Year: 2020

Deutsche Telekom in joint venture with SK Telecom for 5G in-building experiences

“The partnership between SKT and Deutsche Telekom is very meaningful at a time when the world is heavily affected by the Covid-19 pandemic,” said Park Jung-ho, CEO of SK Telecom. “The deepened bond between the two companies will play an important role as a bridge between Asia and Europe and lead us to new technologies that can bring greater value to humanity.”

Tim Höttges, CEO Deutsche Telekom, Park Jung-ho, CEO SK Telecom and their teams at a joint video conference.

…………………………………………………………………………………………………………………………………………………………………………………………………….

SK Telecom and Deutsche Telekom have been working closely since 2016 to lead innovations in ICT, seeing the sharing of fixed and wireless technologies. In May 2020, the two firms announced a collaboration to expand the global 5G ecosystem by accelerating 5G deployment in Europe. As part of this, they constructed a Network Engineer Exchange Programme that will see them exchange their respective technological expertise once the situation with Covid-19 improves.

T‑Mobile expands Home Internet to over 130 additional cities

T-Mobile US will increase its Home Internet service to more than 130 additional cities and towns across Michigan, Minnesota, New York, North Dakota, Ohio, Pennsylvania, South Dakota, West Virginia and Wisconsin. The move comes after it massively expanded its home broadband pilot to more than 20 million households in October.

The $50/month Home Internet pilot service will be deployed in underserved rural markets — through LTE-based coverage, with 5G service coming soon. The company says that only 63 percent of adults in rural America currently have access to high-speed internet.

“Home broadband has been broken for far too long, especially for those in rural areas, and it’s time that cable and telco ISPs have some competition,” said Dow Draper, T-Mobile EVP, Emerging Products. “We’ve already brought T-Mobile Home Internet access to millions of customers who have been underserved by the competition. But we’re just getting started. As we’ve seen in our first few months together with Sprint, our combined network will continue to unlock benefits for our customers, laying the groundwork to bring 5G to Home Internet soon.”

T-Mobile Home Internet is just $50/month all-in and features many of the same benefits that have made T-Mobile the fastest growing wireless provider for the past seven years:

- Self-installation. That means there’s no need for installers to come to your home.

- Taxes and fees included.

- No annual service contracts.

- No maddening “introductory” price offers. What you pay at sign-up is what you’ll pay as long as you have service.

- No hardware rental, sign-up fee or installation costs (because set-up is so easy!).

- No data caps.

- Customer support from the team that consistently ranks #1 in customer service satisfaction year after year.

Now that customers have had access to T-Mobile Home Internet since 2019, the reviews are in … and the feedback speaks for itself. Customers give T-Mobile Home Internet an average Net Promoter Score (NPS) of 42, compared to -75 (that’s a negative 75!) for their previous provider. Seventy-three percent report saving money with T-Mobile Home Internet, with 50% saving more than $30 per month (that’s $360 annually!).

The Home Internet pilot provides home broadband on the Un-carrier’s LTE network. With additional capacity unlocked by the merger with Sprint, T-Mobile is preparing to launch 5G Home Internet commercially nationwide, covering more than 50% of U.S. households within six years and providing a badly needed alternative to incumbent cable and telco ISPs.

Home broadband is one of the most uncompetitive and hated industries in America. Rural areas in particular lack options: more than three-quarters have no high-speed broadband service or only one option available. And when there’s no choice, customers suffer. It’s no wonder internet service providers have the second lowest customer satisfaction ratings out of 46 industries, beating cable and satellite TV companies by just one point according to the ACSI (American Customer Satisfaction Index)!

T-Mobile Home Internet service is available on a first-come, first-served basis, where coverage is eligible, based on equipment inventory and local network capacity, which is expanding all the time. For more information on T-Mobile Home Internet or to check availability for your home in these areas, visit t-mobile.com/isp.

Reference:

Deloitte: India rural broadband penetration at 29.1%; fixed broadband at 7.5%; Challenges noted

Broadband penetration in India’s rural areas continues to be quite low at 29.1% against national average of 51% with 687 million subscribers as of March 2020, according to a new report by Deloitte titled “Broadband for inclusive development—social, economic, and business.” Also noteworthy, fixed broadband penetration in India.

“Broadband penetration has grown at an impressive CAGR of 35% in India over the past three years (2017-2020). However, existing levels of broadband penetration in rural areas (29.1% penetration) and fixed broadband penetration (7.5% of Indian households) across the country offer significant opportunities for growth,” the report said.

Sathish Gopalaiah, Partner and Telecom Sector Leader Deloitte Touche Tohmatsu India LLP said, “This report briefly highlights the state of broadband in our country, how critical and transformative broadband can be for us, the key challenges holding back its growth potential, and certain key interventions that can be made through government policies, government spending, impetus to R&D and product development, and effective on-ground implementation of large initiatives.”

Gopalaiah said the country has witnessed significant progress in broadband in the last three years, primarily on the back of smartphone growth and low data prices. “In the next innings, broadband penetration in rural areas and mass adoption of fixed broadband hold the anchor to continue and accelerate this growth trajectory,” he added.

The Deloitte report also cited statistics from the International Telecommunication Union (ITU) that an increase of 10 percent in fixed broadband penetration yields an increase of 0.8 percent in GDP, and an increase of 10 percent in mobile broadband penetration yields an increase of 1.5 percent in GDP.

According to Deloitte, key challenges holding back the potential growth and mass adoption of broadband in India are right of way issues, cost of infrastructure deployment, levels of digital literacy, and access to affordable devices.

Photo Credit: Mint

……………………………………………………………………………………………………………………………………………………………………………….

Harnessing the full power of broadband is a multi-stage process that would involve availability of stable and high-speed broadband connectivity; accessibility to not only internet but affordable devices such as computers and mobiles; and usability (digital skills and applications/websites for users to rely on, that too, in the relevant vernacular languages).

While India has made significant development in broadband speeds over the years, “there is a large scope for growth in speeds” to enable further growth of technology platforms, social development programmes, businesses, and economic growth.

“As identified by TRAI (Telecom Regulatory Authority of India) significant improvements can be achieved in broadband speeds in the country. An important step is to pursue increasing the minimum broadband speed from 512 kbps to 2 mbps,” it said.

“Significant increase in demand for fixed broadband is estimated to continue, as a result of the pandemic, with extension in work-from-home for most corporates and permanent changes in digital behavior of people in the new normal. The broadband penetration has positive correlation with GDP growth and employment. According to a World Bank report, a 10 per cent increase in broadband penetration levels in developing countries is estimated to lead to 1.38 per cent GDP growth,” the report stated.

………………………………………………………………………………………………………………………………………………………………….

The cloud computing market in India has almost doubled from US$2.5 billion in 2018 to US$4.5 billion in 2020 and is set to grow to approximately US$7 billion by 2023. Meanwhile, “IoT connected devices in the Indian market have grown from only 60 million in 2016 to an estimated 1.9 billion in 2020. This growth is expected to continue for both consumer and industrial IoT with multiple sectors adopting IoT,” the report said.

………………………………………………………………………………………………………………………………………………………………………………….

References:

https://in.news.yahoo.com/covid-19-pandemic-accelerated-pace-082101954.html

T-Mobile US earnings, revenue, and subscriber adds top estimates + Analysis of U.S. 5G leadership

T-Mobile US 3rd quarter 2020 results, reported today, were highlighted by crossing the 100 million wireless “customer” milestone (more clarity below) after reporting record-high postpaid net subscriber additions that were nearly as much as the rest of the U.S. telco industry combined. Controlled by Deutsche Telekom, T-Mobile reported third-quarter earnings of $1 per share, down a penny from $1.01 a share a year earlier. Including the merger with Sprint, pro-forma revenue rose 74% to $19.3 billion, the company said. The Sprint merger closed April 1st.

Since closing its merger with Sprint seven months ago, T-Mobile has been driving hard on integration including unifying employees and customers under one brand, rapidly improving the Sprint customer experience, and quickly rolling out 2.5 GHz spectrum to build the world’s best 5G network. Merger synergies are being realized faster than expected and the company expects to deliver more than $1.2 billion of synergies in 2020.

“Last quarter T-Mobile overtook AT&T to become #2 in U.S. wireless and today we announced our highest ever postpaid net adds. Now, with over 100 million wireless customers and America’s largest 5G network, there is no doubt that we’re the growth leader in wireless,” said Mike Sievert, T–Mobile CEO. “Customers are choosing T-Mobile in record numbers because we are the only ones that can deliver this combination of value and experience with a true 5G network that is available to customers in every single state! We’re consistently and profitably outpacing the competition – and we’re just getting started!”

T-Mo’s strong financial results included:

• Total service revenues increased year-over-year to $14.1 billion in Q3 2020, driven by the Sprint merger and continued customer growth.

• Total revenues increased year-over-year to $19.3 billion in Q3 2020, driven by the Sprint merger and continued customer growth.

• Net income increased year-over-year to $1.3 billion in Q3 2020, as revenue growth outpaced expense increases. Merger-related costs were $288 million pre-tax and $208 million, net of tax, in Q3 2020.

• EPS was relatively flat year-over-year at $1.00 in Q3 2020, as growth in net income was offset by a higher number of outstanding shares as a result of the Sprint merger.

• Adjusted EBITDA increased year-over-year to $7.1 billion in Q3 2020 primarily due to the Sprint merger and continued customer growth.

• Net cash provided by operating activities increased year-over-year to $2.8 billion in Q3 2020.

• Cash purchases of property and equipment including capitalized interest increased year-over-year to $3.2 billion in Q3 2020, as the company accelerated the build-out of its nationwide 5G network and ramped network integration activities related to the Sprint merger.

• Free Cash Flow decreased year-over-year to $352 million in Q3 2020.

Delivering Merger Synergies Faster Than Expected:

T-Mobile says it remains highly confident in its ability to deliver $43 billion of synergies and achieve the $6 billion of annualized savings from the Sprint merger from a combination of cost avoidance and expense reductions. In fact, the company is delivering faster than expected and targeting more than $1.2 billion of synergies in 2020. The company said in its earnings report that they:

• Expect more than $600 million of network synergies primarily from avoided new site builds and early site decommissioning.

• Expect approximately $500 million of sales, service and marketing synergies primarily from accelerated rationalization of retail stores, marketing consolidation and organizational redesign.

• Expect approximately $100 million of back office synergies primarily from accelerated organizational redesign.

The network team is quickly adding capacity to the T-Mobile network to facilitate more Sprint customer traffic. 15 percent of Sprint postpaid customer traffic has already been moved over to the T-Mobile network and customer network migrations have begun, as the company enabled cross-provisioning last month, thus separating the network migration from the billing system migration and enabling gross additions and upgrades from Sprint customers to be activated on the T-Mobile network.

The company also added 1.29 million devices other than phones to its network in the third quarter as school districts built out wireless hot spots to students during the coronavirus pandemic. The increased new wireless connections pushed T-Mobile’s total customer base to 100.4 million. T-Mo counts any wireless device with its own mobile identifier as a single customer.

Management also said that 15% of former Sprint traffic has been shifted over to the T-Mobile network. T-Mobile said its 5G network currently covers 270 million Americans. But that’s mostly on lower-frequency spectrum bands that meet the technical requirements of 5G but don’t deliver the full speed and capacity benefits the new technology promises. Sievert said Thursday that T-Mobile expects to have nationwide 5G coverage on the mid-band 2.5 GHz spectrum by the end of next year.

Extending 5G Network Leadership:

T-Mobile says they’re on a mission to build America’s best 5G network, offering all of the Un-carrier customers unrivalled coverage and capacity in every place that they live, work and play. The company has already been the first to launch a nationwide 5G network, first to launch standalone 5G (without a 5G core network implementation standard), and first to have 5G coverage in all 50 states and Puerto Rico.

- America’s largest 5G network covers 270 million people in 8,300 cities and towns across 1.4 million square miles. That’s more square miles of 5G coverage than Verizon and AT&T combined – 3.5x more than Verizon and 2x more than AT&T.

- T-Mobile continued to leverage its network to expand into new complementary 5G business opportunities like broadband and video to grow revenue per household. ◦ Expanded its Home Internet Pilot service to parts of 450 cities and towns, laying the groundwork for a nationwide 5G commercial launch of fixed wireless broadband.

- Launched its latest Un-carrier move with the introduction of next-gen streaming services TVision LIVE, VIBE and CHANNELS, and the TVision HUB, a new streaming device.

Image Credit: GoranJakus/Dreamstime …………………………………………………………………………………………………………………………………………………………………………………..

T-Mo marketing boss Matt Staneff said remote classes triggered a surge in demand for broadband connections, though the company only counted what it considered long-term accounts among the customer additions. School districts in California and New York were among the first to provide the cellular hot spots to students without enough internet bandwidth at home. “We have the capacity in the network to handle all this traffic,” Mr. Staneff said. “The education system was caught off guard and will never want to be that way again.”

Regarding the wireless telco’s 5G leadership in the U.S., analyst Craig Moffett wrote:

T-Mobile, can benefit from 5G simply by taking market share (from AT&T and Sprint). T-Mobile’s 5G network will be the first to offer significant mid-band coverage, and therefore to deliver meaningfully higher-than-4G speeds, and that advantage is likely to last for years into the future. That advantage will matter most in precisely the segment in which T-Mobile under-indexes most: business wireless.

That T-Mobile is poised to be first in 5G is an extraordinary turn of events. When AT&T made its ill-fated bid to buy TMobile in 2011, T-Mobile was a distant fourth place network. Their 3G GSM network was fast, but coverage was poor, and they compensated with ultra-low prices. T-Mobile made huge strides towards closing that gap in the 4G era, but their position in business wireless still lags. Their prices have remained the industry’s lowest, and their urban speeds are often now the industry’s fastest, but their coverage map is just now catching up. In 5G, T-Mobile won’t just catch Verizon on network quality; we expect they will pass them by. Worst-to-first stories are rare. You don’t have to believe that 5G is “the next big thing” to believe that T-Mobile itself is, well, “the next big thing.”

When T-Mobile’s 2.5 GHz spectrum is more or less fully deployed, they will have 2.5 GHz-based 5G available to 100M pops (potential 5G subscribers- NOT traditional Point of Presence) by the end of 2020. By the end of 2021, T-Mobile’s 5G service will be genuinely differentiated.

Spectrum licenses acquired from Sprint have helped T-Mobile engineers to expand their 5G footprint. The company said its existing 5G towers cover about 270 million Americans.

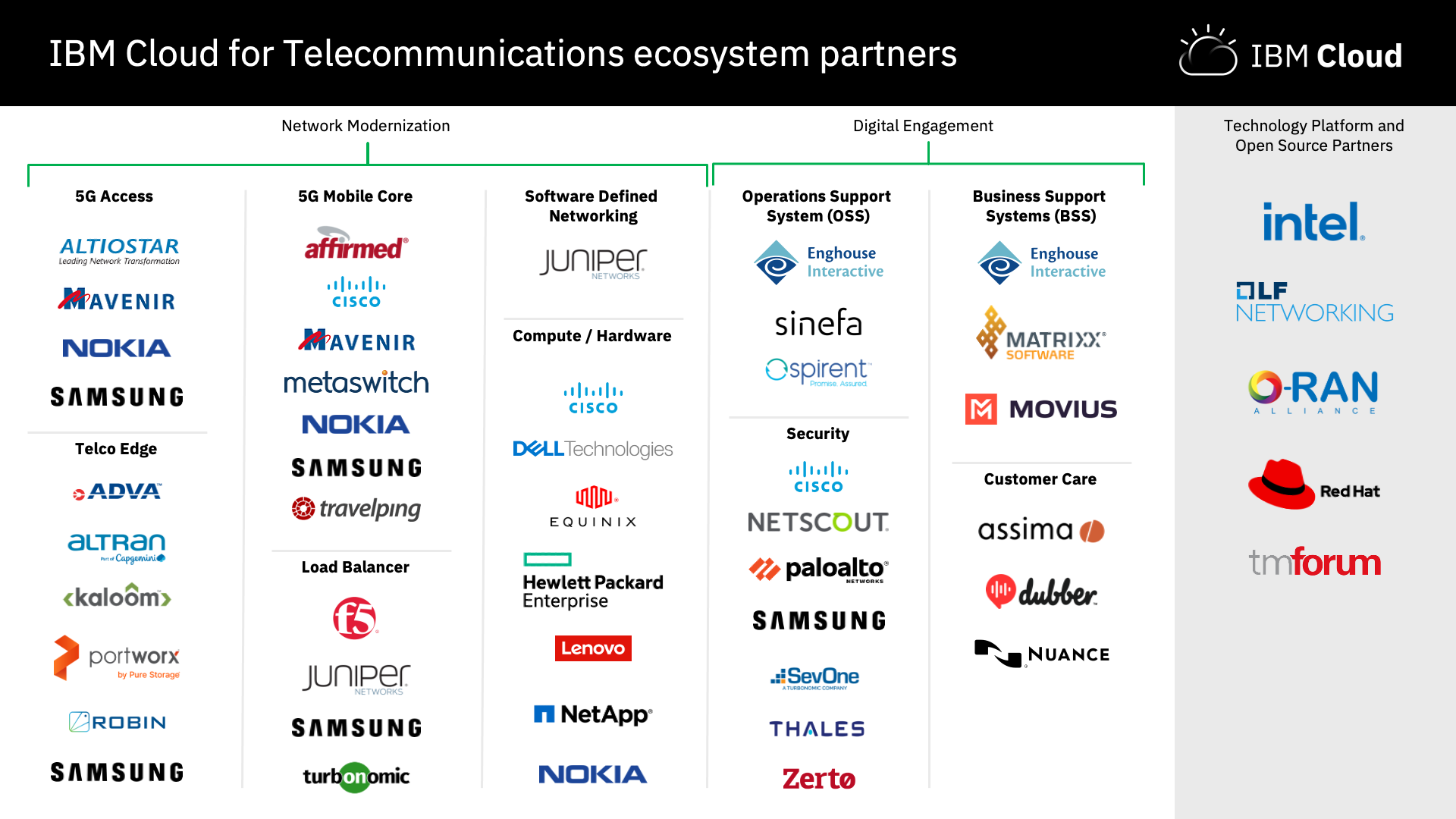

IBM Telco Cloud has 35+ Partners to Help Virtualize Carrier Networks

“IBM Cloud® for Telecommunications provides the first high trust, unified hybrid architecture to address the fundamental transformation challenges facing telecommunications operators today.”

“We are excited to launch the IBM Cloud for Telecommunications – an open, hybrid cloud architecture designed to help telecommunications providers address the specific challenges of the highly-regulated industry: accelerating business transformation, enhancing digital client engagement and improving agility as they modernize their enterprise applications and infrastructure to unlock the power of 5G and edge,” IBM’s Howard Boville wrote in a blog post.

IBM is expanding its presence in the telecom market with a new ecosystem of 35+ partners to help communication service providers virtualize their networks. Companies such as Nokia, Samsung, Juniper Networks and Intel have agreed to help operators take advantage of the new IBM Cloud Satellite platform based on Red Hat OpenShift and deploy the IBM Cloud for Telecommunications services in the cloud, on premises or at the edge.

According to a recent IBV study, 60% of Communications Service Provider (CSP) leaders surveyed agree that they must virtualize their entire network across edge locations, but only half of them are prepared to virtualize in a cloud-native environment. Built on IBM Cloud Satellite, currently in beta, and leveraging Red Hat OpenShift, clients can deploy IBM Cloud services anywhere: on the cloud, on premises or at the edge, while addressing industry-specific requirements and data protection.

The IBM Telco Cloud platform integrates and extends IBM Edge Application Manager and IBM Telco Network Cloud Manager to help reduce network-related infrastructure costs, increase automation, speed deployment of next gen services, and deliver new consumer and enterprise value. The holistic hybrid cloud offering will be complemented by our ecosystem partners’ software and technology, and enable mission critical workloads to be managed consistently from the network core to the edge to position telecom providers to extract more value from their data while they drive innovation for their customers.

Ecosystems fuel platforms, and because the IBM Cloud for Telecommunications is built on an open architecture, a large ecosystem of partners can enhance it with their own solutions in addition to providing services for it – and this is an important distinction. In order for clients to get our best technology with the most scale and flexibility at the start, we’ve built the IBM Cloud for Telecommunications using Red Hat OpenShift, and this strategy positions partners as the engine to drive a multitude of possibilities for clients.

The partners spans numerous categories, including network equipment providers, independent software vendors, software-as-a-service providers and hardware partners. Partners include Cisco, Adva, Enghouse, Dell, Equinix, Palo Alto Networks, Spirent, Altiostar and Affirmed Networks.

………………………………………………………………………………………………………………………………………………………………………………………………………….

“We are happy to team up with IBM to develop 5G solutions at the telecom edge, with Red Hat OpenShift. We believe that our service provider customers will benefit greatly from having an additional choice to quickly and efficiently deploy private 5G networks,” said Jane Rygaard, Head of Edge Cloud, Nokia. “The transition to 5G will be a key step for industries to deliver on their digital transformation plans. Having multiple options of cloud-based solutions will help our industry build this path forward.”

“Samsung is committed to helping enterprises tackle the unique challenges of today’s market by utilizing the latest mobile innovations and advanced network solutions,” said KC Choi, EVP and Head of Global Mobile B2B Team, Mobile Communications Business, Samsung Electronics. “We are excited to work with IBM and Red Hat to develop new user experiences for business based on transformative technologies like 5G, IoT and AI to help drive efficiency and streamline operations.”

“Cisco is excited to bring our industry leading compute, security, and Service Provider solutions to the IBM Cloud for Telecommunications,” said Keith Dyer, VP for IBM Strategic Alliance. “We are delighted to expand our 20+ year partnership with IBM and bring the power of our joint solutions to our mutual customers.”

IBM says their partner ecosystem will provide customers with a wide range of ways to leverage the platform to enable them to deliver next generation 5G and Edge services, deploy and manage new cloud capabilities, and enrich relationships through AI-driven engagement. Those committing to join our growing ecosystem are listed below alongside descriptions about how they are helping customers today, or how we expect to collaborate on IBM Cloud for Telecommunications:

- ADVA Optical Networking SE is contributing low latency 5G access and transport solutions, optical backbones, Network Function Virtualization (NFV), sync and timing, and disaggregated cell site gateways.

- Affirmed Networks, Inc. enables operators to transform the economics of deploying and scaling mobile networks with its complete portfolio of open, cloud-native, 5G solutions.

- Altiostar will provide 4G and 5G open virtualized RAN (Open vRAN) software that supports open interfaces and virtualizes the radio access baseband functions to build a disaggregated multi-vendor, web-scale, cloud-based mobile network.

- Altran, Part of Capgemini, provides 5G solutions (vRAN, Core, Transport, Edge platform & marketplace), advanced Edge applications for industries and deep 5G System Integration & Network Engineering expertise.

- Assima delivers powerful applications training at scale, leveraging its patented cloning technology to create immersive learner experiences.

- Cisco is providing security, compute and Service Provider solutions.

- Dell Technologies. An essential technology company in the data era, Dell Technologies is enabling Telecom network operators to extend their capabilities, moving beyond today’s connectivity to offer new enterprise services that will ignite broad industry innovations and create new revenue streams.

- Dubber’s Voice Intelligence Cloud plans to integrate and be interoperable with IBM Cloud for Telecommunications, to help enable providers to deliver next generation Unified Call Recording and Voice AI Services on one cloud platform.

- Enghouse Networks. Through IBM Cloud, Enghouse Networks offers Telecommunications service providers the ability to Plan, Design, Engineer, Provision, Operate, Monitor, Protect and simplify network complexity in a vendor-agnostic, hybrid cloud network environment.

- Equinix, Inc. plans to host the IBM Cloud for Telecommunications solution on its globally distributed automated bare metal platform.

- F5 Networks Inc. contributes traffic management, security for layers 2-7 and Kubernetes ingress control along with other virtual infrastructure solutions to enhance and support application services in the telco network cloud.

- Hewlett Packard Enterprise delivers a leading, comprehensive portfolio of cloud-enabled software, carrier-grade services, and open, secure infrastructure offerings to accelerate innovation for telco cloud and edge solutions.

- Intel brings a broad ecosystem, enabling new use cases and usage models from the edge to the cloud. Emphasizing an open-based and innovative approach helps to accelerate deployments that are built on Intel technologies with performance and security in mind.

- Juniper Networks Inc. Contrail is an end-to-end software-based network architecture delivering secure, consistent policy to applications regardless of their location and the physical underlay.

- Kaloom offers a fully programmable and automated cloud networking solution that is disrupting how edge and data center networks are built, managed and operated.

- Lenovo’s purpose-built edge servers and storage along with Lenovo’s infrastructure automation software (LOC-A) have been validated with IBM edge application manager to provide easy to consume edge infrastructure.

- Linux Foundation Networking (LFN) facilitates collaboration and operational excellence across open source networking projects

- MATRIXX Software provides a highly performant network application for charging and monetization of network resources.

- Mavenir helps wireless service providers with comprehensive end to end software applications that transforms their networks to run on the cloud.

- Metaswitch, a Microsoft company, provides cloud native IP Multimedia Subsystem (IMS) network functions that help enable the deployment of highly scalable rich communication services on Red Hat OpenShift.

- Movius provides mobile-unified communication software that enables frontline employees to securely communicate with their clients across compliant digital voice and messaging channels.

- NetApp, Inc. helps customers simplify the adoption and readiness of 5G by providing advanced data services to enable hybrid cloud environments that extend to the Edge, and by integrating these data services with container orchestration platforms such as OpenShift and IBM Cloud Pak solutions.

- NETSCOUT Systems provides visibility of digital services to prevent or resolve performance and security problems regardless of the technologies involved. We call it Visibility without Borders.

- Nokia and IBM plan to deploy a fully functioning cloud-based 5G network on the IBM Cloud infrastructure, designed to help service providers to quickly deploy and deliver private 5G solutions to their Enterprise customers

- Nuance Communications, Inc.’s enterprise solutions power over 31 billion intelligent customer interactions annually with cloud-native, AI-powered customer engagement technology to deliver industry-best digital, voice, and biometric security innovations.

- O-RAN ALLIANCE. As a member of the O-RAN ALLIANCE, IBM Cloud for Telecommunication will help to transform the radio access networks towards open, intelligent, virtualized and fully interoperable RAN.

- Palo Alto Networks, Inc. for Zero Trust 5G Security.

- Portworx by Pure Storage will provide a platform of complementary data services for data rich applications running on OpenShift on IBM Satellite, including high availability, data protection, data security, multi-cloud mobility and automated capacity management required to run enterprise applications in production.

- Red Hat will help enable the IBM Cloud for Telecommunication Ecosystem partners to run their solutions on Red Hat OpenShift and Red Hat OpenStack Platform.

- Robin.io’s cloud-native solution for Telco provides end-to-end automation for the deployment, scaling, and lifecycle management of any data- or network-intensive applications – all the way from RAN, Core, Edge, and OSS/BSS on Kubernetes.

- Samsung, IBM, and Red Hat are collaborating to bring AI-driven solutions for clients transforming to Industry 4.0 and beyond by leveraging the power of secure 5G devices, cloud-native 5G networks, and advanced edge computing platforms.

- SevOne, a Turbonomic Company, delivers network performance management solutions with modern monitoring and analytics.

- Sinefa plans to provide Digital Experience Monitoring for remote workers and SD-WAN by leveraging the IBM Telco Cloud.

- Spirent delivers automated test and assurance solutions to accelerate the design, development and deployment of 5G, cloud and virtualized networks.

- THALES Cloud Licensing and Protection helps organizations protect their most sensitive data and software, secure the cloud and achieve compliance through advanced encryption, access management and software licensing solutions.

- TM Forum will be working with IBM Cloud for Telecommunication to help unlock the possibilities of 5G by enabling the industry to build self-sustaining networks

- Travelping accelerates the provision of mobile 2G to 5G Networks, the turnkey solutions to the Telecommunications, Automotive, IoT, Manufacturing, Energy, Financial Services, and Hospitality businesses.

- Turbonomic Application Resource Management (ARM) helps automatically assure applications get the resources they need to perform, no matter where they run or how they are architected.

- Zerto will integrate with IBM Cloud Satellite as an embedded solution providing data protection, disaster recovery and mobility solutions.

- Wipro will launch a solution suite built with IBM Edge Application Manager to help clients leverage 5G and Edge for enterprise use cases.

- HCL’s IBM Ecosystem Unit will help clients, including those in regulated industries such as telecommunications, to develop digital and cloud-native solutions with IBM Cloud Paks.

………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecompaper.com/news/ibm-signs-up-partners-for-telco-hybrid-cloud-platform–1360709

PCMag Study: Starlink speed and latency top satellite Internet from Hughes and Viasat’s Exede

Recent tests revealed in a PCMag study show that speeds and latency levels delivered by Starlink, Elon Musk’s emerging low-Earth orbit satellite broadband service (owned by SpaceX), far exceed those from satellite-powered rivals. However, initial high costs for the new service could be a show stopper even for consumers in rural areas who lack access to broadband Internet service. Starlink has deployed almost 900 satellites to date. The company appears to be ramping up its beta tests ahead of its commercial service launch. SpaceX founder Elon Musk tweeted Monday that “several thousand” additional beta invites are going out this week.

Average Starlink speeds jumped to 79 Mbit/s down and 13.8 Mbit/s up in October, improving on an average speed of 42 Mbit/s down and 9.7 Mbit/s up, according to the PCMag study. The speed tests were conducted by Ookla (Ookla is owned by Ziff Davis, PCMag’s parent company). Starlink quoted speeds of “50Mb/s to 150Mb/s” in a recent email to beta test users, so the results we’re seeing are in that range.

Starlink is joining HughesNet and Viasat’s Exede as a last-resort internet service provider for rural users who can’t get cable or fiber. Starlink’s speeds are a huge jump over existing satellite systems. According to Speedtest Intelligence, in October 2020 HughesNet averaged 19.84Mbps down while Viasat’s Exede system averaged 24.75Mbps down.

Starlink’s latency numbers were outstanding. Latency in recent tests varied wildly, but averaged at 42ms. That’s much longer than wired internet systems but shorter than HughesNet and Exede, which averaged 728ms and 643ms in September, respectively. The company says it expects “to achieve 16ms to 19ms by summer 2021.” 4G LTE is currently in the 40ms range for latency, according to Speedtest Intelligence data. My home fiber connection gets 2-3ms latency.

Latency is extremely important for 2 way video conferencing. Participating in Zoom calls requires both a clear uplink and relatively low latency, which means it’s been very difficult for people using existing satellite connections. Starlink could bring rural users much better remote learning capabilities.

Lower latency is one of the big advantages of the new “low earth orbit (LEO)” satellite systems. Starlink’s many small satellites orbit at about 340 miles above the Earth, while the satellites for HughesNet and Exede are up at 22,000 miles (geostationary orbit). So it takes much longer for a signal to get up to and back down from the older-model satellites.

Satellite internet service is relatively expensive: $99/month in Starlink’s beta phase pricing, plus $499 for the satellite dish and a Wi-Fi router for customer premises transmission/reception. The PCMag report notes that HughesNet’s 25 Mbit/s service with 20 gigabytes of data costs $69.99 per month, while Viasat’s 12 Mbit/s unlimited plan (users can use up to 40GB before data is prioritized behind other customers during periods of network congestion, resulting in slower speeds) goes for $100 per month along with a 30 Mbit/s plan that costs $200 per month.

Starlink’s Beta Program and Future Plans:

According to Business Insider, Musk also noted that Starlink’s beta program, which is focused today on the northern U.S. and southern Canada, could be extended into Florida by January 2021. If Starlink gets the necessary approvals, it could get to parts of Europe by February 2021 and India by mid-2021.

Musk said European countries would get access “as soon as we get country approval,” which he estimated would be in February or March. “This is required for each country individually, as no EU-wide approval system exists. Probably start receiving final (there are many steps) approvals around Feb/March,” he said.

Florida could get access to the public beta in January, he said, adding that “lower latitude states need more satellites in position.”

India can expect connectivity “as soon as we get regulatory approval,” likely in mid-2021, Musk replied to another user.

SpaceX has not said how many people are taking part in its Starlink beta program, but it said this summer that nearly 700,000 people across the US had expressed interest in the service, CNBC reported.

References:

https://www.pcmag.com/news/tested-spacexs-starlink-satellite-internet-service-is-fast-but-itll-cost

http://www.broadbandworldnews.com/author.asp?section_id=733&doc_id=765187&#msgs

Superlatives Reign: Beaming 5G from the Stratosphere via New Type of Wireless Antenna

“5G sky high” is in the mind’s eye of Deutsche Telekom, which has backed UK-based startup Stratospheric Platforms Limited (SPL) and Capgemini-owned Cambridge Consultants to develop and test an airborne 5G network, slated for commercial release in 2024.

SPL said it has developed a high-altitude platform (HAP), in the shape of an unmanned zero-emissions aircraft, to carry a new kind of wireless antenna designed by Cambridge Consultants – which is described as  “unlike anything seen before.” The two startups believe they can provide 5G coverage to the entire UK, from 20,000 metres up, from an airborne antenna array mounted on just 60 aircraft. They say that Germany with 67 aircraft.

“unlike anything seen before.” The two startups believe they can provide 5G coverage to the entire UK, from 20,000 metres up, from an airborne antenna array mounted on just 60 aircraft. They say that Germany with 67 aircraft.

HEALTH WARNING: It’s important to note that there is no standard, nor any standards or specifications work we know of related to airborne 5G via HAPs. The IMT 2020.SPECS and 3GPP 5G NR specs only address terrestrial coverage. In particular, IMT 2020.SPECs: “Detailed specifications of the terrestrial radio interfaces of International Mobile Telecommunications-2020 (IMT-2020).”

Also, the frequencies for such a “HAP based 5G” have not been specified by WRC 19 or ITU-R. However, ITU-R identified the following frequency bands for HAPs use: worldwide (31-31.3 GHz, 38-39.5 GHz, 47.2-47.5 GHz, and 47.9-48.2 GHz) and Region 2 (the Americas) (21.4-22 GHz and 24.25-27.5 GHz).

…………………………………………………………………………………………………………………………………………………………………………..

The Capgemeni press release states:

Operating at a fraction of the cost of building and maintaining terrestrial infrastructure, and with minimal environmental impact due to its zero-emission hydrogen power system, such a fleet could rewrite the economics of mobile broadband.

With the proof of concept now complete, the ultimate antenna is set to be powerful, huge, and yet lightweight. At three meters square and weighing just 120kg, it will take flight to become what’s expected to be the world’s largest commercial airborne communications antenna.

The proof of concept antenna is the culmination of a four-year project with UK-based start-up SPL. Also headquartered in Cambridge, UK, SPL is developing a High-Altitude Platform (HAP) and communication system operating in the stratosphere to bring affordable, fast connectivity to every corner of the world. A single HAP will provide coverage over an area of up to 140 kilometres in diameter, equivalent to deploying hundreds of today’s terrestrial masts. A fleet of around 60 HAPs could blanket the whole of the United Kingdom with connectivity, providing even geographic coverage of peak 5G speeds in excess of 100 Gbps in aggregate. With radically cheaper costs, this new platform has the potential to connect the unconnected in the developing world, to fill gaps in coverage across the developed world and to ensure rural areas aren’t left behind anywhere across the globe. In addition, the hydrogen power system creates a long endurance, low environmental impact aircraft, with low noise, zero CO2 and zero NOx emissions.

As first announced on October 19 2020, SPL completed its first successful test trial during September 2020. Rollout of the first commercial service is anticipated to begin in Germany during 2024.

The companies suggested on a press call yesterday, that the U.K. will require another 400,000 masts to provide national 5G coverage. “This single mega cell tower in the stratosphere will provide coverage that is equal to the combined efforts of hundreds of terrestrial cellular masts, rewriting the economics of mobile broadband,” said Richard Deakin, chief executive at SPL.

Cambridge Consultants claims to have one of the world’s largest independent wireless development teams and this antenna is said to be amongst its crowning achievements. Sitting at one eighth of the intended full size, the proof of concept is a feat of engineering. It has overcome the key technical challenges within simulated flight conditions and proven its modular design can scale seamlessly. Advanced calibration across the four tiles of the prototype deliver beams with astonishing accuracy, maintaining laser-like performance during flight motion and paving the way for the huge 32-tile commercial array to now be developed. Have a look at the video announcing this so called “technology breakthrough.”

Each antenna produces 480 individual, steerable beams, creating patterns that can be ‘painted’ onto the ground to cover specific areas such as roads, railway lines or shipping lanes. The ability to produce hundreds of beams enables the antenna to reuse spectrum ensuring fast and even coverage across the entire covered area. A unique, wholly digital beamforming capability gives massive flexibility in how services are deployed, allowing in-flight reconfiguration to deliver services beyond the reach of conventional fixed terrestrial networks. This includes following mobile users, including trains and autonomous vehicles, and providing coverage exactly where required, for example ending at national borders.

A prototype has already been tested with Deutsche Telekom in southern Germany, according to SPL. Deutsche Telekom has not yet responded to a request from Enterprise IoT Insights for comment. The project raises a number of questions, not least about its viability, as well as about the interplay with existing terrestrial networks and deployment schedules, and whether the new system might be utilised as a shared neutral-host infrastructure.

There is also a question about its likely usage, whether for consumer 5G connectivity or, more likely, for consumer in-fill coverage, plus as a vehicle for massive machine-type communications (mMTC), and redundancy, in general. But the innovation looks considerable, with its authors calling the whole thing, even in proof-mode, a “remarkable technical achievement.”

The antenna is designed to be powerful and low-energy, at the same time, as well as both huge (three meters square) and lightweight (120kg). It will be the “world’s largest commercial airborne communications antenna”, when it finally launches in 2024, said UK-based Cambridge Consultants, acquired by Capgemini in April. The firm called the prototype, even at one eighth of the intended size of the commercial model, one of its “crowning achievements.”

The consultancy said in their press release:

Advanced calibration across the four tiles of the prototype deliver beams with astonishing accuracy, maintaining laser-like performance during flight motion and paving the way for the huge 32-tile commercial array to now be developed. Each antenna produces 480 individual, steerable beams, creating patterns that can be ‘painted’ onto the ground to cover specific areas such as roads, railway lines or shipping lanes.

The ability to produce hundreds of beams enables the antenna to reuse spectrum ensuring fast and even coverage across the entire covered area. A unique, wholly digital beamforming capability gives massive flexibility in how services are deployed, allowing in-flight reconfiguration to deliver services beyond the reach of conventional fixed terrestrial networks. This includes following mobile users, including trains and autonomous vehicles, and providing coverage exactly where required, for example ending at national borders.

The hydrogen-powered aircraft, as the other piece of the innovation, is designed to fly at an altitude of 20,000 metres for around eight days, before coming down for refueling. It offers a low environmental impact, said SPL, with low noise, zero CO2 and zero NOx emissions.

A single HAP will provide coverage over an area of up to 140 kilometres in diameter – “equivalent to hundreds of today’s terrestrial masts,” said SPL and Cambridge Consultants in a statement. A fleet of around 60 HAPs over the UK would provide blanket 5G connectivity with peak 5G speeds in excess of 100 Gbps “in aggregate,” the pair said. This proposed flying-5G network will be a “fraction of the cost of building and maintaining terrestrial infrastructure,” they claimed.

“With radically cheaper costs, this new platform has the potential to connect the unconnected in the developing world, to fill gaps in coverage across the developed world and to ensure rural areas aren’t left behind anywhere across the globe.”

SPL’s Deakins added: “This unique antenna is at the heart of SPL’s stratospheric communications system. It was essential that we overcame significant technical challenges in the design of the antenna to enable us to deliver massive data rates in a unique environment where power was limited, where weight was critical and where cooling in the thin, stratospheric air was difficult.”

“The development and testing of the antenna has met or exceeded the design criteria and working with such a talented team at Cambridge Consultants has been one of the highlights of the program to date. We look forward to continuing the journey as we progress to the production-standard antenna,” he added.

Tim Fowler, chief sales officer at Cambridge Consultants commented: “Four years ago SPL approached Cambridge Consultants with an ambitious vision to revolutionize the telecoms experience by beaming connectivity from the sky. Our role, to design and build this ‘mega cell tower in the stratosphere’, has seen us make breakthrough after breakthrough and we’re excited to build on these innovations with SPL, on the path to commercial deployment.”

Cambridge Consultants became part of the Capgemini Group in April 2020. Capgemini recently announced its first set of Intelligent Industry offerings that leverage the Group’s pioneering capabilities in data, digital and industrial technologies. Focused on 5G and Edge, the new services will enable Communications Service Providers, Network Equipment Providers and Enterprises across industries to implement 5G and Edge technologies at scale.

References:

DT-backed 5G sky-network to launch – offering country-wide 5G with 60 masts, no rents

High Altitude Platform Stations (HAPS) — bringing connectivity to all

Vodafone says Open RAN ready for prime time as Huawei is phased out in the UK

Vodafone has made a major commitment to use Open RAN at about 2,600 mobile base stations currently served by Huawei. That’s about 35% of the Chinese telecom equipment vendor’s installed base within Vodafone’s network, according to a spokesperson for the UK service provider after it was reported by the Financial Times (subscription required).

Approximately 2,600 sites in rural Wales and the south west of England will be switched to OpenRAN by the government-imposed deadline, a process that will commence in 2022. Vodafone wants to be viewed as a trailblazer for OpenRAN, which increasingly looks like the most likely source of telecoms vendor diversity in the wake of Huawei’s blacklisting by the U.S., UK and other countries.

“This commitment can get Open RAN ready for prime time,” Scott Petty, chief technology officer at Vodafone UK, told the Financial Times. He added that although open RAN was still a nascent technology more suited to rural coverage than dense urban areas, including such a large chunk of its network would create an opportunity for it to push into the mainstream. Spanish telecom operator Telefónica is also exploring greater use of open RAN systems for future upgrades.

Vodafone’s plan represents a boost for the UK government, after a task force launched to help strip Huawei equipment out of the country’s 5G networks by 2027 identified open RAN as a potential growth opportunity for the UK. It could also support a government ambition to rebuild a foothold in the telecoms equipment market if growing Open RAN use is used to justify research and development subsidies and companies in the field based themselves in Britain.

“The UK could regain a foothold which it hasn’t had since the break-up of Marconi,” said Mr Petty, referring to the collapsed British telco. Recommended Huawei Technologies Huawei develops plan for chip plant to help beat US sanctions US companies Mavenir, Parallel Wireless and Altiostar have emerged as open RAN specialists in recent years, hoping to compete with larger companies, while hardware vendors like Samsung, NEC and Fujitsu are hoping to win market share as Huawei kit is removed. The move to ban Huawei, the world’s biggest telecoms equipment maker, from 5G networks has meant networks have turned to Ericsson and Nokia to fill the void.

BT has signed deals with both the Ericsson and Nokia to replace Huawei base stations over time, putting the cost of complying with the government phase out at £500m. Ian Livingston, the former BT chief executive and trade minister heading up the government’s telecoms task force, told MPs last week that the push to foster Open RAN would grant telecoms companies a greater choice of vendors in the wake of the Huawei ban and avoid a bottleneck in the supply chain. Using Open RAN is a more costly exercise which has led to some calls within the industry for more financial support. Mr Petty said this need not be in the form of direct subsidies to use the equipment but could be directed at speeding up the development of chips and software to compete with established companies such as Huawei.

Vodafone’s pledge to use emerging open RAN tech for at least 2,600 masts and rooftops is the largest confirmed promise made by a European carrier © Alamy Stock Photo

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Analysis & Opinion:

Vodafone is likely interested in Open RAN because that could boost supplier diversity in a market where there are currently few viable alternatives to the giant kit vendors. Trials in various geographies have already been carried out with Mavenir and Parallel Wireless, two U.S. developers of Open RAN software. Many telecom operators have complained that today’s systems force them to rely on one company for all the RAN technologies at a particular site. Thanks to other “virtualization” schemes, they would be able to run open RAN software on commoditized, general-purpose equipment.

Vodafone hasn’t named any of the vendors that will help it with this initiative. Telecoms.com was told that it’s committing a fair bit to OpenRAN R&D and that it definitely sees a significant role for the technology across its entire radio estate. It seems the UK government has actually been of some help in this matter too, with the creation of a taskforce charged with improving vendor diversity considered a step in the right direction.

Vodafone seems to be trying to set the agenda when it comes to emerging technology trends. For years it promoted NB-IoT, but it’s been silent on that LPWAN (for IoT) lately. OpenRAN suffers from the classic paradox of new technologies in that companies are reluctant to invest much in being first movers. Vodafone is putting its money where its mouth is regarding OpenRAN and it will be watched closely by other operators looking for reassurance before deploying this untested technology.

Vodafone is under pressure to comply with a government deadline for the removal of all Huawei’s 5G products by the end of 2027. This would be fairly straightforward with mainstream technologies from Ericsson and Nokia. Using open RAN as a substitute, even across only 35% of these sites in rural areas, may be tough.

The payoff for Open RAN is a much larger choice of telecom equipment and software vendors. That might even include UK firms, which have not featured in the network equipment sector since the days of Marconi, eventually bought by Ericsson in 2006. Lime Microsystems, based in the UK town of Guildford, is one player that might benefit. It is already supplying 4G equipment to a Vodafone site in Wales that was supposed to be used during this year’s Royal Welsh Show, an agricultural event canceled in 2020 because of the coronavirus pandemic.

Japan’s Rakuten Mobile and U.S. based Dish Network have already made significant open RAN commitments. Yet both of those companies are building their networks from scratch as greenfield wireless carriers. With today’s update, Vodafone is taking a bigger step into the unknown than any other brownfield telco in a developed market has taken, including Telefonica.

………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.ft.com/content/a872a299-2f49-45b3-b3ff-9200f6ce8247

https://www.lightreading.com/vodafone-uk-to-swap-big-part-of-huawei-for-open-ran/d/d-id/765104?

Linksys and Qualcomm Launch the First 5G and Wi-Fi 6 Mobile Hotspot in Korea and Hong Kong

Linksys, the connected home division within the Belkin International and Foxconn Interconnect Technology (FIT) entity (formerly owned by Cisco Systems), has introduced the first 5G and Wi-Fi 6 Mobile Hotspot in Korea with Korea Telecom (KT), the largest Korean mobile carrier and in Hong Kong with CSL. The Linksys 5G Mobile Hotspot is powered by the Qualcomm® Snapdragon™ X55 5G Modem-RF System and Qualcomm® FastConnect™ 6800 mobile connectivity system.

The Linksys 5G Mobile Hotspot harnesses 5G and Wi-Fi 6 for blazing fast and seamless connectivity. The device is the world’s thinnest and lightest 5G mobile hotspot and includes a USB-C port with Qualcomm® Quick Charge™ Technology, ensuring devices are powered up and optimally connected at home or on-the-go.

The Linksys 5G Mobile Hotspot enables a fast and stable network by utilizing the latest Wi-Fi 6 standard and dual-band Wi-Fi (802.11ax) technologies. With USB tethering that supports large-capacity LTE high-speed data, users can stay connected regardless of what environment or situation they are in.

“Mobile hotspots are essential to use fast, seamless wireless networks in a variety of environments, enabling increased connectivity, mobility and productivity across many use cases,” said L.C. Wu, chief operating officer, Connected Home Division (Linksys, Wemo, Phyn), Belkin International. “Linksys is excited to launch the first 5G mobile hotspot supporting 5G and Wi-Fi 6 in Korea with KT and Hong Kong with CSL. We will continue to rollout new innovative 5G devices around the world, and expect many consumers will enjoy a fast and stable mobile life with our products.”

Additional specs include:

- The thinnest and lightest 5G mobile hotspot in the market – 15.5mm thickness and 185g weight

- Connects up to 16 devices

- 4000mAh battery capacity allows all-day usage

Linksys 5G (BKE-500) 5G/WiFi 6 mobile hotspot: Image Credit: Linksys

The Linksys Mobile Hotspot will deliver 5G supersonic speeds to 15+ devices, all day, and on the go. The ultra-thin and lightweight design and all-day battery life is a match made in tech heaven.

- Portable 5G supersonic speed and bandwidth

- WiFi 6 speeds up to 1.8 Gbps (AX1800), Handles 15+ Devices

- Ultra-thin design for maximum convenience

- All-Day Battery capacity to keep you connected at all times*

- Powered by leading edge 5G technology by Qualcomm®

- Quick charging through USB-C, QC3.0 certified

- Future-ready with the latest IPv6 internet protocol

………………………………………………………………………………………………………………………………………………………………………………………….

About Linksys

The Linksys brand has pioneered wireless connectivity since its inception in 1988, being the first router brand to ship 100 million units worldwide. Recognized for its award-winning Velop Intelligent Mesh™ Technology and integrated Linksys Aware WiFi motion sensing software, Linksys enables a connected lifestyle with simplified home and business control, enhanced security and seamless Internet access through innovative features and a growing application and partner ecosystem. Linksys products are sold in more than 60 countries and can be found in major retailers around the world.

About Belkin International

In 2018, Foxconn Interconnect Technology merged with Belkin International (Belkin®, Linksys®, Wemo®, Phyn®) to create a global consumer electronics leader. Today, this group leads in connecting people with technologies at home, at work and on the go within the accessories (“Connected Things” – Belkin brand) and the smart home (“Connected Home” – Linksys, Wemo and Phyn brands) markets.

Qualcomm Snapdragon, Qualcomm FastConnect and Qualcomm Quick Charge are products iof Qualcomm Technologies, Inc. and/or its subsidiaries.

……………………………………………………………………………………………………………………………………………………………………………………

References:

Counterpoint & Canalys: Global Smartphone Market Shows Signs of Recovery in Q3-2020

The global smartphone market contracted 4 percent year on year (YoY), but grew 32% in 3Q-2020 to 365.6 million units. The market was negatively impacted by the Covid pandemic, according to the latest report from Counterpoint Research. The recovery was driven by pent-up demand in key markets such as the US, India and Latin America, said the report, adding that easing lockdown conditions worldwide also helped to streamline the supply chain again.

All leading smartphone brands except Huawei posted sequential growth compared to the second quarter, with Samsung retaining the top spot with 79.8 million shipments, up 2 percent year on year and 47 percent quarter on quarter for a 22 percent market share. Huawei followed with shipments of 50.9 million, down 24 percent year on year and 7 percent sequentially for a 14 percent market share.

The quarter saw Xiaomi overtake Apple to capture the third spot for the first time with a 13 percent market share thanks to its highest-ever shipments of 46.2 million units in Q3. Xiaomi’s shipments were up 28 percent year on year and 35 percent compared to Q2 thanks to an impressive performance in China and rapid growth at Huawei’s expense in new markets like Latin America, Europe and the MEA.

Apple and Oppo rounded out the top 5 with market shares of 11 percent and 8 percent following third-quarter shipments of 41.7 and 31.0 million respectively. The biggest mover was Realme, with a sequential surge of 132 percent in shipments volume to rise to 7th spot thanks to a 4 percent market share, behind Vivo with 8 percent. The result means Realme became the world’s fastest brand to ship 50 million smartphone units since launching, according to the report.

Research Analyst Abhilash Kumar said, “Xiaomi reached its highest-ever shipments at 46.2 million units in Q3 2020. In China, Xiaomi’s struggle for growth ended and shipments were up 28% YoY and 35% QoQ. This impressive show by Xiaomi in China was driven by a series of campaigns and promotions during the brand’s decennial celebrations in August. Also, in new markets like LATAM, Europe and the MEA, Xiaomi’s share expanded rapidly at the expense of Huawei amid US-China trade sanctions. The brand is also performing well in Southeast Asian markets like Indonesia, Philippines and Vietnam.”

Commenting on realme’s performance, Kumar said, “Accumulative shipments of realme smartphones reached over 50 million units in Q3; with this, it became the world’s fastest brand to hit 50 million shipments since inception, surpassing top players such as Samsung, Apple, Huawei and Xiaomi. In Q3, realme grew to become one of the top 5, or even top 3, brands in its key markets, including India, Indonesia, Bangladesh, Philippines and some other Southeast Asian countries. Having released a strong 5G smartphone portfolio during Q3, realme also achieved a remarkable growth in the China market (90% QoQ in terms of sales volume). With its efforts to bring the affordable yet premium-like products to consumers, as well as its ability to offer smooth digital shopping and after-sales services in different countries, realme has emerged as the most resilient brand during and after the pandemic crisis. Additionally, we see realme’s expansion beyond smartphones into the IoT space. Products like smartwatches, TWS and smart TVs will further help the brand strengthen its position in the global market.”

Other Key Takeaways:

- Apple iPhone shipments declined 7% YoY during Q3 2020 as the company delayed its annual iPhone launch from Q3 to Q4. We expect Apple’s performance to bounce back in Q4 2020 with the launch of the 5G-powered iPhone 12 series.

- OnePlus grew 2% YoY and 96% QoQ driven by the strong performance of 8 series and the Nord in key markets like India and Western Europe.

- Huawei drove more than 40% of the total 5G shipments, thanks to strong performance in China.

- Motorola grew 37% QoQ and 4% YoY driven by strong performance in Latin America and the US-driven by the strong performance of E6 and G8 series.

- vivo has been performing well in overseas markets, especially in Southeast Asian countries like Indonesia and the Philippines, driven by its Y series. Like other brands, it has also entered the IoT segment, launching a smartwatch in September.

- OPPO is relying on operator partnerships to expand in European markets. Also, it is building partnerships with leading sports events to grow its influence across Europe.

…………………………………………………………………………………………………………………………………………………………………….

Separately, Canalys reported that worldwide smartphone shipments reached 348.0 million units in Q302020, at a 1% decline year on year. But they were up 22% on the previous quarter. Samsung regained the lead, up 2% to 80.2 million units. Huawei slipped into second place with a 23% fall to 51.7 million units. Xiaomi took third place for the first time, reaching 47.1 million units with 45% growth. Apple, which had no flagship iPhone launch in September, shipped 43.2 million, down 1%, while Vivo completed the top five, shipping 31.8 million units. Oppo came sixth, with 31.1 million units, while its sister brand Realme moved into seventh, its highest ever position, with 15.1 million units. Lenovo reported 10.2 million units, as it finally caught up with orders delayed due to disruption at its Wuhan factory, and Transsion shipped 8.4 million units as recovery started in its key African markets.

“Xiaomi executed with aggression to seize shipments from Huawei,” said Mo Jia, Analyst. “There was symmetry in Q3, as Xiaomi added 14.5 million units and Huawei lost 15.1 million. In Europe, a key battleground, Huawei’s shipments fell 25%, while Xiaomi’s grew 88%. Xiaomi took a risk setting high production targets, but this move paid off when it was able to fill channels in Q3 with high-volume devices, such as the Redmi 9 series. The vendor invested to bring in local expertise to gain the trust of distributors and carriers,” added Jia. “But it still faces competition from Oppo and Vivo, which have grown to cover a wide range of price bands in Southeast Asia, and are now driving into Europe too, where they are positioning as more premium options for carriers, and risk trapping Xiaomi at the low end. Realme is also becoming a serious contender, growing beyond ecommerce, and threatens to undercut Xiaomi as it transforms its go-to-market strategy.”

“Samsung suffered in Q2 due to its dependence on offline retail, but Q3 saw a major recovery,” said Canalys Analyst Shengtao Jin. “Its momentum was fueled by three key factors. Firstly, in many regions it saw pent-up demand from Q2 spill over into Q3. Secondly, it regained second place in India, as its Korean brand was shielded from anti-Chinese sentiment (see Canalys press release: India’s smartphone market rebounds in Q3 2020 to record high of 50 million). Thirdly, Samsung ramped up its launches of low-to-mid-range devices, and introduced other incentives, such as discounts and free online deliveries, to stimulate demand. Samsung is now positioning for more online sales as it launches exclusive online devices, such as the Galaxy F series for Flipkart. Despite its momentum, Samsung’s oversized portfolio is still the biggest pain point for the channel, which is reluctant to hand it more power.”

“This quarter was a welcome relief, with few restrictions on businesses and citizens between July and September,” said Ben Stanton, Senior Analyst. “But the ramifications of the first-half lockdowns still persist. Offline channels, for example, are being increasingly pared back, amid store closures and staff redundancies, and vendors now have to compete harder to attain floorspace. Limited supply of 4G chipsets will cause supply chain bottlenecks and increase production costs. Additionally, rising COVID-19 rates in regions such as Europe will soon force governments to bring back stricter nationwide measures. The second wave will stretch government stimulus budgets, and cause widespread bankruptcies and job losses in affected areas. Unfortunately, the relief of Q3 looks set to be short-lived.”

References:

https://www.canalys.com/newsroom/canalys-worldwide-smartphone-market-q3-2020