ITU Virtual Digital World SME Awards for Connectivity, Smart Cities, e-Health, Digital Finance

- Connectivity – new approaches to increasing universal access to the internet

- Smart cities, smart living – improving urban life in areas such as energy, transport, planning, education

- E-health – improve healthcare through remote diagnosis and treatment

- Digital finance – increase access to the digital economy for the banked and unbanked

From very small satellite-powered remote IoT sensors to mobile finance for smallholder farmers, navigational platforms for smart public transit or portable electrocardiograms for remote diagnosis and much, much more, this virtual edition of the ITU Digital World Awards – open to all small- and medium-sized enterprises (SMEs) worldwide – celebrated creativity and innovation in digital solutions meeting real-world needs.

- Astrome from India, using millimetre wave wireless communication to provide fibre-like backhaul capacity for 4G and 5G infrastructure, in the Connectivity category;

- BusMap from Viet Nam, providing smart public transit solutions through navigation algorithms and advanced user experience features for consumers, corporates and governments in the Smart cities, smart living category;

- Appy Saude from Angola, for their e-health platform identifying the nearest pharmacy location, best price and availability of medicines, in the E-health category;

- OKO Finance from Israel, providing smallholder farmers with crop insurance and access to digital financial tools through simple mobile technologies, in the Digital finance category.

Progress in 5G private networks and Open RAN

Harry Baldock of Total Telecom writes, “The month of November was one of quiet progress for 5G, with more momentum steadily being gained for long-term trends towards private network deployments and open RAN innovation.”

Private 5G networks could be viable connectivity options for major industries like manufacturing and shipping, giving them not only access to the latest technologies to enhance efficiency, but also the flexibility to structure their network however they please.

In Europe, the German telecom regulator announced in November that it has awarded 88 licences for private 5G networks this year and expects more to come. For example, Nokia recently installed a private 5G network in Nuremburg for industrial IoT specialist MYNXG. In France, electronics manufacturer Lacroix is working with with Orange and Ericsson to create a 5G factory, and in the UK BT is installing a 5G network into Belfast Harbour, while Huawei is creating a private 5G testbed in Cambridge.

There has also been significant movement in the U.S., with General Motor’s new Factory ZERO installing a private 5G network from Verizon to manufacture the next generation of electric vehicles.

However, it should be remembered that despite its promise, private 5G networks are also still very much in their infancy, with a survey from STL Partners showing that the majority of enterprises still rely primarily on Wi-Fi and ethernet or fixed broadband for their connectivity needs.

Meanwhile, Open RAN has been gaining momentum for some months now as we reported yesterday in this IEEE Techblog post. In November, Dish and Qualcomm announced that they are set to work together on the U.S.’s first Open RAN-compliant (which spec?) 5G network. Similarly, in the UK, Vodafone’s August pilot for Open RAN, that took place in Wales, is being scaled up to 2,600 Open RAN sites in Wales and England, potentially using them to replace Huawei gear.

Meanwhile, companies like Mavenir continue to rapidly develop open RAN solutions, recently boasting of supporting 2G–5G for its open RAN packet core, thanks to a recent acquisition of ip.access.

Baldock concludes, “it seems fair to say that Open RAN is here to stay and is no longer something of a novelty. While many issues remain around things like standardization (e.g. no liaison with either ITU, ETSI or 3GPP) the movement is beginning to see increasing interest from operators and policymakers alike.”

…………………………………………………………………………………………………………………………………….

References:

https://techblog.comsoc.org/2020/12/04/omdia-and-delloro-group-increase-open-ran-forecasts/

German Telecom Regulator awards 5G private network licenses in the 3.7GHz to 3.8GHz band

Omdia and Dell’Oro Group increase Open RAN forecasts

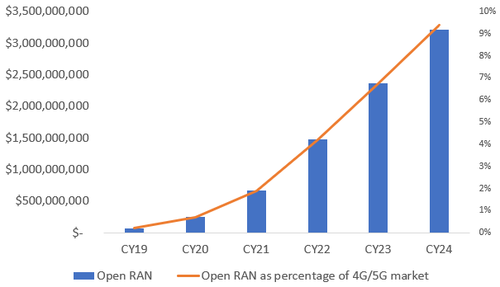

In an updated forecast out this month, Informa owned Omdia predicts that Open RAN is likely to generate about $3.2 billion in annual revenues by 2024. That would make it about 9.4% of the total 4G and 5G cellular market.

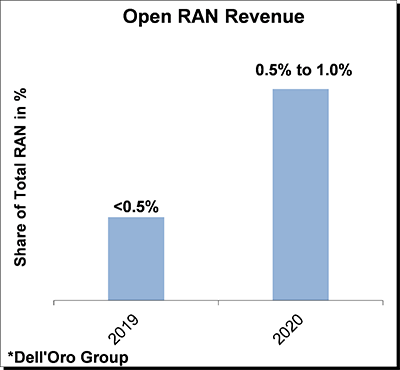

That forecast implies a massive increase on last year’s sales of just $70 million (see Dell’Oro forecast below), and Omdia’s Open RAN numbers have been raised significantly in the last few months. Previously, it was expecting Open RAN to generate about $2.1 billion in revenues in 2024.

Telco buy-in and support is critical, according to Daryl Schoolar, practice leader at Omdia responsible for the firm’s Open RAN forecasts. “Mobile operators remain the real driving force behind the development of open virtual RAN,” he says. “I see this as a positive sign for the market versus other technology and network developments I have seen during my career that were driven by vendors and ultimately went nowhere. The bigger market opportunity is with brownfield deployments, but this takes more time to accomplish as operators have to integrate open RAN with their legacy network systems and make sure those legacy networks and services are not adversely impacted,” Schoolar added.

Here are some of the network operators that have committed to OpenRAN:

- Japan’s Rakuten, which already operates a 4G and 5G network based on open RAN. While customer numbers remain low, its early success has undoubtedly encouraged others.

- Telefónica and Rakuten have announced a partnership to accelerate the development of Open RAN technology for 5G access and core networks, and the associated operations support systems (OSS). They will jointly test, develop and procure Open RAN systems.

- Dish Network, is another greenfield builder that is using open RAN technology to roll out a fourth mobile network in the US. which is primarily focused on business customers.

- Orange sees a role for Open RAN vendors to provide more “plug and play” indoor coverage for businesses through 2021 and 2022. Open RAN could also play a part in the macro network, although that is more likely to come from 2023, and still requires work.

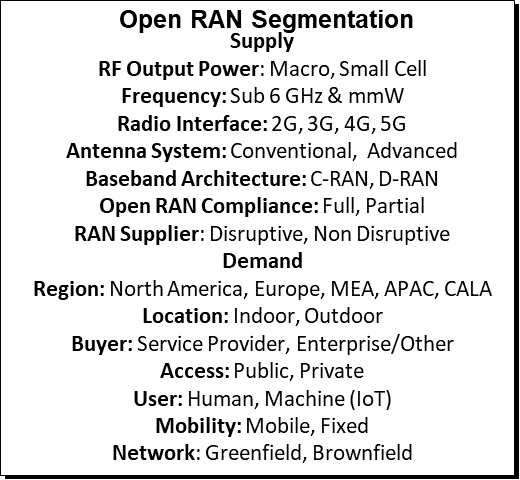

Dell’Oro Group (see forecast below) says: “Dish is running into delays in the US market, Rakuten is moving forward at a rapid pace in Japan deploying a variety of both sub 6 GHz and mmWave RAN systems. In addition, some of the Japanese telecom equipment vendors (e.g. NEC) are reporting that the lion share of their radio shipments are already O-RAN compatible.”

Open RAN progress:

Source: Omdia

……………………………………………………………………………………………………………………

Omdia notes that Open RAN is a potential dilemma for the big telco equipment vendors like Ericsson and Nokia (which intends to supply Open RAN products). The risk is that it decreases their market share for traditional cellular gear, as wireless network providers opt for Open RAN products developed by alternative suppliers. Yet open RAN might also bring opportunities in new markets for the old guard. “Either way, vendors cannot ignore this market trend,” says Omdia.

Gabriel Brown, a principal analyst at Heavy Reading, a sister company to Omdia and Light Reading, says he is positive about Open RAN but warns against expectations of liftoff next year. “The right timeline to view it on is a four-to-five-year timeline,” he said in a discussion with Light Reading this week. “I think next year continues to be primarily trials, scaling the trials … and some operators moving into production networks, but I don’t think it’s the year when it all takes off.”

Separately, Dell’Oro Group’s latest Open RAN forecast, projects that Open RAN baseband and radio investments—including hardware, software, and firmware excluding services—will more than double in 2020 with cumulative investments on track to surpass $5B over the forecast period.

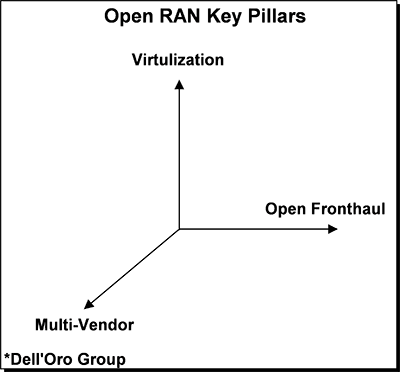

Open and Virtual RAN continues to gain momentum, bolstered by Ericsson now formalizing its support with its Cloud-RAN announcement. The uptake remains mixed. In this blog we will discuss three key takeaways for the 3Q20 quarter including:

1) The primary objective of Open RAN is to address market concentration and vendor lock-in;

2) Open RAN revenues are trending ahead of schedule;

3) Not all Open RAN is disruptive.

Source: Dell’Oro Group

Dell”Oro says that the more favorable Open RAN outlook to a confluence of factors including:

- Verification from live networks the technology is working in some settings;

- Three of the five incumbent RAN suppliers are planning to support various forms of Open RAN – “Partial Open RAN” (open and virtual but not multi-vendor) are at this juncture captured in the Open RAN estimates meaning we require the first two pillars but we are excluding the third multi-vendor requirement as a necessity to reflect the Open RAN movement;

- The geopolitical uncertainty has escalated significantly in the past six months, with multiple operators reassessing and/or reviewing their reliance on Huawei’s RAN portfolio, resulting in an improved entry point for the Open RAN suppliers;

- Progress with full virtualization is firming up, with multiple suppliers announcing the commercial availability of V-RAN, consisting of both vCU and vDU;

- Operators are increasingly optimistic the technology will move beyond the rural settings for brownfield deployments;

- Policies to stimulate Open RAN are on the rise.

Source: Dell’Oro Group

“We estimate total open RAN revenues are tracking ahead of schedule,” wrote Stefan Pongratz of Dell’Oro Group, noting the market research firm recently raised its 2020 open RAN revenue forecast to $300,000 from $200,000. “On the other hand, the lion share of any ‘security’ related RAN swaps are still going to the traditional RAN players, suggesting the technology for basic radio systems remains on track but the smaller players also need to ramp up investments rapidly to get ready for prime time and secure larger brownfield wins.”

…………………………………………………………………………………………………………….

References:

https://www.lightreading.com/open-ran/open-ran-will-be-$32b-market-in-2024-says-omdia/d/d-id/765889?

https://omdia.tech.informa.com/OM011039/Open-RAN-commercial-progress-in-2020 (must be an Omdia client to access)

https://www.delloro.com/open-ran-results-mixed-in-3q20/

Dell’Oro: Telecommunication Equipment Market 1Q20 to 3Q20 +China’s New 5G Base Stations

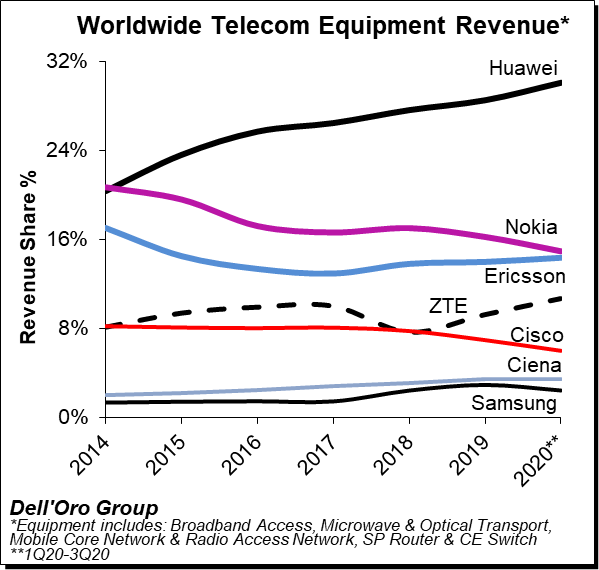

Preliminary estimates by the Dell’Oro Group suggest the overall telecom equipment market advanced 9% Year-Over-Year (Y/Y) during 3Q20 and 5% Y/Y for the 1Q20-3Q20 period. That market includes: Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch (CES).

The analysis contained in these reports suggests revenue rankings remained stable between 2019 and 1Q20-3Q20, with Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung ranked as the top seven suppliers, accounting for more than 80% of the total market. At the same time, revenue shares continued to be impacted by the state of the 5G rollouts in highly concentrated markets.

Huawei and ZTE are both on course to gain two percentage points of market share each this year, at the expense of Nokia, Cisco and Samsung. With investments in China outpacing the overall market, we estimate Huawei and ZTE collectively gained about 3 percentage points of revenue share,” wrote Dell’Oro Analyst Stefan Pongratz in his blog on the matter, implying they actually grabbed around 1.5 percentage points each.

Dell’ Oro estimates the following revenue shares for 2019 and the 1Q20-3Q20 period for the top seven suppliers:

- Following the 4% Y/Y decline during 1Q20, the positive trends that characterized the second quarter extended into the third quarter, underpinned by strong growth in Optical Transport and multiple wireless segments including 5G RAN, 5G Core, and Microwave Mobile Backhaul. Technology segments that were impacted more materially by COVID-19 and the lockdowns during 1Q20 continued to stabilize in the quarter.

- Preliminary estimates indicate increasing Mobile Infrastructure and Optical Transport revenues offset declining investments in Microwave Transport and SP Routers & CES for the 1Q20-3Q20 period.

- The overall telecom equipment market continued to appear disconnected from the underlying economy. While the on-going transition from 4G to 5G is helping to offset reduced capex in slower-to-adopt mobile broadband markets, we also attribute the disconnect to the growing importance of connectivity and the nature of this recession being different than in other downturns improving the visibility for the operators.

- With investments in China outpacing the overall market, we estimate Huawei and ZTE collectively gained about 3 percentage points of revenue share between 2019 and 1Q20-3Q20, together comprising more than 40% of the global telecom equipment market.

- The Dell’Oro analyst team has not made any material changes to the overall outlook and projects the total telecom equipment market to advance 5% to 6% in 2020 and 3% to 4% in 2021. Total telecom equipment revenues are projected to approach $90 B to $95 B in 2021.

………………………………………………………………………………………………………………………………………………………………..

Judging from a report by China Daily “China to build 1 million new 5G stations in 2021.” it appears Huawei and ZTE will continue to increase their telecom equipment market share. Reporter Ma Si of China Daily spoke to Wu Hequan, an academician at the Chinese Academy of Engineering, who reckons China will build over a billion 5G base stations next year, taking the grand total to 1.7 million by the end of the year.

China workers working at the construction site of a 5G base station at Chongqing Hi-tech Zone in Chongqing, Southwest China. [Photo/Xinhua]

“As the construction of 5G networks accelerates, the cost of building each 5G base station will go down,” said Wu. “Even if Chinese telecom carriers earmark the same amount of 5G investments in 2022 as they have done this year, they can build far more 5G base stations next year than this year. I believe Chinese telecom carriers will build more than one million 5G base stations next year, though the specific construction targets will have to wait for the telecom carriers’ official announcements.”

China Mobile, China Telecom and China Unicom did not immediately respond to requests for comment from China Daily.

Wu’s remarks are in line with China’s top industry regulators’ predictions the nation will “moderately” push ahead 5G construction in the next few years. The Ministry of Industry and Information Technology said in October as the country is set to enter a lead-in period in the next three years, China will continue to build 5G networks in a rhythm that is moderately ahead of schedule, so the wider coverage of 5G can help promote its use in more industrial and consumer scenarios.

That lead-in period, according to some industry insiders, means new products, new formats and new models of 5G application are constantly emerging and such applications are shifting from single application to large-scale and systemic scenarios.

China seems to be all the more determined to ensure its domestic telecoms industry goes from strength to strength. In response to the threat to the U.S. from China, John Ratcliffe wrote in the Wall Street Journal (on-line subscription required for access): “Beijing is preparing for an open-ended period of confrontation with the U.S. Washington should also be prepared. Leaders must work across partisan divides to understand the threat, speak about it openly, and take action to address it.”

…………………………………………………………………………………………………………………………………………………………..

References:

Key Takeaways—Telecommunication Equipment Market 1Q20 to 3Q20

Chinese telecoms kit vendors gained global market share this year

https://www.chinadaily.com.cn/a/202012/02/WS5fc74e99a31024ad0ba99633.html

FTTH accelerating in Europe: penetration forecast to reach 65% in 2026

The number of FTTH/B subscribers in Europe is expected to more than double in the next six years, to 208 million in 2026 compared to an estimated 86 million this year. According to the forecasts by iDate presented at the annual (this time virtual) FTTH Council Europe conference, the number of homes passed by fiber will grow over the same period to 317 million from 195 million. That translates into approximately two-thirds fiber network penetration rate, compared to less than half currently.

Roland Montagne of Idate DigiWorld presenting during the second day of the conference.

……………………………………………………………………………………………………………………………………………………………………………………………………..

The forecasts cover 39 countries across Europe. Idate also looked at the 27 EU members plus the UK and found similar growth rates. The number of FTTH/B subscribers in these countries is expected to roughly triple by 2026, to 148 million from 49 million this year, driven by accelerating roll-out in key markets such as Germany, the UK and Italy. Homes passed in the 28 countries are estimated at 202 million in 2026, versus 105 million this year. Some markets are expected to experience an outstanding growth in the number of homes passed in 2026 compared with 2019, including Germany (+730 per cent), United Kingdom (+548 per cent) and Italy (+218 per cent).

While the Covid pandemic has underlined the need for fast broadband at home, other trends were already underway to support fibre take-up, the researchers said. These include the upcoming switch-off of copper networks, more network-sharing and co-investment agreements, strong commitments from public authorities to FTTH, and the need for fiber backhaul on 5G mobile networks.

In the country rankings, it is predicted that Russia will continue leading in terms of FTTH/B homes passed. However, it is also anticipated that Germany will bag the second spot in the 2026 ranking.

In terms of subscribers, the forecast predicts a further increase to around 148 million in 2026 for EU27+UK and approximately 208 million for EU38+UK. The FTTH/B take-up rate is likely to reach 73 per cent in 2026, demonstrating an upward trend compared with a recorded 23.4 per cent in 2012.

The FTTH Council Europe published a separate study by Wik following up on its research last year into the progress with copper shutdowns. While the situation is fragmented in Europe, progress in some countries shows turning off copper and switching to fibre can have significant benefits for the economy and the environment, as well as improving reliability and customer satisfaction.

Consumer awareness about the copper shutdown has been a positive factor in some countries in stimulating fiber take-up. The latest forecasts on fibre take-up are also based in part on the increased perception of broadband’s importance since the coronavirus pandemic. Nevertheless, additional measures by policy-makers aimed at increasing take-up are still crucial for Europe to benefit from the potential of full fiber, the Council said.

FTTH/B deployments are intensifying across Europe, so it is worth noting that a new digital divide for teleworking performance was revealed by the Covid-19 crisis. Beyond its impact on public policies, it is clear that Covid-19 has changed public perception of the importance of broadband and willingness to accept premium for fiber. This new trend is one of the key drivers for the very high estimates for FTTH/B take up. However, additional measures by policy-makers aimed at increasing take-up are still crucial for the future of full fiber.

…………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.fibre-systems.com/news/fibre-forecasts-revealed-ftth-conference

Spain’s plan to bring FTTH and 5G to its entire population

The Spanish government has announced further details of the plan to bring broadband at speeds of at least 100Mbps and 5G to the entire Spanish population. The Plan for Connectivity and Digital Infrastructures and the Strategy to Promote 5G Technology, part of the government’s Spain Digital 2025 Agenda, will receive EUR 4.3 billion of public funding for expanding fiber-optic infrastructure to underserved areas and extending 5G coverage. In a short statement, the government said EUR 883 million is already in the 2021 budget, which should receive parliamentary approval in the next few weeks.

The government added that it expects operators to invest around EUR 24 billion on rolling out FTTH (Fiber To The Home) and 5G technology within the same time frame. “The goal is for everyone, irrespective of where they live, to enjoy the benefits of these advances in connectivity under a plan that is of particular relevance to rural Spain,” said government spokeswoman Maria Jesus Montero.

Fiber optic coverage currently stands at 46% of the Spanish population, double the European average, 84% of Spain’s population can currently access speeds of 100Mbps, a figure the government expects to increase to 91% by the end of 2021.

The Plan for Connectivity and Digital Infrastructures has three main objectives:

- Use broadband as something to favor the territorial structuring of Spain, promoting the deployment of broadband in urban centers and depopulated areas, so that the 100% of the population of Spain have access to at least 100 Mbps speed. Currently, this speed reaches 84% of the population, and by the end of 2021 it is estimated that it will reach 91% of the population. Fiber optic coverage in rural areas now reaches 46% of the population, doubling the European average and well above countries such as France (12%), Germany (6%) or the United Kingdom (6%). However, there is still a long way to go.

- 100% of the industrial estates in Spain have a scalable connection to at least 1 Gbps in 2025. The plan includes all the actions to strengthen connectivity associated with business environments: industrial estates, logistics centers or business parks. The goal is for 100% of industrial estates to have a connection scalable to one gigabit per second by 2025, one of the objectives of the European strategy “the Gigabit Society.”

- For Spain to become a European data hub, being a center for cloud services and interconnection with satellite networks. The plan includes the measures aimed at improving the connectivity of cross-border digital infrastructures and promoting participation in European programs of common interest (IPCEI) that will be executed in the period 2021-2027, such as the industrial alliance for cloud services and the secure communications satellite system, both necessary to cement European digital sovereignty and the growth of the national technology industry.

In addition, the 5G technology push strategy aims to complement fiber optics. Spain is leading the 5G pre-commercial pilot experiences in the EU, being the second European country with the most cities with 5G (39 already), only behind the United Kingdom. Spain’s government wants to expand 5G access to cover at least 75% of the population by 2025. This plan will seek to facilitate the availability of bands for 5G services, where that of 3.5 GHz is already available and that of 700 MHz will soon be in March 2021. It is also aimed at ensuring that there is not a single cutoff of 5G service coverage on major roads, railways or airports.

For this, new aid will be enabled for the deployment of 5G infrastructures. A regulatory and administrative framework will also be created that encourages investments, in addition to creating a safe and reliable environment for the deployment of networks and the establishment of companies.

Cybersecurity Law must transpose into the Spanish legal system the instruments and measures (toolbox) that the Member States of the European Union agreed upon at the beginning of this year in order to mitigate security risks in 5G networks and create a secure and reliable environment that drives deployment and fosters adoption.

…………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.lamoncloa.gob.es/consejodeministros/Paginas/enlaces/011220-enlace-digital.aspx

https://webeenow.com/the-government-promises-fiber-or-5g-for-all-peoples-in-5-years/

Qualcomm’s Snapdragon 888 “5G Mobile Platform” to power nexgen smartphones

Today, at its Snapdragon Tech Summit, Qualcomm unveiled its newest cellular 5G mobile platform for smartphones and other 5G endpoints in a move to extend its seemingly insurmountable lead in the cellular SoC smartphone market.

The Snapdragon 888 is Qualcomm’s newest high-end applications processor 5G SoC for smartphones. It is built on Samsung’s new 5nm semiconductor process and features an eight-core design, with the big core starting with a new super-core ARM Cortex-X1, which Qualcomm calls a “Super Core” at 2.84GHz. There are also three 2.4GHz A78 cores, four 1.8GHz A55 cores, and the GPU graphics cores have been upgraded to the Adreno 660, a design that is unbeatable in terms of performance. The Snapdragon 888 is also Qualcomm’s first integrated flagship 5G SoC, incorporating the Snapdragon X60 5G baseband.

The Snapdragon 888 will feature Qualcomm’s Snapdragon X60 modem announced earlier this year, which uses the 5nm process for better power efficiency and improved 5G carrier aggregation across the mmWave and sub-6GHz spectrum. Global multi-SIM support, 5G SA independent, 5G NSA non-independent, and dynamic spectrum sharing. Between the new 5nm architecture and the power efficiency gains from the integrated modem, it appears that the new chip could provide some substantial battery life improvements in 5G.

In addition to the 5G improvements, Qualcomm also previewed several other advances for the Snapdragon 888, including a sixth-generation AI engine (running on a “redesigned” Qualcomm Hexagon processor) all at an astonishing 26 tera operations per second (TOPS). And a second-generation sensing hub that promises to deliver significant improvements in performance and performance for AI tasks. There’s a big jump in power efficiency.

At the Summit, the company demonstrated the power of Snapdragon 888 through a Radio-Controlled race car connected entirely by a 5G mmWave network. Two race cars were connected to a private 5G network that was built with the help of Verizon and Ericsson and controlled over 5G using a Snapdragon 888 reference design with the Snapdragon X60 5G Modem-RF System. The drivers controlled these cars from over a mile away and viewed live video of the track from afar using the amazing capture capabilities of Snapdragon 888. Additionally, with the help of Tension, the race can be viewed on multiple low latency streams to track the RC cars’ position on a dynamic map using the newest location capabilities of the Qualcomm® Location Suite for improved accuracy. This showcases the use case possibilities when high performance, reliable, and low latency communications are the norm.

Lekha Motiwala, director of product management for Qualcomm Technologies, Inc., shared an inside look at the Company’s most premium offering.

- Snapdragon 888, with the 3rd generation Qualcomm® Snapdragon™ X60 5G Modem-RF System, enables global compatibility by offering mmWave and sub-6 across all major bands worldwide, as well as support for 5G carrier aggregation, global multi-SIM, stand alone, non-stand alone, and Dynamic Spectrum Sharing.

- The new 6th generation Qualcomm® AI Engine, with the completely re-engineered Qualcomm® Hexagon™ processor, takes a pivotal leap forward in AI compared to the previous generation to improve performance, power efficiency—all at an astonishing 26 tera operations per second (TOPS). The platform is further enhanced by the 2nd generation Qualcomm® Sensing Hub, which incorporates lower-power always-on AI processing for intuitive, intelligent features.

- Since its inception, Qualcomm® Snapdragon Elite Gaming™ has delivered dozens of mobile-first technologies to smartphones, including Updateable GPU Drivers, Desktop Forward Rendering, and frame rates achieving up to 144 frames per second (fps). The 3rd generation of Snapdragon Elite Gaming featured in Snapdragon 888 delivers Qualcomm Technologies’ most significant upgrade in Qualcomm® Adreno™ GPU performance.

- Snapdragon 888 will triple down on the future of computational photography and transform smartphones into professional quality cameras. With the faster gigapixel speed Qualcomm Spectra™ ISP, users can capture photos and videos at 2.7 gigapixels per second or roughly 120 photos at 12MP resolution—up to 35% faster than the previous generation.

Image Credit: Qualcomm

……………………………………………………………………………………………………………………………………………………………………………………………….

“I’m thrilled about what’s ahead,” said Qualcomm President Cristiano Amon. “The potential of 5G is astounding.” A number of analysts seemed to agreed with Amon’s positive outlook for their new flagship 5G mobile platform:

“The Snapdragon 888 is Qualcomm’s halo product,” wrote Anshel Sag, a consumer and chip tech analyst at research and consulting firm Moor Insights & Strategy, in response to questions from Light Reading. “The Snapdragon 888 will be the chip that most of the leading Android OEMs [original equipment manufacturers] will leverage to ship their flagship smartphones.”

“I believe that the Snapdragon 888’s X60 5G modem is going to be the biggest differentiator from the competition as most of the industry lags behind Qualcomm in modem capabilities,” Sag added.

“Specs are up across the board,” Tweeted IDC analyst Phil Solis of the Snapdragon 888, noting that it supports more operations per second than any other smartphone on the market.

“We believe that the Snapdragon 888’s modem, AI, gaming and camera specs look very impressive,” wrote Sravan Kundojjala of Strategy Analytics. “Historically, premium tier chips accounted for less than 15% of Qualcomm’s total application processor shipments, but accounted for the bulk of Qualcomm’s revenue and profit, thanks to high average selling prices.”

………………………………………………………………………………………………………………………………………………………………………………………………………………….

According to research firm Strategy Analytics, Qualcomm was the world’s largest provider of cellular baseband processors with 39% share in the second quarter of this year. Qualcomm commanded fully 50% share of the 5G baseband market during that time period. Qualcomm was also the world’s biggest supplier of smartphone application processors with 32% revenue share in the second quarter, according to Strategy Analytics.

………………………………………………………………………………………………………………………………………………………………………………………………………………….

Qualcomm’s cellular ecosystem partners had this to say:

- “Verizon is on the forefront of showcasing the transformative capabilities of 5G Ultra Wideband,” said Nicola Palmer, chief product officer at Verizon. “Qualcomm Technologies’ Snapdragon Tech Summit Digital 2020 is an opportunity to reflect on the successes we’ve had this year, including launching nationwide 5G coverage, dozens of 5G Ultra Wideband cities, MEC deployments, and a multitude of 5G devices and innovations. It also gives us the opportunity to look towards 2021 as we continue to bring the possibilities of 5G to life for businesses, individuals, and society.”

- “NTT DOCOMO has been a leading mobile innovator in Japan for nearly 30 years and this leadership has continued into the 5G era, as the first operator in Japan to launch commercial 5G service in March this year,” said Naoki Tani, executive vice president and chief technology officer, NTT DOCOMO, INC. “5G enables a new era of mobile experiences that are making people’s lives more convenient and comfortable, and these experiences are being brought to life on the DOCOMO 5G network through our exciting portfolio of 5G devices powered by Qualcomm Snapdragon 5G mobile platforms. We look forward to the next generation of 5G devices powered by Qualcomm Technologies’ industry-leading Snapdragon 888 5G Mobile Platform to deliver the best experiences on DOCOMO’s 5G network.”

- “Our work with Qualcomm Technologies is aligned with our mission to make the latest Natural Language Processing technology accessible to researchers and businesses around the globe, and run as fast and efficiently as possible” said Clément Delangue, co-founder and chief executive officer of Hugging Face. “We need our models to run on the most premium of mobile platforms… and that means Qualcomm Snapdragon.”

- “Xperia smartphones are feature-packed with Sony’s advanced imaging and entertainment technologies, and it’s essential for our products to be powered by the latest premium Snapdragon mobile platform to offer the best-in-class experiences to our fans. One of the entertainment experiences which we are very passionate about is mobile gaming, and we are overwhelmed by the incredible positive response we’ve received from fans around the world for Xperia 1 II and Xperia 5 II,” said Mitsuya Kishida, president, Sony Mobile Communications Inc. “We are committed to further enhancing mobile entertainment in the 5G era and look forward to working closely with Qualcomm Technologies to continue delivering world-class mobile gaming and other experiences on the go.”

- “In collaboration with Epic Games, the OnePlus 8 Series became the first smartphones to deliver Fortnite at 90 FPS, a groundbreaking mobile gaming achievement made possible by Qualcomm Snapdragon Elite Gaming,” said Kyle Kiang, chief marketing officer, OnePlus.

- “Over the past decade, from the first generation of Xiaomi mobile phones to the 10th anniversary masterpiece Xiaomi 10 series, we have been joining hands together with Qualcomm Technologies to bring the most advanced mobile experiences to users around the world,” said Lei Jun, Founder, chairman and chief executive officer of Xiaomi. “Snapdragon 888 is the most powerful mobile platform from Qualcomm Technologies ever. In addition to the industry leading 5G connectivity, it has brought groundbreaking breakthroughs and innovations in AI, gaming, and camera. I’m glad that our new flagship smartphone Mi11 will be the one of the first devices with Snapdragon 888. This is another cutting-edge product from us and will be loaded with various hardcore technologies.”

- The following OEMs provided their support for Snapdragon 888, including ASUS, Black Shark, Lenovo, LG, MEIZU, Motorola, Nubia, realme, OnePlus, OPPO, Sharp, vivo, Xiaomi, and ZTE.

This year’s Snapdragon Tech Summit Digital keynotes are being live streamed on Dec 1 and 2 at 7:00 a.m. PST (qualcomm.com/snapdragonsummit). The Qualcomm Twitter handle will have live updates before and during the keynotes. #SnapdragonSummit.

References:

https://www.lightreading.com/iot/qualcomm-hopes-snapdragon-888-will-widen-its-5g-lead/d/d-id/765799?

Ericsson Mobility Report: 5G forecast increased due to China uptake (?)

According to the latest Ericsson Mobility Report, there are signs of an acceleration in 5G deployments. Ericsson estimates that by the end of this year, more than 1 billion people – or 15 percent of the world’s population – will live in an area with 5G coverage. This is expected to reach 60 percent in 2026, when there will be an estimated 3.5 billion 5G users in the world.

Ericsson raised its year-end 2020 estimate for global 5G subscriptions to 220 million, due mainly to faster take-up in China [1.]. More than one in ten Chinese mobile subscribers are expected to use 5G by year-end, and they will account for almost 80 percent of all 5G users in the world (175 mln). The growth in China is driven by a national strategic focus, intense competition between service providers, as well as increasingly affordable 5G smartphones from several vendors, Ericsson said.

Note 1. We have argued for quite some time that China government numbers on 5G (and everything else) can’t be trusted.

…………………………………………………………………………………………………………………………………………………………………………………………………..

North America is the second-largest market for 5G, says Ericsson, with an estimated 4 percent of subscribers using 5G by the end of 2020. Commercialization there is now moving at a rapid pace and by 2026, Ericsson forecasts that 80 percent of North American mobile subscriptions will be 5G, the highest level of any region in the world.

Europe is seeing a slower roll-out of 5G, due in part to delays in spectrum auctions earlier this year. Ericsson predicts the region will end 2020 with about 1 percent of mobile users on 5G subscriptions.

The report further looks at some of the emerging 5G applications, such as cloud gaming and mission critical IoT, which covers real time-sensitive services (e.g. ultra low latency). However, that won’t happen unless URLCC is completed specified/performance texted in 3GPP Release 16 and then implemented.

The Ericsson report has this to say about cellular networks and public safety:

“2020 has also proven to be an exceptional year for cellular networks used for public safety applications. Together with AT&T, we have looked into how FirstNet – the nationwide network deployed to serve first responders in the US – stood up to the test of this year’s emergencies related to the pandemic, one of the most active hurricane seasons on record, and severe wildfires. As society rapidly changes, it is clear that cellular networks are a critical infrastructure that will continue to support many aspects of our everyday life.”

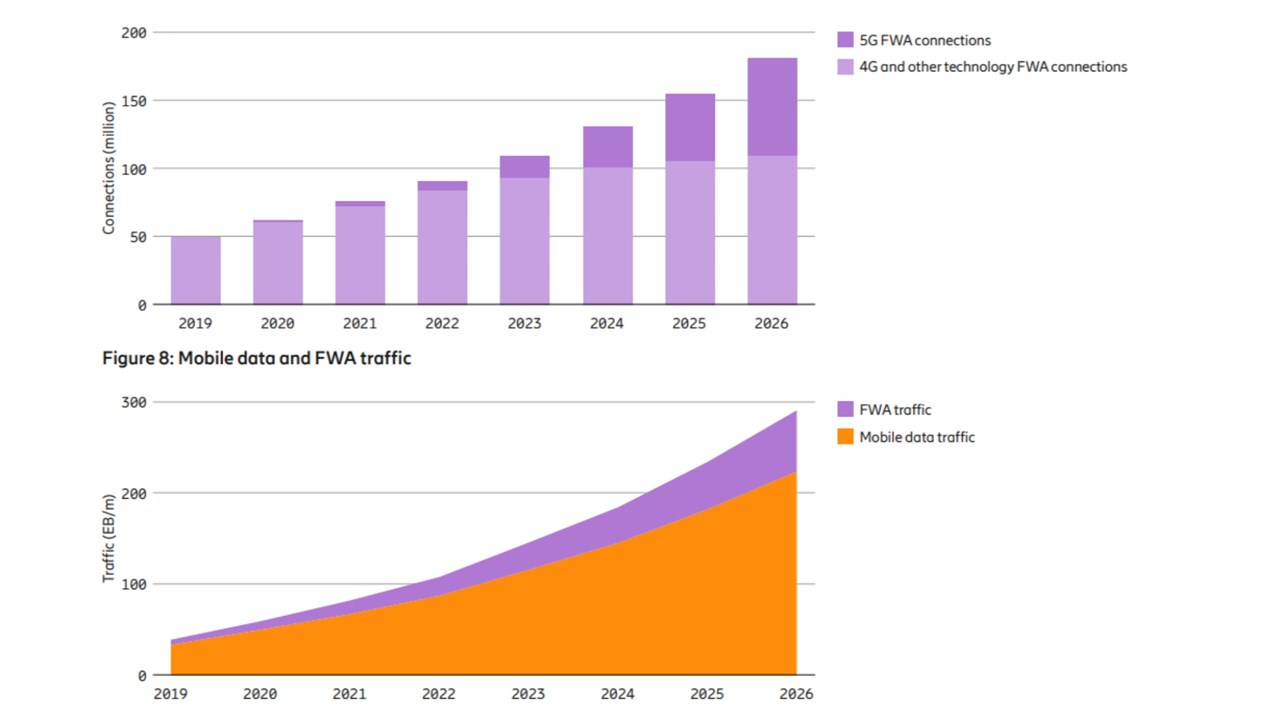

Ericsson also found that almost two-thirds of 5G operators are offering some form of fixed-wireless access (FWA) service. The company forecasts FWA connections to grow more than threefold and reach more than 180 million by the end of 2026, accounting for about a quarter of total mobile network data traffic.

Editor’s Note:

A very interesting point is that 5G Fixed Wireless Access (FWA), which is not even an IMT 2020 Use Case, is being deployed and gaining market traction (along with 4G FWA). The report states that FWA connections will more than threefold by the end of 2026, reaching over 180 million. That service is forecast to account for ~25 percent of total mobile network data traffic globally.

Check out the following two FWA related graphs from the report:

Some of the topics covered in the report include:

- Time-critical communications with 5G

- Mobile cloud gaming – an evolving business opportunity

- Service provider strategies ( three alternative paths to success)

- But the big numbers are still important, So what’s happening with global mobile network growth, 5G in particular?

- 5G’s population coverage is projected to hit 15 per cent this year – over 1 billion people (that’s covered, not all connected)

- 5G’s subscription total will be 3.5 billion in 2026 with 220 million 5G subs expected by the end of this year

- There are around 7.9 billion mobile subscriptions now but this will increase to 8.8 billion by the end of 2026, and 91 percent of those will be for mobile broadband.

- Smartphones account for about 75 per cent of all mobile phone subscriptions

- Cellular IoT has not followed through on all those early, but wildly optimistic projections for cellular IoT. In 2026, NB-IoT and Cat-M technologies are expected to make up just 45 percent of all cellular IoT connections.

- North East Asia leads in cellular IoT connections (China, South Korea and at the end of 2020 is expected to account for 64 per cent of all cellular IoT connections, a figure set to increase to 69 percent by 2026.

…………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.ericsson.com/en/mobility-report/reports/november-2020

https://www.telecomtv.com/content/5g/ericsson-mobility-report-5g-is-here-and-happening-40337/

KPN collaborating on quantum network for Nederlands metro areas

Netherlands telco KPN is partnering QuTech, SURF and OPNT on a project to develop a first-of-its-kind quantum network in the Randstad metropolitan area (Amsterdam, Rotterdam, The Hague and Utrecht). The Fast Mode reports that the project will focus on connecting different quantum processors, a significant distance apart, to create ‘the first fully functional quantum network using high speed fibre connections’. A quantum network is a radically new internet technology, with the potential for creating pioneering applications. Such a network connects quantum processors to each other via optical channels, enabling the exchange of quantum bits (qubits) – which have a number of features very different from the bits in commonplace networks. For example, quantum communication is potentially immune to eavesdropping practices. Quantum networks are expected to evolve over time towards a global quantum network allowing secure communication, position verification, clock synchronisation, computation using external quantum computers, and more.

- QuTech is a leading R&D institute for advanced research in the field of quantum computing and quantum internet.

- SURF is the collaborative organisation for ICT in Dutch education and research.

- OPNT is a Dutch enterprise which has its roots in the science department of VU University Amsterdam.

The project will focus on connecting different quantum processors, a significant distance apart, over a Dutch network. The aim is to build the very first fully functional quantum network using high-speed fibre connections.

A quantum network is a radically new internet technology, with the potential for creating pioneering applications. Such a network connects quantum processors to each other via optical channels, and this enables the exchange of so-called quantum bits (qubits). Qubits have a number of features that make them very different from the bits we currently know and use in classical networks. For example, quantum communication is potentially immune to eavesdropping practices. Quantum communication networks are expected to evolve over time towards a global quantum network, and this would allow secure communication; position verification; clock synchronisation; computation using external quantum computers; and more. Among other things, the project is intended to lead to new techniques, insights and standards that will bring a quantum network closer.

Different parties in the collaboration each contribute their own areas of expertise. Ultimately, the mix of skills will help to create a programmable quantum network that connects quantum processors in different cities. Erwin van Zwet, Internet Division Engineering Lead at QuTech, underlined the project’s importance: “Working with these partners, we expect to have taken significant steps towards a quantum network by the end of the TKI project.”

Although the technology is still at an early stage, all four parties see the benefit of joining forces now. Wojciech Kozlowski, a postdoc at QuTech and responsible for one of the work packages in the TKI project: “Every day we are working on finding answers to the question of how network operators, such as KPN or SURF, can deploy a quantum network, and what sort of services they can offer their users. Although we are still in an early stage of development, we are already building the quantum internet ecosystem of the future by working with key partners. This ecosystem will prove crucial as our quantum network evolves into a fully-fledged quantum internet.”

References:

https://www.commsupdate.com/articles/2020/11/27/kpn-collaborating-on-quantum-network-development/

https://www.overons.kpn/en/news/2020/qutech-kpn-surf-and-opnt-join-forces-to-build-a-quantum-network

IMT 2020.SPECS approved by ITU-R but may not meet 5G performance requirements; no 5G frequencies (revision of M.1036); 5G non-radio aspects not included

ITU-R Approves IMT 2020.SPECS:

At it’s November 23rd meeting, ITU-R SG 5 approved WP5D’s draft recommendation IMT 2020.SPECS which is the first official 5G RAN standard. The document contains the description and implementation details for three new technologies that conform with the International Mobile Telecommunications 2020 (IMT-2020) vision, but this author (and others) do not believe they meet the ITU M.2410 Performance Requirements for the URLLC (ultra reliable, ultra low latency communications) 5G use case. That is because 3GPP’s 5G NR enhancements for URLLC in the RAN had not been completed or performance tested when 3GPP Release 16 was frozen in early July 2020 (see detailed description below) and is therefore NOT included in the IMT 2020.SPECS detailed implementation for 5G NR.

The three Radio Interface (RIT)/Set of Radio Interface (SRIT) Technologies are: 3GPP 5G-SRIT and 3GPP 5G-RIT submitted by 3GPP (contains both Release 15 and 16 functionality), and 5Gi submitted by Telecommunications Standards Development Society India (TSDSI). The 3GPP submissions include support by China and South Korea, which had submitted their own RIT’s that were determined to be “technically identical” with 3GPP’s 5G NR submission so they were effectively combined into one RIT.

TSDSI’s RIT is based on the 3GPP 5G NR RIT with additional functionality to support “Low Mobility Large Cell” (LMLC). The TSDSI-RIT incorporates India specific technology enhancements that can enable longer coverage for meeting the LMLC requirements. The TSDSI-RIT, which is mainly to address the LMLC requirements, exploits a new transmit waveform that increases cell range developed by research institutions in India (IIT Hyderabad, CEWiT and IIT Madras) and supported by several Indian companies. It enables low cost rural coverage. It has additional features which enable higher spectrum efficiency and improved latency. TSDSI-RIT is a key enabler for 5G based rural broadband usage scenario in India and similarly placed geographies.

Author’s NOTEs:

1. It is critically important to understand that IMT 2020.SPECs only apply to the 5G RAN and NOT the 5G core network or any other non-radio aspects of 5G. Also, that the frequencies to be used for 5G RAN are specified in a YET TO BE COMPLETED revision to ITU M.1036 recommendation which should include WRC 19 frequency arrangements (especially for mmWave spectrum).

–>That means there are no official guidelines on what frequencies might be used with any of the IMT 2020 RITs specified.

2. Here’s a description of the ITU-R recommendations that were used for evaluation of IMT 2020 RIT/SRIT submissions to ITU-R WP5D:

- ITU-R M.2410 describes key requirements related to the minimum technical performance of IMT-2020 candidate radio interface technologies.

- ITU-R M.2411 deals with the requirements, evaluation criteria, and submission templates, providing service, spectrum, and technical performance requirements.

- ITU-R M.2412 provides guidelines for the procedure, the methodology, and the criteria (technical, spectrum, and service) to be used in the IMT 2020 evaluation process.

With these documents, the evaluation procedure is designed in such a way that the overall performance of the candidate RITs/SRITs is fairly and equally assessed on a technical basis, ensuring that the overall IMT-2020 objectives are met.

Reference:

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/submission-eval.aspx

………………………………………………………………………………………………………………………………………………………………………………………………….

During the multi-year development and evaluation process by the ITU Radiocommunication Sector (ITU-R), these technologies were deemed to be sufficiently detailed to enable worldwide compatibility of operation and equipment, including roaming.

The outcome of this first release of IMT-2020 supporting 5G is a set of terrestrial radio interface specifications which are incorporated into a global standard in the ITU-R Recommendation titled ‘Detailed specifications of the radio interfaces of IMT-2020.’ This is in final approval to the 193 Member States of ITU.

“IMT-2020 specifications for the fifth generation of mobile communications (5G) will be the backbone of tomorrow’s digital economy, transforming lives and leading industry and society into the automated and intelligent world,” said Houlin Zhao, ITU Secretary-General. “5G will enable much faster data speeds, reliable connectivity and low latency to international mobile telecommunications (IMT) — all needed for our new global communications ecosystem of connected devices sending vast amounts of data via ultrafast broadband.”

Mario Maniewicz, Director of the ITU Radiocommunication Bureau, said: “The successful completion of the evaluation process and the release of this global standard is a significant milestone for the global telecommunication industry and its users. 5G technologies will further enrich the worldwide communications ecosystem, expand the range of innovative applications and support the burgeoning Internet of Things, including machine-to-machine communication.”

The evaluation of the candidate technologies was not carried out by ITU-R alone. It was a highly collaborative process with substantial input from and coordination with ITU Member States, equipment manufacturers, network operators, and involved national, regional, and international standards development organizations, partnerships, the academic community and fora, since ITU-R provides a unique global framework to discuss the capabilities of new radio technologies.

In early 2012, ITU initiated the development of “IMT for 2020 and beyond”, setting the stage for 5G research activities and in 2015 established the vision and requirements for the globalization of 5G. Under ITU’s ongoing IMT programme, ITU membership is continuing its long-standing contribution to mobile communications, facilitating its mission to be “committed to connecting the world.“

Note 1. For the URLLC use case, M.2410 specifies a minimum of 1 msec in the data plane and 10 ms in the control plane for latency (1 way in the RAN). Actual latency (1-way) is the sum of latency in the RAN, core network, and edge network (if any).

……………………………………………………………………………………………………………………………………………………………………………………………………….

3GPP Release 16 5G NR-URLLC in the RAN spec status as of as of October 11, 2020:

- RP-191584 5G NR Physical Layer Enhancements for Ultra-Reliable and Low Latency Communication (URLLC) was 53% complete

- RP-190726 Performance part: Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC) was 0% complete

“In Release 15 the basic support for URLLC was introduced with TTI structures for low latency as well as methods for improved reliability. Use cases with tighter requirements, e.g. higher reliability up to 1E-6 and short latency in the order of 0.5 to 1ms, have been identified as important areas for NR. This work item [1] was approved based on the outcome of the study items as shown in TR 38.824 [2] and TR 38.825 [3].

This work item specifies PDCCH enhancements, UCI enhancements, PUSCH enhancements, enhanced inter UE TX prioritization/multiplexing and enhanced UL configured grant transmission.”

References:

https://www.3gpp.org/ftp/Information/WORK_PLAN/

https://portal.3gpp.org/desktopmodules/Specifications/SpecificationDetails.aspx?specificationId=3493

(Sept 15, 2020 version of Release 16 Description; Summary of Rel-16 Work Items)

……………………………………………………………………………………………………………………………………………………………………………………………………..

The Role of ITU-R:

International Telecommunications Union (ITU), formerly CCITT, is the United Nations specialized agency for information and communication technologies (ICTs), fostering innovation among 193 member states. For more than 150 years, ITU has been coordinating the radio spectrum, establishing standards that foster connectivity globally across multiple technology systems. And for the past 30 years, the ITU Radiocommunication sector (ITU-R) has been coordinating efforts with governments and industries to develop unified global broadband multimedia international mobile telecommunications systems, also known as IMT.

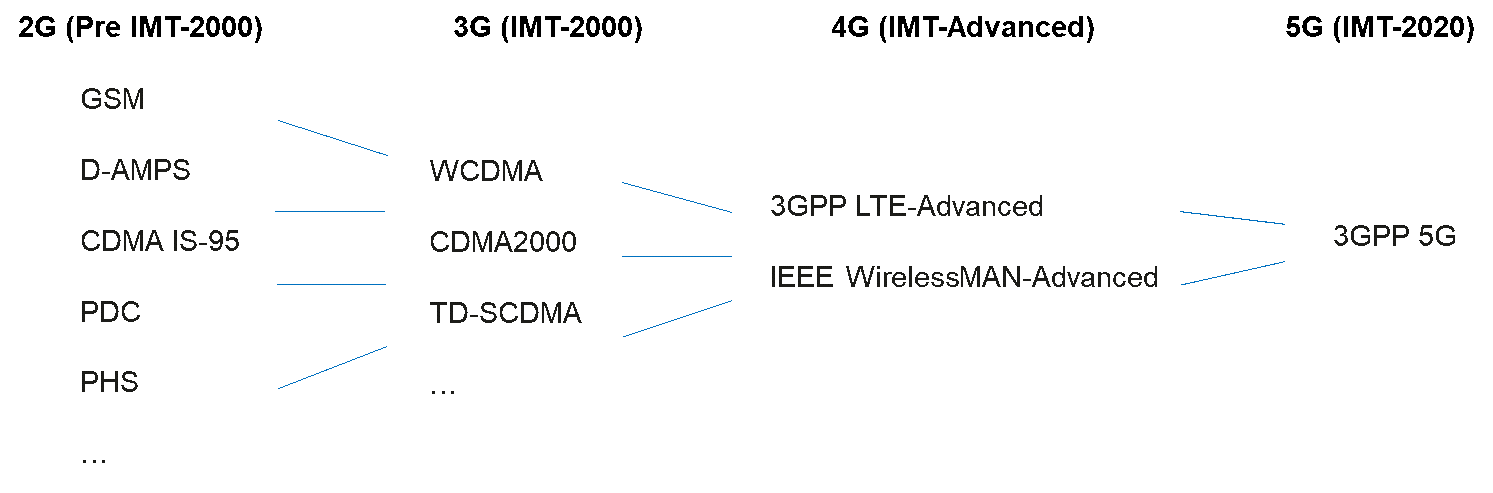

ITU-R plays an important role in achieving the objective of global harmonization and wide industry support for each generation of mobile communication technologies. 2G in the 1990s was the first generation of digital mobile communication system. These technologies provided dramatically enhanced capabilities relative to previous analog technologies, beginning the ongoing prevalence of mobile communication in our daily life. Despite the success of 2G during that era, the fragmented technology standards were incompatible for purposes of global roaming and economies of scale.

Global operation and economies of scale are key requirements for the success of mobile telecommunication systems. In order to achieve this goal, ITU-R established the concept of IMT, which includes a harmonized timeframe for future development, taking into account technical, operational, and spectrum-related aspects. Since then, ITU-R has been striving for harmonized global standards all through the process of IMT-2000 and IMT-Advanced.

ITU-R Progress from 2G to 5G Credit Dell’Oro Group

………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.itu.int/en/mediacentre/Pages/pr26-2020-evaluation-global-affirmation-imt-2020-5g.aspx

https://www.itu.int/pub/R-REP-M.2410

Executive Summary: IMT-2020.SPECS defined, submission status, and 3GPP’s RIT submissions

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

https://portal.3gpp.org/desktopmodules/Specifications/SpecificationDetails.aspx?specificationId=349

8https://www.itu.int/md/R15-IMT.2020-C-0021/en