5G Auctions

Netherlands again delays 5G spectrum auction

The 5G spectrum auction in the Netherlands has been delayed again, much to the local telecom companies’ frustration. “An auction this year is no longer a possibility,” a spokesperson for the National Digital Infrastructure Service (RDI) confirmed to NU.nl. “A new date for the auction has yet to be announced.”

KPN, Vodaphone, and Odido, formerly T-Mobile, are eagerly awaiting the chance to bid on frequencies so they can offer 5G mobile services. Mobile internet traffic in the Netherlands is growing by 30 to 50 percent per year, and consumers expect faster internet on their phones.

The RDI intended to release the 5G spectrum on the 3.5GHz band before the end of the year. But an adjustment to the National Frequency Plan (NFP) has thrown a spanner in the works. According to the Ministry of Economic Affairs and Climate, several parties have appealed against the adjustment. “The court will hear the appeal on October 11 and 12,” a spokesperson for the ministry told NU.nl. “Only then can we provide more clarity about when the auction can take place.”

The Dutch telecom companies were disappointed by this new delay. “This auction should have taken place a long time ago,” a KPN spokesperson told the newspaper. “We are several years out of step with other countries in Europe, and there is still a lot of uncertainty.”

“The 3.5GHz band is particularly important to us and an essential part of the development of our network,” a spokesperson for Vodafone said. “We hope that this will be available for national mobile communications in the short term.”

The Netherlands is at risk of losing its position as the country with the best mobile networks in the world, Odibo said. The new frequencies are desperately needed to handle the ever-increasing mobile internet traffic and enable faster mobile internet traffic. The latter is especially vital for Dutch industry, the Odido spokesperson told the newspaper. Mobile internet traffic is expected to grow by 30% to 50% per year in the country.

Telecom towers – Credit: mrfotos / DepositPhotos – License: DepositPhotos

…………………………………………………………………………………………………………………….

References:

https://nltimes.nl/2023/09/22/dutch-delay-5g-spectrum-auction

Potential delays in Netherlands’ 5G 3.5GHz frequency auction

FCC launches new 5G mid-band wireless spectrum auction (FCC Auction 108)

The U.S. Federal Communications Commission (FCC) said Friday it had opened bidding in its latest mid-band spectrum auction (FCC Auction 108) to boost next generation 5G wireless services. The new round will auction about 8,000 county-based licenses in the 2.5 GHz spectrum band in mostly rural parts of the U.S. FCC Chairwoman Jessica Rosenworcel said Friday, “We all know there are gaps in 5G coverage, especially in rural America, and this auction is a unique opportunity to fill them in.”

Auction 108, which started at 10am ET on Friday, July 29, utilizes a “clock-1” auction format. This format is similar to the clock phase of past FCC auctions, but rather than offering multiple generic spectrum blocks in a category in a geographic area, it will offer only a single frequency-specific license in a category in a county.

The U.S. Congress last year approved $42.5 billion for Commerce Department grants to expand physical broadband deployment in places like rural areas without access to high-speed service. The FCC has been auctioning spectrum in recent years to help address the rising demand for wireless connectivity as the number of internet-connected devices rises sharply.

In January, AT&T Inc led bidders in the 3.45 GHz mid-band spectrum auction, winning $9.1 billion, while T-Mobile won $2.9 billion and Dish Network spent $7.3 billion. In 2021, the three largest U.S. wireless companies won $78 billion in bids in an FCC C-Band spectrum auction. Verizon Communications ultimately paid $52 billion for 3,511 licenses and to quickly clear its use, while AT&T won $23.4 billion in licenses and T-Mobile won $9.3 billion.

FCC Commissioner Brendan Carr in March said the FCC should move to expand spectrum use and consider auctioning other spectrum including looking at the “Lower 3 GHz band and several additional spectrum bands.”

In February, the FCC and National Telecommunications and Information Administration (NTIA) vowed to improve coordination on spectrum management after a 5G aviation dispute threatened flights earlier this year. The agencies said they will work cooperatively to resolve spectrum policy issues and are holding formal, regular meetings to conduct joint spectrum planning.

Addendum:

Here are the (disappointing) results of FCC Auction 108:

References:

https://www.fcc.gov/document/fcc-announces-next-5g-mid-band-spectrum-auction-start-july-29

https://www.reuters.com/technology/us-launches-new-5g-mid-band-wireless-spectrum-auction-2022-07-29/

https://www.tvtechnology.com/news/fcc-starts-5g-mid-band-spectrum-auction

Adani Group planning to enter India’s long delayed 5G spectrum auction

Indian conglomerate Adani Group [1.] is believed to be one of the four companies that (on Friday July 8th) has showed interest in the Indian government’s long delayed 5G spectrum auction. The move would expand the conglomerate’s presence to a sector dominated by established wireless telcos – Reliance Jio, Sunil Mittal-controlled Bharti Airtel, and Vodafone Idea Ltd.

India’s telecom department’s upcoming auction includes the coveted 5G band needed for high-speed wireless internet connectivity.

Note 1. Adani Group is a diversified organization in India with market cap of over $182.02 billion (as of July 8, 2022) composed of 7 publicly traded companies. It has created a world class transport and utility infrastructure portfolio that has a pan-India presence. Adani Group is headquartered in Ahmedabad, in the state of Gujarat, India. Over the years, Adani Group has positioned itself to be the market leader in its transport logistics and energy utility portfolio businesses focusing on large scale infrastructure development in India with O & M practices benchmarked to global standards. With four IG rated businesses, it is the only Infrastructure Investment Grade issuer in India.

……………………………………………………………………………………………………………………………….

Four independent sources told Business Standard that the Adani Group was interested in getting into telecom where it has no experience whatsoever.

Under India’s telecom regulations, the Adani entity would require a unified access service (UAS) permit from the Department of Telecommunications (DoT) to participate in the 5G airwaves auction.

The four telecom bidders would first have to provide ownership details by July 12th and later a bidder-ownership compliance certificate. After that, there will be a pre-qualification of bidders. Companies will have the right to withdraw auction applications by July 19 and bidders will be announced the next day. The auction is expected to begin on July 27.

Experts are divided about the possible strategy of the Gautam Adani-led Adani group. Some say it is investing heavily in data centres, with a view to making it an enterprise business. It has tied up with international company EdgeConnex for a 50-50 joint venture to build and operate large data centres in Chennai, Navi Mumbai, Noida, Vizag, and Hyderabad.

Adani’s enterprise data business will compete with Indian telecom companies and international tech giants like Amazon and Google. It would be a smart move to buy a limited quantity of millimetre band spectrum — it offers high speed and is relatively cheap – and support it by a small amount of spectrum in the 3.5 GHz band.

Other experts believe the Adani group might be planning to enter into 5G services and compete with established companies before likely acquiring or collaborating with an existing player.

News agency PTI, while quoting unnamed sources, reported that Adani was the fourth applicant in the telecom auction and had obtained National Long Distance (NLD) and International Long Distance (ILD) licences.

)

Image Credit: Adani Group

……………………………………………………………………………………………………………………………………………..

References:

India’s 5G auction delayed again to April-May 2022 – Credibility Gap?

India’s 5G spectrum auctions likely to be delayed yet again; Broadband India Forum weighs in

India’s 5G rollout is already behind schedule due to repeated delays (from early 2020) in the 5G spectrum auction. It now appears that the auction will be delayed even further, resulting in even more delays in 5G rollout. The competing interests of telecom service providers (TSPs) and technology giants seeking private networks appear to have slowed the auctioning of 5G spectrum, causing the delay, according to a recent The Hindu Businessline report.

The auction was meant to take place in early June, according to India’s Telecom Minister, but there would be a delay because the Cabinet has not yet adapted the TRAI’s plan. Because issuing the notice inviting applications (NIA) and holding stakeholder meetings can take at least 45 days from the date of Cabinet approval, the auction is unlikely to take place in June.

The main reason for the delay is that various industry bodies and tech giants have requested that the captive 5G networks be allocated to them. Despite the fact that 5G private network users’ spectrum allocation has been excluded from the upcoming auction, these players have addressed the government through their representative bodies. They argue that keeping them out of the country will adversely impact the country’s efforts to digitalize its economy and make its products more competitive in the global market.

The Broadband India Forum (BIF), whose members include Amazon, Cisco, Facebook, Google, Intel, Adani, and Reliance, among others, urged the government to provide this spectrum via an administered allocation route at a nominal rate or for free. Furthermore, TRAI recommended allocating 5G spectrum to enterprises for the construction of their own private captive networks, which they day improves industry efficiency.

The BIF urged the Government to provide these spectrum through administered allocation route at some nominal rates or give it for free. “We should think of the country, the consumer…it is the benefit of the consumer, efficiency of the enterprise and finally improvement of the economy. It (spectrum) is strictly for captive usage for improvement of efficiency,” said TV Ramachandran, President at BIF.

He said not only 5G, but captive network can be set up with 4G also, which the industry body has been requesting the government to open up. For instance, airports, ports, hotels and hospitals around the world use captive network to communicate within their campuses, and that gives faster response time, too.

Telecom Regulatory Authority of India (TRAI), in its recommendations, had also said that non-telecom enterprises would be allocated a 5G spectrum for building their private networks.

For captive network, spectrum is assigned to enterprises, is utilized within a limited geographic area. Therefore, it is also referred as spectrum for localized or local use. Spectrum assigned for localised private captive networks is used in such a manner that the signals are restricted within its geographic area and do not cause interference to other outside systems.

References:

India’s 5G auction delayed again to April-May 2022 – Credibility Gap?

India’s Trai: Coexistence essential for efficient use of mmWave band spectrum

India’s telecom regulator (Trai) believes that its suggestion of coexistence between terrestrial network operators and satellite service providers in the millimeter wave (mmWave) band of 27.5- 28.5 GHz is essential for the “optimum use of airwaves.”

Trai has recommended the mmWave band – 24.25 GHz to 28.5 GHz – be put to auction. It has recommended a base price of Rs 7 crore a unit.

“Both International Mobile Telecommunications (IMT) and satellite bands can co-exist. That has to happen for the efficient use of spectrum,” said a senior Telecom regulator who did not want to be identified by name.

“The Satellite Earth Station Gateway (for satcom) should be permitted to be established in the frequency range 27.5-28.5 GHz at uninhabited or remote locations on a case-to-to-case basis, where there is less likelihood of 5G IMT services to come up,” the Trai official said.

Trai said that such a move would encourage buyers – both telcos and satcom players and eliminate the possibility of a major chunk of such airwaves to remain idle.

Editor’s Note:

As we’ve noted many times, the WRC 19 specified 5G mmWave frequency arrangements have yet to be standardized in the ITU-R M.1036 revision. Hence, it’s a 5G frequency free for all.

…………………………………………………………………………………………..

Why are telecom companies upset with TRAI despite its proposal to cut spectrum prices by 40%?

The Telecom Regulatory Authority of India (TRAI) this week released recommendations on auction of spectrum, including those likely to be used for offering 5G services. The telecom regulator has suggested cutting prices of airwaves across various bands by 35-40% from its earlier proposed base price. However, the Cellular Operators Association of India, whose members include the three private telcos, Bharti Airtel, Reliance Jio and Vodafone Idea, has expressed disappointment, given the industry’s demand for a 90% reduction in the prices.

The telecom regulator has recommended that all available spectrum in the existing bands — 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz, 2500 MHz — should be put up for auction, along with airwaves in new bands such as 600 MHz, 3300-3670 MHz and 24.25-28.5 GHz. In all, more than 1,00,000 MHz of airwaves have been recommended to be put up for auction. The total spectrum on offer at reserve price is valued at about ₹5 lakh crore for 20 years.

For the 3300-3670 MHz band, which has emerged as the prime spectrum for 5G and is likely to be used for deploying 5G in India, the all-India reserve price has been lowered by about 35.5% to ₹317 crore/MHz, from ₹492 crore/MHz recommended earlier. Similarly, the reserve price for the premium 700 MHz band, which saw no takers in the previous auction, has been cut by 40% to ₹3,927 crore/MHz, from about ₹6,568 crore/MHz.

TRAI has determined the reserve price for spectrum bands based on a 20-year spectrum holding period. The reserve price for the increase in spectrum holding period to 30 years would be 1.5x the recommended reserve price for 20 years.

It has also recommended several options for the uptake of Captive Wireless Private Networks (CWPNs), including private networks through telcos, independent isolated network in an enterprise’s premises using telcos’ spectrum, allowing enterprise to take spectrum on lease from telcos or directly from Department of Telecom (DoT) to establish their own isolated captive private networks. TRAI also suggested that enterprises may obtain the spectrum directly from the government and establish their own isolated CWPN.

Given the financial stress in the sector, the government had in November, written to the regulator emphasising the need to strike a balance between generating revenue and the sustainability of the telecom sector in a way that telecom service providers are in good health with sufficient capacities to make regular and substantial capital expenditure for transitioning to 5G technology. It had also highlighted that spectrum lying idle was a waste for the economy.

Further, in the last spectrum auction, held in March 2021, only 37.1% of the spectrum put to auction was acquired by the telecom services providers, largely due to high prices.

“The inputs received by the Authority during the consultation process also point to the need for further rationalisation of the reserve price,” the regulator said in the recommendation running to more than 400 pages.

In its recommendations, the regulator has asserted that the “valuation exercise (and the setting of the reserve prices) is grounded in a techno-economic methodology that is time-tested. The valuation is intended to elicit spectrum prices that encourage buyers to procure radio frequencies in different bands, while at the same time ensuring that bidders are discouraged from collusive behaviour.”

The telecom services providers have via the industry body COAI expressed disappointment with TRAI’s recommendations for auction of 5G spectrum bands.

In a strongly worded reaction, COAI called the recommendation a “step backwards” than forward towards building a digitally connected India.

COAI maintained that the spectrum pricing recommended by TRAI was too high, and noted that throughout the consultation process, the industry had presented extensive arguments based on global research and benchmarks, for significant reduction in spectrum prices. “Industry recommended 90% lower price, and to see only about 35-40% reduction recommended in prices, therefore is deeply disappointing,” it said.

It added that charging a 1.5x price for spectrum for a 30-year period will nullify the relief provided by the Union Cabinet in 2021. The industry body pointed out that by introducing mandatory rollout obligations for 5G networks without factoring the huge cost of such a rollout, TRAI has “delinked itself from reality and is running counter to the Government’s efforts of enhancing ease of doing business”.

On allowing private captive networks for enterprises, COAI argued that TRAI was dramatically altering the industry dynamics and hurting the financial health of the industry rather than improving it. Private networks would be a disincentive for the telecom industry to invest in networks and continue paying high levies and taxes, it contended.

Reference:

Bloomberg: 5G in the U.S. Has Been a $100 Billion Box Office Bomb

From the very start of 5G deployments three years ago, there have been challenges with the technology, like when AT&T confusingly branded 4G as “5G E.” Conspiracy theorists have tagged 5G as a source of harmful radiation and a spreader of the coronavirus.

More recently, airlines and the FAA have complained that C-Band frequencies could interfere with radar and jeopardize air safety. To date, the biggest knock against 5G is that it’s been a nonevent. And, by the time it’s in full force, big tech companies including Amazon, Microsoft, and Google may have beaten the wireless carriers to the kinds of data-hungry applications that superfast 5G networks have been expected to spawn. At FCC auctions, U.S. carriers spent $118B on 5G spectrum- about twice as much as they spent on 4G.

Source: FCC

The higher speeds and greater capacity of 5G are needed to meet growing demand for services such as high-definition video streaming. However, the big improvement with 5G technology was supposed to be Ultra High Reliability and Ultra Low Latency (URLLC), which was to spawn a wide variety of new mission critical and real time control applications. That hasn’t happened because the ITU-R M.2150 RAN standard (based on 3GPP release 15 and 16) doesn’t meet the URLLC performance requirements in ITU M.2410 while the 3GPP Release 16 URLLC in the RAN spec (which was to meet those requirements) has not been completed or performance tested.

Also, all the new 5G features, such as network slicing, can only be realized with a 5G SA core network, but very few have actually been deployed. Adjunct capabilities, like virtualization, automation, and multi-access edge computing also require a “cloud native” 5G SA core network. Finally, the highly touted 5G mmWave services (like Verizon’s Ultra-Wideband) consume a tremendous amount of power, require line of sight communications, and have limited range/coverage.

Lacking a compelling reason to persuade customers to upgrade, carriers have been offering $1,000 5G phones for free to help jump-start the conversion process. Such promotions are needed because 5G isn’t even among the top four reasons people switch carriers, according to surveys by Roger Entner of Recon Analytics Inc. Those reasons typically include price or overall network reliability.

Ironically, one area where 5G has had early success is in providing wireless home broadband service (aka Fixed Wireless Access or FAA). That’s because 5G was designed for mobile- not fixed- communications and FAA was not even a targeted use case by either ITU-R or 3GPP. Nonetheless, as faster 5G mid-band frequencies are built out, customers are finding a wireless alternative to landline providers. This threat to cablecos is likely to spark price battles as the cable operators respond by offering cheaper mobile phone service of their own.

This was not the way 5G was envisioned or promoted. Carriers were rolling out 5G to deliver an “oh, wow” experience that customers would willingly pay extra for. Instead the technology has become a standard feature in an arena where mobile phone companies and cable operators are battling it out with similar packages. As that reality started to take hold, the carriers pointed to bigger, more immediate opportunities such as selling 5G to large companies and governments. “It became apparent a while ago that the most compelling use cases for 5G would revolve around businesses rather than consumers,” GlobalData’s Parker said.

To help make that happen, the major carriers formed partnerships with the so-called webscalers, the big cloud service providers including Amazon’s AWS, Microsoft’s Azure, Google, and Meta Platforms that handle data storage, online ordering, and video streaming for big companies. Each cloud giant sees 5G as a valuable entry into new classes of services, such as secure private networks to replace Wi-Fi, factory automation, and edge computing, which brings network hardware closer to end users to increase speeds.

To help make that happen, the major carriers formed partnerships with the so-called webscalers, the big cloud service providers including Amazon’s AWS, Microsoft’s Azure, Google, and Meta Platforms that handle data storage, online ordering, and video streaming for big companies. Each cloud giant sees 5G as a valuable entry into new classes of services, such as secure private networks to replace Wi-Fi, factory automation, and edge computing, which brings network hardware closer to end users to increase speeds.

The wireless carriers are staking their futures on these workplace roles. But because no 5G hyperconnected, cloud-powered commercial ecosystem has been built before, tech giants and telecommunications companies are collaborating to tackle the challenge.

While new partnerships are still being announced and big 5G projects are moving through the planning stages, executives at the wireless companies say they’re confident they can play a role in the information technology infrastructure of the future. “I’m proud to be the only carrier in the world that has partnership agreements with all three of the big webscalers,” says Verizon Communications Inc.’s business services chief Tami Erwin. “We’re creating the platform for the metaverse to really accelerate.”

As 4G showed, the carriers could create a higher-functioning network, but it was other companies such as Uber, Netflix, and Facebook that cashed in on the connectivity. 5G is set to expand the overall pie again, but the size of the carriers’ slice isn’t certain—bad news because they spent $118.4 billion on 5G airwave auctions, almost double the $61.8 billion they paid for 4G spectrum.

T-Mobile US Inc., which has taken the lead in U.S. 5G deployment, plans to focus on its core network strength as the tech giants sort things out, says Neville Ray, T-Mobile’s president of technology. “Facebook, Apple, Microsoft, Google—all of these massive companies are lining up huge investments in this space, and they need mobile networks in a way that they never did before,” he says. “They will need network capabilities that they simply don’t have any desire to build.”

That’s led a bunch of would-be competitors to work arm-in-arm to create a collective business model. “We have a great partnership with Microsoft,” says AT&T’s Sambar. “We’re a customer of Amazon, and they’re a customer of ours. We’re all friends today, we keep a close eye on each other. You have to cooperate to make this happen.”

The carriers provide businesses with a roster of services including voice, data, network management, and security, and they’ll want to keep control of those relationships as services emerge in 5G, says longtime Wall Street industry analyst Peter Supino. But as the cloud providers gain a bigger role in a business’s network infrastructure, running everything from robotics on the production floor to in-office wireless data systems, the carriers’ role may shift to more of a wholesale supplier of network capacity and mobile cellular service to the cloud companies, according to Supino.

“Over time, I’m confident that the cloud operators will provide too much convenience to be ignored,” he says. “The benefits of 5G will be significant, and they will mostly accrue to people who aren’t the telco carriers.”

References:

https://www.verizon.com/about/news/power-verizon-5g-ultra-wideband-coming

Algar Telecom deploys 1st 5G network in Brazil using 2.3GHz band

Brazilian network operator Algar Telecom announced that it launched what it claims to be the first commercial 5G network in the country. It’s a commercial Non Standalone (NSA) 5G service using its newly acquired 2.3GHz spectrum. The 5G network went live on 15 December and covers selected parts of Uberlandia and Uberaba, as well as Franca in Sao Paulo, with initial coverage reaching some 40 districts in these three cities.

Algar had carried out demonstrations of 5G technology two weeks ago in Uberaba via an implementation carried out together with Nokia and with a focus on agribusiness. According to the company, investments were made in transport network structures, network core and service platforms.

Brazil’s Minister of Communications, Fábio Faria, had anticipated in his hearing before the Senate last week that Algar would be the first telco to launch 5G services in the country.

“For this almost immediate launch to be possible, intensive planning prior to the 5G auction was essential, ensuring the acquisition of the 2.3 GHz frequency, which does not require spectrum cleaning. In addition, the company already had a good part of its infrastructure adequate or easily adapted to offer 5G. We made investments in backhaul structures, network core and service platforms,” the telco said in a release.

In the 5G auction, which ended on November 5, Algar Telecom had secured seven regional slots: five on the 26 GHz frequency, one on the 3.5 GHz frequency and one on the 2.3 GHz frequency. All slots obtained are in Algar Telecom’s original area of operation, where the company has operated since 1954, and which covers 87 municipalities in the states of Minas Gerais, São Paulo, Goiás and Mato Grosso do Sul.

The government of Brazil raised a total of 47.2 billion reals ($8.5 billion) in its recent 5G spectrum auction, making it the second largest auction of assets in the country’s history, according to the government.

Through this auction, the government offered spectrum in the 700 MHz, 2.3 GHz, 3.5 GHZ and 26 GHz bands.

The country’s main mobile operators, Vivo, Claro and TIM, secured 5G spectrum as well as telecoms operators Algar Telecom and Sercomtel. Also, six new entrants secured 5G spectrum in the auction.

The new entrants that secured licenses in the auction are Winity II Telecom, Brisanet, Fly Link, Neko Serviços e Comunicações and Entertainment and Education, Consórcio 5G Sul and Cloud2U Indústria e Comércio de Equipamentos Eletrônicos.

Brazilian Communications Minister Fabio Faria said that the government will schedule a new 5G spectrum auction in 2022 to sell batches that did not attract interest, mainly in the 26 GHZ spectrum band. Faria noted that the 26 GHZ spectrum did not attract interest due to uncertainties in the business model.

The rules previously approved by telecommunications watchdog Anatel stipulate that 5G should be deployed across Brazilian state capitals by July 31, 2022.

Brazilian cities with more than 500,000 inhabitants will have 5G by July 31, 2025, while the deadline for the rollout of the service in locations with more than 200,000 inhabitants is July 31, 2026. Also, Brazilian cities with more than 100,000 inhabitants will have 5G by July 31 2027, and the service will be available in locations with more than 30,000 inhabitants by July 31, 2028.

TeleGeography notes that Algar acquired regional spectrum in the 2.3GHz, 3.5GHz and 26GHz bands in the country’s 5G spectrum auction. Unlike the 3.5GHz band, the 2.3GHz band does not require cleaning for interference before 5G use. Algar executive Marcio De Jesus commented: “The company already had a good part of its infrastructure adequate or easy to adapt to the 5G offer. We made investments in backhaul structures, network core and service platforms.”

References:

https://www.rcrwireless.com/20211216/5g/algar-telecom-activates-first-5g-network-brazil

https://www.commsupdate.com/articles/2021/12/16/algar-telecom-launches-5g-using-2-3ghz-band/

https://www.gsma.com/spectrum/wp-content/uploads/2020/11/5G-and-3.5-GHz-Range-in-Latam.pdf

https://www.rcrwireless.com/20211108/5g/brazil-raises-total-8-billion-5g-spectrum-auction

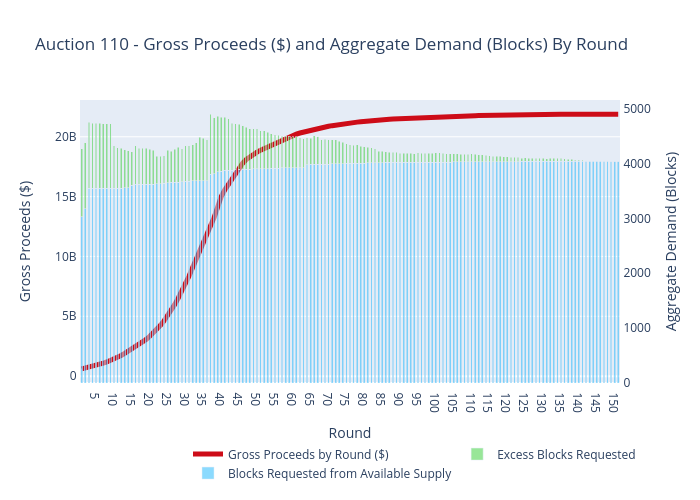

FCC Auction 110 for mid-band 5G spectrum gets $21.9B in winning bids

The latest FCC auction (#110) of mid-band spectrum for 5G ended Tuesday with a total of $21.9 billion in winning bids. That total is roughly in line with pre-auction estimates.

Auction 110 offered 100 megahertz of mid-band spectrum in the 3.45–3.55 GHz band (the 3.45 GHz Service) for flexible use, including 5G wireless. The 100 megahertz of spectrum available in Auction 110 will be licensed on an unpaired basis divided into ten 10-megahertz blocks in partial economic areas (PEAs) located in the contiguous 48 states and the District of Columbia (PEAs 1–41, 43–211, 213–263, 265–297, 299–359, and 361–411). These 10-megahertz blocks are designated as A through J.

The clock phase concluded on November 16, 2021. The FCC will release a public notice within the next few business days announcing details about the assignment phase, including the date and time when bidding in the assignment phase will begin.

See the Auction 110 website for more information.

Highlights:

- Qualified Bidders (Clock Phase)= 33

- Licenses Won=4041

- FCC Held Licenses=19

- Total Licenses=4060

- Gross Proceeds as of Clock Phase=$21,888,007,794

Next up is the auction’s “assignment” phase, wherein winning bidders can select the specific frequencies they want to use. After that phase is over, the FCC will announce the identities of the winning bidders. That might not happen until December or January.

Major participants in the auction included AT&T, Verizon, T-Mobile, Dish Network, Grain Management and Columbia Capital.

The spectrum in this auction is ideal for 5G. Mid-band spectrum is in high demand because it is widely viewed as providing the optimum mix of speed and coverage for 5G. Licenses in Auction 110 sold for an average of $0.666 per MHz per person (MHz pop) in the coverage area, according to Sasha Javid, chief operating officer for BitPath, who has been doing a detailed daily analysis of auction results.

Auction 110 winners will pay less per MHz pop in comparison with what Auction 107 (C-band) winners paid but more than Auction 105 CBRS band winners paid, according to Javid. Those other two auctions also included mid-band spectrum and the C-band auction was record breaking.

Javid notes that the CBRS licenses were subject to power restraints, making them less valuable. He didn’t offer an opinion on why Auction 110 licenses were less costly than Auction 107 licenses (on a MHz-pop basis), but perhaps the disparity is related to license size.

Winning bidders will need to purchase new radio equipment from base station/kit makers Ericsson, Nokia, and Samsung (but not Huawei or ZTE which are banned in the U.S.) to put their spectrum licenses into 5 commercial service.

Unlike past spectrum auctions, cable companies including Comcast and Charter did not participate in the auction. Based on Dish Network’s recent fundraising, the company appears poised to potentially account for as much as a fourth of the auction’s total.

Broadly, the FCC’s 110 auction of spectrum licenses between 3.45GHz and 3.55GHz can be considered a success. The auction started October 5, and bidding crossed the critical $14.8 billion reserve price October 20. That was a necessary milestone considering that reserve price is the cost to move existing, incumbent military users out of the band.

The auction was worth around $0.70 per MHz-POP. The per MHz-POP calculation is applied to most spectrum transactions and reflects the number of people covered compared with the amount of spectrum available, though it can be affected by a wide variety of factors.

In comparison, the recent CBRS auction of mid-band spectrum drew winning bids of just $0.215 per MHz-POP, whereas the massive C-band auction generated winning bids of $0.945 per MHz-POP, a figure that does not account for additional clearing costs.

This FCC auction is the agency’s third-biggest spectrum auction ever. As noted by Next TV, only the $45 billion AWS-3 auction in 2015 and the $81 billion C-band auction earlier this year generated more in winning bids. The auction earlier this month passed the FCC’s broadcast incentive auction of 600MHz licenses, which ended with $19.8 billion in winning bids in 2017.

The value of the spectrum licenses in this auction could rise if interference with aircraft concerns continue to drag on the C-band. However, CTIA President and CEO, Meredith Attwell Baker in response to the bulletin maintained that 5G using C-band won’t cause interference and that timely deployments are key for 5G leadership. “5G networks using C-band spectrum operate safely and without causing harmful interference to aviation equipment.

References:

https://www.fcc.gov/auction/110

https://auctiondata.fcc.gov/public/projects/auction110

https://www.fcc.gov/auction/110/factsheet

https://sashajavid.com/FCC_Auction110.php

FCC Pockets Close to $22B in Auction 110 of 3.45 GHz Band Spectrum

India’s 5G auction delayed again to April-May 2022 – Credibility Gap?

The long delayed auction for the 5G spectrum in India is now likely (???) to take place around April-May 2022, Telecommunications minister Ashwini Vaishnaw said on Thursday. While relief measures announced in September this year for telecom operators marked the first set of reforms, the government will bring out a series of further reforms and “telecom regulatory structure should change in coming 2-3 years”, Vaishnaw said at an event in India.

The Telecom Regulatory Authority of India (Trai) is working on the modalities of the auction. “Our estimate is by April-May. I think it will take time because Trai consultations are complex, diverse opinions are coming,” Vaishnaw said.

[Credibility gap: When he announced the government’s big-bang telecom reforms in September, Vaishnaw had said the auctions would be held in February.]

The telecom department has approached Trai for its recommendations on pricing, amount of 5G spectrum for sale and other modalities.

“The (India) government had budgeted for inflows of nearly Rs 54,000 crore from other communication services for the current year, presumably boosted by the expectation of fresh auction inflows,” according to Aditi Nayar, chief economist, Icra. “We now assess the inflows from the telecom sector into the government’s 2021-22 non tax revenues to be limited to Rs 28,000 crore, trailing the budgeted Rs 54,000 crore, which will modestly widen its fiscal deficit, “ she said.

Image Credit: Shutterstock

The government is targeting a fiscal deficit of 6.8 per cent of GDP in 2021-22, a big improvement over the previous year when the fiscal deficit shot up to 9.3 per cent in the Covid-affected economy. The DoT has sought the views of Trai across multiple bands such as 700Mhz, 800 Mhz, 900 Mhz, 1800 Mhz, 2100 Mhz, 2300 Mhz, 2500 Mhz bands as also 3,300-3,600 Mhz that were not put up for auctions in the last round.

On the timeline for 5G auctions, Vaishnaw noted that the Trai is undergoing consultations on the matter. “I think they will submit their report by February-mid is what we are thinking, maybe February-end, maximum to maximum March. Immediately after that, we will have the auctions,” he said.

References:

India’s DoT preparing for another mega spectrum sale

India’s telecom department has set the stage for another mega spectrum sale by sending a reference to the sector regulator, seeking fresh base prices for the gamut of airwave bands, including key frequencies like 700 MHz, 3.3-3.6 GHz and the coveted millimeter waves such as 26 GHz and 28 GHz that support 5G technology (but have not been agreed upon in revision 6 of ITU-R M.1036 Frequency Arrangements for Terrestrial IMT).

India’s Department of Telecommunications (DoT) has also sought fresh base prices for 4G airwave bands such as 800 MHz, 900 MHz, 1800 MHz, 2100 MHz and 2300 MHz, two people aware of the matter said. But with the time usually taken for the consultation process, sources say it may be tough to meet government’s auction timeline of January-February, 2022.

The reference comes at a time when the government has acknowledged that high spectrum pricing is a prime reason behind the acute financial stress in the debt-laden telecom industry, and is also open to price rationalization in public interest.

In its reference, the department has sought recommendations from the Telecom Regulatory Authority of India (Trai) on the terms of reference for the next auction and the quantum of airwaves proposed to be auctioned, one of the persons cited told ET.

“We have received a detailed reference from DoT about 2-3 days back, seeking our recommendations on spectrum matters and pricing…there are a number of spectrum bands involved, and the Authority is currently examining the reference and will respond to the government,” Trai secretary V Raghunandan told ET. He, though, declined to share details.

Sector analysts expect the potential annual cash flow relief stemming from the four-year moratorium allowed on statutory payouts to give Bharti Airtel and Reliance Jio the financial headroom to participate aggressively in the next spectrum auction. They, though, don’t expect Vodafone Idea (Vi) to participate as strongly if it’s unable to close its much delayed Rs 25,000-crore fundraise.

Another official said that Trai will need to seek additional details from the DoT, before proceeding with its analysis and starting the consultation process.

After a DoT reference, Trai conducts a process which includes a four-week period for stakeholders to submit their views after a consultation paper is floated, followed by two weeks for counter comments. Then Trai holds open-house discussions before arriving at its recommendations. The whole process usually takes about four-five to months at least.

………………………………………………………………………………………………………………………….

On March 1, India concluded its first spectrum auction of 2021. India’s Department of Telecom (DoT), through a Notice Inviting Applications (NIA) issued in January 2021, had put up spectrum for auction in multiple bands, including 700, 800, 900, 1800, 2100, 2300 and 2500 MHz bands. These frequencies cut across 2G, 3G and 4G service bands and included both FDD (paired) and TDD (unpaired) bands.

The auction was a qualified success. It netted the Government $10.6 billion and was almost double initial estimates. However, barely 37% of the total spectrum put up for auction had takers, while the 700 MHz band saw no bids at all.

The main takeaway from this auction is that the focus of India’s telcos is currently on 4G, not 5G. With several licenses coming up for renewal, it was imperative that telcos bid on expiring spectrum to renew but also to consolidate with new holdings. The biggest bidders were Reliance Jio ($7.8 billion), Bharti Airtel ($2.55 billion), followed by VodafoneIDEA a distant third with bids worth $272 million.

There was heavier than expected bidding in the 800 MHz band as well as the 2300 MHz band. All of the three operators bidding have taken different approaches to this auction. The common theme for both Jio and Airtel’s auction strategies was to shore up existing spectrum, acquire new frequencies to consolidate holdings per circle and boost capacity, and lay the groundwork for an eventual 5G network launch.

For its part, Vodafone IDEA (VIL) has taken a very frugal, optimization strategy to spectrum. Their public position has been that they have abundant spectrum and therefore are not hard-pressed to bid aggressively. This is true, with VIL holding ample spectrum, but there is no doubt that they would have had very limited means due to a stressed balance sheet.

Reference: