Analysis: Nokia and Marvell partnership to develop 5G RAN silicon technology + other Nokia moves

Nokia has teamed up with semiconductor company Marvell Technology Group Ltd to develop customized 5G radio access system-on-chip leveraging its ReefShark technology. The alliance underscores Nokia’s commitment to deliver cost-effective and automated 5G network operations, especially at a time when it is aiming to walk the extra mile to revive its faltering 5G business.

As part of the agreement, Marvell Technology’s multi-core Radio Access Technology applications will be incorporated in Nokia’s AirScale RAN product line with its 5G-backed ReefShark portfolio. Equipped with customized ARM-architecture-based processor chips, this potential breakthrough innovation aims to deliver a best-in-class customer experience with reduced power consumption and enhanced performance and capacity.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Tommi Uitto, President of Mobile Networks at Nokia, said:

“This important announcement highlights our continued commitment to expanding the variety and utilization of ReefShark chipsets in our portfolio. This ensures that our 5G solutions are equipped to deliver best-in-class performance to our customers. As service providers continue to evolve their 5G plans and support growing traffic and new vertical services, the infrastructure and components must evolve rapidly. Adopting the latest advancements in silicon technology is a critical step to better serve our customers’ needs.”

“5G networks need to support billions of devices and machines, and this massive increase in volume and scale means that existing infrastructure and components must evolve rapidly, adopting technologies and techniques to enable to deploy 5G networks quickly, added Uitto.”

(Image credit: Nokia)

………………………………………………………………………………………………………………………….

Other Nokia Initiatives:

- Nokia also agreed to a partnership with Intel on programs to accelerate its 5G development. Intel’s new Atom chip is targeted at base stations. Nokia will ship Intel Atom-powered variants of its 5G AirScale radio access technology. The company will also use Intel’s second generation Xeon scalable processor in its AirFrame data center kit, allowing for common architecture from the cloud to the edge of 5G networks.

- Nokia said it needed several partnerships to enable it support and achieve its goals for 5G.

- Nokia will acquire optical networking technology provider Elenion. Nokia said that adding Elenion will broaden its addressable market and unlock some cost benefits.

- Nokia took a $561 million R&D loan which was signed with the European Investment Bank (EIB) in August 2018, but was only disbursed last month. The loan has an average maturity of about five years after disbursement according to Reuters. A Nokia representative said the company would use the loan to further accelerate its research and development of 5G technology

……………………………………………………………………………………………………………………………………………………………………………

Analysis by Zacks Equity Research:

Nokia has long struggled to undertake additional investments related to its 5G powered ReefShark SoCs. These SoCs are best known to leverage a single computer chip to operate an entire system. Unfortunately, its inability to develop ReefShark portfolio has hindered its cost-efficiency feature, compromising its profitability to rivals like Ericsson ERIC, which spends hefty amounts on R&D. Dearth of resources and geared up 5G spending cycle have also put Nokia at the risk of losing out on upcoming commercial launches.

The latest collaboration comes as a savior for the Finnish company to cater new vertical markets especially in the face of burgeoning network traffic and dynamic 5G plans. Dubbed as a key partnership, it is expected to reduce Nokia’s technical disparities and address the complex requirements of 5G NSA, SA, NR specifications for future 5G network deployments.

Nokia’s gross margin was negatively impacted by a high cost level associated with its first generation 5G products, product mix and profitability challenges in China. Despite a 4.2% rise in revenues in third-quarter 2019, the performance was marred by pricing pressure in early 5G deals and temporary capital expenditure constraints in North America related to the proposed merger of T-Mobile US and Sprint. This was followed by its decision to suspend dividend payments and slash guidance for 2020. The company has also decided to retrench about 180 employees in order to trim operating costs.

It remains to be seen whether Nokia will be able to script a turnaround amid a challenging macroeconomic environment and geopolitical uncertainties.

……………………………………………………………………………………………………………………………………………………………………………

About Marvell:

Marvell first revolutionized the digital storage industry by moving information at speeds never thought possible. Today, that same breakthrough innovation remains at the heart of the company’s storage, processing, networking, security and connectivity solutions. With leading intellectual property and deep system-level knowledge, Marvell’s infrastructure semiconductor solutions continue to transform the enterprise, cloud, automotive, industrial, and consumer markets. To learn more, visit: https://www.marvell.com/

About Nokia:

We create the technology to connect the world. Only Nokia offers a comprehensive portfolio of network equipment, software, services and licensing opportunities across the globe. With our commitment to innovation, driven by the award-winning Nokia Bell Labs, we are a leader in the development and deployment of 5G networks.

Our communications service provider customers support more than 6.1 billion subscriptions with our radio networks, and our enterprise customers have deployed over 1,000 industrial networks worldwide. Adhering to the highest ethical standards, we transform how people live, work and communicate. For our latest updates, please visit us online www.nokia.com and follow us on Twitter @nokia.

Media Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: [email protected]

Marvell Communications

Phone: +1 408 222 8966

Email: [email protected]

……………………………………………………………………………………………………………………………………………………………………………

References:

https://www.zacks.com/stock/news/797965/can-nokia-revive-its-5g-business-with-marvell-partnership

https://www.techradar.com/news/nokia-secures-5g-chip-partnerships-with-intel-and-marvell

O-RAN Alliance, Telecom Infra Project (TIP) & OCP Telco may open up telecom equipment market to new entrants

“There was more choice of network equipment suppliers 15 years ago than there is now and the industry is keen on expanding that vendor ecosystem,” Vodafone Group PLC’s Head of Network Strategy and Architecture, Santiago Tenorio, told Dow Jones Newswires.

For sure, the telecom industry would like to have more network equipment vendors to diversify supply chains, reducing risk and lowering costs. Network operators are pushing for change in the telecom-equipment market. Two international alliances of tech and telecom companies, universities and research centers are trying to develop networks that source gear from multiple vendors, which could attract new players to the market.

“Everybody wants it to happen,” said Janardan Menon, technology analyst at brokerage Liberum Capital. Mr. Menon expects progress to be slow but steady, and cautioned that it could take years before these open-architecture networks become a reality.

The O-RAN Alliance–which counts U.S. cell carriers Verizon Communications Inc., AT&T Inc. and Sprint Corp. as well as China Mobile Ltd. and Japan’s SoftBank Corp. among its members–is creating an ecosystem of new products that will support multi-vendor, interoperable radio-access networks. Meanwhile, the Telecom Infra Project, whose members include Facebook Inc. and Vodafone among others, is working on similar projects. Tech giants such as Intel Corp., Qualcomm Inc. and South Korea’s Samsung Electronics Co. are backing both groups.

Nokia is also a member of both the O-RAN Alliance and the Telecom Infra Project OpenRAN group. Ericsson has engaged with the O-RAN Alliance, which the Swedish company sees as aligning closer to its goals, but not with the Telecom Infra Project.

“Ericsson is actively contributing towards O-RAN specifications to make it a viable alternative in the future,” an Ericsson spokesperson said. Nokia and Huawei didn’t respond to requests for comment.

The O-RAN Alliance and the Telecom Infra Project (TIP) in February agreed to collaborate on 5G radio-access networks. They reached a liaison deal that allows for sharing information, referencing specifications and conducting joint testing.

Although some 4G projects using these open-architecture are already in operation, the technology isn’t yet ready to be deployed at scale. Facebook and Telefonica have launched a telecom-infrastructure company in Peru called Internet para Todos, which relies on so-called open radio-access network, or OpenRAN. Meanwhile, Vodafone is testing OpenRAN in rural parts of the U.K., following trials in South Africa and Turkey.

“OpenRAN is ready to be deployed commercially in pockets of the network, but not at scale throughout a market yet,” Mr. Tenorio said. “None of the smaller providers which OpenRAN is bringing into the market are ready yet to compete at scale with the likes of Nokia, Ericsson and Huawei,” he added.

The development of open-architecture networks began before Huawei’s blacklisting problems. The Telecom Infra Project was launched four years ago, and the O-RAN Alliance was formed in 2018 through the combination of two projects with shared goals.

There is no major U.S. manufacturer of cellular equipment currently, even though the U.S. is the biggest market in the industry for telecom equipment. The rise of open-architecture networks could create opportunities for smaller companies like Parallel Wireless, Mavenir or Altiostar, all of them based in the U.S., to have a say in the future of telecom networks.

It is unlikely that these new entrants take revenue from Huawei, Ericsson or Nokia in the next few years, said Liberum’s Mr. Menon. However, as the market begins to perceive that there are alternatives to the trio, their valuations could be hit, Mr. Menon said.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Telco is an important open hardware project within the Open Compute Project (OCP):

There is an industry desire to apply open hardware OCP model to the creation of open telecom optimized hardware. The OCP Telco Project enlists participants from telecom companies and carriers as well as sub systems, software, board and semiconductor suppliers who are seeking to use data center infrastructure to deliver IT services.

As technologists across industries participate in this community, OCP is creating and refining more designs, making it possible for more companies to transition from their old,existing proprietary solutions to Open Compute Project (OCP) solutions gear. and interoperable, multi-vendor supplier support.

The openEDGE Sub-Project is under the direction of the OCP Telco Project Group.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

https://telecominfraproject.com/

https://www.opencompute.org/projects/telco

https://techblog.comsoc.org/2020/02/12/nec-and-mavenir-collaborate-to-deliver-5g-open-vran-platform/

O-RAN Alliance, Telecom Infra Project (TIP) & OCP Telco may open up telecom equipment market to new entrants

“There was more choice of network equipment suppliers 15 years ago than there is now and the industry is keen on expanding that vendor ecosystem,” Vodafone Group PLC’s Head of Network Strategy and Architecture, Santiago Tenorio, told Dow Jones Newswires.

For sure, the telecom industry would like to have more network equipment vendors to diversify supply chains, reducing risk and lowering costs. Network operators are pushing for change in the telecom-equipment market. Two international alliances of tech and telecom companies, universities and research centers are trying to develop networks that source gear from multiple vendors, which could attract new players to the market.

“Everybody wants it to happen,” said Janardan Menon, technology analyst at brokerage Liberum Capital. Mr. Menon expects progress to be slow but steady, and cautioned that it could take years before these open-architecture networks become a reality.

The O-RAN Alliance–which counts U.S. cell carriers Verizon Communications Inc., AT&T Inc. and Sprint Corp. as well as China Mobile Ltd. and Japan’s SoftBank Corp. among its members–is creating an ecosystem of new products that will support multi-vendor, interoperable radio-access networks. Meanwhile, the Telecom Infra Project, whose members include Facebook Inc. and Vodafone among others, is working on similar projects. Tech giants such as Intel Corp., Qualcomm Inc. and South Korea’s Samsung Electronics Co. are backing both groups.

Nokia is also a member of both the O-RAN Alliance and the Telecom Infra Project OpenRAN group. Ericsson has engaged with the O-RAN Alliance, which the Swedish company sees as aligning closer to its goals, but not with the Telecom Infra Project.

“Ericsson is actively contributing towards O-RAN specifications to make it a viable alternative in the future,” an Ericsson spokesperson said. Nokia and Huawei didn’t respond to requests for comment.

The O-RAN Alliance and the Telecom Infra Project (TIP) in February agreed to collaborate on 5G radio-access networks. They reached a liaison deal that allows for sharing information, referencing specifications and conducting joint testing.

Although some 4G projects using these open-architecture are already in operation, the technology isn’t yet ready to be deployed at scale. Facebook and Telefonica have launched a telecom-infrastructure company in Peru called Internet para Todos, which relies on so-called open radio-access network, or OpenRAN. Meanwhile, Vodafone is testing OpenRAN in rural parts of the U.K., following trials in South Africa and Turkey.

“OpenRAN is ready to be deployed commercially in pockets of the network, but not at scale throughout a market yet,” Mr. Tenorio said. “None of the smaller providers which OpenRAN is bringing into the market are ready yet to compete at scale with the likes of Nokia, Ericsson and Huawei,” he added.

The development of open-architecture networks began before Huawei’s blacklisting problems. The Telecom Infra Project was launched four years ago, and the O-RAN Alliance was formed in 2018 through the combination of two projects with shared goals.

There is no major U.S. manufacturer of cellular equipment currently, even though the U.S. is the biggest market in the industry for telecom equipment. The rise of open-architecture networks could create opportunities for smaller companies like Parallel Wireless, Mavenir or Altiostar, all of them based in the U.S., to have a say in the future of telecom networks.

It is unlikely that these new entrants take revenue from Huawei, Ericsson or Nokia in the next few years, said Liberum’s Mr. Menon. However, as the market begins to perceive that there are alternatives to the trio, their valuations could be hit, Mr. Menon said.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Telco is an important open hardware project within the Open Compute Project (OCP):

There is an industry desire to apply open hardware OCP model to the creation of open telecom optimized hardware. The OCP Telco Project enlists participants from telecom companies and carriers as well as sub systems, software, board and semiconductor suppliers who are seeking to use data center infrastructure to deliver IT services.

As technologists across industries participate in this community, OCP is creating and refining more designs, making it possible for more companies to transition from their old,existing proprietary solutions to Open Compute Project (OCP) solutions gear. and interoperable, multi-vendor supplier support.

The openEDGE Sub-Project is under the direction of the OCP Telco Project Group.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

https://telecominfraproject.com/

https://www.opencompute.org/projects/telco

https://techblog.comsoc.org/2020/02/12/nec-and-mavenir-collaborate-to-deliver-5g-open-vran-platform/

Nokia Bell Labs sets world record in fiber optic bit rates

Nokia Bell Labs announced that its researchers set the world record for the highest single carrier bit rate at 1.52 Tbps over 80 km of standard single mode fibre, the equivalent of simultaneously streaming 1.5 million YouTube videos – which is four times the market’s existing approximately 400 Gbps. The company said this world record, along with other announced optical networking innovations, will further strengthen its ability to create networks for the 5G era that meet the ever-growing data, capacity and latency demands of Industrial Internet of Things (IIoT) and consumer applications.

Several of these achievements were presented as part of Nokia Bell Labs’ post deadline research papers at the Optical Fiber Communications Conference & Exhibition (OFC) that took place during March 9-15, 2020 in San Diego, CA. In addition, Nokia Bell Labs researcher Di Che was awarded the OFC Tingye Li Innovation Prize.

The highest single-carrier bitrate at 1.52 Tbps was set by a Nokia Bell Labs optical research team led by Fred Buchali. This record was established by employing a new 128 Gigasample/second converter enabling the generation of signals at 128 Gbaud symbol rate and information rates of the individual symbols beyond 6.0 bits/symbol/polarization. This accomplishment breaks the team’s own record of 1.3 Tbps set in September 2019 while supporting Nokia’s record-breaking field trial with Etisalat.

Nokia Bell Labs researcher Di Che and his team also set a new data-rate world record for directly modulated lasers (DML), which are crucially important for low-cost, high-speed applications such as datacenter connections. The DML team achieved a world record data rate beyond 400 Gbps for links up to 15 km.

Marcus Weldon, Nokia CTO and President of Nokia Bell Labs, said:

“It has been fifty years since the inventions of the low-loss fiber and the associated optics. From the original 45 Megabit-per-second systems to more than 1 Terabit-per-second systems of today – a more than 20,000-fold increase in 40 years – to create the fundamental underpinning of the internet and the digital societies as we know it. The role of Nokia Bell Labs has always been to push the envelope and redefine the limits of what’s possible. Our latest world records in optical research are yet another proof point that we are inventing even faster and more robust networks that will underpin the next industrial revolution.”

In addition to these world records, Nokia Bell Labs researchers have also recently achieved significant achievements in optical communications, including:

- The first field trial using spatial-division-multiplexed (SDM) cable over a 2,000km span of 4-core coupled-core fiber was achieved by researchers Roland Ryf and the SDM team. The experiments clearly show that coupled-core fibers are technically viable, offer high transmission performance, while maintaining an industry standard 125-um cladding diameter.

- A research team led by Rene-Jean Essiambre, Roland Ryf and Murali Kodialam introduced a novel new set of modulation formats that provide improved linear and nonlinear transmission performance at submarine distances of 10,000 km. The proposed transmission formats are generated by a neuronal network and can significantly outperform traditional formats (QPSK) used in today’s submarine systems.

- Researcher Junho Cho and team experimentally demonstrated capacity gains of 23% for submarine cable systems that operate under electrical supply power constraints. The capacity gains were achieved by optimizing the gain shaping filters using neural networks.

The researchers that achieved the world record and research results are part of Nokia Bell Labs’ Smart Optical Fabric & Devices Research Lab, which designs and builds the future of optical communications systems, pushing the state-of-the-art in physics, materials science, math, software and optics to create new networks that adapt to changing conditions and go far beyond today’s limitations.

……………………………………………………………………………………………………..

About Nokia

We create the technology to connect the world. Only Nokia offers a comprehensive portfolio of network equipment, software, services and licensing opportunities across the globe. With our commitment to innovation, driven by the award-winning Nokia Bell Labs, we are a leader in the development and deployment of 5G networks.

Our communications service provider customers support more than 6.4 billion subscriptions with our radio networks, and our enterprise customers have deployed over 1,300 industrial networks worldwide. Adhering to the highest ethical standards, we transform how people live, work and communicate. For our latest updates, please visit us online www.nokia.com and follow us on Twitter @nokia.

About Nokia Bell Labs

Nokia Bell Labs is the world-renowned industrial research arm of Nokia. Over its more than 90-year history, Bell Labs has invented many of the foundational technologies that underpin information and communications networks and all digital devices and systems. This research has resulted in 9 Nobel Prizes, three Turing Awards, three Japan Prizes, a plethora of National Medals of Science and Engineering, as well as three Emmys, two Grammys and an Oscar for technical innovations. For more information, visit www.bell-labs.com.

Media Inquiries:

Nokia

Communications

Phone: +358 (0) 10 448 4900

E-mail: [email protected]

……………………………………………………………………………………………..

References:

GSA: Over 250 5G devices announced with 67 commercially available

The Global mobile Suppliers Association (GSA) today reported that the number of announced 5G devices has broken the 250 barrier, spurred by a surge in 5G phone announcements. In January 2020, the number of announced 5G devices exceeded 200 for the first time; by early March[1] over 250 devices had been announced with GSA identifying 253 announced devices, of which at least 67 are commercially available today.

‘‘We are at a fascinating turning point in the industry where the whole ecosystem is embracing, pushing and delivering new 5G spectrum, networks and devices,” commented Joe Barrett, President of GSA. ‘‘The rate at which new 5G devices are being announced and the diversity of form factors points to continued rapid deployment and uptake of new 5G services. Based on vendors’ statements, we can expect more than 50 additional announced devices to become commercially available before the end of June 2020, and at GSA we’ll will be tracking and reporting regularly on these 5G device launch announcements for the industry as we continue to take the temperature of the 5G ecosystem.”

As more devices become commercially available, GSA is tracking vendor data on spectrum support. The latest market data reveals that just over two-thirds (68.0%) of all announced 5G devices are identified as supporting sub-6 GHz spectrum bands and just under one-third (30.8%) are understood to support mmWave spectrum. Just under 25% of all announced devices are known to support both mmWave and sub-6 GHz spectrum bands. The bands known to be most supported by announced 5G devices are n78, n41, n79 and n77.

Part of the GSA Analyser for Mobile Broadband Devices (GAMBoD) database, the GSA’s 5G device tracking reports global device launches across the 5G ecosystem and contains key details about device form factors, features and support for spectrum bands. Access to the GAMBoD database is only available to GSA Members and to GSA Associates subscribing to the service.

The March 2020 5G Ecosystem Report containing summary statistics can be downloaded for free from GSA’s website:

https://gsacom.com/paper/5g-devices-ecosystem-executive-summary-march-2020/?utm=devicereports5g

By mid-March 2020, GSA had identified:

- 16 announced form factors

- 81 vendors that had announced available or forthcoming 5G devices

- 253 announced devices (including regional variants, and phones that can be upgraded using a separate adapter, but excluding prototypes not expected to be commercialised and operator-branded devices that are essentially rebadged versions of other phones), including at least 67 that are commercially available:

o 87 phones, (up 25 from end January), at least 40 of which are now commercially available (up from 35 at end January). Includes three phones that are upgraded to offer 5G using an adapter.

o 76 CPE devices (indoor and outdoor, including two Verizon-spec compliant devices not meeting 3GPP 5G standards), at least 13 of which are now believed to be commercially available

o 43 modules

o 17 hotspots (including regional variants), at least nine of which are now commercially available

o 5 laptops (notebooks)

o 5 industrial grade CPE/routers/gateways

o 3 robots

o 3 televisions

o 3 tablets

o 3 USB terminals/dongles/modems

o 2 snap-on dongles/adapters

o 2 drones

o 2 head-mounted displays

o 1 switch

o 1 vending machine.

GAMBoD is a unique search and analysis tool that has been developed by GSA to enable searches of mobile broadband devices and new global data on Mobile Broadband Networks, Technologies and Spectrum (NTS). The 5G devices database contains details about device form factors, features, and support for spectrum bands. Results are presented as a list or in charts. Charts may be inserted into documents or presentations, subject to accreditation of GSA as the source.

GAMBoD is a resource dedicated to promoting the success and growth of the Mobile Broadband (MBB) industry and ecosystem and is fully available to all employees of GSA Executive and Ordinary Member companies and GSA Associates who subscribe to the service.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Availability of information about spectrum support is improving as a greater number become commercially available.

- Just over two-thirds (68.0%) of all announced 5G devices are identified as supporting sub-6 GHz spectrum bands and just under one third (30.8%) are understood to support mmWave spectrum. Just under 25% of all announced devices are known to support both mmWave and sub-6 GHz spectrum bands.

- Only 17 of the commercially available devices (25.4% of them) are known to support services operating in mmWave spectrum.

- 83.6% of the commercially available devices are known to support sub-6 GHz spectrum.

The bands known to be most supported by announced 5G devices are n78, n41, n79 and n77. We can expect the device ecosystem to continue to grow quickly and for more data to become available about announced devices as they reach the market. Based on vendors’ statements, we can expect more than 50 additional announced devices to become commercially available before the end of June 2020. GSA will be tracking and reporting regularly on these 5G device launch announcements. Its GAMBoD database contains key details about device form factors, features and support for spectrum bands. Summary statistics are released in this regular monthly publication.

About GSA

GSA is the voice of the mobile vendor ecosystem representing companies engaged in the supply of infrastructure, semiconductors, test equipment, devices, applications and mobile support services. GSA actively promotes the 3GPP technology road-map – 3G, 4G, 5G – and is a single source of information resource for industry reports and market intelligence. The GSA Executive board comprises of Ericsson, Huawei, Intel, Nokia, Qualcomm, and Samsung.

GSA Membership is open to all companies participating in the mobile ecosystem and operators, companies and government bodies can get access to GAMBoD by subscribing as an Associate. More details can be found at https://gsacom.com/gsa-membership

Verizon 5G Ultra Wideband service at DoE’s Pacific Northwest National Laboratory

“Our 5G Ultra Wideband network is built to support transformational innovations and solutions across all industries,” said Tami Erwin, CEO of Verizon Business. “There’s no doubt 5G’s increased data bandwidth and super-low lag will help play a critical role in evolving response connectivity and mission operations for first responders. We’ve seen exciting use cases come out of our 5G First Responder Lab and are thrilled to see the new applications that will arise from our work with PNNL.”

This engagement is part of Verizon Business’ broader strategy to partner with customers, startups, universities and large enterprises to explore how 5G can disrupt and transform nearly every industry. Verizon operates five 5G Labs in the U.S. and one in London that specialize in developing uses cases in industries ranging from health care to public safety to entertainment. In addition, Verizon is setting up 5G labs on-premise for several customers as part of an ongoing initiative to partner on 5G-related use cases to help customers transform their industries.

Verizon 5G Labs and Dignitas are also using the 5G network to enhance e-sports. The goals are to improve participants’ performance and recovery and to enable innovative fan/participant interactions. The first e-sports training facility is at Verizon’s 5G lab. It will serve as Dignitas’ west coast headquarters and home to its league of champions.

References:

https://www.verizon.com/about/news/verizon-business-national-lab

https://www.verizon.com/about/our-company/5g-labs

Verizon Explores 5G Use Cases for National Security, Energy Efficiency at DOE Lab

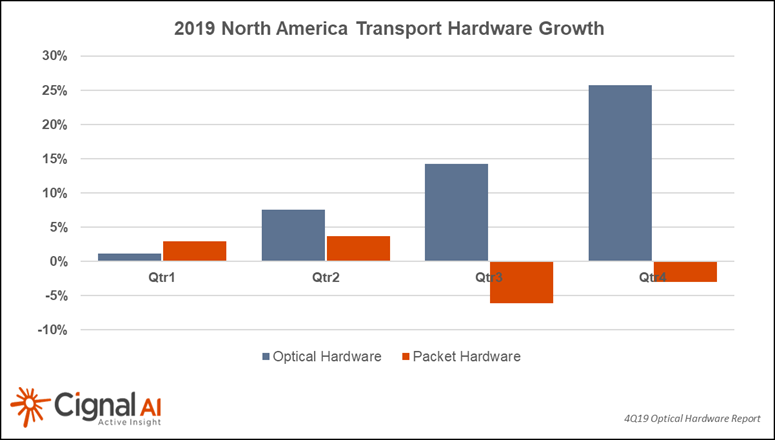

Cignal AI: North American Optical Sales Rebound In 2019

|

||||

|

||||

Additional 4Q19 Transport Hardware Report Findings:

Transport Hardware Superdashboard:

|

||||

About the Transport Hardware Report

About Cignal AI:

Contact Cignal AI/Purchase Report:

|

South Korean operators to invest $3.365B (4T W) in 5G network infrastructure-1st half 2020

South Korea’s Ministry of Science and ICT announced on Friday that the country’s three main network operators SK Telecom, KT and LG Uplus have agreed to invest KRW 4 trillion in their 5G networks in the first half of 2020, The Korea Times reports.

Investments will cover the cost of the installation of additional equipment to enhance 5G service coverage. The agreement was reached on 5 March, during a video conference call between Minister of Science and ICT Choi Ki-young, and SK Telecom CEO Park Jung-ho, KT CEO Koo Hyun-mo, and LG Uplus CEO Ha Hyun-hwoi.

LG Uplus worker installs a 5G base station in Seoul in this Feb. 12 photo. Korea Times file

……………………………………………………………………………………………………………………………………………………………………

The initial investment had been set at KRW 2.7 trillion, but has now been expanded to KRW 4 trillion. The additional investment will be used to deploy 5G infrastructure in subways, railroads, department stores and universities.

South Korea ended January with 92,000 5G base stations installed nationwide.

“For every one LTE base station, there needs to be around four 5G base stations for there to be similar coverage. Coverage also depends on the environment and location,” said an unnamed representative of one of the three South Korean mobile operators.

Many industry experts say the 5G market will continue to grow in the coming months and at its current pace could reach over 11 million subscribers this year, although there were only around 4.95 million as of the end of January.

Market watchers believe diverse services such as cloud gaming and augmented reality will be launched in the first half of the year alongside new 5G-enabled smartphones throughout the year. They say this will contribute to the growth in the industry.

…………………………………………………………………………………………………………………………………………………………………

South Korea ended 2019 with 5 million 5G subscribers. SK Telecom, KT and LG Uplus commercially launched fully-fledged 5G mobile networks on 3 April 2019. In August last year, SK Telecom led South Korea’s 5G market with 84 million subscribers, followed by KT with 630,000 and LG Uplus with 540,000. KT passed 1 million 5G customers on 21 September 2019, less than six months since launching the service.

In January, SK Telecom, KT and LG Uplus collaborated to provide 5G services on subways in major South Korean cities. The three operators completed the deployment of 5G infrastructure on the subway system in Gwangju, 330 kilometers southwest of Seoul. The operators plan to install 5G networks for subways and metro stations in major cities, including Daegu, Daejeon and Busan, in the first quarter of this year.

…………………………………………………………………………………………………….

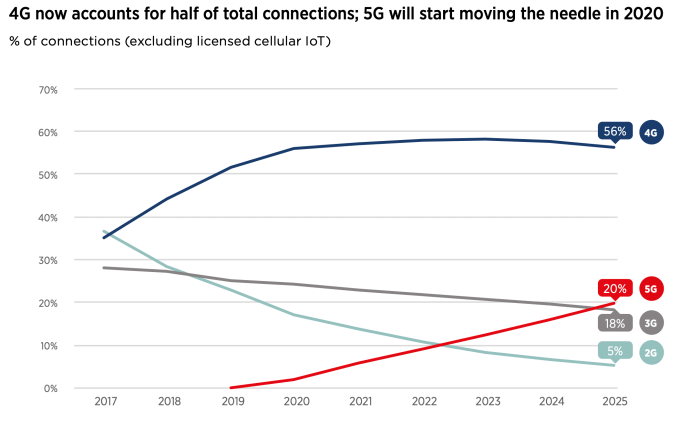

From a GSMA report: 2020 Mobile Economy

In general, consumers in South Korea and China – having witnessed some of the earliest launches – appear to be the most excited by the prospect of upgrading to 5G, while those in the US, Europe and Japan seem more content with 4G for the time being,” the GSMA adds, before striking an upbeat note: “5G is still in its infancy though; as more tangible use cases are deployed, more consumers will appreciate the benefits of 5G.

………………………………………………………………………………………

References:

https://www.koreatimes.co.kr/www/tech/2020/03/133_285715.html

SoftBank to be 1st to launch 5G network service in Japan

SoftBank has announced it will launch 5G services on March 27th in Japan – the first network operator to launch 5G services, according to Japan Times.

SoftBank plans to charge an additional monthly fee of JPY 1,000 (approximately USD 9) for access to its 5G service. However, as a service launch promotion, customers will have free access to SoftBank’s 5G service for the first 2 years, under a sales campaign that runs until August.

SoftBank plans to initially provide its 5G service in Tokyo, Osaka, Chiba, Aichi, Hiroshima, Ishikawa and Fukuoka prefectures, starting 31 March. The operator intends to deploy more than 10,000 base stations by end-March 2023.

SoftBank will start selling two 5G-enabled smartphone models on March 27th and add two more later this year. Sharp and Sony recently unveiled their first 5G smartphone models. SoftBank plans to provide 5G smartphones from Sharp, China’s ZTE, Oppo and LG. Sharp unveiled its first 5G smartphone model, the Aquos R5G, on 17 February. The Android phone will be available in Japan this spring and its price will be similar to existing high-end smartphones, Sharp said.

…………………………………………………………………………………………..

Rivals NTT Docomo Inc. and KDDI Corp. are expected to reveal their own 5G plans soon.

While the launch of 5G in Japan will ramp up domestic competition, Rakuten Inc.’s foray into the market as the nation’s fourth big carrier will stir things up further.

Earlier this week, Rakuten announced it would undercut its rivals with a 4G service on April 8 that only costs ¥2,980 a month for unlimited data usage.

The plan is about half the price charged by the top three mobile phone carriers, but Rakuten’s coverage is limited by comparison. Rakuten also said the first year of its 4G service would be free for the first 3 million subscribers.

SoftBank’s 4G plan costs ¥6,500 a month for up to 50GB of data, with a ¥1,000 discount for the first year. SoftBank, however, has recently lowered prices — ostensibly to head off Rakuten’s aggressive charge — and is laying the groundwork for getting customers to shift to 5G without any added financial catches.

Rakuten will reportedly launch a 5G network in June. This new age carrier had previously announced plans to launch 4G services starting April, and then upgrade to 5G in summer as it gradually expands the network. It aims to have nationwide Japan coverage by March 2021.

Pre-standard 5G networks have already been deployed in the United States, South Korea, China and parts of Europe.

References:

https://www.japantimes.co.jp/news/2020/03/05/business/tech/softbank-5g-japan-first/

https://www.telecompaper.com/news/softbank-to-launch-5g-service-in-japan-on-27-march–1329354

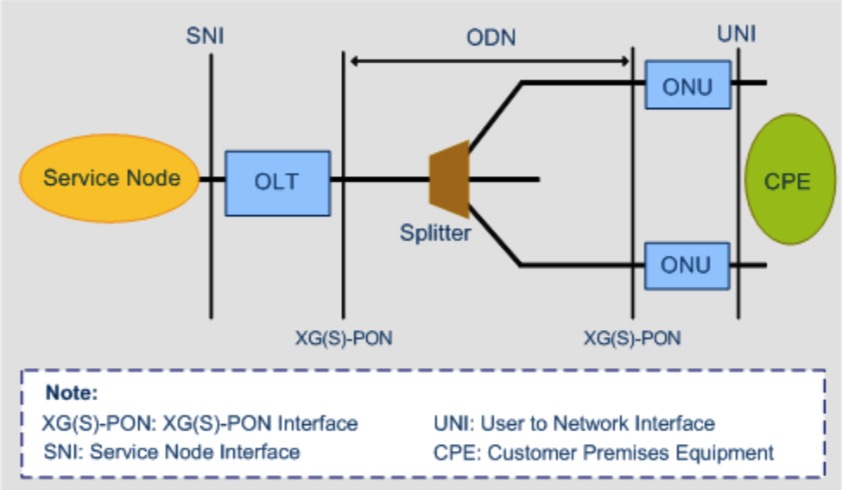

AT&T deploys XGS-PON to power FTTH nets

AT&T has enhanced its fiber-to-the-home (FTTH) “last mile” network by deploying XGS-PON [1.] technology which will be live in 40 markets. AT&T will start out providing 1 gigabit download speeds before eventually boosting them to 10 gigabits per second in both directions as it upgrades from GPON networks. The company said it has deployed XGS-PON in “a few thousand locations” noted that it has employed multiple vendors in the process. It’s part of AT&T’s road map to virtualize network access functions within its last mile network.

NOTE 1. XGS-PON is a fixed wavelength symmetrical 10 Gbps passive optical network technology.

The “X” in XGS represents the number 10, and the letter “S” stands for symmetrical, XGS-PON = 10 Gigabit Symmetrical PON. An earlier, non-symmetrical 10 Gigabit PON version (XG-PON) was limited to 2.5 Gbps in the upstream direction.

PON technology originated in the 1990’s and has continued to develop through multiple iterations with differing wavelengths, speeds and components emerging as the technology has improved. The common denominator of all fiber optic PON networks remains the unpowered or passive state of the fiber and its splitting or combining components, i.e. no active elements such as optical amplifiers, which would require power, are present in the network. With streaming, high definition, 5G and other emerging technologies continually pushing bandwidth demands, the development of XGS-PON and other standards has proven to be essential.

Simultaneous upstream and downstream transmission over the same fiber is made possible through wavelength division multiplexing (WDM). This technology allows one XGS-PON wavelength or color of light transmission for upstream and another for downstream.

………………………………………………………………………………………………………………………………….

Two years ago, AT&T completed trials of 10 Gbps XGS-PON by using Open Source Access Manager Hardware Abstraction (OSAM-HA) software in Atlanta and Dallas. OSAM-HA was released into the Open Networking Foundation (ONF) in 2017 as VOLTHA.

- OSAM, which used the Open Networking Automation Platform (ONAP) platform that AT&T helped develop, is a vendor-agnostic operational suite for managing consumer and business broadband access network elements and capabilities. ONAP has undergone several major releases over the past few years.

- ONF’s Virtual OLT Hardware Abstraction (VOLTHA) open source software project, which is a component of ONF’s SDN Enabled Broadband Access (SEBA) platform, abstracts a PON network to make it manageable as if it were a standard OpenFlow switch.

- SEBA describes how to assemble a collection of open source components to build a virtualized PON network to deliver residential broadband and mobile backhaul. SEBA uses a disaggregated white-box approach for building next generation access networks by using open source.

“AT&T continues to work with open communities such as ONF, ONAP, and OCP (Open Compute Project) to drive innovation, time-to-market, and cost improvements as we build next generation networks,” the company said in a March 4th statement in regard to a request for more information on the deployments in the 40-plus cities.

……………………………………………………………………………………………………………………………….

Conventional wisdom in the fiber broadband industry suggests NG-PON2 is the platform most providers will eventually adopt, with XGS-PON as an interim step to get there.

Verizon seems to be leapfrogging that approach. For what it’s worth regarding conventional wisdom, the AT&T spokesperson tells Telecompetitor, that “AT&T is not currently planning to use NG-PON2 at this time.”

……………………………………………………………………………………………………………………………….

References:

AT&T Fiber Begins Transition to Next Generation XGS-PON FTTH

https://www.fiercetelecom.com/telecom/at-t-tees-up-1-gig-xgs-pon-speeds-over-40-cities

https://www.viavisolutions.com/en-us/xgs-pon

http://www.tarluz.com/ftth/specification-differences-among-gpon-xg-pon-and-xgs-pon/