Month: March 2019

ITU-T SG13 Non Radio Hot Topics and Recommendations related to IMT 2020/5G

IMT 2020 Related Hot Topics for ITU-T SG13:

DISCLAIMER: A few of the referenced hyperlinks point to documents that can only be opened by users with an ITU TIES account. However, most of the hyperlinks point to public documents which can be downloaded free of charge.

SOURCE: ITU-T SG13 4-14 March 2019 meeting in Victoria Falls, Zimbabwe with UPDATES from later 2019 SG13 meetings.

1. Intelligence for network automation, augmentation and amplification

- Identify the standardization needs for intelligence in 5G systems and the telecommunications sector.

- Automatic detection and resolution of anomalies and other incidents of inefficiency, as well as predictive maintenance will reduce the operational expenditure of network operators and service providers

- Address the architecture, interfaces, functional entities, service scenarios and protocols required for intelligence retrieval and actuation, and the performance bench marking and certification of AI techniques

Related Work items:

–>PLEASE SEE 20 AUG 2019 UPDATE BELOW |

2. Realizing 5G/ IMT-2020 vision

- Unified access-independent network management

- Standardization roadmap on IMT-2020

- ICN (Information Centric Networks) with scalability, mobility and security

- Open-source software and standards for 5G

- Software-based networking functions to optimize a per-session based performance

- Emerging fronthaul and midhaul technologies to support the 5G deployment

- Large-bandwidth backhaul and fronthaul solutions

- Concrete strategies for the migration from 4G to 5G systems.

- End-to-end network orchestration, control and management

- Service-based network architecture

- Open service management APIs for the Internet of Things

- Electromagnetic field (EMF) studies around 5G beam-forming capabilities

- Interoperability of services supporting public safety.

Related Work items:

- Y.NGNe-O-arch: Functional architecture of orchestration in NGNe

- Y.IMT2020-qos-fa: QoS functional architecture for IMT-2020 networks

- Y.IMT2020-qos-req: QoS functional requirements for IMT-2020 networks

- Y.qos-ml-arch: Architecture of machine learning based QoS assurance for IMT-2020 networks

- Y.IMT2020.qos-mon: IMT-2020 network QoS monitoring architectural framework

- Y.IMT2020-CEF: Network capability exposure function in IMT-2020 networks

- Y.3MO: Requirements and Architectural Framework of Multi-layer, Multi-Domain, Multi-Technology Orchestration

- Y.IMT2020-ADPP: Advanced Data Plane Programmability for IMT-2020 (renamed- see below)

- Y.NetSoft-SSSDN: High level architectural model of network slice support for IMT-2020 – Part: SDN (renamed- see below)

…………………………………………………………………………………………………………………………………………………….

IMT 2020 non radio recommendations developed by ITU-T SG13:

- Y.3112: Framework for the support of network slicing in the IMT-2020 network (Revised)

- Draft Recommendation ITU-T Y.IMT2020-NSAA-reqts: “Requirements for network slicing with AI-assisted analysis in IMT-2020 networks”

- Draft Recommendation ITU-T Y.IMT2020-CEF: “Network capability exposure function in the IMT-2020 networks”

- Draft Recommendation ITU-T Y.qos-ec-vr-req: ” QoS requirements and architecture for virtual reality delivery using edge computing in IMT-2020″

- Draft Recommendation ITU-T Y.3072 (formerly Y.ICN-ReqN): “Requirements and Capabilities of Name Mapping and Resolution for Information Centric Networking in IMT-2020”

- Draft Recommendation ITU-T Y.3151 (formerly Y.NetSoft-SSSDN): “High level architectural model of network slice support for IMT-2020 – part: SDN”

- Draft Recommendation ITU-T Y.3152(formerly Y.IMT2020-ADPP): “Advanced Data Plane Programmability for IMT-2020”

- Draft Recommendation ITU-T Y.3172 (formerly Y.IMT2020-ML-Arch): “Architectural framework for machine learning in future networks including IMT-2020

- Draft Recommendation ITU-T Y.3106 (formerly Y.IMT2020-qos-req): “QoS functional requirements for the IMT-2020 network”

Editor’s Note:

A summary of SG13 work program provides the timing of each work item, e.g. handbook, technical reports, supplements and recommendation.

…………………………………………………………………………………………………………………………………………….

ITU-T SG13/WP1 work related to IMT-2020:

| Question | (Co-) Rapporteur

(Associate Rapporteur) |

Title |

| Q6/13 | Taesang CHOI (Korea) | Quality of service (QoS) aspects including IMT-2020 networks |

| Guosheng ZHU (China) | ||

| Q20/13 | Nam Seok KO (Korea) | IMT-2020: Network requirements and functional architecture |

| Marco CARUGI (Huawei, China) | ||

| Q21/13 | Kazunori TANIKAWA (Japan)

Yushuang HU (China) |

Network softwarization including software-defined networking, network slicing and orchestration |

| Sangwoo KANG (Korea) | ||

| Q22/13 | Jiguang CAO (China)

Ved P. KAFLE (Japan) |

Upcoming network technologies for IMT-2020 and Future Networks |

| Q23/13 | Jeong Yun KIM (Korea)

Nauxiang Shi (China) |

Fixed-Mobile Convergence including IMT-2020 |

Question 21 of ITU-T SG13 is studying network softwarization including: network slicing, SDN, and orchestration which are highly expected to contribute to IMT-2020. Question 21/SG13 met from 4 to 14 March 2019 at Victoria Falls, Zimbabwe under the chairmanship of co-Rapporteur Ms.Yushuang Hu (China Mobile, China) and Mr. Kazunori TANIKAWA (NEC, Japan). On March 14, 2019, ITU-T SG13 consented to two new Recommendations:

- ITU-T Y.IMT2020-ML-Arch “Architectural framework for machine learning in future networks including IMT-2020” (Ref. SG13-TD355/WP1)

- ITU-T Y.3115 (formerly Y.NetSoft-SSSDN). It describes SDN control interfaces for network slicing, which especially focuses on the control of front haul networks such as PON.

………………………………………………………………………………………………………………………………………………

20 August 2019 Update: New ITU standard has established a basis for the cost-effective integration of Machine Learning into 5G and future networks.

The standard – ITU Y.3172 – describes an architectural framework for networks to accommodate current as well as future use cases of Machine Learning. “Machine Learning will change the way we operate and optimize networks,” said Slawomir Stanczak, Chairman of the ITU-T Focus Group on ‘Machine Learning for Future Networks including 5G’. ITU Y.3172 is under the responsibility of the Focus Group’s parent group, ITU-T Study Group 13 (Future networks and cloud).

“Every company in the networking business is investigating the introduction of Machine Learning, with a view to optimizing network operations, increasing energy efficiency and curtailing the costs of operating a network. This ITU Y.3172 architectural framework provides a common point of reference to improve industry’s orientation when it comes to the introduction of Machine Learning into mobile networks.”

Machine Learning holds great promise to enhance network management and orchestration. Drawing insight from network-generated data, Machine Learning can yield predictions to support the optimization of network operations and maintenance. This optimization is becoming increasingly challenging, and increasingly important, as networks gain in complexity to support the coexistence of a diverse range of information and communication technology (ICT) services.

Network operators aim to fuel Machine Learning models with data correlated from multiple technologies and levels of the network. They are calling for deployment mechanisms able to ‘future-proof’ their investments in Machine Learning. And they are in need of interfaces to transfer data and trained Machine Learning models across Machine Learning functionalities at multiple levels of the network.

The ITU Y.3172 architectural framework is designed to meet these requirements. The standard includes a unique focus on the future.

“ITU Y.3172 provides for the declarative specification of Machine Learning applications, making it the first mechanism to meet industry’s need for a standard method of including future use cases,” says Vishnu Ram, the lead editor of the standard.

“This is the first time that a Study Group has approved a Focus Group deliverable as an ITU standard before the conclusion of the Focus Group’s lifetime,” says Leo Lehmann, Chairman of ITU-T Study Group 13. This represents an important achievement in ITU’s work to expedite the transition from exploratory studies to the agreement of new ITU standards.

ITU-T Focus Groups are open to all interested parties. These groups accelerate ITU studies in fields of growing strategic relevance to ITU membership, delivering base documents to inform related standardization work in membership-driven ITU-T Study Groups.

“I would like to commend the many experts participating in both the Focus Group and ITU-T Study Group 13,” says Lehmann. “This early approval required a considerable amount of planning and extremely close collaboration, which could only have been achieved with dual participation and common interest.”

The standard offers a common vocabulary and nomenclature for Machine Learning functionalities and their relationships with ICT networks, providing for ‘Machine Learning Overlays’ to underlying technology-specific networks such as 5G networks. It describes a ‘loosely coupled’ integration of Machine Learning and 5G functionalities, minimizing their interdependencies to account for their parallel evolution.

The components of the architectural framework include ‘Machine Learning Pipelines’ – sets of logical nodes combined to form a Machine Learning application – as well as a ‘Machine Learning Function Orchestrator’ to manage and orchestrate the nodes of these pipelines.

‘Machine Learning Sandboxes’ are another key component of the framework, offering isolated environments hosting separate Machine learning pipelines to train, test and evaluate Machine Learning applications before deploying them in a live network.

“This combination of an architectural framework for Machine Learning and this declarative language to specify new use cases will give network operators complete power over the extension of Machine Learning to new use cases, the deployment and management of Machine Learning in the network, and the correlation of data from sources at multiple levels of the network,” says Ram.

The ITU Y.3172 architectural framework is the first of a nascent series of ITU standards addressing Machine Learning’s contribution to networking.

“A range of ITU standards under development will complement and complete the architectural framework described by ITU Y.3172,” says Ram. “Collectively these standards will provide a full toolkit to build Machine Learning into our networks.”

Two draft ITU standards will propose mechanisms for data handling and specify the design of the ‘Machine Learning Function Orchestrator.’ “If data is the blood flowing through the heart that is Machine Learning, this function orchestrator can be considered the brain,” Ram added.

Another ITU standard will support the assessment of intelligence levels across different parts of the network.

“Different parts of the network will be supplied by different vendors,” says Ram. “We are developing a standard way for different parties to look the intelligence level of the network, helping operators to evaluate vendors and regulatory authorities to evaluate the network.”

The series of ITU standards will be completed by a standard supporting the interoperability of Machine Learning marketplaces, marketplaces hosting repositories of Machine Learning models.

“The standard would assist potential adopters both in selecting a Machine Learning model capable of addressing their specific needs and in integrating the model into the network,” says Ram.

NOTE: To join the group’s mailing list, request access to documents and sign-up to a working group on the homepage of the ITU Focus Group on Machine Learning for Future Networks including 5G.

……………………………………………………………………………………………………………………………

December 2019 update:

Y.3106 Quality of service functional requirements for the IMT-2020 network standard was posted on December 2019 at the ITU website and is available for free download here.

………………………………………………………………………………………………………………………………………………

Status and timing of SG13 work: https://www.itu.int/itu-t/workprog/wp_search.aspx?sg=13

……………………………………………………………………………………………………………………………

Related: The following ITU-T Technical Report was developed by ITU-T SG15:

Technical Report (GSTR-TN5G) on “Transport network support of IMT-2020/5G”

……………………………………………………………………………………………………………………………

Previous Techblog post on this topic:

New ITU-T Standards for IMT 2020 (5G) + 3GPP Core Network Systems Architecture

Forward Reference (April 2020 IEEE Techblog post):

New ITU-T SG13 Recommendations related to IMT 2020 and Quantum Key Distribution

SD-WAN revenue hits $359 million in Q4 2018; Data Center Networking Highlights

By Josh Bancroft, senior analyst, DC and enterprise SDN, Networked Services, IHS Markit.

Highlights

Software-defined networking (SD-WAN) software revenue, including appliance and control and management software, rose 26 percent quarter over quarter to reach $359 million in the fourth quarter (Q4) of 2018. VMware led SD-WAN market revenue share with 20 percent, followed by Cisco at 14 percent and Aryaka at 12 percent, according to the “Data Center Network Equipment Market Tracker” from IHS Markit.

Editor’s Notes:

- VMware and Cisco acquired SD-WAN start-ups Velocloud and Viptela, respectively in 2018 which enabled them to lead this market.

- There are many types of SD-WANs, none of which are based on standards. Here’s an article describing the different SD-WAN “flavors”

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

In the fourth quarter, vendors began to reap the rewards of partnering with multiple managed-service providers, systems integrators and telcos. Revenue deal sizes have been rising, and the number of enterprise sites deploying SD-WAN continues to grow.

For the foreseeable future, both direct and channel sales will continue to drive SD-WAN market growth. In the IHS Markit “Edge Connectivity Strategies North American Enterprise” survey in February 2019, respondents showed a clear bias for consuming SD-WAN with self-managed on-site hardware and software, or as a standalone managed service bundled with connectivity. However, by 2019 they expect to shift to managed services bundled with other network functions virtualization (NFV) services and connectivity.

“Telcos want to utilize the high speeds and network-slicing capability of 5G, along with the application-traffic steering capability of SD-WAN, to support the industrial internet of things and other new edge applications,” said Josh Bancroft, senior research analyst at IHS Markit. “The telcos view SD-WAN as a key way to ensure various traffic types are automatically steered to the appropriate links. It can also guarantee IoT traffic is prioritized over 5G, and other applications are automatically routed over broadband.”

“If they haven’t done so already, SD-WAN vendors should consider adding IoT-specific features to their offering, such as application identification, prioritization and protocol translation functionality on SD-WAN appliances,” Bancroft said.

Following are some additional data center network market highlights:

- Application delivery controller revenue declined 4 percent quarter over quarter and 7 percent year over year in Q4 2018, reaching $438 million.

- Virtual ADC appliances comprised 35 percent of ADC revenue in Q4 2018.

- F5 revenue declined by 8 percent, quarter over quarter, in Q4 2018, but the company still garnered 47 percent of ADC market share. Citrix followed F5 with 27 percent, and A10 came in third with 8 percent.

Data Center Network Equipment Market Tracker

With forecasts through 2023, this IHS Markit report provides quarterly worldwide and regional market size, vendor market share, analysis and trends for data center Ethernet switches by category and market, application delivery controllers by category, and software-defined WAN (SD-WAN) appliances and control and management software. Vendors tracked include A10, ALE, Arista, Array Networks, Aryaka, Barracuda, Cisco, Citrix, CloudGenix, CradlePoint, Cato, Dell, F5, FatPipe, Fortinet, HPE, Huawei, Hughes, InfoVista, Juniper, KEMP, Nokia (Nuage), Radware, Riverbed, Silver Peak, Talari, TELoIP, VMware, Versa, ZTE and others.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Dell’Oro: #1 Huawei increased market share at the expense of Ericsson, Nokia and ZTE; Mobile CAPEX flat; 5G Market Forecasts

Top Telecom Equipment Vendors:

According to a new Dell’Oro Group report, the top seven telecom equipment makers as of 3Q 2018 are: Huawei, Nokia, Ericsson, Cisco, ZTE, Ciena, and Samsung. Huawei has captured a 29 percent share of the global telecom equipment market, increasing its market share by 8 percentage points since 2013. Huawei’s revenue share improved by two percentage points of market share annually in each of the past five years. That’s despite huge challenges in the U.S., UK, Australia and some European telecom markets due to security and backdoor issues.

During the same time period, Ericsson’s and Nokia’s market share declined about one percentage point annually on average until 2018 when both vendor held their market share flat. ZTE’s share, which had typically been at 10 percent, dropped two percentage points in 2018 due to the U.S. ban that caused the company to shut down portions of its business during the second quarter.

Additional key takeaways from the reporting period include:

- Following three years of decline, the overall telecom equipment market grew 1 percent year-over-year in 2018. The positive turn in the year was due to higher demand for Broadband Access, Optical Transport, Microwave, and Mobile RAN. The remaining equipment—Carrier IP Telephony, Wireless Packet Core, SP Router and Carrier Ethernet Switch—declined in the year. The two largest equipment markets in the year were Mobile RAN and Optical Transport.

- The worldwide Mobile RAN market surprised on the upside and performed better than expected in 2018. In addition to the strong focus on LTE and LTE-Advanced, the shift toward 5G NR (3GPP Release 15 New Radio – Non Stand Alone) continued to accelerate throughout the year.

- The worldwide Optical Transport market continued to expand for a fourth consecutive year driven by strong sales of DWDM equipment in China and to large Internet content providers for data center interconnect (DCI).

According to TelecomLead.com estimates, Huawei generated revenue of around $38 billion from carrier business, $10 billion from enterprises and $52 billion from phones and other devices — in 2018.

- Huawei said in December 2018 that it expects total revenue to increase 21 percent to $109 billion in 2018.

- Nokia Networks business revenue was 20.121 billion euro (–2 percent) or $22.82 billion last year.

- Ericsson’s revenue was SEK 210.8 billion (+3 percent) or $22.58 billion in 2018.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Mobile Operator CAPEX:

The latest GSMA report indicates that mobile operator CAPEX reached $161 billion in 2018 and is forecast to be $161 in 2019 and $160 billion in 2020. 5G related CAPEX will grow to $123 billion in 52 markets in 2020 from $81 billion in 19 markets in 2019 and $41 billion in two markets in 2018.

Mobile operators will invest around $480 billion worldwide between 2018 and 2020 in mobile CAPEX. Their investment focus will be 3G, 4G, 5G roll outs; and network optimization; capabilities beyond core telco.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

5G Market:

5G is on track to account for 15 per cent of global mobile connections by 2025, as the number of 5G network launches and compatible devices ramps up this year, according to a new GSMA report. The 2019 global edition of the GSMA’s flagship Mobile Economy report series reveals that a further 16 major markets worldwide will switch on commercial 5G networks this year, following on from the first 5G launches in South Korea and the US in 2018. It is calculated that mobile operators worldwide are currently investing around $160 billion per year (CAPEX) on expanding and upgrading their networks, despite regulatory and competitive pressures.

“The arrival of 5G forms a major part of the world’s move towards an era of Intelligent Connectivity, which alongside developments in the Internet of Things, big data and artificial intelligence, is poised to be a key driver of economic growth over the coming years,” said Mats Granryd, Director General of the GSMA. “While 5G will transform businesses and provide an array of exciting new services, mobile technology is also helping to close the connectivity gap. We will connect more than a billion new people to the mobile internet over the next few years, spurring adoption of mobile-based tools and solutions in areas such as agriculture, education and healthcare, which will improve livelihoods of people around the world.”

The new GSMA report reveals that:

- The number of 5G connections will reach 1.4 billion by 2025 – 15 per cent of the global total. By this point, 5G is forecast to account for around 30 per cent of connections in markets such as China and Europe, and around half of the total in the US;

- 4G will continue to see strong growth over this period, accounting for almost 60 per cent of global connections by 2025 – up from 43 per cent last year;

- The number of global IoT connections will triple to 25 billion by 2025, while global IoT revenue will quadruple to $1.1 trillion;

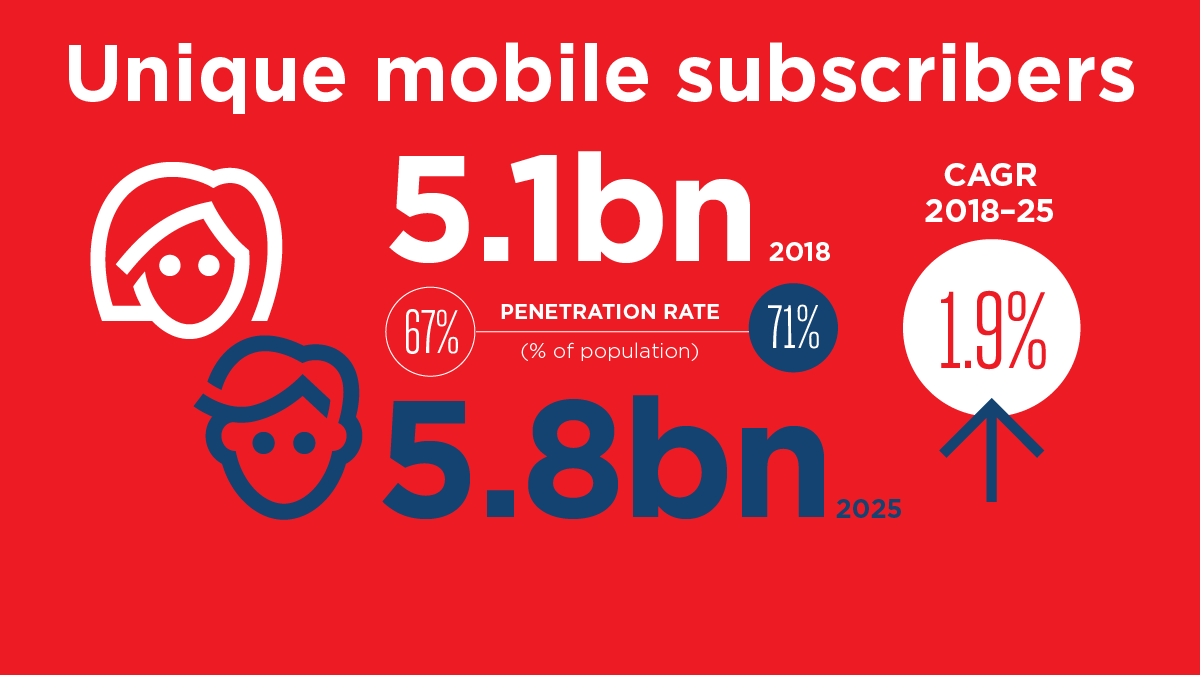

- One billion new unique mobile subscribers2 have been added in the four years since 2013, bringing the total to 5.1 billion by the end of 2018, representing about two thirds of the global population;

- More than 700 million new subscribers are forecast to be added over the next seven years, about a quarter of these coming from India alone;

- An additional 1.4 billion people will start using the mobile internet over the next seven years, bringing the total number of mobile internet subscribers globally to 5 billion by 2025 (more than 60 per cent of the population).

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

According to Telecomlead.com, Huawei has signed 30 plus 5G commercial contracts. Huawei has delivered over 40,000 5G base stations for commercial use. Huawei has 50 plus 5G engagements with customers. Nokia has 20 plus 5G contracts, and almost 100 5G engagements with customers. Samsung shipped 36,000 5G base stations – mainly to operators in the US and Korea — in 2018.

According to Dave Bolen of Dell’Oro Group, Cisco, Ericsson, Huawei, Nokia, and ZTE are the top-five wireless/ mobile packet core infrastructure vendors. At MWC 2019 in Barcelona, each put on a spectacular show with massive stands demonstrating its end-to-end technology prowess empowering 5G use cases, all enabled with their respective cloud-native cores. Their stands were packed with customers and potential customers leading to thousands of meetings. Each vendor had its share of press releases with 5G deals around the globe that are too numerous to name here. Links to the happenings at MWC19 from each of the top-five vendors may be found at Cisco, Ericsson, Huawei, Nokia, and ZTE.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

http://www.delloro.com/delloro-group/telecom-equipment-market-2018

http://www.delloro.com/dave-bolan/5g-mwc19-barcelona-observations-its-all-about-the-core

https://www.gsma.com/r/mobileeconomy/

https://www.gsmaintelligence.com/research/?file=5a33fb6782bc75def8b6dc66af5da976&download

IDC Directions 2019: Autonomous Infrastructure and the Evolution of the Self-Driving Network

Abstract (by Rohit Mehra, IDC Analyst):

Network transformation is well on its way with the evolution of SDN and SD-WAN, leading to flexible network architectures taking hold from the cloud to the enterprise edge, powered by intelligent automation. Increasing use of streaming analytics and pervasive visibility, enhanced by ML and AI, is creating a next-generation, agile network that self-remediates performance issues and proactively responds to security threats. The result will be greater operational efficiencies, improved user experience, and verified SLAs that ensure delivery of meaningful business outcomes. The network is a foundation layer for enabling secure, scalable and efficient use of Cloud, Edge and IoT Applications.

……………………………………………………………………………………………………………………………………………………

Please see comments below this post for Alan’s thoughts on Rohit’s presentation at IDC Directions 2019.

Network Requirements Continue to Expand:

▪Fast and adaptive

▪ Capacity on-demand

▪ Edge-to-Cloud Latency

▪ Network-level security

▪ Analytics capable of yielding new insights and driving digital transformation (DX)

▪ Bridge cloud and telco domains

▪ Global reach

“Self-driving” Networks are now needed to be Automated, Orchestrated and Optimized Network System. Traditional networks break down as they scale (get larger) and increase workloads, making automation essential in future networks, e.g. 5G.

………………………………………………………………………………………………………………………………………………………………………….

Definitions:

Network automation is a methodology in which software automatically configures, provisions, manages and tests network devices. It is used by enterprises and service providers to improve efficiency and reduce human error and operating expenses. Network automation tools support functions ranging from basic network mapping and device discovery, to more complex workflows like network configuration management and the provisioning of virtual network resources. Network automation also plays a key role in software-defined networking, network virtualization and network orchestration, enabling automated provisioning of virtual network tenants and functions, such as virtual load balancing.

Digital Transformation (DX):

IDC defines DX as the continuous process by which enterprises adapt to or drive disruptive changes in their operations, customers, and markets. Today, many businesses are implementing DX without success, and some fail entirely. In part, this is due to pervasive technology shifts that are changing how organizations transact business, address customer expectations, operate and secure products and services, and compete in the marketplace.

………………………………………………………………………………………………………………………………………………………………………….

IDC maintains that virtualization has matured from simple partitioning and encapsulation to leveraging the mobility of virtual machines to improve management and operations of IT environments. Virtualization 2.0 includes a host of new use cases that range from high availability and disaster recovery to hosted clients and true utility computing. Note that this information was not discussed by Rohit, but rather assumed to be known by the session attendees.

………………………………………………………………………………………………………………………………………………………………………….

Emergence of AI-based Network Automation:

✓ Simpler declarative management, enhanced verification and closed-loop processes

✓Network will accurately apply/enforce intent

✓Respond in near real-time to application, network and security events

Limitations of Classical Network Monitoring:

- Lack of pervasive, end-to-end visibility across physical/virtual/cloud

- Minimal application context

- Limited, spotty Analytics

- Frequently complex/costly

- Ping/SNMP/S flow/Trace route

- Unable to capture real-time network events

The Case for Streaming Telemetry In Support for Visibility and Analytics (see Alan’s Comment in box below article):

Infrastructure at Scale Demands Streaming Network Telemetry! Hyperscalers have deployed streaming telemetry extensively because it can provide millions of updates per second: Time stamped at source (for real time and network forensics)

▪ Event-driven, subscription-based

▪ Vendor support for standards based streaming telemetry • e.g., Cisco, Arista, Juniper, Ciena, Nokia

Optimization of apps/user experience (48% 0f respondents), plus security (41%) are top priorities for AI-enabled network automation:

IDC asked: What do you see as the most important aspects of an AI-enabled Network Automation solution? (Pick 3). Here’s the ordered ranking:

- Optimize and enhance application availability/performance and user experience 48%

- Implement security policies, including visibility into encrypted traffic 41%

- Work across multiple networks (on-premises and cloud-based) 38%

- Reduce cost and complexity of network operations 36%

- Simplicity in network deployment, management and operations 36%

- Incorporate streaming telemetry data for real-time visibility and insights 36%

- Leverage existing network infrastructure and/or software defined networking (SDN) deployment 35%

- Anticipate network outages and plan for network changes 30%

Automation at the Network Edge:

▪ Network platforms can leverage aggregate data from 1000s of deployments

▪ Crowd-sourced data is then dynamically applied to similar environments (anonymized)

▪ Benefits include dynamic scaling and mitigation of performance and/or security issues as they arise

Carrier Networks: The Automation Imperative – complexity across carrier networks continues to grow

▪ Multiple-generations of technology

• Ethernet, MPLS, Broadband IP VPNs

• 3G, 4G, 5G cellular

▪ Physical / Virtual

• VMs and Container based VNFs

• Evolution of Telco Cloud

▪ Cloud Aspirations

▪ Monetization Roadmap

The 5G Promise Is Not Achievable Without Significantly Enhanced Automation

▪ Network Slicing is key to delivering on the 5G promise (yet there are no implementable standards for network slicing; they are all proprietary implementations)

▪ Predicated upon automated provisioning, service chaining of cloud-native network components

▪ Automated traffic optimization across fronthaul, mid-haul and back-haul key to efficiency and customer experience

Security Analytics:

▪Traffic Analytics and Behavior Modeling

▪AI-enabled Anomaly Identification

▪Automated, Policy-based Remedial Actions (e.g. Quarantine)

AI-enabled Capacity Planning and Optimization:

▪ AI-powered network automation platforms monitor and assist with network capacity requirements and dynamically optimize flows

▪ Cloud-enabled Day 1 network provisioning and management automation that meets IT and business needs

Automating Enterprise Network Operations:

▪ AI-powered network operations create self-healing networks

• System monitors operations

• Detects performance degradations

• Determines root cause

• Automatically remediates the problem before it impacts users

▪ AI-powered Helpdesk Automation

• User Interfaces leverage Natural Language Processing for queries, e.g. Q: Why is my Wi-Fi coverage weak on the fourth floor? A: Switch to the 2.5Ghz Band

▪ Automated QoS and App Performance Guarantees

• Operator specifies minimum quality of service levels, system automatically maintains those in real time

• Resources are spun up to ensure and maintain service levels

Self-Driving Networks Require Closed-Loop Visibility and Automation:

▪ Self-driving networks will rely on streaming telemetry and closed-loop automation to detect and proactively respond to traffic-management issues and security threats

▪ Feedback loop from AI/ML to policy/intent will provide the ability to Visualize, Correlate and Predict- key ingredients for automation

▪ Requires a robust eco-system of network, visibility/analytics and AI solutions, SI/SPs

Take a Pragmatic Approach to Network Automation:

❖ Pick the right network automation use case(s)

❖ Getting automation right is mission critical

❖ Ensuring Clean, Relevant and Secure Data will be foundational to building AI-enabled network automation

❖ Developing Skills for Network Automation will be key to success

❖ Vendors can do their part by making products simpler to consume, deploy, manage

Final Thoughts on Network Autonomy:

- Journey has begun: We are now at the cusp of major advances thanks to areas such AI, visibility and analytics, streaming telemetry, etc.2

- Broad Applicability: Autonomous Networks will extend from Cloud to the Enterprise/IoT Edge, and will also be foundational to 5G Rollouts

- Augment, not Replace IT: AI-enabled network automation augments human capabilities

- Be Judicious: Move forward judiciously, with caution, leveraging automation lessons from other IT domains

Rohit Mehra: [email protected] +1 (508) 935-4343

SK Telecom and IT&E to deploy “5G” FWA network in Guam and Saipan

South Korean mobile carrier SK Telecom (SKT) is in discussions with Citadel Holdings (venture capital and private equity firm) and IT&E (Pacific Island telecom carrier) to deploy a 5G network in Guam and Saipan [Guam and Saipan – part of the Marianas are separate commonwealths of the U.S.] .

At a meeting held in IT&E’s headquarters located in Guam, SKT and IT&E said they would work together to commercialize the 5G network with a fixed wireless access (FWA) offering in Guam and Saipan in the second half of 2019. “With SK Telecom contributing its engineering expertise as a global leader in the roll out of 5G technology, IT&E’s 5G network will set the standard for communications in Guam and the Marianas for many years to come,” said Jose Ricardo “Ricky” Delgado, president and CEO of Citadel Holdings,

In September 2018, IT&E announced a strategic partnership with SK Telecom to draw from SK Telecom’s knowledge gained from 5G network deployments.

James Oehlerking, chief executive officer for IT&E, announced on Sept. 17, 2018, South Korean giant SK Telecom’s $33 million investments in IT&E on Guam and CNMI. (Photo: Haidee Eugenio/PDN)

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

SKT said IT&E has secured 1150 MHz bandwidth in the 28-GHz frequency band for 5G communications and aims to become the first operator to launch commercial service in the region. SK Telecom and IT&E have decided to develop specific areas for cooperation including 5G. At present, they are primarily focusing on mobile edge computing (MEC). By rolling out 5G networks applied with MEC in main areas of Guam and Saipan, they can dramatically enhance customer experience and lay the groundwork for services that require ultra-high speed data processing.

The 5G FWA network will initially cover dense central areas of cities, local business customers, and areas that lacked fixed broadband infrastructure. This will be expanded gradually to wider areas. There was no mention of what technology would be used for this FWA, which is not a use case for the IMT 2020 5G standard being developed by ITU-R WP 5D.

According to SKT, the decision to deploy 5G FWA initially came as a result of an analysis of the region’s fixed broadband infrastructure, topographic features and the needs of residential and enterprise customers. FWA provides IT&E with a more cost-effective and efficient alternative to offer broadband services in areas with limited access to fixed broadband infrastructure. As part of the collaboration, SKT will help IT&E design a 5G network optimized for the local environment, support network deployment and perform field trials and network optimization.

SKT said it had discussed cooperation with IT&E in other areas, such as deploying SK Telecom’s security solutions to IT&E’s 5G network, and adopting mobile edge computing and quantum cryptography technologies which has been utilized in Deutsche Telekom’s trial network in July 2018, IT&E will be able to provide its subscribers with the safest (safer) 5G service.

Park Jung-ho, CEO and President, SK Telecom:

SK Telecom will work closely with IT&E to deploy safe and stable 5G network in Guam and Saipan. Going forward, SK Telecom will continue to cooperate with diverse players throughout the globe to accelerate 5G-powered innovations.

Jim Oehlerking, CEO of IT&E:

5G is transformational technology, and when supported by SK Telecom’s engineering team and our typhoon-proven network, our subscribers will enjoy a smooth transition to the next generation of mobile connectivity.

IHS Markit: Service Provider VoIP and IMS revenue fell 8% in 2018; More declines expected

By Diane Myers, senior research director, IHS Markit

Global service provider voice over Internet Protocol (VoIP) and IP multimedia subsystem (IMS) product revenue fell to $4 billion in 2018, a year-over-year decline of 8 percent. Overall worldwide revenue is forecast to decline at a compound annual growth rate (CAGR) of 2 percent from 2018, falling to $3.6 billion in 2022. This decline is caused mainly by slowing voice over long-term evolution (VoLTE) network deployments and competitive factors leading to lower prices. Big sales volumes continue in India and China, but pricing in those two countries is lower, which is stunting growth.

Huawei was the leading vendor in 2018 with 27 percent share of global revenue. Huawei was followed by Nokia with 23 percent and Ericsson with 20 percent. ZTE and Ribbon Communications rounded out the top five. For the full year, Nokia and Metaswitch were two noteworthy vendors posting revenue growth.

Service provider VoIP and IMS Market Highlights

- North America was the only global region to post year-over-year growth in 2018, with VoLTE expansion and new rollouts, most notably by Sprint and Shaw. Sales in the region grew 7 percent in 2018, following a 7 percent decline in 2017.

- As of November 2018, 137 operators had launched commercial VoLTE services, with more coming every year, but launches have slowed. Europe Middle-East and Africa launched 80 services, followed by Asia-Pacific with 35, North America, with 15 and Caribbean and Latin America with 7.

Service Provider VoIP and IMS Equipment and Subscribers Market Tracker

Each quarter, the “Service Provider VoIP and IMS Equipment and Subscribers Market Tracker” from IHS Markit provides worldwide and regional vendor market share, market size, forecasts through 2023, analysis and trends for trunk media gateways, SBCs, media servers, softswitches, voice application servers, HSS, and CSCF.

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

IMS Backgrounder:

IMS began as a 3GPP technology for 3G mobile networks, but has been adopted as a broader standard. It is in the development and early testing phase, and its impact remains to be seen. IMS builds on the SIP protocol.

IP Multimedia Subsystem (IMS) is a generic architecture for offering multimedia and voice over IP services, defined by 3rd Generation Partnership Project (3GPP). IMS is access independent as it supports multiple access types including GSM, WCDMA, CDMA2000, WLAN, Wireline broadband and other packet data applications. IMS will make Internet technologies, such as web browsing, e-mail, instant messaging and video conferencing available to everyone from any location. It is also intended to allow operators to introduce new services, such as web browsing, WAP and MMS, at the top level of their packet-switched networks.

IMS Release 7 is also the basis for the CableLabs PacketCable 2.0 standard which is currently under development. This is an architecture specific to service delivery over broadband cable networks which covers VoIP, cellular integration and enhanced telephony.

Some of the possible applications where IMS can be used are:

- Service Convergence (Caller-ID on TV, click to call from TV or web)

- Presence services

- Full Duplex Video Telephony

- Instant messaging

- Unified messaging

- Multimedia advertising

- Multiparty gaming

- Videostreaming

- Web/Audio/Video Conferencing

- Push-to services, such as push-to-talk, push-to-view, push-to-video

GSA 5G Security Primer vs Cisco 5G Security Challenges

| The Global mobile Suppliers Association (GSA), today issued a 5G Security Primer whitepaper, providing the industry with a top-level overview of the security considerations and required approaches necessary for securing next generation networks. 5G is expected to see huge growth in both the number of different types of applications, as well as the volume and diversity of devices that will connect to the network. These two factors have the effect of broadening the potential “attack surface” for 5G networks – introducing potential new risks and meaning that security best practice has never been more important. Drawing on research from GSA member vendors and industry security sources, the whitepaper outlines the potential issues as well as architectural approaches to securing 5G networks. It is available for download from The GSA website.

The whitepaper includes detail on trust models and assumptions within 5G networks compared to their LTE counterparts. It also outlines how 5G’s architecture and features enhance security including: Service-Based Architecture (SBA) and network slicing, Authentication, Identity Management and Privacy, Security Assurance, Inter-operator Security and Signalling Protection, the role of multi-access edge computing (MEC), the potential security impact on user experience and the hardware protection of endpoints, servers. Finally, it also considers approaches to standardization and future developments in the field. “5G is not just about faster speeds, it’s also about an order of magnitude increase in the number of connected devices and potential applications. This significantly increases the potential attack surface, and means that adopting security best practice will be critical to building models of trust between the parties using and supplying 5G networks,” said Joe Barrett, President of the GSA. “Drawing on broad research and experience of our membership, this whitepaper provides a primer for the industry to highlight the challenges and encourage secure thinking to be central to network design and implementation.” About GSA GSA is the voice of the mobile vendor ecosystem representing companies engaged in the supply of infrastructure, semiconductors, test equipment, devices, applications and mobile support services. GSA actively promotes the 3GPP technology road-map – 3G, 4G, 5G – and is a single source of information resource for industry reports and market intelligence. Its Executive board comprises of Ericsson, Huawei, Intel, Nokia, Qualcomm, and Samsung as well as a range of members and associates including Viavi Solutions and ZTE. Membership of GSA is open to any supplier of products; systems or services related to the mobile industry and brings many benefits including access to the GAMBoD database. The range of benefits includes enhanced discussion, networking and influencing opportunities on the key industry topics, and unique promotional/visibility opportunities for your company name, capabilities, positioning and messages. More details can be found at here. …………………………………………………………………………………………………………………………………………………………………………………………………………………………. According to Cisco:

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,, Three use cases for IMT 2020 (the real 5G standard to be completed end of 2020) showing application examples for each use case:

|

Cignal AI: Long-Haul WDM Deployment Growth Sets Stage for Increased Spending in 2019

|

|

|

OFC 2019: Importance of Software and 5G Related Sessions

As optical networking evolves, industry changes emphasize the increasing importance of software in optical communications. Today’s software research extends beyond SDN/NFV to address control and optimization of transmission systems, network planning, and device design, and OFC’s Demo Zone picks up on this trend.

“OFC allows to us explore the latest software developments and discuss emerging trends,” said Laurent Schares, IBM Research, USA, an OFC 2019 general chair. “Now is the time to address operational strategies, use cases and field deployments — and demonstrations drive that point home.”

OFC 2019 expanded this year’s Demo Zone to reflect industry evolution. The Demo Zone will feature live demonstrations of key software functions and tools for optical communication devices, systems and networks. From AI engine cooperation to an open dis-aggregated transport network and beyond, the OFC Demo Zone addresses topics of coordination and collaboration between systems and organizations. These proof-of-concept and research demonstrations offer an opportunity for small group, interactive dialogue, featuring real-time exchanges between attendees and presenters.

………………………………………………………………………………………………………………………………………..

5G related symposia at OFC 2019:

5G Trials, Pilots, and Demonstrations, Monday, 4 March, 08:00 – 16:00

Organizers: Thomas Pfeiffer, Nokia Bell Labs, Germany; Jun Terada, NTT, Japan; Shan Wey, ZTE, USA

The fifth generation mobile networks (5G) have promised to transform mobile broadband services through a new network architecture that will enable significantly faster access speed, ultra-reliable low latency communications, and massive machine-to-machine communications, not only for mission critical applications but for everyone everywhere. As the industry is progressing towards 5G standards and 5G capable technologies, the deployment of 5G networks is about to become reality as evidenced by the flood of new product announcements and field trial reports by network operators.

This symposium is intended to update the OFC community about the latest progress of 5G trials, pilots, and demonstrations. Use case scenarios involving a wide range of relevant vertical sectors, e.g., mobile broadband access, connected transport, digital health, smart cities/venues, creative media, will be discussed. By reporting on recent progress, we hope to highlight the role of photonic technologies in delivering 5G network solutions and further inspire and challenge the photonics industry to advance developments targeting the future mobile communication networks.

The symposium is divided into three sessions. The first session will focus on 5G requirements and how major system vendors will realize x-haul transport over optical systems. The second session will provide insight into the perspectives and first experiences of leading telecom network operators and industrial players using 5G technologies. The third session finally will showcase future applications and field trials related to public sector initiatives.

Session 1 – 5G Trials: Vendor’s Perspective

Monday, 4 March, 08:00 – 10:00

Francis Dominique, Nokia, USA

Requirements of 5G Radio Netwoks on Optical X-haul Transport

The high data rate and very low latency applications supported by 5G require an appropriate transport network to meet the requirements of these applications. This paper provides an insight to the requirements imposed by 5G radio access networks (RAN) on front/midhaul transport.

Li Mo, ZTE, China

ZTE’s 5G Trials

Stefano Stracca, Ericsson, Italy

Network Convergence in 5G Transport

Soundarakumar Masilamani, C-DOT, India

5G Rural Strategy in India

Session 2 – 5G Trials: Network Operators’ and Vertical Industries’ Perspective

Monday, 4 March, 10:30 – 12:30

Kent McCammon, AT&T, USA

Recent Progress of AT&T’s 5G Trials

Yukihiko Okumura, NTT DoCoMo, Japan

5G Trials in Japan

Walid Mathlouthi, Google, USA

Regulatory Aspects for 5G to Enable New Business Models

Yuji Inoue, Toyota InfoTechnology Center, Japan

Industry 4.0

Session 3 – 5G Trials: Public Sector Initiatives

Monday, 4 March, 14:00 – 16:00

Dimitra Simeonidou, University of Bristol, UK

Test Bed and Trials for 5G Content Delivery in England

Harald Haas, University of Edinburgh, UK

5G Rural Trials in Scotland

Dan Kilper, COSMOS-PAWR, USA

COSMOS: An Advanced Optical and Wireless Networking Testbed in NYC

Moises Ribeiro, Universidade Federal do Espírito Santo, Brazil

5G Research and Testbeds in Brazil

https://www.ofcconference.org/en-us/home/program-speakers/symposia/