Month: March 2019

IBD: 5G Network Rollout Spending, Silicon, Entrepreneurship, Use Cases and Applications

Spending On 5G Network Rollout

Morgan Stanley estimates that about $225 billion will be spent on 5G network deployment from this year to 2025. The first 5G-enabled smartphones are just beginning to arrive, though access to 5G networks will be limited. Real-world tests of the technology are underway only in a few dozen U.S. cities and other locations worldwide.

Analysts disagree on where the first impact will be felt. Some say in commercial and industrial applications. Others see 5G technology initially gaining momentum on the consumer side, particularly in gaming. Industrial applications will come later, according to some analysts, as the competency of the technology proves itself. But long term, business applications are where 5G appears likely to have the greatest impact.

“It’s an exciting tech but a lot of hurry-up-and-wait, a lot of hype,” said Jason Leigh, IDC research analyst covering mobility. “Because of that, it’s hard to say which specific industries will really benefit most, but I think the biggest impact will be on the business side overall.”

In addition to network infrastructure providers such as Ericsson, Huawei, and Nokia, other beneficiaries of 5G network deployment include vendors exposed to the metro foundations and core cloud infrastructure. Cisco Systems, Ciena, and Juniper Networks fall into this category, wrote analyst Simon Leopold at Raymond James in a research report on 5G.

More Chips Needed

The deployment of 5G infrastructure also requires lots of semiconductor content, mainly due to higher radio content tied to antenna counts. Analog Devices, Marvell Technology, and Xilinx have large 5G infrastructure content, and each has already experienced early benefits as 5G trials progress, Leopold said.

Chipmakers Intel and Qualcomm, meanwhile, are involved in 5G trials. The rollout also requires network densification, which involves replacing cell towers with smaller, more tightly spaced transmit/receivers and benefits apparatus suppliers such as CommScope.

A report from the Global Mobile Suppliers Association said there are about 201 operators globally that have initiated 5G efforts, as of January. That’s up from 154 the previous year. A 2018 survey by Ericsson found that nearly 20% of 900 companies interviewed aimed to do 5G-related proof-of-concept trials in that year. An additional 38% planned to run trials in 2019.

In 2016, Ericsson found that 59% of respondents thought 5G wouldn’t be on their radar for at least five years. By 2018, that number had fallen to just 11%.

Sparking A New Era Of Entrepreneurship

Altogether, that means the 5G network upgrade will eventually affect almost every aspect of business. This includes manufacturing, health care and emergency services, education, transportation , smart cities and smart homes.

It’s also expected to expand and improve the capabilities of drones and other aerial systems and enhance autonomous vehicles. 5G will also fast-forward the application of virtual reality and augmented reality in industrial applications.

“5G will spark an unprecedented new era of entrepreneurship and business opportunities as new technologies are created, tested and rolled out in cities across the country,” wrote Craig Silliman, Verizon’s executive vice president for public policy, in a December article. He also said the 5G network will act as the backbone of the Fourth Industrial Revolution. And he asserted that robotics, 3D printing, artificial intelligence, virtual reality and drones will change almost every facet of society.

5G Use Cases and Applications

Morgan Stanley analyst Simon Flannery identified seven uses that could drive $156 billion of incremental annual revenue by 2030.

These are: $64 billion for manufacturing automation; $9 billion for cloud gaming; $18 billion for fixed wireless; $7 billion for autonomous vehicles; and $20 billion for surveillance and smart cities. He also estimates $4 billion for drones and $32 billion for remote health care services.

“The business opportunities for 5G are just exponentially bigger than previous-generation networks,” wrote Flannery, who covers North American telecom services. “And while the immediate opportunities may be limited, we believe revenue opportunities will emerge as technologies such as cloud-based gaming, autonomous vehicles, and remote surgery become mainstream.”

The first generation of mobile networks that debuted in the 1980s had the capacity to carry voice calls only. Then, 2G in the mid-1990s brought text messaging, basic data packages and partial internet services. As the new millennium began 3G ushered in the mobile internet, mobile computing, and the proliferation of apps. 4G (also called LTE) provided mobile broadband that allowed streaming video and audio and also enabled an explosion of social media apps and ride hailing services. Improvements to 4G technology continue, with rollouts in far-flung places still underway.

The power of 5G technology goes beyond current 4G wireless in several ways. For example, the time it will take for a wireless data signal to get a network response, known as latency, will shrink to about 1 millisecond, compared with 25 milliseconds with most 4G technology. It boasts bandwidth and data transmission rates more than 10 times faster than 4G LTE.

The number of devices that can connect to a 5G network, compared with existing 4G wireless towers, will also greatly expand. That’s particularly important to the rapidly expanding market for the Internet of Things. IoT is the global network of interconnected electronic devices embedded in everyday objects that share data. These will include smart homes, smart factories, smart power grids and other “systems of systems” networked configurations. There are currently more than 11 billion IoT connections worldwide; that’s expected to grow to more than 20 billion by 2020.

Among the earliest adopters could be gaming and the eSports venues, where services are already monetized and high speeds and ubiquitous connectivity are paramount.

In March, the Google unit of Alphabet announced Stadia. It’s a cloud-based gaming platform and a major move into the video game business.

Stadia is not an external console or set-top box. It is a cloud-based platform, accessible over the internet via a variety of formats.

Google‘s cloud servers will allow Stadia to stream games in 4K ultra-high definition and in 8K in the future. 5G is expected to play a crucial role in making it all work.

Microsoft is also creating its own cloud gaming service, dubbed xCloud.

“Games tend to be the tip of the spear for this kind of technology,” said Bill Morelli, chief of research for enterprise solutions at IHS Markit Technology. “While consumer segments will do better in the near term, business applications will emerge as 5G is more fully implemented and its capabilities are proven.”

Morelli doesn’t see major business applications using 5G emerging until about 2021 or 2022. While businesses are increasingly using digital technology in industrial fields, its been a slow process. Equipment replacement cycles are very long, and industry executives tend to be conservative when it comes to a major transformation.

Currently, the use of wired technology configurations far outweigh the use of wireless in industrial fields. Moreover, the bulk of wireless technology is not standard cellular wireless. It’s not considered fully reliable.

“Historically, cellular has not been a technology that was optimized for that sort of environment,” said Morelli. “But 5G is designed to close that gap, to do things with wireless you’re just not able to do today.”

One of the most anticipated uses is machine-to-machine communications, enhanced by IoT. It refers to direct communication between devices using any communications channel, including wired and wireless. IoT enables sensors or meters to communicate the data it receives so that they can be analyzed and acted upon.

Because 5G supports far more connections, it will provide the ability to connect embedded sensors in virtually everything, significantly accelerating enterprise adoption of IoT products and services.

In the development of smart cities, IoT and 5G will more closely monitor traffic flow and help reduce accidents. The addition of more sensors could also improve the distribution of utilities, monitor agriculture and improve infrastructure safety. This also includes crop monitors gauging water levels in agricultural environments and power-management systems in residential properties.

Many see IoT significantly increasing demand for microcontrollers, sensors, Wi-Fi and cellular chips, flash memory and high-performance processing units.

Among other technologies that will benefit from 5G expansion are drones and other autonomous aerial vehicles. UPS and FedEx are among the companies experimenting with autonomous vehicles and drone delivery.

The impact of 5G wireless will also be big in the health care market. It will accelerate the development and use of wearable devices for physical health monitoring and advance the medical equipment market in the development of surgical assistants and devices for remote surgery.

“There’s a lot to be excited about,” said IDC’s Leigh. “5G wireless will transform technology, but transferring that into dollars is another story.”

ICRA: Indian Telecom Industry Must Migrate from Copper to Dense Fiber Optic Networks

With over one billion mobile phone customers and an explosion of mobile data consumption over the past two years, the Indian telecom industry needs to migrate from traditional copper-based backhaul networks to dense optic fiber cable networks, according to Indian investment information and credit rating agency ICRA.

The proliferation of affordable smartphones, low data tariffs, increase in speeds of delivery and enhanced content have led to 539 million wireless internet subscribers in the country. This translates into daily consumption of 418,330 terabytes (TBs) of data. Each TB measures over 1,000 gigabytes. The data consumption is expected to grow over the long term with increasing applications, improving technology and more content. To meet the requirements, telecom networks need to be robust and have the capacity to carry large amounts of data and deliver it quickly, according to a new ICRA research report.

With each step on technology ladder from 2G to 3G to 4G and soon to be 5G, the fiber requirement has been increasing. 5G and its applications, which will likely grow exponentially in years to come, translate into speeds in excess of 10 Gbps as against the average speeds of 6 Mpbs achieved with 4G technologies in India (against a global average of 17 Mbps).

“Achieving such speeds make fiber connectivity essential. India’s high population density also translates into deeper and denser fiber network,” the report stated. At present, the country has about 500,000 towers of which only 22 per cent are fiberized as against 80 per cent in China. India has 110 million km of fiber deployed compared to 420 million km in the United States and 1,090 million km in China. Hence, India’s fiber coverage in km per capita works out to 0.09, which is far behind 0.87 for China and more than 1.3 for the United States and Japan. “The fiber density in India will have to increase at least four-fold. It means that fiber will evolve as a separate industry in some time, similar to the trajectory seen for telecom tower industry over the past two decades.”

ICRA estimates the present market value of fiber assets owned by major private telecom operators is about Rs 1.2 lakh crore. The extent of fiber rollout over the next few years will require investments of Rs 2.5 lakh crore to 3 lakh crore. Hence sharing of fiber among multiple telcos will be the key driver of a reasonable return on capital.

Trends of Indian Telecom Industry for January 2019 [SOURCE: ICRA Research]:

1) Total subscriber base at 1,203 million; YoY growth of 2.4%; MoM growth of 0.5%

2) 20 out of 22 circles reported increase in subscriber base on MoM basis; North East reported the highest MoM growth

3) Overall tele-density steady at 91.8%; Urban tele-density at 161.3%, rural tele-density at 59.4%

4) Wireless subscriber base at – 1,182 million; YoY growth of 2.6%; MoM growth of 0.5%

5) Active wireless subscriber base at 1,022 million; YoY growth of 1.0%; MoM de-growth of 0.4%

6) Vodafone Idea leads the market with active wireless subscriber market share of 37.6%, followed by Bharti at 32.4% and RJio

at 23.5%

7) Urban wireless subscriber base at 654.2 million; YoY growth of 0.2%; MoM growth of 1.0%

8) Rural wireless subscriber base at 527.8 million; YoY growth at 5.7%; MoM decline of 0.1%

9) Wireline Subscriber base at 21.8 million; YoY decline of 5.5%; BSNL/MTNL continue to be the market leader

10) Broadband subscriber base at 540.0 million; strong YoY growth of 43%

11) For September 2018 quarter, total minutes on network grew 41.2% YoY, while MoU per subscriber grew by 43.9%.

12) For September 2018 quarter, data subscriber base and per subscriber usage continued to report healthy YoY growth

China IT Minister: 5G Licenses Coming this Year; Deployment timing dependent on technology maturation

by Yang Ge (edited by Alan J Weissberger)

China will issue 5G wireless communications licenses by year-end, the nation’s telecoms minister said, as the country pushes aggressively into 5G before the IMT 2020 standard or 3GPP Release 16 spec are completed.

“I expect 5G licenses will be issued at some point this year,” Minister of Industry and Information Technology Miao Wei, said on Thursday in a session at the Boao Forum for Asia in South China’s Hainan province, the Shanghai Securities News reported. Wei added that actual timing for the launch of 5G network deployments will depend on maturation of the necessary technology, most notably 5G handsets. “Large-scale commercial service will need to wait until networks are perfected,” he said. “We need to give China’s (wireless) carriers some time.”

Editor’s Note: The three state owned and controlled China carriers are: China Mobile, China Telecom, and China Unicom.

………………………………………………………………………………………………………………………………………………………………………………………………

China is the world’s largest mobile market with some 1.5 billion subscribers, with many in the world’s most populous country holding multiple accounts. But in the past the nation was slow to roll out the latest generations of new mobile communications, often preferring to wait for the technology to mature first in more advanced Western markets.

Beijing has taken a sharply different tack in 5G, aiming to become a leader in the space for a technology expected to power many of the wireless high-tech applications of the future such as telemedicine and self-driving cars. Accordingly, it wants to roll out its networks sooner rather than later, and for the first time could be among the world’s first major markets to launch service.

The technology could facilitate data-transfer speeds up to 10 times faster than current 4G technology, said Yang Chaobin, president of 5G product lines at China’s own Huawei Technologies, the world’s leading manufacturer of telecom equipment. Miao estimated that 20% of 5G will be used for person-to-person communications, while 80% will be used for communication between things such as applications behind self-driving cars.

Among China’s three major carriers, the largest, China Mobile, is aiming to roll out “pre-commercial” 5G service this year, with full commercial service available sometime next year, said Vice President Li Huidi, according to the Shanghai Securities News report. China Mobile’s smaller rivals, China Unicom and China Telecom, have previously said they will each invest around $1.2 billion this year on 5G networks.

Miao also said that countries and companies should work together on 5G, even as a U.S. coalition is expressing concerns about the security of equipment produced by Huawei, worried it could be used for spying by Beijing. “In my view, in the development of 5G, the most important thing is open collaboration, and a single standard for the world,” Miao said.

Former U.S. Commerce Secretary Carlos Gutierrez also spoke to the recent politicization of 5G earlier in the week at Boao, saying competition in new technologies including 5G is not between different nations, and instead is a competition among enterprises.

Contact reporter Yang Ge ([email protected])

………………………………………………………………………………………………………………………………………………………………………………

Video: https://www.youtube.com/watch?reload=9&v=0_Yobh9MPQw

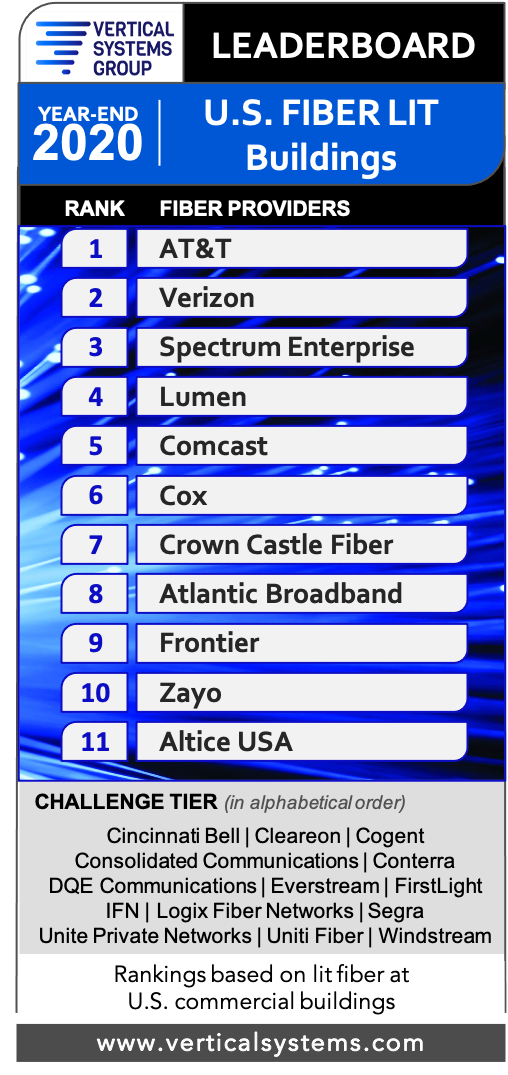

VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020

Vertical Systems Group’s 2020 U.S. Fiber Lit Buildings LEADERBOARD results are as follows (in rank order by number of on-net fiber lit buildings): AT&T, Verizon, Spectrum Enterprise, Lumen, Comcast, Cox, Crown Castle Fiber, Atlantic Broadband, Frontier, Zayo and Altice USA. These eleven retail and wholesale fiber providers qualify for this benchmark with 15,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2020.

Additionally, fourteen companies qualify for the 2020 Challenge Tier as follows (in alphabetical order): Cincinnati Bell, Cleareon, Cogent, Consolidated Communications, Conterra, DQE Communications, Everstream, FirstLight, IFN, Logix Fiber Networks, Segra, Unite Private Networks, Uniti Fiber and Windstream. These fiber providers each qualify for the 2020 Challenge Tier with between 2,000 and 14,999 U.S. fiber lit commercial buildings.

“The base of fiber lit buildings in the U.S. expanded in 2020, although the pace of new installations was hampered by the pandemic. Challenges for fiber providers ranged from impeded installations due to commercial building closures and business shutdowns to supply chain disruptions,” said Rosemary Cochran, principal of Vertical Systems Group. “As the economy rebounds in 2021, fiber providers have opportunities to monetize the millions of small and medium U.S. commercial buildings without fiber, as well as larger multi-tenant buildings with only a single fiber provider. However it remains uncertain how changes in U.S. regulatory policies and federal funding could alter fiber investments and deployment plans in the next several years.”

2020 Fiber Provider Research Highlights:

- AT&T retains the top rank on the U.S. Fiber Lit Buildings LEADERBOARD for the fifth consecutive year.

- The threshold for a rank position on the 2020 Fiber LEADERBOARD is 15,000 fiber lit buildings, up from 10,000 buildings previously.

- Atlantic Broadband advanced to eighth position on the LEADERBOARD, up from eleventh in the previous year.

- Windstream and Consolidated Communications move into the Challenge Tier from the LEADERBOARD.

- Vertical Systems Group’s 2020 U.S. fiber research analysis for five building sizes shows that fiber availability varies significantly based on number of employees. The Fiber 20+ segment, which covers four building sizes with twenty or more employees, has a 69.2% fiber lit availability rate. This compares to 14.1% availability for the Fiber <20 segment, which covers buildings with fewer than twenty employees.

Market Players include all other fiber providers with fewer than 2,000 U.S. commercial fiber lit buildings. The 2020 Market Players tier includes more than two hundred metro, regional and other fiber providers, including the following companies (in alphabetical order): ACD.net, Armstrong Business Solutions, C Spire, Centracom, CTS Telecom, Douglas Fast Net, EnTouch Business, ExteNet Systems, Fatbeam, FiberLight, Fusion Connect, Google Fiber, GTT, Hunter Communications, LS Networks, Mediacom Business, MetroNet Business, Midco Business, Pilot Fiber, PS Lightwave, Shentel Business, Silver Star Telecom, Sonic Business, Syringa, TDS Telecom, TPX Communications, U.S. Signal, Veracity, Wave Broadband, WOW!Business, Ziply Fiber and others.

For this analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

Cuba-Google agreement to speed up Internet access on the island

Google and ETECSA signed a memorandum of understanding to begin the negotiation of a so-called “peering agreement” that would create a cost-free and direct connection between their two networks. That would enable faster access to content hosted on the Google’s servers, which are not located on the island. Internet in Cuba has been notoriously sluggish and unreliable. In a country where information is tightly controlled, it remains to be seen how much Google’d information would be available in Cuba. That’s if and when a fast connection can be made between Cuba’s ETECSA controlled Internet and Google’s servers.

The agreement creates a joint working group of engineers to figure out how to implement this peering arrangement, likely via an undersea cable. What’s needed first is the creation of a physical connection between Cuba’s network and a Google “point of presence,” the closest ones being in South Florida, Mexico and Colombia. Cuba currently has a single fiber-optic connection running under the Caribbean to Venezuela that has been unable to provide the island with sufficient capacity to support its relatively small but growing group of internet users, for reasons never disclosed by either country’s Communist government. Neither Cuban or Google officials provided any estimated timeframe for the island’s connection to a new undersea fiber-optic cable. That step could take years given the slow pace of Cuba’s bureaucracy and the obstacles thrown up by the U.S. trade embargo on the island.

“The implementation of this internet traffic exchange service is part of the strategy of ETECSA for the development and computerization of the country,” Google and ETECSA said in a joint news release, read out at a news conference in Havana.

“We are excited to have reached this memorandum for the benefit of internet users here in Cuba,” Brett Perlmutter, the head of Google Cuba, said before signing the deal.

References:

https://www.businessinsider.com/google-partners-etecsa-cuba-2019-3

https://phys.org/news/2019-03-cuba-google-island.html

GSA: 102 Network Operators in 52 Countries have Deployed NB-IoT and LTE-M LPWANs for IoT

The Global mobile Suppliers Association (GSA) reported on March 27th that 102 operators in 52 countries have now either deployed or launched at least one of the NB-IoT or LTE-M technologies. Of these, 20 operators in 19 countries had deployed or launched both NB-IoT and LTE-M,

Narrowband IoT (NB-IoT) and LTE-M are low power wide area network (LPWAN) radio technology specifications developed by the 3GPP to enable a wide range of cellular devices and services, in particular IoT and machine-to-machine applications. As of the end of March 2019, GSA had identified:

- 149 operators in 69 countries investing in one or both of the NB-IoT and LTE-M network technologies

- 22 countries are now home to deployed/launched NB-IoT and LTE-M networks

- 28 countries are home to deployed/launched NB-IoT networks only, and two countries are home to deployed/launched LTE-M networks only

- 140 operators in 69 countries investing in NB-IoT networks; of which 88 operators in 50 countries had deployed/launched their networks

- 60 operators in 35 countries investing in LTE-M networks; of which 34 operators in 24 countries had deployed/launched their network

“The global momentum behind LPWAN deployments is testament to the revenue opportunities which operators are racing to win and monetise in a diverse range of new IoT applications. Significantly, it can also be seen as a precursor to operators replacing legacy M2M services such as GPRS-based trackers and preparing the ground for the eventual switch-off of their 2G networks,” commented Joe Barrett, President, GSA.

The latest data on NB-IoT and LTE-M devices, is fully available to all employees of GSA Executive, Ordinary Member companies and GSA Associates who subscribe to GSA Analyser for Mobile Broadband Devices (GAMBoD) service. The report can be found at https://gsacom.com/paper/global-narrowband-iot-lte-m-networks-march-2019/

GAMBoD is a unique search and analysis tool that has been developed by GSA to enable searches of mobile broadband devices and global data on Mobile Broadband Networks, Technologies and Spectrum (NTS). The LTE and 5G Devices database can be searched by supplier, form factor, features, peak downlink and uplink speeds, and operating frequency. Results are presented as a list or in charts. Charts may be inserted into documents or presentations, subject to accreditation of GSA as the source.

About GSA:

GSA is the voice of the mobile vendor ecosystem representing companies engaged in the supply of infrastructure, semiconductors, test equipment, devices, applications and mobile support services. GSA actively promotes the 3GPP technology road-map – 3G, 4G, 5G – and is a single source of information resource for industry reports and market intelligence. The GSA Executive board comprises of Ericsson, Huawei, Intel, Nokia, Qualcomm, and Samsung with representation for other members including Viavi Solutions and ZTE.

GSA Membership is open to all companies participating in the mobile ecosystem and operators, companies and government bodies can get access to GAMBoD by subscribing as an Associate. More details can be found at https://gsacom.com/gsa-membership

FCC’s auction of 24 GHz spectrum attracts >$1.5B in bids after 26 rounds; IMT 2020 frequencies?

Bids in the Federal Communications Commission’s (FCC’s) 24 GHz millimeter-wave spectrum auction 102 have passed $1.5 billion after 26 rounds. The figure is more than double the the $704 million collected during the recent sale of 28 GHz spectrum.

Bidding has been from AT&T, T-Mobile US, Verizon and Sprint (bidding as ATI Sub LLC); U.S. Cellular; Dish Network, bidding as Crestone Wireless; Starry Spectrum Holdings and Windstream Communications (which recently filed for bankruptcy protection in the wake of a court case). There are a total of 38 qualified bidders.

Auction 102 is the FCC’s second auction of Upper Microwave Flexible Use Service (UMFUS) licenses (see below for information on auction 1010). Auction 102 offers 2,909 licenses in the 24 GHz band. The lower segment of the 24 GHz band (24.25–24.45 GHz) will be licensed as two 100-megahertz blocks, and the upper segment (24.75–25.25 GHz) will be licensed as five 100-megahertz blocks. Those frequencies are being considered for the IMT 2020 5G radio aspects standard and will be determined at the ITU-R WRC-19 meeting this fall (details in Editor’s Note below).

Three rounds of bidding are being held each day at this point in the auction. The clock auction format begins with a “clock phase” (the current auction phase) which lets participants bid on generic blocks in each Partial Economic Area in successive bidding rounds, followed by an “assignment phase” that allows the winners of the generic blocks to bid for frequency-specific license assignments. The clock phase continues, with prices automatically increasing each round, until bidders’ demand for licenses at a certain price matches the supply — and at that point, the bidders who have indicated they are willing to pay the final clock price for a license will be considered winners and the assignment phase can begin.

The most hotly contested licenses are those covering New York City and Los Angeles, California. New York City metropolitan licenses are dominating the bidding: four bids for NYC licenses in the upper portion of the band are currently above $30 million. One of those is at $41.1 million, the largest bid of the auction thus far. The most expensive bid for a Los Angeles license, also in the upper portion of the band, is up to $31.6 million, with other bids on LA licenses as high as $28.7 million and $26.1 million.

Much of the auction process is secretive—there are anti-collusion rules and bidders can’t talk to one another, for example. The FCC isn’t releasing the names of the winners of the 28-GHz or 24-GHz auctions until both have been concluded.

…………………………………………………………………………………………………………………………………………………………………………………….

The FCC is making a total of 1.55 gigahertz of spectrum available through auctions 101 (which concluded in late January after raising $702 million) and 102. The agency plans to hold three more mmWave auctions during 2019, covering spectrum at 37 GHz, 39 GHz and 47 GHz. Although the FCC has usually makes winning bidders public shortly after the close of an auction, the winning bidders from Auction 101 will not be publicly named until after the close of Auction 102.

References:

https://auctiondata.fcc.gov/public/projects/auction102

https://www.rcrwireless.com/20190325/policy/24-ghz-auction-hits-1-4-billion

……………………………………………………………………………………………………………..

Update on FCC Auction 103:

Analysis and results of FCC Auction 103 for 5G mmWave Spectrum

Deputy PM: 5G Crucial to Vietnam’s Development; Viettel installs Vietnam’s first 5G base stations in Hanoi

Vietnam’s deputy prime minister Vu Duc Dam has thrown his support behind the adoption of 5G in the nation, stating that 5G will be crucial to Vietnam’s development.

During the recent ASEAN Conference on 5G, the deputy prime minister acknowledged that the government will need to proactively support businesses to ensure they are more confident in investing in 5G, according to Nhan Dan Online, the official newsletter of the Communist Party of Vietnam.

Deputy Prime Minister Vu Duc Dam has stated that 5G, the next-generation of mobile communications standard, is crucially important to the development of Vietnam

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

During the conference, Dam said the technology will not only provide major speeds improvements but involve changes in global production methods. He suggested that participants use the Vietnam-organized conference to discuss the pathway to 5G development in the ASEAN region.

Vietnam aims to become one of the world’s early adopters of 5G. Several Vietnamese operators have been allocated licenses to trial the technology in Hanoi and Ho Chi Minh City ahead of a commercial launch.

Also at the event, Vietnam’s ICT minister Nguyen Manh Hung also stated that 5G will be the most vital part of the infrastructure required for the future digital economy. He told the delegates at the conference that Vietnam will be one of the first countries in the world to roll out the next-generation of wireless technology. Several local carriers have been licensed to trial 5G in Hanoi and Ho Chi Minh City, Minister Hung added.

Update (April 10, 2019):

Viettel deploys Vietnam’s first 5G base stations

Vietnamese military-run operator Viettel has installed Vietnam’s first 5G base stations in Hanoi ahead of planned 5G trials.

The operator has deployed three test 5G base stations at various offices, and expects to switch them on for trials in early May, state news agency Nhan Dan Online reported.

Viettel plans to test 70 5G base stations in Hanoi and Ho Chi Minh City in June in preparation for a large-scale deployment, the report states. The military run telecom group is targeting a 5G commercial launch in 2020. Viettel is taking the lead in the deployment of the technology in the market.

Military-run telecommunications group Viettel has installed the first base transceiver station (BTS) of fifth generation (5G) in Vietnam on the roof of the Viettel Centre in Hoan Kiem District.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………

At the recent ASEAN Conference on 5G in Vietnam, minister of information and communications Nguyen Manh Hung said 5G represents an opportunity for Vietnam to change its global rankings by stimulating growth in the digital economy.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Update: April 26, 2018:

Indochina Telecom on Thursday launched Vietnam’s first mobile virtual network operator (MVNO) ITelecom, increasing the number of telecom service providers in the Southeast Asian country to six.

The five veteran mobile network operators in Vietnam include Vinaphone, MobiFone, Viettel, Vietnamobile, and G-tel.

An MVNO is a wireless communications service provider that does not own the wireless network infrastructure over which it provides the service to its customers.

Newcomer ITelecom obtained access to network services from telecom market leader Vinaphone under a business agreement to offer its own network service.

Prefixing phone numbers on its network with 087, ITelecom says it is committed to offering flexible telecom services and stable quality at reasonable costs.

The company’s deputy general director Luu Anh Son said the virtual model helps save considerable costs, time, and effort whilst still ensuring quality for its users.

For Vinaphone, the agreement offers an opportunity to resell voice and data packages and share network operating costs, allowing the telecom giant to ultimately add to its bottom line.

Indochina Telecom’s services are currently offered to workers in industrial parks in nine provinces and cities including Hanoi, Thai Nguyen, Vinh Phuc, Bac Giang, Bac Ninh in northern Vietnam, and Binh Duong, Ho Chi Minh City, Long An and Dong Nai in the south.

The operator’s most popular package allows users to enjoy all under-20-minute calls within its and Vinaphone’s networks, as well as 30-minute calls to other networks and 3GB of daily Internet data at a cost of VND77,000 (US$3.3) a month. ITelecom has yet to establish its own system of representative offices in Vietnam, instead relying on wholesale and authorized agents to connect with customers – a system which could potentially inconvenience customers in need of customer or tech support.

To overcome this drawback, the operator plans to ink agreements with other networks to contract out such services at reasonable prices, while providing a variety of packages to different groups and user segments, according to Son. Established in 2008, Indochina Telecom has more than a decade of experience in providing basic mobile network and Internet services across Vietnam.

GSA announces 5G Device Database and 5G Ecosystem Report +Hadden Telecoms

The Global mobile Suppliers Association (GSA) today launched the industry’s first database tracking worldwide 5G devices. Part of the GSA Analyser for Mobile Broadband Devices (GAMBoD) database, the new 5G device tracking and reporting represents an important milestone for the 5G ecosystem as it moves from service trials and prototype user equipment to commercially available services and devices. 5G Ecosystem Report containing summary statistics can be downloaded here.

The report details that as of mid-March 2019 GSA had identified 23 vendors who have confirmed the availability of forthcoming 5G devices with 33 different devices including regional variants. There were seven announced 5G device form factors: (phones, hotspots, indoor CPE, outdoor CPE, modules, Snap-On dongles, adapters and USB terminals). Breakdown by 5G form factor:

- 12 phones (plus regional variants)

- 5 hotspots (plus regional variants)

- 8 CPE devices (indoor and outdoor)

- 5 modules

- 2 snap-on dongles / adapters

- 1 USB terminal

GSA also confirms that 5G chipsets have been announced or are available from five vendors (Huawei, Intel, Mediatek, Qualcomm and Samsung).

Editor’s Note:

Huawei and Samsung use their 5G chip sets for their products and so far have not announced they would sell them on the merchant market.

………………………………………………………………………………………………………………………………………………………………………………

Other potential, but – as far as GSA has been able to determine – not officially announced, 5G devices, include:

-

- Netgear Nighthawk M2 5G Hotspot – reported by secondary sources as planned for Telstra’s network

- Samsung Galaxy Note 10 5G – secondary source confirmation only, based on analysis of Galaxy Note 10 Kernel code.

- In addition, earlier versions of the Huawei indoor CPE containing the Balong 5G01 chipset are, according to the vendor, still being used in selected pre-commercial trials.

This is the latest component of the GSA Analyser for Mobile Broadband Devices (GAMBoD) database, a tool designed to help industry stakeholders keep track of all this stuff. Its launch comes on the same day at the publication of the latest 5G Market Reality Check from Hadden Telecoms.

“Operators globally are preparing for the large-scale introduction of 5G, the first services have launched, and the devices ecosystem is rapidly building and poised for the imminent scale availability of a range of smartphone models,” said Hadden. “Dozens more operators are expected to launch their respective 5G services in the coming 12 months.”

211 operators are investing in 5G in 87 countries – List

Operators investing in 5G are at a variety of stages, ranging from network deployments, to technology testing, demonstrations and pilot trials. 15 operators have commercially launched 5G services, including Telstra and Optus in Australia, which are offering fixed wireless 5G services on the 3.6-GHz band. Vodafone Australia and the market’s national broadband network operator NBN Co are also investing in 5G.

Download the full list as of 24th March 2019: Operator-5G-investments-240319.pdf

References:

http://telecoms.com/496540/5g-has-already-yielded-12-phones-and-five-chipset-vendors-gsa/

Ericsson: MOU with SK Telecom for 5G SA core network; KT commercial contract for 5G roll-out in April

SK Telecom (SKT) and Ericsson have signed a MOU agreement to collaborate on research and development of 5G standalone (SA) core network technology and architecture. The three year agreement focuses on potential enhancements and optimization enabled by cloud native micro-services based design principles. The collaboration is directed at creating a more agile and programmable 5G standalone core network architecture capable of efficiently managing growth through automation and more simplified operations.

“After the successful launch of 5G [non-standalone] network, SK Telecom is preparing to migrate towards 5G [standalone – no LTE dependence] networks to provide the latest and greatest technology and services to its customers,” SK Telecom SVP and head of 5GX Labs Jong-kwan Park said.

“This joint collaboration with Ericsson on the next generation 5G Standalone Core and cloud native principles will not only enable us to introduce new services faster while at the same time improve our operational efficiency but also support higher availability through simplified operation.”

Ericsson head of packet core Peo Lehto added that cloud native micro-services architecture promises to deliver higher degrees of automation and availability, more predictable performance and more robust operations for next-generation mobile networks.

“This will relieve requirements on the infrastructure by allowing better handling of multiple failures, better infrastructure utilization with more flexible and granular scaling, as well as increased rate of innovation with independent life cycles and in-service software upgrade for each service,” he said.

“Ericsson and SKT have been cooperating closely for many years around 5G innovation. With the new MoU we can accelerate the necessary evolution of 5G core networks the profitable introduction of 5G-based services and use cases.”

A three-year Memorandum of Understanding (MoU) between the companies focuses on possible enhancements and optimization enabled by cloud native micro-services-based principles. The MoU comes as increasing focus is being placed on the need for more agile and programmable 5G standalone core network that efficiently manage growth with automation and simplified operations.

………………………………………………………………………………………………………………………………………………………..

Separately, Ericsson has secured a deal from South Korea’s largest telecom firm KT to implement its forthcoming 5G network as South Korea wireless network operators target 5G launch in April 2019. In addition to 3GPP Release 15 “5G New Radio” hardware and software for KT’s 3.5 GHz Non-Standalone network, Ericsson is facilitating KT to stimulate the Internet of Things (IoT) and Industry 4.0 opportunities to local enterprises on a global scale. In addition to immersive media, KT’s 5G commercialization use case plans covers: smart factories; safety; drones; and connected vehicles.

Many believe that the extensive deployment of 5G networks will boost the adoption of IoT devices that require real time control and low latency. As 5G accelerates the digital transformation in many industries, enabling new use cases in areas such as IoT, automation, transport and Big Data, Ericsson is poised to benefit from favorable growth dynamics. The company is investing heavily in its competitive 5G-ready portfolio to enable customers to seamlessly migrate to 5G.

Jinho Choi, Vice President, Access Network Design, KT, says: “Having worked successfully with Ericsson on 4G LTE, we are pleased to continue that partnership to make our 5G ambitions a reality with Ericsson’s leading 5G technology.

“Korea is one of the most competitive and technology-advanced markets in the world. By taking a global lead to enable nationwide commercial 5G services through commercially available 5G smartphones, KT is demonstrating our commitment to our customers and showing how we can drive a global 5G ecosystem where Korea plays a key role.”

Patrick Johansson, Head of Ericsson Korea, says: “We’ve worked with KT for many years to bring the very best mobile user experiences to its customers. Notably on 5G, we worked closely together to show the world what 5G could do during a major global winter sports event in 2018.

“With 5G we aim to help KT to take their customers’ experiences to new levels, whether through enhanced mobile broadband for mobile subscribers, or helping to make national and global IoT and Industry 4.0 opportunities a reality for enterprises and industries.”

References:

https://www.ericsson.com/ci/en/news/2019/2/ericsson-and-sk-telecom-team-up-on-cloud-native-5g-core

https://www.ericsson.com/en/press-releases/2019/3/ericsson-wins-5g-commercial-deal-with-kt

https://www.telecomasia.net/content/skt-ericsson-team-cloud-native-5g-core