5G satellite networks

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

Converged terrestrial and satellite connectivity is a given, but the path is strewn with unknowns and sizable technological and business challengers, according to satellite operator CEOs. Hopefully, 3GPP Release 18 will contain the necessary specifications for it to be implemented as we explained in this IEEE Techblog post.

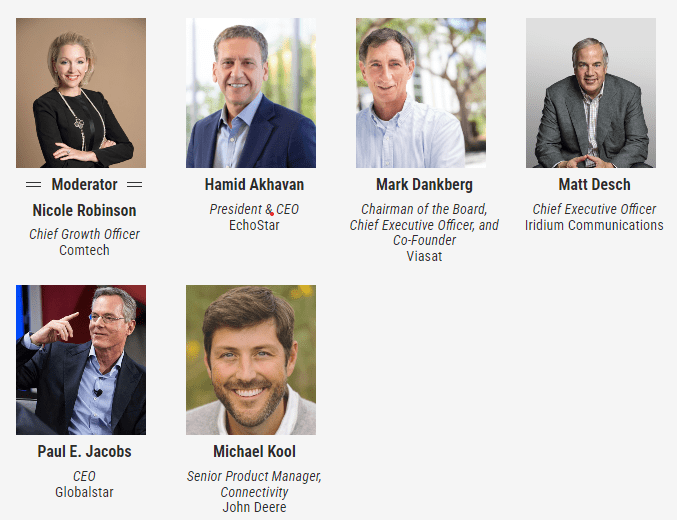

During Access Intelligence’s Satellite 2024 conference in Washington DC this week, Viasat CEO Mark Dankberg said satellite operators must start thinking and acting like mobile network operators, creating an ecosystem that allows seamless roaming among them. Terrestrial/non-terrestrial network (NTN) convergence requires “a complete rethinking” of space and ground segments, as well as two to three orders of magnitude improvement in data pricing, Dankberg said. Standards will help get satellite and terrestrial to fit together, but that evolution will happen slowly, taking 10 to 15 years, Iridium CEO Matt Desch said. It remains to be seen how direct-to-device services will make money, he added. Satellite-enabled SOS messaging on smartphones “is becoming free, and our satellites are not free — we need to make money on it some way,” Desch added.

The regulatory environment around satellite has changed tremendously during the past decade, with the FCC very oriented toward mobile networks’ spectrum needs and now satellite matters making up most of the agenda for the 2027 World Radiocommunication Conference, Desch said. However, there will be regulatory challenges to resolve in satellite/terrestrial convergence, he predicted. There are significant synergies in having a 5G terrestrial network and satcom assets under one roof, he said. Blurring the lines between terrestrial and non-terrestrial makes it easier for manufacturers to build affordable equipment that operates in both modes, Desch concluded.

That inevitable convergence is being driven by declining launch costs, maturing technologies and improved manufacturing, all of which make non-terrestrial network connectivity more economically competitive, said EchoStar CEO Hamid Akhavan. He said the EchoStar/Dish Network combination (see 2401020003) was driven in part by that convergence, consolidating EchoStar’s S-band spectrum holdings outside the U.S. with Dish’s S-band holdings inside the country. The deal also melds Dish’s network operator expertise with Hughes’ satellite expertise.

Wednesday Opening General Session: Are Satellite and Cellular Worlds Converging or Colliding?

To ensure space’s sustainability, missions must follow the mantra of “leave nothing behind,” sustainability advocates said. Space operators should have more universal protocols and vocabulary when exchanging space situational awareness data, as well as more uniformity in what content gets exchanged, said Space Data Association Executive Director Joe Chan. When it comes to space sustainability, clutter isn’t necessarily dangerous, and any rules fostering sustainability should avoid restricting the use of space, he said. Space lawyer Stephanie Roy of Perkins Coie said a mission authorization framework covering space operations that fall outside the regulatory domain of the FCC, FAA and NOAA is needed. Space operators and investors see sustainability rules as inevitable and want to ensure they allow flexibility and don’t mandate use of any particular technology, she added. Many speakers called for a “circular economy” in space, with more reuse of materials via refueling, reuse or life extension.

Separately, space sustainability advocates urged a mission authorization regulatory framework and universal use of design features such as docking plates enabling on-orbit serving or towing. Meanwhile, conference organizers said event attendance reached 14,000.

Also, ITU Secretary-General Doreen Bogdan-Martin urged the satellite industry to join ITU’s Partner2Connect digital coalition aimed at addressing digital divide issues, particularly in the least-developed nations and in landlocked and small island developing countries. The digital divide “is right up there” with climate change as a pressing issue for humanity, said Bogdan-Martin. She noted the coalition has received $46 billion in commitments, with a target of $100 billion by 2026.

References:

https://communicationsdaily.com/article/view?BC=bc_65fb60473d5de&search_id=836928&id=1911572

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

https://www.3gpp.org/specifications-technologies/releases/release-18

Japan telecoms are launching satellite-to-phone services

Japanese telecom carriers are rushing to launch communication services that directly connect smartphones to satellites. In recent years, global telecom carrier interest in non-terrestrial networks, such as space-based services, has grown. Such network services not only allow for expanded coverage to places that would otherwise be difficult to reach, but also are expected to be used in natural disasters. After the January 2023 Noto Peninsula Earthquake in Japan, SpaceX owned Starlink satellite internet service was used for emergency restoration of base stations and to provide internet at disaster shelters.

- Rakuten Mobile Inc. announced Friday that it will start offering a satellite-to-smartphone service that can also be used to make voice calls as early as 2026. The service is expected to provide a connection anywhere in the country, including in mountainous regions and areas offshore, where it is difficult to build base stations. It could prove useful in a natural disaster.

- KDDI Corp. also plans to launch a satellite-to-smartphone service for text messaging. Such satellite-based services do not require a dedicated receiver, and can be accessed with just a smartphone.

For the Rakuten Mobile service, the company will use satellites from AST SpaceMobile Inc., a U.S. startup that has been invested in by the Rakuten Group.

……………………………………………………………………………………………………………….

AST SpaceMobile has launched two test satellites into low-earth orbit at an altitude of about 500 kilometers. Because these satellites orbit lower than geostationary satellites, they can provide communications with less delay. The company plans to have as many as 90 satellites operating in the future.

At a press conference on Friday, Rakuten Mobile Chairman Hiroshi Mikitani said, “Our customers will be able to enjoy mobile connectivity across Japan, even offshore or on an airplane.”

KDDI, which has gotten out ahead by providing access to Starlink, a satellite-based communication network from U.S. company SpaceX, will launch its text messaging service as early as this year.

Starlink currently requires a dedicated terminal, but last month SpaceX successfully launched six satellites that allow smartphones to connect to them directly.

NTT Docomo Inc. and SoftBank Corp. are looking to commercialize high-altitude platform stations, or HAPS. These stations are large unmanned aircraft that stay in the air at an altitude of about 20 kilometers, from where they send out radio signals.

NTT Docomo is currently testing direct links between HAPS and smartphones, and expects to launch a HAPS mobile service in fiscal 2025. However, a framework for space- and air-based services is still being defined.

The frequency bands to be used for the services are expected to be discussed at an international conference, and the Internal Affairs and Communications Ministry is considering technical requirements.

References:

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

Telstra partners with Starlink for home phone service and LEO satellite broadband services

SpaceX has majority of all satellites in orbit; Starlink achieves cash-flow breakeven

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

AST SpaceMobil announced its latest satellite-based connectivity milestone, making “5G” voice and data connections between a standard smartphone and a satellite. We say “5G” because there are no 5G satellite standards – only ITU-R M.2150 for terrestrial 5G. 3GPP Rel 17-20 will specify 5G SatCom.

Using the BlueWalker 3 test satellite and its 693-square-foot array — the largest such commercial telecommunications array in low Earth orbit — engineers at AST SpaceMobile made history on September 8, 2023, by demonstrating the first-ever 5G cellular connectivity from space directly to everyday smartphones. The company proved the feat using AT&T cellular spectrum in Maui, Hawaii, to make a voice call to Vodafone in Madrid, Spain. The call was facilitated by Nokia’s network core. The company also recently achieved other firsts in space-based cellular broadband, an industry it pioneered: voice calls, 4G data downloads of more than 14 Mbps, and 4G video calls.

AST SpaceMobile has included a YouTube link of its own in its latest announcement.

The two new milestones come in the wake of AST SpaceMobile’s announcement in April that it had completed the first ever space-based voice calls using normal smartphones.

It has, of course, come under scrutiny for that claim. In July Lynk, which is building an LEO constellation to create what it terms ‘cell towers in space,’ also claimed to have completed the world’s first voice calls over its network. Lynk seemed to hang much of its claim on the fact that it had a video as proof, although opinions vary on how conclusive such a video could be.

“Once again, we have achieved a significant technological advancement that represents a paradigm shift in access to information. Since the launch of BlueWalker 3, we have achieved full compatibility with phones made by all major manufacturers and support for 2G, 4G LTE, and now 5G,” said AST SpaceMobile CEO Abel Avellan. It’s worth noting that BlueWalker 3 is a test satellite; AST Space Mobile plans to launch its first five commercial satellites in the first quarter of next year.

“Making the first successful 5G cellular broadband connections from space directly to mobile phones is yet another significant advancement in telecommunications AST SpaceMobile has pioneered,” Avellan declared. Vodafone, AT&T and Nokia also contributed – slightly less self-congratulatory – statements about their own roles in proceedings and the potential of the technology to connect the unconnected.

It’s hard to argue with that last point, which is part of the reason why satellite-based connectivity is having something of an extended moment in the spotlight, with AST SpaceMobile, Lynk, Sateliot and others talking up their various achievements.

AST SpaceMobile describes itself as “the company building the first and only space-based cellular broadband network accessible directly by standard mobile phones.”

………………………………………………………………………………………………………………………….

References:

First-Ever 5G Connectivity from Space to Everyday Smartphones Achieved by AST SpaceMobile

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

AST SpaceMobile achieves 4G LTE download speeds >10 Mbps during test in Hawaii

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

FCC proposes regulatory framework for space-mobile network operator collaboration

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

China’s answer to Starlink: GalaxySpace planning to launch 1,000 LEO satellites & deliver 5G from space?

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

New research from Juniper Research forecasts that network operators will generate $17 billion of additional revenue from 3GPP‑compliant 5G satellite networks between 2024 and 2030.

Editor’s Note: There is no serious work in ITU-R on 5G satellite networks as we’ve previously detailed. The real SatCom air interface specifications work is being done by 3GPP, under the umbrella term of NTN (Non-terrestrial Networks), in Release 17 and the forthcoming Release 18.

ITU-R WP5D is responsible for terrestrial IMT radio interfaces (IMT-2000, IMT-Advanced and IMT-2020/M.2150 as well as IMT for 2030 and Beyond), so it won’t be involved in standardizing radio interfaces satellite networks.

ITU-R Working Party 4B (WP 4B) is responsible for recommendations related to: Systems, air interfaces, performance and availability objectives for FSS, BSS and MSS, including IP-based applications and satellite news gathering.

…………………………………………………………………………………………………………………..

The market research firm urges network operators to sign partnerships with SNOs (Satellite Network Operators) which will enable operators to launch monetizable satellite-based 5G services to their subscribers. SNOs possess capabilities to launch next-generation satellite hardware into space, as well as being responsible for the operation and management of the resulting networks.

The new report, Global 5G Satellite Networks Market 2023-2030 offers the most reliable source of data for the market.

Operators Hold the Key Billing Relationship:

Juniper Research predicts the first commercial launch of a 5G satellite network will occur in 2024, with over 110 million 3GPP‑compliant 5G satellite connections in operation by 2030. To capitalise on this growth, the research urges operators to prioritise immediate partnerships with SNOs that can launch GSO (Geostationary Orbit) satellites. These satellites follow the rotation of the earth to always be located above the country that the operator serves; providing consistent connectivity.

Additionally, operators must leverage their pre-existing billing relationship with mobile subscribers and enterprises as a platform to grow 5G satellite connectivity revenue over the next seven years. The report anticipates this existing billing relationship will enable operators to rapidly drive the adoption of satellite connectivity by integrating satellite services into existing terrestrial networks.

Key Forecasts:

- Total Operator-billed 5G Satellite Revenue 2024-2030: $17bn

- Total 3GPP-compliant 5G Satellite Connections in 2030; $110mn

- Average Revenue per 5G Satellite Connection in 2030: $7.98

………………………………………………………………………………………………………………….

3GPP Releases related to SatCom:

3GPP Rel-17 is enabling the launch of satellite-based communications. Unlike traditional telecommunications ecosystems, the development of this market will be defined by the entrance of a new category of players – satellite vendors. These vendors will work with network operators to deploy NTNs (Non-terrestrial Networks) that side alongside terrestrial networks.

NTNs are a joint development between network operators and satellite vendors to drive growth of telecommunications services. In the future, NTNs will integrate directly with satellite-based networks to provide connectivity with comprehensive services.

However, the development of NTN specifications is far from complete, the 3GPP roadmap includes provisions in 3GPP Releases 18 and 19 for enhancements to satellite services. 3GPP Release 20 includes the provision of satellite-based standards for future 6G networks. It is only with these standards that satellite networks can progress past traditional use cases, such as weather monitoring, global positioning services and broadcasting, which require low-to-medium throughput rates and do not need low latency.

Additionally, satellites have not been required, as the low data rates provided by previous iterations of satellite technologies, combined with the high costs of satellite connectivity, have not been able to compete with the service provided by terrestrial networks.

These will be the most immediate benefits of satellite-based services for 5G networks:

• Increased network coverage: Satellites will provide increased coverage to areas where terrestrial networks are financially unviable. This is most notable in rural areas where there is little demand for cellular connectivity; leaving operators with no return on investment into the needed backhaul infrastructure and base stations.

• Increased support of backhaul infrastructure: Given the data-intensive nature of 5G services, satellite infrastructure will be used to carry data in a similar fashion to fibre services in terrestrial networks.

• Increase network capacity and throughput: Satellites can offload data from terrestrial networks. As the number of 5G connections increases, so will the data generated. In turn, satellites can not only provide coverage in areas where there is little support for 5G services, but they can also alleviate geographical areas that require high throughput and support for a large number of connections.

• More network resilience: Satellites will provide an additional layer of network redundancy for communication services during natural disasters or network outages. When terrestrial networks are inoperable, satellites will be used for connectivity in the absence of terrestrial network.

Preparation for 6G Networks:

However, the research predicts operators will increasingly rely on SNOs for service provision as 6G development accelerates. Research author Sam Barker commented:

“Operators must not only think of 5G satellite services when choosing an SNO partner, but also the forward plan for 6G networks, including coverage and throughput capabilities.”

About the Research Suite:

This new Juniper market research suite offers the most comprehensive assessment of the 3GPP‑compliant 5G satellite network to date; providing analysis and forecasts of over 24,000 data points across 60 markets over five years.

View the 5G Satellite Networks market research: https://www.juniperresearch.com/researchstore/operators-providers/5g-satellite-networks-research-report

Download a free sample: https://www.juniperresearch.com/whitepapers/5g-satellite-networks-the-17bn-operator

References:

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies