next gen HFC

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Charter Communications posted a surprise drop in broadband subscribers in the Q4-2023, the company announced on Friday. Charter’s internet customers decreased by 61,000 (-62,000 residential and +1,000 business) in the 4th quarter, with nearly all of the decline from residential customers. That was much worse than expectations for 17,290 additions, according to Visible Alpha and a year-ago gain of +105,000. The broadband subscriber drop was especially disappointing given Charter’s homes passed growth accelerated to 2.5% year-over-year, Craig Moffett said in a research note.

“Internet growth in our existing footprint has been challenging, driven by admittedly more persistent competition from fixed wireless and similar levels of wireline overbuild activity,” CEO Chris Winfrey said on a post-earnings call, adding that new investments will help drive growth despite the “temporary challenges.” Chief Financial Officer Jessica Fischer had warned in December that the company could lose internet customers in the quarter. At the time, speaking at an analyst conference, she said the company was facing short-term challenges and that results would be in line with the rest of the industry.

Charter was not the only cableco/MSO to report decreased broadband internet subscribers in the 4th quarter. Last week, rival Comcast reported a loss of 34,000 broadband customers, fewer than expectations, but exceeding the 18,000 broadband customers it lost in the previous quarter.

Stiff competition across broadband and wireless mobile and the decline of traditional television have been causes of concern, with Charter trying to expand its reach into rural areas in an effort to boost subscriber and earnings growth. Charter is facing heightened competition from Verizon and T-Mobile’s wireless home internet offerings, and the cable company could soon lose even more subscribers when a key government program runs out of funding in April, JPMorgan analysts say in a research note. In particular, the end of the Affordable Connectivity Program (ACP), which provided up to $30 per month to eligible customers to put toward their internet bills, could hurt Charter more than its peers. If ACP is not refunded, “we’ll work very hard to keep customers connected,” Winfrey said. Charter has more than 5 million ACP recipients, the highest in the industry. The majority of them were Charter broadband subscribers before the program began.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 142,000 broadband subs via its rural subsidy program in Q4, for a total of 420,000, and an overall penetration rate of 33.8% – up from 27.2% in the year-ago quarter. The company posted $74 million in rural revenues, up from $39 million a year earlier. Charter pulled in subsidy revenues of $29 million in Q4. Total capex for the project in Q4 was $426 million, down from $567 million in the year-ago quarter. Charter plans to activate 450,000 new subsidized rural passings in 2024. With all programs rolled up, Charter has committed to build 1.75 million subsidized rural passings.

Charter expects to complete its Rural Digital Opportunity Fund (RDOF) builds by the end of 2026 – two years ahead of schedule. Charter also intends to participate in the much larger $42.45 billion Broadband Equity Access and Deployment (BEAD) program.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Completion of Charter’s hybrid fiber/coax (HFC) network upgrade has been delayed to 2026 due in part to a lengthier certification process for distributed access architecture (DAA) technology. Charter’s original plan was to complete its HFC upgrades by the end of 2025. Charter’s HFC evolution plan consists of three steps:

- An upgrade to 15% of its network to 1.2GHz with an upstream-enhancing “high-split” using traditional integrated cable modem termination systems (CMTSs). That enables multi-gigabit downstream speeds and upstream speeds up to 1 Gbit/s.

- An upgrade to 1.2GHz with DAA and a virtual CMTS in 50% of the HFC footprint, enabling downstream speeds up to 5 Gbit/s and upstream speeds up to 1 Gbit/s.

- A full DOCSIS 4.0 upgrade by deploying 1.8GHz with DAA and a vCMTS to 35% of the HFC footprint. That’ll put Charter in position to deliver up to 10 Gbit/s downstream and at least 1 Gbit/s upstream.

Speaking on today’s Q4 2023 earnings call, Charter CEO Chris Winfrey said the operator has launched symmetrical speed tiers in two markets (Reno and Rochester, Minnesota, an official confirmed), with deployments in six additional markets underway that, once completed, will fulfill the phase one plan. Charter expects to start DAA deployments in its phase two markets later this year, Winfrey said.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 546,000 mobile lines in Q4, down from a gain of +615,000 in the year-ago quarter and +594,000 in the prior quarter. Analysts were expecting Charter to add 594,000 mobile lines in the 4th quarter and +2.5 million lines for full 2023, up from 1.7 million in full 2022. The MSO ended 2023 with 7.76 million mobile lines. Charter is also expanding its deployment of CBRS spectrum to help the company offload MVNO costs in high-usage areas. Winfrey said “thousands” of CBRS units have been deployed in one “large” market (believed to be Charlotte, North Carolina). Charter expects to roll CBRS to an additional market later this year, he said.

References:

Charter Communications adds broadband subs and raises CAPEX forecast

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

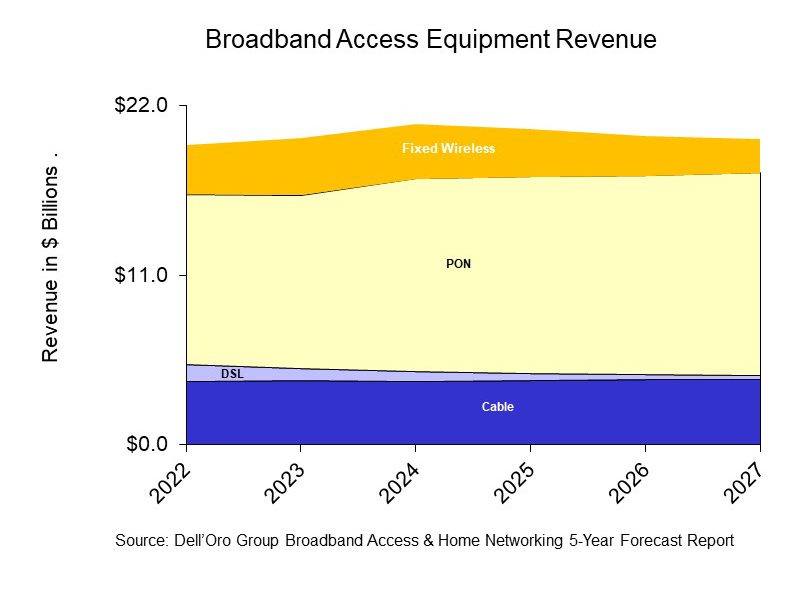

A newly published report by Dell’Oro Group predicts that sales of PON (Passive Optical Network) equipment for fiber-to-the-home deployments, cable broadband access equipment, and fixed wireless CPE will all increase from 2022 to 2027, as service providers continue to expand their fiber and DOCSIS 4.0 networks, while expanding the types of services they deliver to residential subscribers.

“Service providers around the world continue to transition their broadband networks to fiber and retire their existing copper and DSL networks,” said Jeff Heynen, Vice President at Dell’Oro Group. “With markets expected to become more competitive, broadband providers will have to continue spending in order to differentiate their services not only by increasing advertised speeds, but also improving latency and expanding managed Wi-Fi services,” added Heynen.

Additional highlights from the Broadband Access & Home Networking 5-Year January 2023 Forecast Report:

- PON equipment revenue is expected to grow from $11.0 B in 2022 to $13.2 B in 2027, driven largely by XGS-PON deployments in North America, EMEA, and CALA.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MACPHY Devices, and Remote OLTs [1.]) is expected to reach $1.5 B by 2027, as operators ramp their DOCSIS 4.0 and fiber deployments.

- Revenue for Fixed Wireless CPE [2.] is expected to reach $2.2 B by 2027, led by shipments of 5G sub-6GHz and 5G Millimeter Wave units.

Note 1. Remote OLTs (Optical Line Terminals) can be deployed in distributed access nodes to support targeted deployments of FTTP. Comcast is already doing that for its next-gen HFC network. But others, such as Charter Communications, are also ramping up their respective efforts and pursuing similar deployment models.

“You’re now talking about a whole new architecture with remote OLTs, virtual CMTSs and remote PHY. It will take longer to operationalize. It’s a slower burn than it used to be in the past,” Heynan said. He expects cable access network spending to continue climbing past 2027 as other cablecos join the mix.

Note 2. Heynen expects FWA CPE spending to stay steady through 2024, but notes that some providers might run into capacity issues that curtail growth and will also be faced with fiercer competition from fiber and newly upgraded HFC networks. “That puts a ceiling on how much growth can happen for fixed wireless,” he said. While T-Mobile and Verizon are now driving FWA growth in the U.S., we wonder how the future will shake out for the WISP (wireless ISP) sector, which is also seeing steady growth at the moment. As WISPs (Wireless Internet Service Providers) seek out government subsidy opportunities, some may need to consider licensed spectrum or transition to fiber across their footprint.

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

Broadband network spending set to climb as cable gets its groove back | Light Reading