smartphones

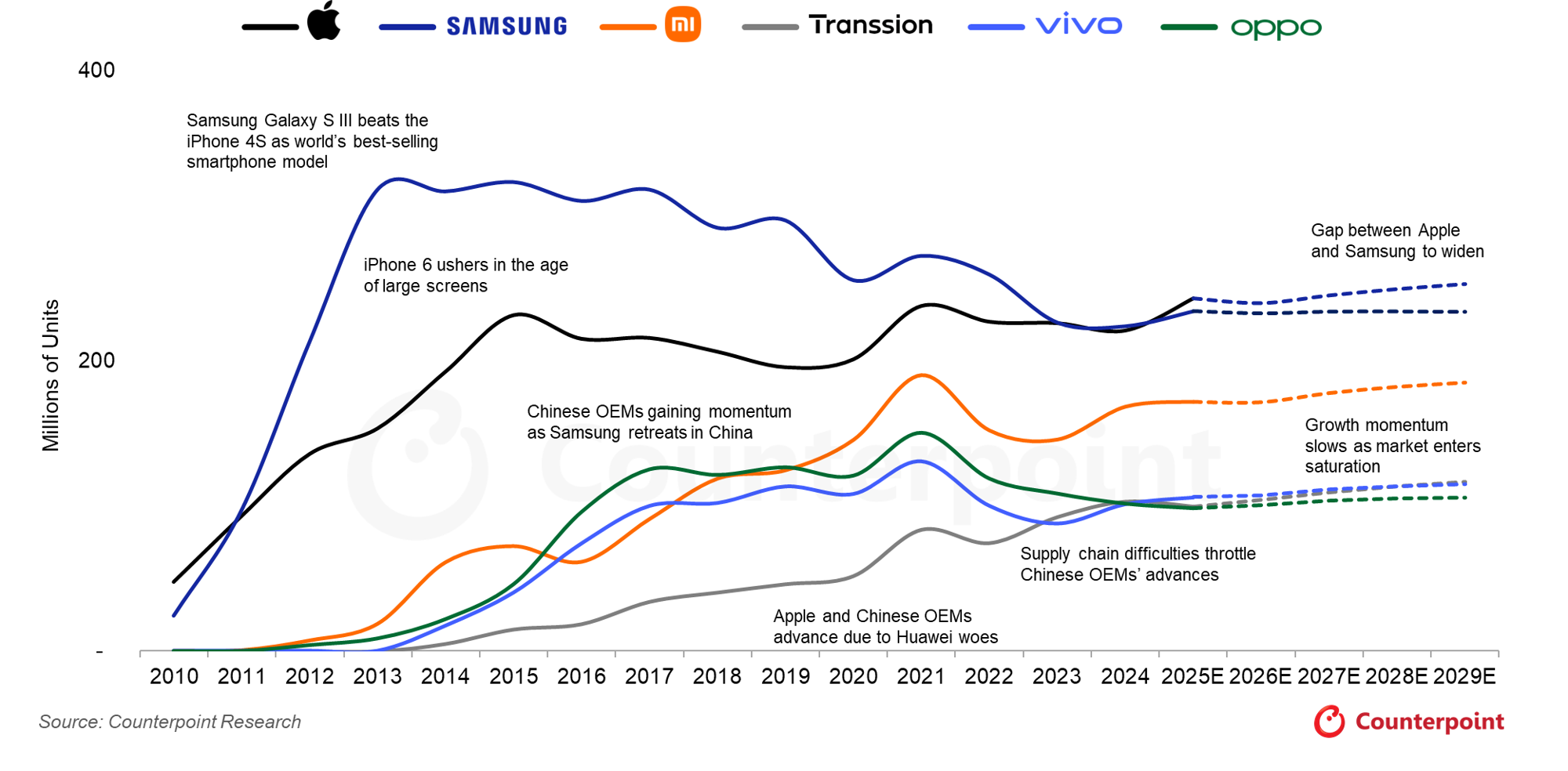

Apple leads 128+% YoY increase in foreign mobile phones shipped within China; Global market share leaders

In November 2025, the volume of foreign-branded mobile phones shipped within China experienced a substantial year-over-year increase of 128.4%. This surge was primarily due to increased sales of Apple iPhones, especially iPhone 17. According to data released by the government-affiliated China Academy of Information and Communications Technology (CAICT), 6.93 million units of international brands were shipped last month. This sharp rise occurred within the context of a broader market increase — total national mobile phone shipments for November reached 30.16 million units, representing a more modest overall year-on-year growth of 1.9%.

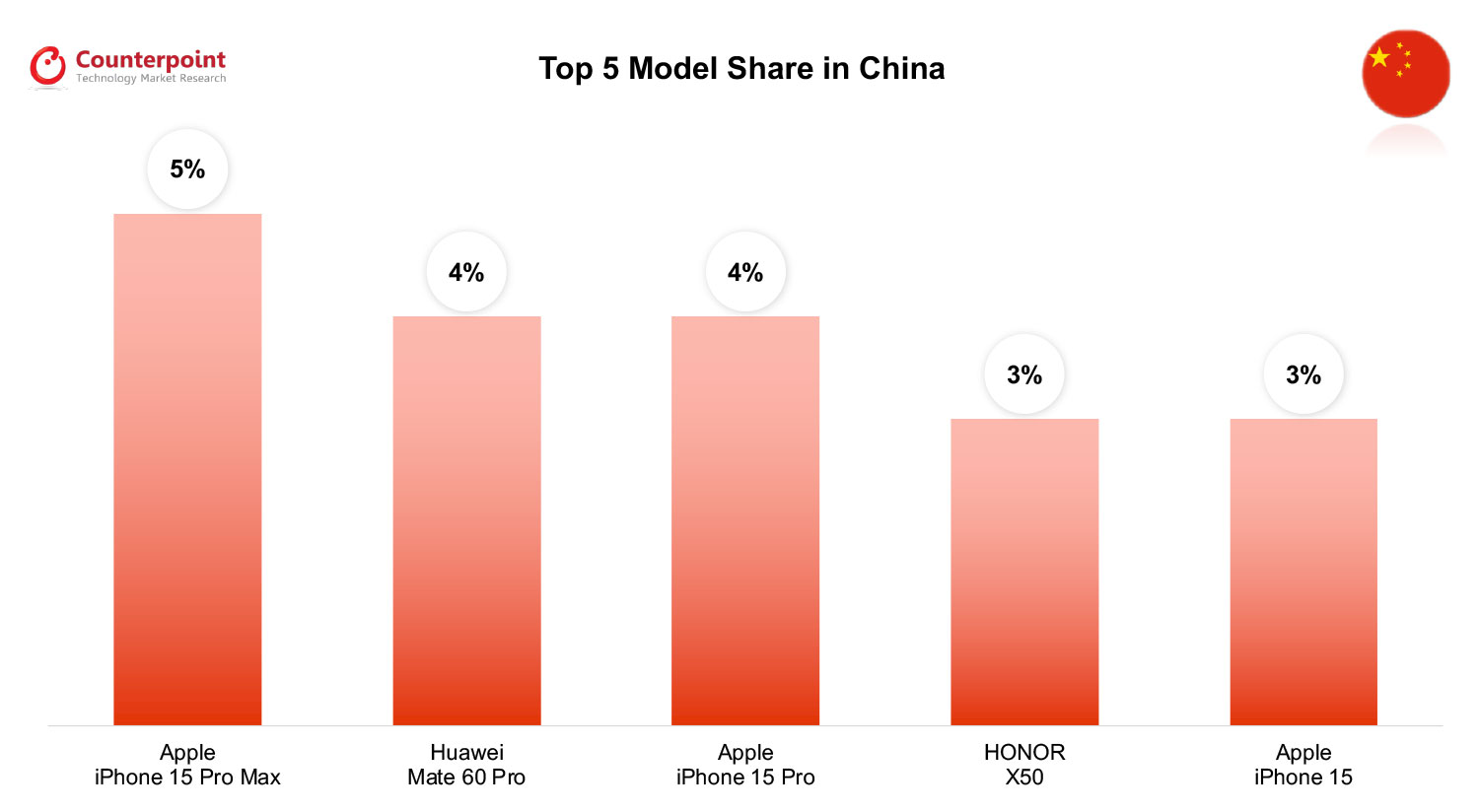

The exceptional increase in foreign branded phones is largely attributed to the robust reception of the new iPhone 17 series in the Chinese market. Reports indicate the iPhone 17 line accounted for a substantial portion of Apple’s sales during the period, successfully recapturing market share that had been lost to strong local competition, such as Huawei, throughout the year.

This marks a significant turnaround for Apple in China. In the first month after the iPhone 17 launch, sales reportedly jumped 22% compared to the iPhone 16 launch the previous year. The performance stands in stark contrast to previous periods in 2024 where Apple’s sales had faced challenges and decline due to intensified competition and market saturation. In October 2025, iPhones reportedly accounted for one in every four smartphones sold in China, their highest market share since 2022.

Meanwhile, domestic phone brands like Huawei and Xiaomi saw slower momentum as they delayed some new product launches. That gave Apple a wider sales window and helped foreign brands capture about 23% of the market, compared with roughly 10% in past months.

China brands account for eight of the top 10 global smartphone market share positions after Samsung and Apple.

………………………………………………………………………………………………………………………

https://counterpointresearch.com/en/insights/Global-Smartphone-Forecast-for-2025

IDC: Worldwide Smartphone Shipment +7.8% YoY; Samsung regains #1 position

Huawei forecast to increase mobile phone shipments despite Android ban

China’s mobile data consumption slumps; Apple’s market share shrinks-no longer among top 5 vendors

Mobile data demand is in a steep decline in China, the world’s largest 5G market by subscribers. China’s MIIT numbers released this week show per user data consumption (DOU) grew just 8.1% in the first half of the year. That compares to a 68% increase in 2019, the year that 5G licenses were issued. That fell to 13% in 2022 and 11% at end- 2023. Since then, there’s been a decrease in growth of nearly three percentage points in six months.

| Indicator name | unit | Cumulative from January to June | Year-on-year

Growth ( %) |

| Total volume of telecommunication business (at constant prices of the previous year) | 100 million yuan | 8992 | 11.1 |

| Operating income | 100 million yuan | 10712 | 2.8 |

| Including: Telecommunication business income | 100 million yuan | 8941 | 3.0 |

| Total call duration of fixed-line outgoing calls | 100 million minutes | 380 | -3.4 |

| Total mobile phone call duration | 100 million minutes | 10688 | -4.6 |

| Mobile SMS traffic | 100 million | 9407 | 0.5 |

| Mobile Internet access traffic | 100 million GB | 1604 | 12.6 |

| Average mobile Internet access traffic per household in the month (DOU) | GB/household · month | 18.15 | 8.1 |

| Note: 1. The duration of fixed-line outgoing calls and mobile phone calls includes the corresponding IP phone call duration.

2. Starting from February 2024, the 5G mobile Internet access traffic and the number of 5G mobile Internet users of China Radio and Television Network Group Co., Ltd. (hereinafter referred to as China Radio and Television) will be included in the industry summary data, and the data for the same period last year will be adjusted synchronously. |

|||

“While China has rapidly rolled out 5G and continues to perform well vs other markets, there is a limit to the number of people in the market that will engage in advanced data services; the slowdown in traffic growth is an indication that we could be reaching that limit,” according to GSMA.

Commercial 5G standalone (SA) networks, now present in seven APAC countries (Australia, India, Japan, the Philippines, Singapore, South Korea, and Thailand), will help fuel this growth, alongside 5G Advanced, RedCap and AI, creating opportunities to launch new 5G applications and kick start a fresh round in 5G investments for enterprises and consumers.

The authors of the report, GSMA Intelligence, expect 5G to add almost $130 billion to the Asia Pacific economy in 2030, with the manufacturing industry forecast to benefit the most, driven by new 5G-enabed applications including smart factories, smart-grids, and IoT-enabled products. Financial services and public administration are also expected to be big beneficiaries, as they turn to 5G to digitally transform services and operations. To help support this growth the GSMA today launched the GSMA APAC Fintech Forum, a new community programme to unite the connected fintech and commerce sectors with Asia Pacific’s mobile network operators through new technologies.

…………………………………………………………………………………………………………………………………………

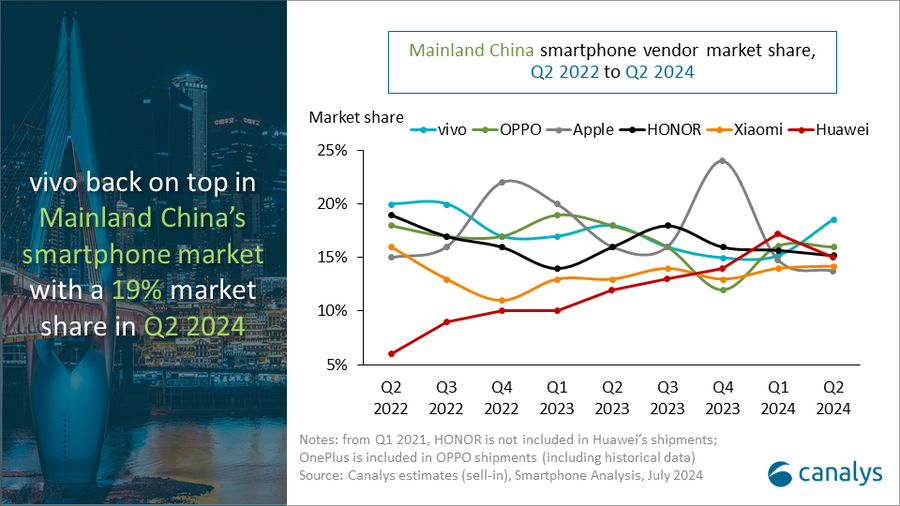

Meanwhile, Apple’s smartphone market share in China shrank by two percentage points in the second quarter of 2024 and the company is no longer one of the top vendors, according to data from market research firm Canalys. The decline underscores the difficulties the U.S. tech giant faces in its third-largest market.

Huawei’s smartphone shipments surged 41 per cent year on year in the the quarter, bolstered by the launch of its new Pura 70 series in April. Chinese smartphone vendors held the top five spots in the second quarter.

“It is the first quarter in history that domestic vendors dominate all the top five positions,” said Canalys Research Analyst Lucas Zhong. “Chinese vendors’ strategies for high-end products and their deep collaboration with local supply chains are starting to pay off in hardware and software features. HONOR’s latest Magic V3, which leverages GenAI, has significantly enhanced the user experience of foldable devices. Conversely, Apple is facing a bottleneck in mainland China. The vendor’s current channel strategy maintains a healthy inventory level and aims to stabilize retail prices and protect margins of channel partners. In the long term, the Chinese high-end market is ripe with opportunity. Local brands such as Huawei, HONOR, OPPO, and vivo are leading the way by incorporating technologies such as GenAI into products and services. Additionally, the localization of Apple’s Intelligence services in mainland China will be crucial in the next 12 months.”

People’s Republic of China (Mainland) smartphone shipments and annual growth

Canalys Smartphone Market Pulse: Q2 2024

|

Vendor |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

vivo |

13.1 |

19% |

11.4 |

18% |

15% |

|

OPPO |

11.3 |

16% |

11.4 |

18% |

-1% |

|

HONOR |

10.7 |

15% |

10.3 |

16% |

4% |

|

Huawei |

10.6 |

15% |

7.5 |

12% |

41% |

|

Xiaomi |

10.0 |

14% |

8.6 |

13% |

17% |

|

Others |

14.8 |

21% |

15.1 |

24% |

-2% |

|

Total |

70.5 |

100% |

64.3 |

100% |

10% |

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments. |

|||||

References:

https://www.miit.gov.cn/gxsj/tjfx/txy/art/2024/art_e2f06366bb134479a40cf4cf86445b1e.html

https://canalys.com/newsroom/china-smartphone-market-Q2-2024

https://www.lightreading.com/5g/slowing-mobile-numbers-cast-doubt-on-gsma-s-buoyant-forecasts

GSMA: China’s 5G market set to top 1 billion this year

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

IDC: Worldwide Smartphone Shipment +7.8% YoY; Samsung regains #1 position

According to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, global smartphone shipments increased 7.8% year over year to 289.4 million units in the first quarter of 2024 (1Q24). This marks the third consecutive quarter of smartphone shipment growth, a strong indicator that a recovery is well underway.

“As expected, smartphone recovery continues to move forward with market optimism slowly building among the top brands,” said Ryan Reith, group vice president with IDC’s Worldwide Mobility and Consumer Device Trackers. “While Apple managed to capture the top spot at the end of 2023, Samsung successfully reasserted itself as the leading smartphone provider in the first quarter. While IDC expects these two companies to maintain their hold on the high end of the market, the resurgence of Huawei in China, as well as notable gains from Xiaomi, Transsion, OPPO/OnePlus, and vivo will likely have both OEMs looking for areas to expand and diversify. As the recovery progresses, we’re likely to see the top companies gain share as the smaller brands struggle for positioning.”

“The smartphone market is emerging from the turbulence of the last two years both stronger and changed,” said Nabila Popal, research director with IDC’s Worldwide Tracker team. “Firstly, we continue to see growth in value and average selling prices (ASPs) as consumers opt for more expensive devices knowing they will hold onto their devices longer. Secondly, there is a shift in power among the Top 5 companies, which will likely continue as market players adjust their strategies in a post-recovery world. Xiaomi is coming back strong from the large declines experienced over the past two years and Transsion is becoming a stable presence in the Top 5 with aggressive growth in international markets. In contrast, while the Top 2 players both saw negative growth in the first quarter, it seems Samsung is in a stronger position overall than they were in recent quarters.”

| Top 5 Companies, Worldwide Smartphone Shipments, Market Share, and Year-Over-Year Growth, Q1 2024 (Preliminary results, shipments in millions of units) | |||||

| Company | 1Q24 Shipments | 1Q24 Market Share | 1Q23 Shipments | 1Q23 Market Share | Year-Over-Year Change |

| 1. Samsung | 60.1 | 20.8% | 60.5 | 22.5% | -0.7% |

| 2. Apple | 50.1 | 17.3% | 55.4 | 20.7% | -9.6% |

| 3. Xiaomi | 40.8 | 14.1% | 30.5 | 11.4% | 33.8% |

| 4.Transsion | 28.5 | 9.9% | 15.4 | 5.7% | 84.9% |

| 5. OPPO | 25.2 | 8.7% | 27.6 | 10.3% | -8.5% |

| Others | 84.7 | 29.3% | 79.0 | 29.4% | 7.2% |

| Total | 289.4 | 100.0% | 268.5 | 100.0% | 7.8% |

| Source: IDC Quarterly Mobile Phone Tracker, April 15, 2024 | |||||

Notes:

• Data are preliminary and subject to change.

- Company shipments are branded device shipments and exclude OEM sales for all vendors.

- The “Company” represents the current parent company (or holding company) for all brands owned and operated as a subsidiary.

- Figures represent new shipments only and exclude refurbished units.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS52032524

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

Huawei reports 1% YoY revenue growth in 3Q-2023; smartphone sales increase in China

Huawei’s comeback: 2023 revenue approaches $100B with smart devices gaining ground

Huawei expects to report revenue exceeding 700 billion yuan ($98.5 billion) for 2023, according to comments from rotating deputy chairman Ken Hu in an internal new year message seen by Reuters.

Mr. Hu Houkun (Ken Hu), Huawei’s deputy chairman Photo Credit: Huawei

That optimistic forecast offers further evidence that Huawei is rebounding after U.S. sanctions starting in 2019 crippled some of its business lines by restricting access to critical global technologies such as advanced chips.

“Thanks to our partners across the value chain for standing with us through thick and thin. And I’d also like to thank every member of the Huawei team for embracing the struggle – for never giving up,” Hu said.

“After years of hard work, we’ve managed to weather the storm. And now we’re pretty much back on track.”

“In 2023, we expect to wrap up the year with over 700 billion yuan [US$98.9 billion] in revenue,” he added. That would be a 9% increase on sales from 2022, when the comparable rate of global telecom revenue growth was less than 1%.

Indeed, 2023 has been a very difficult year for telecom network equipment makers such as Ericsson and Nokia. Ericsson’s revenues for the first nine months fell 7% on a constant-currency basis. Nokia’s were down 3%.

…………………………………………………………………………………………………….

What sectors might be responsible for the 9% sales growth Huawei expects this year? From the first paragraph of Ken Hu’s commentary.

“Our ICT infrastructure business has remained solid, and results from our device business surpassed expectations. Both our digital power and cloud businesses are growing steadily, and our intelligent automotive solutions have become significantly more competitive.”

Huawei’s improvement might be due to the upbeat performance of its devices business which includes smartphones and smartwatches. In 2020, the company’s consumer unit accounted for about 54% of all Huawei’s revenues, but its sales halved the following year. It was badly hurt by sanctions because smartphones have a greater need than networks do for advanced chips. Huawei was also cut off from Google software that runs on other Android smartphones. Its response to all this included the sale of Honor, a big smartphone subsidiary.

This past August, Huawei launched its Mate 60 series of smartphones, which are believed to be powered by a domestically developed chipset. The release was widely viewed as marking Huawei’s comeback into the high-end smartphone market after years of struggling under U.S. sanctions.

Huawei’s smartphone shipments surged 83% in October year-on-year, helping the overall Chinese smartphone market to grow 11% over the same period, according to Counterpoint Research which wrote:

Huawei’s success and climb in the rankings has been helped by the recent launch of its Mate 60 series 5G phones and popularity of its older P-series 4G devices. “The company is posting some very good growth numbers, but obviously there’s base effects happening,” notes China analyst Archie Zhang. “We expect it will grow by more than half this year, but that still doesn’t bring them close to pre-COVID levels. But it’s signalling a promising 2024.”

Huawei’s smartwatch business is doing very well. Counterpoint’s Woojin Son wrote:

“There is significant value in examining the growth drivers of the global smartwatch market in Q3 2023. Amid a global economic slowdown, most consumer device markets like smartphones are still experiencing stagnation compared to a year ago. In contrast, the smartwatch market has recorded YoY growth for two consecutive quarters in both premium and budget segments. Notably, High-level Operating System (HLOS)* smartwatches, typically featuring higher specification and price, have grown largely driven by Huawei in Q3 2023 as the company posted its highest quarterly performance ever. Most of this surge occurred in the Chinese domestic market, coupled with the launch of new Huawei 5G smartphones.”

……………………………………………………………………………………………………………………..

Looking ahead to 2024, Huawei said in the letter the device business would be one of the major business lines it would focus on for expansion. “Our device business needs to double down on its commitment to developing best-in-class products and building a high-end brand with a human touch,” the letter said.

Missing from Hu’s remarks was any reference to Huawei’s profits, which plummeted 69% last year, to just RMB35.6 billion ($1 billion).

Huawei watchers will probably have to wait until the publication of its 2023 annual report for an update. For sure, the company is cutting costs. “We will continue to streamline HQ, simplify management, and ensure consistent policy, while making adjustments where necessary,” said Huawei’s chairman.

Yet the company will likely continue to ramp up R&D spending. RMB161.5 billion ($22.8 billion) was spent on R&D in 2022, about a quarter of total revenues and a 13% year-over-year increase. Expect a similar increase for 2023 and 2024.

References:

Singles Day Growth Boosts Odds of China Market Smartphone Recovery in Q4 2023

Global Smartwatch Market Rebounds; Huawei and Fire-Boltt Hit New Peaks

Huawei reports 1% YoY revenue growth in 3Q-2023; smartphone sales increase in China

Huawei reported a flat third quarter, with sales of 145.7 billion Chinese yuan ($19.9 billion), up just 1% over last year and a net profit margin of 16.0%. The Shenzhen based telecom equipment and mobile phone vendor said the profit margin had been boosted by the latest tranche from the sale of the Honor handset assets three years ago. It said improved efficiencies and optimized sales and product strategies had also had a positive impact on profitability.

“The company’s performance is in line with forecast,” said Ken Hu, Huawei’s Rotating Chairman. “I’d like to thank our customers and partners for their ongoing trust and support. Moving forward, we will continue to increase our investment in R&D to make the most of our business portfolio and take the competitiveness of our products and services to new heights. As always, our goal is to create greater value for our customers, partners, and society.”

Huawei reported growth in the consumer business unit and “strong growth” in the new digital power and cloud businesses, but the company was silent on its carrier equipment unit, its largest, suggesting it has also been hit by the decline in operator spending.

Huawei smartphone summary:

Huawei was the fastest-growing smartphone maker in China in the third quarter after the company released a smartphone with a surprisingly advanced chip inside.

- In September, Huawei launched the Mate 60 Pro in China. It’s equipped with an advanced chip and 5G connectivity, technology that U.S. sanctions had been designed to stop Huawei getting its hands on.

- The success of that device helped Huawei’s smartphone sales in China grow 37% year on year, according to a report from Counterpoint Research.

- Sales of Honor, the largest smartphone maker by market share, rose just 3% year on year. Vivo, Oppo and Apple all saw double-digit declines, according to Counterpoint Research.

References:

https://www.huawei.com/en/news/2023/10/businessresults-threequarters

https://www.lightreading.com/5g/huawei-reports-no-real-growth-in-q3

https://www.lightreading.com/5g/huawei-lifts-handset-outlook-wins-1b-in-5g-orders

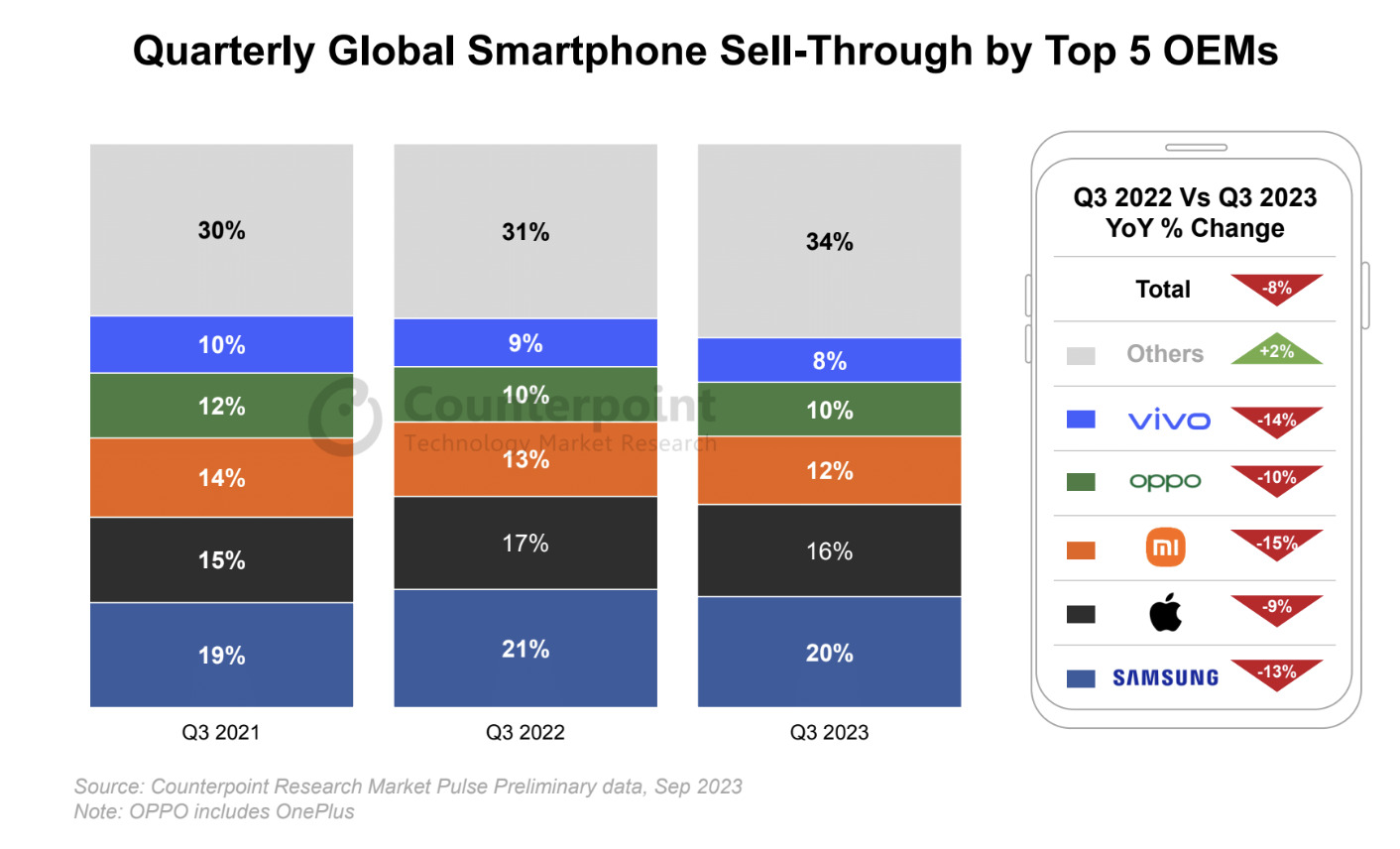

Counterpoint Research: Global Smartphone Market Reaches its Lowest Q3 Levels in a Decade

Global sales of smartphones fell 8% in the third quarter from a year earlier amid a “slower-than-expected recovery in consumer demand,” with both Apple and Samsung losing market share to competing brands during the period, according to Counterpoint Research. Highlights:

- Global smartphone sell-through declined 8% YoY but grew 2% QoQ in Q3 2023.

- Samsung led the market but declined YoY to reach its lowest quarterly level in the last decade.

- A shorter period of iPhone 15 availability in Q3 led to a shift in demand to the next quarter.

- The top five brands’ cumulative share declined in Q3 as challengers’ share grew.

- HONOR, Huawei and Transsion Group were among the only top brands to record YoY growth

The July-September sales figure represented the lowest third-quarter level in a decade, the technology market research firm said, noting that year-over-year global smartphone sales have now fallen for nine consecutive quarters.

However, Counterpoint expects that trend of declines to come to a “halt” in the fourth quarter, as sales benefit from the full impact of the recently launched iPhone 15, the festival season in India, the 11.11 Singles’ Day holiday in China, Christmas, and end-of-year promotions later in the quarter. Counterpoint noted that third-quarter sales were up from the second quarter and that a good performance in September despite the limited availability of the new iPhones provides reason for optimism.

Global market leader Samsung saw its share of the global smartphone market drop to 20% in the third quarter from 21% a year earlier, as sales fell 13%. Apple’s share of the global smartphone market also fell 1 percentage point, to 16%, as its sales declined 9%.

The top five global brands — which also include Chinese smartphone makers Xiaomi, OPPO, and Vivo — made up a combined 64% of the global smartphone market in the third quarter of 2023, down from about 68% in 2022 and 2021, according to Counterpoint’s data. The Chinese companies recorded even steeper smartphone sales declines than Samsung and Apple as they “worked towards strengthening their positions in key markets like China and India while continuing to slow down expansionary efforts in overseas markets,” the report noted.

HONOR, Huawei and Transsion Group gained share and were among the only brands to record YoY growth in Q3. Huawei grew driven by the launch of the Mate 60 series in China, while HONOR’s growth was led by strong overseas performance. Transsion brands continued to expand while also benefiting from the recovery in the Middle East and Africa (MEA) market.

MEA was the only region to record YoY growth in Q3, owing to improvements in macroeconomic indicators. Most developed markets, like North America, Western Europe and South Korea, recorded steep declines. However, we expect most developed markets to grow in Q4 largely due to the delayed effect of the iPhone launch.

Following a strong September, we expect the momentum to continue till the year-end, beginning with the full impact of the iPhone 15 series along with the arrival of the festive season in India, followed by the 11.11 sales event in China and ending with the Christmas and end-of-year promotions across regions. In Q4 2023, we expect the market to halt its series of YoY declines.

However, the market is expected to decline for the full year of 2023, reaching its lowest level in the decade largely due to a shift in device replacement patterns, particularly in developed markets. Notably, the recovery of emerging markets before the global market and the growth of brands outside of the top five indicate the shifting dynamics and opportunities in the global smartphone market.

About Counterpoint Research:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

References:

Global Smartphone Market Reaches its Lowest Q3 Levels in a Decade; Apple’s Share at 16%

Omdia: Global smartphone shipments decline in 2Q23 for 8th consecutive quarter

GfK: Global telecom market (x-North America) posts 9.7% revenue drop; smartphone revenues -10.2% in 2022

IDC: Global smartphone market will remain challenged through 1st half of 2023

Omdia: Global smartphone shipments decline in 2Q23 for 8th consecutive quarter

According to Omdia, smartphone shipments totaled 265,9 million units in the second quarter of 2023. This represents a decline of 9.5% compared to the previous year and a decrease of 1.2% compared to the previous quarter. This is the eighth consecutive quarter of year-on-year decline in overall smartphone shipments.

The three largest OEMs, Apple, Samsung and Xiaomi, all saw their shipments fall more than 10% from 2Q22 to 2Q23.

Samsung had the most shipments in 2Q23, reporting 53.3 million shipments. This is a 11.5% dip from 1Q23, following the release of the S23-series, but more worryingly is a 14.3% fall year-on-year. This result follows the weak demand for mid/low-end smartphones due to the ongoing economic recession, and sales of Samsung’s Galaxy A series significantly declining. Despite this, Samsung smartphones maintained its market share of 20%, and its position as the largest player in the smartphone industry.

Apple had a big quarter-on-quarter fall following a successful 1Q23 for its iPhone 14 series. It recorded 43.2 million shipments, a 24.6% fall from 1Q23 and a 11.7% fall year-on-year from 2Q22. As such, Apple’s market share has fallen back down to its usual level for the second quarter of each year, at 16%. While it previously seemed that Apple was more resilient to the negative down-winds of the economy, it has now begun to feel the squeeze.

“Apple has strong sales of premium models such as the iPhone 14 Pro and Pro Max, while the standard and Plus models sluggish sales compared to their predecessors. Normally, from the second quarter, the standard model should drive up the overall quantity, but this year it is different. Demand for Pro and Pro Max is increasing, especially among high-income consumers.” said Jusy Hong, Senior Research Manager at Omdia.

Xiaomi’s shipments continue to fall globally, falling to 33.2 million, a 15.7% fall year-on-year – from 39.4 million in 2Q22. It still occupies the third spot globally but is facing stiff competition from other Chinese OEMs Oppo and vivo. The weak Indian market remains a problem for Xiaomi, as their biggest market. However, it is further establishing itself in Western Europe, something many other Chinese brands have failed to do.

Oppo Group (including OnePlus) recorded 25.0 million shipments in 1Q23, a fall of 10.5% from the previous year. This fall isn’t as far as Xiaomi’s and as a result, Xiaomi’s lead over Oppo Group has diminished from 11.5 million in 2Q22 to just 8.3 million in 2Q23.

Transsion Holding has recorded a combined total of 24.5 million – a 38.4% increase year-on-year from the 17.7 million shipped in 2Q22. This pushes Transsion Holdings ahead of vivo to be the fifth largest smartphone OEM in 2Q23, coming after a period of long stagnation as it was digesting the inventories from 1Q23. Its efforts to expand into more markets is also proving successful.

Zaker Li, Omdia Principal Analyst says, ‘The main reason for the increase in shipments was that Transsion completed inventory adjustment in the first quarter this year and increased supply of new products from 2Q. Transsion is targeting the low-end smartphone market in more countries in Asia and Oceania.’

Hong concludes: “The smartphone industry remains in a slump, and we are expecting the market to contract year-on-year until 3Q23. But there is hope for a recovery in the fourth quarter this year. Apple and Samsung have both faced challenges and have revised their targets down as a result. But these problems will ease come the end of the year and into 2024. Inflation and the resulting squeeze on wage packets and the economy is already easing globally, and high inventory levels is already being tackled by many OEMs. The growing popularity of recycled smartphones is hindering the growth of new smartphone shipments. In particular, it is the main reason for the recent decline in demand in the mid-range smartphone market. Overall shipment forecasts for this year have been revised down over the past several months. However, we expect the smartphone shipments will also recover as the economy recovers.”

References:

IDC: Global smartphone market will remain challenged through 1st half of 2023

GfK: Global telecom market (x-North America) posts 9.7% revenue drop; smartphone revenues -10.2% in 2022

Omdia and IDC: Samsung regains lead in global smartphone market

Trendforce: Global Smartphone Market to Reach 1.36 Billion Units in 2021 as Samsung regains #1 position

Counterpoint & Canalys: Global Smartphone Market Shows Signs of Recovery in Q3-2020

Huawei forecast to increase mobile phone shipments despite Android ban

According to the China media outlet STN, Huawei has raised its mobile phone shipment target for 2023 to 40 million units. Huawei had set this target at 30 million units at the beginning of the year. In this regard, a relevant person from Huawei told the “Securities Daily” reporter that this adjustment is a normal (shipment) target adjustment. That projected increase in mobile phone sales comes despite the ban preventing Huawei from using the Android OS. Instead, Huawei uses its home made HarmonyOS which is based upon micro kernel based distributed system whereas Android OS is based upon Linux kernel at its core.

People close to Huawei said that the current sales of Huawei smartphones are improving, and the recent sales of P60, MateX3 and other mobile phones are relatively satisfactory. “We have indeed raised our mobile phone shipment target for this year. But the specific number is inconvenient to disclose.”

A person in the supply chain said, “Huawei set its mobile phone shipment target for this year at 30 million units at the beginning of the year. As sales rebounded and market demand increased, Huawei recently adjusted its mobile phone shipment target to 40 million units this year, an increase of over 30%. ”

“If the news is true, it means that Huawei has confidence in the company’s mobile phone shipments in 2023. According to market research firm Omdia, Huawei’s mobile phone shipments in 2022 will be 28 million units,

“The shipment target for this year has been raised by nearly 43%.” A market source who did not want to be named told the reporter. That’s in sharp contrast to the global mobile phone market, which Omdia said declined 12.7% in Q1-2023. Samsung sales contracting 18% and Xiaomi’s falling by 22%. Despite the large year-on-year fall Samsung has experienced, it still had the most shipments in 1Q23, reporting 60 million shipments. It has seen a small 3.2% rise in shipments compared to the previous quarter.

Omdia noted Huawei’s quarterly sales had dipped sequentially in the last two quarters but, thanks to a year of growth from Q4 2021 to Q3 2022, the company “is still in a better position now versus a year ago.”

Huawei ranks tenth on Omdia’s list of global handset vendors with just 2% of the market. Honor, the mid and low-end smartphone brand it sold off two years ago, has a 4% share.

Industry insiders believe that if Huawei raises its shipment target, it is also related to its product market performance. Counterpoint data shows that in the first quarter of 2023, Huawei’s domestic smartphone shipments bucked the trend and increased by 41%, with a domestic market share of 9.2%, a year-on-year increase of 3 percentage points.

“Huawei’s folding screen mobile phone shipments have continued to increase this year and the supply is in short supply. Therefore, Huawei needs to increase its stocking.” Yang Siliang, a partner of Zhou Yan Consulting, said in an interview with a reporter from the “Securities Daily.”

Source: Karlis Dambrans on Flickr, CC 2.0

…………………………………………………………………………………………………………………………………………………………….

Meanwhile in its core carrier equipment business, Huawei continues to dominate the Chinese market. It has just won 7.9 billion Chinese yuan (US$1.1 billion) in orders from China Mobile in China’s largest telecom tender so far this year. Huawei was the dominant supplier in both parts of the tender, which was divided into 2.6GHz and 4.9GHz on one side and 700MHz gear on the other. Huawei was awarded contracts to supply just over half of the 64,000-basestation deployment, worth CNY3.76 billion ($530 million).

For China Mobile’s joint rollout with China Broadnet in the 700MHz band, Huawei won contracts for half of the 23,140 basestations with a total value of around CNY1.74 billion ($243 million), local website C114 calculated.

ZTE won the second largest volume of orders, worth CNY2.1 billion ($294 million), followed by Ericsson with CNY630 million ($88 million), Datang Mobile with CNY550 million ($77 million) and Nokia Bell with CNY400 million ($56 million).

References:

IDC: Global smartphone market will remain challenged through 1st half of 2023

An updated forecast for the worldwide smartphone market from International Data Corporation (IDC) is showing a more prolonged recovery than previously expected. According to the latest Worldwide Quarterly Mobile Phone Tracker forecast, shipments of smartphones will decline 9.1% in 2022, a reduction of 2.6 percentage points from the previous forecast. As a result, IDC expects smartphone shipment volumes to total 1.24 billion units in 2022. While a recovery of 2.8% is still anticipated in 2023, IDC did reduce its 2023 smartphone forecast by roughly 70 million units, given the ongoing macroeconomic environment and its overall impact on demand.

“We believe the global smartphone market will remain challenged through the first half of 2023, with hopes that recovery will improve around the middle of next year and growth across most regions in the second half,” said Ryan Reith, group vice president with IDC’s Worldwide Mobility and Consumer Device Trackers. “Rising costs are an obvious concern for the smartphone market and adjacent consumer technology categories, but we believe most of this reduced demand will be pushed forward and will support global growth in late 2023 and beyond. A device refresh cycle continues to build in many challenged emerging markets while developed markets have offset rising costs with increased promotional activity, more attractive trade-in offers, and extended financing plans. This has supported growth in the high-end of the market despite the economic headwinds.”

5G continues to build out globally and will account for just over half of smartphones shipped worldwide in 2022, rising to 80% by 2026. In addition, market momentum continues to build around foldable phones. While this category is only about 1-2% of the global market in 2022, it still accounts for roughly 15-16 million smartphones. This number will only grow as costs decrease and more OEMs get behind the form factor transition.

“Despite the market slowdown, average selling prices (ASPs) continue to grow as consumers opt for premium devices that can last three to four years as refresh rates elongate in both developed and emerging markets,” said Anthony Scarsella, research director with IDC’s Worldwide Mobility and Consumer Device Trackers. “Smartphone ASPs are expected to grow for the third consecutive year as average selling prices will reach $413, up 6.4% from $388 in 2021. The last time the market witnessed ASPs surpass $400 was in 2011 ($425), when the market displayed over 60% shipment growth. Moreover, iOS unit share will reach 18.7% (the highest of any forecast year), which is a driving force behind the high ASP growth we currently see in 2022.”

| Worldwide Smartphone Forecast by OS, 2023 and 2026 Shipments, Year-Over-Year Growth, and 5-Year CAGR (shipments in millions) | |||||

| OS | 2023 Shipments | 2023/2022 Growth | 2026 Shipments | 2026/2025 Growth | 5-Year CAGR |

| Android | 1036.9 | 3.1% | 1145.7 | 2.5% | 0.4% |

| iOS | 233.5 | 1.3% | 247.5 | 1.9% | 1.0% |

| Total | 1270.3 | 2.8% | 1393.2 | 2.3% | 0.5% |

| Source: IDC Quarterly Mobile Phone Tracker, December 2nd, 2022 | |||||

IDC previously lowered its 2022 smartphone outlook in June, from an initial expectation of 1.6% growth in the space.

Broadly, the global sale of smartphones this year has been affected by a variety of macroeconomic trends including rising costs. For wireless network operators, that means fewer sales of smartphones and fewer opportunities to gain new customers who might switch providers amid the purchase of a new phone.

The trend could also affect 5G specifically. That’s because consumers globally may be holding onto 4G phones longer in order to avoid the purchase of a costly 5G phone.

IDC’s latest forecast follows similar warnings from other players in the space. For example, Qualcomm last month provided a revenue forecast fully $2 billion below market estimates. Qualcomm supplies core silicon to the likes of Apple, Samsung and others.

At the time, Qualcomm also reduced its projections for global 5G handset sales in 2022 to around 650 million, down from earlier forecasts of up to 750 million units

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Kathy Nagamine at 650-350-6423 or [email protected].

Click here to learn about IDC’s full suite of data products and how you can leverage them to grow your business.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,300 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS49927022

IDC: Global Smartphone Shipments +7.4% in 2021, led by Emerging Markets

Omdia and IDC: Samsung regains lead in global smartphone market

Trendforce: Global Smartphone Market to Reach 1.36 Billion Units in 2021 as Samsung regains #1 position

Counterpoint & Canalys: Global Smartphone Market Shows Signs of Recovery in Q3-2020

Musk’s SpaceX and T-Mobile plan to connect mobile phones to LEO satellites in 2023

During a live media event Thursday afternoon, T-Mobile’s Mike Sievert and SpaceX’s Elon Musk announced a new partnership that’s intended to connect T-Mobile sold phones to a new constellation of SpaceX’s Starlink satellites. The result, according to the companies, will be the elimination of all cellular dead zones around the U.S.

“It’s a lot like putting a cellular tower in the sky,” Sievert said, adding that the “vast majority” of T-Mobile’s existing phones would be supported by the service. Meaning, customers will not need to purchase new phones in order to connect them to Starlink’s second-generation satellites.

Sievert said that T-Mobile expects to offer the service for no additional charge on its more expensive plans. For customers on its cheaper plans, he said they may need to pay an additional monthly charge in order to be able to access satellite coverage.

Starlink’s satellites will use T-Mobile’s mid-band spectrum to create a new network. Most phones used by the company’s customers will be compatible with the new service, which will start with texting services in a beta phase beginning by the end of next year. The companies did not say when it might launch commercially.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/WSL6VTEO3FONZGAOYYYFER22AU.jpg)

T-Mobile CEO Mike Sievert at a joint news conference at Space X facility in Brownsville, TX

REUTERS/Adrees Latif

SpaceX has launched nearly 3,000 low-Earth-orbiting (LEO) Starlink satellites since 2019, handily outpacing rivals OneWeb and Amazon.com Inc’s Project Kuiper. Starlink recently suffered a major setback when the FCC rejected the company’s application for almost $900 million in government subsidies. The agency ruled that Starlink’s service likely wouldn’t be able to meet the agency’s speed and service requirements.

SpaceX’s next-generation Starlink satellites, the first of which are planned to launch on SpaceX’s next-generation Starship rocket whenever it is fully developed, will have larger antennae that will allow connectivity directly to mobile phones on the T-mobile network, Musk said.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/D53NNDMLVVKBDL27U25YAODCXA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VX32JK5RMZMCHJKYGKRH3TNOMU.jpg)

SpaceX Starbase, in Brownsville, Texas, U.S., August 25, 2022. REUTERS/Adrees Latif

Meanwhile, U.S telecom firms are in a race to build up the mid-band portion of their 5G networks to catch up with T-Mobile, which bagged a chunky 2.5 GHz of mid-band spectrum thanks to a buyout of rival Sprint.

Mid-band or C-Band has proven to be perfect for 5G, as it provides a good balance of capacity and coverage. T-Mobile said it aims to pursue voice and data coverage after the texting services beta phase.

Others in the Mix:

Satellite communications firm AST SpaceMobile Inc is also building a global cellular broadband network in space that will operate with mobile devices without the need for additional hardware. AST SpaceMobile is relying on SpaceX’s rockets to get its satellites into orbit, having pivoted away from a plan to use Russian rockets after Russia’s invasion of Ukraine.

“Elon [Musk] and Mike [Sievert, of T-Mobile] helped the world focus attention on the huge market opportunity for SpaceMobile, the only planned space-based cellular broadband network,” AST SpaceMobile CEO Abel Avellan wrote on LinkedIn yesterday. “BlueWalker 3 … is scheduled for launch within weeks!”

Meanwhile, Verizon and AT&T each have their own satellite plans: Verizon plans to use Amazon’s planned Project Kuiper satellites to connect its rural cell towers to the Internet, and AT&T is planning a similar setup with OneWeb’s own growing constellation of low-Earth orbit (LEO) satellites.

In 2020, AT&T agreed to let startup AST SpaceMobile use its Band 5 spectrum to test transmissions from its BlueWalker 1 satellite to devices on the ground. AST SpaceMobile is now hoping to launch its new BlueWalker 3 prototype later next month. However, as reported by SpaceNews, supply chain issues delayed the launch of AST SpaceMobile’s first operational satellite by about six months, to late 2023.

AST SpaceMobile’s main rival, Lynk, already has one operational satellite in orbit for phone connections. As noted by Ars Technica, the company is hoping to receive FCC approval to offer satellite-to-phone services across 35 countries by the end of this year.

“Elon said it’s hard, and it’s only been done in the lab, but Lynk has done it in space already,” Lynk’s Charles Miller told the publication yesterday. “We’re the only company in the world that has done that.”

Lynk hasn’t yet announced an agreement with a major U.S. network operator, though it has agreements with a number of international operators. Lynk tested its services in the U.S. with Smith Bagley, a tiny wireless network operator offering services under the Cellular One brand in East Arizona.

“There are significant regulatory hurdles to clear, as the FCC is reviewing SpaceX’s request to launch a constellation of 30,000 Gen2 satellites, while other LEO proposals including Amazon’s Project Kuiper (with whom Verizon is collaborating) and AST SpaceMobile (financial backing from Vodafone and a commercial agreement with AT&T) are also working DC as well as international agencies to put some rules in place for this latest chapter of the Space Race,” Raymond James analysts wrote in a note to investors.

References:

UPDATE: Apple iPhone 14 text messages via Globalstar LEO satellites starting Nov 2022: