth!

Amazon, T-Mobile US, AT&T and Verizon Communications all denied on Friday that anything is happening. T-Mobile’s statement on the matter strongly states that “Amazon has told us they have no plans to add wireless service.”

That echoes Amazon’s own statement which said “We are always exploring adding even more benefits for Prime members, but don’t have plans to add wireless at this time,” said Bradley Mattinger, an Amazon spokesperson.

“AT&T is not in discussions with Amazon to resell wireless services,” a company spokesperson said. A Verizon spokesperson told TechCrunch, “Verizon is not in negotiations with Amazon regarding the resale of the nation’s best and most reliable wireless network. Our company is always open to new and potential opportunities, but we have nothing to report at this time.”

T-Mobile told Barron’sthat “Amazon is a great partner to T-Mobile in many areas, and we are always interested in working more closely with our cross-town neighbors in new ways. However, we are not in discussions about inclusion of our wireless in Prime service, and Amazon has told us they have no plans to add wireless service.”

Wall Street analysts are skeptical that there is anything actually going on. MoffettNathanson analysts Craig Moffett and Michael Morton wrote in a research note published late Friday that any deal for Amazon to start its own phone service seems highly unlikely. (Moffett covers telecom and Morton covers internet stocks.) Moffett and Morton note that while Amazon could make it happen, the cost to the company of providing even a single line would be about $240 a year—above the annual cost of an Amazon Prime membership, currently at $139. And that’s just for one line—the costs would multiply with bigger families.

Another issue, they add, is that Amazon would suddenly be subject to regulation from the FCC. They point out that customer information is more tightly regulated in telecom than in related industries. That adds more risk to Amazon’s existing regulatory worries. “Even a minimal risk like this would be a deal breaker, in our view,” they write.

From a telecom perspective, the analysts also pour cold water on any potential deal. As for Dish Network , Moffett and Morton write, “there is virtually no chance…that Amazon would allow itself to play guinea pig on a start-up Dish wireless network.” Dish did not respond to a request for comment about the report.

In an interview with Barron’s, Moffett noted that Dish only has partial coverage— the company has launched service in 120 cities so far, but not in places like New York, Chicago, Los Angeles, Washington, or San Francisco. To cover the parts of the country it can’t reach, Dish has reseller agreements with both AT&T and T-Mobile. Moffett says that T-Mobile likely’s agreement with Dish doesn’t allow it to resell access to a third party—like Amazon. And AT&T’s agreement has similar language.

“Without the ability to resell AT&T or T-Mobile service, Dish simply isn’t a credible partner,” Moffett and Morton write. “Not only is their coverage insufficient to be a viable offering, but they’ve never operated a wireless network before, let alone a large-scale MVNO. [An MVNO is a carrier that has no network but instead resells service from other carriers.]”

With T-Mobile and Verizon having denied discussions, and Dish seeming very unlikely, that leaves only AT&T. And Moffett and Morton see little chance of that happening. “AT&T is smart enough to understand what an awful idea it would be to let Amazon into the hen house, in our view,” they wrote.

The two analysts also contend that a Prime Wireless plan wouldn’t do much to help Amazon grow its subscription business. They point out that Prime already has signed up about 80% of U.S. households and that churn rates for Prime are already “extremely low.”

Moffett and Morton conclude: “We’re skeptical that the incumbents would be willing to ink a deal with Amazon. We’re skeptical that Amazon would really want to. We’re skeptical that Amazon would be willing to do business with Dish Network. We’re skeptical about…well, all of it.”

Note also that Amazon failed dismally in 2014 with its Fire Phone, which was an attempt to compete with smart phones from Apple Inc. and Samsung Electronics Co., but it was killed a year later. MVNO brands including ESPN Mobile and Virgin Mobile both failed. Alphabet Inc. has the Google Fi service that runs on T-Mobile’s network and has only 2 million customers.

Let’s end with a question: One must consider if Bloomberg can be trusted as a reputable news source after their early morning June 2nd story?

References:

https://www.barrons.com/amp/articles/amazon-prime-phone-service-telecom-stocks-b439ae5a

https://www.barrons.com/articles/amazon-wireless-verizon-dish-stock-att-f23cad24?mod=article_inline

China’s telecom sector had steady growth during January-May 2022 (Updated)

China’s telecommunication industry registered steady growth in the first five months of the year, with strong expansion in emerging businesses and 5G services, official data shows.

The telecom sector had 665 billion yuan (99.46 billion U.S. dollars) in total revenue during the period, up 8.5 percent year on year, according to China’s Ministry of Industry and Information Technology (MIIT).

Emerging businesses, including those in the big data, cloud computing, internet data center and Internet of Things sectors, continued to expand notably in the period.

The combined revenue of the emerging businesses of China’s three telecom giants — China Telecom, China Mobile and China Unicom — surged 34.3 percent year on year to 128.3 billion yuan, accounting for 19.3 percent of the sector’s total revenue, the ministry said.

At the end of May, China had 1.7 million 5G base stations, accounting for 16.7 percent of the country’s mobile network base stations. Some 275,000 5G base stations were built in the first five months of the year.

The data also shows that 5G mobile phone users of the three telecom giants reached 428 million at the end of May, representing 25.8 percent of China’s total mobile phone users.

–>Much more telecom data in the Addendum below.

………………………………………………………………………………………………………………………………..

Image by ADMC from Pixabay

At the end of May, China had a total of 1.7 million 5G base stations, accounting for 16.7% of the country’s mobile network base stations. According to the official data, a total of 275,000 5G base stations were built in the first five months of 2023.

China ended May 2022 with a total of 899.3 million subscribers classified as having 5G plans (even though many only had 4G endpoint devices), according to the carriers’ latest available figures. China network operators recorded a net gain of 30.18 million 5G subscribers in May.

China Mobile, the world’s largest operator in terms of subscribers, added a total of 18.21 million 5G subscribers during last month. The operator said it ended May with 495.13 million 5G subscribers, compared to 221.95 million 5G customers in May 2021.

China Mobile had added a total of 108.32 million subscribers in the 5G segment during the first five months of the year.

Rival operator China Unicom said it added a total of 4.93 million 5G subscribers during May. The carrier ended the month with 179.70 million 5G subscribers.

Meanwhile, China Telecom added 7.04 million 5G subscribers last month to take its total 5G subscribers base to 224.47 million. During the first five months of the year, the telco had added a total of 36.67 million 5G subscribers.

China expects to end this year with nearly 2 million 5G base stations, according to previous reports. Chinese carriers reportedly deployed a total of 654,000 base stations nationwide during last year.

The country’s 5G networks now covers all prefecture-level cities, more than 98% of county-level urban areas and 80% of township-level urban areas across the country..

Earlier this year, the Chinese government had unveiled plans to more than triple the number of 5G base stations over the next four years, targeting a total of 3.64 million by end-2025.

Under this plan, China aims to have 26 5G base stations for every 10,000 people by the end of 2025. In comparison, in 2020, there were five 5G base stations for every 10,000 people in China.

China is expected to reach 892 million connections in the 5G segment in 2025, according to a report recently published by the GSMA.

According to the ‘The Mobile Economy China” report, GSMA expects 5G connections in the country to represent 52% of total mobile lines in 2025, compared to 29% in 2021.

…………………………………………………………………………………………………………………………

| Indicator name | unit | end of the month

arrive |

than the end of last year

net increase (+), reduce(-) |

year-on-year

increase(%) |

| Total landline subscribers | million households | 18170 | 100 | 0.2 |

| Total mobile phone users | million households | 166249 | 1966 | 3.4 |

| Of which: 5G mobile phone users | million households | 42819 | 7334 | 109.2 |

| Of which: Mobile Internet users | million households | 143568 | 2003 | 4.3 |

| Internet broadband access users | million households | 55868 | 2289 | 10.6 |

| Of which: FTTH/O users | million households | 52976 | 2426 | 11.5 |

| Among them: users with a rate of 100M or more | million households | 52291 | 2443 | 13.4 |

| Among them: users with a rate above 1000M | million households | 5591 | 2135 | 358.6 |

| Of which: urban broadband access users | million households | 39415 | 1606 | 10.8 |

| rural broadband access users | million households | 16453 | 683 | 10.1 |

| Number of IPTV (Internet TV) users | million households | 36392 | 1540 | 10.2 |

| Number of Cellular IoT End Users | million households | 159 498 | 19 576 | 26.8 _ |

| Fixed telephone penetration | Department/100 people | 12.9 | 0.1 | – |

| Mobile phone penetration | Department/100 people | 117.9 | 1.5 | – |

http://english.news.cn/20220703/41a9776edd9d44c0ad055252c4e35818/c.html

https://www.miit.gov.cn/gxsj/tjfx/txy/art/2022/art_b8491abea6324484a19b5438b08761a4.html

China’s telecom sector revenues reach almost $100bn in Jan-May

June 2022 Ericsson Mobility Report: 5G subscriptions increased by 70 million in Q1-2022 to reach 620 million

Ericsson new Mobility Report [1.] states that mobile network data traffic grew 10% between the 4th quarter of 2021 and the 1st quarter of 2022. For the year-over-year comparison, growth reached 40%. “In absolute numbers, this means that it has doubled in just two years (since Q1 2020),” the company wrote in its Mobility Report, released June 20th. “Over the long term, traffic growth is driven by both the rising number of smartphone subscriptions and an increasing average data volume per subscription, fueled primarily by increased viewing of video content,” the company added.

The figures are important considering that mobile network operators are rushing to add new spectrum to their networks while upgrading their networks to support 5G, especially 5G SA Core Network. Purchasing both spectrum and 5G equipment is expensive. In the US, for example, mobile network operators are collectively spending an estimated $275 billion to improve their networks with more spectrum, cell sites and 5G.

Note 1. The Ericsson Mobility Report started in 2011, when Ericsson decided to share data and insights openly to all those interested in understanding our industry’s development. Since then, the report and featured articles have seen a continuous evolution and an expanding scope.

………………………………………………………………………………………………………………………………………………………………………………………………………….

Speaking during a webinar to discuss the report’s findings, Richard Möller, senior market analyst at Ericsson, noted that the number of 5G subscribers worldwide had been expected to reach 660 million by the end of 2021. It now seems that the figure was less than forecast: Ericsson is now saying that 5G subscriptions increased by 70 million in Q1 2022 to reach 620 million. The 40 million shortfall is due to changes in how China’s mobile operators are reporting their 5G subscriber figures. Indeed, it has become noticeable over the past year that the Chinese operators are starting to split out “5G package customers” from actual 5G network customers.

“Now we have official numbers and we’ve adjusted our estimates accordingly,” Möller said. “China is early and so large that it affects the global number.” He noted that this adjustment does not “materially affect” the five-year growth forecast. Ericsson is therefore sticking to its estimate of 4.4 billion 5G subscribers by the end of 2027, meaning that 5G will account for almost half of all mobile subscriptions by that point. 5G subscriber growth is expected to accelerate in 2022, reaching around one billion subscribers by the end of the year. The report noted that North America and North East Asia currently have the highest 5G subscription penetration, followed by the Gulf Cooperation Council countries and Western Europe. In 2027, it is projected that North America will have the highest 5G penetration at 90%. In India, where 5G deployments have yet to begin, 5G is expected to account for nearly 40% of all subscriptions by 2027.

At the same time, Möller warned that the war in Ukraine, supply chain constraints and rising inflation will affect future growth. “That’s made us take 100 million subscriptions off the current forecast. However, history has shown that mobile telephony is one of the things that people hang on to … even if the economic world turns negative,” he said.

The report’s executive editor Peter Jonsson said the current uncertainties mean that Ericsson has to be especially careful with its forecasts. However, he reiterated the point that global 5G uptake “is about two years ahead of 4G” on a comparative basis. In addition, 5G rollout “reached 25% of the world’s population about 18 months faster than 4G.”

Global mobile network data traffic and year-over-year growth:

According to Ericsson, mobile subscribers are making use of the additional network capacity and faster speeds provided by those investments. The company said that, globally, the average smartphone user is expected to consume 15GB per month in 2022. Indeed, the 5G share of mobile data traffic is growing, but not as fast as FWA (3G/4G/5G). Continued strong smartphone adoption and video consumption are driving up mobile data traffic, with 5G accounting for around 10 percent of the total in 2021.

In North America, the company estimated that average monthly mobile data usage per smartphone could reach as high as 52GB in 2027. “The data traffic generated per minute of use will increase significantly in line with the expected uptake of new XR and video-based apps,” the company wrote. “This is due to higher video resolutions, increased uplink traffic, and more data from devices off-loaded to cloud compute resources.”

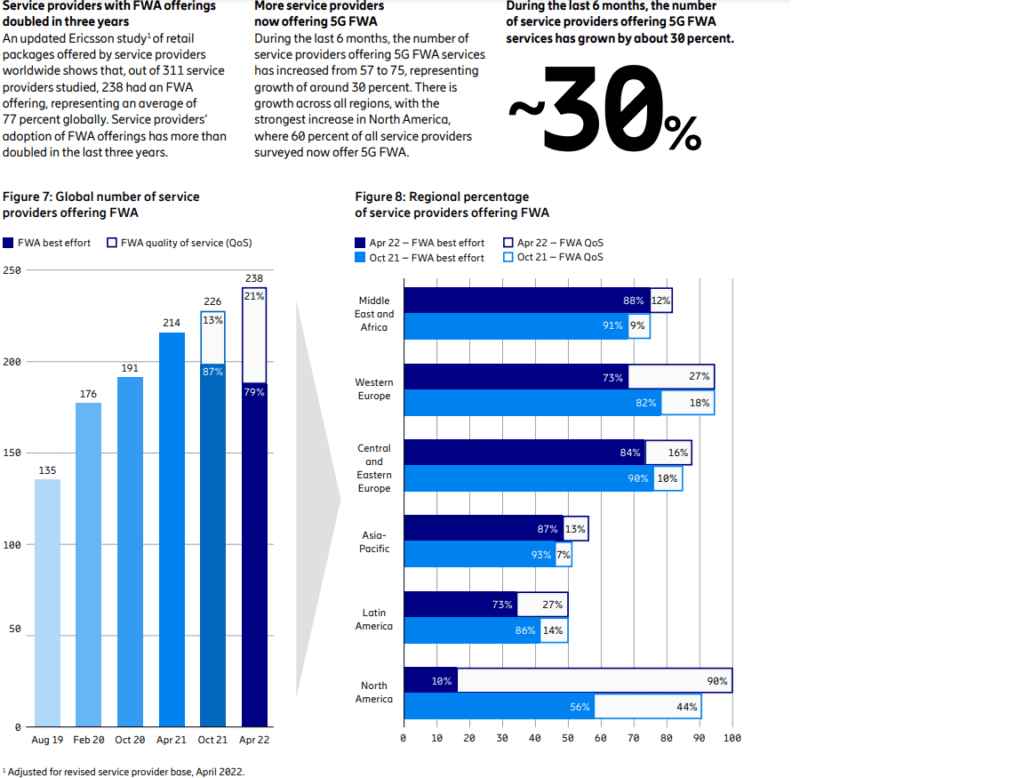

Also, Fixed Wireless Access (FWA) in on the rise as per this graphic:

Over 100 million FWA connections in 2022:

More than 75 percent of service providers surveyed in over 100 countries are offering fixed wireless access (FWA) services. Around 20 percent of these service providers apply differential pricing with speed-based tariff plans.

OpenVault, another vendor that tracks data traffic on wired networks in North America, recently reported similar findings. According to OpenVault, the average wired Internet customer consumed a total of 536.3GB in the fourth quarter of 2021, an increase of 165% over the firm’s findings from the fourth quarter of 2017, when consumption was 202.6GB.

Taken together, the companies’ findings paint a picture of a dramatic expansion in data demand on wired and wireless networks in North America and globally. Indeed, such increases have already sparked unprecedented demand in vendors’ networking equipment to keep pace with demands. Further, such demand has already withstood several price increases among many leading vendors.

The situation reflects the importance of telecom networks globally following a pandemic that pushed many to work and school remotely from home. And in response to the situation, governments globally have begun pushing network operators to construct networks in underserved areas, and to Internet users themselves who may struggle to afford such connections.

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report

https://www.lightreading.com/5g/china-effect-dampens-interim-5g-subs-says-ericsson/d/d-id/778394?

https://www.ctia.org/the-wireless-industry/the-5g-economy

Will 2022 be the year for 5G Fixed Wireless Access (FWA) or a conundrum for telcos?

https://viodi.com/2020/05/05/openvault-broadband-usage-47-in-q1-2020-power-users-are-the-new-normal/