Author: Alan Weissberger

China’s big 3 telcos offer 5G Rich Communication Services (RCS)

China’s big three telecom carriers unveiled a new 5G-enabled messaging service on Wednesday, which analysts said is likely to open a new era for social networking.

China Mobile, China Unicom and China Telecom published a white paper for the 5G messaging service, known as Rich Communication Services, or RCS,. The paper specifies technical details to invite smartphone makers to support the new service.

The 5G RCS messaging service is designed to replace current short messages with a system that is richer, provides phonebook polling, and can transmit in-call multimedia.

5G may facilitate a shift away from basic SMS messaging, ushering in an era of RCS, where mobile messaging can become much more interactive and flexible, more akin to what we now know as iMessaging through platforms like Facebook and WhatsApp. RCS will not only facilitate the sharing of GIFs and high-quality videos, but will also more directly interface with the internet; for example, offering a list of available flights when the user sends a message regarding a holiday.

Editor’s Note:

RCS has been talked about and in development for many years, with very little commercial market acceptance to date. RCS’ biggest problem has been that it requires consensus across a large and complex industry. Contrast that with an OTT messaging startup with a dozen staff can create a viral global app overnight. It remains to be see if the collaboration between China’s big three telecom operators will make 5G RCS successful in China.

………………………………………………………………………………………………………

With the new 5G RCS message service, consumers won’t have to download a variety of mobile apps. They can directly buy train tickets and book flights by sending messages.

Ma Jihua, an independent telecom analyst, said the new 5G-powered messaging service, if properly promoted, will usher in a new era of social networking, and erode the social networking business of Tencent Holdings Ltd.

A pedestrian walks past a 5G promotion board in Nanjing, capital of Jiangsu province. [Photo by Su Yang/For China Daily]

………………………………………………………………………………………………

China Telecom Vice President Wang Guoquan said the new 5G messaging services would enhance 5G innovation and help turn 5G from “the biggest variable affecting the telecom industry” into the biggest vehicle for growth.

He said China Telecom would work with industry partners “to build a new ecosystem and promote the rapid development of rich media information.”

Besides the three operators, 11 device vendors including Huawei, Xiaomi, Vivo, Oppo and Samsung endorsed the new messaging service and promised early support on their handsets. Huawei stated that it would have an RCS-capable phone this June, while Xiaomi has confirmed that all of its new 5G phones will also run the new messaging service.

“Together with ecosystem partners, we will start a new chapter in 5G messaging and further promote RCS applications in China,” said a statement from the three operators releasing the paper.

…………………………………………………………………………………………………….

GSMA says the key development has been the creation of the universal profile (UP), an industry-agreed set of features intended to simplify RCS product development and deployment.

The Chinese players can also take heart from the positive numbers out of the first two years of the RCS-based +Message service in Japan, supported by all three operators.

User numbers rose 35% to 17.5 million in 2019 and are forecast to hit 40 million in 2021, according to a GSMA-commissioned study.

The number of business messages sent over the platform is expected to reach more than 150 million in 2021 and 1.2 billion in 2023.

What’s more, users appear responsive to the marketing messages. The open rate is 85% in Japan and 75% globally, compared to 3% for direct mail.

Says the GSMA: “+Message also allows Japanese consumers to communicate directly with a range of brands and services, for example allowing them to engage with virtual assistants to book flights, buy goods and make restaurant reservations.”

Worldwide, the GSMA says 88 operators have launched RCS, attracting 403 million users.

Messaging research firm MobileSquared has predicted that RCS will be the world’s biggest business messaging platform by 2021, with 2 billion users. The firm notes that while WhatsApp (owned by Facebook) has 1.5 billion users, it may be difficult to monetize it as a marketing channel because users are required to opt in.

References:

http://global.chinadaily.com.cn/a/202004/08/WS5e8d67aea310aeaeeed50c6a.html

https://www.lightreading.com/asia/china-operators-to-offer-rcs-based-5g-messaging/d/d-id/758762?

https://www.totaltele.com/505475/Chinese-operators-back-RCS-in-new-white-paper

Strategy Analytics: Global Smart Phone Market to Decline 25% in 2020

by David Kerr

Strategy Analytics updated smartphone shipment forecast numbers from the previous version published on March 2, 2020, given the latest available info and the escalating and global pandemic situation.

We further lower 2020 global and China smartphone shipment forecast numbers in this version, considering the rapid spread into more countries and the big impact on global economy.

The global smartphone market will ship -25% fewer smartphones than expected in 2020, due to the fear and “paralysis” caused by coronavirus. China smartphone shipments will be -16% less than expected in 2020. All regions will see an double digit annual decline rate this year. All industry stakeholders need to plan for a very soft and tough 2020.

No one wins. All OEMs will ship less smartphones this year, leading by Samsung, Apple, Huawei, OPPO, vivo and Xiaomi etc.

…………………………………………………………………………………….

Strategy Analytics was one of the world’s first mobile research houses to spot the looming disaster of Covid-19, in January 2020.

The firm had previously reported that global smartphone shipments tumbled 38 percent year-on-year in the month of February, 2020. That was the biggest fall ever in the history of the worldwide smartphone market.

Linda Sui, Director at Strategy Analytics, said, “Global smartphone shipments tumbled a huge 38 percent annually from 99.2 million units in the month of February, 2019, to 61.8 million in February, 2020. Smartphone demand collapsed in Asia last month, due to the Covid-19 outbreak, and this dragged down shipments across the world. Some Asian factories were unable to manufacture smartphones, while many consumers were unable or unwilling to visit retail stores and buy new devices.”

Neil Mawston, Executive Director at Strategy Analytics, added, “February 2020 saw the biggest fall ever in the history of the worldwide smartphone market. Supply and demand of smartphones plunged in China, slumped across Asia, and slowed in the rest of the world. It is a period the smartphone industry will want to forget.”

Yiwen Wu, Senior Analyst at Strategy Analytics, added, “Despite tentative signs of recovery in China, we expect global smartphone shipments overall to remain weak throughout March, 2020. The coronavirus scare has spread to Europe, North America and elsewhere, and hundreds of millions of affluent consumers are in lockdown, unable or unwilling to shop for new devices. The smartphone industry will have to work harder than ever to lift sales in the coming weeks, such as online flash sales or generous discounts on bundling with hot products like smartwatches.”

…………………………………………………………………………………………….

About Strategy Analytics

Strategy Analytics is a global, independent research and consulting firm. The company is headquartered in Boston, USA, with offices in the UK, France, Germany, Japan, South Korea, Taiwan, India and China. Visit www.strategyanalytics.com for more information.

Americas Contact:

Linda Sui / +1 617 614 0735 / [email protected]

Internet traffic spikes under “stay at home”; Move to cloud accelerates

With worldwide coronavirus induced “stay at home/shelter in place” orders, almost everyone that has high speed internet at home is using a lot more bandwidth for video conferences and streaming. How is the Internet holding up against the huge increase in data/video traffic? We focus this article on U.S. Internet traffic since the stay at home orders went into effect in late March.

………………………………………………………………………………………..

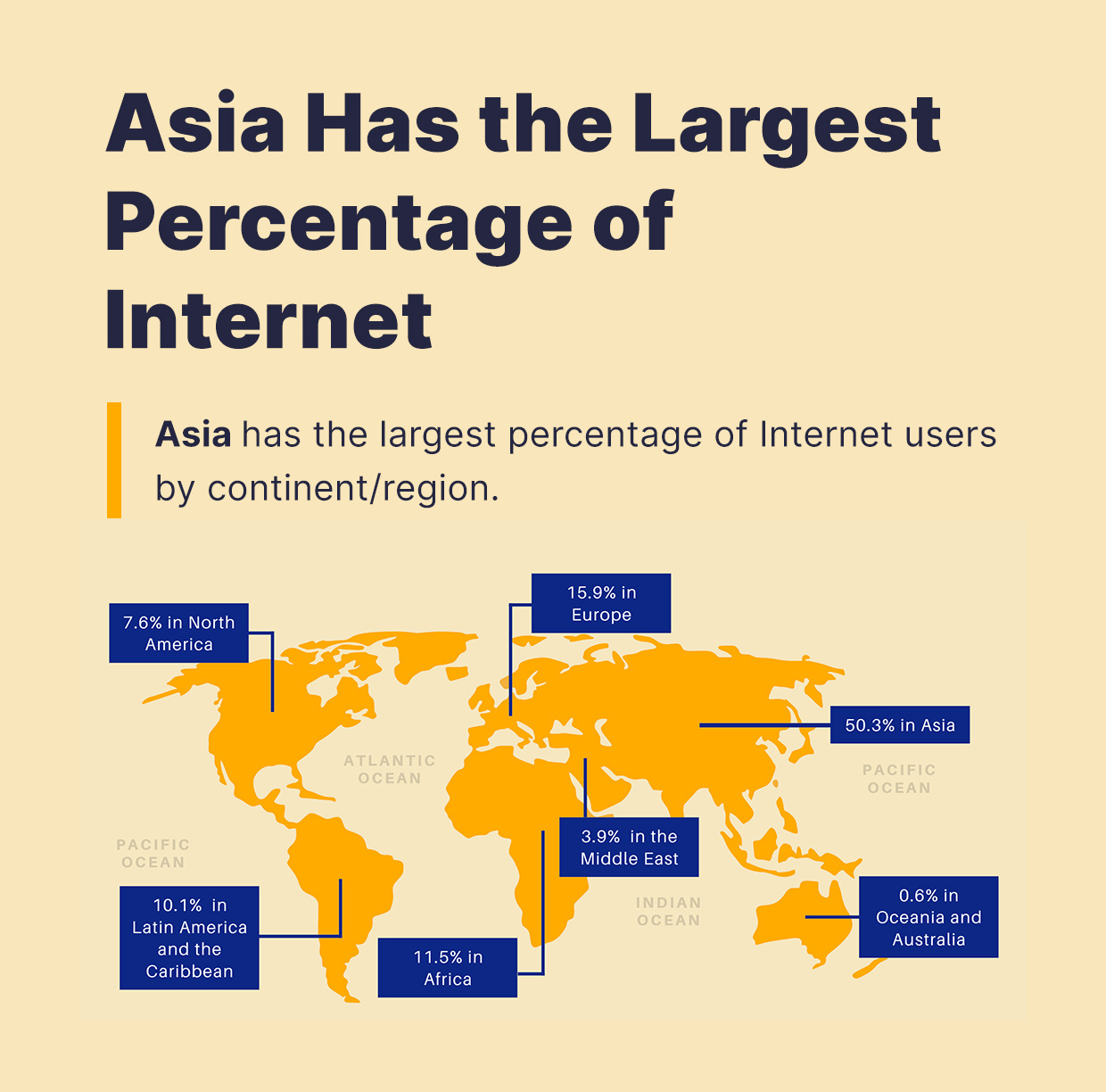

Sidebar: North America has only 7.6% of world’s Internet users:

………………………………………………………………………………………..

According to Eric Savitz of Barron’s, the U.S. networks are handling the traffic spikes without any major hiccups. In a call this past week with reporters, Comcast, the largest U.S. internet service provider, said that its network is working well, with tests done 700,000 times a day through customer modems showing average speeds running 110% to 115% of contracted rates. Overall peak traffic is up 32% on the network, with some areas up 60%, in particular around Seattle and the San Francisco Bay area, where lockdowns were put in place before they were in most of the rest of the country. In both Seattle and San Francisco, peak traffic volumes are plateauing, suggesting a new normal.

While Comcast said its peak internet traffic has increased 32 percent since the start of March, total traffic remains within the overall capacity its network. The increase in people working at home has shifted the downstream peak to earlier in the evening, while upload traffic is growing during the day in most cities. Tony Werner, head of technology at Comcast Cable, says it has a long-term strategy of adding network capacity 12 to 18 months ahead of expected peaks. He says that approach has given Comcast the ability to smoothly absorb the added traffic. The company hasn’t requested that video providers or anyone else limit their traffic.

AT&T, the second largest U.S. internet service provider, likewise asserts that its network is performing “very well” during the pandemic. This past Wednesday, it said, core traffic, including business, home broadband, and wireless, was up 18% from the same day last month. Wireless voice minutes were up 41%, versus the average Wednesday; consumer home voice minutes rose 57%, and WiFi calling was up 105%.

Over the past three weeks, the company has seen new usage patterns on its mobile network, with voice calls up 33% and instant messaging up 63%, while web browsing is down 5% and email is off 18%.

Verizon also says its network is handling the traffic well. One telling stat: The carrier says that mobile handoffs, the shifting of sessions from one cell site to another as users move around, is down 53% in the New York metro area, and 29% nationally; no one is going anywhere. More on Verizon’s COVID-19 initiatives here.

In the United States prior to coronavirus, total home internet traffic averaged about 15% on weekdays. But it started growing in mid March, and by late March it had reached about 35%, clearly connected to all the working and learning from home due to stay-at-home orders.

“The data suggests remote working will remain elevated in the U.S. for a prolonged period of time,” wrote analysts from Cowen analysts.

Craig Moffett of MoffetNathanson said “The cable companies are simply digital infrastructure providers. They are agnostic about how you can get your video content. And the broadband business is going to be just fine.”

“Our broadband connections are becoming our lifelines – figuratively and literally: we are using them to get news, connect to our work environments (now all virtual), and for entertainment too,” wrote Craig Labovitz, CTO for Nokia’s Deepfield portfolio, in a blog post.

………………………………………………………………………………………..

Enterprise IT Accelerates Move to Cloud:

One takeaway from this extended, forced stay at home period is that, more than ever, corporate IT (think enterprise computing and storage) is moving to the cloud. We’ve previously reported on this mega-trend in an IEEE techblog post noting the delay in 5G roll-outs. In particular:

Now the new (5G) technology faces an unprecedented slow down to launch and expand pilot deployments. Why? It’s because of the stay at home/shelter in place orders all over the world. Non essential business’ are closed and manufacturing plants have been idled. Also, why do you need a mobile network if you’re at home 95% of the time?

One reason to deploy 5G is to off load data (especially video) traffic on congested 4G-LTE networks. But just like the physical roads and highways, those 4G networks have experienced less traffic since the virus took hold. People confined to their homes need wired broadband and Wi-Fi, NOT 4G and 5G mobile access.

David Readerman of Endurance Capital Partners, a San Francisco, CA based tech hedge fund told Barron’s: “What’s certainly being reinforced right now, is that cloud-based information-technology architecture is providing agility and resiliency for companies to operate dispersed workforces.”

Readerman says the jury is out on whether there’s a lasting impact on how we work, but he adds that contingency planning now requires the ability to work remotely for extended periods.

On March 27th, the Wall Street Journal reported:

Cloud-computing providers are emerging as among the few corporate winners in the coronavirus pandemic as office and store closures across the U.S. have pushed more activity online.

The remote data storage and processing services provided by Amazon.com Inc., Microsoft Corp., Google and others have become the essential link for many people to remain connected with work and families, or just to unwind.

The hardware and software infrastructure those tech giants and others provide, commonly referred to as the cloud, underpins the operation of businesses that have become particularly popular during the virus outbreak, such as workplace collaboration software provider Slack, streaming video service company Netflix Inc. and online video game maker Epic Games Inc.

Demand has been so strong that Microsoft has told some customers its Azure cloud is running up against limits in parts of Australia.

“Due to increased usage of Azure, some regions have limited capacity,” the software giant said, adding it had, in some instances, placed restrictions on new cloud-based resources, according to a customer notice seen by The Wall Street Journal.

A Microsoft spokesman said the company was “actively monitoring performance and usage trends” to support customers and growth demands. “At the same time,” he said, “these are unprecedented times and we’re also taking proactive steps to plan for these high-usage periods.”

“If we think of the cloud as utility, it’s hard to imagine any other public utility that could sustain a 50% increase in utilization—whether that’s electric or water or sewage system—and not fall over,” Matthew Prince, chief executive of cloud-services provider Cloudflare Inc. said in an interview. “The fact that the cloud is holding up as well as it has is one of the real bright spots of this crisis.”

The migration to the cloud has been happening for about a decade as companies have opted to forgo costly investments into in-house IT infrastructure and instead rent processing hardware and software from the likes of Amazon or Microsoft, paying as they go for storage and data processing features. The trends have made cloud-computing one of the most contested battlefields among business IT providers.

“If you look at Amazon or Azure and how much infrastructure usage increased over the past two weeks, it would probably blow your mind how much capacity they’ve had to spin up to keep the world operating,” said Dave McJannet, HashiCorp Inc., which provides tools for both cloud and traditional servers. “Moments like this accelerate the move to the cloud.”

In a message to rally employees, Andy Jassy, head of the Amazon’s Amazon Web Services (AWS) cloud division, urged them to “think about all of the AWS customers carrying extra load right now because of all of the people at home.”

Brad Schick, chief executive of Seattle-based Skytap Inc., which works with companies to move existing IT systems to the cloud, has seen a 20% jump in use of its services in the past month. “A lot of the growth is driven by increased usage of the cloud to deal with the coronavirus.”

For many companies, one of the attractions of cloud services is they can quickly rent more processing horsepower and storage when it is needed, but can scale back during less busy periods. That flexibility also is helping drive cloud-uptake during the coronavirus outbreak, said Nikesh Parekh, CEO and cofounder of Seattle-based Suplari Inc., which helps companies manage their spending with outside vendors such as cloud services.

“We are starting to see CFOs worry about their cash positions and looking for ways to reduce spending in a world where revenue is going to decline dramatically over the next quarter or two,” he said. “That will accelerate the move from traditional suppliers to the cloud.”

Dan Ives of Wedbush opines that the coronavirus pandemic is a “key turning point” around deploying cloud-driven and remote-learning environments. As a majority of Americans are working or learning from home amid federal social distancing measures, Ives’ projections of moving 55% of workloads to the cloud by 2022 from 33% “now look conservative as these targets could be reached a full year ahead of expectations given this pace,” he said. He also expects that $1 trillion will be spent on cloud services over the next decade, benefiting companies such as Microsoft and Amazon.

…………………………………………………………………………………………………………..

China’s CBN to use 700MHz for 5G network but needs a telco partner

China’s Ministry of Industry and Information Technology (MIIT) announced that it has repurposed the country’s frequency use plan for 700MHz spectrum in order to accelerate the development of 5G technology and to promote the effective use of spectrum resources.

Under the new plan, MIIT will abandon the current usage – 702MHz-to-798MHz for TV and radio and broadcasting – in favor of 703MHz-743MHz/758MHz-798MHz for FDD mobile communication systems. In its notification, the MIIT ruled that mobile systems operating in this band must not interfere with broadcasting or other services operating in the same or adjacent frequency bands. Further, to avoid interference, frequency migration, site relocation and equipment mediation of existing legal radio stations must be carried out. The costs of that will charged to the user(s) of the 700MHz mobile spectrum.

The spectrum in question is currently held by radio and TV broadcaster China Broadcasting Network (CBN), which is also known as China Radio and Television. It plans to use the airwaves in conjunction with its 4.9GHz spectrum to provide a suite of interactive TV services in the short term, and mobile communication (4G and 5G?) plus IoT services in the future.

CBN was a surprise new entrant to mobile when the MIIT issued 5G licenses in June 2019. The company, owned by the National Radio and Television Administration (NRTA), was set up just five years ago. It had total revenues last year of RMB78 billion (US$10.9 billion) — around a third of China Unicom’s and a fifth of China Telecom’s.

CBN began its first wireless network trial last October– a standalone 5G pilot network in central Shanghai, announced last week by the Shanghai city government.

According to broadcast industry website DVBCN, CBN is planning to build pilot networks in 15 or so major cities, such as Beijing, Tianjin and Nanjing.

May 21, 2020 Update:

China Broadcasting Network Corporation (CBN) and China Mobile said they would jointly build and share a 5G network and also collaborate in content and platform sharing.

For China Mobile and CBN, joint network investment and construction at a 1:1 ratio is just one part of their arrangement, which will continue until 2031.

They will jointly own and share the capacity, but China Mobile has committed to wholesaling capacity on its 2.6GHz 5G network to its smaller partner. In areas where the 700MHz band is not yet commercially available, it will open up its 2G and 4G networks.

China Mobile’s statement said while the two partners would retain their own brands, they would explore further joint efforts in areas such as products, operations and content and even in “channels and customer services.”

For China Mobile, which already has 260MHz of 5G spectrum in the 2.6GHz and 4.9GHz bands, the partnership adds to its spectrum inventory and in particular access to precious low-band frequencies.

https://www1.hkexnews.hk/listedco/listconews/sehk/2020/0520/2020052000370.pdf

………………………………………………………………………………………………………………………………………….

As in Shanghai, these will be standalone 5G networks in the 4.9GHz band. The company expects to deploy 200 basestations in each city at an estimated total cost of RMB2-3 billion ($279-419 million).

Table 1. China 5G spectrum allocation

| Operator | Assigned spectrum | Total | Shared spectrum |

| China Mobile | 2515-2675MHz | 160MHz | |

| China Mobile | 4800-4900MHz | 100MHz | |

| China Telecom | 3400-3500MHz | 100MHz | 3300-3400MHz (indoor) |

| China Unicom | 3500-3600MHz | 100MHz | 3300-3400 MHz (indoor) |

| China Broadcast Network | 703-798MHz | 80MHz | 3300-3400 MHz (indoor) |

| China Broadcast Network | 4.9GHz (trial) | TBD | |

| Source: MIIT | |||

Local China news outlet C114 writes that the new network operator (CBN) still needs to clear the spectrum and migrate existing radio and TV services to other frequencies, the cost of which was estimated to run to more than CNY10 billion (USD1.41 billion).

CBN, with income of around $11 billion from cable TV services, lacks the financial scale to build a national network and compete against three big telco incumbents.

CBN has business partners such as Alibaba and financial group Citic, but a partnership with a telco (like China Mobile) is needed to build out the network. The new network rollout cost is estimated to be at least 60 billion yuan (US$8.5 billion).

CBN may be able to reduce that expense through cooperation with cellular providers, though, with a senior China Mobile official quoted as saying that the two providers had communicated ‘to discuss the possibility of co-construction.’

………………………………………………………………………………………………………….

References:

https://www.lightreading.com/5g/china-releases-700mhz-for-5g/d/d-id/758667?

FCC to vote April 23rd to open up 1200 MHz of 6 GHz spectrum for WiFi

“The FCC is aiming to increase the supply of Wi-Fi spectrum with our boldest initiative yet,” Pai said today, “making the entire 6GHz band available for unlicensed use. By doing this, we would effectively increase the amount of spectrum available for Wi-Fi almost by a factor of five.”

The FCC noted that Pai’s draft order initially contemplates two classes of wireless transmissions making use of the 6 GHz band: indoor, low-power operations could use any frequency range within the 1,200 MHz spectrum, while standard power transmissions will be able to access 850 MHz of spectrum, while keeping away from previously permitted 6 GHz users.

Collectively, the 6 GHz channels add over two times more capacity to the FCC’s existing 480 MHz allocation of 5GHz spectrum. They will also give WiFi routers the flexibility to choose between a greater range of additional frequencies. Apart from decongesting existing network environments, including dense housing where multiple users and devices are competing for limited 2.4GHz or 5GHz spectrum, the 6 GHz frequencies might be used for high data rate applications, without the need to rely on shorter-distance millimeter wave spectrum. The FCC said today that it will seek public comments on allowing “very low-power devices” to access the full 1,200MHz of spectrum for “high-performance, wearable, augmented-reality and virtual-reality devices.”

“From Wi-Fi routers to home appliances, Americans’ everyday use of devices that connect to the Internet over unlicensed spectrum has exploded,” said FCC Chairman Pai. “That trend will only continue. Cisco projects that nearly 60% of global mobile data traffic will be off-loaded to WiFi by 2022. To accommodate that increase in Wi-Fi demand, the FCC is aiming to increase the supply of Wi-Fi spectrum with our boldest initiative yet: making the entire 6 GHz band available for unlicensed use. By doing this, we would effectively increase the amount of spectrum available for Wi-Fi almost by a factor of five. This would be a huge benefit to consumers and innovators across the nation. It would be another step toward increasing the capacity of our country’s networks. And it would help advance even further our leadership in next generation wireless technologies, including 5G.”

…………………………………………………………………………………………….

Expert Opinions:

Wi-Fi advocates say the bands currently used for Wi-Fi – the 2.4 and 5 GHz – do not offer enough to meet projected demands. They also say that the 6 GHz band offers super-wide channels, which are needed to carry traffic from a bunch of devices simultaneously, as well as to increase speed. Companies like Amazon, Facebook and Apple are eyeing the band for new devices, including wearables and wireless AR/VR headsets.

”Consumer advocates commend the FCC for its pathbreaking spectrum-sharing order,” said Michael Calabrese, director of the Wireless Future Project at New America’s Open Technology Institute, in a statement. “Opening the entire 6 GHz band for low-power, gigabit-fast Wi-Fi in every home, school, and enterprise will accelerate the availability and affordability of next-generation applications and services nationwide. Even the fastest fiber broadband internet service is useless for consumers without the Wi-Fi spectrum needed to connect all of our laptops, tablets, and smartphones.”

The Wi-Fi Alliance praised today’s FCC announcement while underscoring the growing importance of Wi-Fi. “Ensuring necessary unlicensed spectrum access is critical for Wi-Fi,” it said, “which now more than ever keeps us connected, supports our communications infrastructure, and delivers major economic benefits.”

While many Alliance members offered positive comments on the FCC news, Qualcomm CEO Steve Mollenkopf’s stood out as especially expansive regarding the 6 GHz spectrum’s potential.

“In February,we demonstrated a full suite of Wi-Fi 6E products ready to start using this large new swath of spectrum. We are also optimizing other exciting new technologies for this large swath of spectrum, including the next version of 5G and next generation Wi-Fi.”

A Qualcomm spokesperson noted that 5G NR-U will be optimized to take advantage of the “massive amount of spectrum” in the 6 GHz band.

As expected, the proposed re-allocation of spectrum is being opposed by broadcasters, utilities and other companies that currently use the airwaves in question, known as the 6 gigahertz band, for beaming video signals or monitoring electric grids.

T-Mobile US Inc. and other telecommunications wireless carriers would also lose out. They had hoped to win exclusive rights to some of the airwaves as they build out cellular 5G networks.

……………………………………………………………………………………………..

Conclusions:

FCC approval isn’t guaranteed as a result of the April 23rd vote, but it’s likely, as three of the five commissioners — including Pai — tend to vote in lock step. The Wi-Fi Alliance has said that 6GHz-compatible WiFi 6 devices will be ready to go relatively quickly after approval is finalized.

“Once all the rules are in place, products can move relatively quickly,” Blair Levin, an analyst at New Street Research, wrote in a note to his firm’s clients this week about the expected FCC move.

…………………………………………………………………………………………………….

Addendum – FCC Commissioner O’Rielly released the following statement on April 1st:

I am grateful that Chairman Pai has circulated an item to allow sharing between unlicensed services and incumbent providers in the 6 GHz band. Having worked for most of my professional career on unlicensed service issues and having taken on the lead advocate role for 6 GHz, I am extremely pleased that we have finally reached this point. It’s been a long and winding road.

Today’s item effectively concludes some of the substantive debates and will end some extraneous noise surrounding our approach. While I look forward to reading the specifics, it appears very consistent with my emphatic support for protecting incumbent users while permitting varied unlicensed services within the band.

Specifically, higher powered unlicensed services will be allowed in the band using a slimmed-down automated frequency coordination (AFC) regime, while low power indoor (LPI) use, which probably could use a closer review and improvements to its technical rules over the next couple weeks, will be allowed throughout the band without an AFC.

Although it initially settles on certain lower power limits for LPI use, the further notice will explore increasing these limits, as well as setting workable power limits and more specifics to effectuate very lower powered (VLP) unlicensed devices. “Over the last few years, I have heard from entrepreneurs and innovators discussing how dramatic the impact would be of unleashing such a large unlicensed allocation with seven 160 megahertz channels. I can’t wait to see, and use, the new services and ideas brought forward because of our work here.

Today’s action to permit all 1200 megahertz of the band to be used for unlicensed services means that proposals to license portions of the band were not accepted. I fully support this outcome, but I also remain fully committed to identifying other mid-bands for licensed services. Simply put, U.S. wireless providers must have more mid-band spectrum to meet consumer demand, and I will fight to refill the spectrum pipeline for future licensed wireless services.

This effort is absolutely vital to preserving U.S. leadership in wireless technology and to alleviate the demands being placed on existing networks. I firmly believe that the most likely candidate bands for this purpose are Federal spectrum allocations, such as the 3.1 to 3.55 GHz band, that can be converted to commercial use.

I look forward to discussing this draft with interested parties in the coming weeks, and I will go out on a limb to predict a unanimous vote from my colleagues.

https://docs.fcc.gov/public/attachments/DOC-363454A1.pdf

……………………………………………………………………………………………………………………………………………..

April 23, 2020 UPDATE:

FCC to open up 6 GHz band for unlicensed use – boon for WiFi 6

References:

https://www.fcc.gov/document/chairman-pai-proposes-new-6-ghz-band-rules-unleash-unlicensed-use

FCC sets 6GHz Wi-Fi vote for April 23, opening door to Wi-Fi 6E

https://www.wsj.com/articles/fcc-moves-to-boost-wi-fi-speed-11585763721

https://www.fiercewireless.com/regulatory/fcc-sets-all-1-200-mhz-motion-for-6-ghz-unlicensed

The New T-Mobile (with Sprint): Merging incompatible 3G networks and integrated 5G

At long last, T-Mobile closed its $23 billion acquisition of Sprint today (April 1, 2020) after a two-year effort to merge the two companies. The New T-Mobile also replaced long-time uncarrier CEO (cowboy) John Legere with his hand-picked successor Mike Sievert. T-Mobile now takes its place as an equal among the three major wireless carriers in the US.

The deal was the subject of protracted legal actions, opposition by 11 state attorney generals, lobbying before the FCC and the Justice Department, and other actions as consumer groups tried to find a way to block it.

The merger required Sprint to divest itself of Boost Mobile and the remains of Virgin Mobile, and it required a number of commitments by T-Mobile not to raise prices for three years, and to provide widespread wireless broadband. T-Mobile also had to help Dish Networks become a competitive wireless company as a way to quell fears that the merger would leave the U.S. with only three wireless telcos instead of four.

“During this extraordinary time, it has become abundantly clear how vital a strong and reliable network is to the world we live in. The New T-Mobile’s commitment to delivering a transformative broad and deep nationwide 5G network is more important and more needed than ever and what we are building is mission-critical for consumers,” said Mike Sievert, president and CEO of T-Mobile. “With this powerful network, the New T-Mobile will deliver real choice and value to wireless and home broadband customers and double down on all the things customers have always loved about the Un-carrier. T-Mobile has been changing wireless for good — and now we are going to do it on a whole new level!”

Sievert continued, “All of us at T-Mobile owe John an incredible thank you for everything he’s done to get this company to where we are today. He has changed what it means to be a CEO. Everything that T-Mobile has accomplished is the result of his vision for what a different kind of wireless provider could be. John IS what the Un-carrier is all about: advocating for customers at every turn, forcing us to think differently and always driving for more. He has always pushed the boundaries of what’s possible and pushed us to do the same. His leadership has made us what we are today, and we will take that into the future. Thank you, John, for everything you’ve done for wireless consumers and for our beloved employees!

I also want to thank Marcelo Claure and the entire Sprint leadership team for their hard work to get us to this huge day! We did it!… and I’m looking forward to welcoming Sprint employees into Team Magenta, and to working with you now as a member of our Board of Directors.”

This quantum leap forward can only be achieved by using T-Mobile and Sprint’s combined low-, mid- and high-spectrum bands — and only the New T-Mobile will have the resources to do it quickly.

- The network will have 14 times more capacity in the next six years than T-Mobile alone has today, enabling the New T-Mobile to leapfrog the competition in network capability and experience.

- Customers will have access to average 5G speeds up to eight times faster than current LTE in just a few years and 15 times faster over the next six years.

- Within six years, the New T-Mobile will provide 5G to 99% of the U.S. population and average 5G speeds in excess of 100 Mbps to 90% of the U.S. population.

- New T-Mobile’s business plan is built on covering 90% of rural Americans with average 5G speeds of 50 Mbps, up to two times faster than broadband on average.

“The network is at the core of everything we do as a business, and it’s critically important for keeping customers connected to each other, their communities and the world,” said Neville Ray, president of Technology at T-Mobile. “The supercharged 5G network that we’ll build as a combined company will be a huge step forward, transforming wireless, fueling innovation and delivering new experiences for customers all across the country that we can’t even imagine today.”

Impact on Users:

For users, the merger will initially be a non-event. Sprint is now a subsidiary of T-Mobile and will operate as a separate company. The transition will occur in stages, and while T-Mobile isn’t commenting on that, a highly placed source at T-Mobile said on background that customers of both companies will find that they have access to the other’s network in areas where they need better coverage.

However, many Sprint 3G devices (CDMA) can work on the T-Mobile’s 3G network (GSM), especially for voice calls or if 4G LTE mobile data access is not available. T-Mobile plans to use the model it used when it acquired MetroPCS, which was also an incompatible network. In that merger, T-Mobile replaced incompatible handsets as the old network was decommissioned.

…………………………………………………………………………………………………..

Pundits Weigh In:

Keith Pennachio, EVP and chief strategy officer at SQUAN, a network infrastructure company serving both T-Mobile and Sprint, said that he expects to see growth in network infrastructure. “We’ll see network consolidation, networks convergence for some sites and for moving traffic,” he said.

“I expect T-Mobile to take advantage of spectrum assets where T-Mobile didn’t have assets previously,” Pennachio said. “What you’ll start to see in markets where Sprint had a decent footprint, T-Mobile may opt to supplant some equipment to their own.” This will mean that in areas where T-Mobile didn’t have a great signal, the company will use Sprint’s sites and frequencies to improve things.

As the merger progresses, T-Mobile will update the programming on some cell sites so that Sprint customers with compatible phones will be able to use them. T-Mobile will also begin using Sprint’s 2.5 GHz mid-band spectrum to build out its network.

“I think they’re going to be very busy integrating the business, the networks and the employees,” said Brandon Parris of Morrison & Foerster, “and start in earnest their upgrades and their focus on 5G.” Parris led the team that advised Sprint and and its owner Softbank on the merger with T-Mobile.

“Whenever you have two huge industry giants it takes time,” Parris explained, “but they will go through the process of making sure the technology is integrated, and then adding 5G. You have to integrate everything from office space to compensation arrangements. It’s huge undertaking.”

………………………………………………………………………………………………

Deploying 5G:

According to a FAQ press release, “the new T–Mobile will build a transformative nationwide 5G network that will drive innovation and connect every American. With T–Mobile’s low-band, Sprint’s mid-band, and other spectrum, the highest capacity nationwide network in U.S. history will be built—400MHz+ on average nationwide.”

T-Mobile is starting its 5G buildout “almost immediately”

T-Mobile has long said that the primary driver for its merger with Sprint is its desire to combine its 600MHz spectrum with Sprint’s 2.5GHz spectrum for a 5G network. Indeed, in its press release Wednesday the New T-Mobile promised its forthcoming network would have 14 times more capacity in the next six years than T-Mobile alone has today. The operator added that it expects to provide average 5G speeds above 100Mbit/s to 90% of the US population within the next six years.

In comments to CNBC, incoming CEO Sievert said the operator is going to start on the construction of the network “almost immediately.” He said the company would use equipment from its existing suppliers Nokia and Ericsson to build “the world’s best 5G network.”

A key factor in in the integration of the two networks, will be the speed at which T-Mobile can begin rolling out its use of Sprint’s mid-band spectrum, which is critical to its 5G success.

While T-Mobile already has nationwide 5G with its 600 MHz low-band frequencies that feature much longer range than can exist in higher bands, the low bands have lower speeds. Mid-band spectrum is considered a perfect compromise between the speeds in the millimeter wave bands and the lower speeds in the low bands.

“With its lead in customer care and cost of service, T-Mobile is well positioned to bring that winning culture to its new family members, both the employees of Sprint as well as its customers,” said Ian Greenblatt, TMT head at J. D. Power. “The only 5G nationwide network is notable (despite being 600MHz only – it’s still faster than the fastest 4G-LTE) and will be even more capable with the addition of Sprint’s mid-band spectra.”

CTO Neville Ray told CNET that the operator would turn on its new 5G network first in Philadelphia, and that other cities would go live “rapidly” in the coming weeks.

Conclusions:

According to Pennachio, T-Mobile’s culture will play a critical role in the success of the merged companies. “The culture of T-Mobile is very different,” he said. “Now it creates this third competitor that’s strong from a spectrum but with a culture that’s more in line with technology companies.”

T-Mobile’s “in your face” culture, which has been compared with that at many Silicon Valley startups, could play a significant role in how the company impacts the wireless business.

………………………………………………………………………………………………..

References:

https://www.t-mobile.com/news/t-mobile-sprint-one-company

https://www.t-mobile.com/support/account/t-mobile-sprint-merger-faqs

https://www.lightreading.com/5g/the-eight-new-things-we-learned-about-new-t-mobile/d/d-id/758625?

Europe and U.S. to delay 5G deployments; China to accelerate 5G

Up until the COVID-19 pandemic hit the world hard in late February, 5G seemed a priority for most wireless network operators. Now, with across the board cutbacks everywhere, it will be much further down the must do list for 2020.

In the absence of any new 5G applications or completion of 3GPP 5G Phase 2 and ITU-R IMT 2020, 5G was not expected to ramp this year, despite ridiculous hype and false claims (especially ultra low latency which has not yet been specified let alone standardized yet).

Now the new technology faces an unprecedented slow down to launch and expand pilot deployments. Why? It’s because of the stay at home/shelter in place orders all over the world. Non essential business’ are closed and manufacturing plants have been idled. Also, why do you need a mobile network if you’re at home 95% of the time?

One reason to deploy 5G is to off load data (especially video) traffic on congested 4G-LTE networks. But just like the physical roads and highways, those 4G networks have experienced less traffic since the virus took hold. People confined to their homes need wired broadband and Wi-Fi, NOT 4G and 5G mobile access.

“5G deployment in Europe will certainly be delayed,” said Eric Xu, one of Huawei’s rotating CEOs, during a Huawei (private company) results presentation today. Xu also told reporters the delays could last until “the time when the pandemic is brought under control.”

Huawei’s Eric Xu said the current crisis would “certainly” delay 5G rollouts

………………………………………………………………………………………………………..

Answering questions about its annual report, published on Tuesday, Huawei vice-president Victor Zhang said there would “definitely” be an impact but it would likely be worse in Europe than in the UK.

A few data points from European telcos in the aftermath of COVID-19:

- On March 20, the UK’s BT reported a 5% drop in mobile data traffic, compared with normal levels.

- Today, Belgian incumbent Proximus said capital expenditure would go down this year to offset the impact of COVID-19 on profits.

- A growing number of European countries are delaying 5G spectrum auctions, as restrictions related to the Covid-19 pandemic make it difficult to maintain planning. The EU’s deadline of June for the release of the 700 MHz band for 5G will be missed by several countries, including Spain and Austria.

- In Portugal, MEO, NOS and Vodafone Portugal now face a further wait for frequency rights in the 700MHz, 900MHz, 1800MHz, 2.1GHz, 2.6GHz and 3.6GHz bands

- German company United Internet’s CEO, Ralph Dommermuth, said that the construction of subsidiary 1&1 Drillisch’s 5G network would experience delays due to current measures adopted in the country to prevent a further spread of the COVID-19 pandemic in Germany, local paper Handelsblatt reported.

- In Sweden, which has controversially avoided a total lockdown, telecom incumbent carrier Telia has now cut dividends as it prepares for a hit.

Huawei’s statements imply the U.S. will also face a delay in 5G rollouts. It has overtaken Italy as the country with the highest number of coronavirus infections, and its response to the outbreak has been lackluster and confusing at best, horrendous at worst.

As a mobile-only network equipment vendor, Ericsson looks the most exposed to a 5G slow down. More than 50% of its business is generated in Europe and the Americas, where the rate of COVID-19 infections is rising.

Although less reliant on the 5G wireless base station business than Ericsson, Nokia could also be in trouble due to the slowdown in 5G deployments. Approximately 30% of its sales came from North America last year, and another 28% from Europe.

…………………………………………………………………………………………….

“After the pandemic was brought under control, China has accelerated its 5G deployments,” according to Huawei’s Xu.

China has accelerated its own 5G deployment after the number of cases of Covid-19 subsided, according to Xu, but in other countries, it would depend “on several factors”, including whether telecoms companies had the budget and resources to “win back the time” lost.

Indeed, China Mobile this week awarded 5G contracts worth $5.2 billion with approximately 90% of the contracts going to Huawei and ZTE. Ericsson won contracts worth RMB4.2 billion ($593 million) and small local vendor CICT will net RMB965 million ($136 million). Nokia reportedly bid, but failed to win any of the contracts from China Mobile.

This centralized procurement involves 28 China provinces, autonomous regions and municipalities directly under the central government. According to C114, the total demand is 232,143 5G base stations. At the end of February, the number of 5G base stations owned China Mobile has exceeded 80,000.

References:

https://www.bbc.com/news/technology-52108172

https://www.lightreading.com/5g/covid-19-will-help-china-to-extend-its-5g-lead/d/d-id/758596?

https://www.lightreading.com/5g/5g-auctions-delayed-across-europe-due-to-covid-19/d/d-id/758606?

…………………………………………………………………………………………………

9 April 2020 Update:

5G is looking like a casualty of COVID-19

All 5G companies had accomplished was the design of a technology that provides faster connections and additional capacity on smartphone networks. A few have already been launched, and South Korea, the most advanced market, already has millions of subscribers. Yet local news reports suggest many have been underwhelmed by the 5G experience. For service providers, it has had minimal impact on sales while marketing and rollout costs have made a huge dent in profits.

This will discourage 5G investment in countries under COVID-19 lockdown. As customers downgrade to cheaper services and dump TV sports packages rerunning last year’s highlights, many operators will cut spending. Concerned about exposing field workers to unnecessary health risks, they will prioritize the maintenance of networks already used by the majority. Moreover, people confined to their broadband-equipped homes for most of the day have little use for mobile data networks. Any additional investment is likely to go into fiber-optic equipment.

5G launches will also be delayed in European markets that have postponed auctions of the spectrum needed to support services. Austria, the Czech Republic, France, Portugal and Spain are all now reported to have delayed auctions. Without spectrum, 5G will obviously not fly.

Fear mongering stories linking 5G to illness could also hinder rollout. Countries such as Belgium and Switzerland have imposed limits on the use of 5G antennas amid lingering concern that radiofrequency emissions are carcinogenic. The World Health Organization says mobile frequencies are too low to be dangerous, but activists are unconvinced.

In the UK, operators now have to contend with the ludicrous suggestion that 5G networks transmit COVID-19. After misinformed tweets by celebrities including Amanda Holden, a British actress and reality-TV regular, 5G masts were burnt in the cities of Belfast, Birmingham and Liverpool.

China, meanwhile, remains determined to erect more than half a million 5G base stations by the end of this year. Claiming to have beaten COVID-19, it has lifted restrictions on the movement of people and reopened its factories. For the equipment makers building those 5G networks, this investment program could be essential medicine. Just last month, China Mobile, the country’s largest operator, awarded 5G contracts worth $5.2 billion. Unfortunately, with almost 90% of the work going to domestic suppliers Huawei and ZTE, Western vendors will not be able to count on China for a boost.

https://www.lightreading.com/5g/5g-is-looking-like-a-casualty-of-covid-19/a/d-id/758804?

SK Telecom is 5G market leader after one year of 5G service in Korea

SK Telecom today announced its 5G milestones achieved over the past year since launching the world’s first 5G service on April 3, 2019, along with its plans going forward.

According to the (South) Korean Ministry of Science and ICT released in January 2020, SK Telecom has established itself as the leader in the 5G market with around 2.22 million subscribers and 44.7% market share. With its strong performance in 5G, SK Telecom continues to maintain the unrivaled market leadership it secured since launching the 2G service in (South) Korea.

…………………………………………………………………………………………………………

SK Telecom has increased customers’ 5G experience and acceptance by creating around 70 5G Clusters* in key commercial districts and densely populated areas throughout the nation. To date, around 1 million customers visited 5G Clusters to experience differentiated 5G services including ‘Jump AR Zoo’ and ‘5G LoL Park.’

*5G Clusters are built with more base stations than other 5G coverage areas to offer optimal 5G environment for services like AR and VR.

……………………………………………………………………………………………………

Highlights:

- Since launching the world’s first 5G service on April 3, 2019, the company continues to maintain its leadership in the Korean mobile market backed by 44.7% 5G market share

- Over the past year, the company expanded its business to new areas by leveraging its strength in 5G

- SK Telecom also pronounced its plans to offer the best 5G services through hyper-collaboration

- Its plans include delivering new customer experience through mobile cloud gaming services, mixed reality contents and quantum-safe mobile devices; expanding enterprise business such as 5G MEC-based cloud business and 5G smart factory; and strengthening its 5G network by building more 5G Clusters and expanding 5G network coverage

According to SK Telecom’s analysis on 5G subscribers, people in their 30s and 40s are taking up 53% of the company’s total 5G subscriber base, which is significantly higher than the proportion of people in their 30s and 40s in total LTE subscriber base, which currently stands at 32%.

The total amount of data consumption of SK Telecom’s 5G subscribers reached 62,000 TB on average per month over the past three months (Dec. 2019 ~ Feb. 2020). During the same period, the average monthly data usage of subscribers who switched devices from LTE to 5G has increased about twofold from 14.5 GB (LTE) to 28.5 GB (5G) per person.

SK Telecom’s 5G subscribers are found to be using media services, which generally require greater speeds and bandwidths, much more actively than LTE subscribers. As of February 2020, 5G subscribers are using 7 times more VR services, 3.6 times more video steaming services and 2.7 times more game apps than LTE subscribers.

Moreover, armed with its strong capabilities in 5G, SK Telecom has successfully expanded into new business areas. The company is cooperating with Microsoft and Amazon Web Services in the area of cloud, and has ventured into the U.S. next-generation broadcasting (ATSC 3.0) market with Sinclair Broadcast Group.

SK Telecom also shared its experience and knowhow in 5G with other mobile operators across the globe including Deutsche Telekom, Taiwan Mobile and IT&E.

Going forward, SK Telecom aims to earn the title of the world’s best 5G service provider through hyper-collaboration with strong global companies. At CES 2020, SK Telecom’s President and CEO Park Jung-ho suggested “Hyper-Collaboration” with diverse Korean ICT companies to achieve innovations in areas including artificial intelligence.

For consumers, SK Telecom will focus on providing differentiated 5G services that innovate user experience through borderless collaboration with diverse ICT companies including cloud service providers, device manufacturers and telecommunications companies.

SK Telecom will continue to work closely with Microsoft to prepare mobile cloud streaming games and will also open ‘Jump Studio,’ a mixed-reality content production facility.

SK Telecom and Microsoft are currently providing 92 different games through Project xCloud. Cloud gaming service is being highlighted as the ‘game changer’ that will shift the paradigm in the gaming industry by enabling users to play high quality, premium games anywhere, anytime by accessing the cloud server.

Jump Studio will provide solutions that enable the creation of 3D content like holograms by combining the technological strengths of augmented and virtual reality technologies. SK Telecom expects Jump Studio to accelerate the popularization of realistic media by significantly reducing time and cost for content creation.

SK Telecom plans to release mobile device applied with global leading quantum cryptography technologies and provide advanced security solutions to 5G users.

In B2B, SK Telecom announced its vision of expanding the enterprise business in full scale by marking 2020 as the first year of its B2B business. To this end, the company will work closely with companies of diverse industries to serve as a catalyst for industrial innovations in Korea.

SK Telecom plans to build 5G MEC (Mobile Edge Computing) Centers in 12 different locations across Korea to lead a cloud-driven industrial revolution. To this end, the company is preparing to launch nationwide 5G edge cloud service by joining hands with global leading cloud companies such as Amazon Web Services and Microsoft.

5G edge cloud, once commercialized, will provide ultra-low latency connectivity for services like unmanned delivery robots and telemedicine, thereby bringing unprecedented changes to all industries including manufacturing, distribution and healthcare.

Moreover, SK Telecom plans to deploy a private 5G network at SK Hynix’s semiconductor manufacturing facility to realize 5G smart factory that can lead to a supercycle in the semiconductor industry. The company is planning to add cutting-edge ICT including AI video analytics and AR technology to its 5G network.

SK Telecom is also cooperating with Korea Hydro & Nuclear Power (KHNP) to realize 5G smart power plant. It will first upgrade real-time drone monitoring system for dams, remote water level monitoring system, and situation sharing system by applying private 5G network and quantum cryptography technologies to KHNP’s hydro-electric/ pumped storage power plant.

Furthermore, the company will continue to work closely with Seoul Metropolitan Government to accelerate the C-ITS (Cooperative Intelligent Transportation System) project by applying Road Learner, which consists of 5G ADAS (Advanced Driver Assistance System) and Live HD Map Update solution. 5G ADAS and Live HD Map Update solution are key technologies for autonomous driving as 5G ADAS improves driving safety through features including lane departure warning and forward collision avoidance, and Live HD Map Update solution reflects road situations to HD maps in real time.

In 2020, SK Telecom will bring the total number of its 5G Clusters to 240 and expand 5G coverage to neighborhoods (‘dong’) of 85 cities nationwide by working closely with telecommunications equipment manufacturers.

The company will also secure indoor coverage for a total of 2,000 buildings, including not just airports, department stores and large shopping malls but also small-to medium-sized buildings, by applying its sophisticated 5G in-building solutions.

“SK Telecom was able to secure new business opportunities ahead of others by achieving the world’s first 5G commercialization,” said Ryu Young-sang, Vice President and Head of MNO Business of SK Telecom. “We are confident that the 5G business models to be launched this year will drive the company’s growth over the next decade.”

………………………………………………………………………………………………………….

About SK Telecom:

SK Telecom is Korea’s leading ICT company, driving innovations in the areas of mobile communications, media, security, commerce and mobility. Armed with cutting-edge ICT including AI and 5G, the company is ushering in a new level of convergence to deliver unprecedented value to customers. As the global 5G pioneer, SK Telecom is committed to realizing the full potential of 5G through ground-breaking services that can improve people’s lives, transform businesses, and lead to a better society.

SK Telecom boasts unrivaled leadership in the Korean mobile market with over 30 million subscribers, which account for nearly 50 percent of the market. The company now has 47 ICT subsidiaries and annual revenues approaching KRW 17.8 trillion.

For more information, please contact [email protected] or [email protected].

Media Contact

Yong-jae Lee

SK Telecom Co., Ltd.

(822) 6100 3838

………………………………………………………………………………………………….

Local carriers SK Telecom, KT and LG Uplus had initially launched limited 5G commercial services in December 2018 as part of an agreement with the ICT ministry to launch simultaneously to avoid excessive competition. SK Telecom, KT and LG Uplus initially offered the 5G service in limited areas in Seoul.

Highlights of Heavy Reading’s 5G Network Operator Survey

5G Deployment Timelines & Services (from Heavy Reading’s 5G report), Author: Gabriel Brown, Principal Analyst, Mobile Networks & 5G, Heavy Reading

Key Findings:

• On a 2-year view, 41% of respondents said “faster end user speeds” is the primary driver for 5G, up from 33% in Heavy Reading’s 2019 survey. Over a 5-year view, the ability to “address new markets & services” climbs to first place in the ranking, with 42%. Operators appear to see 5G technology investment as focused on evolving their current service strategies in the near term and becoming more ambitious in the medium term.

• Heavy Reading asked when operators think more than 25% of their subscriber base will have a 5G device. 50% of respondents expect this to be the case by the end of 2022, up slightly from 45% in our 2019 survey. This looks like a bullish view at first glance, but it is in line with Omdia’s independent estimate of 28% 5G penetration in the U.S. during the same timeframe.

• Over a 3-year view, operators expect some differences between their 4G and 5G service portfolios, but not major ones. 43% said their company will offer a “very similar services portfolio” while a comparable 45% believe their portfolio will offer “mostly common services, with some 5G-only services.” Only 8% expect to offer “many 5G-only services.”

As was the case in the 2019 survey, Heavy Reading asked respondents to identify the primary drivers for 5G deployment over 2- and 5-year time horizons.

On a 2-year view, the large st group (41%) said “faster end user speeds” is the primary driver for 5G, up from 33% in 2019. “Addressing new markets and services” comes second with 28%. “System capacity and efficiency” (16%) and “competitive reasons” (16%) bring up the rear, both with reduced support relative to our 2019 survey.

These results fit with how operators tended to market 5G in 2019 – namely, on downlink speed and gigabit performance claims.

Over a 5-year view, the ability to “address new markets and services” climbs to first place in the ranking at 42%, significantly above all other scores. Operators clearly see 5G investment as focused on how advanced technology capabilities can be translated into compelling services over

the medium term.

“ULTRA-RELIABLE LOW LATENCY COMMUNICATION (URLLC) SERVICES ARE ONE OF THE DEFINING FEATURES OF 5G. URLLC REQUIREMENTS WERE INFLUENTIAL IN THE DESIGN OF THE 5G SYSTEM AND AIR INTERFACE.”

Editor’s Note:

It remains to be seen if URLLC capabilities will be finalized in 3GPP Release 16 (June 2020) and included in the first ITU IMT-2020 standard.

…………………………………………………………………………………………………..

…………………………………………………………………………………………………………….

In terms of 5G devices, 50% of respondents expect 25% or more of their subscriber base to have a 5G-compatible handset by the end of 2022. At first glance, this looks like a bullish view, and it is up slightly from Heavy Reading’s 2019 survey. This positive view on 5G adoption perhaps reflects better knowledge of, and greater confidence in, 5G device and chipset development timelines. It also possibly echoes analyst upgrades to 5G device estimates made by research firms across the board in 2019 and widely reported in the media.

For example, the result is in line with Omdia’s independently produced estimate of 28% 5G penetration in the U.S. during the same timeframe. A critical factor is handset replacement cycles for smartphones, which have lengthened in most developed markets in the past few years. In some markets – like China and South Korea – there is evidence that 5G can drive an acceleration in handset upgrades. But this is not a universal phenomenon; for instance, there is not yet good evidence of this in Europe and the U.S.

This may be because first-generation 5G devices tend to come with compromises (e.g., on power consumption, cost, and bugs). Looking into 2020 and 2021, newer handset models at high- and mid-tier prices will become available in volume. For example, a 5G iPhone – rumored for late 2020 – will be important, particularly in the U.S., where iPhone market share is high. As established earlier, over a 5-year view, operators see 5G addressing new markets and driving advanced services (Fig 7). sought insight into the differences between 5G and 4G service portfolios over a 3-year view.

A fair summary would be that operators expect some differences, but not major ones. A large 43% said their company will offer a “very similar services portfolio” for 4G and 5G users, while a comparable 45% believe their portfolio will offer “mostly common services, with some 5G-only services.” Only 8% expect to offer “many 5G-only services.”

In part, this result may reflect that 5G deployed in non-standalone (NSA) mode makes existing 4G services faster rather than fundamentally different. As discussed later, it may be that a transition to standalone (SA) is a prerequisite for service innovation.

Telecom data traffic in Cuba grows 10% due to COVID-19; Free access to EnZona e-commerce platform

Cuba state owned telecom company ETECSA president Mayra Arevich posted on her Twitter account @MayraArevich on Thursday:

“The traffic growth for (last) three days is more than 10% of additional volume on our networks”

The ETECSA official also urged not to use large volumes of data on the mobile network so that the traffic capacity can be shared among all, after noting that navigation requires seven times more resources than voice calls.

“To think as a country is to maintain the stability of our systems to guarantee services to our population. We advise you not to use large volumes of data on the mobile network, so that the traffic capacity can be shared among all,” said the executive president of the state enterprise, Mayra Arevich, quoted by the official Cubadebate site.

These (voice calls) guarantee the fundamental communications with the emergency services and our health system,’ Arevich wrote in another tweet quoted Friday by Cuba’s Granma newspaper after social media were flooded with requests for the telephone company to lower rates.

ETECSA guarantees voice/data network stability at this time of constant surveillance on the coronavirus pandemic, with which more than 465,000 people have already been infected in 200 countries, she said.

Cuba Communications Minister Jorge Luis Perdomo said this Thursday that the measures to fight coronavirus were conceived with integrity.

On Friday, Mayra Arevich Marín tweeted: “Starting today, March 27, 2020, you can access the #EnZona platform, an e-commerce application, which together with #Transfermóvil are the forefront of computerization in our society, free of charge.”

Photo courtesy of SK Telecom

Photo courtesy of SK Telecom