Google Cloud

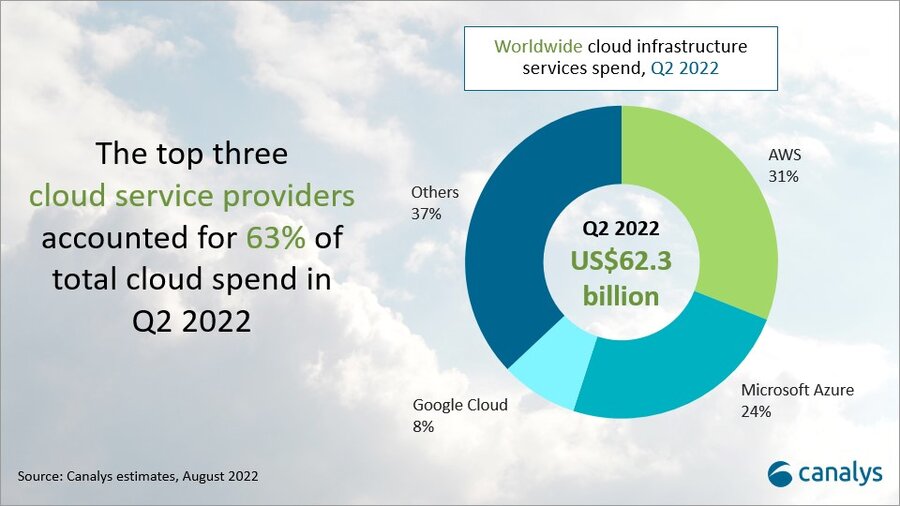

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

According to market research firm Canalys, cloud infrastructure services continued to be in high demand in Q2 2022. Worldwide cloud spending increased 33% year on year to US$62.3 billion, driven by a range of factors, including demand for data analytics and machine learning, data center consolidation, application migration, cloud-native development and service delivery. The growing use of industry-specific cloud applications also contributed to the broader horizontal use cases seen across IT transformation. The latest Canalys data shows expenditure was over US$6 billion more than in the previous quarter and US$15 billion more than in Q2 2021.

The top three vendors in Q2 2022, Amazon Web Services (AWS), Microsoft Azure and Google Cloud, together accounted for 63% of global spending in Q2 2022 and collectively grew 42%. The key to increasing global market share is continually growing and upgrading cloud data center infrastructure, which all big three cloud service providers are working on.

- AWS accounted for 31% of total cloud infrastructure services spend in Q2 2022, making it the leading cloud service provider. It grew 33% on an annual basis.

- Microsoft Azure was the second largest cloud service provider in Q2, with a 24% market share after growing 40% annually.

- Google Cloud grew 45% in the latest quarter and accounted for an 8% market share.

In the next year, AWS plans to launch 24 new availability zones in eight regions, and Microsoft plans to launch 10 new cloud regions. Google Cloud, which accounted for 8% of Q2 cloud spend, recently announced Latin America expansion plans.

The hyperscale battle between leader AWS and challenger Microsoft Azure continues to intensify, with Azure closing the gap on its rival. Fueling this growth, Microsoft had a record number of larger multi-year deals in both the US$100 million-plus and US$1 billion-plus segments. Microsoft also said it plans to increase the efficiency of its server and network equipment by extending the depreciable useful life from four years to six.

A diverse go-to-market ecosystem, combined with a broad portfolio and wide range of software partnerships is enabling Microsoft to stay hot on the heels of AWS in the race to be #1 in cloud services.

“Cloud remains the strong growth segment in tech,” said Canalys VP Alex Smith. “While opportunities abound for providers large and small, the interesting battle remains right at the top between AWS and Microsoft. The race to invest in infrastructure to keep pace with demand will be intense and test the nerves of the companies’ CFOs as both inflation and rising interest rates create cost headwinds.”

Both AWS and Microsoft are continuing to roll out infrastructure. AWS has plans to launch 24 availability zones across eight regions, while Microsoft plans to launch 10 new regions over the next year. In both cases, the providers are increasing investment outside of the US as they look to capture global demand and ensure they can provide low-latency and high data sovereignty solutions.

“Microsoft announced it would extend the depreciable useful life of its server and network equipment from four to six years, citing efficiency improvements in how it is using technology,” said Smith. “This will improve operating income and suggests that Microsoft will sweat its assets more, which helps investment cycles as the scale of its infrastructure continues to soar. The question will be whether customers feel any negative impact in terms of user experience in the future, as some services will inevitably run on legacy equipment.”

Beyond the capacity investments, software capabilities and partnerships will be vital to meet customers’ cloud demands, especially when considering the compute needs of highly specialized services across different verticals.

“Most companies have gone beyond the initial step of moving a portion of their workloads to the cloud and are looking at migrating key services,” said Canalys Research Analyst Yi Zhang. “The top cloud vendors are accelerating their partnerships with a variety of software companies to demonstrate a differentiated value proposition. Recently, Microsoft pointed to expanded services to migrate more Oracle workloads to Azure, which in turn are connected to databases running in Oracle Cloud.”

Canalys defines cloud infrastructure services as those that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly, but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact: Alex Smith: [email protected] OR Yi Zhang: [email protected]

References:

ManTech and Google Cloud open joint facility to expedite government adoption of cloud technologies

In April, Google Cloud announced a partnership with ManTech to accelerate US government adoption of cloud technologies. The partnership will combine Google Cloud technology and security capabilities with ManTech’s federal solution delivery capability and public sector domain expertise. The two companies will launch a joint demonstration facility in Northern Virginia to showcase their combined technology capability.

Together, ManTech and Google Cloud’s full range of capabilities and technology know-how can meet government needs across multi and hybrid cloud environments, infrastructure modernization, application development, data management, artificial intelligence, analytics, and cybersecurity. This will enable the two companies to jointly assist agencies with core areas of modernization including multi-cloud and hybrid cloud adoption, hyperscale analytics, security, 5G, and edge-computing.

Google Cloud’s partnership with ManTech was said to be a critical step toward meeting the federal customer mission by expediting cloud adoption, and helping to solve the government’s unique challenges with new solutions and capabilities. As the need for cloud adoption has accelerated, and cybersecurity threats continue to destabilize our critical infrastructure, strategic private sector partnerships that support U.S. government interests have a key role to play in facilitating remote collaboration, and securing the welfare of Americans.

References:

Gartner: AWS, Azure, and Google Cloud top rankings for Cloud Infrastructure and Platform Services

Gartner’s latest Magic Quadrant report for cloud infrastructure and platform services (CIPS) ranks Amazon Web Services (AWS), Microsoft Azure, and Google Cloud as the top cloud service providers.

Beyond the top three players, Gartner placed Alibaba Cloud in the “visionaries” box, and ranked Oracle, Tencent Cloud, and IBM as “niche players,” in that order.

The scope of Gartner’s Magic Quadrant for CIPS includes infrastructure as a service (IaaS) and integrated platform as a service (PaaS) offerings. These include application PaaS (aPaaS), functions as a service (FaaS), database PaaS (dbPaaS), application developer PaaS (adPaaS) and industrialized distributed cloud offerings that are often deployed in enterprise data centers (i.e. private clouds).

Figure 1: Magic Quadrant for Cloud Infrastructure and Platform Services

……………………………………………………………………………………………..

……………………………………………………………………………………………..

1. Gartner analysts praise Amazon AWS for its broad support of IT services, including cloud native, edge compute, and processing mission-critical workloads. Also noteworthy is Amazon’s “engineering prowess” in designing CPUs and silicon. This focus on owning increasingly larger portions of the supply chain for cloud infrastructure bolsters the No. 1 cloud provider’s long-term outlook and earns it advantages against competitors, according to the Gartner report.

“AWS often sets the pace in the market for innovation, which guides the roadmaps of other CIPS providers. As the innovation leader, AWS has materially more mind share across a broad range of personas and customer types than all other providers,” the analysts wrote.

AWS, which recently achieved $59 billion in annual revenues, contributed 13% of Amazon’s total revenue and almost 54% of its profit during second-quarter 2021.

AWS’s future focus is on attempting to own increasingly larger portions of the supply chain used to deliver cloud services to customers. Its operations are geographically diversified, and its clients tend to be early-stage startups to large enterprises.

……………………………………………………………………………………

2. Microsoft Azure, which remains the #2 Cloud Services Provider, sports a 51% annual growth rate. It earned praise from Gartner for its strength “in all use cases, which include the extended cloud and edge computing,” particularly among Microsoft-centric organizations.

The No. 2 public cloud provider also enjoys broad appeal. “Microsoft has the broadest set of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market,” the analysts wrote.

Microsoft has the broadest sets of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market. From the perspective of IaaS and PaaS, Microsoft has compelling capabilities ranging from developer tooling such as Visual Studio and GitHub to public cloud services.

Enterprises often choose Azure because of the trust in Microsoft built over many years. Such strategic alignment with Microsoft gives Azure advantages across nearly every vertical market.

“Strategic alignment with Microsoft gives Azure advantages across nearly every vertical market,” Gartner said. However, Gartner criticized Microsoft for very complex licensing and contracting. Also, Microsoft sales pressures to grow overall account revenue prevent it from effectively deploying Azure to bring down a customer’s total Microsoft costs.

Microsoft Azure’s forays in operational databases and big data solutions have been markedly successful over the past year. Azure’s Cosmos DB and its joint offering with Databricks stand out in terms of customer adoption.

………………………………………………………………………………………

3. Google Cloud Platform (GCP) is strong in nearly all use cases and is slowly improving its edge compute capabilities. Google continues to invest in being a broad-based provider of IaaS and PaaS by expanding its capabilities as well as the size and reach of its go-to-market operations. Its operations are geographically diversified, and its clients tend to be startups to large enterprises.

The company is making gains in mindshare among enterprises and “lands at the top of survey results when infrastructure leaders are asked about strategic cloud provider selection in the next few years,” Gartner analysts wrote. Google is also closing “meaningful gaps with AWS and Microsoft Azure in CIPS capabilities,” and outpacing its larger competitors in some cases, according to the report.

The analysts also noted that Google Cloud “is the only CIPS provider with significant market share that currently operates at a financial loss.” The No. 3 public cloud provider reported a 54% year-over-year revenue increase and a 59% decrease in operating losses during Q2.

………………………………………………………………………………..

Separately, Dell’Oro Group Research Director Baron Fung recently said that hyperscalers make up a big portion of the overall IT market, with the 10 largest cloud-service providers, including AWS, Google, and Alibaba, accounting for up to 40% of global data center spending, and “some of these companies can have really tremendous weight on the ecosystem.”

The Dell’Oro report noted that some providers have deployed accelerated servers using internally developed artificial intelligence (AI) chips, while other cloud providers and enterprises have commonly deployed solutions based on graphics processing units (GPUs) and FPGAs.

Fung explained that this model has also spilled over into those cloud providers also building their own servers and networking equipment to better fit their needs while “moving away from the traditional model in which users are buying equipment from companies like Dell and [Hewlett Packard Enterprise]. … It’s really disrupting the vendor landscape.”

Certain applications—such as cloud gaming, autonomous driving, and industrial automation—are latency-sensitive, requiring Multi-Access Edge Compute, or MEC, nodes to be situated at the network edge, where sensors are located. Unlike cloud computing, which has been replacing enterprise data centers, edge computing creates new market opportunities for novel use cases.

…………………………………………………………………………………

References:

https://www.gartner.com/doc/reprints?id=1-26YXE86I&ct=210729&st=sb

Google Cloud revenues up 54% YoY; Cloud native security is a top priority

Google Cloud revenues increased 54% year over year to $4.62 billion during the second quarter of 2021, parent company Alphabet reported today. Google Cloud’s operating loss shrunk 59%, from $1.42 billion a year ago to $591 million last quarter.

Google Cloud includes both Google Cloud Platform (GCP) and its Workspace (formerly G Suite) cloud computing services and collaboration tools.

Like previous quarters, “GCPs revenue growth was, again, above cloud overall, reflecting significant growth in both infrastructure and platform services,” the company said in a statement.

“As for Google Cloud, we remain focused on revenue growth, and are pleased with the trends we’re seeing across cloud,” Google CFO Ruth Porat said on the company’s 2Q-2021 earnings call today. Porat added that growth in its Google Cloud Platform segment again surpassed overall cloud gains “reflecting significant growth in both infrastructure and platform services.”

“We will continue to invest aggressively, including expanding our go-to-market organization, our channel expansion, our product offerings, and our compute capacity,” she said.

Also on today’s earnings call, Google CEO Sundar Pichai cited security as a competitive differentiator and “our strongest product portfolio.” Google will continue to invest in security and continue its work to integrate its various security products such as Beyond Corp and Chronicle, he added.

“Cyber threats increasingly are on the mind of not just CIOs but CEOs across our partners. So it’s definitely an area where we are seeing a lot of conversations, a lot of interest…so a definite source of strength and you’ll see us continue to invest here,” he said.

“We are cloud native, we pioneered … zero trust and built the architecture out from a security-first perspective. Particularly, over the course of the last couple of years, with the recent attacks, [companies] really started thinking deeply about vulnerabilities, supply chain security has been a major source of consensus, cyber threats are increasingly on the mind of, not just CIOs, but CEOs across our partners. So it’s definitely an area where we are seeing a lot of conversations, a lot of interest.”

Google Cloud, along with its other business units, boosted Alphabet’s revenue 62% year over year, to $61.9 billion. As usual, Google ad revenue represented the biggest piece of the pie. It grew 69% to $50.44 billion. Retail was the biggest contributor to advertising growth.

Google Cloud holds around 7% market share in the cloud services segment, according to a Canalys report released in April 2021. It trails Amazon Web Services (AWS) and Microsoft Azure, which hold 32% and 19% market share, respectively.

Microsoft posted financial results Tuesday, its Intelligent Cloud revenue increased 30% to $17.4 billion. The company stated Azure revenue grew of 51%, but did not break out a dollar figure. Amazon is set to report earnings on Thursday.

Along with their hyper-scale cloud competitors Google Cloud is partnering with telecom companies all over the world to help them drive transformation and accelerate 5G adoption and monetization.

Here are a few of their telco partners:

………………………………………………………………….

References:

https://abc.xyz/investor/static/pdf/2021Q2_alphabet_earnings_release.pdf?cache=4db52a1

https://www.fiercetelecom.com/financial/google-cloud-revenue-climbs-54-q2

https://www.sdxcentral.com/articles/news/google-cloud-losses-shrink-59-revenue-hits-4-6b/2021/07/

Bell Canada Partners selects Google Cloud to Deliver Next-Generation Network Experiences

Another major national telco has forged a significant relationship with a public cloud service provider to tap into the latter’s functionality and distributed cloud platform. Today, it’s Bell Canada and Google Cloud.

Bell Canad, Canada’s largest telecommunications company, and Google Cloud today announced a strategic partnership to power Bell’s company-wide digital transformation, enhance its network and IT infrastructure, and enable a more sustainable future. This new, multi-year partnership will combine Bell’s 5G network leadership with Google’s expertise in multi-cloud, data analytics, and artificial intelligence (AI), to deliver next-generation experiences for Bell customers across Canada.

As a strategic technology partner, Google Cloud will enable Bell to drive operational efficiencies, increase network automation, and deliver richer customer experiences through the following initiatives:

- Shifting critical workloads to the cloud: By moving and modernizing IT infrastructure, network functions, and critical applications from on-premise to Google Cloud, Bell will be able to drive greater operational efficiencies and enable better application performance.

- Unlocking multicloud, next-generation network technology: With the combined power of Bell’s 5G network and Anthos, Google Cloud’s multicloud solution, Bell will deliver a consistent customer experience with greater automation and enhanced flexibility that scales with customer demand. The increased speed and bandwidth capacity of the Bell 5G network will support applications that can respond faster and handle greater volumes of data than previous generations of wireless technology.

- Leveraging the power of AI, data and analytics: Bell will leverage Google Cloud’s expertise in AI and big data to gain unique insights through real-time network data analytics that will enhance the customer experience, improve service assurance, and assist with network capacity planning.

- Joining forces on a sustainable future: Bell and Google share a common goal to run more sustainable businesses. As the cleanest cloud in the industry, Google Cloud will contribute to Bell’s target of achieving carbon neutral operations by 2025, and reducing greenhouse gas emissions by 2030 in line with the Paris Climate Agreement.

“We’re excited to partner with Google Cloud as part of our ongoing digital transformation and take Bell’s 5G network leadership to the next level,” said Mirko Bibic, CEO, BCE Inc. and Bell Canada. “Supporting Bell’s goal to advance how Canadians connect with each other and the world, Google’s proven expertise in cloud and leadership in sustainability will provide our customers with even faster, more reliable access to the best broadband network and communications services in Canada.”

“The acceleration of 5G has created new opportunities for industry leaders like Bell to redefine their business and create richer customer experiences,” said Thomas Kurian, CEO, Google Cloud. “We’re proud to partner with Bell to support their transformational shift to the cloud, and power a better network experience for people and businesses across Canada.”

As demands on mobile networks evolve and increase, Bell and Google Cloud will collaborate throughout the next decade on new innovations, including cloud solutions for enterprise customers and consumers powered by Google edge solutions, and enhanced customer service through automation and AI. In addition, the two companies will look at new ways to expand Bell’s existing partnership with Google to evolve the network experience and introduction of next-generation services across residential, mobile, and more.

Bell Canada says its relationship with Google Cloud will enable it to “drive operational efficiencies, increase network automation, and deliver richer customer experiences” through a number of initiatives, namely: Shifting multiple workloads from private systems to its partner’s platforms; leveraging “Google Cloud’s expertise in AI and big data to gain unique insights through real-time network data analytics that will enhance the customer experience, improve service assurance, and assist with network capacity planning; and combining the operator’s 5G connectivity with Anthos-hosted applications for an experience that “can respond faster and handle greater volumes of data than previous generations of wireless technology.”

They even squeezed a sustainability angle from the relationship, boasting that the collaboration would help the operator hit its target of achieving carbon neutral operations by 2025.

And this is just the start: The partners say they will “collaborate throughout the next decade on new innovations, including cloud solutions for enterprise customers and consumers powered by Google edge solutions, and enhanced customer service through automation and AI. In addition, the two companies will look at new ways to expand Bell’s existing partnership with Google to evolve the network experience and introduction of next-generation services across residential, mobile, and more.”

Like many network operators, Bell Canada is not monogamous in its public cloud relationships: Only weeks ago it announced it is teaming up with Amazon Web Services (AWS) for telco edge service developments and will integrate AWS Wavelength Zones into its 5G network in an effort to encourage developers to create new services, particularly low-latency applications that can take advantage of edge compute assets and 5G connectivity.

Same is true for Google Cloud- they have many relationship with many telecom service providers. Earlier this year, Google Cloud signed a 10-year deal with the Canadian telco Telus. Additionally, the cloud company extended its partnership with AT&T to offer edge computing and software tools to create 5G applications. As the growth of 5G and edge computing open up new economic opportunities, the major public cloud providers have been busy inking deals with CSPs and other players in the 5G ecosystem.

In addition to its new telco deals, Google recently announced a partnership with Intel to develop reference architectures and technologies that will accelerate the deployment of 5G and edge network solutions.

References:

https://www.prnewswire.com/news/google-cloud/

https://www.zdnet.com/article/google-cloud-signs-multi-year-deal-with-bell-canada/

Related:

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

Vodafone and Google Cloud to Develop Integrated Data Platform

Vodafone and Google Cloud today announced a new, six-year strategic partnership to drive the use of reliable and secure data analytics, insights, and learnings to support the introduction of new digital products and services for Vodafone customers simultaneously worldwide.

In a significant expansion of their existing agreement, Vodafone and Google Cloud will jointly build a powerful new integrated data platform with the added capability of processing and moving huge volumes of data globally from multiple systems into the cloud.

The platform, called ‘Nucleus‘, will house a new system – ‘Dynamo‘ – which will drive data throughout Vodafone to enable it to more quickly offer its customers new, personalized products and services across multiple markets. Dynamo will allow Vodafone to tailor new connectivity services for homes and businesses through the release of smart network features, such as providing a sudden broadband speed boost.

Capable of processing around 50 terabytes of data per day, equivalent to 25,000 hours of HD film (and growing), both Nucleus and Dynamo, which are industry firsts, are being built in-house by Vodafone and Google Cloud specialist teams. Up to 1,000 employees of both companies located in Spain, the UK, and the United States are collaborating on the project.

Vodafone has already identified more than 700 use-cases to deliver new products and services quickly across Vodafone’s markets, support fact-based decision-making, reduce costs, remove duplication of data sources, and simplify and centralize operations. The speed and ease with which Vodafone’s operating companies in multiple countries can access its data analytics, intelligence, and machine-learning capabilities will also be vastly improved.

By generating more detailed insight and data-driven analysis across the organization and with its partners, Vodafone customers around the world can have a better and more enriched experience. Some of the key benefits include:

- Enhancing Vodafone’s mobile, fixed, and TV content and connectivity services through the instantaneous availability of highly personalized rewards, content, and applications. For example, a consumer might receive a sudden broadband speed boost based on personalized individual needs.

- Increasing the number of smart network services in its Google Cloud footprint from eight markets to the entire Vodafone footprint. This allows Vodafone to precisely match network roll-out to consumer demand, increase capacity at critical times, and use machine learning to predict, detect, and fix issues before customers are aware of them.

- Empowering data scientists to collaborate on key environmental and health issues in 11 countries using automated machine learning tools. Vodafone is already assisting governments and aid organisations, upon their request, with secure, anonymised, and aggregated movement data to tackle COVID-19. This partnership will further improve Vodafone’s ability to provide deeper insights, in accordance with local laws and regulations, into the spread of disease through intelligent analytics across a wider geographical area.

- Providing a complete digital replica of many of Vodafone’s internal support functions using artificial intelligence and advanced analytics. Called a digital twin, it enables analytic models on Google Cloud to improve response times to enquiries and predict future demand. The system will also support a digital twin of Vodafone’s vast digital infrastructure worldwide.

- In addition, Vodafone will re-platform its entire SAP environment to Google Cloud, including the migration of its core SAP workloads and key corporate SAP modules such as SAP Central Finance.

Johan Wibergh, Chief Technology Officer for Vodafone, said: “Vodafone is building a powerful foundation for a digital future. We have vast amounts of data which, when securely processed and made available across our footprint using the collective power of Vodafone and Google Cloud’s engineering expertise, will transform our services, to our customers and governments, and the societies where they live and serve.”

Thomas Kurian, CEO at Google Cloud, commented: “Telecommunications firms are increasingly differentiating their customer experiences through the use of data and analytics, and this has never been more important than during the current pandemic. We are thrilled to be selected as Vodafone’s global strategic cloud partner for analytics and SAP, and to co-innovate on new products that will accelerate the industry’s digital transformation.”

Revenues at Google’s Cloud business grew 46% this past quarter. However, Google continues to be a distant third to Amazon and Microsoft in the cloud business.

Technical Notes:

All data generated by Vodafone in the markets in which it operates is stored and processed in the required Google Cloud facilities as per local jurisdiction requirements and in accordance with local laws and regulations. Customer permissions and Vodafone’s own rigorous security and privacy by design processes also apply.

On the back of their collaborative work, Vodafone and Google Cloud will also explore opportunities to provide consultancy services, offered either jointly or independently, to other multi-national organizations and businesses.

The platform is being built using the latest hybrid cloud technologies from Google Cloud to facilitate the rapid standardization and movement of data in both Vodafone’s physical data centers and onto Google Cloud. Dynamo will direct all of Vodafone’s worldwide data, extracting, encrypting, and anonymizing the data from source to cloud and back again, enabling intelligent data analysis and generating efficiencies and insight.

References:

https://cloud.google.com/press-releases/2021/0503/vodafone-google-cloud (video)

Google Cloud and Nokia partner to build cloud-native 5G Core and Edge Networking

Google Cloud, Nokia partner to accelerate cloud-native 5G readiness for communication service providers:

- Google Cloud and Nokia will jointly develop cloud-native 5G core solutions for communication service providers and enterprise customers

- New partnership will deliver cloud capabilities to the network edge to accelerate enterprise digital transformation

Google Cloud and Nokia today announced a global, strategic partnership to bring new solutions for communications service providers (CSPs) that modernize their network infrastructures, build on a cloud-native 5G Core, and develop the network edge as a business services platform for enterprises.

The agreement, which comes three months after Nokia said it will move its on-premises IT infrastructure to Google Cloud, blends multiple technology platforms and services into a more comprehensive and integrated offering, according to the companies.

Google Cloud and Nokia will work closely to validate, optimize and evolve cloud-native network functions, and the two companies will also co-innovate new solutions that will help CSPs deliver 5G connectivity and services at scale.

Today, global CSPs can unlock new monetization opportunities by driving 5G connectivity and advanced services to enterprise customers at the network edge, to deliver new, digital experiences for consumers. Google Cloud and Nokia will create solutions that bring together Nokia’s 5G operations services and networking capabilities with Google Cloud’s leading technologies in AI, ML and analytics, running on Anthos as a platform for shifting workloads to the network edge, across public and private clouds.

As part of this collaboration, Nokia is supplying its voice core, cloud packet core, network exposure function, data management, signaling, and 5G core. This includes Nokia’s IMPACT IoT Connected Device Platform, which enables automated, zero-touch activation and allows for remote management of IoT devices, as well as Nokia’s Converged Charging solution provides real-time rating and charging capabilities that enable CSPs to capture new revenue opportunities from the 5G economy.

Google Cloud’s Anthos for Telecom will serve as the platform for deploying applications, enabling CSPs to build an ecosystem of services that are deployable anywhere, from the edge of the network, to public clouds, private clouds and carrier networks. Anthos is an open hybrid and multi-cloud application platform that offers telecommunications companies the flexibility to modernize existing applications, build new ones and securely run them on-premises and across multiple clouds.

By delivering cloud-native applications at the edge, businesses can benefit from lower latency and reduce the need for costly, on-site infrastructure, enabling them to transform their businesses in industries such as smart retail, connected manufacturing and digital consumer experiences.

In general, Google Cloud is focusing on three strategic areas to support telecommunications companies:

- Helping telecommunications companies monetize 5G as a business services platform.

- Empowering them to better engage their customers through data-driven experiences.

- Assisting them in improving operational efficiencies across core telecom systems.

In December, Google Cloud announced an ecosystem of over 30 partners that will serve more than 200 partner applications at the edge. Google Cloud has more than 2,000 locations globally where it can help service providers monetize their infrastructures.

Adding Nokia as another partner will help Google Cloud modernize telcos’ infrastructures by tapping into 5G connectivity as well as cloud-native applications and capabilities from the 5G network core to the edge.

Note yet again, there are no standards for 5G Core, let alone a cloud-native version. In the References below, we list 5G cloud-native core white papers from Nokia, Ericsson and Samsung.

Supporting Quotes:

“Through our partnership we can give customers choice and simplicity in interfacing with Google Cloud and Nokia systems. In many cases, we can provide pre-integrated solutions from Google Cloud and Nokia, which may offer a time-to-market advantage and a more seamless path to 5G for communications service providers,” a Google Cloud spokesperson wrote in response to questions. “At a high level, our approach to supporting the telecommunications industry will span multiple partnerships, geographies, and technology layers,” the Google Cloud spokesperson said.

George Nazi, VP, Telco, Media & Entertainment Industry Solutions at Google Cloud, said: “Communications service providers have a tremendous opportunity ahead of them to support businesses’ digital transformations at the network edge through both 5G connectivity and cloud-native applications and capabilities. Doing so requires modernized infrastructure, built for a cloud-native 5G core, and we’re proud to partner with Nokia to help the telecommunications industry expand and support these customers.”

Alex Choi, SVP, Strategy and Technology Innovation at Deutsche Telekom, said: “Deutsche Telekom is on a journey to transform to a new open, disaggregated and cloud-native infrastructure with an automated production model. We are therefore excited to see two innovative organizations like Nokia and Google Cloud joining forces to accelerate ecosystem innovation across critical areas like Open RAN and virtual RAN and the cloud-native 5G Core.”

Neil McRae, Chief Architect at BT Group, said: “BT is deploying cloud-native technologies across our platform, creating value for our customers and ensuring they get the best network experience in every aspect of their daily lives, whether at home, on the move or at work. The network and the services that our customers depend upon in their everyday lives can be further enhanced in terms of scalability, reliability, and experience with cloud-native technologies. BT is excited that Google and Nokia are innovating together to help accelerate new, on-demand edge and convergence solutions, creating new possibilities for consumers and enterprises.”

Ron Haberman, CTO of Cloud and Network Services at Nokia, said: “In the past five years, the telecom industry has evolved from physical appliances to virtual network functions and now cloud-native solutions. Nokia is excited to work with Google Cloud in service of our customers, both CSPs and enterprise, to provide choice and freedom to run workloads on premise and in the public cloud. Cloud-native network functions and automation will enable new agility and use-cases in the 5G era.”

References:

https://www.sdxcentral.com/articles/news/nokia-argues-cloud-native-is-essential-to-5g-core/2019/11/

Google Cloud’s telecommunications Strategy

https://www.ericsson.com/en/digital-services/core-network-automation/guide