Month: January 2020

Nokia claims to have 63 signed 5G contracts

Nokia has reached 63 commercial 5G contracts worldwide, positioning it as a global leader in the delivery of end-to-end 5G solutions. The 5G customer list includes AT&T, KDDI, Korea Telecom, LG Uplus, NTT Docomo, O2, SK Telecom, SoftBank, Sprint, STC, T-Mobile US, Verizon, Vodafone Italy and Zain Saudi Arabia. Nokia said it expects to add “many more new deals” this year. The 63 signed commercial contracts exclude any other type of 5G agreements, such as paid network trials, pilots or demonstrations. If such agreements were to be included, the total number of 5G agreements would reach over 100, Nokia said. The group counts more than 350 customers for 4G-LTE.

The company noted that its equipment has been selected by many of the early 5G adopters. It’s working with all four nationwide operators in the US, all three operators in South Korea and all three nationwide operators in Japan. The early start should provide it with extra expertise to assist the next wave of operators launching 5G.

“This milestone highlights the quality and customer confidence in our 5G portfolio and we expect this to continue this year with the addition of many more new deals,” said Tommi Uitto, President of Mobile Networks at Nokia. “Our global end-to-end portfolio includes products and services for every part of a network, which are helping network operators to enable key 5G capabilities such as network slicing, distributed cloud and the industrial Internet of Things. We are delighted that our technologies are helping to shape the delivery and deployment of 5G technologies worldwide and the myriad benefits these will bring to businesses and consumers alike.”

The 63 signed commercial contracts exclude any other type of 5G agreements, such as paid network trials, pilots or demonstrations. If such agreements were to be included, the total number of 5G agreements would reach over 100. Nokia is also a vendor of choice for almost all of the leading early adopter 5G markets.

“Nokia is the only network supplier whose 5G technology has been contracted by all four nationwide operators in the US, all three operators in South Korea and all three nationwide operators in Japan”, Uitto said. “We have more than 350 customers in 4G, but these first 63 customers represent some two thirds of our global Radio Access Networks business in a typical year. Further, these 63 contracts – across the most important pioneering markets, across low bands, middle bands and high bands, and across traditional and cloud network architectures – provide us with invaluable early experiences and insights for the benefit of the rest of the world. So, it is a great start”, he continued.

Nokia claims to be the only vendor with a globally available end-to-end product portfolio that covers all 5G network elements, including radio, core, cloud and transport as well as management, automation and security. This offers operators and enterprise customers with a simple and efficient step-wise upgrade to existing radio access, core and transport domains which helps customers to a faster path to 5G. Approximately 60% of Nokia’s 5G customers select more than just New Radio from its end-to-end portfolio.

Nokia also declared more than 2 000 5G patent families as essential for 5G, a year after making its first declarations for the 3GPP Release 15 specification. Nokia continues to contribute to 3GPP Release 16 as well as participate in ITU-R WP 5D where IMT 2020 radio aspects are being standardized.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

About Nokia

We create the technology to connect the world. We develop and deliver the industry’s only end-to-end portfolio of network equipment, software, services and licensing that is available globally. Our customers include communications service providers whose combined networks support 6.1 billion subscriptions, as well as enterprises in the private and public sector that use our network portfolio to increase productivity and enrich lives.

Through our research teams, including the world-renowned Nokia Bell Labs, we are leading the world to adopt end-to-end 5G networks that are faster, more secure and capable of revolutionizing lives, economies and societies. Nokia adheres to the highest ethical business standards as we create technology with social purpose, quality and integrity. www.nokia.com

Media Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: [email protected]

References:

Investment Analysts: Soft Telecom Capital Spending (CAPEX), but 5G in China to Grow 25% in 2020

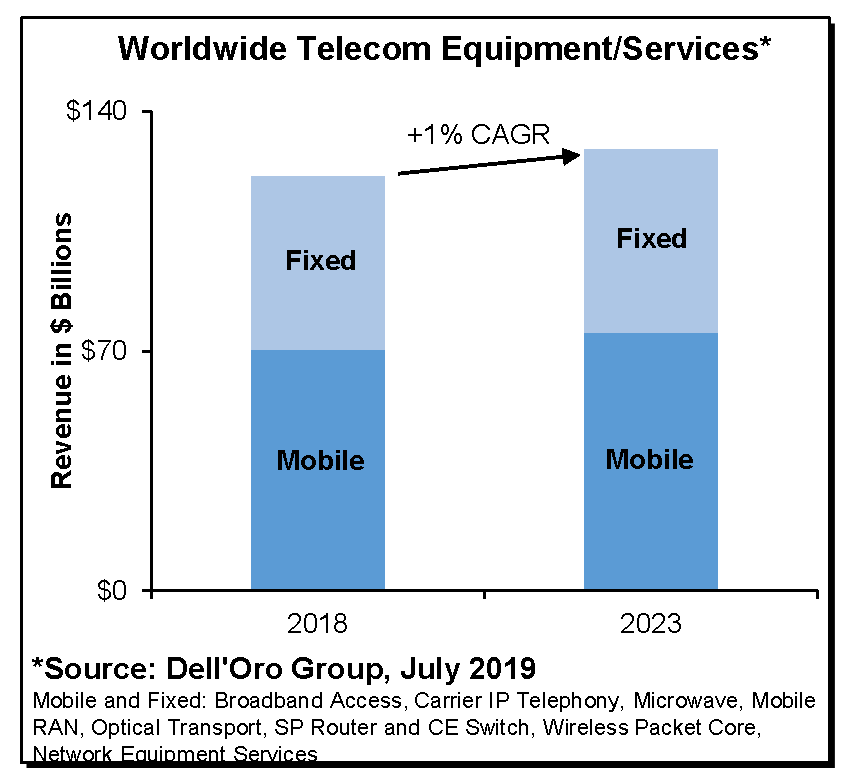

Investor’s Business Daily reports that Goldman Sachs‘ Rod Hall and Bank of America‘s Tal Liani issued separate notes Tuesday and Wednesday which came to the same conclusion: Despite the ultra hyped 5G buildup, they see overall telecom capital spending remaining soft in 2020.

Hall said, “Telco capital spending trends look set to be muted with China being the only driver of growth,” in his note, issued Tuesday. He sees 5G growth in China of 25% this year, but predicts only a 2% hike in global telecom capital spending.

Hall added: “The carrier environment is challenged globally by flat or declining revenue streams with 5G thus far offering limited or no additional revenue opportunities.”

BofA’s Liani concurred in his Wednesday note. He sees global telecom capital spending up only 1% to 2% in 2020, despite 5G network build-outs. The 5G build-out may fail to impress U.S. wireless customers over the next 12 months, he adds. “Contrary to the belief that the U.S. is an early leader with 5G, we see potential for users to be disappointed with either lack of coverage or lack of improvement, or both,” Liani said. Here is an excerpt of his January 8, 2020 note to clients:

5G becomes mainstream, but the U.S. will likely lag:

5G traction remains front and center for 2020, and we expect the first phase of a major smartphone refresh cycle in 2H20, with all major vendors launching 5G devices. In 2019, we saw initial network build-outs, and we expect the device/semiconductor ecosystem to catch up in 2020, supporting and enabling ubiquitous 5G devices. However, some regions may lag behind, particularly the US where a lack of quality 5G spectrum injects delays vs. certain parts of Europe, China, Korea and Japan where mid-band spectrum is more readily available. Our top pick related to this theme is Qualcomm as the semi provider benefits from 5G devices and the China launch.

Verizon Communications and AT&T likely will lower spending on existing fourth-generation networks, says Goldman Sachs’ Hall. They’ll also pare back spending on wireline networks. “Although U.S. 5G deployments should advance in 2020 our U.S. telecom team expects wireless capex to be roughly flat in 2020 as 5G increases are mostly offset by slowing non-5G spending,” Hall said.

Makers of electronic chips, network gear and fiber-optic technologies should gain from the 5G build-out, analysts say. Other5G stocks to watch will be tied to the deployment of “small cell” antennas, radio access network equipment as well as cloud computing infrastructure. Goldman Sachs favors fiber-optic play Corning. It’s cautious on gear makers Nokia and Ericsson.

Liani said Apple’s expected launch of 5G iPhones in late 2020 could be a game-changer. However, he says consumers may be disappointed in the 5G network coverage and 5G speeds provided by Verizon, AT&T, T-Mobile US and Sprint. That’s because not enough mid-band radio spectrum is available yet for 5G services, Liani said.

He calls Qualcomm one of the best 5G stocks to buy because it’s dependent on smartphone sales, not core network upgrades. Qualcomm‘s customers include Apple and Chinese smartphone makers.

In 2020, we see potential for mass device availability to usher in the first meaningful device upgrade cycle for 5G,” Liani added. “In 2021 and 2022, we expect the network equipment investments to potentially pick up once again as 5G usage accelerates and new applications emerge. Most importantly, however, spectrum availability drives both network upgrades and likely customer satisfaction with the new 5G networks.

Let’s close with an interesting graph from Dell’Oro Group which shows very little growth in telecom equipment/services through 2023:

Reference:

https://www.investors.com/news/technology/5g-stocks-telecom-capital-spending/

……………………………………………………………………………………………………………………………………………………………………………..

Addendum: BoAML – Hardware vendors bow to the white box:

Hardware standardization and white box networking continue and drive changes in IT equipment purchasing behavior. Hardware vendors are increasingly being forced to react to three major realities:

1) public cloud capex represents the majority of growth and some companies (e.g. Cisco) find it hard to penetrate,

2) software is taking the forefront, with vendors of traditional networking gear, like ADC, switching, or routing, facing significant pricing pressure and a new breed of competitors, and

3) the value is also pushed to semiconductors, with Cisco’s SiliconOne semiconductor strategy and the proposed acquisition of Acacia designed to address the associated risk and opportunity

Lastly, the trends of software-defined networking, white boxes, and cloud migration come together to support our fifth major trend for 2020: the shift to software-defined branch/campus offices. In our view, this trend began with SD-WAN, continued with Cisco’s Catalyst 9k introduction, and comes fully together with the acceleration of WiFi 6.

Gartner: Telco Pricing Options for 5G Services (before 5G is standardized)

by Stephanie Baghdassarian with Comments by Alan J Weissberger

Introduction:

The advent of 5G will bring opportunities for Communications Service Providers (CSPs) to renew their commercial approach to end users. Whether they propose new services or repackage existing ones, CSPs should focus on simplicity and flexibility to make the most of their offerings.

CSPs should differentiate their 5G services by selecting and combining pricing approaches that fit with their customer base but not limit themselves to pricing as a tool to promote 5G.

…………………………………………………………………………………………….

AJW Comment: This Gartner report is only available by subscription. However, we think it is very premature as “5G” networks continue to be deployed well before the IMT 2020 set of standards is completed ( IMT 2020.specs for RIT/SRIT won’t be completed till end of Nov 2020 at the earliest). Hence, CSPs really don’t have any foundation to charge for 5G services till at least 2021.

From the ITU 5G Backgrounder webpage:

IMT-2020, the name used in ITU for the standards of 5G, is expected to continue to be developed from 2020 onwards, with 5G trials and pre-commercial activities already underway to assist in evaluating the candidate technologies and frequency bands that may be used for this purpose. The first full-scale commercial deployments for 5G are expected sometime after IMT-2020 specifications are finalized.

Furthermore, spectrum is a scarce and very valuable resource, and there is intense – and intensifying – competition for spectrum at the national, regional and international levels. As the radio spectrum is divided into frequency bands allocated to different radiocommunication services, each band may be used only by services that can coexist with each other without creating harmful interference to adjacent services.

ITU-R studies examine the sharing and compatibility of mobile services with a number of other existing radiocommunication services, notably for satellite communications, weather forecasting, monitoring of Earth resources and climate change and radio astronomy.

National and international regulations need to be adopted and applied globally to avoid interference between 5G and these services and to create a viable mobile ecosystem for the future — while reducing prices through the global market’s economies of scale and enabling interoperability and roaming.

That’s why it was important for the additional spectrum to be used by 5G to be identified and harmonized at global and regional levels. For similar reasons, the radio technologies used in 5G devices need to be supported by globally harmonized standards.

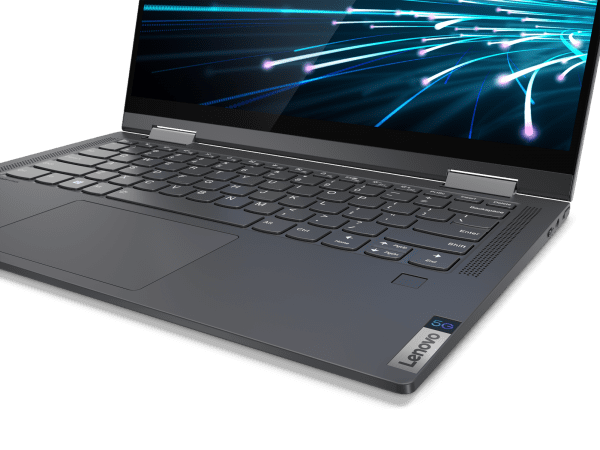

CES 2020: Lenovo Yoga 5G claims to be the first 5G laptop PC

Lenovo has displayed the world’s first “5G” laptop at CES 2020 in Las Vegas, NV. The Chinese company says the Lenovo Yoga 5G is the first PC to be able to connect to (pre-IMT 2020 standard) 5G mmWave networks. However, neither the spectrum used nor the “5G” networks supported were disclosed. The Yoga 5G also supports Bluetooth 5.0 wireless connectivity, but (astonishingly) WiFi is not listed in the data sheet.

The Lenovo Yoga 5G will go on sale in the first quarter of 2020, starting at $1,499 (around £1,200, AU$2,100), and in North America will be known as the Lenovo Flex 5G.

The Lenovo Yoga 5G was previously known as Project Limitless before its official name was unveiled yesterday at CES 2000. As with other Yoga laptops, this is an ultra-portable 2-in-1 device, with a screen that can be folded backwards to turn it into a tablet.

The Lenovo Yoga 5G is also the first laptop to run on the Qualcomm Snapdragon 8cx platform, which includes built-in support for 5G connections, allowing the Yoga 5G to connect via a service provider and access super-fast mobile internet. According to Lenovo, this will allow the user to download large files easily, with download speeds of around 4Gb/s. The company says its 5G laptop is “up to 10 times faster than 4G through a 5G service provider when on the move and reliable WiFi access at home.” That’s quite impressive!

Lenovo said in a press release “5G technology will change entire industries as we know them, disrupting some while helping to launch others.”

Lenovo NOTES:

- Requires 5G network service and separately purchased cellular data plan that may vary by location. Additional terms, conditions and/or charges apply. Connection speeds will vary due to location, environment, network conditions and other factors.

- “5G” Download speeds vary by region and service provider, e.g. Verizon in U.S. offers up to 4Gbs/second. Network strength also varies by 5G service provider.

References:

Lenovo Breaks Barriers with New Consumer Technology Unveiled at CES 2020

https://news.lenovo.com/wp-content/uploads/2020/01/Lenovo-Yoga-5G_14Inch_Qualcomm.pdf

Juniper Research: Telco Operator Voice Revenue to Drop 45% by 2024, Under a Growing OTT Challenge

A new study from Juniper Research has found that mobile operator voice revenue will drop to $208 billion by 2024 from $381 billion in 2019, as users continue to prefer more flexible and free OTT (Over-the-Top) services.

The new research, Mobile Voice: Emerging Opportunities for Operators & Vendors 2019-2024, forecasts that third-party OTT voice services will continue to grow; nearing 4.5 billion users by 2024. The study found that while this trend will contribute to declining voice revenue for operators, 5G proliferation will propel a number of nascent mobile voice and video services; generating fresh revenue streams for service providers.

Operator Voice Revenue Falls, as OTT managed VoIP Users Continue to Grow

The research forecasts that operator voice revenue will decline by 45% by 2024, in the face of an increase of 88% in the total number of third-party OTT mVoIP users over the next five years. The study urges operators to invest in AI-enabled communications platforms that facilitate competitive voice service delivery.

However, the research anticipates that improved 4G coverage and a growing number of capable devices will boost the number of mobile video call users; partially offsetting voice revenue losses. The study forecasts that ViLTE (Video over LTE) operator revenue will exceed $33 billion by 2024.

RTI (Real-Time-Interaction) and Vo5G (Voice Over 5G)

The report anticipates that 5G proliferation will generate new revenue streams for operators by enabling innovative use cases for VoLTE and ViLTE. The study notes that high data throughput and low latency will propel emerging services such as RTI, remote control and Vo5G, which will find wide application across a range of industries.

Additionally, the research prompts operators to accelerate VoLTE launches, in order to benefit from emerging Vo5G services. The study notes that establishing a 5G-enabled IMS (IP Multimedia Subsystem) infrastructure for VoLTE will provide a pivotal foundation for future voice services rollouts, which operators can monetise in upcoming years.

For more insights on mobile voice, download the free whitepaper: How Will 5G Evolve Mobile Voice in an AI-driven World.

……………………………………………………………………………………………..

Juniper Research provides research and analytical services to the global hi-tech communications sector, providing consultancy, analyst reports and industry commentary.

For further details please contact:

Sam Smith, Press Relations

Telephone: +44(0)1256 830002

Email: [email protected]

Samsung #1 in Global 5G smartphone sales with 6.7 Million Galaxy 5G Devices in 2019

Samsung Electronics Co., Ltd. said that it shipped more than 6.7 million Galaxy 5G smartphones globally in 2019, giving consumers the ability to experience next-generation speed and performance. As of November 2019, Samsung accounted for 53.9% of the global 5G smartphone market and led the industry in offering consumers five Galaxy 5G devices globally, including the Galaxy S10 5G, Note10 5G and Note10+ 5G, as well as the recently launched Galaxy A90 5G and Galaxy Fold 5G.

The 6.7 million in Samsung 5G smartphone sales eclipses the 4 million target the firm set itself, though as its main Android competitor (Huawei) is being stifled by political friction, it is hardly surprising Samsung has stormed into the lead. Note also that Apple has not announced a 5G smartphone and probably will not do so till late 2020. In the absence of main competitors, Samsung is maintaining its leadership position in the 5G segment as well as 4G-LTE.

“Consumers can’t wait to experience 5G and we are proud to offer a diverse portfolio of devices that deliver the best 5G experience possible,” said TM Roh, President and Head of Research and Development at IT & Mobile Communications Division, Samsung Electronics. “For Samsung, 2020 will be the year of Galaxy 5G and we are excited to bring 5G to even more device categories and introduce people to mobile experiences they never thought possible,” he added.

The Galaxy Tab S6 5G, which will be available in Korea in the first quarter of 2020, will be the world’s first 5G tablet bringing ultra-fast speeds together with the power and performance of the Galaxy Tab series. With its premium display, multimedia capabilities and now, 5G, the Galaxy Tab S6 5G offers high-quality video conferencing, as well as a premium experience for watching live and pre-recorded video streams or playing cloud and online games with friends.

“5G smartphones contributed to 1% of global smartphone sales in 2019. However, 2020 will be the breakout year, with 5G smartphones poised to grow 1,687% with contribution rising to 18% of the total global smartphone sales volumes,” said Neil Shah, VP of Research at Counterpoint Research. “Samsung has been one of the leading players catalyzing the 5G market development in 2019 with end-to-end 5G offerings from 3GPP standards contribution, semiconductors, mobile devices to networking equipment. With tremendous 5G growth opportunities on the horizon, Samsung, over the next decade, is in a great position to capitalize by further investing and building on the early lead and momentum, ” Shah added.

………………………………………………………………………………………………………………………………………………………………………………………….

Sidebar: Qualcomm or Samsung 5G silicon in future 5G devices?

It has become widely accepted that the latest Qualcomm chipset features in the majority of flagship smartphone devices throughout the year. Only two smartphone makers – Samsung and Huawei – have said they were making their own 5G chipsets which would be integrated into their 5G smartphones. Will Samsung use both its own silicon as well as Qualcomm’s in future 5G devices?

Over the next few months Qualcomm will begin shipping both the Snapdragon 865 and Snapdragon 765 chipsets. The Snapdragon 865 is more powerful, though 5G is on a separate modem, potentially decreasing the power efficiency of devices. The Snapdragon 765 has 5G connectivity integrated, though is notably less powerful. Whichever chipset OEMs elect for, there will be a trade-off to stomach.

Looking at the rumours spreading through the press, it does appear many of the smartphone manufacturers are electing for the Snapdragon 865 and a paired 5G modem in the device. Samsung’s Galaxy S11, Sony Xperia 2 and the Google Pixel 5 are only some of the launches suggested to feature the Snapdragon 865 as opposed to its 5G integrated sister chipset.

With Mobile World Congress 2020 in Barcelona just two months away, there is amble opportunity for new 5G devices to be launched prior, during and just after the event. It will be interesting to see what 5G silicon is used in them.

Incomplete (or non existent) 5G Standards:

Of critical importance is that there are currently no standards for 5G implementations. The closest is IMT 2020.SPECS which won’t be completed and approved till November 23-24, 2020 ITU-R SG5 meeting or later. That spec will likely not include the 5G packet core (5GC), network slicing, virtualization, automation/orchestration/provisioning, network management, security, etc which will either be proprietary or use 4G LTE infrastructure. It also might not include signaling, ultra low latency or ultra high reliability, depending on completion of those items in 3GPP Release 16 and its disposition to ITU-R WP 5D.

………………………………………………………………………………………………………………………………………………………………………………………..

For nearly a decade, Samsung has worked to bring 5G from the lab to real life by working closely with carrier partners, regulatory groups and government agencies to develop the best 5G experience possible. As a leading contributor to industry groups like 3GPP and O-RAN Alliance, Samsung is committed to an open, collaborative approach to networking, which has helped to accelerate delivery of 5G to consumers and businesses. Over the past year, in addition to launching a robust 5G device portfolio, the company reached several historical milestones including providing network equipment for the world’s first 5G commercial service in Korea as well as working closely with global carrier partners to expand 5G networks and introduce 5G experiences and use cases.

In the year ahead, Samsung says they will continue to lead the market in 5G innovation by introducing new advancements that will improve the speed, performance and security of Galaxy 5G devices even further. In 2020, these advancements will give even more people access to new mobile experiences that change the way they watch and interact with movies, TV and sports, play games and talk with friends and family.

For more information about Samsung Galaxy 5G devices please visit news.samsung.com/us/galaxy-5g/, www.samsungmobilepress.com or www.samsung.com/galaxy.

References:

https://news.samsung.com/us/samsung-galaxy-5g-devices-shipping-more-than-6-million-2019/

https://telecoms.com/501580/samsung-claims-the-5g-lead-after-6-7-million-shipments/

https://www.extremetech.com/mobile/304091-samsung-shipped-over-6-7-million-5g-phones-in-2019

At long last: India Telecom Minister gives go ahead for 5G trials

India’s telecom minister has met with the major mobile network operators and invited them to start testing their 5G services. The government also confirmed that Chinese network infrastructure equipment vendors Huawei and ZTE would be allowed to participate in the trials.

The meeting was chaired by telecom secretary Anshu Prakash and was attended by senior representatives of Bharti Airtel, Vodafone Idea, Reliance Jio and all equipment vendors, including Huawei, reports Live Mint. Indian television channel CNBC-TV18 reported the news first, citing a senior official. The trials will be held in January, according to the official, the channel reported.

India’s department of telecom expects to allocate spectrum soon (we’ve heard that before?) for trials, which should begin in Q1-2020, ahead of plans for a spectrum auction no later than April 2020.

India Telecom Minister Ravi Shankar Prasad said earlier that 5G spectrum for trials would be available to all wireless network equipment (base station) vendors. In particular, he told reporters in India earlier this week:

“5G trials will be done with all vendors and operators. We have taken an in-principle decision to give 5G spectrum for trials.” On being asked specifically about Huawei, Prasad said that at this stage, all vendors are invited.

India Telecom Minister Ravi Shankar Prasad

………………………………………………………………………………………………………….

The Indian government believes the trials, which were originally supposed to be held in 2019, will help in the development of the country’s 5G ecosystem. The Indian telcos will be conducting 5G tests with different vendors: Bharti Airtel plans to conduct trials with Nokia, Huawei and Ericsson, while Vodafone Idea wants to partner with Ericsson and Huawei. Reliance Jio, which currently works primarily with Samsung, has applied to conduct 5G tests with the South Korean vendor.

A senior executive at one vendor said the trials should have begun a year ago and now that global testing is over, it does not make sense to start from scratch in India, especially with the auction of 5G airwaves slated for March-April.

…………………………………………………………………………………….

India’s telcos have been asking for clarity from the government regarding the participation of both Chinese vendors in 5G activities. Initially only a handful of vendors, including Cisco, Ericsson, NEC, Nokia and Samsung, received invitations to participate in the 5G trials.

The decision was welcomed by Huawei India in a statement, as well as comments from the Chinese ambassador in India on Twitter. Huawei is already active in the country, where it has deployed 4G networks for Bharti Airtel and Vodafone Idea.

The inclusion in India’s 5G trials is of particular significance for Huawei, which faces trading restrictions in several countries, including Australia, New Zealand and the US, because of security concerns. The US has been lobbying the Indian government to exclude Huawei from the 5G market but, equally, China has been lobbying for Huawei and ZTE to be given equal opportunities in India’s 5G market.

The efforts of the US authorities to restrict Huawei’s business had an impact on the vendor’s sales in 2019, though with expected full-year revenues of almost $122 billion it is still by far the largest supplier of telecoms infrastructure globally and the number two player in the smartphone market.

During the past few years, Chinese vendors have provided crucial support to India’s service providers as they attempted to manage their costs and keep tariffs under control. Chinese network equipment is cheaper than the equivalent offerings from Western rivals, enabling traditional telcos to offer services in a market with one of the lowest average revenue per user (ARPU) figures in the world.

The exclusion of Huawei and ZTE from forthcoming 5G deals would almost certainly result in an increase in capital expenditure by India’s telcos: Sunil Bharti Mittal, the chairman of Bharti Enterprises, the parent company of Airtel, spoke out in support of Huawei during a recent event organized by World Economic Forum, stating that Huawei’s equipment was superior to that of its main European rivals, Ericsson and Nokia.

“Glad to know all players got equal chance to participate in 5G trial in India. A welcome move conducive to initiatives like Digital India,” said Chinese Ambassador Sun Weidong in a social media message.

References:

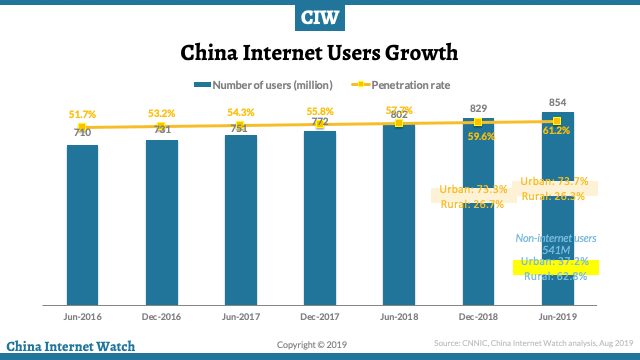

China Internet penetration reached 61.2% in 1st half 2019; 99.1% access Internet via mobile phones!

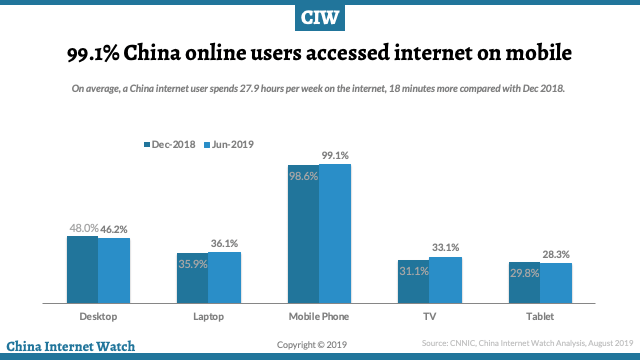

Internet penetration in China reached 61.2 percent in the first half of the year, with 854 million internet users at end June, according to China government-backed research institute MIC (Market Intelligence & Consulting Institute) and reported by China Internet Watch.

China internet users in urban areas account for 73.7% of total internet users. Among the Chinese population who don’t access the internet (which is 541 million), rural areas account for 62.8%. Internet user growth is mainly relying on mobile terminals, which is also very slow.

The number of internet users on mobile phones is 847 million, accounting for over 99% of internet users in China. Smartphones have become the top internet access devices in China.

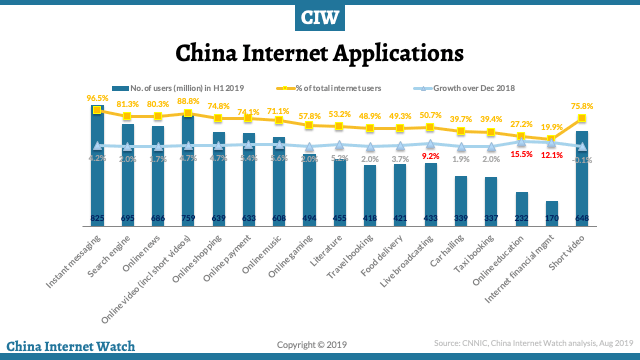

Short video consumers made up 88.8 percent of all internet users, about 760 million, breaking past the 490 million online gamers.

Top online applications by total number of users in the first half of 2019 are instant messaging, search engines, online news, online videos, and online shopping.

About 80.2 percent of internet users on the country’s three major platforms – iQiyi, Tencent, and Youku, watch OTT content. Bilibili, Sohu Video, and Mango TV were also very popular. These platforms are making big investments into exclusive content.

“Content quality has become the key to competitiveness,” MIC said.

References:

https://www.chinainternetwatch.com/statistics/china-internet-users/

https://app.box.com/s/jz9iet7vja58ciqw51j31bxeib986ms1?