Year: 2022

Synopsys 5G SoC enhances 5G development with new RF design flow for TSMC N6RF process

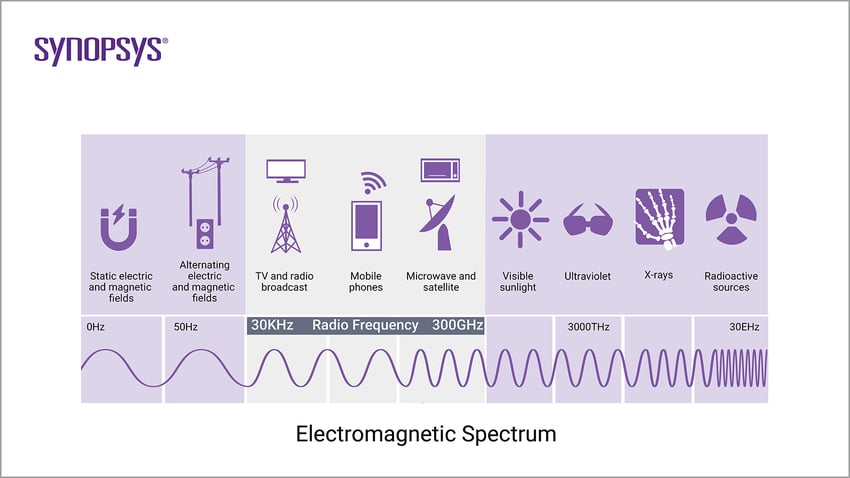

RFICs (Radio Frequency Integrated Circuits) for wireless data transmission systems, such as transceivers and RF front-end components, are becoming more complex based on the demands of our connected world. These next-generation wireless systems are expected to deliver higher bandwidth, lower latency and better coverage across more connected devices. To ensure their RFICs can meet these requirements, designers must be able to accurately measure parameters such as RF performance, spectrum, wavelength and bandwidth.

To address increasingly complex RFIC design requirements, Synopsys, Inc. today announced a new RF design flow developed with Ansys and Keysight for the TSMC N6RF process, the most advanced RF CMOS technology that offers significant performance and power efficiency boosts. The flow helps mutual customers achieve power and performance optimizations for 5G chips while also accelerating design productivity for faster time-to-market.

“Our latest collaboration with Synopsys addresses the challenges of next-generation wireless systems, enabling designers to deliver greater connectivity, higher bandwidth, lower latency and better coverage for our increasingly connected world,” said Suk Lee, vice president of the Design Infrastructure Management Division at TSMC. “With high-quality, tightly integrated solutions from Synopsys as well as Ansys and Keysight, the new TSMC RF Design Reference Flow for the TSMC N6RF process provides a modern, open approach that enhances productivity for developing these complex ICs.”

The new RF design reference flow improves design turnaround time with industry-leading circuit simulation and layout productivity performance, as well as accurate electromagnetic (EM) modeling and electromigration/IR-drop (EMIR) analysis. The flow includes the Synopsys Custom Compiler™ design and layout product, Synopsys PrimeSim™ circuit simulation product, Synopsys StarRC™ parasitic extraction signoff product and Synopsys IC Validator™ physical verification product; Ansys VeloceRF™ inductive component and transmission line synthesis product, Ansys RaptorX™ and Ansys RaptorH™, the advanced nanometer electromagnetic (EM) analysis products, and Ansys Totem-SC®; and Keysight’s PathWave RFPro for EM simulation.

RF applications include:

- Wireless communications, e.g., 5G, cell phones, WiFi, Bluetooth

- Radio broadcasting, e.g., AM/FM radio

- RF remote control, e.g., garage door opener, drones

- Remote sensing, e.g., weather or surveillance radar

- Satellite navigation, e.g., GPS, Galileo, Glonass, Beidou

- Imaging, e.g., body scanners for airport security

“To enable key differentiating advantages for 5G designs, Synopsys continues to deliver robust RF design solutions that integrate electromagnetic synthesis, extraction, design, layout, signoff technologies and simulation workflows,” said Aveek Sarkar, vice president of engineering at Synopsys. “Because of our deep collaboration with TSMC and strong relationships with Ansys and Keysight, our customers can now take advantage of the advanced features within the Synopsys Custom Design Family, using TSMC’s advanced N6RF technology for 5G applications, to improve productivity and achieve silicon success.”

“RF design customers benefit significantly from the interoperability between Synopsys Custom Compiler and PathWave RFPro in the TSMC reference flow,” said Niels Fache, vice president and general manager of PathWave Software Solutions at Keysight Technologies. “Shifting electromagnetic co-simulation left in the design process enables RF circuit designers to optimize for the parasitic effects in advanced chips and multi-technology modules for 5G and WiFi 6/6E applications. This saves days and sometimes weeks in the simulation workflow, while reducing the risk of costly re-spins in the product development cycle. Our partnership with Synopsys and TSMC gives RF customers the design tools and advanced process technology they need to ensure high performance with first-pass success.”

“Ansys is excited to collaborate with Synopsys and TSMC on an advanced reference flow for RFIC designs,” said Yorgos Koutsoyannopoulos, vice president of research and development at Ansys. “Significant complexity driven by the growing need for 5G and 6G designs, along with advanced process effects at nanometer nodes, pose a big challenge to RFIC designers. Accurately modeling advanced process effects in EM and EMIR analyses is critical to creating first-pass silicon operating from DC to tens of GHz. Working seamlessly with the Synopsys Custom Complier platform, Ansys tools such as VeloceRF, RaptorX, Exalto and Totem-SC have the highest capacity to handle the most challenging designs as well as the ability to model all advanced process effects. They provide an intuitive and easy-to-use flow for the design, optimization and verification of RF design blocks.”

Synopsys, Inc. is the Silicon to Software™ partner for innovative companies developing the electronic products and software applications we rely on every day. As an S&P 500 company, Synopsys has a long history of being a global leader in electronic design automation (EDA) and semiconductor IP and offers the industry’s broadest portfolio of application security testing tools and services. Whether you’re a system-on-chip (SoC) designer creating advanced semiconductors, or a software developer writing more secure, high-quality code, Synopsys has the solutions needed to deliver innovative products. Learn more at https://www.synopsys.com.

References:

https://www.synopsys.com/glossary/what-is-rf-circuit-design.html

Telefónica Tech to integrate Red Hat’s OpenShift platform into new enterprise cloud service in Europe and Latin America

Telecom technology integrator Telefónica Tech has signed an agreement with IBM/Red Hat to integrate Red Hat’s OpenShift platform into a new cloud service marketed at enterprises across Telefónica’s footprint in Europe and Latin America.

The integration will be marketed as the Telefónica Red Hat OpenShift Service (TROS), which will tap into the use of containers to help organizations modernize their cloud applications and drive their digital transformation. It will allow those organizations to migrate applications to hybrid cloud or multi-cloud environments using either private or public clouds from hyperscalers like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP).

OpenShift is based on the Kubernetes container orchestration project that allows for the migration of applications across different cloud and on-premises environments. A recent report from TBR Senior Analyst Catie Merrill noted that Red Hat’s OpenShift platform has four-times as many customers as it did before IBM acquired the company for $34 billion in mid-2019.

Red Hat OpenShift differentiates itself by combining multiple hardened open source technologies to provide a more complete modern application platform, enabling organizations to use it as the foundation for current and future IT strategies. Additionally, the use of Red Hat OpenShift allows for use in any type of cloud, facilitating the creation of this Multi-Cloud service for Telefónica Tech.

This new, open hybrid, multi-cloud approach will allow Telefonica Tech to strengthen and differentiate its value proposition, and provide more flexibility to its customers in their digital transformation and application modernization in the markets where Telefónica Tech is present.

The complementary nature of cloud technologies integrated in TROS will enable Telefónica Tech, Red Hat and IBM to jointly define innovative use cases and provide high value-added professional services to customers to help them make the process more efficient, cost-effective and cost-optimal.

The strategic agreement also enables Telefónica Tech to develop additional services on TROS based on Red Hat technologies and IBM Cloud Paks so that customers can accelerate their transformation to cloud-native applications, enabling a more consistent user experience both in their own cloud and on the hyperscalers.

María Jesús Almazor, CEO of Cybersecurity and Cloud at Telefónica Tech, said: “This strategic agreement allows us to strengthen our differential multicloud offer by integrating world class technologies from Red Hat and IBM and consolidate our position as a leading partner for the digital transformation of businesses. We continue to evolve our ecosystem of alliances to enhance the digital capabilities of our professionals and to include in our portfolio the most innovative proposals in the market, fundamental aspects to continue offering the best service to our customers.”

Horacio Morell, IBM General Manager for Spain, Portugal, Greece and Israel: “This alliance enables us to take a quantum leap in our business collaboration with Telefonica Tech to continue co-creating enterprise multi-cloud and cybersecurity solutions that will enable companies around the world, across all industries, to implement their technology transformation strategies with greater speed, consistency and agility, while ensuring data control, privacy and reliability and increasing decision-making efficiency through the unique capabilities of IBM’s technologies.”

Julia Bernal, Country Manager for Spain and Portugal at Red Hat, said: “Red Hat is fully committed to helping our customers and partners optimize their business with open hybrid cloud and focus on innovation rather than simply managing their IT infrastructure. Our mission is to mitigate the complexities of modern cloud-scale IT environments and with managed cloud services they can do just that. Telefónica Red Hat OpenShift Service enables customers to free resources to create and manage applications more quickly across multiple clouds, streamlining time to market and accelerating growth opportunities.”

“It is going to be the way forward and what many customers who want to evolve their business models,” said Santiago Madruga, VP for ecosystem success in EMEA at Red Hat, in an interview with SDxCentral. “When going digital, it’s not just putting workloads on the cloud but really transforming businesses.” Madruga added that the use of OpenShift also allows for the micro-segmentation of application components that will open the door for edge distributed cloud work.

References:

https://www.sdxcentral.com/articles/news/ibm-red-hat-expand-telefonicas-cloud-push/2022/06/

https://newsroom.ibm.com/2021-09-23-Telefonica-Chooses-IBM-To-Implement-Its-First-Ever-Cloud-Native-5G-Core-Network-Platform

Globe Telecom using next-generation antennas to facilitate 4G acceleration and 5G evolution

Philippine’s carrier Globe Telecom Inc. announced it is using next-generation antennas to facilitate 4G acceleration and 5G evolution. The telco said it has completed the deployment of a new series of antennas that efficiently enables the acceleration of 4G and the evolution of 5G technology. Globe said that the antennas adopts enhanced multi-array modules, ultra-high integration architecture, and full-band technology. The deployment is seen to boost the company’s 4G and 5G network and ensure energy efficiency, Globe added.

Since the antenna is smaller than the traditional design, Globe said it makes installation easier and faster even on cell sites with limited space.

The technology combines different frequency bands and accommodate different generations of cellular technologies, including 5G.

It also minimizes feed loss and improves energy efficiency, which means Globe can maximize energy efficiencies and lower electricity utilization through antenna development and power consumption innovation.

Globe said the use of the latest technology is part of its commitment to the United Nations Sustainable Development Goals, particularly UN SDG No. 9, which highlights the roles of infrastructure and innovation as crucial drivers of economic growth and development.

Globe has earmarked P89 billion for 2022 capital expenditures to roll out more 5G sites and in-building solutions, upgrade cell towers to 4G LTE, add more 4G cell sites, and lay down fiber to the homes.

The company deployed 380 new 5G sites in Metro Manila, Rizal, Cavite, Batangas, Bulacan, Davao, Cebu, Misamis Oriental, and Iloilo in the first quarter.

Globe is innovating with its vendor partners on the latest technologies available to improve customer experience through efficient 4G/5G network deployment.

References:

https://www.gizguide.com/2022/06/globe-uses-new-antennas-4g-5g.html

Arrcus MCN solution now part of CoreSite’s Open Cloud Exchange®

Arrcus, a hyperscale networking software company, today announced that CoreSite deployed its MCN solution to help enable CoreSite’s Open Cloud Exchange® (OCX) [1.]

Note 1. Open Cloud Exchange® is an enterprise network services solution that enables customers to deploy high-performance hybrid architectures in a quick, secure, and economical way. CoreSite is leveraging the Arrcus Multi-Cloud Networking (MCN) solution to extend its software-defined networking platform through automating additional provisioning functionality within AWS and Microsoft® Azure Cloud and direct cloud-to-cloud communication capabilities on CoreSite’s fully managed virtual routers.

CoreSite together with Arrcus’ ACE MCN enables enterprises to do the following:

- Rapidly scale and deploy new applications across multiple U.S. markets using inter-market connectivity

- Improve network performance and security with guaranteed private network isolation, throughput and lower latency compared to public internet connections

- Increase speed to market and gain greater control and optionality

- Recoup expensive cloud egress fees and redirect funds and internal resources to other business priorities

“Arrcus is delighted to have been selected by CoreSite for their OCX platform. Enterprises are looking for a seamless and secure hybrid cloud connectivity solution with the flexibility to rapidly scale up or down,” said Shekar Ayyar, CEO and chairman at Arrcus. “The ACE MCN solution differentiated by our unique strength in routing is providing the OCX with secure hyper-scale performance, quicker time to market, and improved economics, giving their customers a competitive edge.”

The Arrcus ACE MCN solution enables highly available connectivity for workloads and data with hyperscale performance and security across any cloud, any region, and any site. Solution consists of ArcEdge – secure data plane software that leverages unique virtual routing capabilities with ArcOS and ArcOrchestrator for cloud-native orchestration that dramatically automates and shortens multi-cloud networking setup time from days to hours.

The programmability and flexibility of the Arrcus solution enable CoreSite to provision virtual routing services for customers in a matter of minutes, dramatically increasing agility and efficiency. Rapid and secure cloud connectivity is critical for businesses to succeed in today’s digital economy. The Arrcus solution enables CoreSite to provide integrated security and orchestration to gain greater control and increased speed to market. This results in their customers’ ability to recoup expensive cloud egress fees and redirect funds and internal resources to other business priorities.

“We leverage Arrcus’ virtual routers in the CoreSite OCX to help enable our customers to quickly expand market reach and gain a competitive edge while lowering TCO,” said Brian Warren, Senior Vice President, Development and Product Engineering at CoreSite. “With just a few clicks in MyCoreSite, our service delivery platform, customers can quickly establish direct and secure virtual connections to multiple service providers and to the public cloud for rapid, automated provisioning.”

The recent Gartner® report that recognizes Arrcus MCN recommends, “Infrastructure and operations leaders responsible for cloud and edge infrastructure should improve networking inside the public cloud by deploying MCNS when advanced networking features and/or a consistent network operations model across multiple public cloud environments is required. Optimize investments in MCNS by choosing lightweight, “cloud-fluent” products that are offered with robust and well-documented APIs, and allow trials before purchase.

Arrcus ACE software is also available on the CoreSite Marketplace.

Additional Resources

T-Mobile US achieves speeds over 3 Gbps using 5G Carrier Aggregation on its 5G SA network

T-Mobile US said it was able to aggregate three channels of mid-band 5G spectrum, reaching speeds over 3 Gbps on its standalone 5G network. It’s the first time the test has ever been done with a commercial device, here the Samsung Galaxy S22 powered by Snapdragon 8 Gen 1 Mobile Platform with Snapdragon X65 Modem-RF System), on a live production network, the company said.

5G Carrier Aggregation (New Radio or NR CA) allows T-Mobile to combine multiple 5G channels (or carriers) to deliver greater speed and performance. In this test, the carrier merged three 5G channels – two channels of 2.5 GHz Ultra Capacity 5G and one channel of 1900 MHz spectrum – creating an effective 210 MHz 5G channel.

The achievement is only possible with standalone 5G architecture (SA) and is just the latest in a series of important SA 5G milestones for T-Mobile. The carrier said it was the first in the world to launch a nationwide SA 5G network nearly two years ago. The carrier began lighting up Voice over 5G (VoNR) this month so that all services can run on 5G. By removing the need for an underlying LTE network and 4G core, 5G will be able to reach its true future potential with incredibly fast speeds, real-time responsiveness and massive connectivity, the company mentioned.

NR CA is live in parts of T-Mobile’s network today, combining two 2.5 GHz 5G channels for greater speeds, performance and capacity. Customers with the Samsung Galaxy S22 will be among the first to experience a third 1900 MHz 5G channel later this year. This functionality will expand across the carrier’s network and to additional devices in the near future.

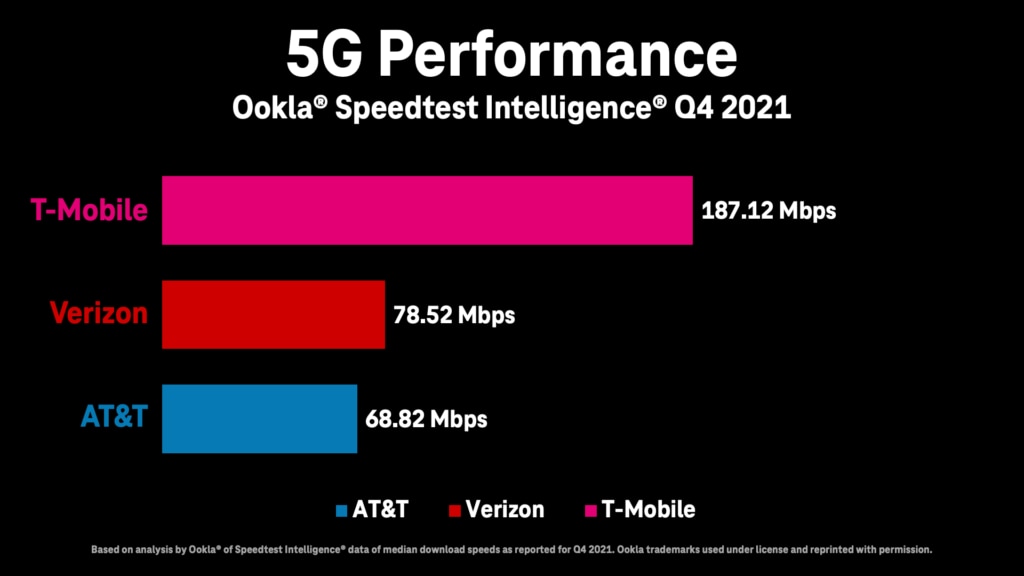

T-Mobile US was the first in the world to launch a nationwide SA 5G network nearly two years ago and has been driving toward a true 5G-only experience for customers ever since. Just this month the Un-carrier began deploying Voice over 5G (VoNR) so ALLvoice services can run on 5G. By removing the need for an underlying 4G LTE network and 4G core, 5G will be able to reach its true future potential with incredibly fast speeds, real-time responsiveness and massive connectivity. The carrier’s 5G network covers 315 million people across 1.8 million square miles. 225 million people nationwide are covered with super-fast Ultra Capacity 5G, and T-Mobile expects to cover 260 million in 2022 and 300 million next year. It also has the fastest 5G network, according to Ookla speed tests in Q4 2021:

Note that neither Verizon or AT&T have deployed 5G SA core networks with no future dates specified.

References:

AT&T CFO sees inflation as main threat, but profits and margins to expand in 2nd half 2022

At the Credit Suisse Communications Conference on Tuesday, AT&T CFO Pascal Desroches said Tuesday that inflation is the issue he is most concerned about, and one that he expects to continue “for the foreseeable future. It’s hard for me to envision that that’s not going to impact the consumer negatively,” Desroches said. “And that we and some others will see some pressure,” he added.

AT&T has already raised prices on some mobile service plans in order to combat the impacts of inflation. The CFO’s comments were made mere weeks after the telecom giant increased the pricing for certain older single-line individual plans by $6 per month or $12 a month for family plans.

Yet Desroches said the company may review its pricing again. AT&T is seeing the impacts of inflation across labor, supplies, energy and transport. Nonetheless, AT&T is expecting to see profit margins expand during the course of the second half of the year, as well as improved profit trends, Desroches added.

Desroches reiterated that AT&T has taken a disciplined approach to growth and investment and made the following points:

- The company continues to grow customer relationships in its strategic focus areas of 5G and fiber. Desroches said the company continues to see healthy consumer demand even with continued expectations that 2022 postpaid wireless industry demand is unlikely to replicate 2021 levels. AT&T continues to successfully attract high-value customers with its consistent, simple go-to-market strategy.

- Desroches remains comfortable that the company can deliver improving postpaid phone ARPU trends in 2022. He noted that postpaid phone ARPU could in fact edge up sequentially in the second quarter.

- Desroches also reiterated expectations for gradual improvement in year-over-year mobility EBITDA trends through the course of 2022. Following a more pronounced impact in the second quarter, the revenue and EBITDA impacts of the previously announced 3G network shutdown and the absence of approximately $100 million in CAF II and FirstNet related reimbursements are expected to be more than mitigated in the back half of year by organic service revenue growth and the lapping of 3G shutdown costs comparisons in the second half of 2021.

- AT&T’s fiber build progress continues with expectations to achieve 30+ million customer locations by 2025. Desroches noted that AT&T is acquiring new customers and seeing strong penetration rates thanks to a straightforward go-to-market approach.

- Desroches shared that the company continues to work with state and local government municipalities across the country to provide affordable broadband connectivity to low-income customers through the Affordable Connectivity Program. Over time, the company believes these efforts can help provide internet for all Americans and expand the total addressable market for broadband access. Additionally, Desroches indicated that any federal funding in support of the company’s fiber buildout would be deployed to expand its network to additional customer locations, representing potential upside above AT&T’s existing guidance.

- AT&T continues to work through its business wireline portfolio rationalization process and focus its efforts on core transport and connectivity solutions. Desroches noted that the company has yet to see a recovery in government sector demand trends which impacted the business during the first quarter.

- With regard to the macroeconomic environment, Desroches said that the company considered a higher-than-typical level of inflation when setting 2022 budget. The company’s recent pricing increases were a response to higher-than-expected inflation trends. Additionally, the company has opportunities to address the impacts of inflation with its ongoing cost savings initiative, which is expected to reach a run rate of $4+ billion by the end of this year.

- Desroches stated the company feels good about its financial flexibility, does not plan to issue any debt in the near-term and remains focused on its goal of achieving a net debt-to-adjusted EBITDA ratio in the 2.5x range by the end of 2023.

References:

https://about.att.com/story/2022/pascal-desroches-webcast-summary-june-14.html

https://www.barrons.com/articles/att-prices-inflation-51655220258

Data Center Networking Market to grow at a CAGR of 6.22% during 2022-2027 to reach $35.6 billion by 2027

According to Arizton’s latest market research report, the data center networking market is expected to grow at a CAGR of 6.22% during 2022-2027. Growth in the adoption of high-capacity switches, Big Data & IoT solutions, and rising data center investments are driving the market.

Data Center Networking Market Report Scope

| Report Attributes | Details |

| MARKET SIZE (INVESTMENT) | $35.6 billion (2027) |

| CAGR | 6.22% (2022-2027) |

| GEOGRAPHICAL COVERAGE | North America (US, Canada), Latin America (Brazil, Rest of Latin America), Western Europe (UK, Germany, France, Netherlands, Ireland, Other Western European Countries), Nordics (Sweden, Other Nordic Countries), Central & Eastern Europe (Russia and Other Central and Eastern European countries), Middle East (UAE, Saudi Arabia, Other Middle Eastern Countries), Africa (South Africa, Other African Countries), APAC (China & Hong Kong, Australia & New Zealand, Japan, India, Rest Of APAC, Singapore, and Other Southeast Asian Countries) |

| MARKET PARTICIPANT COVERAGE | 20+ Network Infrastructure vendors |

| SEGMENTS COVERED | Sectors (BFSI, Government, Cloud, IT & Telecom, & Other Sectors), Product Types (Ethernet Switches, Routers, Storage Networking & Other Network Infrastructure) |

Click Here to Download the Free Sample Report

The data center networking market is dominated by cloud service providers. The increase in data traffic is raising the complexity both on the internet and external data center networks. Internally, the growth in data traffic necessitated the use of a 10 GbE switch configuration on the top of the rack, and switches of higher capacity (greater than 10 GbE) are deployed in aggregation and core layers.

Highlights:

- The increasing bandwidth requirements due to the growing adoption of technologies such as big data, IoT, AI, ML, cloud services, data center consolidation, and virtualization are some major factors driving the demand for high capacity ethernet port switches, controllers, and adaptors.

- The market is witnessing growth in the adoption of software-defined networking solutions as well as application-centric infrastructure by data center operators across all industry sectors.

- The market is dominated by industry sectors such as cloud service providers contributing over 60% of the market share followed by the telecom sector.

- The market is witnessing a trend of businesses switching from FC SAN switches to Ethernet-based data exchanges using iSCSI SAN or FCoE in data centres.

- The growing adoption of converged and hyper-converged infrastructure will increase the opportunities for vendors offering innovative network infrastructure solutions in the market.

Key Offerings:

- Market Size & Forecast by Volume | 2022−2028

- Market Dynamics – Leading trends, growth drivers, restraints, and investment opportunities

- Market Segmentation – A detailed analysis by industry, product, and geography

- Competitive Landscape – 25 vendors are profiled in the report

Competitive Landscape:

Cisco Systems, Dell Technologies, Hewlett Packard Enterprise, Huawei, Juniper Networks, Lenovo, and Oracle have significant revenue shares in the market. Several vendors have begun to sell their goods in different parts of the world. Due to the intense competition among large suppliers, new vendors have been able to enter the market. In terms of opportunities, the United States is already a mature market, with regions such as APAC, Western Europe, and the Nordics seeing considerable demand growth. Central and Eastern Europe, as well as the Middle East and Africa, are in the early stages of development and are projected to see an increase in demand for network infrastructure.

The adoption of orchestration and management solutions in data centers and the automation of network operations will have an impact on the market during the forecast period, requiring vendors to offer solutions matching every business network’s operational needs. The implementation of 5G has taken off in many countries, which is likely to boost data traffic, leading to the procurement of high-capacity networking solutions i.e., 200 GbE/400 GbE switches, as a part of the data center interconnect solutions.

Infrastructure Vendors

- Alcatel-Lucent Enterprise

- Arista Networks

- Black Box offers

- Broadcom

- Cisco Systems

- Dell Technologies

- Digisol Systems

- D-Link

- Enterprise Engineering Solutions (EES)

- Extreme Networks

- Fujitsu

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies

- Intel

- Inventec

- Juniper Networks

- Lenovo

- Marvell Technology

- MiTAC Computing technology

- Oracle

- Quanta Cloud Technology (Quanta Computer)

- Ruijie Networks

- Tripp Lite (EATON)

- Super Micro Computer

- ZTE

Industry

- BFSI Sector

- Government Sector

- Cloud Sector

- It & Telecom Sector

- Other Industry Sectors

Products

- Ethernet Switches

- Storage Networking

- Routers

- Other Network Infrastructure

Geography

- North America

- US

- Canada

- APAC

- China & Hong Kong

- Australia & New Zealand

- Japan

- India

- Rest of APAC

- Western Europe

- UK

- Germany

- France

- Netherlands

- Ireland

- Other Western Europe

- Central & Eastern Europe

- Russia

- Other Central & Eastern Europe Countries

- Latin America

- Brazil

- Other Latin American Countries

- Nordics

- Sweden

- Other Nordics Countries

- Africa

- South Africa

- Other African Countries

- Middle East

- UAE

- Saudi Arabia

- Other Middle Eastern Countries

- Southeast Asia

- Singapore

- Other Southeast Asia countries

Explore our data center knowledge base profile to know more about the industry.

Click Here to Download the Free Sample Report

Read some of the top-selling reports:

- Data Center Market – Global Outlook & Forecast 2022-2027

- Green Data Center Market – Global Outlook & Forecast 2022-2027

- Data Center Server Market – Global Outlook & Forecast 2022-2027

- Data Center Fire Detection and Suppression Market – Global Outlook & Forecast 2022-2027

About Arizton:

Arizton Advisory and Intelligence is an innovation and quality-driven firm, which offers cutting-edge research solutions to clients across the world. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

Helium Network Accelerates Multi-Network Protocol Expansion, Announces New Token Rewards to Scale 5G

Highlights:

- After gaining global traction for its incentive-based decentralized wireless network, the Helium Network is adding to Internet of Things (IoT) with a new incentive model to scale any type of network, starting with 5G

- Helium’s new 5G token, MOBILE, is backed by the HNT economic system and rewards individuals in the community for being part of building out nationwide 5G cellular coverage

- The launch is part of a larger push for Helium to be a Network of Networks ~ ultimately serving an unlimited number of wireless protocols

- With 850,000+ Hotspots deployed and 5,000 cities added monthly, the network is seeing massive adoption from DISH Networks, GigSky, FreedomFi, Volvo, Cisco, Salesforce, and dozens more

The Helium Network, the world’s fastest-growing decentralized wireless network, today announced a major model expansion to meet the demand to support an unlimited number of wireless protocols, each with its own incentive model and governance. “Helium’s mission has always been to create an affordable and accessible network built by and for the people. HIP 51 is the culmination of this goal and I’m excited to support the Helium Network’s role in adopting an unlimited number of protocols.”

Starting with 5G, the Helium Network will have a new token called MOBILE that rewards Hotspot owners for providing 5G coverage. As other networks join over time, each network protocol will have its own token and governance. Each new token will be backed by HNT, still redeemable for HNT at any time.

Today’s expansion was made possible through a majority vote of 96.9% from the community by way of a proposal called HIP 51 ~ a community proposal aimed at unlocking more utility for the network and propelling it to be a ‘Network of Networks.’

“The Network of Networks is the next big chapter for Helium, and will help unlock the full potential of its utility,” said Amir Haleem, founder and CEO of Nova Labs, formerly known as Helium Systems, Inc. “Helium’s mission has always been to create an affordable and accessible network built by and for the people. HIP 51 is the culmination of this goal and I’m excited to support the Helium Network’s role in adopting an unlimited number of protocols.”

“As the network began deploying Helium 5G, it became increasingly evident that the original Helium Network incentive model had to be expanded to serve 5G and beyond,“ said Scott Sigel, COO of The Helium Foundation. “We’ve seen the IoT network power nearly one million Hotspots, so I’m eager to see where the opportunity the 5G network brings us next.”

Introducing the Network of Networks via HIP 51:

Intending to open the door for variety to exist in the Helium ecosystem, HIP 51 introduces a blueprint for an unlimited number of wireless protocols to be added to the network, including the governance and deployment of the network’s current incentive model to include multiple tokens. With the HIP 51 approval announced today, Helium can grow exponentially in addition to its roots in IoT.

Growth of the Network

This August marks three years since the Helium Network debuted and incentivized everyday people to be part of building an affordable and secure global wireless network. Since then, more than 850,000 Hotspots have been launched in 177 countries and 64,000+ cities globally. What started as a people-led effort to provide connectivity for IoT devices, the most underserved market in the telecommunications industry, has quickly become a global effort to power more network protocols.

In recent months, other networks have applied Helium’s crypto-economic model to their ecosystems, including WiFi Dabba, which aims to bring affordable connectivity to the masses in India and Boring Protocol, which tackles privacy with a decentralized VPN. This expansion comes as other major enterprises have joined the growing Helium ecosystem, such as FreedomFi, DISH, and GigSky to help build out a nationwide 5G cellular network.

What This Means For The People’s Network:

Known as The People’s Network, the Helium Network uses crypto to reward everyday people for becoming mini cell towers by deploying Hotspots and providing coverage. Helium 5G is the Network’s second wireless protocol, following the success of its global IoT network that today powers IoT applications from independent developers to large Fortune 500 companies.

Existing holdings of HNT remain unaffected and Hotspots will continue to provide the same network coverage for millions of devices. What’s new is that this model gives individuals and communities agency to own and scale any type of network in the future.

To learn more about The Helium Network, please visit helium.com.

About the Helium Network:

The Helium Network is the first decentralized wireless network, democratizing access to the internet worldwide. Launched in Austin, Texas, in 2019 by the founding team at Nova Labs (formerly known as Helium Systems, Inc.), the Network has since become the fastest-growing wireless network providing open-sourced and decentralized coverage worldwide. IoT and network industry leaders including Actility, Senet, Kore, X-TELIA, and DISH use the Helium Network’s coverage for enterprise customers including Volvo Group, Cisco, Schneider Electric, Accenture, Olympus, One Planet, Hoopo, Invoxia, Victor, and others. More information can be found at helium.com.

References:

https://www.webwire.com/ViewPressRel.asp?aId=290234

How to Deploy IoT Devices & Build Complete Applications w/ Helium – The People’s Network!

Telefonica Deutschland in deal with German fiber association (BUGLAS) to connect 5G sites

Germany has been deploying 5G networks for a number of years now. German telecoms regulator Bundesnetzagentur (BNetzA), announced at the end of last year that coverage had reached 53% coverage of the population. However, much work needs to be done to get new 5G sites to be deployed.

Backhaul solutions must be arranged for all of these new sites, delivering the mobile data from the sites back to the network core. Currently, in most mobile markets, this is done through a mix of wireless technologies (primarily microwave spectrum, but increasingly mmWave spectrum) and fibre, both of which can handle the requirements of 5G. In less developed markets, on the other hand, older copper infrastructure is sometimes used, while some of the most remote sites will be forced to use satellite when no other options are practical.

According to the GSMA, microwave and mmWave links will account for at least 60% of global macro and small cell backhaul links from 2021 to 2027.

Nonetheless, it now seems that Telefonica Deutschland is leaning even more heavily into fibre for its backhaul needs, striking a new agreement with BUGLAS to create a pre-negotiated framework agreement. The agreement should provide a basis for all of BUGLAS’s fibre network operators to strike technology, interconnection, maintenance, and service level agreements with Telefonica in a faster and more efficient manner.

BULGAS represents fibre network operators in more than 80 German cities, all of which can now request this framework agreement from BUGLAS.

Image courtesy of Telefonica

“For both 5G and FTTB/H rollout, co-operations are the central, efficient and resource-saving key to the modern gigabit society. In order to bring together the multitude of local, municipal and regional network operators with national providers such as O2 Telefónica, the telecommunications market needs standardized offers and framework agreements,” said Wolfgang Heer, MD of BULGAS. “We are therefore very pleased to have been able to conclude a 5G framework agreement with O2 Telefónica and also invite all other national network operators to join us in discussing further framework agreements and standardization.”

Telefonica views fibre as a more effective choice than terrestrial wireless for its 5G backhaul needs, suggesting that the technology is “significantly faster and more powerful than conventional microwave links”. There is a future-proofing angle here too, with Telefonica suggesting that wireless backhaul will “reach their limits in future” based on the steady growth of mobile and 5G application data that is expected in the coming years.

Telefonica-Deutschland already has over 100 strategic agreements signed with fiber players in Germany, currently connecting its 28,000 mobile sites with fiber. Earlier this year, the network operator agreed to collaborate with NEC to build an OpenRAN, small cell network in Germany which has already been deployed.

References:

https://www.gsma.com/spectrum/wp-content/uploads/2021/02/wireless-backhaul-spectrum-positions.pdf

Telefónica Germany and NEC partner to deliver 1st Open RAN with small cells in Germany

Gartner: AWS still #1 in IaaS market followed by Microsoft, Alibaba, Google and Huawei

The worldwide infrastructure as a service (IaaS) market grew 41.4% in 2021, to total $90.9 billion, up from $64.3 billion in 2020, according to Gartner press release.

Amazon retained the No. 1 position in the IaaS (Infrastructure as a Service) market in 2021, followed by Microsoft, Alibaba, Google and Huawei.

“The IaaS market continues to grow unabated as cloud-native becomes the primary architecture for modern workloads,” said Sid Nag, VP analyst at Gartner. “Cloud supports the scalability and composability that advanced technologies and applications require, while also enabling enterprises to address emerging needs such as sovereignty, data integration and enhanced customer experience.”

In 2021, the top five IaaS providers accounted for over 80% of the market. Amazon continued to lead the worldwide IaaS market with revenue of $35.4 billion in 2021 and 38.9% market share (see Table 1).

Table 1. Worldwide IaaS Public Cloud Services Market Share, 2020-2021 (Millions of U.S. Dollars)

| Company | 2021 Revenue |

2021 Market Share (%) |

2020 Revenue |

2020 Market Share (%) |

2020-2021 Growth (%) |

| Amazon | 35,380 | 38.9 | 26,201 | 40.8 | 35.0 |

| Microsoft | 19,153 | 21.1 | 12,659 | 19.7 | 51.3 |

| Alibaba | 8,679 | 9.5 | 6,117 | 9.5 | 41.9 |

| 6,436 | 7.1 | 3,932 | 6.1 | 63.7 | |

| Huawei | 4,190 | 4.6 | 2,681 | 4.2 | 56.3 |

| Others | 17,056 | 18.8 | 12,697 | 19.8 | 34.3 |

| Total | 90,894 | 100.0 | 64,286 | 100.0 | 41.4 |

Source: Gartner (June 2022)

Microsoft followed in the No. 2 position with 21.1% share and above-market growth, reaching over $19 billion in IaaS revenue in 2021. With many organizations already relying on Microsoft’s enterprise software and services, Azure has been positioned to capture opportunities across nearly every vertical market. “I don’t hear businesses looking to their IT budgets or digital transformation projects as the place for cuts,” Microsoft CEO Nadella said during Microsoft’s third-quarter earnings call. It’s more likely that these projects are going to accelerate companies’ digital transformations and increase demand for the cloud giant’s services, he added.

Alibaba was again the No. 3 IaaS public cloud provider worldwide with 9.5% market share and revenue of $8.7 billion for 2021. While Alibaba continues to lead the Chinese cloud market, it is also poised to be the leading regional provider in Indonesia, Malaysia, and other emerging cloud markets, given its local market understanding and ability to serve as a bridge to digital commerce.

“Regional cloud ecosystems are becoming increasingly important amidst growing geopolitical fragmentation and emerging regulatory and compliance requirements, presenting an opportunity for providers with a strong regional presence,” said Nag.

Google Cloud saw the highest growth rate of the top five IaaS vendors, growing 63.7% in 2021 to reach $6.4 billion in revenue. This growth was driven by steadily increased adoption for traditional enterprise workloads as well as Google’s innovation in more cutting-edge capabilities such as artificial intelligence and Kubernetes container technologies, supported by an expansion of their partner ecosystem to reach a wider customer base.

While Huawei’s growth tempered in 2021 after two straight years of over 200% growth, it still maintained the No. 5 market share position with $4.2 billion in revenue. Huawei has made significant investments in its IaaS ecosystem in the past two years, and through an enhanced strategy of open hardware, open-source software and partner enablement it has been able to provide expanded offerings for universities, developers and startups.

“The next phase of IaaS growth will be driven by customer experience, digital outcomes and the virtual-first world,” said Nag. “Emerging technologies that can help businesses bring experiences closer to their customers, such as the metaverse, chatbots and digital twins, will require hyperscale infrastructure to meet growing demands for compute and storage power.”

Gartner clients can read more in “Market Share: IT Services, Worldwide, 2021.” Learn how to create a strong cloud strategy in the complimentary Gartner webinar “The Gartner Cloud Strategy Cookbook, 2022.”

References:

Gartner: Public Cloud End-User Spending to approach $500B in 2022; $600B in 2023

Gartner: Accelerated Move to Public Cloud to Overtake Traditional IT Spending in 2025