Author: Alan Weissberger

Morgan Stanley finds little interest in 5G; Finland’s Oulu says 5G won’t mature till 2027

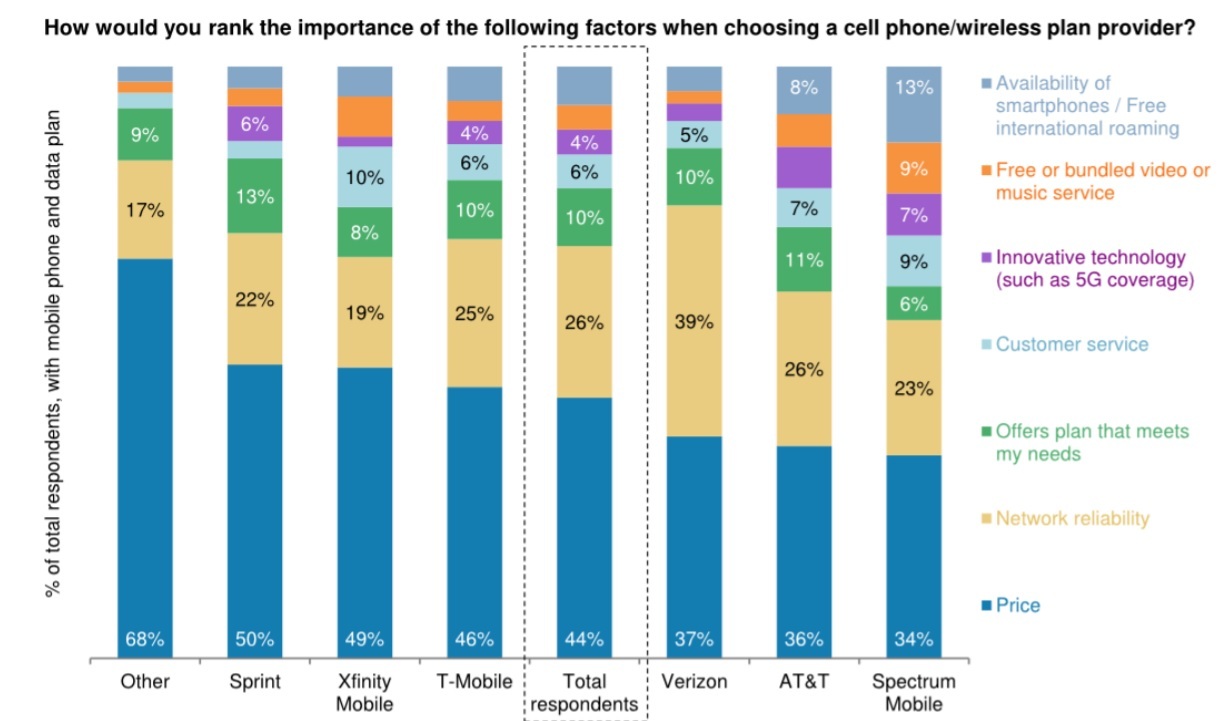

Morgan Stanley surveyed 3,500 broadband customers and found that only 4% of respondents said they would switch carriers to access new technologies like 5G. End users had little interest in an “innovative technology” like 5G, according to the survey results.

It should come as no surprise to IEEE Techblog readers that Finnish university researchers are warning that 5G technology won’t actually mature until the year 2027. Ari Pouttu, vice-director of the 6Genesis program at Finland’s University of Oulu, it might be years more before we see 5G’s “killer app.” Oulu is where a lot of cutting-edge network development happens, so readers should pay attention to what their researchers say.

Ari Pouttu, vice-director of the 6Genesis program at Finland’s University of Oulu, it might be years more before we see 5G’s “killer app.”

“5G is now being introduced, but we only have the first part of 5G in the market, and that’s 4G on steroids,” [5G NSA is 5G NR RAN with 4G LTE core and signaling). That’s not the real promise of 5G. The real promise of 5G is connecting all the objects, bringing intelligence into the service,” Pouttu said.

“The appearance of 5G not serving us more than 4G is partially true, partially wrong,” according to Pouttu. “When we go a few years into the future, the capacity of 4G systems comes to the limit, and we need 5G to continue this path.”

Pasi Leipala, CEO of Haltian, followed up with tacit agreement that the 5G era may be about changes in an ambient industrial world you don’t necessarily see. Haltian is an IoT company focused on smart office buildings and inventory sensors.

“If you have a pallet of something, 10,000 units, how do you track where those assets are going? How do you assure that nobody is stealing those, that they’re in the right place at the right time?” Leipala asked. But that kind of sensor density and energy efficiency will take 6G, not the current form of 5G, he said. “You always overestimate the near future and underestimate the far future,” he lamented.

However, all hope is not lost. According to a new Bloomberg article, some believe the metaverse is how wireless network operators will recoup their 5G investments.

Telecommunications companies are looking to build a platform based on the metaverse, an idea that inspired “Ready Player One” and online games by market darlings such as Roblox Corp. Early-stage examples include virtual and augmented reality headsets or glasses that provide immersive experiences. Advanced versions — still years away pending super-fast wireless data speeds — combine multiple technologies like holograms to bring the internet to life: 3D avatars of people working, interacting and relaxing in digital replicas of offices, factories and leisure venues.

Recognizing the business potential, telcos ranging from China Mobile Ltd. to Verizon Communications Inc. and SK Telecom Co. are jumping into the fray — alongside online-game developers — to build a “killer app” that could resemble a blend of today’s social media and e-commerce, but on steroids. Operators could earn a third more in revenue, potentially reaching $712 billion by 2030, if they introduce such innovative 5G applications on top of just laying pipes, according to a research by Ericsson AB’s research arm Consumer & IndustryLab.

Pernilla Jonsson of Ericsson’s Consumer & Industry Lab suggested that the metaverse might be a 5G “killer app” that would help operators avoid becoming dumb pipes.

“The metaverse is our future business model. It will be our core business platform,” Cho Ik-hwan, SK Telecom’s vice president and head of mixed reality development, told the publication. “We want to create a new kind of economic system. A very giant, very virtual economic system.”

“The metaverse will need the speed and capabilities of the faster network to fully optimize futuristic applications and keep pushing progress. It is critical to pay attention to these mind-bending and evolving applications. The metaverse transformation is global. It will impact us all,” according to an article published last year on Verizon’s website titled “The metaverse is coming – it just needed 5G.”

References:

https://www.lightreading.com/5g/is-sun-finally-starting-to-shine-on-5g/a/d-id/772907

https://www.pcmag.com/news/why-you-wont-really-feel-5g-until-2027

https://www.lightreading.com/aiautomation/the-metaverse-will-save-5g-thats-so-cute!/a/d-id/772368?

ETSI DECT-2020 approved by ITU-R WP5D for next revision of ITU-R M.2150 (IMT 2020)

ETSI DECT-2020 NR, the world’s first non-cellular 5G technology standard, will be included in the next revision of ITU-R M.2150, aka IMT-2020 technology recommendation as per the conclusion of ITU-R WP 5D’s 39th (virtual) meeting on Oct 15, 2021.

[Separately, Nufront’s IMT 2020 RIT submission has been withdrawn for consideration in the next M.2150 revision, but maybe submitted in the future. The 5D SWG on Frequency Arrangements could not agree on a revision of ITU-R M.1036 Frequency Arrangements for Terrestrial IMT, which now can’t be approved till November 2022’s ITU-R SG 5 meeting. That means there is no standard for 5G frequencies, which hasn’t bothered the FCC which is considering licensing frequencies that are not being considered for M.1036, e.g. 12GHz.]

The “DECT-2020 NR” Radio Interface Technology (RIT) is designed to provide a slim but powerful technology foundation for wireless applications deployed in various use cases and markets. It utilizes the frequency bands below 6 GHz identified for International Mobile Telecommunication (IMT) in the ITU Radio Regulations.

The DECT-2020 radio technology includes, but is not limited to: Cordless Telephony, Audio Streaming Applications, Professional Audio Applications, consumer and industrial applications of Internet of Things (IoT) such as industry and building automation and monitoring, and in general solutions for local area deployments for Ultra-Reliable Low Latency (URLLC) and massive Machine Type Communication (mMTC) as envisioned by ITU-R for IMT-2020.

According to an email to this author, ETSI supports this DECT RIT mainly because of its URLLC capabilities (3GPP Release 16 URLLC in the RAN has yet to be completed and performance tested).

DECT-2020 NR is claimed by its sponsor to be a technology foundation is targeted for local area wireless applications, which can be deployed anywhere by anyone at any time. The technology supports autonomous and automatic operation with minimal maintenance effort. Where applicable, interworking functions to wide area networks (WAN). e.g. PLMN, satellite, fiber, and internet protocols foster the vision of a network of networks. DECT-2020 NR can be used as foundation for: Very reliable Point-to-Point and Point-to-Multipoint Wireless Links provisioning (e.g. cable replacement solutions); Local Area Wireless Access Networks following a star topology as in classical DECT deployment supporting URLLC use cases, and Self-Organizing Local Area Wireless Access Networks following a mesh network topology, which enables to support mMTC use cases.

Dr. Günter Kleindl, Chair of the ETSI Technical Committee DECT, said:

“With our traditional DECT standard we already received IMT-2000 approval by ITU-R twenty-one years ago, but the requirements for 5G were so much higher, that we had to develop a completely new, but compatible, radio standard.”

Released last year and revised in April 2021, this ETSI standard sets an example of future connectivity: the infrastructure-less and autonomous, decentralized technology is designed for massive IoT networks for enterprises. It has no single points of failure and is accessible to anyone, costing only a fraction of the cellular networks both in dollars and in carbon footprint.

The IoT standard, defined in ETSI TS 103 636 series, brings 5G to the reach of everyone as it lets any enterprise set up and manage its own network autonomously with no operators anywhere in the world. It eliminates network infrastructure, and single point of failure – at a tenth of the cost in comparison to cellular solutions. It also enables companies to operate without middlemen or subscription fees as well as store and consume the data generated in the way they see best fitting for them (on premises, in public cloud or anything in between).

Another democratizing aspect is the frequency. This new ETSI 5G standard supports efficient shared spectrum operation enabling access to free, international spectrums such as 1,9 GHz.

Jussi Numminen, Vice Chair of the ETSI Technical Committee DECT, explains:

“There’s a lot of talk about private networks but this is the first 5G technology which can support shared spectrum operation and multiple local networks in mobile system frequencies. We see this as a fundamental requirement for massive digitalization for everyone. With the ETSI standard you get immediately access to a free, dedicated 1,9 GHz frequency internationally. It is a perfect match for massive IoT.”

Non-cellular 5G is built on completely different principles from cellular 5G. One of the biggest differences – and advantages – is the decentralized network. In a non-cellular 5G network, every device is a node, every device can be a router – as if every device was a base station. The devices automatically find the best route; adding a new device into the network routing works autonomously as well and if one device is down, the devices will re-route by themselves. It means reliable communication eliminating single point of failures.

The standard fulfills both massive machine-type communications (mMTC) and ultra-reliable low latency communications (URLLC) requirements of 5G. Reliably connecting thousands and even millions of devices is one of the cornerstones for demanding industrial 5G systems. DECT-2020 NR supports local deployments without separate network infrastructure, network planning or spectrum licensing agreements making it affordable and easy to access by anyone and anywhere.

A decentralized mesh with short hops and small transmission power also means a significantly lower carbon footprint of the communications system. A recent study in Tampere University in Finland saw an approximately 60% better energy efficiency at system level compared to traditional cellular topology with the same radio energy profile.

The ETSI DECT-2020 NR standard consists of four parts, published in April 2021:

MAC: ETSI TS 103 636-4 V1.2.1 (2021-04)

PHY: ETSI TS 103 636-3 V1.2.1 (2021-04)

Radio reception and transmission requirements: ETSI TS 103 636-2 V1.2.1 (2021-04)

Overview: ETSI TS 103 636-1 V1.2.1 (2021-04)

Note: Updates are being prepared

………………………………………………………………………………………………………………………………………..

This standard is well suited for businesses such as smart meters, Industry 4.0, building management systems, logistics and smart cities. It will assist in the urbanization, building, and energy consumption in the construction of these smart cities. It also opens opportunities for new use cases, scaling at mass the levels of communication for the future. The energy transition from fossil fuels to electricity boost local renewable energy production and consumption market requiring new communication capabilities. This creates a circular economy and allows for the traceability of goods, raw materials and waste.

Finland-based Wirepas received €10 million in funding to develop and bring to market the first technology solutions for non-cellular 5G based on the new DECT-2020 NR wireless connectivity standard announced by ETSI in October 2020. Wirepas said it was the main contributor to the development of the DECT-2020 New Radio (NR) standard.

ETSI DECT-2020 NR in a nutshell:

- No middleman

- No infrastructure

- No subscription fees

- Free dedicated international frequency

- Dense and massive network capabilities

- One tenth of the cost of cellular

- Lowest carbon footprint of large-scale networks

Editor’s Note: We’ve invited ETSI to submit an IEEE Techblog article providing additional information and applications for the ETSI DECT-2020 NR standard.

About ETSI:

ETSI provides members with an open and inclusive environment to support the development, ratification and testing of globally applicable standards for ICT systems and services across all sectors of industry and society. We are a non-profit body, with more than 950 member organizations worldwide, drawn from 64 countries and five continents. The members comprise a diversified pool of large and small private companies, research entities, academia, government, and public organizations. ETSI is officially recognized by the EU as a European Standards Organization (ESO). For more information, please visit us at https://www.etsi.org/

References:

https://www.eetimes.eu/wirepas-receives-e10m-to-develop-first-non-cellular-5g-technology/

EXFO/Heavy Reading Survey: Nearly half of all mobile network operators plan to deploy 5G SA within 1 year

EXFO worked with Heavy Reading to conduct a survey of Mobile Network Operators (MNOs) across North America and Europe to understand their approach to 5G SA core network and the revenue opportunity it presents. 49% of MNOs are planning to deploy 5G SA within the next year, while a further 39% will deploy 5G SA within one to two years. The main drivers for deploying 5G SA are to support enhanced consumer offerings such as virtual reality, augmented reality and mobile gaming; accelerate time to market for new services; and offer network slice-based services.

While 76% of MNOs believe service assurance will be necessary to sell advanced 5G services and meet stringent service level agreements (SLAs), operations teams don’t have real-time visibility into how outages and degradations impact customers—whether they are humans or “machines” (critical, latency-sensitive applications and devices like emergency services or factory floor robots). 65% of MNOs say that this lack of actionable insight is preventing them from automating networks and fault resolution, which are essential to meeting demanding performance expectations in enterprise applications.

Specifically, most MNOs said they need a range of new tools and capabilities to generate revenues from 5G services:

- 86% say they need real-time network, service and quality of experience intelligence

- 85% say they need to be able to monitor per-service and per-device performance.

- 81% say they need AI-driven anomaly and fault detection, as well as root cause analysis.

- 82% say they need monitoring of end-to-end network slices.

“The opportunity to generate revenues from 5G SA lies in automated networks, which means service providers must deliver on enterprise service level agreements. This survey with Heavy Reading reinforces what we hear regularly from our customers: mobile network operators want greater service assurance and analytics to deliver actionable insights into network performance and user experience,” said Philippe Morin, CEO at EXFO. “This is where EXFO’s unique, adaptive approach to service assurance comes into play. By taking a source-agnostic approach to data collection and analytics, combined with a fully cloud-native architecture, our service assurance platform integrates with legacy and new 5G systems to provide a unified, end-to-end view of customer experience, device and network performance.”

5G NSA (LTE & EPC) 5G SA (NR connected to 5G core)

Benefits of 5G SA core network:

- MNOs can launch new enterprise 5G services such as smart cities, and smart factories

- It is fully virtualized, cloud-native architecture (CNA), which introduces new ways to develop, deploy and manage services

- The architecture enables end to end slicing to logically separate services

- Automation drives up efficiencies while driving down the cost of operating the networks.

- By standardizing on a cloud-native approach, MNOs can also rely on best of breed innovation from both vendors and the open-source communities

“When you look at the number of RFPs that are out there and the dialog we’re having, I think we’re now starting to see the need [to move]from what I would call studying or doing assessment, to potentially now looking at deploying [5G SA],” Morin said. He pointed out that there have been numerous announcements by carriers around 5G private networks and enterprise-based services, which he says are the initial drivers for 5G SA deployment — and are also driving the need for enhanced service assurance capabilities.

“When you’re talking about more business-focused use cases, service-level agreements become even more important and that’s why [there is a]need for service assurance,” Morin said. In contrast to previous network generations, where service assurance was often considered only after a variety of other decisions were made, the expectations of serving enterprise use cases are making service assurance a higher priority. “It’s pretty clear, as you deploy 5G SA, especially in the context of … [having]machines connected to this, IoT devices and so on, and more of an enterprise focus, that service assurance requirements are much more front and center than what we’ve seen in the previous protocols.”

Morin sites two key 5G SA capabilities that offer value:

- The ability to support billions of connections (massive machine-to-machine communications.

- Network slicing to enable differentiated services at scale.

With those opportunities, comes the requirement for MNOs to ensure that they can provide the levels of service and scalability that slicing and massive IoT demand — and that’s where operators will need better monitoring tools, visibility and insights, Morin says, and their acknowledgement of that need is reflected in the survey. EXFO’s joint survey found that 76% of the surveyed MNOs believe that service assurance will be necessary for deploying 5G SA. “I’m pretty sure we would not have the same stats, if you would’ve asked the same questions around 3G and 4G,” Morin added.

“If you’re going to have business use cases that machines are going to be relying on to be able to execute that application, machines won’t be as tolerant as humans, because the service won’t be able to operate. So what this means is that the network operators need a better view of insights on the network performance, that in the past, because it was for humans, maybe was not as required. But clearly, now, for 5G SA and 5G revenues that are going to be driven out of this, getting better visibility on what is happening that is down to the device level– not just the customer; the device, the service and the network — and end-to-end visibility will be really, really critical.”

There’s also the changing nature of service assurance and visibility strategy and tools to consider. As enterprises moved into making use of big data, their strategies and architectures often involved pouring network data into a massive data lake and then retrieving information from there as needed.

“With 5G, and 5G Standalone in particular, we absolutely believe that’s not going to be the architecture of choice. … You cannot wait for the issue to come up, and go into a data lake to try to figure out what happened in the last 15 minutes. We believe that it’s got to be real-time, it’s got to be adaptive — because you can’t start getting information from all the devices and all the IoT. This would have a big impact on your overall cost structure.”

Morin said that 5G SA core network’s cloud-based, orchestrated and automated nature enables the company to support machine-learning and generate insights only when an anomaly or service issue/problem is detected. AI will then determine whether data is needed from the device, service or network layer in order to resolve the issue(s).

“If you’re going to really make 5G SA a success, it will require a higher level of automation, and I do believe that service assurance will be what I would call an automation enabler. If you don’t have that capability to monitor and in an automated way, provide actionable insights to [a specifics]use case and to [a specific]SLA, I think it will be very difficult to go into a high-volume deployment with 5G SA.”

………………………………………………………………………………………………………………………………………………

Author’s Note:

Despite the optimistic results of this 5G SA core network survey, just 13 network operators had launched commercial public 5G SA networks as of the middle of August 2021. Some 45 other operators are planning or deploying 5G SA for public networks, and 23 operators are involved in tests or trials. That’s out of a total of 176 commercial 5G networks launched worldwide (163 of them are 5G NSA networks)!

Note also that there are no ITU standards or 3GPP specifications for how to implement a 5G SA Core network. There are many choices which will lead to different, incompatible implementations of the 5G Core network

References:

https://www.exfo.com/en/products/service-assurance-platform/nova-core/

https://www.exfo.com/en/resources/blog/mobile-private-networks-5g/

https://www.affirmednetworks.com/sa-and-nsa-5g-architectures-the-path-to-profitability/

Open Access Fiber Networks Explained; Underline’s Intelligent Community Network

In Open Access Fiber networks, the same physical network infrastructure is utilized by multiple providers delivering services to subscribers. The Open Access business model has been drawing attention globally as governments and municipalities find the concept of offering competition between providers and the freedom of choice for the subscriber is essential. It has also proved to be a feasible way to connect rural areas where service providers might have a hard time generating enough revenue to justify investing in their own network infrastructure.

Open access fiber networks can be the foundation for distributed healthcare, 5G, and resilient, modernized infrastructure—including responsible energy creation and secure community smart grids.

For subscribers to benefit from the freedom of choice and competition between providers that are delivering services using the same network infrastructure they will need a comprehensive way to browse the assortment of services offered.

Open Access network operators must keep track of:

- Every single subscriber in the network, their physical address, their “technical address” (switch, switch port, etc.).

- Which services they are buying from which provider/s.

- The total number of customers and/or services bought if you’re operating in a three-layer model where you have to report back to the network owners how their network is utilized.

……………………………………………………………………………………………………………………………………….

Already common in Europe with Sweden as the best known example, open access networks are just beginning to gain market traction in the U.S. While U.S. community-wide network operators like SiFi Networks and UTOPIA Fiber (Utah) have adopted a wholesale-like business model, newcomer Underline is taking a bit more of a direct approach.

“When people say open access in this country, they typically mean ISPs can come in and lease fiber and choose to build a given neighborhood that hasn’t been overbuilt yet. We mean something very different,” Underline CEO Robert Thompson told Fierce Telecom. “We are not a wholesale leaser of fiber. We are the fiber network literally to the doorbell.”

Underline isn’t just providing physical fiber-to-the-home infrastructure, but also a unified billing system and cybersecurity layer. The latter will allow the communities it serves to deploy smart city applications over an on-demand Layer 2 (Data Link layer) connection that will never touch the Layer 3 (Network layer) public internet, Thompson said.

“On the one hand, we directly face consumers and businesses, schools and so forth and we provide them network access connectivity and technology for a monthly connection fee. On the other hand, we look like a network infrastructure-as-a-service provider to the ISPs or content community,” Thompson said.

“We don’t provide IP,” he continued. “We’re going to move your traffic from your house ultrafast over fiber and we’re going to hand off you and your traffic to the internet service provider of your choosing. That ISP is then your IP, the routing of your traffic. They’re connecting you to that glorious world wide web,” he added.

Thompson said Underline will charge users directly on a monthly basis for connectivity, with their chosen ISP getting a portion of that cost. So, for instance, in the case where a subscriber takes a $65 per month symmetric gigabit plan, the ISP will get a $15 cut. Underline also plans to charge licensing and per subscriber fees for use of its technology stack.

Underline is now initiating construction in its first market: Colorado Springs, CO. The company will offer residential speeds up to 10 Gbps and enterprise service up to 100 Gbps, with qualifying households eligible to receive a discounted rate on Underline’s bottom tier symmetrical 500 Mbps plan.

The project will be completed in several stages, with a Phase I build set to connect 24,000 homes and 4,000 businesses with 225 route miles of fiber plant. Initial customers will include the the National Cybersecurity Center, the new Space Information Sharing and Analysis Center and Altia Software.

Thompson says that Phase II will cover roughly the same amount of ground and Underline also has a build agreement with an unnamed city “immediately surrounding” Colorado Springs. Taken together, construction in both phases and the second city will amount to “an exercise of approximately $125 million in total capital.”

“We are after this with a vengeance, and we are very thankfully supported by very strong capital,” Thompson said, noting a “drumbeat of steady announcements of drills in the dirt in new communities” is on the way.

Thompson said Underline is targeting communities with populations between 20,000 and 750,000. He noted that such communities have “historically been basically ignored by the incumbents (large telcos) and which by and large will not qualify” for federal support for broadband deployments.

Beyond that, he said Underline’s market assessments include factors like demand point density per fiber route mile, a population productivity ratio, a competition index and a social equity analysis. The latter is a key priority for Underline and “part of our social purpose,” Thompson explained.

“We want to understand and we actually want to target communities that have a significant portion of their demand points that have no internet at all or very poor internet at home because of socio economic status. This country’s got to have internet that’s fast, affordable and fair,” he concluded.

References:

https://www.fiercetelecom.com/operators/underline-has-a-different-vision-for-open-access-fiber-u-s

https://www.cossystems.com/about/open-access/

https://www.foresitegroup.net/what-you-need-to-know-about-open-access-networks-2/

Vodafone Idea to test 5G-based smart city solutions with Larsen & Toubro in Pune, India

India’s struggling telco Vodafone Idea is partnering with engineering and construction conglomerate Larsen & Toubro for a pilot project to test 5G-based smart city solutions, as part of its ongoing 5G trials on government-allocated spectrum.

In the pilot to be conducted in the city of Pune, the companies will collaborate to test and validate 5G use cases built on IoT and video AI technologies leveraging L&T’s Smart City platform, Fusion, to address the challenges of urbanization, safety and security, and offering smart solutions to the citizens.

Vi has deployed its 5G trial in a setup of end-to-end captive network of Cloud Core, new C1 – Vodafone Idea External generation Transport and Radio Access Network.

Abhijit Kishore, chief enterprise business officer at Vodafone Idea, said: “Telecommunications solutions are the backbone of building smart and sustainable cities. The advent of 5G technology opens whole new opportunities to address challenges of urban growth and provide end-to-end solutions to support sustainable creation of Smart Cities, in the future. Vodafone Idea is happy to partner with Larsen & Toubro to test 5G based Smart City solutions and utilize our mutual expertise to find solutions that can help shape cities of the future.”

“In this constantly-evolving world, we are seeing an exponential rise in demand for smarter and more intelligent solutions and L&T Smart World is committed towards leveraging the latest technological innovations in the IoT and Telecommunications areas to benefit society at large. We are excited to partner with Vodafone Idea to bring to the table our experience, of having successfully executed several smart solutions across Indian cities, to develop customized, IoT-driven 5G solutions for various industry and enterprise verticals”, said J. D. Patil, senior executive VP of Defense and smart technologies at L&T.

The partnership between Vodafone Idea and Larsen & Toubro will trial several 5G use cases that cover 5G services such as enhanced Mobile Broadband (eMBB), Ultra Reliable Low Latency Communications (uRLLC) and Multi-Access Edge Computing (MEC). The firms said that the partnership will help to analyze the performance requirements of smart city applications and business models in 5G, design and implement 5G-based “smart and safe city” applications and use data analytics tools to visualize and analyze the trial results.

Vodafone Idea (Vi) has been allocated 26 GHz and 3.5 GHz spectrum in the mmWave band by India’s Department of Telecom (DoT), for their 5G network trials and use cases. In its initial test results Vi has achieved peak speed in excess of 3.7 Gbps with very low latency on the mmWave spectrum band. These speeds were achieved with state-of-the-art equipment in 5G Non-Standalone (NSA) network using 5G NR compliant radios. The Indian telco has also achieved peak download speeds of up to 1.5 Gbps in a 3.5 GHz-band 5G trial network with its original equipment manufacturer (OEM) partners.

The high speed and low latency characteristics of 5G network may enable improved surveillance and video streaming/broadcast to permit the evolution of 5G smart cities and smart factories. Smart City and Industry 4.0 will hopefully accelerate with 5G deployment and usher in new era of Digital India.

As forVi’s two telco competitors:

- Bharti Airtel has recently demonstrated India’s first 5G rural trial using network equipment from Ericsson. It has also showcased 5G cloud gaming.

- India’s wireless network market leader Reliance Jio has trialed 5G VoNR, AI-multimedia chatbot, and immersive high-definition (HD) virtual reality.

The DoT had approved applications of Reliance Jio, Bharti Airtel and Vodafone in May, and MTNL later for 5G trials. The permission has been granted for six-month trials with telecom gear makers Ericsson, Nokia, Samsung and C-DOT.

References:

https://www.vodafoneidea.com/media/press-releases

Vodafone Idea inks partnership to test 5G-based smart city solutions

https://www.businesstoday.in/industry/telecom/story/vodafone-idea-says-achieved-peak-5g-speed-of-over-37-gbps-in-pune-trials-307076-2021-09-19

GSM: VoNR progresses, but requires 5G SA core network

5G non-standalone (5G NSA) networks, voice services were enabled by continued use of LTE and 2G/3G infrastructures, but 5G standalone networks (5G SA) – both public and private – require a new approach. They need to be able to carry QoS-guaranteed voice services (as opposed to over-the-top voice applications), but there is no legacy infrastructure to fall back on.

Voice over New Radio (VoNR) [1.] is designed to meet this challenge. VoNR is also expected to bring improvements in latency, call quality and improved integration with applications and services using 5G data at the same time. VoNR is anticipated to drive innovation in conferencing, augmented and virtual reality applications over 5G networks.

Note 1. 5G NR is the essence of standardized 5G RAN as per 3GPP Release 15, 16 and ITU-R M2150 recommendation for 5G RIT/SRIT. However, VoNR requires a 5G SA core network rather than using LTE signaling and core (EPC).

Additionally, there needs to be a mechanism for devices to use to LTE, or 2G/3G voice networks when outside the coverage of a 5G standalone network. EPS Fallback (EPS-FB) is an early introduction step to VoNR until sufficient NR low-band or low mid-band coverage has been deployed.

The Global mobile Suppliers Association (GSA) announced that 42 devices and 40 5G chipsets from four vendors have been announced supporting Voice over New Radio (VoNR) technology. This includes five discrete modems and 35 mobile processors/platforms. Of these, 36 are known to be commercially available, including four discrete modems and 32 mobile processors and platforms. Chipsets are commercially available from Mediatek, Qualcomm, Samsung and Unisoc.

In the GSA’s latest VoNR Market Report, the industry group found that numerous network operators are heavily investing in the new voice technology for their 5G standalone networks. To date, GSA has catalogued 16 operators publicly announced as investing in VoNR in some way or another. Of those, eight are evaluating/testing/trialing, three are understood to be planning to deploy, three

are deploying the technology, one has soft launched VoNR services and one is offering limited VoNR as part of a market trial of its new 5G SA network.

This past June, Deutsche Telekom (DT) and partners announced the successful completion of the world’s first 5G Voice over New Radio (VoNR) call in an end to end multi-vendor environment. T-Mobile, which is majority owned by DT, is also pursuing VoNR as per this article.

References:

GSA Market Report: Global Progress to Voice over New Radio (VoNR) – October 2021

https://www.telekom.com/en/media/media-information/archive/world-first-end-to-end-multivendor-5g-voice-over-nr-call-628746

https://www.fiercewireless.com/tech/t-mobile-chases-voice-5g-verizon-at-t-not-so-much

Global AI in Telecommunication Market at CAGR ~ 40% through 2026 – 2027

The Global AI in Telecommunication Market [1.] is estimated to be $1.2 Billion (B) in 2021 and is expected to reach $6.3B by 2026, growing at a CAGR of 38%, according to a report by Research and Markets.

For comparison, Valuates says the global AI In Telecommunication market size is projected to reach $14.99B by 2027, from $11.89B in 2020, at a CAGR of 42.6% during 2021-2027.

Note 1. Artificial Intelligence in Telecom includes handling large volumes of data using machine learning and analytics, automating detection and correction of failures in transmission, automating customer care services, and complementing Internet of Things(IoT), e-mail, voice call, and database storage services.

Key factors of AI in telecom include the deployment of 5G mobile networks, growing demand for effective and efficient network management solutions have been driving AI in telecommunications market growth. Increasing AI-embedded smartphones and the growing adoption of AI solutions in various telecom applications are likely to further drive market growth.

Market Drivers:

- Increasing Adoption of AI for Various Applications in the Telecommunication Industry

- AI Can Be the Key to Self-Driving Telecommunication Networks

- Increased Need for Monitoring the Content Spread on Telecommunication Networks

- Growing Demand for Effective and Efficient Network Management Solutions

Telecom vendors commonly use AI for customer service applications, such as chatbots and virtual assistants, to address many support requests for installation, maintenance, and troubleshooting. To improve customer experience, telecom operators are adopting AI.

Other common uses of AI in Telecom include:

-

Predictive maintenance

-

Network optimization

-

Fraud detection and prevention

-

Robotic process automation (RPA)

Opportunities include:

- Cloud-Based AI Offerings in the Telecommunication Industry

- Utilization of AI-Enabled Smartphones

Conversely, incompatibility between telecommunication systems and AI technology, which leads to integration complexity in these solutions, is the major constraint for market growth. Also, the lack of skilled expertise and privacy & identity concerns of individuals are some other factors hindering the market growth.

References:

https://techblog.comsoc.org/2021/08/26/emerging-ai-trends-in-the-telecom-industry/

Huawei Execs: ICT Industry Initiatives for 5G and Green 5G Networks for a Low-Carbon Future

Huawei’s rotating chairman Ken Hu kicked off the 12th annual Global Mobile Broadband Forum (MBBF) in Dubai with a call for the ICT industry to work together on the next stage of 5G development. He outlined the specific areas where the industry needs to improve. The MBBF is hosted by Huawei, together with its industry partners in the GSMA and the SAMENA Telecommunications Council. This forum gathers mobile network operators, vertical industry leaders, and ecosystem partners from around the world to discuss how to maximize the potential of 5G and push the mobile industry forward..

Speaking on the current state of 5G development and new opportunities moving forward, Hu noted, “In just five years of commercial deployment, 5G has provided a considerable upgrade in mobile experience for consumers, and it’s already starting to empower different industries around the globe. Progress was much faster than we expected, especially in terms of the subscriber base, network coverage, and the sheer number of 5G terminals on the market.”

On the device side, he said lowering barriers to headset adoption is critical to reaching a tipping point in virtual reality, one of the key technologies in the Extended Reality repertoire of AR, VR, and MR. “To reach [this tipping point], we have to make improvements to both headsets and content. For headsets, people want devices that are smaller, lighter, and more affordable.” To enrich the content ecosystem, Hu called on the industry to provide cloud platforms and tools that simplify content development, which is notoriously difficult and expensive.

Telecom operators need to enhance their networks and develop new capabilities to get ready for 5GtoB [THAT WILL REQUIRE A UNIFIED 5G SA CORE NETWORK). A strong end-to-end network is key to 5G applications for industrial use, so operators need to keep making improvements to network capabilities such as uplink, positioning, and sensing. As industrial scenarios are much more complex than consumer scenarios, O&M can be a real challenge. In response, Huawei is developing autonomous networks that bring intelligence to all aspects of 5G networks, from planning and construction to maintenance and optimization.

Digital transformation also requires different roles. In addition to providing connectivity, operators can also serve as cloud service providers, systems integrators, and more, and develop the requisite capabilities. To drive broader adoption of 5G in industries, developing industry-specific telecoms standards is also important. In China, operators, together with their industry partners, have begun working on standards for applying 5G in industries like coal mining, steel, and electric power, and this has helped to fuel greater adoption within these sectors.

“Beyond technology,” said Hu, “these are some of the intangible strengths that won’t provide immediate profit, but will be key to long-term competitiveness in the 5GtoB market.”

The ICT industry needs to get ready to go green. According to the World Economic Forum, by 2030, digital technology can help reduce global carbon emissions by at least 15%. “On one hand,” said Hu, “we have a great opportunity to help all industries cut emissions and improve power efficiency with digital technology. On the other hand, we have to recognize that our industry has a growing carbon footprint, and we have to take steps to improve that. Right now Huawei is using new materials and algorithms to lower the power consumption of our products, and we’re remodeling sites, and optimizing power management in our data centers for greater efficiency.”

“We have seen so many changes in the past two years – with the pandemic, technology, business and the economy. Moving forward, as the world begins to recover, we need to recognize the opportunities in front of us and get ready for them. Get our technology ready, get our businesses ready, and get our capabilities ready,” Hu concluded.

Also at the MBBF, Ryan Ding, Huawei’s Executive Director and President of the Carrier Business Group, gave a keynote speech entitled “Green 5G Networks for a Low-Carbon Future.” In his speech, Ding said that 5G has become a new engine for the growth of the mobile industry, and that to adapt to the rapid growth of data traffic, the whole industry will need to keep pursuing innovations in power supply, distribution, use, and management, and build greener 5G networks with higher performance and lower energy consumption.

According to Ding, in countries where 5G is developing faster, operators who have invested heavily in 5G have seen remarkable returns, but he stressed that operators will realize business value only when the 5G user penetration rate is high enough. When the 5G user penetration rate reaches a threshold of 20%, Ding said, rapid development of 5G will follow. In countries such as China, South Korea, and Kuwait, operators were quick to provide continuous nationwide coverage, giving users a consistent experience. They also offer flexible service packages, which delivers a win-win result for both users and themselves. In addition, these operators are providing a gigabit experience—a tangible improvement over 4G—to accelerate user migration and network evolution. In these countries, the 5G user penetration rate has exceeded the 20% threshold, triggering a positive cycle of user growth, business returns, and network construction.

High-quality 5G networks will drive the rapid growth of mobile data traffic. It is estimated that the average data traffic per user per month will reach 600 GB by 2030. If the energy efficiency of existing networks remains unchanged, the energy consumption of wireless networks will increase by more than tenfold. Ding said that to cut the ICT industry’s greenhouse gas emissions by 45%, operators will need to pursue ongoing innovations in power supply, distribution, use, and management to build greener 5G networks with higher performance and lower energy consumption.

Ding said Huawei has already deployed low-carbon site solutions in more than 100 countries, including Saudi Arabia, Greece, Pakistan, and Switzerland, helping operators reduce carbon dioxide emissions by 40 million tons. As a player in the communications industry, Huawei will continue to put green development at the center of everything it does and develop innovative solutions to build greener 5G networks with operators worldwide.

References:

https://www.huawei.com/en/news/2021/10/mbbf2021-huawei-ken-hu

https://www.huawei.com/en/news/2021/10/mbbf2021-huawei-ryan-ding-green-5g

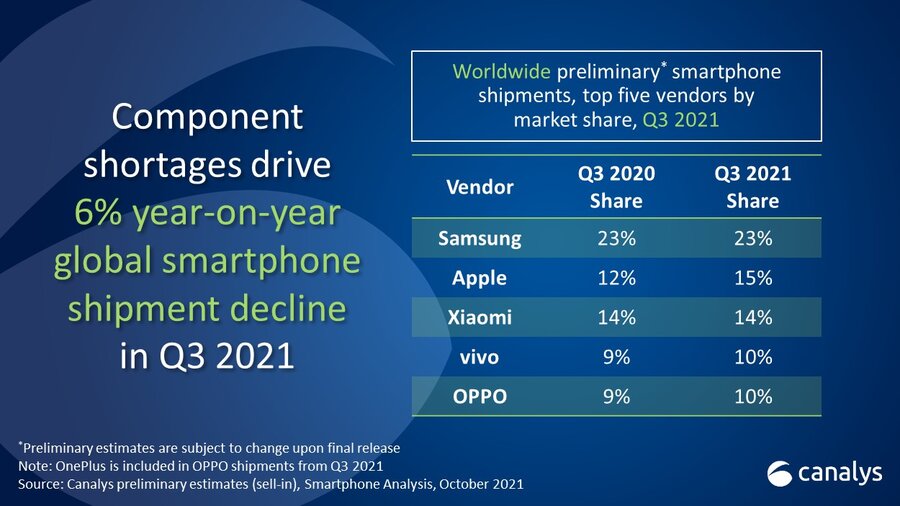

Canalys: Global Smartphone Shipments Fell 6% in 3Q-2021; Samsung Still #1

According to a new report by market tracker Canalys, global smartphone shipments fell 6 per cent in the third quarter (July-September period) this year, as vendors struggled to meet demand for devices amid component shortages. That decline comes after shipments increased by 12% in the second quarter of 2021.

- Samsung was the leading smartphone player with 23 per cent share.

- Apple regained second place in the global smartphone market with 15 per cent share in the third quarter (Q3) this year, thanks to strong early demand for iPhone 13.

- Xiaomi took 14 per cent share for the third place, while Vivo and Oppo completed the top five with 10 per cent share each.

“The chipset famine has truly arrived,” said Canalys Principal Analyst, Ben Stanton. “The smartphone industry is striving to maximize production of devices as best it can. On the supply side, chipset manufacturers are increasing prices to disincentivize over-ordering, in an attempt to close the gap between demand and supply. But despite this, shortages will not ease until well into 2022. As a result of this, as well as high costs of global freight, smartphone brands have reluctantly pushed up device retail pricing.”

“At the local level, smartphone vendors are also having to implement last-minute changes in device specification and order quantities. It is critical for them to do this and maximize volume capacity, but unfortunately it does lead to confusion and inefficiency when communicating with retail and distributor channels,” continued Stanton. “Many channels are nervous heading into important sales holidays, such as Singles’ Day in China, and Black Friday in the west. Channel inventories of smartphones are already running low, and as more customers start to anticipate these sales cycles, the impending wave of demand will be impossible to fulfill. Customers should expect smartphone discounting this year to be less aggressive. But to avoid customer disappointment, smartphone brands which are constrained on margin should look to bundle other devices, such as wearables and IoT, to create good incentives for customers.”

References:

https://www.canalys.com/newsroom/canalys-global-smartphone-market-Q3-2021

Canalys 2Q-2021 smartphone rankings show big gains for Xiaomi and OPPO

Verizon lab trial reaches 711 Mbps upload speeds using mmWave spectrum

Summary:

Verizon said it has achieved a 5G upload speed of 711 Mbps in a technology lab trial using aggregated bands of mmWave spectrum. Samsung Electronics Co., Ltd., and Qualcomm Technologies, Inc. provided the 5G network equipment and 5G endpoint, respectively.

Samsung supplied its 28 GHz 5G compact macro and virtualized radio access network (vRAN) and vCore technology, along with a smartphone form-factor test device that used Qualcomm’s Snapdragon X65 5G modem-RF system.

“Our mmWave build is a critical differentiator, even as we drive towards massive and rapid expansion of our 5G service using our newly acquired mid-band spectrum, we are doubling down on our commitment to mmWave spectrum usage,” said Adam Koeppe, Senior Vice President of Technology Planning for Verizon. “You will see us continue to expand our mmWave footprint to deliver game changing experiences for the densest parts of our network and for unique enterprise solutions. We had over 17k mmWave cell sites at the end of last year and are on track to add 14k more in 2021, with over 30k sites on air by the end of this year, and we’ll keep building after that,” said Koeppe.

Although carriers have seen 5G download speeds above 1 Gbps, it has been more challenging to achieve fast speeds on the uplink. Verizon believes that faster upload speeds are valuable for both fixed and mobile users.

Applications for faster upload speeds:

Speeds approaching those seen in this recent trial (for comparison, 700+ Mbps is the equivalent of a one GB movie uploaded in about 10 seconds) will pave the way for uploading videos, pictures and data to the cloud, social media accounts, or sharing directly with others in densely populated venues like downtown streets, concerts and football stadiums. Whether using a traditional mobile link or fixed wireless access, these speeds will also allow students working from home or employees in distributed workforces the ability to upload and synchronize massive files, complete simultaneous editing of documents in the cloud, and collaborate with colleagues effortlessly.

Verizon says that ultra fast uplink speeds will also drive new private network use cases for enterprises. For example, faster uplink speeds can enable quality control solutions for manufacturers using artificial intelligence to identify tiny product defects in products visible only through ultra HD video feeds. Other upload-intensive solutions such as multi-location, massive security video capabilities and augmented reality centered customer experiences will also get a boost with these increased speeds.

About the trial:

The demonstration surpassed current peak upload speeds by combining 400 MHz of Verizon’s 5G mmWave frequency and 20 MHz of 4G frequency using the latest 5G technologies, including mmWave carrier aggregation and Single-User MIMO (SU-MIMO). Network technology used in the demo included Samsung’s 28 GHz 5G Compact Macro and virtualized RAN (vRAN) and Core (vCore) along with a smartphone form-factor test device powered by the flagship Snapdragon® X65 5G Modem-RF System.

Snapdragon X65 is Qualcomm Technologies’ 4th generation 5G mmWave Modem-RF System for smartphones, mobile broadband, compute, XR, industrial IoT, 5G private networks and fixed wireless access. Commercial mobile devices based on these Modem-RF solutions are expected to launch by late 2021.

Samsung’s Compact Macro delivers 5G mmWave by bringing together a baseband, radio and antenna in a single form factor. This compact and lightweight solution can be easily installed on the sides of buildings, as well as on utility poles, for the swift build-out of 5G networks. The Compact Macro achieved first Common Criteria (CC) certification against Network Device collaborative Protection Profile (NDcPP), an internationally recognized IT security standard.

“In collaboration with Qualcomm Technologies and Verizon, we are excited to begin to reach these ultra-fast uplink speeds, which will enable differentiated 5G experiences and deliver more immersive mobile services for all users”, said Junehee Lee, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “Samsung looks forward to harnessing the full potential of 5G through new breakthroughs that will bring truly transformative benefits to people around the world and across the enterprise landscape.”

“Enhancing uplink speeds opens the door to new possibilities with 5G mmWave, in transit hubs, downtown areas, shopping malls and crowded venues, while also powering robust 5G fixed wireless access services in homes and small businesses,” said Durga Malladi, Senior Vice President and General Manager, 5G, Mobile Broadband and Infrastructure, Qualcomm Technologies, Inc. “Our collaboration with Samsung and Verizon exemplifies how we are collectively driving 5G mmWave commercialization and enabling new and exciting user experiences – everyday.”

References:

https://www.verizon.com/about/news/uploading-data-whole-lot-faster-5g