smartphones

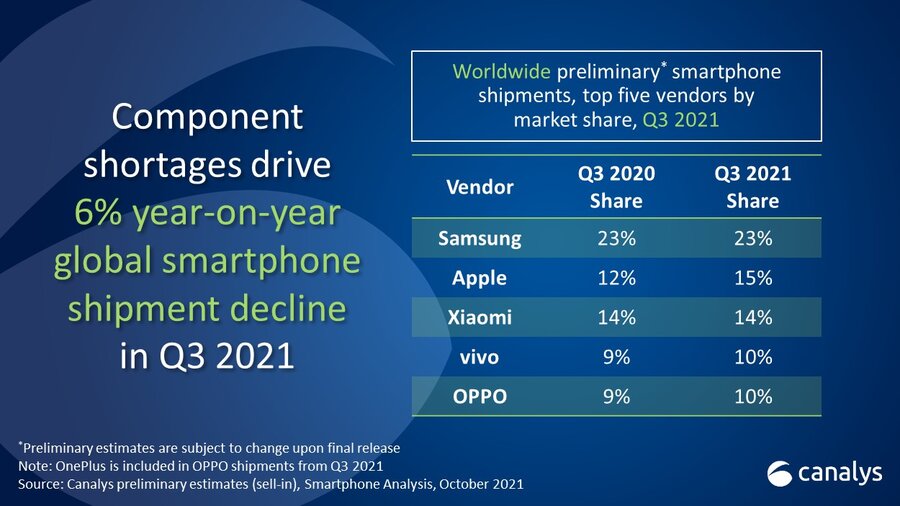

Canalys: Global Smartphone Shipments Fell 6% in 3Q-2021; Samsung Still #1

According to a new report by market tracker Canalys, global smartphone shipments fell 6 per cent in the third quarter (July-September period) this year, as vendors struggled to meet demand for devices amid component shortages. That decline comes after shipments increased by 12% in the second quarter of 2021.

- Samsung was the leading smartphone player with 23 per cent share.

- Apple regained second place in the global smartphone market with 15 per cent share in the third quarter (Q3) this year, thanks to strong early demand for iPhone 13.

- Xiaomi took 14 per cent share for the third place, while Vivo and Oppo completed the top five with 10 per cent share each.

“The chipset famine has truly arrived,” said Canalys Principal Analyst, Ben Stanton. “The smartphone industry is striving to maximize production of devices as best it can. On the supply side, chipset manufacturers are increasing prices to disincentivize over-ordering, in an attempt to close the gap between demand and supply. But despite this, shortages will not ease until well into 2022. As a result of this, as well as high costs of global freight, smartphone brands have reluctantly pushed up device retail pricing.”

“At the local level, smartphone vendors are also having to implement last-minute changes in device specification and order quantities. It is critical for them to do this and maximize volume capacity, but unfortunately it does lead to confusion and inefficiency when communicating with retail and distributor channels,” continued Stanton. “Many channels are nervous heading into important sales holidays, such as Singles’ Day in China, and Black Friday in the west. Channel inventories of smartphones are already running low, and as more customers start to anticipate these sales cycles, the impending wave of demand will be impossible to fulfill. Customers should expect smartphone discounting this year to be less aggressive. But to avoid customer disappointment, smartphone brands which are constrained on margin should look to bundle other devices, such as wearables and IoT, to create good incentives for customers.”

References:

https://www.canalys.com/newsroom/canalys-global-smartphone-market-Q3-2021

Canalys 2Q-2021 smartphone rankings show big gains for Xiaomi and OPPO

Canalys 2Q-2021 smartphone rankings show big gains for Xiaomi and OPPO

Telecom, IT and cloud market research firm Canalys, said that global smartphone shipments increased by 12% in the second quarter of 2021. Samsung still maintains its position as the world’s number one with a market share of 19%. Xiaomi’s mobile phone sales surpassed Apple’s and rose to the second place in the world for the first time, with a share of 17%. Apple ranked third with 14%. OPPO and Vivo ranked fourth and fifth in the world, with a market share of 10%.

Xiaomi’s growth rate is as high as 83%, making it the top five mobile phone brand with the fastest growth rate in market share. Lei Jun, the founder and CEO of Xiaomi, sent three consecutive Weibo messages to express his congratulations to Xiaomi, and at the same time released the “Open Letter to Xiaomi Students.” Lei Jun said that Xiaomi’s becoming the second ranked global smartphone vendor is a major milestone in the history of Xiaomi’s development.

In the third quarter of 2014, Xiaomi entered the top three in the world for the first time, and then encountered huge difficulties, and soon fell out of the top five in the world. In 2020, the launch of Xiaomi Mi 10 series will fully launch the development of Xiaomi mobile phones. In the high-end journey, in the third quarter of the same year, Xiaomi returned to the third place in the world. Only two quarters later, Xiaomi was promoted to the second place in the world.

Lei Jun also said that “the second in the world” is a major victory for Xiaomi’s strategy. In August last year, Xiaomi established its core strategy for the next ten years-mobile phone X AIoT, once again clarifying the core position of the smartphone business, progressing to promote intelligent interconnection, and the AIoT business will build a smart life around the core business of mobile phones. At the same time, it has established the “three iron laws” that will never change: technology-oriented, cost-effectiveness-oriented, and making the coolest products.

About Xiaomi:

Xiaomi is an electronics company based in Beijing, China. It was founded by Lei Jun in April 2010, and in 2014, Xiaomi was the largest smartphone company in China. Today, Xiaomi is one of the top five smartphone vendors in the world.

The “MI” in their logo stands for “Mobile Internet.” It also has other meanings, including “Mission Impossible”, because Xiaomi faced many challenges that had seemed impossible to defy in our early days.

…………………………………………………………………………………………………………………………………………

Meanwhile, Canalys said that OPPO ranked first among Android smartphone manufacturers. In addition to launching 5G phones in the full price range to meet the different needs of consumers, OPPO has been actively taking the lead in applying new technologies to its latest models.

Canalys wrote that in Middle East and Africa, OPPO has climbed to fourth place in market share with a 106% year-on-year growth. The United Arab Emirates and Saudi Arabia have been at the forefront of this rise, witnessing a 196% and a 218% year-on-year growth respectively which was attributed to OPPO’s innovative product offering and strong customer service. In addition, OPPO saw a year-on-year growth of 79% in Egypt.

Ethan Xue, President of OPPO MEA said, “We are proud to see our innovative products and customer-centric approach being well received and reflected in these promising figures. Our growth in the MENA region is phenomenal and illustrates the strong customer base we have that support us and understand our brand mission, technology for mankind, kindness for the world. At OPPO, we continue to push the boundaries and our growth only serves to motivate us even more to offer our customers the best possible products at competitive prices.”

The main proponent of the brands growth is strong product launches that closely align with the evolving demands of smartphone users. Earlier this month, OPPO launched the anticipated Reno6 series, comprising of three variations, the Reno6 Pro 5G, Reno6 5G, and the Reno6 Z 5G that have all been masterfully designed for trendsetting individuals, game enthusiasts and the young at heart. From stunning design details to powerful features, the Reno6 series is already proving to be popular in the region, with a 300% pre-order increase compared to its predecessor, solidifying the demand for the technology brand in MENA.

About OPPO:

OPPO is headquartered in Dongguan, China an has been a leading global technology brand since 2004, dedicated to providing products that seamlessly combines art and innovative technology.

OPPO says they’re on a mission to building a multiple-access smart device ecosystem for the era of intelligent connectivity. The smartphone devices have simply been a gateway for OPPO to deliver a diverse portfolio of smart and frontier technologies in hardware, software and system. In 2019, OPPO launched a $7 Billion US Dollar three-year investment plan in R&D to develop core technologies furthering design through technology.

For the last 10 years, OPPO has focused on manufacturing smartphones with camera capabilities that are second to none. OPPO launched the first mobile phone, the Smile Phone, in 2008, which marked the launch of the brand’s epic journey in exploring and pioneering extraordinary technology. Over the years, OPPO has built a tradition of being number one, which became a reality through inventing the world’s first rotating camera smartphone way back in 2013, launching the world’s then thinnest smartphone in 2014, being the first to introduce 5X Zoom ‘Periscope’ camera technology and developing the first 5G commercial smartphone in Europe.

OPPO is currently ranked as the number four smartphone brand globally. OPPO brings the aesthetics of technology of global consumers through the ColorOS system Experience, and Internet service like OPPO Cloud and OPPO+.

OPPO’s business covers 40 countries with over six research institutes and five R&D centers across the world, from San Francisco to Shenzhen. OPPO also opened an International Design Centre headquartered in London, driving cutting edge technology that will shape the future not only for smartphones but for intelligent connectivity.

References:

https://min.news/en/tech/5f2410bda155bbec25c819b98c454623.html

NEW for 3Q2021 Rankings:

IDC: Global Smartphone Shipments +7.4% in 2021, led by Emerging Markets

IDC forecasts that global smartphone shipments are set to increase by 7.4% this year, marking a return to growth after the Covid-19 pandemic hit the industry in 2020, according to new analyst figures. IDC estimates worldwide smartphone shipments at 1.37 billion units in 2021, which represents “minimal growth” compared with pre-pandemic 2019. Its data for 2019 shows shipments of 1.372 billion, then a 5.9% decline to 1.29 billion the following year. Making comparisons with 2019 (pre-COVID) gives a more accurate picture of the state of the market.

The 7.4% growth can be attributed to a healthy 13.8% growth from iOS devices combined with 6.2% growth from Android. Although COVID-19 drastically impacted 2020 shipments, 2021 shipments have managed to display minimal growth compared to 2019 (pre-pandemic) volumes, giving us a more accurate view of the state of the market. The world’s largest markets – China, the United States, and Western Europe – will still be down from 2019, but growing markets such as India, Japan, the Middle East, and Africa are fueling the recovery.

“The smartphone market was better prepared from a supply chain perspective heading into 2020 given almost all regions were expecting to grow and vendors were preparing accordingly,” said Ryan Reith, group vice president with IDC’s Mobility and Consumer Device Trackers. “2020 was a bust due to the pandemic but all of the top brands continued forward with their production plans with the main difference that the timeline was pushed out. Therefore, we are at a point where inventory levels are much healthier than PCs and some other adjacent markets and we are seeing the resilience of consumer demand in recent quarterly results.”

5G shipments continue to be a primary driver of 2021 growth as both vendors and channels focus on 5G devices that carry a significantly higher average selling price (ASP) than older 4G devices. The ASP of a 5G smartphone will reach $634 in 2021, which is flat from $632 in 2020. However, 4G devices continue to witness a massive price decline as the ASP drops to $206, representing a nearly 30% decline from last year ($277). As a result, the total 5G shipment volume will grow to 570 million units, up 123.4% from last year.

China will continue to lead the smartphone market with 47.1% of the 5G global market share, followed by the USA at 16%, India at 6.1%, and Japan at 4.1%. By the end of 2022, 5G units are expected to make up more than half of all smartphone shipments with a 54.1% share.

“Despite the ongoing issues surrounding the pandemic and the Delta variant, consumers are continuing to upgrade to more premium smartphones this year,” said Anthony Scarsella, research director, Mobile Phones at IDC. “Premium smartphones (priced at $1000+) continued to grow in the second quarter as the segment displayed 116% growth from last year. Moreover, ASPs across the entire market climbed 9% as buyer preferences trend towards more costly 5G models than entry-level devices.”

Closing Comment: We don’t share IDC’s enthusiastic forecast for 5G smartphones, because they do not support any new features, applications or use cases without a 5G SA core network. As 95% of deployed 5G networks are NSA (requiring a 4G anchor/core network), 5G smartphones that use 5G NSA networks are only a little faster [1.] than 4G-LTE phones with no noticeable improvement in latency. Also, there’s no roaming, so users must fall back to 4G-LTE when outside of their 5G carrier serving area. Mobile subscribers will soon realize that and stop buying 5G smartphones.

Note 1. PC magazine has tested smartphones on 5G networks from AT&T, T-Mobile, and Verizon. Their report Fastest Mobile Networks 2021 found that T-Mobile’s new mid-band 5G network is the only U.S. nationwide 5G that’s markedly faster than 4G

…………………………………………………………………………………………………………………………………….

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Kathy Nagamine at 650-350-6423 or [email protected].

References:

https://www.idc.com/getdoc.jsp?containerId=prUS48194821

https://www.idc.com/tracker/showproductinfo.jsp?containerId=IDC_P8397

https://www.pcmag.com/news/fastest-mobile-networks-2021

https://techblog.comsoc.org/2021/08/22/juniper-research-5g-smartphone-trends/

Juniper Research: 5G smartphone trends

A new study by Juniper Research has found that 5G‑compatible smartphones will account for over 50% of smartphone sales revenue by 2025; rising to $337 billion from $108 billion in 2021. It urged mobile handset vendors to ensure hardware maximizes the benefits of future mobile cloud computing solutions. Mobile cloud computing enables service providers to offload intensive tasks to the cloud; freeing on-device resources for essential device processes.

The new research, 5G Smartphones: Trends, Regional Analysis & Market Forecasts 2021-2026, predicts that successful handset vendors will include radios that are able to process large bandwidths and ultra-low latency to ensure that handset users are able to use cloud computing services efficiently, whilst remaining price competitive.

Android OS Handsets to Dominate in Emerging Regions

The report anticipates that increasing the availability of lower-tier 5G smartphones is crucial to propagate 5G handset adoption in emerging markets. It predicts that by 2025, global Android smartphone prices will be 65% lower than global iOS smartphone prices. It also highlights that this lower average cost of Android devices will lead to Android dominating 5G handset markets in regions such as Latin America.

Conversely, the research expects that the enduring popularity of iOS devices in developed markets will make 40% of global 5G smartphone revenue attributable to North America and Europe by 2025.

Development of 5G Handsets:

It is likely that the smartphone market will not see meaningful growth until another significant upgrade becomes available to the majority of consumers, not just those capable of purchasing high-end premium handsets. In addition to developments such as foldable handsets and biometrics, smartphone manufacturers are anticipating that the widespread introduction of 5G handsets will serve to reinvigorate the market, in the same way that the introduction of 4G in 2010 boosted the sales of OEMs, such as HTC and Samsung.

‘Right-to-Repair’ Laws to Impact Shipments

The report warns that long-term 5G smartphone shipment revenue will be limited by impending ‘right-to-repair’ legislation in North America and Europe, as more handset users choose to repair older models rather than upgrading to newer generation devices.

Research author Adam Wears explained:

‘The effect of these laws will not be felt initially, as consumers adopt 5G smartphones to leverage the high speeds and reduced latency of 5G networks. Hardware vendors must use this opportunity to build out new device capabilities to encourage consumers to continue regularly upgrading and avoid churn to competitors.’

References:

https://www.juniperresearch.com/document-library/white-papers/how-to-monetise-future-5g-services

https://www.juniperresearch.com/researchstore/devices-technology/5g-smartphones-research-report

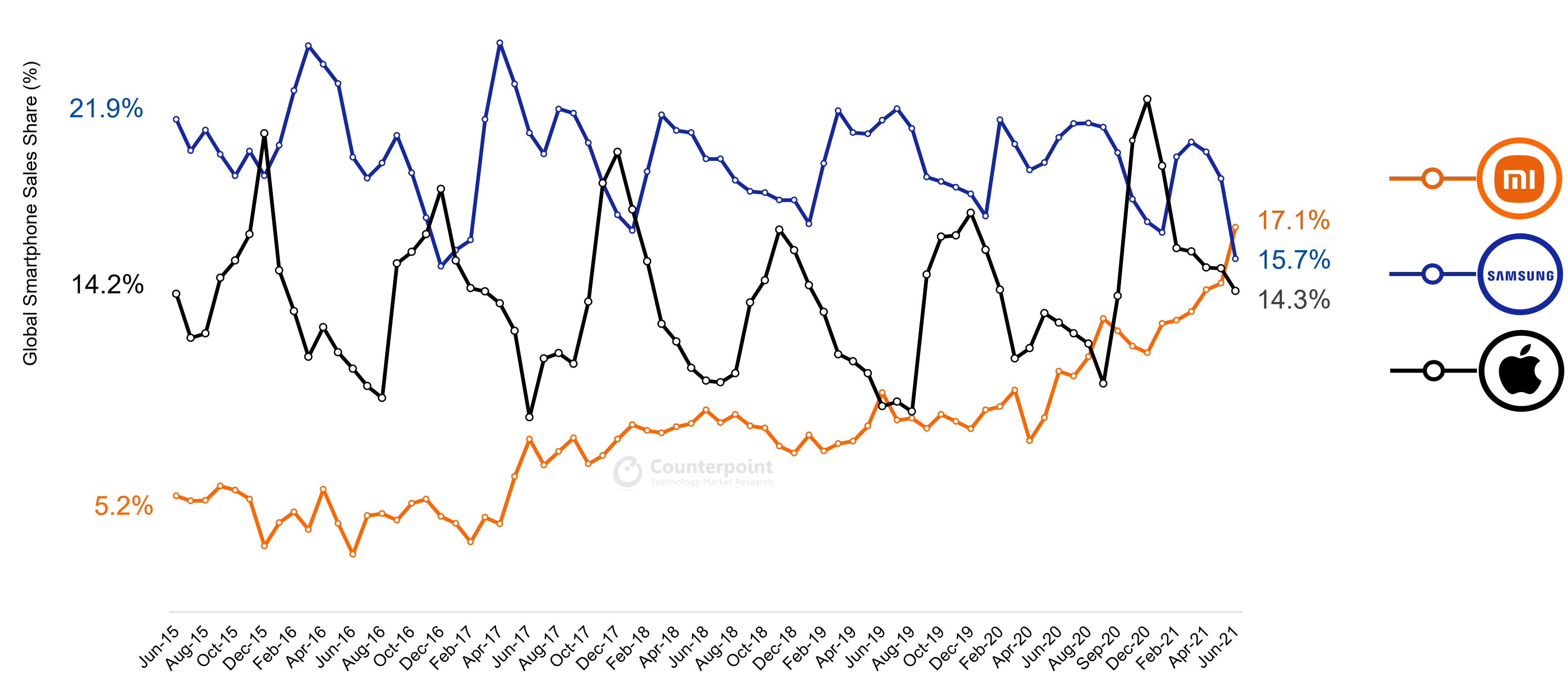

Counterpoint: Xiaomi #1 in global smart phone sales for 1st time

Chinese smartphone maker Xiaomi surpassed Samsung and Apple in June 2021 after a 26% month-on-month increase in sales to become the number one smartphone brand in the world for the first time ever, according to Counterpoint Research’s monthly Market Pulse Service.

Xiaomi was also the number two brand globally for Q2 2021 in terms of sales, and cumulatively, has sold close to 800 million smartphones since its inception in 2011, the report underlined.

Research Director Tarun Pathak noted that Xiaomi has been on a war footing to fill the gap created by the decline of Huawei.

“Ever since the decline of Huawei commenced, Xiaomi has been making consistent and aggressive efforts to fill the gap created by this decline. The OEM has been expanding in Huawei’s and HONOR’s legacy markets like China, Europe, Middle East and Africa. In June, Xiaomi was further helped by China, Europe and India’s recovery and Samsung’s decline due to supply constraints.” Pathak wrote.

Senior Analyst Varun Mishra stated, “China’s market grew 16% MoM in June driven by the 618 festival, with Xiaomi being the fastest growing OEM, riding on its aggressive offline expansion in lower-tier cities and solid performance of its Redmi 9, Redmi Note 9 and the Redmi K series. At the same time, due to a fresh wave of the COVID-19 pandemic in Vietnam, Samsung’s production was disrupted in June, which resulted in the brand’s devices facing shortages across channels. Xiaomi, with its strong mid-range portfolio and wide market coverage, was the biggest beneficiary from the short-term gap left by Samsung’s A series.” the COVID-19 pandemic in Vietnam, Samsung’s production was disrupted in June, which resulted in the brand’s devices facing shortages across channels. Xiaomi, with its strong mid-range portfolio and wide market coverage, was the biggest beneficiary from the short-term gap left by Samsung’s A-series,” Mishra commented on Samsung’s performance.

Going forward, the market research firm expects Samsung’s production to be affected if the situation in Vietnam does not improve while Xiaomi will continue to gain share from the Korean brand.

Exhibit: Global Monthly Smartphone Sales Share Trends (%)

Some of our other smartphone market analyses for Q2 2021:

- Apple Achieves Record June Quarter Shipments, Xiaomi Becomes the Second-Largest Smartphone Brand Globally

- India Smartphone Market Stays Resilient During Second COVID-19 Wave, Crosses 33 Million Shipments

- China Smartphone Market Sees Lowest Q2 Sales Since 2012; vivo Leads as Huawei Plummets

- Podcast: How Xiaomi, Qualcomm are Delivering 5G, AI-based Experiences to Consumers

- Q2 2021: Europe Smartphone Market’s Bumpy Road to Recovery

- MEA Smartphone Market Sees Best Q2 on Record; Samsung Leads but TECNO, Xiaomi Close Gap

- Chinese Players Capture Half of Vietnam Smartphone Market in Q2 2021

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (Technology, Media and Telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

References:

Monthly Pulse: Xiaomi Becomes #1 Smartphone Brand Globally for First Time Ever

Qualcomm’s designing custom CPU’s for dominance in laptop markets; CEO: “We will go big in China”

Qualcomm’s new CEO believes that by next year his company will supply CPU chips for laptop makers competing with Apple. Last year, the Cupertino, CA based company introduced laptops using a custom-designed central processor chip that boasts longer battery life. Longtime processor suppliers Intel Corp and Advanced Micro Devices have no chips as energy efficient as Apple’s.

Qualcomm Chief Executive Cristiano Amon told Reuters on Thursday he believes his company can have the best chip on the market, with help from a team of chip architects who formerly worked on the Apple chip but now work at Qualcomm. In his first interview since taking the top job at Qualcomm, Amon also said the company is also counting on revenue growth from China to power its core smartphone chip business despite political tensions.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RRPGOKG4OVID5I2WPBB3GWCY2Q.jpg)

“We will go big in China,” he said, noting that U.S. sanctions on Huawei Technologies Co Ltd (HWT.UL) give Qualcomm an opportunity to generate a lot more revenue.

Amon said a cornerstone of his strategy comes from a lesson learned in the smartphone chip market: It was not enough just to provide modem chips for phones’ wireless data connectivity. Qualcomm also needed to provide the brains to turn the phone into a computer, which it now does for most premium Android devices.

Now, as Qualcomm looks to push 5G connectivity into laptops, it is pairing modems with a powerful central processor unit, or CPU, Amon said. Instead of using computing core blueprints from longtime partner ARM Ltd, as it now does for smartphones, Qualcomm concluded it needed custom-designed chips if its customers were to rival new laptops from Apple.

As head of Qualcomm’s chip division, Amon this year led the $1.4 billion acquisition of startup, whose ex-Apple founders help design some those Apple laptop chips before leaving to form the startup. Qualcom will start selling Nuvia-based laptop chips next year.

“We needed to have the leading performance for a battery-powered device,” Amon said. “If ARM, which we’ve had a relationship with for years, eventually develops a CPU that’s better than what we can build ourselves, then we always have the option to license from ARM.”

ARM is in the midst of being purchased by Nvidia Corp for $40 billion, a merger that Qualcomm has objected to with regulators.

Amon said Qualcomm has no plans to build its own products to enter the other big market for CPUs – data centers for cloud computing companies. But it will license Nuvia’s designs to cloud computing companies that want to build their own chips, which could put it in competition with parts of ARM.

“We are more than willing to leverage the Nuvia CPU assets to partner with companies that are interested as they build their data center solutions,” Amon said.

Smartphone chips accounted for $12.8 billion of its $16.5 billion in chip revenue in its most recent fiscal year. Some of Qualcomm’s best customers, such as phone maker Xiaomi Corp are in China.

Qualcomm is counting on revenue growth as its Android handset customers swoop in on former users of phones from Huawei, which was forced out of the handset market by Washington’s sanctions.

Kevin Krewell, principal analyst at TIRIAS Research, called it a “political minefield” due to rising U.S.-China tensions. But Amon said the company could do business as usual there.

“We license our technology – we don’t have to do forced joint ventures with technology transfers. Our customers in China are current with their agreements, so you see respect for American intellectual property,” he said.

Another major challenge for Amon will be hanging on to Apple as a customer. Qualcomm’s modem chips are now in all Apple iPhone 12 models after a bruising legal battle. Apple sued Qualcomm in 2017 but eventually dropped its claims and signed chip supply and patent license agreements with Qualcomm in 2019. Apple is now designing chips to displace Qualcomm’s communications chips in iPhones.

“The biggest overhang for Qualcomm’s long-term stock multiple is the worry that right now, it’s as good as it gets, because they’re shipping into all the iPhones, but someday, Apple will do those chips internally,” said Michael Walkley, a senior analyst at Canaccord Genuity Group.

Amon said that Qualcomm has decades of experience designing modem chips that will be hard for any rival to replicate and that the void in the Android market left by Huawei creates new revenue opportunities for Qualcomm.

Another challenge for Amon, a gregarious executive who is energetic onstage during keynote presentations, will be that Qualcomm is not well known to consumers in the way that Intel or Nvidia are, even in Qualcomm’s hometown.

“I flew into San Diego and got an Uber driver at the airport and told him I was going to Qualcomm. He said, ‘You mean the stadium?'” Krewell said, referring to the football arena formerly home to the San Diego Chargers.

Amon has started a new branding program for the company’s Snapdragon smartphone chips to try to change that. “We have a mature smartphone industry today. People care what’s behind the glass,” he said.

References:

https://www.reuters.com/technology/qualcomms-new-ceo-eyes-dominance-laptop-markets-2021-07-01/

Omdia and IDC: Samsung regains lead in global smartphone market

The global smartphone market climbed 28.1% year on year to reach total shipments of 351.1 million units in the first quarter of 2021, according to preliminary data from Informa owned Omdia. That gain consolidates the smartphone market’s recent recovery after it posted its first annual growth since Q3 2019 in the final quarter of 2020. However, Omdia said 2021 is set to be a year of transition with Huawei’s role continuing to change, LG exiting the market and a severe semiconductor shortage affecting sales.

Samsung took over the top spot from Apple in the first 3 months of 2021, shipping 76.1 million units, up 29.2 percent year on year, to reach 22 percent of the market. The company was able to increase shipments by 22.8 percent from Q4 2020 thanks in part to an early update to the Galaxy S line as well as the launch of its latest range of devices in the A series.

Apple followed its blockbuster Q4 2020 with another significant year on year growth of 46.5% to reach 56.4 million units shipped in the quarter, equivalent to 16% of the market, followed in third place by Xiaomi with 14% after shipping 49.5 million units, up 78.3% year on year.

Two more Chinese smartphone brands – Oppo and Vivo – continue to battle for fourth and fifth place in the global rankings and remain tied on 11 percent of the market. Vivo shipped 38.2 million units, just above the 37.8 million units Oppo shipped in Q1.

Year on year, Vivo grew shipments by 95.9 percent and Oppo by 85.3 percent, as they overtook Huawei, which slipped out of the top 5 global smartphone OEM ranking after shipping 14.7 million units, some 70 percent less than in Q1 2020, not including the 3.6 million units shipped by its sub-brand Honor, which is now an independent entity.

Top 10 Shipments per manufacturer

| Rank | OEM | 1Q21 | 4Q20 | 1Q20 | QoQ | YoY | |||

| Shipment (m) | M/S | Shipment (m) | M/S | Shipment (m) | M/S | ||||

| 1 | Samsung | 76.1 | 22% | 62.0 | 16% | 58.9 | 21% | 22.8% | 29.2% |

| 2 | Apple | 56.4 | 16% | 84.5 | 22% | 38.5 | 14% | -33.3% | 46.5% |

| 3 | Xiaomi | 49.5 | 14% | 47.2 | 12% | 27.8 | 10% | 4.9% | 78.3% |

| 4 | vivo | 38.2 | 11% | 34.5 | 9% | 19.5 | 7% | 10.7% | 95.9% |

| 5 | Oppo | 37.8 | 11% | 34.0 | 9% | 20.4 | 7% | 11.1% | 85.3% |

| 6 | Huawei | 14.7 | 4% | 33.0 | 9% | 49.0 | 18% | -55.5% | -70.0% |

| 7 | Motorola | 12.6 | 4% | 9.8 | 3% | 5.5 | 2% | 28.6% | 128.1% |

| 8 | Realme | 11.4 | 3% | 14.3 | 4% | 6.1 | 2% | -20.3% | 86.9% |

| 9 | Tecno | 8.2 | 2% | 7.7 | 2% | 3.5 | 1% | 6.5% | 133.4% |

| 10 | LG | 6.8 | 2% | 8.4 | 2% | 5.4 | 2% | -18.9% | 26.2% |

| Others | 41.3 | 12% | 46.4 | 12% | 41.1 | 15% | -11.0% | 0.6% | |

| Total | 353.0 | 100% | 381.8 | 100% | 275.7 | 100% | -7.5% | 28.1% | |

Gerrit Schneemann, principal analyst at Omdia commented: “The smartphone market continues to show resiliency in the face of multiple challenges. The global component supply shortage is looming large over the market. On the other hand, two well-known smartphone brands will disappear from the global smartphone market this year, in Huawei and LG, opening the door for other brands to reach new markets and buyers.”

……………………………………………………………………………………………………………………………………..

Separately, International Data Corporation (IDC) said that the smartphone market accelerated in the first quarter of 2021 (1Q-2021) with 25.5% year-over-year shipment growth.

According to preliminary data from the (IDC) Worldwide Quarterly Mobile Phone Tracker, smartphone vendors shipped nearly 346 million devices during the quarter. The strong growth came from all regions with the greatest gains coming from China and Asia/Pacific (excluding Japan and China). As the two largest regions globally, accounting for half of all global shipments, these regions experienced 30% and 28% year-over-year growth, respectively.

“The recovery is proceeding faster than we expected, clearly demonstrating a healthy appetite for smartphones globally. But amidst this phenomenal growth, we must remember that we are comparing against one of the worst quarters in smartphone history,1Q20, the start of the pandemic when the bulk of the supply chain was at a halt and China was in full lockdown,” said Nabila Popal, research director with IDC’s Worldwide Mobile Device Trackers. “However, the growth is still very real; when compared to two years ago (1Q19), shipments are 11% higher. The growth is coming from years of repressed refresh cycles with a boost from 5G. But above all, it is a clear illustration of how smartphones are becoming an increasingly important element of our everyday life – a trend that is expected to continue as we head into a post-pandemic world with many consumers carrying forward the new smartphone use cases which emerged from the pandemic.”

As the smartphone market is recovering, a major shift is happening in the competitive landscape. Huawei is finally out of the Top 5 for the first time in many years, after suffering heavy declines under the increased weight of U.S. sanctions. Taking advantage of this are the Chinese vendors Xiaomi, OPPO, and vivo, which all grew share over last quarter landing them in 3rd, 4th, and 5th places globally during the quarter with 14.1%, 10.8%, and 10.1% share, respectively. All three vendors are increasing their focus in international markets where Huawei had grown its share in recent years. In the low- to mid-priced segment, it is these vendors that are gaining the most from Huawei’s decline, while most of the high-end share is going to Apple and Samsung. Samsung regained the top spot in 1Q21 with impressive shipments of 75.3 million and 21.8% share. The new S21 series did well for Samsung, mainly thanks to a successful pricing strategy shaving off $200 from last year’s flagship launch. Apple, with continued success of its iPhone 12 series, lost some share from their very strong holiday quarter but still shipped an impressive 55.2 million iPhones grabbing 16.0% share.

“While Huawei continues its decline in the smartphone market, we’ve also learned that LG is exiting the market altogether,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers. “Most of LG’s volume was in the Americas with North America accounting for over 50% of its volume and Latin America another 30%. Despite the vendor losing ground in recent years, they still had 9% of the North America market and 6% of Latin America. Their exit creates some immediate opportunity for other brands. With competition being more cutthroat than ever, especially at the low-end, it is safe to assume that 6-10 brands are eyeing this share opportunity.”

| Top 5 Smartphone Companies, Worldwide Shipments, Market Share, and Year-Over-Year Growth, Q1 2021 (shipments in millions of units) | |||||

| Company | 1Q21 Shipment Volumes | 1Q21 Market Share | 1Q20 Shipment Volumes | 1Q20 Market Share | Year-Over-Year Change |

| 1. Samsung | 75.3 | 21.8% | 58.4 | 21.2% | 28.8% |

| 2. Apple | 55.2 | 16.0% | 36.7 | 13.3% | 50.4% |

| 3. Xiaomi | 48.6 | 14.1% | 29.5 | 10.7% | 64.8% |

| 4. OPPO | 37.5 | 10.8% | 22.8 | 8.3% | 64.5% |

| 5. vivo | 34.9 | 10.1% | 24.8 | 9.0% | 40.7% |

| Others | 94.1 | 27.2% | 103.0 | 37.4% | -8.7% |

| Total | 345.5 | 100.0% | 275.2 | 100.0% | 25.5% |

| Source: IDC Quarterly Mobile Phone Tracker, April 28, 2021 | |||||

Notes:

- Data are preliminary and subject to change.

- Company shipments are branded device shipments and exclude OEM sales for all vendors.

- The “Company” represents the current parent company (or holding company) for all brands owned and operated as a subsidiary.

- Figures represent new shipments only and exclude refurbished units.

……………………………………………………………………………………………………………………………………………

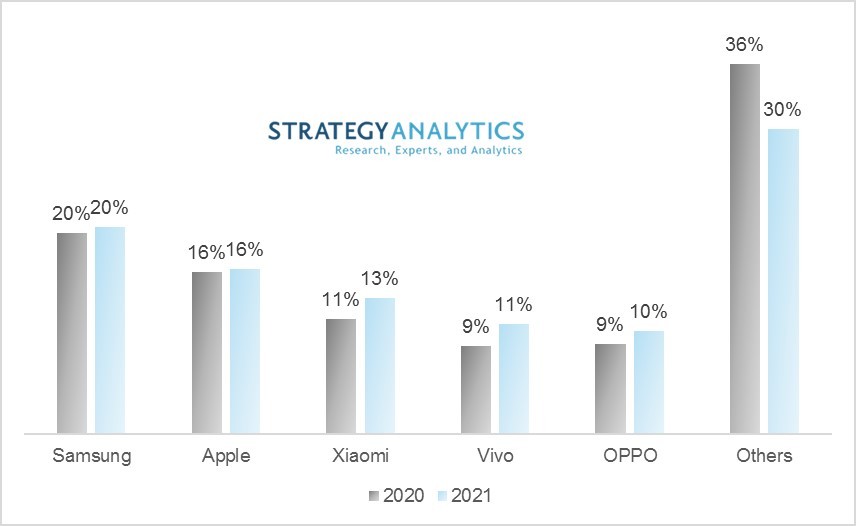

Closing Comment:

“Globally, the top five vendors combined took a 76% market share in Q1 2021, up from 71% a year ago. Chip shortages and supply side constraints did not have a significant impact in Q1 among the top 5 brands,” said Linda Sui, senior director, Strategy Analytics. Samsung’s newly launched A series 4G and 5G phones, and the earlier launched Galaxy S21 series combined drove solid performance in the quarter. Xiaomi maintained strong momentum in both India and China, and the expansion in Europe, Latin America and Africa region also started to bear fruit.

Note: Strategy Analytics said the global smartphone shipments were 340 million units in Q1 2021, up over 24% (year-on-year) representing the highest growth since 2015. The smartphone market rebound was driven by the healthy demand of consumers with aging devices and a phenomenal 5G push from Chinese smartphone vendors.

References:

https://omdia.tech.informa.com/pr/2021-apr/global-smartphone-market-grows-28

https://www.idc.com/getdoc.jsp?containerId=prUS47646721

https://www.idc.com/tracker/showproductinfo.jsp?containerId=IDC_P8397

Apple is new smartphone king, but market declined 5% in 4Q 2020

Apple doesn’t report unit sales for its devices. However, the company said revenue from iPhones grew by 17% in the fourth quarter of calendar 2020 on a year-over-year basis to $65.6 billion. Apple’s business is seasonal, and the quarter ending in December is usually the company’s biggest in terms of sales.

“The sales of more 5G smartphones and lower-to-mid-tier smartphones minimized the market decline in the fourth quarter of 2020,” said Anshul Gupta, senior research director at Gartner. “Even as consumers remained cautious in their spending and held off on some discretionary purchases, 5G smartphones and pro-camera features encouraged some end users to purchase new smartphones or upgrade their current smartphones in the quarter.”

Table 1. Worldwide Top 5 Smartphone Sales to End Users by Vendor in 4Q20 (Thousands of Units)

| Vendor | 4Q20

Sales |

4Q20 Market Share (%) | 4Q19

Sales |

4Q19 Market Share (%) | 4Q20-4Q19 Growth (%) |

| Apple | 79,942.7 | 20.8 | 69,550.6 | 17.1 | 14.9 |

| Samsung | 62,117.0 | 16.2 | 70,404.4 | 17.3 | -11.8 |

| Xiaomi | 43,430.3 | 11.3 | 32,446.9 | 8.0 | 33.9 |

| OPPO | 34,373.7 | 8.9 | 30,452.5 | 7.5 | 12.9 |

| Huawei | 34,315.7 | 8.9 | 58,301.6 | 14.3 | -41.1 |

| Others | 130,442.8 | 33.9 | 145,482.1 | 35.8 | -10.3 |

| Total | 384,622.3 | 100.0 | 406,638.1 | 100.0 | -5.4 |

Due to rounding, some figures may not add up precisely to the totals shown.

Source: Gartner (February 2021)

Full Year 2020 Results:

Samsung experienced a year-on-year decline of 14.6% in 2020, but this did not prevent it from retaining its No. 1 global smartphone vendor position in full year results. It faced tough competition from regional smartphone vendors such as Xiaomi, OPPO and Vivo as these brands grew more aggressive in global markets. In 2020, Apple and Xiaomi were the only two smartphone vendors of the top five ranking to experience growth.

Huawei recorded the highest decline among the top five smartphone vendors which made it lose the No. 2 position to Apple in 2020 (see Table 2). The impact of the ban on use of Google applications on Huawei’s smartphones was detrimental to Huawei’s performance in the year and negatively affected sales.

Table 2. Worldwide Top 5 Smartphone Sales to End Users by Vendor in 2020 (Thousands of Units)

| Vendor | 2020

Sales |

2020

Market Share (%) |

2019

Sales |

2019

Market Share (%) |

2020-2019

Growth (%) |

| Samsung | 253,025.0 | 18.8 | 296,194.0 | 19.2 | -14.6 |

| Apple | 199,847.3 | 14.8 | 193,475.1 | 12.6 | 3.3 |

| Huawei | 182,610.2 | 13.5 | 240,615.5 | 15.6 | -24.1 |

| Xiaomi | 145,802.7 | 10.8 | 126,049.2 | 8.2 | 15.7 |

| OPPO | 111,785.2 | 8.3 | 118,693.2 | 7.7 | -5.8 |

| Others | 454,799.4 | 33.7 | 565,630.0 | 36.7 | -19.6 |

| Total | 1,347,869.8 | 100.0 | 1,540,657.0 | 100.0 | -12.5 |

Due to rounding, some figures may not add up precisely to the totals shown.

Source: Gartner (February 2021)

“In 2021, the availability of lower end 5G smartphones and innovative features will be deciding factors for end users to upgrade their existing smartphones,” said Mr. Gupta. “The rising demand for affordable 5G smartphones outside China will boost smartphone sales in 2021.”

Counterpoint & Canalys: Global Smartphone Market Shows Signs of Recovery in Q3-2020

The global smartphone market contracted 4 percent year on year (YoY), but grew 32% in 3Q-2020 to 365.6 million units. The market was negatively impacted by the Covid pandemic, according to the latest report from Counterpoint Research. The recovery was driven by pent-up demand in key markets such as the US, India and Latin America, said the report, adding that easing lockdown conditions worldwide also helped to streamline the supply chain again.

All leading smartphone brands except Huawei posted sequential growth compared to the second quarter, with Samsung retaining the top spot with 79.8 million shipments, up 2 percent year on year and 47 percent quarter on quarter for a 22 percent market share. Huawei followed with shipments of 50.9 million, down 24 percent year on year and 7 percent sequentially for a 14 percent market share.

The quarter saw Xiaomi overtake Apple to capture the third spot for the first time with a 13 percent market share thanks to its highest-ever shipments of 46.2 million units in Q3. Xiaomi’s shipments were up 28 percent year on year and 35 percent compared to Q2 thanks to an impressive performance in China and rapid growth at Huawei’s expense in new markets like Latin America, Europe and the MEA.

Apple and Oppo rounded out the top 5 with market shares of 11 percent and 8 percent following third-quarter shipments of 41.7 and 31.0 million respectively. The biggest mover was Realme, with a sequential surge of 132 percent in shipments volume to rise to 7th spot thanks to a 4 percent market share, behind Vivo with 8 percent. The result means Realme became the world’s fastest brand to ship 50 million smartphone units since launching, according to the report.

Research Analyst Abhilash Kumar said, “Xiaomi reached its highest-ever shipments at 46.2 million units in Q3 2020. In China, Xiaomi’s struggle for growth ended and shipments were up 28% YoY and 35% QoQ. This impressive show by Xiaomi in China was driven by a series of campaigns and promotions during the brand’s decennial celebrations in August. Also, in new markets like LATAM, Europe and the MEA, Xiaomi’s share expanded rapidly at the expense of Huawei amid US-China trade sanctions. The brand is also performing well in Southeast Asian markets like Indonesia, Philippines and Vietnam.”

Commenting on realme’s performance, Kumar said, “Accumulative shipments of realme smartphones reached over 50 million units in Q3; with this, it became the world’s fastest brand to hit 50 million shipments since inception, surpassing top players such as Samsung, Apple, Huawei and Xiaomi. In Q3, realme grew to become one of the top 5, or even top 3, brands in its key markets, including India, Indonesia, Bangladesh, Philippines and some other Southeast Asian countries. Having released a strong 5G smartphone portfolio during Q3, realme also achieved a remarkable growth in the China market (90% QoQ in terms of sales volume). With its efforts to bring the affordable yet premium-like products to consumers, as well as its ability to offer smooth digital shopping and after-sales services in different countries, realme has emerged as the most resilient brand during and after the pandemic crisis. Additionally, we see realme’s expansion beyond smartphones into the IoT space. Products like smartwatches, TWS and smart TVs will further help the brand strengthen its position in the global market.”

Other Key Takeaways:

- Apple iPhone shipments declined 7% YoY during Q3 2020 as the company delayed its annual iPhone launch from Q3 to Q4. We expect Apple’s performance to bounce back in Q4 2020 with the launch of the 5G-powered iPhone 12 series.

- OnePlus grew 2% YoY and 96% QoQ driven by the strong performance of 8 series and the Nord in key markets like India and Western Europe.

- Huawei drove more than 40% of the total 5G shipments, thanks to strong performance in China.

- Motorola grew 37% QoQ and 4% YoY driven by strong performance in Latin America and the US-driven by the strong performance of E6 and G8 series.

- vivo has been performing well in overseas markets, especially in Southeast Asian countries like Indonesia and the Philippines, driven by its Y series. Like other brands, it has also entered the IoT segment, launching a smartwatch in September.

- OPPO is relying on operator partnerships to expand in European markets. Also, it is building partnerships with leading sports events to grow its influence across Europe.

…………………………………………………………………………………………………………………………………………………………………….

Separately, Canalys reported that worldwide smartphone shipments reached 348.0 million units in Q302020, at a 1% decline year on year. But they were up 22% on the previous quarter. Samsung regained the lead, up 2% to 80.2 million units. Huawei slipped into second place with a 23% fall to 51.7 million units. Xiaomi took third place for the first time, reaching 47.1 million units with 45% growth. Apple, which had no flagship iPhone launch in September, shipped 43.2 million, down 1%, while Vivo completed the top five, shipping 31.8 million units. Oppo came sixth, with 31.1 million units, while its sister brand Realme moved into seventh, its highest ever position, with 15.1 million units. Lenovo reported 10.2 million units, as it finally caught up with orders delayed due to disruption at its Wuhan factory, and Transsion shipped 8.4 million units as recovery started in its key African markets.

“Xiaomi executed with aggression to seize shipments from Huawei,” said Mo Jia, Analyst. “There was symmetry in Q3, as Xiaomi added 14.5 million units and Huawei lost 15.1 million. In Europe, a key battleground, Huawei’s shipments fell 25%, while Xiaomi’s grew 88%. Xiaomi took a risk setting high production targets, but this move paid off when it was able to fill channels in Q3 with high-volume devices, such as the Redmi 9 series. The vendor invested to bring in local expertise to gain the trust of distributors and carriers,” added Jia. “But it still faces competition from Oppo and Vivo, which have grown to cover a wide range of price bands in Southeast Asia, and are now driving into Europe too, where they are positioning as more premium options for carriers, and risk trapping Xiaomi at the low end. Realme is also becoming a serious contender, growing beyond ecommerce, and threatens to undercut Xiaomi as it transforms its go-to-market strategy.”

“Samsung suffered in Q2 due to its dependence on offline retail, but Q3 saw a major recovery,” said Canalys Analyst Shengtao Jin. “Its momentum was fueled by three key factors. Firstly, in many regions it saw pent-up demand from Q2 spill over into Q3. Secondly, it regained second place in India, as its Korean brand was shielded from anti-Chinese sentiment (see Canalys press release: India’s smartphone market rebounds in Q3 2020 to record high of 50 million). Thirdly, Samsung ramped up its launches of low-to-mid-range devices, and introduced other incentives, such as discounts and free online deliveries, to stimulate demand. Samsung is now positioning for more online sales as it launches exclusive online devices, such as the Galaxy F series for Flipkart. Despite its momentum, Samsung’s oversized portfolio is still the biggest pain point for the channel, which is reluctant to hand it more power.”

“This quarter was a welcome relief, with few restrictions on businesses and citizens between July and September,” said Ben Stanton, Senior Analyst. “But the ramifications of the first-half lockdowns still persist. Offline channels, for example, are being increasingly pared back, amid store closures and staff redundancies, and vendors now have to compete harder to attain floorspace. Limited supply of 4G chipsets will cause supply chain bottlenecks and increase production costs. Additionally, rising COVID-19 rates in regions such as Europe will soon force governments to bring back stricter nationwide measures. The second wave will stretch government stimulus budgets, and cause widespread bankruptcies and job losses in affected areas. Unfortunately, the relief of Q3 looks set to be short-lived.”

References:

https://www.canalys.com/newsroom/canalys-worldwide-smartphone-market-q3-2020

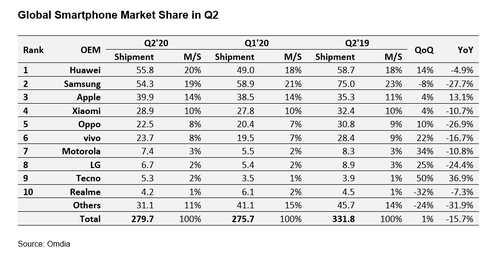

UPDATED: Huawei now #1 global smartphone vendor

Despite the severe U.S. restrictions on Huawei, the company has succeeded in taking the top spot in the global smartphone market, according to figures from Canalys. The market research firm estimates Huawei shipped more smartphones worldwide than any other vendor for the first time in Q2 2020, marking the first quarter in nine years that a company other than Samsung or Apple led the market.

Note, however, that global smartphone sales DECLINED in the second quarter. Huawei shipped an estimated 55.8 million devices in the quarter, down 5 percent year on year. Samsung came second with 53.7 million smartphones, down 30 percent from a year earlier.

Huawei’s resilience was due to its strong position in China, where its shipments rose 8 percent in Q2. This offset an estimated 27 percent fall in its shipments abroad. Canalys estimates over 70 percent of Huawei’s smartphone sales are now in mainland China. That helps explains why the company can be so successful in selling smartphones, despite not being able to use licensed Google Android and associated apps on its latest flagship devices (that’s because Huawei was placed on the U.S. Entity list last year).

Canalys said the situation would likely not have happened without the Covid-19 pandemic. Huawei profited from the strong recovery in the Chinese economy, while Samsung has a very small presence in China, with less than 1 percent market share, and suffered from the restrictions in key markets such as the US, India, Brazil and Europe.

“This is a remarkable result that few people would have predicted a year ago,” said Canalys Senior Analyst Ben Stanton. “If it wasn’t for COVID-19, it wouldn’t have happened. Huawei has taken full advantage of the Chinese economic recovery to reignite its smartphone business. Samsung has a very small presence in China, with less than 1% market share, and has seen its core markets, such as Brazil, India, the United States and Europe, ravaged by outbreaks and subsequent lockdowns.”

“Taking first place is very important for Huawei,” said Canalys Analyst Mo Jia. “It is desperate to showcase its brand strength to domestic consumers, component suppliers and developers. It needs to convince them to invest, and will broadcast the message of its success far and wide in the coming months. But it will be hard for Huawei to maintain its lead in the long term. Its major channel partners in key regions, such as Europe, are increasingly wary of ranging Huawei devices, taking on fewer models, and bringing in new brands to reduce risk. Strength in China alone will not be enough to sustain Huawei at the top once the global economy starts to recover.”

As a result, it will be hard for Huawei to maintain its lead in the long term. Its major channel partners in key regions such as Europe are increasingly wary of stocking Huawei devices, taking on fewer models and bringing in new brands to reduce risk, as per the above Canalys quote from analyst Mo Jia.

Separately, Gartner estimates that 10% of smartphone shipments, or about 220 million units in 2020, will have 5G capability, but they’ll work on “5G” networks with a LTE core (5G NSA).

…………………………………………………………………………………………………………………………………

Addendum:

Huawei’s just announced global licensing agreement with Qualcomm grants Huawei back rights to some of the San Diego-based company’s patents effective Jan. 1, 2020. It remains to be seen if Huawei will design smartphone components that use those patents in their next generation of 5G endpoint devices.

………………………………………………………………………………………………………………………………….

References:

https://www.canalys.com/newsroom/Canalys-huawei-samsung-worldwide-smartphone-market-q2-2020

………………………………………………………………………………………………………………………………………

Update- August 3, 2020:

According to market research firm Omdia, overall Q2-2020 smartphone shipment volume was down a hefty 15.7%, year-on-year, to 229.7 million units.

Samsung will certainly hope there are better times ahead. Omdia figures show the South Korean behemoth lost its #1 position in Q2, dislodged by Huawei. Samsung’s Q2 shipments plummeted nearly 28%, year-on-year, to 54.3 million.

Many of Samsung’s most important markets, were significantly impacted by COVID-19, especially emerging markets, which apparently accounted for more than 70% of Samsung’s overall shipments in 2019.

For its part, Samsung is hopeful of a Q3 smartphone recovery, helped by the launch of new flagship models, including the Galaxy Note and a new foldable phone.

Huawei, helped by a resurgent domestic market in China, snagged a 20% global smartphone share during Q2 (55.8 million units), up from an 18% market share the previous quarter. Year-on-year, Huawei’s Q2 shipment units were down a comparatively modest 4.9%.

Apple was one of the few OEMs to increase Q2 shipment volumes, year-on-year (up 13.1%, to 39.9 million units). The iPhone SE, a model with mid-range pricing, coupled with the iPhone 11, helped Apple expand its unit shipments, and cement its third-spot position with a market share of 14% (up from 11% in Q2 2019).

“With the launch of the iPhone SE in April, Apple has released a long-desired product, with an attractive price,” said Jusy Hong, director of smartphone research at Omdia.

“For existing iPhone users who needed to upgrade their smartphones in the second quarter, the new SE represented an affordable option that does not require a large downpayment or high monthly repayment rates,” added Hong.

Reference:

https://www.lightreading.com/huawei-apple-buck-q2-smartphone-trends—report/d/d-id/762886?